Since August, we have been reporting for you in German on the political processes in Europe and the discourses in Germany relevant to European policy. As of today, we also offer our news and analyses in English. Many observers outside Germany are wondering how the most important EU member state will position itself in Europe in the future after 16 years with Chancellor Angela Merkel. We wish to cater to this desire for information. If you want to test the International Edition yourself or recommend it to your colleagues, you can register here: Europe.Table Professional Briefing

In this issue you will find a lot on climate policy, one of our main topics – not only during COP26. Lukas Scheid reports on the Glasgow Financial Alliance for Net Zero, an alliance of private banks, insurers, and investors that wants to mobilize trillions for renewable energy and sustainable business.

Some see greenwashing behind the initiative – investors should first stop financing fossil fuels, NGOs demand. A new global standard that the International Sustainability Standards Board (ISSB) wants to develop could create more transparency in the market for green investments.

Greta Thunberg complains about greenwashing of a different kind: Together with other activists, she interrupted a panel discussion about so-called offset measures. This form of compensation for one’s CO2 emissions is a “dangerous climate lie” and “hypocritical”.

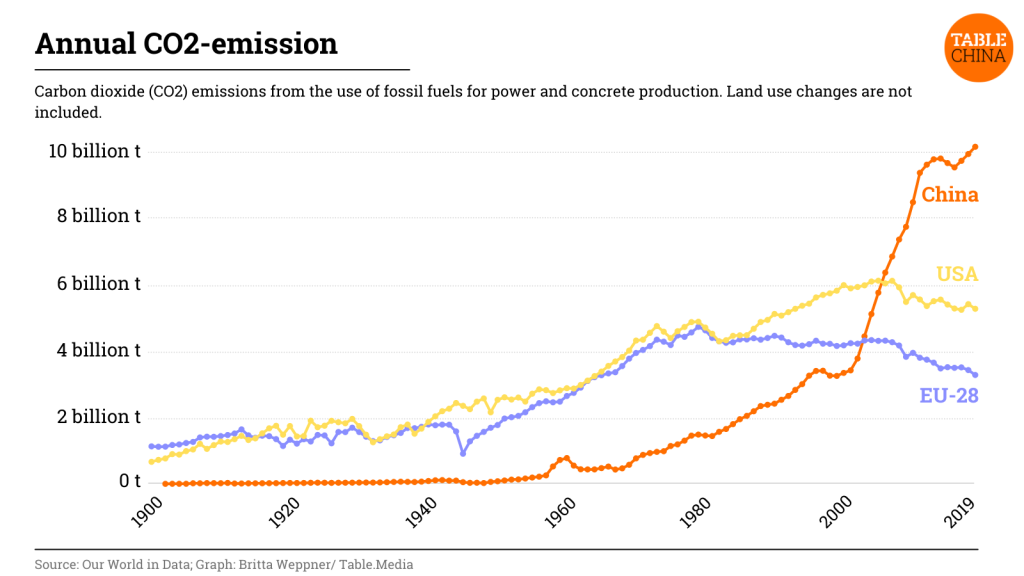

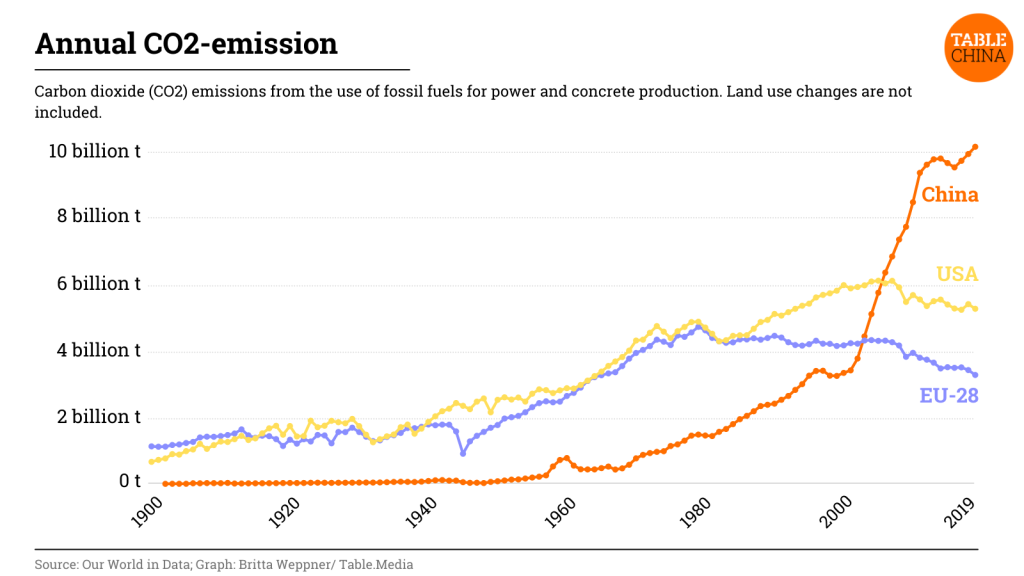

China is often criticized in Europe and the US as a laggard in climate protection. However, for the economy, which generates about 28 percent of global CO2 emissions annually, it will be a gigantic challenge to reduce emissions to “net-zero” by 2060, analyzes Nico Beckert.

The efforts of the US government to exclude Beijing via the steel agreement with the EU could prove to be of little help warns Susanne Dröge, a trade expert at the think tank Stiftung Wissenschaft und Politik, in her guest article.

I hope you enjoy today’s issue. If you have any feedback, please feel free to let me know: till.hoppe@table.media

The members of the alliance, which account for around 40 percent of global capital, declared at the global climate conference in Glasgow (COP26) that they want to take on a “fair share” of the efforts to phase out fossil fuels. They want to make their portfolios carbon-neutral by 2050 by shifting their investments to renewable energy and sustainable economies.

UN climate envoy Mark Carney, who launched the GFANZ, put the investment at $100 trillion over the next three decades. He said the finance industry needed to find ways to raise private money so the effort went far beyond what states could do on their own. The money is there, but it must go to net-zero projects.

“We need to rethink finance,” said Larry Fink, chief executive of Blackrock, the world’s largest asset manager, which has joined the alliance. “We can do something about the climate, but we can’t cherry-pick and greenwash by just asking public companies to step forward.” The development of vaccines against COVID-19 shows what collective action can achieve, he said.

The GFANZ signatories include over 450 companies from 45 countries – including the DAX companies Allianz, Munich Re, and Deutsche Bank. They must submit scientifically sound short, as well as long-term, reduction targets no later than 18 months after joining. Over 90 of the founding institutions have already done so.

Companies must review their targets every five years to see if they are still on the net-zero path and report annually on their progress and the emissions caused by their portfolios. One focus of the alliance is to support developing and emerging countries on the path to a climate-neutral economy.

