The timetable for hearings for the Commissioners-designate has been set. Today’s News explains which candidates have to go to their respective specialist committees and why some people are annoyed about the time schedule.

The EU Parliament’s Legal Affairs Committee’s examination of possible conflicts of interest of the Commissioner candidates also caused anger. All candidates passed the test, but the committee’s approach has been criticized. “Information that was found in the media but not in the candidates’ declarations of interest was not included in the assessment”, Lobbycontrol criticized. Parliament had thus limited itself in its work.

Members of the JURI Committee were also dissatisfied with the procedure. The designated Commissioners would only have to provide information “which could be assumed to lead to a conflict of interest”, said SPD MEP René Repasi. This would allow them to assess for themselves whether conflicts of interest exist. “But that is actually the task of Parliament.” Repasi is therefore calling for a reform of the scrutiny process.

Green MEP Sergey Lagodinsky left the chamber on Thursday in protest together with other Green and Left MEPs. The procedure was driven by the fear of the major parties of losing their candidates, said Lagodinsky. “Instead of asking for concrete information, the committee froze in this fear and pushed the examination through hastily and ill-informed with fearful majorities.”

At the end of the meeting, the chairman of the JURI Committee, Renew politician İlhan Küçük, also found that a review of the procedure was necessary.

I wish you a smooth start to the weekend.

The vote in the Council on the countervailing duties on electric cars manufactured in China reflects the interests of manufacturers and suppliers across the 27 EU member states. The main camps of manufacturers’ consortia are now concentrated in only two member states: France is home to Renault as well as Stellantis with brands such as Alfa Romeo, Peugeot, Citroën, Opel, and Fiat. In Germany, VW, BMW and Mercedes have their headquarters.

The corporate headquarters in France and Germany are differently affected by the tariffs, which is why they are not pulling in the same direction: Paris voted in favor of the tariffs, Berlin against – many EU partners reacted to Olaf Scholz’s decision with incomprehension.

The interests of the French: Stellantis and Renault mainly offer vehicles in the volume segment. They have virtually no presence in the Chinese market. However, they have been feeling the effects of the EV offensive by Chinese manufacturers in Europe for around two years. They chose France first to gain market share by offering competitive prices. As early as 2023, Group CEOs Luca de Meo (Renault) and Carlos Tavares (Stellantis) submitted a request to the EU Commission via the Élysée Palace to impose countervailing duties on EVs produced in China.

The countervailing duties, due to take effect at the end of October, fit the manufacturers’ strategy: The additional tariffs on Chinese-made EVs will increase the price of imports from Asia and improve the sales opportunities of French and Italian manufacturers in the domestic market. Ten member states, representing 46 percent of the EU population, voted in favor of the countervailing duties in the Council. Among them, only France and Italy have a car industry. Countries such as the Netherlands, Estonia, Latvia, Lithuania and Poland have no economic interests of their own in the matter.

The fact that many Member States are no longer affected by upheavals in the automotive industry is also evident from the many countries that abstained in the vote: twelve Member States, representing a third of the EU population. These include Sweden, Finland, Romania, Spain, Croatia and the Czech Republic. However, Spain, Belgium, Croatia, Romania and the Czech Republic have at least assembly plants and supplier factories.

Only five countries voted against the countervailing duties. They represent just under a quarter of the EU population. However, of these countries, only Germany has a large population, namely 19 percent. The other countries that opposed the duties were Hungary, Slovakia, Slovenia and Malta. Hungary and Slovakia may also have voted against the tariffs because they are pro-China. Slovenian Economics Minister Matjaž Han said: “We took the same position as Germany because Germany is our main partner in the automotive industry.”

The interests of the German manufacturers are fundamentally different from those of the French manufacturers: BMW, Mercedes, and the VW brands Audi and Porsche are premium brands and do not compete with Chinese EVs. The CEOs of German companies are expressly opposed to the countervailing duties. For instance, BMW CEO Oliver Zipse recently rejected the tariffs quite brashly in a meeting between car executives and Trade Commissioner Valdis Dombrovskis. He stressed that German manufacturers are competitive and do not need Brussels’ help.

Unlike the French industry, which has no presence in China, German premium manufacturers focus on the Chinese market both in terms of sales and production: On the one hand, they fear that China will retaliate by imposing tariffs on large-volume German-made gasoline cars. Initial signs already point to this. For years, German manufacturers have been making a fortune selling luxury vehicles in China. The profits from this business have formed a significant portion of company profits over the years and have helped compensate for lower returns in the European business.

BMW, Mercedes and Audi have built up their own production capacities in China. In 2023, all three manufacturers sold roughly the same number of luxury cars in China at over 700,000 units each. Only Porsche does not operate any plants of its own in China, having sold just under 80,000 vehicles on the Chinese market in 2023. Retaliatory tariffs on gasoline cars would hurt the bottom lines of BMW, Mercedes and VW. As it is, their biggest concern is that consumption in China is collapsing and sales of premium vehicles are declining drastically.

Moreover, the countervailing duties on EVs produced in China directly affect BMW, VW and Mercedes. In fact, in two ways: Additional countervailing duties will be levied on EVs that they produce in China as well as those imported into the EU. The regular duty rate is already 10 percent. In some cases, the rates of the additional countervailing duties are higher than those of Tesla (7 percent) and Chinese manufacturers such as BYD (17 percent):

BMW is manufacturing two EV models for export to the EU in China: the Mini Cooper SE and the iX1. BMW originally planned to manufacture the e-Mini exclusively in China. Now it will built in the UK after all. Mercedes-Benz has founded a joint venture with the Chinese company Geely to produce the Smart (EV). Two models are currently being manufactured in China and exported to 17 EU member states. A third model has been announced. VW manufactures the Cupra Tavascan (EV) at a Chinese plant. The Tavascan is exported to the EU.

BMW, VW and Mercedes remain silent about the number of units exported to Europe. In terms of total registrations in the EU, German EVs manufactured in China do not play a significant role. However, the companies had firmly included them in their plans to meet the EU fleet-wide emissions. EVs imported from China, which count as zero grams in the CO2 emissions balance, were supposed to reduce the fleet limits and help avoid fines.

This strategy might fail: If EV sales in the EU fall due to the higher tariffs, the fleet-wide emissions of companies will worsen. This means that BMW, Mercedes and VW will have a harder time complying with the stricter fleet limits in 2025. The fines for 2025 could be even higher than recently estimated (15 billion euros).

Undeterred by the cancellation of the Ramstein meeting, which was scheduled for Saturday, Ukrainian President Volodymyr Zelenskyi traveled through Western Europe on Thursday. At meetings with heads of government in London, Paris and in the evening in Rome, as well as this Friday in Berlin, the Ukrainian President is promoting his plan for victory. In London, he also met with NATO Secretary General Mark Rutte.

