EU Energy Commissioner Kadri Simson is promoting a new European electricity market design and long-term Power Purchase Agreements (PPAs) with the promise of “stable and affordable prices”. Now, she says, the focus is on getting these PPAs to companies. Manuel Berkel analyzes how the breakthrough of PPAs can be achieved and how medium-sized companies can benefit from them.

In Germany, politics and business are intensively discussing how to reduce dependence on China. However, the situation is apparently not as dramatic as previously thought, according to a study that examined the profit situation of German companies in the People’s Republic. There is no critical economic dependence of the Federal Republic of Germany on China, the study says. Nevertheless, the authors provide some recommendations, as Christiane Kühl reports. Among other things, they urge EU member states to act in unison on the China issue.

However, there was no talk of European unity after the controversial statements by French President Emmanuel Macron about China and Taiwan. On the US side, there also seems to be a need for discussion: In a phone call with Macron, US President Joe Biden reaffirmed his stance that peace and stability must be maintained in the Taiwan Strait, according to a statement from the White House.

In France, people are now using pots and pans and other utensils to make noise in their protests against Macron and his policies. The phenomenon of “Casserolade” is currently being discussed in a rather lighthearted manner in France. However, the tense atmosphere in the country and Macron’s damaged image are cause for concern, writes Claire Stam in her Column.

According to a new study, Germany’s economy is far less dependent on China in most sectors than is generally assumed. This is the conclusion of a study published on Thursday by the Bertelsmann Foundation, the German Economic Institute (IW), the China Institute Merics and the Federation of German Industries. The study systematically analyzed the profit situation of German companies in China – according to its own information for the first time ever – including special analyses of Bundesbank data.

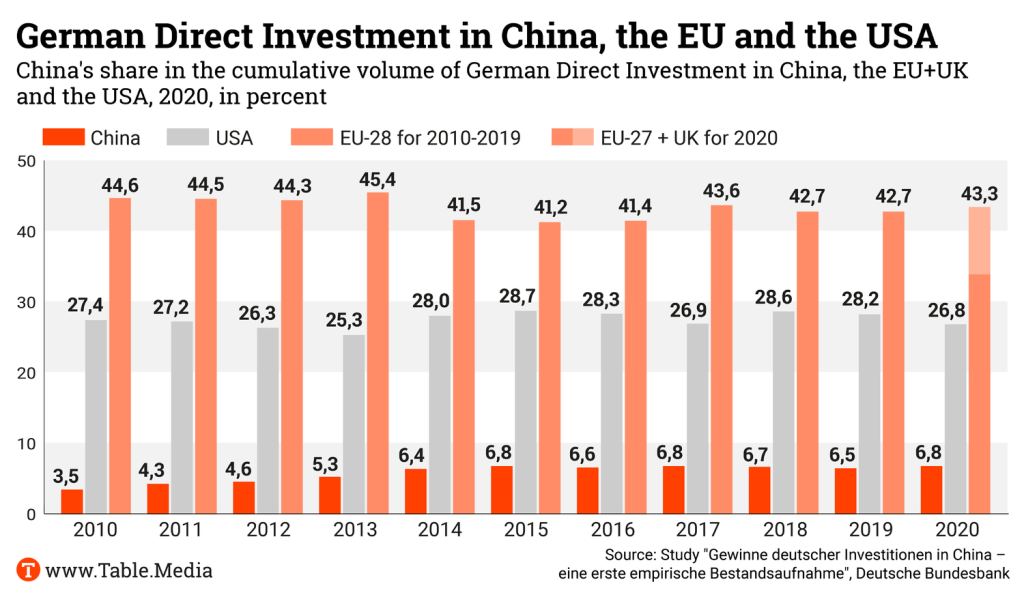

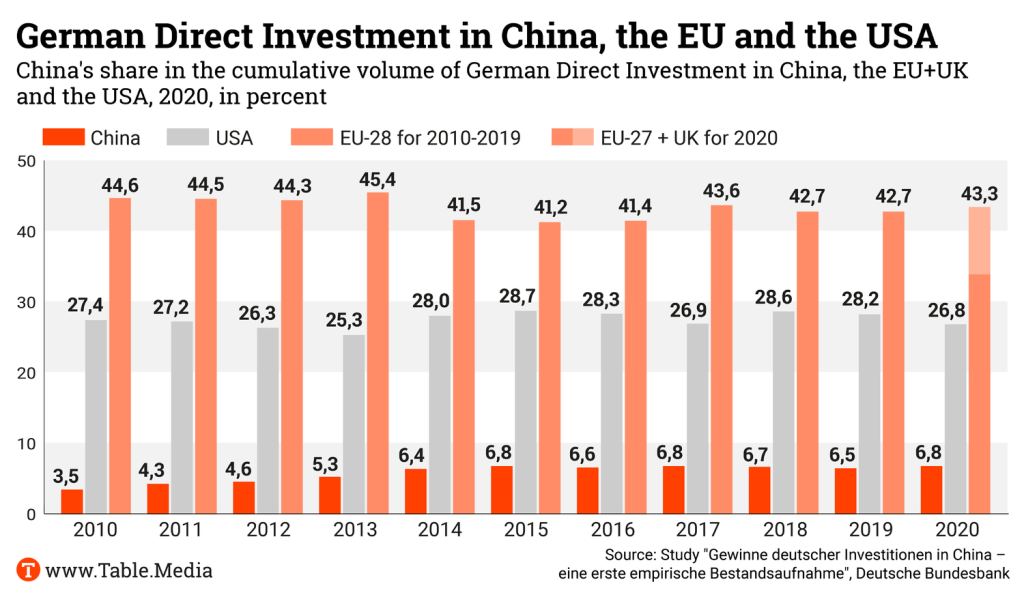

Between 2017 and 2021, profits amounting to seven to eleven billion euros flowed back to Germany each year from the direct investments of German companies in China. This puts China’s significance at about the same level as the USA, with a share of 12 to 16 percent of companies’ foreign profit returns. The EU’s share, however, was significantly higher at an average of 56 percent. The overall economic significance of the profits generated by German companies in China is relevant, but limited.

Despite its growing importance, the People’s Republic continues to play a relatively minor role as a destination for foreign direct investment compared to the EU, the authors write. They argue that Germany’s economic dependence on China is not critical. This is a rather surprising conclusion given the heated debate about excessive dependence on China.

The authors see their findings as an all-clear signal. According to the study, China accounted for only 6.8 percent of German foreign direct investment in 2020, at around 90 billion euros – compared to 34 percent for the EU including the UK and 27 percent for the USA.

Below are some of the key findings of the study:

Especially large corporations like Volkswagen, Mercedes-Benz, BMW and BASF continue their investments in China regardless of the discussion about China in Europe. VW has been calling China its “second home market” for years; BASF is currently building a large Verbund site in southern China.

“More transparency is required here, also at the level of German companies particularly exposed to China,” demands Juergen Matthes, Head of the Global and Regional Markets Department at the IW. “Investors should have an interest in learning more about such cluster risks.” It is “in the overall interest of the German economy that affected large companies safeguard their own existence against geopolitical worst-case scenarios (such as an invasion of Taiwan by China),” the authors warn in the study.

But the investment flow could even rise further. A clear majority of the companies surveyed in the study want to replace exports from Germany with local production by 2030. The trend is well known – in this way, companies are following Chinese demands for more localization, among other things.

