“We are in a community of common destiny in Europe“: That is what Vice-Chancellor Robert Habeck said yesterday in Vienna, where Austria and Germany signed a joint declaration on securing energy supplies. Hans-Peter Siebenhaar and Manuel Berkel analyzed what the declaration means – and where there is still room for improvement in Europe’s energy security.

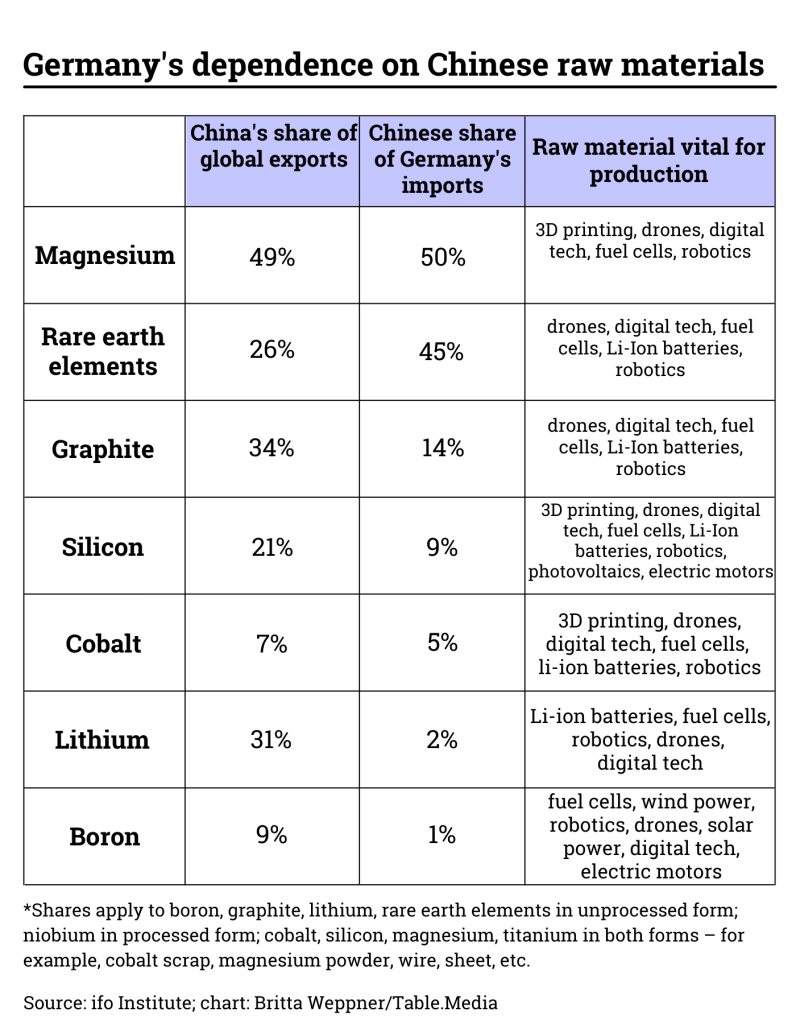

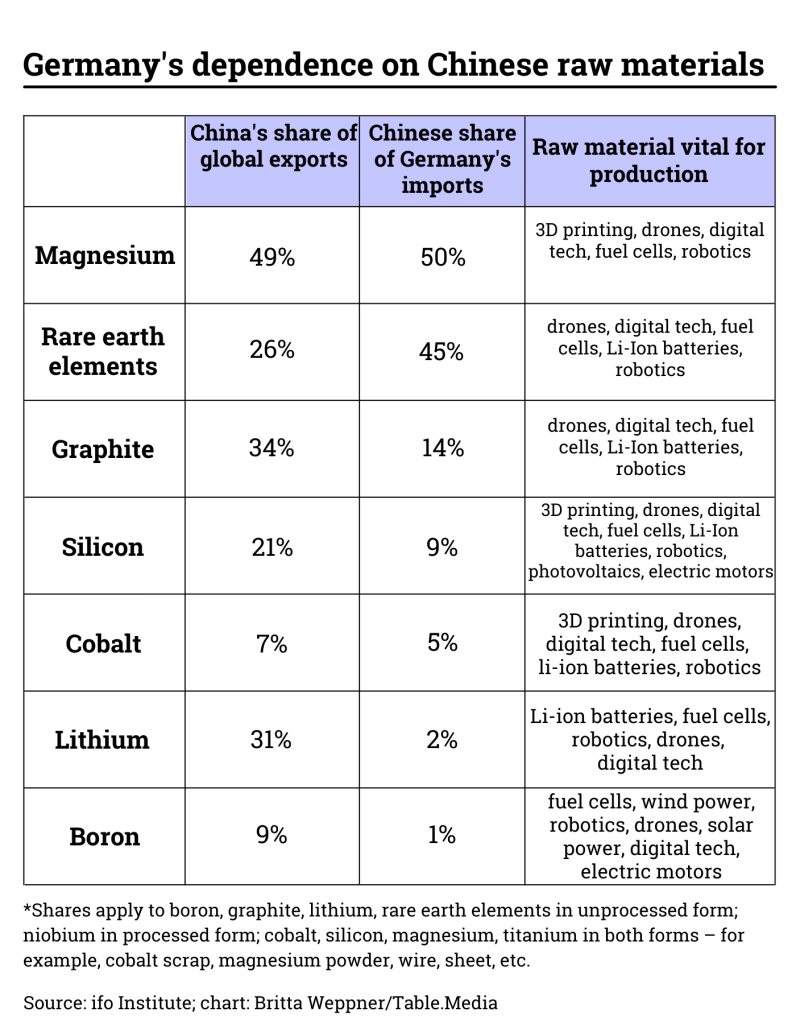

Germany is also dependent when it comes to raw materials – appeals to the industry not to import the majority of their raw materials solely from China had little effect so far. But it is not only the direct dependence on raw material imports that is critical. Every price fluctuation within China affects the German market, as Nico Beckert reports.

The German NGO Welthungerhilfe has raised the alarm: 828 million people are chronically malnourished. The war in Ukraine acts like an accelerant, said Welthungerhilfe President Marlehn Thieme yesterday. Read more in the News section.

Rising energy prices, rising inflation – is this a repeat of the 1970s? No, says Daniel Gros, a member of the board and distinguished fellow at the Centre for European Policy Studies, and explains the key differences in today’s Opinion.

Germany and Austria are closing ranks to liberate themselves from their dependence on Russian gas. German Minister of Economic Affairs, Robert Habeck (Greens), and Austrian Minister of Energy, Leonore Gewessler (Greens), signed a joint declaration on securing gas supplies in Vienna on Tuesday.

Habeck had already signed a similar declaration on Monday during his visit to the Czech Republic. The goal is to help each other in the event of a halt of Russian gas supplies. “We are in a community of common destiny in Europe,” the German Vice-Chancellor said in Vienna on Tuesday. “No country alone is strong enough to stand alone.”

Austria and Germany already signed a solidarity agreement in December 2021. “This also includes the securing of transit rights in the event of a gas shortage situation, provided there are no technical or safety reasons to the contrary,” as yesterday’s statement once again emphasized. A new agreement was reached on deeper cooperation on the use of LNG terminals and on refilling Austria’s natural gas storage facilities 7 Fields and Haidach, which are both directly connected to the German grid.

