Whether it’s forest dieback or the threat of climate collapse, for decades, almost everything in economic policy has revolved around GDP growth. While the introduction of a “happiness indicator” in Germany came to nothing, Shenzhen is trying out a new eco-indicator. Frank Sieren introduces it and the hopes associated with it.

With Foxconn and Xiaomi, two industry giants are entering the EV market. Xiaomi is investing $1.5 billion, Foxconn has developed its own software and hardware platform. Christiane Kühl has the details.

The sanctions against China have made big waves. In an interview with Michael Radunski, Parag Khanna explains why they hardly affect China. Barack Obama’s former foreign policy advisor believes that the massive growth is enough for Beijing to insure itself.

Johnny Erling looks at the Chinese “steel addiction”. China now produces more than half of the world’s steel and is threatening to flood the global markets. Now Beijing also wants to reduce overcapacities because of climate promises. Johnny Erling suspects: As with previous efforts, this will remain an empty promise.

I wish you many new insights and a nice weekend!

Shenzhen has become the first metropolis to introduce a gross domestic product (GDP) alternative. The so-called gross ecosystem product (GEP) is designed to take into account not only what is sold and produced in a state or city, but also factors such as clean water, clean air, and intact green spaces. In this way, the GEP is intended to say more about human well-being than the GDP, which is based on material possessions, and to draw attention to green and sustainable economic development.

As a result, the GEP should then in turn help to ensure that more is invested in sustainable projects and nature conservation in the future. The calculations are based on a system developed by the United Nations, making Shenzhen “a world leader,” says Zhang Yali, deputy head of the Shenzhen Ecology Department. The ideas and techniques of the new measurement system are based on environmental and economic accounting methods of the UN Statistical Commission. They will be “used as a reference” in Shenzhen, Zhang said. The launch was preceded by a six-year pilot phase. Shenzhen’s economy is bigger than Norway’s, Belgium’s, or Singapore’s. And twice the size of Greece’s.

In 2019, the UN organization Habitat produced an in-depth study on the sustainability of the city as a model for the world. And back in 2002, the UN awarded Shenzhen a prize for “the impressive combination of sustainability and growth”.

Shenzhen, for example, is now the world capital of electromobility, with 16,000 e-buses, 22,000 e-taxis and countless e-motorbikes. 137 e-buses are in operation in Berlin, 55 in Hamburg.

For consulting firm McKinsey, Shenzhen is “China’s most sustainable city”. For the Swiss UBS Bank, “Shenzhen is taking the lead as an experimental ground for a set of measures of climate-friendly and sustainable policies that will then be established throughout China.”

Shenzhen is predestined for such innovative projects because it is one of the youngest cities in the world, and the people are therefore very open to ecological developments. Together with Mumbai in India, it is the megacity worldwide with the lowest average age 29 years. In London it is 35, in New York 36, in Berlin and Hong Kong 43.

The idea of GEP goes back to the US ecologist Gretchen Daily, who grew up in Germany and teaches as a professor at Stanford University. She defines GEP as the total value of all ecosystem goods and services provided annually in a region. Natural, measurable ecosystems include forests, grasslands, wetlands, freshwater reservoirs, and oceans, but also artificial systems based on natural processes, such as agriculture, forestry, water conservation, air purification, pastures, aquaculture farms, and urban green spaces and parks.

“Using GEP can create jobs and restore ecosystems. Safeguarding our natural capital is at the heart of a future in which we can all thrive,” she writes in a post. When it comes to environmental policy, “China has gone further than any other country,” Daily says in a summary of a study by her institute.

The Chinese Academy of Sciences has already done pioneering work in the field of GEP with a study on the Chinese “water city” Qinghai published last year. Led by Zhiyun Ouyang, director of the Eco-Environmental Science Research Center, the study compiled a large amount of environmental data for a practical calculation of GEP. “Rapid economic growth in China has been accompanied by environmental damage in many regions,” the researchers write in the study. “It is now widely recognized that it is necessary to go beyond GDP for decision makers to consider important environmental and social dimensions of human well-being.”

Shenzhen, which Beijing declared a model city for all of China back in 2017, plans to unveil its first GEP figures to the public in June. According to Zhang, the GEP should lead local government officials to rethink economic planning, and the plan to rethink its own benchmarks for economic growth coincides with Beijing’s goals of being carbon neutral by 2060 and peaking CO2 emissions before 2030. China’s state and party leader Xi Jinping wants a “green, sustainable and inclusive” development of the People’s Republic.

For a long time, GDP was the main yardstick for China’s recovery. The paradigm shift, of course, also has to do with the fact that the shift from an industrial to a service economy will inevitably slow China’s economic growth. This is a natural development that other industrialized nations have also gone through.

The annual GDP growth rate no longer has great political significance for Beijing. The latest Five-Year Plan lacks a corresponding target.

Beijing is desperate to avoid a situation where China, like other emerging economies on the road to becoming a service economy, gets stuck in the “middle-income trap,” stagnating in terms of income in the middle ground between cheaper low-wage countries and highly developed industrialized nations, while production costs rise and the country’s competitiveness on the global market declines. By contrast, Shenzhen, known as China’s Silicon Valley, faces the dilemma of falling into a “high-income trap” as the city’s economic output has increased nearly 15,000-fold over the past 40 years.

In 2018, the city’s GDP reached ¥2.42 trillion ($372 billion), overtaking Hong Kong for the first time. Before 1980, Shenzhen’s GDP was only 0.2 percent of Hong Kong’s. Over the past four decades, Shenzhen’s GDP per capita has risen from US$200 to US$30,000. According to the World Bank, it now ranks first among mainland Chinese cities and is approaching the level of South Korea.

Technology groups have been pushing into electromobility in China for some time. Companies like Baidu, Alibaba, and Tencent are offering billions in capital and some know-how for the connected car of the future. What’s new is that tech companies now want to build entire cars themselves. The successful smartphone manufacturer Xiaomi just announced that it will invest up to $10 billion in setting up electric car production. To do so, Xiaomi will set up a subsidiary, initially pouring around $1.5 billion into it – with Xiaomi founder Lei Jun himself at the helm. “This will be the last startup of my career,” Lei said in Beijing.

In parallel, Apple’s Taiwanese contract manufacturer Foxconn announced new electric activities every week. Foxconn has unveiled an EV platform called MIH, which will be used to create Foxtron-branded EVs. The company plans to license EVs for other brands with China’s largest private carmaker Geely, back stumbling electric startup Byton and build its own EV factory in America – either in Mexico or at its existing site in the US state of Wisconsin. In February, Foxconn and US startup Fisker announced a manufacturing partnership. Foxconn is also negotiating with Fiat Chrysler – now part of the new Stellantis Group – to set up an electric joint venture in China.

