Today’s technological standards do not yet possess the political significance that they will have in 20 years’ time. Simply because many future technologies have not yet reached broad market maturity. But Europe must be prepared for the People’s Republic of China to turn the development of standards into geopolitical power. The experience made during the Covid pandemic serves as a blueprint.

During the crisis, China has learned how to use delays and shortages in global supply chains to its political advantage. Beijing has also begun to simply threaten all critics with its market power. Should the People’s Republic one day enforce its standards in key areas, its political pressure on other players will increase massively – especially on Germany. It would be naïve to doubt it.

In today’s interview with China.Table, Sibylle Gabler from the German Institute for Standardization notes: “China’s activities have increased here”. My prediction would be: this is just the beginning.

In practice, the People’s Republic is already anchoring the basic framework of its standards in large parts of the world. In the United Arab Emirates, Chinese companies are investing in almost all future key industries as players on the new Silk Road. We have taken a first-hand look at developments in Dubai.

The conclusion: The European Union’s global infrastructure program Global Gateway as an answer to the new Silk Road comes not a day too soon. It is high time for Europe to increase its presence in locations where the People’s Republic has long since begun to stretch out.

Standardization is considered a rather dry topic. Why would we be interested in standardization at all?

There are many answers to this. First of all, standardization is simply an important tool for the competitiveness of the economy. The phrase “he who makes the standard has the market” still applies. So if you manage to include content in a standard that is beneficial for your company, you will have an easier time getting your products onto German or even international markets. And of course, it is also important for the economy as a whole. Because standards are a common language and a common basis. Purely national standards can have the opposite effect. They potentially seal off markets. And standards of course also play a role in safety and consumer protection. Standards have, for example, improved occupational health and safety in the mining industry, thus saving lives. Standardization can also make a significant contribution to environmental protection.

China is now regarded as the new superpower in standardization. What is your take on this? Is it already there?

We have to ask ourselves how we define power at this point. If we look at how intensively China is taking on positions at the international level, we cannot say that China is overpowering. The People’s Republic is ultimately coming from the position of a developing country and has not yet reached the point that would be analogous to its current economic importance. But they are making great strides towards becoming a world power, and that is why we are all growing aware of this. We had a president at ISO from China a few years ago. When it comes to taking over secretariats, we have a significant increase of 106 percent. So they are making huge headway. In doing business with China, Chinese standards are of course also growing in importance. This is definitely a challenge for export-oriented German companies.

Do we have to adopt more Chinese standards now?

There is no simple answer to that. At the international level, it is not the case that someone from one country presents a standard and says “Well, this is my standard, now make it an international standard and write ISO or IEC on it”. It doesn’t work like that. Instead, it has to be negotiated with the experts in individual countries. In this respect, a mandatory adoption is not given or possible at this point. But the moment you enter into trade relations with China, things may look different. Companies that have strong business relationships must of course consider which standards play a role for their business in China.

How do the standardization philosophies differ in the EU, China, and the USA?

There is no singular organization in the US such as DIN in Germany, or similar national organizations in individual European nations. Instead, there are hundreds of standardization organizations, for example within associations. The philosophy here is that the best standard will prevail. Europe and the USA have one thing in common: the bottom-up approach. The economy says, “Okay, we need a standard here now, and then we’ll make one.” In Europe, we have the additional component that the European Commission can also be a client for standards and is an important co-initiator. Incidentally, we are currently anticipating the EU’s standardization strategy, which is due to be revealed soon.

And in China?

Since its reform, the Chinese system has been divided into two parts, a more state-controlled part, and a more market-driven part, so to speak. In this market-driven part, the most important thing is the association standards, which resembles the US model, where standards are developed by numerous organizations. These standards are skyrocketing in numbers, there are more and more coming. Then there is the government-driven part, from which national standards emerge. Some of these are obligatory and therefore most comparable to our technical regulation. Overall, the Chinese system is much more government-driven compared to that of the US and Europe.

A few weeks ago, Beijing presented its “Chinese Standards 2035”. Is this now China’s big play to gain an advantage in standardization?

I rather have the impression that they are leaving all their options open. It’s neither compartmentalization nor a full commitment to international standardization. It is somehow a bit of both. However, I think it is a positive development in general that international standardization is being taken into account. China wants to continue its close international involvement. It is also planned that China will adopt 85 percent of international standards nationally. That is ultimately the decisive factor. Of course, China will be able to contribute everywhere. But what is important is that these standards are subsequently applied. Whether international standards will then actually be adopted without any changes remains to be seen.

How is China involved in international organizations? You already mentioned technical committees or secretariats. Could you briefly explain why these are so important?

The actual technical work needs to be structured organizationally, and that’s where the technical committees come into play. ISO has over 300 of these, for example, for information technology, food, or quality management. There are larger and smaller committees, and these are then further divided, for example for the development of test methods, safety, or quality aspects. And there are again different working groups. Both the secretariat and management of the technical committees have the ability to shape things, to push things forward or not. Germany was and is always quite well positioned in this respect. But now an emerging economy like China comes along and starts taking over secretariats.

What does that mean?

Germany holds very strong standardization positions in some fields, such as mechanical engineering. However, we are not particularly well-positioned when it comes to digital subjects. The USA is very strong in this field, as is China. China has taken the lead in areas such as rare-earth elements, plastics, and lithium. And that, of course, brings us to areas of geopolitical importance.

Is China using standardization as a geopolitical tool?

Topics such as rare-earth elements or lithium are also about recycling and environmental protection. If you have already made your mark in these fields, as China has, then you are one step ahead in terms of content. Here the old saying applies: He who writes, stays. If you initiate standards, and you have already written some things down instead of handing in a blank sheet of paper, then you have already established certain facts. And setting the topic is of course already political. China’s activities have increased here. This also applies to other issues that are important for China, such as rail transport.

Rail transport is a good point when it comes to the Green Deal. What about standardization in the area of sustainability? What can we expect here?

This will be exciting, of course, because we are currently observing two major shifts in industries around the globe, but also in Europe: the digital and the green transformation of the economy. The agreement of the “traffic light coalition” will give this further momentum in Germany. However, these efforts can only succeed if the relevant standards are thought through and elaborated. This is about Germany and Europe have a say in defining and shaping the standards. It’s about designing solutions and requirements to remain competitive. These are the big issues at hand.

How can Germany and Europe respond to the trends set by China?

The best solution for all involved is for us to find common ground in international standardization. Only then, will we have every chance of continuing to play an important role. It is not a question of perceiving China as an adversary, but of assembling at an international level and welcoming Chinese participation and leadership. If this means increased competition, Europe and Germany have to accept this. We need to find key technologies for ourselves in Europe, in which we then need to quickly set the topics ourselves, and then take the lead. If, for example, the German industry is told to become greener, then we must also make sure that we play a very active role in determining the relevant standards on an international level. Germany is not yet leading in this regard. We also need to bring the results of European research into international standardization much more quickly.

Do you think China has an advantage because things can just be pushed through there?

