German Green Party politician Franziska Brantner is State-Secretary in the newly formed Ministry of Economics under Robert Habeck. On Tuesday, Brantner visited the Lithuanian capital to hold talks. The choice of destination was, of course, no coincidence for the former MEP. Brantner showed support for Lithuania, which had clashed with China over a Taiwan office.

Swedish ex-diplomat and political advisor Viking Bohman assesses the matter for us. In an interview with Amelie Richter, he explains, “It would be bad for the EU and its credibility if China was able to force Lithuania to backtrack.” It was not about winning and losing here, but about realpolitik. By backing down, Beijing would learn that intimidation is effective against Europe.

Meanwhile, Bohman fears a fatal miscalculation in the preparation of the future EU instrument against economic coercion. Its strategy is based on the assumption that China will change its behavior as soon as the EU has such an instrument. This is wrong. While it is true that the EU is driving up the economic costs of intimidation attempts, China under Xi, however, is willing to accept these costs to achieve its policy goals. The result would be ever more tiring trench warfare, as we are currently experiencing over Lithuania.

The preparation of the anti-coercion instrument is thus a perfect example of the poor level of information about China, which sinologist Klaus Muehlhahn has already pointed out in China.Table. Political decisions with major implications are currently being made without the ability to assess China’s reaction beforehand.

Has Huawei joined the ranks of car manufacturers or not? We answer this question in today’s profile of the Chinese company Seres, one of Huawei’s cooperation partners. The EV specialist has a colorful company history, in which German managers have also played a part.

Lithuania is the latest example of economic coercion from Beijing, but it is not the first. Can you give us a brief overview?

So the first thing to say is that Beijing’s economic coercion is not a new phenomenon. Other countries have been subject to similar measures in recent years. We have Australia, following its request for an inquiry into the origins of the COVID-19 virus. We have Canada, following the arrest of Huawei Chief Financial Officer Meng Wanzhou, and we have South Korea following its decision to install a US missile defense system. There have also been many cases in the European Union, including in Sweden, where economic coercion has taken the form of travel warnings to restrict tourism, canceled business delegations and talks, as well as the pressure on specific companies. Most recently, it was in response to a decision that excluded Huawei and ZTE from parts of Sweden’s telecommunication networks. What is happening in Lithuania, however, is at a whole new level compared to what we have seen before.

Has economic coercion from China increased in recent years?

It does indeed appear as if the frequency of this type of overt economic coercion has increased in recent years. And this seems to be particularly true for European countries. You can also see that the magnitude of China’s overt economic coercion appears to have increased in recent years if you look at the extensive measures implemented against countries like Australia, Canada, South Korea, Sweden, and Lithuania. This suggests that the amount of pressure Beijing is willing to apply has increased. A further indication of China’s growing willingness to employ economic measures is its use of sanctions in the form of restrictions on travel and “doing business with” China against European entities and individuals in March 2021.

Is Beijing successful with this strategy? And if not, what is the greater intention behind it?

It depends on what we assume the goal is. If we assume that the goal is to reverse the supposedly China-critical policy of the targeted countries, then China has rarely been successful in recent years. In Sweden, for example, China’s actions have been met with heavy criticism and failed to reverse any policies like the exclusion of Huawei. There have been similar reactions in other countries. Failed coercion attempts on the 5G issue have been seen in Germany, France, the United Kingdom, even though these countries are quite reliant on trade with China. The coercion also often seems to be counterproductive. The measures frequently cause anger and damage China’s image as a reliable trading partner, which is a key source of its power in Europe.

You have already mentioned the examples in your home country Sweden with the exclusion of Huawei and ZTE. Do you see any long-term effects of Chinese coercion in Sweden?

Ericsson has reported a significant loss of market share in China, and Ericsson is, of course, an important Swedish company. But I don’t think it had any significant effect on the Swedish economy as a whole, and definitely not anywhere close to what is currently happening in Lithuania. And if you look at trade flows between Sweden and China, they have been going up in recent years. So even though we have experienced an all-time low in political relations, this does not seem to have had a particularly big effect on economic relations.

Would you say the Lithuanian case is special, or could this happen to any country?

What’s happening in Lithuania is, to my knowledge, unprecedented. It appears that there is an on-and-off blanket trade suspension on goods from Lithuania. China has imposed trade restrictions against countries before, but these have always targeted specific sectors, industries, or companies, like in the cases of Australia, South Korea, or Canada, for example. Until recently, Lithuania seemed to be able to deal with this, as very little of its trade goes to China. But now we have seen China putting pressure on multinational firms to cut their ties with Lithuania or risk being shut out of the Chinese market. Investors could pull out of Lithuania and start to look for other suppliers, et cetera. This could really impact the economic flows within the EU. And I think that it is not an exaggeration to say that it is a challenge to the integrity of the EU Single Market.

Do you think the case of Lithuania will deter other EU countries from heading down the same path? Is China successful here with its coercive approach?

It really depends on how this will play out. One question is if Lithuania is going to maintain its current policy and the name of the Taiwanese representative office. Also, how significant will the economic impact from the coercion be and how much support will Lithuania get from the EU and other partners? If the impact becomes too great, other countries might be discouraged from taking similar steps.

But Lithuania has also reacted quickly to the threats from China.

I think there is a lot to learn from the actions of the Lithuanian government that it has taken in response to China’s coercion. It has established a hotline for companies targeted by Chinese coercion, and they have looked at how they can support these companies. They have tried to coordinate with allies, and they have explored opportunities to develop alternative supply chains. It will be interesting to see, later on, how well this has worked.

Recently, the Lithuanian president officially called it “a mistake” for the first time to allow a “Taiwan office” in Vilnius under that name. Are we now witnessing the first cracks forming in the Lithuanian position under China’s pressure?

I think it is hard to say from one statement. The fact that he considers the decision a mistake may not necessarily mean that he wants to reverse the overall policy. However, some may take this as an indication that Lithuania is really under great pressure and that it needs more substantial support from the EU and other allies to deal with it. It would be bad for the EU and its credibility if China was able to force Lithuania to backtrack.

The planned Anti-Coercion Instrument (ACI) is intended to prevent the very situations Lithuania is currently dealing with. The EU Commission plans to use this instrument primarily as a deterrent and hopes that it will never have to use it. Is this an effective approach against China?

