Since last week, the German Wahl-O-Mat (Vote-o-meter) by the Federal Agency for Civic Education can be used for guidance ahead of the Bundestag elections in 2021. However, China only makes a brief appearance with one question on the expansion of communications. There are no questions regarding major foreign policy or even EU-China relations. If you speak German, we recommend the Sin-O-Mat – the Vote-o-meter for China issues. With it, you are able to picture what the German parties think about CAI, Taiwan or the BRI.

With the election campaign entering its final stages, China.Table also takes a look at the German parties’ positions on China policy. To kick off our series on the federal elections, foreign policy spokesman of the SPD parliamentary group, Nils Schmid, explains in an interview with Michael Radunski what challenges he sees on the part of Beijing. The SPD chairman of the German Bundestag’s Foreign Affairs Committee also gives his opinion on where Angela Merkel’s China policy has failed. Till September 26, we will present you with more interviews with top German politicians.

Whether German voters would let themselves be chauffeured through rush-hour traffic by Chinese robot taxis is not a question asked in either the “Wahl-O-Mat” or the “Sin-O-Mat” – but a sensational video could now spark interest: In a clip by AutoX, the Chinese leader in autonomous driving, backed by Alibaba and Shanghai Motors, a car steers smoothly through a busy street – all without a human driver. Frank Sieren investigated what makes the start-up AutoX so special.

Disclaimer: This interview has been translated into English and is not considered an official translation by any party involved in the interview

The West is experiencing its biggest debacle in recent history in Afghanistan. In China, on the other hand, President Xi Jinping is the strong man. Is China about to overtake the West?

No, I do not see this risk. But there is certainly a serious Chinese challenge – and that challenge is much broader than it was during the Cold War with the Soviet Union. China is a military power, is building its nuclear arsenal, and it’s modernizing its army, but Beijing has also managed to be economically and technologically successful despite an authoritarian rule. This makes the People’s Republic attractive in areas where the West has so far reigned supreme. We need to deal with this now.

And how is Germany handling this challenge? How would you rate Germany’s China policy under Angela Merkel?

Angela Merkel is trapped in the past. Although China has changed dramatically, she continues to cling to the convergence thesis that economic exchange would bring China and Europe closer together. “Change through trade” may have worked in the past, but China has taken a different path under President Xi. Merkel, on the other hand, is stuck and manifestly unwilling to change course toward the end of her term. Gone are the days when German companies could assume that growth in China automatically meant growth for themselves. Nor is it true that the emergence of a Chinese middle class automatically increases rule-of-law standards and freedoms. On the contrary, we are seeing increasing persecution in China.

That’s all very abstract. Could you please name two specific points to which you attribute the failure of Germany’s China policy under Merkel?

I’d be happy to. In recent years, we have witnessed two wake-up calls. First, the debate about critical infrastructure and the trustworthiness of Chinese and other foreign suppliers. Here, the simple free trade paradigm cannot be applied. Rather, we need to look at who is behind these companies and how much these companies are at the mercy of authoritarian nations.

And secondly, the access of Chinese investors to sensitive tech companies, as in the Kuka case. Here, too, it is evident that the principle of a joint opening and development no longer applies. Mrs. Merkel does not seem to be aware of this.

Both are economic issues.

Yes. This clearly shows that the challenge posed by China is also very much about economics and technology.

Your examples are correct and yet typical: Germany only always reacts to China. Isn’t there an own plan on how to deal with China?

Yes, there is: with “change through trade” we wanted to bring each other closer and integrate China step by step into the international system and international rules. Up to a certain point, we succeeded. But it was always linked to the assumption that China was a developing country. This was also how we could understand the asymmetrical opening of markets, i.e. that China was unwilling to open up certain areas. But that time is over. We must now redefine our China policy and recognize that China is challenging us and the international system. Beijing wants to restructure the system according to its own ideas, which are not democratic but very authoritarian.

You claim a bit too much innocence for my taste. The SPD has governed for many years and usually also appoints the foreign minister, as it is doing now with Heiko Maas. Hence, they also bear responsibility for the failings in Germany’s China policy.

I don’t see it that way. It was always the SPD-led Foreign Ministry and also Heiko Maas himself who drove the debate on Germany’s China policy. In the cases of 5G and Huawei, the Foreign Office insisted on a geostrategic approach and ensured in the legislation that Germany was provided with appropriate control instruments. This is precisely where Heiko Maas has done the right thing.

In addition, the SPD has always stressed that alongside confrontation and competition there must also be areas of dialogue and cooperation, for example in climate protection or the fight against pandemics.

Now let’s take a look at current events and problems. Germany has sent its frigate Bayern to the Indo-Pacific. What exactly does Germany want in the South China Sea?

In this case, it was also the Foreign Office under the SPD that conceived the guidelines for the Indo-Pacific – and this is where the presence of the frigate Bavaria must be seen. We are sending out the signal that Germany is doing its part when it comes to ensuring freedom of the sea lanes and in international operations – the keywords being the UN embargo against Korea or the fight against piracy.

And now Germany wants to do all that?

It is clear that Germany will not make a military difference. But it is about sending a signal that we support international law, even in the South China Sea. Germany’s contribution to face the challenge posed by the Chinese must, of course, be more of a political and economic contribution than a military one. It would be rather foolhardy to think that Germany is an Indo-Pacific nation.

This makes it all the more important for us to pull our weight in economic and technological issues, for example by agreeing to a free trade agreement with ASEAN and other Indo-Pacific states.

So it’s all about symbolism. Let’s move on to issues where Germany could very well make the difference. How should Germany decide on the buildup of Huawei’s 5G network?

The German Bundestag has already made its decision with the IT Security Act. According to this law, we have the option of excluding untrustworthy companies from critical infrastructure such as the 5G network. I expect that the Federal Government will now also make its decision quickly.

And that means in Huawei’s case?

For all we know, Huawei may not get a shot then.

The next topic is Xinjiang. Volkswagen, among others, has a plant in this specific Chinese province where, according to UN figures, around one million people – mainly Uyghurs – are said to be imprisoned. VW CEO Herbert Diess, however, claims he has never heard of such detention facilities. Have you ever heard of them?

Of course. I was even in Xinjiang once. You can feel the close surveillance there. But of course, the VW plant itself is not an internment camp. Everything there happens according to German standards.

Nobody claimed otherwise.

Good. But of course, the context cannot leave anyone untouched. This is why I’m also pleased that we have passed the Supply Chain Act. It will lead to companies taking a very close look at whether they can remain active in certain regions, or whether they can also source preliminary products from such regions. This is about the human rights responsibility of German companies – regardless of the country in question. This applies just as much to North Korea and Iran, after all.

Here we have a very specific case. So what would be the consequence?

If a German company is proven to source preliminary products from forced labor or internment camps, fines could be imposed and the company could be excluded from public contracts. For the planned EU supply chain law, the SPD demands an import ban in case of serious human rights violations.

But it seems that Mr. Diess has obviously never heard of camps in Xinjiang. Does that put him in the clear?

No, that is not for Mr. Diess to decide, but is checked by an independent body at Bafa (Federal Office of Economics and Export Control).

Let’s put it in another way: Would you as an entrepreneur produce in Xinjiang under these circumstances?

No.

A clear answer. Let’s stay very briefly with the German economy. For years, it was said that a switch to electromobility would not be possible this quickly. But now that China is going all-in on electric mobility, electric vehicles are all the rage in German company headquarters. What does that say about the German economy?

The handling of electromobility is truly not a glorious chapter for German industry, regardless of China. As Baden-Württemberg’s Minister of Economics, I unsuccessfully campaigned for the establishment of battery production. But it was only under pressure from China and the climate debate that the German automotive industry was prepared to make real changes.

And what does that tell us?

This clearly shows that we need to be careful not to lose our future viability. We must now set the course for electromobility, but also fuel cells and hydrogen propulsion. Because of China, but also for our own sake.

Another issue that has lost attention, but not its urgency. Beijing’s grip on Hong Kong is becoming more intense. Has the West betrayed the citizens of Hong Kong?

It would be too harsh to put it that way. With the return of Hong Kong to China under the ‘one country, two systems’ principle, Beijing’s grip on Hong Kong is, of course, a given. And so it is extremely difficult for us on the outside to fight repression in Hong Kong. However, we should generously offer residency rights to those who want out. The UK in particular does that, but we should too. However, the bitter truth is that when an authoritarian state represses its own territory, we have little direct influence apart from targeted sanctions against those responsible or economic sanctions, which is very difficult in the case of China, unfortunately. This is why it is all the more important that we in Europe and in the West jointly condemn Beijing’s actions.

