Just a few years ago, all signs were pointing towards growth – now China’s second-largest real estate group Evergrande is going downhill. And this dramatic slump has a troublesome reason: reports about payment stops are circulating. China’s stock market now fears the worst.

Our author Ning Wang takes a look at the week that has been going more than bad for Evergrande and has been rife with bad news. She wonders: Will Evergrande’s “too big to fail” case continue to result in loan defaults and corporate bankruptcies, or are more consequences looming? Even if the government in Beijing rushes to Evergrande’s aid, things are now looking rather bleak.

Since the beginning of the Covid pandemic, the People’s Republic resembles a fortress: almost impossible to get in from the outside, and visas are hard to come by. And the weeks-long quarantine does its best in scaring off potential entrants. This is why foreigners in Beijing are virtually attracting each other’s attention now, as a German expatriate told our columnist Johnny Erling. In today’s issue, he writes about the dwindling number of foreigners in China. The supposedly globalized People’s Republic brings up the rear in terms of the proportion of foreigners compared to all other major nations.

Have a sunny weekend!

Being the owner of your home is something natural for the Chinese population. For many city dwellers, this has paid off as a good investment. For example, an 80-square-meter apartment near Beijing’s Fifth Ring costs more than 4.5 million yuan – more than 56,000 (the equivalent of 7,335 euros) per square meter.

In recent years, the sector has been in a gold-rush mood due to skyrocketing real estate prices in China. But the bubble is threatening to burst.

The stock markets continue to have the debt-laden real estate group China Evergrande in their crosshairs. After a media report on planned payment stops on loans to two creditor banks, investors feared a collapse of the group – and unceremoniously threw shares and bonds out of their portfolios on Thursday.

On the bond markets, the price of one of the company’s bonds, which matures in January 2023, fell by 30 percent, Reuters reported. The stock market temporarily suspended trading in the bonds because of the severe turmoil. Shares plunged more than 10 percent and were trading at their lowest level in six years, according to the report. They have lost over 75 percent since the beginning of the year.

With views on the rapid downfall, Traders pointed to a report published by financial news service REDD on Monday, stating that Evergrande plans to suspend interest payments to two of its creditor banks. The report went on to say that payments to several escrow companies would also be delayed. All payments for its asset management products were also to be suspended from Wednesday. Evergrande initially refused to comment on the report, according to Reuters.

However, the real estate sector in the People’s Republic has had a problem for some time: As the rapid rise in real estate prices has made real estate speculation more attractive than trading shares on the stock market, prices have been driven up even more. In recent years, this has led to a real boom among real estate companies.

Evergrande, China’s second-largest real estate developer, has not only benefited from peak prices but has also found it increasingly easy to obtain credit. The company grew rapidly, using loan-financed land purchases and home sales at lower margins to drive up sales faster. The resulting excessive speculation with external capital is now the concern of officials in Beijing. The government has announced a crackdown on the country’s financial risks. While this is desirable, it may come too late – and is particularly bitter for Evergrande.

Evergrande had already defaulted on bond interest payments in June. A week ago, Evergrande warned of liquidity and default risks if it failed to resume construction activity, sell equity interests and renew loans.

And there is no end to the bad news for Evergrande: On Tuesday last week, Evergrande had to publicly admit that the group will face bankruptcy if it fails to get immediate access to liquidity. Just one day prior, Evergrande had presented its financial figures for the first half of the year and reported a 29 percent drop in profits for the period.

Investors now fear shock waves for the Chinese banking system should Evergrande collapse. In total, the real estate group is said to be sitting on a mountain of debt equivalent to more than 300 billion dollars.

So the measures initiated by Beijing a while back to cool down overheated prices in its real estate markets are currently having an effect – and are reflected in Evergrande’s balance sheets. In addition to restricting access to new loans, the sale of land property in many cities has also been temporarily suspended. In addition, interest rates on real estate loans have been elevated.

Beijing has also outlined “three red lines” for the groups. For example, the ratio of liabilities to assets must not exceed 70 percent. In addition, the net gearing ratio should not exceed 100 percent. The third “red line” drawn by the government concerns the ratio of liquid assets to short-term liabilities of companies, which must be above a factor of one. Already in April this year, Evergrande was no longer able to comply with any of the three requirements and, as a result, was barred from taking up new loans.

In early June, Xu Jiayin, founder and chairman of Evergrande, pledged to reinstate one of the government’s “three red lines” for property developer debt within a month – so far without success.

On Wednesday, bad news reached Evergrande from the US: the lowering of credit ratings by rating agencies Moody’s and Fitch. The Chinese rating agency China Chengxin International (CCXI) also joined in – leading to a sell-off. Fitch had downgraded Evergrande’s credit rating to “CC”. The default risk of bonds rated “Ca” and “CC”, respectively, is considered high. By comparison, the US investment bank Lehman Brothers was considered safe by rating agencies before the financial crisis.

“The downgrade reflects our view that a default of some kind appears probable,” Fitch analysts said in a statement. “We believe credit risk is high given tight liquidity, declining contracted sales, pressure to address delayed payments to suppliers and contractors, and limited progress on asset disposals,” it added.

“The huge balance sheet will have a real domino effect on China,” said economist Lu Ting of Japanese financial holding Nomura some time ago. “If financial institutions lose money, they’ll tighten credit to other companies and sectors,” Lu further warned.

Xu Jiayin is one of the richest Chinese in the world – according to Forbes, Xu had a net worth of $45 billion in 2017. He was also the embodiment of a successful entrepreneur. The party had him speak at the National People’s Congress just a few years back. At the time, his success fit the party’s narrative: through hard work, you can go from the bottom all the way to the top to become a model entrepreneur.

The now 62-year-old still owns more than 70 percent of the company he founded in Guangzhou back in 1996. Only a few shopping centers, offices, or residential projects built in China’s cities do not originate from the construction plans of his conglomerate. These include a football club, a milk powder manufacturer and most recently the conglomerate has been looking to get involved in the EV sector (China.Table reported).

But Xu Jiayin may now have to divest his conglomerate to service some debts. Its EV division and the company’s headquarters in Hong Kong are under consideration, which could bring in some cash in view of real estate prices in Hong Kong – but nowhere near enough to save Evergrande.

In the end, some of that money will likely come from the government. But that doesn’t mean the company will survive in its current form or that bondholders will walk away unscathed, according to the Wall Street Journal.

According to estimates by Standard and Poor’s, up to 100 billion yuan (the equivalent of 13 billion euros) in bills for suppliers and companies are still pending by the end of the year. And those are just the unpaid bills. The interests Evergrande is no longer able to service are still not included in the list.

