Following Russia’s attack on Ukraine, Western sanctions are beginning to take effect. Coupled with the shock of the Russian invasion, the punitive measures lead to an exodus of Western investors. The sanctions mean “a fundamental reassessment of economic and trade relations with Russia in light of Vladimir Putin’s systematic aggression,” said VDMA CEO Thilo Brodtmann. Till Hoppe summarizes the current sentiment.

In Russia, on the other hand, people are emphatically unimpressed. “But nothing has happened yet!” – was the response of Putin’s press spokesman to the question of whether measures were planned to support citizens and the economy. Russian newspapers say that the sanctions have had no impact on people’s lives. Eugenie Ankowitsch took a look at the Russian media. In addition to all kinds of appeasement, she has also encountered concerned voices.

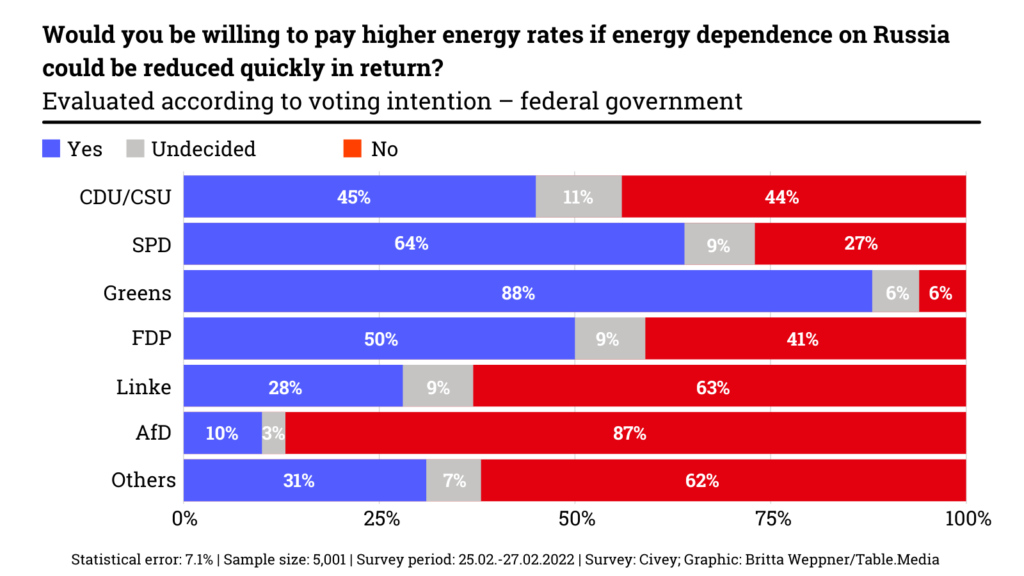

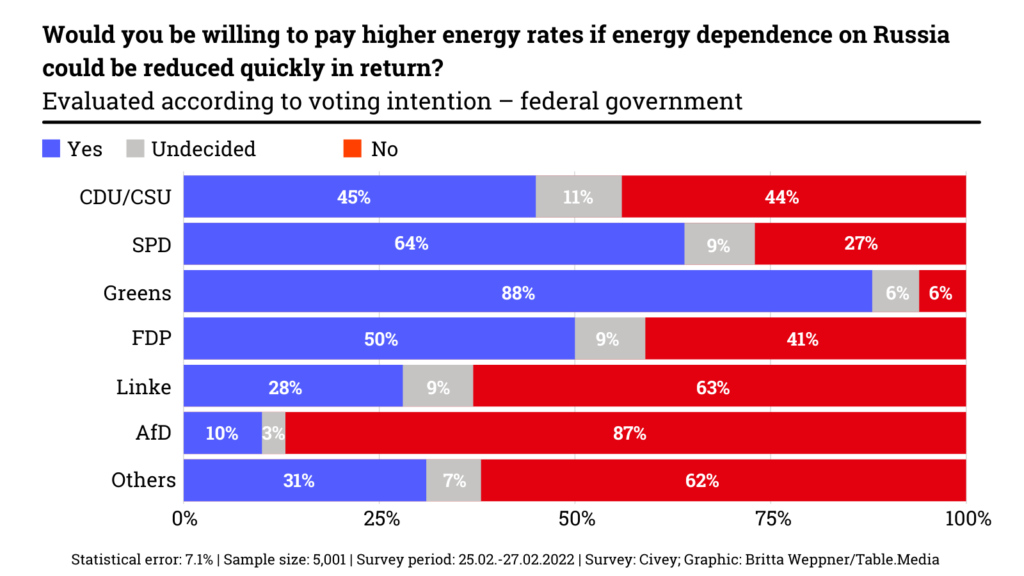

In Germany, a multi-stage procedure is to ensure that gas storage facilities reach a specified minimum level by certain dates. The German government wants to lay this down in a law on national gas reserves. Manuel Berkel explains the background to the procedure and lends a platform to experts who warn of a “subsidy war” over gas – and of a scenario that has barely been discussed so far: what to do if Russia floods the markets with gas?

