“The Russian invasion has failed” – at least that is what European Commission chief Ursula von der Leyen and UK Prime Minister Liz Truss said after a meeting at the United Nations General Assembly in New York on Wednesday. President Vladimir Putin’s decision to order a partial Russian mobilization for the fight in Ukraine was a sign of weakness, they said. Putin’s announcement prompted EU foreign ministers to hold an emergency meeting on Wednesday to discuss new sanctions and arms deliveries to Kyiv. Speaking with Ella Joyner, Michael Gahler, foreign policy spokesman for the EPP Group, explains how he interprets Putin’s announcement and what he believes the West needs to do now.

Will the climate goals of the German government soon fall victim to high energy and food prices? The plan is already to postpone the increase of the national carbon price in the Fuel Emissions Trading Act by one year. Climate strategy plans are also shaky at the European level. Lukas Scheid analyzes what impact this will have.

China welcomes foreign investors – and they are coming, despite the rising market risks. For German companies, in particular, the growth in China is tempting. But how long will it last? China is catching up, wants to become the market leader itself, and will in all likelihood replace foreign companies at some point. My colleague Nico Beckert talks about dependencies, tensions and investment opportunities on the Chinese market.

Mr. Gahler, what does a partial mobilization mean for the war?

Apparently, the “special operation” isn’t going according to plan after all, or else he wouldn’t be calling for a partial mobilization. He will not be able to rally the 300,000 men. It is an expression of the impending defeat. We should join forces and continue to support Ukraine with weapons.

Can he use it to turn the tide of war in eastern and southern Ukraine in Russia’s favor?

I don’t think so, because he won’t be able to get the men there quickly. The logistics for that are not there. But it will be a challenge for the Ukrainians. We have to do our part to ensure that they are well armed and can defend themselves.

What is your opinion of the announced referendums in the occupied territories?

These referendums are fake. Putin knows that we know it’s a fake, and yet he’s building a Potemkin façade of legitimacy. This is entirely political and legally irrelevant to us. We will never acknowledge that. And he knows that.

And the allusion to nuclear weapons?

This is classic fearmongering. All the experts say that he will not follow through on this threat. It would not only be an escalation but proof that his attempt to conquer his neighbor has failed. Nuclear weapons serve as a political deterrent, but they are not capable of ending a war.

Are you worried that the war might spread to other European countries?

I don’t see that. Russia is not capable of that. We must help the Ukrainians to push the Russians back to their own border. Then it will be possible to discuss with Moscow. The Ukrainians are willing and able to do that. We have to provide them with enough weapons.

When do you believe peace negotiations are an option?

When Russia is ready to return to the status quo ante. In any case, to the status before February 24. Then it will be up to the Ukrainians to decide whether that is enough to force the Russians to the negotiating table, or whether they will also try to retake Crimea or the occupied territories of Donetsk and Luhansk.

Do you think Germany should supply battle tanks?

There are 12 or 13 countries in the West that possess the Leopard 2, a total of 2,000 units. If we jointly provide 200 of them to Ukraine, then it would not be Germany going it alone, but a joint action to help the Ukrainians take back their territories. I think that’s what we should do.

Would this encourage Putin to escalate the situation further?

I don’t think he has the capacity for that. The only way out is for him to agree to come to the negotiating table. For that, he would have to say: Okay, I accept the territorial sovereignty of Ukraine.

The German government wants to postpone the increase of the national carbon price in the Fuel Emissions Trading Act (BEHG) by one year. As part of the third relief package, it was announced that the levy of currently €30 would not be raised to €35 per metric ton of CO2 until January 1, 2024. Accordingly, other planned adjustments will also be postponed by one year.

It is the first sign of what the energy crisis will do to the climate protection ambitions of the German government. After all, carbon pricing is an adequate market-based instrument to reduce emissions from industry and consumers. For the EU, it is by far the most important instrument for achieving the Green Deal goals. Nevertheless, this instrument has been cut despite Green government participation.

The demands of some industrial sectors go even further. An alliance of real estate, waste disposal and municipal companies, for example, demanded to stop the extension of the Fuel Emissions Trading Act to waste incineration planned for 2023. The argument: it is vital to avoid even higher financial burdens for private households and businesses. The economic and environmental committee of the Federal Council called for a postponement of two years.

The Federal Council did not follow this recommendation last week in its first reading of the amendment to the Fuel Emissions Trading Act submitted by the Federal Ministry for Economic Affairs and Climate Action (BMWK), arguing that the discrimination against recycling by the inclusion of waste incineration must be stopped. But here, too, it is clear that calls to stop or postpone climate protection measures are no longer all that unpopular.

And even if the price signal of the Fuel Emissions Trading Act as an incentive to conserve energy is considered to be limited – the price of CO2 reaches a plus with a total increase of 0.671 ct/kWh (gross) on the gas price, 6.7 ct/l on gasoline and 7.7 ct/l on diesel. The willingness demonstrated by the German government to accept compromises on climate protection instruments in the face of rising living and production costs shows that nothing is as impossible as it seemed just a few months ago.

This is just as true at the European level. The German Chemical Industry Association (VCI) wants to stop the EU chemicals strategy, the Industrial Emissions Directive and the planned Carbon Border Adjustment Mechanism (CBAM) for the time being, as they “further burden the competitiveness of the industry”. The intention is to mitigate the impact of the energy crisis. However, the whole truth is that the VCI’s demand is not new and is not solely motivated by rising energy prices. Even before the energy crisis started, these legislative initiatives were a thorn in the association’s side, as they pose enormous challenges for the industry. But in the current situation, calls for less climate protection are simply gaining renewed momentum.

