Europe’s neighbors will be looking nervously at Germany on Sunday when the votes from the Bundestag elections are counted. There is great concern that the most important member state will remain paralyzed by unclear majorities and months of coalition wrangling. In the other capitals, hopes are high for a federal government that is capable of action and willing to lead.

Because the EU is facing an existential challenge. Donald Trump is threatening to shatter the decades-old alliance of liberal democracies. The US president and his fellow campaigners openly support radical right-wing and nationalist forces in Europe. They seem to have in mind an international of autocrats that includes Vladimir Putin and possibly also Xi Jinping.

The challenge is huge and cannot be overcome without a stable government in Berlin. Friedrich Merz seems to be aware of the dimensions and wants to conduct the talks on a new coalition under his leadership quickly and reasonably peacefully. The major issues of defense funding, migration and the economy are to be explored with potential partners in the smallest of circles and, if possible, already resolved.

With the SPD’s likely new strongmen, Lars Klingbeil and Boris Pistorius, this should be possible, perhaps also with the Greens’ Robert Habeck. The real uncertainty there lies in the final votes of the party conferences or member surveys. Merz may also need more than one partner. Even involving the FDP could complicate the talks to no end if the Liberals continue to declare the debt brake untouchable.

The foreseeable electoral success of the AfD could exacerbate the uncertainty of the centrist parties and at the same time strengthen centrifugal forces. Merz and all the others therefore face a difficult task. Whether they are up to it will help decide the future of the European Union.

Have an exciting election Sunday,

Jim Farley has been making unusual noises recently. While the American business world seems to be cheering on the new US President Donald Trump so far, the head of US car manufacturer Ford is warning of “a lot of costs and a lot of chaos.” He is referring to the US government’s current tariff policy. A 25 percent tariff on the border with Mexico and Canada would “tear a hole in the US industry that we’ve never seen before,” Farley recently said at a conference in New York.

Companies in the USA are increasingly turning away from Trump’s current tariff policy. They fear massive damage to their business, as the additional levies would drastically increase costs. Some now expect that the recipients of Trump’s measures could become the beneficiaries – including Europe.

In the first weeks of his second term in office, Trump has threatened dozens of trading partners with drastic tariffs and has already introduced some of them. These include tariffs on steel and aluminum imports of 25 percent, tariffs on Chinese imports of ten percent and tariffs on goods from Mexico and Canada of 25 percent, which were initially postponed until March. Trump has also threatened to impose tariffs on cars, chips and pharmaceuticals, probably at a rate of 25% from April.

This is not only scaring off foreign countries, but also the domestic economy, which is facing drastic price increases. The uncertainty index for US SMEs, compiled by the National Federation of Independent Business (NFIB), rose in February to its third-highest level since records began. The number of mergers and acquisitions in the US also fell to a ten-year low in January, which economists explain with the volatile market environment.

“Many companies in the US are suddenly alarmed about the tariff policy,” said Robert Handfield, professor of supply chain management at North Carolina State University. The latest tariff announcements would “make no sense at all, as these products are mainly imported.” This would drive up costs massively, Handfield warned in an interview with Table.Briefings. The expert therefore believes that Trump is bluffing and using his announcement as a negotiating threat. After all, he would otherwise come under increasing pressure from American companies.

Entrepreneurs such as Ford boss Farley are nevertheless concerned with the scenario that Trump could be serious – and at the same time warn that some recipients of the tariff policy could even become beneficiaries. This would be particularly true if there were different tariff levels between America’s neighbors and the rest of the world.

“South Korean, Japanese and European companies, which bring one and a half to two million vehicles to the USA and would not be affected by Mexican and Canadian tariffs, would then have a free hand,” warned Farley. It is true that German car manufacturers also produce large parts of their vehicles for the American market in Mexico. However, US companies such as Ford and General Motors or Stellantis (formerly Fiat-Chrysler) are far more dependent on the location in the neighboring country.

The steel processing industry, on the other hand, already sees itself at a disadvantage compared to its foreign competitors. The latest tariffs would drive up steel and aluminum prices, and delivery times would be significantly longer, according to a recent statement from the Coalition of American Metal Manufacturers and Users (CAMMU). “As a result, US manufacturers are paying significantly more for steel and aluminum than their global competitors, undermining their competitiveness.”

SMEs in particular are at risk as they are losing orders to overseas competitors who have unrestricted access to these important raw materials. “Foreign customers are shifting their supply chains away from US manufacturers,” the statement reads.

However, experts such as Alex Durante do not want to proclaim America’s trading partners, especially Europe, as the beneficiaries of this tariff policy. “It’s hard for me to see how the EU would actually benefit,” said the senior economist at the Tax Foundation think tank. “Businesses on both sides will lose out here.” After all, the tariffs would make all products more expensive. Furthermore, Europeans should not forget that Trump also threatened universal tariffs during the election campaign. “There won’t be this kind of substitution between countries and different sectors, because everyone would have the same tariffs,” says Durante.

Irrespective of mere business, however, Europe could emerge stronger from a trade war in other areas, such as the recruitment of important skilled workers. A dispute has recently flared up within the Trump camp over the granting of so-called H-1B visas. With this work permit, American tech companies in particular have brought up to 85,000 foreign talents to the United States every year, including many engineers and developers.

While Trump’s new circle of supporters from Silicon Valley wants to continue recruiting foreign specialists, arch-conservative traditionalists are warning that migrant workers could take well-paid jobs away from their compatriots. If the US government were to impose an entry ban on H-1B visa holders, it would not only be European talent that would be forced to remain in their home country. Many skilled workers from India or China could then be drawn to Europe instead of the USA.

At the same time, the clear-cutting by the so-called DOGE Commission means that some American researchers and scientists are likely to lose their jobs. The “Department Of Government Efficiency” under the leadership of billionaire Elon Musk has already massively frozen or cut federal spending, some of which was used to fund the work of universities and research institutes. Christian Stöcker, Professor of Communication at HAW Hamburg, sees this as an opportunity. Europe should now make it “extremely easy for US academics to obtain long-term visas,” the psychologist suggests. Many additional research positions in key areas are needed, as well as new and generous science and research funds. “We should welcome them.” Laurin Meyer

