The Commission has set out how it envisages industrial support under the Green Deal Industrial Plan – the EU’s response to the US Inflation Reduction Act (IRA) – in an internal paper available to Table.Media. According to the paper, the plan is to give preferential treatment to aid in the form of tax breaks. Particularly generous maximum rates are to apply to areas from European regional aid. Subsidies worth billions, comparable to IRA funding in the USA, are to be possible – but only under very specific conditions. Manuel Berkel gives an overview.

Rarely is the link between a company and Russia’s war of aggression on Ukraine as obvious as in the case of the Russian diamond producer Alrosa. So far, however, neither Russian diamonds nor the pro-Kremlin company are on the EU’s sanctions lists. If a couple of Belgian politicians have their way, this should change quickly – but given the economic importance of diamonds for his country, Belgium’s Head of Government Alexander De Croo is having a hard time with this step. Now he is to present a compromise with the Commission, as Stephan Israel reports.

In today’s Opinion, Kadri Liik of the European Council on Foreign Relations takes a look at cooperation among member states nearly a year after Russia launched its war of aggression against Ukraine. Europe has not allowed itself to be divided, Liik writes. But a new order is forming. Responsibility has been distributed among different shoulders – while at the same time, new coalitions and unusual networks have emerged.

If you enjoy Europe.Table, please forward us. If this mail was sent to you: Here you can test our briefings for free.

When it comes to industrial support under the Green Deal Industrial Plan, the EU Commission wants to give priority to aid in the form of tax breaks. That’s according to the authority’s consultation for the Temporary Crisis Framework (TCF) amendment, which was made available to Table.Media on Monday. The Commission sent the internal document to member states earlier this month when it presented its response to the US Inflation Reduction Act (IRA).

Accordingly, member states are to be able to support investments in strategically important industries with up to ten percent of the costs and up to €100 million as a rule. Strategically important industries include batteries, photovoltaics, wind turbines, heat pumps, electrolyzers for hydrogen, and CO2 utilization or storage (CCUS).

However, if national governments want to provide aid in the form of write-offs, the draft states that the permissible aid intensity can be five percentage points higher. Last week, German Minister for Economic Affairs Robert Habeck already described depreciation as a “very strong response to the IRA“, arguing above all that tax breaks are less bureaucratic than aid applications.

According to the Commission’s consultation paper, a further ten to 20 percentage points of aid for small and medium-sized enterprises (SMEs) should be possible, as usual.

Even more generous maximum rates are also to apply to areas from European regional aid. For the most disadvantaged regions (A-assisted areas), aid may technically amount to 30 instead of ten percent and up to €300 million. In Germany, however, there are only so-called C-assisted areas, where aid of 15 percent and up to €150 million are possible (see annexes to the current maps of assisted areas).

However, in response to the IRA, some billions in subsidies are in the offing, for example, for battery factories. The Commission therefore also wants to approve higher subsidies individually. However, matching with subsidies from third countries must be linked to one of the following conditions:

For the manufacturing sector, aid will also be facilitated for investments to electrify or convert the industrial process to electrolysis hydrogen. Previously, only cost benefits over the lifetime of the new plant were eligible for aid. In the future, lump-sum investment subsidies of 30 or 60 percent will also be possible – depending on the energy savings and the technology used.

In the case of support for renewables and storage under REPowerEU, it is also clarified that ongoing aid is to be paid in the form of bilateral Contracts for Difference (CfD). Already under the current TCF, ongoing subsidies must be designed in such a way that member states have the possibility to “react” to unexpectedly high profits of operators in times of high electricity or gas prices, for example by skimming them off.

Under the new framework, the skimming of windfall profits in the form of CfD becomes mandatory. The Commission has hidden a far-reaching detail in a footnote. As before, subsidy payments would be capped at 20 years, but in the future, “member states will be free to require installations to continue repayments under the contracts for as long as the subsidized installation is in operation.”

Through this, the Commission could also send a lasting signal for the reform of the electricity market design. CfD are also mentioned as a possible reform model in an ongoing consultation among market participants. However, because of the nature of a permanent subsidy, CfD are controversial. Threatening to permanently skim off excess profits even beyond the subsidy period could be a measure to make CfD unattractive and push operators into direct marketing.

A Russian submarine bears the name of its sponsor: the parastatal diamond producer Alrosa. Only recently, the Kilo-class fighter submarine returned to the main base of the Black Sea Fleet in Sevastopol after an elaborate modernization.

Rarely is the connection between a company and the Russian war of aggression against Ukraine as obvious as in the case of diamond producer Alrosa. And yet, neither Russian diamonds nor the Kremlin-affiliated company have appeared on the EU’s sanctions lists so far. That could change now.

MEP Kathleen Van Brempt hails from Antwerp, which houses the world’s largest trading center for rough diamonds; the politician from the Flemish Socialists is pushing for the Belgian government to actively help close this loophole. Van Brempt’s party is part of the governing coalition in Brussels.

Alrosa finances Vladimir Putin’s war machine with its profits in the hundreds of millions, says the MEP. The diamond company should be on the sanctions list, as should its CEO Sergei Ivanov. In addition to an import ban on Russian diamonds, an initiative is needed at the G7 level to ensure the traceability and origin of diamonds.