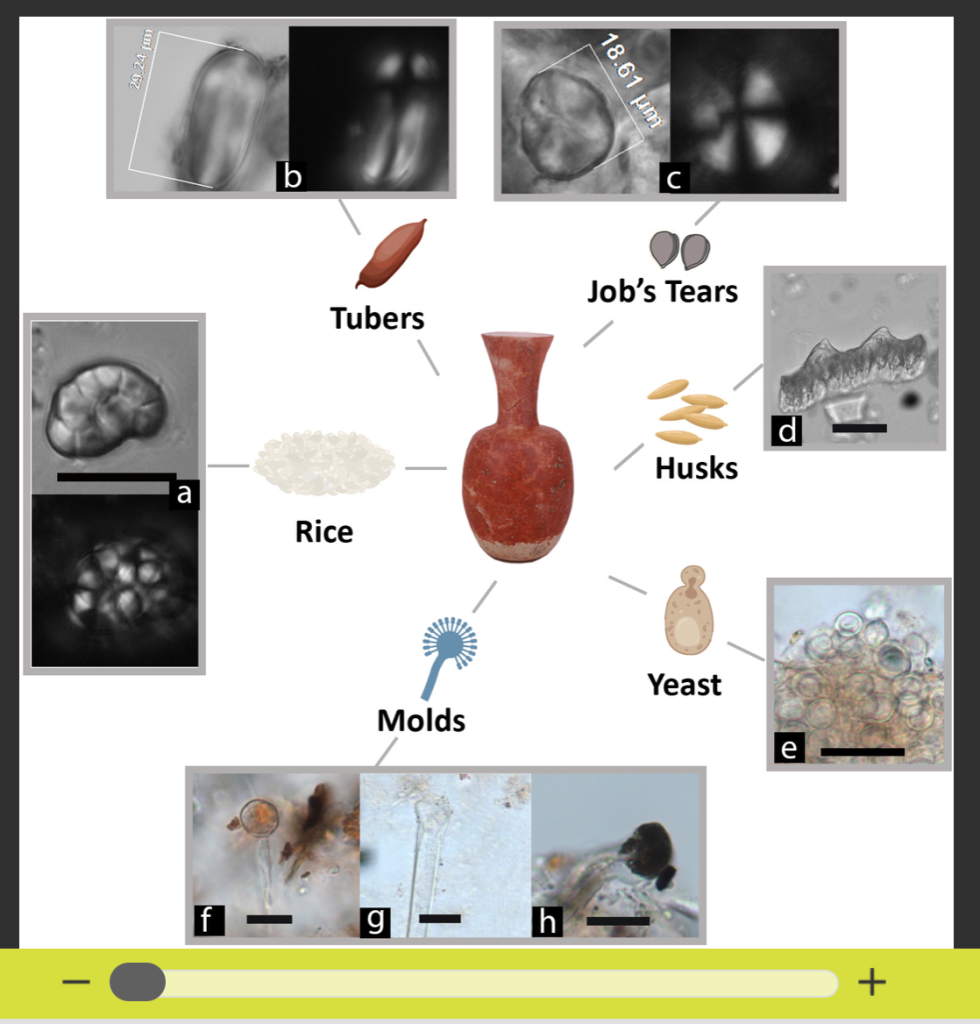

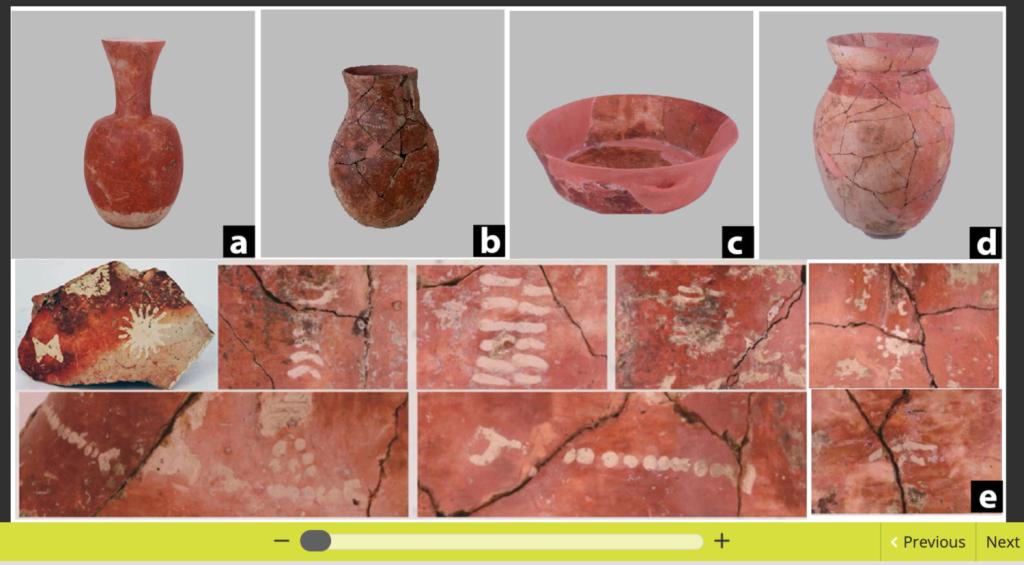

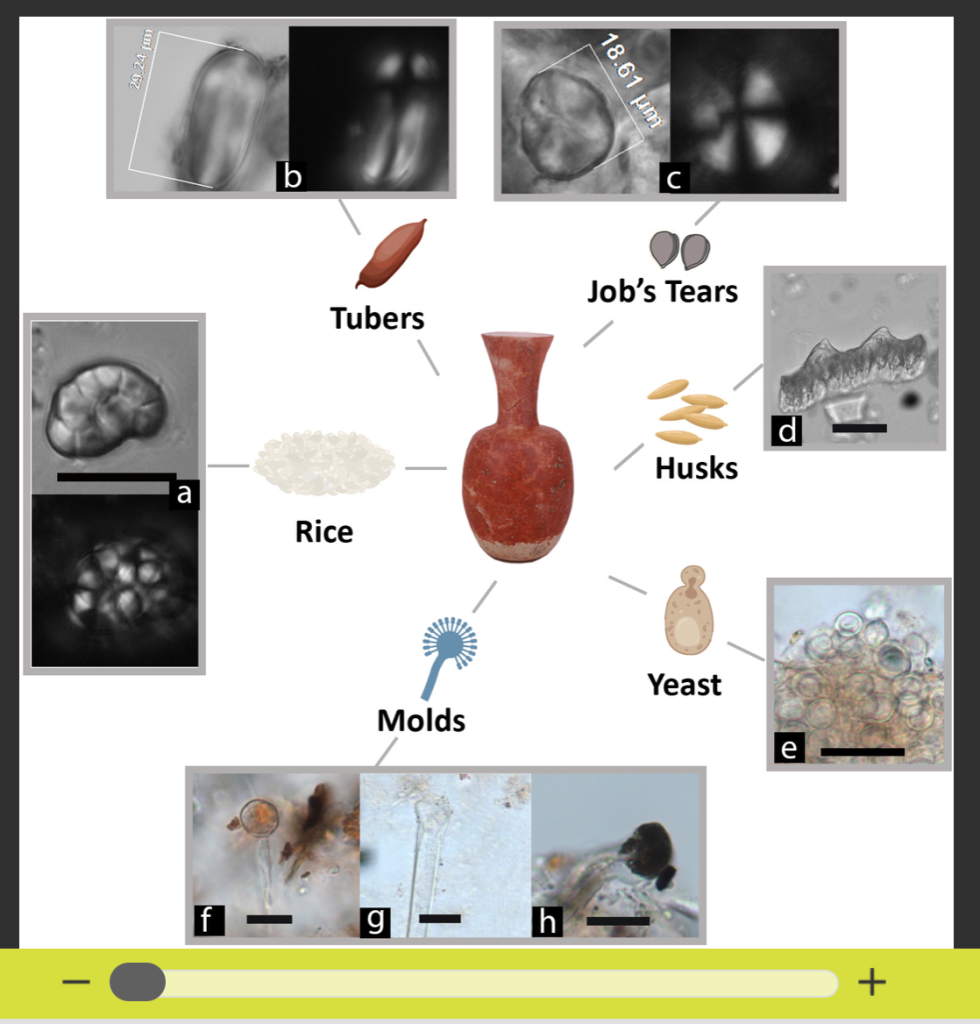

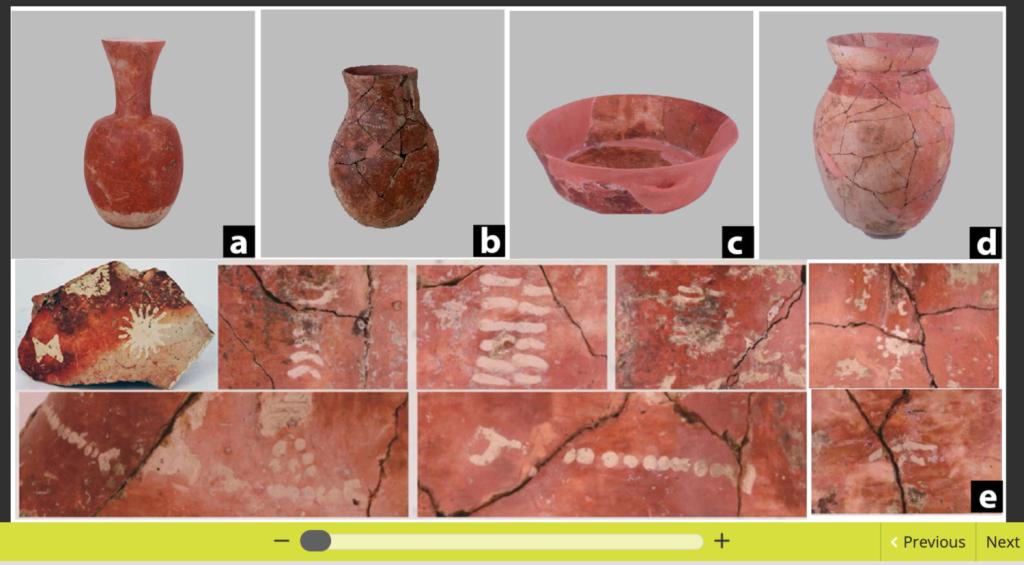

In Qiaotou, a town in the southern Chinese province of Zhejiang, the oldest evidence to date of the consumption of beer in Chinese mourning rituals has been discovered: Three Chinese researchers found 50 intact clay pots ornate with abstract patterns in a burial mound next to two human skeletons, made around 9000 years ago. Some pots resembled modern-day drinking glasses in size, while others were reminiscent of long-necked “hu vessels” used for the consumption of alcohol in later times. The three scientists presented their finds in the US interdisciplinary science journal PLOS One.

Upon discovery, the pottery was analyzed for residue – and found that it was most likely used to store an early form of beer. The find is now considered the earliest evidence that wakes included beer even back then, something that is still common in many societies around the world.

While beer consumption and its social function have already been extensively studied through research in Ancient Egypt and the Andes, according to the scientific publication, there is still a need to catch up on the role of beer in ancient China during the Holocene period between 9,000 and 8,700 BC.

“We found that some of the pots held beer made of rice,” writes co-author Wang Jiajing, assistant professor of anthropology at Dartmouth in the UK. He published the paper together with Zhang Leping and Sun Hanlong of the Zhejiang Provincial Institute of Cultural Relics and Archaeology in Hangzhou. The excavation finds at Qiaotou are located southwest of Shanghai. For their work, the researchers developed a new method to analyze fermented grain based on microfossils.