One of the main problems with this instrument is that it is based on the assumption that it will be able to deter China. Proponents say that the mere existence of the ACI will have a deterrent effect, and ideally the instrument would never have to be used. I find this quite unlikely. China’s current foreign policy trajectory suggests that the EU’s ability to influence decision-making in Beijing is quite small. And there seem to be red lines that have been defined by China’s top leaders that they are not willing to budge on. In order to defend the credibility of these red lines, China appears to be willing to accept quite high reputational, political and economic costs.

What would be the consequences?

To me, it seems unlikely that China, under its current uncompromising “wolf warrior” approach to diplomacy, would refrain from this type of coercive action just to avoid the economic costs of a European trade and investment restriction. That doesn’t mean that the EU shouldn’t do something. But the strategy cannot be based on an assumption that China will change its behavior. China might continue this type of coercion, and we have to plan for that.

You suggest that the ACI should be more focused on better absorbing China’s economic pressures, rather than potentially taking countermeasures. Can you elaborate on this?

The problem with an instrument that focuses on countermeasures is that it doesn’t do much for the country targeted by China’s economic coercion. And that could in effect mean that China successfully frightens and deters other countries from criticizing it or acting against its interests. One way to solve this would be to shift the focus from countermeasures to actions that aim to absorb the effects of coercion. Under this design, the ACI’s main function would be to provide tailored support to targeted EU member states to prevent or upset any economic fallout, for example, in cases where supply chains are disrupted

That would mean a realignment of the ACI.

It could help open new connections to alternative partners and suppliers, or provide financial aid for specific switching costs. It could also consist of a solidarity mechanism whereby the member states on a voluntary basis would agree to assist or share some of that economic burden with the target country. The goal here would not be to deter China but to make a coercion attempt ineffective while maintaining an independent policy direction.

What other flaws do you see in the EU Commission’s current proposal on the ACI?

Another problem with the mechanism is that China’s actions are usually hard to verify. They operate in this sort of gray zone, and it’s difficult to know if the state contributed to the coercion and how. For example, it is difficult to verify if a boycott or canceled business delegation is caused directly by the state. If China conceals the act, it is probably hard to prove, which means that the EU would not have a clear case at the WTO.

What do the current drafts envisage here?

In the current proposal, decisions on the use of the ACI will be made by the commission after consulting a committee made up of representatives from the member states. I am not sure if this is an ideal option and if it will be accepted by the member states. As the issues at hand will be very political and foreign policy-oriented, I would expect the member states to play a bigger role.

The ACI does not yet exist, and it will take some time before it comes into force. What options does the EU have at this stage in the case of Lithuania?

China’s more assertive approach requires action. But the reflex to respond to economic coercion by retaliating with similar countermeasures may not be the best option. I think it is more important now to give Lithuania the support it needs to maintain an independent policy. It would not look good if China successfully forced Lithuania to back down. A WTO case against China or retaliatory trade sanctions does not really provide any concrete help for Lithuania. Even if the EU could impose such measures today.

What scenarios are possible now?

The pressure that China is putting on companies to cut ties with Lithuania really interferes with the internal flows of the single market. The EU’s response should focus on preventing or mitigating the effects of this. Otherwise, the Lithuanian economy could really become squeezed. After the US imposed sanctions against Iran in 2018, the EU took steps to prevent European companies from pulling out of the Iranian market through the so-called Blocking Statute. A similar move may not be possible in the Lithuanian case, but I think it would be useful to look at how the EU and its member states can change the incentives for companies thinking about whether to cut ties with Lithuania in order to preserve their access to China’s markets.

Viking Bohman is an analyst at the Swedish National China Centre. The research center is part of the renowned Swedish Institute of International Affairs and conducts research on China-related matters. Bohman has previously worked at the Swedish Ministry of Foreign Affairs and the Swedish Embassy in Beijing.

There is currently a bit of confusion surrounding the car manufacturer Seres – ever since the company has appeared as a partner of the electronics group Huawei. Identical products pop up under different names. And there is also varying information about the company’s origin. Here are the most important facts:

The contradictory reports about the company are owed to its history, which has experienced many breaks – and is now taking a happy turn thanks to Huawei. Seres set out for Silicon Valley in 2016 with big plans in mind. At the time, the company was still called SF Motors. The plan was to shake up the EV market. The company even enlisted Martin Eberhard, co-founder and former CEO of Tesla, as a strategic advisor.

Under Eberhard, Seres acquired EV and battery technology company InEVit in 2017 for $33 million (a combination of ‘electric vehicle’ and the word ‘inevitable’). Back in 2016, Seres had acquired AM General’s manufacturing assets – the factory that produced the infamous Hummer – for $160 million.

Eberhard rose to the position of Chief Innovation Officer. Heiner Fees, the founder of InEVit, moved to the innovation team. The funds were there, as was the experience in the vehicle business. Seres is, after all, a sister company of Dongfeng Sokon Automobile (DFSK), one of the largest Chinese car brands.

In 2018, Seres then presented the SF5 and SF7 prototypes: premium electric SUVs with some whopping 1,000 horsepower. The plan was to manufacture and sell 50,000 models in the USA, with another 150,000 in the People’s Republic. These ambitious goals even motivated Elon Musk to take on President Trump on Twitter. Musk pointed out to the belligerent president that Chinese automakers already operate several wholly-owned subsidiaries in the US – including SF Motors.

However, it quickly became clear that Seres would not be able to keep its full-bodied promises. Fees left the company again after only four months, and the ongoing trade conflicts prompted Seres to cease production in the USA entirely.

The Seres 3 has been available in China since November 2020. A compact SUV that shares the platform with the Fengon 500. The SF5 also made it to China in April 2021. However, just 7,080 models were sold up to and including November. Revised and equipped with Huawei’s Harmony OS operating system, it is now to make a name for itself as the Aito M5.

And also in Germany. The importer Indimo plans to offer the car from the second quarter of 2022, albeit under the name Seres 5. Huawei and Seres had actually founded the Aito brand, but the German company does not want to go along with the change for the time being. In any case, Indimo is cautious. The company ordered only four units to check out the model first.

The vehicle is available in the People’s Republic with a range extender. This means that it actually runs with an electric motor, but comes also equipped with a gas-powered generator that is able to generate power. In Germany, however, only the purely electric version will be available. It is unclear how high the CO2 emissions of the Chinese four-cylinder engine are and whether it will be approved.

On the German market, the Aito M5 (or Seres 5 or SF5) will therefore only be available as a pure electric SUV. The front and rear axles will each be powered by an electric motor with around 340 hp, Indimo told China.Table. The package will cost at least €50,000, with €60,000 being more likely. The importer does not want to give details on the exact performance data and range until the car has arrived in Germany. However, three-phase charging and a 400-volt electrical system are standard.

