Trump heralded his new term of office yesterday as a “golden age.” At least that is how it should be for the USA. For the rest of the world, it is an era of uncertainty that is dawning. In Brussels, people were eagerly waiting to see whether Trump would impose tariffs on the very first day. Exact figures and initial decrees on the imposition of tariffs were not forthcoming for the time being, but the new president promised a new US trade system.

“Instead of taxing our citizens and to enrich other countries, we will tariff and tax foreign countries to enrich our citizens,” Trump said. As you can read in today’s Dessert, so far, he has mainly enriched himself. Trade models would doubt Trump’s statement that he can enrich his citizens with tariffs, but who cares about trade models in the “golden age”?

In contrast to Panama and Mexico, which Trump threatened quite explicitly in his speech, Europe remained under the radar. In Brussels, they are trying to play it cool for as long as possible. The best answer that can be given is to work on our own strength and competitiveness, said Eurogroup President Paschal Donohoe at a press conference in Brussels yesterday shortly after Trump’s speech. Roberta Metsola, António Costa and Ursula von der Leyen invoked transatlantic cooperation on X. As long as the threat has not yet materialized in the form of a new tariff, no one wants to make rhetorical waves. The US security guarantee is too important for the old continent. Or is it a promise of security? Just a hope of security?

If Trump is trying to unsettle his partners with his threats, he has certainly succeeded. It will perhaps also help him to obtain certain concessions. But it is also fueling a backlash that is likely to make the EU less dependent on the US in the long term. The progress made on the trade agreements with Mercosur, Mexico and now Malaysia would hardly have been possible without Trump. And the fact that the heads of state and government are beginning to talk seriously about a powerful European defense fund would also be unthinkable without Trump.

Have a truly golden Tuesday,

With Donald Trump’s return to the White House, the debate in Europe about greater personal responsibility for defense and higher arms spending is gaining momentum. It is clear to everyone that the two percent target for defense spending is the “absolute minimum,” said David McAllister ahead of a debate in the EU Parliament on the “geopolitical and economic impact” of the new Trump administration: “We will have to do a lot more for our security and our defense in the coming years.”

Marie-Agnes Strack-Zimmermann, Chair of the new SEDE Committee, expressed a similar view: the decisive factor is not only the money that is invested but also what “the result is in terms of quality.”

The two foreign and security policy experts were also reacting to an appearance by Mark Rutte in the EU Parliament last week. The NATO Secretary General had spoken of a requirement of 3.6 or 3.7 percent, based on the capability targets as agreed between the alliance members.

However, discussions on the regional plans are still ongoing and the determination of national shares and contributions should be completed in the first half of the year. However, the new spending target is likely to dominate the NATO summit in The Hague at the end of June anyway. Unlike the previous two percent target, the new spending target is to be based on concrete needs, as Rutte has indicated.

With his initiative, the NATO Secretary General reportedly wants to steal Donald Trump’s thunder, who recently called for five percent. Previously, two percent had been discussed as the new lower threshold and three percent as a possible new target. Within the Alliance, countries such as Germany, that are just reaching the two percent threshold or are well below it, such as Belgium or Italy, criticize the one-sided fixation on percentage figures.

Critics consider the specific capabilities that a country contributes to be more important than a fixed target. Poland and the Baltic states, on the other hand, are at three or more percent, with Lithuania’s new government even wanting to spend five to six percent of economic output on defense from next year.

Mark Rutte will also be attending the first pure defense summit hosted by EU Council President António Costa on Feb. 3. And at the dinner, Keir Starmer will be the first British prime minister to attend a meeting of the 27 heads of state and government since Brexit. A clear sign that the Europeans want to move closer together.

The first details of the new format of the closed meeting are now known. The venue is the Château de Limont near Liège, with very limited media access. Given the threat posed by Russia, the meeting is intended to signal that defense is at the top of the agenda. It is also intended as a sign to Trump that Europe wants to take more responsibility for its own security. As was recently the case with the protection of critical infrastructure in the Baltic Sea, which is being carried out with virtually no American involvement.

The heads of state and government are to discuss first and foremost what the member states could plan and procure together at the European level in the future when it comes to defense. There are signs of friction with NATO, which sees itself in the lead when it comes to analyzing requirements and defining capability gaps.

Second on the agenda at the defense summit is the question of financing. All options are likely to be up for discussion: private financing with the help of the EIB, the EU budget or new common debt.

A decision on the sensitive issue of financing is not expected shortly before the Bundestag elections, but the heads of state and government are likely to give EU Foreign Policy Chief Kaja Kallas guidelines for the White Paper on defense, which is to be presented on March 11. German Chancellor Olaf Scholz will visit President Emmanuel Macron on Wednesday to align positions ahead of the defense summit in early February.

The USA accounts for 64 percent of all defense spending in the alliance, while the other NATO states together account for the rest, according to foreign and security policy experts McAllister and Strack-Zimmermann in Brussels. This is not a healthy ratio.

There is also a need to catch up when it comes to procurement: Russia’s defense industry produces as many armaments in three months as the EU does in a year. The warning that Russia could be in a position to attack a NATO state in four or five years is therefore not an empty phrase. Even among experts, however, it is disputed whether the NATO states can keep up with the Russian war economy and whether the arms industry in both Europe and the USA could even meet the demand with a spending target of three percent or more. In Brussels, reference is often made to the ever-longer delivery times of the US arms industry.

With Donald Trump as the new US president, the European steel industry must prepare for even more difficult times – especially as many companies are already talking about an existential crisis. It was Trump who introduced additional tariffs of between 10 percent and 25 percent on European metal exports in 2018 during his first term of office.

The EU responded with counter-tariffs on products such as Harley-Davidson motorcycles, whiskey and jeans. However, it was not until the subsequent US administration under President Joe Biden that the Commission was able to partially suspend the reciprocal trade barriers again in 2021. However, negotiations on a permanent agreement under the working title “Global arrangement on sustainable steel and aluminum” failed in 2023.

The European side has paused the customs disputes until the end of March. There is thus little time to conduct negotiations. Nevertheless, the suspension of Section 232, which regulates the US tariffs, will remain in place for a little longer than the EU regulation, namely until the end of the year. Trump could of course decide to reintroduce the tariffs before then. But the imminent expiry of his own regulation would at least allow the EU Commission to quickly reintroduce the retaliatory tariffs.