In a way, yes. And this is where we are back at different standardization philosophies. If the party in China says, “Now we do it this way,” then that’s how it’s done. In a democracy, of course, that doesn’t work, we have different processes. I think we need to find solutions in the future to new challenges that are posed to standardization by more state-driven nations. Our industry-driven approach remains the foundation. That’s just our tradition and our approach. But we also need to look, in terms of strategic autonomy and digital sovereignty in Europe, at what needs to be done to ensure that the European economy stays competitive as a whole. There is this tradition in Germany and essentially also in Europe, which states that politics actually has to stay out of standardization. But times are now changing due to players like China. In the case of lithium, for example, the EU Commission was alarmed and recognized that this would become a strategic issue for electromobility in the years to come.

Do we have enough proficient experts in Germany and Europe? And do we invest enough money in the development of standards?

That’s actually the biggest problem. I wouldn’t even say that it’s all about money. Of course, money is always an issue, but I think the biggest challenge is the experts. The shortage of experts is also noticeable in standardization. For years, we have been complaining about a lack of experts. At this point, we have to increase training in Germany and, for example, have more incentives for scientists to participate in standardization. One approach could also be increased participation of authority representatives

What opportunities are there for cooperation with China, then?

We have been cooperating with the German-Chinese Commission for Standardization for some time now. There, discussions take place on a strategic level, but also on specific topics such as electromobility, Industry 4.0, or autonomous driving. Technical experts from China and Germany meet there bilaterally and learn from each other. However, there are also examples where cooperation does not work as well. For example, when centralized data collection comes into play. Companies criticize that China seeks to define aspects within committees that are not compatible with our approach to data, i.e. the General Data Protection Regulation.

Sibylle Gabler has been Director of Government Relations at DIN since 2014. As an expert on standardization, she advises the German Bundestag, among others.

The drive along the six- and in places eight- and ten-lane Sheikh Zayed Road in Dubai offers a fascinating insight into the birth of a city from the vial. At a maximum speed of 100 km/h, there is plenty of time to marvel at the bulky facades of the skyscrapers to the left and right. World-class buildings erupt like oil from the desert sand.

There are abundantly clear parallels with China here. They are no coincidence. The seven states of the United Arab Emirates also want to set standards for infrastructure and modernity today, after still being considered backward in the last century. Nowadays, there is plenty of money on both sides. Dubai and Abu Dhabi, in particular, are now drawing on the full resources of their construction projects. China is a role model, partner, and financier. At the same time, this new dimension of partnership is integrating the Emirates ever more closely into the new Silk Road.

The People’s Republic is thus providing important components for the impressive display of a new melting pot of cultures on the Arabian Peninsula. The fact that Chinese companies are building extravagant new skyscrapers is only a superficial sign of profound development. China’s companies are also providing the digital framework for smart-city concepts and traffic systems. They are providing the equipment for fiber-optic networks and offering technical components for video surveillance of all corners of the emirates. They are flanking the construction of a huge solar park with the construction of a coal-fired power plant, automating logistics of the affluent consumer society, and settling by the thousands along the coast between Dubai and Abu Dhabi in the form of start-ups and tech companies.

The Emirates have long been the largest beneficiary of Chinese direct investment in the region. Bilateral trade climbed to over $50 billion before the Covid crisis. To those who, until now, had no idea of the intensity and determination with which Beijing is working on the construction of its new Silk Road, the so-called MENA region (Middle East and Northern Africa) will provide an impressive display. Chinese interests are increasingly represented, not only in the Emirates but also in Kuwait, Oman, Qatar, Saudi Arabia, and Egypt.

In addition to the construction sector, the focus lies primarily in the transfer of new data and telecommunications technologies. This happens quickly and almost silently. A mixture is emerging here that is likely to be entirely in the interests of the major donor country, China. The Emirates benefit economically, but there is no opposition and no critical debate from civil society. The growing ties to an increasingly totalitarian regime are thus not called into question. Nor is there any limit to the extensive appliance of Chinese surveillance technology. At the same time, China is allowed to export its standards here.

China also sees itself as a shrewd, calculating investor – an attitude that is backed by its business success. “Specifically, in recent years, the business environment of Arab countries has improved, and the governments have made great efforts to attract Chinese investors.,” says Luo Lin of the International and Regional Studies Institute in Beijing.

The strategy of making Chinese investment appealing to its hosts follows the same universal principle that is taking root in other regions of the world. “The Belt and Road cooperation between China and Arab countries is building a road of peace, prosperity, and opening-up for both China and the Arab world,” Luo explains. In return, Beijing only expects Arabs to operate within internationally established frameworks: “Arab countries are supportive of the rules of multilateral trading under the framework of the World Trade Organization to achieve the goal of realizing the sustainable development of all nations.”

China’s call for multilateralism under World Trade Organization rules always includes a sideswipe at the United States. The message between the lines: While Washington bans Chinese companies from its own market, China advocates global cooperation for the benefit of all the world’s nations. The countries of the MENA region only see few objections to the Chinese interpretation of the geostrategic bigger picture.

The result is a number of major projects, including in the Emirates, that go to Chinese companies or are funded by China. The development of the state railway company Etihad Rail, with a volume of around $2 billion, is largely handled by construction companies from the People’s Republic. The construction of the coal-fired power plant Hassyan for around $3.4 billion is being funded by the sheiks, largely through loans from Chinese banks.

China Petroleum Pipeline Engineering won the tender for the design and construction preparations for a gas pipeline. The expansion and operation of a second container terminal in the port of Abu Dhabi have been fixed for a total of 35 years in a joint venture between the local operator and the Chinese Cosco Shipping Ports.

Other contracts have even longer durations. The lease for an industrial area in the free trade zone by the Jiangsu Provincial Overseas Cooperation & Investment Company runs for 50 years. Companies from the eastern Chinese province of Jiangsu have announced investments of around $300 million. Chinese money is also flowing into the construction of a wholesale market in the free trade zone. In addition, there are projects such as the development of industrial areas or the construction of a plant for the production of industrial gas methanol.

To be sure, European companies are also earning their share from the Emirates’ development. For example, Siemens supplies turbines for railway construction, and French logistics and shipping company CMA CGM operates another container terminal with a local partner for several decades. But area-wide investments covering all core areas of industry and commerce are covered exclusively by China.

German observers on-site are also noticing the shift towards China. “The economic interests of the People’s Republic are also becoming clear at the Expo,” says Dietmar Schmitz. He is the General Director of the German pavilion at Expo2020 in Dubai, which did not open its doors until October this year due to the Covid pandemic. “China’s approach here is much more focused on establishing new business relationships than Germany’s, for example.” With their presence, the Germans also wanted to promote their companies in the region. But while the Federal Republic is trying to whet the world’s appetite for sustainability “made in Germany” through the playful presentation of its innovations, China is advertising directly with offers from its companies (China.Table reported).

To counter China’s competition and BRI strategy, however, the European Union is now also digging deep into its pockets. The EU wants to provide €300 billion to breathe life into its Global Gateway counter-campaign (China.Table reported). Details of the plan are to be presented in Brussels on Wednesday. The Emirates are emblematic of the fact that it is high time for the Europeans to take action if they are indeed serious about standing up to Chinese interests in both the MENA and other regions of the world.