Among the substances that could be found in the jars were yeast and mold residues, as well as tiny starch grains and fossilized plant material (phytolith), all of which points to the fermentation process. The researchers suspect that additional rice, grains and other plants were used as fermenting agents. “Our results revealed that the pottery vessels were used to hold beer, in the most general sense – a fermented beverage made of rice, a grain called Job’s tears, and unidentified tubers,” Wang says. “This ancient beer, though, would not have been like the IPA that we have today. Instead, it was likely a slightly fermented and sweet beverage, which was probably cloudy in color,” Wang continued.

Today, rice is the predominant staple food in southern China. However, the rice plant was domesticated in the Yangtze Valley only 10,000 to 6,000 years ago. 9,000 years ago, when the burial site was created, the area was mainly inhabited by hunter-gatherers. This is another reason why scientists have difficulties determining when exactly the fermentation process was discovered.

“If people had some leftover rice and the grains became moldy, they may have noticed that the grains became sweeter and alcoholic with age,” Wang says. In any case, beer was a luxury good that was costly to produce and therefore only drunk on special occasions by wealthier people.

Given that the Qiaotou pottery was found in a non-residential area, the researchers conclude that the beer mugs were likely used in ritual ceremonies associated with burying the dead. They speculate that ritualized drinking may have been an essential part of building social relationships and cooperation between different groups.

Since the 1950s, archaeologists have been discussing the thesis that the longing for more beer prompted people to begin farming and settling down: “Did man once live by beer alone?” is a well-known essay on the subject, which speculates on whether beer was once more important than bread. Chinese research into beer archaeology should be seen in this context.

“Ritualized drinking probably played an integrative role in maintaining social relationships, paving the way for the rise of complex farming societies four millennia later.,” the authors write in their article. The drinking cups from which beer was consumed at this site are among the oldest painted cups in existence.