That doesn’t bode well for Taiwan.

Taiwan is a different story. Over the last few decades, Taiwan has built up its own social, administrative and economic model. All of this, of course, while maintaining the One China policy, because there must be no independence.

But Taiwan’s fate is a test for all the world’s democracies. Taiwan must continue to be able to define the conditions of unification with the mainland on their own terms; this must not be forced on Taiwan.

Xi Jinping, however, has clearly said that Taiwan must return to the motherland – and that this must not be postponed to future generations. With your red line, we are heading for war.

No. It’s more because of China. We focus on the status quo on the Taiwan issue. Reunification with mainland China is conceivable and desirable, but only if Taiwan’s social model and authority to make decisions are preserved. Changes must only take place peacefully. In the short term, I do not see war. But as Chinese threatening gestures increase, it is important that both America and, we too, declare our support for Taiwan.

The trustworthiness of the US has been severely shaken by their chaotic withdrawal from Afghanistan. Do you really believe in US support for Taiwan?

Yeah. Absolutely.

The European component of Germany’s China policy is very important to you. However, Chinese influence over Europe has recently led to a blockade of the EU on several occasions. How should Europe deal with this?

Germany must take a leading role here and actively formulate a China policy and be prepared to compromise with European partners. We must finally also take the interests of our EU partners into account, and not just focus on our economic advantages with China. One thing is clear, after all: the fact that China has been able to gain so much influence is also due to the lack of solidarity among Europeans; in Greece, for example, European investment has simply failed to materialize. This also sends a clear signal to China. In addition, there are instruments such as investment screening or transparency with regard to the ownership structure of companies.

You emphasize Germany’s special responsibility. So far, France in particular, with its President Emmanuel Macron, has taken on this leadership role. Why is so little coming from Germany?

That has a lot to do with Merkel’s outdated China policy. And yes, that has to change. I am confident that any new government will handle this differently.

Xi Jinping is resolutely positioned against Western values. Around the world, China is promoting its model as an alternative to Western democracy. Isn’t it time to take a firm stand against this?

Yes, by taking three steps. Firstly, we need visible European investment, for example in Africa. Secondly, we need to bring more leaders to Germany and Europe through exchange programs. The Chinese are very generous in this respect. It is clear why elites in Africa feel more connected to China through such programs. And thirdly, we need a greater presence in international institutions to better react to China’s repeatedly forged broad coalitions.

You have now criticized Angela Merkel’s China policy several times. What would the SPD do differently, most importantly, do better, with its China policy?

We will also pursue a strict European policy on China. Above all, we will not only focus on dialogue and trade but also seek opposition where necessary. It is high time that we finally actively defend our model of economy and governance and the way of living together.

And you don’t see that with the other parties?

There are such voices in all parties. But only the SPD has so far managed to successfully maintain a balance between dialogue and opposition. And Olaf Scholz has the necessary competence to do so.

Nils Schmid is the foreign policy spokesman of the SPD parliamentary group and the SPD’s representative on the Foreign Affairs Committee of the German Bundestag.

In a new video, Chinese autonomous driving leader AutoX, which is backed by Alibaba and Shanghai Motors, demonstrates how efficiently its robot taxis are now able to maneuver through traffic. The clip, released on Monday, was recorded during a drive in a busy Chinese residential area during evening rush hour. The fully autonomous vehicle can be seen maneuvering stop-and-go through the chaotic bustle of pedestrians, animals, cyclists, scooters, food stalls and construction barriers.

In addition, the “Ultimate RoboTaxi Challenge,” as the 10-minute video is titled, demonstrates some challenging “decisions.” In one scene, after a lightning-fast evaluation of the situation, the RoboTaxi decided to back up twice to make room for another car that is at the other end of a too narrow lane.

The RoboTaxi in the video is equipped with the AutoX Gen5 system, which was unveiled last month in Shanghai. It has 50 sensors, 28 cameras and six high-resolution LiDAR systems that guarantee 360-degree coverage of the environment. They image 15 million points per second. And the 28 cameras capture as many as 220 million pixels per second – which are then processed in the central processing unit at 2,200 TOPS, or trillions of computing operations per second. By comparison, the AI computer chip built into the new iPad manages eleven TOPS.

In the global AI startup ranking by Analytics Inside, one of the leading trade magazines in this field, published at the end of August, AutoX is ranked 15th as the only Chinese company in the top 20 and the only company from the autonomous driving sector. AutoX’s strongest competitors include Pony.ai and Weride from Guangzhou, as well as Baidu’s Apollo fleet in Beijing.

But unlike its competitors, AutoX relies much more on expensive LiDAR radar systems than comparatively simple cameras backed by elaborate image recognition software. That is why AutoX is considered a sensor-dependent AI software company for cars. AutoX calls itself a “platform.”

The company’s list of pioneering successes is long: AutoX had the first autonomous driving system tested in a Chinese metropolis. The first system able to drive anywhere from point A to point B in a Chinese metropolis. AutoX was the second and only Chinese company, after Google’s Waymo, to receive a permit in California for autonomous test operations at speeds of up to 75 km/h. It was the first company to receive licenses in three Chinese metropolises (in Shenzhen, Shanghai and Guangzhou). AutoX was already allowed to make their autonomous driving taxis publicly available to users without a backup driver late last year. And finally, it is now the first company to be on a nationwide mobility platform with their partner Alibaba Amap.

What’s amazing is that AutoX has managed these accomplishments with relatively little investment. While AutoX has only raised 160 million US dollars, its American competitor, Google subsidiary Waymo, has raised a total of 3.2 billion US dollars and recently announced a new investment round of 2.5 billion US dollars.

But Waymo cars are lagging behind the competition. That’s why Waymo CEO John Krafcik had to leave in April. At the end of August, Waymo announced public-access rides in a major American city for the first time. However, the autonomous cabs in San Francisco still rely on backup safety drivers. It is the first step outside previously tranquil tests on wide, empty streets under good weather conditions in Phoenix, Arizona.

The advantage of AutoX: In the maze of China’s metropolises, the company is able to collect more data faster, which in turn allows its own AI software to learn and improve.

“To date, we offer the only fully driverless robot taxi operation in China,” says Jewel Li, chief operating officer of AutoX. And China is a leader in this field.

The company, headquartered in Shenzhen, was founded in 2016 by Dr. Jianxiong Xiao, a former assistant professor at Princeton University, who wants to “democratize” autonomous driving with AutoX, as Xiao repeatedly emphasizes on his website and in interviews, i.e. make driverless driving affordable for everyone. Xiao wants to “create universal access to mobility for people and goods.”

ProfX, as Jiahnxiong Xiao is also known, wants to do for autonomous driving what Bill Gates did for software. Everyone should have unrestricted access to affordable, individualized mobility. ProfX is convinced that this can only be achieved through a combination of low-cost sensors and good software.

That’s why he mainly uses $50 cameras. But that alone is not enough, of course. The ultra-high-resolution radar is made by Israeli start-up Arbe Robotics. Back in April, AutoX had ordered 400,000 of these systems, which gives an indication of how quickly AutoX wants to roll out its system. The radar uses 2K resolution at 30 frames per second. It is considered 100 times more detailed than any other radar currently on the market.

AutoX now operates eight offices and five R&D centers around the globe. Last year, the company opened a 7,000-square-meter “Gigafactory” in Shanghai, which it claims is the largest data center for self-driving cars in China and the largest RoboTaxi test center in all of Asia. It also has a team of more than 100 research and development engineers in the U.S., where AutoX founded the first RoboDelivery pilot service in California, which delivers eco-products directly and without driver from producer straight to customers. Meanwhile, AutoX has more than 100 RoboTaxis in operation in Shanghai, Shenzhen, Wuhan and other cities.

AutoX launched the largest test run without security personnel on December 3, 2020, in Pingshan, a suburb of the tech metropolis Shenzhen, with a fleet of 25 converted Chrysler Pacifica minivans. However, the company limited itself to an area of 144 square kilometers. At this stage of implementation, accidents could spell commercial doom for a start-up, especially under the watchful eye of the state.

China’s market for autonomous vehicles is developing faster than that of the United States, thanks to government regulatory and financial support. Since Beijing approved tests for self-driving cars on designated public roads more than three years ago, numerous municipalities have issued permits to more than 70 companies for their pilot programs. In January this year, the Ministry of Industry and Information Technology (MIIT) released draft guidelines allowing tests on highways.

Swiss bank UBS estimates that the global robot taxi market will be worth at least $2 trillion annually by 2030, with purchases of robot taxi fleets potentially accounting for 12 percent of all new cars sold.

