Yesterday, the US and the UK announced that they will no longer import oil (and some gas) from Russia in the future (read more in the News).

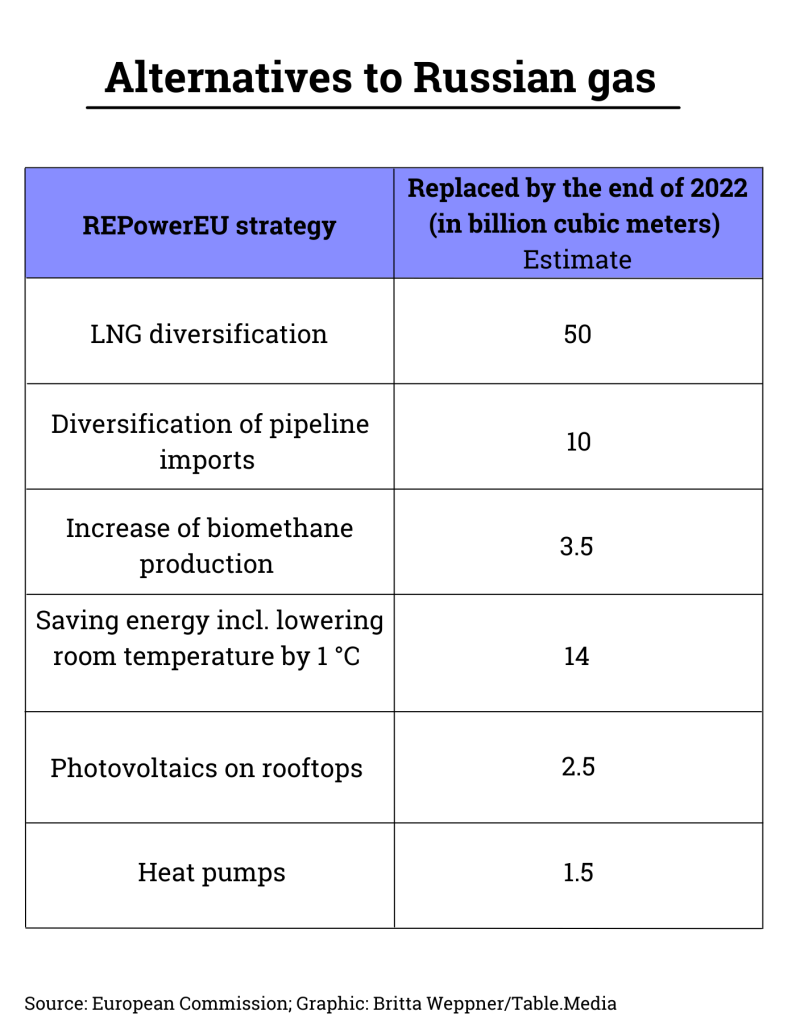

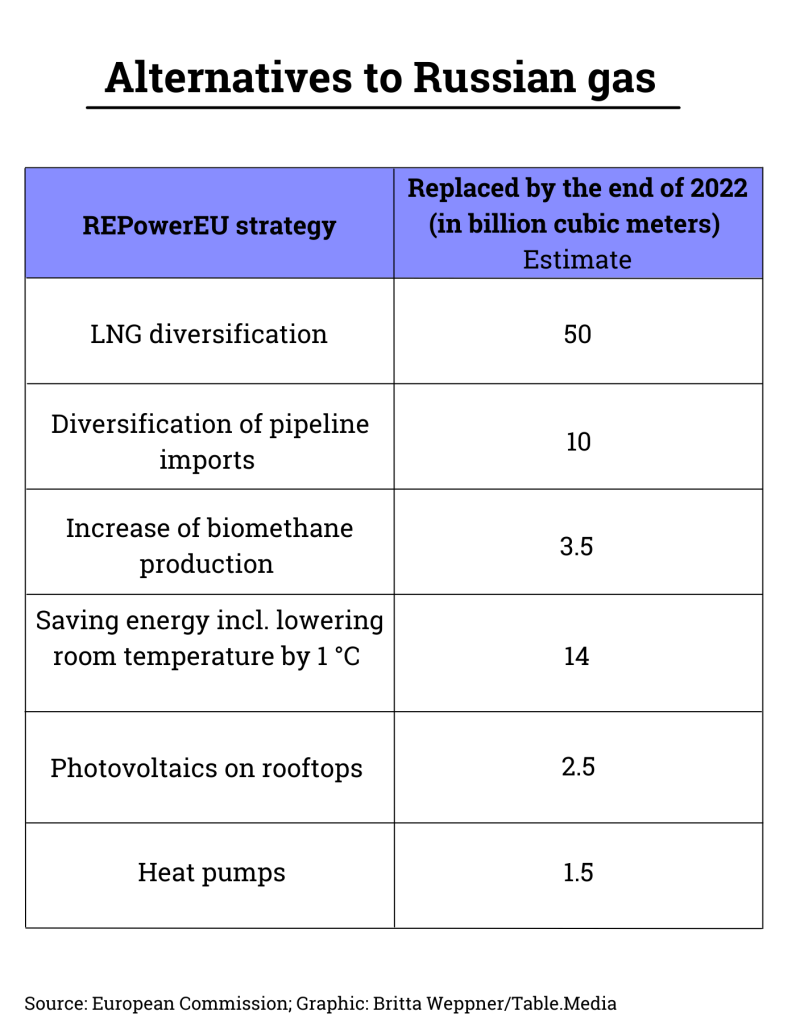

The EU countries cannot afford to take this step ad hoc. Yesterday, the EU Commission presented a plan on how Europe can succeed in reducing its dependence on Russian gas by two-thirds this year. The measures include: Considering gas storage facilities critical infrastructure across Europe going forward, drastically increasing LNG imports, and even lowering room temperatures in homes. Manuel Berkel breaks down which alternatives are needed in what quantities to get away from Russian gas.

China must also act to ensure energy security within its borders. While higher purchase volumes for coal and gas from Russia are a possibility in the short term, Beijing does not want to become permanently dependent. In the long term, the expansion of renewables continues to be in the Chinese interest, but President Xi Jinping reiterated in a speech during the National People’s Congress (NPC) that China’s energy transition will not happen overnight. Nico Beckert analyzes China’s strategy.

Xi, German Chancellor Scholz, and French President Emmanuel Macron again called for humanitarian relief and access to the embattled areas in a video call on Tuesday (more on this in the News). There will be a ceasefire from 8 a.m. today to allow people to flee Kiev and four other cities, according to the Tass news agency.

Russia may be militarily superior to Ukraine so far. But the determination with which the Ukrainians are fighting, together with Western support, could possibly turn the tide in their favor, as Daniel Gros writes in today’s guest article. After all, the capital expenditures that have flowed into the Russian military in recent years may have been too small to keep the huge power apparatus alive for long.

The plan had long been expected, and on Tuesday, the EU Commission presented its strategy for becoming less dependent on Russian gas. The Fit for 55 package alone will reduce gas consumption by 100 billion cubic meters, explained Commission Vice President Frans Timmermans in Brussels. However, this only applies in the long term for the period up to 2030. This year, however, the Commission also wants to reduce Russian gas imports into the EU by 100 billion cubic meters (bcm) – primarily through LNG imports.

Obviously, the Commission is willing to pay a lot for this. Because 50 bcm are to reach the continent via liquefied natural gas terminals. For this, however, the member states would have to buy up almost the entire additional quantities available. Just a few days ago, the International Energy Agency (IEA) put the figure at 60 bcm. However, for the EU, the IEA considered only 20 bcm to be realistic given the current price curves. To put it plainly: If the Europeans wanted to buy the world market dry, the already exorbitant prices would have to rise even further. Other countries – primarily in Asia – would then lose out.

It is also noteworthy that the Commission wants to impose colder homes on citizens. A total of 10 bcm is to come from lowering the room temperature by 1 degree. It will be exciting to see how governments want to communicate this to their citizens. In contrast, other measures such as more renewable energies and heat pumps have hardly any effects in the short term, according to the Commission’s calculations. The doubling of biomethane expansion to 35 bcm by 2030 even overestimates what is technically feasible, warned E3G consultant Raphael Hanoteaux. In the case of hydrogen imports, an unrealistically fast expansion of renewables in neighboring countries is assumed.