However, US policy under the new president would be far from the only topic for a “European Steel Summit.” German Chancellor Olaf Scholz, among others, had called for such a meeting to tackle the current crisis in the steel industry from the EU Commission. According to Commission sources, it is still unclear whether such a summit is actually planned. However, the “Steel and Metals Action Plan” already announced in the mission letter from Commission Vice-President Stéphane Séjourné is said to be in the works and should be published in the first half of the year.

Dennis Radtke can do without a steel summit. “We don’t need any more new rounds of blabbering, the analyses are all on the table,” said the EPP MEP from the Ruhr region, who is also Chairman of the Christian Democratic Workers’ Union (CDA), to Table.Briefings. Instead, the Commission mist implement concrete measures quickly. “I am constantly being put off by the Commission and by Ursula von der Leyen’s staff,” says Radtke. “But the window of opportunity to save the steel industry is closing. I am very disillusioned.”

One quick measure that Radtke advocates would be an increase in the applicable minimum import prices for certain products such as grain-oriented electrical steel. This is because the European steel industry currently feels threatened by imports from Asia in particular. Although anti-dumping duties are already in place for Chinese steel until June 2026, these duties are considered both too low and insufficiently enforced.

Kerstin Rippel, Managing Director of the German Steel Federation, is also dissatisfied with the Commission’s work. “The regulations currently in place to protect against unfair trade are not being used sufficiently by the EU Commission – and they fall short,” she says. In addition, the EU’s review procedures take too long.

Both Rippel and Radtke are therefore pushing for the rules of the World Trade Organization (WTO) to be interpreted more broadly in the Steel Action Plan than they have been to date. This is because the competing manufacturers themselves are currently acting unfairly. “First of all, I would like to see the practices of our Chinese and Asian colleagues become WTO-compatible,” says Rippel. “There is currently a massive amount of dumped steel coming from China to Europe, often via detours.”

The changed geo-economic competition with China and the USA now requires drastic interventions in import law: “The two big players in world trade no longer adhere to WTO rules,” says Rippel. “Do we want the legal gold stamp, but then unfortunately the industry has not survived?” Radtke from the EPP group seconds the criticism of the Commission: “The EU people at the technical level are still behaving as if they were in a regulatory delicatessen.”

Other points on the EU’s steel agenda, according to Rippel, include

Another problem for the steel industry is the high energy prices, particularly in Germany. These are also likely to be mentioned in the steel action plan, at least with reference to other Commission projects. The industry has long been calling for the EU rules on low-carbon hydrogen to be made more flexible to encourage more investment in the energy sector.

In Germany in particular, there are plans to use large quantities of “green” hydrogen in steel production in the future. There is currently a debate as to whether non-renewable energy should also be used in hydrogen production. In the industry’s vocabulary, this would then be referred to as “gray” or “blue” hydrogen. “We need openness when it comes to the color theory for hydrogen,” says Radtke.

Jan. 22-24, 2025; Jan. 27-29, 2025; online

ERA, Seminar Fundamentals of EU State Aid Law: Substantive and Procedural Aspects

The Academy of European Law (ERA) aims at providing legal practitioners with a thorough overview of EU State aid law and in-depth understanding of its core notions. INFO & REGISTRATION

Jan. 22, 2025; 12:30-2 p.m., Florence (Italy)

FSR, Seminar Governing Tech Giants

The Florence School of Regulation (FSR) discusses how regulators can effectively govern tech giants that possess superior expertise and adapt rapidly to technological change. INFO & REGISTRATION

Jan. 23, 2025; 9 a.m.-1:30 p.m., Brussels (Belgium)

ECFR, Discussion Strategic reset: Re-designing EU-Africa partnerships on critical minerals

The European Council on Foreign Relations (ECFR) discusses structural challenges facing Europe’s positioning in mineral value chains and Africa’s limitations in attracting significant market interest in its mines. INFO & REGISTRATION

Donald Trump’s inauguration brings new momentum in the EU’s free trade talks. On Monday, the EU Commission announced the resumption of negotiations for a free trade agreement with Malaysia. “While some turn inwards towards isolation and fragmentation, Europe and Malaysia are choosing a different path,” Commission President Ursula von der Leyen was quoted in a barely concealed reference to the new US president’s trade policy.

The EU and Malaysia had previously negotiated a free trade agreement between 2010 and 2012. The negotiations were broken off by the government in Kuala Lumpur at the time. In 2023, both sides began exploratory talks to restart the negotiations. Trade in goods between the EU and Malaysia amounted to almost €45 billion in 2023 – almost half of which was trade between Germany and Malaysia. Machinery and electrical appliances are traded most intensively, followed by fats and oils.

Like the conclusion of negotiations with Mercosur in December and with Mexico last Friday, the start of negotiations with Malaysia is also likely to have been accelerated by the start of the Trump presidency in the USA. The countries are looking for predictable trading partners.

During his visit to Brussels on Monday, Indian Trade Minister Piyush Goyal emphasized that his country intends to conclude trade talks with the EU by the end of the year. So far, the negotiations have only made slow progress because the Indians do not want to open their market to European industry. New Delhi is also taking issue with European sustainability laws such as CBAM or the Supply Chain Directive. According to reports, an EU-India summit is to take place relatively soon to spark new momentum. The exact date is not yet known.

Many EU member states and third countries want to use free trade agreements to cushion the impact of the tariffs announced by Trump by opening other markets. However, it will be some time before the agreement with Malaysia can fulfill this purpose. In the EU, it usually takes several years between the start of negotiations and ratification of the agreement. jaa

The voluntary code of conduct to combat illegal hate speech online (from 2016) will become part of the Digital Services Act (DSA) in a revised form as the Code of Conduct+. This was announced by the Commission on Monday. Signatories to the code include Facebook, Instagram, Linkedin, Microsoft Hosted Consumer Services, Snapchat, TikTok and YouTube. In contrast to the Code of Practice on Disinformation, X is also still a signatory to the Code of Conduct+.

Article 45 of the DSA provides for the possibility of integrating voluntary codes of conduct into its legal framework. The basic idea behind the integration of codes of conduct is to promote cooperation between online platforms and the regulatory authorities in order to achieve the objectives set out in the DSA. In doing so, the codes of conduct should help to facilitate the implementation of the act provisions and ensure effective enforcement.

