Many questions remain unanswered about the leaks in the two Baltic Sea gas pipelines Nord Stream 1 and Nord Stream 2. The governments in Denmark, Poland and Sweden assume sabotage after measuring stations in Denmark and Sweden recorded powerful detonations under water. German gas supplies are not affected, as no gas from Russia flows through either pipeline to Germany.

The German government wants to avoid possible bottlenecks in energy supply, also in view of the dire situation in France, by extending the operating lives of two German nuclear power plants, as German Economic Affairs Minister Robert Habeck said yesterday in Berlin.

In order to become independent of Russian energy, the heads of state and government of the EU member states also look to the African continent. Many investments are flowing into fossil energy sources. Ella Joyner analyzes to what extent this is an opportunity and a risk for African countries such as Mozambique, Nigeria, Algeria and Senegal.

Meanwhile, the planned excess profits tax for fossil energy companies in the EU could be extended from one to two years. This is the result of a compromise proposal by the Council Presidency. Read the details in the News.

Another look at the digital sector: For six months, nothing has happened with the Transatlantic Data Privacy Framework (TADPF). Personal data may still not be transferred from the EU to the USA without a legal basis. But there could soon be a decision, one that, as Falk Steiner reports, could become a very big problem for the German economy.

I wish you an informative read.

The EU High Representative for Foreign Affairs, Josep Borrell, put it succinctly when he recently described a renewed focus on Africa: “Energy is at the heart of our relations with the people of Africa,” he said in Prague. “We need them. They produce natural gas. And they need us.”

In doing so, he struck a different tone from the lofty rhetoric of the African Union-European Union summit in February, but the war in Ukraine and the energy crisis have changed many things.

In their quest to move away from Russian natural gas, EU leaders have courted various suppliers in recent months, including Norway, Qatar, the United States and Azerbaijan. Several African countries – notably Nigeria, Algeria, Senegal, Mozambique and Egypt – also have large supplies available to Europe for varying degrees of economic, security or political reasons.

In recent months, there have also been an impressive number of visits to Africa that seem to be bearing fruit. In June, EU Commission President Ursula von der Leyen proudly announced an agreement with Israel and Egypt. In July, Algeria took on Russia as Italy’s top gas supplier. Nigeria is also showing willingness to supply more gas to Europe. In return, these countries often receive investment in gas infrastructure that (officials and politicians believe) can later transport clean fuels such as hydrogen.

For Europe, the strategy has worked. Von der Leyen said the EU now gets 9 percent of its natural gas from Russia instead of 40 percent as before the invasion of Ukraine. Norway has now replaced Russia as the EU’s largest supplier.

And for Africa? Many governments in these countries would like to exploit their natural fossil resources, although activists warn that this would seriously undermine the fight against the climate crisis. AU countries are likely to use the next UN climate summit in November to push for massive new fossil fuel investments in Africa, the British newspaper The Guardian reported.

“This energy crisis comes at an interesting time for Africa,” said Gwamaka Kifukwe, an expert at the European Council on Foreign Relations. Many African countries often don’t even have enough energy for clean cooking or for interconnected power grids, Kifukwe says.

Europe is asking Africa to “make electricity an export commodity and sell to them, even though we have a shortage and need exponential growth in electricity,” he said. “And of course, resource extraction in Africa does not have a very good history.”

Mozambique, where a violent insurgency is raging in the north of the country, is often described by activists as a case of the “resource curse”. “The growth of the fossil fuel industry in the region and its impacts on local communities who continue to live in poverty, together with unmet political and corporate promises, has fuelled social unrest,” a coalition of more than 20 NGOs from Africa and Europe wrote in a March report. According to the report, public and private financial institutions have invested at least $132.3 billion in fossil fuel companies and projects in Africa between 2016 and 2021.

As Kifukwe points out, selling energy to Europe is an opportunity for growth, but also “an opportunity to find other people to be corrupt with”.

It is not only the energy crisis that has increased European interest in Africa. The war in Ukraine has also strengthened the resolve to counter Russia’s growing influence on the continent. This – like China’s influence – has been on the EU’s agenda for some time. At the end of 2021, it imposed sanctions on the mercenary Wagner Force. The EU accuses it of “fomenting violence, plundering natural resources and intimidating civilians”, particularly in Africa’s Sahel region”.