David Ryfisch, International Climate Policy Team Leader at the environment and development organization Germanwatch, welcomes the announcement. “The GFANZ are not only committing to Net-Zero by 2050, but they also want to reduce emissions from their activities by 50 percent by 2030,” he said in an interview with Europe.Table. He added that it would only be possible to say how effective the alliance was once all the details were known. Yet, the announcement that the financial portfolios will be shifted quickly towards green investments is the first step.

The framework developed by GFANZ will be decisive. It defines the extent to which emissions in the portfolios of banks, insurers, and investors must be reduced to achieve the targets. The crucial factor here is which emissions are included. Ryfisch demands that so-called Scope 3 emissions are also taken into account – i.e. those that arise along the supply chain and are not caused directly by the company.

However, others are less convinced. “Behind these cheery headlines lie a plethora of loopholes and opportunities for backtracking,” said the Environmental Justice Foundation. “Net-zero pledges mean nothing without fossil fuel phase-out. It’s time for financial institutions to walk the talk and stop financing climate-destroying fossil fuels,” added the NGO’s executive director Steve Trent.

At least 19 countries are expected to announce at today’s COP26 energy day that they will end public financing of fossil fuels abroad by the end of 2022. Big private investors are still holding back on such announcements, as they still invest much of their capital in emissions-intensive activities.

For Rachel Rose Jackson, director of climate policy and research at the NGO Corporate Accountability, the announcements are too vague. “Corporations need to spell out exactly how their trillions will go towards the rapid implementation of real and proven solutions, not risky and fantastical technical solutions.” We already know the modus operandi of companies and financiers making big promises with big numbers, she said. “Then they don’t deliver on those promises.”

Heinz Bierbaum, President of the European Left, also expressed skepticism about the promise of the financial industry. It was questionable whether the changes in investment strategies were compatible with the associated return expectations. Rather, there would have to be binding commitments “that also have political support”, Bierbaum said. With rtr

For Berlin and Washington, Beijing has been part of the problem so far. “China’s role is disappointing,” Environment State Secretary Jochen Flasbarth said on Tuesday at the world climate summit in Glasgow. The commitments made so far by the largest greenhouse gas emitter were not enough. The US had also criticized China, saying that the country could do more.

Yet from China’s point of view, its climate targets are ambitious. Within the next eight years, it wants to reach the peak in national CO2 emissions. By 2060, emissions are then to fall to “net-zero” – at which point only greenhouse gases that are offset elsewhere may be emitted.

The climate targets require action “at an unprecedented speed and scale,” according to climate expert and journalist Liu Hongqiao. “The road to net-zero will not be an easy one.” Economic, social, and political tensions loom. Can China succeed in transforming an economy that causes about 28 percent of global CO2 emissions annually at the necessary speed?

In terms of economic policy, China faces two major challenges: power security and ensuring growth and jobs.

China’s electricity mix currently still consists of about 65 percent coal-fired power. It is clear to everyone that it will be difficult to reduce dependence on an energy source that is readily available. For this to happen, the majority of China’s power supply will have to be changed to renewable energies within a fairly short timeframe.

In its recently adopted climate plans, the government itself talks about “building before destroying.” Before accelerating the phase-out of coal, sufficient renewable energy capacity, power storage, and transmission capacity should first be built. Those in charge will not take any risks here. The current power crisis made it clear to political leaders what is at stake if the shift to renewables jeopardizes power security.

In the past ten years, China has strongly expanded its renewable energy capacities. Wind energy capacity has increased tenfold. The increase in solar energy has been even steeper. However, the overall power demand also increased heavily. Renewables have not yet been able to push back the share of coal-fired power.

China also faces major challenges in building the necessary power lines and storage systems. In recent years, even the construction of some new power plants in the wind and sun-rich western provinces of Gansu, Xinjiang, and Tibet has been halted due to a lack of required transmission capacity and storage systems. In some provinces, more than seven percent of the power produced from renewable sources is thus lost. In Tibet, the figure is almost 25 percent.

The restructuring of the economy will not be easy either. At present, the majority of China’s economy mainly consists of industry. 38 percent of economic output originates from the industrial and construction sectors. In economies such as India, Japan, and the USA, the figure is between 20 and 25 percent. In addition, sectors with high power demand and heavy CO2 emissions are dominating steel, concrete, and aluminum industries, the construction sector, and the (petro)chemical industry. And it is precisely in these sectors in which it is most difficult to reduce greenhouse gas emissions.