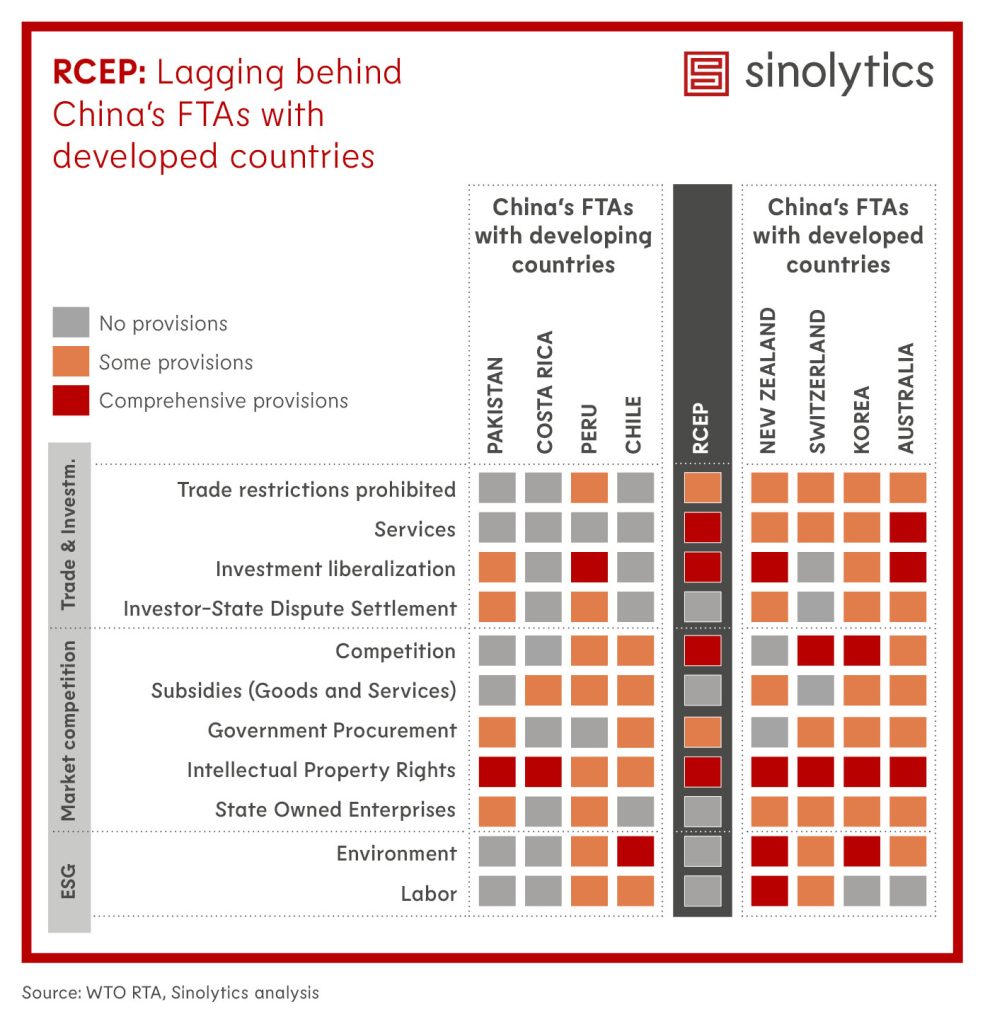

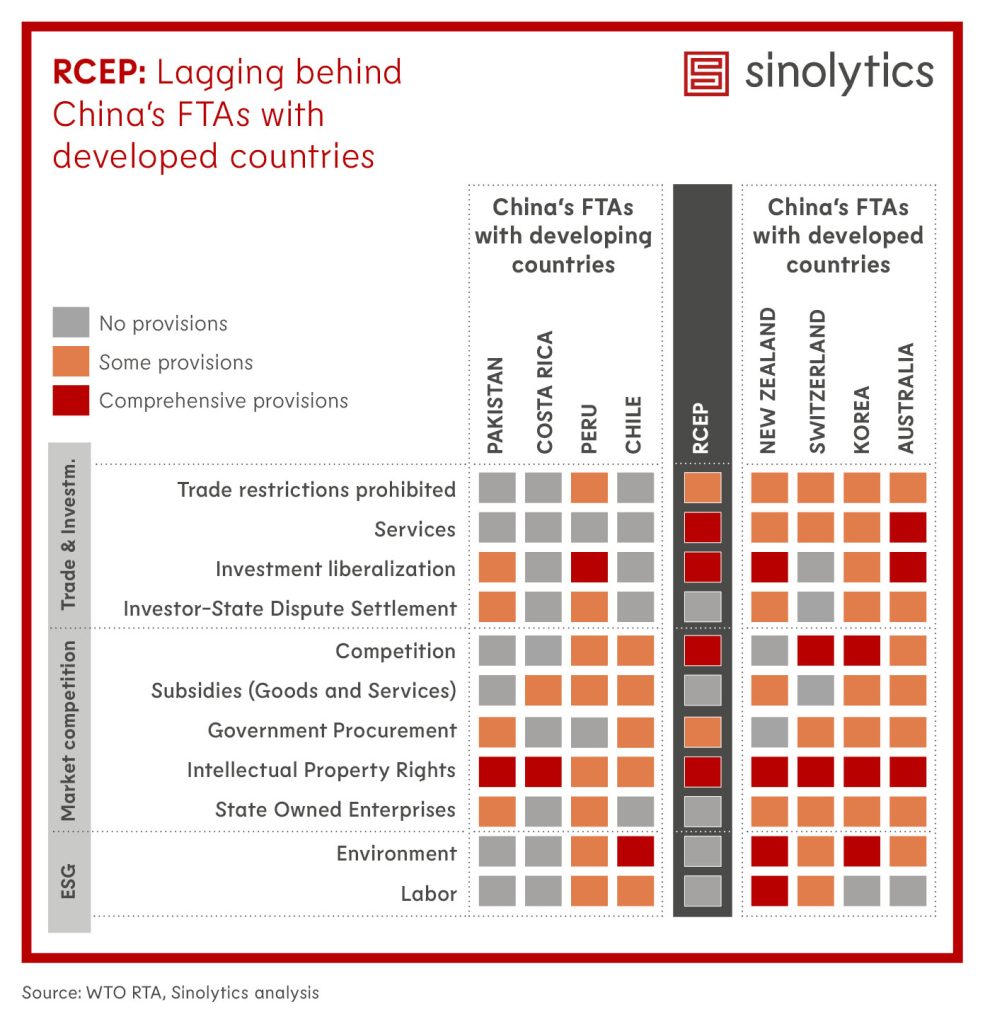

Sinolytics is a European consulting and analysis company that focuses entirely on China. It advises European companies on their strategic orientation and concrete business activities in China.

The central Chinese province of Henan wants to place journalists and foreign students under close surveillance. This is revealed by documents analyzed by Reuters. The plan is to precisely track the movement profiles of members of the two groups, among other “suspicious persons” in Henan in the future.

