China’s economy is currently dominated by two major issues: the power shortage and the crisis surrounding the stumbling real estate giant Evergrande. After we looked at the power crisis in yesterday’s issue, we now turn to the latest on Evergrande. Finn Mayer-Kuckuk analyzes Beijing’s search for ways to tackle the problems at Evergrande without severely affecting other parts of the economy. Because a default seems inevitable.

While the real estate sector is in turmoil, China’s electric car segment is booming unabated. And the importance of one particular element becomes apparent: Software that controls intelligent car functions. Frank Sieren takes a close look at one of the leading Chinese companies for smart car software, the start-up Banma. It is already cooperating with many manufacturers, including Volkswagen. Meanwhile, Japanese carmaker Honda announced plans to create a new electric brand in China. From 2030 onwards, Honda won’t launch any new models with combustion engines on the Chinese market.

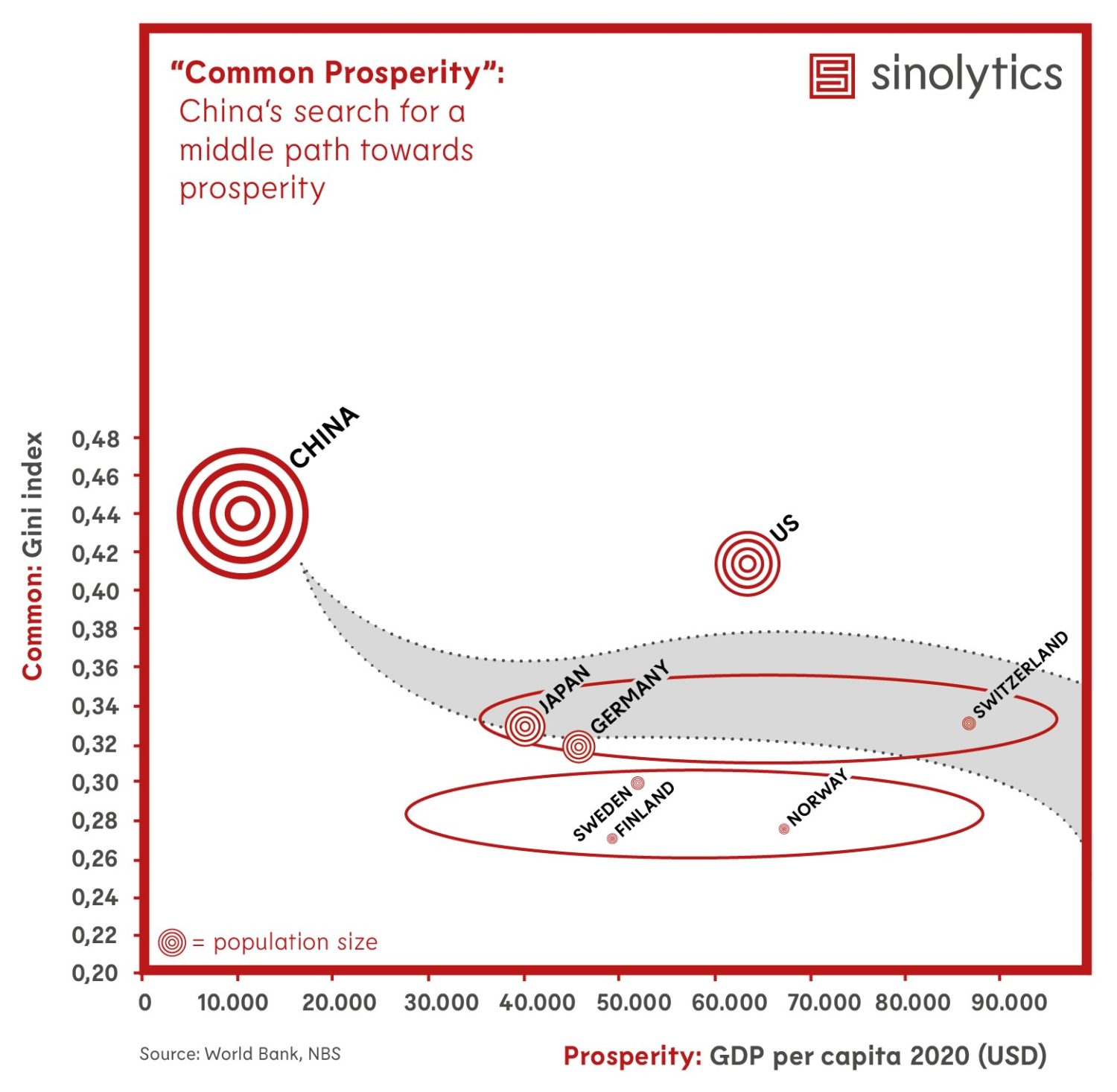

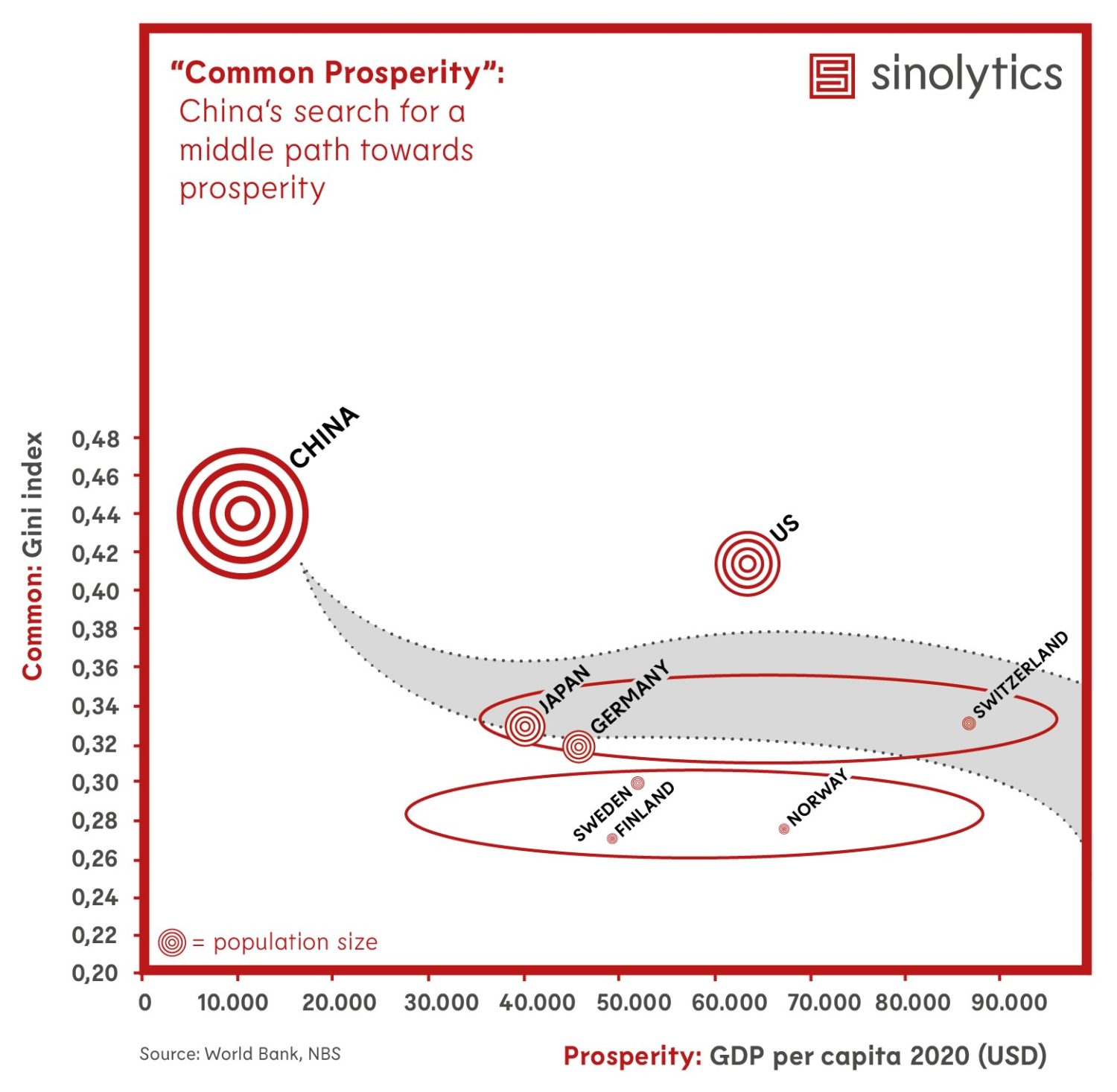

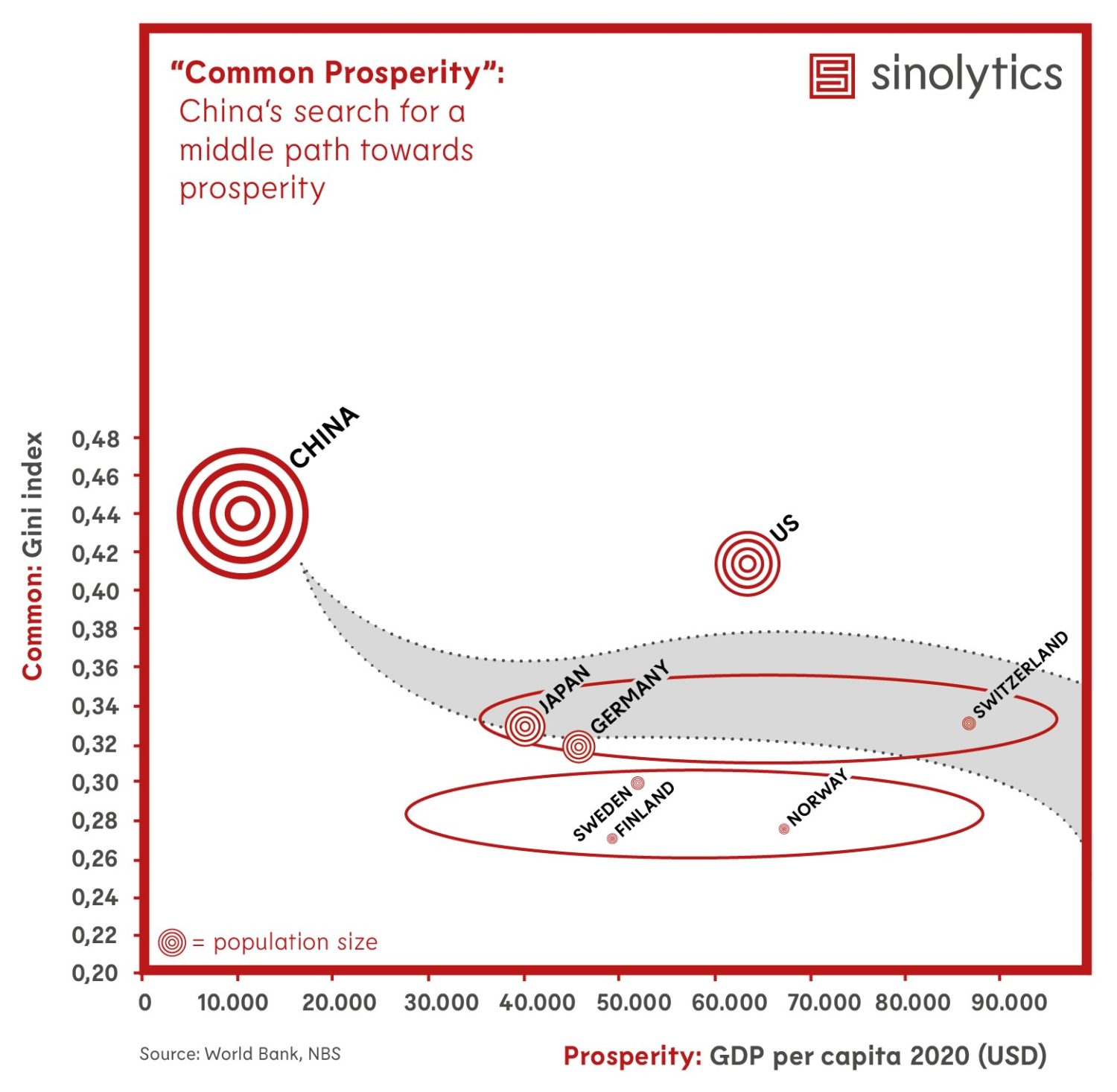

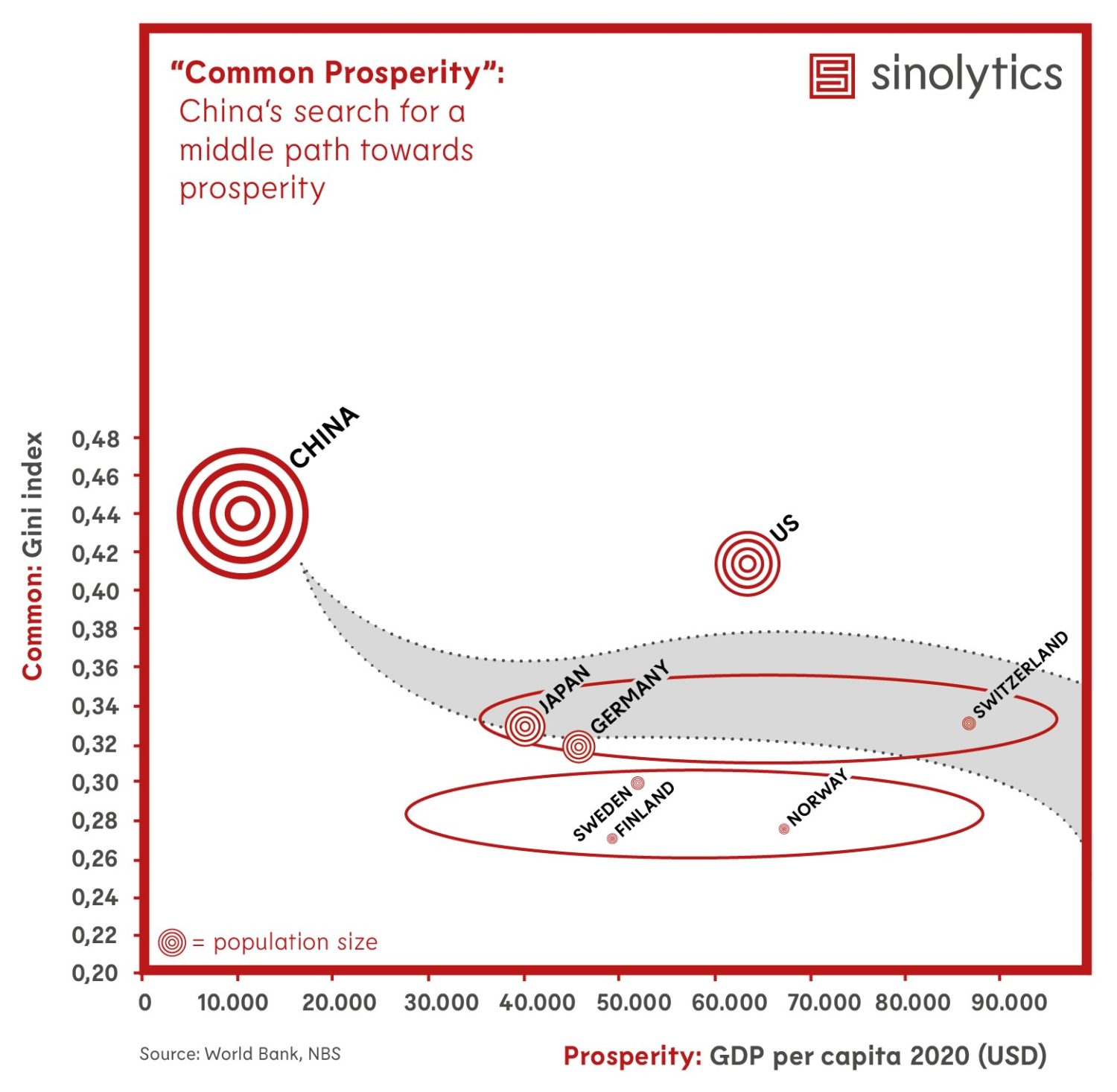

We are also pleased to announce new cooperation: The consulting firm Sinolytics will now present an aspect of China in a weekly graphic. This week, it’s about the concept of “Common Prosperity” conceived by President Xi Jinping.

And while the possible successors to Angela Merkel’s German government are holding negotiation talks, the chancellor once again spoke with Xi Jinping over the phone. It was a “farewell conversation” in which Xi, according to Xinhua, urged Merkel to continue working for productive relations between Germany, Europe, and China.

We hope you enjoy today’s issue!

Concerns about the credit rating of China’s Evergrande real estate group are spreading throughout the markets. The company has missed several deadlines for interest payments to its investors over the week. What alert market participants have long suspected is becoming a certainty: The company does not have enough liquid reserves to service its numerous loans. The default will almost certainly turn into bankruptcy.

The prices of riskier Chinese bonds dropped significantly over the course of the week for this reason. Because just Evergrande has borrowed too much money. The 21 largest Chinese real estate companies have to pay ¥1.06 in interest for every yuan they earn, as analysts have calculated. This makes their debt levels not sustainable at all in this form. In the end, investors won’t get back everything they lent to these companies.

The question is therefore no longer if the Chinese real estate industry will undergo a major transformation – but instead, whether it will happen as a catastrophic conflagration or as a slash-and-burn of parts that are not capable of surviving. Chinese regulators are definitely aiming for the latter, to avoid a systemic spread of debt problems.

