European policymakers seem to be reacting more tautly to the US Inflation Reduction Act (IRA) than industry and commerce. Biden’s law is intended to promote domestic climate protection through subsidies, but discriminates against European companies, according to the EU Commission, for example. But trade experts and companies can even see positive sides to the IRA, as Nico Beckert writes in his analysis.

The EU’s ninth sanctions package against Russia could be launched as early as next week. Commission President Ursula von der Leyen announced sanctions against almost 200 more people and more banks. More on this in the News.

The traffic lights coalition has been in power in Berlin for a year. In terms of European policy, it had set out to do a lot better – but there are many problems. How this is becoming a problem for the EU and Berlin, and what needs to be improved in 2023? We have put together an overview for you.

In today’s Heads, we introduce Ivana Karásková, who researches China’s influence on Central and Eastern Europe at the Association for International Affairs think tank in Prague. She has also founded the Choice initiative, a hub for China experts from Central and Eastern Europe, and MapInfluenCE. The project looks at how China and Russia relate to each other in the battle of narratives.

We wish you an exciting read!

There’s a lot of stir about Joe Biden’s billion-dollar climate change program. Emmanuel Macron called the Inflation Reduction Act (IRA) “super aggressive” and is promoting a “Buy European” act in response. Robert Habeck also argues for his own “robust industrial strategy.” The EU Commission called the IRA “clearly discriminatory” in its statement. European industries would be disadvantaged, jobs and growth endangered.

Trade experts are less critical of the law. “The US subsidies are unlikely to lead to a major wave of tech companies settling here from abroad,” says Holger Görg of the Kiel Institute for World Economy (IfW). Already in 2017, the US had “significantly reduced” its profit tax for entrepreneurs from 35 to 21 percent. That “did not lead to masses of new foreign companies setting up shop,” according to the head of international trade and investment research. Many industries are also more relaxed. Only the automobile and hydrogen industries see risks.

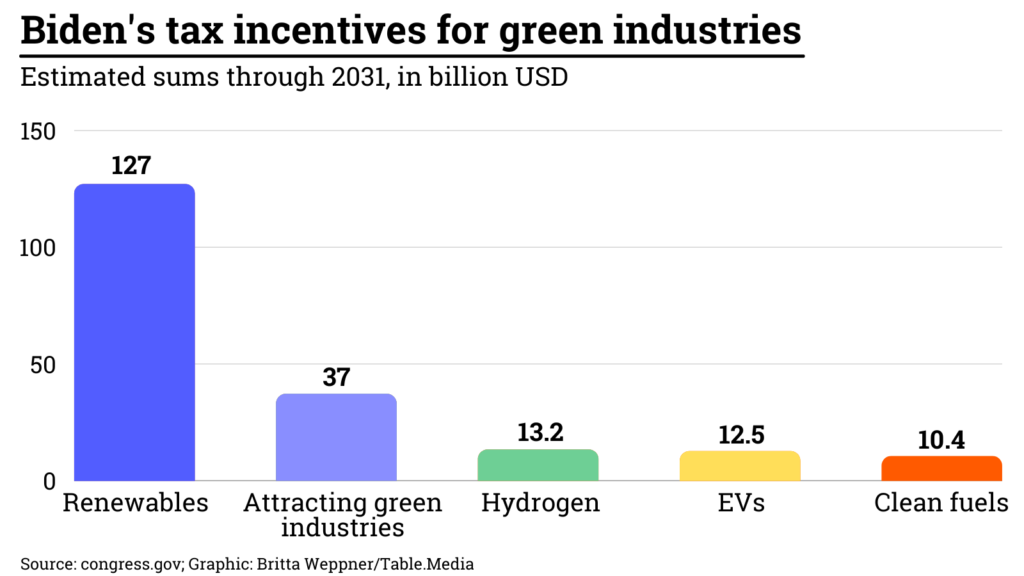

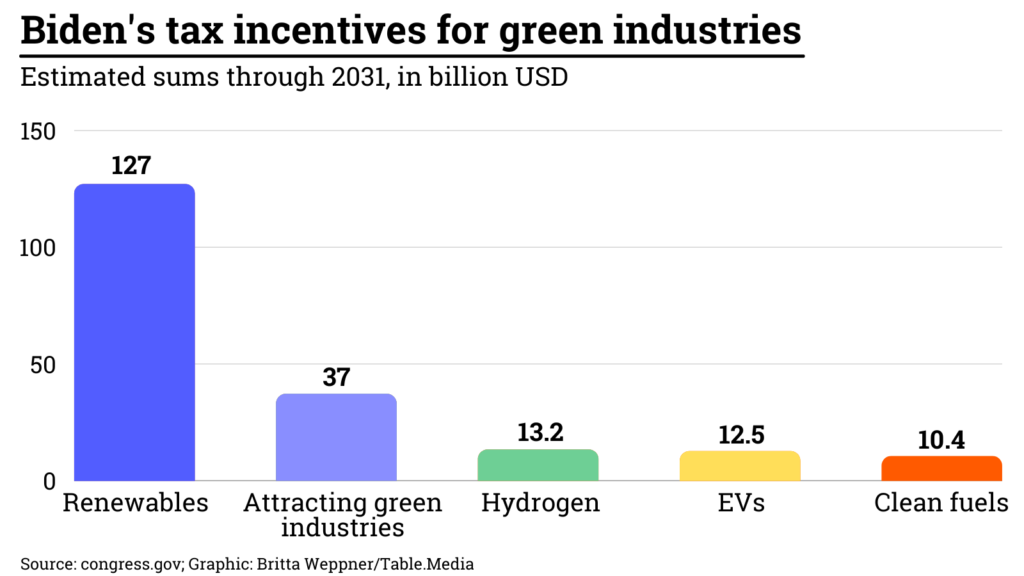

The IRA focuses on expanding renewable energy and operating climate-friendly power plants. US companies are only slightly favored:

However, European plant manufacturers will also benefit from these subsidies. According to Holger Görg, the “buy local” tax bonus “doesn’t make a big difference”. That alone is not the reason why any company migrates.

Many companies also disagree with the complaints of politicians. At Wacker Chemie, the Inflation Reduction Act is actually viewed quite positively. The company, which was also present at the launch of the new “Clean Tech Europe” platform, produces polysilicon for solar modules in the US and Germany. “The Inflation Reduction Act will increase polysilicon demand outside China, which is positive – even for our production site in Germany,” says a spokeswoman.

European suppliers could also benefit from increased demand, according to the German Wind Energy Association. However, the European states would have to keep pace: “Instead of a withdrawal of the IRA, we advocate an imitation at the European level,” writes the association.

Meyer Burger, a manufacturer of solar cells and modules, is currently already investing in the US. The investment decision was made before the IRA was passed. The law has made the US an “immense growth market for the solar industry,” a spokeswoman said.

The Biden administration is also awarding tax incentives to attract green industries (see Table 5 for details). The $37 billion is intended to reduce dependence on global supply chains. However, because the incentives are to run for nine years, this amounts to only about $4 billion annually.

Trade expert Görg is skeptical that this will trigger a major wave of settlements. Fundamental weaknesses are more important, he says: “Above all, uncertainties in the political system, increasing protectionism and the question of whether a Republican president will continue to push climate protection are scaring off investors. IRA subsidies won’t change that.”

The German chambers of commerce do not see it quite as negatively, but generally agree on the impact of the IRA. A survey by the AHK Chamber of Foreign Trade shows that business prospects in the USA are among the best. Low energy prices, a good supplier network and the availability of skilled workers all speak in favor of the US, says Volker Treier, DIHK head of foreign trade: “The tax incentives in the Inflation Reduction Act can create additional incentives in the US once again.”

However, the subsidies are “not a central point in the investment decisions of many German companies,” adds Matthias Hoffmann, AHK managing director for Atlanta. Measured against the ten-year term, the volume of the IRA is too small for fundamental changes. In addition, certain sectors of the economy are only eligible for subsidies to a limited extent, says the AHK representative.