Daniel Caspary and Angelika Niebler from the EPP also take advantage of this. “Burdensome legislation” must be put on hold, Caspary demands, referring to the Industrial Emissions Directive, the Soil Health Law and the Supply Chain Act. “Additional burdens on business and agriculture must be avoided at all costs in this dramatic time of crisis.” Niebler calls the Commission’s proposed Legislation on Plant Protection Products unacceptable in times of food shortages. It will mean “that our farmers will no longer be able to produce enough to feed the continent,” the CSU politician fears. Nor are Caspary and Niebler’s criticisms of these legislative proposals new, only the rationale has changed.

However, the position of group colleague Peter Liese, EPP spokesman on environmental policy and rapporteur for the reform of the European Emissions Trading System (ETS), seems to have actually changed. Liese no longer defends the importance of a strong price signal from the ETS for climate protection as fiercely as he did a few months ago. While he still prevailed in the negotiations in the EU Parliament’s Environment Committee against a number of more conservative EPP MEPs who would have welcomed a less ambitious ETS reform, he now strikes different tones.

Liese supports his group’s demand for a short-term intervention in emissions trading to relieve the burden on electricity consumers and companies. The EPP wants to extend the Commission’s much-criticized proposal to sell emission allowances from the market stability reserve worth €20 billion to finance REPowerEU. Liese explicitly demands that the allowances be released onto the market as quickly as possible so that the measure also has a swift dampening effect on the carbon price.

Unlike the German Fuel Emissions Trading Act, the European carbon price already has a clear steering effect. According to the EU Commission, emissions from the sectors covered by the ETS have been reduced by 42.8 percent since its introduction in 2005. The reform is intended to strengthen the system even further, which is why high hopes for climate protection rest on the instrument.

This is why watering down ambitions is also seen critically, even in the face of the energy crisis. “Calls to weaken the EU ETS are based on the mistaken belief that we can lower energy prices and inflation by lowering ETS allowance prices,” argues Sabine Frank, Executive Director at Carbon Market Watch. Selling MSR allowances would set a precedent, she says. “Even if the European Parliament or the Council impose strict conditions and amend the text to say it is an ‘exceptional and one-off measure,’ there is a risk it would be used again.” The MSR is not a fundraising tool, Frank warns.

The word from Green circles in Brussels is that they want to prevent the postponement or halting of climate policy measures at all costs. A lower emission price, like through the sale of MSR allowances, would also lead to lower revenues from the ETS. Revenue that would be missing from EU members and various investment funds to support the transformation of the economy. “It is possible that some countries have already earmarked part of these revenues for climate protection projects, so they will have to find other sources of funding if prices fall drastically,” says Sabine Frank.

The Commission does not want to hear anything about these concerns. According to Commission sources, member states cannot earmark revenues from the rising carbon price resulting from the ETS reform, as the reform has not yet been finalized anyway.

That the EU would lose sight of its climate protection ambitions is denied at every opportunity by both Green Deal Commissioner Frans Timmermans and Commission President Ursula von der Leyen. The goals of the Green Deal are to remain untouched, and the measures to contain the energy crisis are not to burden the climate through increased carbon emissions. Carbon Market Watch believes this is credible, too. “Since the State of the Union address and the proposed measures, including an overhaul of the electricity market design, calls for intervention in the carbon market have quieted down a bit,” Frank says.

China’s Vice Premier, Han Zheng, usually has more important things to do than inaugurate new factories. But Han made an exception for BASF. As the chemical giant celebrated the start of production at its ten-billion-euro Verbund site in Zhanjiang, Han dropped by for an event in Beijing. The high-profile visit was meant to send a signal: China welcomes foreign investors.

Actually, the People’s Republic does not even have to woo German companies. Apart from BASF, the automotive industry continues to be one of the biggest investors in the country. In 2020, Volkswagen announced plans to invest €15 billion in electric mobility with its Chinese joint venture partners by 2024.

After European countries and the United States, China is the biggest target market for German companies. They have made a total of over 90 billion in investments there – more than a third of which came from the automotive industry.

Economists believe, however, that major investments by the German industry in China are no longer as low-risk as they were a few years ago. The People’s Republic remains a growth market. But for how much longer? The government in Beijing is pursuing a clear medium-term strategy: Catching up technologically and turning its own champions into market leaders. “German producers have to brace themselves for being replaced by domestic companies. They are in the hands of the government,” says Rolf Langhammer of the Kiel Institute for the World Economy (IfW). The trade expert warns, “Anyone who runs a business in China knows that these investments are only temporary.”

But is China growing so fast that even investments in the billions will yield quick profits with correspondingly low business risk? According to Langhammer, there are definitely risks: “It may well be that large German companies will have to adjust their forecasts for the Chinese market again in the future and revise them downward“.

Moreover, China’s growth is cooling noticeably. Zero-Covid and geopolitical tensions are further added to the mix. “China is likely to become a more difficult market for all foreign companies in the coming years,” says Noah Barkin of the analysis firm Rhodium Group. The cost-benefit ratio “is tipping in an unfavorable direction,” he estimates. According to Barkin, it cannot be ruled out that European companies will be forced to accept large financial losses on their investments in China.

Deutsche Bank’s CEO also voiced concern about dependencies. “The country’s increasing isolation and growing tensions, especially with the US, pose a significant risk for Germany,” Christian Sewing said. Some economists demand a fundamental rethinking. After all, shareholders and creditors of companies with a strong China focus could also be affected by increasing China risks, said Juergen Matthes of the German Economic Institute (IW) in Cologne. Because of geopolitical tensions, “it’s about looking at risk exposure and making sure the company can survive in case of escalation.” The head of the Global and Regional Markets cluster at the IW assumes that “the financial market will also demand greater transparency about China risks.”