Another huge lever for gas substitution does not even appear in the Commission paper. Bruegel expert Simone Tagliapietra calculated that switching from gas to coal in power generation could save 30 bcm. Russian gas imports could even be reduced by 80 percent. In Germany, lignite-fired power generation is also likely to increase again, Wilfried Rickels of the Kiel Institute for the World Economy told Europe.Table. Economics Minister Robert Habeck has so far only wanted to keep open the possibility of generating more electricity from coal, which has lower emissions.

To ensure that natural gas is actually available in the coming winter, the Commission paper envisages a minimum filling level of European storage facilities of 90 percent by the beginning of October. With this, the EU wants to go even further than the German target of 80 percent, which Habeck wants to stipulate in a new law. Germany will, therefore, probably have to adapt the draft, says Rickels.

For months, it has been noticeable that the filling levels are particularly low in the storage facilities controlled by Gazprom. The Commission explicitly mentions the Russian state-owned company in its paper. Therefore, it wants to declare gas storage facilities to be critical infrastructure in the future. To this end, the owners are to undergo certification to ensure that they do not pose a risk to supply security. At the press conference, Energy Commissioner Kadri Simson was even more explicit.

“In the event of a negative assessment, ownership unbundling could be required,” the commissioner explained. Such ownership unbundling is the sharpest option for how to implement the competitive separation of infrastructure and generation or trading. What is meant by this is nothing less than a forced sale of majority shares – a Brussels threat to Gazprom.

The chairman of the Industry Committee, Christian Buşoi, expressed a positive view: “The ITRE Committee supports the initiative to make Europe less dependent on Russian gas.” The Commission should now make it possible for the Parliament to quickly deal with the proposals. In the paper, the Commission had already encouraged its co-legislators to increase or bring forward targets for renewable energy and energy efficiency.

Energy security is currently more important to the political leadership than climate goals. Last year’s power crisis and rising prices for fossil energy raw materials in the wake of the Ukraine war are causing concern for China’s leaders. As a result, the key goal of energy policy is to secure the power supply. Oil and gas production, as well as coal mining, are to be expanded.

Xi Jinping reiterated in his speech at the People’s Congress that China’s energy transition will not happen overnight. The new must first be built before the old can be torn down, Xi said. Coal-fired power still accounts for a good 60 percent of the People’s Republic’s energy demand. As long as renewables or other energy sources such as gas and nuclear power cannot replace coal, Xi will not take any risks and will not accelerate the shutdown of coal-fired power plants.

Russia’s attack on Ukraine was a topic that was barely mentioned at the People’s Congress. But energy security is a medal with at least two sides. China’s political leaders want to ensure secure access to energy and power for its economy and citizens. But at the same time, China cannot afford to become too dependent on imports of energy commodities such as coal, gas, and oil – because this would put energy security at risk during crises. Xi Jinping already emphasized back in October that they “must hold our energy supplies firmly in our own hands”.

Unlike many European countries, the People’s Republic is not dependent on Russian energy supplies. While Russia is China’s largest supplier of coal, imports from its neighbor account for only a mere 0.3 percent of the People’s Republic’s coal consumption. China can cover the vast majority of its needs from domestic sources. China can cover the vast majority of its requirements from domestic sources. When it comes to gas, the Russian share is higher. However, China is not yet as dependent on gas in many areas as Europe. A switch back to coal would be easy, according to analysts at the consulting firm Trivium China.

Beijing is in an ideal position. In the next few years, China could buy up all the Russian gas that Europe spurns. If Russia escalates the war in Ukraine to the point where it would become a permanent international pariah, discounts could even beckon for Beijing. Still, China’s political leaders will most likely be smart enough not to become trapped in a gas dependency on an unpredictable Russia. That would contradict its goal of energy security.

However, China could buy its way into Russian power companies such as Gazprom. According to Bloomberg information, responsible policymakers in Beijing are in talks with state-owned enterprises such as China National Petroleum about possible investments in Russian companies or assets. Any stake would serve to boost China’s energy imports and security, Bloomberg cites individuals familiar with the talks as saying. The stated goal, they say, is not to support Russia’s invasion. However, the talks between Chinese and Russian companies are reportedly still in early stages.

On top of that: China is still dependent on Western exports and technologies in many economic areas. A too large swing toward Russia that would scare off Western business and trade partners is not very likely. As Trivium analysts write, “We believe that the costs of a true alliance with Putin against the world outweigh the benefits by far.”

Even though coal consumption is likely to increase in the short term, China is not ignoring the expansion of renewable energies. According to Premier Li Keqiang’s work report, China plans to push ahead with the expansion of large-scale wind and solar power plants. In addition, China plans to increase the capacity of its power grids.

This would result in less renewable energy being lost. Offshore wind power is to be promoted in particular. Power storage facilities are also to be expanded (China.Table reported). To this end, a “Five-Year Energy Storage Plan” is currently being discussed. The Chinese Ministry of Finance also announced that it would finally pay out overdue subsidies to developers of renewable energy projects. There have been major delays in this regard in recent years, with the result that funds have been lacking in some cases to launch new projects.

But the expansion of renewable energy sources takes time. It will take several years before solar, wind, and hydropower can drastically reduce the share of fossil fuels in the energy mix – especially if power demand continues to rise.

Beijing, Berlin, and Paris want to work together for a diplomatic solution to the Ukraine war. In an hour-long exchange, German Chancellor Olaf Scholz and the presidents of China and France, Xi Jinping and Emmanuel Macron, also spoke out in favor of humanitarian aid and access to the combat areas, according to the German government spokesman Steffen Hebestreit. Functioning evacuation corridors should be established.

All three countries expressed their willingness to provide further humanitarian aid. Xi supports Franco-German efforts to reach a cease-fire, the French presidential office said. Xi described the situation in Ukraine as concerning, according to state media, and called for “maximum restraint.” He also expressed concern about the impact of sanctions on the stability of global finance, energy security, and transportation and supply chains.

China has so far refused to condemn the Russian incursion or call it an invasion. Foreign Minister Wang Yi had described China’s friendship with Russia as “rock solid” on Monday (China.Table reported): “No matter how perilous the international landscape, we will maintain our strategic focus and promote the development of a comprehensive China-Russia partnership in the new era.”

According to Wang, however, Beijing is ready to use its influence on Russia: President Xi had already spoken on the phone with Vladimir Putin on February 25. In this telephone call, Xi expressed his wish for Russia and Ukraine to hold peace talks as soon as possible. Putin responded positively. rtr/rad

US President Joe Biden announced a ban on Russian oil and other energy imports on Tuesday in retaliation for the invasion of Ukraine. “That means Russian oil will no longer be acceptable in US ports,” Biden said. The decision was made with allies, he explained. EU states, however, are not following Washington’s lead for the time being.

The US is much less dependent on Russian energy sources than Europeans. The US imported more than 20.4 million barrels of crude oil and petroleum products per month from Russia last year. That’s eight percent of US imports of liquid fuels.

The British government announced it would stop importing oil from Russia by the end of the year. “This transition period will give the market, businesses, and supply chains more than enough time to replace Russian imports,” UK Business Secretary Kwasi Kwarteng wrote on Twitter. Russian oil currently accounts for eight percent of British demand.

Gas imports from Russia are not affected for the time being. However, Kwarteng announced that he would examine options for an exit here as well. Russian gas accounts for only four percent of the British supply.

The British oil company Shell announced that in the future it will no longer buy oil and gas from Russia. The company said it would stop buying Russian crude oil on the spot market with immediate effect and would not renew existing contracts. Shell would completely withdraw from its Russian business and divest its 27.5 percent stake in the Sakhalin 2 LNG plant, which is operated by Gazprom. In addition, all service stations in Russia were to be closed.

Shell also wants to remove Russian crude oil from its own supply chains “as quickly as possible” in coordination with the governments involved. However, according to the company, this will take several weeks and lead to bottlenecks at some refineries. The business with Russian pipeline gas as well as liquefied natural gas is also to be scaled back piece by piece. However, Shell stressed that it would be dependent on the cooperation of governments and energy suppliers to achieve this.