The Biden administration is taking a clear Buy America approach to the promotion of EVs. Tax rebates are only available for EVs that are assembled in the USA, Canada or Mexico. From 2024 and 2025 on, the batteries may no longer be manufactured in countries that are problematic for the USA, such as China – or even contain materials from these countries.

The clauses on local precursors and final assembly are expected to have the greatest impact on Europe’s industry. The exact effects of the IRA are not yet foreseeable, says Hildegard Müller, President of the German Association of the Automotive Industry (VDA). But: “Exports from Germany have less of a chance as a result of the regulation.” The association calls for “open and non-discriminatory promotion.”

A Mercedes-Benz spokeswoman says various aspects of the law are “a challenge for the industry and, in the short term, also for Mercedes-Benz.” Subsidies, however, are only one factor when it comes to investment decisions. BMW adds that it produces “local for local” anyway; vehicles for the local market are produced locally wherever possible.

Karsten Neuhoff, a climate expert at DIW Berlin, does see “negative effects of the protectionist orientation” of EV subsidies. At the same time, “US investments in the production of green products could also create opportunities, for example for mechanical engineering in Europe.”

For clean hydrogen, there are tax breaks only if it is produced in the US. The Hydrogen Europe association sees a risk that US manufacturers will gain a competitive advantage as a result “if the EU does not act quickly to create its own regulatory framework for hydrogen.” It is “certainly a possibility” that European manufacturers will migrate to the US if the EU does not also create a better framework. The coming year will be a crucial one for the European hydrogen industry, the association said.

However, the majority of the IRA’s subsidies are not necessarily tied to the purchase of North American goods. Investors and suppliers from Europe can also benefit from the subsidy. Many experts agree that the IRA hardly raises new trade barriers. But the EU is coming under pressure to improve the framework conditions for green investments itself. For example, Internal Market Commissioner Thierry Breton will present a new alliance for the European photovoltaic industry on Friday.

Guntram Wolff, the director of the German Council on Foreign Relations in Berlin and previously in Brussels at the think tank Bruegel, chooses positive words: “The traffic light government is clearly pro-European and supports the central concerns of the EU and EU values,” he says in response to a Europe.Table inquiry.

However, there is a gap between aspiration and reality: “In communicating and implementing our own measures, however, there have been technical errors and inconsistencies on several occasions. Overall, I would like to see the German government thinking even more strongly about the European dimension of its actions right from the start.”

Martin Schirdewan, chairman of the Left Party and member of the European Parliament, does not put it so politely: “In the coalition paper, the traffic light coalition has presented itself as highly European, but first remained without ideas and then began to attract attention by more and more solo efforts,” he criticizes. “Chancellor Scholz as well as Ministers Habeck and Lindner have so far ironed away all important proposals from the other member states.”

It depends on the chosen point of view how one assesses the European policy performance of the traffic light coalition, says Yann Wernert of the Jacques Delors Center in Berlin: “Measured against the status quo before the government came to power, the traffic light coalition has achieved a lot: The sanctions policy toward Russia was very well organized, there has been progress in industrial policy, and the federal government has done a lot on the issue of European Union enlargement.”

Measured against the current challenges, however, the performance is unsatisfactory, he says. “The internal coordination in the traffic light coalition is not going well and gives an inconsistent picture, which irritates other member states that are unclear about the German position and makes progress difficult,” Wernert says.

Just how difficult it has been so far for the traffic light coalition to formulate European policy in a coherent way was demonstrated immediately after taking office – in the dispute over the EU Commission’s delegated act on the green taxonomy. After the draft was announced in early January, the Greens called the inclusion of nuclear power a “serious mistake” and “absolutely unacceptable.”

The same applied to natural gas, although the Commission’s draft stipulated stricter requirements here. The SPD and FDP, on the other hand, agreed with the assessment of natural gas and initially also declared their willingness to give in to France’s insistence with regard to nuclear power.

In its statement to the Commission, the German government then rejected the classification of nuclear power as “sustainable” at the end of January, but supported the classification of gas as a bridging solution under certain conditions – also in its own interest. A formulaic compromise with no consequences, because legal action against the adopted taxonomy was ruled out early on.

Internal disagreement continues on the question of whether new combustion engines will be allowed to drive after 2035 if e-fuels produced with almost no CO2 emissions are used. The responsible Green Minister Steffi Lemke (like the SPD part of the government) rejects the use of e-fuels in cars and has actually made her position quite clear within the government.

The FDP had promised to open a gateway for e-fuels in the Bundestag election campaign and even during the negotiations in the Council. The conflict was already known during the coalition negotiations, was then perpetuated with ambiguous wording in the coalition agreement. As a result, when Italy and some Eastern European countries made a push for e-fuels, Berlin’s EU diplomats were unable to speak. The push petered out, as did the e-fuels.

When it comes to regulating platform work, Germany fails to act as a moderator or pioneer of compromises. The conflict is between the leading Ministry of Labour and Social Affairs and the FDP departments. Department head Hubertus Heil advocates robust and far-reaching regulation. The FDP is against it, fearing too much bureaucracy.

When it comes to positioning the second emissions trading system for buildings and road transport, ETS 2, one of the traffic light partners is already facing issues within its own party. While the Greens in the German government are among the strongest advocates within the Council, the European Greens are among the biggest critics.

The latter prevailed in positioning in the EU Parliament that ETS 2 should only be introduced for commercial customers. The governing Greens in Berlin were not happy: they see ETS 2 as one of the most important means of reducing emissions in the road transport and building heating sectors.

When it comes to social compensation for the additional costs of ETS 2, the German government itself is putting on the brakes in the Council. Much to the displeasure of the European Greens and Social Democrats. The social climate fund is actually supposed to help compensate for the additional costs and, in the view of the EU Parliament, be as financially strong as possible. However, the German government is trying to squeeze the size of the fund so as not to hand over control of revenue from emissions trading to Brussels.

Such German disputes have repercussions for Germany’s role and perception in Europe: instead of speaking with one voice, Germany too often speaks with many – or is unable to speak. This is precisely the behavior known as the German Vote that should actually be avoided. But the conditions for this are lacking.

This is because the traffic light coalition has changed little at the core of European coordination: The departmental principle is unchangeable, and the houses first coordinate at the working level. If no agreement can be reached there, department heads and state secretaries are called in.

What is new is that the particularly difficult issues are tackled in a regular meeting round of four at the level of State Secretaries: Undine Ruge, head of the European Department for the SPD-led Chancellery, Green State Secretary Sven Giegold (BMWK), Andreas Michaelis (AA), also a Green, and State Secretary Carsten Pillath for the FDP-led BMF must seek solutions.

The high need for coordination within the coalition sometimes even means that the German government informs its EU partners too late. For example, those responsible in Berlin simply forgot to inform the other member states about the €200 billion defense umbrella for the energy crisis – the criticism of this was hard to ignore.

In particular, coordination with France became a problem at times, despite many mutual visits: The engine sputtered unmistakably in the first year of traffic light coalition. The Chancellor’s intercultural competence was a problem, it was said in Paris. During one of Macron’s visits, he turned down an invitation to drink wine after the official part of the meeting and went to bed early instead.

Regardless of whether the story actually happened, the fact that it is circulating at all is part of the problem. At the same time, Foreign Minister Annalena Baerbock and Vice-Chancellor Robert Habeck are seen as welcome guests at the Elysee, even though they are not on a par with Emmanuel Macron in terms of protocol.

In Brussels, Paris and the other capitals, hardly anyone doubts the pro-European sentiments of the traffic light parties. In practice, however, the German government tends to go it alone. The LNG deal with Qatar, for example, contradicts the agreement at the EU summit to proceed in a coordinated manner when purchasing gas in the future, according to representatives of several member states. The German government has also failed to inform its neighbors about reforms to the immigration of skilled workers – although the plans would have a direct impact on them as well.

So there is no lack of potential for improvement. Meanwhile, there is hope at a relevant point: “After a phase of irritation, which peaked in the postponed Franco-German Council of Ministers, the signs are pointing to productive cooperation,” says Yann Wernert, assessing the Franco-German situation at the end of the year. However, the really big chunks are still ahead: electricity market reform, fiscal rules reform and the concrete response to US President Biden’s Inflation Reduction Act.