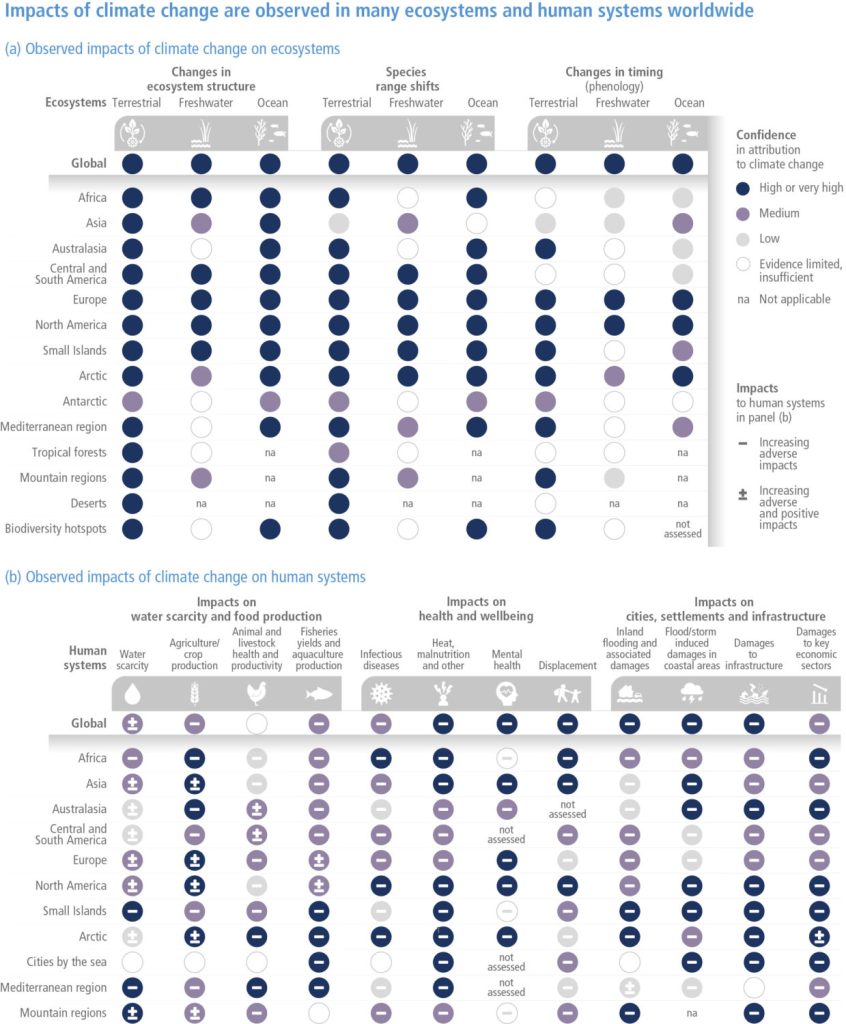

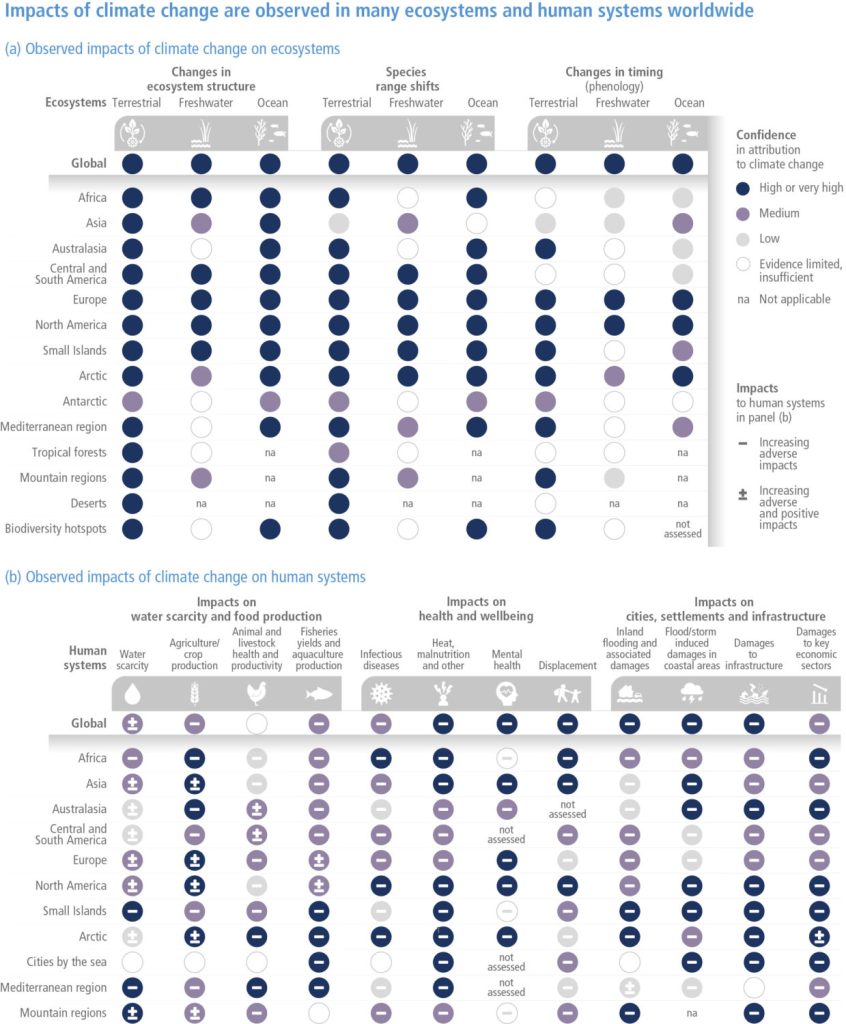

There is also gloomy news from the Intergovernmental Panel on Climate Change. In the event of global warming of 2 degrees, a third of the population in southern Europe could suffer from water shortages – this is one of the forecasts in the new IPCC report. This latest report mainly focuses on what options there are for adapting to climate change – for example, to secure the supply of food. Lukas Scheid summarizes the most important findings and initial reactions.

Valdis Dombrovskis was clear: “If Russia does not end its aggression, it will become a pariah state,” the EU Commission Vice President responsible for trade said yesterday. He said the EU and its partners are prepared to impose even tougher sanctions if necessary – even if that means less growth and higher inflation in the EU as well. “This is the price to pay to defend democracy and peace,” the Latvian told the European Parliament’s trade committee.

The Western sanctions package, in particular the massive restrictions on Russian banks and export restrictions, is largely strangling the Russian business of European companies. Danish logistics giant Maersk announced yesterday that it was considering suspending all container bookings to and from Russia in light of the sanctions imposed. This applies to freight transport by sea as well as overland.

With the EU also closing its airspace to aircraft from Russia, and Russia returning the favor yesterday, air cargo traffic has come to a standstill. Loopholes are also shrinking: Switzerland yesterday joined some of the EU punitive measures after prolonged hesitation, closing its airspace to Russian aircraft and imposing sanctions on President Vladimir Putin, Foreign Minister Sergei Lavrov, and hundreds of members of parliament and officials. Dombrovskis praised the decision by the traditionally neutral country as a “big step”.

Russia is trying to limit the damage. Among other things, Putin ordered far-reaching capital controls, according to which Russian citizens are no longer allowed to transfer money to foreign accounts.

But sanctions and public outrage over Russia’s war of aggression are leading to an exodus of Western investors. After BP, the Norwegian energy company Equinor also parted ways with its joint ventures in Russia. In the evening, Shell also announced it was ending its cooperation with Gazprom, which includes financing the Nord Stream 2 Baltic Sea pipeline. The European soccer association UEFA terminated its sponsorship agreements with the Russian energy giant.

The sanctions against a number of Russian banks make it enormously difficult to do business with partners in Russia – “they effectively block Russian exports and imports,” Dombrovskis said. In addition, there are tightened export restrictions on dual-use and many high-tech goods, which affect the mechanical engineering and electronics industries, for example. The sanctions represent “a fundamental reassessment of economic and trade relations with Russia in light of Vladimir Putin’s systematic aggression,” said VDMA Executive Director Thilo Brodtmann.

According to Brodtmann, the new supply bans affected large parts of the industry, affecting exports worth several hundred million euros. The conditions of the sanctions and their effects now need to be analyzed in detail.

Specialized law firms are experiencing a rush of their clients right now. “Many companies are currently reconsidering their investments in Russia because it leaves them open to legal and political attack,” says Roland Stein, a partner at law firm Blomstein. Doing business with partners there is still possible in principle but difficult.

The EU export restrictions tightened last Friday severely narrow the scope. Goods that can be used for civilian and military purposes are now hardly allowed to be delivered to Russia, and financing and maintenance services are also prohibited. The exceptions are very narrow, Stein says. These include, for example, medical purposes or software updates.

In addition, the new rules prohibit the supply of numerous high-tech goods that are not on the dual-use list. For this purpose, a new Annex VII was added to the regulation, which lists semiconductors, sensors, and lasers, for example.

Upon approval by the national regulatory authority, some other dual-use technologies may be exported, such as when they serve joint space projects or marine safety. Supplies whose contracts were concluded before February 26 and which were notified to the authorities by May 1 can also be approved.

The European Union and the German government have responded to Russia’s invasion of Ukraine with various sanctions. Here you will find the sanctions imposed, as far as published in the Official Journal of the EU.

Legal regulation L40 (Decree 2022/236, Decision 2022/241)

Details

Legal regulation L42 I (Regulations 2022/259-263, Decisions 2022/264-267)

Details

Legal regulation L48 (Decision CFSP 2022/327)

Details

Legal regulation L49 (Regulation EU 2022/328)

Details

Legislation L50 (Decision CFSP 2022/329)

Details

Legislation L51 (Regulation EU 2022/330)

Details

Legislation L52 (Decision CFSP 2022/331)

Details

Legal regulation L53 (Implementing regulation 2022/332)

Details

Legislation L54 (Decision EU 2022/333)

Details

These sanctions are effective upon publication in the Official Journal of the European Union unless a different effective date is specified.

“But nothing has happened yet!” Russian Presidential Press Secretary Dmitry Peskov replied at his weekday press briefing on Monday when asked if measures were planned to support citizens and the economy. Shortly before, the EU had put the announced severe sanctions against the Russian Central Bank into force.

In response, the Russian central bank attempted to mitigate the ruble’s crash with a massive interest rate hike. The key interest rate rose from 9.5 to 20 percent. In addition, the central bank and the Ministry of Finance announced that domestic companies should sell 80 percent of their foreign currency earnings. It didn’t help. The dollar rose at times by almost 42 percent on Monday morning to a historic record high of 119 rubles. On Friday, one still had to pay around 84 rubles for a dollar. The Russian Central Bank also announced that the Moscow Stock Exchange would not open Monday “due to the current situation”. The derivatives market also remained closed.

However, the sanctions would initially not have a major impact on the daily lives of citizens. This is what the newspaper “Komsomolskaya Pravda” writes in an article on the most important issues related to Western sanctions. “Our country has been intimidated by these sanctions for several years now,” the author says. During this time, it has managed to create an alternative to the international financial infrastructure: namely, the Mir payment system (replacing VISA and MasterCard), the Financial Messaging System (replacing SWIFT), and the Speedy Payment System (replacing retail transactions through telephone transfers).

“Our country’s decoupling from SWIFT and VISA/MasterCard will have no impact on domestic transactions,” the statement continues. “You will be able to withdraw money from your card, pay in stores and transfer money to other people.”

Impulsiveness and panic are out of place, stressed Evgenia Lazareva, head of the project “For the rights of borrowers” of the All-Russian People’s Front (ONF) in the newspaper “Izvestia”. The Russian financial and economic system is self-sufficient. 2014 showed that exchange rates and stocks were strengthening again and that attempts to buy up foreign currency and give in to panic were damaging. Hasty decisions can lead to someone buying a currency at an inflated rate, which will lead to some losses in the future, warned FG-Finam analyst Andrey Maslov.