“These societal challenges highlight the dilemma between putting pressure on the Russian government over its atrocities in Ukraine and ensuring stable, secure energy supplies across Europe,” Shell CEO Ben van Beurden said, according to a statement. In the statement, the company also apologized for buying a cargo of oil from Russia as recently as last week after the war broke out. It said it wanted to donate the profits from this to humanitarian causes. dpa/rtr

Despite the discussion about sanctions against Russian oil and gas supplies, the German government is sticking to nuclear power and coal phase-out. Yesterday, Economics Minister Robert Habeck and Environment Minister Steffi Lemke (both Greens) spoke out in a joint report against extending the operating lives of the remaining nuclear power plants. Habeck also said after a special meeting of the energy ministers of the federal states that they would also stick to the coal phase-out. “However, we will keep all coal-fired power plants that go off the grid in reserve.”

Like Chancellor Olaf Scholz before him, Habeck rejected a European import ban on Russian gas and oil. Sanctions had been agreed, which would hit Russia hard because of the invasion of Ukraine, but would also be sustainable for years. Energy dependence on Russia must be corrected as soon as possible, but “undersupply” must be avoided in the meantime. In addition, it was being examined whether it would be possible to additionally tax the profits of energy companies that, for example, had bought gas very cheaply and were now selling it at a very high price.

The economics and environment ministries spoke out against extending the operating lives of the three nuclear power plants still in production. After weighing the benefits and risks, this was not recommended, even in light of the current gas crisis. “In this weighing, we have a minimum additional production of electricity for maximum high safety risks,” Habeck said. “And that is why I have come to the conclusion that this is the wrong way to go.” rtr

The war in Ukraine has led to severe distortions in the nickel market. On Tuesday, the price of a ton of the industrial metal rose by more than 50 percent to over $100,000 US at times. Trading on the London Commodity Exchange was then suspended – possibly for several days, the LME exchange said. Since Monday alone, the price has more than tripled at its peak. NickelCMNI3 is needed in particular for steel production.

Experts attribute the extreme price increase mainly to speculators who had previously bet on falling prices. At the same time, there is a supply shortage. The price of nickel had already risen significantly before the war. If the price then continues to rise, more and more speculators who had bet on falling prices get into trouble. They then have to buy nickel to close out their positions, which drives the price even higher.

In other metal markets, investors are stocking up for fear of supply shortfalls (Europe.Table reported). PalladiumXPD, which is used for autocatalysts and whose main exporter is Russia, rose more than six percent to $3,195 per troy ounce. AluminumCMAL3, which is needed in aircraft and automotive construction, rose more than four percent to $3,900 per ton. dpa/rtr/luk

Russian state-controlled media outlet Russia Today has challenged an EU ban on its activities in the European Union, Europe’s second top court said in a tweet on Tuesday. The EU imposed the ban last week, accusing RT of systematic disinformation over Russia’s invasion of Ukraine. The sanction means EU operators will be prohibited from broadcasting, facilitating, or otherwise contributing to the dissemination of any RT content.

The move, which applies to RT’s English unit and operations in Britain, Germany, France, and Spain, also suspends RT’s broadcasting licenses and authorization, transmission, and distribution arrangements with its EU counterparts.

“RussiaToday (France) has challenged @eu_council decision and regulation of 1 March 2022 on the restrictive measures in view of #Russia’s actions destabilizing the situation in #Ukraine before #EUGeneralCourt,” the Luxembourg-based tribunal tweeted. It will, in the coming months, set a date for a hearing before it issues a ruling. The EU also banned another Russian state-owned media outlet, Sputnik. The case is T-125/22.

Moscow describes its actions in Ukraine as a “special operation” to disarm its neighbor and arrest leaders it calls “neo-Nazis”. Ukraine and its Western allies call this a baseless pretext for an invasion.

Russia passed a law on Friday that gives Moscow much stronger powers to crack down on independent journalism. rtr

The European Parliament is set to approve on Wednesday a report urging the EU to ban golden passport schemes by 2025 and immediately stop the issuance of visas and passports to rich Russians in exchange for investments. The move follows Russia’s invasion of Ukraine which has triggered global sanctions of unprecedented severity against Moscow, with targets including a number of powerful and wealthy Russians seen as close to President Vladimir Putin.

The golden passport industry, which between 2011 and 2019 generated investments in EU countries of over €20 billion ($21.8 billion), is currently almost entirely unregulated in the EU, despite many countries having run these schemes for years. EU states such as Malta and Cyprus have made huge profits with their schemes and the European Commission’s vice president overseeing financial policy, Valdis Dombrovskis, set up a successful residence investment program in Latvia when he was prime minister there at the beginning of the last decade.

EU lawmakers say in their report that ending such schemes could have a significant economic impact in some countries. They are therefore proposing the gradual phase-out of golden passport schemes and tight rules for residence arrangements, including much more rigorous checks on applicants.

Companies developing and promoting these programs would face strict requirements. Under the proposal, which is backed by a majority of legislators, revenues generated by these schemes would be taxed to fund the EU budget. In an amendment to the original proposal prompted by the Russian invasion of Ukraine, the parliament urges an immediate halt to sales of visa and residence permits to Russians, among the biggest beneficiaries of these schemes.

Once approved, the report will go to the European Commission, which has the power to propose legislation.

EU Justice Commissioner Didier Reynders told lawmakers that the EU executive disagreed with the need for new rules on sales of citizenship because it was already pushing through legal proceedings to shut down existing golden passport schemes in Malta, Cyprus, and Bulgaria.

But the Commission has said it will assess the need for new laws to tighten golden visa schemes, and also issue shortly a non-binding recommendation on EU member states’ issuance of golden passports and residence permits to Russians. Last month, Britain scrapped golden visas for wealthy investors amid concerns about the inflow of illicit Russian money at a time when Russia was massing forces along the border with Ukraine, a week before launching its invasion. rtr

Global energy-related carbon dioxide emissions rose six percent last year to 36.3 billion metric tons, according to an analysis by the International Energy Agency (IEA). This is the highest level ever, more than offsetting the previous year’s decline that occurred at the start of the COVID-19 pandemic, the IEA announced in Paris on Tuesday. The recovery of the global economy after the COVID crisis relied heavily on coal. In addition, unfavorable weather and high natural gas prices led to more coal being burned, even though power generation from renewable sources saw the largest growth ever.

Coal accounted for more than 40 percent of the total growth in global CO2 emissions in 2021, reaching an all-time high of 15.3 billion metric tons, according to the IEA analysis. CO2 emissions from natural gas rose well above 2019 levels to 7.5 billion metric tons. At 10.7 billion metric tons, CO2 emissions from oil remained well below pre-pandemic levels due to the limited recovery in global transportation activity, mainly aviation.

Despite increased coal consumption, renewable energy sources and nuclear power represented a higher share of global electricity generation than coal in 2021, the IEA said. According to the report, electricity generation from renewables reached an all-time high of more than 8,000 terawatt-hours (TWh), up 500 TWh from 2020. Output from wind and photovoltaics also increased, while hydropower generation declined due to the effects of drought, particularly in the US and Brazil.

As the IEA data show, China is largely responsible for the increase in global CO2 emissions. According to the data, China was the only major economy to experience economic growth in both 2020 and 2021. The increase in emissions in China more than offset the overall decline in the rest of the world over the period. In 2021 alone, China’s CO2 emissions rose to more than 11.9 billion metric tons, accounting for 33 percent of the global total, according to the IEA analysis. dpa

Last week, the French Presidency of the Council of the European Union presented a compromise proposal for the creation of a European Carbon Boundary Adjustment Mechanism (CBAM), which Contexte published on Monday. The dossier from the Fit for 55 package is considered one of the priorities of the French and President Emmanuel Macron, as it could lay the groundwork for future external climate and trade policies.

However, the Council Presidency’s compromise proposal, which serves as the basis for the member states’ position, is largely based on the Commission’s proposal. The sectors whose imports into the EU are to be affected by the CBAM would not be expanded but would be limited to electricity, iron and steel, aluminum, cement, and fertilizers.

Only within the sectors does the French Presidency want to include other products that the Commission had not covered. Among them: Aluminum components, aluminum cables, and aluminum containers such as tanks, cans, or drums. In addition, all iron or steel products are also to be covered by the CBAM.

The rapporteur of the lead ENVI committee in the EU Parliament, Mohammed Chahim (S&D), had proposed to extend the scope of the CBAM to organic chemicals, hydrogen, and polymers (Europe.Table reported). Chahim had also demanded that indirect emissions arising from the extraction, transport, and production of the products concerned be included. However, the French compromise does not provide for this. Instead, only emissions from the direct generation of energy that goes into the production of the final product are to be covered by the CBAM.

