A week ago, the German government presented its startup strategy. The joint project of the German “traffic light” coalition also covers a number of EU areas. Which and why they play a major role in the strategy’s success, Falk Steiner has the details.

My colleague Nico Beckert took a look at what China’s military actions around Taiwan will mean for supply chains. Taiwan is, after all, the world’s largest supplier of microchips. As of Thursday evening, experts are giving the all-clear – but that could quickly change if China expands the maneuvers even further.

Saving is the order of the day: Germany will need to save ten billion cubic meters of gas by March next year to meet the target set by the EU. Read more about the calculations and what the Federation of German Industries has to say about it in the News section.

For Latvian-born Ekaterina Boening, playing a practical part in the transformation was the reason why she moved this year from the think tank Transport & Environment Deutschland to the energy giant Siemens Energy. Find out more about the exciting field she manages now in today’s Profile.

The goal is clear: “We want to become the driving force for a European location. That is the only sensible goal,” says Anna Christmann, start-up representative of the German government. “We need to be visible as Europe and attractive for start-ups. As the largest country in the EU, we have a special role.”

For this to succeed, measures are to be taken both in Germany and with other EU members and at the EU level. France, in particular, repeatedly emphasized the importance of an improved start-up policy during the first term of office of the liberal French President Macron and during the Council Presidency in the first half of this year. Compared to the grand French goals, which are also partly reflected in the policy of EU Commissioner for Internal Market Thierry Breton, Germany once again appears hesitant here.

At the beginning of the year, the French government announced that it would not only breed a large number of so-called unicorns with a market value of more than €1 billion by 2030. The goal at the time was to have 10 so-called hectocorns by 2030; technology companies with more than €100 billion in market value. Anna Christmann sees France’s efforts as an incentive: “We rely on networking to move forward together. I see the fact that France in particular also has a lot of activities in this area as very positive, because it means we push each other.”

For this to succeed at all, French policymakers attach importance to an improved financing environment – just as German start-up policymakers now do. This means, in particular, better funding for start-ups in the founding and especially the growth phase. Because that is precisely where European investors are scarce – instead, emerging European start-ups are primarily supported by venture capitalists from the US and Asia. “Long-term investments in research-intensive start-ups, for example in the field of quantum computing and artificial intelligence, are particularly important,” says Daniel Breitinger, Head of Start-ups at Bitkom.

But one essential prerequisite is missing: “There is a lack of institutional capital; these investors tend to invest in larger amounts. This makes the comparatively small-volume VC funds in Europe uninteresting for larger investors. So far, there are hardly any funds whose volume exceeds €1 billion.” That is what policymakers now aim to change – but they encounter new problems in the process.

On the initiative of French Minister for the Economy and Finances, Bruno LeMaire (LREM/Renew), German Minister of Finance, Christian Lindner, (FDP/Renew) announced match funding for the €10 billion European Tech Champions Initiative (ETCI) in April: France and Germany will each provide €1 billion to the fund at the European Investment Bank, while Germany will contribute its significant chunk via the Future Fund at the federally owned Kfw – Kreditanstalt für Wiederaufbau (“Credit Institute for Reconstruction”). The European Investment Bank (EIB) is to contribute another €500 million. Many other EU countries have signaled their interest in participating. Shortly before the French presidential election. But since the announcements, the ETCI has gone quiet. When asked, the German Finance Ministry assures that the ETCI is expected to “be able to make its first investments by the end of the year”.

Start-up representative and Green Party politician Christmann also wants to use additional European funds to create more European unicorns: “We are looking at the investment quotas that we have set for the ERP/EIF facility at the European Investment Fund with currently at least 20 percent for climate and social impact investment,” says the start-up representative. “This should also continue to grow, because of course we are not satisfied with 20 percent in the long term.”

While all of these measures do not require regulatory changes, the conditions for start-ups in other areas depend on both the EU and the national levels. When it comes to the coalition’s planned employee equity participation, the players in Brussels will probably be left out, as they will be in the planned, purely German plans for administrative digitization, which will then also make things easier for start-ups. However, Christmann also sees opportunities in new regulations, such as the Artificial Intelligence Act: “The living lab regulation basically also comes from Germany, we have the Data Act and all regulation on data at the European level, and also Solvency II.” These regulations must “of course be designed to be innovation- and start-up-friendly”.

The revision of the Solvency II Directive, in particular, is causing headaches for some observers. From the perspective of the start-up and venture capital industry, a key aspect of this is the question under what conditions financially strong insurers will be allowed to further invest. “The German government is committed to targeted adjustments that further improve the regulatory framework while leading to balanced effects on capital requirements,” the Federal Ministry of Finance stated in response to a query. “This is central to the stability of the industry and the general investment capacity of insurers.”

But insurers themselves fear above all that changes to the model for forward calculations of the yield curve would increase their capital requirements. Life insurers especially often have to decide on their strategies over very long periods, in some cases 40 years – but the predictive power of financial mathematical models does not allow for reliable forecasts this far into the future, which is why yield curves are extrapolated into the future after 20 years. The insurance regulator EIOPA proposed new criteria for this.

But these would reduce investment opportunities even further, according to the industry, especially in riskier asset classes such as venture capital. “The new model would create incentives to invest more in long-dated bonds, such as government bonds,” a GDV spokesman told Europe.Table. “This could reduce funds for investments in real assets.”

The Federal Ministry of Finance does not share this opinion: “The subject of the review of Solvency II is also potential regulatory relaxation for long-term investments to better exploit the investment potential of insurers,” the ministry of FDP Minister of Finance Christian Lindner said. “The German government is committed to risk-appropriate adjustments that also adequately take the protection of policyholders into account.”

One area is completely absent from the German start-up strategy: The defense industry, which German policymakers have recently rediscovered after Russia’s attack on Ukraine. But there is no talk of a watershed in German start-up policy here, as Christmann explains: “We have identified focus areas that are about solving societal challenges. These are climate crisis, health, biotechnology, these are main focus areas that we also serve with the start-up strategy.” The issue is of course increasingly present, says the start-up representative, who is also the aerospace coordinator of the German coalition: “Of course, there are also some areas in which dual-use is an issue, even in aerospace alone, for which I am also in charge. But the focus is on the areas we have listed in the start-up strategy.”