Specifically, the signatories commit to, among other things:

In addition, signatories will make specific transparency commitments regarding the measures taken to reduce the dissemination of hate speech on their services, including through automated detection tools. vis

In a study published on Tuesday, the Center for European Policy (CEP) warns that the EU’s automotive strategy could fail. The researchers conducted the study on behalf of the European manufacturers’ association ACEA, which Table.Briefings was able to view in advance.

The de facto end of combustion engines for cars and light commercial vehicles in 2035 and the lack of prospects for operating heavy commercial vehicles with alternative fuels could mean the end of the affected industries in the EU, it says. The strategy of relying solely on electric drive systems for cars and light commercial vehicles and on electric and hydrogen drive systems for trucks after 2035 is threatening to fail, as demand will not materialize due to unsatisfactory framework conditions. Consumers still do not see electric vehicles as a superior technology compared to combustion engines when it comes to total cost of ownership (TCO), range, and charging and refueling options.

In no other relevant automotive market in the world is automotive regulation so one-sidedly focused on battery-electric solutions and as strict as in the EU. As a result, EU regulation impairs the competitiveness of the domestic industry. “Many countries with a significant demand and/or automotive industry are pursuing medium and long-term multi-technology strategies, which are also reflected in their CO2 emission regulations.”

It should be questioned whether EU legislation should actually restrict the ability of EU car manufacturers to adapt to the conditions of the global automotive market by “imposing a de facto ban on combustion engines for cars and vans on their domestic market,” the researchers appeal.

The authors analyzed the Commission’s impact assessment of the CO2 fleet legislation as part of the Fit for 55 package. In its legislative proposal, the Commission selected the strictest of three scenarios. The EU climate targets (minus 55 percent in 2030 and net zero in 2050) could also be achieved in the other two scenarios with less stringent interventions in CO2 fleet legislation. The ETS 2 provides for this. The researchers conclude: “The long-term goal of complete decarbonization of road transport can also be achieved with more flexibility in the CO2 emission standards for cars and vans as well as for trucks.”

The authors present three options for the review of CO2 fleet legislation, which is due by 2026 at the latest according to EU legislation:

1. A change in CO2 fleet legislation with the following options:

2. More flexibility for manufacturers with regard to the CO2 fleet limits:

3. Use of e-fuels in new vehicles after the end of combustion engines in 2035. mgr

The Strategic Dialog on the Future of the Automotive Industry starts on Jan. 30. Under the leadership of Commission President Ursula von der Leyen, representatives of manufacturers and suppliers will meet with trade unionists, representatives of infrastructure and civil society. Transport Commissioner Apostolos Tzitzikostas will also present an industrial action plan for the automotive sector.

Depending on the portfolio, other members of the Commission will be consulted. The first meeting aims to “arrive at a common view of the most important challenges and potential solutions,” according to a conceptual note from the Commission. Specific goals for the dialog could be formulated at the first meeting. Subsequently, working groups made up of representatives from the Commission and industry will be formed to “develop more detailed proposals.” The working groups will report to a steering group. Parliament and the Council are also to be involved and regularly informed about the status of the talks.

Five possible topics for the working groups were identified. One working group is to determine the status of EU industry with regard to future technologies. It should deal with the framework conditions for innovation in industry as well as specific areas of technology. A second working group is to deal with outstanding regulatory issues.

The paper mentions penalties for manufacturers if they fail to meet climate targets. Some industry representatives are calling for the rules to be eased, while others are in favor of retaining the current rules. This working group could discuss EU legislation, the status of the charging infrastructure, and purchase incentives.

Harmonization of purchase incentives and taxes between the member states could also be a topic. It would be conceivable to talk about cooperation between companies to develop an e-vehicle at low cost, as well as coordinated attempts to consolidate suppliers and the ramp-up of components for e-vehicles.

A third working group could deal with the topic of competitiveness and resilience. For example, the aim would be to ensure that the EU is competitive in terms of the cost of labor, energy and raw materials. In terms of wage and energy costs, there is a gap between the EU and its competitors. In terms of raw materials, there is a risk of bottlenecks in the EU, for example in chips and raw materials for battery production.

A fourth working group should deal with trade relations and internationally comparable framework conditions. The paper addresses “distortions of competition,” such as “substantial state investment” in automotive industries. Investments by third countries in the EU in companies in the automotive supply chain should also be addressed.

Another working group is to look into improved processes and coordination in EU regulation. Coherence and consistency between EU regulations, for example on batteries, safety and data protection, must be ensured. The timing and scope of regulation must be better coordinated. For example, “pain points” of regulation and ways to alleviate them could be identified.

No information was provided on the schedule for the dialog and when results are to be presented. mgr

Last Friday, German Chancellor Olaf Scholz spoke on the phone with Slovakian Prime Minister Robert Fico and discussed the gas supply. Fico made the announcement on Facebook. A government spokesperson in Berlin confirmed the phone call, but did not want to give any precise details about the content. “As far as the fundamental issue of gas supply and gas transit is concerned, the European Commission is still in constructive talks with Slovakia on this topic. We expressly welcome this,” Scholz’s spokesperson told Table.Briefings on Monday.

It is good that there are now alternatives for gas supply at the European level. The vast majority of member states no longer purchase gas from Russia. “At the same time, we are committed to further diversification of the energy supply and greater energy independence,” said the government spokesperson.

Fico announced that he had reaffirmed the Slovakian government’s position in the meeting, which had been initiated by Scholz. If the Ukrainian government’s decision is not reversed, Slovakia will take countermeasures. The gas transit contract for Russian gas through Ukraine expired at the turn of the year. Fico then threatened Kyiv, among other things, to stop exporting electricity to the country. The SPD in the Bundestag wants to support Slovakia’s gas supply. “We must try to use the technical possibilities to get gas to Slovakia by other means,” said MP Jörg Nürnberger. ber

The EU filed another complaint against China at the World Trade Organization (WTO). The EU Commission accuses Beijing of having empowered its courts to set worldwide royalty rates for EU standard essential patents – without the patent owner’s consent. “This pressures innovative European high-tech companies into lowering their rates on a worldwide basis, thus giving Chinese manufacturers cheaper access to those European technologies unfairly,” it said in a statement on Monday. According to the EU, this violates the WTO agreement on intellectual property (TRIPS). Despite repeated negotiations with China, no solution has yet been found.

“The EU’s vibrant high-tech industries must be allowed to compete fairly and on a level playing field. Where this is not the case, the Commission takes decisive action to protect their rights,” said Maroš Šefčovič, EU Commissioner for Trade and Economic Security. If no agreement is reached within 60 days, the EU can convene a WTO dispute settlement body. The case concerns standard essential patents (SEPs), which protect technologies essential for manufacturing goods that meet a certain standard, such as 5G for mobile phones.

