The war in Ukraine has pushed the energy transition back to the top of Europe’s political agenda. Germany wants to invest more in “freedom energies” (German Minister of Finance Christian Lindner on renewables). The EU wants to move away from Russian gas. Will China move to fill this gap and become the main buyer of Russian energy raw materials?

There are indeed first rumors that Chinese state-owned enterprises could now buy into Gazprom and others. But China could hardly be interested in becoming dependent on Russian gas. The People’s Republic is striving for energy security, and that includes remaining relatively independent of foreign countries when it comes to energy raw materials. Energy security is one of the key issues at the National People’s Congress. More likely than a gas dependence on Russia, China will continue to rely on domestic coal to secure its power supply.

But the People’s Republic is also investing heavily in the expansion of renewable energies. Christiane Kuehl analyzes how the Olympic and Paralympic Winter Games were used as a pilot project for the energy transition. At the venue in Zhangjiakou, a power grid was installed that is specifically tailored to renewable energies. A pumped-storage power plant was constructed to store surplus wind and solar power. Zhangjiakou could now serve as a blueprint for the further expansion of renewable energies. Perhaps European countries can learn a thing or two from this pilot project for their own energy transition?

Over the first few days of the National People’s Congress (NPC), it once again became clear that energy security is currently more important to the political leadership than climate goals. Last year’s power crisis and rising prices for fossil energy raw materials in the wake of the Ukraine war are causing concern for China’s leaders. As a result, the key goal of energy policy is to secure the power supply. Oil and gas production, as well as coal mining, are to be expanded.

Xi Jinping reiterated in his speech at the People’s Congress that China’s energy transition will not happen overnight. The new must first be built before the old can be torn down, Xi said. Coal-fired power still accounts for a good 60 percent of the People’s Republic’s energy demand. As long as renewables or other energy sources such as gas and nuclear power cannot replace coal, Xi will not take any risks and will not accelerate the shutdown of coal-fired power plants. But what does that mean in practice? Is coal consumption in China about to increase even further to guarantee energy security?

There is some indication that China will consume more coal in the short term. The NPC focused on economic growth. China is aiming for growth of “about 5.5 percent”. Xi Jinping’s re-election is coming up in the fall. So those in charge will pull out all the stops to ensure that growth figures reach or even exceed the envisioned figure by then. Surprisingly, the government has not set a goal for the reduction of power consumption per unit of economic growth for this year. Instead, Beijing wants to retain “appropriate flexibility”.

The government thus wants to keep some room open for infrastructure and construction projects, as well as rapid growth through heavy industry output. However, all these sectors consume a lot of power. Energy analyst Lauri Myllyvirta of the Centre for Research on Energy and Clean Air writes: “I continue to expect that coal consumption and CO2 emissions will increase slightly this year.” This is also confirmed by statements made by the authorities that coal-fired power plants should “exploit their full potential” and “maximize their output” (China.Table reported).

Russia’s attack on Ukraine was a topic that was barely mentioned at the People’s Congress. But energy security is a medal with at least two sides. China’s political leaders want to ensure secure access to energy and power for its economy and citizens. But at the same time, Cina cannot afford to become too dependent on imports of energy commodities such as coal, gas, and oil – because this would put energy security at risk during crises. Xi Jinping already emphasized back in October that they “must hold our energy supplies firmly in our own hands”.

So what implications does the Russian war in Ukraine have for China’s energy security? Unlike many European countries, the People’s Republic is not dependent on Russian energy supplies. While Russia is China’s largest supplier of coal, imports from its neighbor account for only a mere 0.3 percent of the People’s Republic’s coal consumption. China can cover the vast majority of its needs from domestic sources. China can cover the vast majority of its requirements from domestic sources. When it comes to gas, the Russian share is higher. However, China is not yet as dependent on gas in many areas as Europe. A switch back to coal would be easy, according to analysts at the consulting firm Trivium China.

Beijing is in an ideal position. In the next few years, China could buy up all the Russian gas that Europe spurns. If Russia escalates the war in Ukraine to the point where it would become a permanent international pariah, discounts could even beckon for Beijing. Still, China’s political leaders will most likely be smart enough not to become trapped in a gas dependency on an unpredictable Russia. That would contradict its goal of energy security.

However, China could buy its way into Russian power companies such as Gazprom. According to Bloomberg information, responsible policymakers in Beijing are in talks with state-owned enterprises such as China National Petroleum about possible investments in Russian companies or assets. Any stake would serve to boost China’s energy imports and security, Bloomberg cites individuals familiar with the talks as saying. The stated goal, they say, is not to support Russia’s invasion. However, the talks between Chinese and Russian companies are reportedly still in early stages.