With the Aito M5, Huawei is going on the offensive in car manufacturing. The electronics group’s smartphone sales have slumped due to the US sanctions. These losses are now to be offset with the entry into the automotive sector. The underlying reason is that smart cars, mobility applications, and autonomous driving are considered to be a growth industry. However, the chips required for these applications are not as complex as those used in smartphones. Huawei could meet the demand even without US suppliers.

In 2021, Huawei formed the “5G Automotive Ecosystem”. To this end, the Group has signed agreements with a total of 18 automakers that will offer the Huawei HiCar system in their cars in the future. These include big names such as Great Wall Motor, Geely, Changan Automobile, BAIC Group, SAIC Motor, and GAC Group. The software can also be installed in older models. BYD was the first manufacturer to present a vehicle with the Huawei screen in February 2021.

Huawei is placing a particular focus on autonomous driving in its partnerships. The brand Arcfox presented the Alpha-S station wagon, for example. The car is equipped with Huawei technology and is said to already be capable of autonomous driving at level three (L3) in some areas. This would allow the driver to actually devote his attention to other things while driving. Jetour’s Great Sage X-1 is already the next electric SUV with extensive Huawei technology in the starting blocks. Christian Domke Seidel

The German government continues to show solidarity with Lithuania in its dispute with China. Franziska Brantner, State-Secretary in the newly set up Ministry for Economic Affairs and Climate Protection, visited the Lithuanian capital Vilnius for talks on Tuesday. It is a matter of protecting the EU’s single market from attacks, Spiegel quoted the Green politician as saying. Lithuania would remain a good place for investment.

The dispute was sparked by the opening of a “Taiwan office” in Vilnius (China.Table reported). China also extended threats of trade restrictions to any companies sourcing goods from Lithuania. The EU sees its strategy of creating an instrument against economic coercion vindicated by the dispute.

Meanwhile, a statement by the Lithuanian president caused some confusion when he admitted that the controversial name “Taiwan” in the office’s title was based more on ignorance of consequences than on a sophisticated strategy. Foreign Minister Gabrielius Landsbergis, on the other hand, is fully committed to the confrontational course toward China. He explicitly welcomed Brantner’s visit as an important sign.

According to Der Spiegel, Brantner also met with company representatives during her visit. They did not want to make their worries about Lithuanian-Chinese relations public because they feared it would cause new problems. Now they were able to express their concerns directly to the representative of the German government.

While China is fuming, Taiwan is trying to compensate for the damages Lithuania is suffering. The government has already set up a fund for investments in Lithuania, and has now launched a loan program. It immediately received a budget of $1 billion. The money is also intended to help companies that are affected by unofficial Chinese sanctions. fin

While market leader Volkswagen has suffered considerably under chip supply bottlenecks over recent months, and Daimler also recorded a slight decline in sales, BMW 2021 was able to significantly increase its sales in China. Sales increased by 8.9 percent to just under 850,000 vehicles. BMW thus sold more cars in China than ever before, the Munich-based company announced.

The automotive industry has been struggling with the shortage of semiconductors around the globe for more than a year. Many manufacturers were forced to halt production again and again due to a shortage of key parts. BMW, however, had a better handle on chip supply. According to experts, one factor here is that BMW did not cut back its orders as much as other companies at the peak of the first Covid wave in March 2020.

This year’s highlight: BMW plans to acquire a majority stake in its joint venture with Chinese supplier Brilliance. The deal is expected to close before the end of the first quarter. flee/rtr