Since February 2022, another case against China concerning the patent protection of European tech companies has been ongoing at the WTO. The case revolves around a Chinese regulation that allows courts to prohibit patent holders from enforcing their rights in foreign courts. Failure to comply could result in fines of the equivalent of €130,000 per day. fpe

Before the EU Commission launches an omnibus procedure to cut red tape, the EPP, S&D and Renew should reach an agreement on this in the EU Parliament. MEP Pascal Canfin (Renew) is calling for this in the run-up to the Ecofin Council on Tuesday, where the planned project will be discussed at the finance minister level.

Canfin said that calls for a simplification of the CSRD, CSDDD and taxonomy should not lead to the Green Deal being blamed for the lack of competitiveness of the European industrial sector. According to the Frenchman, there is a risk that all the technical work currently being done to implement these laws will be undone.

With a prior agreement in the EU Parliament, Canfin wants to negotiate a “clean and stable version” of the omnibus law. This would also reduce the risk for French companies, he says.

He sees the idea of raising the thresholds for companies in terms of reporting obligations as a trap. This could lead to “the entire German SME sector being removed,” while all French companies remain in. “This would create something completely unfair for both sides,” says Canfin.

France is the first member state to implement the CSRD directive on sustainability reporting. France has yet to issue an official statement on the EU Commission’s plans for the Omnibus Regulation.

The French Association of Private Enterprises (Afep) stated that increased global competition calls for a rethink of the regulatory framework for sustainable finance. The taxonomy should become a “real strategic tool for managing the green transition and an opportunity to develop new products and services to conquer new markets,” writes the association. cst

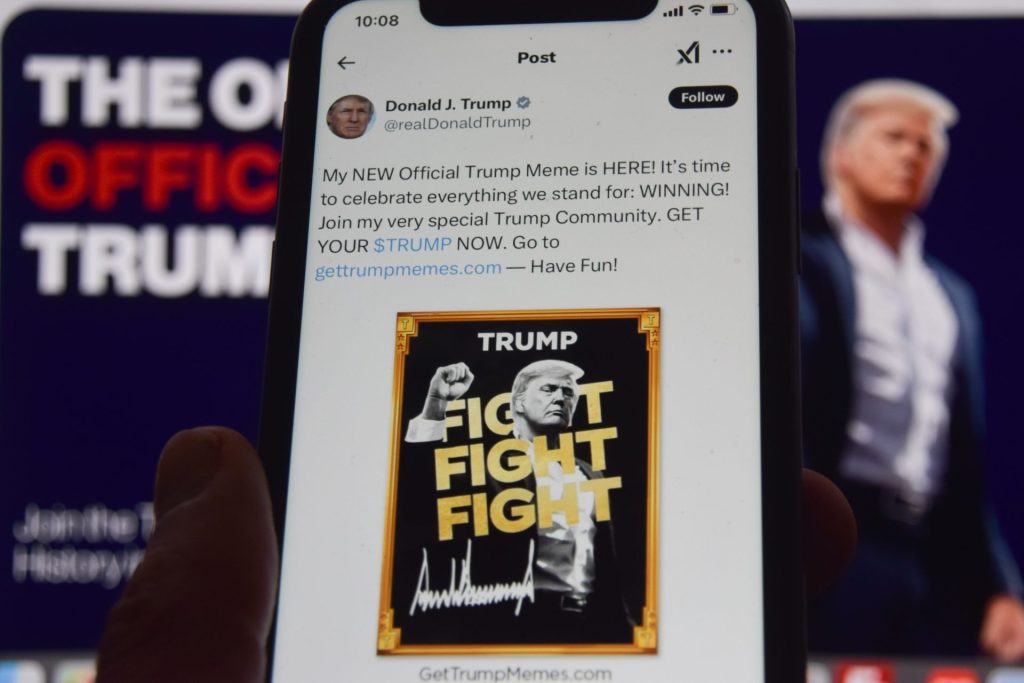

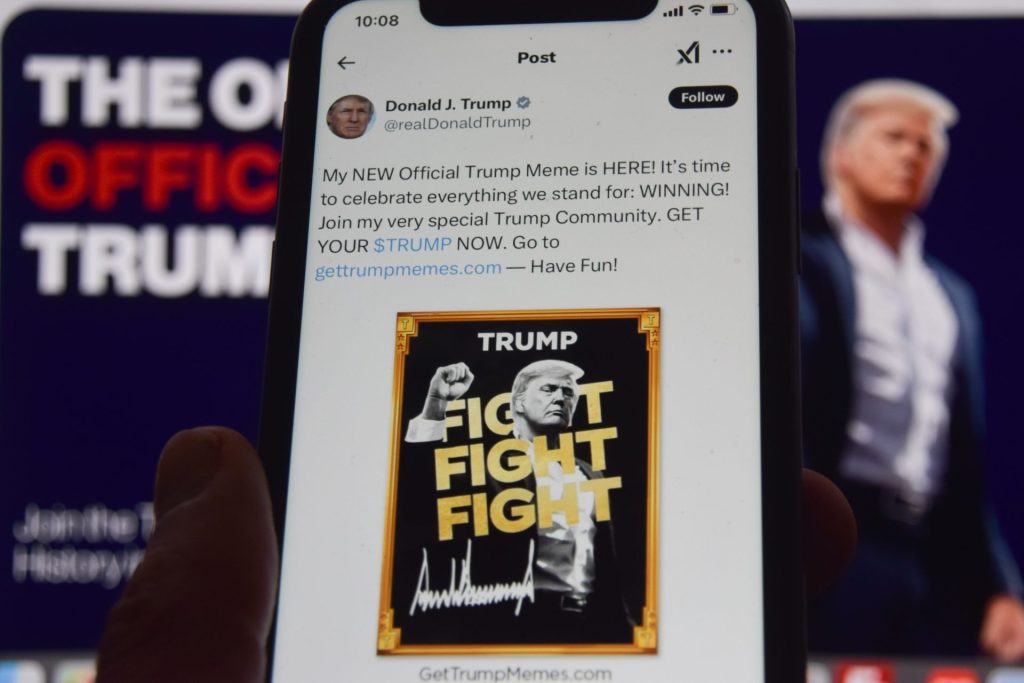

Today’s dessert is hard to digest. You could also call it a rip-off. In any case, it’s about making a lot of quick money. Here are the facts:

On Friday, Donald Trump created a meme coin called $TRUMP. On the first day, 200 million $TRUMP were available. Within three years, the volume is expected to grow to a total of one billion $TRUMP.