Zelenskyi wants permission from the UK and France to use the Storm Shadow (UK) and Scalp (France) cruise missiles supplied to Ukraine against targets on Russian territory. However, a spokesman for British Prime Minister Keir Starmer said on Thursday: “There has been no change in the British government’s position on the use of long-range missiles.”

The Ukrainian president is hoping to gain territory in order to strengthen his negotiating position. The Italian newspaper “Corriere della Sera” had speculated that Zelenskyi was prepared to agree to a ceasefire if Ukraine received security guarantees from the USA in return and could join the EU quickly. However, the Ukrainian Foreign Ministry sharply rejected the “manipulative representations of some foreign media” on Thursday evening.

One basis for the Italian interpretation was a tweet by Zelenskyi on Wednesday evening, in which he wrote: “The situation on the battlefield offers the opportunity to end the war by 2025 at the latest through decisive action.” Zelenskyi also wrote that a NATO invitation to Ukraine and future membership would be “a real step towards peace”. Without the certainty that Ukraine would never be subjugated by Russia, peace would not be possible.

With regard to the peace summit, which is to take place this year, Zelenskyi continued: “In October, November and December we have a real chance to move things in the direction of peace and lasting stability.”

Zelenskyi knows that his country’s resilience ultimately depends on support from abroad. And there are several foreseeable risks. Even if Donald Trump, who maintained direct contact with Russia’s ruler Vladimir Putin after his term in office, is not elected as US president, the level of aid from Washington is uncertain.

Populists in the EU pose a further risk. They question aid for Kyiv, particularly during election campaigns; in Germany, such voices can be found in both the AfD and the Sahra Wagenknecht (BSW) alliance, which considers itself to be on the left. The envy debates they are stirring up are bearing fruit. The total amount of aid for Ukraine is rather small compared to the amount spent on other crises. According to the Kiel Institute for the World Economy, the total EU funds up to and including August 2024 amounted to just under one-eighth of the funds to combat the economic impact of Covid.

The main problem is the dependency that exists between European and US support, as the US alone provides more than half of the military aid, explains Pietro Bomprezzi when asked. He heads the Ukraine Support Tracker project at the Kiel Institute. And he points to another problem: “The military-industrial expansion in Europe is currently slower than that in Russia.”

Putin’s government is planning to spend a third of the 2025 state budget on the military and the defense industry – 32.4 percent of all spending, three percentage points more than this year. Despite 14 sanctions packages, the regime has stabilized the economy, at least for the foreseeable future. During a visit to Berlin this week, Lev Gudkov, one of Russia’s most experienced and respected sociologists, summarized the situation in his home country as follows: “There is no way Russia will end the war due to economic exhaustion.”

Oct. 14, 2024

21st meeting of the EU-Kazakhstan Cooperation Council

Topics: Discussion of the status and next steps of the agreement on enhanced partnership and cooperation between the EU and Kazakhstan; exchange of views on political, economic and trade policy issues. Info

Oct. 14, 2024; 9:30 a.m.

Council of the EU: Environment

Topics: Approval of the conclusions on the preparation of the 29th Conference of the Parties (COP 29) to the United Nations Framework Convention on Climate Change; conclusions on the Convention on Biological Diversity; exchange of views on the implementation of the EU chemicals strategy. Draft agenda

Oct. 14, 2024; 10 a.m.

Council of the EU: Foreign Affairs

Topics: Exchange of views on Russian aggression against Ukraine; exchange of views on the situation in the Middle East. Draft agenda

Oct. 14, 2024; 3-7 p.m.

Meeting of the Development Committee (DEVE)

Topics: Exchange of views on the humanitarian situation in Sudan; Exchange of views on the humanitarian situation in Lebanon; Exchange of views on the Global Gateway Strategy. Draft agenda

Oct. 14, 2024; 3-7 p.m.

Meeting of the Committee on Agriculture and Rural Development (AGRI)

Topics: Public hearing on the Strategic Dialogue on the future of EU agriculture. Draft agenda

Oct. 14, 2024; 3-7 p.m.

Meeting of the Budget Committee (BUDG)

Topics: Vote on the general budget of the European Union for the financial year 2025; vote on the mobilization of the European Globalization Adjustment Fund for the benefit of redundant workers. Draft agenda

Oct. 14, 2024; 3-6:30 p.m.

Meeting of the International Trade Committee (INTA)

Topics: Vote on the establishment of the cooperation mechanism for Ukraine loans and the provision of extraordinary macro-financial assistance for Ukraine; discussions on financial assistance for various countries. Draft agenda

Oct. 14, 2024; 3-6:30 p.m.

Meeting of the Employment and Social Affairs Committee (EMPL)

Topics: Discussion with the Executive Directors of the agencies within the EMPL Committee’s remit. Draft agenda

Oct. 14, 2024; 3-6:30 p.m.

Meeting of the Committee for Transport and Tourism (TRAN)

Topics: Explanation of the priorities of the Hungarian Presidency; vote on the implementation of the Single European Sky (recast). Draft agenda

Oct. 14, 2024; 3-5:30 p.m.

Meeting of the Committee on Economic and Monetary Affairs (ECON)

Topics: Hearing with José Manuel Campa (Chairman of the European Banking Authority); Hearing with Petra Hielkema (Chairwoman of the European Insurance and Occupational Pensions Authority); Draft report on faster and more secure procedures for the relief of excess withholding taxes. Draft agenda

Oct. 14, 2024; 5-6:30 p.m.

Meeting of the Committee on Foreign Affairs (AFET)

Topics: Exchange of views on Tunisia; debriefing of the Jordanian election observation mission; report on the implementation of the Common Foreign and Security Policy. Draft agenda

Oct. 15, 2024; 9:30 a.m.

Council of the EU: Transport, Telecommunications and Energy

Topics: Exchange of views on the contribution of the energy sector to the competitiveness of the

European Union (follow-up to the recommendations of the Draghi report); exchange of views on the divergence of wholesale electricity prices; presentation by the Commission on the report on the state of the Energy Union and the follow-up to the implementation of the REPowerEU plan. Draft agenda

Oct. 15, 2024, 10 a.m.

Council of the EU: General Affairs

Topics: Exchange of ideas in preparation for the European Council meeting on October 17/18, 2024; status of EU-Switzerland relations; approval of the European Semester 2024 (integrated country-specific recommendations). Draft agenda

Oct. 16, 2024

Summit meeting between the EU and the Gulf Cooperation Council

Topics: The EU leaders and the leaders of the Gulf Cooperation Council meet for consultations. Info

Oct. 17-18, 2024

European Council

Topics: Ukraine; Middle East; Competitiveness. Draft agenda

Oct. 17-18, 2024

Informal ministerial meeting on trade

Topics: Exchange of views on the European Union’s trade relations with the ASEAN countries and on trade relations between the EU and China; exchange of views on the future direction of the EU’s investment protection policy. Info

Oct. 17, 2024; 10:45 a.m.-1 p.m.

