Beijing citizens celebrate in fantastic May weather on what may be the last days before a lockdown. So far, many citizens have been left guessing if and when the lockdowns will come, as our Beijing team reports. But as always, the people of Beijing adapt quickly to the measures: Restaurants, for example, are simply putting tables out on the street as they are no longer allowed to serve indoors. Beijing registered 51 new cases on Wednesday. That is still a reassuringly low number. Another positive development is the news that China will slightly shorten quarantine periods for people entering the country.

The beautiful spring sun also benefits the energy supply, which is rapidly being transformed into renewable sources. Huge wind and photovoltaic plants are being built in the desert regions of the West. To protect the climate, the People’s Republic also relies heavily on nuclear power, which is also emission-free. Beijing has set itself enormous nuclear expansion goals for the coming decades. Nico Beckert analyzes why the expansion plans progress slower than planned and how China fares in the difficult search for a nuclear waste storage.

The People’s Republic is also a global leader in digitization in the mobility sector. The country’s tech-savvy customers demand high-tech in their cars, and especially in EVs for the future. German automakers are years behind their Chinese competitors, as Christian Domke Seidel analyzes. He explains how Volkswagen plans to remedy the situation in the Group’s largest single market with the help of its software subsidiary Cariad. CEO Diess wants Cariad to turn VW into a “software-driven mobility provider”.

Temperatures in Beijing climbed above 30 degrees for the first time this year in early May, and it shows in the cityscape. During the holidays, the city’s more popular gathering places are crowded with people. Like, for example, the shopping mile in the Sanlitun district, where stores are open as usual. About two dozen photographers stand on the shopping mile wildly snapping photos of every stylish-looking Beijing woman who strolls by – or even chase them with their video cameras drawn. A young, eccentrically dressed man in a hat and glasses draws attention with loud singing and dance moves. A young father films his daughter dancing with his cell phone. The video will probably end up on TikTok.

About 430 locally transmitted cases are reported for Beijing in total. The capital reported 51 new infections alone on Wednesday. Due to the high infection numbers, cafés and restaurants are no longer allowed to serve food indoors – but take-away and delivery services are still allowed. Shopping malls and stores were also allowed to remain open.

“Everything is the same as always,” says one Beijing resident. “You just can’t get into the café and have to find another place to sit.” So people sit close together on the few benches under the trees or move out onto the steps in front of Sanlitun’s large Apple Store. In their hands they hold cold or hot drinks and chat, or take selfies. Some wear masks, others don’t. On their shirts, most wear a dark purple sticker that reads “Taikooli”. The security guards of the shopping mall hand out this sticker to all those who showed a valid Covid test from the last 48 hours and a green “health code” when entering the plaza. Those wearing the sticker are then allowed to leave and re-enter the area freely – and do not need to prove again that they are Covid-free, even in stores.

On Wednesday, Covid measures were slightly tightened. The city announced to close 60 subway stations and over 150 bus lines temporarily. Workers should avoid public transportation on their daily commute. The hardest-hit district, Chaoyang, urged citizens to work from home if possible starting Thursday, according to a Global Times report. Beijing’s schools will also remain closed throughout the week. All other holiday measures remain in place for now.

The measures themselves have been causing surprises and confusion for weeks. A closer look at the city map shows 66 closed stations instead of 60. Some shopping centers only let customers in who have a 24-hour old Covid test, while 48 hours is enough for others.

There are similar differences among employers. Many try to protect themselves with the help of anticipatory obedience to remain open, and therefore also demand new tests every 24 hours. One Beijing woman expressed concern – though not so much about a possible infection. “The worries I have about the virus are nowhere near as big as the worries I have about what the measures might mean for my job,” says the young worker.

She alludes to a possible lockdown that looms over the city. Rumors about it have been making the rounds for weeks (China.Table reported). Panic buying, however, only caused empty shelves for a short time. But all the greater was the general frustration that delivery services could no longer keep up and had to cancel orders. By the start of the May holidays, however, bottlenecks had largely been resolved. Ultimately, the many lockdown rumors have not yet come true.

Still, many expats have already stocked up on things that will be difficult to obtain in the event of a lockdown: Chocolate, wine or other luxury foodstuffs that, in case of doubt, would probably not pass directly as essentials.

Some residents simply live in the here and now because of the back-and-forth about the possible impending lockdown. “Sure, it could come at any moment. And before that happens, we probably won’t hear about it anyway. So we’d rather enjoy as much of the nice weather as we can now. As long as we can,” says someone.

There is a crowd in front of many test stations; the services vary. Some tests are free, others cost around 25 yuan (about €3.50). Social distancing rules are rarely followed or enforced here. The people are aware that this carries a certain risk of infection – and they express this openly on social media such as WeChat. The elderly also have a few problems at the testing stations. That’s because everything there can only be done via mobile app and with WeChat payment. Not every pensioner in Beijing is able to keep up. “Don’t you have children or grandchildren who can pay it?” the young employees dressed in protective suits keep asking.

Those who want to stay away from high-risk parts of the city can do this easily with the app Gaode Ditu. This map and navigation app not only lists the latest traffic jams, but also cordoned-off residential areas. It also shows how isolated and selective quarantines still are. Most of them are individual neighborhoods that have been declared high-risk areas.

The response of many restaurant operators to the ban on serving food indoors is also typical of Beijing. Many simply place a table in the front door where people can order and then take their food home. Others put small tables and plastic stools on the street and serve their guests there.