The German Federal Ministry for Economic Affairs and Climate Action also considered exercising more control. Investments by German companies in China should be subject to greater scrutiny. But after fierce criticism from the business community, the ministry appears to abandon these plans, as Reuters reports.

However, there are also economists who are more positive about the situation. “The investment opportunities in China are still great,” says Horst Loechel, head of the Sino-German Center at the Frankfurt School of Finance & Management. “If you compare the opportunities to the potential risks – geopolitical and otherwise – it is still reasonable to be invested in China.” He remains optimistic that bridges between the People’s Republic and the West will not be burned. “The peak of geopolitical tensions is very likely already behind us.”

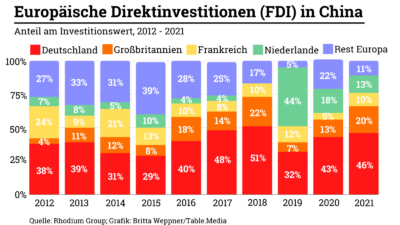

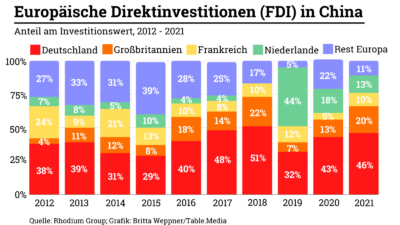

Yet, the number of companies that continue to show unlimited enthusiasm for China is steadily declining. While investments in the People’s Republic are growing in volume, the majority of the money comes from fewer and larger companies. The top ten European investors in China have accounted for an average of nearly 80 percent of all investments over the past four years, according to a new analysis by Rhodium Group. German conglomerates rank among the top investors.

Volkswagen, BMW, Daimler and BASF alone accounted for about 34 percent of all European investments in China between 2018 and 2021, according to Rhodium. “Our findings point to a widening gap in how European firms perceive the balance of risks and opportunities in the Chinese market,” the authors conclude.

BASF, for example, points out the opportunities. When asked about potential investment risks, a company spokeswoman commented that China remains an important growth market. “By 2030, China will account for more than two-thirds of global chemical production growth. China will then account for 50 percent of the global market.” Developing additional markets in the People’s Republic would be “of high strategic and economic value,” the spokeswoman said. The company monitors geopolitical developments and takes measures to safeguard investments, she added.

Some companies pursue a rather surprising strategy to cope with the risks. They are “investing even more in China, but to make their local business more independent of their global operations,” Mikko Huotari, director of the Merics research institute, told Reuters. China, he said, is considered a separate business entity. Workforce, supply chains and data flows are becoming increasingly localized, the Rhodium research also notes. That would reduce risks, the report says. In the event of any sanctions against the People’s Republic, there would then be fewer exchanges with company units in other countries.

Huotari believes companies act “logically” in the short term. “Many are trying to do good business in China for at least another 10, 15, maybe 20 years.” The important question here is whether companies will be able to find the right time to jump ship. The situation with Russia, for example, has shown that escalation can happen fairly abruptly. Huotari warns, “Some companies underestimate not only the downward pressure of the Chinese economy, but above all geopolitical risks of the location.”

So how can the risks of major investments in China be reduced? Matthes of the IW suggests that companies “should be obligated in their financial statement to report on geopolitical cluster risks and on potential operating losses in the realization of these risks.” This would make the risks of doing business in China more transparent. Company leaders would then possibly calculate differently.

Politics should also scale back existing incentives for doing business in China, Matthes said. The German Ministry of Economics is already considering scaling back government investment and export guarantees and China loans granted by the German development bank KfW. In addition, trade relations are to be diversified and agreements signed with other countries in the region.

The Commission has approved another €5.2 billion for 35 hydrogen projects in the EU. The second round of the hydrogen IPCEI would trigger another €7 billion in private investment, the authority announced yesterday. Among the 29 beneficiary companies from 13 EU states and Norway, however, none of them was German.

Germany did not participate in the funding round called Hy2Use. This second wave funds infrastructure projects for the production, storage and transport of hydrogen on the one hand, and applications in important industries such as cement, steel and glass on the other. However, the German group Uniper, which is about to be nationalized, is involved with an infrastructure project in the Netherlands.

After two of four funding waves, it is the German basic materials industry, of all sectors, that is still waiting for the approval of hydrogen projects. In the first funding round, only four German projects had been approved. ber

To achieve the carbon reduction targets of the Green Deal and the Fit for 55 package, the European Aviation Safety Agency (EASA) is calling for more ambitious intra-sector targets for aviation. These include measures to expand the supply and use of sustainable aviation fuels (SAF).

In this year’s European Aviation Environmental Report, EASA recommends faster approval of higher SAF admixtures of up to 100 percent. Currently, only the admixture of a maximum of 50 percent SAF is approved in Europe. Industry and fuel standard committees are already examining the use of 100 percent by 2030, according to EASA. To support SAF investments, the authors also call to use money from the EU Innovation Fund, which is fed by revenues from the European Emissions Trading System (ETS).

The gradual inclusion of the costs of environmental and climate impacts of aviation in the pricing of passenger and cargo flights must continue and passengers should be given incentives to fly “greener”, an EASA official urged on Wednesday. To that end, cross-border solutions and minimizing network constraints are to be promoted as part of the creation of a Single European Sky.

In addition, the agency is calling for stricter legal thresholds for environmental certification standards for technological innovations – not just for Europe, but globally. Latest data is to serve as a basis for what is technologically feasible, economically viable and environmentally compatible. luk

According to a study by the Brussels-based think tank Bruegel, European governments have earmarked nearly half a trillion euros to protect citizens and businesses from rising gas and electricity prices. The 27 EU countries have together allocated €314 billion since September 2021, according to Bruegel calculations. In addition, the UK has set aside €178 billion.