There is still no mention of structural reforms, discussions on enlargement and the rule of law, or how to deal with new, as yet unforeseeable crises. Or as Guntram Wolff puts it: Perhaps it would help if the traffic light coalition in its second year “thought about the European dimension of its actions from the very beginning.” Falk Steiner/Till Hoppe/Leonie Düngefeld/Markus Grabitz/Lukas Scheid

Dec. 9, 2022; 10 a.m.-12 p.m., online

BVMed, Seminar Supply Chain Sourcing Obligations Act

This seminar is intended to provide guidance on the practical implementation of the Supply Chain Due Diligence Act in companies, with a particular focus on companies in the healthcare sector. REGISTRATION UNTIL 08.12.2022

Dec. 9, 2022; 12:30 p.m., online

KAS, Lecture Taxes in a Difficult Situation: A Review of the Czech EU Presidency

The Konrad Adenauer-Stiftung (KAS) wants to take stock of the Czech Presidency in terms of European policy, one topic is the perspective of some Visegrád states on the Ukraine war. INFO & REGISTRATION

Dec. 9, 2022; 5 p.m., Utting

HSS, Seminar Agricultural Policy: Agriculture & Consumer

This Hanns Seidel Foundation (HSS) event will focus on the challenges of current crises, such as the Ukraine war and climate change, for agriculture. INFO & REGISTRATION

Dec. 9, 2022; 6:30-8 p.m., Frankfurt/Main

FNF, Discussion A New Security Order for Europe and the World

The new foreign and security policy challenges posed by Russia’s attack on Ukraine for Germany, Europe and NATO are the topics of this event organized by the Friedrich Naumann Foundation for Freedom (FNF). INFO & REGISTRATION

Dec. 9-11, 2022; Staffelstein

HSS, Seminar World politics 2022

In this event, the Hanns Seidel Foundation (HSS) deals with the crises and challenges of the year 2022 for international politics. INFO & REGISTRATION

Dec. 12, 2022; 10 a.m.-12 p.m., Brussels (Belgium)/online

ERCST, Workshop Certification of hydrogen and hydrogen-based end products

This meeting of the European Roundtable on Climate Change and Sustainable Transition (ERCST) will address the relevance of hydrogen and hydrogen-based product certification, the different standards and methodologies, and the connection points between EU and national standards. INFO & REGISTRATION

Dec. 12, 2022; 2 p.m., online

EBD, Lecture De-briefing EPSCO

On the occasion of the Employment, Social Policy, Health and Consumer Affairs Council (EPSCO) meeting on 8-9/12/2022, the European Movement Germany (EBD) is organizing a de-briefing on employment and social policy. INFORMATION

Dec. 13, 2022; 1-2 p.m., online

Data Protection Foundation, Lecture The Trans-Atlantic Data Privacy Framework – one step forward and soon two steps back?

The speaker at the event will provide an overview of the content and implications of the EU-US Data Exchange Agreement (TADPF).

REGISTRATION

Dec. 13, 2022; 5-6 p.m., Brussels (Belgium)

ERCST, Workshop State of the European Green Deal year-in-review

The European Roundtable on Climate Change and Sustainable Transition (ERCST) will present the current state of the European Green Deal, as well as a perspective for 2023. INFO & REGISTRATION

Dec. 13, 2022; 5:30-7 p.m., online

KAS, Discussion The EU in crisis mode – How do we protect the economy, values and European interests?

The question on which values the European Union is based and how these can be protected in the future is the focus of this event of the Konrad Adenauer-Stiftung (KAS). INFO & REGISTRATION

Dec. 13, 2022; 6-8 p.m., online

KAS, Lecture The future of the Republic of Moldova lies in the European Union

At this event of the Konrad Adenauer-Stiftung (KAS) the view of the Republic of Moldova towards Russia and the security situation will be discussed. INFO & REGISTRATION

Tuesday night, negotiators from the EU Commission, Parliament and Council closed another chapter of the Fit for 55 package. The trilogue agreement on the inclusion of air traffic in the European Emissions Trading System (ETS) stipulates that from 2026, initially only intra-European flights will be charged a CO2 fee.

From 2028, flights with destinations outside the European Economic Area (EEA) could also be added. This is subject to the Commission’s prior approval of CORSIA, the global market-based carbon reduction scheme for aviation, as effective in reducing the sector’s CO2 emissions.

For the environmental organization Transport & Environment (T&E), this does not go far enough. It has long criticized the ineffectiveness of CORSIA, saying the system does not effectively reduce aviation emissions. As a result, 58 percent of CO2 emissions from European aviation remain unaccounted for, T&E writes. The Commission also assessed CORSIA as insufficient to meet EU climate targets more than two years ago. A stricter regulation failed due to the resistance of the member states.

The trilateral agreement is therefore a bet on the future, as it presupposes reforms of CORSIA. Bas Eickhout, parliamentary shadow rapporteur for the Greens, calls it a “classic compromise” and the last chance for CORSIA.

In theory, aviation is already subject to the ETS, but airlines currently receive free emission allowances, so they effectively pay no CO2 fee. These free allocations will now be phased out by 2026. From 2024, a quarter of them will be gone, then half from 2025. In 2026, the industry will pay the full CO2 price at least for its European flights.

The trilogue agreement also provides:

The Parliament and the Council still have to officially approve the trilogue result, but this is considered a formality. luk

The EU is stepping up its action against China in two cases at the World Trade Organization (WTO). Brussels has requested the establishment of two arbitration tribunals for two ongoing cases, the EU Commission announced on Wednesday. The WTO cases involve the de facto trade blockade against Lithuania and patent protection for high-tech products. In both cases, Brussels requested consultations with the People’s Republic at the beginning of the year, which took place, according to the EU. A solution could not be found.

“In both cases, the Chinese measures are severely damaging to European businesses,” the Commission said. The “discriminatory measures against Lithuania” affected the internal market and supply chains within the EU.

Now the WTO’s Dispute Settlement Body will consider the establishment of the arbitration tribunals on Dec. 20. Beijing can oppose the establishment once. If it does, the EU says it will renew the request and refer the matter to the body a second time at the end of January 2023. These proceedings can then take up to one and a half years.

The move sends an important message to China, Lithuanian Foreign Minister Gabrielius Landsbergis said: “The EU will defend the single market and EU member states by all means against China’s politically motivated economic coercion.” Official import restrictions are in place against beef, alcohol, and grain from Lithuania, among others. With this evidence and testimonies from affected companies on other Chinese customs crackdowns, the case is expected to be successful, EU sources say. ari

On Wednesday, the EU Commission presented a series of draft laws aimed at making the EU capital markets more attractive, autonomous and resilient. Specifically, the aim is to strengthen clearing systems in the Union and harmonize insolvency rules. Also relevant to strengthening the digital economy is the legislation on listing on public markets (Listing Act).

Background: The EU is overly dependent on central counterparties (CCPs) outside the EU for some derivatives that are classified as systemically important by the European Securities and Markets Authority. For example, one of the UK-based CCPs handled more than 90 percent of the volume of euro-denominated over-the-counter interest rate derivatives at the end of 2020.

Objective: With simplified procedures and enhanced supervision, clearing in the EU should become more attractive and resilient. The obligation for clearing members and clients to maintain an active account with a CCP in the EU is intended to reduce overdependence on systemically important CCPs in third countries.

Measures: The proposal amends the European Market Infrastructure Regulation (EMIR), and makes targeted changes to the supervisory frameworks for banks (Capital Requirements Regulation, Capital Requirements Directive) and investment firms (Investment Firms Directive), as well as the Investment Funds (UCITS) Directive and the Money Market Funds (MMF) Regulation.

Background: Each Member State has its own insolvency regime. For investors who want to invest across borders, evaluating an investment opportunity is a major challenge as they have to consider 27 different insolvency regimes.