The decision-making process for sanctions in the EU is unfortunately a black box, Van Brempt complains. For each of the nine sanctions packages against Russia to date, the EU Commission first sounded out the chances in the capitals before discussing them at the ambassadorial level. Brussels has not formally proposed an import ban on Russian diamonds in any round so far, EU diplomats say.

The background to this is that the EU Commission does not present punitive measures that exclusively affect a member state or harm the EU more than Russia. In the case of diamonds, both grounds for exclusion would possibly apply. Especially in the case of certain industrial diamonds, for example for surgery, there are said to be no real alternatives.

Therefore, it may also be true when Belgium’s Prime Minister Alexander De Croo says that his country has not blocked any punitive measures related to the diamond sector so far. However, this is contradicted by the fact that Alrosa was on the list in a leaked draft sanctions package in October, but later disappeared from that list.

Ukrainian President Volodymyr Zelenskiy has already personally called on Belgium’s government to stop Russia’s lucrative business – the US led the way last year by imposing sanctions on Alrosa and its CEO Ivanov.

This has not remained without consequences for Antwerp. The diamond industry recently generated €37 billion in sales and accounted for five percent of Belgium’s exports. Even before the invasion of Ukraine, just under a third of rough diamonds came from Russia. In response to the US sanctions, imports from Alrosa’s mines in Russia’s Far East plummeted by 80 percent in the fall, probably mainly due to traders’ fears of contact.

Tom Neys of the Antwerp World Diamond Centre (AWDC) sees the warnings of the umbrella organization confirmed that sanctions do not work. Alrosa now simply delivers the stones to Dubai or, above all, to India, where a large part of the bulk goods is already being processed. Once they have been cut or resold together with other diamonds, the flow of money and origin can no longer be traced, says Neys. Despite the sanctions, Russian diamonds end up in the US or in China, where 90 percent of India’s exports are processed into jewelry.

In Antwerp, the focus on diamonds is fundamentally disturbing. In fact, Russian uranium for Europe’s nuclear power plants or aluminum has so far also been spared from the punitive measures. Antwerp is also wrongly accused of being a non-transparent trading center, says Tom Neys. After all, Antwerp proved during the Kimberley process against blood diamonds from Africa that it was interested in ethically clean trade.

Similar to MEP Van Brempt, the diamond traders’ spokesperson calls for an agreement within the G7 framework to ensure the transparency and traceability of stones. The EU wants to adopt the tenth sanctions package in time for the first anniversary of the Russian invasion of Ukraine on Feb. 24.

Belgium’s Head of Government is shying away from a decision in view of the economic importance of the diamond sector and is pushing for an initiative by the G7 countries. Alexander De Croo is not only getting pressure from Ukraine, the Baltic States and Poland – in addition to the Flemish Social Democrats, the Greens are also pushing the coalition to close the loopholes by sanctioning Alrosa.

The coalition sought a way out of this dilemma during a meeting on Monday. De Croo has been instructed to explore a compromise with the EU Commission, said Vicky Reynaert, a member of the Flemish Socialists (Vooruit) in the Belgian parliament. Accordingly, the EU would first try to find a solution within the G7 countries on “traceability” to prevent circumvention deals. After six months, an import ban on Russian diamonds would automatically come into force.

In January alone, Russian diamonds with a maximum value of €132 million were imported at the Antwerp trading center, Reynaert said. Compared to these foreign exchange earnings for the Russian state in just one month, Belgium’s aid to Ukraine totaling €180 million so far seems shamefully low.

Whether diamonds from Russia will be in the sanctions package will become clear in the next few days. Brussels wants to intensify the exploratory talks with the member states after the summit at the end of the week. There is not much time left until the anniversary of the Russian invasion of Ukraine.

Feb. 8-March 29, 2023; online

FSR, Seminar EU Gas Network Code

The Florence School of Regulation (FSR) offers comprehensive knowledge about the EU Gas Network Codes from the experts actively involved in their development. INFO & REGISTRATION

Feb. 8-10, 2023; Zaragoza (Spain)

Conference Renmad Hidrógeno

Renmad Hidrógeno is the meeting place of the main companies and institutions that are shaping the renewable hydrogen industry in Spain and Portugal. INFO & REGISTRATION

Feb. 8-9, 2023; Brussels (Belgium)

Conference 2nd Europe CCUS & Hydrogen Decarbonisation Summit

The conference will assess and review the opportunities within the EU Energy Sector and review the different hydrogen road maps set out by the European Commission. INFO & REGISTRATION

Feb. 8, 2023; 2-3 p.m., online

FSR, Discussion Are Contracts-for-Differences here to stay?

The Florence School of Regulation (FSR) gives an overview of Contracts-for-Differences used for renewable energy procurement, and their role as risk management tool to facilitate financing. INFO & REGISTRATION

Ukrainian President Volodymyr Zelenskiy is expected to arrive in Brussels on Thursday. A special session of the European Parliament is to be held, at which Zelenskiy is expected to speak. He is also expected to attend the European Council, the meeting of heads of state and government. The special summit on Thursday and Friday will focus on Ukraine and Russia, migration, and the EU economy. mgr

The SPD parliamentary group is in favor of linking the EU accession process more closely to concrete progress made by the candidate countries. “All financial aid should be tied to the actual strengthening of rule-of-law structures, the development of an independent media landscape, and respect for and promotion of democratic institutions,” reads a position paper on the Western Balkans, which is to be adopted by the parliamentary group today and was made available to Table.Media in advance. Moreover, progress made by the countries should be rewarded by increased cooperation in selected areas, while regressions should be sanctioned more clearly.