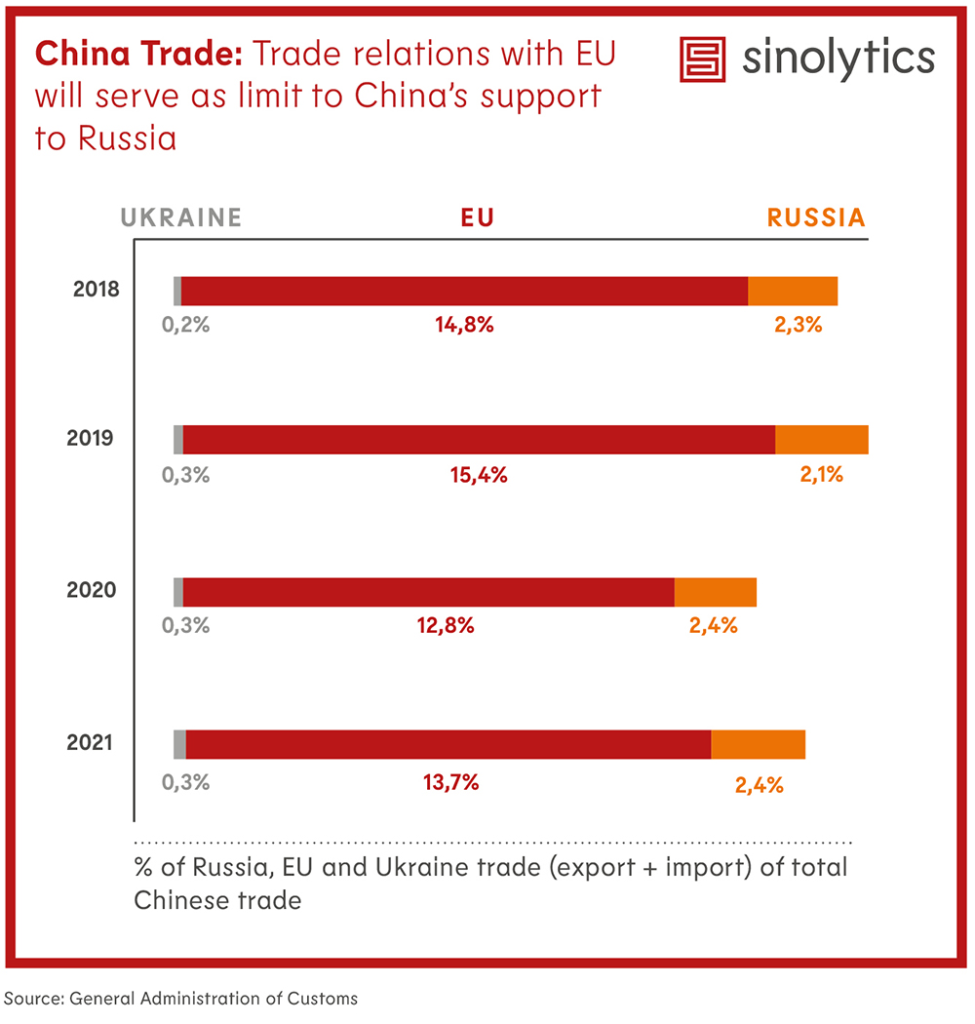

On top of that: China is still dependent on Western exports and technologies in many economic areas. A too large swing toward Russia that would scare off Western business and trade partners is not very likely. As Trivium analysts write, “We believe that the costs of a true alliance with Putin against the world outweigh the benefits by far.”

Even though coal consumption is likely to increase in the short term, China is not ignoring the expansion of renewable energies. According to Premier Li Keqiang’s work report, China plans to push ahead with the expansion of large-scale wind and solar power plants. In addition, China plans to increase the capacity of its power grids. This would result in less renewable energy being lost. Offshore wind power is to be promoted in particular. Power storage facilities are also to be expanded (China.Table reported). To this end, a “Five-Year Energy Storage Plan” is currently being discussed. The Chinese Ministry of Finance also announced that it would finally pay out overdue subsidies to developers of renewable energy projects. There have been major delays in this regard in recent years, with the result that funds have been lacking in some cases to launch new projects.

But the expansion of renewable energy sources takes time. It will take several years before solar, wind and hydro power can drastically reduce the share of fossil fuels in the energy mix – especially if power demand continues to rise.

Green, carbon-neutral Games is what Beijing wanted to host. This is practically impossible for the Winter Games if material and power consumption for the venues are taken into account. The organizers have to publish their climate balance sheet after the end of the Paralympics. But for the future, the remaining infrastructure is more decisive than the climate balance of the Olympics. After all, the Olympics have made Zhangjiakou a pilot region for the generation, grid feeding and direct marketing of wind and solar power.

The new infrastructure that was built for the Olympics currently supplies the 25 sports venues with green power – and soon Beijing’s metropolitan area. Wind and sun could currently generate around 44 terawatt-hours (TWh) per year in Zhangjiakou, more than many countries in the world, according to an analysis by energy experts Lauri Myllyvirta and Xing Zhang from the Centre for Research on Energy and Clean Air. Without the Olympics, Zhangjiakou and the surrounding area consume around 19 TWh of their own power.

So, according to the Olympic planners, 25 TWh will be available once all athletes have left. Of these, about 14 TWh of renewable energy is expected to be transferred from Zhangjiakou to Beijing each year. That corresponds to about ten percent of the capital’s power demand. Another seven TWh annually are to be transmitted to Xiong’an, the “City of the Future” currently under construction in southeast Beijing, a pet project of the head of state Xi Jinping.

A dedicated power grid has also been created for the Olympics. A total of ¥12.5 billion (just under €1.8 billion) went into building the “Zhangbei Renewable Energy Flexible DC Power Grid Demonstration Project” (DC stands for “direct current”; Zhangbei 张北 refers to northern Zhangjiakou). “The ‘flexible green electricity grid’ in Zhangjiakou is the first of its kind to use direct current, a technology much better suited for very long-distance transmission than alternating current,” write Myllyvirta and Zhang. Power to Xiong’an is said to be transmitted via an ultra-high-voltage line.

A stable power supply is to be ensured by a new pumped storage power plant with a capacity of 3.6 gigawatts near the small town of Fengning located north of Beijing. Its principle is simple: If the wind and sun generate more power than required, water with the surplus energy is pumped from a lower basin to an upper one and “parked” there. When neither the sun nor the wind generates power, this water is released from the upper basin back into the lower basin. In the process, it flows through two turbines and generates power. “Compared with technologies like utility-scale batteries, utilizing hydropower for energy storage is less complex and more cost-effective,” S&P Global’s Ivy Yin and Eric Yep conclude in a recent article on energy transition.

But power must not only be generated, it also has to be available for purchase. In September 2021, China launched a pilot project for trading green power. It enables large consumers to buy renewable power generated nationwide. Previously, there had only been regional mechanisms for the direct purchase of green power, for example with the involvement of BASF in Guangdong (China.Table reported). Winter Olympics sports venues have been given priority on this new trading platform, according to Myllyvirta and Zhang, allowing venues to buy renewable power at a lower rate.

Zhangjiakou could now serve as a blueprint for the further expansion of renewable energies. By 2030, China’s wind and solar capacity is expected to reach 1,200 gigawatts, almost twice as much as today. The so-called 30/60 targets aim for emissions reversal before 2030 and carbon neutrality by 2060. Premier Li Keqiang, speaking at the plenum of the National People’s Congress on Friday, highlighted the importance of wind and solar power for achieving these goals – and surprisingly did not mention hydropower and nuclear power (China.Table reported).

China’s National Development and Reform Commission also published its goals for 2022 on Saturday, in which the solar industry was also mentioned to be a key to further growth (China.Table reported).