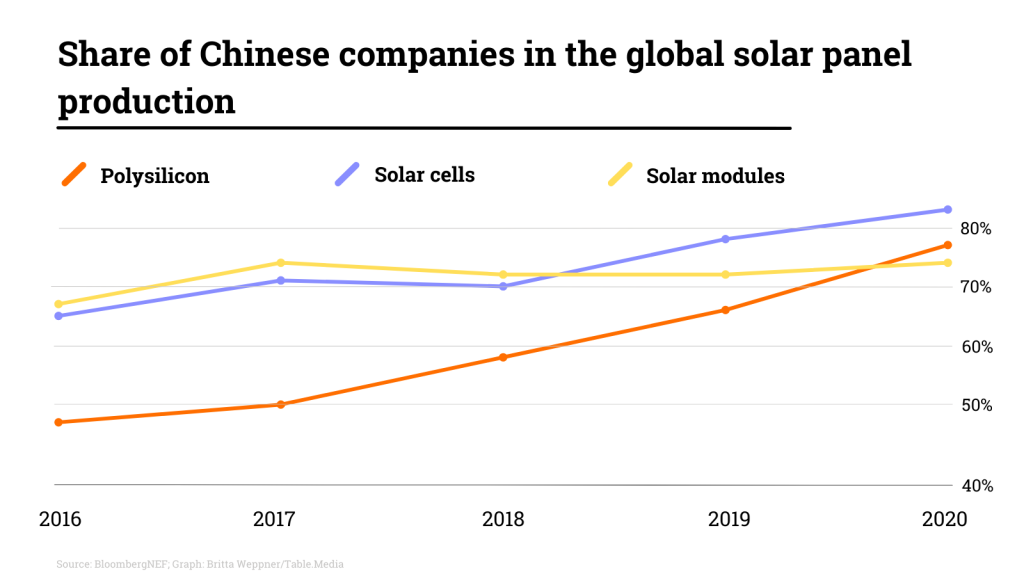

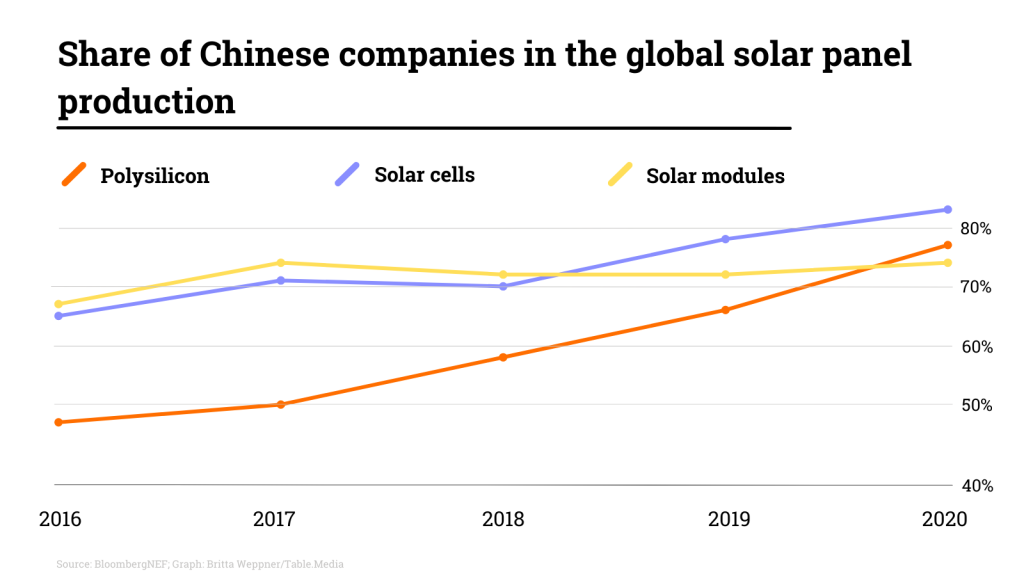

China is investing billions in new factories for the production of polysilicon, the base material for solar panels. According to market analysts, polysilicon prices will remain high until the summer. By 2023, however, they could drop “to a historic low,” Bloomberg quotes one expert as saying. According to the report, the supply of solar modules will increase massively over the next few years, causing prices to fall. At the end of 2021, the price of polysilicon was still at a 10-year-high. After three Chinese manufacturers opened new factories with a total capacity of 160,000 tons per year – more than a quarter of the previous global capacity – prices already fell by 17 percent, according to Bloomberg.

China dominates the market for polysilicon, solar cells, and modules. Worldwide, three out of four solar modules and 83 percent of solar cells are produced in China. In the case of polysilicon, China dominates 77 percent of the global market. The People’s Republic is facing massive criticism due to circumstantial evidence of Uyghur forced labor involved in the production of polysilicon (China.Table reported). According to Bloomberg, many of the new polysilicon factories are located outside Xinjiang’s Uyghur province. The US recently passed a law embargoing imports suspected of using forced labor in Xinjiang. Germany’s new Foreign Minister Annalena Baerbock also recently proposed a similar approach (China.Table reported).

According to analysts, addressing the polysilicon shortage is crucial for the solar industry, Bloomberg reports. Producing the raw material is said to be the most difficult step in the supply chain to create new capacities. It could take 18 to 24 months to bring new factories online due to complicated manufacturing processes. By the end of the year, there could be a global polysilicon capacity to build 500 gigawatts of new solar capacity, according to Bloomberg. nib

China plans to build a total of 6.5 million affordable rental apartments in 40 major cities by 2025. The Ministry of Housing and Urban-Rural Construction made the announcement on Tuesday. These apartments are expected to account for about a quarter of all new housing in the cities in question and benefit 13 million young people and newcomers, Bloomberg reports.

For some years now, Chinese rents and housing prices have been barely affordable for many people. China’s President Xi Jinping had also called for more affordable housing last year during the presentation of his concept for common prosperity (China.Table reported). The current 14th Five-Year Plan and several political speeches repeatedly stated that housing was not intended for speculation.

The initiative to build social housing could also benefit real estate developers struggling to survive. However, it is still unclear who will pay for the construction of the apartments and who will manage and own them. Last year, more than 930,000 affordable rental apartments were built in 40 cities, according to the Ministry of Housing. nib

Saudi Arabia is planning to extradite two Uyghur prisoners to the People’s Republic of China. This has come to the attention of the human rights organization Human Rights Watch (HRW). The two men, who come from Turkey, have been held in Saudi Arabia for almost two years without formal charges. If extradited to the People’s Republic, Nurmemet Rozi and Hemdullah Abduweli face imprisonment and torture, HRW fears. “If Saudi Arabia deports these two Uyghur men, it will be sending a clear message that it stands arm-in-arm with the Chinese government and its crimes against humanity targeting Turkic Muslims,” said Michael Page of HRW Middle East.

Abduweli is accused of calling for armed resistance against Chinese oppression of the Uyghurs in Xinjiang in an Uyghur community during a pilgrimage to Saudi Arabia. His daughter posted a video in Arabic on Twitter a few days ago. In it, she asks Saudi authorities to let the two men return to Turkey, according to HRW. HRW did not specify the charges against Rozi.

Although Arabs and the Turkic Uyghur people are predominantly Muslim, Saudi Arabia’s Crown Prince Mohammed bin Salman stands firmly alongside China. In February 2019, the monarch voiced support for China’s so-called “anti-terrorism” policy. In Xinjiang, an estimated one million Uyghurs are being forcefully detained in internment camps. Saudi Arabia has also repeatedly positioned itself alongside China at the United Nations. grz

China’s Foreign Minister Wang Yi is seeking dialogue with potential and established partner countries of the new Silk Road (Belt and Road, BRI). Currently, Wang is still touring Indian Ocean littoral states. He is visiting Sri Lanka, the Maldives, Eritrea, and Kenya. Then, at the end of this week, it will be the turn of the Gulf Cooperation Council countries. Representatives from Saudi Arabia, Kuwait, Oman, Bahrain, Iran, and Turkey are visiting China on Friday despite Covid restrictions, reports the South China Morning Post. fin

If you ask Carsten Liske what he gained from his time in China, he always answers with the same flippant phrase: “My son.” His son, born in China, is now nine, and Liske is back working in Germany. Since March, he has been CEO at the mechanical engineering supplier Chiron in Tuttlingen, where he is responsible for the company’s site in Taicang, among other things. He supervises operational business, production and logistics, and the company’s global positioning.

But the one thing that immediately creates a smile on the 48-year-old’s face is the technology behind it. “I’m still a bit in love with that,” he says. Whenever technical drawings of CNC milling machines or turnkey solutions are on the table, the graduate engineer is happy that he still has the opportunity to read them. After all, the technical aspect was one reason why he went to Zurich to study business and production sciences after graduating from school in Waldshut, in the German state of Baden-Württemberg.

However, after graduating, he never built machines; instead, he ensured the globalization of the companies he joined. “It came out of necessity,” says Liske. To sell capital goods, you have to be competitive in price and quality. And that’s where globalization quickly came in. It started with Italy, Sweden, and Finland. Liske quickly moved in international circles before he went to Changzhou near Shanghai in 2011 with his entire family to set up a plant for the machine manufacturer Rieter.