Other experts, however, expect the sanctions to have a major impact on consumers in Russia. If Russian banks are disconnected from SWIFT, they will have to choose between equipment for oil production or goods for people, according to an article in the Kremlin-critical newspaper Novaya Gazeta.

The companies would have to set priorities – “roughly speaking, decide what is more important: transactions for the purchase of industrial facilities for Russian industry and oil production or money for containers of women’s boots and children’s toys,” the statement added. It was foreseeable that companies would choose industrial equipment. For other products, this means less variety, higher prices, even if the goods are produced domestically, is his forecast.

In general, the freezing of central bank reserves seems to be making higher waves than Russia’s decoupling from SWIFT. The Russian government was taken by surprise, claims the renowned Russian economist Sergei Guriev, Chief Economist of the European Bank for Reconstruction and Development until 2019, in an interview with the independent Russian-language online portal “Meduza”.

But the decision on SWIFT was nevertheless an important symbolic signal. “Although from my point of view the sanctions against the central bank are much more painful than the shutdown of SWIFT, the shutdown itself shows that what was considered too scary yesterday is now being discussed and implemented,” he said.

In his opinion, the situation is more serious than in 2014 after the annexation of Crimea. Back then, there were reserves and the central bank knew what it could and could not do. While oil prices are high today, it is not clear whether Russian oil exporters will be able to sell that oil and transfer the dollars they get for it to Russia. It is a realistic scenario for Guriev that Russians will have to forcibly exchange their dollar savings into rubles at the rate set by the government.

This is what some Russians are apparently afraid of. In the Western media and on social networks, there are increasing reports of empty ATMs and vain attempts by people to withdraw foreign currencies such as dollars and euros. Russian mass media, however, are appeasing. Russian banks have indeed noticed an increased demand from the population for foreign currency transactions, the press services of the credit institutions admitted when asked by the Russian news agency TASS. According to the statistics of the Standard Bank, for example, the total number of cash transactions has increased by 41 percent in recent days compared with the previous week. However, the foreign currency stocks would be sufficient to allow currency exchange as usual.

At current prices, storing 700 terawatt-hours of gas would cost at least €70 billion for the entire EU – compared to €10 billion in previous years, Bruegel analyst Simone Tagliapietra wrote on Twitter.

In Germany, a multi-stage procedure is to take effect in the future in order to reach defined minimum gas storage levels by certain dates. From August onwards, the level will initially be 65 percent, and from October onwards it will be 80 percent, according to sources in the Federal Ministry for Economic Affairs and Climate Action (BMWK). After the peak in December, obligations are also to take effect to make the stored gas available to the market again. Levels of at least 40 percent are to be reached by February 1. On Monday, the law went to the departmental vote, it is to come into force on May 1.

The market participants will continue to fill the storage facilities as a matter of priority. If necessary, however, the market area manager, Trading Hub Europe GmbH, will in the future procure gas in several steps via tenders, so-called Strategic Storage Based Options (SSBO).

“If storage users do not use capacities booked by them, they are withdrawn from them and made available to the market area manager,” the sources added. “The latter either has them filled by market players by way of tendering SSBOs or buys gas itself to store it. The withdrawal mechanism is intended to prevent hoarding of capacity on the one hand and to stimulate filling of booked capacity on the other. The costs incurred by these instruments are passed on to network users.”

Storage obligations, however, only work well if they are coordinated across Europe, according to a new paper by Bruegel: “Otherwise, EU countries might outbid each other to refill their storages amid limited supplies.” Such a “subsidy war” would lead to higher prices for everyone, making gas suppliers richer without allowing significantly higher imports.

It is known that Germany coordinates with the Pentalateral Forum, i.e., Austria, Switzerland, France, and the Benelux countries, on issues of regulation and security of supply. More precise information on the coordination of gas reserves could not be obtained from the BMWK. The US is apparently not currently considered a priority source for additional LNG supplies. The talks of which he is aware are not aimed at America, but natural gas from the Arab region, said Economics Minister Robert Habeck (Greens) on the fringes of the Energy Ministers Council in Brussels.

In connection with Russia, Bruegel warned of a possible move by Gazprom that has received little attention to date. Whereas previously the only concern was a halt to deliveries under long-term contracts, the think tank analyzed the consequences of a possible resumption of spot deliveries, which the gas company had largely halted in recent months.

If Russia floods the markets with gas compared to the current level, prices could fall. For this reason, gas traders could hold back on purchases and filling storage facilities at the current high prices so as not to make losses later on.

“The EU should offer companies that store gas, especially in the most vulnerable EU states, financial guarantees against such a scenario,” Bruegel writes. Contracts for difference are conceivable in the event that prices fall below €70 per megawatt-hour again next winter. Such contracts for difference had also been brought into play by the EU Commission in the draft of its communication on energy prices. The final version was originally to be presented next Wednesday, but this was postponed at short notice.

In southern Europe, one-third of the population could suffer from water shortages in the event of global warming of 2 degrees. At 3 degrees, this risk would double. This is what it says in the second of a total of three sub-reports of the sixth assessment report of the Intergovernmental Panel on Climate Change (IPCC), which was presented on Monday.

For many cities in Western and Central Europe, the risk of water shortages is likely to increase sharply with 3 degrees of global warming. At the same time, the damage caused by seasonal extreme precipitation and river flooding threatens to double. The report’s authors forecast that coastal flood damage would increase at least tenfold by the end of the 21st century. With current adaptation measures, the scientists are certain, this could happen even sooner.

According to the Climate Action Tracker, the planet is heading for a warming of 2.5 to 2.9 degrees with the current global climate policy measures – not including announcements and target plans that have not yet been implemented. Such a temperature rise would also pose a huge threat to Europe’s food supply. Over the course of the 21st century, agricultural production could suffer significant losses that could not be offset even by additional capacity in northern Europe as a result of global warming, the IPCC authors write.

Short-term measures limiting global warming to close to 1.5 degrees would significantly reduce projected loss and damage, but they cannot completely eliminate it. For this reason, the second sub-report places particular focus on adaptation options.

Something can be done, says Hermann Lotze-Campen, head of the Climate Resilience Research Department at the Potsdam Institute for Climate Impact Research (PIK). “Effective protection of 30 to 50 percent of land and water areas can help not only stabilize important ecosystems, but also secure food supplies.” In addition, a diet that is as plant-based as possible can reduce competition for land and water and increase regional adaptation margins, the PIK researcher said.

According to the IPCC report, adaptation options in Europe include vegetation cover, changes in farming methods and crop and livestock species, and alternate planting. In addition, there is prophylactic agroecology and forest management to prevent forest fires and make forests more resilient to climatic changes. To prevent water shortages, water reuse, early warning systems and land use should also be optimized.

The summary for decision-makers published together with the IPCC report states that adaptation potentials have not yet been exhausted and could make a difference, especially in the Global South. The main issue here is appropriate climate finance. The vast majority of global climate finance has gone to mitigation. Only a small portion has gone to adaptation.

To this end, access to finance for the implementation of adaptation measures must be improved, says the IPCC. Public finance could leverage private sector adaptation finance by removing regulatory, cost and market barriers, for example, through public-private partnerships.

This is where the richest countries have a role to play, says Rixa Schwarz, head of the International Climate Policy team at Germanwatch. The G7 must ensure that the $100 billion per year for climate protection and climate adaptation that the industrialized countries have actually already pledged by 2020 are achieved this year. The funds for climate adaptation in this package would have to be “at least doubled”, Schwarz said.

She also hopes for more commitment from Germany. Not even the annual amount of €6 billion from 2025, which was still promised by former Chancellor Angela Merkel, has so far been secured in the medium-term financial planning. Germanwatch is therefore calling for an increase to at least €8 billion annually from the federal budget for climate protection and adaptation in the Global South.

On Monday, Federal Environment Minister Steffi Lemke (Greens) promptly promised that the federal government would consistently address climate adaptation. “With the immediate climate adaptation program, we are expanding and supplementing existing measures. In addition, we are working on permanent funding for climate adaptation.” Lemke did not name the scope of this funding. The Minister of State for Europe and Climate, Anna Lührmann, also emphasized that large industrialized countries must now move forward with climate adaptation and its financing and bring other countries along with them.

Jörn Birkmann, coordinating lead author of the report, also pointed out that policymakers should not wait until after extreme weather events, when the consequences of climate change are immediately noticeable, to talk about adaptation measures. Precautionary plans must be in place for such cases.