Xiaomi has so far presented hardly any details about its electric plans. The scene, however, is already taking the success-addled company seriously, not only because, unlike the startups, it has plenty of its own capital – nearly ¥100 billion (the equivalent of over €12.5 billion) towards the end of 2020 – and company founder Lei Jun has always been interested in connected EVs. It also owns a brand with which its target audience is very familiar: In addition to popular smartphones, Xiaomi also sells fashionably designed rice cookers, air purifiers, and robo-vacuums in plain white. “I am fully aware of the risks in the auto industry,” Lei Jun said in Beijing. “I am also aware that the project will take at least three to five years with tens of billions of investment.” Xiaomi does not plan to invite outside investors as the company wants to retain full control of its automotive business, the 52-year-old said.

Xiaomi has already hired engineers to develop the software that will be embedded in its cars, Bloomberg news agency reports, citing a source familiar with the plans. According to the report, Lei led a study on the potential of the EV sector several months ago and only made the final decision to venture in a few weeks ago.

What could have convinced Lei, asks long-time China auto analyst Michael Dunne – and immediately provides the answer himself: “Chinese consumers are using EVs like never before – even without incentives. That wasn’t always the case.” Until a year ago, he says, “compliance” cars dominated the electric market: Traditional brands like BAIC, SAIC, and BYD sold cars to fleet operators and controlled the subsidized segment with a market share of more than 95 percent, according to Dunne. Now there are hardly any subsidies. And yet, “All EV growth in 2020 was driven by individuals buying enticing new products from Tesla, Nio, Li Auto, WM Motor, Xpeng, and SGMW,” Dunne says. Good timing, then, for Xiaomi.

The same, of course, applies to Foxconn, which like Xiaomi, has experience with a variety of products – just not as a brand but as a contract manufacturer. At the heart of its entry into electric mobility is the MIH Open Platform presented in Taipei in October: software and hardware for e-car production that is accessible to all partners. The MIH Alliance already lists around 400 partner companies on its website, including Siemens, Bosch, Microsoft, Nvidia, and the German supplier Leoni. Foxconn also founded its own brand called Foxtron, which is expected to produce e-buses from 2022 and an electric SUV from 2023. The MIH ecosystem is expected to be transferred to its own subsidiary soon. Whether Foxconn’s new partners – most notably Byton – will also use the MIH Open Platform is currently unknown.

Foxconn will produce a second electric model for Fisker, according to a February letter of intent. The first model, called Ocean, is scheduled to roll off the production line at the end of 2022 at the supplier Magna, which has also built up its own electric capacities. Model number two won’t be produced until late 2023, concrete details are scarce so far. According to Foxconn, the very ambitious codename is: ‘Project PEAR’, written out as ‘Personal Electric Automotive Revolution’. Startup founder Henrik Fisker wrote on Twitter: “This vehicle is so revolutionary that we HAVE to keep is secret until the launch in end of 2023! It might be too futuristic for some!” According to Foxconn, teams from both companies will now nail down details on design, technology, engineering, and manufacturing, before agreeing to a formal partnership in the second quarter. Meanwhile, the status on the proposed Foxconn-FCA joint venture is unclear.

Xiaomi also wants to outsource production, but not to established carmakers, Bloomberg writes, citing another source with access to Xiaomi decision makers. Private SUV maker Great Wall Motor already dismissed a Reuters report that it would help Xiaomi build cars. The decision may not even be made yet. Incidentally, Xiaomi’s contract manufacturers for smartphones include a Taiwanese company called Foxconn.

The entry of the two companies will once again shake up China’s electronics segment, which is dominated by startups and state-owned companies. In any case, the industry is currently in a state of flux: Geely Auto followed up its joint venture with Foxconn by setting up another with its own group holding company to develop premium EVs under the Zeekr brand (China.Table reported). Zeekr’s competitors, according to Geely, are Tesla and local startup NIO. NIO just had its 100,000th car roll off the production line – but is now struggling with chip supply. Tesla sold 30 percent of its cars in China in 2020 – but just got in trouble there over built-in cameras. The cameras are not enabled outside North America, Tesla hastened to announce Wednesday. Geely also wants to partner with AI pioneer Baidu to build smart EVs. It remains exciting.

Mr. Khanna, in your book “The Second World”, you vehemently called for Europe’s emancipation as early as 2008. It should find its own role in the world and make its own decisions. About two weeks ago, the EU imposed sanctions on China for the first time since 1989. Is this the right approach?

No, that’s no good at all. China has become far too powerful in the meantime. If you really cared about Xinjiang or Tibet, you could have done it 25 years ago. Back then, one still had some leverage to influence Chinese domestic politics. Today’s outcry is nothing more than self-satisfaction on the part of the West.

Why?

China can overlook this because Beijing can replace all foreign investment in these areas and regions with its own money and commitment without losing anything. So I wonder what the point of this theatre is.

That sounds a lot like Xi Jinping’s view. China’s president praises the Chinese model as superior to the West. Where do they see the advantages of the Chinese system?

I see the advantages of the Chinese system mainly in its own context.

What do you mean?

This means that what is good for China is not necessarily good for the rest of the world. That is why I am not afraid of China exporting its model worldwide. Since 2003, we have seen time and again countries in Africa or Latin America whose governments say we are leaning towards the Chinese model. But that doesn’t mean they have the discipline to invest in their infrastructure, for example, or in labor productivity. What those countries mean is: We would like to have economic success without giving up political power.

What are the advantages that work in the Chinese context – and not in the European context?

They are capable of making decisions very quickly. That contradicts our idea of technocracy. We always think of the Soviet Union – but what we really mean is corrupt states. In China, on the other hand, it means deciding quickly and then providing a lot of money for a decision.

So it’s all purely economic. Nothing else?

In China, we have a very strong state, which is not only capable of deciding but which also enforces its decision against resistance and exerts influence on all areas. It is a state that interferes deep into companies and society. And a state that eliminates political resistance. This is what is happening in China now and has been for 4000 years. So I don’t see why it surprises anyone these days.

If it’s all so successful, should we do it the same way? Or why wouldn’t it work for us?

Because we are democracies with our own structures, because we have a different culture – and because we want things to be different. But much more important at this point is another point: You don’t have to be like China to compete successfully with China.

The idea that systems cannot be adopted because of different cultural backgrounds – this approach is also taken by Beijing, which claims: “Democracy like that in the West would not work at all here in China.“

But let’s face it, it doesn’t take political failure in the West to make the Chinese so self-confident and reject the Western model. China’s own economic growth is the source of its self-confidence. And they can see for themselves every day how successful they are at it. The failure of the West in the past 15 to 20 years is added to this. But there was no need for that. Their own growth is enough for the Chinese to reassure themselves.

Another claim from Beijing is that it is not expansionist. But a look at the South China Sea or the Himalayas reveals a different picture.

Of course, China is expansionist. But: not in a colonial way like the West used to be, but rather in a mercantilist way.

Very nitpicky.

There is a huge difference. Colonialism goes hand in hand with political control, with direct occupation of a country, whereas mercantilism in this context means control over supply chains.