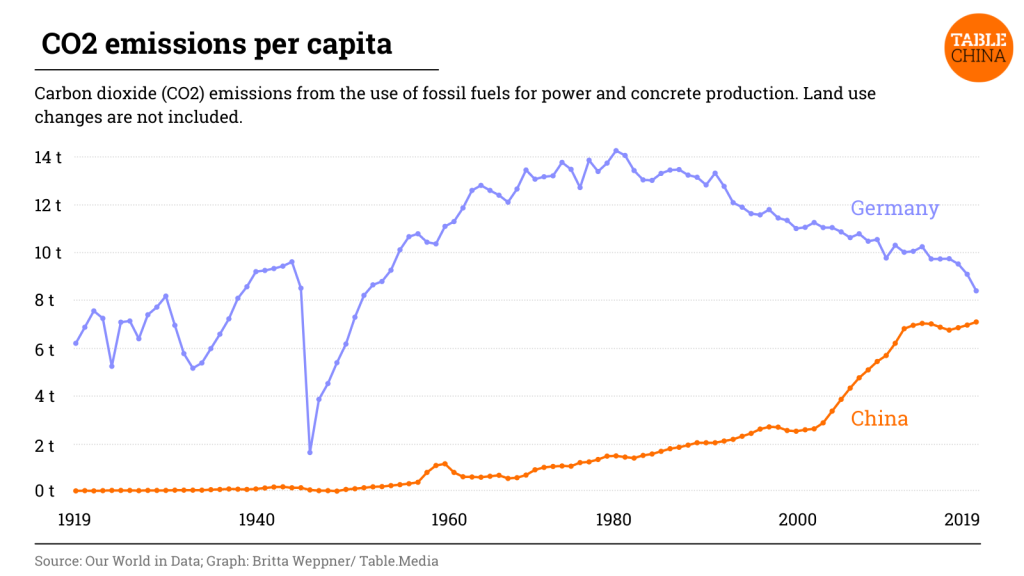

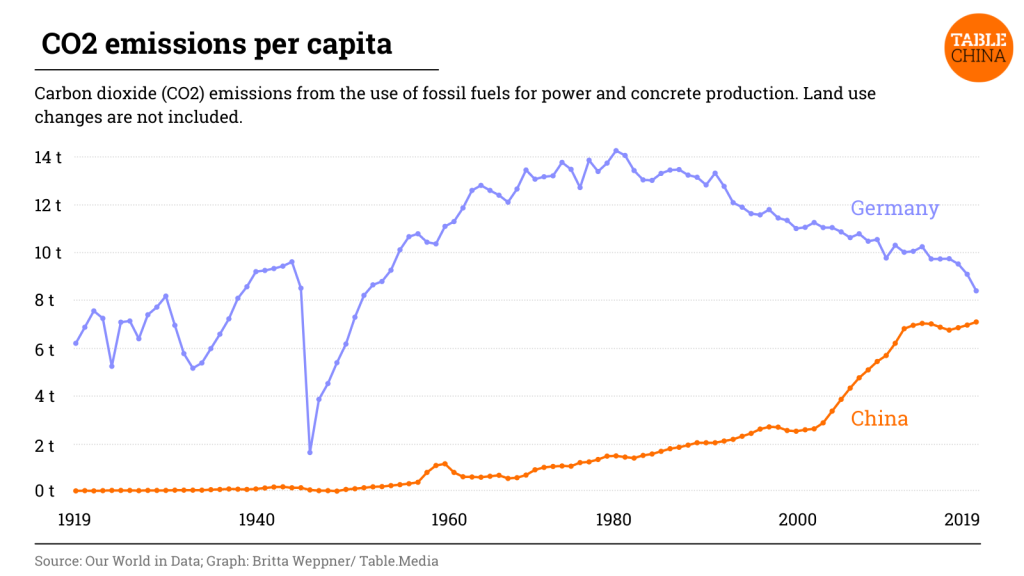

The positive news is that, overall, China has been quite successful in decoupling economic growth from CO2 emissions since 2010. “China has almost doubled per capita economic output since 2010, while CO2 emissions have remained reasonably stable,” says Liu.

And yet, the more emissions are supposed to drop, the harder it will be to maintain the old growth model. Growth through the CO2-intensive construction sector has also helped the political elite in crises past. During the most recent economic crisis in the wake of the Covid pandemic, Beijing fell back on old patterns: Billions were pumped into the CO2-intensive construction sector.

However, China’s political leadership is willing to shut down CO2-intensive industries, says Alexander Brown, an analyst at China research institute Merics. This has social consequences: Already since 2015, employment in coal mining and metal production has been on the decline.

The climate reversal also holds potential for major social tensions. The legitimacy of the Chinese Communist Party rests on its ability to create jobs and enable citizens to share in the growing prosperity. There are “threats of social instability and economic stagnation,” writes Sam Geall, an energy and environment expert at think tank Chatham House. This is one reason why the government is not adopting more ambitious climate targets for now.

China’s CO2-intensive industries employ tens of millions of workers. The construction sector alone employs 54 to over 60 million people, varying by source. Coal mining employs between 2.6 and 5 million Chinese citizens, varying by source. By comparison, according to scientific forecasts, the Chinese solar industry will have created approximately 2.3 million new jobs in manufacturing, assembly, and maintenance by 2035. New solar jobs do not even begin to compensate for lost coal employment.

In addition to the loss of jobs in the power industry, millions of workers in the steel, aluminum, and chemical industries, as well as in service industries dependent on these sectors, could lose their jobs. And many of those jobs are located in the poorer regions of the country, says Merics analyst Brown. In Shanxi, coal mining accounts for nearly six percent of employment. “Energy-intensive industries are crucial to driving employment and economic output outside of China’s more developed eastern region,” Brown said. The trend is thus hitting rural China the hardest. Yet the government originally wanted to stem the exodus from western China to its rich coastal regions.

What’s more, many workers in the CO2-intensive sectors are poorly educated. According to development economist Scott Rozelle of Stanford University, China is already suffering from a massive shortage of skilled labor.

The vast majority of its workforce, according to Rozelle, lacks basic skills to become specialists in the service sector, technicians in a chip factory, or to take on office jobs. As a result, 200 to 300 million people could be structurally “unemployable” in the future, Rozelle said. In 2008, he was honored with the Chinese Government’s Friendship Award, the highest award for foreign experts.

The International Labour Organization (ILO) also states in a study that the number of new jobs created by the renewable energy sector is limited. The restructuring of the power industry will “increasingly create employment problems”, writes the ILO. Older and poorly trained workers in particular have few employment chances in the sector.

So the faster China rebuilds its economy towards more climate protection, the more of its poorly educated people are at risk of being left behind, which will lead to greater social unrest.

On top of all these challenges, China is not a monolithic political bloc. Climate policy is largely defined by the central government. But there are powerful actors in China’s provinces and cities with interests that stand in the way of climate policy. Local officials and municipal leaders traditionally rise within the Chinese Communist Party if they create high economic growth, which in the past has often been at the expense of the environment and the climate.

The preservation of tax revenues and jobs from and in fossil industries is also an important political goal for some provincial governors. There are efforts to give environmental aspects a greater role when promoting civil servants, but how quickly these efforts will become reality remains to be seen.

Whether China’s political elite will succeed in reconciling climate protection with vital growth, power security and social stability will be a central question in the coming decades. At present, China’s environmental and climate protection lobbies within the political elite “still face an uphill battle to increase domestic ambition when faced with powerful incumbents“, analyses Sam Geall.

A decade of setting goals should be followed by a decade of implementation. This is the credo of the World Climate Conference (COP26). On Tuesday, more than 40 heads of state and government signed the so-called “Glasgow Breakthrough Agenda” with five concrete common concerns up to the year 2030. The states, including the USA, India, China, and the EU, want to better coordinate and strengthen their climate protection measures, particularly in emission-intensive areas to accelerate the development and use of clean technologies and reduce costs as much as possible.

The agreement also aims to promote private investment in green technologies by gaining the confidence of potential investors in functioning markets through appropriate announcements. In addition to the energy sector, the transport sector, and agriculture, this also includes the global steel industry. By 2030, “virtually emission-free” steel is to become the first choice worldwide. To this end, green hydrogen is also to be made globally available as an energy carrier. The signatory countries account for 32 percent of global steel production, and the sector in turn is responsible for around seven percent of global greenhouse gas emissions.

If the state framework conditions were right, companies would follow suit and embark on the path of climate neutrality, according to State Secretary for the Environment Jochen Flasbarth. However, policy-makers have concentrated on the energy sector for too long and ignored the fact that the decarbonization processes in other parts of the economy are considerably more demanding. Energy-intensive industries such as the steel sector, therefore, need support not only in converting production. After all, the innovative processes are also associated with higher operating costs.

As a possible solution, so-called carbon contracts for difference are already being traded in Europe, whereby the additional costs of emission-free production compared to the use of conventional technologies are compensated by the state. “But decarbonization of steel production will not succeed through public financial aid alone,” says Flasbarth. “In addition, we need stronger international cooperation, a level playing field.”

For Aditya Mittal, CEO of the steel group ArcelorMittal, one of the key requirements of the world climate conference is to develop such a partnership, particularly between industrialized and emerging countries. Otherwise, the opportunity for a balanced market would be missed, Western countries would be left behind in decarbonization and poorer countries would be left without the corresponding development potential.