A corresponding announcement on the provincial government’s website made in July reveals the authorities’ intention to use facial recognition technology to identify respective individuals The Shenyang-based company Neusoft is to supply the necessary software, which links the images with relevant databases of the security authorities and is to give a warning when a suspicious person checks into a hotel, for example. According to Reuters, this is the first time that such a system is being utilized in the People’s Republic.

These plans see journalists categorized into red, yellow, and green – to indicate the urgency of tracking. 2,000 police officers are to be assigned to monitor the system. The software integrates 3,000 cameras whose images can be matched with the data. According to the tender, facial recognition must be accurate even if observed persons wear face masks or glasses.

To place all journalists and international students under suspicion is another step by China towards a totalitarian surveillance state. With a steadily growing number of cameras in public spaces, including facial recognition, as well as the use of mobile phone tracking, authorities want to identify alleged threats to national security at an early stage. While journalists are generally considered a source of risk because of their work, Henan now also brands all foreign students as possible spies. grz

With the expansion of several bases in the Indo-Pacific, the US wants to better prepare itself for potential operations against Russia and China (China.Table reported). According to a statement issued by the US Department of Defense on Monday, military facilities on the Pacific island of Guam and in Australia are to be expanded. This mainly includes military airports and ammunition depots. In addition, the Pentagon wants to station new fighter aircraft and bombers in Australia on a rotating basis and train ground troops.

Among other things, the expansion serves the purpose of countering “the increased threat from China and North Korea,” explains Mara Karlin, the Pentagon’s director of strategic affairs. The expansion is to enable swifter and larger deployment of troops. In addition, the increased US presence should also help bolster deterrence against Russia and enable NATO forces to “operate more effectively”.

China reacted sharply to the announcement. Foreign Ministry spokesman Zhao Lijian said on Tuesday that Washington was creating “an imaginary enemy” and sparing no effort “to surround and contain China”. The Chinese navy has been steadily expanding its operations into the Indo-Pacific in recent years. The US also considers the growing Chinese presence in the South China Sea in particular as a threat to its hitherto unique maritime position of power in the region (China.Table reported). fpe

The European Union is making progress in new guidelines for the European market that intends to encourage China to open up in the field of public procurement. The draft of the so-called “International Procurement Instrument” (IPI) was adopted on Tuesday by the European Parliament’s Committee on International Trade. MEPs thus approved two types of IPI measures, which the EU Commission can utilize to address unequal access to public procurement markets. The first measure is the price adjustment mechanism proposed by EU member states. The second potential measure is to exclude a company from tendering altogether.

In addition, the Committee has reduced the number of exceptions to two, where contracting authorities can refuse IPI measures:

The areas of public health or environmental protection are mentioned as examples. The draft sees companies from developing countries excluded from the IPI requirements. Different threshold values are to apply to public tenders: starting at €10 million for construction tenders and starting at €5 million for goods and services.

The bill is to be voted on in January in the plenary of the EU Parliament. There are still disagreements between the European Parliament and the EU Council on the implementation of the IPI, explained Daniel Caspary, the CDU politician in charge of the draft position of the European Parliament on IPI. The EU Council wants to place the decision-making power in the Member States, the EU Parliament sees it with the EU Commission.

The IPI is not a regulation “against China”, stressed Reinhard Buetikofer, a Greens politician. However, the People’s Republic was the elephant in the room on this issue. China had not kept its promise to open up its procurement market, Buetikofer stated. The new requirements must now be implemented without loopholes. ari

The European Union has called on Chinese authorities to conduct “a full, fair and transparent investigation” into the allegations of sexual assault made by tennis player Peng Shuai’s against former Vice Premier Zhang Gaoli. In a statement released Tuesday, Brussels also called on the Chinese government to “provide verifiable proof of Peng Shuai’s safety, well-being and whereabouts.”

China would have to comply with its human rights obligations under national and international law. The tennis player’s public appearance had not allayed concerns about her safety and freedom.

Peng was seen in a video phone call with IOC President Thomas Bach just over a week ago (China.Table reported). In the conversation, the athlete stressed that she was well and living in her home in Beijing. Human rights activists such as the Chinese lawyer Teng Biao assume while Peng was not physically harmed, she was placed under high psychological pressure (China.Table reported). ari

The China Association of Performing Arts (CAPA) has blacklisted another 85 internet livestreamers. So-called “key opinion leaders” such as Tie Shankao (铁山靠) or Guo Laoshi (郭老师) have exerted a bad influence on society and especially on the youth, the cultural authority writes in an official statement.

Since the introduction of the “blacklist management system” in 2018, 446 livestreamers have already been banned from major streaming platforms in the country. Those who are placed on the blacklist are banned from Douyin, China’s version of TikTok, as well as all other popular platforms.

The accusations against the livestreamers include tax evasion, but also “immoral behavior” that does not correspond to the “socialist core values”. Influencer Guo Laoshi, who became famous on Douyin, apparently ended up on the list in part because she smelled her feet on camera. Back in September, Beijing had called on the country’s media outlets to ban male stars whose appearance was too feminine and “effeminate” (China.Table reported).

Online influencers have become a significant economic factor as sellers and brand ambassadors in China’s e-commerce world. Last year, China’s “social commerce” sector turned over $242 billion, ten times as much as in the USA. Social commerce refers to the sale of products via social media platforms and livestreaming events. fpe

ByteDance, the parent company of the popular social-media platform TikTok, has a not-so-secret weapon. Its powerful algorithms are able to predict users’ preferences with precision and recommend content they actually want to see, thereby keeping them glued to their screens. But ByteDance may soon have to sheathe that weapon – or, at least, dull its blade.

Internet-platform companies in China are facing a slew of new data regulations that could curtail the use of recommendation engines. For starters, the Personal Information Protection Law, which took effect this month, requires platforms to allow users to opt-out of personalized content and targeted ads.

But China may soon go much further. Its internet regulator, the Cyberspace Administration of China (CAC), recently issued new draft guidelines that entail a host of restrictions on the collection and processing of data and its transfer across borders. Notably, apps would have to obtain explicit consent from users before collecting or using data to make personalized recommendations. In other words, individuals would have to opt into personalization, rather than opting out of it, as is the current norm.

This policy could go a long way toward eroding the business models of online platforms like Douyin (the version of TikTok used in China) and Taobao (an online-shopping platform owned by the Alibaba Group), with potentially far-reaching implications for future innovation in the Chinese tech sector. The reason is simple: many users, if asked, decide that personalization is not worth giving up their privacy.

Asking makes all the difference. When Apple buried the option to refuse tracking by apps in its complicated privacy settings, only 25% of users took the time to find it and opt-out. But when the company began prompting iPhone users with the opportunity to opt-out of tracking, 84% took it.

Apple’s new opt-out policy, which it introduced to its iPhone iOS last April, has been devastating for US tech firms such as Facebook, whose business models are built on the collection of user data and the sale of targeted ads. According to one estimate, Apple’s policy change cost Facebook, Snap, Twitter, and YouTube together nearly $10 billion in revenue – or 12% of the total – in the second half of 2021. Online advertisers, who now must pay much more to reach potential customers, are panicking.