The French also want to retain the transitional phase envisaged by the Commission between 2023 and 2025, in which the CBAM already applies, but importing companies do not yet have to pay border compensation. CO2 border adjustment payments would not actually be due for imports across EU borders until 2026. Not only rapporteur Chahim, but also numerous EU politicians from various camps, had called for a faster introduction.

A few changes are foreseen in the compromise regarding the Commission’s reporting obligation before the end of the transition period. A Commission report is to assess the impact of the CBAM on indirectly affected sectors, trade, European exports, and vulnerable third countries. In addition, based on the report, the Commission is to present, if necessary, a legislative proposal extending the scope of the CBAM. A very new proposal from the French: Imports up to a value of €150 are to be exempted from the CBAM.

One of the key points of contention in the dossier is the phased introduction of the CBAM with a simultaneous decrease in free ETS allowance allocations for the industries concerned. The Commission had planned to take away ten percent of the free allocations each year for ten years and introduce the CBAM in equal amounts each time. Accordingly, the CBAM would not be fully in place until 2036.

In his draft report, Chahim had called for the free allocation of allowances to be phased out in significantly larger steps by the end of 2028 – seven years earlier than planned by the Commission. However, the phasing out of allowances is the subject of the ETS reform, not the CBAM dossier, which is why ETS rapporteur Peter Liese (EPP) had accused Chahim of exceeding his competence (Europe.Table reported).

The French compromise proposal is completely reticent in this respect. Proposals on the duration of the introduction phase of the CBAM are completely missing. However, the Council Presidency points out that negotiations with the EU Parliament cannot begin until the Council has also made decisive progress on ETS reform.

The French also remain cautious on the controversial question of what to do with the revenues from the CBAM. This is to be discussed at a later date, they say. However, the compromise draft points out that the EU must support the least developed countries in decarbonization. However, detailed explanations on this are missing. In the EU Parliament, the dispute over whether revenues should be used for the decarbonization of the EU’s own industry, as compensation for consumers, or for climate protection financing in third countries thus continues.

The proposal is now with the embassies of the member states, which must confirm it this week. On March 15, the text will finally be presented to the finance ministers of the EU member states. luk

The AI law must strike a balance between freedom and control. This is emphasized by the responsible rapporteur in the Industry Committee (ITRE) Eva Maydell (EPP) in the draft of her opinion on the AI law available to Europe.Table. Therefore, further provisions would have to find their way into the regulation, which would enable not only small businesses but also SMEs and start-ups to remain competitive and creative. They should, for example, be better involved in the development of codes of conduct and standardization norms and be more strongly represented in the planned European Artificial Intelligence Board.

Maydell also wants to weaken the Commission’s formulations in a whole series of regulations. For example, the Commission stipulates that the data sets used must be error-free and complete. In contrast, the ITRE rapporteur suggests that high-risk AI systems should be “designed and developed to the best of their ability” and must be “reasonably tested for errors and completeness in accordance with industry standards”.

Another example is the logging obligation. According to the Commission’s proposal, high-risk AI systems should have functional features that enable automatic recording of operations and events (logging) throughout their operation. Logging should ensure that the functioning of the AI system is traceable throughout its lifecycle.

The rapporteur now wants to weaken the phrases “during the entire operation” and “during its entire life cycle”. For example, in her view, logging should ensure that the functioning of the AI system is traceable “over a certain period of time”. There is also no longer any talk of automatic recording. The AI systems should only be technically capable of carrying out such logging.

Maydell proposes that SMEs and start-ups also be given the opportunity to participate in the so-called “regulatory sandboxes”. She even wants to expand the instrument further and create a European AI regulatory sandboxes program. To avoid fragmentation of the digital single market and different handling between member states, she wants the program to be managed centrally by the Commission. In doing so, the latter is to take into account the specifics of the member states in terms of liability law and insurance systems.

The ITRE rapporteur also suggests creating a common European authority for benchmarking. It should bring together national metrology and benchmarking authorities to establish a unified approach to measuring accuracy, robustness, and other relevant criteria. Currently, there are no relevant metrics at the European level to guide AI developers and vendors, she complains.

While standardization organizations define the standards, the task of benchmarking organizations would be to define how these standards are met and measured. In Maydell’s view, a common European authority – perhaps in the form of a European Benchmarking Institute or as a subgroup of the European AI Committee – would enable a coherent European approach to benchmarking and metrics. It should be modeled on existing structures, such as the Laboratoire national de métrologie et d’essais (LNE) in France or the Technology’s Software Quality Group on Metrics and Measures in the United States, the ITRE rapporteur suggests.

“Given the new obligations, we need to provide companies with clearer guidance, simpler tools, and more efficient resources,” she stresses. For example, Maydell calls for clear definitions of AI and AI systems. These definitions should be consistent with internationally established definitions, she stresses. For example, the Commission’s proposed definition is largely based on the OECD definition (OECD/LEGAL/0449). However, using an identical definition to the OECD would provide more certainty for industry, businesses, start-ups, and SMEs. And that is ultimately one of the committee’s main goals. It would also be key to the future development of common international standards.

The French presidency of the EU Council has proposed exempting micro-enterprises offering high-risk systems from the obligation to set up a quality management system, according to the French news portal Contexte. Among other changes related to innovation support measures to be discussed in a working group on March 10, Paris sets out conditions for testing high-risk AI systems in real-world conditions in or outside so-called regulatory sandboxes. ank

Women in Europe must be much better protected against rape and harassment, according to the EU Commission. Therefore, the Brussels-based authority proposed a law on Tuesday that would, for the first time, regulate the fight against violence against women across the EU. “I want a society where violence against women is prevented, condemned, and prosecuted when it happens. It is time to ensure justice and equality,” said EU Commission President Ursula von der Leyen.

Specifically, the proposal, which EU member states and the European Parliament must now negotiate, provides for the introduction of “rape based on lack of consent” and female genital mutilation as criminal offenses throughout the EU. Cyber violence is also to be criminalized. This includes sharing intimate photos without consent, online stalking, and incitement to violence and hatred on the Internet. The EU Commission also proposed what the minimum prison terms should be for certain offenses: at least eight years for rape, five years for female genital mutilation, and two years for cyber-stalking.

In addition, the EU Commission proposed gender-sensitive and more accessible reporting channels for such acts of violence, which should increase the rate of reported cases. Professionals such as psychiatrists or healthcare workers should also not be prevented from reporting a reasonable suspicion of an “imminent risk of serious physical harm” due to confidentiality rules.

In court proceedings, evidence and questions concerning the private lives of victims should be used with extreme restraint. In addition, victims should be entitled to compensation from the perpetrator, for example, lost income, medical care, or psychological damage. There should also be specialized and free help telephones that can be reached around the clock. dpa

War represents a contest of wills, the German strategist Carl von Clausewitz argued some 200 years ago. On this point, the Ukrainians fiercely defending their homeland seem to have a distinct advantage over the invading Russian forces. But, to win a war, will must be supported by military means – and that requires industrial and economic strength. Here, Russia might have an advantage over Ukraine for now, but it is far weaker than the West it ultimately aims to challenge.

In terms of economic and industrial strength, Russia is a mid-size power, at best. Its manufacturing output is only half that of Germany, and its GDP is about the same size as Italy’s. The European Union’s combined GDP is almost ten times larger than Russia’s. And that is before the new round of punitive Western sanctions begin to take their toll.

Given its large economy, Europe can afford to build credible defense capabilities. For European countries to meet their NATO commitment to spend 2 percent of GDP annually on defense, they must increase spending by just 0.5 percent of GDP, on average. If one considers that total government expenditure in these countries currently averages 45 percent of GDP, this seems entirely feasible.

Even for laggard Germany, the recently announced short-term defense investment of €100 billion ($109 billion) represents only about 2.5 percent of GDP. Russia, for its part, probably dedicates more than 4 percent of its GDP to defense – a significant burden for a country that needs to maintain costly infrastructure to link its vast territory.

While defense spending accounts for a significant share of Russia’s economy, the sum itself is rather modest, especially by “great-power” standards. Russia spent an estimated $60 billion on defense in 2020, compared to Germany’s $50 billion outlay. At that spending level, and given the corruption that pervades Russian governance, building a large modern fighting force able to sustain a prolonged conflict, while maintaining an outsize nuclear force and advancing great-power ambitions globally, would be a truly astonishing achievement.