While the majority of the measures were intended as temporary interventions, many have since been expanded into “structural” measures. “This is clearly not sustainable from a public finance perspective,” says Bruegel expert Simone Tagliapietra. “Governments with more fiscal space will inevitably better manage the energy crisis by out-competing their neighbors for limited energy resources over the winter months.”

When added to the money governments have earmarked for nationalizing, bailing out, or providing loans to ailing utilities, EU governments have spent nearly €450 billion, the think tank noted. On Wednesday, Germany nationalized gas importer Uniper and the UK capped wholesale electricity and gas costs for companies.

Germany, the EU’s largest economy, is spending by far the most – €100 billion, compared to €59 billion in Italy or €200 million in Estonia, for example. Croatia, Greece, Italy and Latvia have earmarked more than 3 percent of their GDP to tackle the energy crisis.

Last week, the EU proposed Union-wide measures to respond to skyrocketing energy prices and overlay the patchwork of national measures with a coordinated response. rtr

Several dozen MEPs from various European countries are calling for EU negotiations with Taiwan on an investment agreement. “Taiwan is key partner and democratic ally in the Indo-Pacific,” they wrote in a letter to EU Commission President Ursula von der Leyen and EU Council President Charles Michel published on Wednesday. The 35 signatories include Green Party MEP Reinhard Bütikofer and FDP deputy parliamentary group leader in the German Bundestag, Gyde Jensen.

Deepening relations “with our democratic Taiwanese friends” would not only be beneficial for both sides, the parliamentarians argued. It would also be “of geo-economic importance” as the EU is heavily dependent on Taiwan’s advanced semiconductors. They called for the start of a “structured dialogue” on a bilateral investment agreement that would include cooperation in “green technology,” robust supply chains and the digital economy, including semiconductors.

The parliamentarians stressed that the continued development of the EU partnership with Taiwan is particularly important in view of the “ongoing provocations” by the People’s Republic of China. The Chinese leadership considers liberal Taiwan part of the communist People’s Republic and threatens to conquer it. Since Russia’s invasion of Ukraine, concerns have grown that Beijing, too, might one day follow through on its threats. The Chinese leadership is also trying to isolate Taiwan on the international stage.

During a visit to Taiwan by EU Parliament Vice President Nicola Beer (FDP) in July, the island republic expressed its desire for closer cooperation with the EU in view of the threat posed by China. President Tsai Ing-wen also underlined the willingness for a bilateral investment agreement with the EU. dpa

Because Germany has not properly implemented new EU rules on work-life balance, the European Commission is taking action against the Federal Republic. On Wednesday, the Brussels-based authority announced to send a letter of formal notice to Germany, thus initiating a so-called infringement procedure. The German government now has two months to respond. The Commission can then decide whether to take further steps. At the end of the procedure, a complaint could be filed with the European Court of Justice. 18 other EU countries also received a letter from the Commission on the matter.

Since August 2, the new rules stipulate, among other things, that fathers or second parents are entitled to paid leave of at least ten days after the birth of a child. However, this requirement has so far not been implemented in Germany. The Federal Ministry of Family Affairs justified this at the beginning of August by saying that the German government had negotiated an exception. The measures already in place to reconcile family and career in some cases went far beyond the new EU rules, it said.

For example, EU rules stipulate that each parent is to receive up to four months of parental leave, at least two of which must be paid. Germany is more generous in this respect: Employees can take up to three years of parental leave. If both parents share the time, up to 14 months of it can be paid.

This is not enough for some associations, however. A petition organized by the Dresden Väterzentrum (Fathers’ Center) is calling for ten days of paternity leave in Germany as well. In its coalition agreement, the government of the SPD, Greens and FDP has already committed itself to this. In August, the Ministry of Family Affairs announced that it would introduce a law on the subject before the end of the year. dpa

“I was told that I once was the youngest professor in Germany for a time,” says Michael Zürn about his meteoric entry into the academic world. In 1993, he became professor of international and transnational relations, including peace and conflict research, at the University of Bremen – just two years after he earned his Ph.D. In his mid-thirties, he benefited from the reunification of Germany, he says with a sly smile: “The appointments in the new federal states brought an incredible amount of dynamism into play.”

Michael Zürn is still a professor; he has been teaching at the Free University of Berlin since 2004. Since then, he has also headed the Global Governance Department at the Berlin Social Science Center (WZB). Together with 25 colleagues, he conducts research on the question of how politics can be organized on the global stage – or rather, where it fails. “Institutionalism has taken a few blows lately,” Zürn says, for example, about the school of thought that has accompanied him since his doctoral thesis.

Because one of their basic assumptions is that governments have an interest in cooperation and establishing international institutions due to mutual dependencies. But these institutions have faced a double challenge for some years, Zürn analyzes: “On the one hand, they have too little influence, and on the other, too much.” Too little, in the sense that they are too weak to effectively regulate climate change or financial markets. “And too much, in the sense that significant parts of society reject these institutions.”

In a globalized world, where important decisions are often made in EU, NATO or IMF bodies, many people have the feeling that they no longer have a voice. Populists of all stripes and governments of some countries would exploit this feeling and demand the abolition of these organizations. “This is one of the core issues of the dispute along this new line of conflict between cosmopolitans and communitarians,” Zürn explains.

As a spokesperson for the Cluster of Excellence “Contestations of the Liberal Script,” the 63-year-old focuses extensively on the challenges liberal democracies have to face. And with possible solutions: Zürn believes international institutions like the EU need to become more democratic. But it is a dilemma to have to reach consensus on EU reforms with EU opponents, he says. “In the meantime, even former advocates of this system like Germany or France are realizing: it’s a problem if there’s someone who always says no.”