“We will only have safety again when we have made ourselves independent of Russian energy supplies,” Gewessler said. “This conviction unites us.” Europe cannot allow itself to be divided in this crisis.

The solidarity agreement between Austria and Germany is still a rare exception in the EU. Yesterday, both countries called on member states to finalize all outstanding agreements “as soon as possible and, if possible, before October”.

Habeck also made it clear for the first time that private households “also have to do their part” when it comes to saving gas. Until now, households belonged to the protected customers according to the emergency regulation, which, in contrast to the vast majority of companies, are not supposed to accept any restrictions in the event of a shortage. But Habeck did not say what exactly this part would be. In any case, he said, this issue “may have to be revisited”.

The Minister also said that there was a need for improvement regarding solidarity requests from EU member states: “If a country scales back its industrial activity in order to provide warm homes for another country, there must also be a solidarity mechanism of compensation to some extent. And that, too, has not yet been addressed. If there is an answer to both of those questions, it would be great.”

The already concluded bilateral agreement between Austria and Germany for transit rights in the event of a Russian gas embargo is particularly important for the alpine republic. This is because Tyrol and Vorarlberg can only be supplied via the German gas network. A bilateral agreement on the replenishment of gas storage facilities is also to be signed, the Austrian Minister of Energy stressed: “Security of supply is the top priority”.

For this reason, the Haidach mega gas storage facility in Salzburg is also to be connected to the Austrian network as soon as possible. This is because the gas storage facility, which can store more gas than the five storage facilities in Bavaria, has so far only been connected to the German gas network. The government in Vienna recently decided that the gas storage facility must also be connected to the Austrian network. The necessary work is to be completed before the end of this year.

The German gas storage facility in Haidach, Austria, is a curiosity. A decade and a half ago, Gazprom Germania constructed the second-largest natural gas storage facility in Western Europe jointly with Wintershall subsidiary Wingas (owned by Gazprom since 2015) and Austria’s RAG. In 2011, its capacities were more than doubled. The ownership structure is complicated.

The surface sections are two-thirds owned by Gazprom and its subsidiaries Wingas (33 percent), Gazprom Germania (22 percent) and Centrex Europe Energy & Gas AG (11 percent) in Austria and Germany, and one-third by RAG. The underground section, in turn, belongs to the Republic of Austria. Marketing and filling are in the hands of Gazprom subsidiaries. Gazprom Germania and Astra, which market the gas in Haidach, have been under state supervision by the Federal Network Agency since the beginning of April. It manages the energy companies as a fiduciary.

Austria is even more dependent on Russian gas supplies than Germany. The alpine republic obtained over 80 percent of its gas from Russia. Austria already expressed its displeasure at Gazprom’s supply difficulties in mid-May. At that time, the government decided that unused storage capacities would have to be returned if they were not used by the operator.

Vienna-based energy regulator E-Control may award Gazprom’s unused storage capacity to a competitor, such as RAG, OMV and troubled Uniper. Recently, Gazprom failed to fill Western Europe’s second-largest gas storage facility in Haidach, close to Salzburg. According to AGSI, the fill level of Gazprom’s GSA storage facility has been 0.0 for a long time. Under a gas storage law, Germany has committed itself to ensure that gas storage facilities are at 90 percent capacity by November 1. Austria is content with 80 percent.

Meanwhile, the risk that Gazprom will impose a full and permanent embargo on Austria and Germany is high. According to information from OMV on Tuesday, 70 percent less gas is currently being delivered than ordered. Since mid-June, Gazprom has already delivered only half of the gas ordered.

While the German gas storage facilities are already at 64 percent capacity, according to the AGSI, Austria has only 48 percent of its maximum capacity. The Austrian government is already taking the necessary steps. Large consumers are to switch to other fossil fuels – especially oil. Private households are to do their utmost to save energy next winter. In five years, Austria wants to be completely independent of Russian gas. With Manuel Berkel

For decades, it was unthinkable that Russia would eventually stop supplying gas to Germany. Now Vladimir Putin has cut gas supplies. German ministries are developing emergency plans for the winter. Not only private households are affected, but also the industry, which will almost certainly have to curb production.

This also draws attention to other dependencies: China is the largest supplier of important raw materials such as rare earth elements and magnesium. For other raw materials, the People’s Republic is among the top 5 exporters worldwide. There is now growing concern among managers, economists, and politicians about the consequences of a conflict with China, which would hit Germany hard economically in several respects.

Half of Germany’s magnesium imports and 45 percent of its imports of rare earth elements come from the People’s Republic, according to a new study by the Ifo Institute. The metals are used in important future technologies such as fuel cells, electric motors, wind turbines, digital technology, and robots.

There are already concrete warning signs. At the end of last year, China curbed magnesium production due to the power crisis. The European industry, which is dependent on magnesium from the People’s Republic for aluminum production, suffered as a result. The problem was quickly resolved but shows the dependencies very clearly.

In the meantime, China temporarily had a quasi-monopoly on rare earth elements. In 2011, the country accounted for 97 percent of global production. Since then, China’s share of global production has fallen but is still around 58 percent. Since the People’s Republic consumes a lot, the export share is lower and amounts to 26 percent. There were already warning signs for rare earths as well. At the end of 2010, China restricted exports to Japan for several weeks due to diplomatic disagreements.

According to Ifo researchers, rare earth elements and magnesium are among the “raw materials with critical dependencies”. They are important for many key technologies and are only mined and exported on a large scale by few countries.

Germany’s dependence on China is less pronounced for seven other critical raw materials. Only in the case of graphite does the share of imports from China exceed 10 percent. Nevertheless, the rest of the world as a whole is even more dependent on China than Germany. This is reflected in the data. Globally, the share of imports from China is usually higher than the German figure. “German imports are more diversified than the average global trade,” says Lisandra Flach, one of the authors of the Ifo study.

But that only applies to direct dependencies. China is the world’s largest producer and consumer of raw materials. “Any change in China that is relevant to raw materials, for example, cyclical fluctuations in demand, affects the global raw materials markets and price developments,” says Yun Schueler-Zhou, China expert at the German Mineral Ressources Agency (DERA). Because Germany is dependent on raw material imports, price fluctuations have a major impact on the German industry. “This indirect dependence on China is much more far-reaching than the direct supply dependence,” Schueler-Zhou says.

In addition, there are dependencies due to branched supply chains. “The dependency along the value chain can be even greater than shown in our study,” says Flach. When other EU countries import raw materials from China, process them, and then export them to Germany in intermediate goods, there is an indirect dependence on China, she said. This is particularly striking in the case of rare earth elements. EU countries import 98 percent of their demand from China.

China is often not the only country that has certain raw material deposits. But due to price advantages, producers from other countries have sometimes been forced out of the market. The best example of this is rare earth elements. Contrary to what the name suggests, these 17 metals are not rare in the earth’s crust. But: “China is dominant in the mining of rare earths because environmental and health standards are low,” says Michael Reckordt, raw materials expert at the NGO PowerShift.