“These plans threaten to weaken Germany’s future export prospects. In the medium term, this could be to the detriment of Germany as a business location and the jobs that depend on exports to China and Asia,” warns Merics head economist Max Zenglein. The previously accepted thesis that investments in China automatically benefit Germany as a business location no longer necessarily applies, he says.

The authors provide recommendations for the German government’s economic policy and China strategy. “Germany’s new China policy should be oriented independently of individual corporate and sectoral interests,” says Cora Jungbluth, China expert at the Bertelsmann Stiftung. “Securing prosperity for the entire German business location should be the main focus.”

The authors make further recommendations:

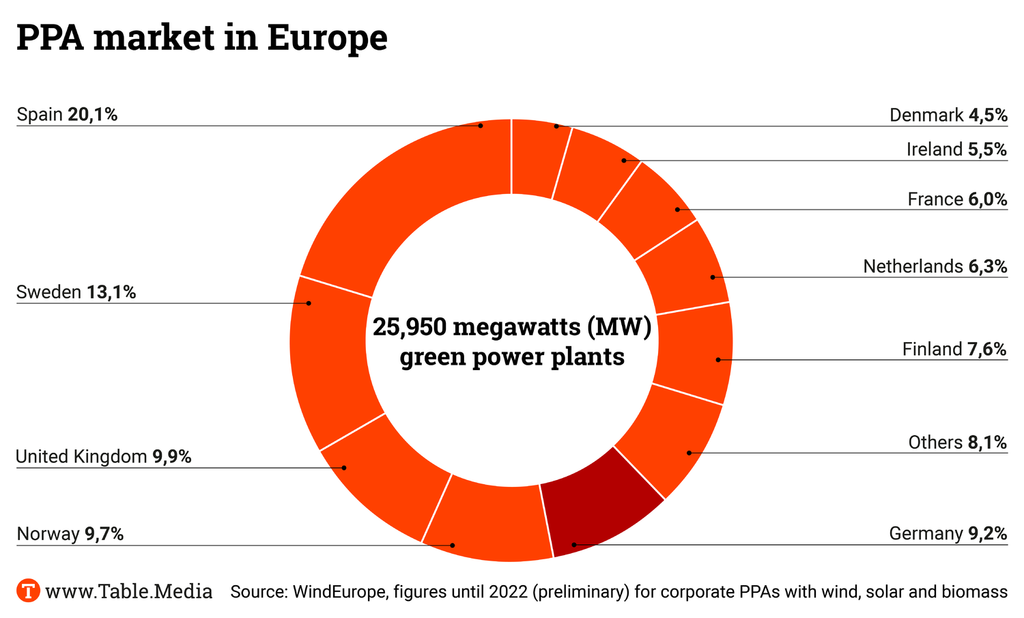

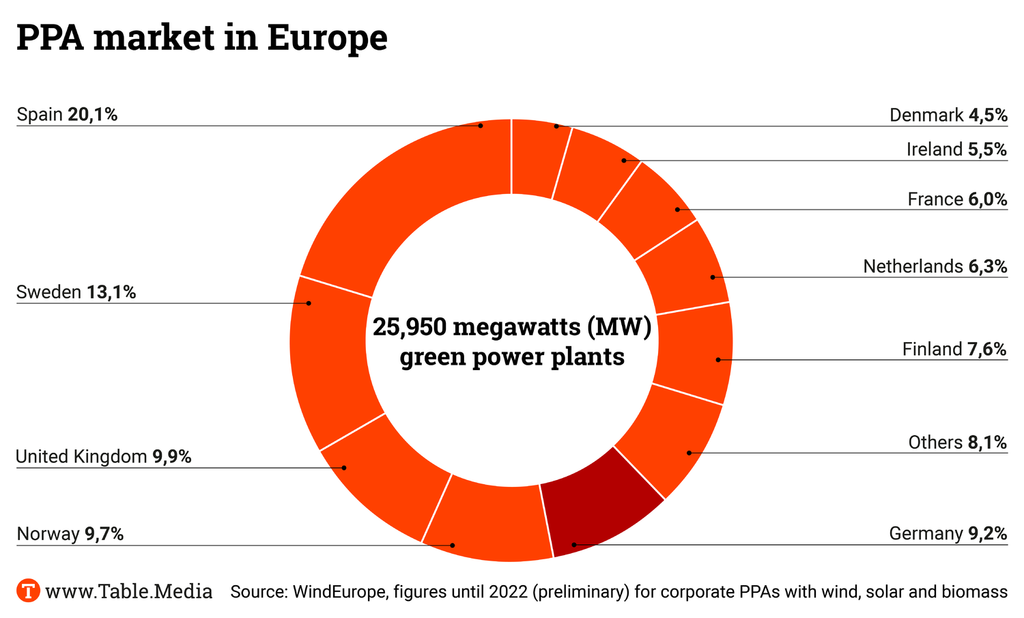

“Stable and affordable prices” – with this prospect, EU Energy Commissioner Kadri Simson is promoting a new European electricity market design and, in particular, long-term power purchase agreements. The question now, she says, is how Power Purchase Agreements (PPAs) can reach the breadth of companies.

Medium-sized companies with high energy consumption rarely have the financial means to finance entire wind farms. They are also confounded by the many different types of long-term purchase agreements. Ideally, companies with a PPA buy green electricity from a single solar or wind farm. In this way, they theoretically benefit from low generation costs.

But because generation fluctuates, the remaining electricity volumes have to be purchased on the wholesale market. “The customer assumes the structuring risk from the supplier,” explains Michael Claußner of the consulting firm Energy Brainpool. If the customer does not want to pay a service provider, they need their own procurement department – another reason why the complex contracts have so far been the domain of energy-intensive large companies.

Many industrial companies also still do not want to commit for long and possibly miss out on falling prices. “Typical terms for PPAs are up to five years, in individual cases even ten,” says Wolf Stötzel of the German Wind Energy Association (BWE), representing green power producers and marketers.

At the heart of the EU reform for this is a risk that is relatively easy to address: the potential default of electricity purchasers. Some energy-intensive companies would not be rated by rating agencies. As a result, banks lack the decision-making basis for financing new green power plants through direct contracts, according to the commission. With the reform, member states should ensure that the financial market provides hedging instruments – supported by government guarantees if needed.

However, Stötzel objects that precisely such financial hedges already exist in Germany on the EEX power exchange. The contracting parties could register their PPA with the exchange, which would assume the default risk for a fee. Nevertheless, the chambers of commerce and industry are convinced that state guarantees for small and medium-sized enterprises can turn things around. “In Norway, there are already guarantees for PPAs, which has boosted the market,” says DIHK energy officer Josephine Möslein.

The Federal Ministry for Economic Affairs is already examining ways to improve the financing of PPAs, for example, via KfW and default guarantees, writes the BMWK in its key points for a wind energy onshore strategy. For wind farms in particular, there are currently hardly any PPAs, says Tibor Fischer, head of renewable energies at the German Energy Agency (Dena). In the case of wind power, it is clear that it is not just a matter of giving small and medium-sized companies easier access to green power projects. The supply is simply too small.

There are still too few new, approved areas for wind farms. As a result, public tenders have been signed and government premiums are even more attractive for operators. “The PPA market in Germany currently consists mainly of segments for which there are no longer any subsidies,” says Fischer. He says these include wind farms, for which the 20-year subsidy period has expired, and especially large solar plants over 20 megawatts in capacity. They are already excluded from subsidized tenders in the Renewable Energy Sources Act (EEG).