German automotive suppliers seem to be having a hard time with the long-known changes on the international automotive markets: the shift from combustion engines and to electric drives.

“To be honest, we could have thought about it earlier,” admitted Klaus Rosenfeld, CEO of automotive supplier Schaeffler, just a few days ago in the podcast “Chefgespräch” with German news magazine WirtschaftsWoche. He said that the automotive supplier had been too late with its focus on electromobility.

His words reflect what the study “The Transformation of German Automotive Suppliers to Electromobility” also reveals in its core statements. According to the study, more than 80 percent of the German automotive suppliers surveyed assume electromobility to become the new standard. However, 88 percent do not expect the combustion engine to be “fully replaced” until 2030 or later. The study was commissioned by the German Association of the Automotive Industry (VDA) in cooperation with auditing and consulting company Deloitte; 83 of 586 suppliers participated. However, the implications of this study for suppliers seem not to have taken root yet.

52 of the suppliers surveyed stated that they were pursuing a so-called “Harvest-Strategy”. Through it, they try to exploit the market for the old technology as much as possible, to later invest the profits in the development of competencies for electromobility. Only 15 of these 52 suppliers have made any progress in this respect. However, according to their own assessment, the majority still see themselves in the first phases (second to fourth) of the transition.

The authors of the study divided the transition phases to electric mobility into seven development stages. Only twelve of the 52 companies – anonymously – stated to be in the fifth phase. According to the study’s matrix, this is the stage in which suppliers are “exclusively focused on electromobility”. Only four of the respondents claim to be in the final stage of the transition. This means that currently, only 22 companies have already started the second half of their transformation.

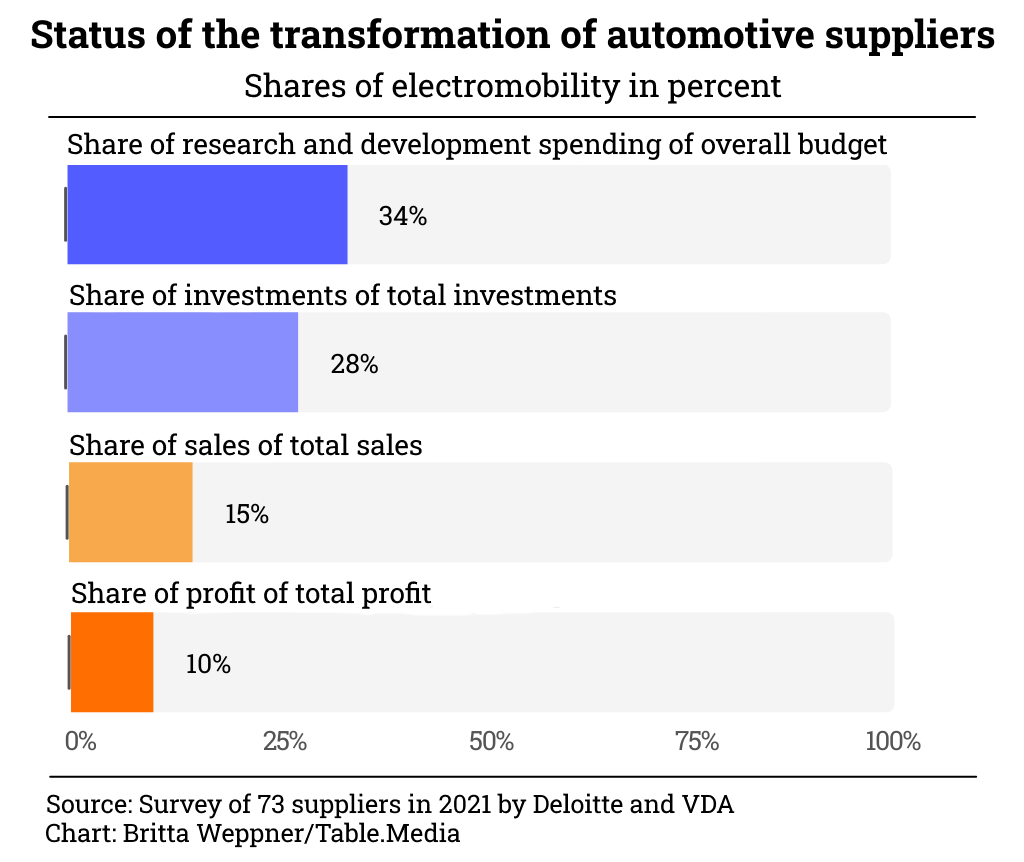

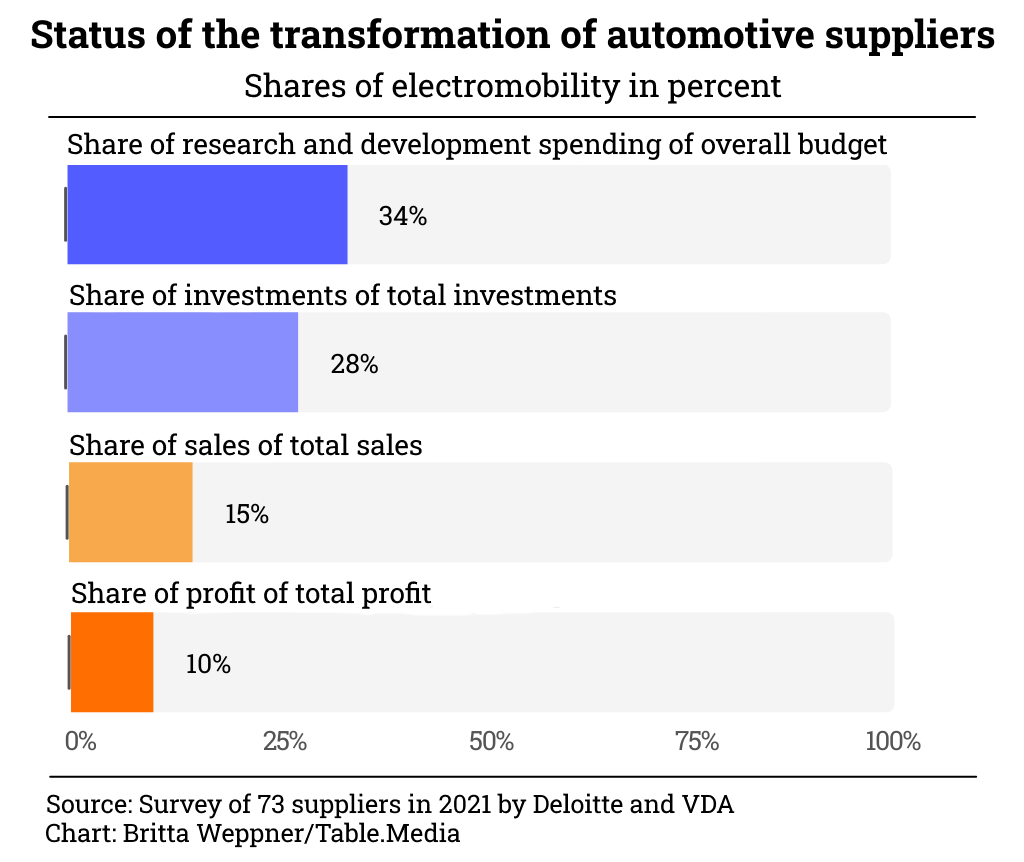

And suppliers affected invest around 15 percent of their total revenue in electromobility innovations. Suppliers who see themselves in the final stage six of the transformation to e-mobility have invested as much as 66 percent of their capital in research and development, which also accounts for 90 percent of their investments. However, the share of sales accounted for by e-drive products in this group is 12 percent and profits 10 percent (see China.Table chart above).

The VDA-Deloitte study also shows that the COVID-19 pandemic poses additional challenges for car manufactures, such as supply shortages of chips (China.Table reported). “There are concerns that suppliers will lack the necessary resources to accelerate the shift to electromobility as a result,” the authors warn. Nevertheless, more than two-thirds of respondents also see the pandemic “as an accelerator” for the shift to e-mobility.

Eight companies, on the other hand, stated that they saw no need at all to shift their business towards electromobility because they only produce parts that are not directly related to drive technology.

The situation in China is different. Hundreds of companies have emerged in the past four years focusing on the development of electric cars, even before the pandemic. Only time will tell whether they are successful (China.Table reported), but the direction of economic policy is clear – and thus also provides a certain degree of planning security for China’s EV pioneers.

Additionally, China is the most important automotive parts supplier outside the European Union according to Germany Trade & Invest (GTAI), a government-owned economic development agency. GTAI experts are convinced that China’s importance will continue to grow thanks to the shift towards electromobility. China has an almost complete value chain – both for vehicles with combustion engines, electric or hybrid drives, and fuel cells, explains Corinne Abele of GTAI.