Mittal welcomes India’s recent commitment to climate neutrality. The country has great potential for renewable energy and the joint venture with Nippon Steel for the production of Green Steel, he said. But India is a poor country and cannot manage the process on its own, Mittal said, calling for financial support from developed nations.

A current study by the think tank Agora Energiewende provides a further financing approach for the transformation of the global steel industry. According to the authors, more than 70 percent of existing coal-based blast furnaces worldwide will have reached the end of their technical service life by 2030, making reinvestment necessary. In Japan, South Korea, and China, the figure is even higher, and in the USA it is almost 97 percent.

According to Agora, if these reinvestments were channeled into switching to green technologies, around 1.3 million existing jobs in the steel industry could be converted from coal-based to clean production, while 240,000 new green jobs would be created in emerging economies. At the same time, this could stop 1.3 gigatons of CO2 from entering the atmosphere each year.

Frankfurt will be the headquarters of the new International Sustainability Standards Board, ISSB. The Board of Directors will be based there and the ISSB Chair will have his office there, the International Financial Reporting Standards Foundation (IFRS Foundation) announced in Glasgow. Other key functions will also be located in Montreal, Canada.

The ISSB aims to set global standards for climate-related corporate financial reporting. “Sustainability, and climate change, in particular, is the defining issue of our time,” said Erkki Liikanen, Chairman of the Foundation. To assess opportunities and risks, investors need high-quality, transparent, and globally comparable reporting, he added. The global IFRS accounting standards have already been created under the umbrella of the Foundation.

There is currently still a patchwork of reporting on sustainability and climate issues worldwide. The development of uniform requirements is intended to better protect investors from “greenwashing”. According to Ashley Adler, Chairman of the International Organization of Securities Commissions (IOSCO), the creation of a security framework is being considered, by which it is checked whether companies also comply with the ISSB standards. This already exists for traditional financial reporting. rtr

Controversial surveillance software maker NSO Group has been placed on a sanctions list for rogue cyber actors by the U.S. Department of Commerce. This will make it more difficult for the company to operate in the US as well as maintain business relationships with US companies – these will be subject to approval.

The restrictions could significantly reduce the company’s access to not only hardware and software but also to services. The company’s business-critical access to previously unknown security vulnerabilities could also be made more difficult in the future due to its inclusion on the list of export restrictions. In addition to NSO Group, another Israeli provider, Candiru, was added to the sanctions list, as was a company from Singapore and another from Russia.

Secretary of Commerce Gina Raimondo justified the move, saying the US felt obligated to “aggressively use export controls to hold accountable those companies that develop, trade, or use technology for malicious activities and that threaten the cybersecurity of members of civil society, dissidents, government officials, and organizations here and abroad.” The Department of Industry and Security’s assessment also specifically mentions a threat to business people, academics, and embassy staff.

A spokesperson for NSO Group rejects this assessment by US authorities. The spokesperson said NSO Group was “dismayed by this decision, as our technologies support US national security interests and policies by preventing terrorism and crime, and we will therefore work to reverse this decision.” It said it wanted to fully demonstrate to the US side “how it operates the most rigorous compliance and human rights program in the world” based on America’s values, which it shares. This program has already led to multiple contract terminations with government agencies that have misused the company’s products, an NSO spokesperson told Europe.Table.

Surveillance software from NSO Group has also been used by European states and against European citizens, in particular the product “Pegasus”. French and Hungarian nationals, among others, have been demonstrably affected. Especially the use by Hungarian authorities is criticized, but also the use by the German Federal Criminal Police Office is controversial.

In response to a request from Europe.Table, the German Interior Ministry did not comment on Wednesday on whether the US sanctions decision would have consequences for use by German authorities, for reasons of method protection. Only on Tuesday, French President Emmanuel Macron and Israeli Prime Minister Naftali Bennet are said to have agreed on a “discreet treatment” of the NSO affair. fst

According to all three political parties, the coalition negotiators are aiming to abolish the electricity rate surcharge for the expansion of green electricity in 2023. From January of that year, the so-called EEG surcharge should no longer be levied, representatives of the SPD, Greens, and FDP told Reuters on Wednesday. “This is the right signal given high-energy prices and is also financeable,” a negotiator said.

FDP leader Christian Lindner confirmed to the FAZ that the levy would soon be abolished: “If it is possible to abolish the EEG levy without higher taxes, that is a win. The fact that the three parties have agreed on this is a good signal to the center in our country.” Even before the election, all three parties had spoken out in favor of a reduction or rapid abolition of the levy.

However, progress seems to be less rapid in other areas: The Greens are calling for improvements to a jointly presented exploratory paper. According to information from all three parties, this relates in particular to the transport sector. In the exploratory paper, reference is made to the EU Commission’s Fit for 55 package, which provides for a de facto ban on new gas or diesel cars by 2035 at the latest. However, it does not contain any tightening of the fleet limits for new cars in terms of CO2 emissions by 2030.

A reduction of 55 percent compared to 2021 is still anchored here, but this is considered by climate protectionists to be far from sufficient. To restrict the sale of diesel and gas cars, some of which have been on the road for more than 15 years, the figure would have to be 75 to 80 percent. This has not only been calculated by environmental groups, the estimate can also be found in internal analyses of the current federal government, which are available to Reuters. rtr

Alphabet plans to reopen its Google News service in Spain early next year after the government passed new legislation that allows media outlets to negotiate directly with the tech giant, the company said on Wednesday.

The service closed in 2014 after the government passed a rule that forced Alphabet and other news aggregators to pay a collective licensing fee to republish headlines or snippets of news.

“Starting early next year, Google News will provide links to useful and relevant news stories,” Google Spain Country Manager Fuencisla Clemares wrote on a company blog. “Over the coming months, we will be working with publishers to reach agreements which cover their rights under the new law,” he added.

The Spanish government on Tuesday approved a European Union copyright directive that allows third-party online news platforms to negotiate directly with content providers. The EU legislation, which must be adopted by all member states, requires platforms such as Google, Facebook, and others to share revenue with publishers but it also removes the collective fee and allows them to reach individual or group agreements with publishers.

The debate over Google News had pitched traditional media, who backed the old system, against a new breed of online outlets, who expected more revenues from direct agreements with Alphabet and the other platforms than through their share of the collective fee. rtr/sas

Susanne Dröge is Senior Fellow at the Stiftung Wissenschaft und Politik

While the world looks to Glasgow for climate policy breakthroughs, the EU and the US announced a project on the sidelines of the G20 summit last weekend that aims to reduce emissions in a new way. With a “Global Arrangement on Sustainable Steel and Aluminum“, the two trading partners aim not only to settle their long-running dispute over US tariffs on steel and aluminum products but also to drive decarbonization in the two energy-intensive sectors. Can this succeed and is this a viable “climate club”?