On Wednesday, the International Monetary Fund (IMF) expressed faith in China’s ability to overcome the debt crisis of its real estate sector without major “contagion” to other sectors. At the same time, economists at international institutions warned that a bailout should not happen too soon or be too generous. Evergrande must be a lesson to financial managers, they said. “The impression that individual companies are too big to fail cannot be allowed.”

Despite the domineering position of China’s CP, Beijing ultimately wants to give more power to market forces (China.Table reported). In its current state, the party has lost power over the private sector on the one hand, and yet it still needs to painstakingly control it. Instead, Xi wants to return to a state in which the party rules unrivaled over a social market economy.

Regulators therefore deliberately popped the Chinese real estate bubble last year. To this end, they have issued new minimum capital requirements. These are now known as the infamous “three red lines”. For example, a company’s debt must not exceed 70 percent of its value-added assets. In addition, it must always have enough liquid assets to be able to service short-term loans in full.

As a result, companies like Evergrande are no longer able to freely issue bonds to service their existing debt. The company’s ratios do not even come close to meeting the new requirements. Moreover, the government’s apparent distrust has, for the first time, created genuine distrust among other players: If Beijing drops real estate developers, no one else wants to touch them either.

Beijing is now looking for ways to solve the problems at Evergrande without major impacts on other parts of its economy. There is a particular care for small property buyers. In some cases, they have made a full down payment on apartments that Evergrande has not even built yet. There is word from China that county and municipal governments now contract local construction companies to have these projects finished if possible. Because if ordinary citizens were left empty-handed, the party would have a real legitimacy crisis on its hands.

At the same time, head of state Xi Jinping is unraveling the overly good relations between the cadres of his own party, big banks, and the private real estate companies. He is thus stripping financial institutions of their power and once again shows who calls the shots in China: the CP, not private capital. In the end, big national banks will also catch a large part of the toxic fallout emanating from the Evergrande’s affair. They are the biggest investors in China – and at the same time are obliged to serve the interests of the state.