What does that mean in concrete terms?

China has no interest at all in the culture of a country or in governing it. They only want the respective raw materials. And they want to dominate the respective market with their own goods. But they don’t want to rule another country. They already have enough people to rule at home. That’s enough.

They don’t want any of that. But then what does Beijing want?

China wants diplomatic obedience because it serves the purpose of smooth supply chains. It is very important that we recognize and agree on this. Beijing sees other people from the rest of the world as barbarians – and they don’t want to rule these barbarians after all.

Look at Africa. There are some states there from which China has already withdrawn. Ten years ago, we believed that Angola was well on the way to becoming a Chinese province. Today there are very few Chinese and Chinese projects in Angola because they simply no longer need the oil. So when China no longer needs a country, they leave and move on. No colonial power does that. A colonial power wants to stay for all eternity and dominate the country.

Let’s get back to dealing with China. If the current sanctions do nothing, that sounds very fatalistic, almost as if the West can do nothing.

No, not at all. But if you really want to change something, you have to be present in China. The West must remain present in order to be able to influence the situation in the long term.

This is very reminiscent of the slogan “change through trade”, which, however, failed. Many in the West believed that China would develop in our direction through economic integration with the West.

This is actually wrong. This approach cannot work. Trade breeds modernization. But modernization does not necessarily mean westernization. This is the West’s arrogant view of the world.

So decades of trade with China has only increased the profits of Western corporations. Nothing has changed?

That is not entirely true either. In the past decades, a lot has changed in China’s society, very much for the better. People have more money and more rights. Unfortunately, not all of them. The minorities mentioned are suffering. But sanctions are really not the way to go. China has long had a plan to conquer and oppress these areas and the people there. To think now that you can change it with a few words and these sanctions is delusional.

So what should western companies do?

So if, for example, Volkswagen really wants to improve the human rights situation in Xinjiang, then they should be active in the region and be a factor. They should build plants there and act as role models, for example, by saying: We only hire Uyghurs, and they get a good salary.

The Italian government has prevented telecoms firm Linkem from purchasing 5G components and expert guidance from Huawei and ZTE, according to a media report. Rome has imposed regulations “regarding the notification of the company Linkem, which concerns the acquisition of hardware and software elements from Huawei and ZTE for the completion of the 5G SA network”, news portal Formiche reported yesterday, citing a decree to the Italian Parliament. According to the report, the move came under the so-called “golden power” rules, which allow the state to interfere in the business of companies from the point of view of national security.

The government under Mario Draghi had already prevented telecoms company Fastweb from buying equipment from ZTE and Taiwanese manufacturer Askey via a “golden power” rule in early March, Formiche reported. The government had thus prevented Fastweb from buying 5G CPE (customer premise equipment) from ZTE. The Italian Parliamentary Intelligence Committee (Copasir) had warned of a security threat from Chinese telecom equipment suppliers in a December 2019 report.

According to observers, the decision signals a continuation of the Draghi government’s turn towards Washington and Brussels. ari

The city of Beijing aims to have over 10,000 fuel cell vehicles on the road and build 74 hydrogen filling stations by 2025, Reuters reports. Some of the vehicles are to be ready for use as early as the 2022 Winter Olympics in Beijing. The plan is to replace 4,400 heavy trucks with those powered by fuel cells by 2025, saving 145,000 tons of diesel fuel. By the end of 2020, China had fewer than 10,000 trucks and buses running on hydrogen. However, according to Reuters, many provinces and cities were making efforts to develop hydrogen plans. They are calling for government subsidies to boost the sector. nib

Hong Kong activist and former opposition MP Nathan Law has been granted political asylum in the UK. After four months, his application has been approved, the 27-year-old wrote on Twitter. “The UK has a proud history of providing protection to those who need it,” British Foreign Secretary Dominic Raab wrote on the announcement of Law’s asylum, also on Twitter. The UK also announced it would support immigrant Hong Kong citizens.

For this purpose, a fund in the amount of £43 million (about €50 million) has been created within the framework of a new system for holders of British overseas passports, the British Home Office announced. The goal is to make it easier for those affected to gain access to housing, work, and educational support. London had facilitated the entry for Hong Kong citizens at the beginning of the year. Hundreds of thousands are expected to move to the UK under the program.

The asylum decision for Law caused new irritations between London and Beijing. Chinese Foreign Office spokesman Zhao Lijian accused the British side of protecting “wanted criminals” and blatantly supporting Hong Kong separatists, according to media reports. He said it was a “blatant interference” in Hong Kong justice, a violation of international law and basic international norms. ari

China’s Ministry of Finance wants to “actively and steadily” push forward legislation for a property tax, the business portal Caixin reports. So far, China has no ongoing tax on real estate property. Instead, the People’s Republic levies taxes on the construction and transfer of real estate, Caixin said. A property tax could bring in billions of yuans in revenue for provincial governments, according to the report. The introduction of a property tax has been debated since the beginning of the last decade. Fears that such a tax would damage the real estate market have prevented its introduction so far, Caixin reports.

Some local governments had been reluctant to support the new tax because they profit heavily from land sales and fear a property tax would lower real estate prices and demand for land.

Following the goals of the 14th Five-Year Plan, China’s Ministry of Finance further plans to reform the tax collection system to better redistribute wealth and reduce the gap between rich and poor, Caixin said. nib

The European Parliament wants to subject Czech MEP and former chairman of the informal club of China-friendly EU parliamentarians, Jan Zahradil, to a formal investigation, according to a media report. The background to the investigation is a lack of clarity over the sponsorship of a meeting of the China Club by the Chinese EU mission in 2019, which Zahradil is said to have failed to disclose correctly.

In a letter to Dutch investigative magazine Follow The Money, a senior EU official confirmed that European Parliament President David Sassoli had instructed a group of MEPs to investigate whether Zahradil had followed the institution’s rules on disclosing financial support. The European Parliament did not initially confirm the investigation to China.Table, citing internal confidentiality on the matter.

Zahradil and the China Friendship Group, whose activities are currently on hold, have been criticized several times in the past. Complaints have been made about the group’s lack of transparency, as the list of members has never been disclosed. The friendship group has been accused of being close to Beijing, and Zahradil is also vice-chairman of the EU Parliament’s trade committee and thus had access to important EU Commission documents concerning EU trade policy.

The sponsorship of the event by the Chinese EU mission was not mentioned in official financial statements by Zahradil or in the statements of a handful of members believed to be part of the informal group, according to a media report. The Czech MP had admitted to sponsorship in November and subsequently reinstated the China Friendship Group for the time being. It was not clear what the consequences of the possible investigation might be. A question from China.Table to the MEP was not answered at first. ari

The message from the two super agencies was not an April Fool’s joke, but it read like one. The National Development and Reform Commission (NDRC) and the State Inspectorate of Industrial and Information Technology (MIIT) jointly declared war on steel overproduction on April 1. They plan to get underway as early as 2021 to cut excess capacity and reduce CO2 emissions in the new Five-Year Plan. With a “look back” inspection, they would scour the country to find out why the same campaign to cut China’s steel mountains failed five years ago.