This is a competitive advantage that can depress prices. Mines in the USA have had to close for this reason. Companies are often simply not willing to pay a higher price for raw materials. This shows a parallel to Russian gas: Instead of looking to other suppliers and LNG at an early stage, German companies have become dependent on Russia. As long as the supply was plentiful and cheap, the problems with this strategy were not noticeable.

Although there have been regular complaints about dependencies on raw materials from China for years, they remain disturbingly high. In the case of rare earths, according to the Info-Institute, the share was

It is unclear whether the recent decline represents a trend reversal, as China’s COVID policy has also affected the mining sector. For magnesium, there has actually been a slight increase in China’s import share over the past few years, from 40 percent in 2017 to 51 percent in 2021. For other metals, imports have actually increased dramatically. These include chromium, bismuth, zirconium, indium, and many iron and steel products, according to Schueler-Zhou of DERA.

It is difficult to assess whether enough has been done to reduce dependencies. “The efforts usually happen at the plant or company level,” says raw materials expert Reckordt. In addition, Malaysia and Myanmar are also not ideal suppliers of rare earth elements. “Thus, the list of alternatives is very quickly reduced to the US,” Reckordt says.

According to experts, dependence on China also comes with political risks. “Trade relations with China could be interrupted in the course of foreign policy conflicts,” says Schueler-Zhou. Strategic raw materials such as rare earth elements are now far more politically relevant than normal economic goods, she says. “Their importance for the energy transition in China and Western countries has increased. This increases competition and the potential for conflict,” Schueler-Zhou says.

As an export-oriented industrialized country, Germany remains dependent on imports of raw materials from other countries, especially from China. Reducing dependencies – as in the case of Russian gas dependency – will be accompanied by higher costs. In other regions of the world, higher environmental and social standards apply. However, if the German industry is serious about reducing the risks of excessive dependency, it will have to accept higher prices.

After a break of about two years, a trade dialogue between the EU and China will take place next week. Commissioner for Trade and EU Executive Vice-President Valdis Dombrovskis will meet with China’s Vice Premier Liu He in a video conference on July 19, the EU Directorate-General for Trade confirmed. Commissioner for Financial Services Mairead McGuinness and representatives of several EU Directorates-General and Chinese ministries will also participate.

According to the Trade Directorate, the agenda includes topics such as the global energy and food crises. Supply chains and “bilateral trade and investment relations” will be discussed. There is a whole range of unresolved issues between the EU and the People’s Republic:

The last trade dialogue took place in July 2020. The EU-China summit in April this year was a failure: Brussels wanted to talk about China’s role in the war against Ukraine, and Beijing about trade.

Last week, EU Climate Commissioner Frans Timmermans and Vice Premier Han Zheng already met for an online summit. “There are many opportunities for the EU and China to work more closely together“, Timmermans tweeted after the meeting. For example, on clean energy and hydrogen, and carbon markets. The latter is particularly interesting given the EU’s planned carbon border adjustment. Negotiations on this are currently underway between the European Parliament, the Commission, and the EU Council. ari

The company behind the Nord Stream 2 Baltic gas pipeline, which has not been put into operation, has scored a victory at the European Court of Justice. On Tuesday, the ECJ overturned a 2020 ruling by the European Union’s lower court that Nord Stream 2 AG was not allowed to challenge EU rules requiring the unbundling of production and distribution. The decision was not valid, the court said.

The ECJ referred the case back to the court. However, there are no immediate consequences for the operation of the pipeline in the near future, as the approval procedure is still suspended due to the Russian invasion of Ukraine.

“For the time being, the decision has no relevance for the Federal Network Agency,” said the Bonn-based authority responsible for regulation. It said the ECJ had referred the case back to the European General Court, which now has to deal with Nord Stream 2’s arguments on the matter. “How these proceedings will turn out is currently completely open.”

The Federal Network Agency rejected the application for exemption from regulation of Nord Stream 2 on May 15, 2020. This rejection was confirmed by the Düsseldorf Higher Regional Court. The proceedings are still pending before the German Federal Court of Justice (BGH). “The Federal Network Agency does not currently see any direct impact on these proceedings.”

Nord Stream 2, like Nord Stream 1, which has been in operation for over ten years, is controlled by Russia’s Gazprom Group. Nord Stream 1 is currently undergoing maintenance. The work is scheduled to be completed on July 21. The German government does not rule out the risk that Russia could delay the maintenance work or suspend operations altogether due to political tensions with Germany. rtr

The German NGO Welthungerhilfe (World Hunger Aid) fears a rising number of people affected by hunger worldwide due to skyrocketing food prices and due to the war in Ukraine. In light of growing world hunger, also fueled by climate change and increasing droughts, “the Russian war of aggression on Ukraine acts as a further accelerant,” warned Welthungerhilfe President Marlehn Thieme on Tuesday.

According to the latest figures from the United Nations (UN), 828 million people worldwide are already chronically malnourished. This means that they have not had enough food for at least a year. The figures recently provided by the UN’s Food and Agriculture Organization (FAO) represent “a real wake-up call to the entire world,” Thieme said.

The fights in Ukraine, which is considered one of the breadbaskets of the world, now intensify the situation. The harvest season has begun in Ukraine. But according to Thieme, it is already becoming apparent that only two-thirds of the land can be harvested: “That will certainly represent a major decline.”

According to initial estimates, this could ultimately lead to an additional 50 million affected by hunger around the world. However, this figure should be taken with great caution, “because we don’t yet know how the markets will react.” It is unclear, for example, whether China and Brazil will export grain and food in needed quantities.

It also remains to be seen how the harvests in Central Europe will turn out. However, it is feared that they might turn out to be slightly lower. Added to this are droughts and climate change: “These are influencing factors that cannot be disregarded,” said the Welthungerhilfe President. Exports of wheat and other grains from Ukraine have declined as a result of the war. Before the Russian invasion on February 24, the two countries combined accounted for nearly one-third of global wheat exports. Since then, exports have faltered via Ukraine’s Black Sea ports, where Russian warships patrol offshore. rtr

Slovenian Prime Minister Richard Golob has suggested dividing the EU accession process with the six Western Balkan countries. The problem today would be that the accession candidates have to take a huge step of reforms before they could become EU members, Golob said in a Reuters TV interview on Tuesday.

“If we can just cut it into small steps and let each country see that there is something for it then it’s very easy to convince other countries that they do those same steps,” said Golob. As an example, Golob cited energy projects with North Macedonia, one of the Western Balkan countries. As soon as a candidate country has adopted the European aquis, for example in energy, joint energy projects could be launched even before accession. He criticized the EU for withholding visa liberalization from Kosovo, even though the country has met all the conditions. “Kosovo is a special problem. We simply have to act,” he said. rtr

The definite exchange rate for the adoption of the euro in Croatia has been set. The exchange rate was set at 7.5345 kuna per euro at the meeting of European ministers of finance on Tuesday, according to an EU Council statement. The Balkan state plans to adopt the European single currency on January 1, 2023 – meaning it has just under half a year left for technical preparations. Currently, the euro area consists of 19 of 27 EU member states. Lithuania last adopted the euro as its official currency in 2015.