The negotiations, which are scheduled to last two years, will be interesting in three respects. Firstly, the punitive tariffs of 25 and 10 percent on steel and aluminum imports from the EU and other countries introduced under President Trump in 2018 will be withdrawn immediately. The EU challenged their justification before the WTO and in return imposed tariffs on American consumer goods.

The conflict has now been defused, although not yet fully, because for the time being, there is only duty-free treatment for the quantities that have been traded up to 2018. However, this paves the way for closer cooperation in trade policy and better cooperation on climate policy projects.

Secondly, this transatlantic project is an important test for climate policy coordination. The agreements, which have yet to be specified, could help to reduce CO2 emissions from two energy-intensive sectors. After all, global steel production accounts for eight percent, and aluminum for two percent of the annual global volume of this greenhouse gas. To this end, the two parties want to do something about global overcapacities as well as talk about common standards for emissions and agree on methods for measuring them.

The deal thus takes the sand out of the gears, which is severely disturbing the connection between the Commission’s Green Deal and Joe Biden’s climate agenda. With its plans for a carbon cap and trade mechanism (CBAM), the European Commission had ensured that the still-new US administration was under pressure at the beginning of the year to position itself with its offers and proposals.

In July, the Commission then fleshed out the draft CBAM as part of the Fit for 55 legislative packages. A levy on imported goods from four industrial sectors and electricity imports, based on their CO2 content, is intended to ensure that EU producers remain competitive in the face of rising CO2 prices in the future.

The US was not enthusiastic about the idea, especially since crediting foreign CO2 prices for US goods is not possible – this is because the US does not have a CO2 price. Instead, there are strict standards and other regulatory measures to reduce emissions in the US industry. The negotiations will therefore also be about reaching an understanding on reciprocal crediting of climate policy measures.

In proclaiming a “global” arrangement, there also seems to be an invitation that this deal could encompass more than just the two transatlantic partners and thus have the makings of a blueprint for a “climate club“.

However, both initiators have already disqualified one important partner: China. Steel from China will instead confront continued access restrictions to the EU and US markets because Chinese companies are accused of dumping and of emitting too much CO2. The White House stresses that this would encourage carbon leakage, but in doing so it is primarily addressing American voters who are more afraid of Chinese job competition than climate change.

The plan could therefore turn into a poisoned gift to the global community if it alienates potential supporters and possibly only lasts as long as the Democrats in the US remain in power. For the EU the question also arises whether it wants to combine climate protection with market isolation from the biggest climate polluter in the long term. Given the COP26 and its diplomatic minefields, more openness towards the Chinese partners would have done a better job.

3.50 British pounds, equivalent to about 4 euros – that’s how much the participants of the climate summit in Glasgow have to pay for a croissant at the conference. A steep price, even by post-Brexit island standards. Critics already suspected a French surcharge after the current incidents – but no, that too, probably not the reason.

The butter-dripping puff pastry specialty is now causing discussions for completely different reasons: The CO2 costs are shown on all COP26 dishes. Did the organizers buy emission rights and included them in the price calculation?

A vigilant Irish journalist snapped a photo showing that a single croissant was the equivalent of 0.5 kilograms of carbon dioxide, according to the tag. And thus more than the 0.4 kilograms of bun with traditional Ayrshire bacon is said to cause.

So what’s going on there? Are the croissants being delivered to the climate summit by plane?

British investigative media, at any rate, pounced on the story of the delicious, but both health-wise and ecological questionable French treat. Even the French Minister for the Environment, Barbara Pompili, was quoted as saying that she had demanded that her compatriots resort to alternatives given the croissants’ mediocre eco-balance.

The whole fuss about the Glasgow croissants turned out to be pretty pointless in the end: The calculation was simply wrong – the climate summit croissants might be overpriced, but at least they’re vegan.

This calls for a Baguette Magique!

Since August, we have been reporting for you in German on the political processes in Europe and the discourses in Germany relevant to European policy. As of today, we also offer our news and analyses in English. Many observers outside Germany are wondering how the most important EU member state will position itself in Europe in the future after 16 years with Chancellor Angela Merkel. We wish to cater to this desire for information. If you want to test the International Edition yourself or recommend it to your colleagues, you can register here: Europe.Table Professional Briefing

In this issue you will find a lot on climate policy, one of our main topics – not only during COP26. Lukas Scheid reports on the Glasgow Financial Alliance for Net Zero, an alliance of private banks, insurers, and investors that wants to mobilize trillions for renewable energy and sustainable business.

Some see greenwashing behind the initiative – investors should first stop financing fossil fuels, NGOs demand. A new global standard that the International Sustainability Standards Board (ISSB) wants to develop could create more transparency in the market for green investments.

Greta Thunberg complains about greenwashing of a different kind: Together with other activists, she interrupted a panel discussion about so-called offset measures. This form of compensation for one’s CO2 emissions is a “dangerous climate lie” and “hypocritical”.

China is often criticized in Europe and the US as a laggard in climate protection. However, for the economy, which generates about 28 percent of global CO2 emissions annually, it will be a gigantic challenge to reduce emissions to “net-zero” by 2060, analyzes Nico Beckert.

The efforts of the US government to exclude Beijing via the steel agreement with the EU could prove to be of little help warns Susanne Dröge, a trade expert at the think tank Stiftung Wissenschaft und Politik, in her guest article.

I hope you enjoy today’s issue. If you have any feedback, please feel free to let me know: till.hoppe@table.media

The members of the alliance, which account for around 40 percent of global capital, declared at the global climate conference in Glasgow (COP26) that they want to take on a “fair share” of the efforts to phase out fossil fuels. They want to make their portfolios carbon-neutral by 2050 by shifting their investments to renewable energy and sustainable economies.

UN climate envoy Mark Carney, who launched the GFANZ, put the investment at $100 trillion over the next three decades. He said the finance industry needed to find ways to raise private money so the effort went far beyond what states could do on their own. The money is there, but it must go to net-zero projects.

“We need to rethink finance,” said Larry Fink, chief executive of Blackrock, the world’s largest asset manager, which has joined the alliance. “We can do something about the climate, but we can’t cherry-pick and greenwash by just asking public companies to step forward.” The development of vaccines against COVID-19 shows what collective action can achieve, he said.

The GFANZ signatories include over 450 companies from 45 countries – including the DAX companies Allianz, Munich Re, and Deutsche Bank. They must submit scientifically sound short, as well as long-term, reduction targets no later than 18 months after joining. Over 90 of the founding institutions have already done so.

Companies must review their targets every five years to see if they are still on the net-zero path and report annually on their progress and the emissions caused by their portfolios. One focus of the alliance is to support developing and emerging countries on the path to a climate-neutral economy.