That sounds determined but will come to nothing. Because for the dismantling of old blast furnaces between 2016 and 2020, a lot of new capacities were added on the quiet. The culprit was Beijing, which had stimulated China’s crippled economy with subsidies in the last Five-Year Plan and in 2020 gave the construction and automotive sectors a major boost in the fight against COVID. Steel prices and demand promptly went through the roof. The two ministries admit as much: “Regions and companies blindly followed the impulse to bet on new steel projects. The capacity reduction could not be consolidated in this way.” In plain language: China’s provinces and industries were racing to produce crude steel because it was profitable for them to do so. The World Steel Association recently noted with alarm: In 2019, the People’s Republic produced 996 million tons of crude steel, more than half of the world’s output. A year later, it set the bar even higher. In 2020, China produced 1.065 billion tons, according to Reuters.

The insatiable appetite for steel is déjà vu. It has been in the DNA of his Communist Party since Mao’s time. Thanks to the half-baked mixture of market and planned economy, in which the state can flick the market mechanism on and off like a switch, steel went from being a scarce commodity in socialist states to a surplus product in China. The world markets tried in vain to seal themselves off from the subsidized steel glut from China with punitive tariffs and anti-dumping procedures.

But there were warnings. In 2009, the EU Chamber in Beijing identified overcapacities in Chinese industries, especially steel, in a 50-page study. The president of the chamber at the time, Jörg Wuttke, spoke of “destructive consequences” for China and for the global economy. In 2015, a second Chamber study appeared because, Wuttke said, “The situation has changed from bad to dire.” In 2008, China had produced 512 million tons of crude steel. In 2014, it was 813 million tons. Between 2004 and 2014, global steel production increased 57 percent. China accounted for 91 percent of that.

This April, the Office of the New United States Trade Representative (USTR) denounced the People’s Republic as the world’s leading “producer of non-economic capacities”. The unwieldy phrase serves as justification for new punitive tariffs. China’s “continued bloat of steel production, plus its growing inventories and incentives for exports, threaten to flood global markets with excess steel at a moment when the global steel industry is trying to recover from the demand shock caused by the COVID-19 pandemic”.

Beijing would have good reason to reorganize its steel mess. President Xi Jinping made a climate policy commitment to his country to achieve maximum greenhouse gas emissions by 2030 and to make it carbon neutral by 2060. To do that, he would have to get to the steel. According to China’s calculations, the metallurgical industry alone accounts for around 15 percent of national CO2 emissions.