Meeting of the Human Rights Committee (DROI)

Topics: Debate on the International Criminal Court (ICC) and EU policy on international humanitarian law and the fight against impunity; debate with Sirpa Rautio (Director of the European Union Agency for Fundamental Rights); Annual Report 2024 on human rights and democracy in the world and the European Union’s policy in this area. Draft agenda

The heads of the political groups in the European Parliament, Conference of Presidents (CoP), have decided on the timetable for the hearings of the Commissioners-designate in the committees. The hearings will take place between Nov. 4-12.

According to information from Table.Briefings, a majority from the EPP, ECR and PfE decided on the timetable – to the annoyance of the Social Democrats. The S&D had previously wanted to ensure that Executive Vice-President Raffaele Fitto (ECR) would have his turn at the very end. The calculation was probably to reject party colleague Giorgia Melonis without the EPP being able to reject a Socialist Executive Vice-President in return. The Christian Democrats and right-wingers have now ensured that Competition Commissioner Teresa Ribera (S&D) will be heard after Fitto, presumably in order to block Ribera in the event of Fitto’s rejection.

Parliament President Roberta Metsola and the heads of the parliamentary groups also agreed on the written list of questions that the candidates must answer by Oct. 22.

On Thursday, the EU Parliament’s Legal Affairs Committee also concluded its examination of possible conflicts of interest of the Commissioner candidates. “None of the candidates proposed by the member states were found to have a financial conflict of interest”, said René Repasi, member of the JURI Committee. The first step in the examination of the future Commissioners has thus been taken.

However, there had been “findings” for three candidates that could be forwarded to the hearing committees. He did not provide any details. luk

The controversial German border controls could remain in place for longer than initially planned. Minister Nancy Faeser hinted at this at a meeting with her EU counterparts in Luxembourg. Faeser said that border controls in Germany would have to remain in place until European solutions were found to better protect the EU’s external borders.

So far, the German government has only notified the EU Commission for six months. Controls at all German internal borders are therefore set to end on March 15, 2025. However, the effective protection of Europe’s external borders is likely to take considerably longer. Faeser urged that the necessary measures be taken sooner than planned.

“We want to further reduce irregular migration, stop smugglers, but also put a stop to criminals and recognize Islamists at an early stage”, said the SPD politician on the sidelines of the meeting in Luxembourg. Other neighboring countries had also reintroduced border controls. Sweden recently notified an extension until May 2025.

Faeser also advocated new deportation rules. The return directive urgently needs to be revised because it often does not work in practice, she said. This also applies to refoulement at the borders. This has been a priority for the German government since the terrorist attack in Solingen.

Other EU states also spoke out in favor of facilitating deportations. A consensus is emerging from the talks, it was reported in Luxembourg. On the initiative of Austria and the Netherlands, 17 Schengen countries have called on the EU Commission to revise the 2008 Return Directive. Germany also recently joined in.

Another topic was “innovative solutions” for so-called return centers (“hubs”) in third countries. Hungary and Italy had spoken out in favor of this. Faeser said that a partner state was needed for such plans. She considers this to be the “most difficult point”. Italy is planning such a center with Albania. Closed asylum camps are to be created there.

Migration is also on the agenda at next week’s EU summit. A draft of the summit conclusions calls for “decisive action at all levels” to expand and accelerate returns. ebo

At their next meeting on Oct. 21, the EU agriculture ministers want to unanimously adopt a declaration on how they envisage the next reform of the Common Agricultural Policy (CAP). Today, the preparatory body, the Special Committee on Agriculture (SCA), is negotiating this for the second time. A current draft of the declaration, which is available to Table.Briefings, provides for a commitment to the CAP as a separate item in the EU budget. It is the appropriate instrument for the distribution of agricultural subsidies, it says.

It therefore emphatically calls for “the retention of a separate and independent CAP with two pillars“. If the Agriculture Council adopts the text in this way, it would implicitly oppose the possible plans for a reform of the EU budget that have recently been leaked from the EU Commission. According to media reports, part of the consideration is to abolish agricultural subsidies in their current form. Instead, the majority of the budget for specific reform plans would flow to the member states as a “subsidy” to the national budget.

With regard to the future use of EU agricultural funds, the draft takes a similar line to the Strategy Dialogue on Agriculture: There needs to be an income support component, as well as incentives for environmental and climate services. The paper also calls for support for small farms – unlike the strategy dialog, however, it does not call for direct payments to be tied to the neediness of the farms.

It is also about more flexibility for companies and the member states. National strategy plans should be approved more quickly and with fewer bureaucratic hurdles, and it should be easier to make adjustments. The EU Court of Auditors recently called for the opposite: more effective monitoring to ensure that the plans are in line with climate and environmental targets.

While the draft emphasizes the growing importance of crisis instruments in the CAP, it remains unclear what form these should take. This is probably partly due to differences of opinion between the member states. For example, between financially strong countries, which can rely on national crisis funds, and less financially strong countries, which see this as a distortion of the internal market and would like to see strict European state aid rules.

Accordingly, the document states that a crisis framework must offer flexibility, but must not have a discriminatory effect. How both can be combined is not explained. It also states that the crisis reserve must be “better” designed. What this means, however, also remains open. jd

The EU Parliament and Council of Ministers have started work on the European Commission’s proposal to postpone the EU rules for deforestation-free supply chains (EUDR) by six months. According to diplomatic circles, the proposal met with broad approval at an initial discussion between EU ambassadors on Wednesday. The ambassadors could vote by the end of the month – possibly as early as Oct. 23.

Meanwhile, according to parliamentary sources, the coordinators in the responsible ENVI committee have agreed to request the use of the urgency procedure. This means that the plenary will vote directly instead of the responsible committee first. They want to submit the request after the ambassadors have voted. If it accepts the fast-track procedure, Parliament could vote on the proposal at one of the two plenary sessions in November.

The Council and Parliament can skip the trilogue negotiations if they both support the Commission proposal without substantial changes. The previous start date for the EUDR rules was Dec. 30, 2024, by which time the postponement should be finalized. jd/luk

In view of the high national debt, France’s new center-right government led by Prime Minister Michel Barnier has launched an austerity budget. In the coming year, €60 billion are to be made good through savings and additional revenue, as the government explained after the cabinet meeting. Two-thirds of the billion euros are to be achieved through spending cuts and one-third through tax increases aimed at companies with high turnover and high-income households.

The EU Commission is pursuing deficit proceedings against France due to excessive new debt. France must submit a consolidation plan to Brussels by the end of October. France expects a budget deficit of 6.1 percent this year, which is to be reduced to five percent in 2025 and brought back below the European limit of three percent in 2029.