“When you’re abroad with your family, you get to know each other all over again,” says Carsten Liske today. It was a challenge, especially for his wife and daughter, who found themselves in a foreign country without speaking the language. But Shanghai was still an easy place to live at the time because so many foreigners lived and worked there, Liske says.

In China, however, he again noticed what he had also seen elsewhere: The cultural differences are smaller than the one big similarity. “All the people I have met in this world always have one thing in common: They want to be respected for what they have done and what they achieve,” says Liske.

The cosmopolitan view of the world is also reflected in his work. At Chiron, he is currently working on moving the organization away from the local and toward the global. This is not only met with approval; change in a 100-year-old company is not easy. But he has “perseverance,” says Liske, and doesn’t give up easily.

Given the current major challenges, this is especially important. Chip shortages, lack of container capacity – they’re all affecting them, too, including at the assembly plant in Taicang. “These global supply chains that we’ve been relying on relatively well for the last ten years are a bit out of step.” Add to that are trade disputes between the US and China. It will probably be a long time before that eases, he says. But he persists, “We’ve probably reached a turning point.” Marita Wehlus

Michael Mueller, the former governing mayor of Berlin, will report on China, Japan and the Middle East in the SPD Foreign Affairs Working Group. The assignments were decided Wednesday in the party’s working group.

Wu Junli becomes the new president of Chinaoil, a unit of PetroChina responsible for oil and gas trading. Previously, Wu was PetroChina’s regional head for the Americas.

Urjit Patel becomes the new vice-president of the Regions of South Asia, South East Asia and Pacific Islands of the Asian Infrastructure Investment Bank (AIIB). He was previously a senior manager at the Central Bank of India. The AIIB is a development bank under Chinese leadership.

High-speed trains swarm out of this railroad depot in Chengdu. From January 17, the railroad company expects the start of the travel wave before the Spring Festival. Technicians have specially rechecked all trains to make sure there are no technical problems. In China, delays and cancellations are very rare despite the enormous amount of passengers.

German Green Party politician Franziska Brantner is State-Secretary in the newly formed Ministry of Economics under Robert Habeck. On Tuesday, Brantner visited the Lithuanian capital to hold talks. The choice of destination was, of course, no coincidence for the former MEP. Brantner showed support for Lithuania, which had clashed with China over a Taiwan office.

Swedish ex-diplomat and political advisor Viking Bohman assesses the matter for us. In an interview with Amelie Richter, he explains, “It would be bad for the EU and its credibility if China was able to force Lithuania to backtrack.” It was not about winning and losing here, but about realpolitik. By backing down, Beijing would learn that intimidation is effective against Europe.

Meanwhile, Bohman fears a fatal miscalculation in the preparation of the future EU instrument against economic coercion. Its strategy is based on the assumption that China will change its behavior as soon as the EU has such an instrument. This is wrong. While it is true that the EU is driving up the economic costs of intimidation attempts, China under Xi, however, is willing to accept these costs to achieve its policy goals. The result would be ever more tiring trench warfare, as we are currently experiencing over Lithuania.

The preparation of the anti-coercion instrument is thus a perfect example of the poor level of information about China, which sinologist Klaus Muehlhahn has already pointed out in China.Table. Political decisions with major implications are currently being made without the ability to assess China’s reaction beforehand.

Has Huawei joined the ranks of car manufacturers or not? We answer this question in today’s profile of the Chinese company Seres, one of Huawei’s cooperation partners. The EV specialist has a colorful company history, in which German managers have also played a part.

Lithuania is the latest example of economic coercion from Beijing, but it is not the first. Can you give us a brief overview?

So the first thing to say is that Beijing’s economic coercion is not a new phenomenon. Other countries have been subject to similar measures in recent years. We have Australia, following its request for an inquiry into the origins of the COVID-19 virus. We have Canada, following the arrest of Huawei Chief Financial Officer Meng Wanzhou, and we have South Korea following its decision to install a US missile defense system. There have also been many cases in the European Union, including in Sweden, where economic coercion has taken the form of travel warnings to restrict tourism, canceled business delegations and talks, as well as the pressure on specific companies. Most recently, it was in response to a decision that excluded Huawei and ZTE from parts of Sweden’s telecommunication networks. What is happening in Lithuania, however, is at a whole new level compared to what we have seen before.

Has economic coercion from China increased in recent years?

It does indeed appear as if the frequency of this type of overt economic coercion has increased in recent years. And this seems to be particularly true for European countries. You can also see that the magnitude of China’s overt economic coercion appears to have increased in recent years if you look at the extensive measures implemented against countries like Australia, Canada, South Korea, Sweden, and Lithuania. This suggests that the amount of pressure Beijing is willing to apply has increased. A further indication of China’s growing willingness to employ economic measures is its use of sanctions in the form of restrictions on travel and “doing business with” China against European entities and individuals in March 2021.

Is Beijing successful with this strategy? And if not, what is the greater intention behind it?

It depends on what we assume the goal is. If we assume that the goal is to reverse the supposedly China-critical policy of the targeted countries, then China has rarely been successful in recent years. In Sweden, for example, China’s actions have been met with heavy criticism and failed to reverse any policies like the exclusion of Huawei. There have been similar reactions in other countries. Failed coercion attempts on the 5G issue have been seen in Germany, France, the United Kingdom, even though these countries are quite reliant on trade with China. The coercion also often seems to be counterproductive. The measures frequently cause anger and damage China’s image as a reliable trading partner, which is a key source of its power in Europe.

You have already mentioned the examples in your home country Sweden with the exclusion of Huawei and ZTE. Do you see any long-term effects of Chinese coercion in Sweden?

Ericsson has reported a significant loss of market share in China, and Ericsson is, of course, an important Swedish company. But I don’t think it had any significant effect on the Swedish economy as a whole, and definitely not anywhere close to what is currently happening in Lithuania. And if you look at trade flows between Sweden and China, they have been going up in recent years. So even though we have experienced an all-time low in political relations, this does not seem to have had a particularly big effect on economic relations.

Would you say the Lithuanian case is special, or could this happen to any country?

What’s happening in Lithuania is, to my knowledge, unprecedented. It appears that there is an on-and-off blanket trade suspension on goods from Lithuania. China has imposed trade restrictions against countries before, but these have always targeted specific sectors, industries, or companies, like in the cases of Australia, South Korea, or Canada, for example. Until recently, Lithuania seemed to be able to deal with this, as very little of its trade goes to China. But now we have seen China putting pressure on multinational firms to cut their ties with Lithuania or risk being shut out of the Chinese market. Investors could pull out of Lithuania and start to look for other suppliers, et cetera. This could really impact the economic flows within the EU. And I think that it is not an exaggeration to say that it is a challenge to the integrity of the EU Single Market.