But even if the political expansion targets are achieved in the next few years, PPAs are unlikely to be a panacea for high electricity costs. Levies and surcharges still account for up to one-third of the electricity price for industrial customers and about half for commercial customers, even considering the recent relief provided by the elimination of the EEG surcharge.

“Medium-sized companies would benefit above all from reduced network charges, which would be subsidized by the German government,” says Möslein. In the DIHK’s view, another “big step” for SMEs would be higher de minimis limits for so-called on-site PPAs. In this case, the renewable energy system is located on the customer’s premises and operated by a service provider. In this way, the company saves on all surcharges. However, according to Möslein, it becomes an electricity supplier as soon as it feeds surplus electricity into the grid to supply its neighbors and must meet the full regulatory requirements.

In order to help PPAs achieve a breakthrough, contracts would also have to be highly standardized, says management consultant Claußner: “A medium-sized company can’t spend 24 hours on energy procurement.” Another advantage of standardization: Contracts would become more comparable and prices would possibly fall. The rapporteur in the European Parliament, Nicolás González Casares (S&D), has already announced that the Commission’s legislative proposal will be tightened up with a view to greater transparency.

In the long term, Dena expert Fischer is convinced that the market for small and medium-sized enterprises will develop in two directions: “If there is sufficient supply, SMEs can form pools and thus spread risks and share transaction costs because PPAs will remain more complex than normal supply contracts.” Such pooling is already widespread in the USA and Australia.

The second, currently more widespread option: “Companies can also purchase green power from energy suppliers that conclude PPAs. In this case, the companies only obtain green power indirectly, but from additional plants, and they have less effort because the supplier takes over the structuring,” explains Fischer.

This additionality is, according to the Dena expert, the second crucial reason, alongside the pricing issue, why more companies could opt for PPAs in the future. Own green commitments and sustainability standards are motivating suppliers and corporations to green their production through green energy. “Compared to other measures, it is still fast and uncomplicated,” says Claußner as well. However, the vast majority of the green energy certificates used for this purpose come from decades-old Norwegian hydropower plants.

“PPAs for new plants have a different value,” Fischer is convinced. The wind industry, on the other hand, is still sobered by the experience with special certificates for regional electricity from Germany. “Demand from industry and end consumers has been very restrained so far,” says Stötzel.

But Fischer currently sees growing interest in high-quality green power across Europe: “The Epex Spot power exchange got back into trading guarantees of origin last fall, and you can already see there that certificates from unsubsidized plants and certain countries are fetching higher prices.”

Especially since the cheap alternative from imported certificates is not assured. “Last summer, the Norwegian parliament had already made a push to use guarantees of origin to decarbonize its own industry,” Fischer recounts. “Since more than 90 percent of the guarantees of origin traded in this country come from Norway, many companies in Germany would then have had no more proof of green electricity.”

April 24-25, 2023

Meeting of the Committee on Economic and Monetary Affairs (ECON)

Topics: Draft report on financial activities of the European Investment Bank, annual report 2022 on the Banking Union, annual report 2022 on competition policy. Draft Agenda

April 24-25, 2023

Meeting of the Committee on Transport and Tourism (TRAN)

Topics: Public hearing on Future challenges for the rail infrastructure (single European Track Access charges and investments needed towards decarbonisation), Structured Dialogue with Commissioner Breton on the Implementation of the EU Tourism Agenda 2030 and update on new developments for the tourism sector, Structured Dialogue with Commissioner Vălean on the latest and upcoming transport-related proposals. Draft Agenda

April 24-25, 2023

Meeting of the Committee on Industry, Research and Energy (ITRE)

Topics: Public hearing on the reform of the electricity market, Draft report on laying down measures for a high level of public sector interoperability across the Union (Interoperable Europe Act), Draft report on the horizontal cybersecurity requirements for products with digital elements. Draft Agenda

April 24-25, 2023

Meeting of the Committee on Internal Market and Consumer Protection (IMCO)

Topics: Draft opinion on the European Health Data Space, Draft opinion on the horizontal cybersecurity requirements for products with digital elements, Draft report on establishing a Single Market emergency instrument. Draft Agenda

April 24-25, 2023

Meeting of the Committee on Human Rights (DROI)

Topics: Draft opinion on prohibiting products made with forced labour on the Union market, Exchange of views on EU instruments for tackling corruption globally. Draft Agenda

April 24-25, 2023

Meeting of the Committee on Agriculture and Rural Development (AGRI)

Topics: Draft opinion on packaging and packaging waste, Draft report on ensuring food security and long term resilience of the EU agriculture, Draft report on generational renewal in the EU farms of the future. Draft Agenda

April 24, 2023; 10 a.m.

Council of the EU: Foreign Affairs

Topics: Exchange of views on the Russian aggression against Ukraine, Exchange of views on the Implementation of the EU action plan on the geopolitical consequences of the Russian aggression against Ukraine (engagement with third countries). Draft Agenda

April 24, 2023; 5 p.m.

EU-Uzbekistan Cooperation Council

Topics: Exchange of views on general and political matters (including internal and constitutional reforms, justice and home affairs, human rights and rule of law issues), Discussion of trade, economic and investment issues, Consideration of regional and international issues. Infos

April 25, 2023

Trilogue: RefuelEU Aviation

Topics: Im womöglich letzten Trilog wird es zum einen um die Höhe der Quoten für nachhaltige Flugkraftstoffe (Sustainable Aviation Fuels, SAF) gehen. Das Parlament will eine steil ansteigende SAF-Quote mit 85 Prozent in 2050. Kommission und Rat sehen ab diesem Datum nur 63 Prozent vor. Der zweite Knackpunkt der Verhandlungen ist die Definition von SAF und die Frage, ob auch mit Kernenergie hergestellte Kraftstoffe dazu zählen, wie von Frankreich gefordert und von Deutschland mittlerweile teilweise unterstützt. Offen ist, wie sich das EU-Parlament in dieser Sache positioniert.

April 25, 2023; 9-11:30 a.m.

Joint Meeting of the Committee on Environment, Public Health and Food Safety (ENVI) and of the Committee on Agriculture and Rural Development (AGRI)

Topics: Public hearing on “Sustainable management of water resources in agriculture”. Draft Agenda

April 25, 2023; 10 a.m.

Council of the EU: Agriculture and Fisheries

Topics: Policy debate on the Regulation on the certification of carbon removals (agricultural and forestry aspects), Exchange of views on CAP Strategic Plans (state of play), Approval of the conclusions on the opportunities of the bioeconomy in the light of current challenges with special emphasis on rural areas. Draft Agenda

April 25, 2023; 2.30-3 p.m.