Archaeologists in China are paid above average and they receive large research funds – because it is important to the government to discover as much as possible about ancient China. While beer was not first invented in China, fermentation by molds was.

During the great dynasties, however, beer did not play a major role for the people of China. Later, foreigners came into play: Germans and Englishmen founded the Germania Brewery with German brewmasters in the German colony of Tsingtao in 1903. Even today, the Tsingtao Brewery Co is one of the two largest breweries in China, with a market share of more than 17 percent.

It was only with the economic reforms of the 1980s and 1990s and the rising income of an internationally oriented middle class that beer consumption grew steadily. Today, the People’s Republic is the world’s largest beer producer, with 440 million hectoliters a year. China now consumes twice as much beer as the USA and more than five times as much as Germany, which is the EU’s largest beer market.

China accounts for about 12 percent of global beer sales, with an annual consumption of 45.7 billion liters. In 2019, China imported more than US$821 million worth of beer, mainly from EU producers, which accounted for about three-quarters of imports. China’s beer market continued to grow by seven percent last year. Over the past five years, the beer market in the People’s Republic has grown by as much as 42 percent.

China has pledged humanitarian aid worth 200 million yuan for Afghanistan (about 26 million euros). The goods include grain, medicine and vaccines, the Foreign Ministry in Beijing announced on Thursday, according to the South China Morning Post (SCMP). According to the report, Foreign Minister Wang Yi made the pledge during a video conference with his counterparts from nations neighboring Afghanistan. China will supply three million doses of Covid vaccine in its first vaccine batch. The People’s Republic is also prepared to supply further emergency aid and goods for the fight against the pandemic, the statement added.

Afghanistan was facing serious challenges such as humanitarian problems and the pandemic, Wang Yi said during the talks, according to ministry sources. Neighboring countries wanted to help Afghanistan to “get out of chaos.” But he also called on the US to live up to its responsibilities after the withdrawal. “The US and its allies bear the main responsibility” to provide economic and humanitarian assistance to help Afghans, maintain stability, and avoid chaos. Apart from Wang Yi, the video conference was attended by the foreign ministers of Pakistan, Iran, Tajikistan, Uzbekistan, and the deputy foreign minister of Turkmenistan.

Wang Yi also reiterated his call for the Taliban to cut ties with all terror groups, saying China will work with countries in the region to track down and fight terror groups that have “have scattered and infiltrated into Afghanistan’s neighbouring countries.” He warned of the spread of terror groups. “Some international terror forces based in Afghanistan are planning to sneak to neighboring countries,” Wang said, according to the report.

China had not participated in multilateral talks between Germany, the US and 20 other countries, although an invitation had been extended. When prompted, Chinese Foreign Ministry spokesman Wang Wenbin said Wednesday, according to the SCMP, that the international community should strengthen coordination in Afghanistan. However, this should focus on tangible results rather than “empty talk.” ari

New troubles for China’s billion-dollar app industry: regulators have indefinitely suspended issuing new sales permits for online games. The media regulator also called on managers of companies such as Tencent and Neteasy at a meeting to stop “solely fixating on profit” and to help counter what it claimed was widespread video game addiction. This was reported by the South China Morning Post (SCMP). Chinese tech companies have been taking a beating throughout the year. Most recently, the government has cut the time children are allowed to spend playing games (China.Table reported). While many of the providers’ basic applications are free, the Internet giants finance themselves largely through in-game microtransaction. fin

The European Union plans closer cooperation with countries in the Indo-Pacific region in the digital sector. As part of the Indo-Pacific strategy that the European Commission will present next week, the EU wants to seek digital partnership agreements with Japan, South Korea and Singapore, Bloomberg reported on Thursday. According to the report, the agreements aim to create standards for technologies such as artificial intelligence and strengthen the exchange of trusted data. The EU also wants to work on improving supply chains for semiconductors.

The EU hopes to use the new approach – based on existing free trade agreements – to “build more resilient technology supply chains, support value-based innovation and facilitate business opportunities for start-ups and SMEs,” Politico reported from the draft strategy paper. The EU Commission will present it next Tuesday. On Wednesday, EU Commission chief Ursula von der Leyen is also expected to address cooperation with the region in her State of the EU speech. ari

How certifications from third countries like China will be dealt with under the European Union’s planned CO2 border adjustment is not yet clear, according to an EU Commission representative. “We are now trying to learn from mistakes within the EU,” Gerassimos Thomas said Thursday during a debate on the border levy. Thomas is an official at the Commission’s Directorate-General for Taxation and Customs Union (TAXUD).

The debate took place before the European Parliament’s Environment Committee. The “best practice” on certifications within the EU serves to “prevent us from making the same mistakes externally”, said Thomas. He was responding to a question about how CO2 certificates from the People’s Republic, for example, should be dealt with in future. These may have been issued under lower standards or in some cases simply falsified. To prevent this, a system of independent verification would be introduced, Thomas stressed.

For the time being, the EU Commission had chosen a rather narrow approach of basic materials for thelegislative proposal for CO2 border adjustment (CBAM for short, after the abbreviation for “Carbon Border Adjustment Mechanism”). In the first phase, onlyimports of cement, various iron, steel and aluminium goods, fertilisers and electricity will be affected. However, an expansion of the sectors is firmly planned, Thomas stressed. The transition period of the first phase is there to gather information and create a “predictable path” for businesses and administration, he said. Thomas rejected subsidies for EU exports to countries with lower environmental standards. Border adjustment is an environmental and not a trade measure, the EU Commission representative said.

The amount of the CO2 border adjustment is to be based on the average weekly price that European companies have to pay for the purchase of EU emission certificates. Companies from third countries will be able to claim CO2 costs incurred in their home country and will then have to show correspondingly fewer “CBAM rights”. China also started emissions trading in mid-July. Whether this will be compatible with the European ETS, however, is highly questionable(China.Table reported). After a transitional phase, the CO2 limit compensation is to come into full effect for the first sectors from 2026. ari

Just the other day, the president of the EU Chamber of Commerce in Beijing, Jörg Wuttke, told me how he travelled through China 44 times on domestic flights in the pandemic year of 2020. The frequent flyer noticed that almost all passengers were Chinese, “Only once I walked by a foreigner at an airport. That was so unusual that I turned around to look at him.” To Wuttke, it felt like stepping back in time to the 1980s, when China was opening up and foreigners were a rare sight. Back then, hope resonated that foreigner policies would soon change: “They needed us for their reforms, and they wanted us in China.” Now, however, he senses the opposite trend: “Worst of all, no one seems to mind if there are fewer foreigners.”