This is an ominous sign for China’s tech companies – not least because the CAC’s draft data regulations go well beyond Apple’s new rule. Whereas Apple requires apps to get permission before sharing a user’s data with third parties, the new Chinese measures would require apps to secure user opt-in even to use the data themselves.

China’s proposed opt-in requirement also appears to be stricter than the European Union’s General Data Protection Regulation – currently one of the world’s toughest privacy laws. While the GDPR requires platforms to secure user consent before collecting and processing data, it does not require specific consent to enable recommendation services.

It remains to be seen how Chinese platforms will respond to the proposed regulation. They will almost certainly lobby the government not to implement it at all. If the government refuses to listen, they will probably try to circumvent the rule by redesigning app features, though this will take time and raise serious compliance risks.

And yet, for the CAC, the struggles of private tech companies may not be much of a concern. While it is impossible to say exactly what factored into the body’s cost-benefit analysis of the proposed opt-in requirement, it seems clear that encouraging business growth and technological innovation is not part of the CAC’s mandate.

So, what are the CAC’s goals? To answer that question, we must consider the agency’s bureaucratic mission, culture, and structure. Given that Chinese administrative enforcement is shaped by path dependence, we must also look to the CAC’s past behavior – in particular, it’s status as one of China’s most interventionist government departments.

Operating under the Central Cyberspace Affairs Commission, a leadership group chaired by President Xi Jinping himself, the CAC was initially charged with ensuring cybersecurity and regulating internet content. But since 2013, it has expanded significantly, including by absorbing other cybersecurity agencies.

In July, the CAC grabbed headlines when it surprised the ride-hailing company Didi Chuxing with a cybersecurity inspection just two days after the firm’s initial public offering in New York. The CAC subsequently mandated cybersecurity checks for any data-rich Chinese tech firm planning overseas listings, effectively establishing itself as a gatekeeper for efforts to raise capital abroad.

Given that data are the lifeblood of the platform economy, the CAC has significant scope to expand its bureaucratic bailiwick. And, if the new draft regulation is any indication, it plans to do just that, tearing down the walls surrounding the “walled gardens” of internet platforms, prohibiting algorithmic price discrimination, and clamping down on other unfair pricing practices.

These efforts will undoubtedly overlap with the mandate of China’s antitrust regulator, the State Administration for Market Regulation. But no matter: emboldened by the government’s push to rein in tech giants, the CAC has big regulatory ambitions. In the coming years, its efforts to realize them will play a major role in determining the trajectory of platform businesses – and tech innovation – in China.

Angela Huyue Zhang, a law professor, is Director of the Center for Chinese Law at the University of Hong Kong. She is the author of Chinese Antitrust Exceptionalism: How the Rise of China Challenges Global Regulation.

Copyright: Project Syndicate, 2021.

www.project-syndicate.org

Li Hongtao will join investment company Stratos as Head of Greater China. Li previously worked at Airbus, where he most recently held the position of Sales Director China. His expertise is in demand at Stratos because the company specializes in investments in the aviation industry.

Heavenly endurance test: 48 parked trucks with a total weight of 1,680 tons test the load-bearing capacity of the Yangbaoshan Bridge in the southwestern Chinese province of Guizhou. The 650-meter-long link spanning valleys is the first bridge in China to be built using the so-called “air spinning” method, in which small wires are spun together to form giant suspension cables.

Today’s technological standards do not yet possess the political significance that they will have in 20 years’ time. Simply because many future technologies have not yet reached broad market maturity. But Europe must be prepared for the People’s Republic of China to turn the development of standards into geopolitical power. The experience made during the Covid pandemic serves as a blueprint.

During the crisis, China has learned how to use delays and shortages in global supply chains to its political advantage. Beijing has also begun to simply threaten all critics with its market power. Should the People’s Republic one day enforce its standards in key areas, its political pressure on other players will increase massively – especially on Germany. It would be naïve to doubt it.

In today’s interview with China.Table, Sibylle Gabler from the German Institute for Standardization notes: “China’s activities have increased here”. My prediction would be: this is just the beginning.

In practice, the People’s Republic is already anchoring the basic framework of its standards in large parts of the world. In the United Arab Emirates, Chinese companies are investing in almost all future key industries as players on the new Silk Road. We have taken a first-hand look at developments in Dubai.

The conclusion: The European Union’s global infrastructure program Global Gateway as an answer to the new Silk Road comes not a day too soon. It is high time for Europe to increase its presence in locations where the People’s Republic has long since begun to stretch out.

Standardization is considered a rather dry topic. Why would we be interested in standardization at all?

There are many answers to this. First of all, standardization is simply an important tool for the competitiveness of the economy. The phrase “he who makes the standard has the market” still applies. So if you manage to include content in a standard that is beneficial for your company, you will have an easier time getting your products onto German or even international markets. And of course, it is also important for the economy as a whole. Because standards are a common language and a common basis. Purely national standards can have the opposite effect. They potentially seal off markets. And standards of course also play a role in safety and consumer protection. Standards have, for example, improved occupational health and safety in the mining industry, thus saving lives. Standardization can also make a significant contribution to environmental protection.

China is now regarded as the new superpower in standardization. What is your take on this? Is it already there?

We have to ask ourselves how we define power at this point. If we look at how intensively China is taking on positions at the international level, we cannot say that China is overpowering. The People’s Republic is ultimately coming from the position of a developing country and has not yet reached the point that would be analogous to its current economic importance. But they are making great strides towards becoming a world power, and that is why we are all growing aware of this. We had a president at ISO from China a few years ago. When it comes to taking over secretariats, we have a significant increase of 106 percent. So they are making huge headway. In doing business with China, Chinese standards are of course also growing in importance. This is definitely a challenge for export-oriented German companies.

Do we have to adopt more Chinese standards now?

There is no simple answer to that. At the international level, it is not the case that someone from one country presents a standard and says “Well, this is my standard, now make it an international standard and write ISO or IEC on it”. It doesn’t work like that. Instead, it has to be negotiated with the experts in individual countries. In this respect, a mandatory adoption is not given or possible at this point. But the moment you enter into trade relations with China, things may look different. Companies that have strong business relationships must of course consider which standards play a role for their business in China.

How do the standardization philosophies differ in the EU, China, and the USA?

There is no singular organization in the US such as DIN in Germany, or similar national organizations in individual European nations. Instead, there are hundreds of standardization organizations, for example within associations. The philosophy here is that the best standard will prevail. Europe and the USA have one thing in common: the bottom-up approach. The economy says, “Okay, we need a standard here now, and then we’ll make one.” In Europe, we have the additional component that the European Commission can also be a client for standards and is an important co-initiator. Incidentally, we are currently anticipating the EU’s standardization strategy, which is due to be revealed soon.

And in China?

Since its reform, the Chinese system has been divided into two parts, a more state-controlled part, and a more market-driven part, so to speak. In this market-driven part, the most important thing is the association standards, which resembles the US model, where standards are developed by numerous organizations. These standards are skyrocketing in numbers, there are more and more coming. Then there is the government-driven part, from which national standards emerge. Some of these are obligatory and therefore most comparable to our technical regulation. Overall, the Chinese system is much more government-driven compared to that of the US and Europe.