Yet, constitutional reform is particularly necessary at present. But Zürn can also imagine scenarios in which changes become possible: “I don’t want to rule out at all that we will end up in situations where the pressure becomes so great that even people like Orbán and Kaczyński realize: We have to build our own European defense capability.” And that capability, he says, is now really hard to imagine with the Unanimity Rule. Paul Meerkamp

“The Russian invasion has failed” – at least that is what European Commission chief Ursula von der Leyen and UK Prime Minister Liz Truss said after a meeting at the United Nations General Assembly in New York on Wednesday. President Vladimir Putin’s decision to order a partial Russian mobilization for the fight in Ukraine was a sign of weakness, they said. Putin’s announcement prompted EU foreign ministers to hold an emergency meeting on Wednesday to discuss new sanctions and arms deliveries to Kyiv. Speaking with Ella Joyner, Michael Gahler, foreign policy spokesman for the EPP Group, explains how he interprets Putin’s announcement and what he believes the West needs to do now.

Will the climate goals of the German government soon fall victim to high energy and food prices? The plan is already to postpone the increase of the national carbon price in the Fuel Emissions Trading Act by one year. Climate strategy plans are also shaky at the European level. Lukas Scheid analyzes what impact this will have.

China welcomes foreign investors – and they are coming, despite the rising market risks. For German companies, in particular, the growth in China is tempting. But how long will it last? China is catching up, wants to become the market leader itself, and will in all likelihood replace foreign companies at some point. My colleague Nico Beckert talks about dependencies, tensions and investment opportunities on the Chinese market.

Mr. Gahler, what does a partial mobilization mean for the war?

Apparently, the “special operation” isn’t going according to plan after all, or else he wouldn’t be calling for a partial mobilization. He will not be able to rally the 300,000 men. It is an expression of the impending defeat. We should join forces and continue to support Ukraine with weapons.

Can he use it to turn the tide of war in eastern and southern Ukraine in Russia’s favor?

I don’t think so, because he won’t be able to get the men there quickly. The logistics for that are not there. But it will be a challenge for the Ukrainians. We have to do our part to ensure that they are well armed and can defend themselves.

What is your opinion of the announced referendums in the occupied territories?

These referendums are fake. Putin knows that we know it’s a fake, and yet he’s building a Potemkin façade of legitimacy. This is entirely political and legally irrelevant to us. We will never acknowledge that. And he knows that.

And the allusion to nuclear weapons?

This is classic fearmongering. All the experts say that he will not follow through on this threat. It would not only be an escalation but proof that his attempt to conquer his neighbor has failed. Nuclear weapons serve as a political deterrent, but they are not capable of ending a war.

Are you worried that the war might spread to other European countries?

I don’t see that. Russia is not capable of that. We must help the Ukrainians to push the Russians back to their own border. Then it will be possible to discuss with Moscow. The Ukrainians are willing and able to do that. We have to provide them with enough weapons.

When do you believe peace negotiations are an option?

When Russia is ready to return to the status quo ante. In any case, to the status before February 24. Then it will be up to the Ukrainians to decide whether that is enough to force the Russians to the negotiating table, or whether they will also try to retake Crimea or the occupied territories of Donetsk and Luhansk.

Do you think Germany should supply battle tanks?

There are 12 or 13 countries in the West that possess the Leopard 2, a total of 2,000 units. If we jointly provide 200 of them to Ukraine, then it would not be Germany going it alone, but a joint action to help the Ukrainians take back their territories. I think that’s what we should do.

Would this encourage Putin to escalate the situation further?

I don’t think he has the capacity for that. The only way out is for him to agree to come to the negotiating table. For that, he would have to say: Okay, I accept the territorial sovereignty of Ukraine.

The German government wants to postpone the increase of the national carbon price in the Fuel Emissions Trading Act (BEHG) by one year. As part of the third relief package, it was announced that the levy of currently €30 would not be raised to €35 per metric ton of CO2 until January 1, 2024. Accordingly, other planned adjustments will also be postponed by one year.

It is the first sign of what the energy crisis will do to the climate protection ambitions of the German government. After all, carbon pricing is an adequate market-based instrument to reduce emissions from industry and consumers. For the EU, it is by far the most important instrument for achieving the Green Deal goals. Nevertheless, this instrument has been cut despite Green government participation.

The demands of some industrial sectors go even further. An alliance of real estate, waste disposal and municipal companies, for example, demanded to stop the extension of the Fuel Emissions Trading Act to waste incineration planned for 2023. The argument: it is vital to avoid even higher financial burdens for private households and businesses. The economic and environmental committee of the Federal Council called for a postponement of two years.

The Federal Council did not follow this recommendation last week in its first reading of the amendment to the Fuel Emissions Trading Act submitted by the Federal Ministry for Economic Affairs and Climate Action (BMWK), arguing that the discrimination against recycling by the inclusion of waste incineration must be stopped. But here, too, it is clear that calls to stop or postpone climate protection measures are no longer all that unpopular.

And even if the price signal of the Fuel Emissions Trading Act as an incentive to conserve energy is considered to be limited – the price of CO2 reaches a plus with a total increase of 0.671 ct/kWh (gross) on the gas price, 6.7 ct/l on gasoline and 7.7 ct/l on diesel. The willingness demonstrated by the German government to accept compromises on climate protection instruments in the face of rising living and production costs shows that nothing is as impossible as it seemed just a few months ago.

This is just as true at the European level. The German Chemical Industry Association (VCI) wants to stop the EU chemicals strategy, the Industrial Emissions Directive and the planned Carbon Border Adjustment Mechanism (CBAM) for the time being, as they “further burden the competitiveness of the industry”. The intention is to mitigate the impact of the energy crisis. However, the whole truth is that the VCI’s demand is not new and is not solely motivated by rising energy prices. Even before the energy crisis started, these legislative initiatives were a thorn in the association’s side, as they pose enormous challenges for the industry. But in the current situation, calls for less climate protection are simply gaining renewed momentum.