However, the IPCC authors also point out that loss and damage will increase as a result of climate change. If warming exceeds 1.5 degrees, some ecosystem-based adaptation measures would lose their effectiveness. Human and natural systems could reach their adaptation limits as a result. Particularly at risk: Warm-water coral reefs, coastal wetlands, rainforests, and polar and mountain ecosystems.

A total of 270 authors from 67 countries evaluated more than 34,000 scientific contributions for the second partial report. The first partial report was published in August 2021. The third partial report is to be published as early as the beginning of April and will identify options for mitigating climate change. The IPCC’s full Sixth Assessment Report is due to be published in September 2022.

An EU Parliament resolution scheduled for a vote this Tuesday push for Ukraine to join the EU. The text calls on the EU institutions to grant the country EU candidate status. In the meantime, the resolution says work should continue to integrate the Ukrainian market into the EU’s single market. The resolution has been made available to Deutsche Presse-Agentur. It has reportedly been agreed among the parliamentary groups, with the exception of the right-wing nationalist ID faction.

Ukrainian President Volodymyr Zelenskiy insists on his country’s EU accession in the face of Russian aggression. “We appeal to the EU for Ukraine’s immediate accession under a new special procedure,” Zelenskiy said on Monday.

“When President Zelenskiy asks for EU membership, he is asking for peace, freedom, and democracy for his country,” said the chairman of the EPP Group in the European Parliament, Manfred Weber (CSU). Membership is a lengthy process, but nevertheless, the signal is: “Ukraine belongs to the EU.”

The presidents of eight Eastern and Central European countries are also calling for Ukraine to be granted the status of a candidate country for EU membership immediately and to start accession negotiations. “We, the presidents of the EU member states Republic of Bulgaria, Czech Republic, Republic of Estonia, Republic of Latvia, Republic of Lithuania, Republic of Poland, Slovak Republic, and Republic of Slovenia strongly believe that Ukraine deserves an immediate EU accession perspective,” an open letter reads.

However, a spokesman for the European Commission dampened expectations for rapid accession. There is a process for accession negotiations to become an EU member, the spokesman said. The final decision rests with EU countries, not the Commission. Before countries can become EU members, they must transpose existing EU laws into national law and meet a number of criteria.

Foreign Minister Annalena Baerbock also expressed reservations about the country’s rapid accession to the EU. Everyone is aware that “EU accession is not something that can be accomplished in a few months,” the Green politician said on Monday after a meeting with her Slovenian colleague Anže Logar in Berlin. Instead, such a project would entail an intensive and far-reaching transformation process. At the same time, Baerbock stressed, “Ukraine is part of the house of Europe.”

Ukrainian President Volodymyr Zelenskiy says he has signed a formal request for his country to join the European Union. According to high-ranking EU circles, this could be an issue for the heads of state and government at an unofficial summit in March. EU Commission President Ursula von der Leyen had also spoken out in favor of Ukraine’s accession on Sunday. dpa/rtr

EU energy ministers discussed how to strengthen Europe’s security of supply at an extraordinary meeting in Brussels on Monday. The focus was also on Ukraine’s special needs since the Russian attack: “We have come together to provide a solid and solidarity-based response,” said French Council President and Environment Minister Barbara Pompili in the evening.

Since last Thursday, Ukraine’s power grid has no longer been connected to the Russian grid and is only functioning in “isolation mode”, i.e., virtually as an island. This increases the risk of a blackout. Ukraine would like to connect its grid to that of the EU, which had been planned for some time anyway and for which a test was running on the day of the Russian invasion. Ukraine should have been reconnected to the Russian network after the test, but this will no longer happen after the attack.

Ukraine has asked the EU for an emergency connection. The connection of the Ukrainian power grid to that of neighboring EU countries must now be accelerated, Pompili said. But technical problems would have to be solved for this to happen. The Commission, the member states, and the network agency Entso-e were intensifying the relevant work.

EU Energy Commissioner Kadri Simson pointed out that Moldova’s power grid also operates in isolation mode and needs to be connected to the European grid together with Ukraine. There is a strong political will to bring forward the connection scheduled for next year. This will be possible within “a few days to a few weeks”. German Economics Minister Robert Habeck welcomed the plan, saying, “Of course we support Ukraine getting a common power grid with Europe more quickly.” However, it must be ensured that the Ukrainian grid is secure according to European standards and robust against cyber attacks.

Also discussed at the meeting were fuel supplies and the safety of nuclear power plants in Ukraine. The war against Ukraine is not only a turning point for the security architecture in Europe but also for the energy system, said Commissioner Simson. Also discussed at the meeting were the issue of future strategic gas reserves, energy price trends, and the Green Deal.

Barbara Pompili stressed that the French Presidency of the Council of the EU wants to press ahead with work on the Fit for 55 legislative package regardless of the current crisis: “We clearly want to intensify negotiations on the package,” the minister said. Renewable energies and energy efficiency are the best way to reduce Europe’s energy dependence. Currently, there is no threat to security of supply. But for the next winter season, diversification is needed, including more LNG terminals and new supply contracts.

“We want to prepare for all eventualities,” she said, also with a view to rising energy prices. Member states had therefore asked the EU Commission to update its planned communication on energy prices. The Commission wanted to present its communication already this Wednesday, an addition to the so-called toolbox from last year. In view of the crisis, there is a need for exceptional instruments that member states can make use of to protect consumers, Pompili said.

The focus will be even more clearly on how the EU can strengthen its security of supply, in addition to questions of price development and strategic gas reserves, according to Commission sources. The Commission intends to adopt the communication, possibly with a slight delay, at its meeting next Tuesday in Strasbourg. sti

An alleged attack on the satellite network operator Viasat also has consequences for German wind farms. The control and monitoring of wind turbines that communicate via the KA-SAT satellite system of the operator Viasat is currently not functioning in this way.

“Since Thursday, a total of 5,800 wind turbines in Central Europe with a total output of 11 gigawatts have been affected by the connection failure,” wind turbine operator Enercon announced. There was no risk to the turbines as they continued to operate on “auto mode” and can basically regulate themselves autonomously and independently.

Although maintenance is limited, “no effects on power grid stability are currently expected due to redundant communication capabilities of the responsible grid operators,” the German Federal Office for Information Security (BSI) explained. Together with the Federal Network Agency, the authority is responsible for the cyber security of energy systems.

The operator of the KA-SAT system Viasat informed Europe.Table that there was a partial network outage. This affected broadband customers in Ukraine and the rest of Europe. “Our investigation is still ongoing, currently we believe the cause is a cyber incident.”

The US-based company had called in law enforcement and government agencies, and an external service provider was also involved. The failure of the KA-SAT system coincides with the attack on Ukraine. In total, some 30,000 satellite terminals are said to have failed. fst

Following the EU sanctions on refinery technology, importers expect higher prices even in the event of a possible total loss of Russian oil products, but no bottlenecks. Russia exports eight to 10 million tons of petroleum products to Germany annually, mainly diesel and, to a lesser extent, heating oil, Hans Wenck, managing director of the Foreign Trade Association for Mineral Oil and Energy, told Europe.Table. “Balancing these volumes is not straightforward. What will not happen, however, is that service stations run dry,” Wenck said.

However, it is still unclear whether, when, and how much Russian exports will fall. According to a spokeswoman on Friday, the EU Commission assumes that the sanctions against Russian refineries will affect the economy there but will have no impact on Europe’s consumers.

On Saturday night, the EU published the implementing rules for its new energy sanctions. There will be no immediate embargo on crude oil and oil products. Unlike after the annexation of Crimea in 2014, no further technologies for particularly challenging explorations of new oil and gas fields are affected either.

Instead, the current sanctions relate solely to equipment for oil refineries. The community of states would like to ensure that Russian manufacturers of oil products are no longer able to meet the high technical requirements of the Euro 6 standard. Imports into the European Union would then no longer be possible.

The sanctions will have a significant effect on exports to the EU, the Commission spokeswoman said. In 2019, Russia earned €24 billion from exporting oil products to the EU. However, it remains to be seen for the time being when the indirect import restrictions will make themselves felt.

According to the Foreign Trade Association, there is free refinery capacity for low-sulfur diesel fuels, primarily in India. In Germany, too, refineries are not yet operating at full capacity. On their own, however, domestic producers would not be able to cover a complete shortfall of Russian middle distillates, Wenck said. The US, too, is currently finding it difficult to supply this type of oil product; it is itself an importer.