That doesn’t mean everything is in the can just yet. On Monday alone, Evergrande owed investors $150 million in interest. This is money that financial market players had counted on. It is now missing elsewhere in the economic system. Moreover, if banks now have to completely write off large amounts of bonds, they will be stingy with loans elsewhere. That would be bad for the economy.

There are clear and present risks for the overall economy (China.Table reported). China’s real estate sector generates between four and five trillion euros annually, accounting for a quarter of China’s economic output. A sharp downturn in business activity would impact growth and employment rates. The missing percentage points to the growth target would be difficult to recoup. Especially when China has both an energy crisis and a pandemic on its hands.

While its main real estate business unit is about to collapse under the weight of its debts, Evergrande’s EV branch is apparently remaining undeterred. While a planned IPO is off the table for the time being (China.Table reported), Li Yongzhou, head of the automobile division, reiterated at a conference plans to bring the first products to market next year. This makes sense since production plants are already largely ready. Road tests of prototypes have also been completed. As long as there is enough funding, the automobile division will stick to its market plans.

Once upon a time, a car was defined by its engine performance, or perhaps the design. But in the future, a vehicle will be more defined by its software – especially in China. “Software is increasingly defining the car,” summarizes an industry report by Business Wire. So-called over-the-air updates (OTAs) are a key element. This means that the car’s software is constantly being updated, just like a smartphone – something providers are more than happy to additionally charge for.

The software factor will shape the car industry of the future the most, Tesla CEO Elon Musk himself also said recently – “from design to manufacturing, and especially autonomous driving.” Consumers in China are demanding more and more connected and intelligent features, according to Musk. As a result, he sees great growth potential for car software, including autonomous driving. When it comes to software, the Tesla CEO thinks some Chinese companies have become very good at it. Among others, China’s tech giants like Baidu, Tencent, and Huawei are developing their own car software systems.

Today, car developers are paying particular attention to Shanghai-based Banma Network Technology Co, Ltd, a leading supplier of smart car software. The startup was founded in 2015 as a joint venture between Alibaba and Shanghai Automotive (SAIC), one of China’s largest state-owned automakers. Banma then developed its software based on the AliOS system developed by Alibaba, which supports functions such as navigation, voice recognition, and entertainment in cars.