But while there is no shortage of start-up policy, one question has remained unanswered: What qualifies as a start-up in the first place? What as a scale-up? And what counts as a technology-intensive innovation? However, before the first quarter of 2023, EU Commission does not want to answer this question, which is not exactly unimportant for any political control, on all start-up policies at the German and European level: As part of the European Innovation Agenda, a report will then be presented to provide a more uniform Europe-wide answer to precisely this question. At least until then, all participants can continue to have very different definitions – and call them all a start-up.

The logistics, trade, import and export sectors have become thin-skinned in recent years. Too often, global politics and pandemics have thrown their supply schedules out of sync. So news of extended naval operations around Taiwan has caused a scare.

Will chips from Taiwan now become scarce? Will Taiwanese goods be delayed from reaching Europe? Is there a risk of container congestion at important global ports such as Kaohsiung, Anping, Keelung or Taipei? After all, the Taiwan Strait is one of the busiest shipping routes in the region.

But experts are sounding the all-clear for now. “If the military maneuvers only last a short time and are not too extensive, then the disruptions will be mostly limited,” economist Wan-Hsin Liu of the Kiel Institute for the World Economy (IfW Kiel) told China.Table. There would be alternative routes. The planned duration of the exercises of three days is also within the range that freight companies can still easily accept as a delay.

At any rate, the military exercises have not yet caused any major delays or supply chain problems on the first day. Some shipping companies immediately rerouted their ships to alternative routes after the announcement. Taiwan’s shipping authorities already provided them with options to avoid the danger zones by a wide margin.

Some freighters have also changed their destination and are now calling at ports on the mainland. Others have reduced their speed to reach the critical zones by the weekend after the exercises have ended. However, most freighters simply bypass areas where military exercises are being held.

Ships without a direct destination on Taiwan are also affected. Almost half of the world’s container ships passed through the Taiwan Strait last year, Bloomberg reports. Thus, the restricted zones not only hinder Taiwan traffic, but also ships from Japan, South Korea, and China with destinations in Europe or the United States.

But even if the ships cannot pass through the Taiwan Strait and instead pass by the eastern flank of the island, the delays are only about three days. Such delays are not uncommon in global shipping. Extreme weather such as typhoons regularly cause similar deviations.

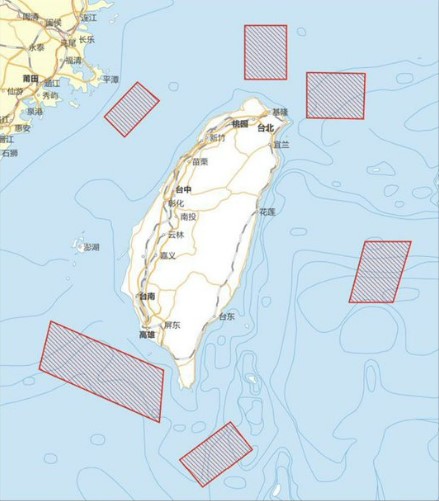

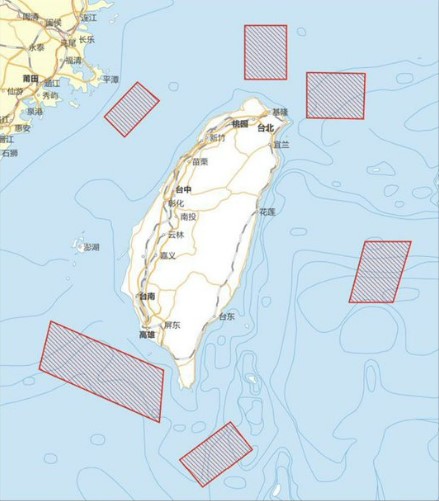

However, some uncertainty remains. Nancy Pelosi, the Speaker of the US House of Representatives, only spent a few hours in Taiwan. Her visit, however, has left the region in turmoil. The military exercises around Taiwan have already reached a new dimension. Whether the People’s Republic will be content with that remains to be seen. The designation of the maneuver zones already looks like a preparatory exercise for a naval blockade of Taiwan. According to Taiwanese media, this is exactly how Chinese General Meng Xiangjun portrays the situation.

If China were to extend the exercises, problems might emerge after all. Companies and logisticians would have to be prepared for “considerable disruptions in global supply chains and thus also in the global economy,” according to globalization expert Liu from the IfW. However, experts believe it is too early to be too alarmed. “We might be concerned if the drills become longer and more intense to impact supply chains, but there is no sign of that happening now,” says Huang Huiming, a fund manager at Nanjing Jing Heng Investment Management.

However, even dealing with the scenario is quite relevant in light of the experience of the past few years. Taiwan possesses the world’s largest production base for microchips. The market leader Taiwan Semiconductor Manufacturing (TSMC) alone holds a share of 53 percent.

According to Liu, semiconductors accounted for a good 51 percent of Taiwanese exports in the first half of the year. If these components are missing, the assembly lines in Germany will also come to a standstill. As a result, the German economy sees a strong dependence on Taiwan. Above all, it is aware of the possibility of indirect effects caused by outages in the People’s Republic (China.Table reported) and was already an issue before the current crisis.

China also still has the option of extending the sanctions to other Taiwanese commodity groups imposed after Pelosi’s visit. This scenario would involve a customs tricks instead of a naval blockade. China is already rejecting goods on various questionable grounds (China.Table reported).

So far, the food and construction industries have been most affected. But product groups relevant to manufacturing could also become the target of revenge for Pelosi’s provocation. This would hit Taiwan hard. The People’s Republic is the island’s largest trading partner. Last year, it shipped goods worth just under $190 billion to China. Germany accounted for a good $245 billion.

However, far-reaching sanctions are currently considered unlikely. China would also hurt itself by isolating Taiwan economically. The People’s Republic is also dependent on semiconductors from Taiwan (China.Table reported).

To meet the EU’s 15 percent savings target, Germany must save as much gas as five million four-person households consume on average per year. According to a calculation by the Deutsche Presse-Agentur based on data from the EU Commission, Germany will have to consume around ten billion cubic meters less gas between the beginning of August and March next year in order to achieve the target set by all EU countries. In absolute terms, Germany will have to save more than all other EU countries.