Nevertheless, the association representative continues to expect sufficient supplies from alternative suppliers on the world markets: “With the high margins in Western Europe, enough will arrive here. For middle distillates, however, there will be price increases.”

The En2X fuel association said it would not participate in price speculation but generally referred to potentially higher transportation costs for sea routes. ber

The EU and China will hold a summit on April 1, according to EU Commission Vice President Valdis Dombrovskis. The goal is to ease growing tensions between the two sides, he said Monday.

“We know that our relations with China are in a complicated phase,” he told the EU Parliament’s trade committee. He said it was necessary to look at the highest political level “to what extent we can improve and align our cooperation.”

EU sources said it would likely be a virtual summit. Dombrovskis did not say whether the Russian invasion of Ukraine would be a topic. The EU sees China as a strategic rival on some issues, but as a partner on others, such as the fight against climate change. rtr

The war itself is enormously tragic, first and foremost for the Ukrainian people, but also for the Russian people and the global order more generally. When something like this happens, we expect it to be like a morality play in which all the bad consequences play out equally dramatically in every dimension, including the economy. But the economy does not work that way.

True, financial markets reacted swiftly to news of Russia’s invasion. The MSCI All Country World Index, a leading global equity gauge, fell to its lowest level in almost a year. The price of oil rose above $100 a barrel, while European natural gas prices initially surged by almost 70 percent.

These energy-price increases will negatively affect the global economy. Europe is especially vulnerable, because it did little in recent years to reduce its dependence on Russian gas, and in some cases – notably, Germany, which abandoned nuclear power – even exacerbated it.

Oil-importing countries will experience a headwind from higher prices. The United States is more hedged: Because its oil production is equal to its oil consumption, more expensive oil is roughly neutral for GDP. But higher oil prices will hurt US consumers while helping a more limited segment of businesses and workers tied to the oil and gas industry. The price surge will also add to inflation, which is already at its highest levels in a generation in the US, Europe, and other advanced economies.

But some perspective on these immediate consequences is in order. At $100 a barrel, oil is about one-quarter below its inflation-adjusted price during 2011 to 2014. Moreover, prices for oil futures are lower than spot prices, suggesting that the market expects this increase to be temporary. Central banks may therefore largely look through events in Ukraine, neither holding off on tightening nor speeding it up in response to higher headline inflation. And global stock markets are still up over the last year.

Similarly, although the Russian stock market has fallen significantly since the start of the invasion, Western sanctions are unlikely to have immediate dramatic effects. Sanctions rarely do; they are simply not the economic equivalent of the bombs that Russia is currently dropping on Ukraine.

Moreover, Russia is better prepared than most countries to weather sanctions. The country has been running an enormous current-account surplus and has accumulated record foreign-exchange reserves of $630 billion – sufficient to cover nearly two years of imports. And while Russia is dependent on revenue from Europe, Europeans are dependent on Russia’s oil and gas – which may be even harder to replace in the short run.

But, in the longer term, Russia will likely be the biggest economic loser from the conflict (after Ukraine, whose losses will go well beyond what can be measured in the national accounts). Russia’s economy, and the well-being of its population, have been stagnant since the Kremlin’s 2014 annexation of Crimea. The fallout from its current, large-scale invasion will almost certainly be more severe over time.

Sanctions will increasingly take a toll, and Russia’s growing isolation, as well as heightened investor uncertainty, will weaken trade and other economic links. In addition, Europe can be expected to reduce its fossil-fuel dependence on Russia.

The longer-term economic consequences for the rest of the world will be far less severe than they are for Russia, but they will still be a persistent challenge for policymakers. There is a risk, albeit a relatively unlikely one, that higher short-run inflation will become embedded in increasingly unanchored inflation expectations, and thus persist. If that happens, central banks’ already difficult job will become even more complicated.

In addition, defense budgets are likely to rise in Europe, the US, and some other countries to reflect the increasingly dangerous global situation. This will not reduce GDP growth, but it will reduce people’s well-being, because resources dedicated to defense are resources that cannot go toward consumption or investment in education, health care, or infrastructure.

The medium- and long-term consequences for the global economy of Russia’s invasion of Ukraine will depend on choices. By invading, Russia has already made one terrible choice. The US, the European Union, and other governments have made initial choices on sanctions, but it remains to be seen how Russia will react to them or whether further penalties will be imposed. To the extent that sanctions and counter-responses escalate, the costs will be larger – first and foremost for Russia, but also to some degree for the rest of the global economy.

Global economic relations are positive-sum, and Russia’s growing isolation will remove a small positive. More broadly, uncertainty is never good for the economy.

But, as the world continues to respond to the Russian invasion, concerns about GDP seem minor by comparison. Far more important is a world where people and countries feel secure. And that is something worth paying for – even more than the world’s leaders have paid so far.

In cooperation with Project Syndicate, 2022.

Following Russia’s attack on Ukraine, Western sanctions are beginning to take effect. Coupled with the shock of the Russian invasion, the punitive measures lead to an exodus of Western investors. The sanctions mean “a fundamental reassessment of economic and trade relations with Russia in light of Vladimir Putin’s systematic aggression,” said VDMA CEO Thilo Brodtmann. Till Hoppe summarizes the current sentiment.

In Russia, on the other hand, people are emphatically unimpressed. “But nothing has happened yet!” – was the response of Putin’s press spokesman to the question of whether measures were planned to support citizens and the economy. Russian newspapers say that the sanctions have had no impact on people’s lives. Eugenie Ankowitsch took a look at the Russian media. In addition to all kinds of appeasement, she has also encountered concerned voices.

In Germany, a multi-stage procedure is to ensure that gas storage facilities reach a specified minimum level by certain dates. The German government wants to lay this down in a law on national gas reserves. Manuel Berkel explains the background to the procedure and lends a platform to experts who warn of a “subsidy war” over gas – and of a scenario that has barely been discussed so far: what to do if Russia floods the markets with gas?

There is also gloomy news from the Intergovernmental Panel on Climate Change. In the event of global warming of 2 degrees, a third of the population in southern Europe could suffer from water shortages – this is one of the forecasts in the new IPCC report. This latest report mainly focuses on what options there are for adapting to climate change – for example, to secure the supply of food. Lukas Scheid summarizes the most important findings and initial reactions.

Valdis Dombrovskis was clear: “If Russia does not end its aggression, it will become a pariah state,” the EU Commission Vice President responsible for trade said yesterday. He said the EU and its partners are prepared to impose even tougher sanctions if necessary – even if that means less growth and higher inflation in the EU as well. “This is the price to pay to defend democracy and peace,” the Latvian told the European Parliament’s trade committee.

The Western sanctions package, in particular the massive restrictions on Russian banks and export restrictions, is largely strangling the Russian business of European companies. Danish logistics giant Maersk announced yesterday that it was considering suspending all container bookings to and from Russia in light of the sanctions imposed. This applies to freight transport by sea as well as overland.

With the EU also closing its airspace to aircraft from Russia, and Russia returning the favor yesterday, air cargo traffic has come to a standstill. Loopholes are also shrinking: Switzerland yesterday joined some of the EU punitive measures after prolonged hesitation, closing its airspace to Russian aircraft and imposing sanctions on President Vladimir Putin, Foreign Minister Sergei Lavrov, and hundreds of members of parliament and officials. Dombrovskis praised the decision by the traditionally neutral country as a “big step”.

Russia is trying to limit the damage. Among other things, Putin ordered far-reaching capital controls, according to which Russian citizens are no longer allowed to transfer money to foreign accounts.

But sanctions and public outrage over Russia’s war of aggression are leading to an exodus of Western investors. After BP, the Norwegian energy company Equinor also parted ways with its joint ventures in Russia. In the evening, Shell also announced it was ending its cooperation with Gazprom, which includes financing the Nord Stream 2 Baltic Sea pipeline. The European soccer association UEFA terminated its sponsorship agreements with the Russian energy giant.

The sanctions against a number of Russian banks make it enormously difficult to do business with partners in Russia – “they effectively block Russian exports and imports,” Dombrovskis said. In addition, there are tightened export restrictions on dual-use and many high-tech goods, which affect the mechanical engineering and electronics industries, for example. The sanctions represent “a fundamental reassessment of economic and trade relations with Russia in light of Vladimir Putin’s systematic aggression,” said VDMA Executive Director Thilo Brodtmann.

According to Brodtmann, the new supply bans affected large parts of the industry, affecting exports worth several hundred million euros. The conditions of the sanctions and their effects now need to be analyzed in detail.