Daniel Caspary and Angelika Niebler from the EPP also take advantage of this. “Burdensome legislation” must be put on hold, Caspary demands, referring to the Industrial Emissions Directive, the Soil Health Law and the Supply Chain Act. “Additional burdens on business and agriculture must be avoided at all costs in this dramatic time of crisis.” Niebler calls the Commission’s proposed Legislation on Plant Protection Products unacceptable in times of food shortages. It will mean “that our farmers will no longer be able to produce enough to feed the continent,” the CSU politician fears. Nor are Caspary and Niebler’s criticisms of these legislative proposals new, only the rationale has changed.

However, the position of group colleague Peter Liese, EPP spokesman on environmental policy and rapporteur for the reform of the European Emissions Trading System (ETS), seems to have actually changed. Liese no longer defends the importance of a strong price signal from the ETS for climate protection as fiercely as he did a few months ago. While he still prevailed in the negotiations in the EU Parliament’s Environment Committee against a number of more conservative EPP MEPs who would have welcomed a less ambitious ETS reform, he now strikes different tones.

Liese supports his group’s demand for a short-term intervention in emissions trading to relieve the burden on electricity consumers and companies. The EPP wants to extend the Commission’s much-criticized proposal to sell emission allowances from the market stability reserve worth €20 billion to finance REPowerEU. Liese explicitly demands that the allowances be released onto the market as quickly as possible so that the measure also has a swift dampening effect on the carbon price.

Unlike the German Fuel Emissions Trading Act, the European carbon price already has a clear steering effect. According to the EU Commission, emissions from the sectors covered by the ETS have been reduced by 42.8 percent since its introduction in 2005. The reform is intended to strengthen the system even further, which is why high hopes for climate protection rest on the instrument.

This is why watering down ambitions is also seen critically, even in the face of the energy crisis. “Calls to weaken the EU ETS are based on the mistaken belief that we can lower energy prices and inflation by lowering ETS allowance prices,” argues Sabine Frank, Executive Director at Carbon Market Watch. Selling MSR allowances would set a precedent, she says. “Even if the European Parliament or the Council impose strict conditions and amend the text to say it is an ‘exceptional and one-off measure,’ there is a risk it would be used again.” The MSR is not a fundraising tool, Frank warns.

The word from Green circles in Brussels is that they want to prevent the postponement or halting of climate policy measures at all costs. A lower emission price, like through the sale of MSR allowances, would also lead to lower revenues from the ETS. Revenue that would be missing from EU members and various investment funds to support the transformation of the economy. “It is possible that some countries have already earmarked part of these revenues for climate protection projects, so they will have to find other sources of funding if prices fall drastically,” says Sabine Frank.

The Commission does not want to hear anything about these concerns. According to Commission sources, member states cannot earmark revenues from the rising carbon price resulting from the ETS reform, as the reform has not yet been finalized anyway.

That the EU would lose sight of its climate protection ambitions is denied at every opportunity by both Green Deal Commissioner Frans Timmermans and Commission President Ursula von der Leyen. The goals of the Green Deal are to remain untouched, and the measures to contain the energy crisis are not to burden the climate through increased carbon emissions. Carbon Market Watch believes this is credible, too. “Since the State of the Union address and the proposed measures, including an overhaul of the electricity market design, calls for intervention in the carbon market have quieted down a bit,” Frank says.

China’s Vice Premier, Han Zheng, usually has more important things to do than inaugurate new factories. But Han made an exception for BASF. As the chemical giant celebrated the start of production at its ten-billion-euro Verbund site in Zhanjiang, Han dropped by for an event in Beijing. The high-profile visit was meant to send a signal: China welcomes foreign investors.

Actually, the People’s Republic does not even have to woo German companies. Apart from BASF, the automotive industry continues to be one of the biggest investors in the country. In 2020, Volkswagen announced plans to invest €15 billion in electric mobility with its Chinese joint venture partners by 2024.

After European countries and the United States, China is the biggest target market for German companies. They have made a total of over 90 billion in investments there – more than a third of which came from the automotive industry.

Economists believe, however, that major investments by the German industry in China are no longer as low-risk as they were a few years ago. The People’s Republic remains a growth market. But for how much longer? The government in Beijing is pursuing a clear medium-term strategy: Catching up technologically and turning its own champions into market leaders. “German producers have to brace themselves for being replaced by domestic companies. They are in the hands of the government,” says Rolf Langhammer of the Kiel Institute for the World Economy (IfW). The trade expert warns, “Anyone who runs a business in China knows that these investments are only temporary.”

But is China growing so fast that even investments in the billions will yield quick profits with correspondingly low business risk? According to Langhammer, there are definitely risks: “It may well be that large German companies will have to adjust their forecasts for the Chinese market again in the future and revise them downward“.

Moreover, China’s growth is cooling noticeably. Zero-Covid and geopolitical tensions are further added to the mix. “China is likely to become a more difficult market for all foreign companies in the coming years,” says Noah Barkin of the analysis firm Rhodium Group. The cost-benefit ratio “is tipping in an unfavorable direction,” he estimates. According to Barkin, it cannot be ruled out that European companies will be forced to accept large financial losses on their investments in China.

Deutsche Bank’s CEO also voiced concern about dependencies. “The country’s increasing isolation and growing tensions, especially with the US, pose a significant risk for Germany,” Christian Sewing said. Some economists demand a fundamental rethinking. After all, shareholders and creditors of companies with a strong China focus could also be affected by increasing China risks, said Juergen Matthes of the German Economic Institute (IW) in Cologne. Because of geopolitical tensions, “it’s about looking at risk exposure and making sure the company can survive in case of escalation.” The head of the Global and Regional Markets cluster at the IW assumes that “the financial market will also demand greater transparency about China risks.”