Early on Saturday morning, the coin started at a price of less than ten US dollars and reached a high of just under 75 dollars on Sunday, which corresponds to a market capitalization of around 15 billion dollars. From a standing start, the meme coin made it into the list of the 20 largest cryptocurrencies. The price fell significantly on Monday. You can track the current price at Coin Market Cap.

A brief explanation: A meme coin is a cryptocurrency that was created for fun, out of a hype, or as a parody and offers no profound technical benefit. The official “use” of the Trump coin is that the purchaser can use it to express their support for Trump’s “ideals and beliefs.”

The Trump coin is therefore purely an object of speculation. “GetTrumpMemes.com is not political and has nothing to do with any political campaign or any political office or government agency,” the website claims. Melania Trump launched her own cryptocurrency based on the same concept on Sunday.

The remaining 800 million $TRUMP coins that are not yet in circulation are owned by two companies close to Trump. These are CIC Digital LLC and Fight Fight Fight LLC. The latter is a company that was founded in Delaware on Jan. 7, as reported by Forbes.

Both companies therefore also receive income from trading. The exact sum is unclear. In general, every transaction on the exchanges generates fees (between one and five percent of the transaction value). A portion of these fees goes to the developers or operators of the token (companies close to Trump). According to reports, the Trump companies made 58 million dollars from such fees in the first few days alone.

The bottom line is that Trump is cashing in on his current popularity. He and his clan can earn millions, potentially billions of US dollars. The meme coin can make him the richest man in the world – without him investing or risking anything himself.

Green MEP Alexandra Geese was one of the first to warn of the political consequences. “A US presidential cryptocurrency is similar to a Swiss bank account into which people can make secret deposits,” said Geese. “This opens the door to secret influence by rich individuals, corporations and states. In a normal world, we would call that corruption.”

Anyone who wants to favor Trump or put pressure on him can now invest anonymously, manipulate the exchange rate and thus channel billions into his pockets – or put him in financial distress. “The EU must not stand idly by and watch this development,” demands Geese. Corinna Visser

Trump heralded his new term of office yesterday as a “golden age.” At least that is how it should be for the USA. For the rest of the world, it is an era of uncertainty that is dawning. In Brussels, people were eagerly waiting to see whether Trump would impose tariffs on the very first day. Exact figures and initial decrees on the imposition of tariffs were not forthcoming for the time being, but the new president promised a new US trade system.

“Instead of taxing our citizens and to enrich other countries, we will tariff and tax foreign countries to enrich our citizens,” Trump said. As you can read in today’s Dessert, so far, he has mainly enriched himself. Trade models would doubt Trump’s statement that he can enrich his citizens with tariffs, but who cares about trade models in the “golden age”?

In contrast to Panama and Mexico, which Trump threatened quite explicitly in his speech, Europe remained under the radar. In Brussels, they are trying to play it cool for as long as possible. The best answer that can be given is to work on our own strength and competitiveness, said Eurogroup President Paschal Donohoe at a press conference in Brussels yesterday shortly after Trump’s speech. Roberta Metsola, António Costa and Ursula von der Leyen invoked transatlantic cooperation on X. As long as the threat has not yet materialized in the form of a new tariff, no one wants to make rhetorical waves. The US security guarantee is too important for the old continent. Or is it a promise of security? Just a hope of security?

If Trump is trying to unsettle his partners with his threats, he has certainly succeeded. It will perhaps also help him to obtain certain concessions. But it is also fueling a backlash that is likely to make the EU less dependent on the US in the long term. The progress made on the trade agreements with Mercosur, Mexico and now Malaysia would hardly have been possible without Trump. And the fact that the heads of state and government are beginning to talk seriously about a powerful European defense fund would also be unthinkable without Trump.

Have a truly golden Tuesday,

With Donald Trump’s return to the White House, the debate in Europe about greater personal responsibility for defense and higher arms spending is gaining momentum. It is clear to everyone that the two percent target for defense spending is the “absolute minimum,” said David McAllister ahead of a debate in the EU Parliament on the “geopolitical and economic impact” of the new Trump administration: “We will have to do a lot more for our security and our defense in the coming years.”

Marie-Agnes Strack-Zimmermann, Chair of the new SEDE Committee, expressed a similar view: the decisive factor is not only the money that is invested but also what “the result is in terms of quality.”

The two foreign and security policy experts were also reacting to an appearance by Mark Rutte in the EU Parliament last week. The NATO Secretary General had spoken of a requirement of 3.6 or 3.7 percent, based on the capability targets as agreed between the alliance members.

However, discussions on the regional plans are still ongoing and the determination of national shares and contributions should be completed in the first half of the year. However, the new spending target is likely to dominate the NATO summit in The Hague at the end of June anyway. Unlike the previous two percent target, the new spending target is to be based on concrete needs, as Rutte has indicated.

With his initiative, the NATO Secretary General reportedly wants to steal Donald Trump’s thunder, who recently called for five percent. Previously, two percent had been discussed as the new lower threshold and three percent as a possible new target. Within the Alliance, countries such as Germany, that are just reaching the two percent threshold or are well below it, such as Belgium or Italy, criticize the one-sided fixation on percentage figures.

Critics consider the specific capabilities that a country contributes to be more important than a fixed target. Poland and the Baltic states, on the other hand, are at three or more percent, with Lithuania’s new government even wanting to spend five to six percent of economic output on defense from next year.

Mark Rutte will also be attending the first pure defense summit hosted by EU Council President António Costa on Feb. 3. And at the dinner, Keir Starmer will be the first British prime minister to attend a meeting of the 27 heads of state and government since Brexit. A clear sign that the Europeans want to move closer together.

The first details of the new format of the closed meeting are now known. The venue is the Château de Limont near Liège, with very limited media access. Given the threat posed by Russia, the meeting is intended to signal that defense is at the top of the agenda. It is also intended as a sign to Trump that Europe wants to take more responsibility for its own security. As was recently the case with the protection of critical infrastructure in the Baltic Sea, which is being carried out with virtually no American involvement.

