China's national debt, the Evergrande crisis, and China’s global debt diplomacy: Read all the important and latest news from China.Table editorial team.

How much debt is China in?

China's national debt is estimated to rise to 14 trillion US Dollars in 2022. This number approximately amounts to 78 percent of China’s gross domestic product (GDP). Large parts of China’s national debt can be attributed to supporting non-profitable state-owned enterprises.

Furthermore, in 2020, following the coronavirus pandemic, China’s debt-to-GDP ratio rose to 270%. However, in 2021, the trend was reversed due to higher consumption and exports. Nevertheless, there is a lot of speculation on the sustainability of China’s model and whether or when the bubble would burst. A collapse could lead to a global financial crisis.

Evergrande debt crisis, and more: What does that mean for China's economy?

China's economic growth is built upon debt. Local governments are piling up deficits to boost the economic development of provinces. However, China’s central government announced in its 14th Five-Year Plan that it would stabilize financial markets and prevent further accumulation of deficit.

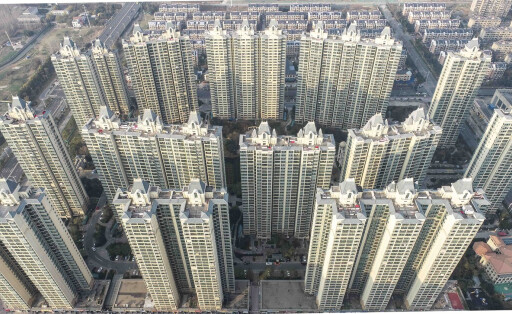

China’s Evergrande debt crisis starting in 2020 demonstrates the issues concerning China’s strategy. After new regulations on limits for Evergrande and other companies in China’s property sector were put into effect, Evergrande started facing immense difficulties. The real estate market is regarded as a core problem of the Chinese economy.

Yet, despite China’s high national debt, experts believe that the Chinese government has sufficient instruments at its disposal to cushion a collapse of its economy resulting from a possible financial crisis. Climate change, on the other hand, is seen as a far greater threat to China's prosperity.

How does China use foreign debt?

Recently, accusations against China’s foreign debt diplomacy in African and Asian countries have arisen. China is the most important lender to many African countries. Countries use the money for infrastructure development. However, China uses this diplomacy to promote its values and narratives. Economic aid is often followed by political and economic dependencies. China’s debt diplomacy has risen the question as to whether it should be considered a trap for countries relying on China’s lending.

Read all the latest news on China’s policies and foreign debt diplomacy, delivered to you by China.Table.