Objective: To reduce the cost of capital for companies, certain aspects of insolvency proceedings are to be harmonized across the EU. Overall, the benefits of the proposal are estimated at more than €10 billion per year.

Measures: In addition to the harmonization of certain rules, for example on the preservation of the insolvency estate, simplified rules for micro-enterprises are to be introduced. In addition, the member states are to prepare information sheets to help cross-border investors make their decisions.

Background: EU capital markets are fragmented and too small. Many EU companies find going public too complicated and costly – especially SMEs and startups. Thus, this innovation and potentially high-growth sector remains underfunded – or goes public outside the EU.

Objective: SMEs and start-ups in particular are to benefit from better visibility for investors on the financial markets. Investors can hope for shorter, more up-to-date and simpler company information and build on more efficient monitoring thanks to simpler and clearer listing rules.

Measures: Simplification of prospectus requirements, adapted rules against market abuse, and the introduction of multiple-vote shares. The latter are intended to enable owners to retain control of their company when they raise capital on the stock exchange for the first time. Added to this is the improvement in the production and distribution of research on midcaps and SMEs. vis

The European Commission wants to put further pressure on Russia with a ninth package of sanctions. “Russia continues to bring death and devastation to Ukraine,” EU Commission President Ursula von der Leyen wrote on Twitter Wednesday. “We stand by Ukraine and we are making Russia pay for its cruelty.” The eight sanctions packages introduced by the EU so far are already having a significant impact, von der Leyen said.

The ninth package will add almost 200 individuals and organizations to the sanctions list. According to Josep Borrell, the High Representative of the Union for Foreign Affairs, the list includes members of the Russian military, the defense industry and the government. Among others, those responsible for the missile attacks on Ukraine and the theft of Ukrainian grain are to be hit.

In addition, three more Russian banks are to be sanctioned, according to von der Leyen. The sanctions are also intended to restrict Russia’s access to drones, particularly via third countries such as Iran.

Von der Leyen also mentioned new export restrictions on goods that can be used for both civilian and military purposes. Four news organizations that, according to the head of the commission, spread propaganda are to be taken offline. Finally, she mentioned economic measures against the Russian energy and mining sectors.

The measures proposed by the EU Commission will now be discussed by the EU member states. Ideally, they should be adopted and come into force next week. dpa

The German government wants to give new impetus to the digitization of the energy transition. To this end, the Ministry for Economic Affairs and Climate Action (BMWK) has drafted a bill to relaunch the digitization of the energy transition (GNDEW), which is now going into departmental coordination. With this law, the BMWK aims to reduce bureaucracy and speed up the smart meter rollout. Compared with the rest of Europe, Germany has some catching up to do in this area. The Bundestag is expected to pass the law in the first quarter of 2023 if possible.

Smart meters have a key function on the road to climate neutrality. Without these smart metering systems, which consist of a modern measuring device (digital meter) and a smart meter gateway (communication unit), the power grids cannot manage the millions of decentralized energy producers and users.

Germany has been very thorough in its preparations for the smart meter rollout. The new law, an update of the previous Metering Point Operation Act (MsbG) from 2016, is intended to speed things up, Federal Minister for Economic Affairs and Climate Protection Robert Habeck (Greens) announced weeks ago. The GNDEW removes an important hurdle: The previously required market analysis and market declaration by the BSI are no longer necessary, as there is now a sufficient supply of smart meter gateways.

The most important changes:

Building the hydrogen economy is complicated by the multitude of different definitions of terms. This is the conclusion of a new publication by the Foundation for Environmental Energy Law (SUER). “The multitude of hydrogen-related terms used in Union law, as well as the sometimes different definitions of the same terms, lead to an incoherent legal framework that can be an obstacle to the market ramp-up of hydrogen,” writes author Anna Halbig.

The foundation has systematized dozens of hydrogen-related terms from various laws and drafts, including fuels, combustibles and gases of biogenic origin. “Union law recognizes the term ‘hydrogen‘ in some places, however, many terms also include hydrogen without explicitly stating this. Thus, the hydrogen reference is not always obvious at first glance.”

The overview divides the terms according to the origin of the energy, the area of application and the legal consequences, among other things. The legal acts examined relate not only to energy law but also to tax and state aid law, for example.

In contrast, another publication by Hydrogen Europe and DVGW deals with a special form of hydrogen production, pyrolysis. The publication examines potentials and applications of turquoise hydrogen.

In pyrolysis, organic substances are thermochemically decomposed in the absence of oxygen. The carbon does not have to be separated in the form of CO2, but remains in pure, solid form. This graphite can be reused as a raw material in limited quantities. The starting material for pyrolysis can be natural gas and other gases, but also waste and wastewater. ber

In her bestseller “The Brussels Effect,” US scientist Anu Bradford argued that the EU sets global standards as a regulatory superpower. A new study now provides the first scientific evidence for this thesis.

The results of the as yet unpublished study by Cristina Herghelegiu from the Chief Economist team in the EU Commission’s DG Grow and Fernando Martin Espejo from the Catholic University of Leuven were presented yesterday at a conference on the single market in Prague. The two researchers used quantitative methods to investigate the likelihood that new regulations in the EU would lead to similar regulations in other countries. To do so, they analyzed data from 83 countries on consumer protection and safety regulations, such as those for food ingredients.

They found a measurable correlation, Herghelegiu said. The closer the trade relations, the greater the likelihood that a country would adopt rules similar to those previously adopted by the EU. Both trade agreements and companies’ interests in uniform rules played a role. tho

China’s role in Central and Eastern Europe has changed. Not for the better, according to Ivana Karásková. Karásková is a China Research Fellow and project coordinator at the think tank Association for International Affairs (AMO) in Prague.

She originally wanted to become a journalist and report from around the world. But after graduation, she was deterred by the uncertain future prospects. She opted for science and studied and taught in Prague, Shanghai and Taipei. Karásková thus explored the world that she would later report on as a scientist.

Because at AMO, Karásková examines China’s influence in Central and Eastern Europe. Looking back at the past few years, she says: The economic crisis of 2008 hit Eastern Europe hard. Hopes were high that Chinese investment would help the region get back on its feet. But the investment boom never materialized because “China didn’t have a plan for where it really wanted to invest,” Karásková says.

There was also another catch: “The investments from China came with political demands,” Karásková explains. The fact that the situation in Hong Kong and Xinjiang concerned many countries in Central and Eastern Europe was not well received in Beijing.

Nevertheless, China remained an important player. And Karásková has made it her task to research its influence. In 2016, she founded the Choice (China Observers in Central and Eastern Europe) initiative – a hub for China experts from Central and Eastern Europe. “I could have met China experts in Berlin, Brussels and Washington, but not in Prague or Warsaw.” She is also the founder of MapInfluenCE. The project details how China and Russia behave in the battle of narratives.

As Karásková explains, China has been trying to undermine trust in Western democracies via social media and classic media formats for years. One example: In the spring of 2020, the spokesman for the Chinese Foreign Ministry, Zhao Lijian, claimed that the Coronavirus originated in a US laboratory. This lie spread rapidly through Western social media channels.

In part because an army of new fake accounts, along with accounts of Chinese officials, propagated the hoax, including the Polish version of China Radio International (CRI).

Anyone who compares Western reporting and Chinese disinformation might assume that the truth lies somewhere between the two information poles. This is not only wrong but also dangerous for democracies, whose most valuable currency is the truth, says Karásková.

For Karásková, Russia’s invasion of Ukraine is adding a new dimension. Because China and Russia learn from each other and multiply the same anti-Western narratives. And this is happening on Western social networks.

China’s message is that NATO is to blame for the war and that European democracies are on the verge of collapse. Eastern Europe in particular is the target of such disinformation campaigns. As a result, China is “turning from a problematic partner into a pariah partner for Central and Eastern Europe,” says Karásková.