Today, there are already about one million cars outfitted with Banma technology on China’s streets. Car manufacturers such as SAIC, FAW, and Volkswagen also use Banma software. Banma also signed a strategic partnership with the electric startup Nio in 2020.

The EVs developed by Chinese start-ups are increasingly autonomous and networked. They rely on a completely new and much simpler drive architecture consisting of batteries, electric motors, and electronic controls. Compared to conventional vehicles, the production of electric cars can be more easily divided into different modules, says Wen Gai, a senior executive at the tech subsidiary of Guangzhou Automobile Group (GAC). As a result, the production of a car will be more like the production of a smartphone in the future. Software will play a key role. “In the new era of car manufacturing, manufacturing will be just one part of the long business chain that includes software services, after-sales services, and even financial services,” Gai explains. “Equipment manufacturers can tap into the market in many places.”

This also makes the market for smart automotive technology increasingly lucrative. Especially since the Chinese EV market is currently growing reliably. According to the China Association of Automobile Manufacturers (CAAM), sales of new energy vehicles, including hybrid electric cars, rose by 190 percent year-on-year to 2.16 million cars in the first three quarters of 2021 – including 1.79 million pure battery vehicles. Meanwhile, the global market for connected vehicles is also of interest to suppliers like Banma. And according to estimates by market research company Counterpoint Insights, this will grow by 270 percent between 2018 and 2022 to more than 125 million networked vehicles worldwide.

Thanks to autonomous driving, car software will need to cover more and more functions. Banma is therefore constantly working on new developments. In July, Banma received a substantial cash injection from its major shareholders Alibaba, SAIC, CMG-SDIC Capital Management, and Yunfeng Capital of ¥3 billion ($464 million). Banma plans to invest this money mainly into the R&D of smart vehicle operating systems, explains co-chief executive Zhang Chunhui, former president of Alibaba’s OS Business Group.

This is the second major round of funding for the startup, which had already raised more than $247 million in investments in 2018. This earned it a valuation of over $1 billion at the time, making it one of the so-called tech unicorns. The company’s current valuation is not published.

Before the end of this year, Banma plans the launch of a smart cockpit system developed in-house. Banma is also focusing on cooperation with providers of cutting-edge technologies. For example, the company entered into a strategic partnership with Robosense, a leading manufacturer of 3D LiDAR sensors in China, and AutoX, a leading platform for artificial intelligence-based autonomous driving. Together, they aim to promote the integration of intelligent cockpits with autonomous driving systems. By merging hardware, software, and AI capabilities, the goal is to create a complete ecosystem in the process. Banma is contributing system solutions to support the perceptual performance of Robosense’s LiDAR sensors, according to CIO Qiang Xiu, while AutoX provides Banma with “a comprehensive toolchain, cloud and end service system.”

The concept of “Common Prosperity” is intended to provide answers to one of the fundamental questions China is facing: How will China balance growing prosperity and the massive inequality of this prosperity in the future. So far, the picture is as follows:

Sinolytics is a European consulting and analysis company that focuses entirely on China. Sinolytics advises European companies on strategic orientation and specific business activities in China.

Was it the last phone call between Xi Jinping and Angela Merkel? The German chancellor and China’s president met via video conference for a “farewell talk”, according to a spokeswoman for the German government. According to the statement, Merkel and Xi discussed the development of bilateral relations and current issues on the international agenda, such as preparations for the upcoming G20 summit and the Covid pandemic. Xi will likely not attend the summit in Italy later this month in person, so there will be no opportunity for informal talks with him there. While Beijing has not yet officially canceled his travel plans, Xi has not left China since the Covid crisis began.

According to the spokeswoman, the discussion also focused on an unfinished project of the Chancellor: the CAI investment agreement between the EU and China. Merkel had pushed for a political agreement on it during Germany’s EU presidency a year ago, after several years of negotiations – but at the end of her chancellorship, the deal between Brussels and Beijing is now on ice. Merkel and Xi also stressed the importance of next year’s 50th anniversary of the establishment of diplomatic relations between Germany and China.

Meanwhile, state news agency Xinhua reported it in an even loftier manner “I still remember every exchange we had over the past decade,” the chancellor said, according to Xinhua. She said there had been “deep exchanges” between her and Xi that had led to “improved mutual understanding”. Xi expressed hopes that Merkel would continue to care about and support the advancement of relations between Germany, the EU, and China.

During her 16 years as chancellor of Germany, Merkel has accompanied China’s rise and its resulting growing value for the German economy (China.Table reported). German exports to China have more than quadrupled since she took office, to around 96 billion euros at last count. ari

China’s exports are growing ever faster. In September, the People’s Republic’s exports increased by 28.1 percent year on year. Imports climbed by 17.6 percent. Exports had already grown by an unexpectedly strong 26.5 percent back in August. The strong export figures came as a surprise to experts, who had expected a lesser increase due to production downtimes resulting from power shortages that continue plaguing China.

In the first nine months of 2021, the value of exports of electronic equipment rose 23 percent, customs spokesman Li Kuiwen said Wednesday. Electronic goods account for nearly two-thirds of the value of all Chinese exports.

Conversely, imports of key commodities such as coal and oil fell slightly in volume between January and September, Li said. But the prices of commodities such as iron ore, crude oil, and copper rose by more than 30 percent. This is another reason why the value of imports rose – albeit at a much slower pace than in August (+33.1 percent).

Meanwhile, China bought conspicuously little from Germany and the EU as a whole in September. Imports from Germany dropped by 2.4 percent, according to customs data, while imports from the EU rose only minimally by 1.1 percent. Conversely, exports to Germany increased by a whopping 37.5 percent, and overall exports to the EU rose by 30.6 percent. ck

The United Nations Convention on Biological Diversity (COP15) has issued a preliminary document on the protection of global biodiversity. The “Kunming Declaration”, which has so far been rather vague, contains above all the goal of placing 30 percent of land and marine areas under protection by 2030. “Many states” had called for this. A “combination of measures” is needed to halt and reverse the threatening extinction of species, it said. The statement lists the following measure: change of land and sea use, enhancing the

conservation and restoration of ecosystems, mitigation of climate change, pollution reduction,

control over invasive alien species and prevention of overexploitation.

China’s President Xi Jinping had promised the equivalent of about e200 million for global species conservation on Tuesday. In his video statement, he announced the creation of a fund with a Chinese financial contribution of ¥1.5 billion. This aims to support developing countries in protecting their biodiversity. Xi also invited other countries to participate in the fund. He promised increased Chinese efforts in the fight against the dangerous extinction of species, including the expansion of China’s nature reserves. These currently account for about 18 percent of China’s land area.

In her speech, German Federal Environment Minister Svenja Schulze called for the COP15 targets to be transcribed into national plans and remarked: “This time we must ensure that none of the targets remain empty promises.” In 2010, the nearly 200 signatory states to the UN Convention on Biological Diversity (CBD) in Aichi, Japan, had set themselves the goal of halting the loss of biodiversity by 2020. However, the targets were missed by a wide margin. It was important to phase out subsidies that were harmful to the environment or harmed nature, Schulze continued.