This is because Europe’s largest economy also consumes the most gas. Overall, the EU needs to consume around 45 billion cubic meters less gas – so Germany would have to save 10.35 billion cubic meters, almost a quarter of that. This is in proportion to Germany’s economic strength, as it is also responsible for almost a quarter of the EU’s economic output in terms of gross domestic product (GDP).

Other countries have to save less gas in terms of volume, but in some cases that is not in proportion to their economic output. Italy ranks second with over eight billion cubic meters saved – a relatively high amount compared to GDP. France needs to cut consumption by around five billion cubic meters, which is rather low compared to its economic output. The 15 percent target applies to all EU countries, albeit voluntary at first.

Against the backdrop of the war in Ukraine, EU countries have agreed on a contingency plan amid fears of a complete stop of Russian gas deliveries. The plan calls for a voluntary 15 percent reduction in national gas consumption between August 1, 2022, and March 31, 2023, based on average consumption during the same period over the past five years. If not enough gas is saved and widespread supply shortages emerge, a Union alert with mandatory savings quotas can be declared.

According to the German Minister of Economic Affairs, Robert Habeck (Greens), Germany is already on the right track. The Federal Republic currently saves between 14 and 15 percent – albeit compared to the previous year and not adjusted for temperature. Therefore, the relevant percentage figure is likely to be significantly lower. The Federal Ministry for Economic Affairs and Climate Action did not provide a specific figure upon inquiry. It explained that calculations were being made and that measures already taken were being taken into account.

However, further measures would have to follow in order to achieve the savings target. The ministry also stated that Germany would have to save more than the 15 percent agreed upon by the EU countries. dpa

The auctions planned by the German government to save gas do not go far enough for the Federation of German Industries (BDI). In addition to a short-term auction model for companies to save gas, there also needs to be a second instrument for the medium-term release of gas quotas by companies. “Otherwise, the auction mechanism runs the risk of bypassing the needs of industry,” BDI President Siegfried Russwurm commented on Thursday. When other energy sources are procured or individual production facilities are shut down, there could be additional costs that the government would have to compensate for, at least on a pro-rata basis.

The chemical association VCI also criticized the auction model yesterday. “The way the gas auction model is currently planned contributes to the stabilization of the gas network this fall. However, the opportunity to fill the storage facilities at an early stage is being missed,” the association tweeted.

A day earlier, the German Federal Network Agency (BNetzA) also indicated that the auction model is more practical for the short-term lowering of peak loads. “This offer can then be called up by the market area manager, for example, if increased gas consumption is expected due to falling temperatures,” said BNetzA Vice President Barbie Kornelia Haller in an interview with the information service of the Institute of the German Economy.

According to some experts, the existing gas market offers sufficient incentives to save energy. “If I bought gas as the industry, I can return it today for €180. That is the incentive mechanism. I don’t understand why we need anything else on top,” said energy economist Lion Hirth of the Hertie School in mid-July at the Table.Live briefing on the EU’s winter emergency plan. Since then, the price of gas on the spot market has even risen to €200 per megawatt hour. ber, dpa

German Minister of Finance Christian Lindner wants the EU to return to strict budgetary rules after the massive debt incurred during the Covid crisis. What is needed is a more reliable and ambitious path to debt reduction, the FDP politician told the German newspaper Handelsblatt.

The German proposal for the reform of the EU Stability and Growth Pact also calls for the debt rules to be retained, according to the Handelsblatt. These allow member states a maximum annual new debt of 3 percent of economic output and a maximum total debt of 60 percent.

In addition, Lindner wants to mandate debt reduction. So far, the principle that member states are only allowed to have an annual structural deficit of 0.5 percent or close to it is not binding. Lindner wants to change that: The medium-term budget targets are to become binding. A gradual adjustment to a largely balanced budget would also be acceptable, he said.

The EU Commission plans to present its proposal for the reform this fall. Among members, different camps have formed. Germany always rejected far-reaching reforms and a softening of the debt rules called for by other countries.

Achim Post, vice chairman of the SPD parliamentary group, welcomed the fact that Lindner and the German government are actively involved in the debate. “It will be all the more important that Germany acts flexibly and in a mediatory manner in further negotiations in the interests of ultimately finding a solution that is viable for everyone and fit for the future,” he warned. The Stability and Growth Pact would need an update that would bring it up to date with fair and realistic goals and challenges. dpa

According to sources in the German government, the European Union intends to put together another financing package for Ukraine until September. The package is worth about €8 billion. A part of it will be in grants that do not have to be paid back, another part will be loans, a government representative said on Thursday. Two steps may be needed to reach the goal, he said. The first step is expected to be ready in September.

Germany wants a fairer distribution of the burden. EU states that had been holding back so far must now do more. “Germany will also participate in further aid,” said the government representative. To this end, Germany is in close contact with the EU Commission and its European partners.

In the spring, the seven leading industrialized nations (G7) put together a package of more than $9 billion for Ukraine. This secured funding for the country for several months. The USA bore the brunt of this with $7.5 billion, while Germany had provided a grant of €1 billion, which has already been disbursed. In the G7 circle, EU partners France and Italy kept a very low profile. In the meantime, the EU Commission has also provided a grant of €1 billion.

The aid is exclusively short-term budget support for the government in Kyiv. Military aid, humanitarian aid and subsequent reconstruction of the country will be financed from other funds. The government representative said that Germany does not want to have to pay twice. The previous grant to Ukraine must be at least partially credited.

Ukrainian President Volodymyr Zelenskiy said this week that the budget deficit still amounts to $5 billion per month as a result of the war. Experts believe that the country’s liquidity needs will continue beyond 2022. More and more aid is thus likely. Media reports have recently cited Ukrainian accusations against Germany of blocking the disbursement of EU funds. rtr

Despite the resumption of grain exports via Ukrainian Black Sea ports, the EU intends to maintain its initiative for alternative freight routes. As it will be difficult to quickly restore the export volume via the Black Sea ports to pre-war levels, other transport routes remain crucial, an official of the responsible EU Commission explained in response to a query from the Deutsche Presse-Agentur.

Every ton exported would count and increasing the capacity and flexibility of the European transport system, it could help secure food supplies in poor partner countries.

Adina Vălean, the EU commissioner responsible for the transport sector, said, “There is still room for improvement”. For example, there are not enough freight cars and barges and more capacity would be needed for the temporary storage of Ukrainian exports. Any kind of help would be welcome.