Borrell expressed concern about the spread of pro-Russian disinformation campaigns about the Ukraine war. A statement from the Polish government said, “The countries of the region are being persuaded that the West – especially the US – is treating Africa like a colonial territory in which Europe and the US have no serious interest.”

Many in Europe were disappointed that several African countries (including Algeria, Senegal, and South Africa) abstained from voting at the UN convention in March to condemn Russian aggression against Ukraine. For ECFR’s Kifukwe, however, this decision was not necessarily a sign of support for Russia. Rather, he said, it was a matter of maintaining a strategic balance.

“Most African countries negotiate with external partners from a position of weakness,” he said. “They are poor, they are needy, and so it is in their interest to have as many partnerships as possible. For many countries, this war is a “European problem,” he said.

In part, he said, it’s also about European colonialism: “Why put all your eggs in one basket, especially when you haven’t always had good experiences with that basket?” But there is no reason to panic. “The fact that other countries are gaining influence in Africa is not a problem per se, but a question of resilience,” stresses the ECFR expert.

The basic problem is exactly the same as it was six months ago when US President Joe Biden and EU Commission President Ursula von der Leyen appeared before the press together: Companies face heavy fines and a ban on transferring personal data from the EU to the US without a legal basis. So far, nothing concrete has come of the political announcement – and time is running out.

The various European data protection supervisors are still deliberating on the draft decision of the Irish data protection supervisory authority DPC Ireland in the relevant Meta/Facebook case. But this process is finite. The objections of other supervisory authorities are currently being tried to be resolved by consensus. And at some point in the coming weeks, according to the DPC, a decision will be made. In all likelihood, this will then also bring down the last widely used legal option for transferring personal data to the USA: the standard contractual clauses.

That would be a problem for the German economy, as shown by a recent survey by the German IT interest group Bitkom. 59 percent of the 277 companies that transfer data outside the scope of the GDPR do so to the United States – and 91 percent use standard contractual clauses to do so. If these cease to be an instrument and no adequate political solution is found, says Bitkom board member Susanne Dehmel, this would have massive consequences.

Above all, companies with more than 500 employees rely on solutions outside the immediate GDPR regime. At the top of the list for 87 percent of them is the use of cloud services. Communication systems are used by 83 percent. And for 80 percent of large companies, all kinds of service providers are standard. But without standard contractual clauses, the legal basis used for many data transfers would no longer apply.

The Transatlantic Data Privacy Framework (TADPF) announced by Biden and von der Leyen six months ago is actually intended to remedy this situation. On the surface, the procedure seems simple: The US side must ensure that data from EU citizens is processed in a way that meets the requirements of the European Court of Justice. But to avoid having to change laws that would require congressional approval, the Biden administration wants to rely exclusively on executive orders. Whether these can provide sufficient guarantees, however, is disputed.

EU Justice Commissioner Didier Reynders is currently in almost daily contact with US Commerce Secretary Gina Raimondo, Rupert Schlegelmilch, deputy director general at DG Trade reported at a conference last week.

Data protection activist Max Schrems successfully brought down the predecessor agreements Safe Harbor and Privacy Shield with lawsuits. He sees little reason for optimism at the moment, saying that what he knows about the TADPF so far is more reason to worry that a third inadequate agreement will be concluded. “It is astonishing that two democracies that agree on principles such as judicial authorization of surveillance measures cannot reach a proper agreement,” Schrems says. “It seems that the US is still taking the position that people outside the US should not have fundamental rights.”

And the next problem is already looming on the horizon: Although it is currently still at the beginning of the consultation process. But in the United Kingdom, which has left the EU, there are far-reaching plans to change the data protection standard, which has so far been well comparable with the EU’s GDPR standard. There, work is currently underway on the Data Protection and Digital Information Bill (DPDI).

This could significantly change data protection in the UK. And, depending on the degree of deviation from the GDPR, also call into question the Commission’s adequacy decision. This would then also make the UK a problem country for the transfer of personal data.

The parliamentary procedure is not yet far advanced. Actually, it was supposed to go quickly. But the change of prime minister and the mourning ceremonies surrounding the Queen’s death caused delays in the House of Commons. Work on this is now to continue at full speed in the fall. The law firm DAC Beachcroft has compiled a synopsis of the changes that the government’s proposed version of the DPDI could bring.