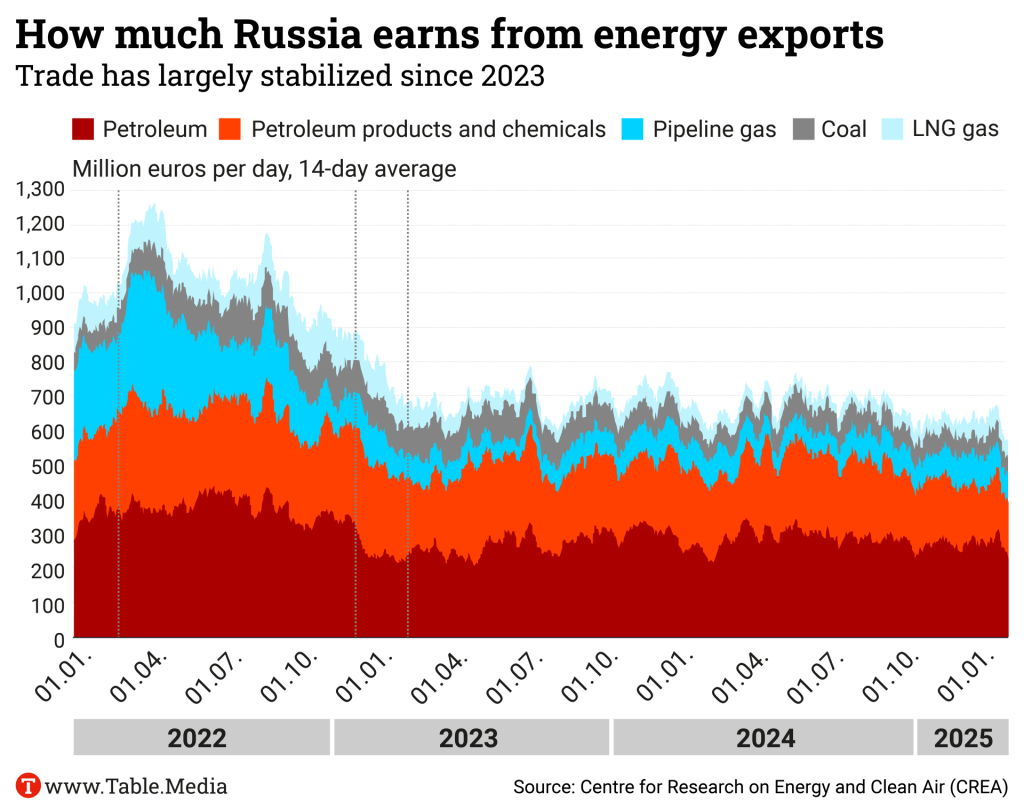

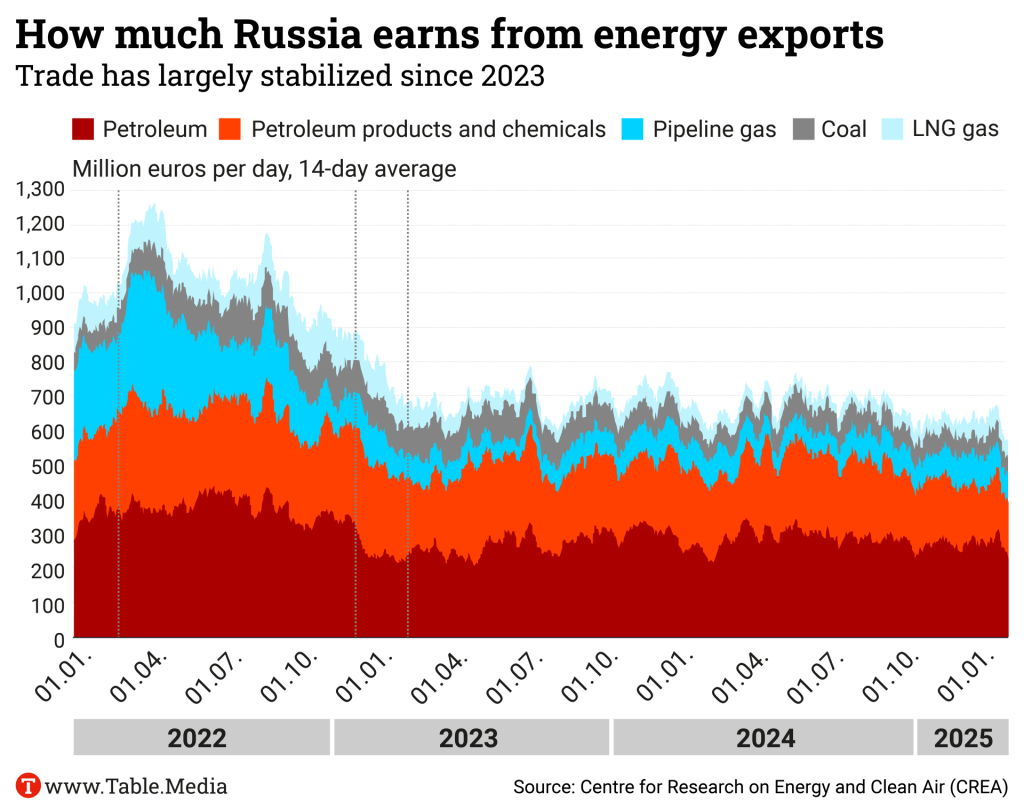

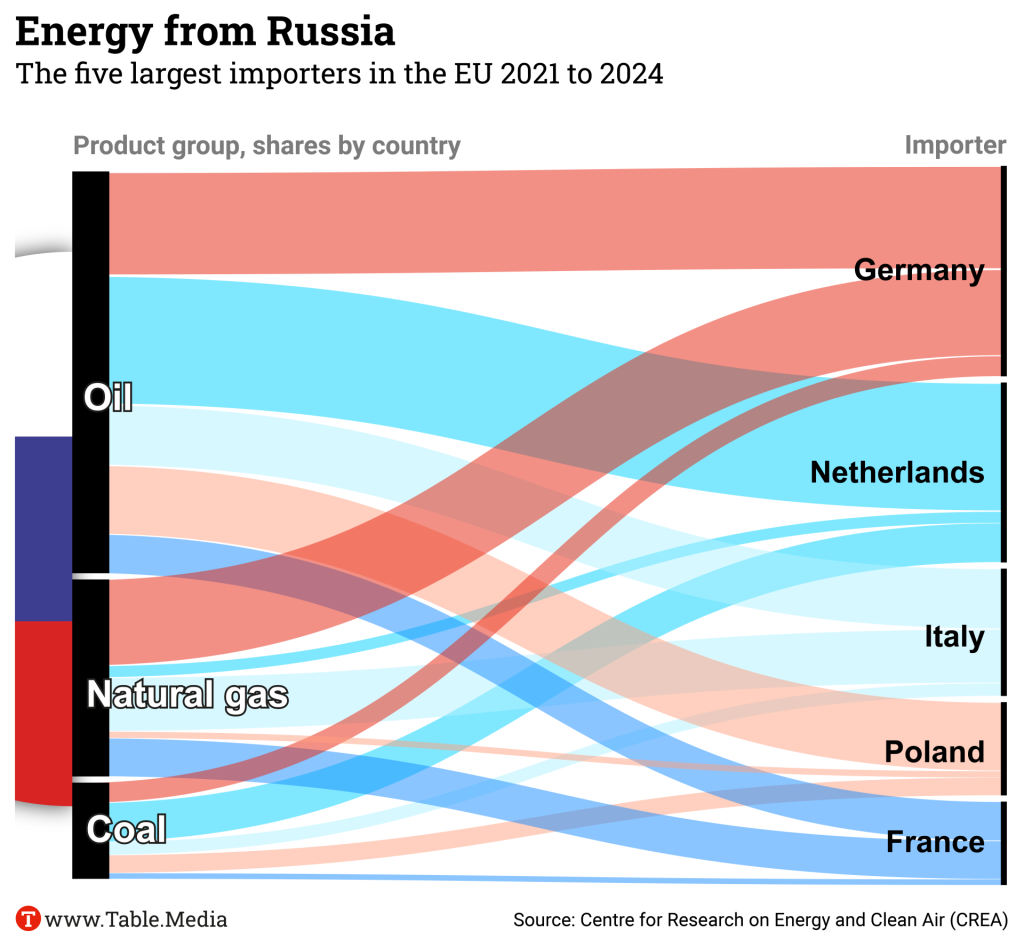

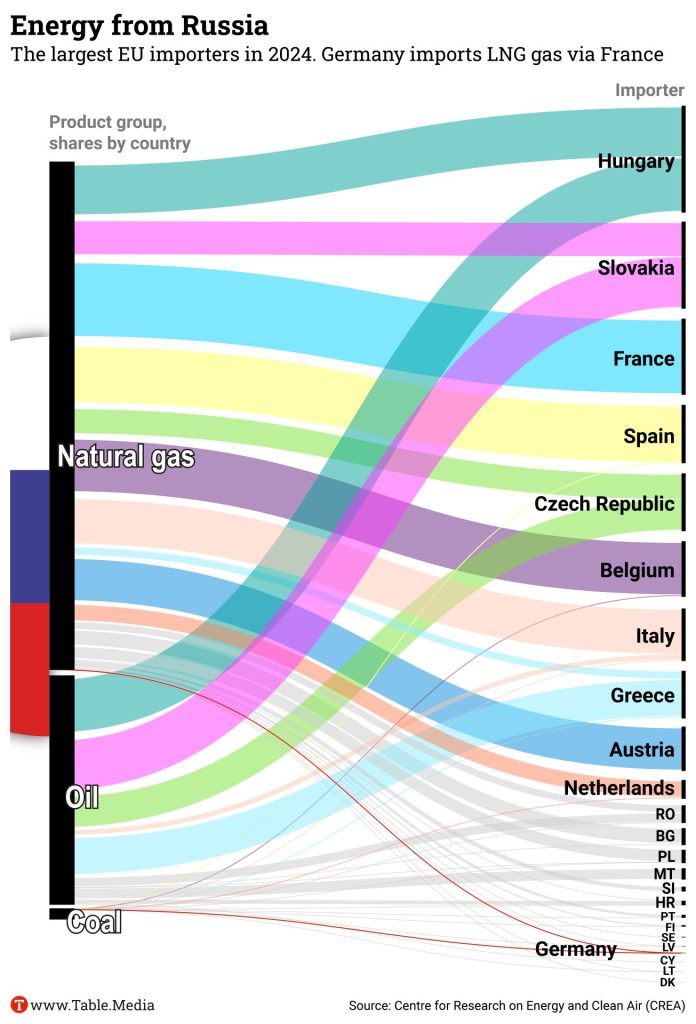

China, India, Turkey, South Korea and Brazil were the five most important buyers of oil, gas and coal from Russia last year. They purchased a total of 76 percent of all exports of these fossil fuels. Although significantly less oil is flowing to Europe, demand for Russian liquid gas has risen massively.