The EU is committed to facilitating agricultural exports from Ukraine because blockades caused by Russia’s war of aggression have a significant impact on global food markets and jeopardize food security in countries in the Middle East, Asia and Africa.

However, the greatest hopes are currently resting on an agreement brokered by the United Nations and Turkey, which should enable a resumption of regular Ukrainian agricultural exports via the Black Sea. According to EU figures, until before the war, around 90 percent of grain and oilseed exports went through Ukraine’s Black Sea ports – for grain, the figure was up to five million tons per month.

Regardless, it is considered unlikely that this level can be regained in the foreseeable future. The first ship to leave the port of Odesa under the UN deal earlier this week had loaded just about 26,000 tons of corn. It is expected to arrive in the Lebanese port city of Tripoli on Sunday.

Turkey’s Defense Minister Hulusi Akar announced on Thursday that three ships are scheduled to leave Ukrainian ports on Friday as part of the agreement to free grain exports.

Akar also said that an empty ship is scheduled to sail toward Ukraine after an inspection in Istanbul. According to the statement, Akar held talks with Ukrainian ministers of defense and infrastructure to discuss the situation of grain shipments. dpa/rtr

After the International Civil Aviation Organization (ICAO) identified violations of international aviation rules by Russia, the EU Commission has now reacted and condemned the violations. Russia disobeys basic international aviation rules and instructs its airlines to work against them, EU Transport Commissioner Adina Vălean warned.

At the end of June, ICAO already noticed that Russian airlines added aircraft registered in other countries to the Russian aircraft register. The aircraft belong to foreign leasing companies and were not returned after the start of the war in Ukraine and the sanctions against Russia. The EU Commission considers these aircrafts “stolen”.

Due to the illegal double registration, ICAO sees serious safety concerns regarding the international validity of each aircraft’s certificate of airworthiness and radio station license. In response, the UN agency has called on Russia to immediately cease its violations of international aviation rules.

Several safety requirements were deliberately violated “in an attempt by the Russian government to circumvent EU sanctions,” the Commission said on Thursday. “It is of utmost importance for all countries to defend the international aviation rules-based system, for the safety of passengers and crew,” Vălean commented. EU High Representative Josep Borrell called it another example of Russia’s “blatant disregard of international rules and standards, putting the lives of people at risk, including Russian citizens”. luk

Google may once again be in the sights of the European Commission’s competition watchdogs. This time, Brussels is investigating the regulations for Google’s App Store, according to information from Politico. For this purpose, the competition authority has sent out confidential questionnaires regarding the billing conditions and developer fees for the Google Play Store.

The European Commission refused to comment on Thursday, as did Google.

Developers who sell their apps on the Google Play Store pay a fee of up to 30 percent for access to the Google Play Store. In addition, Google requires providers to use Google’s own billing system to accept payments from users.

A similar investigation is currently underway against the Google Play Store in the Netherlands, which is expected to be closed when the EU launches an official investigation. In parallel, the British Competition and Markets Authority is also investigating the conditions of the Google Play Store. In addition, there is a similar investigation in Brussels against Apple’s App Store. Apple allegedly abuses its dominant position in the distribution of music streaming apps.

In March 2022, the European Commission last initiated formal antitrust proceedings against Google and Meta. Here, it is examining whether an agreement between Google and Meta (Facebook) relating to display advertising may violate EU antitrust rules (Europe.Table reported).

The Commission has already closed other antitrust proceedings against Google. These involved Google Search Shopping, Google Search Adsense and the Google Android operating system. In total, fines amounted to more than €8 billion – although Google is still in dispute with the Commission before the European Court of Justice.

On July 19, Google announced in a blog post that it would reduce fees for developers of non-gaming apps in the Google Play Store who switch to competing payment systems from 15 percent to 12 percent to comply with new EU regulations. The fee reduction will only apply to European consumers, while the ability to use a different payment system will also be extended to gaming apps, the company said.

The background to this is that big tech companies like Alphabet parent Google will be subject to the new EU Digital Markets Act (DMA) regulations next year. Under it, app developers must allow the use of competing payment platforms for app sales – or risk fines of up to 10 percent of their global revenue.

“As part of our efforts to comply with these new rules, we are announcing a new program to support billing alternatives for EEA users,” Estelle Werth, Google’s Director of EU Government Affairs and Public Policy, announced in the blog post. This means that developers of non-gaming apps can offer their users in Europe an alternative to Google Play’s billing system.

The DMA is set to be incorporated into the EU regulatory framework in October this year, and tech companies under its scope will be required to be compliant in early 2024. vis

Since April, Jekaterina Boening has been responsible for sustainability in the Industrial Applications department at Siemens Energy. The energy division of the Munich-based conglomerate offers companies in industry – such as the energy-intensive chemical industry – concepts for green transformation.

The 32-year-old is responsible for implementing the company’s own sustainability goals in the Industrial Applications unit. Boening is thus moving away from her previous focus on a sustainable transport sector. At the think tank “Transport & Environment Germany”, she was division manager for energy, climate and fuels. “By moving from the think tank to Siemens Energy, I finally wanted to play a practical role in the transformation,” Boening explains.

One of their central tasks is to implement the EU taxonomy in their own company. The first step is to create the processes for measuring “green” investments. In addition, another important task for Boening is to check the climate protection suitability of the company’s own sites. “We want to obtain one hundred percent of our electricity from green sources starting next year and become climate-neutral in all our own operating processes by 2030,” explains Boening.

No easy feat for an industrial company, but perhaps it was precisely this challenge of helping to transform an energy giant that attracted Boening to Siemens Energy. “Of course, there are other companies, for example, from the finance or IT sectors, that announce that they have been climate-neutral for years. But there you have to remember that those companies only had to decarbonize a few offices. For us, and especially for our customers in the energy-intensive industry, it’s a bit more demanding,” says Boening.

Energy has accompanied the Latvian-born, staunch European, and committed Berliner since the beginning of her professional career. “In my first job at Eon, I witnessed the beginning of the German energy transition,” says Boening. Shortly before that, former Chancellor Merkel had announced the phase-out of nuclear energy under the impact of the nuclear disaster in Fukushima.