But transmitting the green power is the crux. “A long-standing challenge with China’s long-distance transmission lines has been their inflexible operation,” Myllyvirta and Zhang explain. One problem is that coal-fired power is often given priority in the power grid of Chinese regions. This is why the Zhangjiakou green power project is also about pioneering a new institutional set-up, according to the two experts. This is said to be at least as important as new facilities for generating green power.

The pumped storage power used in the Zhangbei pilot project will also be utilized in the expansion. China plans to double it to 62 GW by 2025 compared to today, and quadruple it to 120 GW by 2030. Some of China’s largest state-owned power utilities, such as the Huadian Group, Huaneng Group, Datang Group and Guohua Power, have been developing green power projects in Zhangjiakou, according to S&P’s Yin and Yep. They could take advantage of this experience.

In any case, Zhangjiakou’s energy mix is well ahead of the rest of the country. Myllyvirta and Zhang calculated that the region would generate a total of 60 percent of its power from wind and solar in January and February 2022. By comparison, the power in the capital is generated almost exclusively from gas. The province of Hebei – where Zhangjiakou is located – burns equal parts coal and gas to generate power, which collectively produces a whopping 90 percent of its power

The region now plans to more than double its wind and solar capacity by 2030, to 50 gigawatts. By 2030, Zhangjiakou plans to have 80 percent renewables, Yin and Yep write, citing local plans. By 2030, it plans to power all public transportation and residential buildings with renewable energy. All industrial sectors are then to operate carbon neutrally. If all this can be verifiably achieved, Zhangjiakou, in the barren mountains of Hebei, could truly become a model region.

Beijing, Berlin, and Paris want to work together for a diplomatic solution to the Ukraine war. In an hour-long exchange, German Chancellor Olaf Scholz and the presidents of China and France, Xi Jinping and Emmanuel Macron, also spoke out in favor of humanitarian aid and access to the combat areas, according to the German government spokesman Steffen Hebestreit. Functioning evacuation corridors should be established.

All three countries expressed their willingness to provide further humanitarian aid. Xi supports Franco-German efforts to reach a cease-fire, the French presidential office said. Xi described the situation in Ukraine as concerning, according to state media, and called for “maximum restraint.” He also expressed concern about the impact of sanctions on the stability of global finance, energy security, and transportation and supply chains.

China has so far refused to condemn the Russian incursion or call it an invasion. Foreign Minister Wang Yi had described China’s friendship with Russia as “rock solid” on Monday (China.Table reported): “No matter how perilous the international landscape, we will maintain our strategic focus and promote the development of a comprehensive China-Russia partnership in the new era.”

According to Wang, however, Beijing is ready to use its influence on Russia: President Xi had already spoken on the phone with Vladimir Putin on February 25. In this telephone call, Xi expressed his wish for Russia and Ukraine to hold peace talks as soon as possible. Putin responded positively – and since then, two rounds of negotiations between Ukraine and Russia have already taken place. The hope now is that further progress will be made in the upcoming third round of talks. rtr/rad

UN High Commissioner for Human Rights, Michelle Bachelet, plans to travel to China in May. One of the stops on her trip will be the Xinjiang region, as Bachelet announced at the UN Human Rights Council on Tuesday. The modalities of the trip have been negotiated for years.

China has detained Uyghurs in Xinjiang in internment camps against their will. The numbers of people detained range from hundreds of thousands to more than one million. There is evidence of forced labor, torture, indoctrination and abuse, which the UN Commission on Human Rights and the UN Labor Organization (ILO), among others, refer to in their assessments. The Chinese side, on the other hand, speaks of “training centers”.

The People’s Republic has drastically restricted access to the region in recent years. Independent movement in Xinjiang and journalistic investigations are only possible in secret and at great risk of arrest. Bachelet, on the other hand, is to be granted free access to the region and will be able to speak unhindered with interlocutors from civil society. According to a spokeswoman for the UN High Commissioner for Human Rights, China has guaranteed this.

Bachelet had a report prepared on the human rights situation in Xinjiang. It has yet to be published. In an open letter, Human Rights Watch joined 195 human rights organizations in calling for the release of the report.

Zhang Jun, China’s ambassador to the UN, said, “We welcome the High Commissioner’s visit to Xinjiang in this May. And China will work together with (her office) to make good preparation for this visit.” At this point, it is unclear how much China’s position is just diplomatic banter. A completely free visit by Bachelet would be a turning point in the Xinjiang causa, but is considered highly unlikely by experts. nib

According to circles, diplomat Patricia Flor is to become the new German ambassador to Beijing. Flor currently serves as the EU ambassador to Tokyo. EU sources confirmed the staffing decision to China.Table, but with reservation. Politico had first reported on this in its Brussels newsletter, without naming more specific sources. Neither the German Foreign Office nor the European External Action Service, to which Flor currently belongs as EU ambassador, wanted to comment on the new appointment.

The 60-year-old has been the European Union’s ambassador to Japan since mid-2018. She previously held various posts in German embassies and missions as part of the Foreign Service. Flor would succeed Jan Hecker, who unexpectedly passed away in September (China.Table reported). In the meantime, former State Secretary Miguel Berger was being considered for the important embassy position in Beijing (China.Table reported). Berger, however, apparently turned down the offer, according to political sources in Berlin.

The embassy in Beijing is one of the most important German missions abroad, along with Washington and Paris. After Hecker’s death shortly before the Bundestag elections, it was considered certain that the old government would not immediately appoint a replacement, but would instead let the successor government decide on the top personnel. Flor would be the first woman to occupy the highest post in the Beijing embassy. ari

Due to the alleged involvement of Huawei in the Ukraine war, soccer star Robert Lewandowski has terminated his high-paying advertising contract with the Chinese telecommunications supplier. “Today, we decided to end the marketing cooperation between Robert Lewandowski and the Huawei brand,” an advisor to the FC Bayern player told AFP news agency on Monday.

According to British press reports, Huawei allegedly helped the Russian army protect itself from cyberattacks by pro-Ukrainian activists. Huawei declared that the reports, which trace back to the hacker group Anonymous, were “fake news.” “This story is untrue and based on inaccurate and false information from an article which has since been corrected,” a company spokesman said.

Lewandowski only extended his contract as Huawei brand ambassador in Eastern Europe and the Baltic and Scandinavian states in January. As a result of the termination, he is now waiving an income of around €5 million per year.