Accordingly, automotive parts exports from China are on the rise. Its main customers are Germany, Japan and the USA. While China’s exports and imports of automotive parts and components were still balanced in 2010, exports of automotive parts will amount to 1.7 times imports in 2019 and 2020, which according to the GTAI study is clearly the result of increased competitiveness. So far, according to the China Automotive Dealers Association, the spare parts business, which accounts for about 70 percent of China’s automotive parts exports, has dominated the market.

Nevertheless, Chinese companies have already established themselves as system suppliers to international and German automotive groups outside China. The GTAI study cites the tool sector for the manufacturing of motor vehicles as an example.

There are only five Chinese companies among the 100 largest automotive parts manufacturers in 2021 – three of them (BHAP, CATL and Citic Dicastal) are newcomers. But they are joined by new suppliers, some from outside the industry, in the EV sector. CATL, one of the largest manufacturers of EV batteries, is one such candidate (China.Table reported). Two weeks ago, CATL became the newest member of German industry network Automotive Thueringen. Mathias Hasecke, chairman of the network, said that he also sees this as a signal for a strategic partnership for future innovation projects. Automotive Thueringen mainly consists of automotive suppliers.

In autumn 2019, CATL began the construction of a lithium-ion battery factory in Thuringia’s largest industrial park, “Erfurter Kreuz”. Production is scheduled to begin as early as the end of next year.

Particularly when it comes to batteries for all-electric cars, the question often arises: Is it better to manufacture or to buy them? All major battery manufacturers are Asian companies – such as LG Chem from South Korea, Panasonic from Japan or BYD and CATL from China. The dependence is already so prevalent that many OEMs such as Volkswagen, Daimler and BMW have begun to build their own battery cell factories in Europe. However, less than one percent of all batteries are produced in Europe, while more than 90 percent are imported from Asia.

A study by auditing firm PricewaterhouseCoopers shows that German suppliers focus primarily on research and development. On average, German suppliers invested 6.1 percent of their revenue in research and development – significantly more than their competitors in the rest of Europe (4.8 percent), America (3.6 percent) and Asia (3.8 percent).

However, whether this will be enough to prevent not being left behind by Chinese suppliers in the shift from combustion engines to electric drives will also depend on where investment funds will come from. They will be “a decisive driver of an accelerated transformation,” concludes the VDA study.

China’s exports increased by 25.6 percent in August compared to the same period last year (calculated in US dollars). This was reported by China Customs in Beijing on Tuesday. Imports even saw an increase of 33.1 percent. With these figures, the world’s second-largest economy is presenting itself even stronger than expected – despite recent Covid outbreaks.

Experts had even expected a slowdown in Chinese growth. Overall, however, there was a plus of 28.8 percent. The trade surplus reached 58.3 billion US dollars.

The values show that higher shipping costs and Covid-related delays at ports appear to have had far less of an impact on trade than had originally expected. Experts had also attributed their significantly lower expectations to higher commodity prices and supply bottlenecks in China and had also predicted weaker export growth for the rest of the year.

However, German exporters were not able to benefit much from the upwind in Chinese foreign trade. German exports to China rose by only 5.6 percent, while imports from China increased by 29.2 percent. The total bilateral trade volume thus grew by 16.4 percent.

China’s trade with the entire European Union increased by 22.8 percent. Its exports to the EU climbed by 29.4 percent, while imports rose by 12.4 percent.

“The new foreign trade figures point to a steady economic recovery in China,” Jens Hildebrandt, executive board member of the German Chamber of Commerce in China (AHK), told news agency dpa. German companies could also benefit from this, but in markets of other global regions, they are also increasingly encountering Chinese competition. rad

Hong Kong will allow Chinese mainland and Macao residents to enter the city without going through mandatory quarantine starting Sept. 15, implementing a measure that had been delayed since May, Chief Executive Carrie Lam announced Tuesday.

“We have been talking about this for a long time but were never able to launch it, as there were often problems, either because of the rebound in cases in Hong Kong, or the mainland’s pandemic situation,” the Hong Kong leader said during her weekly press conference.

Under the program, up to 2,000 people will be allowed to enter the special administrative region, 1,000 through the Shenzhen Bay Port and 1,000 via the Hong Kong-Zhuhai-Macao Bridge Port, Lam said.

Starting Wednesday, Hong Kong residents coming in from anywhere on the mainland or Macao will also be allowed to enter without going through quarantine, the chief executive said.

Previously, only residents returning from the neighboring Guangdong province could bypass quarantine.

Hong Kong residents who want to return to the city will have to stay in Macao or the mainland for two weeks straight before entry. They will also be required to present a negative Covid-19 test result at the port of entry and submit to regular testing after their arrival, according to local media reports. niw

The Geely brand Lotus is planning to produce its electric models in China. Between 2022 and 2026, four new electric models are to roll off production lines at a newly planned plant in Wuhan in the People’s Republic. The production of 2,000 compact SUVs will begin as early as next year, Feng Qingfeng, chief executive of Lotus, told Reuters. About one billion euros will be invested in the new production facility in China.

The plant, which covers an area of more than one million square meters, will increase Lotus’ production capacity to 150,000 vehicles a year. The development of a new Lotus Technology business unit will also be partially located at the site in China, the company announced.

Chinese Business unit Lotus Technology is responsible for mass-produced EVs, designed for higher sales figures, and for coordination between individual development units, which, in addition to the units in the UK and China, also include the German-based R&D centre (Lotus Technology Innovation Centre) in Raunheim.

Lotus, which has been majority-owned by Chinese auto brand Geely since 2017, had most recently received investment from Nio Capital, the investment arm of EV manufacturer Nio.

Production at the plant in Wuhan is to be ramped up to 20,000 cars by 2023. The company also plans to open up to 70 sales outlets in China by 2024. The manufacturer of the Lotus Esprit, made famous by its appearance in the James Bond movies, plans to open 20 outlets in the coming year alone. niw

Italy’s Prime Minister Mario Draghi has lobbied China’s President Xi Jinping for a special G20 summit on the situation in Afghanistan. In a phone call, Xi and Draghi discussed the “latest developments in the Afghanistan crisis and possible forums on international cooperation to address it, including the G20,” Italy’s news agency Ansa reported. According to the report, they also discussed bilateral cooperation between Italy and the People’s Republic and preparations for the regular G20 summit in Rome in October.

Xi pledged to support Italy’s efforts to make next month’s summit a success, China’s news agency Xinhua reported. According to the report, Xi added that he hoped Italy would play an active role in promoting China-EU relations. Xinhua did not mention a possible special summit.

Italy currently holds the G20 presidency and is working on organizing a separate ad hoc G20 summit focused on Afghanistan to be held ahead of the regular G20 meeting. It is not yet known whether Xi will travel to Europe for the October summit.

Xi also addressed the China-Italy Year of Culture and Tourism planned for 2022, according to state media, and promoted strengthening bilateral cooperation in winter sports. The two sides should support each other in hosting the Beijing Winter Olympics and the Milan-Cortina Winter Games in 2026, Xi Jinping said. ari

The chili sauce of the Chinese brand “Lao Gan Ma” doesn’t exactly look all that glamorous, the design even seems really old-fashioned. And yet, it has a cult following in China: You can buy Lao Gan Ma T-shirts and mobile phone covers on the internet. At New York Fashion Week in 2018, sweaters appeared donning the likeness of the somber-looking woman in the logo. Her name is Tao Huabi. She is the creator of Lao Gan Ma, which translates roughly to “old godmother.” As a successful businesswoman who had no formal education and was forced to overcome many hardships in life, the 77-year-old is regarded by many Chinese today as the ultimate embodiment of the “Chinese Dream”.

Tao was born in 1947 in Guizhou, one of China’s poorest provinces. Her biography titled “If I Hadn’t Been Strong, I Would’ve Starved” became a bestseller in China. Instead of learning to read and write, Tao had to help feed the family as a child. She invented her product during the Great Famine that followed Mao’s campaign of the “Great Leap Forward.” At that time, between 1959 and 1961, several million Chinese died. The combination of wild-growing medicinal plants and home-grown chili peppers was intended to make the meager root vegetables that served as her family’s main food source at the time a little more palatable.

After years as a migrant worker, Tao, who was widowed at an early age, had saved up enough money in the late 1980s to open a small cookshop. There, however, she discovered that customers came not primarily for her noodles, but for the homemade chili sauce she used to spice up the dishes.