It was a reasonable political decision, the Czech EU presidency said. “Croatia has successfully completed all the required economic criteria.” Among the criteria reviewed ahead of Tuesday’s formal decision were price and exchange rate stability, solid fiscal management and long-term interest rates. The Czech Republic has not yet adopted the euro.

The European Central Bank stated that many Croatian financial institutions have already been supervised by the ECB since 2020. ECB President Christine Lagarde spoke of a reason for joy and congratulated Croatia. EU Commission Vice President Valdis Dombrovskis said a larger eurozone would also have more international influence. With the euro, it would become easier to invest in Croatia. More jobs in the country and a rising standard of living can be expected.

Ukraine has been granted an additional loan of €1 billion by the European Union. A corresponding proposal by the EU Commission was approved by the EU states on Tuesday. The money is to be used to cover running costs, for example, pension payments and the operation of hospitals.

The European Parliament has already approved the aid, which will be provided as a long-term loan on preferential terms. To further ease the burden on Ukraine, the interest will initially be covered by a loan from the EU budget. EU Commission President Ursula von der Leyen said the money should reach Ukraine this month.

The loan is the first part of a €9 billion aid package announced in May and scheduled to be implemented until the end of the year. The EU summit in May already agreed in principle to the nine-billion package. Since the start of the war, the EU has so far provided Ukraine with €2.2 billion in so-called macro-financial assistance. rtr/dpa

The EU has identified the three greatest risks to public health: Pandemics, nuclear threat, and antimicrobial resistance. This is to ensure that, in the event of an emergency, the EU is better prepared than it was, for example, at the beginning of the Covid crisis. These were life-threatening or otherwise seriously threatening health risks that could spread across borders to member states, the EU Commission announced. The next step will be to secure the development, procurement, production and storage of medical goods.

“This exercise is the first step in ensuring that medical countermeasures can be made available and accessible for all Member States swiftly when needed,” said Stella Kyriakides, Commissioner for Health and Food Safety. The list was compiled by The Commission’s Health Emergency Preparedness and Response Authority (HERA), in collaboration with other EU agencies and international partners and experts.

Specifically, three categories of serious cross-border health threats are now identified. In addition to pathogens with high pandemic potential, these include chemical, biological, radiological and nuclear threats – regardless of whether they are released unintentionally or intentionally, for example, due to political tensions. In addition, threats from antimicrobial resistance are listed. These pose one of the greatest risks to human health, the EU Commission said. dpa

A new EU law regulating tech giants could serve as a benchmark for global legislation to protect children online. Concerns about the impact of social media on young people are growing worldwide, say child rights activists.

The EU’s Digital Services Act (DSA) includes a ban on targeted advertising to children and prohibits the algorithmic promotion of content that could be harmful to minors, such as videos about eating disorders or self-harm.

By specifying steep fines for companies that fail to remove illegal content from their platforms, such as child sexual abuse images. The DSA effectively ends an era of voluntary self-regulation by companies, activists say.

“The importance of this legislation is (to say): No, it’s not optional, there are certain things you have to do,” said Daniela Ligiero, co-founder of Brave Movement, a survivor-led organization that works to end childhood sexual violence. “We believe that not only can it help protect children in Europe, but it can also serve as an example for the rest of the world,” she added.

While detailed regulations for child pornography have yet to be drafted by the European Union, the DSA provides for fines of up to 6 percent of global revenue for platforms that fail to remove illegal content.

Despite praise for the legislation from rights advocates, there are concerns about its enforcement. The European Commission has set up a task force that is said to include about 80 officials, which critics call insufficient.

Some have pointed to the poor enforcement of EU data protection rules for big tech companies, known as the General Data Protection Regulation (GDPR).

Four years after its introduction, the EU data protection commissioner lamented the stalled progress in lengthy cases and called for an EU supervisory authority instead of national authorities to handle cross-border data protection cases. rtr

The similarities are obvious. In 2022, like in the 1970s, an energy-price shock has led to a sustained increase in the prices of many other goods. The so-called core inflation rate, which strips out volatile energy and food prices, is now approaching 6 percent in the United States and 4 percent in the eurozone. And fears are mounting that, as in the 1970s, this trend will prove persistent.

But we are hardly living through a repeat of the 1970s. One key difference lies in labor markets. Back then, widespread wage indexation meant that higher energy and other prices led automatically to an equivalent increase in wages. Where wage indexation was less important, unions achieved the same outcome, as they refused to accept any deterioration in their members’ living standards.

This is not the case today, at least in the eurozone. According to the European Central Bank’s new wage tracker, eurozone wages have increased by only 3 percent so far – far less than the 8.6 percent inflation recorded in June. In other words, there is no sign of the wage-price spiral of the 1970s.

Another difference today is that European producers have been able to increase their prices enough to offset a significant portion of the energy-cost rise. Based on June 2022 prices, the eurozone’s energy import bill is set to increase by over 4 percent of GDP this year. Over the last year, surging energy prices have fueled a 24 percent increase in the European Union’s import prices, after more than a decade of stability.

But the prices charged by EU exporters also rose, by over 12 percent – and the EU exports more than it imports. European producers have thus been able to offset slightly more than half of the income loss from higher energy prices, keeping it to just under 2 percent of GDP. This is a hefty price to pay, but it is also a manageable one.

The challenge will be to distribute income losses across economic sectors. With real wages having fallen by about 5 percent, European workers have so far borne all the costs of inflation. Given that the wage share amounts to about 62 percent of GDP in the eurozone, a 5 percent fall in real wages would make available to other sectors about 3.1 percent of GDP, more than the income loss of 2 percent, allowing profits to increase. That is more than sufficient to offset the terms-of-trade losses suffered so far.

The situation is very different in the US. As the world’s biggest oil and natural-gas producer, it exports as much energy as it imports. America’s terms of trade thus have not suffered at all, with import and export prices increasing by the same amount. But wages have increased by over 6 percent, according to the Federal Reserve Bank of Atlanta’s wage tracker, meaning that the US is much closer to a wage-price spiral than Europe.

How reliable is Europe’s wage moderation? As it stands, the EU is experiencing more inflation in profits than in wages, despite the overall income loss. And falling real wages are particularly difficult to accept when profits are soaring. In fact, wage demands are already creeping up across the eurozone.

Germany’s influential IG Metall union, for example, is calling for an 8 percent wage hike for workers in the metal industry, which currently is enjoying high profits. To keep social peace, several countries, including Germany, have introduced double-digit increases in minimum wages.

Nonetheless, negotiated wage increases have so far remained modest, at around 4 percent, according to the ECB. Actual wages might climb further, as employers in sectors experiencing shortages decide that it is worth paying workers a premium. Still, there is little indication that wages are set to catch up with inflation any time soon.

The main reason for this is that governments all over Europe are delivering direct transfers to households, in order to offset higher energy costs. For example, Germany’s government has unveiled a relief package that includes a lump-sum payment for employees and a heating-cost subsidy for households on housing benefits.