Within the EU, Hungary, Slovenia and France were Moscow’s most important energy trading partners in 2024. However, Sefe – a former Gazprom company nationalized by the federal government – buys LNG via the French port of Dunkerque. This means that German imports via France may be declared as French imports.

Energy exports account for just under 30 percent of the Russian state budget. They are essential for financing the war against Ukraine. The 16th package of sanctions against Russia, which the EU intends to adopt next Monday, is intended to hit more than 70 additional Russian tankers in the shadow fleet. Overall, however, the West has not yet managed to sustainably hit Moscow’s revenues from trade in fossil fuels. This is shown by data from the Finnish organization Centre for Research on Energy and Clean Air (CREA).

Oil is still the most important product for Russia in global trade. So far, it has managed to circumvent the price caps imposed by Western countries and sell oil above the USD 60 per barrel mark, not least thanks to its shadow fleet.

Today, Russia earns around the same amount from exporting its energy sources as it did before the full invasion in 2022. In 2021, it was 230 billion euros, in 2022 – at the height of the war shock – 372 billion euros, in 2023 around 253 billion euros and in 2024 around 243 billion euros.

Russia can fill its war chest, even if the cost of selling the goods increases and the new customers demand discounts. The reason: The West’s sanctions regime is “not effective enough to hit Russia’s export revenues hard for several reasons. These include a lack of political will for tougher sanctions, legal loopholes, a lack of enforcement of sanctions and new importers of Russian energy sources,” explains Isaac Levi, head of the CREA analysis team for Europe-Russia policy and energy.

In the spring of 2022, Russia not only converted its economy to a war footing very quickly, but also found new sales markets for its most important export products faster than the West found its tools of punishment. The most important points of contention in the West are always how quickly a country becomes independent of Russia’s energy and how tough it is when it comes to circumventing sanctions. On March 26, the EU wants to present a plan on how the Union should free itself from its dependence on Russian energy.

In internal EU votes, Hungary is often cited as the main brake on sanctions. However, the fact that Greek shipowners have benefited in particular from the establishment of a shadow fleet for Russian oil when selling tankers to companies in third countries rarely reaches the public. And German shipping companies are also involved.

The USA and the EU are now taking action against the shadow fleet only after a long delay. The sale of old tankers is not illegal, but the sellers must ultimately have been aware of the purpose for which the ships were intended by their new owners. The 16th sanctions package on the 3rd anniversary of the full-scale invasion includes punitive measures against the captains and owners of the tankers.

Experts do not expect the new sanctions package to have much effect. “Russia’s most important trading partners are now India, China, Turkey and the United Arab Emirates. They are pursuing their own interests and are quite indifferent to how the war ends,” says Sergey Vakulenko in an interview with Table.Briefings. He has worked for more than 25 years in top positions in the Russian oil and gas industry and is now an analyst for the Carnegie Russia Eurasia Center. “The West has virtually no economic relations with Russia, so it no longer has much leverage to influence Moscow.”

Russia has learned to manage without Western trade services, explains Vakulenko. “The idea that breaking off contact would lead to a rapid collapse of the Russian economy has not come true. Of course, the problems in the Russian economy are growing, and they pose serious long-term threats to the country’s development. But these will mainly not be Putin’s problems, but those of his successors.”

Feb. 24, 2025

Council of the EU: Foreign Affairs

Topics: Exchange on Russian aggression against Ukraine, the situation in the Middle

East (Syria, Lebanon, UNRWA), the Democratic Republic of the Congo and Iran. Provisional agenda

Feb. 24, 2025

Council of the EU: Agriculture and Fisheries

Topics: Implementation of the principle of rural proof, market situation

after the invasion of Ukraine. Provisional agenda

Feb. 24, 2025

EU-Israel Association Council

Topics: Conflict in the Gaza Strip and Israeli-Palestinian relations, regional issues including Iran as well as global issues, bilateral relations between the EU and Israel. Info

Feb. 25, 2025

Council of the EU: General Affairs

Topics: Commission work program for 2025, annual and multi-year programming. Provisional agenda

Feb. 26, 2025

Weekly commission meeting

Topics: Clean Industry Agreement, First Omnibus Proposal, Action Plan for

Affordable Energy. Provisional agenda

The investment omnibus, which the Commission intends to propose on Wednesday, is intended to stimulate additional investment of 50 billion euros for future projects by the end of the multiannual financial framework in 2027 and bring massive bureaucratic relief for participating companies. The Commission does not want to mobilize fresh money.

Instead, it proposes increasing the InvestEU sum guaranteed by the EU budget by 2.5 billion euros. This money is to be fed from returns from EU funding programs such as EFSI and other financial instruments. InvestEU provides companies with guarantees for investment loans. The additional guarantees amounting to 2.5 billion euros are to be leveraged by a factor of ten and thus trigger investments amounting to 25 billion euros. The Commission wants to mobilize further investments of 25 billion euros by making InvestEU easier to combine with other EU financial instruments.

This emerges from the draft for the investment omnibus, which is available to Table.Briefings. According to the evaluation, InvestEU triggered investments of 280 billion euros between 2021 and July 2024. 201 billion of this came from the private sector. The European Investment Bank (EIB) examines InvestEU’s funding applications and releases guarantees for low-interest loans.

Bureaucracy is to be reduced in the approval procedures for InvestEU, EFSI and other EU financial instruments. The Commission promises that its own commitments will be kept. This would mean 25 percent fewer reporting obligations for all companies and 35 percent fewer reporting obligations for SMEs. According to the draft, simplifications should save 200 million euros in bureaucratic costs.

If a company has already gone through the registration procedure for InvestEU once, the procedure should not be necessary again for another EU financial instrument, for example. In the future, recipients of funds should only be named if the sum involved exceeds one million euros. This is to be decided by the co-legislators. The Commission also holds out the prospect of further simplifications that are not subject to co-legislation.

MEP Markus Ferber (CSU) praises: “InvestEU has proven itself in principle.” Upgrading the program and simplifying it at the same time is the right decision. “Whether the sums announced by the Commission will actually materialize in the end remains to be seen.” More important than another EU investment fund, however, is that the framework conditions in the EU are right.

Sebastian Mack from the Jacques Delors Centre takes a similar view: “The proposal to use the additional funds to finance riskier projects and make greater use of equity instruments is the right one.” Both Letta and Draghi have made it clear that the EU must undergo a cultural change if it wants to regain technological leadership. “This means more risk-taking for both private investors and the public sector.”

Mack criticizes the measures to reduce bureaucracy: “Where tax money is distributed, there needs to be transparency and accountability.” If recipients only have to be disclosed starting at one million euros in the future, this would undermine democratic control. He also criticizes the fact that the Commission has not made any proposals to improve the effectiveness of InvestEU. “To ensure that EU funds actually support the Green Deal, we need clarity on how the funded projects contribute to climate and environmental protection and how many of the investments meet the requirements of the Green Taxonomy.” mgr

According to a new article by the Center on Global Energy Policy at Columbia University, intervention by the EU Commission to increase imports of American liquefied natural gas this year is unnecessary. “Higher EU imports of US LNG in 2025 will likely come about for two market-driven reasons that have nothing to do with policy,” writes gas expert Anne-Sophie Corbeau.

According to the paper, two new liquefaction terminals will go into operation in the United States this year, Plaquemines and Corpus Christi 3, which will increase US exports by 17%, according to data from the EIA. At the same time, there is greater demand in the EU to fill gas storage facilities and compensate for the loss of the Ukraine transit. So far, gas prices in the EU have been high enough for LNG tankers from the USA to land their cargoes in the EU and not in Asia, writes Corbeau.

However, only a small number of European companies have concluded long-term contracts with US terminals under construction – for 12.7 billion cubic meters (bcm) of LNG per year. According to a leak, the EU Commission wants to support importers with such contracts because it expects lower gas prices as a result. According to the paper, German companies such as EnBW, RWE, SEFE and BASF were particularly active in concluding contracts for 15 to 20 years in 2022 and 2023. ber

In order to promote the different types of CO₂ removals equally, the European Science Advisory Board on Climate Change (ESABCC) is calling for separate targets for the individual areas. In addition to legally binding targets for gross emission reductions, sub-targets are also needed for permanent CO₂ removals, such as CCS. As well as temporary removals, such as carbon sequestration in soil or wood. In this way, investments should be steered more clearly and innovations driven forward, explains the Council in a report published on Friday.