The austerity budget has met with resistance in parliament. Even before it was presented, there was criticism from the left-wing camp and the right-wing nationalists. There are also reservations in the ranks of the government, whose members are unhappy with the budget cuts. Criticism also came from the High Council for Finance, which examined the government’s plans for their sustainability. The underlying growth forecasts were too optimistic, according to the Council.

As the government does not have its own majority in parliament, it may only be able to get the budget through with major changes or push through its version over the heads of MPs using a special article of the constitution. Shortly after taking office, the budget negotiations will become a test of strength for the government. Protests on the streets cannot be ruled out either. dpa

The former Soviet republic of Moldova, which is striving to join the EU, can hope for new aid from Brussels amounting to €1.8 billion. EU Commission President Ursula von der Leyen said at a meeting with Moldova’s head of state Maia Sandu ahead of the presidential election and referendum on Oct. 20 that the aim was to invest in jobs, growth, services and infrastructure.

For example, new hospitals and the road link from Moldova’s capital Chișinău to the Ukrainian port city of Odessa. The planned support package has the potential to double the size of the country’s economy within a decade, said von der Leyen.

The plan for the new EU aid must still be approved by the member states and the European Parliament. It is also intended as an incentive for the people in the EU accession candidate country between Ukraine and EU member Romania to continue to support the current government’s pro-European course.

Moldova, which has a population of around 2.5 million, is divided between pro-European and pro-Russian forces. On Oct. 20, a referendum will be held at the same time as the presidential election to decide whether EU accession should be enshrined as a goal in the constitution. dpa

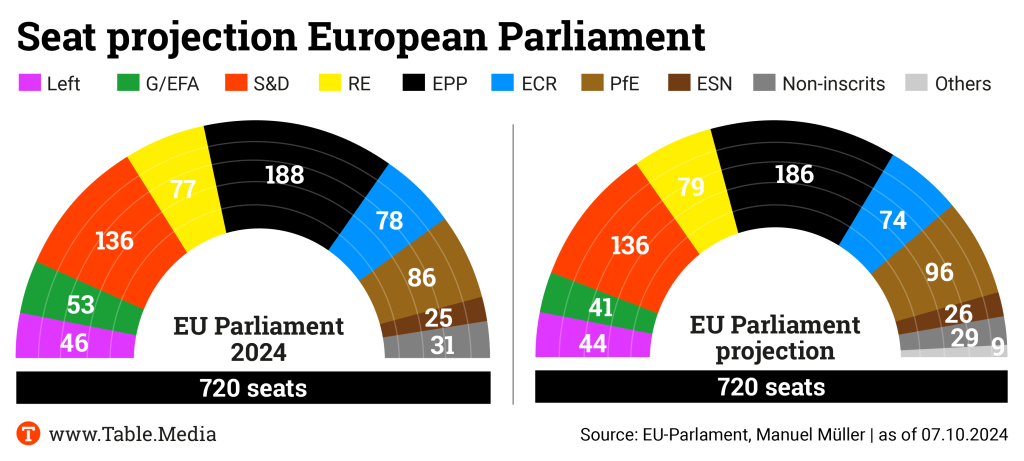

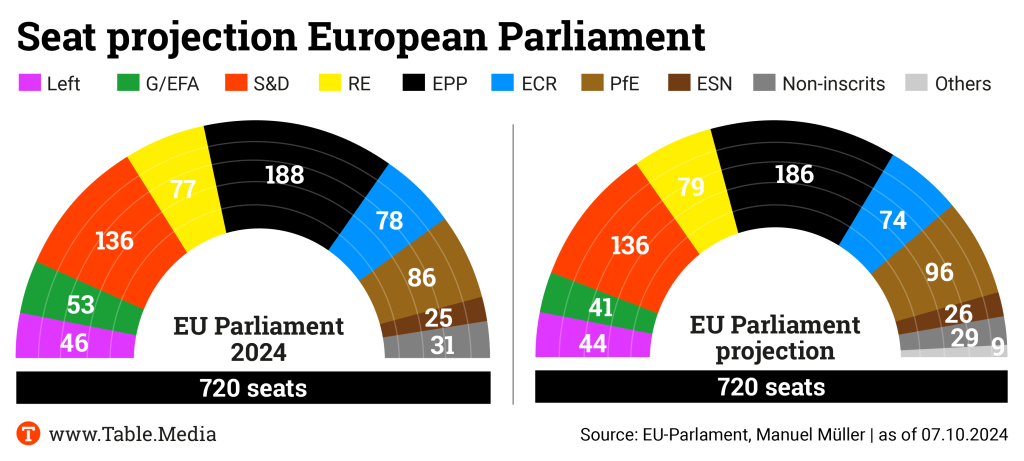

Four months after the European elections, the European far-right parties are still on the upswing. In the Austrian parliamentary elections at the end of September, the FPÖ (PfE) became the strongest party, while far-right parties could finish in second place in the Lithuanian and Bulgarian parliamentary elections this October. The three far-right parties are also making further gains at EU level. In the base scenario of the current seat projection, they would achieve a total of 196 seats. That is nine more than in the European elections in June and ten more than in the most recent projection in August.

This upswing is mainly due to the “Patriots for Europe”, the largest of the three far-right groups. The PfE not only made slight gains in Austria, but also in several other member states. They are also benefiting from the first parliamentary group change of the new legislative period: At the beginning of October, it was joined by two previously non-attached MEPs from the Polish Konfederacja. In total, the PfE now has 96 seats (+8 compared to August), a new all-time high.

The two other far-right groups – the ECR with the Polish PiS and the Italian Fratelli d’Italia and the “Europe of Sovereign Nations” (ESN) group with the German AfD – can only make slight gains in each case. In the projection, the ECR has 74 seats (+1), the ESN 26 (+1).

The EPP, on the other hand, has suffered losses: After making slight gains in the August projection, it has now fallen slightly below its result in the European elections in June (186/-5). However, most of these losses are only small fluctuations, often within the margin of error of the polls, which only happen to point in the same direction. There is also a clear counter-trend in Hungary, where the Tisza party led by shooting star Péter Magyar, which joined the EPP group after the European elections, is making strong gains and is now only just behind Viktor Orbán’s Fidesz (PfE) in some polls.

However, Tisza’s gains are largely at the expense of other Hungarian opposition parties – such as the social democratic DK. The past few weeks have also been rather mixed for the European Social Democrats: While they made slight gains in Germany and Greece, they ended their brief summer highs in Italy and Spain. Overall, the social democratic S&D group has 136 seats, one less than in the last projection.

The liberal Renew Group (79 seats/+2) is in a slightly better position. It is benefiting above all from developments in Italy, where the alliance of the two parties IV and +Europa (which ran in the European elections under the name “Stati Uniti d’Europa”) would now narrowly overcome the national four-percent hurdle. The Liberals, on the other hand, are in trouble in Bulgaria, where their member party DPS split into two competing lists shortly before the national parliamentary elections.