And so the mood in Beijing these days is mainly one of enjoying the sun carefree in the streets. In parks and smaller green strips, pensioners play cards or do sports. However, Beijing’s elderly have to limit their activities on a square along the green belt, which is widely known as the “first ring”. The city government has converted the popular square into a mobile Covid testing station. Now, tents and containers stand exactly where the elderly usually hold their famous mass dances in the evenings. Gregor Koppenburg/Joern Petring

To achieve its climate goals, China also relies on nuclear power. Recently, the government approved the construction of 6 new reactors. In the next 15 years, China plans to build 150 reactors, as announced by the chairman of the state-owned China General Nuclear Power Group. That alone is more than Germany has ever had. The People’s Republic has already become one of the largest producers of nuclear power. In the last thirty years, China has built 54 reactors, and 20 more are under construction.

At present, however, nuclear power accounts for just over five percent of China’s electricity mix. Nevertheless, China produces more electricity from nuclear fission than from solar power (3.6 percent). The current Five-Year Plan aims to increase nuclear power capacity to 70 gigawatts by 2025 – up from just over 50 gigawatts. This means that between 2022 and 2025, five gigawatts of new nuclear capacity would have to come online each year – that is about five reactors per year.

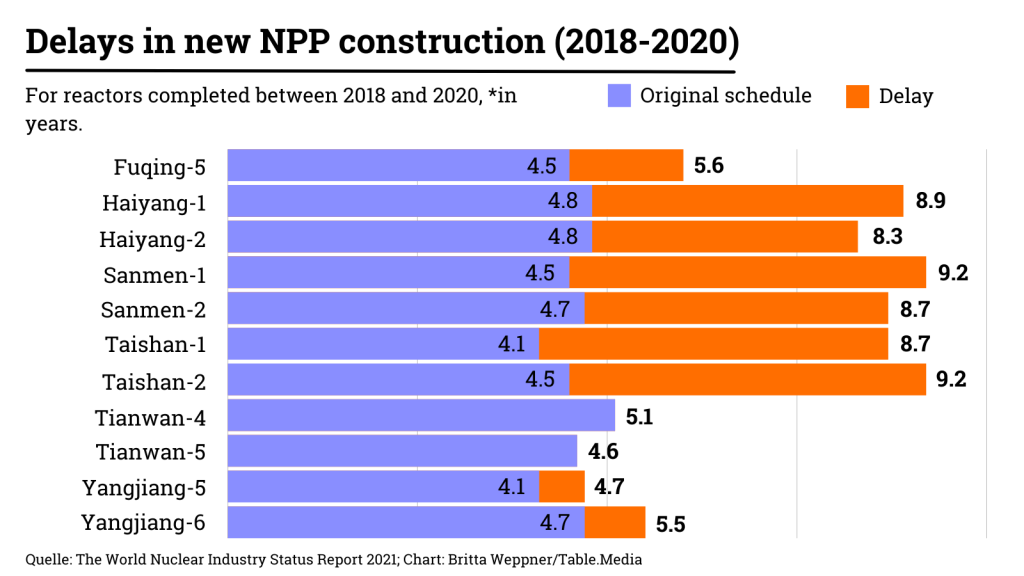

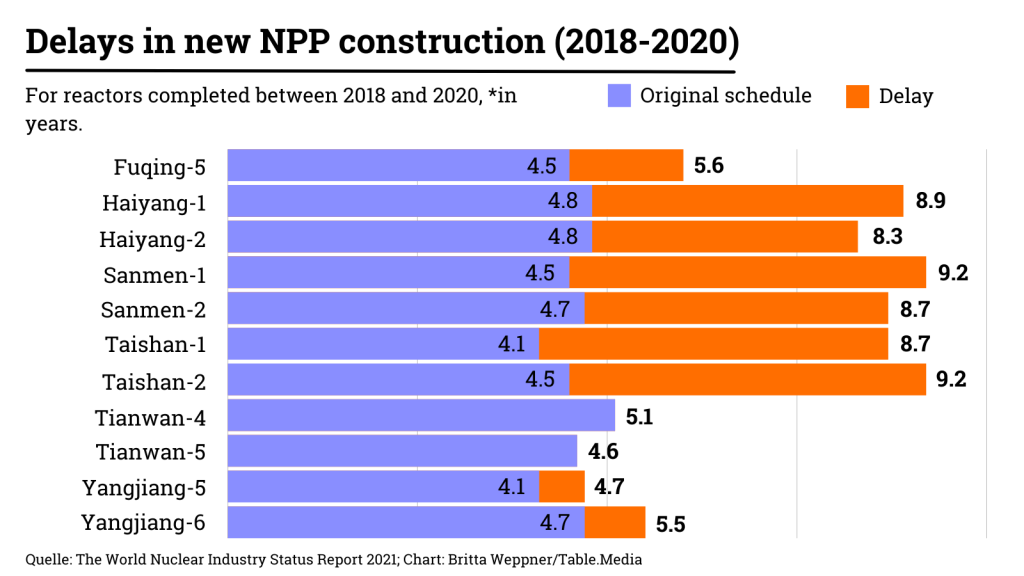

As ambitious as these goals may sound, the reality on the ground is different. Between 2016 and 2018, authorities did not approve a single new nuclear power plant (China.Table reported). In fact, 58 gigawatts of nuclear capacity were supposed to have been connected to the grid two years ago. This target, however, was missed by several gigawatts. After the 2011 reactor disaster in Fukushima, Japan, Chinese authorities also became more cautious. At that time, the government ordered a thorough safety review and imposed a moratorium on new projects. The construction of already approved reactors was also delayed. Two reactors have been under construction since 2012, and three others since 2015, although some of them were originally scheduled for completion within four years, as one builder and operator had assured.