The heads of state and government are to discuss first and foremost what the member states could plan and procure together at the European level in the future when it comes to defense. There are signs of friction with NATO, which sees itself in the lead when it comes to analyzing requirements and defining capability gaps.

Second on the agenda at the defense summit is the question of financing. All options are likely to be up for discussion: private financing with the help of the EIB, the EU budget or new common debt.

A decision on the sensitive issue of financing is not expected shortly before the Bundestag elections, but the heads of state and government are likely to give EU Foreign Policy Chief Kaja Kallas guidelines for the White Paper on defense, which is to be presented on March 11. German Chancellor Olaf Scholz will visit President Emmanuel Macron on Wednesday to align positions ahead of the defense summit in early February.

The USA accounts for 64 percent of all defense spending in the alliance, while the other NATO states together account for the rest, according to foreign and security policy experts McAllister and Strack-Zimmermann in Brussels. This is not a healthy ratio.

There is also a need to catch up when it comes to procurement: Russia’s defense industry produces as many armaments in three months as the EU does in a year. The warning that Russia could be in a position to attack a NATO state in four or five years is therefore not an empty phrase. Even among experts, however, it is disputed whether the NATO states can keep up with the Russian war economy and whether the arms industry in both Europe and the USA could even meet the demand with a spending target of three percent or more. In Brussels, reference is often made to the ever-longer delivery times of the US arms industry.

With Donald Trump as the new US president, the European steel industry must prepare for even more difficult times – especially as many companies are already talking about an existential crisis. It was Trump who introduced additional tariffs of between 10 percent and 25 percent on European metal exports in 2018 during his first term of office.

The EU responded with counter-tariffs on products such as Harley-Davidson motorcycles, whiskey and jeans. However, it was not until the subsequent US administration under President Joe Biden that the Commission was able to partially suspend the reciprocal trade barriers again in 2021. However, negotiations on a permanent agreement under the working title “Global arrangement on sustainable steel and aluminum” failed in 2023.

The European side has paused the customs disputes until the end of March. There is thus little time to conduct negotiations. Nevertheless, the suspension of Section 232, which regulates the US tariffs, will remain in place for a little longer than the EU regulation, namely until the end of the year. Trump could of course decide to reintroduce the tariffs before then. But the imminent expiry of his own regulation would at least allow the EU Commission to quickly reintroduce the retaliatory tariffs.

However, US policy under the new president would be far from the only topic for a “European Steel Summit.” German Chancellor Olaf Scholz, among others, had called for such a meeting to tackle the current crisis in the steel industry from the EU Commission. According to Commission sources, it is still unclear whether such a summit is actually planned. However, the “Steel and Metals Action Plan” already announced in the mission letter from Commission Vice-President Stéphane Séjourné is said to be in the works and should be published in the first half of the year.

Dennis Radtke can do without a steel summit. “We don’t need any more new rounds of blabbering, the analyses are all on the table,” said the EPP MEP from the Ruhr region, who is also Chairman of the Christian Democratic Workers’ Union (CDA), to Table.Briefings. Instead, the Commission mist implement concrete measures quickly. “I am constantly being put off by the Commission and by Ursula von der Leyen’s staff,” says Radtke. “But the window of opportunity to save the steel industry is closing. I am very disillusioned.”

One quick measure that Radtke advocates would be an increase in the applicable minimum import prices for certain products such as grain-oriented electrical steel. This is because the European steel industry currently feels threatened by imports from Asia in particular. Although anti-dumping duties are already in place for Chinese steel until June 2026, these duties are considered both too low and insufficiently enforced.

Kerstin Rippel, Managing Director of the German Steel Federation, is also dissatisfied with the Commission’s work. “The regulations currently in place to protect against unfair trade are not being used sufficiently by the EU Commission – and they fall short,” she says. In addition, the EU’s review procedures take too long.

Both Rippel and Radtke are therefore pushing for the rules of the World Trade Organization (WTO) to be interpreted more broadly in the Steel Action Plan than they have been to date. This is because the competing manufacturers themselves are currently acting unfairly. “First of all, I would like to see the practices of our Chinese and Asian colleagues become WTO-compatible,” says Rippel. “There is currently a massive amount of dumped steel coming from China to Europe, often via detours.”

The changed geo-economic competition with China and the USA now requires drastic interventions in import law: “The two big players in world trade no longer adhere to WTO rules,” says Rippel. “Do we want the legal gold stamp, but then unfortunately the industry has not survived?” Radtke from the EPP group seconds the criticism of the Commission: “The EU people at the technical level are still behaving as if they were in a regulatory delicatessen.”

Other points on the EU’s steel agenda, according to Rippel, include

Another problem for the steel industry is the high energy prices, particularly in Germany. These are also likely to be mentioned in the steel action plan, at least with reference to other Commission projects. The industry has long been calling for the EU rules on low-carbon hydrogen to be made more flexible to encourage more investment in the energy sector.

In Germany in particular, there are plans to use large quantities of “green” hydrogen in steel production in the future. There is currently a debate as to whether non-renewable energy should also be used in hydrogen production. In the industry’s vocabulary, this would then be referred to as “gray” or “blue” hydrogen. “We need openness when it comes to the color theory for hydrogen,” says Radtke.

Jan. 22-24, 2025; Jan. 27-29, 2025; online

ERA, Seminar Fundamentals of EU State Aid Law: Substantive and Procedural Aspects

The Academy of European Law (ERA) aims at providing legal practitioners with a thorough overview of EU State aid law and in-depth understanding of its core notions. INFO & REGISTRATION

Jan. 22, 2025; 12:30-2 p.m., Florence (Italy)

FSR, Seminar Governing Tech Giants

The Florence School of Regulation (FSR) discusses how regulators can effectively govern tech giants that possess superior expertise and adapt rapidly to technological change. INFO & REGISTRATION

Jan. 23, 2025; 9 a.m.-1:30 p.m., Brussels (Belgium)

ECFR, Discussion Strategic reset: Re-designing EU-Africa partnerships on critical minerals

The European Council on Foreign Relations (ECFR) discusses structural challenges facing Europe’s positioning in mineral value chains and Africa’s limitations in attracting significant market interest in its mines. INFO & REGISTRATION

Donald Trump’s inauguration brings new momentum in the EU’s free trade talks. On Monday, the EU Commission announced the resumption of negotiations for a free trade agreement with Malaysia. “While some turn inwards towards isolation and fragmentation, Europe and Malaysia are choosing a different path,” Commission President Ursula von der Leyen was quoted in a barely concealed reference to the new US president’s trade policy.