As in 2014 and 2019, the European Greens are suffering from a European election hangover: after making significant gains shortly before the election, they have slumped again in the polls after the election. They are currently struggling in Germany and Denmark, among others; they also fell slightly short of expectations in the Austrian elections. Overall, the Greens/EFA group still has 41 seats (-4), falling behind the Left Group (44 seats/±0).

The latter has made gains in the Netherlands, among other countries, while its Greek member party Syriza is plagued by internal power struggles. The recent split in the European Left Party has no impact on the projection: the old European Left and the new European Left Alliance continue to form a joint parliamentary group.

The non-attached parties have slightly fewer seats than in August (29/-2), mainly due to the PfE accession of Konfederacja. Finally, there were few changes among the “other” parties – i.e. parties that are not represented in the European Parliament and cannot be clearly assigned to a political group (9 seats/±0).

As there are no pan-European election polls, the seat projection is based on aggregated national polls and election results from all member states. In the baseline scenario, all national parties are assigned to their current parliamentary group (or the parliamentary group of their European umbrella party); parties without a clear assignment are shown as “other”.

The dynamic scenario assigns all “other” parties to a parliamentary group that they could plausibly join and also takes into account possible future changes of parliamentary group by parties already represented in parliament. Currently, however, the “other” seats would be so widely distributed across the parliamentary groups that the two scenarios hardly differ. A more detailed breakdown of the results as well as information on the data basis and methodology of the projection can be found on the blog “The (European) Federalist“.

The timetable for hearings for the Commissioners-designate has been set. Today’s News explains which candidates have to go to their respective specialist committees and why some people are annoyed about the time schedule.

The EU Parliament’s Legal Affairs Committee’s examination of possible conflicts of interest of the Commissioner candidates also caused anger. All candidates passed the test, but the committee’s approach has been criticized. “Information that was found in the media but not in the candidates’ declarations of interest was not included in the assessment”, Lobbycontrol criticized. Parliament had thus limited itself in its work.

Members of the JURI Committee were also dissatisfied with the procedure. The designated Commissioners would only have to provide information “which could be assumed to lead to a conflict of interest”, said SPD MEP René Repasi. This would allow them to assess for themselves whether conflicts of interest exist. “But that is actually the task of Parliament.” Repasi is therefore calling for a reform of the scrutiny process.

Green MEP Sergey Lagodinsky left the chamber on Thursday in protest together with other Green and Left MEPs. The procedure was driven by the fear of the major parties of losing their candidates, said Lagodinsky. “Instead of asking for concrete information, the committee froze in this fear and pushed the examination through hastily and ill-informed with fearful majorities.”

At the end of the meeting, the chairman of the JURI Committee, Renew politician İlhan Küçük, also found that a review of the procedure was necessary.

I wish you a smooth start to the weekend.

The vote in the Council on the countervailing duties on electric cars manufactured in China reflects the interests of manufacturers and suppliers across the 27 EU member states. The main camps of manufacturers’ consortia are now concentrated in only two member states: France is home to Renault as well as Stellantis with brands such as Alfa Romeo, Peugeot, Citroën, Opel, and Fiat. In Germany, VW, BMW and Mercedes have their headquarters.

The corporate headquarters in France and Germany are differently affected by the tariffs, which is why they are not pulling in the same direction: Paris voted in favor of the tariffs, Berlin against – many EU partners reacted to Olaf Scholz’s decision with incomprehension.

The interests of the French: Stellantis and Renault mainly offer vehicles in the volume segment. They have virtually no presence in the Chinese market. However, they have been feeling the effects of the EV offensive by Chinese manufacturers in Europe for around two years. They chose France first to gain market share by offering competitive prices. As early as 2023, Group CEOs Luca de Meo (Renault) and Carlos Tavares (Stellantis) submitted a request to the EU Commission via the Élysée Palace to impose countervailing duties on EVs produced in China.

The countervailing duties, due to take effect at the end of October, fit the manufacturers’ strategy: The additional tariffs on Chinese-made EVs will increase the price of imports from Asia and improve the sales opportunities of French and Italian manufacturers in the domestic market. Ten member states, representing 46 percent of the EU population, voted in favor of the countervailing duties in the Council. Among them, only France and Italy have a car industry. Countries such as the Netherlands, Estonia, Latvia, Lithuania and Poland have no economic interests of their own in the matter.

The fact that many Member States are no longer affected by upheavals in the automotive industry is also evident from the many countries that abstained in the vote: twelve Member States, representing a third of the EU population. These include Sweden, Finland, Romania, Spain, Croatia and the Czech Republic. However, Spain, Belgium, Croatia, Romania and the Czech Republic have at least assembly plants and supplier factories.

Only five countries voted against the countervailing duties. They represent just under a quarter of the EU population. However, of these countries, only Germany has a large population, namely 19 percent. The other countries that opposed the duties were Hungary, Slovakia, Slovenia and Malta. Hungary and Slovakia may also have voted against the tariffs because they are pro-China. Slovenian Economics Minister Matjaž Han said: “We took the same position as Germany because Germany is our main partner in the automotive industry.”

The interests of the German manufacturers are fundamentally different from those of the French manufacturers: BMW, Mercedes, and the VW brands Audi and Porsche are premium brands and do not compete with Chinese EVs. The CEOs of German companies are expressly opposed to the countervailing duties. For instance, BMW CEO Oliver Zipse recently rejected the tariffs quite brashly in a meeting between car executives and Trade Commissioner Valdis Dombrovskis. He stressed that German manufacturers are competitive and do not need Brussels’ help.

Unlike the French industry, which has no presence in China, German premium manufacturers focus on the Chinese market both in terms of sales and production: On the one hand, they fear that China will retaliate by imposing tariffs on large-volume German-made gasoline cars. Initial signs already point to this. For years, German manufacturers have been making a fortune selling luxury vehicles in China. The profits from this business have formed a significant portion of company profits over the years and have helped compensate for lower returns in the European business.

BMW, Mercedes and Audi have built up their own production capacities in China. In 2023, all three manufacturers sold roughly the same number of luxury cars in China at over 700,000 units each. Only Porsche does not operate any plants of its own in China, having sold just under 80,000 vehicles on the Chinese market in 2023. Retaliatory tariffs on gasoline cars would hurt the bottom lines of BMW, Mercedes and VW. As it is, their biggest concern is that consumption in China is collapsing and sales of premium vehicles are declining drastically.