The paper goes on to say that the EU has so far relied too much on stability and that the “elites often co-opted for ethnic-nationalist interests.” This approach, however, has “largely failed.” The EU should therefore work more closely with pro-European democratic forces in parliaments, parties and civil society. In particular, the MEPs sharply criticize Serbian President Aleksandar Vučić: During his term in office, there has been an “erosion of democracy in the country, which is worrying.”

Like Chancellor Olaf Scholz, the SPD Members of Parliament are clearly committed to the goal of full EU membership for all six Western Balkan states. This is “in our very own interest,” claims foreign policy spokesman Nils Schmid. Nationalist actors inside and outside the region, such as Russia, Turkey or China, use the lack of EU integration of the states for their own purposes through economic, ideological and military influence.

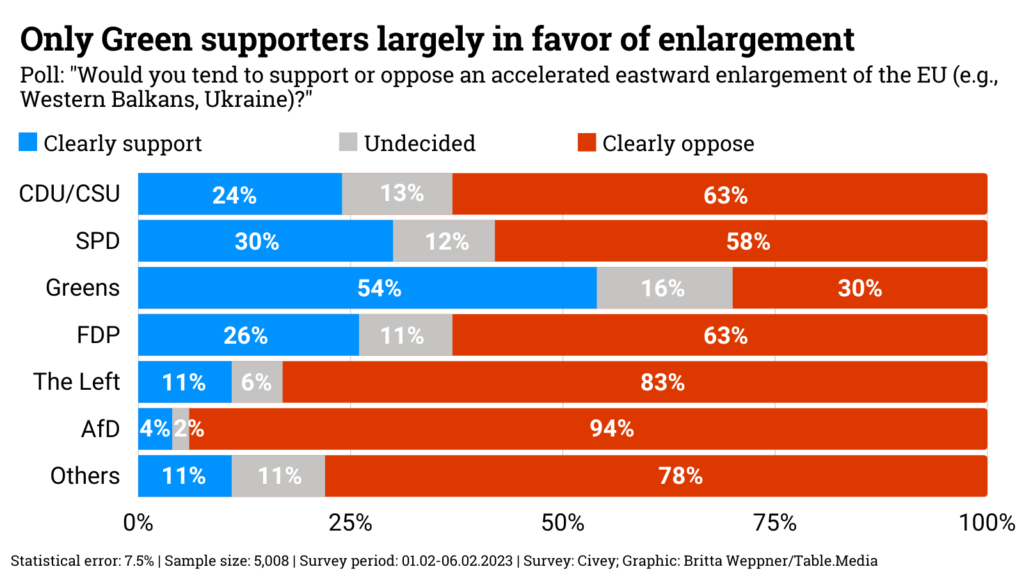

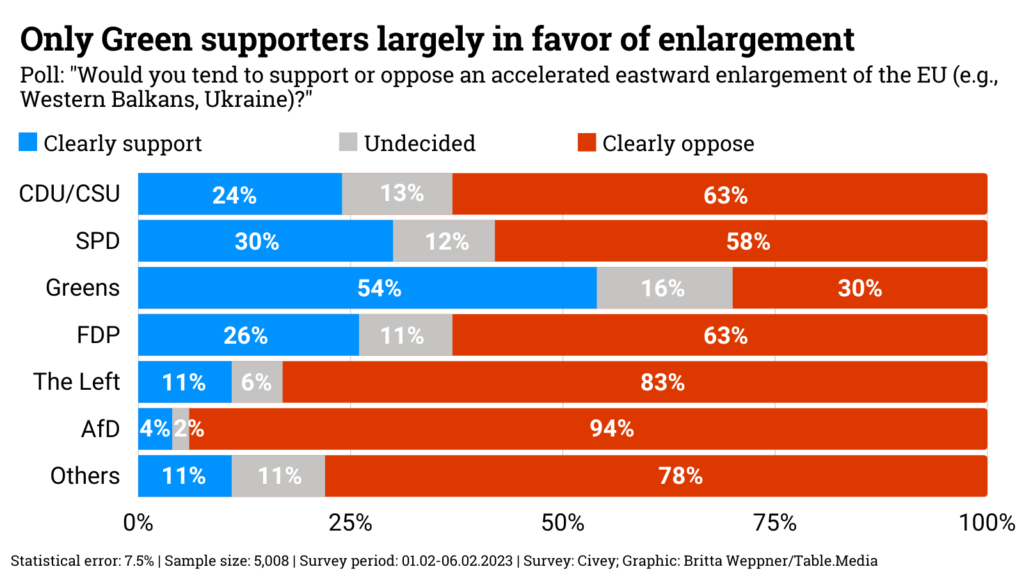

However, there are still considerable reservations among the German population about the rapid admission of new members, as a survey conducted by Civey on behalf of Table.Media shows. According to the survey, 65 percent of respondents reject an accelerated eastward expansion. Even among SPD supporters, skeptics are in the majority, as seen in the chart. tho

Parliament’s negotiators on the Renewable Energy Directive (RED), Nils Torvalds (Renew) for the Environment Committee ENVI and Markus Pieper (CDU) for the Industry Committee ITRE, have canceled the trilogue scheduled for today.