The planned EU-wide excess profits tax for fossil energy companies could be extended from one to two years. Member states should be able to decide for themselves whether to levy the excess profits tax on oil, coal, gas, and refined products only in 2022, only in 2023 or in both years. That’s according to a compromise proposal from the Council presidency on Tuesday, which is available to Europe.Table. The Commission originally wanted a tax on profits from 2022.

Monday and Tuesday, the Council’s Energy Working Group had again discussed the draft regulation. Today, the Permanent Representatives will meet before the Energy Ministers are expected to adopt the text on Friday.

According to the bill, excess profits are taxable revenues that are more than 20 percent of the average for 2018 [previously 2019] through 2021. States are to use the revenues to relieve households and businesses of high energy costs, for example. Equivalent national measures already adopted are to remain unaffected by the regulation.

In the electricity sector, member states would be given the option of levying excess profits taxes only on 90 percent of the revenues concerned. Marketers would therefore be left with a kind of allowance of ten percent. Additionally, EU countries would be free to exempt income from balancing energy and redispatching from the tax. In Germany alone, this involves billions of euros to stabilize the power supply. Control energy is offered by power plants, energy-intensive industrial companies and electricity storage facilities.

“The excess profits must finally be skimmed off and quickly distributed to Europe’s citizens as energy money,” said Green Party MEP Michael Bloss. “At the same time, it must be clear that the money goes to those who need it. The conditions must be clearly defined. In the end, however, it must be clear to us that the motto of this crisis must be “save, save, save”. Electricity and gas savings must be mandatory for the member countries. Anyone who shirks responsibility here is shaking European solidarity.” ber

Federal Economic Affairs Minister Robert Habeck considers it necessary to operate the two nuclear reactors in southern Germany over the winter given the current situation. He referred to the situation in France, where many nuclear power plants cannot run due to maintenance work. There, he said, the situation had deteriorated further with a view to the winter. “Today, I must say that the data from France speak for the fact that we then also call the reserve,” said the Green politician on Tuesday in Berlin.

The Neckarwestheim 2 and Isar 2 nuclear power plants would then have to run beyond the planned shutdown at the end of the year. The final decision would have to be made in December at the latest for Isar 2 for technical reasons; for Neckarwestheim, this would also be possible at the beginning of the year. At the longest, the nuclear power plants are to run until mid-April 2023. In neighboring countries, the decision is being followed closely because of the energy shortage.

Actually, the last three nuclear power plants should be shut down at the end of the year as part of the nuclear phase-out. According to the Ministry for Economic Affairs, this will continue to apply to the Lingen reactor in the Emsland region in any case. rtr

Two days after the victory of the right-wing alliance in Italy’s parliamentary elections, the EU Commission has approved a further tranche from the Next Generation EU recovery program for the country. The authority was in favor of releasing €21 billion from the pot. The member states now have the final say.

The transfer rewards the efforts of the previous government under Prime Minister Mario Draghi, which had requested the disbursement of the second tranche at the end of June after it considered that the agreed 45 milestones had been reached. These included reforms to public administration, public procurement and financial management. The additional funds are to enable investments, for example, in the expansion of high-speed Internet provision and the digitization of schools.

Italy had already received a first tranche of €21 billion from the pot in April. The country is the biggest beneficiary of the reconstruction program. In total, it has the prospect of receiving almost €192 billion, of which €69 billion are grants. The rest is available as loans. However, all the money is tied to the implementation of further reforms.

Economic Affairs Commissioner Paolo Gentiloni appealed to the new government to “seize the opportunity”. It should fulfill the commitments it has made to drive forward the necessary structural change in the Italian economy.