Do you think the case of Lithuania will deter other EU countries from heading down the same path? Is China successful here with its coercive approach?

It really depends on how this will play out. One question is if Lithuania is going to maintain its current policy and the name of the Taiwanese representative office. Also, how significant will the economic impact from the coercion be and how much support will Lithuania get from the EU and other partners? If the impact becomes too great, other countries might be discouraged from taking similar steps.

But Lithuania has also reacted quickly to the threats from China.

I think there is a lot to learn from the actions of the Lithuanian government that it has taken in response to China’s coercion. It has established a hotline for companies targeted by Chinese coercion, and they have looked at how they can support these companies. They have tried to coordinate with allies, and they have explored opportunities to develop alternative supply chains. It will be interesting to see, later on, how well this has worked.

Recently, the Lithuanian president officially called it “a mistake” for the first time to allow a “Taiwan office” in Vilnius under that name. Are we now witnessing the first cracks forming in the Lithuanian position under China’s pressure?

I think it is hard to say from one statement. The fact that he considers the decision a mistake may not necessarily mean that he wants to reverse the overall policy. However, some may take this as an indication that Lithuania is really under great pressure and that it needs more substantial support from the EU and other allies to deal with it. It would be bad for the EU and its credibility if China was able to force Lithuania to backtrack.

The planned Anti-Coercion Instrument (ACI) is intended to prevent the very situations Lithuania is currently dealing with. The EU Commission plans to use this instrument primarily as a deterrent and hopes that it will never have to use it. Is this an effective approach against China?

One of the main problems with this instrument is that it is based on the assumption that it will be able to deter China. Proponents say that the mere existence of the ACI will have a deterrent effect, and ideally the instrument would never have to be used. I find this quite unlikely. China’s current foreign policy trajectory suggests that the EU’s ability to influence decision-making in Beijing is quite small. And there seem to be red lines that have been defined by China’s top leaders that they are not willing to budge on. In order to defend the credibility of these red lines, China appears to be willing to accept quite high reputational, political and economic costs.

What would be the consequences?

To me, it seems unlikely that China, under its current uncompromising “wolf warrior” approach to diplomacy, would refrain from this type of coercive action just to avoid the economic costs of a European trade and investment restriction. That doesn’t mean that the EU shouldn’t do something. But the strategy cannot be based on an assumption that China will change its behavior. China might continue this type of coercion, and we have to plan for that.

You suggest that the ACI should be more focused on better absorbing China’s economic pressures, rather than potentially taking countermeasures. Can you elaborate on this?

The problem with an instrument that focuses on countermeasures is that it doesn’t do much for the country targeted by China’s economic coercion. And that could in effect mean that China successfully frightens and deters other countries from criticizing it or acting against its interests. One way to solve this would be to shift the focus from countermeasures to actions that aim to absorb the effects of coercion. Under this design, the ACI’s main function would be to provide tailored support to targeted EU member states to prevent or upset any economic fallout, for example, in cases where supply chains are disrupted

That would mean a realignment of the ACI.

It could help open new connections to alternative partners and suppliers, or provide financial aid for specific switching costs. It could also consist of a solidarity mechanism whereby the member states on a voluntary basis would agree to assist or share some of that economic burden with the target country. The goal here would not be to deter China but to make a coercion attempt ineffective while maintaining an independent policy direction.

What other flaws do you see in the EU Commission’s current proposal on the ACI?

Another problem with the mechanism is that China’s actions are usually hard to verify. They operate in this sort of gray zone, and it’s difficult to know if the state contributed to the coercion and how. For example, it is difficult to verify if a boycott or canceled business delegation is caused directly by the state. If China conceals the act, it is probably hard to prove, which means that the EU would not have a clear case at the WTO.

What do the current drafts envisage here?

In the current proposal, decisions on the use of the ACI will be made by the commission after consulting a committee made up of representatives from the member states. I am not sure if this is an ideal option and if it will be accepted by the member states. As the issues at hand will be very political and foreign policy-oriented, I would expect the member states to play a bigger role.

The ACI does not yet exist, and it will take some time before it comes into force. What options does the EU have at this stage in the case of Lithuania?

China’s more assertive approach requires action. But the reflex to respond to economic coercion by retaliating with similar countermeasures may not be the best option. I think it is more important now to give Lithuania the support it needs to maintain an independent policy. It would not look good if China successfully forced Lithuania to back down. A WTO case against China or retaliatory trade sanctions does not really provide any concrete help for Lithuania. Even if the EU could impose such measures today.

What scenarios are possible now?

The pressure that China is putting on companies to cut ties with Lithuania really interferes with the internal flows of the single market. The EU’s response should focus on preventing or mitigating the effects of this. Otherwise, the Lithuanian economy could really become squeezed. After the US imposed sanctions against Iran in 2018, the EU took steps to prevent European companies from pulling out of the Iranian market through the so-called Blocking Statute. A similar move may not be possible in the Lithuanian case, but I think it would be useful to look at how the EU and its member states can change the incentives for companies thinking about whether to cut ties with Lithuania in order to preserve their access to China’s markets.

Viking Bohman is an analyst at the Swedish National China Centre. The research center is part of the renowned Swedish Institute of International Affairs and conducts research on China-related matters. Bohman has previously worked at the Swedish Ministry of Foreign Affairs and the Swedish Embassy in Beijing.

There is currently a bit of confusion surrounding the car manufacturer Seres – ever since the company has appeared as a partner of the electronics group Huawei. Identical products pop up under different names. And there is also varying information about the company’s origin. Here are the most important facts:

The contradictory reports about the company are owed to its history, which has experienced many breaks – and is now taking a happy turn thanks to Huawei. Seres set out for Silicon Valley in 2016 with big plans in mind. At the time, the company was still called SF Motors. The plan was to shake up the EV market. The company even enlisted Martin Eberhard, co-founder and former CEO of Tesla, as a strategic advisor.

Under Eberhard, Seres acquired EV and battery technology company InEVit in 2017 for $33 million (a combination of ‘electric vehicle’ and the word ‘inevitable’). Back in 2016, Seres had acquired AM General’s manufacturing assets – the factory that produced the infamous Hummer – for $160 million.