However, according to consulting and analysis company Sinolytics, nuclear expansion is now picking up momentum. “China’s government is now clearly committed to a swift expansion of its nuclear energy capacity,” the experts write (China.Table reported). Nuclear power should be “actively and properly promoted,” China’s National Energy Administration announced in its recent energy work guidance. Concrete expansion targets – unlike for other energy sources – are not mentioned. But for the first time in ten years, authorities emphasize the “active expansion” of nuclear power.

Nuclear expansion helps ensure the country’s energy security. The issue has gained much political relevance in the wake of last year’s power outages. “Nuclear power is ideal in that it can help improve China’s energy security, reduce dependence on energy imports and meet decarbonization targets,” Bin Yan of Sinolytics told China.Table.

However, there are doubts about whether China will be able to achieve its ambitious expansion targets. The number of new approvals is only increasing very slowly, according to the experts at Trivium China, another consulting and analysis company. China faces the problem that nuclear power plants are large projects. “The massive scale of current nuclear projects is a major reason for construction delays,” Cory Combs of Trivium China told China.Table.

Smaller, modular reactors, on the other hand, are still only under development. No one knows when these smaller reactors will become economically viable, Combs said. The goal of building 150 reactors makes much more sense if they are smaller, modular reactors. These could be industrially manufactured in the future, effectively as mass products. This lowers costs compared to the current generation of nuclear power plants. Due to the long construction time of six years per reactor on average, the World Nuclear Industry Status Report estimates that China will have around 100 gigawatts of nuclear capacity by 2030.

Another problem concerns the locations of nuclear power plants. Current standard reactors need stable access to cooling water, Combs said. That is the reason why almost all reactors are built on China’s coasts. However, the construction of up to 150 NPPs would overload the coastal power grid. Combs says that “150 reactors of the current generation along the coast is not feasible from a grid perspective.” One possible solution, he says, lies in a massive expansion of power transmission and energy trading between provinces. But such policy reform is still in its infancy. Newer reactors that do not require cooling water have been in development for years, but are not yet economical. Despite these problems, however, nuclear power is “an important pillar for China’s clean energy future,” Combs said.

The delays in nuclear expansion could have a negative impact on the climate. This is because nuclear power plants are a reliable source of electricity – apart from safety-related outages. They are not dependent on wind and sun. It is therefore likely that the baseload in China will be covered by coal-fired power for even longer. Authorities also see it that way. “Coal-fired power will continue to play an important role in ensuring energy security for a long time,” says the Vice Director of China’s National Energy Administration.

Additionally, China also faces the fundamental problem of nuclear power: the disposal of nuclear waste. And the more reactors exist, the more nuclear waste has to be safely stored somewhere – and for dozens of millennia. Even in China, there is still no permanent repository. The search for a suitable storage site has been going on for 35 years. Just as in Germany and elsewhere, a quick solution is not to be expected. At least the issue of repositories does appear in the current 14th Five-Year Plan.

And last summer, a site was chosen in a part of the Gobi Desert belonging to Gansu Province for the construction of an underground laboratory. Local rock is to be analyzed until 2040. Then a decision is expected as to whether the region is suitable for a repository. According to the government’s plans, it will take until 2050 before a possible repository is completed.

The disposal of low- to medium-level radioactive waste is also reaching its limits. The People’s Republic does have three repositories for this waste. But the capacities of these repositories are “stressed and deficient,” according to an official at the National Nuclear Safety Administration. As a result, new repositories for low- to medium-level radioactive waste are currently being explored. But efforts are complicated by a not in my backyard mentality and public fears about radiation, the official said. No province wants to build a repository, but rather ship the waste to other provinces. That, too, is a familiar problem around the world, including Germany. It is up to the central government to determine the locations of other repositories, an expert told the South China Morning Post.

In early April, organizers canceled the auto show in Beijing. The pandemic and the zero-covid policy prevented the industry summit from taking place. Nevertheless, manufacturers took the opportunity to present their ideas for the cars of the future. Audi presented the Urban Sphere Concept (China.Table reported), BMW the i7 and Mercedes the EQS. All three received a slap in the face from critics. While it was welcome that the Germans had stopped simply converting classic internal combustion engines to electric drive, they still don’t know anything about modern electric cars, critics said. Their models were labeled too conservative, and the technology is years behind Chinese competitors. The Germans confuse large screens with intelligence, automotive analyst Lin Xiao points out in Shentu Car.

Sales figures confirm the harsh assessment (China.Table reported). In March 2022, NIO alone sold around 10,000 all-electric vehicles in the premium category (over ¥300,000, around €43,000) according to the China Automotive Technology and Research Center (CATARC). That is more than twice as many as Audi (120 units), BMW (3,100) and Mercedes (1,200) combined.

The Volkswagen Group has long been aware of the problem (China.Table reported). The software subsidiary Cariad is now expected to provide the solution. The foundation is €30 billion, which is to be invested by 2026. Cariad’s acquisitions include Diconium, a software company based in Stuttgart, and Hella Aglaia, a specialist in camera software. About 5,000 employees currently work at the VW subsidiary – 600 of them at the China branch since the end of April 2022. By the end of 2023, that number is expected to rise to 1,200 employees. At least 90 percent of them are to come directly from the People’s Republic. China is the largest single market for Volkswagen and a global leader in the field of digitalization in the mobility sector.