Joint Meeting of the Committee on Security and Defence (SEDE), of the Committee on Foreign Affairs (AFET), and of the Committee on Industry, Research and Energy (ITRE)

Topics: Draft report on establishing the European defence industry reinforcement through common procurement act. Draft Agenda

April 26-27, 2023

Meeting of the Committee on Foreign Affairs (AFET)

Topics: 2022 Commission Report on Serbia, 2022 Commission Report on Kosovo, Draft report on EU-Switzerland relations. Draft Agenda

April 26-27, 2023

Meeting of the Committee on International Trade (INTA)

Topics: Draft opinion on Uzbekistan, Public hearing on reinforcing EU-Latin America Trade Relations, Exchange of views on the state of play of the modernization process of the Energy Charter Treaty and of the corresponding EU position. Draft Agenda

April 26-27, 2023

Meeting of the Committtee on Employment and Social Affairs (EMPL)

Topics: Draft motion for a resolution on the roadmap on a Social Europe (two years after Porto), Draft opinion on prohibiting products made with forced labour on the Union market. Draft Agenda

April 26-27, 2023

Meeting of the Committee on Budgets (BUDG)

Topics: Public Hearing on ‘Financial impact of the war in Ukraine: current and future challenges for the EU Budget’, Draft report on the impact on the 2024 EU budget of increasing European Union Recovery Instrument borrowing costs, Draft opinion on the definition of criminal offences and penalties for the violation of Union restrictive measures. Draft Agenda

April 26-27, 2023

Meeting of the Committee on Culture and Education (CULT)

Topics: Draft report on establishing a common framework for media services in the internal market (European Media Freedom Act), Draft opinion on EU-Switzerland relations. Draft Agenda

April 26-27, 2023

Meeting of the Committee on Environment, Public Health and Food Safety (ENVI)

Topics: Report back on ongoing interinstitutional negotiations, Hearing of the candidate for the function of the Executive Director of the European Environment Agency, Draft report on urban wastewater treatment. Draft Agenda

April 26, 2023

Weekly Commission Meeting

Topics: Patent package (Compulsory licensing of patents, Standard essential patents, Revision of the legislation on supplementary protection certificates), Customs reform, Pharmaceutical package (Revision of the pharmaceutical legislation, Revision of the EU legislation on medicines for children and rare diseases, Council Recommendation on stepping up EU actions to combat antimicrobial resistance in a one health approach). Draft Agenda

April 26, 2023; 9 a.m.-6.30 p.m.

Meeting of the Committee on Development (DEVE)

Topics: Critical Raw Materials – the DEVE perspective, Structured Dialogue on the Commission Work Programme. Draft Agenda

April 26, 2023; 9 a.m.-12:30 p.m.

Meeting of the Special Committee on foreign interference and disinformation, and on strengthening integrity in the EP (ING2)

Topics: Draft report on foreign interference in all democratic processes in the European Union (including disinformation), Exchange of views on “Doppelganger – Media Clones Serving Russian Propaganda” with Alexandre Alaphilippe (Executive Director, EU DisinfoLab). Draft Agenda

April 26, 2023; 11.30 a.m.-12.30 p.m.

Joint Meeting of the Committee on Foreign Affairs (AFET) and of the Committee on International Trade (INTA)

Topics: Implementation report on the EU-UK Trade and Cooperation Agreement. Draft Agenda

April 26, 2023; 2.30-3.30 p.m.

Joint Meeting of the Committee on Internal Market and Consumer Protection (IMCO) and of the Committee on Legal Affairs (JURI)

Topics: Draft report on the liability for defective products. Draft Agenda

April 26, 2023; 2.30-3.15 p.m.

Joint Meeting of the Committee on Environment, Public Health and Food Safety (ENVI) and of the Committee on Industry, Research and Energy (ITRE)

Topics: Draft report on Methane emissions reduction in the energy sector. Draft Agenda

April 26, 2023; 5.30-6.30 p.m.

Joint Meeting of the Committee on International Trade (INTA) and of the Committee on Internal Market and Consumer Protection (IMCO)

Topics: Proposal for a Regulation on prohibiting products made with forced labour on the Union market. Draft Agenda

April 27, 2023; 10.30-10.45 a.m.

Joint Meeting of the Committee on Environment, Public Health and Food Safety (ENVI) and of the Committee on Agriculture and Rural Development (AGRI)

Topics: Draft report on specific rules relating to the entry into Northern Ireland from other parts of the United Kingdom of certain consignments of retail goods, plants for planting, seed potatoes, machinery and certain vehicles operated for agricultural or forestry purposes, as well as non-commercial movements of certain pet animals into Northern Ireland. Draft Agenda

April 28-29, 2023

Informal meeting of EU economy and finance ministers

Topics: Exchange of views on financing future growth in Europe, Exchange of views on a long-term perspective on stabilisation policies and sustainable public finances, Discussion on Ukraine reconstruction and coordination of support. Draft Agenda

April 28, 2023; 9 a.m.

Eurogroup

Topics: Stocktaking on the Banking Union and banking sector developments, Debrief from the March Euro summit, International Meetings: debrief on IMF spring meetings and preparation for the May G7 meeting. Draft Agenda

Rapporteurs for the AI Act have set new negotiation dates for several technical and political meetings over the next two weeks. Representatives of various political groups believe it is realistic that the planned vote in the lead committees IMCO and LIBE can actually take place on May 11 as now planned.

Many things are close to an agreement but not yet completely closed, according to negotiating circles. By May 11, however, this could well be achieved in a few rounds of negotiations.

Outstanding discussion items include Annex III (List of High-Risk AI Systems), Article 5 (Prohibited Practices), General Purpose AI (GPAI) and the Fundamental Rights Assessment. The following negotiation dates are scheduled:

Technical meetings:

Shadows meetings:

The vote in the plenary of the EU Parliament is scheduled for June 12, so that the start of the trilogue can still take place under the Swedish Council Presidency. vis

Germany is lagging behind: Soon, three and a half years after the adoption of an EU directive on whistleblower protection, the Federal Republic still has not implemented it and must therefore pay a daily fine of €50,000. The traffic light coalition is now sharply criticizing the Union. The Union is doubly responsible for the delay, Stephan Thomae, parliamentary managing director of the FDP parliamentary group, said to Table.Media, “The Union must take responsibility for this.”

According to Thomae, the previous government failed to create a law, and now, through its opposition in the Bundesrat, it is also responsible for Germany having to pay penalties. “The traffic lights worked flat out to present a good law that would have solved the problem inherited from the CDU/CSU,” Thomae complains. “I cannot understand this blockade.” The proposal of the governing coalition protects whistleblowers and keeps the burden on companies and authorities as low as possible.

Most companies themselves have “a veritable interest” in the law, says Thomae. They also want whistleblowers to report and correct wrongdoing within their own company. That’s why it’s important to “put the protection of whistleblowers on a legally secure footing. It is important not to overburden companies bureaucratically and financially.

Among other things, the traffic light coalition is aiming for companies with 50 to 249 employees to introduce a uniform internal reporting channel. steb

The European Parliament has positioned itself in favor of negotiations on a comprehensive reform of asylum and migration policy. MEPs voted on Thursday in Strasbourg in favor of starting talks with EU states.

Among other things, parliament advocated the registration of illegal entrants at EU borders. In addition, there must be an independent mechanism to monitor fundamental rights. This should prevent illegal “pushbacks”, i.e., pushing refugees back without checking their entitlement to asylum. In addition, EU countries should show more solidarity with each other in migration policy.

As the mandates previously adopted by the Interior Committee had been contested by members of parliament, an additional vote in plenary became necessary. The aim is to conclude negotiations with the EU countries by the end of the year. Then the laws could be passed before the European elections in spring 2024.