Brussels is currently working with an overall target for CO₂ removals, without subdividing the individual sectors. It is expected to become part of the EU climate target for 2040. In order to achieve the 90 percent reduction in emissions compared to 1990 that the EU Commission is aiming for, CO₂ removals from the atmosphere are also necessary.

With the sub-targets, both temporary and permanent CO₂ removals should contribute to achieving the climate targets without distracting from the continued need to reduce emissions, explains Advisory Board Chairman Ottmar Edenhofer. Otherwise, there is a risk that actors will rely too heavily on removals instead of reducing their emissions.

The minimum targets are also intended to prevent qualitatively different forms of removal from being treated equally in the balance sheet. In other words, a cheap but short-term removal of a ton of CO₂ must not be treated in the same way as a significantly more expensive but permanently removed ton of CO₂.

Edenhofer also insists that measurable and binding sustainability regulations be applied to the certification of CO₂ removals. This should prevent removals from not only being made on paper, but actually counteracting climate change.

Consequently, the EU Climate Council is in favor of integrating only permanent CO₂ removals into the existing European Emissions Trading Scheme (ETS). The scientists are calling for this to happen in the upcoming ETS reform next year. Temporary removals should also receive a price incentive in the future, but in a new system. luk

The EU Commission’s announced strategy for heating and cooling will also include recommendations on where EU citizens can best use heat pumps. “One of the big questions is where to choose heat pumps and where to choose district heating. There are often good arguments for both. Answering some of these questions must also be part of our strategy,” said Energy Commissioner Dan Jørgensen in the EU Parliament’s Industry Committee on Thursday.

Jørgensen had announced the strategy in his confirmation hearing. However, the date is still open. It is not included in the Commission’s work program for this year. Thursday’s hearing came just under a week before the Commission plans to present the Clean Industrial Deal and the action plan on energy prices.

Jørgensen called on the EU states to discuss the level of energy taxation: “It’s contradictory. Everyone agrees that we need to lower prices. But there is one thing we could do tomorrow and that is to lower taxes [on energy].” In the leak of the Clean Industrial Deal, the Commission already points out to the member states that they could, for example, reduce VAT on electricity, gas and district heating to up to five percent in accordance with the EU VAT Directive.

Jørgensen attributed strategic importance to electrification for the industry. Switching to electricity as an energy source is one of the most sensible ways to become more efficient. The EU is lagging behind the USA and China when it comes to electrification.

The Commissioner also called for dynamic grid charges that vary according to supply and demand and by region in order to reduce energy prices for everyone. “In many times, this would not restrict production in industry or the everyday lives of citizens,” said Jørgensen. ber

The Commission has approved the German funding for Infineon Technologies’ Smart Power Fab in Dresden under the European Chips Act. The Federal Ministry for Economic Affairs and Climate Protection (BMWK), which is responsible for disbursing the funding, welcomed the Commission’s green light. The next step will be “the finalization of the intended funding under grant law”, explained the ministry.

According to the Commission, Germany has notified an aid measure worth 920 million euros for the construction of a new semiconductor manufacturing plant. The factory should enable the production of a wide range of different chips. It is therefore in line with the objectives of the communication on the European chip law and the political guidelines, the Commission explained its decision. The new production plant will “provide the EU with flexible production capacities and thus strengthen Europe’s security of supply, resilience and technological autonomy in the field of semiconductor technologies.”

The Smart Power Fab is already being funded as part of the IPCEI ME/CT (Important Project of Common European Interest on Microelectronics and Communication Technologies) innovation program, Infineon also announced. Accordingly, the total funding for the Dresden site amounts to around one billion euros. The opening is planned for 2026.

Infineon plans to invest a total of five billion euros in the expansion of its Dresden site and create up to 1,000 new jobs. In the Smart Power Fab, Infineon wants to build technologies that drive decarbonization and digitalization, for example through efficient energy supply solutions for artificial intelligence. vis

The European Commission wants to let the temporary trade facilitations for Ukraine expire if no new agreement is reached before they end on June 5. It is still possible to agree on new, permanent trade relaxations in time. However, it depends on Kyiv’s willingness to negotiate, according to Commission circles.

The Brussels authority is thus putting pressure on Ukraine: If it does not accept Brussels’ demands, it could fall back to the situation before the Russian war of aggression. Tariffs and quotas for trade with the EU would apply again. Kyiv, on the other hand, had demanded that the current facilitations be extended until the negotiations are concluded.

The Commission is likely hoping that Kyiv will agree to further safeguard clauses for agricultural goods. After all, competition from imports is a thorn in the side of many farmers in the EU. Instead of a new, temporary regulation, Brussels and Kyiv are currently negotiating a permanent reduction in customs duties in Ukraine’s association agreement with the EU.

The Commission has not yet said when it intends to make public proposals on the new trade rules. According to participants at a closed hearing before the EU Committee on Agriculture this week, it also did not give a timetable. According to the Brussels authority, it is still observing how the geopolitical situation surrounding the war in Ukraine develops. jd

The Federation of German Consumer Organizations (VZBV) criticizes the plans for the European digital identity (eID) and presents an expert opinion and a position paper on the subject. According to the VZBV, consumers must expect data misuse through tracking and profiling if the digital wallet (EUDI wallet) does not meet strict data protection requirements.

“For consumers to be able to use a digital wallet without hesitation, the data must be collected sparingly and the most secure setting must be selected automatically,” demands Michaela Schröder, Head of Consumer Policy at VZBV. The association sees the involvement of large digital companies as particularly problematic. “The digital wallet must not lead to private providers such as Google, Amazon or Apple further expanding their monopoly positions,” warns Schröder.

The eIDAS Regulation 2.0 stipulates that all EU member states must provide a digital identity wallet by fall 2026 at the latest. The European Commission is currently working on technical specifications, which should be available by November 2024. In Germany, the Federal Ministry of the Interior and Home Affairs (BMI) is coordinating the implementation.

The German government is relying on a state EUDI wallet based on the online ID function. The first applications are due to be available in 2025, with the full launch planned for 2027. At the same time, pilot projects with private providers are underway. The VZBV sees this as a risk and is calling for strict regulations to protect consumers from data misuse.

The report on the architecture of the EUDI wallet highlights several technical and legal weaknesses. The possibility for providers to link usage data and create user profiles is particularly problematic. The VZBV is therefore calling for consumers to be able to control what data they share at all times. “We clearly reject clear, permanent personal identification that leads to complete traceability,” the position paper states.

The VZBV also warns against possible overidentification. Providers should not request more data than is actually necessary for a service. However, the EU’s current proposals do not clearly indicate whether a query is mandatory or voluntary. The VZBV is therefore calling for mandatory registration for all service providers in order to better protect consumers. These “must trust the technology so that the benefits of the digital wallet can be realized,” says Schröder. vis

MEPs from the S&D, EPP, ECR and the Left are protesting against the Commission’s decision to shelve its proposal for standard essential patents (SEPs). The Commission had surprisingly announced the withdrawal of the proposal in the work program and left open whether a new proposal will be made or a different approach will be chosen.

SEPs are patents that are part of a standard, such as the 5G mobile communications standard, which plays a role in connected driving. Originally, the Commission wanted to create a more transparent framework for these patents and reduce lengthy legal disputes. The current decision is a “serious setback for the future plans and prospects of many companies,” according to a letter to Commission President Ursula von der Leyen, which is available to Table.Briefings.

The letter was signed by:

Parliament had quickly found its position on the dossier and was ready for the further legislative process. The Polish Council Presidency had scheduled four full days for working group meetings on the dossier. The Commission wants to make work easier for companies, especially SMEs, and remove legal uncertainties. This is exactly what the SEP regulation is about.