Moreover, the countervailing duties on EVs produced in China directly affect BMW, VW and Mercedes. In fact, in two ways: Additional countervailing duties will be levied on EVs that they produce in China as well as those imported into the EU. The regular duty rate is already 10 percent. In some cases, the rates of the additional countervailing duties are higher than those of Tesla (7 percent) and Chinese manufacturers such as BYD (17 percent):

BMW is manufacturing two EV models for export to the EU in China: the Mini Cooper SE and the iX1. BMW originally planned to manufacture the e-Mini exclusively in China. Now it will built in the UK after all. Mercedes-Benz has founded a joint venture with the Chinese company Geely to produce the Smart (EV). Two models are currently being manufactured in China and exported to 17 EU member states. A third model has been announced. VW manufactures the Cupra Tavascan (EV) at a Chinese plant. The Tavascan is exported to the EU.

BMW, VW and Mercedes remain silent about the number of units exported to Europe. In terms of total registrations in the EU, German EVs manufactured in China do not play a significant role. However, the companies had firmly included them in their plans to meet the EU fleet-wide emissions. EVs imported from China, which count as zero grams in the CO2 emissions balance, were supposed to reduce the fleet limits and help avoid fines.

This strategy might fail: If EV sales in the EU fall due to the higher tariffs, the fleet-wide emissions of companies will worsen. This means that BMW, Mercedes and VW will have a harder time complying with the stricter fleet limits in 2025. The fines for 2025 could be even higher than recently estimated (15 billion euros).

Undeterred by the cancellation of the Ramstein meeting, which was scheduled for Saturday, Ukrainian President Volodymyr Zelenskyi traveled through Western Europe on Thursday. At meetings with heads of government in London, Paris and in the evening in Rome, as well as this Friday in Berlin, the Ukrainian President is promoting his plan for victory. In London, he also met with NATO Secretary General Mark Rutte.

Zelenskyi wants permission from the UK and France to use the Storm Shadow (UK) and Scalp (France) cruise missiles supplied to Ukraine against targets on Russian territory. However, a spokesman for British Prime Minister Keir Starmer said on Thursday: “There has been no change in the British government’s position on the use of long-range missiles.”

The Ukrainian president is hoping to gain territory in order to strengthen his negotiating position. The Italian newspaper “Corriere della Sera” had speculated that Zelenskyi was prepared to agree to a ceasefire if Ukraine received security guarantees from the USA in return and could join the EU quickly. However, the Ukrainian Foreign Ministry sharply rejected the “manipulative representations of some foreign media” on Thursday evening.

One basis for the Italian interpretation was a tweet by Zelenskyi on Wednesday evening, in which he wrote: “The situation on the battlefield offers the opportunity to end the war by 2025 at the latest through decisive action.” Zelenskyi also wrote that a NATO invitation to Ukraine and future membership would be “a real step towards peace”. Without the certainty that Ukraine would never be subjugated by Russia, peace would not be possible.

With regard to the peace summit, which is to take place this year, Zelenskyi continued: “In October, November and December we have a real chance to move things in the direction of peace and lasting stability.”

Zelenskyi knows that his country’s resilience ultimately depends on support from abroad. And there are several foreseeable risks. Even if Donald Trump, who maintained direct contact with Russia’s ruler Vladimir Putin after his term in office, is not elected as US president, the level of aid from Washington is uncertain.

Populists in the EU pose a further risk. They question aid for Kyiv, particularly during election campaigns; in Germany, such voices can be found in both the AfD and the Sahra Wagenknecht (BSW) alliance, which considers itself to be on the left. The envy debates they are stirring up are bearing fruit. The total amount of aid for Ukraine is rather small compared to the amount spent on other crises. According to the Kiel Institute for the World Economy, the total EU funds up to and including August 2024 amounted to just under one-eighth of the funds to combat the economic impact of Covid.

The main problem is the dependency that exists between European and US support, as the US alone provides more than half of the military aid, explains Pietro Bomprezzi when asked. He heads the Ukraine Support Tracker project at the Kiel Institute. And he points to another problem: “The military-industrial expansion in Europe is currently slower than that in Russia.”

Putin’s government is planning to spend a third of the 2025 state budget on the military and the defense industry – 32.4 percent of all spending, three percentage points more than this year. Despite 14 sanctions packages, the regime has stabilized the economy, at least for the foreseeable future. During a visit to Berlin this week, Lev Gudkov, one of Russia’s most experienced and respected sociologists, summarized the situation in his home country as follows: “There is no way Russia will end the war due to economic exhaustion.”

Oct. 14, 2024

21st meeting of the EU-Kazakhstan Cooperation Council

Topics: Discussion of the status and next steps of the agreement on enhanced partnership and cooperation between the EU and Kazakhstan; exchange of views on political, economic and trade policy issues. Info

Oct. 14, 2024; 9:30 a.m.

Council of the EU: Environment

Topics: Approval of the conclusions on the preparation of the 29th Conference of the Parties (COP 29) to the United Nations Framework Convention on Climate Change; conclusions on the Convention on Biological Diversity; exchange of views on the implementation of the EU chemicals strategy. Draft agenda

Oct. 14, 2024; 10 a.m.

Council of the EU: Foreign Affairs

Topics: Exchange of views on Russian aggression against Ukraine; exchange of views on the situation in the Middle East. Draft agenda

Oct. 14, 2024; 3-7 p.m.

Meeting of the Development Committee (DEVE)

Topics: Exchange of views on the humanitarian situation in Sudan; Exchange of views on the humanitarian situation in Lebanon; Exchange of views on the Global Gateway Strategy. Draft agenda

Oct. 14, 2024; 3-7 p.m.

Meeting of the Committee on Agriculture and Rural Development (AGRI)

Topics: Public hearing on the Strategic Dialogue on the future of EU agriculture. Draft agenda

Oct. 14, 2024; 3-7 p.m.

Meeting of the Budget Committee (BUDG)

Topics: Vote on the general budget of the European Union for the financial year 2025; vote on the mobilization of the European Globalization Adjustment Fund for the benefit of redundant workers. Draft agenda

Oct. 14, 2024; 3-6:30 p.m.

Meeting of the International Trade Committee (INTA)

Topics: Vote on the establishment of the cooperation mechanism for Ukraine loans and the provision of extraordinary macro-financial assistance for Ukraine; discussions on financial assistance for various countries. Draft agenda

Oct. 14, 2024; 3-6:30 p.m.

Meeting of the Employment and Social Affairs Committee (EMPL)

Topics: Discussion with the Executive Directors of the agencies within the EMPL Committee’s remit. Draft agenda

Oct. 14, 2024; 3-6:30 p.m.

Meeting of the Committee for Transport and Tourism (TRAN)

Topics: Explanation of the priorities of the Hungarian Presidency; vote on the implementation of the Single European Sky (recast). Draft agenda

Oct. 14, 2024; 3-5:30 p.m.