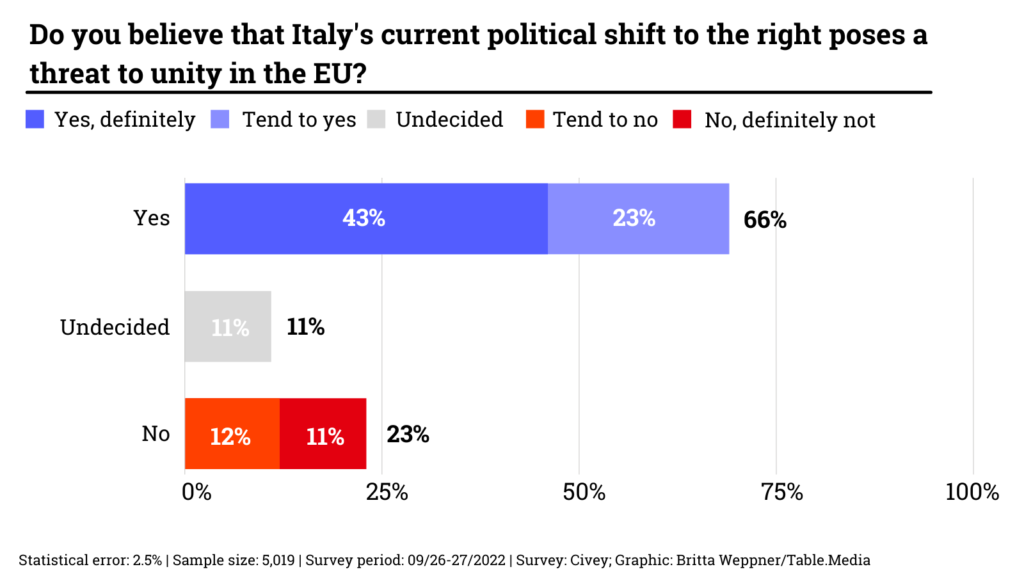

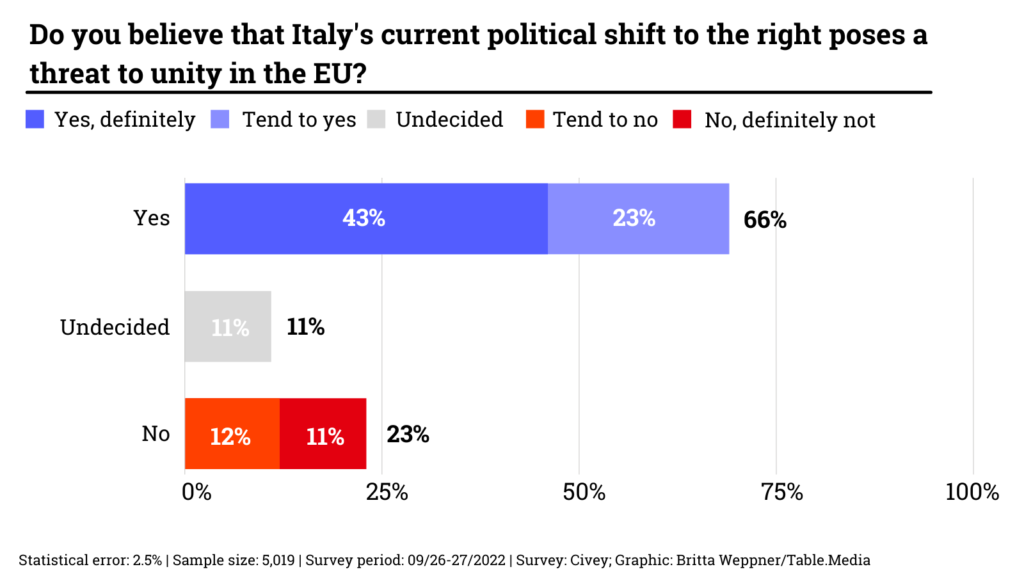

The election victory of the right-wing camp around Giorgia Meloni, head of the Brothers of Italy party, had caused considerable unrest in Brussels and other capitals. The election result is also causing concern among citizens in Germany: In a representative survey conducted by the opinion research institute Civey on behalf of Europe.Table, two-thirds of respondents say the shift to the right endangers political cohesion in the EU. According to the survey, 61 percent fear that the new government’s policies could plunge Italy into a debt crisis. Only among AfD supporters is a clear majority unconcerned. tho

Germany and France will present a joint position on the planned Critical Raw Materials Act at tomorrow’s meeting of the Competitiveness Council. With this, the two delegations want to stimulate the discussion in the European Council and simultaneously ensure unity of both countries with regard to the raw materials strategy. Last week, they published the joint position in written form as a so-called non-paper.