Specialized law firms are experiencing a rush of their clients right now. “Many companies are currently reconsidering their investments in Russia because it leaves them open to legal and political attack,” says Roland Stein, a partner at law firm Blomstein. Doing business with partners there is still possible in principle but difficult.

The EU export restrictions tightened last Friday severely narrow the scope. Goods that can be used for civilian and military purposes are now hardly allowed to be delivered to Russia, and financing and maintenance services are also prohibited. The exceptions are very narrow, Stein says. These include, for example, medical purposes or software updates.

In addition, the new rules prohibit the supply of numerous high-tech goods that are not on the dual-use list. For this purpose, a new Annex VII was added to the regulation, which lists semiconductors, sensors, and lasers, for example.

Upon approval by the national regulatory authority, some other dual-use technologies may be exported, such as when they serve joint space projects or marine safety. Supplies whose contracts were concluded before February 26 and which were notified to the authorities by May 1 can also be approved.

The European Union and the German government have responded to Russia’s invasion of Ukraine with various sanctions. Here you will find the sanctions imposed, as far as published in the Official Journal of the EU.

Legal regulation L40 (Decree 2022/236, Decision 2022/241)

Details

Legal regulation L42 I (Regulations 2022/259-263, Decisions 2022/264-267)

Details

Legal regulation L48 (Decision CFSP 2022/327)

Details

Legal regulation L49 (Regulation EU 2022/328)

Details

Legislation L50 (Decision CFSP 2022/329)

Details

Legislation L51 (Regulation EU 2022/330)

Details

Legislation L52 (Decision CFSP 2022/331)

Details

Legal regulation L53 (Implementing regulation 2022/332)

Details

Legislation L54 (Decision EU 2022/333)

Details

These sanctions are effective upon publication in the Official Journal of the European Union unless a different effective date is specified.

“But nothing has happened yet!” Russian Presidential Press Secretary Dmitry Peskov replied at his weekday press briefing on Monday when asked if measures were planned to support citizens and the economy. Shortly before, the EU had put the announced severe sanctions against the Russian Central Bank into force.

In response, the Russian central bank attempted to mitigate the ruble’s crash with a massive interest rate hike. The key interest rate rose from 9.5 to 20 percent. In addition, the central bank and the Ministry of Finance announced that domestic companies should sell 80 percent of their foreign currency earnings. It didn’t help. The dollar rose at times by almost 42 percent on Monday morning to a historic record high of 119 rubles. On Friday, one still had to pay around 84 rubles for a dollar. The Russian Central Bank also announced that the Moscow Stock Exchange would not open Monday “due to the current situation”. The derivatives market also remained closed.

However, the sanctions would initially not have a major impact on the daily lives of citizens. This is what the newspaper “Komsomolskaya Pravda” writes in an article on the most important issues related to Western sanctions. “Our country has been intimidated by these sanctions for several years now,” the author says. During this time, it has managed to create an alternative to the international financial infrastructure: namely, the Mir payment system (replacing VISA and MasterCard), the Financial Messaging System (replacing SWIFT), and the Speedy Payment System (replacing retail transactions through telephone transfers).

“Our country’s decoupling from SWIFT and VISA/MasterCard will have no impact on domestic transactions,” the statement continues. “You will be able to withdraw money from your card, pay in stores and transfer money to other people.”

Impulsiveness and panic are out of place, stressed Evgenia Lazareva, head of the project “For the rights of borrowers” of the All-Russian People’s Front (ONF) in the newspaper “Izvestia”. The Russian financial and economic system is self-sufficient. 2014 showed that exchange rates and stocks were strengthening again and that attempts to buy up foreign currency and give in to panic were damaging. Hasty decisions can lead to someone buying a currency at an inflated rate, which will lead to some losses in the future, warned FG-Finam analyst Andrey Maslov.

Other experts, however, expect the sanctions to have a major impact on consumers in Russia. If Russian banks are disconnected from SWIFT, they will have to choose between equipment for oil production or goods for people, according to an article in the Kremlin-critical newspaper Novaya Gazeta.

The companies would have to set priorities – “roughly speaking, decide what is more important: transactions for the purchase of industrial facilities for Russian industry and oil production or money for containers of women’s boots and children’s toys,” the statement added. It was foreseeable that companies would choose industrial equipment. For other products, this means less variety, higher prices, even if the goods are produced domestically, is his forecast.

In general, the freezing of central bank reserves seems to be making higher waves than Russia’s decoupling from SWIFT. The Russian government was taken by surprise, claims the renowned Russian economist Sergei Guriev, Chief Economist of the European Bank for Reconstruction and Development until 2019, in an interview with the independent Russian-language online portal “Meduza”.

But the decision on SWIFT was nevertheless an important symbolic signal. “Although from my point of view the sanctions against the central bank are much more painful than the shutdown of SWIFT, the shutdown itself shows that what was considered too scary yesterday is now being discussed and implemented,” he said.

In his opinion, the situation is more serious than in 2014 after the annexation of Crimea. Back then, there were reserves and the central bank knew what it could and could not do. While oil prices are high today, it is not clear whether Russian oil exporters will be able to sell that oil and transfer the dollars they get for it to Russia. It is a realistic scenario for Guriev that Russians will have to forcibly exchange their dollar savings into rubles at the rate set by the government.

This is what some Russians are apparently afraid of. In the Western media and on social networks, there are increasing reports of empty ATMs and vain attempts by people to withdraw foreign currencies such as dollars and euros. Russian mass media, however, are appeasing. Russian banks have indeed noticed an increased demand from the population for foreign currency transactions, the press services of the credit institutions admitted when asked by the Russian news agency TASS. According to the statistics of the Standard Bank, for example, the total number of cash transactions has increased by 41 percent in recent days compared with the previous week. However, the foreign currency stocks would be sufficient to allow currency exchange as usual.

At current prices, storing 700 terawatt-hours of gas would cost at least €70 billion for the entire EU – compared to €10 billion in previous years, Bruegel analyst Simone Tagliapietra wrote on Twitter.

In Germany, a multi-stage procedure is to take effect in the future in order to reach defined minimum gas storage levels by certain dates. From August onwards, the level will initially be 65 percent, and from October onwards it will be 80 percent, according to sources in the Federal Ministry for Economic Affairs and Climate Action (BMWK). After the peak in December, obligations are also to take effect to make the stored gas available to the market again. Levels of at least 40 percent are to be reached by February 1. On Monday, the law went to the departmental vote, it is to come into force on May 1.

The market participants will continue to fill the storage facilities as a matter of priority. If necessary, however, the market area manager, Trading Hub Europe GmbH, will in the future procure gas in several steps via tenders, so-called Strategic Storage Based Options (SSBO).

“If storage users do not use capacities booked by them, they are withdrawn from them and made available to the market area manager,” the sources added. “The latter either has them filled by market players by way of tendering SSBOs or buys gas itself to store it. The withdrawal mechanism is intended to prevent hoarding of capacity on the one hand and to stimulate filling of booked capacity on the other. The costs incurred by these instruments are passed on to network users.”

Storage obligations, however, only work well if they are coordinated across Europe, according to a new paper by Bruegel: “Otherwise, EU countries might outbid each other to refill their storages amid limited supplies.” Such a “subsidy war” would lead to higher prices for everyone, making gas suppliers richer without allowing significantly higher imports.

It is known that Germany coordinates with the Pentalateral Forum, i.e., Austria, Switzerland, France, and the Benelux countries, on issues of regulation and security of supply. More precise information on the coordination of gas reserves could not be obtained from the BMWK. The US is apparently not currently considered a priority source for additional LNG supplies. The talks of which he is aware are not aimed at America, but natural gas from the Arab region, said Economics Minister Robert Habeck (Greens) on the fringes of the Energy Ministers Council in Brussels.

In connection with Russia, Bruegel warned of a possible move by Gazprom that has received little attention to date. Whereas previously the only concern was a halt to deliveries under long-term contracts, the think tank analyzed the consequences of a possible resumption of spot deliveries, which the gas company had largely halted in recent months.

If Russia floods the markets with gas compared to the current level, prices could fall. For this reason, gas traders could hold back on purchases and filling storage facilities at the current high prices so as not to make losses later on.

“The EU should offer companies that store gas, especially in the most vulnerable EU states, financial guarantees against such a scenario,” Bruegel writes. Contracts for difference are conceivable in the event that prices fall below €70 per megawatt-hour again next winter. Such contracts for difference had also been brought into play by the EU Commission in the draft of its communication on energy prices. The final version was originally to be presented next Wednesday, but this was postponed at short notice.