Meeting of the Committee on Economic and Monetary Affairs (ECON)

Topics: Hearing with José Manuel Campa (Chairman of the European Banking Authority); Hearing with Petra Hielkema (Chairwoman of the European Insurance and Occupational Pensions Authority); Draft report on faster and more secure procedures for the relief of excess withholding taxes. Draft agenda

Oct. 14, 2024; 5-6:30 p.m.

Meeting of the Committee on Foreign Affairs (AFET)

Topics: Exchange of views on Tunisia; debriefing of the Jordanian election observation mission; report on the implementation of the Common Foreign and Security Policy. Draft agenda

Oct. 15, 2024; 9:30 a.m.

Council of the EU: Transport, Telecommunications and Energy

Topics: Exchange of views on the contribution of the energy sector to the competitiveness of the

European Union (follow-up to the recommendations of the Draghi report); exchange of views on the divergence of wholesale electricity prices; presentation by the Commission on the report on the state of the Energy Union and the follow-up to the implementation of the REPowerEU plan. Draft agenda

Oct. 15, 2024, 10 a.m.

Council of the EU: General Affairs

Topics: Exchange of ideas in preparation for the European Council meeting on October 17/18, 2024; status of EU-Switzerland relations; approval of the European Semester 2024 (integrated country-specific recommendations). Draft agenda

Oct. 16, 2024

Summit meeting between the EU and the Gulf Cooperation Council

Topics: The EU leaders and the leaders of the Gulf Cooperation Council meet for consultations. Info

Oct. 17-18, 2024

European Council

Topics: Ukraine; Middle East; Competitiveness. Draft agenda

Oct. 17-18, 2024

Informal ministerial meeting on trade

Topics: Exchange of views on the European Union’s trade relations with the ASEAN countries and on trade relations between the EU and China; exchange of views on the future direction of the EU’s investment protection policy. Info

Oct. 17, 2024; 10:45 a.m.-1 p.m.

Meeting of the Human Rights Committee (DROI)

Topics: Debate on the International Criminal Court (ICC) and EU policy on international humanitarian law and the fight against impunity; debate with Sirpa Rautio (Director of the European Union Agency for Fundamental Rights); Annual Report 2024 on human rights and democracy in the world and the European Union’s policy in this area. Draft agenda

The heads of the political groups in the European Parliament, Conference of Presidents (CoP), have decided on the timetable for the hearings of the Commissioners-designate in the committees. The hearings will take place between Nov. 4-12.

According to information from Table.Briefings, a majority from the EPP, ECR and PfE decided on the timetable – to the annoyance of the Social Democrats. The S&D had previously wanted to ensure that Executive Vice-President Raffaele Fitto (ECR) would have his turn at the very end. The calculation was probably to reject party colleague Giorgia Melonis without the EPP being able to reject a Socialist Executive Vice-President in return. The Christian Democrats and right-wingers have now ensured that Competition Commissioner Teresa Ribera (S&D) will be heard after Fitto, presumably in order to block Ribera in the event of Fitto’s rejection.

Parliament President Roberta Metsola and the heads of the parliamentary groups also agreed on the written list of questions that the candidates must answer by Oct. 22.

On Thursday, the EU Parliament’s Legal Affairs Committee also concluded its examination of possible conflicts of interest of the Commissioner candidates. “None of the candidates proposed by the member states were found to have a financial conflict of interest”, said René Repasi, member of the JURI Committee. The first step in the examination of the future Commissioners has thus been taken.

However, there had been “findings” for three candidates that could be forwarded to the hearing committees. He did not provide any details. luk

The controversial German border controls could remain in place for longer than initially planned. Minister Nancy Faeser hinted at this at a meeting with her EU counterparts in Luxembourg. Faeser said that border controls in Germany would have to remain in place until European solutions were found to better protect the EU’s external borders.

So far, the German government has only notified the EU Commission for six months. Controls at all German internal borders are therefore set to end on March 15, 2025. However, the effective protection of Europe’s external borders is likely to take considerably longer. Faeser urged that the necessary measures be taken sooner than planned.

“We want to further reduce irregular migration, stop smugglers, but also put a stop to criminals and recognize Islamists at an early stage”, said the SPD politician on the sidelines of the meeting in Luxembourg. Other neighboring countries had also reintroduced border controls. Sweden recently notified an extension until May 2025.

Faeser also advocated new deportation rules. The return directive urgently needs to be revised because it often does not work in practice, she said. This also applies to refoulement at the borders. This has been a priority for the German government since the terrorist attack in Solingen.

Other EU states also spoke out in favor of facilitating deportations. A consensus is emerging from the talks, it was reported in Luxembourg. On the initiative of Austria and the Netherlands, 17 Schengen countries have called on the EU Commission to revise the 2008 Return Directive. Germany also recently joined in.

Another topic was “innovative solutions” for so-called return centers (“hubs”) in third countries. Hungary and Italy had spoken out in favor of this. Faeser said that a partner state was needed for such plans. She considers this to be the “most difficult point”. Italy is planning such a center with Albania. Closed asylum camps are to be created there.

Migration is also on the agenda at next week’s EU summit. A draft of the summit conclusions calls for “decisive action at all levels” to expand and accelerate returns. ebo

At their next meeting on Oct. 21, the EU agriculture ministers want to unanimously adopt a declaration on how they envisage the next reform of the Common Agricultural Policy (CAP). Today, the preparatory body, the Special Committee on Agriculture (SCA), is negotiating this for the second time. A current draft of the declaration, which is available to Table.Briefings, provides for a commitment to the CAP as a separate item in the EU budget. It is the appropriate instrument for the distribution of agricultural subsidies, it says.

It therefore emphatically calls for “the retention of a separate and independent CAP with two pillars“. If the Agriculture Council adopts the text in this way, it would implicitly oppose the possible plans for a reform of the EU budget that have recently been leaked from the EU Commission. According to media reports, part of the consideration is to abolish agricultural subsidies in their current form. Instead, the majority of the budget for specific reform plans would flow to the member states as a “subsidy” to the national budget.

With regard to the future use of EU agricultural funds, the draft takes a similar line to the Strategy Dialogue on Agriculture: There needs to be an income support component, as well as incentives for environmental and climate services. The paper also calls for support for small farms – unlike the strategy dialog, however, it does not call for direct payments to be tied to the neediness of the farms.

It is also about more flexibility for companies and the member states. National strategy plans should be approved more quickly and with fewer bureaucratic hurdles, and it should be easier to make adjustments. The EU Court of Auditors recently called for the opposite: more effective monitoring to ensure that the plans are in line with climate and environmental targets.

While the draft emphasizes the growing importance of crisis instruments in the CAP, it remains unclear what form these should take. This is probably partly due to differences of opinion between the member states. For example, between financially strong countries, which can rely on national crisis funds, and less financially strong countries, which see this as a distortion of the internal market and would like to see strict European state aid rules.