Moreover, she suspects “disinformation about Ukraine also involves Taiwan.” The goal, she says, is to already fuel anti-NATO narratives so that China’s propaganda can already build on existing anti-Western propaganda in the event of an invasion of Taiwan. The EU must anticipate this and do more to counter Chinese disinformation, Karásková urges. Jonathan Kaspar Teacher

Boeing is saying goodbye to the jumbo, the king of the skies, but the “jumbo” has only landed in Brussels. Next week, a completely new negotiation format will start in Brussels – the so-called Jumbo Trilogue. For three days, three institutions will negotiate three legislative proposals and if things go badly, there will be no result in the end. ETS reform, CBAM and climate social fund are to be decided in a huge round of negotiations between EU Commission, Parliament and Council. It is the king of trilogues, because the three dossiers are inextricably linked.

Parliamentary rapporteurs are currently meeting almost daily to discuss possible compromise lines for the Jumbo Trilogue. They want to define their position this week. Whether red lines will be announced in advance is not yet known, said Green Party rapporteur Michael Bloss on Wednesday. Apparently, this is a negotiating strategy.

The Council has defined its position and shows little willingness to compromise on the vast majority of points. A separation between private and commercial use in the ETS for buildings and road transport (ETS 2), as demanded by the Parliament, is still out of the question for the Council.

The Parliament, on the other hand, is stubbornly sticking to social compensation for the additional burden on consumers caused by the new CO2 fee. If the climate social fund in the originally planned amount (€72 billion) does not materialize, the Parliament could drop the ETS 2 as a whole. Weeks of negotiations in the trilogue and previously in the Parliament and Council would then have been in vain. But this is now seen as a quite likely scenario. It would be a jumbo fail.

And then there is the next jumbo issue, CBAM, on which the vote in Parliament has already failed once. Here, too, both parties insist on their positions. The Parliament wants to melt down the free emission rights for the industry as quickly as possible (read more), while the Council wants to do so much more slowly and, above all, only from a later date on (read more). The outcome is open.

Boeing had the Jumbo in its program for 53 years and is now ending production due to lack of demand. It would be nice if the jumbo chapter “Jumbo in Brussels” is more entertaining, even if the demand has recently increased considerably after night-long small-scale negotiations. Lukas Scheid

European policymakers seem to be reacting more tautly to the US Inflation Reduction Act (IRA) than industry and commerce. Biden’s law is intended to promote domestic climate protection through subsidies, but discriminates against European companies, according to the EU Commission, for example. But trade experts and companies can even see positive sides to the IRA, as Nico Beckert writes in his analysis.

The EU’s ninth sanctions package against Russia could be launched as early as next week. Commission President Ursula von der Leyen announced sanctions against almost 200 more people and more banks. More on this in the News.

The traffic lights coalition has been in power in Berlin for a year. In terms of European policy, it had set out to do a lot better – but there are many problems. How this is becoming a problem for the EU and Berlin, and what needs to be improved in 2023? We have put together an overview for you.

In today’s Heads, we introduce Ivana Karásková, who researches China’s influence on Central and Eastern Europe at the Association for International Affairs think tank in Prague. She has also founded the Choice initiative, a hub for China experts from Central and Eastern Europe, and MapInfluenCE. The project looks at how China and Russia relate to each other in the battle of narratives.

We wish you an exciting read!

There’s a lot of stir about Joe Biden’s billion-dollar climate change program. Emmanuel Macron called the Inflation Reduction Act (IRA) “super aggressive” and is promoting a “Buy European” act in response. Robert Habeck also argues for his own “robust industrial strategy.” The EU Commission called the IRA “clearly discriminatory” in its statement. European industries would be disadvantaged, jobs and growth endangered.

Trade experts are less critical of the law. “The US subsidies are unlikely to lead to a major wave of tech companies settling here from abroad,” says Holger Görg of the Kiel Institute for World Economy (IfW). Already in 2017, the US had “significantly reduced” its profit tax for entrepreneurs from 35 to 21 percent. That “did not lead to masses of new foreign companies setting up shop,” according to the head of international trade and investment research. Many industries are also more relaxed. Only the automobile and hydrogen industries see risks.

The IRA focuses on expanding renewable energy and operating climate-friendly power plants. US companies are only slightly favored:

However, European plant manufacturers will also benefit from these subsidies. According to Holger Görg, the “buy local” tax bonus “doesn’t make a big difference”. That alone is not the reason why any company migrates.

Many companies also disagree with the complaints of politicians. At Wacker Chemie, the Inflation Reduction Act is actually viewed quite positively. The company, which was also present at the launch of the new “Clean Tech Europe” platform, produces polysilicon for solar modules in the US and Germany. “The Inflation Reduction Act will increase polysilicon demand outside China, which is positive – even for our production site in Germany,” says a spokeswoman.

European suppliers could also benefit from increased demand, according to the German Wind Energy Association. However, the European states would have to keep pace: “Instead of a withdrawal of the IRA, we advocate an imitation at the European level,” writes the association.

Meyer Burger, a manufacturer of solar cells and modules, is currently already investing in the US. The investment decision was made before the IRA was passed. The law has made the US an “immense growth market for the solar industry,” a spokeswoman said.

The Biden administration is also awarding tax incentives to attract green industries (see Table 5 for details). The $37 billion is intended to reduce dependence on global supply chains. However, because the incentives are to run for nine years, this amounts to only about $4 billion annually.

Trade expert Görg is skeptical that this will trigger a major wave of settlements. Fundamental weaknesses are more important, he says: “Above all, uncertainties in the political system, increasing protectionism and the question of whether a Republican president will continue to push climate protection are scaring off investors. IRA subsidies won’t change that.”

The German chambers of commerce do not see it quite as negatively, but generally agree on the impact of the IRA. A survey by the AHK Chamber of Foreign Trade shows that business prospects in the USA are among the best. Low energy prices, a good supplier network and the availability of skilled workers all speak in favor of the US, says Volker Treier, DIHK head of foreign trade: “The tax incentives in the Inflation Reduction Act can create additional incentives in the US once again.”

However, the subsidies are “not a central point in the investment decisions of many German companies,” adds Matthias Hoffmann, AHK managing director for Atlanta. Measured against the ten-year term, the volume of the IRA is too small for fundamental changes. In addition, certain sectors of the economy are only eligible for subsidies to a limited extent, says the AHK representative.

The Biden administration is taking a clear Buy America approach to the promotion of EVs. Tax rebates are only available for EVs that are assembled in the USA, Canada or Mexico. From 2024 and 2025 on, the batteries may no longer be manufactured in countries that are problematic for the USA, such as China – or even contain materials from these countries.

The clauses on local precursors and final assembly are expected to have the greatest impact on Europe’s industry. The exact effects of the IRA are not yet foreseeable, says Hildegard Müller, President of the German Association of the Automotive Industry (VDA). But: “Exports from Germany have less of a chance as a result of the regulation.” The association calls for “open and non-discriminatory promotion.”

A Mercedes-Benz spokeswoman says various aspects of the law are “a challenge for the industry and, in the short term, also for Mercedes-Benz.” Subsidies, however, are only one factor when it comes to investment decisions. BMW adds that it produces “local for local” anyway; vehicles for the local market are produced locally wherever possible.

Karsten Neuhoff, a climate expert at DIW Berlin, does see “negative effects of the protectionist orientation” of EV subsidies. At the same time, “US investments in the production of green products could also create opportunities, for example for mechanical engineering in Europe.”

For clean hydrogen, there are tax breaks only if it is produced in the US. The Hydrogen Europe association sees a risk that US manufacturers will gain a competitive advantage as a result “if the EU does not act quickly to create its own regulatory framework for hydrogen.” It is “certainly a possibility” that European manufacturers will migrate to the US if the EU does not also create a better framework. The coming year will be a crucial one for the European hydrogen industry, the association said.

However, the majority of the IRA’s subsidies are not necessarily tied to the purchase of North American goods. Investors and suppliers from Europe can also benefit from the subsidy. Many experts agree that the IRA hardly raises new trade barriers. But the EU is coming under pressure to improve the framework conditions for green investments itself. For example, Internal Market Commissioner Thierry Breton will present a new alliance for the European photovoltaic industry on Friday.