However, the EU states have not yet taken a position on crucial issues. There has been a dispute over migration policy since the large-scale flight movement in 2015/2016. At its core was the question of whether protection seekers should be distributed among all member states. Countries like Poland and Hungary vehemently reject a binding quota. That is why the EU Commission presented new reform proposals in 2020. dpa

The EU Commission simplifies requirements for mergers of companies. The new rules are intended to reduce the effort and cost of preparing merger notifications for companies and consultants, the EU Commission announced on Thursday. In the future, for example, less information will have to be provided to authorities for certain mergers, according to the announcement.

“The package adopted today serves the Commission’s goal of reducing reporting obligations by 25 percent,” it said. This will also help the Commission by allowing it to focus its resources on the most complicated cases, said Competition Commissioner Margrethe Vestager. The new rules will apply from Sep. 1. dpa

A noun that first appeared in France around 1830 has resurfaced in recent days: Casserolade. The word refers to a form of protest which consists of a group of people making noise by banging pots, lids, pans and other noisy utensils. Protesters sometimes take a decidedly creative approach to their protest, and the same goes for the accompanying memes.

Last Monday, for example, more than 350 noisy concerts began at 8 p.m., scattered throughout France, as French President Emmanuel Macron gave a televised speech. “Macron doesn’t listen to us, we don’t listen to him either,” the protesters shouted. The response wasn’t long in coming: “It’s not cooking pots that will move France forward,” the French president said last Wednesday during a factory visit in Alsace. The traditional pot manufacturer Cristel, however, saw things differently.

Meanwhile, all of France is laughing at the ban on cooking pots, also known as “portable sound devices” in official parlance, issued yesterday in Ganges (southern France). The reason for the ban was Emmanuel Macron’s visit to a school in Ganges.

The result is a veritable dialogue of deaf ears between the French executive and civil society, with each insisting on its positions. This status quo and its explosive potential did not escape the notice of EU parliamentarians who gathered in Strasbourg this week for a plenary session and exchanged views on the French constitutional framework in the corridors. Almost invariably, one question emerged: How could a law as important as the one on pension reform be passed without parliamentary approval?

“It is crucial to understand that it is not necessarily constitutional jurisdiction that is being questioned, but the conditions under which it is exercised in France,” writes Lauréline Fontaine, a professor of public law, in a guest editorial in the daily Le Monde.

The French constitutional system is heavily focused on the executive branch, and in particular on the president of the republic, write Laurent Pech, professor of European law at Middlesex University in London, and Sébastien Platon, professor of public law at the University of Bordeaux, in a study commissioned by the European Green Party. The current French constitution also allows executive interference in the legislative sphere in some cases, the two researchers further point out.

However, the ongoing protests since January show that the French are less and less willing to accept this vertical power. This is all the more true because the exercise of this power is taking place in a context in which the functioning of the health, education and justice systems has deteriorated. And galloping inflation is only adding fuel to the fire of already fierce political protests.

What about the structural counterforces? It is well known that the countervailing forces offered by a federal administrative and political structure in a country like Germany do not exist in France. This lends particular weight to the action of civil society as a counterforce.

“Is this country really exemplary in terms of the rule of law? It must be noted that civil liberties have been weakened over the last decade,” writes Thomas Perroud, professor of public law at Panthéon-Assas University, in the study mentioned above. Indeed, to respond to the terrorist attacks and later to the health crisis, successive governments introduced prolonged states of emergency that were then normalized in the current legal framework, he explains.

The French constitutional framework thus allows for a solitary exercise of power, which France’s traditional partners felt during his trip to China. Macron’s statements on China and Taiwan caused all the more confusion because they seemed to ignore all the talks and meetings held with them in advance.

A year after his re-election, Macron seems quite isolated, with a badly damaged image, even abroad. And the French head of state will begin the second year of his second term next Monday, burdened by an unpopularity that could make him dangerous. A year after his re-election, he must try to regain control of this strange five-year term that seems to be slipping away from him.

Because there are real questions and concerns about the future of France. The far right has arrived at the center of power in Italy, Sweden and Finland, and is knocking on the door in Belgium and Spain. The fact is that there is more at stake in France than the reform of the pension system. The country is in a social, political and democratic crisis. The fact that Marine Le Pen’s Rassemblement National party is the big winner of Macron’s crisis is hardly disputed in France at the moment.

EU Energy Commissioner Kadri Simson is promoting a new European electricity market design and long-term Power Purchase Agreements (PPAs) with the promise of “stable and affordable prices”. Now, she says, the focus is on getting these PPAs to companies. Manuel Berkel analyzes how the breakthrough of PPAs can be achieved and how medium-sized companies can benefit from them.

In Germany, politics and business are intensively discussing how to reduce dependence on China. However, the situation is apparently not as dramatic as previously thought, according to a study that examined the profit situation of German companies in the People’s Republic. There is no critical economic dependence of the Federal Republic of Germany on China, the study says. Nevertheless, the authors provide some recommendations, as Christiane Kühl reports. Among other things, they urge EU member states to act in unison on the China issue.

However, there was no talk of European unity after the controversial statements by French President Emmanuel Macron about China and Taiwan. On the US side, there also seems to be a need for discussion: In a phone call with Macron, US President Joe Biden reaffirmed his stance that peace and stability must be maintained in the Taiwan Strait, according to a statement from the White House.

In France, people are now using pots and pans and other utensils to make noise in their protests against Macron and his policies. The phenomenon of “Casserolade” is currently being discussed in a rather lighthearted manner in France. However, the tense atmosphere in the country and Macron’s damaged image are cause for concern, writes Claire Stam in her Column.

According to a new study, Germany’s economy is far less dependent on China in most sectors than is generally assumed. This is the conclusion of a study published on Thursday by the Bertelsmann Foundation, the German Economic Institute (IW), the China Institute Merics and the Federation of German Industries. The study systematically analyzed the profit situation of German companies in China – according to its own information for the first time ever – including special analyses of Bundesbank data.

Between 2017 and 2021, profits amounting to seven to eleven billion euros flowed back to Germany each year from the direct investments of German companies in China. This puts China’s significance at about the same level as the USA, with a share of 12 to 16 percent of companies’ foreign profit returns. The EU’s share, however, was significantly higher at an average of 56 percent. The overall economic significance of the profits generated by German companies in China is relevant, but limited.

Despite its growing importance, the People’s Republic continues to play a relatively minor role as a destination for foreign direct investment compared to the EU, the authors write. They argue that Germany’s economic dependence on China is not critical. This is a rather surprising conclusion given the heated debate about excessive dependence on China.

The authors see their findings as an all-clear signal. According to the study, China accounted for only 6.8 percent of German foreign direct investment in 2020, at around 90 billion euros – compared to 34 percent for the EU including the UK and 27 percent for the USA.

Below are some of the key findings of the study:

Especially large corporations like Volkswagen, Mercedes-Benz, BMW and BASF continue their investments in China regardless of the discussion about China in Europe. VW has been calling China its “second home market” for years; BASF is currently building a large Verbund site in southern China.

“More transparency is required here, also at the level of German companies particularly exposed to China,” demands Juergen Matthes, Head of the Global and Regional Markets Department at the IW. “Investors should have an interest in learning more about such cluster risks.” It is “in the overall interest of the German economy that affected large companies safeguard their own existence against geopolitical worst-case scenarios (such as an invasion of Taiwan by China),” the authors warn in the study.