Eberhard rose to the position of Chief Innovation Officer. Heiner Fees, the founder of InEVit, moved to the innovation team. The funds were there, as was the experience in the vehicle business. Seres is, after all, a sister company of Dongfeng Sokon Automobile (DFSK), one of the largest Chinese car brands.

In 2018, Seres then presented the SF5 and SF7 prototypes: premium electric SUVs with some whopping 1,000 horsepower. The plan was to manufacture and sell 50,000 models in the USA, with another 150,000 in the People’s Republic. These ambitious goals even motivated Elon Musk to take on President Trump on Twitter. Musk pointed out to the belligerent president that Chinese automakers already operate several wholly-owned subsidiaries in the US – including SF Motors.

However, it quickly became clear that Seres would not be able to keep its full-bodied promises. Fees left the company again after only four months, and the ongoing trade conflicts prompted Seres to cease production in the USA entirely.

The Seres 3 has been available in China since November 2020. A compact SUV that shares the platform with the Fengon 500. The SF5 also made it to China in April 2021. However, just 7,080 models were sold up to and including November. Revised and equipped with Huawei’s Harmony OS operating system, it is now to make a name for itself as the Aito M5.

And also in Germany. The importer Indimo plans to offer the car from the second quarter of 2022, albeit under the name Seres 5. Huawei and Seres had actually founded the Aito brand, but the German company does not want to go along with the change for the time being. In any case, Indimo is cautious. The company ordered only four units to check out the model first.

The vehicle is available in the People’s Republic with a range extender. This means that it actually runs with an electric motor, but comes also equipped with a gas-powered generator that is able to generate power. In Germany, however, only the purely electric version will be available. It is unclear how high the CO2 emissions of the Chinese four-cylinder engine are and whether it will be approved.

On the German market, the Aito M5 (or Seres 5 or SF5) will therefore only be available as a pure electric SUV. The front and rear axles will each be powered by an electric motor with around 340 hp, Indimo told China.Table. The package will cost at least €50,000, with €60,000 being more likely. The importer does not want to give details on the exact performance data and range until the car has arrived in Germany. However, three-phase charging and a 400-volt electrical system are standard.

With the Aito M5, Huawei is going on the offensive in car manufacturing. The electronics group’s smartphone sales have slumped due to the US sanctions. These losses are now to be offset with the entry into the automotive sector. The underlying reason is that smart cars, mobility applications, and autonomous driving are considered to be a growth industry. However, the chips required for these applications are not as complex as those used in smartphones. Huawei could meet the demand even without US suppliers.

In 2021, Huawei formed the “5G Automotive Ecosystem”. To this end, the Group has signed agreements with a total of 18 automakers that will offer the Huawei HiCar system in their cars in the future. These include big names such as Great Wall Motor, Geely, Changan Automobile, BAIC Group, SAIC Motor, and GAC Group. The software can also be installed in older models. BYD was the first manufacturer to present a vehicle with the Huawei screen in February 2021.

Huawei is placing a particular focus on autonomous driving in its partnerships. The brand Arcfox presented the Alpha-S station wagon, for example. The car is equipped with Huawei technology and is said to already be capable of autonomous driving at level three (L3) in some areas. This would allow the driver to actually devote his attention to other things while driving. Jetour’s Great Sage X-1 is already the next electric SUV with extensive Huawei technology in the starting blocks. Christian Domke Seidel

The German government continues to show solidarity with Lithuania in its dispute with China. Franziska Brantner, State-Secretary in the newly set up Ministry for Economic Affairs and Climate Protection, visited the Lithuanian capital Vilnius for talks on Tuesday. It is a matter of protecting the EU’s single market from attacks, Spiegel quoted the Green politician as saying. Lithuania would remain a good place for investment.

The dispute was sparked by the opening of a “Taiwan office” in Vilnius (China.Table reported). China also extended threats of trade restrictions to any companies sourcing goods from Lithuania. The EU sees its strategy of creating an instrument against economic coercion vindicated by the dispute.

Meanwhile, a statement by the Lithuanian president caused some confusion when he admitted that the controversial name “Taiwan” in the office’s title was based more on ignorance of consequences than on a sophisticated strategy. Foreign Minister Gabrielius Landsbergis, on the other hand, is fully committed to the confrontational course toward China. He explicitly welcomed Brantner’s visit as an important sign.

According to Der Spiegel, Brantner also met with company representatives during her visit. They did not want to make their worries about Lithuanian-Chinese relations public because they feared it would cause new problems. Now they were able to express their concerns directly to the representative of the German government.

While China is fuming, Taiwan is trying to compensate for the damages Lithuania is suffering. The government has already set up a fund for investments in Lithuania, and has now launched a loan program. It immediately received a budget of $1 billion. The money is also intended to help companies that are affected by unofficial Chinese sanctions. fin

While market leader Volkswagen has suffered considerably under chip supply bottlenecks over recent months, and Daimler also recorded a slight decline in sales, BMW 2021 was able to significantly increase its sales in China. Sales increased by 8.9 percent to just under 850,000 vehicles. BMW thus sold more cars in China than ever before, the Munich-based company announced.

The automotive industry has been struggling with the shortage of semiconductors around the globe for more than a year. Many manufacturers were forced to halt production again and again due to a shortage of key parts. BMW, however, had a better handle on chip supply. According to experts, one factor here is that BMW did not cut back its orders as much as other companies at the peak of the first Covid wave in March 2020.

This year’s highlight: BMW plans to acquire a majority stake in its joint venture with Chinese supplier Brilliance. The deal is expected to close before the end of the first quarter. flee/rtr

China is investing billions in new factories for the production of polysilicon, the base material for solar panels. According to market analysts, polysilicon prices will remain high until the summer. By 2023, however, they could drop “to a historic low,” Bloomberg quotes one expert as saying. According to the report, the supply of solar modules will increase massively over the next few years, causing prices to fall. At the end of 2021, the price of polysilicon was still at a 10-year-high. After three Chinese manufacturers opened new factories with a total capacity of 160,000 tons per year – more than a quarter of the previous global capacity – prices already fell by 17 percent, according to Bloomberg.

China dominates the market for polysilicon, solar cells, and modules. Worldwide, three out of four solar modules and 83 percent of solar cells are produced in China. In the case of polysilicon, China dominates 77 percent of the global market. The People’s Republic is facing massive criticism due to circumstantial evidence of Uyghur forced labor involved in the production of polysilicon (China.Table reported). According to Bloomberg, many of the new polysilicon factories are located outside Xinjiang’s Uyghur province. The US recently passed a law embargoing imports suspected of using forced labor in Xinjiang. Germany’s new Foreign Minister Annalena Baerbock also recently proposed a similar approach (China.Table reported).