In southern Europe, one-third of the population could suffer from water shortages in the event of global warming of 2 degrees. At 3 degrees, this risk would double. This is what it says in the second of a total of three sub-reports of the sixth assessment report of the Intergovernmental Panel on Climate Change (IPCC), which was presented on Monday.

For many cities in Western and Central Europe, the risk of water shortages is likely to increase sharply with 3 degrees of global warming. At the same time, the damage caused by seasonal extreme precipitation and river flooding threatens to double. The report’s authors forecast that coastal flood damage would increase at least tenfold by the end of the 21st century. With current adaptation measures, the scientists are certain, this could happen even sooner.

According to the Climate Action Tracker, the planet is heading for a warming of 2.5 to 2.9 degrees with the current global climate policy measures – not including announcements and target plans that have not yet been implemented. Such a temperature rise would also pose a huge threat to Europe’s food supply. Over the course of the 21st century, agricultural production could suffer significant losses that could not be offset even by additional capacity in northern Europe as a result of global warming, the IPCC authors write.

Short-term measures limiting global warming to close to 1.5 degrees would significantly reduce projected loss and damage, but they cannot completely eliminate it. For this reason, the second sub-report places particular focus on adaptation options.

Something can be done, says Hermann Lotze-Campen, head of the Climate Resilience Research Department at the Potsdam Institute for Climate Impact Research (PIK). “Effective protection of 30 to 50 percent of land and water areas can help not only stabilize important ecosystems, but also secure food supplies.” In addition, a diet that is as plant-based as possible can reduce competition for land and water and increase regional adaptation margins, the PIK researcher said.

According to the IPCC report, adaptation options in Europe include vegetation cover, changes in farming methods and crop and livestock species, and alternate planting. In addition, there is prophylactic agroecology and forest management to prevent forest fires and make forests more resilient to climatic changes. To prevent water shortages, water reuse, early warning systems and land use should also be optimized.

The summary for decision-makers published together with the IPCC report states that adaptation potentials have not yet been exhausted and could make a difference, especially in the Global South. The main issue here is appropriate climate finance. The vast majority of global climate finance has gone to mitigation. Only a small portion has gone to adaptation.

To this end, access to finance for the implementation of adaptation measures must be improved, says the IPCC. Public finance could leverage private sector adaptation finance by removing regulatory, cost and market barriers, for example, through public-private partnerships.

This is where the richest countries have a role to play, says Rixa Schwarz, head of the International Climate Policy team at Germanwatch. The G7 must ensure that the $100 billion per year for climate protection and climate adaptation that the industrialized countries have actually already pledged by 2020 are achieved this year. The funds for climate adaptation in this package would have to be “at least doubled”, Schwarz said.

She also hopes for more commitment from Germany. Not even the annual amount of €6 billion from 2025, which was still promised by former Chancellor Angela Merkel, has so far been secured in the medium-term financial planning. Germanwatch is therefore calling for an increase to at least €8 billion annually from the federal budget for climate protection and adaptation in the Global South.

On Monday, Federal Environment Minister Steffi Lemke (Greens) promptly promised that the federal government would consistently address climate adaptation. “With the immediate climate adaptation program, we are expanding and supplementing existing measures. In addition, we are working on permanent funding for climate adaptation.” Lemke did not name the scope of this funding. The Minister of State for Europe and Climate, Anna Lührmann, also emphasized that large industrialized countries must now move forward with climate adaptation and its financing and bring other countries along with them.

Jörn Birkmann, coordinating lead author of the report, also pointed out that policymakers should not wait until after extreme weather events, when the consequences of climate change are immediately noticeable, to talk about adaptation measures. Precautionary plans must be in place for such cases.

However, the IPCC authors also point out that loss and damage will increase as a result of climate change. If warming exceeds 1.5 degrees, some ecosystem-based adaptation measures would lose their effectiveness. Human and natural systems could reach their adaptation limits as a result. Particularly at risk: Warm-water coral reefs, coastal wetlands, rainforests, and polar and mountain ecosystems.

A total of 270 authors from 67 countries evaluated more than 34,000 scientific contributions for the second partial report. The first partial report was published in August 2021. The third partial report is to be published as early as the beginning of April and will identify options for mitigating climate change. The IPCC’s full Sixth Assessment Report is due to be published in September 2022.

An EU Parliament resolution scheduled for a vote this Tuesday push for Ukraine to join the EU. The text calls on the EU institutions to grant the country EU candidate status. In the meantime, the resolution says work should continue to integrate the Ukrainian market into the EU’s single market. The resolution has been made available to Deutsche Presse-Agentur. It has reportedly been agreed among the parliamentary groups, with the exception of the right-wing nationalist ID faction.

Ukrainian President Volodymyr Zelenskiy insists on his country’s EU accession in the face of Russian aggression. “We appeal to the EU for Ukraine’s immediate accession under a new special procedure,” Zelenskiy said on Monday.

“When President Zelenskiy asks for EU membership, he is asking for peace, freedom, and democracy for his country,” said the chairman of the EPP Group in the European Parliament, Manfred Weber (CSU). Membership is a lengthy process, but nevertheless, the signal is: “Ukraine belongs to the EU.”

The presidents of eight Eastern and Central European countries are also calling for Ukraine to be granted the status of a candidate country for EU membership immediately and to start accession negotiations. “We, the presidents of the EU member states Republic of Bulgaria, Czech Republic, Republic of Estonia, Republic of Latvia, Republic of Lithuania, Republic of Poland, Slovak Republic, and Republic of Slovenia strongly believe that Ukraine deserves an immediate EU accession perspective,” an open letter reads.

However, a spokesman for the European Commission dampened expectations for rapid accession. There is a process for accession negotiations to become an EU member, the spokesman said. The final decision rests with EU countries, not the Commission. Before countries can become EU members, they must transpose existing EU laws into national law and meet a number of criteria.

Foreign Minister Annalena Baerbock also expressed reservations about the country’s rapid accession to the EU. Everyone is aware that “EU accession is not something that can be accomplished in a few months,” the Green politician said on Monday after a meeting with her Slovenian colleague Anže Logar in Berlin. Instead, such a project would entail an intensive and far-reaching transformation process. At the same time, Baerbock stressed, “Ukraine is part of the house of Europe.”

Ukrainian President Volodymyr Zelenskiy says he has signed a formal request for his country to join the European Union. According to high-ranking EU circles, this could be an issue for the heads of state and government at an unofficial summit in March. EU Commission President Ursula von der Leyen had also spoken out in favor of Ukraine’s accession on Sunday. dpa/rtr

EU energy ministers discussed how to strengthen Europe’s security of supply at an extraordinary meeting in Brussels on Monday. The focus was also on Ukraine’s special needs since the Russian attack: “We have come together to provide a solid and solidarity-based response,” said French Council President and Environment Minister Barbara Pompili in the evening.

Since last Thursday, Ukraine’s power grid has no longer been connected to the Russian grid and is only functioning in “isolation mode”, i.e., virtually as an island. This increases the risk of a blackout. Ukraine would like to connect its grid to that of the EU, which had been planned for some time anyway and for which a test was running on the day of the Russian invasion. Ukraine should have been reconnected to the Russian network after the test, but this will no longer happen after the attack.

Ukraine has asked the EU for an emergency connection. The connection of the Ukrainian power grid to that of neighboring EU countries must now be accelerated, Pompili said. But technical problems would have to be solved for this to happen. The Commission, the member states, and the network agency Entso-e were intensifying the relevant work.

EU Energy Commissioner Kadri Simson pointed out that Moldova’s power grid also operates in isolation mode and needs to be connected to the European grid together with Ukraine. There is a strong political will to bring forward the connection scheduled for next year. This will be possible within “a few days to a few weeks”. German Economics Minister Robert Habeck welcomed the plan, saying, “Of course we support Ukraine getting a common power grid with Europe more quickly.” However, it must be ensured that the Ukrainian grid is secure according to European standards and robust against cyber attacks.

Also discussed at the meeting were fuel supplies and the safety of nuclear power plants in Ukraine. The war against Ukraine is not only a turning point for the security architecture in Europe but also for the energy system, said Commissioner Simson. Also discussed at the meeting were the issue of future strategic gas reserves, energy price trends, and the Green Deal.