The German Federal Ministry for Economic Affairs and Climate Action also considered exercising more control. Investments by German companies in China should be subject to greater scrutiny. But after fierce criticism from the business community, the ministry appears to abandon these plans, as Reuters reports.

However, there are also economists who are more positive about the situation. “The investment opportunities in China are still great,” says Horst Loechel, head of the Sino-German Center at the Frankfurt School of Finance & Management. “If you compare the opportunities to the potential risks – geopolitical and otherwise – it is still reasonable to be invested in China.” He remains optimistic that bridges between the People’s Republic and the West will not be burned. “The peak of geopolitical tensions is very likely already behind us.”

Yet, the number of companies that continue to show unlimited enthusiasm for China is steadily declining. While investments in the People’s Republic are growing in volume, the majority of the money comes from fewer and larger companies. The top ten European investors in China have accounted for an average of nearly 80 percent of all investments over the past four years, according to a new analysis by Rhodium Group. German conglomerates rank among the top investors.

Volkswagen, BMW, Daimler and BASF alone accounted for about 34 percent of all European investments in China between 2018 and 2021, according to Rhodium. “Our findings point to a widening gap in how European firms perceive the balance of risks and opportunities in the Chinese market,” the authors conclude.

BASF, for example, points out the opportunities. When asked about potential investment risks, a company spokeswoman commented that China remains an important growth market. “By 2030, China will account for more than two-thirds of global chemical production growth. China will then account for 50 percent of the global market.” Developing additional markets in the People’s Republic would be “of high strategic and economic value,” the spokeswoman said. The company monitors geopolitical developments and takes measures to safeguard investments, she added.

Some companies pursue a rather surprising strategy to cope with the risks. They are “investing even more in China, but to make their local business more independent of their global operations,” Mikko Huotari, director of the Merics research institute, told Reuters. China, he said, is considered a separate business entity. Workforce, supply chains and data flows are becoming increasingly localized, the Rhodium research also notes. That would reduce risks, the report says. In the event of any sanctions against the People’s Republic, there would then be fewer exchanges with company units in other countries.

Huotari believes companies act “logically” in the short term. “Many are trying to do good business in China for at least another 10, 15, maybe 20 years.” The important question here is whether companies will be able to find the right time to jump ship. The situation with Russia, for example, has shown that escalation can happen fairly abruptly. Huotari warns, “Some companies underestimate not only the downward pressure of the Chinese economy, but above all geopolitical risks of the location.”

So how can the risks of major investments in China be reduced? Matthes of the IW suggests that companies “should be obligated in their financial statement to report on geopolitical cluster risks and on potential operating losses in the realization of these risks.” This would make the risks of doing business in China more transparent. Company leaders would then possibly calculate differently.

Politics should also scale back existing incentives for doing business in China, Matthes said. The German Ministry of Economics is already considering scaling back government investment and export guarantees and China loans granted by the German development bank KfW. In addition, trade relations are to be diversified and agreements signed with other countries in the region.

The Commission has approved another €5.2 billion for 35 hydrogen projects in the EU. The second round of the hydrogen IPCEI would trigger another €7 billion in private investment, the authority announced yesterday. Among the 29 beneficiary companies from 13 EU states and Norway, however, none of them was German.

Germany did not participate in the funding round called Hy2Use. This second wave funds infrastructure projects for the production, storage and transport of hydrogen on the one hand, and applications in important industries such as cement, steel and glass on the other. However, the German group Uniper, which is about to be nationalized, is involved with an infrastructure project in the Netherlands.

After two of four funding waves, it is the German basic materials industry, of all sectors, that is still waiting for the approval of hydrogen projects. In the first funding round, only four German projects had been approved. ber

To achieve the carbon reduction targets of the Green Deal and the Fit for 55 package, the European Aviation Safety Agency (EASA) is calling for more ambitious intra-sector targets for aviation. These include measures to expand the supply and use of sustainable aviation fuels (SAF).

In this year’s European Aviation Environmental Report, EASA recommends faster approval of higher SAF admixtures of up to 100 percent. Currently, only the admixture of a maximum of 50 percent SAF is approved in Europe. Industry and fuel standard committees are already examining the use of 100 percent by 2030, according to EASA. To support SAF investments, the authors also call to use money from the EU Innovation Fund, which is fed by revenues from the European Emissions Trading System (ETS).

The gradual inclusion of the costs of environmental and climate impacts of aviation in the pricing of passenger and cargo flights must continue and passengers should be given incentives to fly “greener”, an EASA official urged on Wednesday. To that end, cross-border solutions and minimizing network constraints are to be promoted as part of the creation of a Single European Sky.

In addition, the agency is calling for stricter legal thresholds for environmental certification standards for technological innovations – not just for Europe, but globally. Latest data is to serve as a basis for what is technologically feasible, economically viable and environmentally compatible. luk

According to a study by the Brussels-based think tank Bruegel, European governments have earmarked nearly half a trillion euros to protect citizens and businesses from rising gas and electricity prices. The 27 EU countries have together allocated €314 billion since September 2021, according to Bruegel calculations. In addition, the UK has set aside €178 billion.

While the majority of the measures were intended as temporary interventions, many have since been expanded into “structural” measures. “This is clearly not sustainable from a public finance perspective,” says Bruegel expert Simone Tagliapietra. “Governments with more fiscal space will inevitably better manage the energy crisis by out-competing their neighbors for limited energy resources over the winter months.”