The reason is that the Commission has still not submitted the Delegated Act with the definition of green hydrogen. In a letter to the Swedish Council Presidency and Energy Commissioner Kadri Simson, the two MEPs made it clear that, without the act, they would not have the calculation basis to seriously negotiate the targets for hydrogen as an energy carrier in transport and industry. mgr

Denmark has awarded its first three licenses allowing companies to store CO2 under the seabed of the North Sea on a larger scale. The permits went to the TotalEnergies group and a consortium comprising the companies Ineos and Wintershall Dea, the Danish climate and energy ministry announced on Monday. This means that work could begin immediately. It is expected that the two projects will be able to store up to 13 million tons of carbon dioxide per year under the Danish part of the North Sea, starting in 2030.

The Danish Energy Agency had recommended that the ministry award the first three permits for research into major CO2 storage in the North Sea to the companies in question. It is an important step in making Denmark’s CCS strategy a reality, according to the agency. CCS stands for carbon capture and storage. The process captures emitted CO2 and pumps it underground.

Denmark wants to be climate neutral by 2045. Shortly after COP27, the new government in Copenhagen even announced a new net emissions reduction target of 110 percent by 2050.

TotalEnergies’ project is called Bifrost and is expected to store up to 3 million metric tons of CO2 in an already depleted oil and gas field starting 2027 – eventually accumulating to 5 million metric tons by 2030. Ineos and Wintershall Dea plan to start storing up to 1.5 million metric tons of CO2 in depleted oil and gas fields in the North Sea with the Greensand project by 2025. In 2030, capacity is to be increased to 8 million tons per year.

According to Reuters information, the Danish state intends to bear just under half of the total investment of the equivalent of 60 million euros for Greensand and 21 million euros for Bifrost. dpa/luk/rtr

Udo Bullmann (SPD) has been elected Chairman of the Human Rights Committee in the European Parliament (DROI) with the votes of all members present. The 66-year-old succeeds Maria Arena (S&D), who resigned in the wake of the Eva Kaili corruption affair. She was forced to admit that she had attended a human rights conference in Doha and had her expenses reimbursed by the Gulf state.

Bullmann said after the election: “We’re not sitting here for those who carry suitcases full of money around, we’re here for those who don’t have a voice.” He said the Human Rights Committee, a subcommittee of the Foreign Affairs Committee, would not allow its important work to be damaged by the scandal. Bullmann is from Hesse and led the Socialist group in the last mandate. mgr

When Russia launched its war on Ukraine on Feb. 24, 2022, many expected European unity to be one of the early casualties. It seemed almost inevitable that though Europe might be united in condemning the war, in practical policy it would be split between risk-aware West and high-principled East.

This has not happened. One year on, Europe does have its differences and its debates, but it is not split, much less paralyzed: its overall policy direction remains largely the same; the differences there tend to concern the pace, rather than the direction of travel. ECFR’s recent study of policy-makers’ views in the EU member states helps to shed some light on how that European unity is shaped and maintained.

In stark difference with the period after Russia’s annexation of Crimea, when Germany acted as a country that consolidated and shaped European positions, Europe’s current unity appears leaderless. No country emerges as a focal point: while Germany, France, and Poland all get some votes for the role (6, 4 and 2 respectively), neither of them appears as a dominant power. Instead, responsibility is more evenly divided across the EU, with different countries playing different roles in forming common policies.

One can see that Germany still has considerable gravitational pull – six member states view it as an EU leader, while many others mention it as one of their preferred partners. However, nowadays Germany’s attractiveness is not in its steering power: it is not seen as a country that thinks ahead and shapes policies.

Germany’s domestic debates and occasionally bumpy policy process are there for all to see, but while it might make Berlin an EU laggard in some countries’ eyes, it actually inspires a sense of affinity in many other countries that have similar domestic debates and/or clashing views across the political spectrum. In Germany, they see themselves, and this gives Berlin’s policies – even if wobbly – weight in their eyes.

Poland and the Baltic states have a strong claim for what one could call a “moral leadership”: a number of countries view their uncompromising and maximalist stance as a beacon that signals a perfect principled position. Still, this is not easily translated into true leadership in the field of policy-making. For one, these countries themselves are not experienced in steering EU policies. As admitted by a Polish expert – “we are very good in articulating a moral position, but not very good in figuring out what to do, and building coalitions around our desired action.”

Secondly, the Polish-Baltic maximalism can also be scary. A number of countries – mostly smaller ones and further South – view them as utterly focused on punishing Russia, while paying little attention to the interests of other EU members, and, what is worse, being recklessly dismissive of the possibility that Russia might escalate and drag NATO into an all-out war. For them, Germany’s cautiousness is something that inspires a sense of trust and safety. They feel that if Berlin moves – to a tougher stance on Russia – they can move too.

And finally, France. In a way, France’s position on Russia has always stood in some contrast with those of both Germany and Poland, along with the Baltic states. For a long time, the latter sought to change Russia, to democratize it, though they chose different means to achieve that: where Germany relied on the carrot on a stick named trade and dialogue, Poland and the Baltics resorted to the stick of criticism.