At the end of 1994, Tao opened a small shop where she offered her preserved chili oil sauce in different varieties. It was the cornerstone of the Lao Gan Ma empire: today, the group Tao runs with her two sons is the largest producer and seller of chili products in China, producing 1.3 million jars per day. In 2020, the company achieved record sales of more than 5.4 billion yuan (about 835.6 million U.S. dollars) – a 7 percent increase from the previous year. “I have to be the number one if I want to do anything,” says the aged entrepreneur.

Tao’s sauces – there are now 17 different varieties available – can now be found in Asian supermarkets in more than 30 countries. YouTube is home to numerous videos paying homage to the spicy ingredient. In early 2020, British chef Alex Rushmer proclaimed on Twitter, “I would eat a bowl of gravel if it was smothered in Lao Gan Ma.” She even has her own fan clubs – on Facebook, the Lao Gan Ma Appreciation Society has 4000 members.

An unbelievable success story – yet Tao still forgoes modern marketing. Lao Gan Ma has no social media accounts and its website hasn’t been updated in years, nor has its logo, which is still emblazoned with Tao’s grim likeness. “We sell the taste, not the packaging,” she once said.

In 2019, Lao Gan Ma was named one of China’s top 100 brands along with China Mobile, TikTok, Tsingtao, Huawei and Alibaba. Still, Tao does not want to take her company public. “Going public is cheating money from others,” she said in 2013. For the government in Beijing, the millionaire entrepreneur is a patriotic role model. Tao, who to this day cannot read properly, is a party member and active as a representative of the Standing Committee of the People’s Congress in her native Guizhou.

When asked about the price difference of Lao Gan Ma in China (ten yuan, which is about 1.30 euros per glass) and other countries (4.99 euros on Amazon.de), she says: “I am Chinese. I don’t make money from Chinese people. I want to sell Lao Gan Ma abroad and make money from foreigners.” Fabian Peltsch

Liu Yuchao is the new Senior Vice President for Supply Chain in China for the e-car start-up Faraday Future. The Chinese-American company had just raised around one billion US dollars in an IPO on the New York Technology Exchange at the end of July. The fresh capital should now help the company finally bring its first model, a luxury electric SUV called FF91, to market, said CEO Carsten Breitfeld (China.Table reported). “I am looking forward to starting a new chapter in my career at FF. I know my supply chain experience can help accelerate the mass production and delivery of the FF 1 in the Chinese market,” Yu said of his new position.

Cheng Wei, founder and CEO of ride-hailing service Didi, will head the Information and Data Security (IDS) Commission established in July, according to an internal memo obtained by the South China Morning Post. Chief technology officer Zhang Bo will become deputy director. The move is a significant departure from the ride-hailing company’s previous practices. Established in 2016, the commission previously served only as a supporting unit. In the future, it will consist of data security, cyberspace, information security, personal data protection, algorithm security and content security, and will also protect the company’s overseas data, SCMP reports.

Residents of the ancient city of Ciqikou in the southwest Chinese province of Chongqing move their furniture to a safe place. Earlier this week, a flood control alert was declared. After heavy rains, the Jialing River in Chongqing burst its banks. Floods in the central Chinese city of Zhengzhou had claimed the lives of 99 people at the end of July. Authorities estimate that direct economic damage resulting from floods will amount to about 71 billion yuan (nine billion euros). Climate experts believe that floods will also continue to increase in China due to climate change.

Since last week, the German Wahl-O-Mat (Vote-o-meter) by the Federal Agency for Civic Education can be used for guidance ahead of the Bundestag elections in 2021. However, China only makes a brief appearance with one question on the expansion of communications. There are no questions regarding major foreign policy or even EU-China relations. If you speak German, we recommend the Sin-O-Mat – the Vote-o-meter for China issues. With it, you are able to picture what the German parties think about CAI, Taiwan or the BRI.

With the election campaign entering its final stages, China.Table also takes a look at the German parties’ positions on China policy. To kick off our series on the federal elections, foreign policy spokesman of the SPD parliamentary group, Nils Schmid, explains in an interview with Michael Radunski what challenges he sees on the part of Beijing. The SPD chairman of the German Bundestag’s Foreign Affairs Committee also gives his opinion on where Angela Merkel’s China policy has failed. Till September 26, we will present you with more interviews with top German politicians.

Whether German voters would let themselves be chauffeured through rush-hour traffic by Chinese robot taxis is not a question asked in either the “Wahl-O-Mat” or the “Sin-O-Mat” – but a sensational video could now spark interest: In a clip by AutoX, the Chinese leader in autonomous driving, backed by Alibaba and Shanghai Motors, a car steers smoothly through a busy street – all without a human driver. Frank Sieren investigated what makes the start-up AutoX so special.

Disclaimer: This interview has been translated into English and is not considered an official translation by any party involved in the interview

The West is experiencing its biggest debacle in recent history in Afghanistan. In China, on the other hand, President Xi Jinping is the strong man. Is China about to overtake the West?

No, I do not see this risk. But there is certainly a serious Chinese challenge – and that challenge is much broader than it was during the Cold War with the Soviet Union. China is a military power, is building its nuclear arsenal, and it’s modernizing its army, but Beijing has also managed to be economically and technologically successful despite an authoritarian rule. This makes the People’s Republic attractive in areas where the West has so far reigned supreme. We need to deal with this now.

And how is Germany handling this challenge? How would you rate Germany’s China policy under Angela Merkel?

Angela Merkel is trapped in the past. Although China has changed dramatically, she continues to cling to the convergence thesis that economic exchange would bring China and Europe closer together. “Change through trade” may have worked in the past, but China has taken a different path under President Xi. Merkel, on the other hand, is stuck and manifestly unwilling to change course toward the end of her term. Gone are the days when German companies could assume that growth in China automatically meant growth for themselves. Nor is it true that the emergence of a Chinese middle class automatically increases rule-of-law standards and freedoms. On the contrary, we are seeing increasing persecution in China.

That’s all very abstract. Could you please name two specific points to which you attribute the failure of Germany’s China policy under Merkel?

I’d be happy to. In recent years, we have witnessed two wake-up calls. First, the debate about critical infrastructure and the trustworthiness of Chinese and other foreign suppliers. Here, the simple free trade paradigm cannot be applied. Rather, we need to look at who is behind these companies and how much these companies are at the mercy of authoritarian nations.

And secondly, the access of Chinese investors to sensitive tech companies, as in the Kuka case. Here, too, it is evident that the principle of a joint opening and development no longer applies. Mrs. Merkel does not seem to be aware of this.

Both are economic issues.

Yes. This clearly shows that the challenge posed by China is also very much about economics and technology.

Your examples are correct and yet typical: Germany only always reacts to China. Isn’t there an own plan on how to deal with China?

Yes, there is: with “change through trade” we wanted to bring each other closer and integrate China step by step into the international system and international rules. Up to a certain point, we succeeded. But it was always linked to the assumption that China was a developing country. This was also how we could understand the asymmetrical opening of markets, i.e. that China was unwilling to open up certain areas. But that time is over. We must now redefine our China policy and recognize that China is challenging us and the international system. Beijing wants to restructure the system according to its own ideas, which are not democratic but very authoritarian.

You claim a bit too much innocence for my taste. The SPD has governed for many years and usually also appoints the foreign minister, as it is doing now with Heiko Maas. Hence, they also bear responsibility for the failings in Germany’s China policy.

I don’t see it that way. It was always the SPD-led Foreign Ministry and also Heiko Maas himself who drove the debate on Germany’s China policy. In the cases of 5G and Huawei, the Foreign Office insisted on a geostrategic approach and ensured in the legislation that Germany was provided with appropriate control instruments. This is precisely where Heiko Maas has done the right thing.

In addition, the SPD has always stressed that alongside confrontation and competition there must also be areas of dialogue and cooperation, for example in climate protection or the fight against pandemics.

Now let’s take a look at current events and problems. Germany has sent its frigate Bayern to the Indo-Pacific. What exactly does Germany want in the South China Sea?

In this case, it was also the Foreign Office under the SPD that conceived the guidelines for the Indo-Pacific – and this is where the presence of the frigate Bavaria must be seen. We are sending out the signal that Germany is doing its part when it comes to ensuring freedom of the sea lanes and in international operations – the keywords being the UN embargo against Korea or the fight against piracy.

And now Germany wants to do all that?

It is clear that Germany will not make a military difference. But it is about sending a signal that we support international law, even in the South China Sea. Germany’s contribution to face the challenge posed by the Chinese must, of course, be more of a political and economic contribution than a military one. It would be rather foolhardy to think that Germany is an Indo-Pacific nation.