When added to the money governments have earmarked for nationalizing, bailing out, or providing loans to ailing utilities, EU governments have spent nearly €450 billion, the think tank noted. On Wednesday, Germany nationalized gas importer Uniper and the UK capped wholesale electricity and gas costs for companies.

Germany, the EU’s largest economy, is spending by far the most – €100 billion, compared to €59 billion in Italy or €200 million in Estonia, for example. Croatia, Greece, Italy and Latvia have earmarked more than 3 percent of their GDP to tackle the energy crisis.

Last week, the EU proposed Union-wide measures to respond to skyrocketing energy prices and overlay the patchwork of national measures with a coordinated response. rtr

Several dozen MEPs from various European countries are calling for EU negotiations with Taiwan on an investment agreement. “Taiwan is key partner and democratic ally in the Indo-Pacific,” they wrote in a letter to EU Commission President Ursula von der Leyen and EU Council President Charles Michel published on Wednesday. The 35 signatories include Green Party MEP Reinhard Bütikofer and FDP deputy parliamentary group leader in the German Bundestag, Gyde Jensen.

Deepening relations “with our democratic Taiwanese friends” would not only be beneficial for both sides, the parliamentarians argued. It would also be “of geo-economic importance” as the EU is heavily dependent on Taiwan’s advanced semiconductors. They called for the start of a “structured dialogue” on a bilateral investment agreement that would include cooperation in “green technology,” robust supply chains and the digital economy, including semiconductors.

The parliamentarians stressed that the continued development of the EU partnership with Taiwan is particularly important in view of the “ongoing provocations” by the People’s Republic of China. The Chinese leadership considers liberal Taiwan part of the communist People’s Republic and threatens to conquer it. Since Russia’s invasion of Ukraine, concerns have grown that Beijing, too, might one day follow through on its threats. The Chinese leadership is also trying to isolate Taiwan on the international stage.

During a visit to Taiwan by EU Parliament Vice President Nicola Beer (FDP) in July, the island republic expressed its desire for closer cooperation with the EU in view of the threat posed by China. President Tsai Ing-wen also underlined the willingness for a bilateral investment agreement with the EU. dpa

Because Germany has not properly implemented new EU rules on work-life balance, the European Commission is taking action against the Federal Republic. On Wednesday, the Brussels-based authority announced to send a letter of formal notice to Germany, thus initiating a so-called infringement procedure. The German government now has two months to respond. The Commission can then decide whether to take further steps. At the end of the procedure, a complaint could be filed with the European Court of Justice. 18 other EU countries also received a letter from the Commission on the matter.

Since August 2, the new rules stipulate, among other things, that fathers or second parents are entitled to paid leave of at least ten days after the birth of a child. However, this requirement has so far not been implemented in Germany. The Federal Ministry of Family Affairs justified this at the beginning of August by saying that the German government had negotiated an exception. The measures already in place to reconcile family and career in some cases went far beyond the new EU rules, it said.

For example, EU rules stipulate that each parent is to receive up to four months of parental leave, at least two of which must be paid. Germany is more generous in this respect: Employees can take up to three years of parental leave. If both parents share the time, up to 14 months of it can be paid.

This is not enough for some associations, however. A petition organized by the Dresden Väterzentrum (Fathers’ Center) is calling for ten days of paternity leave in Germany as well. In its coalition agreement, the government of the SPD, Greens and FDP has already committed itself to this. In August, the Ministry of Family Affairs announced that it would introduce a law on the subject before the end of the year. dpa

“I was told that I once was the youngest professor in Germany for a time,” says Michael Zürn about his meteoric entry into the academic world. In 1993, he became professor of international and transnational relations, including peace and conflict research, at the University of Bremen – just two years after he earned his Ph.D. In his mid-thirties, he benefited from the reunification of Germany, he says with a sly smile: “The appointments in the new federal states brought an incredible amount of dynamism into play.”

Michael Zürn is still a professor; he has been teaching at the Free University of Berlin since 2004. Since then, he has also headed the Global Governance Department at the Berlin Social Science Center (WZB). Together with 25 colleagues, he conducts research on the question of how politics can be organized on the global stage – or rather, where it fails. “Institutionalism has taken a few blows lately,” Zürn says, for example, about the school of thought that has accompanied him since his doctoral thesis.

Because one of their basic assumptions is that governments have an interest in cooperation and establishing international institutions due to mutual dependencies. But these institutions have faced a double challenge for some years, Zürn analyzes: “On the one hand, they have too little influence, and on the other, too much.” Too little, in the sense that they are too weak to effectively regulate climate change or financial markets. “And too much, in the sense that significant parts of society reject these institutions.”

In a globalized world, where important decisions are often made in EU, NATO or IMF bodies, many people have the feeling that they no longer have a voice. Populists of all stripes and governments of some countries would exploit this feeling and demand the abolition of these organizations. “This is one of the core issues of the dispute along this new line of conflict between cosmopolitans and communitarians,” Zürn explains.

As a spokesperson for the Cluster of Excellence “Contestations of the Liberal Script,” the 63-year-old focuses extensively on the challenges liberal democracies have to face. And with possible solutions: Zürn believes international institutions like the EU need to become more democratic. But it is a dilemma to have to reach consensus on EU reforms with EU opponents, he says. “In the meantime, even former advocates of this system like Germany or France are realizing: it’s a problem if there’s someone who always says no.”

Yet, constitutional reform is particularly necessary at present. But Zürn can also imagine scenarios in which changes become possible: “I don’t want to rule out at all that we will end up in situations where the pressure becomes so great that even people like Orbán and Kaczyński realize: We have to build our own European defense capability.” And that capability, he says, is now really hard to imagine with the Unanimity Rule. Paul Meerkamp