Further negotiations will follow in January, before the adoption of the final framework agreement at a meeting in Kunming from April 25 to May 8. However, the agreement is expected to be less binding than the Paris climate agreement, which is often seen as a model – partly because experts say it is difficult to link targets to actual figures. ck

Japanese automaker Honda Motor plans the launch of a new electric vehicle brand in China in 2022. The new brand, called “e:N Series”, will launch ten models over the next five years with joint venture partners Guangzhou Auto (GAC) and Dongfeng Motor, according to Honda, Reuters reported on Wednesday. From 2030 on, Honda plans to launch only battery-powered cars, plug-in hybrids, and fuel cell vehicles on the Chinese market, according to the report. New Honda models with conventional combustion engines will no longer be available in China. However, the sale of fossil-fueled cars will continue after 2030. The report did not mention for how long.

According to Reuters, the two joint ventures GAC-Honda and Dongfeng-Honda are each planning the construction of an all-electric car factory, in which cars are expected to leave the production line in 2024. Honda wants to set up an “e:N Series” section at all of its roughly 1,200 dealerships in the country. Sales of electric cars, plug-in hybrids, and fuel cell cars will rise to three million in 2021, according to a forecast by the automakers’ association CAAM on Tuesday. In the first three quarters, the segment’s sales grew 190 percent year on year. ck

Many young people in China’s cities are growing skeptical about marriage. The reluctance is even stronger among women than men, according to a survey by the Communist Youth League. Some 44 percent of the women surveyed said they did not want to marry or were unsure whether they wanted to tie the knot, DPA reported. Among men, the figure was just under 25 percent. The Youth League had surveyed 2905 women and men between the ages of 18 and 26 in various cities.

“In recent years, more and more young people are staying out of the wedding halls,” the report on the survey said. “Delaying the wedding age and young people’s reluctance to get married have become a hidden concern for society as a whole.” In the survey, 46 percent of respondents said the cost of a wedding was too high. Also, 56 percent said giving birth and raising children in China was too expensive.

Despite a relaxation of its strict family planning policies, the world’s most populous country is now suffering from a massive decline in births (China.Table reported). Last year, the number of births declined by 18 percent to twelve million, and the aging population is growing (China.Table reported). ari

German citizens have little concern about a conflict between Europe and China, according to a survey. Around one in two do not fear tensions between Europe and the People’s Republic, according to a study published on Wednesday by the Konrad Adenauer Foundation (KAS) on the Germans’ opinion of security. According to the study, however, there was a difference between the new and old federal states: West Germans are more likely than East Germans to see a potential threat resulting from tensions between China and Europe (26:19 percent of respondents).

According to the KAS survey, however, Germany’s cooperation with China is not very popular: Only three percent of the respondents are in favor of “very close cooperation”. However, 27 percent were at least in favor of “close cooperation” with Beijing. Just under one in two, on the other hand, would like Germany to cooperate less closely with China currently. Close or very close cooperation with China was advocated slightly less often by West Germans than by East Germans. The KAS also surveyed the German political party spectrum. The supporters of the FDP (21 percent) and the Greens (19 percent) are less likely than average to favor close or very close cooperation with the People’s Republic.

German citizens are skeptical about China as a partner. According to the survey, only twelve percent believe that China is a reliable partner for Germany in matters of security. Here, too, there was an east-west divide: More people in Eastern Germany expressed confidence in China as a reliable partner country than in the West (17:11 percent). Supporters of the AfD (27 percent) and the Left (21 percent) see the People’s Republic as a reliable partner with above-average frequency – approval is slightly below average among supporters of the SPD (9 percent) and the Greens (9 percent).

For the study “Together or Alone? Germany’s Security”, 1,003 eligible voters were surveyed in January of this year. ari

Richard Li’s first step toward his own empire began with a broken satellite. In the early 1990s, after a brief stint in the Canadian investment industry, Li – then in his early 20s – had just returned to his native Hong Kong to join the same industry. When he heard about a broken satellite at work, a vision was born: Why not fix the satellite and broadcast television programs to viewers across Asia via small satellite dishes? With seven employees and a multimillion-dollar investment from his father, Li founded the satellite-based cable television service STAR – short for Satellite Television Asian Region.

The anecdote about the spontaneous purchase of a satellite makes it clear that Richard Li was not exactly the ordinary young man next door. Even though he dropped out of university and earned his money at times at the fast-food chain McDonald’s and as a caddy on the golf course, Li is the younger son of Hong Kong businessman Li Ka-Shing, who has been the city’s richest man for decades. Forbes estimated Li senior’s fortune at more than $35 billion in February.

After Li Ka-Shing fled with his family from southern China to Hong Kong as a teenager to escape the Japanese army, he became rich over the years by selling plastic roses. The now 93-year-old often had the right nose with his investments: he put money into Facebook and Spotify early on, for example. From a young age, Li senior showed his sons Richard and Victor how he led business negotiations. “Neither Victor nor I went to business school,” LA Times once quoted Richard Li as saying.

Other than this, the businessman is reluctant to talk about his family, and Richard Li often prefers to remain silent on political issues. Some journalists say that Li junior flinches when faced with personal questions. Consequently, little private information can be found about the man ranked 22nd richest person in Hong Kong. His CV and articles about him frequently mention that he is a licensed pilot and rescue diver. That seems to be important information.

In February 1993, Richard Li’s new company STAR already reached more than 45 million viewers. That same year, Li decided to sell the television service to Australian media mogul Rupert Murdoch for more than $950 million. “Some complain that I have been very rough and harsh. But there was no other way,” he once told LA Times of his management style during that time. With the money made from the STAR sale, Li founded the investment group Pacific Century Group (PCG), which he still heads today. He has remained loyal to the telecommunications and technology sectors in particular: Li has a stake in Hong Kong’s largest mobile phone provider, HKT, for example.

Richard Li is currently working on two major projects. On the one hand, he is working on the IPO of life insurance company FWD, which is also part of PCG’s portfolio. The reason for this is that Li would be able to retain control of the voting rights there, unlike in Hong Kong. The 54-year-old wants to raise three billion US dollars with the IPO, which could take place in September, according to reports.

In addition, Li is following a stock market trend together with Paypal co-founder Peter Thiel: As Bloomberg reported, the two founded a Special Acquisition Company (SPAC) for $595 million last year. With this empty company shell, the two entrepreneurs want to acquire Asian companies in technology, financial services, and media sectors and take them directly public. One of the first deals: The merger of their SPAC called Bridgetown 2 Holdings with digital real estate company PropertyGuru, which contains more than 2.8 million property listings per month and serves 37 million property searchers from countries such as Singapore and Indonesia. Li attempts to expand his empire outside Hong Kong in uncertain times – and preferably without angering the Chinese regime. Lisa Or

Ralf Schmidt is the new Senior Manager of Passive Safety and Restraint System at Daimler Greater China. Schmidt previously held various positions at Daimler AG in China and Germany.

Kathrin Mauch took up the position of Senior Manager Revenue Controlling Greater China/NAFTA & Pricing Products at Mercedes-Benz AG earlier this month. She was previously Head of Result Controlling MBC at Daimler AG.