VDA President Hildegard Müller also criticized: “Practical cases confirm that the existing licensing practice puts small and medium-sized companies at a disproportionate disadvantage.” In times when SMEs have reached the limits of their resilience anyway, action must be taken. “The threat of supply disruptions and production stoppages for small and medium-sized companies ultimately has an impact on the entire automotive supply chain.” mgr

The fifth and final thematic working session of the Auto Dialogue focused on CO₂-free charging and refueling infrastructure. Transport Commissioner Apóstolos Tzitzikóstas received fleet operators such as DHL, charging station operators such as Ionity, associations such as ACEA and CLEPA and NGOs such as BEUC. All participants spoke out in favor of a rapid and uniform expansion of the infrastructure. As at the other meetings, there were few indications from the Commission regarding the action plan, which Tzitzikóstas is to present on March 5. Two days before this, there will be another round of meetings between Ursula von der Leyen and the CEOs of manufacturers and suppliers. mgr

The Hungarian Kata Tüttő is the new President of the European Committee of the Regions. The Social Democrat was previously Deputy Mayor of Budapest and Chairwoman of the city’s water company. Her first deputy on the Committee will be the conservative President of the Spanish region of Andalusia, Juan Manuel Moreno Bonilla. He and Tüttő are expected to swap the chairmanship after two and a half years. ber

Is something changing in your organization? Send a note for our personnel section to heads@table.media!

First the good news: Never before has interest in a Bundestag election abroad been as great as this time. And never before have so many Germans living abroad registered to vote. According to Federal Returning Officer Ruth Brand, 210,297 German citizens living abroad had registered on the electoral roll by Monday. That is a good 60 percent more than in the last federal election in 2021, as reported by RedaktionsNetzwerk Deutschland.

Now the bad news: Many Germans living abroad will not be able to cast their vote, as the election date was set too late and the postal voting documents were sent out too late. This not only affects distant dream countries such as South Africa or problem states such as Iraq, but also neighboring Belgium – and thus the political “heart of Europe,” where thousands of German EU officials, diplomats, MEPs and lobbyists live and work.

A strike at the Belgian postal service is to blame, which has paralyzed the major distribution centers in Brussels and Liège. The strike began just at the critical time a week ago when the voting documents were due to reach the approximately 45,000 Germans in Belgium – and only ended on Wednesday. Those who were very lucky got their ticket for the election on Thursday after all. The German embassy in Brussels even offered a last-minute mailing service for latecomers, merci!

But most of them probably came away empty-handed – like the author of these lines. After days of nervously sneaking around the letterbox, I will soon be able to throw my election documents in the garbage can – they arrived too late. I wouldn’t be surprised if there were repercussions. Brussels is teeming with German lawyers and other know-it-alls who won’t let their right to vote be taken away so easily and could lodge a complaint.

However, I have another concern: What should the other Europeans think of us German non-voters? They have already made fun of the “German vote” – the German abstention in the EU Council of Ministers. Towards the end of the Ampel coalition, it even became a real nuisance. Now there is also a “German vote” in the Bundestag elections, which are so important for Europe – mass abstentions because the ballot papers arrived too late.

Yet Friedrich Merz promised that this would end after his (probable) election. Now it is starting with a “German vote” against his will, in Brussels of all places. Eric Bonse

Europe’s neighbors will be looking nervously at Germany on Sunday when the votes from the Bundestag elections are counted. There is great concern that the most important member state will remain paralyzed by unclear majorities and months of coalition wrangling. In the other capitals, hopes are high for a federal government that is capable of action and willing to lead.

Because the EU is facing an existential challenge. Donald Trump is threatening to shatter the decades-old alliance of liberal democracies. The US president and his fellow campaigners openly support radical right-wing and nationalist forces in Europe. They seem to have in mind an international of autocrats that includes Vladimir Putin and possibly also Xi Jinping.

The challenge is huge and cannot be overcome without a stable government in Berlin. Friedrich Merz seems to be aware of the dimensions and wants to conduct the talks on a new coalition under his leadership quickly and reasonably peacefully. The major issues of defense funding, migration and the economy are to be explored with potential partners in the smallest of circles and, if possible, already resolved.

With the SPD’s likely new strongmen, Lars Klingbeil and Boris Pistorius, this should be possible, perhaps also with the Greens’ Robert Habeck. The real uncertainty there lies in the final votes of the party conferences or member surveys. Merz may also need more than one partner. Even involving the FDP could complicate the talks to no end if the Liberals continue to declare the debt brake untouchable.

The foreseeable electoral success of the AfD could exacerbate the uncertainty of the centrist parties and at the same time strengthen centrifugal forces. Merz and all the others therefore face a difficult task. Whether they are up to it will help decide the future of the European Union.

Have an exciting election Sunday,

Jim Farley has been making unusual noises recently. While the American business world seems to be cheering on the new US President Donald Trump so far, the head of US car manufacturer Ford is warning of “a lot of costs and a lot of chaos.” He is referring to the US government’s current tariff policy. A 25 percent tariff on the border with Mexico and Canada would “tear a hole in the US industry that we’ve never seen before,” Farley recently said at a conference in New York.

Companies in the USA are increasingly turning away from Trump’s current tariff policy. They fear massive damage to their business, as the additional levies would drastically increase costs. Some now expect that the recipients of Trump’s measures could become the beneficiaries – including Europe.

In the first weeks of his second term in office, Trump has threatened dozens of trading partners with drastic tariffs and has already introduced some of them. These include tariffs on steel and aluminum imports of 25 percent, tariffs on Chinese imports of ten percent and tariffs on goods from Mexico and Canada of 25 percent, which were initially postponed until March. Trump has also threatened to impose tariffs on cars, chips and pharmaceuticals, probably at a rate of 25% from April.

This is not only scaring off foreign countries, but also the domestic economy, which is facing drastic price increases. The uncertainty index for US SMEs, compiled by the National Federation of Independent Business (NFIB), rose in February to its third-highest level since records began. The number of mergers and acquisitions in the US also fell to a ten-year low in January, which economists explain with the volatile market environment.

“Many companies in the US are suddenly alarmed about the tariff policy,” said Robert Handfield, professor of supply chain management at North Carolina State University. The latest tariff announcements would “make no sense at all, as these products are mainly imported.” This would drive up costs massively, Handfield warned in an interview with Table.Briefings. The expert therefore believes that Trump is bluffing and using his announcement as a negotiating threat. After all, he would otherwise come under increasing pressure from American companies.

Entrepreneurs such as Ford boss Farley are nevertheless concerned with the scenario that Trump could be serious – and at the same time warn that some recipients of the tariff policy could even become beneficiaries. This would be particularly true if there were different tariff levels between America’s neighbors and the rest of the world.

“South Korean, Japanese and European companies, which bring one and a half to two million vehicles to the USA and would not be affected by Mexican and Canadian tariffs, would then have a free hand,” warned Farley. It is true that German car manufacturers also produce large parts of their vehicles for the American market in Mexico. However, US companies such as Ford and General Motors or Stellantis (formerly Fiat-Chrysler) are far more dependent on the location in the neighboring country.

The steel processing industry, on the other hand, already sees itself at a disadvantage compared to its foreign competitors. The latest tariffs would drive up steel and aluminum prices, and delivery times would be significantly longer, according to a recent statement from the Coalition of American Metal Manufacturers and Users (CAMMU). “As a result, US manufacturers are paying significantly more for steel and aluminum than their global competitors, undermining their competitiveness.”

SMEs in particular are at risk as they are losing orders to overseas competitors who have unrestricted access to these important raw materials. “Foreign customers are shifting their supply chains away from US manufacturers,” the statement reads.

However, experts such as Alex Durante do not want to proclaim America’s trading partners, especially Europe, as the beneficiaries of this tariff policy. “It’s hard for me to see how the EU would actually benefit,” said the senior economist at the Tax Foundation think tank. “Businesses on both sides will lose out here.” After all, the tariffs would make all products more expensive. Furthermore, Europeans should not forget that Trump also threatened universal tariffs during the election campaign. “There won’t be this kind of substitution between countries and different sectors, because everyone would have the same tariffs,” says Durante.

Irrespective of mere business, however, Europe could emerge stronger from a trade war in other areas, such as the recruitment of important skilled workers. A dispute has recently flared up within the Trump camp over the granting of so-called H-1B visas. With this work permit, American tech companies in particular have brought up to 85,000 foreign talents to the United States every year, including many engineers and developers.

While Trump’s new circle of supporters from Silicon Valley wants to continue recruiting foreign specialists, arch-conservative traditionalists are warning that migrant workers could take well-paid jobs away from their compatriots. If the US government were to impose an entry ban on H-1B visa holders, it would not only be European talent that would be forced to remain in their home country. Many skilled workers from India or China could then be drawn to Europe instead of the USA.