A few weeks ago, Beijing presented its “Chinese Standards 2035”. Is this now China’s big play to gain an advantage in standardization?

I rather have the impression that they are leaving all their options open. It’s neither compartmentalization nor a full commitment to international standardization. It is somehow a bit of both. However, I think it is a positive development in general that international standardization is being taken into account. China wants to continue its close international involvement. It is also planned that China will adopt 85 percent of international standards nationally. That is ultimately the decisive factor. Of course, China will be able to contribute everywhere. But what is important is that these standards are subsequently applied. Whether international standards will then actually be adopted without any changes remains to be seen.

How is China involved in international organizations? You already mentioned technical committees or secretariats. Could you briefly explain why these are so important?

The actual technical work needs to be structured organizationally, and that’s where the technical committees come into play. ISO has over 300 of these, for example, for information technology, food, or quality management. There are larger and smaller committees, and these are then further divided, for example for the development of test methods, safety, or quality aspects. And there are again different working groups. Both the secretariat and management of the technical committees have the ability to shape things, to push things forward or not. Germany was and is always quite well positioned in this respect. But now an emerging economy like China comes along and starts taking over secretariats.

What does that mean?

Germany holds very strong standardization positions in some fields, such as mechanical engineering. However, we are not particularly well-positioned when it comes to digital subjects. The USA is very strong in this field, as is China. China has taken the lead in areas such as rare-earth elements, plastics, and lithium. And that, of course, brings us to areas of geopolitical importance.

Is China using standardization as a geopolitical tool?

Topics such as rare-earth elements or lithium are also about recycling and environmental protection. If you have already made your mark in these fields, as China has, then you are one step ahead in terms of content. Here the old saying applies: He who writes, stays. If you initiate standards, and you have already written some things down instead of handing in a blank sheet of paper, then you have already established certain facts. And setting the topic is of course already political. China’s activities have increased here. This also applies to other issues that are important for China, such as rail transport.

Rail transport is a good point when it comes to the Green Deal. What about standardization in the area of sustainability? What can we expect here?

This will be exciting, of course, because we are currently observing two major shifts in industries around the globe, but also in Europe: the digital and the green transformation of the economy. The agreement of the “traffic light coalition” will give this further momentum in Germany. However, these efforts can only succeed if the relevant standards are thought through and elaborated. This is about Germany and Europe have a say in defining and shaping the standards. It’s about designing solutions and requirements to remain competitive. These are the big issues at hand.

How can Germany and Europe respond to the trends set by China?

The best solution for all involved is for us to find common ground in international standardization. Only then, will we have every chance of continuing to play an important role. It is not a question of perceiving China as an adversary, but of assembling at an international level and welcoming Chinese participation and leadership. If this means increased competition, Europe and Germany have to accept this. We need to find key technologies for ourselves in Europe, in which we then need to quickly set the topics ourselves, and then take the lead. If, for example, the German industry is told to become greener, then we must also make sure that we play a very active role in determining the relevant standards on an international level. Germany is not yet leading in this regard. We also need to bring the results of European research into international standardization much more quickly.

Do you think China has an advantage because things can just be pushed through there?

In a way, yes. And this is where we are back at different standardization philosophies. If the party in China says, “Now we do it this way,” then that’s how it’s done. In a democracy, of course, that doesn’t work, we have different processes. I think we need to find solutions in the future to new challenges that are posed to standardization by more state-driven nations. Our industry-driven approach remains the foundation. That’s just our tradition and our approach. But we also need to look, in terms of strategic autonomy and digital sovereignty in Europe, at what needs to be done to ensure that the European economy stays competitive as a whole. There is this tradition in Germany and essentially also in Europe, which states that politics actually has to stay out of standardization. But times are now changing due to players like China. In the case of lithium, for example, the EU Commission was alarmed and recognized that this would become a strategic issue for electromobility in the years to come.

Do we have enough proficient experts in Germany and Europe? And do we invest enough money in the development of standards?

That’s actually the biggest problem. I wouldn’t even say that it’s all about money. Of course, money is always an issue, but I think the biggest challenge is the experts. The shortage of experts is also noticeable in standardization. For years, we have been complaining about a lack of experts. At this point, we have to increase training in Germany and, for example, have more incentives for scientists to participate in standardization. One approach could also be increased participation of authority representatives

What opportunities are there for cooperation with China, then?

We have been cooperating with the German-Chinese Commission for Standardization for some time now. There, discussions take place on a strategic level, but also on specific topics such as electromobility, Industry 4.0, or autonomous driving. Technical experts from China and Germany meet there bilaterally and learn from each other. However, there are also examples where cooperation does not work as well. For example, when centralized data collection comes into play. Companies criticize that China seeks to define aspects within committees that are not compatible with our approach to data, i.e. the General Data Protection Regulation.

Sibylle Gabler has been Director of Government Relations at DIN since 2014. As an expert on standardization, she advises the German Bundestag, among others.

The drive along the six- and in places eight- and ten-lane Sheikh Zayed Road in Dubai offers a fascinating insight into the birth of a city from the vial. At a maximum speed of 100 km/h, there is plenty of time to marvel at the bulky facades of the skyscrapers to the left and right. World-class buildings erupt like oil from the desert sand.

There are abundantly clear parallels with China here. They are no coincidence. The seven states of the United Arab Emirates also want to set standards for infrastructure and modernity today, after still being considered backward in the last century. Nowadays, there is plenty of money on both sides. Dubai and Abu Dhabi, in particular, are now drawing on the full resources of their construction projects. China is a role model, partner, and financier. At the same time, this new dimension of partnership is integrating the Emirates ever more closely into the new Silk Road.

The People’s Republic is thus providing important components for the impressive display of a new melting pot of cultures on the Arabian Peninsula. The fact that Chinese companies are building extravagant new skyscrapers is only a superficial sign of profound development. China’s companies are also providing the digital framework for smart-city concepts and traffic systems. They are providing the equipment for fiber-optic networks and offering technical components for video surveillance of all corners of the emirates. They are flanking the construction of a huge solar park with the construction of a coal-fired power plant, automating logistics of the affluent consumer society, and settling by the thousands along the coast between Dubai and Abu Dhabi in the form of start-ups and tech companies.

The Emirates have long been the largest beneficiary of Chinese direct investment in the region. Bilateral trade climbed to over $50 billion before the Covid crisis. To those who, until now, had no idea of the intensity and determination with which Beijing is working on the construction of its new Silk Road, the so-called MENA region (Middle East and Northern Africa) will provide an impressive display. Chinese interests are increasingly represented, not only in the Emirates but also in Kuwait, Oman, Qatar, Saudi Arabia, and Egypt.

In addition to the construction sector, the focus lies primarily in the transfer of new data and telecommunications technologies. This happens quickly and almost silently. A mixture is emerging here that is likely to be entirely in the interests of the major donor country, China. The Emirates benefit economically, but there is no opposition and no critical debate from civil society. The growing ties to an increasingly totalitarian regime are thus not called into question. Nor is there any limit to the extensive appliance of Chinese surveillance technology. At the same time, China is allowed to export its standards here.