The big goal is to have a technology package ready in 2026 that will allow autonomous driving at level four. This means that the system will permanently take control of the vehicle. Only in individual situations should the driver take over the wheel for a short time. In China, the NIO ET7 has already mastered this level. But Volkswagen’s schedule for this already seems to be shaky. The market launch of various projects based on the new software has been pushed back. Jan Becker, head of the software company Apex.AI, explains to the German newspaper Handelsblatt that no German manufacturer has a finished operating system. Without it, however, neither tests could be run nor could additional applications be programmed.

Cariad is supposed to turn VW into a “software-driven mobility provider,” as CEO Herbert Diess calls it. Two paths lead there. Either VW develops and programs everything itself – or the solutions come from suppliers and partnerships. Both options have advantages and disadvantages.

Ned Curic, Chief Technology Officer at Stellantis, believes car companies should build cars, not program software. After all, the driving experience is also important for intelligent EVs. Manufacturers should not squander this advantage. And for a long time, it looked as if Volkswagen was also going down this path.

But the current state of the software cooperation does not bode well for VW. A partnership with Daimler has ended. The joint development with Bosch is struggling. And investments in Google’s Waymo or involvement by Continental have failed. Volkswagen currently negotiates with Huawei (China.Table reported) about the takeover of a department that works on autonomous driving. The cost: up to €10 billion. All without the guarantee that its developers will even make the leap to Volkswagen.

For the time being, Cariad has to work on digitization on its own. This is expensive and slow, but it also has advantages. On the one hand, VW would be less affected by trade wars or political decisions. If Volkswagen develops and builds exclusively in China, embargoes and tariffs do not immediately threaten the entire business model. Furthermore, Volkswagen does not have to give up a piece of the pie.

This is why Cariad is under pressure in China. Results are needed. The world’s largest EV market with the most digital customers is considered an important benchmark. Chang Qing, CEO of Cariad China, is aware of the situation and steps up to the challenge: “We will develop, update and continuously improve our products at China-speed based on local customers’ experience.” Hopefully, Volkswagen can keep up with China-speed.

Tesla has selected the site for its planned construction of a second production line in Shanghai, near its existing Gigafactory 3. This was reported by the South China Morning Post on Wednesday, citing a letter from the US electric carmaker to local authorities. In it, Tesla spoke of an annual capacity for the new assembly line of 450,000 cars a year. Once the first phase of construction is completed, Model 3 and Model Y vehicles are expected to roll off the assembly line.

The letter confirmed a report in the newspaper on February 25 that Tesla intends to build a second production line in Shanghai to more than double its capacity in China. Tesla intends to use the move to strengthen the Shanghai site’s role as the world’s “largest export center”. In 2019, the first Model 3 cars rolled off the production line at Gigafactory 3. In 2021, Tesla produced nearly 485,00 Model 3s and Model Ys in Shanghai, 321,000 of which were sold in China, 117 percent more than in 2020, with the remaining 160,000-plus cars going to Tesla’s key markets such as Germany and Japan.

Currently, the Tesla Gigafactory suffers under the lockdown in Shanghai, just like other car factories. However, the factory was one of the first 666 locations that were allowed to resume production in April under certain conditions. Tesla initially faced supply chain disruptions, as did many others. But according to trade magazine InsideEVs, Tesla is now back to manufacturing at about 80 percent of its capacity. This week, Reuters reported on assistance from the authorities for Tesla. Authorities organized the transfer of about 6,000 closed-loop production workers to the site in April and provided Tesla the necessary disinfection of the factory. ck

Beijing has slightly eased Covid measures for inbound travelers from abroad. Entrants now only have to stay in quarantine facilities for ten days, state broadcaster CCTV reported, according to Reuters. Previously, the minimum period was 14 days. After their stay in quarantine facilities, however, arrivals will still have to remain in isolation at home for another seven days. nib

He just worked for three weeks straight, says Christoph Trebesch; now he finally has some time to think again – and to spend more time with his children. He recently submitted a grant application to the European Research Council, into which he “threw everything he had”. Trebesch hopes to receive funding approval. The 42-year-old economist is a renowned expert on debt crises – a topic that receives far too little media attention.

Since 2017, Trebesch has headed the research field of International Financial Markets and Macroeconomics at the Kiel Institute for the World Economy. At Kiel University, he teaches as a professor of macroeconomics. In recent years, he has focused particularly on China’s lending policies. Currently, he is concerned with the question of political power in the financial system. His new research agenda revolves around the question of what new world order the rise of China will bring about, Trebesch tells us. This is also what his research proposal is about.

While the US-dominated international system slowly erodes, world events are increasingly shifting toward Asia, according to Trebesch – with China playing the decisive role in this shift. The big question, according to the academic, is: Is the world becoming even more globalized thanks to China? Or will it break up into different spheres of influence again? “What’s next? This is the question that drives me,” says Trebesch.

The Kiel economist also sees research on China as an obligation: “For a country to develop such a large international footprint in such a short time is rare in history – and incredibly impressive.” As an economist, he says, he simply has to look to China – also because there is still far too little understanding of how China, as a state-governed system, was able to achieve so much economic success, contrary to popular belief. Moreover, researchers know far too little about how China’s growth model works within the country and where its risks lie. There is hardly any transparency and little data: “We are still poking around in the fog far too much.”