It is an achievement Russia cannot claim. In fact, it seems that Russia has had a Potemkin military all along. The “Potemkin” term is taken from Grigory Aleksandrovich Potemkin, the governor of New Russia who is said to have constructed fake settlements to impress Catherine the Great during her 1787 journey to inspect the newly acquired Crimea and surrounding territories. But the story of “Potemkin villages” is largely a myth, and historians disagree about what the czarina actually saw on her tour. It seems that, in reality, Potemkin made considerable investments in infrastructure in and around Crimea, but lacked the resources to link the newly conquered territory to the rest of Russia.

The resulting infrastructure weaknesses, together with a failure to build logistical capabilities, severely impeded Russia’s ability to defend itself against English and other European forces during the Crimean War 60 years later. Reports that troops in Ukraine today are facing food and fuel shortages suggest that Russia did not learn its lesson. Logistics is always the area most vulnerable to corruption in the military.

Understanding the consequences of the Russian military’s lack of resources requires us to look not only at what has happened in Ukraine, but also – and perhaps more importantly – at what has not. For starters, Russia has failed to destroy communications and other electronic-control systems.

It has long been widely assumed that Russia would support any military offensive with “devastating” cyberattacks. But this threat has not materialized, presumably because Ukraine has the support of Western intelligence agencies whose cyberwar capabilities are based on a vastly larger pool of talent and the know-how of US tech giants.

In fact, just a few hours before the invasion began, Microsoft detected – and blocked – malware aimed at wiping data from Ukrainian government ministries and financial institutions. The company subsequently shared the code with other European countries, in order to prevent its further use.

Likewise, SpaceX has sent Starlink internet terminals to Ukraine, in order to offset internet disruptions in the country. Making the satellite-internet system operational in the country will take time, because a large number of base stations must be put in place. But this is a question of weeks, not years.

Another Russian dog that did not bark is the air force, which has not established control of Ukraine’s airspace, even though Russia has almost ten times as many planes as Ukraine does. Yes, Russia deployed a barrage of missiles to knock out radar and airfields on the first day of the invasion. But the first volley was not followed by a second, because Russia’s stockpile of precision-guided missiles and other expensive ordnance is limited. Moreover, Russia’s pilots appear to have little experience – probably because, like precision-guided weapons, effective pilot training is expensive. And, finally, crucial weapons-delivery systems are not up to date.

Putin could have gone into this war with a large supply of precision-guided missiles or with a large stock of foreign-exchange reserves. He chose the latter. Now that half of those reserves have been blocked by unprecedented Western sanctions, he is probably regretting that decision. Given Russia’s limited capacity to ramp up weapons production quickly – especially production of sophisticated weapons systems, which require inputs he can no longer source from abroad – Putin’s prospects for sustaining his war in Ukraine seem limited.

In a struggle between two equally motivated opponents, broad economic and industrial strength is decisive. Putin has launched a war from a weak material starting point. He has motivated Europe to start investing in its own defense. He has set Russia on a course of demoralizing economic decline. And, above all, he has motivated Ukrainians to fight fiercely for their freedom.

If the Ukrainians manage to hold out against the initial onslaught, their determination, together with potentially unlimited Western support, could turn the tide of Putin’s war – and of Putin’s regime.

In cooperation with Project Syndicate, 2022.

Yesterday, the US and the UK announced that they will no longer import oil (and some gas) from Russia in the future (read more in the News).

The EU countries cannot afford to take this step ad hoc. Yesterday, the EU Commission presented a plan on how Europe can succeed in reducing its dependence on Russian gas by two-thirds this year. The measures include: Considering gas storage facilities critical infrastructure across Europe going forward, drastically increasing LNG imports, and even lowering room temperatures in homes. Manuel Berkel breaks down which alternatives are needed in what quantities to get away from Russian gas.

China must also act to ensure energy security within its borders. While higher purchase volumes for coal and gas from Russia are a possibility in the short term, Beijing does not want to become permanently dependent. In the long term, the expansion of renewables continues to be in the Chinese interest, but President Xi Jinping reiterated in a speech during the National People’s Congress (NPC) that China’s energy transition will not happen overnight. Nico Beckert analyzes China’s strategy.

Xi, German Chancellor Scholz, and French President Emmanuel Macron again called for humanitarian relief and access to the embattled areas in a video call on Tuesday (more on this in the News). There will be a ceasefire from 8 a.m. today to allow people to flee Kiev and four other cities, according to the Tass news agency.

Russia may be militarily superior to Ukraine so far. But the determination with which the Ukrainians are fighting, together with Western support, could possibly turn the tide in their favor, as Daniel Gros writes in today’s guest article. After all, the capital expenditures that have flowed into the Russian military in recent years may have been too small to keep the huge power apparatus alive for long.

The plan had long been expected, and on Tuesday, the EU Commission presented its strategy for becoming less dependent on Russian gas. The Fit for 55 package alone will reduce gas consumption by 100 billion cubic meters, explained Commission Vice President Frans Timmermans in Brussels. However, this only applies in the long term for the period up to 2030. This year, however, the Commission also wants to reduce Russian gas imports into the EU by 100 billion cubic meters (bcm) – primarily through LNG imports.

Obviously, the Commission is willing to pay a lot for this. Because 50 bcm are to reach the continent via liquefied natural gas terminals. For this, however, the member states would have to buy up almost the entire additional quantities available. Just a few days ago, the International Energy Agency (IEA) put the figure at 60 bcm. However, for the EU, the IEA considered only 20 bcm to be realistic given the current price curves. To put it plainly: If the Europeans wanted to buy the world market dry, the already exorbitant prices would have to rise even further. Other countries – primarily in Asia – would then lose out.

It is also noteworthy that the Commission wants to impose colder homes on citizens. A total of 10 bcm is to come from lowering the room temperature by 1 degree. It will be exciting to see how governments want to communicate this to their citizens. In contrast, other measures such as more renewable energies and heat pumps have hardly any effects in the short term, according to the Commission’s calculations. The doubling of biomethane expansion to 35 bcm by 2030 even overestimates what is technically feasible, warned E3G consultant Raphael Hanoteaux. In the case of hydrogen imports, an unrealistically fast expansion of renewables in neighboring countries is assumed.

Another huge lever for gas substitution does not even appear in the Commission paper. Bruegel expert Simone Tagliapietra calculated that switching from gas to coal in power generation could save 30 bcm. Russian gas imports could even be reduced by 80 percent. In Germany, lignite-fired power generation is also likely to increase again, Wilfried Rickels of the Kiel Institute for the World Economy told Europe.Table. Economics Minister Robert Habeck has so far only wanted to keep open the possibility of generating more electricity from coal, which has lower emissions.

To ensure that natural gas is actually available in the coming winter, the Commission paper envisages a minimum filling level of European storage facilities of 90 percent by the beginning of October. With this, the EU wants to go even further than the German target of 80 percent, which Habeck wants to stipulate in a new law. Germany will, therefore, probably have to adapt the draft, says Rickels.

For months, it has been noticeable that the filling levels are particularly low in the storage facilities controlled by Gazprom. The Commission explicitly mentions the Russian state-owned company in its paper. Therefore, it wants to declare gas storage facilities to be critical infrastructure in the future. To this end, the owners are to undergo certification to ensure that they do not pose a risk to supply security. At the press conference, Energy Commissioner Kadri Simson was even more explicit.

“In the event of a negative assessment, ownership unbundling could be required,” the commissioner explained. Such ownership unbundling is the sharpest option for how to implement the competitive separation of infrastructure and generation or trading. What is meant by this is nothing less than a forced sale of majority shares – a Brussels threat to Gazprom.

The chairman of the Industry Committee, Christian Buşoi, expressed a positive view: “The ITRE Committee supports the initiative to make Europe less dependent on Russian gas.” The Commission should now make it possible for the Parliament to quickly deal with the proposals. In the paper, the Commission had already encouraged its co-legislators to increase or bring forward targets for renewable energy and energy efficiency.

Energy security is currently more important to the political leadership than climate goals. Last year’s power crisis and rising prices for fossil energy raw materials in the wake of the Ukraine war are causing concern for China’s leaders. As a result, the key goal of energy policy is to secure the power supply. Oil and gas production, as well as coal mining, are to be expanded.