The Spanish government, for its part, is subsidizing the cost of natural gas for power producers. This approach to holding down electricity prices is flawed, as it encourages gas use at a time when Russian President Vladimir Putin is threatening to cut supplies. But such schemes reflect a new social contract that is emerging in Europe: governments protect workers from the bulk of higher energy costs, in exchange for workers moderating their wage demands.

In the aftermath of the 2008 global financial crisis, a recurrent criticism of the eurozone framework was that the absence of a fiscal authority meant that the ECB was “the only game in town.” This time seems different. By stepping in to provide income support, governments are helping to prevent a 1970s-style wage-price spiral – and making the ECB’s job much easier.

In cooperation with Project Syndicate.

“The devil is in the details,” Pedro Oliveira quotes a phrase you hear frequently in Brussels. “I find it fulfilling to pierce through draft legislation to the point where I find these details.” The Portuguese works as Director for Legal Affairs at BusinessEurope. The employers’ association is a heavyweight among lobby groups in Brussels. It includes 40 member associations from various countries. Thus, BusinessEurope claims to represent the interests of 20 million companies.

“We try to translate the many different voices from business into one voice,” Oliveira describes his task. The many voices of the members are fascinating, but also a challenge: “We represent companies from small stores to huge factories, so it is sometimes difficult to agree on a common position. This is because – in true European fashion – it is developed as unanimously as possible. This works particularly well for issues that affect all members across all sectors.

At present, the jurist is dealing with the planned EU Supply Chain Act: “That is definitely one of the primary topics I’m spending a lot of time on right now.” He is taking a close look at the Commission’s draft in order to be able to exert influence in the further process. In his department, he is supported by three other lawyers and a secretary. In total, BusinessEurope employs around 1,200 experts. Oliveira emphasizes that he is a European through and through.

Born on May 9 – Europe Day – he studied law and banking law in Lisbon and European law in Brussels. This helps him to bring the many voices of Europe’s entrepreneurs to a common level: He speaks not only Portuguese and English, but also Dutch, Spanish and French. Before Oliveira joined BusinessEurope in 2009, he already spent several years working on European communication. At the College of Europe, he devoted himself to the “codification and consolidation of EU law” – on behalf of the Commission and together with colleagues who spoke all official languages of the EU.

“It was a little nerdy,” Oliveira admits. “Our job was to sift through legislation to look for inconsistencies and language errors.” That attention to detail, he says, suited him well. Their report then went to the EU Parliament and Council for improvements.

He has now been Director for Legal Affairs at BusinessEurope for four years. The 42-year-old says the highlight of his job is the thematic and human variety. There’s constant conversation, he says, “not only with our members from the business community, but also with various NGOs and consumers.” Admittedly, they don’t always agree. “But at least we are able to discuss with each other, which is extremely important.” Paul Meerkamp

“We are in a community of common destiny in Europe“: That is what Vice-Chancellor Robert Habeck said yesterday in Vienna, where Austria and Germany signed a joint declaration on securing energy supplies. Hans-Peter Siebenhaar and Manuel Berkel analyzed what the declaration means – and where there is still room for improvement in Europe’s energy security.

Germany is also dependent when it comes to raw materials – appeals to the industry not to import the majority of their raw materials solely from China had little effect so far. But it is not only the direct dependence on raw material imports that is critical. Every price fluctuation within China affects the German market, as Nico Beckert reports.

The German NGO Welthungerhilfe has raised the alarm: 828 million people are chronically malnourished. The war in Ukraine acts like an accelerant, said Welthungerhilfe President Marlehn Thieme yesterday. Read more in the News section.

Rising energy prices, rising inflation – is this a repeat of the 1970s? No, says Daniel Gros, a member of the board and distinguished fellow at the Centre for European Policy Studies, and explains the key differences in today’s Opinion.

Germany and Austria are closing ranks to liberate themselves from their dependence on Russian gas. German Minister of Economic Affairs, Robert Habeck (Greens), and Austrian Minister of Energy, Leonore Gewessler (Greens), signed a joint declaration on securing gas supplies in Vienna on Tuesday.

Habeck had already signed a similar declaration on Monday during his visit to the Czech Republic. The goal is to help each other in the event of a halt of Russian gas supplies. “We are in a community of common destiny in Europe,” the German Vice-Chancellor said in Vienna on Tuesday. “No country alone is strong enough to stand alone.”

Austria and Germany already signed a solidarity agreement in December 2021. “This also includes the securing of transit rights in the event of a gas shortage situation, provided there are no technical or safety reasons to the contrary,” as yesterday’s statement once again emphasized. A new agreement was reached on deeper cooperation on the use of LNG terminals and on refilling Austria’s natural gas storage facilities 7 Fields and Haidach, which are both directly connected to the German grid.

“We will only have safety again when we have made ourselves independent of Russian energy supplies,” Gewessler said. “This conviction unites us.” Europe cannot allow itself to be divided in this crisis.

The solidarity agreement between Austria and Germany is still a rare exception in the EU. Yesterday, both countries called on member states to finalize all outstanding agreements “as soon as possible and, if possible, before October”.

Habeck also made it clear for the first time that private households “also have to do their part” when it comes to saving gas. Until now, households belonged to the protected customers according to the emergency regulation, which, in contrast to the vast majority of companies, are not supposed to accept any restrictions in the event of a shortage. But Habeck did not say what exactly this part would be. In any case, he said, this issue “may have to be revisited”.

The Minister also said that there was a need for improvement regarding solidarity requests from EU member states: “If a country scales back its industrial activity in order to provide warm homes for another country, there must also be a solidarity mechanism of compensation to some extent. And that, too, has not yet been addressed. If there is an answer to both of those questions, it would be great.”

The already concluded bilateral agreement between Austria and Germany for transit rights in the event of a Russian gas embargo is particularly important for the alpine republic. This is because Tyrol and Vorarlberg can only be supplied via the German gas network. A bilateral agreement on the replenishment of gas storage facilities is also to be signed, the Austrian Minister of Energy stressed: “Security of supply is the top priority”.

For this reason, the Haidach mega gas storage facility in Salzburg is also to be connected to the Austrian network as soon as possible. This is because the gas storage facility, which can store more gas than the five storage facilities in Bavaria, has so far only been connected to the German gas network. The government in Vienna recently decided that the gas storage facility must also be connected to the Austrian network. The necessary work is to be completed before the end of this year.

The German gas storage facility in Haidach, Austria, is a curiosity. A decade and a half ago, Gazprom Germania constructed the second-largest natural gas storage facility in Western Europe jointly with Wintershall subsidiary Wingas (owned by Gazprom since 2015) and Austria’s RAG. In 2011, its capacities were more than doubled. The ownership structure is complicated.

The surface sections are two-thirds owned by Gazprom and its subsidiaries Wingas (33 percent), Gazprom Germania (22 percent) and Centrex Europe Energy & Gas AG (11 percent) in Austria and Germany, and one-third by RAG. The underground section, in turn, belongs to the Republic of Austria. Marketing and filling are in the hands of Gazprom subsidiaries. Gazprom Germania and Astra, which market the gas in Haidach, have been under state supervision by the Federal Network Agency since the beginning of April. It manages the energy companies as a fiduciary.