His fascination with international issues dates back to his youth, Trebesch says. “Looking outward was something I was born with.” As a diplomat’s child, he realized early on that Germany and Europe are not the center of the world. Trebesch was born in Brussels and grew up in Bonn and Rome. In Berlin, he first studied business administration at the Technical University, then economics at the Free University. Trebesch gained international recognition with his research on historical debt crises and debt cuts; during the Greek financial crisis, Trebesch was therefore in great demand.

With the onset of China’s lending boom, Trebesch began to shift his focus to its effects and made an international name for himself in this area as well. Although he has been conducting intensive research on China for several years, Trebesch has never been to the country himself. That almost embarrasses him, he says. Because he has actually wanted to go for a long time. “But first the births of our three children got in the way. And then Covid came along.” So his first trip to China will have to wait. Adrian Meyer

Matthias Luettich is the new Head of Production System, Operational Excellence and Digitalization at the BMW Brilliance Automotive joint venture in Shenyang. This is already his second position at BMW Brilliance. From 2016 to 2020, Luettich was Head of Strategy & Business Control. In the meantime, he worked at the BMW Group in Munich as Head of Program Planning and Production Control.

Michael Rothweiler is the new General Manager at EMKA China, based in Tianjin. The EMKA Group is a major manufacturer of latches, hinges and seals used in switch and control cabinets. Until April 2022, Rothweiler was General Manager at Hahn+Kolb Werkzeuge GmbH, also based in Tianjin.

Hong Hao, China analyst at Bocom International Holdings, left the company after its social media accounts were closed. According to a company spokesperson, Hong resigned from his post for personal reasons. Hong’s WeChat account has been suspended since Saturday. Censors are currently taking action against critical posts about the economic consequences of its numerous lockdowns.

Two-way traffic would be bad here – Tourists cross a spectacular bridge through the picturesque landscape of Enshi in central China’s Hubei province during the May Day vacation on May 3, 2022.

Beijing citizens celebrate in fantastic May weather on what may be the last days before a lockdown. So far, many citizens have been left guessing if and when the lockdowns will come, as our Beijing team reports. But as always, the people of Beijing adapt quickly to the measures: Restaurants, for example, are simply putting tables out on the street as they are no longer allowed to serve indoors. Beijing registered 51 new cases on Wednesday. That is still a reassuringly low number. Another positive development is the news that China will slightly shorten quarantine periods for people entering the country.

The beautiful spring sun also benefits the energy supply, which is rapidly being transformed into renewable sources. Huge wind and photovoltaic plants are being built in the desert regions of the West. To protect the climate, the People’s Republic also relies heavily on nuclear power, which is also emission-free. Beijing has set itself enormous nuclear expansion goals for the coming decades. Nico Beckert analyzes why the expansion plans progress slower than planned and how China fares in the difficult search for a nuclear waste storage.

The People’s Republic is also a global leader in digitization in the mobility sector. The country’s tech-savvy customers demand high-tech in their cars, and especially in EVs for the future. German automakers are years behind their Chinese competitors, as Christian Domke Seidel analyzes. He explains how Volkswagen plans to remedy the situation in the Group’s largest single market with the help of its software subsidiary Cariad. CEO Diess wants Cariad to turn VW into a “software-driven mobility provider”.

Temperatures in Beijing climbed above 30 degrees for the first time this year in early May, and it shows in the cityscape. During the holidays, the city’s more popular gathering places are crowded with people. Like, for example, the shopping mile in the Sanlitun district, where stores are open as usual. About two dozen photographers stand on the shopping mile wildly snapping photos of every stylish-looking Beijing woman who strolls by – or even chase them with their video cameras drawn. A young, eccentrically dressed man in a hat and glasses draws attention with loud singing and dance moves. A young father films his daughter dancing with his cell phone. The video will probably end up on TikTok.

About 430 locally transmitted cases are reported for Beijing in total. The capital reported 51 new infections alone on Wednesday. Due to the high infection numbers, cafés and restaurants are no longer allowed to serve food indoors – but take-away and delivery services are still allowed. Shopping malls and stores were also allowed to remain open.

“Everything is the same as always,” says one Beijing resident. “You just can’t get into the café and have to find another place to sit.” So people sit close together on the few benches under the trees or move out onto the steps in front of Sanlitun’s large Apple Store. In their hands they hold cold or hot drinks and chat, or take selfies. Some wear masks, others don’t. On their shirts, most wear a dark purple sticker that reads “Taikooli”. The security guards of the shopping mall hand out this sticker to all those who showed a valid Covid test from the last 48 hours and a green “health code” when entering the plaza. Those wearing the sticker are then allowed to leave and re-enter the area freely – and do not need to prove again that they are Covid-free, even in stores.

On Wednesday, Covid measures were slightly tightened. The city announced to close 60 subway stations and over 150 bus lines temporarily. Workers should avoid public transportation on their daily commute. The hardest-hit district, Chaoyang, urged citizens to work from home if possible starting Thursday, according to a Global Times report. Beijing’s schools will also remain closed throughout the week. All other holiday measures remain in place for now.

The measures themselves have been causing surprises and confusion for weeks. A closer look at the city map shows 66 closed stations instead of 60. Some shopping centers only let customers in who have a 24-hour old Covid test, while 48 hours is enough for others.