This makes it all the more important for us to pull our weight in economic and technological issues, for example by agreeing to a free trade agreement with ASEAN and other Indo-Pacific states.

So it’s all about symbolism. Let’s move on to issues where Germany could very well make the difference. How should Germany decide on the buildup of Huawei’s 5G network?

The German Bundestag has already made its decision with the IT Security Act. According to this law, we have the option of excluding untrustworthy companies from critical infrastructure such as the 5G network. I expect that the Federal Government will now also make its decision quickly.

And that means in Huawei’s case?

For all we know, Huawei may not get a shot then.

The next topic is Xinjiang. Volkswagen, among others, has a plant in this specific Chinese province where, according to UN figures, around one million people – mainly Uyghurs – are said to be imprisoned. VW CEO Herbert Diess, however, claims he has never heard of such detention facilities. Have you ever heard of them?

Of course. I was even in Xinjiang once. You can feel the close surveillance there. But of course, the VW plant itself is not an internment camp. Everything there happens according to German standards.

Nobody claimed otherwise.

Good. But of course, the context cannot leave anyone untouched. This is why I’m also pleased that we have passed the Supply Chain Act. It will lead to companies taking a very close look at whether they can remain active in certain regions, or whether they can also source preliminary products from such regions. This is about the human rights responsibility of German companies – regardless of the country in question. This applies just as much to North Korea and Iran, after all.

Here we have a very specific case. So what would be the consequence?

If a German company is proven to source preliminary products from forced labor or internment camps, fines could be imposed and the company could be excluded from public contracts. For the planned EU supply chain law, the SPD demands an import ban in case of serious human rights violations.

But it seems that Mr. Diess has obviously never heard of camps in Xinjiang. Does that put him in the clear?

No, that is not for Mr. Diess to decide, but is checked by an independent body at Bafa (Federal Office of Economics and Export Control).

Let’s put it in another way: Would you as an entrepreneur produce in Xinjiang under these circumstances?

No.

A clear answer. Let’s stay very briefly with the German economy. For years, it was said that a switch to electromobility would not be possible this quickly. But now that China is going all-in on electric mobility, electric vehicles are all the rage in German company headquarters. What does that say about the German economy?

The handling of electromobility is truly not a glorious chapter for German industry, regardless of China. As Baden-Württemberg’s Minister of Economics, I unsuccessfully campaigned for the establishment of battery production. But it was only under pressure from China and the climate debate that the German automotive industry was prepared to make real changes.

And what does that tell us?

This clearly shows that we need to be careful not to lose our future viability. We must now set the course for electromobility, but also fuel cells and hydrogen propulsion. Because of China, but also for our own sake.

Another issue that has lost attention, but not its urgency. Beijing’s grip on Hong Kong is becoming more intense. Has the West betrayed the citizens of Hong Kong?

It would be too harsh to put it that way. With the return of Hong Kong to China under the ‘one country, two systems’ principle, Beijing’s grip on Hong Kong is, of course, a given. And so it is extremely difficult for us on the outside to fight repression in Hong Kong. However, we should generously offer residency rights to those who want out. The UK in particular does that, but we should too. However, the bitter truth is that when an authoritarian state represses its own territory, we have little direct influence apart from targeted sanctions against those responsible or economic sanctions, which is very difficult in the case of China, unfortunately. This is why it is all the more important that we in Europe and in the West jointly condemn Beijing’s actions.

That doesn’t bode well for Taiwan.

Taiwan is a different story. Over the last few decades, Taiwan has built up its own social, administrative and economic model. All of this, of course, while maintaining the One China policy, because there must be no independence.

But Taiwan’s fate is a test for all the world’s democracies. Taiwan must continue to be able to define the conditions of unification with the mainland on their own terms; this must not be forced on Taiwan.

Xi Jinping, however, has clearly said that Taiwan must return to the motherland – and that this must not be postponed to future generations. With your red line, we are heading for war.

No. It’s more because of China. We focus on the status quo on the Taiwan issue. Reunification with mainland China is conceivable and desirable, but only if Taiwan’s social model and authority to make decisions are preserved. Changes must only take place peacefully. In the short term, I do not see war. But as Chinese threatening gestures increase, it is important that both America and, we too, declare our support for Taiwan.

The trustworthiness of the US has been severely shaken by their chaotic withdrawal from Afghanistan. Do you really believe in US support for Taiwan?

Yeah. Absolutely.

The European component of Germany’s China policy is very important to you. However, Chinese influence over Europe has recently led to a blockade of the EU on several occasions. How should Europe deal with this?

Germany must take a leading role here and actively formulate a China policy and be prepared to compromise with European partners. We must finally also take the interests of our EU partners into account, and not just focus on our economic advantages with China. One thing is clear, after all: the fact that China has been able to gain so much influence is also due to the lack of solidarity among Europeans; in Greece, for example, European investment has simply failed to materialize. This also sends a clear signal to China. In addition, there are instruments such as investment screening or transparency with regard to the ownership structure of companies.

You emphasize Germany’s special responsibility. So far, France in particular, with its President Emmanuel Macron, has taken on this leadership role. Why is so little coming from Germany?

That has a lot to do with Merkel’s outdated China policy. And yes, that has to change. I am confident that any new government will handle this differently.

Xi Jinping is resolutely positioned against Western values. Around the world, China is promoting its model as an alternative to Western democracy. Isn’t it time to take a firm stand against this?

Yes, by taking three steps. Firstly, we need visible European investment, for example in Africa. Secondly, we need to bring more leaders to Germany and Europe through exchange programs. The Chinese are very generous in this respect. It is clear why elites in Africa feel more connected to China through such programs. And thirdly, we need a greater presence in international institutions to better react to China’s repeatedly forged broad coalitions.

You have now criticized Angela Merkel’s China policy several times. What would the SPD do differently, most importantly, do better, with its China policy?

We will also pursue a strict European policy on China. Above all, we will not only focus on dialogue and trade but also seek opposition where necessary. It is high time that we finally actively defend our model of economy and governance and the way of living together.

And you don’t see that with the other parties?

There are such voices in all parties. But only the SPD has so far managed to successfully maintain a balance between dialogue and opposition. And Olaf Scholz has the necessary competence to do so.

Nils Schmid is the foreign policy spokesman of the SPD parliamentary group and the SPD’s representative on the Foreign Affairs Committee of the German Bundestag.

In a new video, Chinese autonomous driving leader AutoX, which is backed by Alibaba and Shanghai Motors, demonstrates how efficiently its robot taxis are now able to maneuver through traffic. The clip, released on Monday, was recorded during a drive in a busy Chinese residential area during evening rush hour. The fully autonomous vehicle can be seen maneuvering stop-and-go through the chaotic bustle of pedestrians, animals, cyclists, scooters, food stalls and construction barriers.

In addition, the “Ultimate RoboTaxi Challenge,” as the 10-minute video is titled, demonstrates some challenging “decisions.” In one scene, after a lightning-fast evaluation of the situation, the RoboTaxi decided to back up twice to make room for another car that is at the other end of a too narrow lane.

The RoboTaxi in the video is equipped with the AutoX Gen5 system, which was unveiled last month in Shanghai. It has 50 sensors, 28 cameras and six high-resolution LiDAR systems that guarantee 360-degree coverage of the environment. They image 15 million points per second. And the 28 cameras capture as many as 220 million pixels per second – which are then processed in the central processing unit at 2,200 TOPS, or trillions of computing operations per second. By comparison, the AI computer chip built into the new iPad manages eleven TOPS.

In the global AI startup ranking by Analytics Inside, one of the leading trade magazines in this field, published at the end of August, AutoX is ranked 15th as the only Chinese company in the top 20 and the only company from the autonomous driving sector. AutoX’s strongest competitors include Pony.ai and Weride from Guangzhou, as well as Baidu’s Apollo fleet in Beijing.

But unlike its competitors, AutoX relies much more on expensive LiDAR radar systems than comparatively simple cameras backed by elaborate image recognition software. That is why AutoX is considered a sensor-dependent AI software company for cars. AutoX calls itself a “platform.”

The company’s list of pioneering successes is long: AutoX had the first autonomous driving system tested in a Chinese metropolis. The first system able to drive anywhere from point A to point B in a Chinese metropolis. AutoX was the second and only Chinese company, after Google’s Waymo, to receive a permit in California for autonomous test operations at speeds of up to 75 km/h. It was the first company to receive licenses in three Chinese metropolises (in Shenzhen, Shanghai and Guangzhou). AutoX was already allowed to make their autonomous driving taxis publicly available to users without a backup driver late last year. And finally, it is now the first company to be on a nationwide mobility platform with their partner Alibaba Amap.