Guntram Wolff, the director of the German Council on Foreign Relations in Berlin and previously in Brussels at the think tank Bruegel, chooses positive words: “The traffic light government is clearly pro-European and supports the central concerns of the EU and EU values,” he says in response to a Europe.Table inquiry.

However, there is a gap between aspiration and reality: “In communicating and implementing our own measures, however, there have been technical errors and inconsistencies on several occasions. Overall, I would like to see the German government thinking even more strongly about the European dimension of its actions right from the start.”

Martin Schirdewan, chairman of the Left Party and member of the European Parliament, does not put it so politely: “In the coalition paper, the traffic light coalition has presented itself as highly European, but first remained without ideas and then began to attract attention by more and more solo efforts,” he criticizes. “Chancellor Scholz as well as Ministers Habeck and Lindner have so far ironed away all important proposals from the other member states.”

It depends on the chosen point of view how one assesses the European policy performance of the traffic light coalition, says Yann Wernert of the Jacques Delors Center in Berlin: “Measured against the status quo before the government came to power, the traffic light coalition has achieved a lot: The sanctions policy toward Russia was very well organized, there has been progress in industrial policy, and the federal government has done a lot on the issue of European Union enlargement.”

Measured against the current challenges, however, the performance is unsatisfactory, he says. “The internal coordination in the traffic light coalition is not going well and gives an inconsistent picture, which irritates other member states that are unclear about the German position and makes progress difficult,” Wernert says.

Just how difficult it has been so far for the traffic light coalition to formulate European policy in a coherent way was demonstrated immediately after taking office – in the dispute over the EU Commission’s delegated act on the green taxonomy. After the draft was announced in early January, the Greens called the inclusion of nuclear power a “serious mistake” and “absolutely unacceptable.”

The same applied to natural gas, although the Commission’s draft stipulated stricter requirements here. The SPD and FDP, on the other hand, agreed with the assessment of natural gas and initially also declared their willingness to give in to France’s insistence with regard to nuclear power.

In its statement to the Commission, the German government then rejected the classification of nuclear power as “sustainable” at the end of January, but supported the classification of gas as a bridging solution under certain conditions – also in its own interest. A formulaic compromise with no consequences, because legal action against the adopted taxonomy was ruled out early on.

Internal disagreement continues on the question of whether new combustion engines will be allowed to drive after 2035 if e-fuels produced with almost no CO2 emissions are used. The responsible Green Minister Steffi Lemke (like the SPD part of the government) rejects the use of e-fuels in cars and has actually made her position quite clear within the government.

The FDP had promised to open a gateway for e-fuels in the Bundestag election campaign and even during the negotiations in the Council. The conflict was already known during the coalition negotiations, was then perpetuated with ambiguous wording in the coalition agreement. As a result, when Italy and some Eastern European countries made a push for e-fuels, Berlin’s EU diplomats were unable to speak. The push petered out, as did the e-fuels.

When it comes to regulating platform work, Germany fails to act as a moderator or pioneer of compromises. The conflict is between the leading Ministry of Labour and Social Affairs and the FDP departments. Department head Hubertus Heil advocates robust and far-reaching regulation. The FDP is against it, fearing too much bureaucracy.

When it comes to positioning the second emissions trading system for buildings and road transport, ETS 2, one of the traffic light partners is already facing issues within its own party. While the Greens in the German government are among the strongest advocates within the Council, the European Greens are among the biggest critics.

The latter prevailed in positioning in the EU Parliament that ETS 2 should only be introduced for commercial customers. The governing Greens in Berlin were not happy: they see ETS 2 as one of the most important means of reducing emissions in the road transport and building heating sectors.

When it comes to social compensation for the additional costs of ETS 2, the German government itself is putting on the brakes in the Council. Much to the displeasure of the European Greens and Social Democrats. The social climate fund is actually supposed to help compensate for the additional costs and, in the view of the EU Parliament, be as financially strong as possible. However, the German government is trying to squeeze the size of the fund so as not to hand over control of revenue from emissions trading to Brussels.

Such German disputes have repercussions for Germany’s role and perception in Europe: instead of speaking with one voice, Germany too often speaks with many – or is unable to speak. This is precisely the behavior known as the German Vote that should actually be avoided. But the conditions for this are lacking.

This is because the traffic light coalition has changed little at the core of European coordination: The departmental principle is unchangeable, and the houses first coordinate at the working level. If no agreement can be reached there, department heads and state secretaries are called in.

What is new is that the particularly difficult issues are tackled in a regular meeting round of four at the level of State Secretaries: Undine Ruge, head of the European Department for the SPD-led Chancellery, Green State Secretary Sven Giegold (BMWK), Andreas Michaelis (AA), also a Green, and State Secretary Carsten Pillath for the FDP-led BMF must seek solutions.

The high need for coordination within the coalition sometimes even means that the German government informs its EU partners too late. For example, those responsible in Berlin simply forgot to inform the other member states about the €200 billion defense umbrella for the energy crisis – the criticism of this was hard to ignore.

In particular, coordination with France became a problem at times, despite many mutual visits: The engine sputtered unmistakably in the first year of traffic light coalition. The Chancellor’s intercultural competence was a problem, it was said in Paris. During one of Macron’s visits, he turned down an invitation to drink wine after the official part of the meeting and went to bed early instead.

Regardless of whether the story actually happened, the fact that it is circulating at all is part of the problem. At the same time, Foreign Minister Annalena Baerbock and Vice-Chancellor Robert Habeck are seen as welcome guests at the Elysee, even though they are not on a par with Emmanuel Macron in terms of protocol.

In Brussels, Paris and the other capitals, hardly anyone doubts the pro-European sentiments of the traffic light parties. In practice, however, the German government tends to go it alone. The LNG deal with Qatar, for example, contradicts the agreement at the EU summit to proceed in a coordinated manner when purchasing gas in the future, according to representatives of several member states. The German government has also failed to inform its neighbors about reforms to the immigration of skilled workers – although the plans would have a direct impact on them as well.

So there is no lack of potential for improvement. Meanwhile, there is hope at a relevant point: “After a phase of irritation, which peaked in the postponed Franco-German Council of Ministers, the signs are pointing to productive cooperation,” says Yann Wernert, assessing the Franco-German situation at the end of the year. However, the really big chunks are still ahead: electricity market reform, fiscal rules reform and the concrete response to US President Biden’s Inflation Reduction Act.

There is still no mention of structural reforms, discussions on enlargement and the rule of law, or how to deal with new, as yet unforeseeable crises. Or as Guntram Wolff puts it: Perhaps it would help if the traffic light coalition in its second year “thought about the European dimension of its actions from the very beginning.” Falk Steiner/Till Hoppe/Leonie Düngefeld/Markus Grabitz/Lukas Scheid

Dec. 9, 2022; 10 a.m.-12 p.m., online

BVMed, Seminar Supply Chain Sourcing Obligations Act

This seminar is intended to provide guidance on the practical implementation of the Supply Chain Due Diligence Act in companies, with a particular focus on companies in the healthcare sector. REGISTRATION UNTIL 08.12.2022

Dec. 9, 2022; 12:30 p.m., online

KAS, Lecture Taxes in a Difficult Situation: A Review of the Czech EU Presidency

The Konrad Adenauer-Stiftung (KAS) wants to take stock of the Czech Presidency in terms of European policy, one topic is the perspective of some Visegrád states on the Ukraine war. INFO & REGISTRATION

Dec. 9, 2022; 5 p.m., Utting

HSS, Seminar Agricultural Policy: Agriculture & Consumer

This Hanns Seidel Foundation (HSS) event will focus on the challenges of current crises, such as the Ukraine war and climate change, for agriculture. INFO & REGISTRATION

Dec. 9, 2022; 6:30-8 p.m., Frankfurt/Main

FNF, Discussion A New Security Order for Europe and the World

The new foreign and security policy challenges posed by Russia’s attack on Ukraine for Germany, Europe and NATO are the topics of this event organized by the Friedrich Naumann Foundation for Freedom (FNF). INFO & REGISTRATION

Dec. 9-11, 2022; Staffelstein

HSS, Seminar World politics 2022

In this event, the Hanns Seidel Foundation (HSS) deals with the crises and challenges of the year 2022 for international politics. INFO & REGISTRATION

Dec. 12, 2022; 10 a.m.-12 p.m., Brussels (Belgium)/online

ERCST, Workshop Certification of hydrogen and hydrogen-based end products

This meeting of the European Roundtable on Climate Change and Sustainable Transition (ERCST) will address the relevance of hydrogen and hydrogen-based product certification, the different standards and methodologies, and the connection points between EU and national standards. INFO & REGISTRATION

Dec. 12, 2022; 2 p.m., online

EBD, Lecture De-briefing EPSCO

On the occasion of the Employment, Social Policy, Health and Consumer Affairs Council (EPSCO) meeting on 8-9/12/2022, the European Movement Germany (EBD) is organizing a de-briefing on employment and social policy. INFORMATION

Dec. 13, 2022; 1-2 p.m., online

Data Protection Foundation, Lecture The Trans-Atlantic Data Privacy Framework – one step forward and soon two steps back?