There are similar differences among employers. Many try to protect themselves with the help of anticipatory obedience to remain open, and therefore also demand new tests every 24 hours. One Beijing woman expressed concern – though not so much about a possible infection. “The worries I have about the virus are nowhere near as big as the worries I have about what the measures might mean for my job,” says the young worker.

She alludes to a possible lockdown that looms over the city. Rumors about it have been making the rounds for weeks (China.Table reported). Panic buying, however, only caused empty shelves for a short time. But all the greater was the general frustration that delivery services could no longer keep up and had to cancel orders. By the start of the May holidays, however, bottlenecks had largely been resolved. Ultimately, the many lockdown rumors have not yet come true.

Still, many expats have already stocked up on things that will be difficult to obtain in the event of a lockdown: Chocolate, wine or other luxury foodstuffs that, in case of doubt, would probably not pass directly as essentials.

Some residents simply live in the here and now because of the back-and-forth about the possible impending lockdown. “Sure, it could come at any moment. And before that happens, we probably won’t hear about it anyway. So we’d rather enjoy as much of the nice weather as we can now. As long as we can,” says someone.

There is a crowd in front of many test stations; the services vary. Some tests are free, others cost around 25 yuan (about €3.50). Social distancing rules are rarely followed or enforced here. The people are aware that this carries a certain risk of infection – and they express this openly on social media such as WeChat. The elderly also have a few problems at the testing stations. That’s because everything there can only be done via mobile app and with WeChat payment. Not every pensioner in Beijing is able to keep up. “Don’t you have children or grandchildren who can pay it?” the young employees dressed in protective suits keep asking.

Those who want to stay away from high-risk parts of the city can do this easily with the app Gaode Ditu. This map and navigation app not only lists the latest traffic jams, but also cordoned-off residential areas. It also shows how isolated and selective quarantines still are. Most of them are individual neighborhoods that have been declared high-risk areas.

The response of many restaurant operators to the ban on serving food indoors is also typical of Beijing. Many simply place a table in the front door where people can order and then take their food home. Others put small tables and plastic stools on the street and serve their guests there.

And so the mood in Beijing these days is mainly one of enjoying the sun carefree in the streets. In parks and smaller green strips, pensioners play cards or do sports. However, Beijing’s elderly have to limit their activities on a square along the green belt, which is widely known as the “first ring”. The city government has converted the popular square into a mobile Covid testing station. Now, tents and containers stand exactly where the elderly usually hold their famous mass dances in the evenings. Gregor Koppenburg/Joern Petring

To achieve its climate goals, China also relies on nuclear power. Recently, the government approved the construction of 6 new reactors. In the next 15 years, China plans to build 150 reactors, as announced by the chairman of the state-owned China General Nuclear Power Group. That alone is more than Germany has ever had. The People’s Republic has already become one of the largest producers of nuclear power. In the last thirty years, China has built 54 reactors, and 20 more are under construction.

At present, however, nuclear power accounts for just over five percent of China’s electricity mix. Nevertheless, China produces more electricity from nuclear fission than from solar power (3.6 percent). The current Five-Year Plan aims to increase nuclear power capacity to 70 gigawatts by 2025 – up from just over 50 gigawatts. This means that between 2022 and 2025, five gigawatts of new nuclear capacity would have to come online each year – that is about five reactors per year.

As ambitious as these goals may sound, the reality on the ground is different. Between 2016 and 2018, authorities did not approve a single new nuclear power plant (China.Table reported). In fact, 58 gigawatts of nuclear capacity were supposed to have been connected to the grid two years ago. This target, however, was missed by several gigawatts. After the 2011 reactor disaster in Fukushima, Japan, Chinese authorities also became more cautious. At that time, the government ordered a thorough safety review and imposed a moratorium on new projects. The construction of already approved reactors was also delayed. Two reactors have been under construction since 2012, and three others since 2015, although some of them were originally scheduled for completion within four years, as one builder and operator had assured.

However, according to consulting and analysis company Sinolytics, nuclear expansion is now picking up momentum. “China’s government is now clearly committed to a swift expansion of its nuclear energy capacity,” the experts write (China.Table reported). Nuclear power should be “actively and properly promoted,” China’s National Energy Administration announced in its recent energy work guidance. Concrete expansion targets – unlike for other energy sources – are not mentioned. But for the first time in ten years, authorities emphasize the “active expansion” of nuclear power.

Nuclear expansion helps ensure the country’s energy security. The issue has gained much political relevance in the wake of last year’s power outages. “Nuclear power is ideal in that it can help improve China’s energy security, reduce dependence on energy imports and meet decarbonization targets,” Bin Yan of Sinolytics told China.Table.

However, there are doubts about whether China will be able to achieve its ambitious expansion targets. The number of new approvals is only increasing very slowly, according to the experts at Trivium China, another consulting and analysis company. China faces the problem that nuclear power plants are large projects. “The massive scale of current nuclear projects is a major reason for construction delays,” Cory Combs of Trivium China told China.Table.

Smaller, modular reactors, on the other hand, are still only under development. No one knows when these smaller reactors will become economically viable, Combs said. The goal of building 150 reactors makes much more sense if they are smaller, modular reactors. These could be industrially manufactured in the future, effectively as mass products. This lowers costs compared to the current generation of nuclear power plants. Due to the long construction time of six years per reactor on average, the World Nuclear Industry Status Report estimates that China will have around 100 gigawatts of nuclear capacity by 2030.