Boening also learned about Russia’s approach to energy long before Russia used energy as a bargaining chip against the West. She spent four months advising the Russian Energy Ministry on energy conservation as part of a UN Development Program project. Because that is still considered hardly necessary in Russia. “There you are in the student dormitory in a T-shirt and shorts with windows open. It’s minus twenty degrees outside and the heating is on full blast,” explains Boening.

Her country of birth has already gone through the learning process. But it wasn’t easy for the small country either, says Boening. The fact that climate protection and environmental protection hardly played a role in Latvia until recently is due to the fact that such topics require a certain level of prosperity. “With the help of the EU, too, Latvia has achieved that, however, and the Green Deal means that the issues are becoming increasingly important,” Boening explains. David Renke

A week ago, the German government presented its startup strategy. The joint project of the German “traffic light” coalition also covers a number of EU areas. Which and why they play a major role in the strategy’s success, Falk Steiner has the details.

My colleague Nico Beckert took a look at what China’s military actions around Taiwan will mean for supply chains. Taiwan is, after all, the world’s largest supplier of microchips. As of Thursday evening, experts are giving the all-clear – but that could quickly change if China expands the maneuvers even further.

Saving is the order of the day: Germany will need to save ten billion cubic meters of gas by March next year to meet the target set by the EU. Read more about the calculations and what the Federation of German Industries has to say about it in the News section.

For Latvian-born Ekaterina Boening, playing a practical part in the transformation was the reason why she moved this year from the think tank Transport & Environment Deutschland to the energy giant Siemens Energy. Find out more about the exciting field she manages now in today’s Profile.

The goal is clear: “We want to become the driving force for a European location. That is the only sensible goal,” says Anna Christmann, start-up representative of the German government. “We need to be visible as Europe and attractive for start-ups. As the largest country in the EU, we have a special role.”

For this to succeed, measures are to be taken both in Germany and with other EU members and at the EU level. France, in particular, repeatedly emphasized the importance of an improved start-up policy during the first term of office of the liberal French President Macron and during the Council Presidency in the first half of this year. Compared to the grand French goals, which are also partly reflected in the policy of EU Commissioner for Internal Market Thierry Breton, Germany once again appears hesitant here.

At the beginning of the year, the French government announced that it would not only breed a large number of so-called unicorns with a market value of more than €1 billion by 2030. The goal at the time was to have 10 so-called hectocorns by 2030; technology companies with more than €100 billion in market value. Anna Christmann sees France’s efforts as an incentive: “We rely on networking to move forward together. I see the fact that France in particular also has a lot of activities in this area as very positive, because it means we push each other.”

For this to succeed at all, French policymakers attach importance to an improved financing environment – just as German start-up policymakers now do. This means, in particular, better funding for start-ups in the founding and especially the growth phase. Because that is precisely where European investors are scarce – instead, emerging European start-ups are primarily supported by venture capitalists from the US and Asia. “Long-term investments in research-intensive start-ups, for example in the field of quantum computing and artificial intelligence, are particularly important,” says Daniel Breitinger, Head of Start-ups at Bitkom.

But one essential prerequisite is missing: “There is a lack of institutional capital; these investors tend to invest in larger amounts. This makes the comparatively small-volume VC funds in Europe uninteresting for larger investors. So far, there are hardly any funds whose volume exceeds €1 billion.” That is what policymakers now aim to change – but they encounter new problems in the process.

On the initiative of French Minister for the Economy and Finances, Bruno LeMaire (LREM/Renew), German Minister of Finance, Christian Lindner, (FDP/Renew) announced match funding for the €10 billion European Tech Champions Initiative (ETCI) in April: France and Germany will each provide €1 billion to the fund at the European Investment Bank, while Germany will contribute its significant chunk via the Future Fund at the federally owned Kfw – Kreditanstalt für Wiederaufbau (“Credit Institute for Reconstruction”). The European Investment Bank (EIB) is to contribute another €500 million. Many other EU countries have signaled their interest in participating. Shortly before the French presidential election. But since the announcements, the ETCI has gone quiet. When asked, the German Finance Ministry assures that the ETCI is expected to “be able to make its first investments by the end of the year”.

Start-up representative and Green Party politician Christmann also wants to use additional European funds to create more European unicorns: “We are looking at the investment quotas that we have set for the ERP/EIF facility at the European Investment Fund with currently at least 20 percent for climate and social impact investment,” says the start-up representative. “This should also continue to grow, because of course we are not satisfied with 20 percent in the long term.”

While all of these measures do not require regulatory changes, the conditions for start-ups in other areas depend on both the EU and the national levels. When it comes to the coalition’s planned employee equity participation, the players in Brussels will probably be left out, as they will be in the planned, purely German plans for administrative digitization, which will then also make things easier for start-ups. However, Christmann also sees opportunities in new regulations, such as the Artificial Intelligence Act: “The living lab regulation basically also comes from Germany, we have the Data Act and all regulation on data at the European level, and also Solvency II.” These regulations must “of course be designed to be innovation- and start-up-friendly”.

The revision of the Solvency II Directive, in particular, is causing headaches for some observers. From the perspective of the start-up and venture capital industry, a key aspect of this is the question under what conditions financially strong insurers will be allowed to further invest. “The German government is committed to targeted adjustments that further improve the regulatory framework while leading to balanced effects on capital requirements,” the Federal Ministry of Finance stated in response to a query. “This is central to the stability of the industry and the general investment capacity of insurers.”

But insurers themselves fear above all that changes to the model for forward calculations of the yield curve would increase their capital requirements. Life insurers especially often have to decide on their strategies over very long periods, in some cases 40 years – but the predictive power of financial mathematical models does not allow for reliable forecasts this far into the future, which is why yield curves are extrapolated into the future after 20 years. The insurance regulator EIOPA proposed new criteria for this.

But these would reduce investment opportunities even further, according to the industry, especially in riskier asset classes such as venture capital. “The new model would create incentives to invest more in long-dated bonds, such as government bonds,” a GDV spokesman told Europe.Table. “This could reduce funds for investments in real assets.”

The Federal Ministry of Finance does not share this opinion: “The subject of the review of Solvency II is also potential regulatory relaxation for long-term investments to better exploit the investment potential of insurers,” the ministry of FDP Minister of Finance Christian Lindner said. “The German government is committed to risk-appropriate adjustments that also adequately take the protection of policyholders into account.”