The Warsaw-born athlete had already worn a captain’s armband in the Ukrainian national colors shortly after the Russian attack on Ukraine. He had also announced that he would not be available for the World Cup playoff match against Russia in Moscow on March 24. Lewandowski was named FIFA World Player of the Year in 2020 and 2021. fpe

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

It seems like an impossible task. This year, with the all-important 20th Party Congress approaching, it is crucial for the “Two Sessions” to convey a sense of calm and stability, reassuring the country that China is on a clear course into the future. There could hardly be a more difficult time to achieve this goal. Domestically, China’s government is facing the challenges of its strict No-COVID policy. Abroad, China’s leadership is trying to balance its conflicting interests in the war in Ukraine, resulting in a meandering positioning. Not ideal circumstances for conveying confidence and serenity.

However, the National People’s Congress (NPC) session is the ideal occasion to communicate stability in times of uncertainty. The NPC with its ritualistic, precisely scripted procedures, is never meant to controversially debate urgent issues or to produce tough crisis decisions. The NPC is the ideal setting to push current turbulences into the background and instead focus on reaffirming the leadership’s long-term plan for steering China into the future.

While the “Two Sessions” will not bring major policy shifts, the NPC still provides a window into the leadership’s political priorities, perception of challenges and recipes for addressing these challenges. Here are three of the most important questions, this year’s NPC is raising:

How to get to 5.5%? The annual growth target, as traditionally announced during the Premier’s presentation of the “Work Report”, is the number that always makes it into global news. This year, the number is “around 5.5%”. Down from last year’s “over 6%”. But still, an ambitious target in times of uncertainty. It sends a signal: Despite unfavorable conditions, China’s leadership is confident to defend the growth China needs to stay its course.

However, China’s leadership has a sober view of the pressures that weigh on China’s economy. The NDRC spells them out as a supplement to the Premier’s work report: 1. shrinking demand in consumption and investment; 2. shortage of production inputs (coal, chips); 3. producer price inflation; 4. risks in real estate, small banks, and regional government debts; 5. low confidence of small businesses and individuals towards market prospects.

These challenges make the 5.5% growth target more impressive, but less convincing. It seems likely that securing the target means compromising in other policy areas. Two of the areas to probably act as safety valves, creating short term growth as necessary, are China’s decarbonization agenda and the real estate sector. In both sectors, signals point towards a relaxation of the government’s course in favor of growth.

In 2021, the Central Economic Work Conference showed a shift in rhetoric on decarbonization. The new emphasis was on balancing the CO2 emission reductions against supply chain security and, thus, economic growth. Specifically, this pointed to the slowdown of phasing out coal, compensated by a delay in the transition to renewable energy.

In the real state sector, regulators have abandoned strict restrictions over real estate credit, asking banks and local governments to meet housing needs of consumers. The idea of property tax trials is missing in the governmental work report. Reducing the Chinese economy’s reliance on real estate apparently has to take a back seat when it comes to defending the short-term growth targets.

How to build a digital economy? Building a digital economy and tapping into data as a growth driver of the future is one of the most forward-looking themes of this year’s “Two Sessions.” Last year, China’s vision of the digital economy underwent a shift. 2021 saw a dramatic showdown in China’s tech sector, intensifying the regulators’ grip on previously largely unchecked digital and technological growth. Going forward, the state now plans to take a more active steering role, redirecting China’s innovative tech as a means to push industries up the value chain.

China’s policymakers acknowledge that it will be a long path for China’s companies to reach digitalization goals. A 2020 assessment found that only 5% of companies leverage digital knowledge for manufacturing optimization. The government response is the recent 14th Five-Year-Plan on Informatization, providing a blueprint for accelerating digitalization and setting the ambitious goal for added value of China’s digital economy to reach 10% of the country’s GDP by 2025.

As China’s vision of its digital economy shifts from facilitating consumption to accelerating digital industries, data will be treated as the key strategic resource. The protection of such a resource is crucial. The “Two Sessions” report mentions national security and cybersecurity in the same breath. It is not a coincidence that 2021 was the year the country saw the enactment of two landmark cyber-related laws, the Data Security Law and the Personal Information Protection Law. Together with the 2017 Cybersecurity Law, they form a three-pronged framework to protect the data most vital to the state.

As China prepares the ground for a massive expansion of its digital economy, the government will have to perform the balancing act between state regulation and market innovation. Data protection enforcement will increase as the state continues to build the regulatory architecture to support a burgeoning digital market. The “Two Sessions” underline: China is currently writing the first chapter of a new playbook on its own version of a digital economy.

How to secure social stability? At a time of slowed economy and geopolitical uncertainty, social security in China is under significant strain. As one People’s Daily article puts it, “people’s livelihood is the biggest politics”.

Stabilizing employment is the most imminent challenge. The work report promises to create more than eleven million new urban jobs. For the ten million college graduates in 2022, this means expanded employment channels, relaxed urban settlement policy and more incentives for entrepreneurship, especially in high-tech areas including big data, cloud computing and semiconductors. The report also vows to invest one trillion RMB into training a skilled labor force for “high-quality manufacturing” development.

Equal access to public services is another key focus, especially in the context of regional population imbalance and economic disparity. A few months ago, NDRC published the 14th FYP for Public Services, drawing binding targets on elderly care, childcare, primary education, healthcare and housing by 2025. The government work report supplemented it by calling to extend municipal-level public services to counties and below through more coordinated regional development. Despite not mentioning any new specific measures on “Common Prosperity”, NDRC hinted in its report that an overarching plan is underway. Equalizing public services and improving regional coordination will likely be a key part of it.

As the relaxation of the One-Child Policy failed to initiate a demographic turn around, China’s pension system – with heavy reliance on the government and corporate annuity – will come under increasing pressure. The “Two Sessions” report highlights two acknowledged solutions: developing the third pillar – individual pension plan – and more efficient fund management through a unified national pension system. While the solutions are clear, it is yet to be observed whether the actions can catch up with the growing financial burden of a fast-aging society.

All the proposed initiatives to improve China’s social policies have a common denominator: massive government spending. And here the circle closes: To keep the promises on employment, social welfare and equality, China needs the envisioned 5.5% economic growth.