Another Soccer World Cup 2022 without China? The People’s Republic team lost the match in Jeddah against Saudi Arabia by a narrow margin of 3:2. China is therefore only in fifth place in the Asian World Cup Group B qualification after four matches. Now it urgently needs points in the upcoming games against Oman (November 11) and Australia (November 16), since only the top two teams qualify directly for the World Cup next winter in Qatar. And even to retain a slim chance, China must finish third, which leads to a play-off qualifying round. With six games remaining and a six-point gap to second, anything seems possible, but the trend speaks for itself with nine goals conceded and just one win out of four games. The conclusion: Coach Li Tie’s team needs to stop relying solely on goals from Spain-bound striker Wu Lei to keep their World Cup dream alive.

China’s economy is currently dominated by two major issues: the power shortage and the crisis surrounding the stumbling real estate giant Evergrande. After we looked at the power crisis in yesterday’s issue, we now turn to the latest on Evergrande. Finn Mayer-Kuckuk analyzes Beijing’s search for ways to tackle the problems at Evergrande without severely affecting other parts of the economy. Because a default seems inevitable.

While the real estate sector is in turmoil, China’s electric car segment is booming unabated. And the importance of one particular element becomes apparent: Software that controls intelligent car functions. Frank Sieren takes a close look at one of the leading Chinese companies for smart car software, the start-up Banma. It is already cooperating with many manufacturers, including Volkswagen. Meanwhile, Japanese carmaker Honda announced plans to create a new electric brand in China. From 2030 onwards, Honda won’t launch any new models with combustion engines on the Chinese market.

We are also pleased to announce new cooperation: The consulting firm Sinolytics will now present an aspect of China in a weekly graphic. This week, it’s about the concept of “Common Prosperity” conceived by President Xi Jinping.

And while the possible successors to Angela Merkel’s German government are holding negotiation talks, the chancellor once again spoke with Xi Jinping over the phone. It was a “farewell conversation” in which Xi, according to Xinhua, urged Merkel to continue working for productive relations between Germany, Europe, and China.

We hope you enjoy today’s issue!

Concerns about the credit rating of China’s Evergrande real estate group are spreading throughout the markets. The company has missed several deadlines for interest payments to its investors over the week. What alert market participants have long suspected is becoming a certainty: The company does not have enough liquid reserves to service its numerous loans. The default will almost certainly turn into bankruptcy.

The prices of riskier Chinese bonds dropped significantly over the course of the week for this reason. Because just Evergrande has borrowed too much money. The 21 largest Chinese real estate companies have to pay ¥1.06 in interest for every yuan they earn, as analysts have calculated. This makes their debt levels not sustainable at all in this form. In the end, investors won’t get back everything they lent to these companies.

The question is therefore no longer if the Chinese real estate industry will undergo a major transformation – but instead, whether it will happen as a catastrophic conflagration or as a slash-and-burn of parts that are not capable of surviving. Chinese regulators are definitely aiming for the latter, to avoid a systemic spread of debt problems.

On Wednesday, the International Monetary Fund (IMF) expressed faith in China’s ability to overcome the debt crisis of its real estate sector without major “contagion” to other sectors. At the same time, economists at international institutions warned that a bailout should not happen too soon or be too generous. Evergrande must be a lesson to financial managers, they said. “The impression that individual companies are too big to fail cannot be allowed.”

Despite the domineering position of China’s CP, Beijing ultimately wants to give more power to market forces (China.Table reported). In its current state, the party has lost power over the private sector on the one hand, and yet it still needs to painstakingly control it. Instead, Xi wants to return to a state in which the party rules unrivaled over a social market economy.

Regulators therefore deliberately popped the Chinese real estate bubble last year. To this end, they have issued new minimum capital requirements. These are now known as the infamous “three red lines”. For example, a company’s debt must not exceed 70 percent of its value-added assets. In addition, it must always have enough liquid assets to be able to service short-term loans in full.

As a result, companies like Evergrande are no longer able to freely issue bonds to service their existing debt. The company’s ratios do not even come close to meeting the new requirements. Moreover, the government’s apparent distrust has, for the first time, created genuine distrust among other players: If Beijing drops real estate developers, no one else wants to touch them either.

Beijing is now looking for ways to solve the problems at Evergrande without major impacts on other parts of its economy. There is a particular care for small property buyers. In some cases, they have made a full down payment on apartments that Evergrande has not even built yet. There is word from China that county and municipal governments now contract local construction companies to have these projects finished if possible. Because if ordinary citizens were left empty-handed, the party would have a real legitimacy crisis on its hands.

At the same time, head of state Xi Jinping is unraveling the overly good relations between the cadres of his own party, big banks, and the private real estate companies. He is thus stripping financial institutions of their power and once again shows who calls the shots in China: the CP, not private capital. In the end, big national banks will also catch a large part of the toxic fallout emanating from the Evergrande’s affair. They are the biggest investors in China – and at the same time are obliged to serve the interests of the state.

That doesn’t mean everything is in the can just yet. On Monday alone, Evergrande owed investors $150 million in interest. This is money that financial market players had counted on. It is now missing elsewhere in the economic system. Moreover, if banks now have to completely write off large amounts of bonds, they will be stingy with loans elsewhere. That would be bad for the economy.

There are clear and present risks for the overall economy (China.Table reported). China’s real estate sector generates between four and five trillion euros annually, accounting for a quarter of China’s economic output. A sharp downturn in business activity would impact growth and employment rates. The missing percentage points to the growth target would be difficult to recoup. Especially when China has both an energy crisis and a pandemic on its hands.

While its main real estate business unit is about to collapse under the weight of its debts, Evergrande’s EV branch is apparently remaining undeterred. While a planned IPO is off the table for the time being (China.Table reported), Li Yongzhou, head of the automobile division, reiterated at a conference plans to bring the first products to market next year. This makes sense since production plants are already largely ready. Road tests of prototypes have also been completed. As long as there is enough funding, the automobile division will stick to its market plans.

Once upon a time, a car was defined by its engine performance, or perhaps the design. But in the future, a vehicle will be more defined by its software – especially in China. “Software is increasingly defining the car,” summarizes an industry report by Business Wire. So-called over-the-air updates (OTAs) are a key element. This means that the car’s software is constantly being updated, just like a smartphone – something providers are more than happy to additionally charge for.

The software factor will shape the car industry of the future the most, Tesla CEO Elon Musk himself also said recently – “from design to manufacturing, and especially autonomous driving.” Consumers in China are demanding more and more connected and intelligent features, according to Musk. As a result, he sees great growth potential for car software, including autonomous driving. When it comes to software, the Tesla CEO thinks some Chinese companies have become very good at it. Among others, China’s tech giants like Baidu, Tencent, and Huawei are developing their own car software systems.

Today, car developers are paying particular attention to Shanghai-based Banma Network Technology Co, Ltd, a leading supplier of smart car software. The startup was founded in 2015 as a joint venture between Alibaba and Shanghai Automotive (SAIC), one of China’s largest state-owned automakers. Banma then developed its software based on the AliOS system developed by Alibaba, which supports functions such as navigation, voice recognition, and entertainment in cars.

Today, there are already about one million cars outfitted with Banma technology on China’s streets. Car manufacturers such as SAIC, FAW, and Volkswagen also use Banma software. Banma also signed a strategic partnership with the electric startup Nio in 2020.