Barbara Pompili stressed that the French Presidency of the Council of the EU wants to press ahead with work on the Fit for 55 legislative package regardless of the current crisis: “We clearly want to intensify negotiations on the package,” the minister said. Renewable energies and energy efficiency are the best way to reduce Europe’s energy dependence. Currently, there is no threat to security of supply. But for the next winter season, diversification is needed, including more LNG terminals and new supply contracts.

“We want to prepare for all eventualities,” she said, also with a view to rising energy prices. Member states had therefore asked the EU Commission to update its planned communication on energy prices. The Commission wanted to present its communication already this Wednesday, an addition to the so-called toolbox from last year. In view of the crisis, there is a need for exceptional instruments that member states can make use of to protect consumers, Pompili said.

The focus will be even more clearly on how the EU can strengthen its security of supply, in addition to questions of price development and strategic gas reserves, according to Commission sources. The Commission intends to adopt the communication, possibly with a slight delay, at its meeting next Tuesday in Strasbourg. sti

An alleged attack on the satellite network operator Viasat also has consequences for German wind farms. The control and monitoring of wind turbines that communicate via the KA-SAT satellite system of the operator Viasat is currently not functioning in this way.

“Since Thursday, a total of 5,800 wind turbines in Central Europe with a total output of 11 gigawatts have been affected by the connection failure,” wind turbine operator Enercon announced. There was no risk to the turbines as they continued to operate on “auto mode” and can basically regulate themselves autonomously and independently.

Although maintenance is limited, “no effects on power grid stability are currently expected due to redundant communication capabilities of the responsible grid operators,” the German Federal Office for Information Security (BSI) explained. Together with the Federal Network Agency, the authority is responsible for the cyber security of energy systems.

The operator of the KA-SAT system Viasat informed Europe.Table that there was a partial network outage. This affected broadband customers in Ukraine and the rest of Europe. “Our investigation is still ongoing, currently we believe the cause is a cyber incident.”

The US-based company had called in law enforcement and government agencies, and an external service provider was also involved. The failure of the KA-SAT system coincides with the attack on Ukraine. In total, some 30,000 satellite terminals are said to have failed. fst

Following the EU sanctions on refinery technology, importers expect higher prices even in the event of a possible total loss of Russian oil products, but no bottlenecks. Russia exports eight to 10 million tons of petroleum products to Germany annually, mainly diesel and, to a lesser extent, heating oil, Hans Wenck, managing director of the Foreign Trade Association for Mineral Oil and Energy, told Europe.Table. “Balancing these volumes is not straightforward. What will not happen, however, is that service stations run dry,” Wenck said.

However, it is still unclear whether, when, and how much Russian exports will fall. According to a spokeswoman on Friday, the EU Commission assumes that the sanctions against Russian refineries will affect the economy there but will have no impact on Europe’s consumers.

On Saturday night, the EU published the implementing rules for its new energy sanctions. There will be no immediate embargo on crude oil and oil products. Unlike after the annexation of Crimea in 2014, no further technologies for particularly challenging explorations of new oil and gas fields are affected either.

Instead, the current sanctions relate solely to equipment for oil refineries. The community of states would like to ensure that Russian manufacturers of oil products are no longer able to meet the high technical requirements of the Euro 6 standard. Imports into the European Union would then no longer be possible.

The sanctions will have a significant effect on exports to the EU, the Commission spokeswoman said. In 2019, Russia earned €24 billion from exporting oil products to the EU. However, it remains to be seen for the time being when the indirect import restrictions will make themselves felt.

According to the Foreign Trade Association, there is free refinery capacity for low-sulfur diesel fuels, primarily in India. In Germany, too, refineries are not yet operating at full capacity. On their own, however, domestic producers would not be able to cover a complete shortfall of Russian middle distillates, Wenck said. The US, too, is currently finding it difficult to supply this type of oil product; it is itself an importer.

Nevertheless, the association representative continues to expect sufficient supplies from alternative suppliers on the world markets: “With the high margins in Western Europe, enough will arrive here. For middle distillates, however, there will be price increases.”

The En2X fuel association said it would not participate in price speculation but generally referred to potentially higher transportation costs for sea routes. ber

The EU and China will hold a summit on April 1, according to EU Commission Vice President Valdis Dombrovskis. The goal is to ease growing tensions between the two sides, he said Monday.

“We know that our relations with China are in a complicated phase,” he told the EU Parliament’s trade committee. He said it was necessary to look at the highest political level “to what extent we can improve and align our cooperation.”

EU sources said it would likely be a virtual summit. Dombrovskis did not say whether the Russian invasion of Ukraine would be a topic. The EU sees China as a strategic rival on some issues, but as a partner on others, such as the fight against climate change. rtr

The war itself is enormously tragic, first and foremost for the Ukrainian people, but also for the Russian people and the global order more generally. When something like this happens, we expect it to be like a morality play in which all the bad consequences play out equally dramatically in every dimension, including the economy. But the economy does not work that way.

True, financial markets reacted swiftly to news of Russia’s invasion. The MSCI All Country World Index, a leading global equity gauge, fell to its lowest level in almost a year. The price of oil rose above $100 a barrel, while European natural gas prices initially surged by almost 70 percent.

These energy-price increases will negatively affect the global economy. Europe is especially vulnerable, because it did little in recent years to reduce its dependence on Russian gas, and in some cases – notably, Germany, which abandoned nuclear power – even exacerbated it.

Oil-importing countries will experience a headwind from higher prices. The United States is more hedged: Because its oil production is equal to its oil consumption, more expensive oil is roughly neutral for GDP. But higher oil prices will hurt US consumers while helping a more limited segment of businesses and workers tied to the oil and gas industry. The price surge will also add to inflation, which is already at its highest levels in a generation in the US, Europe, and other advanced economies.

But some perspective on these immediate consequences is in order. At $100 a barrel, oil is about one-quarter below its inflation-adjusted price during 2011 to 2014. Moreover, prices for oil futures are lower than spot prices, suggesting that the market expects this increase to be temporary. Central banks may therefore largely look through events in Ukraine, neither holding off on tightening nor speeding it up in response to higher headline inflation. And global stock markets are still up over the last year.

Similarly, although the Russian stock market has fallen significantly since the start of the invasion, Western sanctions are unlikely to have immediate dramatic effects. Sanctions rarely do; they are simply not the economic equivalent of the bombs that Russia is currently dropping on Ukraine.

Moreover, Russia is better prepared than most countries to weather sanctions. The country has been running an enormous current-account surplus and has accumulated record foreign-exchange reserves of $630 billion – sufficient to cover nearly two years of imports. And while Russia is dependent on revenue from Europe, Europeans are dependent on Russia’s oil and gas – which may be even harder to replace in the short run.

But, in the longer term, Russia will likely be the biggest economic loser from the conflict (after Ukraine, whose losses will go well beyond what can be measured in the national accounts). Russia’s economy, and the well-being of its population, have been stagnant since the Kremlin’s 2014 annexation of Crimea. The fallout from its current, large-scale invasion will almost certainly be more severe over time.

Sanctions will increasingly take a toll, and Russia’s growing isolation, as well as heightened investor uncertainty, will weaken trade and other economic links. In addition, Europe can be expected to reduce its fossil-fuel dependence on Russia.

The longer-term economic consequences for the rest of the world will be far less severe than they are for Russia, but they will still be a persistent challenge for policymakers. There is a risk, albeit a relatively unlikely one, that higher short-run inflation will become embedded in increasingly unanchored inflation expectations, and thus persist. If that happens, central banks’ already difficult job will become even more complicated.

In addition, defense budgets are likely to rise in Europe, the US, and some other countries to reflect the increasingly dangerous global situation. This will not reduce GDP growth, but it will reduce people’s well-being, because resources dedicated to defense are resources that cannot go toward consumption or investment in education, health care, or infrastructure.

The medium- and long-term consequences for the global economy of Russia’s invasion of Ukraine will depend on choices. By invading, Russia has already made one terrible choice. The US, the European Union, and other governments have made initial choices on sanctions, but it remains to be seen how Russia will react to them or whether further penalties will be imposed. To the extent that sanctions and counter-responses escalate, the costs will be larger – first and foremost for Russia, but also to some degree for the rest of the global economy.

Global economic relations are positive-sum, and Russia’s growing isolation will remove a small positive. More broadly, uncertainty is never good for the economy.

But, as the world continues to respond to the Russian invasion, concerns about GDP seem minor by comparison. Far more important is a world where people and countries feel secure. And that is something worth paying for – even more than the world’s leaders have paid so far.

In cooperation with Project Syndicate, 2022.