Even, or especially when the world is turned on its head, the “Two Sessions” are not the place for drastic shifts in political strategy. Instead, the 2022 “Two Sessions” are a demonstration of staying the course, not being distracted by the turbulences all around and stoically pushing ahead with the leadership’s plan for the future. However, behind the curtain, China’s top leadership will ask itself the question, if more dramatic course corrections are ultimately needed to steer China through today’s troubled waters. The answer will have to wait until the main event, the 20th Party Congress.

Bjoern Conrad is the CEO and Co-Founder of Sinolytics and an expert on China’s economic, industrial and technology policies. Tiffany Wong is a project leader and an expert on cyber, digital policy. Bin Yan is a Project Leader and expert on China’s economic policy and financial sector. Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on strategic orientation and specific business activities in the People’s Republic.

Adrian Siu is to become the new head of Adidas’ Greater China division, according to a media report. Siu, who currently heads the sportswear maker’s Hong Kong operations, is to succeed Jason Thomas in April, according to the Financial Times. Adidas had been losing market share in China. In the past two quarters, sales had fallen by 15 percent. A consumer boycott is said to be the cause, as Adidas refuses to use cotton from Xinjiang.

Xiao Qian was appointed as the new Chinese ambassador to Australia, succeeding Cheng Jingye.

Dinosaur fans have long known that China is an Eldorado for paleontologists. Nowhere else have so many primordial lizards been unearthed as in the People’s Republic. Near the megacity of Chongqing, the presumably oldest Stegosaurus in Asia has now been excavated. The species, called “Bashanosaurus primitivus,” lived 168 million years ago.

The war in Ukraine has pushed the energy transition back to the top of Europe’s political agenda. Germany wants to invest more in “freedom energies” (German Minister of Finance Christian Lindner on renewables). The EU wants to move away from Russian gas. Will China move to fill this gap and become the main buyer of Russian energy raw materials?

There are indeed first rumors that Chinese state-owned enterprises could now buy into Gazprom and others. But China could hardly be interested in becoming dependent on Russian gas. The People’s Republic is striving for energy security, and that includes remaining relatively independent of foreign countries when it comes to energy raw materials. Energy security is one of the key issues at the National People’s Congress. More likely than a gas dependence on Russia, China will continue to rely on domestic coal to secure its power supply.

But the People’s Republic is also investing heavily in the expansion of renewable energies. Christiane Kuehl analyzes how the Olympic and Paralympic Winter Games were used as a pilot project for the energy transition. At the venue in Zhangjiakou, a power grid was installed that is specifically tailored to renewable energies. A pumped-storage power plant was constructed to store surplus wind and solar power. Zhangjiakou could now serve as a blueprint for the further expansion of renewable energies. Perhaps European countries can learn a thing or two from this pilot project for their own energy transition?

Over the first few days of the National People’s Congress (NPC), it once again became clear that energy security is currently more important to the political leadership than climate goals. Last year’s power crisis and rising prices for fossil energy raw materials in the wake of the Ukraine war are causing concern for China’s leaders. As a result, the key goal of energy policy is to secure the power supply. Oil and gas production, as well as coal mining, are to be expanded.

Xi Jinping reiterated in his speech at the People’s Congress that China’s energy transition will not happen overnight. The new must first be built before the old can be torn down, Xi said. Coal-fired power still accounts for a good 60 percent of the People’s Republic’s energy demand. As long as renewables or other energy sources such as gas and nuclear power cannot replace coal, Xi will not take any risks and will not accelerate the shutdown of coal-fired power plants. But what does that mean in practice? Is coal consumption in China about to increase even further to guarantee energy security?

There is some indication that China will consume more coal in the short term. The NPC focused on economic growth. China is aiming for growth of “about 5.5 percent”. Xi Jinping’s re-election is coming up in the fall. So those in charge will pull out all the stops to ensure that growth figures reach or even exceed the envisioned figure by then. Surprisingly, the government has not set a goal for the reduction of power consumption per unit of economic growth for this year. Instead, Beijing wants to retain “appropriate flexibility”.

The government thus wants to keep some room open for infrastructure and construction projects, as well as rapid growth through heavy industry output. However, all these sectors consume a lot of power. Energy analyst Lauri Myllyvirta of the Centre for Research on Energy and Clean Air writes: “I continue to expect that coal consumption and CO2 emissions will increase slightly this year.” This is also confirmed by statements made by the authorities that coal-fired power plants should “exploit their full potential” and “maximize their output” (China.Table reported).

Russia’s attack on Ukraine was a topic that was barely mentioned at the People’s Congress. But energy security is a medal with at least two sides. China’s political leaders want to ensure secure access to energy and power for its economy and citizens. But at the same time, Cina cannot afford to become too dependent on imports of energy commodities such as coal, gas, and oil – because this would put energy security at risk during crises. Xi Jinping already emphasized back in October that they “must hold our energy supplies firmly in our own hands”.

So what implications does the Russian war in Ukraine have for China’s energy security? Unlike many European countries, the People’s Republic is not dependent on Russian energy supplies. While Russia is China’s largest supplier of coal, imports from its neighbor account for only a mere 0.3 percent of the People’s Republic’s coal consumption. China can cover the vast majority of its needs from domestic sources. China can cover the vast majority of its requirements from domestic sources. When it comes to gas, the Russian share is higher. However, China is not yet as dependent on gas in many areas as Europe. A switch back to coal would be easy, according to analysts at the consulting firm Trivium China.

Beijing is in an ideal position. In the next few years, China could buy up all the Russian gas that Europe spurns. If Russia escalates the war in Ukraine to the point where it would become a permanent international pariah, discounts could even beckon for Beijing. Still, China’s political leaders will most likely be smart enough not to become trapped in a gas dependency on an unpredictable Russia. That would contradict its goal of energy security.

However, China could buy its way into Russian power companies such as Gazprom. According to Bloomberg information, responsible policymakers in Beijing are in talks with state-owned enterprises such as China National Petroleum about possible investments in Russian companies or assets. Any stake would serve to boost China’s energy imports and security, Bloomberg cites individuals familiar with the talks as saying. The stated goal, they say, is not to support Russia’s invasion. However, the talks between Chinese and Russian companies are reportedly still in early stages.