Austria is even more dependent on Russian gas supplies than Germany. The alpine republic obtained over 80 percent of its gas from Russia. Austria already expressed its displeasure at Gazprom’s supply difficulties in mid-May. At that time, the government decided that unused storage capacities would have to be returned if they were not used by the operator.

Vienna-based energy regulator E-Control may award Gazprom’s unused storage capacity to a competitor, such as RAG, OMV and troubled Uniper. Recently, Gazprom failed to fill Western Europe’s second-largest gas storage facility in Haidach, close to Salzburg. According to AGSI, the fill level of Gazprom’s GSA storage facility has been 0.0 for a long time. Under a gas storage law, Germany has committed itself to ensure that gas storage facilities are at 90 percent capacity by November 1. Austria is content with 80 percent.

Meanwhile, the risk that Gazprom will impose a full and permanent embargo on Austria and Germany is high. According to information from OMV on Tuesday, 70 percent less gas is currently being delivered than ordered. Since mid-June, Gazprom has already delivered only half of the gas ordered.

While the German gas storage facilities are already at 64 percent capacity, according to the AGSI, Austria has only 48 percent of its maximum capacity. The Austrian government is already taking the necessary steps. Large consumers are to switch to other fossil fuels – especially oil. Private households are to do their utmost to save energy next winter. In five years, Austria wants to be completely independent of Russian gas. With Manuel Berkel

For decades, it was unthinkable that Russia would eventually stop supplying gas to Germany. Now Vladimir Putin has cut gas supplies. German ministries are developing emergency plans for the winter. Not only private households are affected, but also the industry, which will almost certainly have to curb production.

This also draws attention to other dependencies: China is the largest supplier of important raw materials such as rare earth elements and magnesium. For other raw materials, the People’s Republic is among the top 5 exporters worldwide. There is now growing concern among managers, economists, and politicians about the consequences of a conflict with China, which would hit Germany hard economically in several respects.

Half of Germany’s magnesium imports and 45 percent of its imports of rare earth elements come from the People’s Republic, according to a new study by the Ifo Institute. The metals are used in important future technologies such as fuel cells, electric motors, wind turbines, digital technology, and robots.

There are already concrete warning signs. At the end of last year, China curbed magnesium production due to the power crisis. The European industry, which is dependent on magnesium from the People’s Republic for aluminum production, suffered as a result. The problem was quickly resolved but shows the dependencies very clearly.

In the meantime, China temporarily had a quasi-monopoly on rare earth elements. In 2011, the country accounted for 97 percent of global production. Since then, China’s share of global production has fallen but is still around 58 percent. Since the People’s Republic consumes a lot, the export share is lower and amounts to 26 percent. There were already warning signs for rare earths as well. At the end of 2010, China restricted exports to Japan for several weeks due to diplomatic disagreements.

According to Ifo researchers, rare earth elements and magnesium are among the “raw materials with critical dependencies”. They are important for many key technologies and are only mined and exported on a large scale by few countries.

Germany’s dependence on China is less pronounced for seven other critical raw materials. Only in the case of graphite does the share of imports from China exceed 10 percent. Nevertheless, the rest of the world as a whole is even more dependent on China than Germany. This is reflected in the data. Globally, the share of imports from China is usually higher than the German figure. “German imports are more diversified than the average global trade,” says Lisandra Flach, one of the authors of the Ifo study.

But that only applies to direct dependencies. China is the world’s largest producer and consumer of raw materials. “Any change in China that is relevant to raw materials, for example, cyclical fluctuations in demand, affects the global raw materials markets and price developments,” says Yun Schueler-Zhou, China expert at the German Mineral Ressources Agency (DERA). Because Germany is dependent on raw material imports, price fluctuations have a major impact on the German industry. “This indirect dependence on China is much more far-reaching than the direct supply dependence,” Schueler-Zhou says.

In addition, there are dependencies due to branched supply chains. “The dependency along the value chain can be even greater than shown in our study,” says Flach. When other EU countries import raw materials from China, process them, and then export them to Germany in intermediate goods, there is an indirect dependence on China, she said. This is particularly striking in the case of rare earth elements. EU countries import 98 percent of their demand from China.

China is often not the only country that has certain raw material deposits. But due to price advantages, producers from other countries have sometimes been forced out of the market. The best example of this is rare earth elements. Contrary to what the name suggests, these 17 metals are not rare in the earth’s crust. But: “China is dominant in the mining of rare earths because environmental and health standards are low,” says Michael Reckordt, raw materials expert at the NGO PowerShift.

This is a competitive advantage that can depress prices. Mines in the USA have had to close for this reason. Companies are often simply not willing to pay a higher price for raw materials. This shows a parallel to Russian gas: Instead of looking to other suppliers and LNG at an early stage, German companies have become dependent on Russia. As long as the supply was plentiful and cheap, the problems with this strategy were not noticeable.

Although there have been regular complaints about dependencies on raw materials from China for years, they remain disturbingly high. In the case of rare earths, according to the Info-Institute, the share was

It is unclear whether the recent decline represents a trend reversal, as China’s COVID policy has also affected the mining sector. For magnesium, there has actually been a slight increase in China’s import share over the past few years, from 40 percent in 2017 to 51 percent in 2021. For other metals, imports have actually increased dramatically. These include chromium, bismuth, zirconium, indium, and many iron and steel products, according to Schueler-Zhou of DERA.

It is difficult to assess whether enough has been done to reduce dependencies. “The efforts usually happen at the plant or company level,” says raw materials expert Reckordt. In addition, Malaysia and Myanmar are also not ideal suppliers of rare earth elements. “Thus, the list of alternatives is very quickly reduced to the US,” Reckordt says.

According to experts, dependence on China also comes with political risks. “Trade relations with China could be interrupted in the course of foreign policy conflicts,” says Schueler-Zhou. Strategic raw materials such as rare earth elements are now far more politically relevant than normal economic goods, she says. “Their importance for the energy transition in China and Western countries has increased. This increases competition and the potential for conflict,” Schueler-Zhou says.

As an export-oriented industrialized country, Germany remains dependent on imports of raw materials from other countries, especially from China. Reducing dependencies – as in the case of Russian gas dependency – will be accompanied by higher costs. In other regions of the world, higher environmental and social standards apply. However, if the German industry is serious about reducing the risks of excessive dependency, it will have to accept higher prices.

After a break of about two years, a trade dialogue between the EU and China will take place next week. Commissioner for Trade and EU Executive Vice-President Valdis Dombrovskis will meet with China’s Vice Premier Liu He in a video conference on July 19, the EU Directorate-General for Trade confirmed. Commissioner for Financial Services Mairead McGuinness and representatives of several EU Directorates-General and Chinese ministries will also participate.

According to the Trade Directorate, the agenda includes topics such as the global energy and food crises. Supply chains and “bilateral trade and investment relations” will be discussed. There is a whole range of unresolved issues between the EU and the People’s Republic:

The last trade dialogue took place in July 2020. The EU-China summit in April this year was a failure: Brussels wanted to talk about China’s role in the war against Ukraine, and Beijing about trade.