But the investment flow could even rise further. A clear majority of the companies surveyed in the study want to replace exports from Germany with local production by 2030. The trend is well known – in this way, companies are following Chinese demands for more localization, among other things.

“These plans threaten to weaken Germany’s future export prospects. In the medium term, this could be to the detriment of Germany as a business location and the jobs that depend on exports to China and Asia,” warns Merics head economist Max Zenglein. The previously accepted thesis that investments in China automatically benefit Germany as a business location no longer necessarily applies, he says.

The authors provide recommendations for the German government’s economic policy and China strategy. “Germany’s new China policy should be oriented independently of individual corporate and sectoral interests,” says Cora Jungbluth, China expert at the Bertelsmann Stiftung. “Securing prosperity for the entire German business location should be the main focus.”

The authors make further recommendations:

“Stable and affordable prices” – with this prospect, EU Energy Commissioner Kadri Simson is promoting a new European electricity market design and, in particular, long-term power purchase agreements. The question now, she says, is how Power Purchase Agreements (PPAs) can reach the breadth of companies.

Medium-sized companies with high energy consumption rarely have the financial means to finance entire wind farms. They are also confounded by the many different types of long-term purchase agreements. Ideally, companies with a PPA buy green electricity from a single solar or wind farm. In this way, they theoretically benefit from low generation costs.

But because generation fluctuates, the remaining electricity volumes have to be purchased on the wholesale market. “The customer assumes the structuring risk from the supplier,” explains Michael Claußner of the consulting firm Energy Brainpool. If the customer does not want to pay a service provider, they need their own procurement department – another reason why the complex contracts have so far been the domain of energy-intensive large companies.

Many industrial companies also still do not want to commit for long and possibly miss out on falling prices. “Typical terms for PPAs are up to five years, in individual cases even ten,” says Wolf Stötzel of the German Wind Energy Association (BWE), representing green power producers and marketers.

At the heart of the EU reform for this is a risk that is relatively easy to address: the potential default of electricity purchasers. Some energy-intensive companies would not be rated by rating agencies. As a result, banks lack the decision-making basis for financing new green power plants through direct contracts, according to the commission. With the reform, member states should ensure that the financial market provides hedging instruments – supported by government guarantees if needed.

However, Stötzel objects that precisely such financial hedges already exist in Germany on the EEX power exchange. The contracting parties could register their PPA with the exchange, which would assume the default risk for a fee. Nevertheless, the chambers of commerce and industry are convinced that state guarantees for small and medium-sized enterprises can turn things around. “In Norway, there are already guarantees for PPAs, which has boosted the market,” says DIHK energy officer Josephine Möslein.

The Federal Ministry for Economic Affairs is already examining ways to improve the financing of PPAs, for example, via KfW and default guarantees, writes the BMWK in its key points for a wind energy onshore strategy. For wind farms in particular, there are currently hardly any PPAs, says Tibor Fischer, head of renewable energies at the German Energy Agency (Dena). In the case of wind power, it is clear that it is not just a matter of giving small and medium-sized companies easier access to green power projects. The supply is simply too small.

There are still too few new, approved areas for wind farms. As a result, public tenders have been signed and government premiums are even more attractive for operators. “The PPA market in Germany currently consists mainly of segments for which there are no longer any subsidies,” says Fischer. He says these include wind farms, for which the 20-year subsidy period has expired, and especially large solar plants over 20 megawatts in capacity. They are already excluded from subsidized tenders in the Renewable Energy Sources Act (EEG).

But even if the political expansion targets are achieved in the next few years, PPAs are unlikely to be a panacea for high electricity costs. Levies and surcharges still account for up to one-third of the electricity price for industrial customers and about half for commercial customers, even considering the recent relief provided by the elimination of the EEG surcharge.

“Medium-sized companies would benefit above all from reduced network charges, which would be subsidized by the German government,” says Möslein. In the DIHK’s view, another “big step” for SMEs would be higher de minimis limits for so-called on-site PPAs. In this case, the renewable energy system is located on the customer’s premises and operated by a service provider. In this way, the company saves on all surcharges. However, according to Möslein, it becomes an electricity supplier as soon as it feeds surplus electricity into the grid to supply its neighbors and must meet the full regulatory requirements.

In order to help PPAs achieve a breakthrough, contracts would also have to be highly standardized, says management consultant Claußner: “A medium-sized company can’t spend 24 hours on energy procurement.” Another advantage of standardization: Contracts would become more comparable and prices would possibly fall. The rapporteur in the European Parliament, Nicolás González Casares (S&D), has already announced that the Commission’s legislative proposal will be tightened up with a view to greater transparency.

In the long term, Dena expert Fischer is convinced that the market for small and medium-sized enterprises will develop in two directions: “If there is sufficient supply, SMEs can form pools and thus spread risks and share transaction costs because PPAs will remain more complex than normal supply contracts.” Such pooling is already widespread in the USA and Australia.

The second, currently more widespread option: “Companies can also purchase green power from energy suppliers that conclude PPAs. In this case, the companies only obtain green power indirectly, but from additional plants, and they have less effort because the supplier takes over the structuring,” explains Fischer.

This additionality is, according to the Dena expert, the second crucial reason, alongside the pricing issue, why more companies could opt for PPAs in the future. Own green commitments and sustainability standards are motivating suppliers and corporations to green their production through green energy. “Compared to other measures, it is still fast and uncomplicated,” says Claußner as well. However, the vast majority of the green energy certificates used for this purpose come from decades-old Norwegian hydropower plants.

“PPAs for new plants have a different value,” Fischer is convinced. The wind industry, on the other hand, is still sobered by the experience with special certificates for regional electricity from Germany. “Demand from industry and end consumers has been very restrained so far,” says Stötzel.

But Fischer currently sees growing interest in high-quality green power across Europe: “The Epex Spot power exchange got back into trading guarantees of origin last fall, and you can already see there that certificates from unsubsidized plants and certain countries are fetching higher prices.”

Especially since the cheap alternative from imported certificates is not assured. “Last summer, the Norwegian parliament had already made a push to use guarantees of origin to decarbonize its own industry,” Fischer recounts. “Since more than 90 percent of the guarantees of origin traded in this country come from Norway, many companies in Germany would then have had no more proof of green electricity.”

April 24-25, 2023

Meeting of the Committee on Economic and Monetary Affairs (ECON)

Topics: Draft report on financial activities of the European Investment Bank, annual report 2022 on the Banking Union, annual report 2022 on competition policy. Draft Agenda

April 24-25, 2023

Meeting of the Committee on Transport and Tourism (TRAN)

Topics: Public hearing on Future challenges for the rail infrastructure (single European Track Access charges and investments needed towards decarbonisation), Structured Dialogue with Commissioner Breton on the Implementation of the EU Tourism Agenda 2030 and update on new developments for the tourism sector, Structured Dialogue with Commissioner Vălean on the latest and upcoming transport-related proposals. Draft Agenda

April 24-25, 2023

Meeting of the Committee on Industry, Research and Energy (ITRE)

Topics: Public hearing on the reform of the electricity market, Draft report on laying down measures for a high level of public sector interoperability across the Union (Interoperable Europe Act), Draft report on the horizontal cybersecurity requirements for products with digital elements. Draft Agenda

April 24-25, 2023

Meeting of the Committee on Internal Market and Consumer Protection (IMCO)

Topics: Draft opinion on the European Health Data Space, Draft opinion on the horizontal cybersecurity requirements for products with digital elements, Draft report on establishing a Single Market emergency instrument. Draft Agenda

April 24-25, 2023

Meeting of the Committee on Human Rights (DROI)

Topics: Draft opinion on prohibiting products made with forced labour on the Union market, Exchange of views on EU instruments for tackling corruption globally. Draft Agenda

April 24-25, 2023

Meeting of the Committee on Agriculture and Rural Development (AGRI)

Topics: Draft opinion on packaging and packaging waste, Draft report on ensuring food security and long term resilience of the EU agriculture, Draft report on generational renewal in the EU farms of the future. Draft Agenda

April 24, 2023; 10 a.m.