At the same time, the clear-cutting by the so-called DOGE Commission means that some American researchers and scientists are likely to lose their jobs. The “Department Of Government Efficiency” under the leadership of billionaire Elon Musk has already massively frozen or cut federal spending, some of which was used to fund the work of universities and research institutes. Christian Stöcker, Professor of Communication at HAW Hamburg, sees this as an opportunity. Europe should now make it “extremely easy for US academics to obtain long-term visas,” the psychologist suggests. Many additional research positions in key areas are needed, as well as new and generous science and research funds. “We should welcome them.” Laurin Meyer

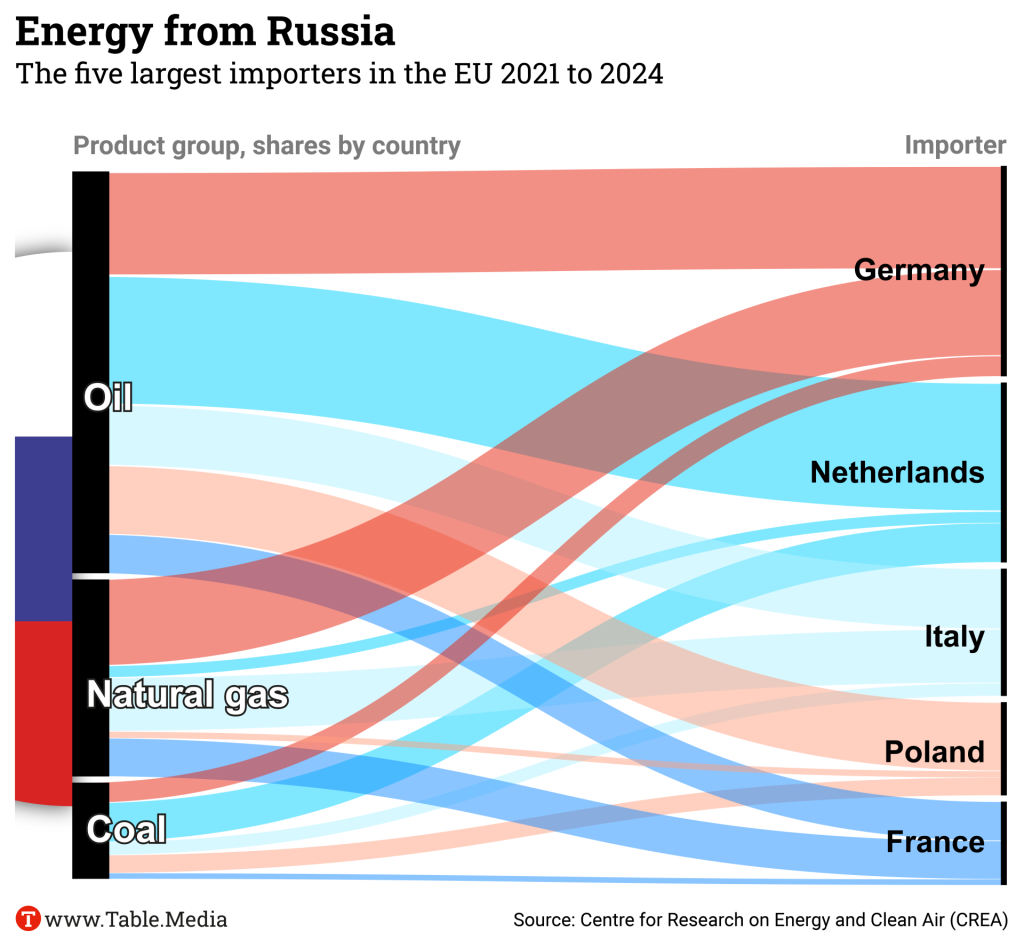

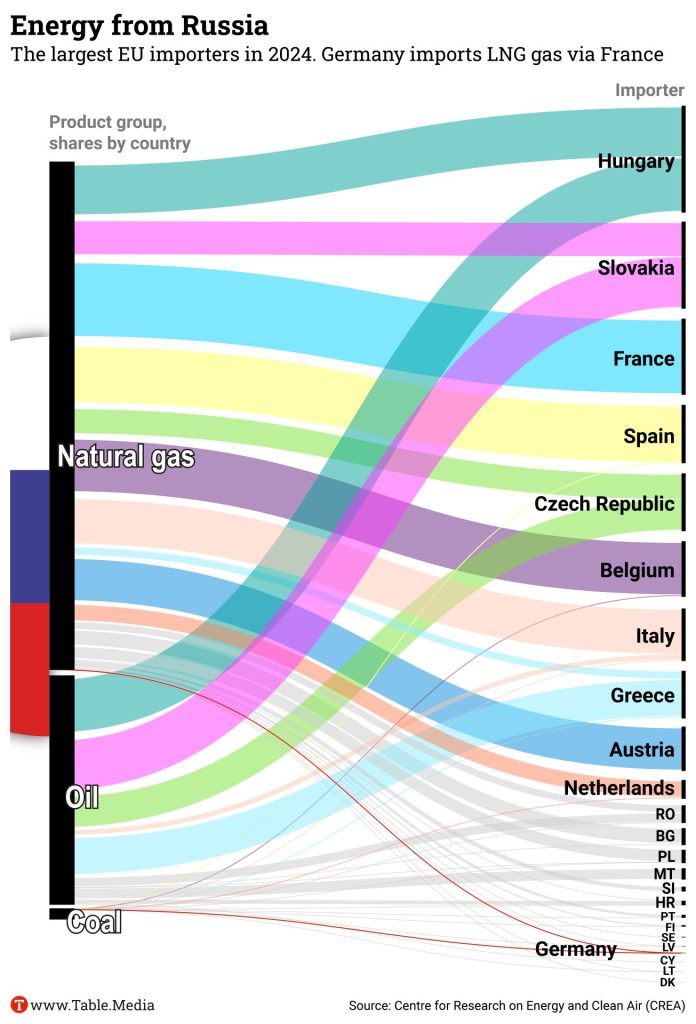

China, India, Turkey, South Korea and Brazil were the five most important buyers of oil, gas and coal from Russia last year. They purchased a total of 76 percent of all exports of these fossil fuels. Although significantly less oil is flowing to Europe, demand for Russian liquid gas has risen massively.

Within the EU, Hungary, Slovenia and France were Moscow’s most important energy trading partners in 2024. However, Sefe – a former Gazprom company nationalized by the federal government – buys LNG via the French port of Dunkerque. This means that German imports via France may be declared as French imports.

Energy exports account for just under 30 percent of the Russian state budget. They are essential for financing the war against Ukraine. The 16th package of sanctions against Russia, which the EU intends to adopt next Monday, is intended to hit more than 70 additional Russian tankers in the shadow fleet. Overall, however, the West has not yet managed to sustainably hit Moscow’s revenues from trade in fossil fuels. This is shown by data from the Finnish organization Centre for Research on Energy and Clean Air (CREA).

Oil is still the most important product for Russia in global trade. So far, it has managed to circumvent the price caps imposed by Western countries and sell oil above the USD 60 per barrel mark, not least thanks to its shadow fleet.

Today, Russia earns around the same amount from exporting its energy sources as it did before the full invasion in 2022. In 2021, it was 230 billion euros, in 2022 – at the height of the war shock – 372 billion euros, in 2023 around 253 billion euros and in 2024 around 243 billion euros.

Russia can fill its war chest, even if the cost of selling the goods increases and the new customers demand discounts. The reason: The West’s sanctions regime is “not effective enough to hit Russia’s export revenues hard for several reasons. These include a lack of political will for tougher sanctions, legal loopholes, a lack of enforcement of sanctions and new importers of Russian energy sources,” explains Isaac Levi, head of the CREA analysis team for Europe-Russia policy and energy.

In the spring of 2022, Russia not only converted its economy to a war footing very quickly, but also found new sales markets for its most important export products faster than the West found its tools of punishment. The most important points of contention in the West are always how quickly a country becomes independent of Russia’s energy and how tough it is when it comes to circumventing sanctions. On March 26, the EU wants to present a plan on how the Union should free itself from its dependence on Russian energy.

In internal EU votes, Hungary is often cited as the main brake on sanctions. However, the fact that Greek shipowners have benefited in particular from the establishment of a shadow fleet for Russian oil when selling tankers to companies in third countries rarely reaches the public. And German shipping companies are also involved.

The USA and the EU are now taking action against the shadow fleet only after a long delay. The sale of old tankers is not illegal, but the sellers must ultimately have been aware of the purpose for which the ships were intended by their new owners. The 16th sanctions package on the 3rd anniversary of the full-scale invasion includes punitive measures against the captains and owners of the tankers.