According to analysts, addressing the polysilicon shortage is crucial for the solar industry, Bloomberg reports. Producing the raw material is said to be the most difficult step in the supply chain to create new capacities. It could take 18 to 24 months to bring new factories online due to complicated manufacturing processes. By the end of the year, there could be a global polysilicon capacity to build 500 gigawatts of new solar capacity, according to Bloomberg. nib

China plans to build a total of 6.5 million affordable rental apartments in 40 major cities by 2025. The Ministry of Housing and Urban-Rural Construction made the announcement on Tuesday. These apartments are expected to account for about a quarter of all new housing in the cities in question and benefit 13 million young people and newcomers, Bloomberg reports.

For some years now, Chinese rents and housing prices have been barely affordable for many people. China’s President Xi Jinping had also called for more affordable housing last year during the presentation of his concept for common prosperity (China.Table reported). The current 14th Five-Year Plan and several political speeches repeatedly stated that housing was not intended for speculation.

The initiative to build social housing could also benefit real estate developers struggling to survive. However, it is still unclear who will pay for the construction of the apartments and who will manage and own them. Last year, more than 930,000 affordable rental apartments were built in 40 cities, according to the Ministry of Housing. nib

Saudi Arabia is planning to extradite two Uyghur prisoners to the People’s Republic of China. This has come to the attention of the human rights organization Human Rights Watch (HRW). The two men, who come from Turkey, have been held in Saudi Arabia for almost two years without formal charges. If extradited to the People’s Republic, Nurmemet Rozi and Hemdullah Abduweli face imprisonment and torture, HRW fears. “If Saudi Arabia deports these two Uyghur men, it will be sending a clear message that it stands arm-in-arm with the Chinese government and its crimes against humanity targeting Turkic Muslims,” said Michael Page of HRW Middle East.

Abduweli is accused of calling for armed resistance against Chinese oppression of the Uyghurs in Xinjiang in an Uyghur community during a pilgrimage to Saudi Arabia. His daughter posted a video in Arabic on Twitter a few days ago. In it, she asks Saudi authorities to let the two men return to Turkey, according to HRW. HRW did not specify the charges against Rozi.

Although Arabs and the Turkic Uyghur people are predominantly Muslim, Saudi Arabia’s Crown Prince Mohammed bin Salman stands firmly alongside China. In February 2019, the monarch voiced support for China’s so-called “anti-terrorism” policy. In Xinjiang, an estimated one million Uyghurs are being forcefully detained in internment camps. Saudi Arabia has also repeatedly positioned itself alongside China at the United Nations. grz

China’s Foreign Minister Wang Yi is seeking dialogue with potential and established partner countries of the new Silk Road (Belt and Road, BRI). Currently, Wang is still touring Indian Ocean littoral states. He is visiting Sri Lanka, the Maldives, Eritrea, and Kenya. Then, at the end of this week, it will be the turn of the Gulf Cooperation Council countries. Representatives from Saudi Arabia, Kuwait, Oman, Bahrain, Iran, and Turkey are visiting China on Friday despite Covid restrictions, reports the South China Morning Post. fin

If you ask Carsten Liske what he gained from his time in China, he always answers with the same flippant phrase: “My son.” His son, born in China, is now nine, and Liske is back working in Germany. Since March, he has been CEO at the mechanical engineering supplier Chiron in Tuttlingen, where he is responsible for the company’s site in Taicang, among other things. He supervises operational business, production and logistics, and the company’s global positioning.

But the one thing that immediately creates a smile on the 48-year-old’s face is the technology behind it. “I’m still a bit in love with that,” he says. Whenever technical drawings of CNC milling machines or turnkey solutions are on the table, the graduate engineer is happy that he still has the opportunity to read them. After all, the technical aspect was one reason why he went to Zurich to study business and production sciences after graduating from school in Waldshut, in the German state of Baden-Württemberg.

However, after graduating, he never built machines; instead, he ensured the globalization of the companies he joined. “It came out of necessity,” says Liske. To sell capital goods, you have to be competitive in price and quality. And that’s where globalization quickly came in. It started with Italy, Sweden, and Finland. Liske quickly moved in international circles before he went to Changzhou near Shanghai in 2011 with his entire family to set up a plant for the machine manufacturer Rieter.

“When you’re abroad with your family, you get to know each other all over again,” says Carsten Liske today. It was a challenge, especially for his wife and daughter, who found themselves in a foreign country without speaking the language. But Shanghai was still an easy place to live at the time because so many foreigners lived and worked there, Liske says.

In China, however, he again noticed what he had also seen elsewhere: The cultural differences are smaller than the one big similarity. “All the people I have met in this world always have one thing in common: They want to be respected for what they have done and what they achieve,” says Liske.

The cosmopolitan view of the world is also reflected in his work. At Chiron, he is currently working on moving the organization away from the local and toward the global. This is not only met with approval; change in a 100-year-old company is not easy. But he has “perseverance,” says Liske, and doesn’t give up easily.

Given the current major challenges, this is especially important. Chip shortages, lack of container capacity – they’re all affecting them, too, including at the assembly plant in Taicang. “These global supply chains that we’ve been relying on relatively well for the last ten years are a bit out of step.” Add to that are trade disputes between the US and China. It will probably be a long time before that eases, he says. But he persists, “We’ve probably reached a turning point.” Marita Wehlus

Michael Mueller, the former governing mayor of Berlin, will report on China, Japan and the Middle East in the SPD Foreign Affairs Working Group. The assignments were decided Wednesday in the party’s working group.

Wu Junli becomes the new president of Chinaoil, a unit of PetroChina responsible for oil and gas trading. Previously, Wu was PetroChina’s regional head for the Americas.

Urjit Patel becomes the new vice-president of the Regions of South Asia, South East Asia and Pacific Islands of the Asian Infrastructure Investment Bank (AIIB). He was previously a senior manager at the Central Bank of India. The AIIB is a development bank under Chinese leadership.

High-speed trains swarm out of this railroad depot in Chengdu. From January 17, the railroad company expects the start of the travel wave before the Spring Festival. Technicians have specially rechecked all trains to make sure there are no technical problems. In China, delays and cancellations are very rare despite the enormous amount of passengers.