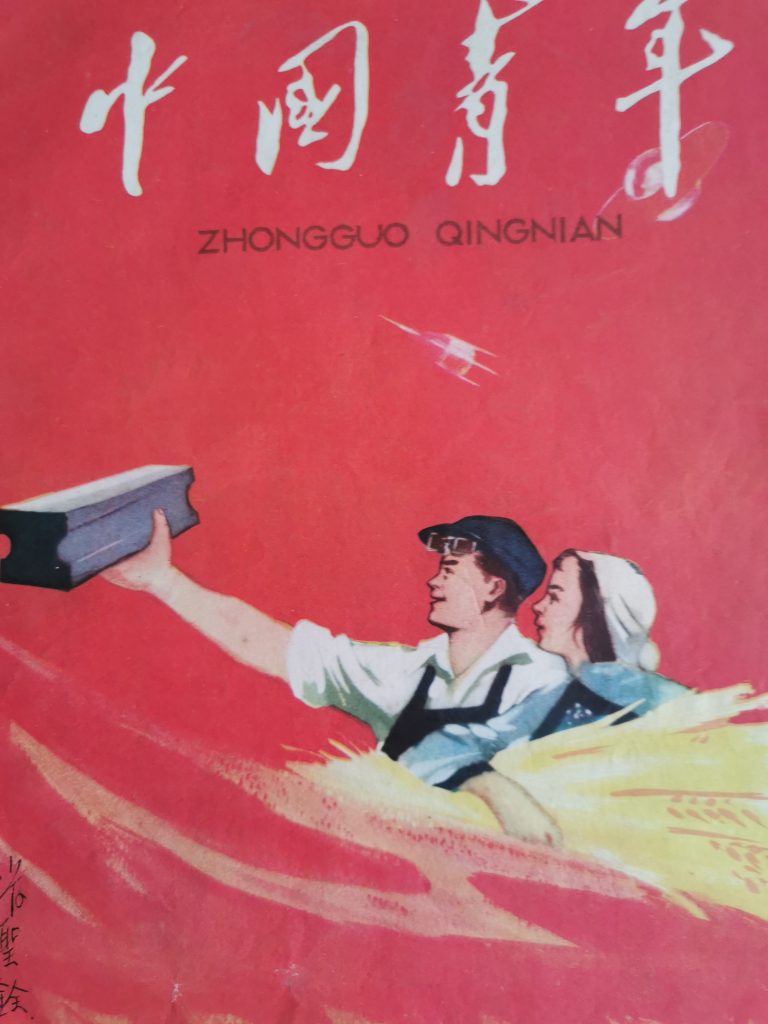

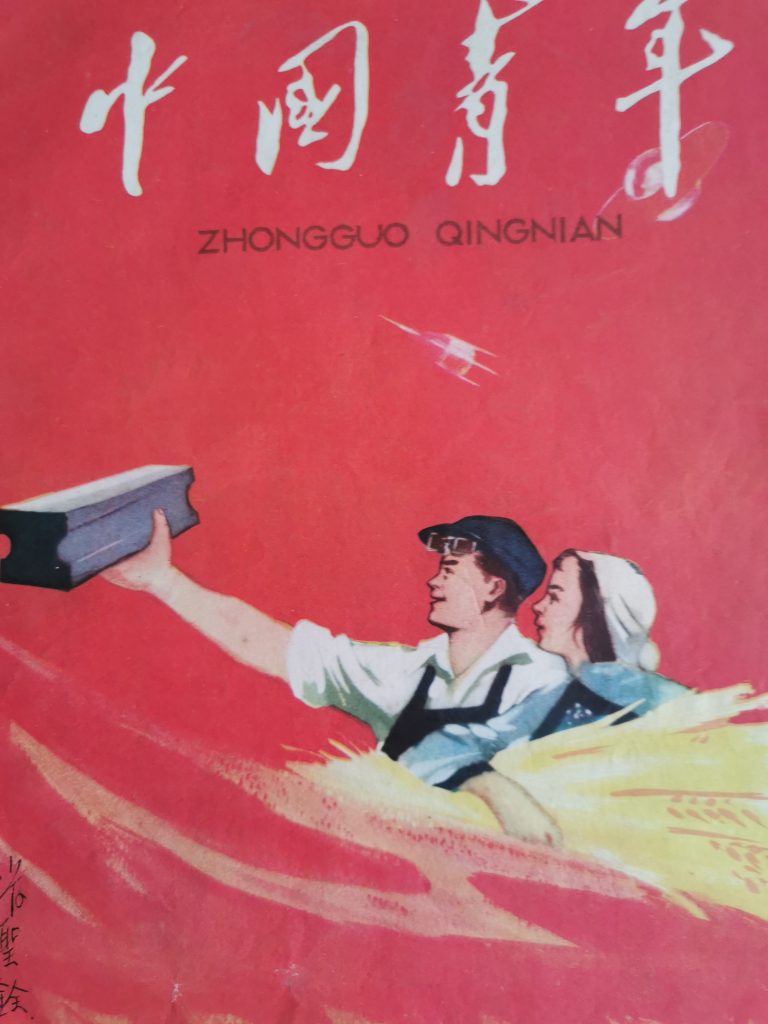

But steel is addiction (China.Table reported). Mao fell for it in Moscow in late 1957. Spurred by Soviet leader Nikita Khrushchev’s Sputnik success and his ostentatious announcement that he would overtake the United States in production in 15 years, Mao promised to do the same to England in 15 years. Back in Beijing, he lined up 60 million Chinese to “cook steel” and build 240,000 small blast furnaces. Propaganda posters of the time show glorified workers lifting steel into the red sky with a Soviet satellite flying. More steel and more grain became magical symbols of Chinese communism.

“In the Great Leap of Steel Production,” Mao called for doubling China’s output from 5.35 million tons of steel in 1957 in one year. On December 19, 1958, Xinhua cheered: 60 million workers had met the goal of 10.7 million tons of steel. It later turned out that barely eight million tons were usable. Everything else was slag.

Chinese party historians traced how Mao constantly changed his claim to overtake Britain in 15 years. On May 18, 1958, he proclaimed that China “will have caught up with Britain in as little as seven years. And another eight to ten years later, we will have caught up with the United States.” The formula was now “Chao Ying Gan Mei” (超英赶美) overtake Britain and catch up with the US.

Despite all the terrible setbacks, Beijing’s obsession with steel did not wane. The People’s Republic was the only country to celebrate itself with two special stamps when it managed to produce more than 100 million tons of steel in 1997, a world record. One stamp shows iron smelting in ancient times, where China also claims to have been number one.

Beijing can’t get off the high steel track. Because it needs even more steel for its rearmament, at the center of which is the expansion of the navy. Just as it once was in Germany or Japan. Seen in this light, the latest message on steel reduction seems like an April Fool’s joke.

Whether it’s forest dieback or the threat of climate collapse, for decades, almost everything in economic policy has revolved around GDP growth. While the introduction of a “happiness indicator” in Germany came to nothing, Shenzhen is trying out a new eco-indicator. Frank Sieren introduces it and the hopes associated with it.

With Foxconn and Xiaomi, two industry giants are entering the EV market. Xiaomi is investing $1.5 billion, Foxconn has developed its own software and hardware platform. Christiane Kühl has the details.

The sanctions against China have made big waves. In an interview with Michael Radunski, Parag Khanna explains why they hardly affect China. Barack Obama’s former foreign policy advisor believes that the massive growth is enough for Beijing to insure itself.

Johnny Erling looks at the Chinese “steel addiction”. China now produces more than half of the world’s steel and is threatening to flood the global markets. Now Beijing also wants to reduce overcapacities because of climate promises. Johnny Erling suspects: As with previous efforts, this will remain an empty promise.

I wish you many new insights and a nice weekend!

Shenzhen has become the first metropolis to introduce a gross domestic product (GDP) alternative. The so-called gross ecosystem product (GEP) is designed to take into account not only what is sold and produced in a state or city, but also factors such as clean water, clean air, and intact green spaces. In this way, the GEP is intended to say more about human well-being than the GDP, which is based on material possessions, and to draw attention to green and sustainable economic development.

As a result, the GEP should then in turn help to ensure that more is invested in sustainable projects and nature conservation in the future. The calculations are based on a system developed by the United Nations, making Shenzhen “a world leader,” says Zhang Yali, deputy head of the Shenzhen Ecology Department. The ideas and techniques of the new measurement system are based on environmental and economic accounting methods of the UN Statistical Commission. They will be “used as a reference” in Shenzhen, Zhang said. The launch was preceded by a six-year pilot phase. Shenzhen’s economy is bigger than Norway’s, Belgium’s, or Singapore’s. And twice the size of Greece’s.

In 2019, the UN organization Habitat produced an in-depth study on the sustainability of the city as a model for the world. And back in 2002, the UN awarded Shenzhen a prize for “the impressive combination of sustainability and growth”.

Shenzhen, for example, is now the world capital of electromobility, with 16,000 e-buses, 22,000 e-taxis and countless e-motorbikes. 137 e-buses are in operation in Berlin, 55 in Hamburg.

For consulting firm McKinsey, Shenzhen is “China’s most sustainable city”. For the Swiss UBS Bank, “Shenzhen is taking the lead as an experimental ground for a set of measures of climate-friendly and sustainable policies that will then be established throughout China.”

Shenzhen is predestined for such innovative projects because it is one of the youngest cities in the world, and the people are therefore very open to ecological developments. Together with Mumbai in India, it is the megacity worldwide with the lowest average age 29 years. In London it is 35, in New York 36, in Berlin and Hong Kong 43.

The idea of GEP goes back to the US ecologist Gretchen Daily, who grew up in Germany and teaches as a professor at Stanford University. She defines GEP as the total value of all ecosystem goods and services provided annually in a region. Natural, measurable ecosystems include forests, grasslands, wetlands, freshwater reservoirs, and oceans, but also artificial systems based on natural processes, such as agriculture, forestry, water conservation, air purification, pastures, aquaculture farms, and urban green spaces and parks.

“Using GEP can create jobs and restore ecosystems. Safeguarding our natural capital is at the heart of a future in which we can all thrive,” she writes in a post. When it comes to environmental policy, “China has gone further than any other country,” Daily says in a summary of a study by her institute.

The Chinese Academy of Sciences has already done pioneering work in the field of GEP with a study on the Chinese “water city” Qinghai published last year. Led by Zhiyun Ouyang, director of the Eco-Environmental Science Research Center, the study compiled a large amount of environmental data for a practical calculation of GEP. “Rapid economic growth in China has been accompanied by environmental damage in many regions,” the researchers write in the study. “It is now widely recognized that it is necessary to go beyond GDP for decision makers to consider important environmental and social dimensions of human well-being.”

Shenzhen, which Beijing declared a model city for all of China back in 2017, plans to unveil its first GEP figures to the public in June. According to Zhang, the GEP should lead local government officials to rethink economic planning, and the plan to rethink its own benchmarks for economic growth coincides with Beijing’s goals of being carbon neutral by 2060 and peaking CO2 emissions before 2030. China’s state and party leader Xi Jinping wants a “green, sustainable and inclusive” development of the People’s Republic.