Experts do not expect the new sanctions package to have much effect. “Russia’s most important trading partners are now India, China, Turkey and the United Arab Emirates. They are pursuing their own interests and are quite indifferent to how the war ends,” says Sergey Vakulenko in an interview with Table.Briefings. He has worked for more than 25 years in top positions in the Russian oil and gas industry and is now an analyst for the Carnegie Russia Eurasia Center. “The West has virtually no economic relations with Russia, so it no longer has much leverage to influence Moscow.”

Russia has learned to manage without Western trade services, explains Vakulenko. “The idea that breaking off contact would lead to a rapid collapse of the Russian economy has not come true. Of course, the problems in the Russian economy are growing, and they pose serious long-term threats to the country’s development. But these will mainly not be Putin’s problems, but those of his successors.”

Feb. 24, 2025

Council of the EU: Foreign Affairs

Topics: Exchange on Russian aggression against Ukraine, the situation in the Middle

East (Syria, Lebanon, UNRWA), the Democratic Republic of the Congo and Iran. Provisional agenda

Feb. 24, 2025

Council of the EU: Agriculture and Fisheries

Topics: Implementation of the principle of rural proof, market situation

after the invasion of Ukraine. Provisional agenda

Feb. 24, 2025

EU-Israel Association Council

Topics: Conflict in the Gaza Strip and Israeli-Palestinian relations, regional issues including Iran as well as global issues, bilateral relations between the EU and Israel. Info

Feb. 25, 2025

Council of the EU: General Affairs

Topics: Commission work program for 2025, annual and multi-year programming. Provisional agenda

Feb. 26, 2025

Weekly commission meeting

Topics: Clean Industry Agreement, First Omnibus Proposal, Action Plan for

Affordable Energy. Provisional agenda

The investment omnibus, which the Commission intends to propose on Wednesday, is intended to stimulate additional investment of 50 billion euros for future projects by the end of the multiannual financial framework in 2027 and bring massive bureaucratic relief for participating companies. The Commission does not want to mobilize fresh money.

Instead, it proposes increasing the InvestEU sum guaranteed by the EU budget by 2.5 billion euros. This money is to be fed from returns from EU funding programs such as EFSI and other financial instruments. InvestEU provides companies with guarantees for investment loans. The additional guarantees amounting to 2.5 billion euros are to be leveraged by a factor of ten and thus trigger investments amounting to 25 billion euros. The Commission wants to mobilize further investments of 25 billion euros by making InvestEU easier to combine with other EU financial instruments.

This emerges from the draft for the investment omnibus, which is available to Table.Briefings. According to the evaluation, InvestEU triggered investments of 280 billion euros between 2021 and July 2024. 201 billion of this came from the private sector. The European Investment Bank (EIB) examines InvestEU’s funding applications and releases guarantees for low-interest loans.

Bureaucracy is to be reduced in the approval procedures for InvestEU, EFSI and other EU financial instruments. The Commission promises that its own commitments will be kept. This would mean 25 percent fewer reporting obligations for all companies and 35 percent fewer reporting obligations for SMEs. According to the draft, simplifications should save 200 million euros in bureaucratic costs.

If a company has already gone through the registration procedure for InvestEU once, the procedure should not be necessary again for another EU financial instrument, for example. In the future, recipients of funds should only be named if the sum involved exceeds one million euros. This is to be decided by the co-legislators. The Commission also holds out the prospect of further simplifications that are not subject to co-legislation.

MEP Markus Ferber (CSU) praises: “InvestEU has proven itself in principle.” Upgrading the program and simplifying it at the same time is the right decision. “Whether the sums announced by the Commission will actually materialize in the end remains to be seen.” More important than another EU investment fund, however, is that the framework conditions in the EU are right.

Sebastian Mack from the Jacques Delors Centre takes a similar view: “The proposal to use the additional funds to finance riskier projects and make greater use of equity instruments is the right one.” Both Letta and Draghi have made it clear that the EU must undergo a cultural change if it wants to regain technological leadership. “This means more risk-taking for both private investors and the public sector.”

Mack criticizes the measures to reduce bureaucracy: “Where tax money is distributed, there needs to be transparency and accountability.” If recipients only have to be disclosed starting at one million euros in the future, this would undermine democratic control. He also criticizes the fact that the Commission has not made any proposals to improve the effectiveness of InvestEU. “To ensure that EU funds actually support the Green Deal, we need clarity on how the funded projects contribute to climate and environmental protection and how many of the investments meet the requirements of the Green Taxonomy.” mgr

According to a new article by the Center on Global Energy Policy at Columbia University, intervention by the EU Commission to increase imports of American liquefied natural gas this year is unnecessary. “Higher EU imports of US LNG in 2025 will likely come about for two market-driven reasons that have nothing to do with policy,” writes gas expert Anne-Sophie Corbeau.

According to the paper, two new liquefaction terminals will go into operation in the United States this year, Plaquemines and Corpus Christi 3, which will increase US exports by 17%, according to data from the EIA. At the same time, there is greater demand in the EU to fill gas storage facilities and compensate for the loss of the Ukraine transit. So far, gas prices in the EU have been high enough for LNG tankers from the USA to land their cargoes in the EU and not in Asia, writes Corbeau.

However, only a small number of European companies have concluded long-term contracts with US terminals under construction – for 12.7 billion cubic meters (bcm) of LNG per year. According to a leak, the EU Commission wants to support importers with such contracts because it expects lower gas prices as a result. According to the paper, German companies such as EnBW, RWE, SEFE and BASF were particularly active in concluding contracts for 15 to 20 years in 2022 and 2023. ber

In order to promote the different types of CO₂ removals equally, the European Science Advisory Board on Climate Change (ESABCC) is calling for separate targets for the individual areas. In addition to legally binding targets for gross emission reductions, sub-targets are also needed for permanent CO₂ removals, such as CCS. As well as temporary removals, such as carbon sequestration in soil or wood. In this way, investments should be steered more clearly and innovations driven forward, explains the Council in a report published on Friday.

Brussels is currently working with an overall target for CO₂ removals, without subdividing the individual sectors. It is expected to become part of the EU climate target for 2040. In order to achieve the 90 percent reduction in emissions compared to 1990 that the EU Commission is aiming for, CO₂ removals from the atmosphere are also necessary.

With the sub-targets, both temporary and permanent CO₂ removals should contribute to achieving the climate targets without distracting from the continued need to reduce emissions, explains Advisory Board Chairman Ottmar Edenhofer. Otherwise, there is a risk that actors will rely too heavily on removals instead of reducing their emissions.

The minimum targets are also intended to prevent qualitatively different forms of removal from being treated equally in the balance sheet. In other words, a cheap but short-term removal of a ton of CO₂ must not be treated in the same way as a significantly more expensive but permanently removed ton of CO₂.

Edenhofer also insists that measurable and binding sustainability regulations be applied to the certification of CO₂ removals. This should prevent removals from not only being made on paper, but actually counteracting climate change.

Consequently, the EU Climate Council is in favor of integrating only permanent CO₂ removals into the existing European Emissions Trading Scheme (ETS). The scientists are calling for this to happen in the upcoming ETS reform next year. Temporary removals should also receive a price incentive in the future, but in a new system. luk

The EU Commission’s announced strategy for heating and cooling will also include recommendations on where EU citizens can best use heat pumps. “One of the big questions is where to choose heat pumps and where to choose district heating. There are often good arguments for both. Answering some of these questions must also be part of our strategy,” said Energy Commissioner Dan Jørgensen in the EU Parliament’s Industry Committee on Thursday.

Jørgensen had announced the strategy in his confirmation hearing. However, the date is still open. It is not included in the Commission’s work program for this year. Thursday’s hearing came just under a week before the Commission plans to present the Clean Industrial Deal and the action plan on energy prices.

Jørgensen called on the EU states to discuss the level of energy taxation: “It’s contradictory. Everyone agrees that we need to lower prices. But there is one thing we could do tomorrow and that is to lower taxes [on energy].” In the leak of the Clean Industrial Deal, the Commission already points out to the member states that they could, for example, reduce VAT on electricity, gas and district heating to up to five percent in accordance with the EU VAT Directive.

Jørgensen attributed strategic importance to electrification for the industry. Switching to electricity as an energy source is one of the most sensible ways to become more efficient. The EU is lagging behind the USA and China when it comes to electrification.