Wuttke estimates that in some areas, half of all expats have already left China since 2019. Among Germans, this is less drastic than with other nations. But everyone is noticing the effects, he says, be it in housing estates once favored by foreigners, or in the occupancy of foreign schools. Of course, the main reasons for this are the pandemic and China’s radical defense measures since 28 March 2020, halt to foreign tourism, the difficulties in entering and leaving the country, and the weeks-long quarantine for anyone seeking to enter China.

The nationalistic mood in society, bureaucratic hurdles, and newly planned taxes also had a frustrating effect. As early as 2016, major foreign chambers warned that the majority of their members no longer felt welcome in the People’s Republic. Wuttke has been dreading this for a long time. He also plans to comment on this at the presentation of the new position paper of his EU chamber of commerce, which will be published on 23 September.

China’s disappearing proportion of foreigners appears inconsistent with its claim to be a globalized world power. According to the analysis of its latest census – conducted every ten years – released on May 11, 2021, only 845,697 foreigners lived among 1.41 billion Chinese as of November 1, 2020. They make up 0.06 percent of the population. All foreigners who had been living in the country for more than three months were counted.

At first glance, it was just under a quarter of a million more people in 2020 than the 593,832 foreigners last counted in 2010. But after the outbreak of the pandemic and due to the deteriorating sociopolitical atmosphere with its patriotic to nationalistic undertones, the numbers are stagnating. In the apparent world metropolises such as Shanghai and Beijing, they are even decreasing in absolute terms. In the 24 million megacity of Shanghai, 163,955 resident foreigners were still counted, whilst in the capital Beijing only 62,812.

Even if one adds the 585,000 citizens of Hong Kong (371,380), Macao (55,732) and Taiwan (157,886) who are recorded by the census as neither foreigners nor mainland Chinese, the total number rises to only 1,430,695 individuals of international origin. Of these, most now live in South China’s coastal province of Guangdong (418,509). This is the result of the relocation of mainly Hong Kong Chinese, as well as the economic role of the newly expanded Pearl River Delta and Guangdong’s more relaxed admission policies in contrast to the rest of China. It reconnects with its historical role as a foreign gateway of entry for China.

Even added up, 1.43 million people also account for only 0.1 percent of the population. In 2019, the United Nations ranked the People’s Republic – now the world’s second-largest economy – last in international migration in its statistics on global immigration.

These numbers underline once again that the People’s Republic is currently not a country of immigration. And China demonstrates that it doesn’t plan to become one either, de jure or de facto. This was not always the case: In their first 2018 Beijing Annual Report on International Migration, (中国国际移民报告 2018), migration researchers and reformers were still hopeful that, thanks to globalization policies and the Silk Road Initiative, the modern People’s Republic was “gradually evolving from a source country for global emigration to a destination country for immigration.” Due to an influx of foreigners coming to China to “follow the Chinese dream, administrative and governmental measures would also improve more and more for them.”

China’s path leads elsewhere, as the farce in its green-card issuance shows. Beijing introduced the ten-year residence permit on August 15, 2004, after its 2001 accession to the World Trade Organization (WTO). But its bureaucracy balked at liberalized admission rules. In the 15 years until 2019, only just under 20,000 green cards were issued to foreigners in the whole of China.

By comparison, according to the U.S. Department of Homeland Security, the U.S., which considers itself a country of immigration, grants up to one million green cards annually. In 2019, the U.S. counted 13.9 million green card holders, 9.1 million of whom were eligible to become U.S. citizens.

China’s Ministry of Justice failed when it tried to push through at least an improved green card acquisition bill via a public hearing on February 29, 2020. The plan sparked protests on social media. Bloggers spouted that China did not need more foreigners. Because of the pandemic, the draft was put on hold for the time being.

In 2016, the US Chamber of Commerce had already complained in its annual Beijing report about the deteriorating business climate in the People’s Republic. 77 percent of US companies surveyed claimed they felt less and less welcome in China. They were plagued by more bureaucratic obstacles and harassment. Other foreign chambers of commerce also hear similar complaints from their member companies.

Beijing’s old propaganda slogan, “Our friends are all over the world” (我们的朋友遍天下), also flies off the tongue as a slogan for China’s globalization. Only their friends are best kept abroad.

Denny Herrmann is Head of Series Planning Foshan at FAW-Volkswagen since the beginning of August. Previously, Herrmann was Executive Assistant to the Vice President (Technology) / Head of Strategy Planning, also at FAW-Volkswagen.

After more than three years as Project Executive at Airbus China Innovation Center, Andreas Maurmaier was appointed new Head of Architecture & Operation for Environmental Control System at Airbus earlier this month.

Marc Schlesinger has joined BSH China from Willi Elbe Steering Systems in Nanjing. He has been working as an expert on Metal Forming since July.

One swipe on the smartphone app and within 15 minutes, orders arrive at the doorstep in China’s major cities. Deliveries are made by scooter – or by using public transport: Here, a Foodpanda delivery man sits in the Hong Kong subway. Foodpanda is owned by the German delivery service Delivery Hero. More than two years ago, Delivery Hero sold its national business in Germany to Dutch competitor Takeaway for about 930 million euros. After tests in several districts of Berlin, Delivery Hero will now offer delivery services in Frankfurt, Hamburg and Munich again under the Foodpanda brand. The fact that food or toilet paper will then be delivered in addition to food is in line with the demand in Germany.

Just a few years ago, all signs were pointing towards growth – now China’s second-largest real estate group Evergrande is going downhill. And this dramatic slump has a troublesome reason: reports about payment stops are circulating. China’s stock market now fears the worst.

Our author Ning Wang takes a look at the week that has been going more than bad for Evergrande and has been rife with bad news. She wonders: Will Evergrande’s “too big to fail” case continue to result in loan defaults and corporate bankruptcies, or are more consequences looming? Even if the government in Beijing rushes to Evergrande’s aid, things are now looking rather bleak.

Since the beginning of the Covid pandemic, the People’s Republic resembles a fortress: almost impossible to get in from the outside, and visas are hard to come by. And the weeks-long quarantine does its best in scaring off potential entrants. This is why foreigners in Beijing are virtually attracting each other’s attention now, as a German expatriate told our columnist Johnny Erling. In today’s issue, he writes about the dwindling number of foreigners in China. The supposedly globalized People’s Republic brings up the rear in terms of the proportion of foreigners compared to all other major nations.

Have a sunny weekend!

Being the owner of your home is something natural for the Chinese population. For many city dwellers, this has paid off as a good investment. For example, an 80-square-meter apartment near Beijing’s Fifth Ring costs more than 4.5 million yuan – more than 56,000 (the equivalent of 7,335 euros) per square meter.

In recent years, the sector has been in a gold-rush mood due to skyrocketing real estate prices in China. But the bubble is threatening to burst.