David Ryfisch, International Climate Policy Team Leader at the environment and development organization Germanwatch, welcomes the announcement. “The GFANZ are not only committing to Net-Zero by 2050, but they also want to reduce emissions from their activities by 50 percent by 2030,” he said in an interview with Europe.Table. He added that it would only be possible to say how effective the alliance was once all the details were known. Yet, the announcement that the financial portfolios will be shifted quickly towards green investments is the first step.

The framework developed by GFANZ will be decisive. It defines the extent to which emissions in the portfolios of banks, insurers, and investors must be reduced to achieve the targets. The crucial factor here is which emissions are included. Ryfisch demands that so-called Scope 3 emissions are also taken into account – i.e. those that arise along the supply chain and are not caused directly by the company.

However, others are less convinced. “Behind these cheery headlines lie a plethora of loopholes and opportunities for backtracking,” said the Environmental Justice Foundation. “Net-zero pledges mean nothing without fossil fuel phase-out. It’s time for financial institutions to walk the talk and stop financing climate-destroying fossil fuels,” added the NGO’s executive director Steve Trent.

At least 19 countries are expected to announce at today’s COP26 energy day that they will end public financing of fossil fuels abroad by the end of 2022. Big private investors are still holding back on such announcements, as they still invest much of their capital in emissions-intensive activities.

For Rachel Rose Jackson, director of climate policy and research at the NGO Corporate Accountability, the announcements are too vague. “Corporations need to spell out exactly how their trillions will go towards the rapid implementation of real and proven solutions, not risky and fantastical technical solutions.” We already know the modus operandi of companies and financiers making big promises with big numbers, she said. “Then they don’t deliver on those promises.”

Heinz Bierbaum, President of the European Left, also expressed skepticism about the promise of the financial industry. It was questionable whether the changes in investment strategies were compatible with the associated return expectations. Rather, there would have to be binding commitments “that also have political support”, Bierbaum said. With rtr

For Berlin and Washington, Beijing has been part of the problem so far. “China’s role is disappointing,” Environment State Secretary Jochen Flasbarth said on Tuesday at the world climate summit in Glasgow. The commitments made so far by the largest greenhouse gas emitter were not enough. The US had also criticized China, saying that the country could do more.

Yet from China’s point of view, its climate targets are ambitious. Within the next eight years, it wants to reach the peak in national CO2 emissions. By 2060, emissions are then to fall to “net-zero” – at which point only greenhouse gases that are offset elsewhere may be emitted.

The climate targets require action “at an unprecedented speed and scale,” according to climate expert and journalist Liu Hongqiao. “The road to net-zero will not be an easy one.” Economic, social, and political tensions loom. Can China succeed in transforming an economy that causes about 28 percent of global CO2 emissions annually at the necessary speed?

In terms of economic policy, China faces two major challenges: power security and ensuring growth and jobs.

China’s electricity mix currently still consists of about 65 percent coal-fired power. It is clear to everyone that it will be difficult to reduce dependence on an energy source that is readily available. For this to happen, the majority of China’s power supply will have to be changed to renewable energies within a fairly short timeframe.

In its recently adopted climate plans, the government itself talks about “building before destroying.” Before accelerating the phase-out of coal, sufficient renewable energy capacity, power storage, and transmission capacity should first be built. Those in charge will not take any risks here. The current power crisis made it clear to political leaders what is at stake if the shift to renewables jeopardizes power security.

In the past ten years, China has strongly expanded its renewable energy capacities. Wind energy capacity has increased tenfold. The increase in solar energy has been even steeper. However, the overall power demand also increased heavily. Renewables have not yet been able to push back the share of coal-fired power.

China also faces major challenges in building the necessary power lines and storage systems. In recent years, even the construction of some new power plants in the wind and sun-rich western provinces of Gansu, Xinjiang, and Tibet has been halted due to a lack of required transmission capacity and storage systems. In some provinces, more than seven percent of the power produced from renewable sources is thus lost. In Tibet, the figure is almost 25 percent.

The restructuring of the economy will not be easy either. At present, the majority of China’s economy mainly consists of industry. 38 percent of economic output originates from the industrial and construction sectors. In economies such as India, Japan, and the USA, the figure is between 20 and 25 percent. In addition, sectors with high power demand and heavy CO2 emissions are dominating steel, concrete, and aluminum industries, the construction sector, and the (petro)chemical industry. And it is precisely in these sectors in which it is most difficult to reduce greenhouse gas emissions.

The positive news is that, overall, China has been quite successful in decoupling economic growth from CO2 emissions since 2010. “China has almost doubled per capita economic output since 2010, while CO2 emissions have remained reasonably stable,” says Liu.

And yet, the more emissions are supposed to drop, the harder it will be to maintain the old growth model. Growth through the CO2-intensive construction sector has also helped the political elite in crises past. During the most recent economic crisis in the wake of the Covid pandemic, Beijing fell back on old patterns: Billions were pumped into the CO2-intensive construction sector.

However, China’s political leadership is willing to shut down CO2-intensive industries, says Alexander Brown, an analyst at China research institute Merics. This has social consequences: Already since 2015, employment in coal mining and metal production has been on the decline.

The climate reversal also holds potential for major social tensions. The legitimacy of the Chinese Communist Party rests on its ability to create jobs and enable citizens to share in the growing prosperity. There are “threats of social instability and economic stagnation,” writes Sam Geall, an energy and environment expert at think tank Chatham House. This is one reason why the government is not adopting more ambitious climate targets for now.

China’s CO2-intensive industries employ tens of millions of workers. The construction sector alone employs 54 to over 60 million people, varying by source. Coal mining employs between 2.6 and 5 million Chinese citizens, varying by source. By comparison, according to scientific forecasts, the Chinese solar industry will have created approximately 2.3 million new jobs in manufacturing, assembly, and maintenance by 2035. New solar jobs do not even begin to compensate for lost coal employment.

In addition to the loss of jobs in the power industry, millions of workers in the steel, aluminum, and chemical industries, as well as in service industries dependent on these sectors, could lose their jobs. And many of those jobs are located in the poorer regions of the country, says Merics analyst Brown. In Shanxi, coal mining accounts for nearly six percent of employment. “Energy-intensive industries are crucial to driving employment and economic output outside of China’s more developed eastern region,” Brown said. The trend is thus hitting rural China the hardest. Yet the government originally wanted to stem the exodus from western China to its rich coastal regions.

What’s more, many workers in the CO2-intensive sectors are poorly educated. According to development economist Scott Rozelle of Stanford University, China is already suffering from a massive shortage of skilled labor.

The vast majority of its workforce, according to Rozelle, lacks basic skills to become specialists in the service sector, technicians in a chip factory, or to take on office jobs. As a result, 200 to 300 million people could be structurally “unemployable” in the future, Rozelle said. In 2008, he was honored with the Chinese Government’s Friendship Award, the highest award for foreign experts.