The EVs developed by Chinese start-ups are increasingly autonomous and networked. They rely on a completely new and much simpler drive architecture consisting of batteries, electric motors, and electronic controls. Compared to conventional vehicles, the production of electric cars can be more easily divided into different modules, says Wen Gai, a senior executive at the tech subsidiary of Guangzhou Automobile Group (GAC). As a result, the production of a car will be more like the production of a smartphone in the future. Software will play a key role. “In the new era of car manufacturing, manufacturing will be just one part of the long business chain that includes software services, after-sales services, and even financial services,” Gai explains. “Equipment manufacturers can tap into the market in many places.”

This also makes the market for smart automotive technology increasingly lucrative. Especially since the Chinese EV market is currently growing reliably. According to the China Association of Automobile Manufacturers (CAAM), sales of new energy vehicles, including hybrid electric cars, rose by 190 percent year-on-year to 2.16 million cars in the first three quarters of 2021 – including 1.79 million pure battery vehicles. Meanwhile, the global market for connected vehicles is also of interest to suppliers like Banma. And according to estimates by market research company Counterpoint Insights, this will grow by 270 percent between 2018 and 2022 to more than 125 million networked vehicles worldwide.

Thanks to autonomous driving, car software will need to cover more and more functions. Banma is therefore constantly working on new developments. In July, Banma received a substantial cash injection from its major shareholders Alibaba, SAIC, CMG-SDIC Capital Management, and Yunfeng Capital of ¥3 billion ($464 million). Banma plans to invest this money mainly into the R&D of smart vehicle operating systems, explains co-chief executive Zhang Chunhui, former president of Alibaba’s OS Business Group.

This is the second major round of funding for the startup, which had already raised more than $247 million in investments in 2018. This earned it a valuation of over $1 billion at the time, making it one of the so-called tech unicorns. The company’s current valuation is not published.

Before the end of this year, Banma plans the launch of a smart cockpit system developed in-house. Banma is also focusing on cooperation with providers of cutting-edge technologies. For example, the company entered into a strategic partnership with Robosense, a leading manufacturer of 3D LiDAR sensors in China, and AutoX, a leading platform for artificial intelligence-based autonomous driving. Together, they aim to promote the integration of intelligent cockpits with autonomous driving systems. By merging hardware, software, and AI capabilities, the goal is to create a complete ecosystem in the process. Banma is contributing system solutions to support the perceptual performance of Robosense’s LiDAR sensors, according to CIO Qiang Xiu, while AutoX provides Banma with “a comprehensive toolchain, cloud and end service system.”

The concept of “Common Prosperity” is intended to provide answers to one of the fundamental questions China is facing: How will China balance growing prosperity and the massive inequality of this prosperity in the future. So far, the picture is as follows:

Sinolytics is a European consulting and analysis company that focuses entirely on China. Sinolytics advises European companies on strategic orientation and specific business activities in China.

Was it the last phone call between Xi Jinping and Angela Merkel? The German chancellor and China’s president met via video conference for a “farewell talk”, according to a spokeswoman for the German government. According to the statement, Merkel and Xi discussed the development of bilateral relations and current issues on the international agenda, such as preparations for the upcoming G20 summit and the Covid pandemic. Xi will likely not attend the summit in Italy later this month in person, so there will be no opportunity for informal talks with him there. While Beijing has not yet officially canceled his travel plans, Xi has not left China since the Covid crisis began.

According to the spokeswoman, the discussion also focused on an unfinished project of the Chancellor: the CAI investment agreement between the EU and China. Merkel had pushed for a political agreement on it during Germany’s EU presidency a year ago, after several years of negotiations – but at the end of her chancellorship, the deal between Brussels and Beijing is now on ice. Merkel and Xi also stressed the importance of next year’s 50th anniversary of the establishment of diplomatic relations between Germany and China.

Meanwhile, state news agency Xinhua reported it in an even loftier manner “I still remember every exchange we had over the past decade,” the chancellor said, according to Xinhua. She said there had been “deep exchanges” between her and Xi that had led to “improved mutual understanding”. Xi expressed hopes that Merkel would continue to care about and support the advancement of relations between Germany, the EU, and China.

During her 16 years as chancellor of Germany, Merkel has accompanied China’s rise and its resulting growing value for the German economy (China.Table reported). German exports to China have more than quadrupled since she took office, to around 96 billion euros at last count. ari

China’s exports are growing ever faster. In September, the People’s Republic’s exports increased by 28.1 percent year on year. Imports climbed by 17.6 percent. Exports had already grown by an unexpectedly strong 26.5 percent back in August. The strong export figures came as a surprise to experts, who had expected a lesser increase due to production downtimes resulting from power shortages that continue plaguing China.

In the first nine months of 2021, the value of exports of electronic equipment rose 23 percent, customs spokesman Li Kuiwen said Wednesday. Electronic goods account for nearly two-thirds of the value of all Chinese exports.

Conversely, imports of key commodities such as coal and oil fell slightly in volume between January and September, Li said. But the prices of commodities such as iron ore, crude oil, and copper rose by more than 30 percent. This is another reason why the value of imports rose – albeit at a much slower pace than in August (+33.1 percent).

Meanwhile, China bought conspicuously little from Germany and the EU as a whole in September. Imports from Germany dropped by 2.4 percent, according to customs data, while imports from the EU rose only minimally by 1.1 percent. Conversely, exports to Germany increased by a whopping 37.5 percent, and overall exports to the EU rose by 30.6 percent. ck

The United Nations Convention on Biological Diversity (COP15) has issued a preliminary document on the protection of global biodiversity. The “Kunming Declaration”, which has so far been rather vague, contains above all the goal of placing 30 percent of land and marine areas under protection by 2030. “Many states” had called for this. A “combination of measures” is needed to halt and reverse the threatening extinction of species, it said. The statement lists the following measure: change of land and sea use, enhancing the

conservation and restoration of ecosystems, mitigation of climate change, pollution reduction,

control over invasive alien species and prevention of overexploitation.

China’s President Xi Jinping had promised the equivalent of about e200 million for global species conservation on Tuesday. In his video statement, he announced the creation of a fund with a Chinese financial contribution of ¥1.5 billion. This aims to support developing countries in protecting their biodiversity. Xi also invited other countries to participate in the fund. He promised increased Chinese efforts in the fight against the dangerous extinction of species, including the expansion of China’s nature reserves. These currently account for about 18 percent of China’s land area.

In her speech, German Federal Environment Minister Svenja Schulze called for the COP15 targets to be transcribed into national plans and remarked: “This time we must ensure that none of the targets remain empty promises.” In 2010, the nearly 200 signatory states to the UN Convention on Biological Diversity (CBD) in Aichi, Japan, had set themselves the goal of halting the loss of biodiversity by 2020. However, the targets were missed by a wide margin. It was important to phase out subsidies that were harmful to the environment or harmed nature, Schulze continued.

Further negotiations will follow in January, before the adoption of the final framework agreement at a meeting in Kunming from April 25 to May 8. However, the agreement is expected to be less binding than the Paris climate agreement, which is often seen as a model – partly because experts say it is difficult to link targets to actual figures. ck

Japanese automaker Honda Motor plans the launch of a new electric vehicle brand in China in 2022. The new brand, called “e:N Series”, will launch ten models over the next five years with joint venture partners Guangzhou Auto (GAC) and Dongfeng Motor, according to Honda, Reuters reported on Wednesday. From 2030 on, Honda plans to launch only battery-powered cars, plug-in hybrids, and fuel cell vehicles on the Chinese market, according to the report. New Honda models with conventional combustion engines will no longer be available in China. However, the sale of fossil-fueled cars will continue after 2030. The report did not mention for how long.