Last week, EU Climate Commissioner Frans Timmermans and Vice Premier Han Zheng already met for an online summit. “There are many opportunities for the EU and China to work more closely together“, Timmermans tweeted after the meeting. For example, on clean energy and hydrogen, and carbon markets. The latter is particularly interesting given the EU’s planned carbon border adjustment. Negotiations on this are currently underway between the European Parliament, the Commission, and the EU Council. ari

The company behind the Nord Stream 2 Baltic gas pipeline, which has not been put into operation, has scored a victory at the European Court of Justice. On Tuesday, the ECJ overturned a 2020 ruling by the European Union’s lower court that Nord Stream 2 AG was not allowed to challenge EU rules requiring the unbundling of production and distribution. The decision was not valid, the court said.

The ECJ referred the case back to the court. However, there are no immediate consequences for the operation of the pipeline in the near future, as the approval procedure is still suspended due to the Russian invasion of Ukraine.

“For the time being, the decision has no relevance for the Federal Network Agency,” said the Bonn-based authority responsible for regulation. It said the ECJ had referred the case back to the European General Court, which now has to deal with Nord Stream 2’s arguments on the matter. “How these proceedings will turn out is currently completely open.”

The Federal Network Agency rejected the application for exemption from regulation of Nord Stream 2 on May 15, 2020. This rejection was confirmed by the Düsseldorf Higher Regional Court. The proceedings are still pending before the German Federal Court of Justice (BGH). “The Federal Network Agency does not currently see any direct impact on these proceedings.”

Nord Stream 2, like Nord Stream 1, which has been in operation for over ten years, is controlled by Russia’s Gazprom Group. Nord Stream 1 is currently undergoing maintenance. The work is scheduled to be completed on July 21. The German government does not rule out the risk that Russia could delay the maintenance work or suspend operations altogether due to political tensions with Germany. rtr

The German NGO Welthungerhilfe (World Hunger Aid) fears a rising number of people affected by hunger worldwide due to skyrocketing food prices and due to the war in Ukraine. In light of growing world hunger, also fueled by climate change and increasing droughts, “the Russian war of aggression on Ukraine acts as a further accelerant,” warned Welthungerhilfe President Marlehn Thieme on Tuesday.

According to the latest figures from the United Nations (UN), 828 million people worldwide are already chronically malnourished. This means that they have not had enough food for at least a year. The figures recently provided by the UN’s Food and Agriculture Organization (FAO) represent “a real wake-up call to the entire world,” Thieme said.

The fights in Ukraine, which is considered one of the breadbaskets of the world, now intensify the situation. The harvest season has begun in Ukraine. But according to Thieme, it is already becoming apparent that only two-thirds of the land can be harvested: “That will certainly represent a major decline.”

According to initial estimates, this could ultimately lead to an additional 50 million affected by hunger around the world. However, this figure should be taken with great caution, “because we don’t yet know how the markets will react.” It is unclear, for example, whether China and Brazil will export grain and food in needed quantities.

It also remains to be seen how the harvests in Central Europe will turn out. However, it is feared that they might turn out to be slightly lower. Added to this are droughts and climate change: “These are influencing factors that cannot be disregarded,” said the Welthungerhilfe President. Exports of wheat and other grains from Ukraine have declined as a result of the war. Before the Russian invasion on February 24, the two countries combined accounted for nearly one-third of global wheat exports. Since then, exports have faltered via Ukraine’s Black Sea ports, where Russian warships patrol offshore. rtr

Slovenian Prime Minister Richard Golob has suggested dividing the EU accession process with the six Western Balkan countries. The problem today would be that the accession candidates have to take a huge step of reforms before they could become EU members, Golob said in a Reuters TV interview on Tuesday.

“If we can just cut it into small steps and let each country see that there is something for it then it’s very easy to convince other countries that they do those same steps,” said Golob. As an example, Golob cited energy projects with North Macedonia, one of the Western Balkan countries. As soon as a candidate country has adopted the European aquis, for example in energy, joint energy projects could be launched even before accession. He criticized the EU for withholding visa liberalization from Kosovo, even though the country has met all the conditions. “Kosovo is a special problem. We simply have to act,” he said. rtr

The definite exchange rate for the adoption of the euro in Croatia has been set. The exchange rate was set at 7.5345 kuna per euro at the meeting of European ministers of finance on Tuesday, according to an EU Council statement. The Balkan state plans to adopt the European single currency on January 1, 2023 – meaning it has just under half a year left for technical preparations. Currently, the euro area consists of 19 of 27 EU member states. Lithuania last adopted the euro as its official currency in 2015.

It was a reasonable political decision, the Czech EU presidency said. “Croatia has successfully completed all the required economic criteria.” Among the criteria reviewed ahead of Tuesday’s formal decision were price and exchange rate stability, solid fiscal management and long-term interest rates. The Czech Republic has not yet adopted the euro.

The European Central Bank stated that many Croatian financial institutions have already been supervised by the ECB since 2020. ECB President Christine Lagarde spoke of a reason for joy and congratulated Croatia. EU Commission Vice President Valdis Dombrovskis said a larger eurozone would also have more international influence. With the euro, it would become easier to invest in Croatia. More jobs in the country and a rising standard of living can be expected.

Ukraine has been granted an additional loan of €1 billion by the European Union. A corresponding proposal by the EU Commission was approved by the EU states on Tuesday. The money is to be used to cover running costs, for example, pension payments and the operation of hospitals.

The European Parliament has already approved the aid, which will be provided as a long-term loan on preferential terms. To further ease the burden on Ukraine, the interest will initially be covered by a loan from the EU budget. EU Commission President Ursula von der Leyen said the money should reach Ukraine this month.

The loan is the first part of a €9 billion aid package announced in May and scheduled to be implemented until the end of the year. The EU summit in May already agreed in principle to the nine-billion package. Since the start of the war, the EU has so far provided Ukraine with €2.2 billion in so-called macro-financial assistance. rtr/dpa

The EU has identified the three greatest risks to public health: Pandemics, nuclear threat, and antimicrobial resistance. This is to ensure that, in the event of an emergency, the EU is better prepared than it was, for example, at the beginning of the Covid crisis. These were life-threatening or otherwise seriously threatening health risks that could spread across borders to member states, the EU Commission announced. The next step will be to secure the development, procurement, production and storage of medical goods.

“This exercise is the first step in ensuring that medical countermeasures can be made available and accessible for all Member States swiftly when needed,” said Stella Kyriakides, Commissioner for Health and Food Safety. The list was compiled by The Commission’s Health Emergency Preparedness and Response Authority (HERA), in collaboration with other EU agencies and international partners and experts.

Specifically, three categories of serious cross-border health threats are now identified. In addition to pathogens with high pandemic potential, these include chemical, biological, radiological and nuclear threats – regardless of whether they are released unintentionally or intentionally, for example, due to political tensions. In addition, threats from antimicrobial resistance are listed. These pose one of the greatest risks to human health, the EU Commission said. dpa

A new EU law regulating tech giants could serve as a benchmark for global legislation to protect children online. Concerns about the impact of social media on young people are growing worldwide, say child rights activists.