What’s amazing is that AutoX has managed these accomplishments with relatively little investment. While AutoX has only raised 160 million US dollars, its American competitor, Google subsidiary Waymo, has raised a total of 3.2 billion US dollars and recently announced a new investment round of 2.5 billion US dollars.

But Waymo cars are lagging behind the competition. That’s why Waymo CEO John Krafcik had to leave in April. At the end of August, Waymo announced public-access rides in a major American city for the first time. However, the autonomous cabs in San Francisco still rely on backup safety drivers. It is the first step outside previously tranquil tests on wide, empty streets under good weather conditions in Phoenix, Arizona.

The advantage of AutoX: In the maze of China’s metropolises, the company is able to collect more data faster, which in turn allows its own AI software to learn and improve.

“To date, we offer the only fully driverless robot taxi operation in China,” says Jewel Li, chief operating officer of AutoX. And China is a leader in this field.

The company, headquartered in Shenzhen, was founded in 2016 by Dr. Jianxiong Xiao, a former assistant professor at Princeton University, who wants to “democratize” autonomous driving with AutoX, as Xiao repeatedly emphasizes on his website and in interviews, i.e. make driverless driving affordable for everyone. Xiao wants to “create universal access to mobility for people and goods.”

ProfX, as Jiahnxiong Xiao is also known, wants to do for autonomous driving what Bill Gates did for software. Everyone should have unrestricted access to affordable, individualized mobility. ProfX is convinced that this can only be achieved through a combination of low-cost sensors and good software.

That’s why he mainly uses $50 cameras. But that alone is not enough, of course. The ultra-high-resolution radar is made by Israeli start-up Arbe Robotics. Back in April, AutoX had ordered 400,000 of these systems, which gives an indication of how quickly AutoX wants to roll out its system. The radar uses 2K resolution at 30 frames per second. It is considered 100 times more detailed than any other radar currently on the market.

AutoX now operates eight offices and five R&D centers around the globe. Last year, the company opened a 7,000-square-meter “Gigafactory” in Shanghai, which it claims is the largest data center for self-driving cars in China and the largest RoboTaxi test center in all of Asia. It also has a team of more than 100 research and development engineers in the U.S., where AutoX founded the first RoboDelivery pilot service in California, which delivers eco-products directly and without driver from producer straight to customers. Meanwhile, AutoX has more than 100 RoboTaxis in operation in Shanghai, Shenzhen, Wuhan and other cities.

AutoX launched the largest test run without security personnel on December 3, 2020, in Pingshan, a suburb of the tech metropolis Shenzhen, with a fleet of 25 converted Chrysler Pacifica minivans. However, the company limited itself to an area of 144 square kilometers. At this stage of implementation, accidents could spell commercial doom for a start-up, especially under the watchful eye of the state.

China’s market for autonomous vehicles is developing faster than that of the United States, thanks to government regulatory and financial support. Since Beijing approved tests for self-driving cars on designated public roads more than three years ago, numerous municipalities have issued permits to more than 70 companies for their pilot programs. In January this year, the Ministry of Industry and Information Technology (MIIT) released draft guidelines allowing tests on highways.

Swiss bank UBS estimates that the global robot taxi market will be worth at least $2 trillion annually by 2030, with purchases of robot taxi fleets potentially accounting for 12 percent of all new cars sold.

German automotive suppliers seem to be having a hard time with the long-known changes on the international automotive markets: the shift from combustion engines and to electric drives.

“To be honest, we could have thought about it earlier,” admitted Klaus Rosenfeld, CEO of automotive supplier Schaeffler, just a few days ago in the podcast “Chefgespräch” with German news magazine WirtschaftsWoche. He said that the automotive supplier had been too late with its focus on electromobility.

His words reflect what the study “The Transformation of German Automotive Suppliers to Electromobility” also reveals in its core statements. According to the study, more than 80 percent of the German automotive suppliers surveyed assume electromobility to become the new standard. However, 88 percent do not expect the combustion engine to be “fully replaced” until 2030 or later. The study was commissioned by the German Association of the Automotive Industry (VDA) in cooperation with auditing and consulting company Deloitte; 83 of 586 suppliers participated. However, the implications of this study for suppliers seem not to have taken root yet.

52 of the suppliers surveyed stated that they were pursuing a so-called “Harvest-Strategy”. Through it, they try to exploit the market for the old technology as much as possible, to later invest the profits in the development of competencies for electromobility. Only 15 of these 52 suppliers have made any progress in this respect. However, according to their own assessment, the majority still see themselves in the first phases (second to fourth) of the transition.

The authors of the study divided the transition phases to electric mobility into seven development stages. Only twelve of the 52 companies – anonymously – stated to be in the fifth phase. According to the study’s matrix, this is the stage in which suppliers are “exclusively focused on electromobility”. Only four of the respondents claim to be in the final stage of the transition. This means that currently, only 22 companies have already started the second half of their transformation.

And suppliers affected invest around 15 percent of their total revenue in electromobility innovations. Suppliers who see themselves in the final stage six of the transformation to e-mobility have invested as much as 66 percent of their capital in research and development, which also accounts for 90 percent of their investments. However, the share of sales accounted for by e-drive products in this group is 12 percent and profits 10 percent (see China.Table chart above).

The VDA-Deloitte study also shows that the COVID-19 pandemic poses additional challenges for car manufactures, such as supply shortages of chips (China.Table reported). “There are concerns that suppliers will lack the necessary resources to accelerate the shift to electromobility as a result,” the authors warn. Nevertheless, more than two-thirds of respondents also see the pandemic “as an accelerator” for the shift to e-mobility.

Eight companies, on the other hand, stated that they saw no need at all to shift their business towards electromobility because they only produce parts that are not directly related to drive technology.

The situation in China is different. Hundreds of companies have emerged in the past four years focusing on the development of electric cars, even before the pandemic. Only time will tell whether they are successful (China.Table reported), but the direction of economic policy is clear – and thus also provides a certain degree of planning security for China’s EV pioneers.

Additionally, China is the most important automotive parts supplier outside the European Union according to Germany Trade & Invest (GTAI), a government-owned economic development agency. GTAI experts are convinced that China’s importance will continue to grow thanks to the shift towards electromobility. China has an almost complete value chain – both for vehicles with combustion engines, electric or hybrid drives, and fuel cells, explains Corinne Abele of GTAI.

Accordingly, automotive parts exports from China are on the rise. Its main customers are Germany, Japan and the USA. While China’s exports and imports of automotive parts and components were still balanced in 2010, exports of automotive parts will amount to 1.7 times imports in 2019 and 2020, which according to the GTAI study is clearly the result of increased competitiveness. So far, according to the China Automotive Dealers Association, the spare parts business, which accounts for about 70 percent of China’s automotive parts exports, has dominated the market.

Nevertheless, Chinese companies have already established themselves as system suppliers to international and German automotive groups outside China. The GTAI study cites the tool sector for the manufacturing of motor vehicles as an example.

There are only five Chinese companies among the 100 largest automotive parts manufacturers in 2021 – three of them (BHAP, CATL and Citic Dicastal) are newcomers. But they are joined by new suppliers, some from outside the industry, in the EV sector. CATL, one of the largest manufacturers of EV batteries, is one such candidate (China.Table reported). Two weeks ago, CATL became the newest member of German industry network Automotive Thueringen. Mathias Hasecke, chairman of the network, said that he also sees this as a signal for a strategic partnership for future innovation projects. Automotive Thueringen mainly consists of automotive suppliers.

In autumn 2019, CATL began the construction of a lithium-ion battery factory in Thuringia’s largest industrial park, “Erfurter Kreuz”. Production is scheduled to begin as early as the end of next year.

Particularly when it comes to batteries for all-electric cars, the question often arises: Is it better to manufacture or to buy them? All major battery manufacturers are Asian companies – such as LG Chem from South Korea, Panasonic from Japan or BYD and CATL from China. The dependence is already so prevalent that many OEMs such as Volkswagen, Daimler and BMW have begun to build their own battery cell factories in Europe. However, less than one percent of all batteries are produced in Europe, while more than 90 percent are imported from Asia.

A study by auditing firm PricewaterhouseCoopers shows that German suppliers focus primarily on research and development. On average, German suppliers invested 6.1 percent of their revenue in research and development – significantly more than their competitors in the rest of Europe (4.8 percent), America (3.6 percent) and Asia (3.8 percent).

However, whether this will be enough to prevent not being left behind by Chinese suppliers in the shift from combustion engines to electric drives will also depend on where investment funds will come from. They will be “a decisive driver of an accelerated transformation,” concludes the VDA study.