The EU and Malaysia had previously negotiated a free trade agreement between 2010 and 2012. The negotiations were broken off by the government in Kuala Lumpur at the time. In 2023, both sides began exploratory talks to restart the negotiations. Trade in goods between the EU and Malaysia amounted to almost €45 billion in 2023 – almost half of which was trade between Germany and Malaysia. Machinery and electrical appliances are traded most intensively, followed by fats and oils.

Like the conclusion of negotiations with Mercosur in December and with Mexico last Friday, the start of negotiations with Malaysia is also likely to have been accelerated by the start of the Trump presidency in the USA. The countries are looking for predictable trading partners.

During his visit to Brussels on Monday, Indian Trade Minister Piyush Goyal emphasized that his country intends to conclude trade talks with the EU by the end of the year. So far, the negotiations have only made slow progress because the Indians do not want to open their market to European industry. New Delhi is also taking issue with European sustainability laws such as CBAM or the Supply Chain Directive. According to reports, an EU-India summit is to take place relatively soon to spark new momentum. The exact date is not yet known.

Many EU member states and third countries want to use free trade agreements to cushion the impact of the tariffs announced by Trump by opening other markets. However, it will be some time before the agreement with Malaysia can fulfill this purpose. In the EU, it usually takes several years between the start of negotiations and ratification of the agreement. jaa

The voluntary code of conduct to combat illegal hate speech online (from 2016) will become part of the Digital Services Act (DSA) in a revised form as the Code of Conduct+. This was announced by the Commission on Monday. Signatories to the code include Facebook, Instagram, Linkedin, Microsoft Hosted Consumer Services, Snapchat, TikTok and YouTube. In contrast to the Code of Practice on Disinformation, X is also still a signatory to the Code of Conduct+.

Article 45 of the DSA provides for the possibility of integrating voluntary codes of conduct into its legal framework. The basic idea behind the integration of codes of conduct is to promote cooperation between online platforms and the regulatory authorities in order to achieve the objectives set out in the DSA. In doing so, the codes of conduct should help to facilitate the implementation of the act provisions and ensure effective enforcement.

Specifically, the signatories commit to, among other things:

In addition, signatories will make specific transparency commitments regarding the measures taken to reduce the dissemination of hate speech on their services, including through automated detection tools. vis

In a study published on Tuesday, the Center for European Policy (CEP) warns that the EU’s automotive strategy could fail. The researchers conducted the study on behalf of the European manufacturers’ association ACEA, which Table.Briefings was able to view in advance.

The de facto end of combustion engines for cars and light commercial vehicles in 2035 and the lack of prospects for operating heavy commercial vehicles with alternative fuels could mean the end of the affected industries in the EU, it says. The strategy of relying solely on electric drive systems for cars and light commercial vehicles and on electric and hydrogen drive systems for trucks after 2035 is threatening to fail, as demand will not materialize due to unsatisfactory framework conditions. Consumers still do not see electric vehicles as a superior technology compared to combustion engines when it comes to total cost of ownership (TCO), range, and charging and refueling options.

In no other relevant automotive market in the world is automotive regulation so one-sidedly focused on battery-electric solutions and as strict as in the EU. As a result, EU regulation impairs the competitiveness of the domestic industry. “Many countries with a significant demand and/or automotive industry are pursuing medium and long-term multi-technology strategies, which are also reflected in their CO2 emission regulations.”

It should be questioned whether EU legislation should actually restrict the ability of EU car manufacturers to adapt to the conditions of the global automotive market by “imposing a de facto ban on combustion engines for cars and vans on their domestic market,” the researchers appeal.

The authors analyzed the Commission’s impact assessment of the CO2 fleet legislation as part of the Fit for 55 package. In its legislative proposal, the Commission selected the strictest of three scenarios. The EU climate targets (minus 55 percent in 2030 and net zero in 2050) could also be achieved in the other two scenarios with less stringent interventions in CO2 fleet legislation. The ETS 2 provides for this. The researchers conclude: “The long-term goal of complete decarbonization of road transport can also be achieved with more flexibility in the CO2 emission standards for cars and vans as well as for trucks.”

The authors present three options for the review of CO2 fleet legislation, which is due by 2026 at the latest according to EU legislation:

1. A change in CO2 fleet legislation with the following options:

2. More flexibility for manufacturers with regard to the CO2 fleet limits:

3. Use of e-fuels in new vehicles after the end of combustion engines in 2035. mgr

The Strategic Dialog on the Future of the Automotive Industry starts on Jan. 30. Under the leadership of Commission President Ursula von der Leyen, representatives of manufacturers and suppliers will meet with trade unionists, representatives of infrastructure and civil society. Transport Commissioner Apostolos Tzitzikostas will also present an industrial action plan for the automotive sector.

Depending on the portfolio, other members of the Commission will be consulted. The first meeting aims to “arrive at a common view of the most important challenges and potential solutions,” according to a conceptual note from the Commission. Specific goals for the dialog could be formulated at the first meeting. Subsequently, working groups made up of representatives from the Commission and industry will be formed to “develop more detailed proposals.” The working groups will report to a steering group. Parliament and the Council are also to be involved and regularly informed about the status of the talks.

Five possible topics for the working groups were identified. One working group is to determine the status of EU industry with regard to future technologies. It should deal with the framework conditions for innovation in industry as well as specific areas of technology. A second working group is to deal with outstanding regulatory issues.

The paper mentions penalties for manufacturers if they fail to meet climate targets. Some industry representatives are calling for the rules to be eased, while others are in favor of retaining the current rules. This working group could discuss EU legislation, the status of the charging infrastructure, and purchase incentives.

Harmonization of purchase incentives and taxes between the member states could also be a topic. It would be conceivable to talk about cooperation between companies to develop an e-vehicle at low cost, as well as coordinated attempts to consolidate suppliers and the ramp-up of components for e-vehicles.

A third working group could deal with the topic of competitiveness and resilience. For example, the aim would be to ensure that the EU is competitive in terms of the cost of labor, energy and raw materials. In terms of wage and energy costs, there is a gap between the EU and its competitors. In terms of raw materials, there is a risk of bottlenecks in the EU, for example in chips and raw materials for battery production.

A fourth working group should deal with trade relations and internationally comparable framework conditions. The paper addresses “distortions of competition,” such as “substantial state investment” in automotive industries. Investments by third countries in the EU in companies in the automotive supply chain should also be addressed.