On top of that: China is still dependent on Western exports and technologies in many economic areas. A too large swing toward Russia that would scare off Western business and trade partners is not very likely. As Trivium analysts write, “We believe that the costs of a true alliance with Putin against the world outweigh the benefits by far.”

Even though coal consumption is likely to increase in the short term, China is not ignoring the expansion of renewable energies. According to Premier Li Keqiang’s work report, China plans to push ahead with the expansion of large-scale wind and solar power plants. In addition, China plans to increase the capacity of its power grids. This would result in less renewable energy being lost. Offshore wind power is to be promoted in particular. Power storage facilities are also to be expanded (China.Table reported). To this end, a “Five-Year Energy Storage Plan” is currently being discussed. The Chinese Ministry of Finance also announced that it would finally pay out overdue subsidies to developers of renewable energy projects. There have been major delays in this regard in recent years, with the result that funds have been lacking in some cases to launch new projects.

But the expansion of renewable energy sources takes time. It will take several years before solar, wind and hydro power can drastically reduce the share of fossil fuels in the energy mix – especially if power demand continues to rise.

Green, carbon-neutral Games is what Beijing wanted to host. This is practically impossible for the Winter Games if material and power consumption for the venues are taken into account. The organizers have to publish their climate balance sheet after the end of the Paralympics. But for the future, the remaining infrastructure is more decisive than the climate balance of the Olympics. After all, the Olympics have made Zhangjiakou a pilot region for the generation, grid feeding and direct marketing of wind and solar power.

The new infrastructure that was built for the Olympics currently supplies the 25 sports venues with green power – and soon Beijing’s metropolitan area. Wind and sun could currently generate around 44 terawatt-hours (TWh) per year in Zhangjiakou, more than many countries in the world, according to an analysis by energy experts Lauri Myllyvirta and Xing Zhang from the Centre for Research on Energy and Clean Air. Without the Olympics, Zhangjiakou and the surrounding area consume around 19 TWh of their own power.

So, according to the Olympic planners, 25 TWh will be available once all athletes have left. Of these, about 14 TWh of renewable energy is expected to be transferred from Zhangjiakou to Beijing each year. That corresponds to about ten percent of the capital’s power demand. Another seven TWh annually are to be transmitted to Xiong’an, the “City of the Future” currently under construction in southeast Beijing, a pet project of the head of state Xi Jinping.

A dedicated power grid has also been created for the Olympics. A total of ¥12.5 billion (just under €1.8 billion) went into building the “Zhangbei Renewable Energy Flexible DC Power Grid Demonstration Project” (DC stands for “direct current”; Zhangbei 张北 refers to northern Zhangjiakou). “The ‘flexible green electricity grid’ in Zhangjiakou is the first of its kind to use direct current, a technology much better suited for very long-distance transmission than alternating current,” write Myllyvirta and Zhang. Power to Xiong’an is said to be transmitted via an ultra-high-voltage line.

A stable power supply is to be ensured by a new pumped storage power plant with a capacity of 3.6 gigawatts near the small town of Fengning located north of Beijing. Its principle is simple: If the wind and sun generate more power than required, water with the surplus energy is pumped from a lower basin to an upper one and “parked” there. When neither the sun nor the wind generates power, this water is released from the upper basin back into the lower basin. In the process, it flows through two turbines and generates power. “Compared with technologies like utility-scale batteries, utilizing hydropower for energy storage is less complex and more cost-effective,” S&P Global’s Ivy Yin and Eric Yep conclude in a recent article on energy transition.

But power must not only be generated, it also has to be available for purchase. In September 2021, China launched a pilot project for trading green power. It enables large consumers to buy renewable power generated nationwide. Previously, there had only been regional mechanisms for the direct purchase of green power, for example with the involvement of BASF in Guangdong (China.Table reported). Winter Olympics sports venues have been given priority on this new trading platform, according to Myllyvirta and Zhang, allowing venues to buy renewable power at a lower rate.

Zhangjiakou could now serve as a blueprint for the further expansion of renewable energies. By 2030, China’s wind and solar capacity is expected to reach 1,200 gigawatts, almost twice as much as today. The so-called 30/60 targets aim for emissions reversal before 2030 and carbon neutrality by 2060. Premier Li Keqiang, speaking at the plenum of the National People’s Congress on Friday, highlighted the importance of wind and solar power for achieving these goals – and surprisingly did not mention hydropower and nuclear power (China.Table reported).

China’s National Development and Reform Commission also published its goals for 2022 on Saturday, in which the solar industry was also mentioned to be a key to further growth (China.Table reported).

But transmitting the green power is the crux. “A long-standing challenge with China’s long-distance transmission lines has been their inflexible operation,” Myllyvirta and Zhang explain. One problem is that coal-fired power is often given priority in the power grid of Chinese regions. This is why the Zhangjiakou green power project is also about pioneering a new institutional set-up, according to the two experts. This is said to be at least as important as new facilities for generating green power.

The pumped storage power used in the Zhangbei pilot project will also be utilized in the expansion. China plans to double it to 62 GW by 2025 compared to today, and quadruple it to 120 GW by 2030. Some of China’s largest state-owned power utilities, such as the Huadian Group, Huaneng Group, Datang Group and Guohua Power, have been developing green power projects in Zhangjiakou, according to S&P’s Yin and Yep. They could take advantage of this experience.

In any case, Zhangjiakou’s energy mix is well ahead of the rest of the country. Myllyvirta and Zhang calculated that the region would generate a total of 60 percent of its power from wind and solar in January and February 2022. By comparison, the power in the capital is generated almost exclusively from gas. The province of Hebei – where Zhangjiakou is located – burns equal parts coal and gas to generate power, which collectively produces a whopping 90 percent of its power

The region now plans to more than double its wind and solar capacity by 2030, to 50 gigawatts. By 2030, Zhangjiakou plans to have 80 percent renewables, Yin and Yep write, citing local plans. By 2030, it plans to power all public transportation and residential buildings with renewable energy. All industrial sectors are then to operate carbon neutrally. If all this can be verifiably achieved, Zhangjiakou, in the barren mountains of Hebei, could truly become a model region.