China also sees itself as a shrewd, calculating investor – an attitude that is backed by its business success. “Specifically, in recent years, the business environment of Arab countries has improved, and the governments have made great efforts to attract Chinese investors.,” says Luo Lin of the International and Regional Studies Institute in Beijing.

The strategy of making Chinese investment appealing to its hosts follows the same universal principle that is taking root in other regions of the world. “The Belt and Road cooperation between China and Arab countries is building a road of peace, prosperity, and opening-up for both China and the Arab world,” Luo explains. In return, Beijing only expects Arabs to operate within internationally established frameworks: “Arab countries are supportive of the rules of multilateral trading under the framework of the World Trade Organization to achieve the goal of realizing the sustainable development of all nations.”

China’s call for multilateralism under World Trade Organization rules always includes a sideswipe at the United States. The message between the lines: While Washington bans Chinese companies from its own market, China advocates global cooperation for the benefit of all the world’s nations. The countries of the MENA region only see few objections to the Chinese interpretation of the geostrategic bigger picture.

The result is a number of major projects, including in the Emirates, that go to Chinese companies or are funded by China. The development of the state railway company Etihad Rail, with a volume of around $2 billion, is largely handled by construction companies from the People’s Republic. The construction of the coal-fired power plant Hassyan for around $3.4 billion is being funded by the sheiks, largely through loans from Chinese banks.

China Petroleum Pipeline Engineering won the tender for the design and construction preparations for a gas pipeline. The expansion and operation of a second container terminal in the port of Abu Dhabi have been fixed for a total of 35 years in a joint venture between the local operator and the Chinese Cosco Shipping Ports.

Other contracts have even longer durations. The lease for an industrial area in the free trade zone by the Jiangsu Provincial Overseas Cooperation & Investment Company runs for 50 years. Companies from the eastern Chinese province of Jiangsu have announced investments of around $300 million. Chinese money is also flowing into the construction of a wholesale market in the free trade zone. In addition, there are projects such as the development of industrial areas or the construction of a plant for the production of industrial gas methanol.

To be sure, European companies are also earning their share from the Emirates’ development. For example, Siemens supplies turbines for railway construction, and French logistics and shipping company CMA CGM operates another container terminal with a local partner for several decades. But area-wide investments covering all core areas of industry and commerce are covered exclusively by China.

German observers on-site are also noticing the shift towards China. “The economic interests of the People’s Republic are also becoming clear at the Expo,” says Dietmar Schmitz. He is the General Director of the German pavilion at Expo2020 in Dubai, which did not open its doors until October this year due to the Covid pandemic. “China’s approach here is much more focused on establishing new business relationships than Germany’s, for example.” With their presence, the Germans also wanted to promote their companies in the region. But while the Federal Republic is trying to whet the world’s appetite for sustainability “made in Germany” through the playful presentation of its innovations, China is advertising directly with offers from its companies (China.Table reported).

To counter China’s competition and BRI strategy, however, the European Union is now also digging deep into its pockets. The EU wants to provide €300 billion to breathe life into its Global Gateway counter-campaign (China.Table reported). Details of the plan are to be presented in Brussels on Wednesday. The Emirates are emblematic of the fact that it is high time for the Europeans to take action if they are indeed serious about standing up to Chinese interests in both the MENA and other regions of the world.

Sinolytics is a European consulting and analysis company that focuses entirely on China. It advises European companies on their strategic orientation and concrete business activities in China.

The central Chinese province of Henan wants to place journalists and foreign students under close surveillance. This is revealed by documents analyzed by Reuters. The plan is to precisely track the movement profiles of members of the two groups, among other “suspicious persons” in Henan in the future.

A corresponding announcement on the provincial government’s website made in July reveals the authorities’ intention to use facial recognition technology to identify respective individuals The Shenyang-based company Neusoft is to supply the necessary software, which links the images with relevant databases of the security authorities and is to give a warning when a suspicious person checks into a hotel, for example. According to Reuters, this is the first time that such a system is being utilized in the People’s Republic.

These plans see journalists categorized into red, yellow, and green – to indicate the urgency of tracking. 2,000 police officers are to be assigned to monitor the system. The software integrates 3,000 cameras whose images can be matched with the data. According to the tender, facial recognition must be accurate even if observed persons wear face masks or glasses.

To place all journalists and international students under suspicion is another step by China towards a totalitarian surveillance state. With a steadily growing number of cameras in public spaces, including facial recognition, as well as the use of mobile phone tracking, authorities want to identify alleged threats to national security at an early stage. While journalists are generally considered a source of risk because of their work, Henan now also brands all foreign students as possible spies. grz

With the expansion of several bases in the Indo-Pacific, the US wants to better prepare itself for potential operations against Russia and China (China.Table reported). According to a statement issued by the US Department of Defense on Monday, military facilities on the Pacific island of Guam and in Australia are to be expanded. This mainly includes military airports and ammunition depots. In addition, the Pentagon wants to station new fighter aircraft and bombers in Australia on a rotating basis and train ground troops.

Among other things, the expansion serves the purpose of countering “the increased threat from China and North Korea,” explains Mara Karlin, the Pentagon’s director of strategic affairs. The expansion is to enable swifter and larger deployment of troops. In addition, the increased US presence should also help bolster deterrence against Russia and enable NATO forces to “operate more effectively”.

China reacted sharply to the announcement. Foreign Ministry spokesman Zhao Lijian said on Tuesday that Washington was creating “an imaginary enemy” and sparing no effort “to surround and contain China”. The Chinese navy has been steadily expanding its operations into the Indo-Pacific in recent years. The US also considers the growing Chinese presence in the South China Sea in particular as a threat to its hitherto unique maritime position of power in the region (China.Table reported). fpe

The European Union is making progress in new guidelines for the European market that intends to encourage China to open up in the field of public procurement. The draft of the so-called “International Procurement Instrument” (IPI) was adopted on Tuesday by the European Parliament’s Committee on International Trade. MEPs thus approved two types of IPI measures, which the EU Commission can utilize to address unequal access to public procurement markets. The first measure is the price adjustment mechanism proposed by EU member states. The second potential measure is to exclude a company from tendering altogether.

In addition, the Committee has reduced the number of exceptions to two, where contracting authorities can refuse IPI measures:

The areas of public health or environmental protection are mentioned as examples. The draft sees companies from developing countries excluded from the IPI requirements. Different threshold values are to apply to public tenders: starting at €10 million for construction tenders and starting at €5 million for goods and services.

The bill is to be voted on in January in the plenary of the EU Parliament. There are still disagreements between the European Parliament and the EU Council on the implementation of the IPI, explained Daniel Caspary, the CDU politician in charge of the draft position of the European Parliament on IPI. The EU Council wants to place the decision-making power in the Member States, the EU Parliament sees it with the EU Commission.