According to Reuters, the two joint ventures GAC-Honda and Dongfeng-Honda are each planning the construction of an all-electric car factory, in which cars are expected to leave the production line in 2024. Honda wants to set up an “e:N Series” section at all of its roughly 1,200 dealerships in the country. Sales of electric cars, plug-in hybrids, and fuel cell cars will rise to three million in 2021, according to a forecast by the automakers’ association CAAM on Tuesday. In the first three quarters, the segment’s sales grew 190 percent year on year. ck

Many young people in China’s cities are growing skeptical about marriage. The reluctance is even stronger among women than men, according to a survey by the Communist Youth League. Some 44 percent of the women surveyed said they did not want to marry or were unsure whether they wanted to tie the knot, DPA reported. Among men, the figure was just under 25 percent. The Youth League had surveyed 2905 women and men between the ages of 18 and 26 in various cities.

“In recent years, more and more young people are staying out of the wedding halls,” the report on the survey said. “Delaying the wedding age and young people’s reluctance to get married have become a hidden concern for society as a whole.” In the survey, 46 percent of respondents said the cost of a wedding was too high. Also, 56 percent said giving birth and raising children in China was too expensive.

Despite a relaxation of its strict family planning policies, the world’s most populous country is now suffering from a massive decline in births (China.Table reported). Last year, the number of births declined by 18 percent to twelve million, and the aging population is growing (China.Table reported). ari

German citizens have little concern about a conflict between Europe and China, according to a survey. Around one in two do not fear tensions between Europe and the People’s Republic, according to a study published on Wednesday by the Konrad Adenauer Foundation (KAS) on the Germans’ opinion of security. According to the study, however, there was a difference between the new and old federal states: West Germans are more likely than East Germans to see a potential threat resulting from tensions between China and Europe (26:19 percent of respondents).

According to the KAS survey, however, Germany’s cooperation with China is not very popular: Only three percent of the respondents are in favor of “very close cooperation”. However, 27 percent were at least in favor of “close cooperation” with Beijing. Just under one in two, on the other hand, would like Germany to cooperate less closely with China currently. Close or very close cooperation with China was advocated slightly less often by West Germans than by East Germans. The KAS also surveyed the German political party spectrum. The supporters of the FDP (21 percent) and the Greens (19 percent) are less likely than average to favor close or very close cooperation with the People’s Republic.

German citizens are skeptical about China as a partner. According to the survey, only twelve percent believe that China is a reliable partner for Germany in matters of security. Here, too, there was an east-west divide: More people in Eastern Germany expressed confidence in China as a reliable partner country than in the West (17:11 percent). Supporters of the AfD (27 percent) and the Left (21 percent) see the People’s Republic as a reliable partner with above-average frequency – approval is slightly below average among supporters of the SPD (9 percent) and the Greens (9 percent).

For the study “Together or Alone? Germany’s Security”, 1,003 eligible voters were surveyed in January of this year. ari

Richard Li’s first step toward his own empire began with a broken satellite. In the early 1990s, after a brief stint in the Canadian investment industry, Li – then in his early 20s – had just returned to his native Hong Kong to join the same industry. When he heard about a broken satellite at work, a vision was born: Why not fix the satellite and broadcast television programs to viewers across Asia via small satellite dishes? With seven employees and a multimillion-dollar investment from his father, Li founded the satellite-based cable television service STAR – short for Satellite Television Asian Region.

The anecdote about the spontaneous purchase of a satellite makes it clear that Richard Li was not exactly the ordinary young man next door. Even though he dropped out of university and earned his money at times at the fast-food chain McDonald’s and as a caddy on the golf course, Li is the younger son of Hong Kong businessman Li Ka-Shing, who has been the city’s richest man for decades. Forbes estimated Li senior’s fortune at more than $35 billion in February.

After Li Ka-Shing fled with his family from southern China to Hong Kong as a teenager to escape the Japanese army, he became rich over the years by selling plastic roses. The now 93-year-old often had the right nose with his investments: he put money into Facebook and Spotify early on, for example. From a young age, Li senior showed his sons Richard and Victor how he led business negotiations. “Neither Victor nor I went to business school,” LA Times once quoted Richard Li as saying.

Other than this, the businessman is reluctant to talk about his family, and Richard Li often prefers to remain silent on political issues. Some journalists say that Li junior flinches when faced with personal questions. Consequently, little private information can be found about the man ranked 22nd richest person in Hong Kong. His CV and articles about him frequently mention that he is a licensed pilot and rescue diver. That seems to be important information.

In February 1993, Richard Li’s new company STAR already reached more than 45 million viewers. That same year, Li decided to sell the television service to Australian media mogul Rupert Murdoch for more than $950 million. “Some complain that I have been very rough and harsh. But there was no other way,” he once told LA Times of his management style during that time. With the money made from the STAR sale, Li founded the investment group Pacific Century Group (PCG), which he still heads today. He has remained loyal to the telecommunications and technology sectors in particular: Li has a stake in Hong Kong’s largest mobile phone provider, HKT, for example.

Richard Li is currently working on two major projects. On the one hand, he is working on the IPO of life insurance company FWD, which is also part of PCG’s portfolio. The reason for this is that Li would be able to retain control of the voting rights there, unlike in Hong Kong. The 54-year-old wants to raise three billion US dollars with the IPO, which could take place in September, according to reports.

In addition, Li is following a stock market trend together with Paypal co-founder Peter Thiel: As Bloomberg reported, the two founded a Special Acquisition Company (SPAC) for $595 million last year. With this empty company shell, the two entrepreneurs want to acquire Asian companies in technology, financial services, and media sectors and take them directly public. One of the first deals: The merger of their SPAC called Bridgetown 2 Holdings with digital real estate company PropertyGuru, which contains more than 2.8 million property listings per month and serves 37 million property searchers from countries such as Singapore and Indonesia. Li attempts to expand his empire outside Hong Kong in uncertain times – and preferably without angering the Chinese regime. Lisa Or

Ralf Schmidt is the new Senior Manager of Passive Safety and Restraint System at Daimler Greater China. Schmidt previously held various positions at Daimler AG in China and Germany.

Kathrin Mauch took up the position of Senior Manager Revenue Controlling Greater China/NAFTA & Pricing Products at Mercedes-Benz AG earlier this month. She was previously Head of Result Controlling MBC at Daimler AG.

Another Soccer World Cup 2022 without China? The People’s Republic team lost the match in Jeddah against Saudi Arabia by a narrow margin of 3:2. China is therefore only in fifth place in the Asian World Cup Group B qualification after four matches. Now it urgently needs points in the upcoming games against Oman (November 11) and Australia (November 16), since only the top two teams qualify directly for the World Cup next winter in Qatar. And even to retain a slim chance, China must finish third, which leads to a play-off qualifying round. With six games remaining and a six-point gap to second, anything seems possible, but the trend speaks for itself with nine goals conceded and just one win out of four games. The conclusion: Coach Li Tie’s team needs to stop relying solely on goals from Spain-bound striker Wu Lei to keep their World Cup dream alive.