For a long time, GDP was the main yardstick for China’s recovery. The paradigm shift, of course, also has to do with the fact that the shift from an industrial to a service economy will inevitably slow China’s economic growth. This is a natural development that other industrialized nations have also gone through.

The annual GDP growth rate no longer has great political significance for Beijing. The latest Five-Year Plan lacks a corresponding target.

Beijing is desperate to avoid a situation where China, like other emerging economies on the road to becoming a service economy, gets stuck in the “middle-income trap,” stagnating in terms of income in the middle ground between cheaper low-wage countries and highly developed industrialized nations, while production costs rise and the country’s competitiveness on the global market declines. By contrast, Shenzhen, known as China’s Silicon Valley, faces the dilemma of falling into a “high-income trap” as the city’s economic output has increased nearly 15,000-fold over the past 40 years.

In 2018, the city’s GDP reached ¥2.42 trillion ($372 billion), overtaking Hong Kong for the first time. Before 1980, Shenzhen’s GDP was only 0.2 percent of Hong Kong’s. Over the past four decades, Shenzhen’s GDP per capita has risen from US$200 to US$30,000. According to the World Bank, it now ranks first among mainland Chinese cities and is approaching the level of South Korea.

Technology groups have been pushing into electromobility in China for some time. Companies like Baidu, Alibaba, and Tencent are offering billions in capital and some know-how for the connected car of the future. What’s new is that tech companies now want to build entire cars themselves. The successful smartphone manufacturer Xiaomi just announced that it will invest up to $10 billion in setting up electric car production. To do so, Xiaomi will set up a subsidiary, initially pouring around $1.5 billion into it – with Xiaomi founder Lei Jun himself at the helm. “This will be the last startup of my career,” Lei said in Beijing.

In parallel, Apple’s Taiwanese contract manufacturer Foxconn announced new electric activities every week. Foxconn has unveiled an EV platform called MIH, which will be used to create Foxtron-branded EVs. The company plans to license EVs for other brands with China’s largest private carmaker Geely, back stumbling electric startup Byton and build its own EV factory in America – either in Mexico or at its existing site in the US state of Wisconsin. In February, Foxconn and US startup Fisker announced a manufacturing partnership. Foxconn is also negotiating with Fiat Chrysler – now part of the new Stellantis Group – to set up an electric joint venture in China.

Xiaomi has so far presented hardly any details about its electric plans. The scene, however, is already taking the success-addled company seriously, not only because, unlike the startups, it has plenty of its own capital – nearly ¥100 billion (the equivalent of over €12.5 billion) towards the end of 2020 – and company founder Lei Jun has always been interested in connected EVs. It also owns a brand with which its target audience is very familiar: In addition to popular smartphones, Xiaomi also sells fashionably designed rice cookers, air purifiers, and robo-vacuums in plain white. “I am fully aware of the risks in the auto industry,” Lei Jun said in Beijing. “I am also aware that the project will take at least three to five years with tens of billions of investment.” Xiaomi does not plan to invite outside investors as the company wants to retain full control of its automotive business, the 52-year-old said.

Xiaomi has already hired engineers to develop the software that will be embedded in its cars, Bloomberg news agency reports, citing a source familiar with the plans. According to the report, Lei led a study on the potential of the EV sector several months ago and only made the final decision to venture in a few weeks ago.

What could have convinced Lei, asks long-time China auto analyst Michael Dunne – and immediately provides the answer himself: “Chinese consumers are using EVs like never before – even without incentives. That wasn’t always the case.” Until a year ago, he says, “compliance” cars dominated the electric market: Traditional brands like BAIC, SAIC, and BYD sold cars to fleet operators and controlled the subsidized segment with a market share of more than 95 percent, according to Dunne. Now there are hardly any subsidies. And yet, “All EV growth in 2020 was driven by individuals buying enticing new products from Tesla, Nio, Li Auto, WM Motor, Xpeng, and SGMW,” Dunne says. Good timing, then, for Xiaomi.

The same, of course, applies to Foxconn, which like Xiaomi, has experience with a variety of products – just not as a brand but as a contract manufacturer. At the heart of its entry into electric mobility is the MIH Open Platform presented in Taipei in October: software and hardware for e-car production that is accessible to all partners. The MIH Alliance already lists around 400 partner companies on its website, including Siemens, Bosch, Microsoft, Nvidia, and the German supplier Leoni. Foxconn also founded its own brand called Foxtron, which is expected to produce e-buses from 2022 and an electric SUV from 2023. The MIH ecosystem is expected to be transferred to its own subsidiary soon. Whether Foxconn’s new partners – most notably Byton – will also use the MIH Open Platform is currently unknown.

Foxconn will produce a second electric model for Fisker, according to a February letter of intent. The first model, called Ocean, is scheduled to roll off the production line at the end of 2022 at the supplier Magna, which has also built up its own electric capacities. Model number two won’t be produced until late 2023, concrete details are scarce so far. According to Foxconn, the very ambitious codename is: ‘Project PEAR’, written out as ‘Personal Electric Automotive Revolution’. Startup founder Henrik Fisker wrote on Twitter: “This vehicle is so revolutionary that we HAVE to keep is secret until the launch in end of 2023! It might be too futuristic for some!” According to Foxconn, teams from both companies will now nail down details on design, technology, engineering, and manufacturing, before agreeing to a formal partnership in the second quarter. Meanwhile, the status on the proposed Foxconn-FCA joint venture is unclear.

Xiaomi also wants to outsource production, but not to established carmakers, Bloomberg writes, citing another source with access to Xiaomi decision makers. Private SUV maker Great Wall Motor already dismissed a Reuters report that it would help Xiaomi build cars. The decision may not even be made yet. Incidentally, Xiaomi’s contract manufacturers for smartphones include a Taiwanese company called Foxconn.

The entry of the two companies will once again shake up China’s electronics segment, which is dominated by startups and state-owned companies. In any case, the industry is currently in a state of flux: Geely Auto followed up its joint venture with Foxconn by setting up another with its own group holding company to develop premium EVs under the Zeekr brand (China.Table reported). Zeekr’s competitors, according to Geely, are Tesla and local startup NIO. NIO just had its 100,000th car roll off the production line – but is now struggling with chip supply. Tesla sold 30 percent of its cars in China in 2020 – but just got in trouble there over built-in cameras. The cameras are not enabled outside North America, Tesla hastened to announce Wednesday. Geely also wants to partner with AI pioneer Baidu to build smart EVs. It remains exciting.

Mr. Khanna, in your book “The Second World”, you vehemently called for Europe’s emancipation as early as 2008. It should find its own role in the world and make its own decisions. About two weeks ago, the EU imposed sanctions on China for the first time since 1989. Is this the right approach?