Council of the EU: Foreign Affairs

Topics: Exchange of views on the Russian aggression against Ukraine, Exchange of views on the Implementation of the EU action plan on the geopolitical consequences of the Russian aggression against Ukraine (engagement with third countries). Draft Agenda

April 24, 2023; 5 p.m.

EU-Uzbekistan Cooperation Council

Topics: Exchange of views on general and political matters (including internal and constitutional reforms, justice and home affairs, human rights and rule of law issues), Discussion of trade, economic and investment issues, Consideration of regional and international issues. Infos

April 25, 2023

Trilogue: RefuelEU Aviation

Topics: Im womöglich letzten Trilog wird es zum einen um die Höhe der Quoten für nachhaltige Flugkraftstoffe (Sustainable Aviation Fuels, SAF) gehen. Das Parlament will eine steil ansteigende SAF-Quote mit 85 Prozent in 2050. Kommission und Rat sehen ab diesem Datum nur 63 Prozent vor. Der zweite Knackpunkt der Verhandlungen ist die Definition von SAF und die Frage, ob auch mit Kernenergie hergestellte Kraftstoffe dazu zählen, wie von Frankreich gefordert und von Deutschland mittlerweile teilweise unterstützt. Offen ist, wie sich das EU-Parlament in dieser Sache positioniert.

April 25, 2023; 9-11:30 a.m.

Joint Meeting of the Committee on Environment, Public Health and Food Safety (ENVI) and of the Committee on Agriculture and Rural Development (AGRI)

Topics: Public hearing on “Sustainable management of water resources in agriculture”. Draft Agenda

April 25, 2023; 10 a.m.

Council of the EU: Agriculture and Fisheries

Topics: Policy debate on the Regulation on the certification of carbon removals (agricultural and forestry aspects), Exchange of views on CAP Strategic Plans (state of play), Approval of the conclusions on the opportunities of the bioeconomy in the light of current challenges with special emphasis on rural areas. Draft Agenda

April 25, 2023; 2.30-3 p.m.

Joint Meeting of the Committee on Security and Defence (SEDE), of the Committee on Foreign Affairs (AFET), and of the Committee on Industry, Research and Energy (ITRE)

Topics: Draft report on establishing the European defence industry reinforcement through common procurement act. Draft Agenda

April 26-27, 2023

Meeting of the Committee on Foreign Affairs (AFET)

Topics: 2022 Commission Report on Serbia, 2022 Commission Report on Kosovo, Draft report on EU-Switzerland relations. Draft Agenda

April 26-27, 2023

Meeting of the Committee on International Trade (INTA)

Topics: Draft opinion on Uzbekistan, Public hearing on reinforcing EU-Latin America Trade Relations, Exchange of views on the state of play of the modernization process of the Energy Charter Treaty and of the corresponding EU position. Draft Agenda

April 26-27, 2023

Meeting of the Committtee on Employment and Social Affairs (EMPL)

Topics: Draft motion for a resolution on the roadmap on a Social Europe (two years after Porto), Draft opinion on prohibiting products made with forced labour on the Union market. Draft Agenda

April 26-27, 2023

Meeting of the Committee on Budgets (BUDG)

Topics: Public Hearing on ‘Financial impact of the war in Ukraine: current and future challenges for the EU Budget’, Draft report on the impact on the 2024 EU budget of increasing European Union Recovery Instrument borrowing costs, Draft opinion on the definition of criminal offences and penalties for the violation of Union restrictive measures. Draft Agenda

April 26-27, 2023

Meeting of the Committee on Culture and Education (CULT)

Topics: Draft report on establishing a common framework for media services in the internal market (European Media Freedom Act), Draft opinion on EU-Switzerland relations. Draft Agenda

April 26-27, 2023

Meeting of the Committee on Environment, Public Health and Food Safety (ENVI)

Topics: Report back on ongoing interinstitutional negotiations, Hearing of the candidate for the function of the Executive Director of the European Environment Agency, Draft report on urban wastewater treatment. Draft Agenda

April 26, 2023

Weekly Commission Meeting

Topics: Patent package (Compulsory licensing of patents, Standard essential patents, Revision of the legislation on supplementary protection certificates), Customs reform, Pharmaceutical package (Revision of the pharmaceutical legislation, Revision of the EU legislation on medicines for children and rare diseases, Council Recommendation on stepping up EU actions to combat antimicrobial resistance in a one health approach). Draft Agenda

April 26, 2023; 9 a.m.-6.30 p.m.

Meeting of the Committee on Development (DEVE)

Topics: Critical Raw Materials – the DEVE perspective, Structured Dialogue on the Commission Work Programme. Draft Agenda

April 26, 2023; 9 a.m.-12:30 p.m.

Meeting of the Special Committee on foreign interference and disinformation, and on strengthening integrity in the EP (ING2)

Topics: Draft report on foreign interference in all democratic processes in the European Union (including disinformation), Exchange of views on “Doppelganger – Media Clones Serving Russian Propaganda” with Alexandre Alaphilippe (Executive Director, EU DisinfoLab). Draft Agenda

April 26, 2023; 11.30 a.m.-12.30 p.m.

Joint Meeting of the Committee on Foreign Affairs (AFET) and of the Committee on International Trade (INTA)

Topics: Implementation report on the EU-UK Trade and Cooperation Agreement. Draft Agenda

April 26, 2023; 2.30-3.30 p.m.

Joint Meeting of the Committee on Internal Market and Consumer Protection (IMCO) and of the Committee on Legal Affairs (JURI)

Topics: Draft report on the liability for defective products. Draft Agenda

April 26, 2023; 2.30-3.15 p.m.

Joint Meeting of the Committee on Environment, Public Health and Food Safety (ENVI) and of the Committee on Industry, Research and Energy (ITRE)

Topics: Draft report on Methane emissions reduction in the energy sector. Draft Agenda

April 26, 2023; 5.30-6.30 p.m.

Joint Meeting of the Committee on International Trade (INTA) and of the Committee on Internal Market and Consumer Protection (IMCO)

Topics: Proposal for a Regulation on prohibiting products made with forced labour on the Union market. Draft Agenda

April 27, 2023; 10.30-10.45 a.m.

Joint Meeting of the Committee on Environment, Public Health and Food Safety (ENVI) and of the Committee on Agriculture and Rural Development (AGRI)

Topics: Draft report on specific rules relating to the entry into Northern Ireland from other parts of the United Kingdom of certain consignments of retail goods, plants for planting, seed potatoes, machinery and certain vehicles operated for agricultural or forestry purposes, as well as non-commercial movements of certain pet animals into Northern Ireland. Draft Agenda

April 28-29, 2023

Informal meeting of EU economy and finance ministers

Topics: Exchange of views on financing future growth in Europe, Exchange of views on a long-term perspective on stabilisation policies and sustainable public finances, Discussion on Ukraine reconstruction and coordination of support. Draft Agenda

April 28, 2023; 9 a.m.