The International Labour Organization (ILO) also states in a study that the number of new jobs created by the renewable energy sector is limited. The restructuring of the power industry will “increasingly create employment problems”, writes the ILO. Older and poorly trained workers in particular have few employment chances in the sector.

So the faster China rebuilds its economy towards more climate protection, the more of its poorly educated people are at risk of being left behind, which will lead to greater social unrest.

On top of all these challenges, China is not a monolithic political bloc. Climate policy is largely defined by the central government. But there are powerful actors in China’s provinces and cities with interests that stand in the way of climate policy. Local officials and municipal leaders traditionally rise within the Chinese Communist Party if they create high economic growth, which in the past has often been at the expense of the environment and the climate.

The preservation of tax revenues and jobs from and in fossil industries is also an important political goal for some provincial governors. There are efforts to give environmental aspects a greater role when promoting civil servants, but how quickly these efforts will become reality remains to be seen.

Whether China’s political elite will succeed in reconciling climate protection with vital growth, power security and social stability will be a central question in the coming decades. At present, China’s environmental and climate protection lobbies within the political elite “still face an uphill battle to increase domestic ambition when faced with powerful incumbents“, analyses Sam Geall.

A decade of setting goals should be followed by a decade of implementation. This is the credo of the World Climate Conference (COP26). On Tuesday, more than 40 heads of state and government signed the so-called “Glasgow Breakthrough Agenda” with five concrete common concerns up to the year 2030. The states, including the USA, India, China, and the EU, want to better coordinate and strengthen their climate protection measures, particularly in emission-intensive areas to accelerate the development and use of clean technologies and reduce costs as much as possible.

The agreement also aims to promote private investment in green technologies by gaining the confidence of potential investors in functioning markets through appropriate announcements. In addition to the energy sector, the transport sector, and agriculture, this also includes the global steel industry. By 2030, “virtually emission-free” steel is to become the first choice worldwide. To this end, green hydrogen is also to be made globally available as an energy carrier. The signatory countries account for 32 percent of global steel production, and the sector in turn is responsible for around seven percent of global greenhouse gas emissions.

If the state framework conditions were right, companies would follow suit and embark on the path of climate neutrality, according to State Secretary for the Environment Jochen Flasbarth. However, policy-makers have concentrated on the energy sector for too long and ignored the fact that the decarbonization processes in other parts of the economy are considerably more demanding. Energy-intensive industries such as the steel sector, therefore, need support not only in converting production. After all, the innovative processes are also associated with higher operating costs.

As a possible solution, so-called carbon contracts for difference are already being traded in Europe, whereby the additional costs of emission-free production compared to the use of conventional technologies are compensated by the state. “But decarbonization of steel production will not succeed through public financial aid alone,” says Flasbarth. “In addition, we need stronger international cooperation, a level playing field.”

For Aditya Mittal, CEO of the steel group ArcelorMittal, one of the key requirements of the world climate conference is to develop such a partnership, particularly between industrialized and emerging countries. Otherwise, the opportunity for a balanced market would be missed, Western countries would be left behind in decarbonization and poorer countries would be left without the corresponding development potential.

Mittal welcomes India’s recent commitment to climate neutrality. The country has great potential for renewable energy and the joint venture with Nippon Steel for the production of Green Steel, he said. But India is a poor country and cannot manage the process on its own, Mittal said, calling for financial support from developed nations.

A current study by the think tank Agora Energiewende provides a further financing approach for the transformation of the global steel industry. According to the authors, more than 70 percent of existing coal-based blast furnaces worldwide will have reached the end of their technical service life by 2030, making reinvestment necessary. In Japan, South Korea, and China, the figure is even higher, and in the USA it is almost 97 percent.

According to Agora, if these reinvestments were channeled into switching to green technologies, around 1.3 million existing jobs in the steel industry could be converted from coal-based to clean production, while 240,000 new green jobs would be created in emerging economies. At the same time, this could stop 1.3 gigatons of CO2 from entering the atmosphere each year.

Frankfurt will be the headquarters of the new International Sustainability Standards Board, ISSB. The Board of Directors will be based there and the ISSB Chair will have his office there, the International Financial Reporting Standards Foundation (IFRS Foundation) announced in Glasgow. Other key functions will also be located in Montreal, Canada.

The ISSB aims to set global standards for climate-related corporate financial reporting. “Sustainability, and climate change, in particular, is the defining issue of our time,” said Erkki Liikanen, Chairman of the Foundation. To assess opportunities and risks, investors need high-quality, transparent, and globally comparable reporting, he added. The global IFRS accounting standards have already been created under the umbrella of the Foundation.

There is currently still a patchwork of reporting on sustainability and climate issues worldwide. The development of uniform requirements is intended to better protect investors from “greenwashing”. According to Ashley Adler, Chairman of the International Organization of Securities Commissions (IOSCO), the creation of a security framework is being considered, by which it is checked whether companies also comply with the ISSB standards. This already exists for traditional financial reporting. rtr

Controversial surveillance software maker NSO Group has been placed on a sanctions list for rogue cyber actors by the U.S. Department of Commerce. This will make it more difficult for the company to operate in the US as well as maintain business relationships with US companies – these will be subject to approval.

The restrictions could significantly reduce the company’s access to not only hardware and software but also to services. The company’s business-critical access to previously unknown security vulnerabilities could also be made more difficult in the future due to its inclusion on the list of export restrictions. In addition to NSO Group, another Israeli provider, Candiru, was added to the sanctions list, as was a company from Singapore and another from Russia.

Secretary of Commerce Gina Raimondo justified the move, saying the US felt obligated to “aggressively use export controls to hold accountable those companies that develop, trade, or use technology for malicious activities and that threaten the cybersecurity of members of civil society, dissidents, government officials, and organizations here and abroad.” The Department of Industry and Security’s assessment also specifically mentions a threat to business people, academics, and embassy staff.

A spokesperson for NSO Group rejects this assessment by US authorities. The spokesperson said NSO Group was “dismayed by this decision, as our technologies support US national security interests and policies by preventing terrorism and crime, and we will therefore work to reverse this decision.” It said it wanted to fully demonstrate to the US side “how it operates the most rigorous compliance and human rights program in the world” based on America’s values, which it shares. This program has already led to multiple contract terminations with government agencies that have misused the company’s products, an NSO spokesperson told Europe.Table.

Surveillance software from NSO Group has also been used by European states and against European citizens, in particular the product “Pegasus”. French and Hungarian nationals, among others, have been demonstrably affected. Especially the use by Hungarian authorities is criticized, but also the use by the German Federal Criminal Police Office is controversial.