Xi Jinping reiterated in his speech at the People’s Congress that China’s energy transition will not happen overnight. The new must first be built before the old can be torn down, Xi said. Coal-fired power still accounts for a good 60 percent of the People’s Republic’s energy demand. As long as renewables or other energy sources such as gas and nuclear power cannot replace coal, Xi will not take any risks and will not accelerate the shutdown of coal-fired power plants.

Russia’s attack on Ukraine was a topic that was barely mentioned at the People’s Congress. But energy security is a medal with at least two sides. China’s political leaders want to ensure secure access to energy and power for its economy and citizens. But at the same time, China cannot afford to become too dependent on imports of energy commodities such as coal, gas, and oil – because this would put energy security at risk during crises. Xi Jinping already emphasized back in October that they “must hold our energy supplies firmly in our own hands”.

Unlike many European countries, the People’s Republic is not dependent on Russian energy supplies. While Russia is China’s largest supplier of coal, imports from its neighbor account for only a mere 0.3 percent of the People’s Republic’s coal consumption. China can cover the vast majority of its needs from domestic sources. China can cover the vast majority of its requirements from domestic sources. When it comes to gas, the Russian share is higher. However, China is not yet as dependent on gas in many areas as Europe. A switch back to coal would be easy, according to analysts at the consulting firm Trivium China.

Beijing is in an ideal position. In the next few years, China could buy up all the Russian gas that Europe spurns. If Russia escalates the war in Ukraine to the point where it would become a permanent international pariah, discounts could even beckon for Beijing. Still, China’s political leaders will most likely be smart enough not to become trapped in a gas dependency on an unpredictable Russia. That would contradict its goal of energy security.

However, China could buy its way into Russian power companies such as Gazprom. According to Bloomberg information, responsible policymakers in Beijing are in talks with state-owned enterprises such as China National Petroleum about possible investments in Russian companies or assets. Any stake would serve to boost China’s energy imports and security, Bloomberg cites individuals familiar with the talks as saying. The stated goal, they say, is not to support Russia’s invasion. However, the talks between Chinese and Russian companies are reportedly still in early stages.

On top of that: China is still dependent on Western exports and technologies in many economic areas. A too large swing toward Russia that would scare off Western business and trade partners is not very likely. As Trivium analysts write, “We believe that the costs of a true alliance with Putin against the world outweigh the benefits by far.”

Even though coal consumption is likely to increase in the short term, China is not ignoring the expansion of renewable energies. According to Premier Li Keqiang’s work report, China plans to push ahead with the expansion of large-scale wind and solar power plants. In addition, China plans to increase the capacity of its power grids.

This would result in less renewable energy being lost. Offshore wind power is to be promoted in particular. Power storage facilities are also to be expanded (China.Table reported). To this end, a “Five-Year Energy Storage Plan” is currently being discussed. The Chinese Ministry of Finance also announced that it would finally pay out overdue subsidies to developers of renewable energy projects. There have been major delays in this regard in recent years, with the result that funds have been lacking in some cases to launch new projects.

But the expansion of renewable energy sources takes time. It will take several years before solar, wind, and hydropower can drastically reduce the share of fossil fuels in the energy mix – especially if power demand continues to rise.

Beijing, Berlin, and Paris want to work together for a diplomatic solution to the Ukraine war. In an hour-long exchange, German Chancellor Olaf Scholz and the presidents of China and France, Xi Jinping and Emmanuel Macron, also spoke out in favor of humanitarian aid and access to the combat areas, according to the German government spokesman Steffen Hebestreit. Functioning evacuation corridors should be established.

All three countries expressed their willingness to provide further humanitarian aid. Xi supports Franco-German efforts to reach a cease-fire, the French presidential office said. Xi described the situation in Ukraine as concerning, according to state media, and called for “maximum restraint.” He also expressed concern about the impact of sanctions on the stability of global finance, energy security, and transportation and supply chains.

China has so far refused to condemn the Russian incursion or call it an invasion. Foreign Minister Wang Yi had described China’s friendship with Russia as “rock solid” on Monday (China.Table reported): “No matter how perilous the international landscape, we will maintain our strategic focus and promote the development of a comprehensive China-Russia partnership in the new era.”

According to Wang, however, Beijing is ready to use its influence on Russia: President Xi had already spoken on the phone with Vladimir Putin on February 25. In this telephone call, Xi expressed his wish for Russia and Ukraine to hold peace talks as soon as possible. Putin responded positively. rtr/rad

US President Joe Biden announced a ban on Russian oil and other energy imports on Tuesday in retaliation for the invasion of Ukraine. “That means Russian oil will no longer be acceptable in US ports,” Biden said. The decision was made with allies, he explained. EU states, however, are not following Washington’s lead for the time being.

The US is much less dependent on Russian energy sources than Europeans. The US imported more than 20.4 million barrels of crude oil and petroleum products per month from Russia last year. That’s eight percent of US imports of liquid fuels.

The British government announced it would stop importing oil from Russia by the end of the year. “This transition period will give the market, businesses, and supply chains more than enough time to replace Russian imports,” UK Business Secretary Kwasi Kwarteng wrote on Twitter. Russian oil currently accounts for eight percent of British demand.

Gas imports from Russia are not affected for the time being. However, Kwarteng announced that he would examine options for an exit here as well. Russian gas accounts for only four percent of the British supply.

The British oil company Shell announced that in the future it will no longer buy oil and gas from Russia. The company said it would stop buying Russian crude oil on the spot market with immediate effect and would not renew existing contracts. Shell would completely withdraw from its Russian business and divest its 27.5 percent stake in the Sakhalin 2 LNG plant, which is operated by Gazprom. In addition, all service stations in Russia were to be closed.

Shell also wants to remove Russian crude oil from its own supply chains “as quickly as possible” in coordination with the governments involved. However, according to the company, this will take several weeks and lead to bottlenecks at some refineries. The business with Russian pipeline gas as well as liquefied natural gas is also to be scaled back piece by piece. However, Shell stressed that it would be dependent on the cooperation of governments and energy suppliers to achieve this.

“These societal challenges highlight the dilemma between putting pressure on the Russian government over its atrocities in Ukraine and ensuring stable, secure energy supplies across Europe,” Shell CEO Ben van Beurden said, according to a statement. In the statement, the company also apologized for buying a cargo of oil from Russia as recently as last week after the war broke out. It said it wanted to donate the profits from this to humanitarian causes. dpa/rtr

Despite the discussion about sanctions against Russian oil and gas supplies, the German government is sticking to nuclear power and coal phase-out. Yesterday, Economics Minister Robert Habeck and Environment Minister Steffi Lemke (both Greens) spoke out in a joint report against extending the operating lives of the remaining nuclear power plants. Habeck also said after a special meeting of the energy ministers of the federal states that they would also stick to the coal phase-out. “However, we will keep all coal-fired power plants that go off the grid in reserve.”

Like Chancellor Olaf Scholz before him, Habeck rejected a European import ban on Russian gas and oil. Sanctions had been agreed, which would hit Russia hard because of the invasion of Ukraine, but would also be sustainable for years. Energy dependence on Russia must be corrected as soon as possible, but “undersupply” must be avoided in the meantime. In addition, it was being examined whether it would be possible to additionally tax the profits of energy companies that, for example, had bought gas very cheaply and were now selling it at a very high price.

The economics and environment ministries spoke out against extending the operating lives of the three nuclear power plants still in production. After weighing the benefits and risks, this was not recommended, even in light of the current gas crisis. “In this weighing, we have a minimum additional production of electricity for maximum high safety risks,” Habeck said. “And that is why I have come to the conclusion that this is the wrong way to go.” rtr

The war in Ukraine has led to severe distortions in the nickel market. On Tuesday, the price of a ton of the industrial metal rose by more than 50 percent to over $100,000 US at times. Trading on the London Commodity Exchange was then suspended – possibly for several days, the LME exchange said. Since Monday alone, the price has more than tripled at its peak. NickelCMNI3 is needed in particular for steel production.

Experts attribute the extreme price increase mainly to speculators who had previously bet on falling prices. At the same time, there is a supply shortage. The price of nickel had already risen significantly before the war. If the price then continues to rise, more and more speculators who had bet on falling prices get into trouble. They then have to buy nickel to close out their positions, which drives the price even higher.