The Commissioner also called for dynamic grid charges that vary according to supply and demand and by region in order to reduce energy prices for everyone. “In many times, this would not restrict production in industry or the everyday lives of citizens,” said Jørgensen. ber

The Commission has approved the German funding for Infineon Technologies’ Smart Power Fab in Dresden under the European Chips Act. The Federal Ministry for Economic Affairs and Climate Protection (BMWK), which is responsible for disbursing the funding, welcomed the Commission’s green light. The next step will be “the finalization of the intended funding under grant law”, explained the ministry.

According to the Commission, Germany has notified an aid measure worth 920 million euros for the construction of a new semiconductor manufacturing plant. The factory should enable the production of a wide range of different chips. It is therefore in line with the objectives of the communication on the European chip law and the political guidelines, the Commission explained its decision. The new production plant will “provide the EU with flexible production capacities and thus strengthen Europe’s security of supply, resilience and technological autonomy in the field of semiconductor technologies.”

The Smart Power Fab is already being funded as part of the IPCEI ME/CT (Important Project of Common European Interest on Microelectronics and Communication Technologies) innovation program, Infineon also announced. Accordingly, the total funding for the Dresden site amounts to around one billion euros. The opening is planned for 2026.

Infineon plans to invest a total of five billion euros in the expansion of its Dresden site and create up to 1,000 new jobs. In the Smart Power Fab, Infineon wants to build technologies that drive decarbonization and digitalization, for example through efficient energy supply solutions for artificial intelligence. vis

The European Commission wants to let the temporary trade facilitations for Ukraine expire if no new agreement is reached before they end on June 5. It is still possible to agree on new, permanent trade relaxations in time. However, it depends on Kyiv’s willingness to negotiate, according to Commission circles.

The Brussels authority is thus putting pressure on Ukraine: If it does not accept Brussels’ demands, it could fall back to the situation before the Russian war of aggression. Tariffs and quotas for trade with the EU would apply again. Kyiv, on the other hand, had demanded that the current facilitations be extended until the negotiations are concluded.

The Commission is likely hoping that Kyiv will agree to further safeguard clauses for agricultural goods. After all, competition from imports is a thorn in the side of many farmers in the EU. Instead of a new, temporary regulation, Brussels and Kyiv are currently negotiating a permanent reduction in customs duties in Ukraine’s association agreement with the EU.

The Commission has not yet said when it intends to make public proposals on the new trade rules. According to participants at a closed hearing before the EU Committee on Agriculture this week, it also did not give a timetable. According to the Brussels authority, it is still observing how the geopolitical situation surrounding the war in Ukraine develops. jd

The Federation of German Consumer Organizations (VZBV) criticizes the plans for the European digital identity (eID) and presents an expert opinion and a position paper on the subject. According to the VZBV, consumers must expect data misuse through tracking and profiling if the digital wallet (EUDI wallet) does not meet strict data protection requirements.

“For consumers to be able to use a digital wallet without hesitation, the data must be collected sparingly and the most secure setting must be selected automatically,” demands Michaela Schröder, Head of Consumer Policy at VZBV. The association sees the involvement of large digital companies as particularly problematic. “The digital wallet must not lead to private providers such as Google, Amazon or Apple further expanding their monopoly positions,” warns Schröder.

The eIDAS Regulation 2.0 stipulates that all EU member states must provide a digital identity wallet by fall 2026 at the latest. The European Commission is currently working on technical specifications, which should be available by November 2024. In Germany, the Federal Ministry of the Interior and Home Affairs (BMI) is coordinating the implementation.

The German government is relying on a state EUDI wallet based on the online ID function. The first applications are due to be available in 2025, with the full launch planned for 2027. At the same time, pilot projects with private providers are underway. The VZBV sees this as a risk and is calling for strict regulations to protect consumers from data misuse.

The report on the architecture of the EUDI wallet highlights several technical and legal weaknesses. The possibility for providers to link usage data and create user profiles is particularly problematic. The VZBV is therefore calling for consumers to be able to control what data they share at all times. “We clearly reject clear, permanent personal identification that leads to complete traceability,” the position paper states.

The VZBV also warns against possible overidentification. Providers should not request more data than is actually necessary for a service. However, the EU’s current proposals do not clearly indicate whether a query is mandatory or voluntary. The VZBV is therefore calling for mandatory registration for all service providers in order to better protect consumers. These “must trust the technology so that the benefits of the digital wallet can be realized,” says Schröder. vis

MEPs from the S&D, EPP, ECR and the Left are protesting against the Commission’s decision to shelve its proposal for standard essential patents (SEPs). The Commission had surprisingly announced the withdrawal of the proposal in the work program and left open whether a new proposal will be made or a different approach will be chosen.

SEPs are patents that are part of a standard, such as the 5G mobile communications standard, which plays a role in connected driving. Originally, the Commission wanted to create a more transparent framework for these patents and reduce lengthy legal disputes. The current decision is a “serious setback for the future plans and prospects of many companies,” according to a letter to Commission President Ursula von der Leyen, which is available to Table.Briefings.

The letter was signed by:

Parliament had quickly found its position on the dossier and was ready for the further legislative process. The Polish Council Presidency had scheduled four full days for working group meetings on the dossier. The Commission wants to make work easier for companies, especially SMEs, and remove legal uncertainties. This is exactly what the SEP regulation is about.

VDA President Hildegard Müller also criticized: “Practical cases confirm that the existing licensing practice puts small and medium-sized companies at a disproportionate disadvantage.” In times when SMEs have reached the limits of their resilience anyway, action must be taken. “The threat of supply disruptions and production stoppages for small and medium-sized companies ultimately has an impact on the entire automotive supply chain.” mgr

The fifth and final thematic working session of the Auto Dialogue focused on CO₂-free charging and refueling infrastructure. Transport Commissioner Apóstolos Tzitzikóstas received fleet operators such as DHL, charging station operators such as Ionity, associations such as ACEA and CLEPA and NGOs such as BEUC. All participants spoke out in favor of a rapid and uniform expansion of the infrastructure. As at the other meetings, there were few indications from the Commission regarding the action plan, which Tzitzikóstas is to present on March 5. Two days before this, there will be another round of meetings between Ursula von der Leyen and the CEOs of manufacturers and suppliers. mgr

The Hungarian Kata Tüttő is the new President of the European Committee of the Regions. The Social Democrat was previously Deputy Mayor of Budapest and Chairwoman of the city’s water company. Her first deputy on the Committee will be the conservative President of the Spanish region of Andalusia, Juan Manuel Moreno Bonilla. He and Tüttő are expected to swap the chairmanship after two and a half years. ber

Is something changing in your organization? Send a note for our personnel section to heads@table.media!

First the good news: Never before has interest in a Bundestag election abroad been as great as this time. And never before have so many Germans living abroad registered to vote. According to Federal Returning Officer Ruth Brand, 210,297 German citizens living abroad had registered on the electoral roll by Monday. That is a good 60 percent more than in the last federal election in 2021, as reported by RedaktionsNetzwerk Deutschland.

Now the bad news: Many Germans living abroad will not be able to cast their vote, as the election date was set too late and the postal voting documents were sent out too late. This not only affects distant dream countries such as South Africa or problem states such as Iraq, but also neighboring Belgium – and thus the political “heart of Europe,” where thousands of German EU officials, diplomats, MEPs and lobbyists live and work.

A strike at the Belgian postal service is to blame, which has paralyzed the major distribution centers in Brussels and Liège. The strike began just at the critical time a week ago when the voting documents were due to reach the approximately 45,000 Germans in Belgium – and only ended on Wednesday. Those who were very lucky got their ticket for the election on Thursday after all. The German embassy in Brussels even offered a last-minute mailing service for latecomers, merci!

But most of them probably came away empty-handed – like the author of these lines. After days of nervously sneaking around the letterbox, I will soon be able to throw my election documents in the garbage can – they arrived too late. I wouldn’t be surprised if there were repercussions. Brussels is teeming with German lawyers and other know-it-alls who won’t let their right to vote be taken away so easily and could lodge a complaint.

However, I have another concern: What should the other Europeans think of us German non-voters? They have already made fun of the “German vote” – the German abstention in the EU Council of Ministers. Towards the end of the Ampel coalition, it even became a real nuisance. Now there is also a “German vote” in the Bundestag elections, which are so important for Europe – mass abstentions because the ballot papers arrived too late.

Yet Friedrich Merz promised that this would end after his (probable) election. Now it is starting with a “German vote” against his will, in Brussels of all places. Eric Bonse