No, that’s no good at all. China has become far too powerful in the meantime. If you really cared about Xinjiang or Tibet, you could have done it 25 years ago. Back then, one still had some leverage to influence Chinese domestic politics. Today’s outcry is nothing more than self-satisfaction on the part of the West.

Why?

China can overlook this because Beijing can replace all foreign investment in these areas and regions with its own money and commitment without losing anything. So I wonder what the point of this theatre is.

That sounds a lot like Xi Jinping’s view. China’s president praises the Chinese model as superior to the West. Where do they see the advantages of the Chinese system?

I see the advantages of the Chinese system mainly in its own context.

What do you mean?

This means that what is good for China is not necessarily good for the rest of the world. That is why I am not afraid of China exporting its model worldwide. Since 2003, we have seen time and again countries in Africa or Latin America whose governments say we are leaning towards the Chinese model. But that doesn’t mean they have the discipline to invest in their infrastructure, for example, or in labor productivity. What those countries mean is: We would like to have economic success without giving up political power.

What are the advantages that work in the Chinese context – and not in the European context?

They are capable of making decisions very quickly. That contradicts our idea of technocracy. We always think of the Soviet Union – but what we really mean is corrupt states. In China, on the other hand, it means deciding quickly and then providing a lot of money for a decision.

So it’s all purely economic. Nothing else?

In China, we have a very strong state, which is not only capable of deciding but which also enforces its decision against resistance and exerts influence on all areas. It is a state that interferes deep into companies and society. And a state that eliminates political resistance. This is what is happening in China now and has been for 4000 years. So I don’t see why it surprises anyone these days.

If it’s all so successful, should we do it the same way? Or why wouldn’t it work for us?

Because we are democracies with our own structures, because we have a different culture – and because we want things to be different. But much more important at this point is another point: You don’t have to be like China to compete successfully with China.

The idea that systems cannot be adopted because of different cultural backgrounds – this approach is also taken by Beijing, which claims: “Democracy like that in the West would not work at all here in China.“

But let’s face it, it doesn’t take political failure in the West to make the Chinese so self-confident and reject the Western model. China’s own economic growth is the source of its self-confidence. And they can see for themselves every day how successful they are at it. The failure of the West in the past 15 to 20 years is added to this. But there was no need for that. Their own growth is enough for the Chinese to reassure themselves.

Another claim from Beijing is that it is not expansionist. But a look at the South China Sea or the Himalayas reveals a different picture.

Of course, China is expansionist. But: not in a colonial way like the West used to be, but rather in a mercantilist way.

Very nitpicky.

There is a huge difference. Colonialism goes hand in hand with political control, with direct occupation of a country, whereas mercantilism in this context means control over supply chains.

What does that mean in concrete terms?

China has no interest at all in the culture of a country or in governing it. They only want the respective raw materials. And they want to dominate the respective market with their own goods. But they don’t want to rule another country. They already have enough people to rule at home. That’s enough.

They don’t want any of that. But then what does Beijing want?

China wants diplomatic obedience because it serves the purpose of smooth supply chains. It is very important that we recognize and agree on this. Beijing sees other people from the rest of the world as barbarians – and they don’t want to rule these barbarians after all.

Look at Africa. There are some states there from which China has already withdrawn. Ten years ago, we believed that Angola was well on the way to becoming a Chinese province. Today there are very few Chinese and Chinese projects in Angola because they simply no longer need the oil. So when China no longer needs a country, they leave and move on. No colonial power does that. A colonial power wants to stay for all eternity and dominate the country.

Let’s get back to dealing with China. If the current sanctions do nothing, that sounds very fatalistic, almost as if the West can do nothing.

No, not at all. But if you really want to change something, you have to be present in China. The West must remain present in order to be able to influence the situation in the long term.

This is very reminiscent of the slogan “change through trade”, which, however, failed. Many in the West believed that China would develop in our direction through economic integration with the West.

This is actually wrong. This approach cannot work. Trade breeds modernization. But modernization does not necessarily mean westernization. This is the West’s arrogant view of the world.

So decades of trade with China has only increased the profits of Western corporations. Nothing has changed?

That is not entirely true either. In the past decades, a lot has changed in China’s society, very much for the better. People have more money and more rights. Unfortunately, not all of them. The minorities mentioned are suffering. But sanctions are really not the way to go. China has long had a plan to conquer and oppress these areas and the people there. To think now that you can change it with a few words and these sanctions is delusional.

So what should western companies do?

So if, for example, Volkswagen really wants to improve the human rights situation in Xinjiang, then they should be active in the region and be a factor. They should build plants there and act as role models, for example, by saying: We only hire Uyghurs, and they get a good salary.

The Italian government has prevented telecoms firm Linkem from purchasing 5G components and expert guidance from Huawei and ZTE, according to a media report. Rome has imposed regulations “regarding the notification of the company Linkem, which concerns the acquisition of hardware and software elements from Huawei and ZTE for the completion of the 5G SA network”, news portal Formiche reported yesterday, citing a decree to the Italian Parliament. According to the report, the move came under the so-called “golden power” rules, which allow the state to interfere in the business of companies from the point of view of national security.

The government under Mario Draghi had already prevented telecoms company Fastweb from buying equipment from ZTE and Taiwanese manufacturer Askey via a “golden power” rule in early March, Formiche reported. The government had thus prevented Fastweb from buying 5G CPE (customer premise equipment) from ZTE. The Italian Parliamentary Intelligence Committee (Copasir) had warned of a security threat from Chinese telecom equipment suppliers in a December 2019 report.

According to observers, the decision signals a continuation of the Draghi government’s turn towards Washington and Brussels. ari

The city of Beijing aims to have over 10,000 fuel cell vehicles on the road and build 74 hydrogen filling stations by 2025, Reuters reports. Some of the vehicles are to be ready for use as early as the 2022 Winter Olympics in Beijing. The plan is to replace 4,400 heavy trucks with those powered by fuel cells by 2025, saving 145,000 tons of diesel fuel. By the end of 2020, China had fewer than 10,000 trucks and buses running on hydrogen. However, according to Reuters, many provinces and cities were making efforts to develop hydrogen plans. They are calling for government subsidies to boost the sector. nib

Hong Kong activist and former opposition MP Nathan Law has been granted political asylum in the UK. After four months, his application has been approved, the 27-year-old wrote on Twitter. “The UK has a proud history of providing protection to those who need it,” British Foreign Secretary Dominic Raab wrote on the announcement of Law’s asylum, also on Twitter. The UK also announced it would support immigrant Hong Kong citizens.

For this purpose, a fund in the amount of £43 million (about €50 million) has been created within the framework of a new system for holders of British overseas passports, the British Home Office announced. The goal is to make it easier for those affected to gain access to housing, work, and educational support. London had facilitated the entry for Hong Kong citizens at the beginning of the year. Hundreds of thousands are expected to move to the UK under the program.