The EU’s Digital Services Act (DSA) includes a ban on targeted advertising to children and prohibits the algorithmic promotion of content that could be harmful to minors, such as videos about eating disorders or self-harm.

By specifying steep fines for companies that fail to remove illegal content from their platforms, such as child sexual abuse images. The DSA effectively ends an era of voluntary self-regulation by companies, activists say.

“The importance of this legislation is (to say): No, it’s not optional, there are certain things you have to do,” said Daniela Ligiero, co-founder of Brave Movement, a survivor-led organization that works to end childhood sexual violence. “We believe that not only can it help protect children in Europe, but it can also serve as an example for the rest of the world,” she added.

While detailed regulations for child pornography have yet to be drafted by the European Union, the DSA provides for fines of up to 6 percent of global revenue for platforms that fail to remove illegal content.

Despite praise for the legislation from rights advocates, there are concerns about its enforcement. The European Commission has set up a task force that is said to include about 80 officials, which critics call insufficient.

Some have pointed to the poor enforcement of EU data protection rules for big tech companies, known as the General Data Protection Regulation (GDPR).

Four years after its introduction, the EU data protection commissioner lamented the stalled progress in lengthy cases and called for an EU supervisory authority instead of national authorities to handle cross-border data protection cases. rtr

The similarities are obvious. In 2022, like in the 1970s, an energy-price shock has led to a sustained increase in the prices of many other goods. The so-called core inflation rate, which strips out volatile energy and food prices, is now approaching 6 percent in the United States and 4 percent in the eurozone. And fears are mounting that, as in the 1970s, this trend will prove persistent.

But we are hardly living through a repeat of the 1970s. One key difference lies in labor markets. Back then, widespread wage indexation meant that higher energy and other prices led automatically to an equivalent increase in wages. Where wage indexation was less important, unions achieved the same outcome, as they refused to accept any deterioration in their members’ living standards.

This is not the case today, at least in the eurozone. According to the European Central Bank’s new wage tracker, eurozone wages have increased by only 3 percent so far – far less than the 8.6 percent inflation recorded in June. In other words, there is no sign of the wage-price spiral of the 1970s.

Another difference today is that European producers have been able to increase their prices enough to offset a significant portion of the energy-cost rise. Based on June 2022 prices, the eurozone’s energy import bill is set to increase by over 4 percent of GDP this year. Over the last year, surging energy prices have fueled a 24 percent increase in the European Union’s import prices, after more than a decade of stability.

But the prices charged by EU exporters also rose, by over 12 percent – and the EU exports more than it imports. European producers have thus been able to offset slightly more than half of the income loss from higher energy prices, keeping it to just under 2 percent of GDP. This is a hefty price to pay, but it is also a manageable one.

The challenge will be to distribute income losses across economic sectors. With real wages having fallen by about 5 percent, European workers have so far borne all the costs of inflation. Given that the wage share amounts to about 62 percent of GDP in the eurozone, a 5 percent fall in real wages would make available to other sectors about 3.1 percent of GDP, more than the income loss of 2 percent, allowing profits to increase. That is more than sufficient to offset the terms-of-trade losses suffered so far.

The situation is very different in the US. As the world’s biggest oil and natural-gas producer, it exports as much energy as it imports. America’s terms of trade thus have not suffered at all, with import and export prices increasing by the same amount. But wages have increased by over 6 percent, according to the Federal Reserve Bank of Atlanta’s wage tracker, meaning that the US is much closer to a wage-price spiral than Europe.

How reliable is Europe’s wage moderation? As it stands, the EU is experiencing more inflation in profits than in wages, despite the overall income loss. And falling real wages are particularly difficult to accept when profits are soaring. In fact, wage demands are already creeping up across the eurozone.

Germany’s influential IG Metall union, for example, is calling for an 8 percent wage hike for workers in the metal industry, which currently is enjoying high profits. To keep social peace, several countries, including Germany, have introduced double-digit increases in minimum wages.

Nonetheless, negotiated wage increases have so far remained modest, at around 4 percent, according to the ECB. Actual wages might climb further, as employers in sectors experiencing shortages decide that it is worth paying workers a premium. Still, there is little indication that wages are set to catch up with inflation any time soon.

The main reason for this is that governments all over Europe are delivering direct transfers to households, in order to offset higher energy costs. For example, Germany’s government has unveiled a relief package that includes a lump-sum payment for employees and a heating-cost subsidy for households on housing benefits.

The Spanish government, for its part, is subsidizing the cost of natural gas for power producers. This approach to holding down electricity prices is flawed, as it encourages gas use at a time when Russian President Vladimir Putin is threatening to cut supplies. But such schemes reflect a new social contract that is emerging in Europe: governments protect workers from the bulk of higher energy costs, in exchange for workers moderating their wage demands.

In the aftermath of the 2008 global financial crisis, a recurrent criticism of the eurozone framework was that the absence of a fiscal authority meant that the ECB was “the only game in town.” This time seems different. By stepping in to provide income support, governments are helping to prevent a 1970s-style wage-price spiral – and making the ECB’s job much easier.

In cooperation with Project Syndicate.

“The devil is in the details,” Pedro Oliveira quotes a phrase you hear frequently in Brussels. “I find it fulfilling to pierce through draft legislation to the point where I find these details.” The Portuguese works as Director for Legal Affairs at BusinessEurope. The employers’ association is a heavyweight among lobby groups in Brussels. It includes 40 member associations from various countries. Thus, BusinessEurope claims to represent the interests of 20 million companies.

“We try to translate the many different voices from business into one voice,” Oliveira describes his task. The many voices of the members are fascinating, but also a challenge: “We represent companies from small stores to huge factories, so it is sometimes difficult to agree on a common position. This is because – in true European fashion – it is developed as unanimously as possible. This works particularly well for issues that affect all members across all sectors.

At present, the jurist is dealing with the planned EU Supply Chain Act: “That is definitely one of the primary topics I’m spending a lot of time on right now.” He is taking a close look at the Commission’s draft in order to be able to exert influence in the further process. In his department, he is supported by three other lawyers and a secretary. In total, BusinessEurope employs around 1,200 experts. Oliveira emphasizes that he is a European through and through.

Born on May 9 – Europe Day – he studied law and banking law in Lisbon and European law in Brussels. This helps him to bring the many voices of Europe’s entrepreneurs to a common level: He speaks not only Portuguese and English, but also Dutch, Spanish and French. Before Oliveira joined BusinessEurope in 2009, he already spent several years working on European communication. At the College of Europe, he devoted himself to the “codification and consolidation of EU law” – on behalf of the Commission and together with colleagues who spoke all official languages of the EU.

“It was a little nerdy,” Oliveira admits. “Our job was to sift through legislation to look for inconsistencies and language errors.” That attention to detail, he says, suited him well. Their report then went to the EU Parliament and Council for improvements.

He has now been Director for Legal Affairs at BusinessEurope for four years. The 42-year-old says the highlight of his job is the thematic and human variety. There’s constant conversation, he says, “not only with our members from the business community, but also with various NGOs and consumers.” Admittedly, they don’t always agree. “But at least we are able to discuss with each other, which is extremely important.” Paul Meerkamp