In response to a request from Europe.Table, the German Interior Ministry did not comment on Wednesday on whether the US sanctions decision would have consequences for use by German authorities, for reasons of method protection. Only on Tuesday, French President Emmanuel Macron and Israeli Prime Minister Naftali Bennet are said to have agreed on a “discreet treatment” of the NSO affair. fst

According to all three political parties, the coalition negotiators are aiming to abolish the electricity rate surcharge for the expansion of green electricity in 2023. From January of that year, the so-called EEG surcharge should no longer be levied, representatives of the SPD, Greens, and FDP told Reuters on Wednesday. “This is the right signal given high-energy prices and is also financeable,” a negotiator said.

FDP leader Christian Lindner confirmed to the FAZ that the levy would soon be abolished: “If it is possible to abolish the EEG levy without higher taxes, that is a win. The fact that the three parties have agreed on this is a good signal to the center in our country.” Even before the election, all three parties had spoken out in favor of a reduction or rapid abolition of the levy.

However, progress seems to be less rapid in other areas: The Greens are calling for improvements to a jointly presented exploratory paper. According to information from all three parties, this relates in particular to the transport sector. In the exploratory paper, reference is made to the EU Commission’s Fit for 55 package, which provides for a de facto ban on new gas or diesel cars by 2035 at the latest. However, it does not contain any tightening of the fleet limits for new cars in terms of CO2 emissions by 2030.

A reduction of 55 percent compared to 2021 is still anchored here, but this is considered by climate protectionists to be far from sufficient. To restrict the sale of diesel and gas cars, some of which have been on the road for more than 15 years, the figure would have to be 75 to 80 percent. This has not only been calculated by environmental groups, the estimate can also be found in internal analyses of the current federal government, which are available to Reuters. rtr

Alphabet plans to reopen its Google News service in Spain early next year after the government passed new legislation that allows media outlets to negotiate directly with the tech giant, the company said on Wednesday.

The service closed in 2014 after the government passed a rule that forced Alphabet and other news aggregators to pay a collective licensing fee to republish headlines or snippets of news.

“Starting early next year, Google News will provide links to useful and relevant news stories,” Google Spain Country Manager Fuencisla Clemares wrote on a company blog. “Over the coming months, we will be working with publishers to reach agreements which cover their rights under the new law,” he added.

The Spanish government on Tuesday approved a European Union copyright directive that allows third-party online news platforms to negotiate directly with content providers. The EU legislation, which must be adopted by all member states, requires platforms such as Google, Facebook, and others to share revenue with publishers but it also removes the collective fee and allows them to reach individual or group agreements with publishers.

The debate over Google News had pitched traditional media, who backed the old system, against a new breed of online outlets, who expected more revenues from direct agreements with Alphabet and the other platforms than through their share of the collective fee. rtr/sas

Susanne Dröge is Senior Fellow at the Stiftung Wissenschaft und Politik

While the world looks to Glasgow for climate policy breakthroughs, the EU and the US announced a project on the sidelines of the G20 summit last weekend that aims to reduce emissions in a new way. With a “Global Arrangement on Sustainable Steel and Aluminum“, the two trading partners aim not only to settle their long-running dispute over US tariffs on steel and aluminum products but also to drive decarbonization in the two energy-intensive sectors. Can this succeed and is this a viable “climate club”?

The negotiations, which are scheduled to last two years, will be interesting in three respects. Firstly, the punitive tariffs of 25 and 10 percent on steel and aluminum imports from the EU and other countries introduced under President Trump in 2018 will be withdrawn immediately. The EU challenged their justification before the WTO and in return imposed tariffs on American consumer goods.

The conflict has now been defused, although not yet fully, because for the time being, there is only duty-free treatment for the quantities that have been traded up to 2018. However, this paves the way for closer cooperation in trade policy and better cooperation on climate policy projects.

Secondly, this transatlantic project is an important test for climate policy coordination. The agreements, which have yet to be specified, could help to reduce CO2 emissions from two energy-intensive sectors. After all, global steel production accounts for eight percent, and aluminum for two percent of the annual global volume of this greenhouse gas. To this end, the two parties want to do something about global overcapacities as well as talk about common standards for emissions and agree on methods for measuring them.

The deal thus takes the sand out of the gears, which is severely disturbing the connection between the Commission’s Green Deal and Joe Biden’s climate agenda. With its plans for a carbon cap and trade mechanism (CBAM), the European Commission had ensured that the still-new US administration was under pressure at the beginning of the year to position itself with its offers and proposals.

In July, the Commission then fleshed out the draft CBAM as part of the Fit for 55 legislative packages. A levy on imported goods from four industrial sectors and electricity imports, based on their CO2 content, is intended to ensure that EU producers remain competitive in the face of rising CO2 prices in the future.

The US was not enthusiastic about the idea, especially since crediting foreign CO2 prices for US goods is not possible – this is because the US does not have a CO2 price. Instead, there are strict standards and other regulatory measures to reduce emissions in the US industry. The negotiations will therefore also be about reaching an understanding on reciprocal crediting of climate policy measures.

In proclaiming a “global” arrangement, there also seems to be an invitation that this deal could encompass more than just the two transatlantic partners and thus have the makings of a blueprint for a “climate club“.

However, both initiators have already disqualified one important partner: China. Steel from China will instead confront continued access restrictions to the EU and US markets because Chinese companies are accused of dumping and of emitting too much CO2. The White House stresses that this would encourage carbon leakage, but in doing so it is primarily addressing American voters who are more afraid of Chinese job competition than climate change.

The plan could therefore turn into a poisoned gift to the global community if it alienates potential supporters and possibly only lasts as long as the Democrats in the US remain in power. For the EU the question also arises whether it wants to combine climate protection with market isolation from the biggest climate polluter in the long term. Given the COP26 and its diplomatic minefields, more openness towards the Chinese partners would have done a better job.

3.50 British pounds, equivalent to about 4 euros – that’s how much the participants of the climate summit in Glasgow have to pay for a croissant at the conference. A steep price, even by post-Brexit island standards. Critics already suspected a French surcharge after the current incidents – but no, that too, probably not the reason.

The butter-dripping puff pastry specialty is now causing discussions for completely different reasons: The CO2 costs are shown on all COP26 dishes. Did the organizers buy emission rights and included them in the price calculation?

A vigilant Irish journalist snapped a photo showing that a single croissant was the equivalent of 0.5 kilograms of carbon dioxide, according to the tag. And thus more than the 0.4 kilograms of bun with traditional Ayrshire bacon is said to cause.

So what’s going on there? Are the croissants being delivered to the climate summit by plane?

British investigative media, at any rate, pounced on the story of the delicious, but both health-wise and ecological questionable French treat. Even the French Minister for the Environment, Barbara Pompili, was quoted as saying that she had demanded that her compatriots resort to alternatives given the croissants’ mediocre eco-balance.

The whole fuss about the Glasgow croissants turned out to be pretty pointless in the end: The calculation was simply wrong – the climate summit croissants might be overpriced, but at least they’re vegan.

This calls for a Baguette Magique!