China’s exports increased by 25.6 percent in August compared to the same period last year (calculated in US dollars). This was reported by China Customs in Beijing on Tuesday. Imports even saw an increase of 33.1 percent. With these figures, the world’s second-largest economy is presenting itself even stronger than expected – despite recent Covid outbreaks.

Experts had even expected a slowdown in Chinese growth. Overall, however, there was a plus of 28.8 percent. The trade surplus reached 58.3 billion US dollars.

The values show that higher shipping costs and Covid-related delays at ports appear to have had far less of an impact on trade than had originally expected. Experts had also attributed their significantly lower expectations to higher commodity prices and supply bottlenecks in China and had also predicted weaker export growth for the rest of the year.

However, German exporters were not able to benefit much from the upwind in Chinese foreign trade. German exports to China rose by only 5.6 percent, while imports from China increased by 29.2 percent. The total bilateral trade volume thus grew by 16.4 percent.

China’s trade with the entire European Union increased by 22.8 percent. Its exports to the EU climbed by 29.4 percent, while imports rose by 12.4 percent.

“The new foreign trade figures point to a steady economic recovery in China,” Jens Hildebrandt, executive board member of the German Chamber of Commerce in China (AHK), told news agency dpa. German companies could also benefit from this, but in markets of other global regions, they are also increasingly encountering Chinese competition. rad

Hong Kong will allow Chinese mainland and Macao residents to enter the city without going through mandatory quarantine starting Sept. 15, implementing a measure that had been delayed since May, Chief Executive Carrie Lam announced Tuesday.

“We have been talking about this for a long time but were never able to launch it, as there were often problems, either because of the rebound in cases in Hong Kong, or the mainland’s pandemic situation,” the Hong Kong leader said during her weekly press conference.

Under the program, up to 2,000 people will be allowed to enter the special administrative region, 1,000 through the Shenzhen Bay Port and 1,000 via the Hong Kong-Zhuhai-Macao Bridge Port, Lam said.

Starting Wednesday, Hong Kong residents coming in from anywhere on the mainland or Macao will also be allowed to enter without going through quarantine, the chief executive said.

Previously, only residents returning from the neighboring Guangdong province could bypass quarantine.

Hong Kong residents who want to return to the city will have to stay in Macao or the mainland for two weeks straight before entry. They will also be required to present a negative Covid-19 test result at the port of entry and submit to regular testing after their arrival, according to local media reports. niw

The Geely brand Lotus is planning to produce its electric models in China. Between 2022 and 2026, four new electric models are to roll off production lines at a newly planned plant in Wuhan in the People’s Republic. The production of 2,000 compact SUVs will begin as early as next year, Feng Qingfeng, chief executive of Lotus, told Reuters. About one billion euros will be invested in the new production facility in China.

The plant, which covers an area of more than one million square meters, will increase Lotus’ production capacity to 150,000 vehicles a year. The development of a new Lotus Technology business unit will also be partially located at the site in China, the company announced.

Chinese Business unit Lotus Technology is responsible for mass-produced EVs, designed for higher sales figures, and for coordination between individual development units, which, in addition to the units in the UK and China, also include the German-based R&D centre (Lotus Technology Innovation Centre) in Raunheim.

Lotus, which has been majority-owned by Chinese auto brand Geely since 2017, had most recently received investment from Nio Capital, the investment arm of EV manufacturer Nio.

Production at the plant in Wuhan is to be ramped up to 20,000 cars by 2023. The company also plans to open up to 70 sales outlets in China by 2024. The manufacturer of the Lotus Esprit, made famous by its appearance in the James Bond movies, plans to open 20 outlets in the coming year alone. niw

Italy’s Prime Minister Mario Draghi has lobbied China’s President Xi Jinping for a special G20 summit on the situation in Afghanistan. In a phone call, Xi and Draghi discussed the “latest developments in the Afghanistan crisis and possible forums on international cooperation to address it, including the G20,” Italy’s news agency Ansa reported. According to the report, they also discussed bilateral cooperation between Italy and the People’s Republic and preparations for the regular G20 summit in Rome in October.

Xi pledged to support Italy’s efforts to make next month’s summit a success, China’s news agency Xinhua reported. According to the report, Xi added that he hoped Italy would play an active role in promoting China-EU relations. Xinhua did not mention a possible special summit.

Italy currently holds the G20 presidency and is working on organizing a separate ad hoc G20 summit focused on Afghanistan to be held ahead of the regular G20 meeting. It is not yet known whether Xi will travel to Europe for the October summit.

Xi also addressed the China-Italy Year of Culture and Tourism planned for 2022, according to state media, and promoted strengthening bilateral cooperation in winter sports. The two sides should support each other in hosting the Beijing Winter Olympics and the Milan-Cortina Winter Games in 2026, Xi Jinping said. ari

The chili sauce of the Chinese brand “Lao Gan Ma” doesn’t exactly look all that glamorous, the design even seems really old-fashioned. And yet, it has a cult following in China: You can buy Lao Gan Ma T-shirts and mobile phone covers on the internet. At New York Fashion Week in 2018, sweaters appeared donning the likeness of the somber-looking woman in the logo. Her name is Tao Huabi. She is the creator of Lao Gan Ma, which translates roughly to “old godmother.” As a successful businesswoman who had no formal education and was forced to overcome many hardships in life, the 77-year-old is regarded by many Chinese today as the ultimate embodiment of the “Chinese Dream”.

Tao was born in 1947 in Guizhou, one of China’s poorest provinces. Her biography titled “If I Hadn’t Been Strong, I Would’ve Starved” became a bestseller in China. Instead of learning to read and write, Tao had to help feed the family as a child. She invented her product during the Great Famine that followed Mao’s campaign of the “Great Leap Forward.” At that time, between 1959 and 1961, several million Chinese died. The combination of wild-growing medicinal plants and home-grown chili peppers was intended to make the meager root vegetables that served as her family’s main food source at the time a little more palatable.

After years as a migrant worker, Tao, who was widowed at an early age, had saved up enough money in the late 1980s to open a small cookshop. There, however, she discovered that customers came not primarily for her noodles, but for the homemade chili sauce she used to spice up the dishes.

At the end of 1994, Tao opened a small shop where she offered her preserved chili oil sauce in different varieties. It was the cornerstone of the Lao Gan Ma empire: today, the group Tao runs with her two sons is the largest producer and seller of chili products in China, producing 1.3 million jars per day. In 2020, the company achieved record sales of more than 5.4 billion yuan (about 835.6 million U.S. dollars) – a 7 percent increase from the previous year. “I have to be the number one if I want to do anything,” says the aged entrepreneur.

Tao’s sauces – there are now 17 different varieties available – can now be found in Asian supermarkets in more than 30 countries. YouTube is home to numerous videos paying homage to the spicy ingredient. In early 2020, British chef Alex Rushmer proclaimed on Twitter, “I would eat a bowl of gravel if it was smothered in Lao Gan Ma.” She even has her own fan clubs – on Facebook, the Lao Gan Ma Appreciation Society has 4000 members.

An unbelievable success story – yet Tao still forgoes modern marketing. Lao Gan Ma has no social media accounts and its website hasn’t been updated in years, nor has its logo, which is still emblazoned with Tao’s grim likeness. “We sell the taste, not the packaging,” she once said.

In 2019, Lao Gan Ma was named one of China’s top 100 brands along with China Mobile, TikTok, Tsingtao, Huawei and Alibaba. Still, Tao does not want to take her company public. “Going public is cheating money from others,” she said in 2013. For the government in Beijing, the millionaire entrepreneur is a patriotic role model. Tao, who to this day cannot read properly, is a party member and active as a representative of the Standing Committee of the People’s Congress in her native Guizhou.

When asked about the price difference of Lao Gan Ma in China (ten yuan, which is about 1.30 euros per glass) and other countries (4.99 euros on Amazon.de), she says: “I am Chinese. I don’t make money from Chinese people. I want to sell Lao Gan Ma abroad and make money from foreigners.” Fabian Peltsch

Liu Yuchao is the new Senior Vice President for Supply Chain in China for the e-car start-up Faraday Future. The Chinese-American company had just raised around one billion US dollars in an IPO on the New York Technology Exchange at the end of July. The fresh capital should now help the company finally bring its first model, a luxury electric SUV called FF91, to market, said CEO Carsten Breitfeld (China.Table reported). “I am looking forward to starting a new chapter in my career at FF. I know my supply chain experience can help accelerate the mass production and delivery of the FF 1 in the Chinese market,” Yu said of his new position.