The stock markets continue to have the debt-laden real estate group China Evergrande in their crosshairs. After a media report on planned payment stops on loans to two creditor banks, investors feared a collapse of the group – and unceremoniously threw shares and bonds out of their portfolios on Thursday.

On the bond markets, the price of one of the company’s bonds, which matures in January 2023, fell by 30 percent, Reuters reported. The stock market temporarily suspended trading in the bonds because of the severe turmoil. Shares plunged more than 10 percent and were trading at their lowest level in six years, according to the report. They have lost over 75 percent since the beginning of the year.

With views on the rapid downfall, Traders pointed to a report published by financial news service REDD on Monday, stating that Evergrande plans to suspend interest payments to two of its creditor banks. The report went on to say that payments to several escrow companies would also be delayed. All payments for its asset management products were also to be suspended from Wednesday. Evergrande initially refused to comment on the report, according to Reuters.

However, the real estate sector in the People’s Republic has had a problem for some time: As the rapid rise in real estate prices has made real estate speculation more attractive than trading shares on the stock market, prices have been driven up even more. In recent years, this has led to a real boom among real estate companies.

Evergrande, China’s second-largest real estate developer, has not only benefited from peak prices but has also found it increasingly easy to obtain credit. The company grew rapidly, using loan-financed land purchases and home sales at lower margins to drive up sales faster. The resulting excessive speculation with external capital is now the concern of officials in Beijing. The government has announced a crackdown on the country’s financial risks. While this is desirable, it may come too late – and is particularly bitter for Evergrande.

Evergrande had already defaulted on bond interest payments in June. A week ago, Evergrande warned of liquidity and default risks if it failed to resume construction activity, sell equity interests and renew loans.

And there is no end to the bad news for Evergrande: On Tuesday last week, Evergrande had to publicly admit that the group will face bankruptcy if it fails to get immediate access to liquidity. Just one day prior, Evergrande had presented its financial figures for the first half of the year and reported a 29 percent drop in profits for the period.

Investors now fear shock waves for the Chinese banking system should Evergrande collapse. In total, the real estate group is said to be sitting on a mountain of debt equivalent to more than 300 billion dollars.

So the measures initiated by Beijing a while back to cool down overheated prices in its real estate markets are currently having an effect – and are reflected in Evergrande’s balance sheets. In addition to restricting access to new loans, the sale of land property in many cities has also been temporarily suspended. In addition, interest rates on real estate loans have been elevated.

Beijing has also outlined “three red lines” for the groups. For example, the ratio of liabilities to assets must not exceed 70 percent. In addition, the net gearing ratio should not exceed 100 percent. The third “red line” drawn by the government concerns the ratio of liquid assets to short-term liabilities of companies, which must be above a factor of one. Already in April this year, Evergrande was no longer able to comply with any of the three requirements and, as a result, was barred from taking up new loans.

In early June, Xu Jiayin, founder and chairman of Evergrande, pledged to reinstate one of the government’s “three red lines” for property developer debt within a month – so far without success.

On Wednesday, bad news reached Evergrande from the US: the lowering of credit ratings by rating agencies Moody’s and Fitch. The Chinese rating agency China Chengxin International (CCXI) also joined in – leading to a sell-off. Fitch had downgraded Evergrande’s credit rating to “CC”. The default risk of bonds rated “Ca” and “CC”, respectively, is considered high. By comparison, the US investment bank Lehman Brothers was considered safe by rating agencies before the financial crisis.

“The downgrade reflects our view that a default of some kind appears probable,” Fitch analysts said in a statement. “We believe credit risk is high given tight liquidity, declining contracted sales, pressure to address delayed payments to suppliers and contractors, and limited progress on asset disposals,” it added.

“The huge balance sheet will have a real domino effect on China,” said economist Lu Ting of Japanese financial holding Nomura some time ago. “If financial institutions lose money, they’ll tighten credit to other companies and sectors,” Lu further warned.

Xu Jiayin is one of the richest Chinese in the world – according to Forbes, Xu had a net worth of $45 billion in 2017. He was also the embodiment of a successful entrepreneur. The party had him speak at the National People’s Congress just a few years back. At the time, his success fit the party’s narrative: through hard work, you can go from the bottom all the way to the top to become a model entrepreneur.

The now 62-year-old still owns more than 70 percent of the company he founded in Guangzhou back in 1996. Only a few shopping centers, offices, or residential projects built in China’s cities do not originate from the construction plans of his conglomerate. These include a football club, a milk powder manufacturer and most recently the conglomerate has been looking to get involved in the EV sector (China.Table reported).

But Xu Jiayin may now have to divest his conglomerate to service some debts. Its EV division and the company’s headquarters in Hong Kong are under consideration, which could bring in some cash in view of real estate prices in Hong Kong – but nowhere near enough to save Evergrande.

In the end, some of that money will likely come from the government. But that doesn’t mean the company will survive in its current form or that bondholders will walk away unscathed, according to the Wall Street Journal.

According to estimates by Standard and Poor’s, up to 100 billion yuan (the equivalent of 13 billion euros) in bills for suppliers and companies are still pending by the end of the year. And those are just the unpaid bills. The interests Evergrande is no longer able to service are still not included in the list.

In Qiaotou, a town in the southern Chinese province of Zhejiang, the oldest evidence to date of the consumption of beer in Chinese mourning rituals has been discovered: Three Chinese researchers found 50 intact clay pots ornate with abstract patterns in a burial mound next to two human skeletons, made around 9000 years ago. Some pots resembled modern-day drinking glasses in size, while others were reminiscent of long-necked “hu vessels” used for the consumption of alcohol in later times. The three scientists presented their finds in the US interdisciplinary science journal PLOS One.

Upon discovery, the pottery was analyzed for residue – and found that it was most likely used to store an early form of beer. The find is now considered the earliest evidence that wakes included beer even back then, something that is still common in many societies around the world.

While beer consumption and its social function have already been extensively studied through research in Ancient Egypt and the Andes, according to the scientific publication, there is still a need to catch up on the role of beer in ancient China during the Holocene period between 9,000 and 8,700 BC.

“We found that some of the pots held beer made of rice,” writes co-author Wang Jiajing, assistant professor of anthropology at Dartmouth in the UK. He published the paper together with Zhang Leping and Sun Hanlong of the Zhejiang Provincial Institute of Cultural Relics and Archaeology in Hangzhou. The excavation finds at Qiaotou are located southwest of Shanghai. For their work, the researchers developed a new method to analyze fermented grain based on microfossils.

Among the substances that could be found in the jars were yeast and mold residues, as well as tiny starch grains and fossilized plant material (phytolith), all of which points to the fermentation process. The researchers suspect that additional rice, grains and other plants were used as fermenting agents. “Our results revealed that the pottery vessels were used to hold beer, in the most general sense – a fermented beverage made of rice, a grain called Job’s tears, and unidentified tubers,” Wang says. “This ancient beer, though, would not have been like the IPA that we have today. Instead, it was likely a slightly fermented and sweet beverage, which was probably cloudy in color,” Wang continued.