France, at the same time, has always been more inclined to accept that Russia is as it is – the West cannot change Russia but needs to manage the relationship. This position also finds some followership today, especially in Europe’s South. “Emphasis on the importance of multilateralism and diplomacy, while condemning Russia for the invasion” – this position, as summed up by one of ECFR’s researchers, makes France attractive to a number of countries, mostly in its neighborhood, but not exclusively.

One can also observe a number of networks at play in the EU. Some of these are interest-based: as the costs of the war affect different member states differently, (temporary) coalitions emerge that unite countries that have shared interests on one issue or another.

Some of these are traditional: It is customary for big member states to have frequent consultations among themselves, for the Nordic-Baltic networks to compare notes, and for the Mediterraneans to have their own discussions (with the Visegrad group being somewhat disabled by the outlier position of Hungary).

But one can also observe less usual networks at lay: Austria, Ireland and Malta, for instance, look at one another to figure out what would be a fitting position for formally neutral, but morally minded EU countries to take. At the same time, Finland and Sweden – close partners anyway – find themselves in intensified collaboration given their simultaneous bids to join NATO. The Czech Republic and Slovakia get lauded from different corners as the countries who have used their meager military and diplomatic resources notably well: to support Ukraine and to bridge the East-West differences in the EU.

And the EU as a whole possesses strong gravitational pull: Many countries, especially those further away from Russia acknowledge that whatever their opinions, they will in the end go with the EU mainstream.

Finally, two outside powers have played a strong role in shaping the EU consensus and policies. One is the US: The leadership offered by the Biden administration earns applause from a diverse array of EU member states; its approach that combines support for Ukraine with careful escalation management is one behind which pretty much all EU members are happy to line up.

But secondly, one needs to mention Russia. The Russian military’s brutal behavior in Ukraine and President Putin’s evident reluctance to review his maximalist war aims have stripped many potentially negotiation-minded countries of arguments and helped make supporting Ukraine the main, if not the sole focus of the EU’s current policy.

The Commission has set out how it envisages industrial support under the Green Deal Industrial Plan – the EU’s response to the US Inflation Reduction Act (IRA) – in an internal paper available to Table.Media. According to the paper, the plan is to give preferential treatment to aid in the form of tax breaks. Particularly generous maximum rates are to apply to areas from European regional aid. Subsidies worth billions, comparable to IRA funding in the USA, are to be possible – but only under very specific conditions. Manuel Berkel gives an overview.

Rarely is the link between a company and Russia’s war of aggression on Ukraine as obvious as in the case of the Russian diamond producer Alrosa. So far, however, neither Russian diamonds nor the pro-Kremlin company are on the EU’s sanctions lists. If a couple of Belgian politicians have their way, this should change quickly – but given the economic importance of diamonds for his country, Belgium’s Head of Government Alexander De Croo is having a hard time with this step. Now he is to present a compromise with the Commission, as Stephan Israel reports.

In today’s Opinion, Kadri Liik of the European Council on Foreign Relations takes a look at cooperation among member states nearly a year after Russia launched its war of aggression against Ukraine. Europe has not allowed itself to be divided, Liik writes. But a new order is forming. Responsibility has been distributed among different shoulders – while at the same time, new coalitions and unusual networks have emerged.

If you enjoy Europe.Table, please forward us. If this mail was sent to you: Here you can test our briefings for free.

When it comes to industrial support under the Green Deal Industrial Plan, the EU Commission wants to give priority to aid in the form of tax breaks. That’s according to the authority’s consultation for the Temporary Crisis Framework (TCF) amendment, which was made available to Table.Media on Monday. The Commission sent the internal document to member states earlier this month when it presented its response to the US Inflation Reduction Act (IRA).

Accordingly, member states are to be able to support investments in strategically important industries with up to ten percent of the costs and up to €100 million as a rule. Strategically important industries include batteries, photovoltaics, wind turbines, heat pumps, electrolyzers for hydrogen, and CO2 utilization or storage (CCUS).

However, if national governments want to provide aid in the form of write-offs, the draft states that the permissible aid intensity can be five percentage points higher. Last week, German Minister for Economic Affairs Robert Habeck already described depreciation as a “very strong response to the IRA“, arguing above all that tax breaks are less bureaucratic than aid applications.

According to the Commission’s consultation paper, a further ten to 20 percentage points of aid for small and medium-sized enterprises (SMEs) should be possible, as usual.

Even more generous maximum rates are also to apply to areas from European regional aid. For the most disadvantaged regions (A-assisted areas), aid may technically amount to 30 instead of ten percent and up to €300 million. In Germany, however, there are only so-called C-assisted areas, where aid of 15 percent and up to €150 million are possible (see annexes to the current maps of assisted areas).

However, in response to the IRA, some billions in subsidies are in the offing, for example, for battery factories. The Commission therefore also wants to approve higher subsidies individually. However, matching with subsidies from third countries must be linked to one of the following conditions:

For the manufacturing sector, aid will also be facilitated for investments to electrify or convert the industrial process to electrolysis hydrogen. Previously, only cost benefits over the lifetime of the new plant were eligible for aid. In the future, lump-sum investment subsidies of 30 or 60 percent will also be possible – depending on the energy savings and the technology used.