Beijing, Berlin, and Paris want to work together for a diplomatic solution to the Ukraine war. In an hour-long exchange, German Chancellor Olaf Scholz and the presidents of China and France, Xi Jinping and Emmanuel Macron, also spoke out in favor of humanitarian aid and access to the combat areas, according to the German government spokesman Steffen Hebestreit. Functioning evacuation corridors should be established.

All three countries expressed their willingness to provide further humanitarian aid. Xi supports Franco-German efforts to reach a cease-fire, the French presidential office said. Xi described the situation in Ukraine as concerning, according to state media, and called for “maximum restraint.” He also expressed concern about the impact of sanctions on the stability of global finance, energy security, and transportation and supply chains.

China has so far refused to condemn the Russian incursion or call it an invasion. Foreign Minister Wang Yi had described China’s friendship with Russia as “rock solid” on Monday (China.Table reported): “No matter how perilous the international landscape, we will maintain our strategic focus and promote the development of a comprehensive China-Russia partnership in the new era.”

According to Wang, however, Beijing is ready to use its influence on Russia: President Xi had already spoken on the phone with Vladimir Putin on February 25. In this telephone call, Xi expressed his wish for Russia and Ukraine to hold peace talks as soon as possible. Putin responded positively – and since then, two rounds of negotiations between Ukraine and Russia have already taken place. The hope now is that further progress will be made in the upcoming third round of talks. rtr/rad

UN High Commissioner for Human Rights, Michelle Bachelet, plans to travel to China in May. One of the stops on her trip will be the Xinjiang region, as Bachelet announced at the UN Human Rights Council on Tuesday. The modalities of the trip have been negotiated for years.

China has detained Uyghurs in Xinjiang in internment camps against their will. The numbers of people detained range from hundreds of thousands to more than one million. There is evidence of forced labor, torture, indoctrination and abuse, which the UN Commission on Human Rights and the UN Labor Organization (ILO), among others, refer to in their assessments. The Chinese side, on the other hand, speaks of “training centers”.

The People’s Republic has drastically restricted access to the region in recent years. Independent movement in Xinjiang and journalistic investigations are only possible in secret and at great risk of arrest. Bachelet, on the other hand, is to be granted free access to the region and will be able to speak unhindered with interlocutors from civil society. According to a spokeswoman for the UN High Commissioner for Human Rights, China has guaranteed this.

Bachelet had a report prepared on the human rights situation in Xinjiang. It has yet to be published. In an open letter, Human Rights Watch joined 195 human rights organizations in calling for the release of the report.

Zhang Jun, China’s ambassador to the UN, said, “We welcome the High Commissioner’s visit to Xinjiang in this May. And China will work together with (her office) to make good preparation for this visit.” At this point, it is unclear how much China’s position is just diplomatic banter. A completely free visit by Bachelet would be a turning point in the Xinjiang causa, but is considered highly unlikely by experts. nib

According to circles, diplomat Patricia Flor is to become the new German ambassador to Beijing. Flor currently serves as the EU ambassador to Tokyo. EU sources confirmed the staffing decision to China.Table, but with reservation. Politico had first reported on this in its Brussels newsletter, without naming more specific sources. Neither the German Foreign Office nor the European External Action Service, to which Flor currently belongs as EU ambassador, wanted to comment on the new appointment.

The 60-year-old has been the European Union’s ambassador to Japan since mid-2018. She previously held various posts in German embassies and missions as part of the Foreign Service. Flor would succeed Jan Hecker, who unexpectedly passed away in September (China.Table reported). In the meantime, former State Secretary Miguel Berger was being considered for the important embassy position in Beijing (China.Table reported). Berger, however, apparently turned down the offer, according to political sources in Berlin.

The embassy in Beijing is one of the most important German missions abroad, along with Washington and Paris. After Hecker’s death shortly before the Bundestag elections, it was considered certain that the old government would not immediately appoint a replacement, but would instead let the successor government decide on the top personnel. Flor would be the first woman to occupy the highest post in the Beijing embassy. ari

Due to the alleged involvement of Huawei in the Ukraine war, soccer star Robert Lewandowski has terminated his high-paying advertising contract with the Chinese telecommunications supplier. “Today, we decided to end the marketing cooperation between Robert Lewandowski and the Huawei brand,” an advisor to the FC Bayern player told AFP news agency on Monday.

According to British press reports, Huawei allegedly helped the Russian army protect itself from cyberattacks by pro-Ukrainian activists. Huawei declared that the reports, which trace back to the hacker group Anonymous, were “fake news.” “This story is untrue and based on inaccurate and false information from an article which has since been corrected,” a company spokesman said.

Lewandowski only extended his contract as Huawei brand ambassador in Eastern Europe and the Baltic and Scandinavian states in January. As a result of the termination, he is now waiving an income of around €5 million per year.

The Warsaw-born athlete had already worn a captain’s armband in the Ukrainian national colors shortly after the Russian attack on Ukraine. He had also announced that he would not be available for the World Cup playoff match against Russia in Moscow on March 24. Lewandowski was named FIFA World Player of the Year in 2020 and 2021. fpe

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

It seems like an impossible task. This year, with the all-important 20th Party Congress approaching, it is crucial for the “Two Sessions” to convey a sense of calm and stability, reassuring the country that China is on a clear course into the future. There could hardly be a more difficult time to achieve this goal. Domestically, China’s government is facing the challenges of its strict No-COVID policy. Abroad, China’s leadership is trying to balance its conflicting interests in the war in Ukraine, resulting in a meandering positioning. Not ideal circumstances for conveying confidence and serenity.

However, the National People’s Congress (NPC) session is the ideal occasion to communicate stability in times of uncertainty. The NPC with its ritualistic, precisely scripted procedures, is never meant to controversially debate urgent issues or to produce tough crisis decisions. The NPC is the ideal setting to push current turbulences into the background and instead focus on reaffirming the leadership’s long-term plan for steering China into the future.

While the “Two Sessions” will not bring major policy shifts, the NPC still provides a window into the leadership’s political priorities, perception of challenges and recipes for addressing these challenges. Here are three of the most important questions, this year’s NPC is raising:

How to get to 5.5%? The annual growth target, as traditionally announced during the Premier’s presentation of the “Work Report”, is the number that always makes it into global news. This year, the number is “around 5.5%”. Down from last year’s “over 6%”. But still, an ambitious target in times of uncertainty. It sends a signal: Despite unfavorable conditions, China’s leadership is confident to defend the growth China needs to stay its course.