Another problem concerns the locations of nuclear power plants. Current standard reactors need stable access to cooling water, Combs said. That is the reason why almost all reactors are built on China’s coasts. However, the construction of up to 150 NPPs would overload the coastal power grid. Combs says that “150 reactors of the current generation along the coast is not feasible from a grid perspective.” One possible solution, he says, lies in a massive expansion of power transmission and energy trading between provinces. But such policy reform is still in its infancy. Newer reactors that do not require cooling water have been in development for years, but are not yet economical. Despite these problems, however, nuclear power is “an important pillar for China’s clean energy future,” Combs said.

The delays in nuclear expansion could have a negative impact on the climate. This is because nuclear power plants are a reliable source of electricity – apart from safety-related outages. They are not dependent on wind and sun. It is therefore likely that the baseload in China will be covered by coal-fired power for even longer. Authorities also see it that way. “Coal-fired power will continue to play an important role in ensuring energy security for a long time,” says the Vice Director of China’s National Energy Administration.

Additionally, China also faces the fundamental problem of nuclear power: the disposal of nuclear waste. And the more reactors exist, the more nuclear waste has to be safely stored somewhere – and for dozens of millennia. Even in China, there is still no permanent repository. The search for a suitable storage site has been going on for 35 years. Just as in Germany and elsewhere, a quick solution is not to be expected. At least the issue of repositories does appear in the current 14th Five-Year Plan.

And last summer, a site was chosen in a part of the Gobi Desert belonging to Gansu Province for the construction of an underground laboratory. Local rock is to be analyzed until 2040. Then a decision is expected as to whether the region is suitable for a repository. According to the government’s plans, it will take until 2050 before a possible repository is completed.

The disposal of low- to medium-level radioactive waste is also reaching its limits. The People’s Republic does have three repositories for this waste. But the capacities of these repositories are “stressed and deficient,” according to an official at the National Nuclear Safety Administration. As a result, new repositories for low- to medium-level radioactive waste are currently being explored. But efforts are complicated by a not in my backyard mentality and public fears about radiation, the official said. No province wants to build a repository, but rather ship the waste to other provinces. That, too, is a familiar problem around the world, including Germany. It is up to the central government to determine the locations of other repositories, an expert told the South China Morning Post.

In early April, organizers canceled the auto show in Beijing. The pandemic and the zero-covid policy prevented the industry summit from taking place. Nevertheless, manufacturers took the opportunity to present their ideas for the cars of the future. Audi presented the Urban Sphere Concept (China.Table reported), BMW the i7 and Mercedes the EQS. All three received a slap in the face from critics. While it was welcome that the Germans had stopped simply converting classic internal combustion engines to electric drive, they still don’t know anything about modern electric cars, critics said. Their models were labeled too conservative, and the technology is years behind Chinese competitors. The Germans confuse large screens with intelligence, automotive analyst Lin Xiao points out in Shentu Car.

Sales figures confirm the harsh assessment (China.Table reported). In March 2022, NIO alone sold around 10,000 all-electric vehicles in the premium category (over ¥300,000, around €43,000) according to the China Automotive Technology and Research Center (CATARC). That is more than twice as many as Audi (120 units), BMW (3,100) and Mercedes (1,200) combined.

The Volkswagen Group has long been aware of the problem (China.Table reported). The software subsidiary Cariad is now expected to provide the solution. The foundation is €30 billion, which is to be invested by 2026. Cariad’s acquisitions include Diconium, a software company based in Stuttgart, and Hella Aglaia, a specialist in camera software. About 5,000 employees currently work at the VW subsidiary – 600 of them at the China branch since the end of April 2022. By the end of 2023, that number is expected to rise to 1,200 employees. At least 90 percent of them are to come directly from the People’s Republic. China is the largest single market for Volkswagen and a global leader in the field of digitalization in the mobility sector.

The big goal is to have a technology package ready in 2026 that will allow autonomous driving at level four. This means that the system will permanently take control of the vehicle. Only in individual situations should the driver take over the wheel for a short time. In China, the NIO ET7 has already mastered this level. But Volkswagen’s schedule for this already seems to be shaky. The market launch of various projects based on the new software has been pushed back. Jan Becker, head of the software company Apex.AI, explains to the German newspaper Handelsblatt that no German manufacturer has a finished operating system. Without it, however, neither tests could be run nor could additional applications be programmed.

Cariad is supposed to turn VW into a “software-driven mobility provider,” as CEO Herbert Diess calls it. Two paths lead there. Either VW develops and programs everything itself – or the solutions come from suppliers and partnerships. Both options have advantages and disadvantages.

Ned Curic, Chief Technology Officer at Stellantis, believes car companies should build cars, not program software. After all, the driving experience is also important for intelligent EVs. Manufacturers should not squander this advantage. And for a long time, it looked as if Volkswagen was also going down this path.

But the current state of the software cooperation does not bode well for VW. A partnership with Daimler has ended. The joint development with Bosch is struggling. And investments in Google’s Waymo or involvement by Continental have failed. Volkswagen currently negotiates with Huawei (China.Table reported) about the takeover of a department that works on autonomous driving. The cost: up to €10 billion. All without the guarantee that its developers will even make the leap to Volkswagen.

For the time being, Cariad has to work on digitization on its own. This is expensive and slow, but it also has advantages. On the one hand, VW would be less affected by trade wars or political decisions. If Volkswagen develops and builds exclusively in China, embargoes and tariffs do not immediately threaten the entire business model. Furthermore, Volkswagen does not have to give up a piece of the pie.