In other metal markets, investors are stocking up for fear of supply shortfalls (Europe.Table reported). PalladiumXPD, which is used for autocatalysts and whose main exporter is Russia, rose more than six percent to $3,195 per troy ounce. AluminumCMAL3, which is needed in aircraft and automotive construction, rose more than four percent to $3,900 per ton. dpa/rtr/luk

Russian state-controlled media outlet Russia Today has challenged an EU ban on its activities in the European Union, Europe’s second top court said in a tweet on Tuesday. The EU imposed the ban last week, accusing RT of systematic disinformation over Russia’s invasion of Ukraine. The sanction means EU operators will be prohibited from broadcasting, facilitating, or otherwise contributing to the dissemination of any RT content.

The move, which applies to RT’s English unit and operations in Britain, Germany, France, and Spain, also suspends RT’s broadcasting licenses and authorization, transmission, and distribution arrangements with its EU counterparts.

“RussiaToday (France) has challenged @eu_council decision and regulation of 1 March 2022 on the restrictive measures in view of #Russia’s actions destabilizing the situation in #Ukraine before #EUGeneralCourt,” the Luxembourg-based tribunal tweeted. It will, in the coming months, set a date for a hearing before it issues a ruling. The EU also banned another Russian state-owned media outlet, Sputnik. The case is T-125/22.

Moscow describes its actions in Ukraine as a “special operation” to disarm its neighbor and arrest leaders it calls “neo-Nazis”. Ukraine and its Western allies call this a baseless pretext for an invasion.

Russia passed a law on Friday that gives Moscow much stronger powers to crack down on independent journalism. rtr

The European Parliament is set to approve on Wednesday a report urging the EU to ban golden passport schemes by 2025 and immediately stop the issuance of visas and passports to rich Russians in exchange for investments. The move follows Russia’s invasion of Ukraine which has triggered global sanctions of unprecedented severity against Moscow, with targets including a number of powerful and wealthy Russians seen as close to President Vladimir Putin.

The golden passport industry, which between 2011 and 2019 generated investments in EU countries of over €20 billion ($21.8 billion), is currently almost entirely unregulated in the EU, despite many countries having run these schemes for years. EU states such as Malta and Cyprus have made huge profits with their schemes and the European Commission’s vice president overseeing financial policy, Valdis Dombrovskis, set up a successful residence investment program in Latvia when he was prime minister there at the beginning of the last decade.

EU lawmakers say in their report that ending such schemes could have a significant economic impact in some countries. They are therefore proposing the gradual phase-out of golden passport schemes and tight rules for residence arrangements, including much more rigorous checks on applicants.

Companies developing and promoting these programs would face strict requirements. Under the proposal, which is backed by a majority of legislators, revenues generated by these schemes would be taxed to fund the EU budget. In an amendment to the original proposal prompted by the Russian invasion of Ukraine, the parliament urges an immediate halt to sales of visa and residence permits to Russians, among the biggest beneficiaries of these schemes.

Once approved, the report will go to the European Commission, which has the power to propose legislation.

EU Justice Commissioner Didier Reynders told lawmakers that the EU executive disagreed with the need for new rules on sales of citizenship because it was already pushing through legal proceedings to shut down existing golden passport schemes in Malta, Cyprus, and Bulgaria.

But the Commission has said it will assess the need for new laws to tighten golden visa schemes, and also issue shortly a non-binding recommendation on EU member states’ issuance of golden passports and residence permits to Russians. Last month, Britain scrapped golden visas for wealthy investors amid concerns about the inflow of illicit Russian money at a time when Russia was massing forces along the border with Ukraine, a week before launching its invasion. rtr

Global energy-related carbon dioxide emissions rose six percent last year to 36.3 billion metric tons, according to an analysis by the International Energy Agency (IEA). This is the highest level ever, more than offsetting the previous year’s decline that occurred at the start of the COVID-19 pandemic, the IEA announced in Paris on Tuesday. The recovery of the global economy after the COVID crisis relied heavily on coal. In addition, unfavorable weather and high natural gas prices led to more coal being burned, even though power generation from renewable sources saw the largest growth ever.

Coal accounted for more than 40 percent of the total growth in global CO2 emissions in 2021, reaching an all-time high of 15.3 billion metric tons, according to the IEA analysis. CO2 emissions from natural gas rose well above 2019 levels to 7.5 billion metric tons. At 10.7 billion metric tons, CO2 emissions from oil remained well below pre-pandemic levels due to the limited recovery in global transportation activity, mainly aviation.

Despite increased coal consumption, renewable energy sources and nuclear power represented a higher share of global electricity generation than coal in 2021, the IEA said. According to the report, electricity generation from renewables reached an all-time high of more than 8,000 terawatt-hours (TWh), up 500 TWh from 2020. Output from wind and photovoltaics also increased, while hydropower generation declined due to the effects of drought, particularly in the US and Brazil.

As the IEA data show, China is largely responsible for the increase in global CO2 emissions. According to the data, China was the only major economy to experience economic growth in both 2020 and 2021. The increase in emissions in China more than offset the overall decline in the rest of the world over the period. In 2021 alone, China’s CO2 emissions rose to more than 11.9 billion metric tons, accounting for 33 percent of the global total, according to the IEA analysis. dpa

Last week, the French Presidency of the Council of the European Union presented a compromise proposal for the creation of a European Carbon Boundary Adjustment Mechanism (CBAM), which Contexte published on Monday. The dossier from the Fit for 55 package is considered one of the priorities of the French and President Emmanuel Macron, as it could lay the groundwork for future external climate and trade policies.

However, the Council Presidency’s compromise proposal, which serves as the basis for the member states’ position, is largely based on the Commission’s proposal. The sectors whose imports into the EU are to be affected by the CBAM would not be expanded but would be limited to electricity, iron and steel, aluminum, cement, and fertilizers.

Only within the sectors does the French Presidency want to include other products that the Commission had not covered. Among them: Aluminum components, aluminum cables, and aluminum containers such as tanks, cans, or drums. In addition, all iron or steel products are also to be covered by the CBAM.

The rapporteur of the lead ENVI committee in the EU Parliament, Mohammed Chahim (S&D), had proposed to extend the scope of the CBAM to organic chemicals, hydrogen, and polymers (Europe.Table reported). Chahim had also demanded that indirect emissions arising from the extraction, transport, and production of the products concerned be included. However, the French compromise does not provide for this. Instead, only emissions from the direct generation of energy that goes into the production of the final product are to be covered by the CBAM.

The French also want to retain the transitional phase envisaged by the Commission between 2023 and 2025, in which the CBAM already applies, but importing companies do not yet have to pay border compensation. CO2 border adjustment payments would not actually be due for imports across EU borders until 2026. Not only rapporteur Chahim, but also numerous EU politicians from various camps, had called for a faster introduction.

A few changes are foreseen in the compromise regarding the Commission’s reporting obligation before the end of the transition period. A Commission report is to assess the impact of the CBAM on indirectly affected sectors, trade, European exports, and vulnerable third countries. In addition, based on the report, the Commission is to present, if necessary, a legislative proposal extending the scope of the CBAM. A very new proposal from the French: Imports up to a value of €150 are to be exempted from the CBAM.

One of the key points of contention in the dossier is the phased introduction of the CBAM with a simultaneous decrease in free ETS allowance allocations for the industries concerned. The Commission had planned to take away ten percent of the free allocations each year for ten years and introduce the CBAM in equal amounts each time. Accordingly, the CBAM would not be fully in place until 2036.

In his draft report, Chahim had called for the free allocation of allowances to be phased out in significantly larger steps by the end of 2028 – seven years earlier than planned by the Commission. However, the phasing out of allowances is the subject of the ETS reform, not the CBAM dossier, which is why ETS rapporteur Peter Liese (EPP) had accused Chahim of exceeding his competence (Europe.Table reported).

The French compromise proposal is completely reticent in this respect. Proposals on the duration of the introduction phase of the CBAM are completely missing. However, the Council Presidency points out that negotiations with the EU Parliament cannot begin until the Council has also made decisive progress on ETS reform.

The French also remain cautious on the controversial question of what to do with the revenues from the CBAM. This is to be discussed at a later date, they say. However, the compromise draft points out that the EU must support the least developed countries in decarbonization. However, detailed explanations on this are missing. In the EU Parliament, the dispute over whether revenues should be used for the decarbonization of the EU’s own industry, as compensation for consumers, or for climate protection financing in third countries thus continues.