The speaker at the event will provide an overview of the content and implications of the EU-US Data Exchange Agreement (TADPF).

REGISTRATION

Dec. 13, 2022; 5-6 p.m., Brussels (Belgium)

ERCST, Workshop State of the European Green Deal year-in-review

The European Roundtable on Climate Change and Sustainable Transition (ERCST) will present the current state of the European Green Deal, as well as a perspective for 2023. INFO & REGISTRATION

Dec. 13, 2022; 5:30-7 p.m., online

KAS, Discussion The EU in crisis mode – How do we protect the economy, values and European interests?

The question on which values the European Union is based and how these can be protected in the future is the focus of this event of the Konrad Adenauer-Stiftung (KAS). INFO & REGISTRATION

Dec. 13, 2022; 6-8 p.m., online

KAS, Lecture The future of the Republic of Moldova lies in the European Union

At this event of the Konrad Adenauer-Stiftung (KAS) the view of the Republic of Moldova towards Russia and the security situation will be discussed. INFO & REGISTRATION

Tuesday night, negotiators from the EU Commission, Parliament and Council closed another chapter of the Fit for 55 package. The trilogue agreement on the inclusion of air traffic in the European Emissions Trading System (ETS) stipulates that from 2026, initially only intra-European flights will be charged a CO2 fee.

From 2028, flights with destinations outside the European Economic Area (EEA) could also be added. This is subject to the Commission’s prior approval of CORSIA, the global market-based carbon reduction scheme for aviation, as effective in reducing the sector’s CO2 emissions.

For the environmental organization Transport & Environment (T&E), this does not go far enough. It has long criticized the ineffectiveness of CORSIA, saying the system does not effectively reduce aviation emissions. As a result, 58 percent of CO2 emissions from European aviation remain unaccounted for, T&E writes. The Commission also assessed CORSIA as insufficient to meet EU climate targets more than two years ago. A stricter regulation failed due to the resistance of the member states.

The trilateral agreement is therefore a bet on the future, as it presupposes reforms of CORSIA. Bas Eickhout, parliamentary shadow rapporteur for the Greens, calls it a “classic compromise” and the last chance for CORSIA.

In theory, aviation is already subject to the ETS, but airlines currently receive free emission allowances, so they effectively pay no CO2 fee. These free allocations will now be phased out by 2026. From 2024, a quarter of them will be gone, then half from 2025. In 2026, the industry will pay the full CO2 price at least for its European flights.

The trilogue agreement also provides:

The Parliament and the Council still have to officially approve the trilogue result, but this is considered a formality. luk

The EU is stepping up its action against China in two cases at the World Trade Organization (WTO). Brussels has requested the establishment of two arbitration tribunals for two ongoing cases, the EU Commission announced on Wednesday. The WTO cases involve the de facto trade blockade against Lithuania and patent protection for high-tech products. In both cases, Brussels requested consultations with the People’s Republic at the beginning of the year, which took place, according to the EU. A solution could not be found.

“In both cases, the Chinese measures are severely damaging to European businesses,” the Commission said. The “discriminatory measures against Lithuania” affected the internal market and supply chains within the EU.

Now the WTO’s Dispute Settlement Body will consider the establishment of the arbitration tribunals on Dec. 20. Beijing can oppose the establishment once. If it does, the EU says it will renew the request and refer the matter to the body a second time at the end of January 2023. These proceedings can then take up to one and a half years.

The move sends an important message to China, Lithuanian Foreign Minister Gabrielius Landsbergis said: “The EU will defend the single market and EU member states by all means against China’s politically motivated economic coercion.” Official import restrictions are in place against beef, alcohol, and grain from Lithuania, among others. With this evidence and testimonies from affected companies on other Chinese customs crackdowns, the case is expected to be successful, EU sources say. ari

On Wednesday, the EU Commission presented a series of draft laws aimed at making the EU capital markets more attractive, autonomous and resilient. Specifically, the aim is to strengthen clearing systems in the Union and harmonize insolvency rules. Also relevant to strengthening the digital economy is the legislation on listing on public markets (Listing Act).

Background: The EU is overly dependent on central counterparties (CCPs) outside the EU for some derivatives that are classified as systemically important by the European Securities and Markets Authority. For example, one of the UK-based CCPs handled more than 90 percent of the volume of euro-denominated over-the-counter interest rate derivatives at the end of 2020.

Objective: With simplified procedures and enhanced supervision, clearing in the EU should become more attractive and resilient. The obligation for clearing members and clients to maintain an active account with a CCP in the EU is intended to reduce overdependence on systemically important CCPs in third countries.

Measures: The proposal amends the European Market Infrastructure Regulation (EMIR), and makes targeted changes to the supervisory frameworks for banks (Capital Requirements Regulation, Capital Requirements Directive) and investment firms (Investment Firms Directive), as well as the Investment Funds (UCITS) Directive and the Money Market Funds (MMF) Regulation.

Background: Each Member State has its own insolvency regime. For investors who want to invest across borders, evaluating an investment opportunity is a major challenge as they have to consider 27 different insolvency regimes.

Objective: To reduce the cost of capital for companies, certain aspects of insolvency proceedings are to be harmonized across the EU. Overall, the benefits of the proposal are estimated at more than €10 billion per year.

Measures: In addition to the harmonization of certain rules, for example on the preservation of the insolvency estate, simplified rules for micro-enterprises are to be introduced. In addition, the member states are to prepare information sheets to help cross-border investors make their decisions.

Background: EU capital markets are fragmented and too small. Many EU companies find going public too complicated and costly – especially SMEs and startups. Thus, this innovation and potentially high-growth sector remains underfunded – or goes public outside the EU.

Objective: SMEs and start-ups in particular are to benefit from better visibility for investors on the financial markets. Investors can hope for shorter, more up-to-date and simpler company information and build on more efficient monitoring thanks to simpler and clearer listing rules.

Measures: Simplification of prospectus requirements, adapted rules against market abuse, and the introduction of multiple-vote shares. The latter are intended to enable owners to retain control of their company when they raise capital on the stock exchange for the first time. Added to this is the improvement in the production and distribution of research on midcaps and SMEs. vis

The European Commission wants to put further pressure on Russia with a ninth package of sanctions. “Russia continues to bring death and devastation to Ukraine,” EU Commission President Ursula von der Leyen wrote on Twitter Wednesday. “We stand by Ukraine and we are making Russia pay for its cruelty.” The eight sanctions packages introduced by the EU so far are already having a significant impact, von der Leyen said.

The ninth package will add almost 200 individuals and organizations to the sanctions list. According to Josep Borrell, the High Representative of the Union for Foreign Affairs, the list includes members of the Russian military, the defense industry and the government. Among others, those responsible for the missile attacks on Ukraine and the theft of Ukrainian grain are to be hit.

In addition, three more Russian banks are to be sanctioned, according to von der Leyen. The sanctions are also intended to restrict Russia’s access to drones, particularly via third countries such as Iran.