Another working group is to look into improved processes and coordination in EU regulation. Coherence and consistency between EU regulations, for example on batteries, safety and data protection, must be ensured. The timing and scope of regulation must be better coordinated. For example, “pain points” of regulation and ways to alleviate them could be identified.

No information was provided on the schedule for the dialog and when results are to be presented. mgr

Last Friday, German Chancellor Olaf Scholz spoke on the phone with Slovakian Prime Minister Robert Fico and discussed the gas supply. Fico made the announcement on Facebook. A government spokesperson in Berlin confirmed the phone call, but did not want to give any precise details about the content. “As far as the fundamental issue of gas supply and gas transit is concerned, the European Commission is still in constructive talks with Slovakia on this topic. We expressly welcome this,” Scholz’s spokesperson told Table.Briefings on Monday.

It is good that there are now alternatives for gas supply at the European level. The vast majority of member states no longer purchase gas from Russia. “At the same time, we are committed to further diversification of the energy supply and greater energy independence,” said the government spokesperson.

Fico announced that he had reaffirmed the Slovakian government’s position in the meeting, which had been initiated by Scholz. If the Ukrainian government’s decision is not reversed, Slovakia will take countermeasures. The gas transit contract for Russian gas through Ukraine expired at the turn of the year. Fico then threatened Kyiv, among other things, to stop exporting electricity to the country. The SPD in the Bundestag wants to support Slovakia’s gas supply. “We must try to use the technical possibilities to get gas to Slovakia by other means,” said MP Jörg Nürnberger. ber

The EU filed another complaint against China at the World Trade Organization (WTO). The EU Commission accuses Beijing of having empowered its courts to set worldwide royalty rates for EU standard essential patents – without the patent owner’s consent. “This pressures innovative European high-tech companies into lowering their rates on a worldwide basis, thus giving Chinese manufacturers cheaper access to those European technologies unfairly,” it said in a statement on Monday. According to the EU, this violates the WTO agreement on intellectual property (TRIPS). Despite repeated negotiations with China, no solution has yet been found.

“The EU’s vibrant high-tech industries must be allowed to compete fairly and on a level playing field. Where this is not the case, the Commission takes decisive action to protect their rights,” said Maroš Šefčovič, EU Commissioner for Trade and Economic Security. If no agreement is reached within 60 days, the EU can convene a WTO dispute settlement body. The case concerns standard essential patents (SEPs), which protect technologies essential for manufacturing goods that meet a certain standard, such as 5G for mobile phones.

Since February 2022, another case against China concerning the patent protection of European tech companies has been ongoing at the WTO. The case revolves around a Chinese regulation that allows courts to prohibit patent holders from enforcing their rights in foreign courts. Failure to comply could result in fines of the equivalent of €130,000 per day. fpe

Before the EU Commission launches an omnibus procedure to cut red tape, the EPP, S&D and Renew should reach an agreement on this in the EU Parliament. MEP Pascal Canfin (Renew) is calling for this in the run-up to the Ecofin Council on Tuesday, where the planned project will be discussed at the finance minister level.

Canfin said that calls for a simplification of the CSRD, CSDDD and taxonomy should not lead to the Green Deal being blamed for the lack of competitiveness of the European industrial sector. According to the Frenchman, there is a risk that all the technical work currently being done to implement these laws will be undone.

With a prior agreement in the EU Parliament, Canfin wants to negotiate a “clean and stable version” of the omnibus law. This would also reduce the risk for French companies, he says.

He sees the idea of raising the thresholds for companies in terms of reporting obligations as a trap. This could lead to “the entire German SME sector being removed,” while all French companies remain in. “This would create something completely unfair for both sides,” says Canfin.

France is the first member state to implement the CSRD directive on sustainability reporting. France has yet to issue an official statement on the EU Commission’s plans for the Omnibus Regulation.

The French Association of Private Enterprises (Afep) stated that increased global competition calls for a rethink of the regulatory framework for sustainable finance. The taxonomy should become a “real strategic tool for managing the green transition and an opportunity to develop new products and services to conquer new markets,” writes the association. cst

Today’s dessert is hard to digest. You could also call it a rip-off. In any case, it’s about making a lot of quick money. Here are the facts:

On Friday, Donald Trump created a meme coin called $TRUMP. On the first day, 200 million $TRUMP were available. Within three years, the volume is expected to grow to a total of one billion $TRUMP.

Early on Saturday morning, the coin started at a price of less than ten US dollars and reached a high of just under 75 dollars on Sunday, which corresponds to a market capitalization of around 15 billion dollars. From a standing start, the meme coin made it into the list of the 20 largest cryptocurrencies. The price fell significantly on Monday. You can track the current price at Coin Market Cap.

A brief explanation: A meme coin is a cryptocurrency that was created for fun, out of a hype, or as a parody and offers no profound technical benefit. The official “use” of the Trump coin is that the purchaser can use it to express their support for Trump’s “ideals and beliefs.”

The Trump coin is therefore purely an object of speculation. “GetTrumpMemes.com is not political and has nothing to do with any political campaign or any political office or government agency,” the website claims. Melania Trump launched her own cryptocurrency based on the same concept on Sunday.

The remaining 800 million $TRUMP coins that are not yet in circulation are owned by two companies close to Trump. These are CIC Digital LLC and Fight Fight Fight LLC. The latter is a company that was founded in Delaware on Jan. 7, as reported by Forbes.

Both companies therefore also receive income from trading. The exact sum is unclear. In general, every transaction on the exchanges generates fees (between one and five percent of the transaction value). A portion of these fees goes to the developers or operators of the token (companies close to Trump). According to reports, the Trump companies made 58 million dollars from such fees in the first few days alone.

The bottom line is that Trump is cashing in on his current popularity. He and his clan can earn millions, potentially billions of US dollars. The meme coin can make him the richest man in the world – without him investing or risking anything himself.

Green MEP Alexandra Geese was one of the first to warn of the political consequences. “A US presidential cryptocurrency is similar to a Swiss bank account into which people can make secret deposits,” said Geese. “This opens the door to secret influence by rich individuals, corporations and states. In a normal world, we would call that corruption.”

Anyone who wants to favor Trump or put pressure on him can now invest anonymously, manipulate the exchange rate and thus channel billions into his pockets – or put him in financial distress. “The EU must not stand idly by and watch this development,” demands Geese. Corinna Visser