However, China’s leadership has a sober view of the pressures that weigh on China’s economy. The NDRC spells them out as a supplement to the Premier’s work report: 1. shrinking demand in consumption and investment; 2. shortage of production inputs (coal, chips); 3. producer price inflation; 4. risks in real estate, small banks, and regional government debts; 5. low confidence of small businesses and individuals towards market prospects.

These challenges make the 5.5% growth target more impressive, but less convincing. It seems likely that securing the target means compromising in other policy areas. Two of the areas to probably act as safety valves, creating short term growth as necessary, are China’s decarbonization agenda and the real estate sector. In both sectors, signals point towards a relaxation of the government’s course in favor of growth.

In 2021, the Central Economic Work Conference showed a shift in rhetoric on decarbonization. The new emphasis was on balancing the CO2 emission reductions against supply chain security and, thus, economic growth. Specifically, this pointed to the slowdown of phasing out coal, compensated by a delay in the transition to renewable energy.

In the real state sector, regulators have abandoned strict restrictions over real estate credit, asking banks and local governments to meet housing needs of consumers. The idea of property tax trials is missing in the governmental work report. Reducing the Chinese economy’s reliance on real estate apparently has to take a back seat when it comes to defending the short-term growth targets.

How to build a digital economy? Building a digital economy and tapping into data as a growth driver of the future is one of the most forward-looking themes of this year’s “Two Sessions.” Last year, China’s vision of the digital economy underwent a shift. 2021 saw a dramatic showdown in China’s tech sector, intensifying the regulators’ grip on previously largely unchecked digital and technological growth. Going forward, the state now plans to take a more active steering role, redirecting China’s innovative tech as a means to push industries up the value chain.

China’s policymakers acknowledge that it will be a long path for China’s companies to reach digitalization goals. A 2020 assessment found that only 5% of companies leverage digital knowledge for manufacturing optimization. The government response is the recent 14th Five-Year-Plan on Informatization, providing a blueprint for accelerating digitalization and setting the ambitious goal for added value of China’s digital economy to reach 10% of the country’s GDP by 2025.

As China’s vision of its digital economy shifts from facilitating consumption to accelerating digital industries, data will be treated as the key strategic resource. The protection of such a resource is crucial. The “Two Sessions” report mentions national security and cybersecurity in the same breath. It is not a coincidence that 2021 was the year the country saw the enactment of two landmark cyber-related laws, the Data Security Law and the Personal Information Protection Law. Together with the 2017 Cybersecurity Law, they form a three-pronged framework to protect the data most vital to the state.

As China prepares the ground for a massive expansion of its digital economy, the government will have to perform the balancing act between state regulation and market innovation. Data protection enforcement will increase as the state continues to build the regulatory architecture to support a burgeoning digital market. The “Two Sessions” underline: China is currently writing the first chapter of a new playbook on its own version of a digital economy.

How to secure social stability? At a time of slowed economy and geopolitical uncertainty, social security in China is under significant strain. As one People’s Daily article puts it, “people’s livelihood is the biggest politics”.

Stabilizing employment is the most imminent challenge. The work report promises to create more than eleven million new urban jobs. For the ten million college graduates in 2022, this means expanded employment channels, relaxed urban settlement policy and more incentives for entrepreneurship, especially in high-tech areas including big data, cloud computing and semiconductors. The report also vows to invest one trillion RMB into training a skilled labor force for “high-quality manufacturing” development.

Equal access to public services is another key focus, especially in the context of regional population imbalance and economic disparity. A few months ago, NDRC published the 14th FYP for Public Services, drawing binding targets on elderly care, childcare, primary education, healthcare and housing by 2025. The government work report supplemented it by calling to extend municipal-level public services to counties and below through more coordinated regional development. Despite not mentioning any new specific measures on “Common Prosperity”, NDRC hinted in its report that an overarching plan is underway. Equalizing public services and improving regional coordination will likely be a key part of it.

As the relaxation of the One-Child Policy failed to initiate a demographic turn around, China’s pension system – with heavy reliance on the government and corporate annuity – will come under increasing pressure. The “Two Sessions” report highlights two acknowledged solutions: developing the third pillar – individual pension plan – and more efficient fund management through a unified national pension system. While the solutions are clear, it is yet to be observed whether the actions can catch up with the growing financial burden of a fast-aging society.

All the proposed initiatives to improve China’s social policies have a common denominator: massive government spending. And here the circle closes: To keep the promises on employment, social welfare and equality, China needs the envisioned 5.5% economic growth.

Even, or especially when the world is turned on its head, the “Two Sessions” are not the place for drastic shifts in political strategy. Instead, the 2022 “Two Sessions” are a demonstration of staying the course, not being distracted by the turbulences all around and stoically pushing ahead with the leadership’s plan for the future. However, behind the curtain, China’s top leadership will ask itself the question, if more dramatic course corrections are ultimately needed to steer China through today’s troubled waters. The answer will have to wait until the main event, the 20th Party Congress.

Bjoern Conrad is the CEO and Co-Founder of Sinolytics and an expert on China’s economic, industrial and technology policies. Tiffany Wong is a project leader and an expert on cyber, digital policy. Bin Yan is a Project Leader and expert on China’s economic policy and financial sector. Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on strategic orientation and specific business activities in the People’s Republic.

Adrian Siu is to become the new head of Adidas’ Greater China division, according to a media report. Siu, who currently heads the sportswear maker’s Hong Kong operations, is to succeed Jason Thomas in April, according to the Financial Times. Adidas had been losing market share in China. In the past two quarters, sales had fallen by 15 percent. A consumer boycott is said to be the cause, as Adidas refuses to use cotton from Xinjiang.

Xiao Qian was appointed as the new Chinese ambassador to Australia, succeeding Cheng Jingye.

Dinosaur fans have long known that China is an Eldorado for paleontologists. Nowhere else have so many primordial lizards been unearthed as in the People’s Republic. Near the megacity of Chongqing, the presumably oldest Stegosaurus in Asia has now been excavated. The species, called “Bashanosaurus primitivus,” lived 168 million years ago.