Von der Leyen also mentioned new export restrictions on goods that can be used for both civilian and military purposes. Four news organizations that, according to the head of the commission, spread propaganda are to be taken offline. Finally, she mentioned economic measures against the Russian energy and mining sectors.

The measures proposed by the EU Commission will now be discussed by the EU member states. Ideally, they should be adopted and come into force next week. dpa

The German government wants to give new impetus to the digitization of the energy transition. To this end, the Ministry for Economic Affairs and Climate Action (BMWK) has drafted a bill to relaunch the digitization of the energy transition (GNDEW), which is now going into departmental coordination. With this law, the BMWK aims to reduce bureaucracy and speed up the smart meter rollout. Compared with the rest of Europe, Germany has some catching up to do in this area. The Bundestag is expected to pass the law in the first quarter of 2023 if possible.

Smart meters have a key function on the road to climate neutrality. Without these smart metering systems, which consist of a modern measuring device (digital meter) and a smart meter gateway (communication unit), the power grids cannot manage the millions of decentralized energy producers and users.

Germany has been very thorough in its preparations for the smart meter rollout. The new law, an update of the previous Metering Point Operation Act (MsbG) from 2016, is intended to speed things up, Federal Minister for Economic Affairs and Climate Protection Robert Habeck (Greens) announced weeks ago. The GNDEW removes an important hurdle: The previously required market analysis and market declaration by the BSI are no longer necessary, as there is now a sufficient supply of smart meter gateways.

The most important changes:

Building the hydrogen economy is complicated by the multitude of different definitions of terms. This is the conclusion of a new publication by the Foundation for Environmental Energy Law (SUER). “The multitude of hydrogen-related terms used in Union law, as well as the sometimes different definitions of the same terms, lead to an incoherent legal framework that can be an obstacle to the market ramp-up of hydrogen,” writes author Anna Halbig.

The foundation has systematized dozens of hydrogen-related terms from various laws and drafts, including fuels, combustibles and gases of biogenic origin. “Union law recognizes the term ‘hydrogen‘ in some places, however, many terms also include hydrogen without explicitly stating this. Thus, the hydrogen reference is not always obvious at first glance.”

The overview divides the terms according to the origin of the energy, the area of application and the legal consequences, among other things. The legal acts examined relate not only to energy law but also to tax and state aid law, for example.

In contrast, another publication by Hydrogen Europe and DVGW deals with a special form of hydrogen production, pyrolysis. The publication examines potentials and applications of turquoise hydrogen.

In pyrolysis, organic substances are thermochemically decomposed in the absence of oxygen. The carbon does not have to be separated in the form of CO2, but remains in pure, solid form. This graphite can be reused as a raw material in limited quantities. The starting material for pyrolysis can be natural gas and other gases, but also waste and wastewater. ber

In her bestseller “The Brussels Effect,” US scientist Anu Bradford argued that the EU sets global standards as a regulatory superpower. A new study now provides the first scientific evidence for this thesis.

The results of the as yet unpublished study by Cristina Herghelegiu from the Chief Economist team in the EU Commission’s DG Grow and Fernando Martin Espejo from the Catholic University of Leuven were presented yesterday at a conference on the single market in Prague. The two researchers used quantitative methods to investigate the likelihood that new regulations in the EU would lead to similar regulations in other countries. To do so, they analyzed data from 83 countries on consumer protection and safety regulations, such as those for food ingredients.

They found a measurable correlation, Herghelegiu said. The closer the trade relations, the greater the likelihood that a country would adopt rules similar to those previously adopted by the EU. Both trade agreements and companies’ interests in uniform rules played a role. tho

China’s role in Central and Eastern Europe has changed. Not for the better, according to Ivana Karásková. Karásková is a China Research Fellow and project coordinator at the think tank Association for International Affairs (AMO) in Prague.

She originally wanted to become a journalist and report from around the world. But after graduation, she was deterred by the uncertain future prospects. She opted for science and studied and taught in Prague, Shanghai and Taipei. Karásková thus explored the world that she would later report on as a scientist.

Because at AMO, Karásková examines China’s influence in Central and Eastern Europe. Looking back at the past few years, she says: The economic crisis of 2008 hit Eastern Europe hard. Hopes were high that Chinese investment would help the region get back on its feet. But the investment boom never materialized because “China didn’t have a plan for where it really wanted to invest,” Karásková says.

There was also another catch: “The investments from China came with political demands,” Karásková explains. The fact that the situation in Hong Kong and Xinjiang concerned many countries in Central and Eastern Europe was not well received in Beijing.

Nevertheless, China remained an important player. And Karásková has made it her task to research its influence. In 2016, she founded the Choice (China Observers in Central and Eastern Europe) initiative – a hub for China experts from Central and Eastern Europe. “I could have met China experts in Berlin, Brussels and Washington, but not in Prague or Warsaw.” She is also the founder of MapInfluenCE. The project details how China and Russia behave in the battle of narratives.

As Karásková explains, China has been trying to undermine trust in Western democracies via social media and classic media formats for years. One example: In the spring of 2020, the spokesman for the Chinese Foreign Ministry, Zhao Lijian, claimed that the Coronavirus originated in a US laboratory. This lie spread rapidly through Western social media channels.

In part because an army of new fake accounts, along with accounts of Chinese officials, propagated the hoax, including the Polish version of China Radio International (CRI).

Anyone who compares Western reporting and Chinese disinformation might assume that the truth lies somewhere between the two information poles. This is not only wrong but also dangerous for democracies, whose most valuable currency is the truth, says Karásková.

For Karásková, Russia’s invasion of Ukraine is adding a new dimension. Because China and Russia learn from each other and multiply the same anti-Western narratives. And this is happening on Western social networks.

China’s message is that NATO is to blame for the war and that European democracies are on the verge of collapse. Eastern Europe in particular is the target of such disinformation campaigns. As a result, China is “turning from a problematic partner into a pariah partner for Central and Eastern Europe,” says Karásková.

Moreover, she suspects “disinformation about Ukraine also involves Taiwan.” The goal, she says, is to already fuel anti-NATO narratives so that China’s propaganda can already build on existing anti-Western propaganda in the event of an invasion of Taiwan. The EU must anticipate this and do more to counter Chinese disinformation, Karásková urges. Jonathan Kaspar Teacher

Boeing is saying goodbye to the jumbo, the king of the skies, but the “jumbo” has only landed in Brussels. Next week, a completely new negotiation format will start in Brussels – the so-called Jumbo Trilogue. For three days, three institutions will negotiate three legislative proposals and if things go badly, there will be no result in the end. ETS reform, CBAM and climate social fund are to be decided in a huge round of negotiations between EU Commission, Parliament and Council. It is the king of trilogues, because the three dossiers are inextricably linked.

Parliamentary rapporteurs are currently meeting almost daily to discuss possible compromise lines for the Jumbo Trilogue. They want to define their position this week. Whether red lines will be announced in advance is not yet known, said Green Party rapporteur Michael Bloss on Wednesday. Apparently, this is a negotiating strategy.

The Council has defined its position and shows little willingness to compromise on the vast majority of points. A separation between private and commercial use in the ETS for buildings and road transport (ETS 2), as demanded by the Parliament, is still out of the question for the Council.

The Parliament, on the other hand, is stubbornly sticking to social compensation for the additional burden on consumers caused by the new CO2 fee. If the climate social fund in the originally planned amount (€72 billion) does not materialize, the Parliament could drop the ETS 2 as a whole. Weeks of negotiations in the trilogue and previously in the Parliament and Council would then have been in vain. But this is now seen as a quite likely scenario. It would be a jumbo fail.

And then there is the next jumbo issue, CBAM, on which the vote in Parliament has already failed once. Here, too, both parties insist on their positions. The Parliament wants to melt down the free emission rights for the industry as quickly as possible (read more), while the Council wants to do so much more slowly and, above all, only from a later date on (read more). The outcome is open.

Boeing had the Jumbo in its program for 53 years and is now ending production due to lack of demand. It would be nice if the jumbo chapter “Jumbo in Brussels” is more entertaining, even if the demand has recently increased considerably after night-long small-scale negotiations. Lukas Scheid