In the case of support for renewables and storage under REPowerEU, it is also clarified that ongoing aid is to be paid in the form of bilateral Contracts for Difference (CfD). Already under the current TCF, ongoing subsidies must be designed in such a way that member states have the possibility to “react” to unexpectedly high profits of operators in times of high electricity or gas prices, for example by skimming them off.

Under the new framework, the skimming of windfall profits in the form of CfD becomes mandatory. The Commission has hidden a far-reaching detail in a footnote. As before, subsidy payments would be capped at 20 years, but in the future, “member states will be free to require installations to continue repayments under the contracts for as long as the subsidized installation is in operation.”

Through this, the Commission could also send a lasting signal for the reform of the electricity market design. CfD are also mentioned as a possible reform model in an ongoing consultation among market participants. However, because of the nature of a permanent subsidy, CfD are controversial. Threatening to permanently skim off excess profits even beyond the subsidy period could be a measure to make CfD unattractive and push operators into direct marketing.

A Russian submarine bears the name of its sponsor: the parastatal diamond producer Alrosa. Only recently, the Kilo-class fighter submarine returned to the main base of the Black Sea Fleet in Sevastopol after an elaborate modernization.

Rarely is the connection between a company and the Russian war of aggression against Ukraine as obvious as in the case of diamond producer Alrosa. And yet, neither Russian diamonds nor the Kremlin-affiliated company have appeared on the EU’s sanctions lists so far. That could change now.

MEP Kathleen Van Brempt hails from Antwerp, which houses the world’s largest trading center for rough diamonds; the politician from the Flemish Socialists is pushing for the Belgian government to actively help close this loophole. Van Brempt’s party is part of the governing coalition in Brussels.

Alrosa finances Vladimir Putin’s war machine with its profits in the hundreds of millions, says the MEP. The diamond company should be on the sanctions list, as should its CEO Sergei Ivanov. In addition to an import ban on Russian diamonds, an initiative is needed at the G7 level to ensure the traceability and origin of diamonds.

The decision-making process for sanctions in the EU is unfortunately a black box, Van Brempt complains. For each of the nine sanctions packages against Russia to date, the EU Commission first sounded out the chances in the capitals before discussing them at the ambassadorial level. Brussels has not formally proposed an import ban on Russian diamonds in any round so far, EU diplomats say.

The background to this is that the EU Commission does not present punitive measures that exclusively affect a member state or harm the EU more than Russia. In the case of diamonds, both grounds for exclusion would possibly apply. Especially in the case of certain industrial diamonds, for example for surgery, there are said to be no real alternatives.

Therefore, it may also be true when Belgium’s Prime Minister Alexander De Croo says that his country has not blocked any punitive measures related to the diamond sector so far. However, this is contradicted by the fact that Alrosa was on the list in a leaked draft sanctions package in October, but later disappeared from that list.

Ukrainian President Volodymyr Zelenskiy has already personally called on Belgium’s government to stop Russia’s lucrative business – the US led the way last year by imposing sanctions on Alrosa and its CEO Ivanov.

This has not remained without consequences for Antwerp. The diamond industry recently generated €37 billion in sales and accounted for five percent of Belgium’s exports. Even before the invasion of Ukraine, just under a third of rough diamonds came from Russia. In response to the US sanctions, imports from Alrosa’s mines in Russia’s Far East plummeted by 80 percent in the fall, probably mainly due to traders’ fears of contact.

Tom Neys of the Antwerp World Diamond Centre (AWDC) sees the warnings of the umbrella organization confirmed that sanctions do not work. Alrosa now simply delivers the stones to Dubai or, above all, to India, where a large part of the bulk goods is already being processed. Once they have been cut or resold together with other diamonds, the flow of money and origin can no longer be traced, says Neys. Despite the sanctions, Russian diamonds end up in the US or in China, where 90 percent of India’s exports are processed into jewelry.

In Antwerp, the focus on diamonds is fundamentally disturbing. In fact, Russian uranium for Europe’s nuclear power plants or aluminum has so far also been spared from the punitive measures. Antwerp is also wrongly accused of being a non-transparent trading center, says Tom Neys. After all, Antwerp proved during the Kimberley process against blood diamonds from Africa that it was interested in ethically clean trade.

Similar to MEP Van Brempt, the diamond traders’ spokesperson calls for an agreement within the G7 framework to ensure the transparency and traceability of stones. The EU wants to adopt the tenth sanctions package in time for the first anniversary of the Russian invasion of Ukraine on Feb. 24.

Belgium’s Head of Government is shying away from a decision in view of the economic importance of the diamond sector and is pushing for an initiative by the G7 countries. Alexander De Croo is not only getting pressure from Ukraine, the Baltic States and Poland – in addition to the Flemish Social Democrats, the Greens are also pushing the coalition to close the loopholes by sanctioning Alrosa.

The coalition sought a way out of this dilemma during a meeting on Monday. De Croo has been instructed to explore a compromise with the EU Commission, said Vicky Reynaert, a member of the Flemish Socialists (Vooruit) in the Belgian parliament. Accordingly, the EU would first try to find a solution within the G7 countries on “traceability” to prevent circumvention deals. After six months, an import ban on Russian diamonds would automatically come into force.

In January alone, Russian diamonds with a maximum value of €132 million were imported at the Antwerp trading center, Reynaert said. Compared to these foreign exchange earnings for the Russian state in just one month, Belgium’s aid to Ukraine totaling €180 million so far seems shamefully low.