The IPI is not a regulation “against China”, stressed Reinhard Buetikofer, a Greens politician. However, the People’s Republic was the elephant in the room on this issue. China had not kept its promise to open up its procurement market, Buetikofer stated. The new requirements must now be implemented without loopholes. ari

The European Union has called on Chinese authorities to conduct “a full, fair and transparent investigation” into the allegations of sexual assault made by tennis player Peng Shuai’s against former Vice Premier Zhang Gaoli. In a statement released Tuesday, Brussels also called on the Chinese government to “provide verifiable proof of Peng Shuai’s safety, well-being and whereabouts.”

China would have to comply with its human rights obligations under national and international law. The tennis player’s public appearance had not allayed concerns about her safety and freedom.

Peng was seen in a video phone call with IOC President Thomas Bach just over a week ago (China.Table reported). In the conversation, the athlete stressed that she was well and living in her home in Beijing. Human rights activists such as the Chinese lawyer Teng Biao assume while Peng was not physically harmed, she was placed under high psychological pressure (China.Table reported). ari

The China Association of Performing Arts (CAPA) has blacklisted another 85 internet livestreamers. So-called “key opinion leaders” such as Tie Shankao (铁山靠) or Guo Laoshi (郭老师) have exerted a bad influence on society and especially on the youth, the cultural authority writes in an official statement.

Since the introduction of the “blacklist management system” in 2018, 446 livestreamers have already been banned from major streaming platforms in the country. Those who are placed on the blacklist are banned from Douyin, China’s version of TikTok, as well as all other popular platforms.

The accusations against the livestreamers include tax evasion, but also “immoral behavior” that does not correspond to the “socialist core values”. Influencer Guo Laoshi, who became famous on Douyin, apparently ended up on the list in part because she smelled her feet on camera. Back in September, Beijing had called on the country’s media outlets to ban male stars whose appearance was too feminine and “effeminate” (China.Table reported).

Online influencers have become a significant economic factor as sellers and brand ambassadors in China’s e-commerce world. Last year, China’s “social commerce” sector turned over $242 billion, ten times as much as in the USA. Social commerce refers to the sale of products via social media platforms and livestreaming events. fpe

ByteDance, the parent company of the popular social-media platform TikTok, has a not-so-secret weapon. Its powerful algorithms are able to predict users’ preferences with precision and recommend content they actually want to see, thereby keeping them glued to their screens. But ByteDance may soon have to sheathe that weapon – or, at least, dull its blade.

Internet-platform companies in China are facing a slew of new data regulations that could curtail the use of recommendation engines. For starters, the Personal Information Protection Law, which took effect this month, requires platforms to allow users to opt-out of personalized content and targeted ads.

But China may soon go much further. Its internet regulator, the Cyberspace Administration of China (CAC), recently issued new draft guidelines that entail a host of restrictions on the collection and processing of data and its transfer across borders. Notably, apps would have to obtain explicit consent from users before collecting or using data to make personalized recommendations. In other words, individuals would have to opt into personalization, rather than opting out of it, as is the current norm.

This policy could go a long way toward eroding the business models of online platforms like Douyin (the version of TikTok used in China) and Taobao (an online-shopping platform owned by the Alibaba Group), with potentially far-reaching implications for future innovation in the Chinese tech sector. The reason is simple: many users, if asked, decide that personalization is not worth giving up their privacy.

Asking makes all the difference. When Apple buried the option to refuse tracking by apps in its complicated privacy settings, only 25% of users took the time to find it and opt-out. But when the company began prompting iPhone users with the opportunity to opt-out of tracking, 84% took it.

Apple’s new opt-out policy, which it introduced to its iPhone iOS last April, has been devastating for US tech firms such as Facebook, whose business models are built on the collection of user data and the sale of targeted ads. According to one estimate, Apple’s policy change cost Facebook, Snap, Twitter, and YouTube together nearly $10 billion in revenue – or 12% of the total – in the second half of 2021. Online advertisers, who now must pay much more to reach potential customers, are panicking.

This is an ominous sign for China’s tech companies – not least because the CAC’s draft data regulations go well beyond Apple’s new rule. Whereas Apple requires apps to get permission before sharing a user’s data with third parties, the new Chinese measures would require apps to secure user opt-in even to use the data themselves.

China’s proposed opt-in requirement also appears to be stricter than the European Union’s General Data Protection Regulation – currently one of the world’s toughest privacy laws. While the GDPR requires platforms to secure user consent before collecting and processing data, it does not require specific consent to enable recommendation services.

It remains to be seen how Chinese platforms will respond to the proposed regulation. They will almost certainly lobby the government not to implement it at all. If the government refuses to listen, they will probably try to circumvent the rule by redesigning app features, though this will take time and raise serious compliance risks.

And yet, for the CAC, the struggles of private tech companies may not be much of a concern. While it is impossible to say exactly what factored into the body’s cost-benefit analysis of the proposed opt-in requirement, it seems clear that encouraging business growth and technological innovation is not part of the CAC’s mandate.

So, what are the CAC’s goals? To answer that question, we must consider the agency’s bureaucratic mission, culture, and structure. Given that Chinese administrative enforcement is shaped by path dependence, we must also look to the CAC’s past behavior – in particular, it’s status as one of China’s most interventionist government departments.

Operating under the Central Cyberspace Affairs Commission, a leadership group chaired by President Xi Jinping himself, the CAC was initially charged with ensuring cybersecurity and regulating internet content. But since 2013, it has expanded significantly, including by absorbing other cybersecurity agencies.

In July, the CAC grabbed headlines when it surprised the ride-hailing company Didi Chuxing with a cybersecurity inspection just two days after the firm’s initial public offering in New York. The CAC subsequently mandated cybersecurity checks for any data-rich Chinese tech firm planning overseas listings, effectively establishing itself as a gatekeeper for efforts to raise capital abroad.

Given that data are the lifeblood of the platform economy, the CAC has significant scope to expand its bureaucratic bailiwick. And, if the new draft regulation is any indication, it plans to do just that, tearing down the walls surrounding the “walled gardens” of internet platforms, prohibiting algorithmic price discrimination, and clamping down on other unfair pricing practices.

These efforts will undoubtedly overlap with the mandate of China’s antitrust regulator, the State Administration for Market Regulation. But no matter: emboldened by the government’s push to rein in tech giants, the CAC has big regulatory ambitions. In the coming years, its efforts to realize them will play a major role in determining the trajectory of platform businesses – and tech innovation – in China.

Angela Huyue Zhang, a law professor, is Director of the Center for Chinese Law at the University of Hong Kong. She is the author of Chinese Antitrust Exceptionalism: How the Rise of China Challenges Global Regulation.

Copyright: Project Syndicate, 2021.

www.project-syndicate.org

Li Hongtao will join investment company Stratos as Head of Greater China. Li previously worked at Airbus, where he most recently held the position of Sales Director China. His expertise is in demand at Stratos because the company specializes in investments in the aviation industry.

Heavenly endurance test: 48 parked trucks with a total weight of 1,680 tons test the load-bearing capacity of the Yangbaoshan Bridge in the southwestern Chinese province of Guizhou. The 650-meter-long link spanning valleys is the first bridge in China to be built using the so-called “air spinning” method, in which small wires are spun together to form giant suspension cables.