Today, rice is the predominant staple food in southern China. However, the rice plant was domesticated in the Yangtze Valley only 10,000 to 6,000 years ago. 9,000 years ago, when the burial site was created, the area was mainly inhabited by hunter-gatherers. This is another reason why scientists have difficulties determining when exactly the fermentation process was discovered.

“If people had some leftover rice and the grains became moldy, they may have noticed that the grains became sweeter and alcoholic with age,” Wang says. In any case, beer was a luxury good that was costly to produce and therefore only drunk on special occasions by wealthier people.

Given that the Qiaotou pottery was found in a non-residential area, the researchers conclude that the beer mugs were likely used in ritual ceremonies associated with burying the dead. They speculate that ritualized drinking may have been an essential part of building social relationships and cooperation between different groups.

Since the 1950s, archaeologists have been discussing the thesis that the longing for more beer prompted people to begin farming and settling down: “Did man once live by beer alone?” is a well-known essay on the subject, which speculates on whether beer was once more important than bread. Chinese research into beer archaeology should be seen in this context.

“Ritualized drinking probably played an integrative role in maintaining social relationships, paving the way for the rise of complex farming societies four millennia later.,” the authors write in their article. The drinking cups from which beer was consumed at this site are among the oldest painted cups in existence.

Archaeologists in China are paid above average and they receive large research funds – because it is important to the government to discover as much as possible about ancient China. While beer was not first invented in China, fermentation by molds was.

During the great dynasties, however, beer did not play a major role for the people of China. Later, foreigners came into play: Germans and Englishmen founded the Germania Brewery with German brewmasters in the German colony of Tsingtao in 1903. Even today, the Tsingtao Brewery Co is one of the two largest breweries in China, with a market share of more than 17 percent.

It was only with the economic reforms of the 1980s and 1990s and the rising income of an internationally oriented middle class that beer consumption grew steadily. Today, the People’s Republic is the world’s largest beer producer, with 440 million hectoliters a year. China now consumes twice as much beer as the USA and more than five times as much as Germany, which is the EU’s largest beer market.

China accounts for about 12 percent of global beer sales, with an annual consumption of 45.7 billion liters. In 2019, China imported more than US$821 million worth of beer, mainly from EU producers, which accounted for about three-quarters of imports. China’s beer market continued to grow by seven percent last year. Over the past five years, the beer market in the People’s Republic has grown by as much as 42 percent.

China has pledged humanitarian aid worth 200 million yuan for Afghanistan (about 26 million euros). The goods include grain, medicine and vaccines, the Foreign Ministry in Beijing announced on Thursday, according to the South China Morning Post (SCMP). According to the report, Foreign Minister Wang Yi made the pledge during a video conference with his counterparts from nations neighboring Afghanistan. China will supply three million doses of Covid vaccine in its first vaccine batch. The People’s Republic is also prepared to supply further emergency aid and goods for the fight against the pandemic, the statement added.

Afghanistan was facing serious challenges such as humanitarian problems and the pandemic, Wang Yi said during the talks, according to ministry sources. Neighboring countries wanted to help Afghanistan to “get out of chaos.” But he also called on the US to live up to its responsibilities after the withdrawal. “The US and its allies bear the main responsibility” to provide economic and humanitarian assistance to help Afghans, maintain stability, and avoid chaos. Apart from Wang Yi, the video conference was attended by the foreign ministers of Pakistan, Iran, Tajikistan, Uzbekistan, and the deputy foreign minister of Turkmenistan.

Wang Yi also reiterated his call for the Taliban to cut ties with all terror groups, saying China will work with countries in the region to track down and fight terror groups that have “have scattered and infiltrated into Afghanistan’s neighbouring countries.” He warned of the spread of terror groups. “Some international terror forces based in Afghanistan are planning to sneak to neighboring countries,” Wang said, according to the report.

China had not participated in multilateral talks between Germany, the US and 20 other countries, although an invitation had been extended. When prompted, Chinese Foreign Ministry spokesman Wang Wenbin said Wednesday, according to the SCMP, that the international community should strengthen coordination in Afghanistan. However, this should focus on tangible results rather than “empty talk.” ari

New troubles for China’s billion-dollar app industry: regulators have indefinitely suspended issuing new sales permits for online games. The media regulator also called on managers of companies such as Tencent and Neteasy at a meeting to stop “solely fixating on profit” and to help counter what it claimed was widespread video game addiction. This was reported by the South China Morning Post (SCMP). Chinese tech companies have been taking a beating throughout the year. Most recently, the government has cut the time children are allowed to spend playing games (China.Table reported). While many of the providers’ basic applications are free, the Internet giants finance themselves largely through in-game microtransaction. fin

The European Union plans closer cooperation with countries in the Indo-Pacific region in the digital sector. As part of the Indo-Pacific strategy that the European Commission will present next week, the EU wants to seek digital partnership agreements with Japan, South Korea and Singapore, Bloomberg reported on Thursday. According to the report, the agreements aim to create standards for technologies such as artificial intelligence and strengthen the exchange of trusted data. The EU also wants to work on improving supply chains for semiconductors.

The EU hopes to use the new approach – based on existing free trade agreements – to “build more resilient technology supply chains, support value-based innovation and facilitate business opportunities for start-ups and SMEs,” Politico reported from the draft strategy paper. The EU Commission will present it next Tuesday. On Wednesday, EU Commission chief Ursula von der Leyen is also expected to address cooperation with the region in her State of the EU speech. ari

How certifications from third countries like China will be dealt with under the European Union’s planned CO2 border adjustment is not yet clear, according to an EU Commission representative. “We are now trying to learn from mistakes within the EU,” Gerassimos Thomas said Thursday during a debate on the border levy. Thomas is an official at the Commission’s Directorate-General for Taxation and Customs Union (TAXUD).

The debate took place before the European Parliament’s Environment Committee. The “best practice” on certifications within the EU serves to “prevent us from making the same mistakes externally”, said Thomas. He was responding to a question about how CO2 certificates from the People’s Republic, for example, should be dealt with in future. These may have been issued under lower standards or in some cases simply falsified. To prevent this, a system of independent verification would be introduced, Thomas stressed.

For the time being, the EU Commission had chosen a rather narrow approach of basic materials for thelegislative proposal for CO2 border adjustment (CBAM for short, after the abbreviation for “Carbon Border Adjustment Mechanism”). In the first phase, onlyimports of cement, various iron, steel and aluminium goods, fertilisers and electricity will be affected. However, an expansion of the sectors is firmly planned, Thomas stressed. The transition period of the first phase is there to gather information and create a “predictable path” for businesses and administration, he said. Thomas rejected subsidies for EU exports to countries with lower environmental standards. Border adjustment is an environmental and not a trade measure, the EU Commission representative said.