Whether diamonds from Russia will be in the sanctions package will become clear in the next few days. Brussels wants to intensify the exploratory talks with the member states after the summit at the end of the week. There is not much time left until the anniversary of the Russian invasion of Ukraine.

Feb. 8-March 29, 2023; online

FSR, Seminar EU Gas Network Code

The Florence School of Regulation (FSR) offers comprehensive knowledge about the EU Gas Network Codes from the experts actively involved in their development. INFO & REGISTRATION

Feb. 8-10, 2023; Zaragoza (Spain)

Conference Renmad Hidrógeno

Renmad Hidrógeno is the meeting place of the main companies and institutions that are shaping the renewable hydrogen industry in Spain and Portugal. INFO & REGISTRATION

Feb. 8-9, 2023; Brussels (Belgium)

Conference 2nd Europe CCUS & Hydrogen Decarbonisation Summit

The conference will assess and review the opportunities within the EU Energy Sector and review the different hydrogen road maps set out by the European Commission. INFO & REGISTRATION

Feb. 8, 2023; 2-3 p.m., online

FSR, Discussion Are Contracts-for-Differences here to stay?

The Florence School of Regulation (FSR) gives an overview of Contracts-for-Differences used for renewable energy procurement, and their role as risk management tool to facilitate financing. INFO & REGISTRATION

Ukrainian President Volodymyr Zelenskiy is expected to arrive in Brussels on Thursday. A special session of the European Parliament is to be held, at which Zelenskiy is expected to speak. He is also expected to attend the European Council, the meeting of heads of state and government. The special summit on Thursday and Friday will focus on Ukraine and Russia, migration, and the EU economy. mgr

The SPD parliamentary group is in favor of linking the EU accession process more closely to concrete progress made by the candidate countries. “All financial aid should be tied to the actual strengthening of rule-of-law structures, the development of an independent media landscape, and respect for and promotion of democratic institutions,” reads a position paper on the Western Balkans, which is to be adopted by the parliamentary group today and was made available to Table.Media in advance. Moreover, progress made by the countries should be rewarded by increased cooperation in selected areas, while regressions should be sanctioned more clearly.

The paper goes on to say that the EU has so far relied too much on stability and that the “elites often co-opted for ethnic-nationalist interests.” This approach, however, has “largely failed.” The EU should therefore work more closely with pro-European democratic forces in parliaments, parties and civil society. In particular, the MEPs sharply criticize Serbian President Aleksandar Vučić: During his term in office, there has been an “erosion of democracy in the country, which is worrying.”

Like Chancellor Olaf Scholz, the SPD Members of Parliament are clearly committed to the goal of full EU membership for all six Western Balkan states. This is “in our very own interest,” claims foreign policy spokesman Nils Schmid. Nationalist actors inside and outside the region, such as Russia, Turkey or China, use the lack of EU integration of the states for their own purposes through economic, ideological and military influence.

However, there are still considerable reservations among the German population about the rapid admission of new members, as a survey conducted by Civey on behalf of Table.Media shows. According to the survey, 65 percent of respondents reject an accelerated eastward expansion. Even among SPD supporters, skeptics are in the majority, as seen in the chart. tho

Parliament’s negotiators on the Renewable Energy Directive (RED), Nils Torvalds (Renew) for the Environment Committee ENVI and Markus Pieper (CDU) for the Industry Committee ITRE, have canceled the trilogue scheduled for today.

The reason is that the Commission has still not submitted the Delegated Act with the definition of green hydrogen. In a letter to the Swedish Council Presidency and Energy Commissioner Kadri Simson, the two MEPs made it clear that, without the act, they would not have the calculation basis to seriously negotiate the targets for hydrogen as an energy carrier in transport and industry. mgr

Denmark has awarded its first three licenses allowing companies to store CO2 under the seabed of the North Sea on a larger scale. The permits went to the TotalEnergies group and a consortium comprising the companies Ineos and Wintershall Dea, the Danish climate and energy ministry announced on Monday. This means that work could begin immediately. It is expected that the two projects will be able to store up to 13 million tons of carbon dioxide per year under the Danish part of the North Sea, starting in 2030.

The Danish Energy Agency had recommended that the ministry award the first three permits for research into major CO2 storage in the North Sea to the companies in question. It is an important step in making Denmark’s CCS strategy a reality, according to the agency. CCS stands for carbon capture and storage. The process captures emitted CO2 and pumps it underground.

Denmark wants to be climate neutral by 2045. Shortly after COP27, the new government in Copenhagen even announced a new net emissions reduction target of 110 percent by 2050.

TotalEnergies’ project is called Bifrost and is expected to store up to 3 million metric tons of CO2 in an already depleted oil and gas field starting 2027 – eventually accumulating to 5 million metric tons by 2030. Ineos and Wintershall Dea plan to start storing up to 1.5 million metric tons of CO2 in depleted oil and gas fields in the North Sea with the Greensand project by 2025. In 2030, capacity is to be increased to 8 million tons per year.