The asylum decision for Law caused new irritations between London and Beijing. Chinese Foreign Office spokesman Zhao Lijian accused the British side of protecting “wanted criminals” and blatantly supporting Hong Kong separatists, according to media reports. He said it was a “blatant interference” in Hong Kong justice, a violation of international law and basic international norms. ari

China’s Ministry of Finance wants to “actively and steadily” push forward legislation for a property tax, the business portal Caixin reports. So far, China has no ongoing tax on real estate property. Instead, the People’s Republic levies taxes on the construction and transfer of real estate, Caixin said. A property tax could bring in billions of yuans in revenue for provincial governments, according to the report. The introduction of a property tax has been debated since the beginning of the last decade. Fears that such a tax would damage the real estate market have prevented its introduction so far, Caixin reports.

Some local governments had been reluctant to support the new tax because they profit heavily from land sales and fear a property tax would lower real estate prices and demand for land.

Following the goals of the 14th Five-Year Plan, China’s Ministry of Finance further plans to reform the tax collection system to better redistribute wealth and reduce the gap between rich and poor, Caixin said. nib

The European Parliament wants to subject Czech MEP and former chairman of the informal club of China-friendly EU parliamentarians, Jan Zahradil, to a formal investigation, according to a media report. The background to the investigation is a lack of clarity over the sponsorship of a meeting of the China Club by the Chinese EU mission in 2019, which Zahradil is said to have failed to disclose correctly.

In a letter to Dutch investigative magazine Follow The Money, a senior EU official confirmed that European Parliament President David Sassoli had instructed a group of MEPs to investigate whether Zahradil had followed the institution’s rules on disclosing financial support. The European Parliament did not initially confirm the investigation to China.Table, citing internal confidentiality on the matter.

Zahradil and the China Friendship Group, whose activities are currently on hold, have been criticized several times in the past. Complaints have been made about the group’s lack of transparency, as the list of members has never been disclosed. The friendship group has been accused of being close to Beijing, and Zahradil is also vice-chairman of the EU Parliament’s trade committee and thus had access to important EU Commission documents concerning EU trade policy.

The sponsorship of the event by the Chinese EU mission was not mentioned in official financial statements by Zahradil or in the statements of a handful of members believed to be part of the informal group, according to a media report. The Czech MP had admitted to sponsorship in November and subsequently reinstated the China Friendship Group for the time being. It was not clear what the consequences of the possible investigation might be. A question from China.Table to the MEP was not answered at first. ari

The message from the two super agencies was not an April Fool’s joke, but it read like one. The National Development and Reform Commission (NDRC) and the State Inspectorate of Industrial and Information Technology (MIIT) jointly declared war on steel overproduction on April 1. They plan to get underway as early as 2021 to cut excess capacity and reduce CO2 emissions in the new Five-Year Plan. With a “look back” inspection, they would scour the country to find out why the same campaign to cut China’s steel mountains failed five years ago.

That sounds determined but will come to nothing. Because for the dismantling of old blast furnaces between 2016 and 2020, a lot of new capacities were added on the quiet. The culprit was Beijing, which had stimulated China’s crippled economy with subsidies in the last Five-Year Plan and in 2020 gave the construction and automotive sectors a major boost in the fight against COVID. Steel prices and demand promptly went through the roof. The two ministries admit as much: “Regions and companies blindly followed the impulse to bet on new steel projects. The capacity reduction could not be consolidated in this way.” In plain language: China’s provinces and industries were racing to produce crude steel because it was profitable for them to do so. The World Steel Association recently noted with alarm: In 2019, the People’s Republic produced 996 million tons of crude steel, more than half of the world’s output. A year later, it set the bar even higher. In 2020, China produced 1.065 billion tons, according to Reuters.

The insatiable appetite for steel is déjà vu. It has been in the DNA of his Communist Party since Mao’s time. Thanks to the half-baked mixture of market and planned economy, in which the state can flick the market mechanism on and off like a switch, steel went from being a scarce commodity in socialist states to a surplus product in China. The world markets tried in vain to seal themselves off from the subsidized steel glut from China with punitive tariffs and anti-dumping procedures.

But there were warnings. In 2009, the EU Chamber in Beijing identified overcapacities in Chinese industries, especially steel, in a 50-page study. The president of the chamber at the time, Jörg Wuttke, spoke of “destructive consequences” for China and for the global economy. In 2015, a second Chamber study appeared because, Wuttke said, “The situation has changed from bad to dire.” In 2008, China had produced 512 million tons of crude steel. In 2014, it was 813 million tons. Between 2004 and 2014, global steel production increased 57 percent. China accounted for 91 percent of that.

This April, the Office of the New United States Trade Representative (USTR) denounced the People’s Republic as the world’s leading “producer of non-economic capacities”. The unwieldy phrase serves as justification for new punitive tariffs. China’s “continued bloat of steel production, plus its growing inventories and incentives for exports, threaten to flood global markets with excess steel at a moment when the global steel industry is trying to recover from the demand shock caused by the COVID-19 pandemic”.

Beijing would have good reason to reorganize its steel mess. President Xi Jinping made a climate policy commitment to his country to achieve maximum greenhouse gas emissions by 2030 and to make it carbon neutral by 2060. To do that, he would have to get to the steel. According to China’s calculations, the metallurgical industry alone accounts for around 15 percent of national CO2 emissions.

But steel is addiction (China.Table reported). Mao fell for it in Moscow in late 1957. Spurred by Soviet leader Nikita Khrushchev’s Sputnik success and his ostentatious announcement that he would overtake the United States in production in 15 years, Mao promised to do the same to England in 15 years. Back in Beijing, he lined up 60 million Chinese to “cook steel” and build 240,000 small blast furnaces. Propaganda posters of the time show glorified workers lifting steel into the red sky with a Soviet satellite flying. More steel and more grain became magical symbols of Chinese communism.

“In the Great Leap of Steel Production,” Mao called for doubling China’s output from 5.35 million tons of steel in 1957 in one year. On December 19, 1958, Xinhua cheered: 60 million workers had met the goal of 10.7 million tons of steel. It later turned out that barely eight million tons were usable. Everything else was slag.

Chinese party historians traced how Mao constantly changed his claim to overtake Britain in 15 years. On May 18, 1958, he proclaimed that China “will have caught up with Britain in as little as seven years. And another eight to ten years later, we will have caught up with the United States.” The formula was now “Chao Ying Gan Mei” (超英赶美) overtake Britain and catch up with the US.

Despite all the terrible setbacks, Beijing’s obsession with steel did not wane. The People’s Republic was the only country to celebrate itself with two special stamps when it managed to produce more than 100 million tons of steel in 1997, a world record. One stamp shows iron smelting in ancient times, where China also claims to have been number one.

Beijing can’t get off the high steel track. Because it needs even more steel for its rearmament, at the center of which is the expansion of the navy. Just as it once was in Germany or Japan. Seen in this light, the latest message on steel reduction seems like an April Fool’s joke.