Eurogroup

Topics: Stocktaking on the Banking Union and banking sector developments, Debrief from the March Euro summit, International Meetings: debrief on IMF spring meetings and preparation for the May G7 meeting. Draft Agenda

Rapporteurs for the AI Act have set new negotiation dates for several technical and political meetings over the next two weeks. Representatives of various political groups believe it is realistic that the planned vote in the lead committees IMCO and LIBE can actually take place on May 11 as now planned.

Many things are close to an agreement but not yet completely closed, according to negotiating circles. By May 11, however, this could well be achieved in a few rounds of negotiations.

Outstanding discussion items include Annex III (List of High-Risk AI Systems), Article 5 (Prohibited Practices), General Purpose AI (GPAI) and the Fundamental Rights Assessment. The following negotiation dates are scheduled:

Technical meetings:

Shadows meetings:

The vote in the plenary of the EU Parliament is scheduled for June 12, so that the start of the trilogue can still take place under the Swedish Council Presidency. vis

Germany is lagging behind: Soon, three and a half years after the adoption of an EU directive on whistleblower protection, the Federal Republic still has not implemented it and must therefore pay a daily fine of €50,000. The traffic light coalition is now sharply criticizing the Union. The Union is doubly responsible for the delay, Stephan Thomae, parliamentary managing director of the FDP parliamentary group, said to Table.Media, “The Union must take responsibility for this.”

According to Thomae, the previous government failed to create a law, and now, through its opposition in the Bundesrat, it is also responsible for Germany having to pay penalties. “The traffic lights worked flat out to present a good law that would have solved the problem inherited from the CDU/CSU,” Thomae complains. “I cannot understand this blockade.” The proposal of the governing coalition protects whistleblowers and keeps the burden on companies and authorities as low as possible.

Most companies themselves have “a veritable interest” in the law, says Thomae. They also want whistleblowers to report and correct wrongdoing within their own company. That’s why it’s important to “put the protection of whistleblowers on a legally secure footing. It is important not to overburden companies bureaucratically and financially.

Among other things, the traffic light coalition is aiming for companies with 50 to 249 employees to introduce a uniform internal reporting channel. steb

The European Parliament has positioned itself in favor of negotiations on a comprehensive reform of asylum and migration policy. MEPs voted on Thursday in Strasbourg in favor of starting talks with EU states.

Among other things, parliament advocated the registration of illegal entrants at EU borders. In addition, there must be an independent mechanism to monitor fundamental rights. This should prevent illegal “pushbacks”, i.e., pushing refugees back without checking their entitlement to asylum. In addition, EU countries should show more solidarity with each other in migration policy.

As the mandates previously adopted by the Interior Committee had been contested by members of parliament, an additional vote in plenary became necessary. The aim is to conclude negotiations with the EU countries by the end of the year. Then the laws could be passed before the European elections in spring 2024.

However, the EU states have not yet taken a position on crucial issues. There has been a dispute over migration policy since the large-scale flight movement in 2015/2016. At its core was the question of whether protection seekers should be distributed among all member states. Countries like Poland and Hungary vehemently reject a binding quota. That is why the EU Commission presented new reform proposals in 2020. dpa

The EU Commission simplifies requirements for mergers of companies. The new rules are intended to reduce the effort and cost of preparing merger notifications for companies and consultants, the EU Commission announced on Thursday. In the future, for example, less information will have to be provided to authorities for certain mergers, according to the announcement.

“The package adopted today serves the Commission’s goal of reducing reporting obligations by 25 percent,” it said. This will also help the Commission by allowing it to focus its resources on the most complicated cases, said Competition Commissioner Margrethe Vestager. The new rules will apply from Sep. 1. dpa

A noun that first appeared in France around 1830 has resurfaced in recent days: Casserolade. The word refers to a form of protest which consists of a group of people making noise by banging pots, lids, pans and other noisy utensils. Protesters sometimes take a decidedly creative approach to their protest, and the same goes for the accompanying memes.

Last Monday, for example, more than 350 noisy concerts began at 8 p.m., scattered throughout France, as French President Emmanuel Macron gave a televised speech. “Macron doesn’t listen to us, we don’t listen to him either,” the protesters shouted. The response wasn’t long in coming: “It’s not cooking pots that will move France forward,” the French president said last Wednesday during a factory visit in Alsace. The traditional pot manufacturer Cristel, however, saw things differently.

Meanwhile, all of France is laughing at the ban on cooking pots, also known as “portable sound devices” in official parlance, issued yesterday in Ganges (southern France). The reason for the ban was Emmanuel Macron’s visit to a school in Ganges.

The result is a veritable dialogue of deaf ears between the French executive and civil society, with each insisting on its positions. This status quo and its explosive potential did not escape the notice of EU parliamentarians who gathered in Strasbourg this week for a plenary session and exchanged views on the French constitutional framework in the corridors. Almost invariably, one question emerged: How could a law as important as the one on pension reform be passed without parliamentary approval?

“It is crucial to understand that it is not necessarily constitutional jurisdiction that is being questioned, but the conditions under which it is exercised in France,” writes Lauréline Fontaine, a professor of public law, in a guest editorial in the daily Le Monde.

The French constitutional system is heavily focused on the executive branch, and in particular on the president of the republic, write Laurent Pech, professor of European law at Middlesex University in London, and Sébastien Platon, professor of public law at the University of Bordeaux, in a study commissioned by the European Green Party. The current French constitution also allows executive interference in the legislative sphere in some cases, the two researchers further point out.

However, the ongoing protests since January show that the French are less and less willing to accept this vertical power. This is all the more true because the exercise of this power is taking place in a context in which the functioning of the health, education and justice systems has deteriorated. And galloping inflation is only adding fuel to the fire of already fierce political protests.

What about the structural counterforces? It is well known that the countervailing forces offered by a federal administrative and political structure in a country like Germany do not exist in France. This lends particular weight to the action of civil society as a counterforce.

“Is this country really exemplary in terms of the rule of law? It must be noted that civil liberties have been weakened over the last decade,” writes Thomas Perroud, professor of public law at Panthéon-Assas University, in the study mentioned above. Indeed, to respond to the terrorist attacks and later to the health crisis, successive governments introduced prolonged states of emergency that were then normalized in the current legal framework, he explains.

The French constitutional framework thus allows for a solitary exercise of power, which France’s traditional partners felt during his trip to China. Macron’s statements on China and Taiwan caused all the more confusion because they seemed to ignore all the talks and meetings held with them in advance.

A year after his re-election, Macron seems quite isolated, with a badly damaged image, even abroad. And the French head of state will begin the second year of his second term next Monday, burdened by an unpopularity that could make him dangerous. A year after his re-election, he must try to regain control of this strange five-year term that seems to be slipping away from him.

Because there are real questions and concerns about the future of France. The far right has arrived at the center of power in Italy, Sweden and Finland, and is knocking on the door in Belgium and Spain. The fact is that there is more at stake in France than the reform of the pension system. The country is in a social, political and democratic crisis. The fact that Marine Le Pen’s Rassemblement National party is the big winner of Macron’s crisis is hardly disputed in France at the moment.