According to Reuters information, the Danish state intends to bear just under half of the total investment of the equivalent of 60 million euros for Greensand and 21 million euros for Bifrost. dpa/luk/rtr

Udo Bullmann (SPD) has been elected Chairman of the Human Rights Committee in the European Parliament (DROI) with the votes of all members present. The 66-year-old succeeds Maria Arena (S&D), who resigned in the wake of the Eva Kaili corruption affair. She was forced to admit that she had attended a human rights conference in Doha and had her expenses reimbursed by the Gulf state.

Bullmann said after the election: “We’re not sitting here for those who carry suitcases full of money around, we’re here for those who don’t have a voice.” He said the Human Rights Committee, a subcommittee of the Foreign Affairs Committee, would not allow its important work to be damaged by the scandal. Bullmann is from Hesse and led the Socialist group in the last mandate. mgr

When Russia launched its war on Ukraine on Feb. 24, 2022, many expected European unity to be one of the early casualties. It seemed almost inevitable that though Europe might be united in condemning the war, in practical policy it would be split between risk-aware West and high-principled East.

This has not happened. One year on, Europe does have its differences and its debates, but it is not split, much less paralyzed: its overall policy direction remains largely the same; the differences there tend to concern the pace, rather than the direction of travel. ECFR’s recent study of policy-makers’ views in the EU member states helps to shed some light on how that European unity is shaped and maintained.

In stark difference with the period after Russia’s annexation of Crimea, when Germany acted as a country that consolidated and shaped European positions, Europe’s current unity appears leaderless. No country emerges as a focal point: while Germany, France, and Poland all get some votes for the role (6, 4 and 2 respectively), neither of them appears as a dominant power. Instead, responsibility is more evenly divided across the EU, with different countries playing different roles in forming common policies.

One can see that Germany still has considerable gravitational pull – six member states view it as an EU leader, while many others mention it as one of their preferred partners. However, nowadays Germany’s attractiveness is not in its steering power: it is not seen as a country that thinks ahead and shapes policies.

Germany’s domestic debates and occasionally bumpy policy process are there for all to see, but while it might make Berlin an EU laggard in some countries’ eyes, it actually inspires a sense of affinity in many other countries that have similar domestic debates and/or clashing views across the political spectrum. In Germany, they see themselves, and this gives Berlin’s policies – even if wobbly – weight in their eyes.

Poland and the Baltic states have a strong claim for what one could call a “moral leadership”: a number of countries view their uncompromising and maximalist stance as a beacon that signals a perfect principled position. Still, this is not easily translated into true leadership in the field of policy-making. For one, these countries themselves are not experienced in steering EU policies. As admitted by a Polish expert – “we are very good in articulating a moral position, but not very good in figuring out what to do, and building coalitions around our desired action.”

Secondly, the Polish-Baltic maximalism can also be scary. A number of countries – mostly smaller ones and further South – view them as utterly focused on punishing Russia, while paying little attention to the interests of other EU members, and, what is worse, being recklessly dismissive of the possibility that Russia might escalate and drag NATO into an all-out war. For them, Germany’s cautiousness is something that inspires a sense of trust and safety. They feel that if Berlin moves – to a tougher stance on Russia – they can move too.

And finally, France. In a way, France’s position on Russia has always stood in some contrast with those of both Germany and Poland, along with the Baltic states. For a long time, the latter sought to change Russia, to democratize it, though they chose different means to achieve that: where Germany relied on the carrot on a stick named trade and dialogue, Poland and the Baltics resorted to the stick of criticism.

France, at the same time, has always been more inclined to accept that Russia is as it is – the West cannot change Russia but needs to manage the relationship. This position also finds some followership today, especially in Europe’s South. “Emphasis on the importance of multilateralism and diplomacy, while condemning Russia for the invasion” – this position, as summed up by one of ECFR’s researchers, makes France attractive to a number of countries, mostly in its neighborhood, but not exclusively.

One can also observe a number of networks at play in the EU. Some of these are interest-based: as the costs of the war affect different member states differently, (temporary) coalitions emerge that unite countries that have shared interests on one issue or another.

Some of these are traditional: It is customary for big member states to have frequent consultations among themselves, for the Nordic-Baltic networks to compare notes, and for the Mediterraneans to have their own discussions (with the Visegrad group being somewhat disabled by the outlier position of Hungary).

But one can also observe less usual networks at lay: Austria, Ireland and Malta, for instance, look at one another to figure out what would be a fitting position for formally neutral, but morally minded EU countries to take. At the same time, Finland and Sweden – close partners anyway – find themselves in intensified collaboration given their simultaneous bids to join NATO. The Czech Republic and Slovakia get lauded from different corners as the countries who have used their meager military and diplomatic resources notably well: to support Ukraine and to bridge the East-West differences in the EU.

And the EU as a whole possesses strong gravitational pull: Many countries, especially those further away from Russia acknowledge that whatever their opinions, they will in the end go with the EU mainstream.

Finally, two outside powers have played a strong role in shaping the EU consensus and policies. One is the US: The leadership offered by the Biden administration earns applause from a diverse array of EU member states; its approach that combines support for Ukraine with careful escalation management is one behind which pretty much all EU members are happy to line up.

But secondly, one needs to mention Russia. The Russian military’s brutal behavior in Ukraine and President Putin’s evident reluctance to review his maximalist war aims have stripped many potentially negotiation-minded countries of arguments and helped make supporting Ukraine the main, if not the sole focus of the EU’s current policy.