One area is completely absent from the German start-up strategy: The defense industry, which German policymakers have recently rediscovered after Russia’s attack on Ukraine. But there is no talk of a watershed in German start-up policy here, as Christmann explains: “We have identified focus areas that are about solving societal challenges. These are climate crisis, health, biotechnology, these are main focus areas that we also serve with the start-up strategy.” The issue is of course increasingly present, says the start-up representative, who is also the aerospace coordinator of the German coalition: “Of course, there are also some areas in which dual-use is an issue, even in aerospace alone, for which I am also in charge. But the focus is on the areas we have listed in the start-up strategy.”

But while there is no shortage of start-up policy, one question has remained unanswered: What qualifies as a start-up in the first place? What as a scale-up? And what counts as a technology-intensive innovation? However, before the first quarter of 2023, EU Commission does not want to answer this question, which is not exactly unimportant for any political control, on all start-up policies at the German and European level: As part of the European Innovation Agenda, a report will then be presented to provide a more uniform Europe-wide answer to precisely this question. At least until then, all participants can continue to have very different definitions – and call them all a start-up.

The logistics, trade, import and export sectors have become thin-skinned in recent years. Too often, global politics and pandemics have thrown their supply schedules out of sync. So news of extended naval operations around Taiwan has caused a scare.

Will chips from Taiwan now become scarce? Will Taiwanese goods be delayed from reaching Europe? Is there a risk of container congestion at important global ports such as Kaohsiung, Anping, Keelung or Taipei? After all, the Taiwan Strait is one of the busiest shipping routes in the region.

But experts are sounding the all-clear for now. “If the military maneuvers only last a short time and are not too extensive, then the disruptions will be mostly limited,” economist Wan-Hsin Liu of the Kiel Institute for the World Economy (IfW Kiel) told China.Table. There would be alternative routes. The planned duration of the exercises of three days is also within the range that freight companies can still easily accept as a delay.

At any rate, the military exercises have not yet caused any major delays or supply chain problems on the first day. Some shipping companies immediately rerouted their ships to alternative routes after the announcement. Taiwan’s shipping authorities already provided them with options to avoid the danger zones by a wide margin.

Some freighters have also changed their destination and are now calling at ports on the mainland. Others have reduced their speed to reach the critical zones by the weekend after the exercises have ended. However, most freighters simply bypass areas where military exercises are being held.

Ships without a direct destination on Taiwan are also affected. Almost half of the world’s container ships passed through the Taiwan Strait last year, Bloomberg reports. Thus, the restricted zones not only hinder Taiwan traffic, but also ships from Japan, South Korea, and China with destinations in Europe or the United States.

But even if the ships cannot pass through the Taiwan Strait and instead pass by the eastern flank of the island, the delays are only about three days. Such delays are not uncommon in global shipping. Extreme weather such as typhoons regularly cause similar deviations.

However, some uncertainty remains. Nancy Pelosi, the Speaker of the US House of Representatives, only spent a few hours in Taiwan. Her visit, however, has left the region in turmoil. The military exercises around Taiwan have already reached a new dimension. Whether the People’s Republic will be content with that remains to be seen. The designation of the maneuver zones already looks like a preparatory exercise for a naval blockade of Taiwan. According to Taiwanese media, this is exactly how Chinese General Meng Xiangjun portrays the situation.

If China were to extend the exercises, problems might emerge after all. Companies and logisticians would have to be prepared for “considerable disruptions in global supply chains and thus also in the global economy,” according to globalization expert Liu from the IfW. However, experts believe it is too early to be too alarmed. “We might be concerned if the drills become longer and more intense to impact supply chains, but there is no sign of that happening now,” says Huang Huiming, a fund manager at Nanjing Jing Heng Investment Management.

However, even dealing with the scenario is quite relevant in light of the experience of the past few years. Taiwan possesses the world’s largest production base for microchips. The market leader Taiwan Semiconductor Manufacturing (TSMC) alone holds a share of 53 percent.

According to Liu, semiconductors accounted for a good 51 percent of Taiwanese exports in the first half of the year. If these components are missing, the assembly lines in Germany will also come to a standstill. As a result, the German economy sees a strong dependence on Taiwan. Above all, it is aware of the possibility of indirect effects caused by outages in the People’s Republic (China.Table reported) and was already an issue before the current crisis.

China also still has the option of extending the sanctions to other Taiwanese commodity groups imposed after Pelosi’s visit. This scenario would involve a customs tricks instead of a naval blockade. China is already rejecting goods on various questionable grounds (China.Table reported).

So far, the food and construction industries have been most affected. But product groups relevant to manufacturing could also become the target of revenge for Pelosi’s provocation. This would hit Taiwan hard. The People’s Republic is the island’s largest trading partner. Last year, it shipped goods worth just under $190 billion to China. Germany accounted for a good $245 billion.

However, far-reaching sanctions are currently considered unlikely. China would also hurt itself by isolating Taiwan economically. The People’s Republic is also dependent on semiconductors from Taiwan (China.Table reported).

To meet the EU’s 15 percent savings target, Germany must save as much gas as five million four-person households consume on average per year. According to a calculation by the Deutsche Presse-Agentur based on data from the EU Commission, Germany will have to consume around ten billion cubic meters less gas between the beginning of August and March next year in order to achieve the target set by all EU countries. In absolute terms, Germany will have to save more than all other EU countries.

This is because Europe’s largest economy also consumes the most gas. Overall, the EU needs to consume around 45 billion cubic meters less gas – so Germany would have to save 10.35 billion cubic meters, almost a quarter of that. This is in proportion to Germany’s economic strength, as it is also responsible for almost a quarter of the EU’s economic output in terms of gross domestic product (GDP).

Other countries have to save less gas in terms of volume, but in some cases that is not in proportion to their economic output. Italy ranks second with over eight billion cubic meters saved – a relatively high amount compared to GDP. France needs to cut consumption by around five billion cubic meters, which is rather low compared to its economic output. The 15 percent target applies to all EU countries, albeit voluntary at first.