The proposal is now with the embassies of the member states, which must confirm it this week. On March 15, the text will finally be presented to the finance ministers of the EU member states. luk

The AI law must strike a balance between freedom and control. This is emphasized by the responsible rapporteur in the Industry Committee (ITRE) Eva Maydell (EPP) in the draft of her opinion on the AI law available to Europe.Table. Therefore, further provisions would have to find their way into the regulation, which would enable not only small businesses but also SMEs and start-ups to remain competitive and creative. They should, for example, be better involved in the development of codes of conduct and standardization norms and be more strongly represented in the planned European Artificial Intelligence Board.

Maydell also wants to weaken the Commission’s formulations in a whole series of regulations. For example, the Commission stipulates that the data sets used must be error-free and complete. In contrast, the ITRE rapporteur suggests that high-risk AI systems should be “designed and developed to the best of their ability” and must be “reasonably tested for errors and completeness in accordance with industry standards”.

Another example is the logging obligation. According to the Commission’s proposal, high-risk AI systems should have functional features that enable automatic recording of operations and events (logging) throughout their operation. Logging should ensure that the functioning of the AI system is traceable throughout its lifecycle.

The rapporteur now wants to weaken the phrases “during the entire operation” and “during its entire life cycle”. For example, in her view, logging should ensure that the functioning of the AI system is traceable “over a certain period of time”. There is also no longer any talk of automatic recording. The AI systems should only be technically capable of carrying out such logging.

Maydell proposes that SMEs and start-ups also be given the opportunity to participate in the so-called “regulatory sandboxes”. She even wants to expand the instrument further and create a European AI regulatory sandboxes program. To avoid fragmentation of the digital single market and different handling between member states, she wants the program to be managed centrally by the Commission. In doing so, the latter is to take into account the specifics of the member states in terms of liability law and insurance systems.

The ITRE rapporteur also suggests creating a common European authority for benchmarking. It should bring together national metrology and benchmarking authorities to establish a unified approach to measuring accuracy, robustness, and other relevant criteria. Currently, there are no relevant metrics at the European level to guide AI developers and vendors, she complains.

While standardization organizations define the standards, the task of benchmarking organizations would be to define how these standards are met and measured. In Maydell’s view, a common European authority – perhaps in the form of a European Benchmarking Institute or as a subgroup of the European AI Committee – would enable a coherent European approach to benchmarking and metrics. It should be modeled on existing structures, such as the Laboratoire national de métrologie et d’essais (LNE) in France or the Technology’s Software Quality Group on Metrics and Measures in the United States, the ITRE rapporteur suggests.

“Given the new obligations, we need to provide companies with clearer guidance, simpler tools, and more efficient resources,” she stresses. For example, Maydell calls for clear definitions of AI and AI systems. These definitions should be consistent with internationally established definitions, she stresses. For example, the Commission’s proposed definition is largely based on the OECD definition (OECD/LEGAL/0449). However, using an identical definition to the OECD would provide more certainty for industry, businesses, start-ups, and SMEs. And that is ultimately one of the committee’s main goals. It would also be key to the future development of common international standards.

The French presidency of the EU Council has proposed exempting micro-enterprises offering high-risk systems from the obligation to set up a quality management system, according to the French news portal Contexte. Among other changes related to innovation support measures to be discussed in a working group on March 10, Paris sets out conditions for testing high-risk AI systems in real-world conditions in or outside so-called regulatory sandboxes. ank

Women in Europe must be much better protected against rape and harassment, according to the EU Commission. Therefore, the Brussels-based authority proposed a law on Tuesday that would, for the first time, regulate the fight against violence against women across the EU. “I want a society where violence against women is prevented, condemned, and prosecuted when it happens. It is time to ensure justice and equality,” said EU Commission President Ursula von der Leyen.

Specifically, the proposal, which EU member states and the European Parliament must now negotiate, provides for the introduction of “rape based on lack of consent” and female genital mutilation as criminal offenses throughout the EU. Cyber violence is also to be criminalized. This includes sharing intimate photos without consent, online stalking, and incitement to violence and hatred on the Internet. The EU Commission also proposed what the minimum prison terms should be for certain offenses: at least eight years for rape, five years for female genital mutilation, and two years for cyber-stalking.

In addition, the EU Commission proposed gender-sensitive and more accessible reporting channels for such acts of violence, which should increase the rate of reported cases. Professionals such as psychiatrists or healthcare workers should also not be prevented from reporting a reasonable suspicion of an “imminent risk of serious physical harm” due to confidentiality rules.

In court proceedings, evidence and questions concerning the private lives of victims should be used with extreme restraint. In addition, victims should be entitled to compensation from the perpetrator, for example, lost income, medical care, or psychological damage. There should also be specialized and free help telephones that can be reached around the clock. dpa

War represents a contest of wills, the German strategist Carl von Clausewitz argued some 200 years ago. On this point, the Ukrainians fiercely defending their homeland seem to have a distinct advantage over the invading Russian forces. But, to win a war, will must be supported by military means – and that requires industrial and economic strength. Here, Russia might have an advantage over Ukraine for now, but it is far weaker than the West it ultimately aims to challenge.

In terms of economic and industrial strength, Russia is a mid-size power, at best. Its manufacturing output is only half that of Germany, and its GDP is about the same size as Italy’s. The European Union’s combined GDP is almost ten times larger than Russia’s. And that is before the new round of punitive Western sanctions begin to take their toll.

Given its large economy, Europe can afford to build credible defense capabilities. For European countries to meet their NATO commitment to spend 2 percent of GDP annually on defense, they must increase spending by just 0.5 percent of GDP, on average. If one considers that total government expenditure in these countries currently averages 45 percent of GDP, this seems entirely feasible.

Even for laggard Germany, the recently announced short-term defense investment of €100 billion ($109 billion) represents only about 2.5 percent of GDP. Russia, for its part, probably dedicates more than 4 percent of its GDP to defense – a significant burden for a country that needs to maintain costly infrastructure to link its vast territory.

While defense spending accounts for a significant share of Russia’s economy, the sum itself is rather modest, especially by “great-power” standards. Russia spent an estimated $60 billion on defense in 2020, compared to Germany’s $50 billion outlay. At that spending level, and given the corruption that pervades Russian governance, building a large modern fighting force able to sustain a prolonged conflict, while maintaining an outsize nuclear force and advancing great-power ambitions globally, would be a truly astonishing achievement.

It is an achievement Russia cannot claim. In fact, it seems that Russia has had a Potemkin military all along. The “Potemkin” term is taken from Grigory Aleksandrovich Potemkin, the governor of New Russia who is said to have constructed fake settlements to impress Catherine the Great during her 1787 journey to inspect the newly acquired Crimea and surrounding territories. But the story of “Potemkin villages” is largely a myth, and historians disagree about what the czarina actually saw on her tour. It seems that, in reality, Potemkin made considerable investments in infrastructure in and around Crimea, but lacked the resources to link the newly conquered territory to the rest of Russia.

The resulting infrastructure weaknesses, together with a failure to build logistical capabilities, severely impeded Russia’s ability to defend itself against English and other European forces during the Crimean War 60 years later. Reports that troops in Ukraine today are facing food and fuel shortages suggest that Russia did not learn its lesson. Logistics is always the area most vulnerable to corruption in the military.

Understanding the consequences of the Russian military’s lack of resources requires us to look not only at what has happened in Ukraine, but also – and perhaps more importantly – at what has not. For starters, Russia has failed to destroy communications and other electronic-control systems.

It has long been widely assumed that Russia would support any military offensive with “devastating” cyberattacks. But this threat has not materialized, presumably because Ukraine has the support of Western intelligence agencies whose cyberwar capabilities are based on a vastly larger pool of talent and the know-how of US tech giants.

In fact, just a few hours before the invasion began, Microsoft detected – and blocked – malware aimed at wiping data from Ukrainian government ministries and financial institutions. The company subsequently shared the code with other European countries, in order to prevent its further use.

Likewise, SpaceX has sent Starlink internet terminals to Ukraine, in order to offset internet disruptions in the country. Making the satellite-internet system operational in the country will take time, because a large number of base stations must be put in place. But this is a question of weeks, not years.