This is why Cariad is under pressure in China. Results are needed. The world’s largest EV market with the most digital customers is considered an important benchmark. Chang Qing, CEO of Cariad China, is aware of the situation and steps up to the challenge: “We will develop, update and continuously improve our products at China-speed based on local customers’ experience.” Hopefully, Volkswagen can keep up with China-speed.

Tesla has selected the site for its planned construction of a second production line in Shanghai, near its existing Gigafactory 3. This was reported by the South China Morning Post on Wednesday, citing a letter from the US electric carmaker to local authorities. In it, Tesla spoke of an annual capacity for the new assembly line of 450,000 cars a year. Once the first phase of construction is completed, Model 3 and Model Y vehicles are expected to roll off the assembly line.

The letter confirmed a report in the newspaper on February 25 that Tesla intends to build a second production line in Shanghai to more than double its capacity in China. Tesla intends to use the move to strengthen the Shanghai site’s role as the world’s “largest export center”. In 2019, the first Model 3 cars rolled off the production line at Gigafactory 3. In 2021, Tesla produced nearly 485,00 Model 3s and Model Ys in Shanghai, 321,000 of which were sold in China, 117 percent more than in 2020, with the remaining 160,000-plus cars going to Tesla’s key markets such as Germany and Japan.

Currently, the Tesla Gigafactory suffers under the lockdown in Shanghai, just like other car factories. However, the factory was one of the first 666 locations that were allowed to resume production in April under certain conditions. Tesla initially faced supply chain disruptions, as did many others. But according to trade magazine InsideEVs, Tesla is now back to manufacturing at about 80 percent of its capacity. This week, Reuters reported on assistance from the authorities for Tesla. Authorities organized the transfer of about 6,000 closed-loop production workers to the site in April and provided Tesla the necessary disinfection of the factory. ck

Beijing has slightly eased Covid measures for inbound travelers from abroad. Entrants now only have to stay in quarantine facilities for ten days, state broadcaster CCTV reported, according to Reuters. Previously, the minimum period was 14 days. After their stay in quarantine facilities, however, arrivals will still have to remain in isolation at home for another seven days. nib

He just worked for three weeks straight, says Christoph Trebesch; now he finally has some time to think again – and to spend more time with his children. He recently submitted a grant application to the European Research Council, into which he “threw everything he had”. Trebesch hopes to receive funding approval. The 42-year-old economist is a renowned expert on debt crises – a topic that receives far too little media attention.

Since 2017, Trebesch has headed the research field of International Financial Markets and Macroeconomics at the Kiel Institute for the World Economy. At Kiel University, he teaches as a professor of macroeconomics. In recent years, he has focused particularly on China’s lending policies. Currently, he is concerned with the question of political power in the financial system. His new research agenda revolves around the question of what new world order the rise of China will bring about, Trebesch tells us. This is also what his research proposal is about.

While the US-dominated international system slowly erodes, world events are increasingly shifting toward Asia, according to Trebesch – with China playing the decisive role in this shift. The big question, according to the academic, is: Is the world becoming even more globalized thanks to China? Or will it break up into different spheres of influence again? “What’s next? This is the question that drives me,” says Trebesch.

The Kiel economist also sees research on China as an obligation: “For a country to develop such a large international footprint in such a short time is rare in history – and incredibly impressive.” As an economist, he says, he simply has to look to China – also because there is still far too little understanding of how China, as a state-governed system, was able to achieve so much economic success, contrary to popular belief. Moreover, researchers know far too little about how China’s growth model works within the country and where its risks lie. There is hardly any transparency and little data: “We are still poking around in the fog far too much.”

His fascination with international issues dates back to his youth, Trebesch says. “Looking outward was something I was born with.” As a diplomat’s child, he realized early on that Germany and Europe are not the center of the world. Trebesch was born in Brussels and grew up in Bonn and Rome. In Berlin, he first studied business administration at the Technical University, then economics at the Free University. Trebesch gained international recognition with his research on historical debt crises and debt cuts; during the Greek financial crisis, Trebesch was therefore in great demand.

With the onset of China’s lending boom, Trebesch began to shift his focus to its effects and made an international name for himself in this area as well. Although he has been conducting intensive research on China for several years, Trebesch has never been to the country himself. That almost embarrasses him, he says. Because he has actually wanted to go for a long time. “But first the births of our three children got in the way. And then Covid came along.” So his first trip to China will have to wait. Adrian Meyer

Matthias Luettich is the new Head of Production System, Operational Excellence and Digitalization at the BMW Brilliance Automotive joint venture in Shenyang. This is already his second position at BMW Brilliance. From 2016 to 2020, Luettich was Head of Strategy & Business Control. In the meantime, he worked at the BMW Group in Munich as Head of Program Planning and Production Control.

Michael Rothweiler is the new General Manager at EMKA China, based in Tianjin. The EMKA Group is a major manufacturer of latches, hinges and seals used in switch and control cabinets. Until April 2022, Rothweiler was General Manager at Hahn+Kolb Werkzeuge GmbH, also based in Tianjin.

Hong Hao, China analyst at Bocom International Holdings, left the company after its social media accounts were closed. According to a company spokesperson, Hong resigned from his post for personal reasons. Hong’s WeChat account has been suspended since Saturday. Censors are currently taking action against critical posts about the economic consequences of its numerous lockdowns.

Two-way traffic would be bad here – Tourists cross a spectacular bridge through the picturesque landscape of Enshi in central China’s Hubei province during the May Day vacation on May 3, 2022.