Against the backdrop of the war in Ukraine, EU countries have agreed on a contingency plan amid fears of a complete stop of Russian gas deliveries. The plan calls for a voluntary 15 percent reduction in national gas consumption between August 1, 2022, and March 31, 2023, based on average consumption during the same period over the past five years. If not enough gas is saved and widespread supply shortages emerge, a Union alert with mandatory savings quotas can be declared.

According to the German Minister of Economic Affairs, Robert Habeck (Greens), Germany is already on the right track. The Federal Republic currently saves between 14 and 15 percent – albeit compared to the previous year and not adjusted for temperature. Therefore, the relevant percentage figure is likely to be significantly lower. The Federal Ministry for Economic Affairs and Climate Action did not provide a specific figure upon inquiry. It explained that calculations were being made and that measures already taken were being taken into account.

However, further measures would have to follow in order to achieve the savings target. The ministry also stated that Germany would have to save more than the 15 percent agreed upon by the EU countries. dpa

The auctions planned by the German government to save gas do not go far enough for the Federation of German Industries (BDI). In addition to a short-term auction model for companies to save gas, there also needs to be a second instrument for the medium-term release of gas quotas by companies. “Otherwise, the auction mechanism runs the risk of bypassing the needs of industry,” BDI President Siegfried Russwurm commented on Thursday. When other energy sources are procured or individual production facilities are shut down, there could be additional costs that the government would have to compensate for, at least on a pro-rata basis.

The chemical association VCI also criticized the auction model yesterday. “The way the gas auction model is currently planned contributes to the stabilization of the gas network this fall. However, the opportunity to fill the storage facilities at an early stage is being missed,” the association tweeted.

A day earlier, the German Federal Network Agency (BNetzA) also indicated that the auction model is more practical for the short-term lowering of peak loads. “This offer can then be called up by the market area manager, for example, if increased gas consumption is expected due to falling temperatures,” said BNetzA Vice President Barbie Kornelia Haller in an interview with the information service of the Institute of the German Economy.

According to some experts, the existing gas market offers sufficient incentives to save energy. “If I bought gas as the industry, I can return it today for €180. That is the incentive mechanism. I don’t understand why we need anything else on top,” said energy economist Lion Hirth of the Hertie School in mid-July at the Table.Live briefing on the EU’s winter emergency plan. Since then, the price of gas on the spot market has even risen to €200 per megawatt hour. ber, dpa

German Minister of Finance Christian Lindner wants the EU to return to strict budgetary rules after the massive debt incurred during the Covid crisis. What is needed is a more reliable and ambitious path to debt reduction, the FDP politician told the German newspaper Handelsblatt.

The German proposal for the reform of the EU Stability and Growth Pact also calls for the debt rules to be retained, according to the Handelsblatt. These allow member states a maximum annual new debt of 3 percent of economic output and a maximum total debt of 60 percent.

In addition, Lindner wants to mandate debt reduction. So far, the principle that member states are only allowed to have an annual structural deficit of 0.5 percent or close to it is not binding. Lindner wants to change that: The medium-term budget targets are to become binding. A gradual adjustment to a largely balanced budget would also be acceptable, he said.

The EU Commission plans to present its proposal for the reform this fall. Among members, different camps have formed. Germany always rejected far-reaching reforms and a softening of the debt rules called for by other countries.

Achim Post, vice chairman of the SPD parliamentary group, welcomed the fact that Lindner and the German government are actively involved in the debate. “It will be all the more important that Germany acts flexibly and in a mediatory manner in further negotiations in the interests of ultimately finding a solution that is viable for everyone and fit for the future,” he warned. The Stability and Growth Pact would need an update that would bring it up to date with fair and realistic goals and challenges. dpa

According to sources in the German government, the European Union intends to put together another financing package for Ukraine until September. The package is worth about €8 billion. A part of it will be in grants that do not have to be paid back, another part will be loans, a government representative said on Thursday. Two steps may be needed to reach the goal, he said. The first step is expected to be ready in September.

Germany wants a fairer distribution of the burden. EU states that had been holding back so far must now do more. “Germany will also participate in further aid,” said the government representative. To this end, Germany is in close contact with the EU Commission and its European partners.

In the spring, the seven leading industrialized nations (G7) put together a package of more than $9 billion for Ukraine. This secured funding for the country for several months. The USA bore the brunt of this with $7.5 billion, while Germany had provided a grant of €1 billion, which has already been disbursed. In the G7 circle, EU partners France and Italy kept a very low profile. In the meantime, the EU Commission has also provided a grant of €1 billion.

The aid is exclusively short-term budget support for the government in Kyiv. Military aid, humanitarian aid and subsequent reconstruction of the country will be financed from other funds. The government representative said that Germany does not want to have to pay twice. The previous grant to Ukraine must be at least partially credited.

Ukrainian President Volodymyr Zelenskiy said this week that the budget deficit still amounts to $5 billion per month as a result of the war. Experts believe that the country’s liquidity needs will continue beyond 2022. More and more aid is thus likely. Media reports have recently cited Ukrainian accusations against Germany of blocking the disbursement of EU funds. rtr

Despite the resumption of grain exports via Ukrainian Black Sea ports, the EU intends to maintain its initiative for alternative freight routes. As it will be difficult to quickly restore the export volume via the Black Sea ports to pre-war levels, other transport routes remain crucial, an official of the responsible EU Commission explained in response to a query from the Deutsche Presse-Agentur.

Every ton exported would count and increasing the capacity and flexibility of the European transport system, it could help secure food supplies in poor partner countries.

Adina Vălean, the EU commissioner responsible for the transport sector, said, “There is still room for improvement”. For example, there are not enough freight cars and barges and more capacity would be needed for the temporary storage of Ukrainian exports. Any kind of help would be welcome.

The EU is committed to facilitating agricultural exports from Ukraine because blockades caused by Russia’s war of aggression have a significant impact on global food markets and jeopardize food security in countries in the Middle East, Asia and Africa.

However, the greatest hopes are currently resting on an agreement brokered by the United Nations and Turkey, which should enable a resumption of regular Ukrainian agricultural exports via the Black Sea. According to EU figures, until before the war, around 90 percent of grain and oilseed exports went through Ukraine’s Black Sea ports – for grain, the figure was up to five million tons per month.