The amount of the CO2 border adjustment is to be based on the average weekly price that European companies have to pay for the purchase of EU emission certificates. Companies from third countries will be able to claim CO2 costs incurred in their home country and will then have to show correspondingly fewer “CBAM rights”. China also started emissions trading in mid-July. Whether this will be compatible with the European ETS, however, is highly questionable(China.Table reported). After a transitional phase, the CO2 limit compensation is to come into full effect for the first sectors from 2026. ari

Just the other day, the president of the EU Chamber of Commerce in Beijing, Jörg Wuttke, told me how he travelled through China 44 times on domestic flights in the pandemic year of 2020. The frequent flyer noticed that almost all passengers were Chinese, “Only once I walked by a foreigner at an airport. That was so unusual that I turned around to look at him.” To Wuttke, it felt like stepping back in time to the 1980s, when China was opening up and foreigners were a rare sight. Back then, hope resonated that foreigner policies would soon change: “They needed us for their reforms, and they wanted us in China.” Now, however, he senses the opposite trend: “Worst of all, no one seems to mind if there are fewer foreigners.”

Wuttke estimates that in some areas, half of all expats have already left China since 2019. Among Germans, this is less drastic than with other nations. But everyone is noticing the effects, he says, be it in housing estates once favored by foreigners, or in the occupancy of foreign schools. Of course, the main reasons for this are the pandemic and China’s radical defense measures since 28 March 2020, halt to foreign tourism, the difficulties in entering and leaving the country, and the weeks-long quarantine for anyone seeking to enter China.

The nationalistic mood in society, bureaucratic hurdles, and newly planned taxes also had a frustrating effect. As early as 2016, major foreign chambers warned that the majority of their members no longer felt welcome in the People’s Republic. Wuttke has been dreading this for a long time. He also plans to comment on this at the presentation of the new position paper of his EU chamber of commerce, which will be published on 23 September.

China’s disappearing proportion of foreigners appears inconsistent with its claim to be a globalized world power. According to the analysis of its latest census – conducted every ten years – released on May 11, 2021, only 845,697 foreigners lived among 1.41 billion Chinese as of November 1, 2020. They make up 0.06 percent of the population. All foreigners who had been living in the country for more than three months were counted.

At first glance, it was just under a quarter of a million more people in 2020 than the 593,832 foreigners last counted in 2010. But after the outbreak of the pandemic and due to the deteriorating sociopolitical atmosphere with its patriotic to nationalistic undertones, the numbers are stagnating. In the apparent world metropolises such as Shanghai and Beijing, they are even decreasing in absolute terms. In the 24 million megacity of Shanghai, 163,955 resident foreigners were still counted, whilst in the capital Beijing only 62,812.

Even if one adds the 585,000 citizens of Hong Kong (371,380), Macao (55,732) and Taiwan (157,886) who are recorded by the census as neither foreigners nor mainland Chinese, the total number rises to only 1,430,695 individuals of international origin. Of these, most now live in South China’s coastal province of Guangdong (418,509). This is the result of the relocation of mainly Hong Kong Chinese, as well as the economic role of the newly expanded Pearl River Delta and Guangdong’s more relaxed admission policies in contrast to the rest of China. It reconnects with its historical role as a foreign gateway of entry for China.

Even added up, 1.43 million people also account for only 0.1 percent of the population. In 2019, the United Nations ranked the People’s Republic – now the world’s second-largest economy – last in international migration in its statistics on global immigration.

These numbers underline once again that the People’s Republic is currently not a country of immigration. And China demonstrates that it doesn’t plan to become one either, de jure or de facto. This was not always the case: In their first 2018 Beijing Annual Report on International Migration, (中国国际移民报告 2018), migration researchers and reformers were still hopeful that, thanks to globalization policies and the Silk Road Initiative, the modern People’s Republic was “gradually evolving from a source country for global emigration to a destination country for immigration.” Due to an influx of foreigners coming to China to “follow the Chinese dream, administrative and governmental measures would also improve more and more for them.”

China’s path leads elsewhere, as the farce in its green-card issuance shows. Beijing introduced the ten-year residence permit on August 15, 2004, after its 2001 accession to the World Trade Organization (WTO). But its bureaucracy balked at liberalized admission rules. In the 15 years until 2019, only just under 20,000 green cards were issued to foreigners in the whole of China.

By comparison, according to the U.S. Department of Homeland Security, the U.S., which considers itself a country of immigration, grants up to one million green cards annually. In 2019, the U.S. counted 13.9 million green card holders, 9.1 million of whom were eligible to become U.S. citizens.

China’s Ministry of Justice failed when it tried to push through at least an improved green card acquisition bill via a public hearing on February 29, 2020. The plan sparked protests on social media. Bloggers spouted that China did not need more foreigners. Because of the pandemic, the draft was put on hold for the time being.

In 2016, the US Chamber of Commerce had already complained in its annual Beijing report about the deteriorating business climate in the People’s Republic. 77 percent of US companies surveyed claimed they felt less and less welcome in China. They were plagued by more bureaucratic obstacles and harassment. Other foreign chambers of commerce also hear similar complaints from their member companies.

Beijing’s old propaganda slogan, “Our friends are all over the world” (我们的朋友遍天下), also flies off the tongue as a slogan for China’s globalization. Only their friends are best kept abroad.

Denny Herrmann is Head of Series Planning Foshan at FAW-Volkswagen since the beginning of August. Previously, Herrmann was Executive Assistant to the Vice President (Technology) / Head of Strategy Planning, also at FAW-Volkswagen.

After more than three years as Project Executive at Airbus China Innovation Center, Andreas Maurmaier was appointed new Head of Architecture & Operation for Environmental Control System at Airbus earlier this month.

Marc Schlesinger has joined BSH China from Willi Elbe Steering Systems in Nanjing. He has been working as an expert on Metal Forming since July.

One swipe on the smartphone app and within 15 minutes, orders arrive at the doorstep in China’s major cities. Deliveries are made by scooter – or by using public transport: Here, a Foodpanda delivery man sits in the Hong Kong subway. Foodpanda is owned by the German delivery service Delivery Hero. More than two years ago, Delivery Hero sold its national business in Germany to Dutch competitor Takeaway for about 930 million euros. After tests in several districts of Berlin, Delivery Hero will now offer delivery services in Frankfurt, Hamburg and Munich again under the Foodpanda brand. The fact that food or toilet paper will then be delivered in addition to food is in line with the demand in Germany.