Accordingly, the document states that a crisis framework must offer flexibility, but must not have a discriminatory effect. How both can be combined is not explained. It also states that the crisis reserve must be “better” designed. What this means, however, also remains open. jd

The EU Parliament and Council of Ministers have started work on the European Commission’s proposal to postpone the EU rules for deforestation-free supply chains (EUDR) by six months. According to diplomatic circles, the proposal met with broad approval at an initial discussion between EU ambassadors on Wednesday. The ambassadors could vote by the end of the month – possibly as early as Oct. 23.

Meanwhile, according to parliamentary sources, the coordinators in the responsible ENVI committee have agreed to request the use of the urgency procedure. This means that the plenary will vote directly instead of the responsible committee first. They want to submit the request after the ambassadors have voted. If it accepts the fast-track procedure, Parliament could vote on the proposal at one of the two plenary sessions in November.

The Council and Parliament can skip the trilogue negotiations if they both support the Commission proposal without substantial changes. The previous start date for the EUDR rules was Dec. 30, 2024, by which time the postponement should be finalized. jd/luk

In view of the high national debt, France’s new center-right government led by Prime Minister Michel Barnier has launched an austerity budget. In the coming year, €60 billion are to be made good through savings and additional revenue, as the government explained after the cabinet meeting. Two-thirds of the billion euros are to be achieved through spending cuts and one-third through tax increases aimed at companies with high turnover and high-income households.

The EU Commission is pursuing deficit proceedings against France due to excessive new debt. France must submit a consolidation plan to Brussels by the end of October. France expects a budget deficit of 6.1 percent this year, which is to be reduced to five percent in 2025 and brought back below the European limit of three percent in 2029.

The austerity budget has met with resistance in parliament. Even before it was presented, there was criticism from the left-wing camp and the right-wing nationalists. There are also reservations in the ranks of the government, whose members are unhappy with the budget cuts. Criticism also came from the High Council for Finance, which examined the government’s plans for their sustainability. The underlying growth forecasts were too optimistic, according to the Council.

As the government does not have its own majority in parliament, it may only be able to get the budget through with major changes or push through its version over the heads of MPs using a special article of the constitution. Shortly after taking office, the budget negotiations will become a test of strength for the government. Protests on the streets cannot be ruled out either. dpa

The former Soviet republic of Moldova, which is striving to join the EU, can hope for new aid from Brussels amounting to €1.8 billion. EU Commission President Ursula von der Leyen said at a meeting with Moldova’s head of state Maia Sandu ahead of the presidential election and referendum on Oct. 20 that the aim was to invest in jobs, growth, services and infrastructure.

For example, new hospitals and the road link from Moldova’s capital Chișinău to the Ukrainian port city of Odessa. The planned support package has the potential to double the size of the country’s economy within a decade, said von der Leyen.

The plan for the new EU aid must still be approved by the member states and the European Parliament. It is also intended as an incentive for the people in the EU accession candidate country between Ukraine and EU member Romania to continue to support the current government’s pro-European course.

Moldova, which has a population of around 2.5 million, is divided between pro-European and pro-Russian forces. On Oct. 20, a referendum will be held at the same time as the presidential election to decide whether EU accession should be enshrined as a goal in the constitution. dpa

Four months after the European elections, the European far-right parties are still on the upswing. In the Austrian parliamentary elections at the end of September, the FPÖ (PfE) became the strongest party, while far-right parties could finish in second place in the Lithuanian and Bulgarian parliamentary elections this October. The three far-right parties are also making further gains at EU level. In the base scenario of the current seat projection, they would achieve a total of 196 seats. That is nine more than in the European elections in June and ten more than in the most recent projection in August.

This upswing is mainly due to the “Patriots for Europe”, the largest of the three far-right groups. The PfE not only made slight gains in Austria, but also in several other member states. They are also benefiting from the first parliamentary group change of the new legislative period: At the beginning of October, it was joined by two previously non-attached MEPs from the Polish Konfederacja. In total, the PfE now has 96 seats (+8 compared to August), a new all-time high.

The two other far-right groups – the ECR with the Polish PiS and the Italian Fratelli d’Italia and the “Europe of Sovereign Nations” (ESN) group with the German AfD – can only make slight gains in each case. In the projection, the ECR has 74 seats (+1), the ESN 26 (+1).

The EPP, on the other hand, has suffered losses: After making slight gains in the August projection, it has now fallen slightly below its result in the European elections in June (186/-5). However, most of these losses are only small fluctuations, often within the margin of error of the polls, which only happen to point in the same direction. There is also a clear counter-trend in Hungary, where the Tisza party led by shooting star Péter Magyar, which joined the EPP group after the European elections, is making strong gains and is now only just behind Viktor Orbán’s Fidesz (PfE) in some polls.

However, Tisza’s gains are largely at the expense of other Hungarian opposition parties – such as the social democratic DK. The past few weeks have also been rather mixed for the European Social Democrats: While they made slight gains in Germany and Greece, they ended their brief summer highs in Italy and Spain. Overall, the social democratic S&D group has 136 seats, one less than in the last projection.

The liberal Renew Group (79 seats/+2) is in a slightly better position. It is benefiting above all from developments in Italy, where the alliance of the two parties IV and +Europa (which ran in the European elections under the name “Stati Uniti d’Europa”) would now narrowly overcome the national four-percent hurdle. The Liberals, on the other hand, are in trouble in Bulgaria, where their member party DPS split into two competing lists shortly before the national parliamentary elections.

As in 2014 and 2019, the European Greens are suffering from a European election hangover: after making significant gains shortly before the election, they have slumped again in the polls after the election. They are currently struggling in Germany and Denmark, among others; they also fell slightly short of expectations in the Austrian elections. Overall, the Greens/EFA group still has 41 seats (-4), falling behind the Left Group (44 seats/±0).

The latter has made gains in the Netherlands, among other countries, while its Greek member party Syriza is plagued by internal power struggles. The recent split in the European Left Party has no impact on the projection: the old European Left and the new European Left Alliance continue to form a joint parliamentary group.

The non-attached parties have slightly fewer seats than in August (29/-2), mainly due to the PfE accession of Konfederacja. Finally, there were few changes among the “other” parties – i.e. parties that are not represented in the European Parliament and cannot be clearly assigned to a political group (9 seats/±0).

As there are no pan-European election polls, the seat projection is based on aggregated national polls and election results from all member states. In the baseline scenario, all national parties are assigned to their current parliamentary group (or the parliamentary group of their European umbrella party); parties without a clear assignment are shown as “other”.

The dynamic scenario assigns all “other” parties to a parliamentary group that they could plausibly join and also takes into account possible future changes of parliamentary group by parties already represented in parliament. Currently, however, the “other” seats would be so widely distributed across the parliamentary groups that the two scenarios hardly differ. A more detailed breakdown of the results as well as information on the data basis and methodology of the projection can be found on the blog “The (European) Federalist“.