Regardless, it is considered unlikely that this level can be regained in the foreseeable future. The first ship to leave the port of Odesa under the UN deal earlier this week had loaded just about 26,000 tons of corn. It is expected to arrive in the Lebanese port city of Tripoli on Sunday.

Turkey’s Defense Minister Hulusi Akar announced on Thursday that three ships are scheduled to leave Ukrainian ports on Friday as part of the agreement to free grain exports.

Akar also said that an empty ship is scheduled to sail toward Ukraine after an inspection in Istanbul. According to the statement, Akar held talks with Ukrainian ministers of defense and infrastructure to discuss the situation of grain shipments. dpa/rtr

After the International Civil Aviation Organization (ICAO) identified violations of international aviation rules by Russia, the EU Commission has now reacted and condemned the violations. Russia disobeys basic international aviation rules and instructs its airlines to work against them, EU Transport Commissioner Adina Vălean warned.

At the end of June, ICAO already noticed that Russian airlines added aircraft registered in other countries to the Russian aircraft register. The aircraft belong to foreign leasing companies and were not returned after the start of the war in Ukraine and the sanctions against Russia. The EU Commission considers these aircrafts “stolen”.

Due to the illegal double registration, ICAO sees serious safety concerns regarding the international validity of each aircraft’s certificate of airworthiness and radio station license. In response, the UN agency has called on Russia to immediately cease its violations of international aviation rules.

Several safety requirements were deliberately violated “in an attempt by the Russian government to circumvent EU sanctions,” the Commission said on Thursday. “It is of utmost importance for all countries to defend the international aviation rules-based system, for the safety of passengers and crew,” Vălean commented. EU High Representative Josep Borrell called it another example of Russia’s “blatant disregard of international rules and standards, putting the lives of people at risk, including Russian citizens”. luk

Google may once again be in the sights of the European Commission’s competition watchdogs. This time, Brussels is investigating the regulations for Google’s App Store, according to information from Politico. For this purpose, the competition authority has sent out confidential questionnaires regarding the billing conditions and developer fees for the Google Play Store.

The European Commission refused to comment on Thursday, as did Google.

Developers who sell their apps on the Google Play Store pay a fee of up to 30 percent for access to the Google Play Store. In addition, Google requires providers to use Google’s own billing system to accept payments from users.

A similar investigation is currently underway against the Google Play Store in the Netherlands, which is expected to be closed when the EU launches an official investigation. In parallel, the British Competition and Markets Authority is also investigating the conditions of the Google Play Store. In addition, there is a similar investigation in Brussels against Apple’s App Store. Apple allegedly abuses its dominant position in the distribution of music streaming apps.

In March 2022, the European Commission last initiated formal antitrust proceedings against Google and Meta. Here, it is examining whether an agreement between Google and Meta (Facebook) relating to display advertising may violate EU antitrust rules (Europe.Table reported).

The Commission has already closed other antitrust proceedings against Google. These involved Google Search Shopping, Google Search Adsense and the Google Android operating system. In total, fines amounted to more than €8 billion – although Google is still in dispute with the Commission before the European Court of Justice.

On July 19, Google announced in a blog post that it would reduce fees for developers of non-gaming apps in the Google Play Store who switch to competing payment systems from 15 percent to 12 percent to comply with new EU regulations. The fee reduction will only apply to European consumers, while the ability to use a different payment system will also be extended to gaming apps, the company said.

The background to this is that big tech companies like Alphabet parent Google will be subject to the new EU Digital Markets Act (DMA) regulations next year. Under it, app developers must allow the use of competing payment platforms for app sales – or risk fines of up to 10 percent of their global revenue.

“As part of our efforts to comply with these new rules, we are announcing a new program to support billing alternatives for EEA users,” Estelle Werth, Google’s Director of EU Government Affairs and Public Policy, announced in the blog post. This means that developers of non-gaming apps can offer their users in Europe an alternative to Google Play’s billing system.

The DMA is set to be incorporated into the EU regulatory framework in October this year, and tech companies under its scope will be required to be compliant in early 2024. vis

Since April, Jekaterina Boening has been responsible for sustainability in the Industrial Applications department at Siemens Energy. The energy division of the Munich-based conglomerate offers companies in industry – such as the energy-intensive chemical industry – concepts for green transformation.

The 32-year-old is responsible for implementing the company’s own sustainability goals in the Industrial Applications unit. Boening is thus moving away from her previous focus on a sustainable transport sector. At the think tank “Transport & Environment Germany”, she was division manager for energy, climate and fuels. “By moving from the think tank to Siemens Energy, I finally wanted to play a practical role in the transformation,” Boening explains.

One of their central tasks is to implement the EU taxonomy in their own company. The first step is to create the processes for measuring “green” investments. In addition, another important task for Boening is to check the climate protection suitability of the company’s own sites. “We want to obtain one hundred percent of our electricity from green sources starting next year and become climate-neutral in all our own operating processes by 2030,” explains Boening.

No easy feat for an industrial company, but perhaps it was precisely this challenge of helping to transform an energy giant that attracted Boening to Siemens Energy. “Of course, there are other companies, for example, from the finance or IT sectors, that announce that they have been climate-neutral for years. But there you have to remember that those companies only had to decarbonize a few offices. For us, and especially for our customers in the energy-intensive industry, it’s a bit more demanding,” says Boening.

Energy has accompanied the Latvian-born, staunch European, and committed Berliner since the beginning of her professional career. “In my first job at Eon, I witnessed the beginning of the German energy transition,” says Boening. Shortly before that, former Chancellor Merkel had announced the phase-out of nuclear energy under the impact of the nuclear disaster in Fukushima.

Boening also learned about Russia’s approach to energy long before Russia used energy as a bargaining chip against the West. She spent four months advising the Russian Energy Ministry on energy conservation as part of a UN Development Program project. Because that is still considered hardly necessary in Russia. “There you are in the student dormitory in a T-shirt and shorts with windows open. It’s minus twenty degrees outside and the heating is on full blast,” explains Boening.

Her country of birth has already gone through the learning process. But it wasn’t easy for the small country either, says Boening. The fact that climate protection and environmental protection hardly played a role in Latvia until recently is due to the fact that such topics require a certain level of prosperity. “With the help of the EU, too, Latvia has achieved that, however, and the Green Deal means that the issues are becoming increasingly important,” Boening explains. David Renke