The document says Germany and France want the position to “contribute to the work of the Commission (…)” and encourage the other member states to comment at Thursday’s Council meeting. They name three pillars on which legislation on critical raw materials should be based:

The European Commission is planning a law on critical raw materials as part of its raw materials strategy. Commission President Ursula von der Leyen had once again underlined the importance of such a Raw Materials Act in her State of the Union address in mid-September. A Commission proposal is expected next year.

At tomorrow’s Competitiveness Council meeting, ministers will mainly discuss the Single Market Emergency Instrument (SMEI) and the Ecodesign Directive for Sustainable Products (ESPR) . The German delegation will also provide information on an initiative to establish a “European Alliance for Transformation Technologies”. leo

The future of money is digital. The European Central Bank (ECB) is also working on a digital euro. But for the Federation of German Industries, this is not happening fast enough. “Due to the partially large lead of other central banks, Europe is in danger of losing out here,” says a BDI position paper on the digital euro available to Europe.Table. This applies, in particular, to use by companies, for example, in supply chain management. “The danger is too great that waiting too long would create competitive disadvantages that would be difficult to make up,” write the BDI authors.

Approximately over 80 percent of central banks are considering the introduction of a digital central bank currency (CBDC) or have already done so, according to a study by the accounting firm PwC. The CBDC tracker provides an overview of the status of digital central bank currencies. While China and Canada are already in the pilot phase, the ECB has been stuck in the research phase since October 2021 and will not decide whether to introduce the digital euro – and in what form – until it is completed in 2023. The BDI is now calling for “aspects of international competition and the associated time component to be taken into account in the analyses currently underway”.

The ability to innovate is of great importance for the economic success of Germany and Europe. To this end, industry needs an innovation framework that fits the dynamic developments of industrial production that is becoming increasingly digitally networked across its value chains (Industry 4.0). “The digital currency is the currency of these ecosystems. We, therefore, consider the establishment of a digital euro to be indispensable,” the BDI said. The introduction of a digital euro has the potential to significantly accelerate the digitization of the European economy – both for large corporations and SMEs.

However, industry is concerned that insufficient attention is being paid to business needs. “In the event that business needs are not sufficiently heard, private-sector solutions would have to fill the application gaps on a transitional basis,” the position paper states. These solutions, which are being discussed among experts in parallel to the ECB project, could be used “if the digital euro is not equipped with the functionalities that are important for companies or if it is introduced too late in relation to the needs of market participants”. Essentially, this is about the programmability of the euro for Industry 4.0.

To harness the full potential of a digital currency, the entire payment process would have to be programmable. But it doesn’t look like that’s going to happen at the moment: In July, Burkhard Balz, a member of the Deutsche Bundesbank’s executive board, had said during a speech that the digital euro could be designed to support programmable payments in a highly automated environment. “This possibility will probably not be available immediately at launch, but should be taken into account during development.”

If private-sector solutions come first, the BDI urges standardization and interoperability. And for “reasons of confidence-building, acceptance and legal stability,” a digital currency should always be issued by a regulated entity – i.e., a bank and not, say, a big-tech company like Apple or Google. Finally, the BDI also wants the digital euro to be issued and managed in an energy-efficient manner so as not to hinder the achievement of European climate targets. vis

In the case of the possible remuneration for Manfred Weber as EPP party leader, reported by Europe.Table, further details become known. According to the report, the Presidium of the European People’s Party decided at a meeting after Weber’s election as party leader at the end of May that he may receive an “expense allowance“. According to information available to Europa.Table, at the beginning of the meeting, a table document in English was distributed to the party’s vice leaders and secretary general, Commission President Ursula von der Leyen and Parliament President Roberta Metsola, which spoke of a “remuneration” for Weber.

The amount of the expense allowance is not specified in the paper. It is expected that the details of the payment should be decided at another meeting of the Presidium. In the EPP, it was said yesterday that the news on the expense allowance for Manfred Weber will cause questions from the national parties that are members of the European family of parties of the Christian Democrats.

Until now, the leadership of European parties was an honorary position. Only if the party leader was not also a member of the European Parliament and therefore did not have a salary was there payment. Weber also leads the EPP group in the European Parliament. In CDU circles, the demand was made that a possible expense allowance for Weber as party leader should be partially offset against his other remunerations. mgr

The CDU/CSU parliamentary group in the Bundestag is against more leeway in EU fiscal rules. It is necessary to “slim down the Stability and Growth Pact (SGP) to a few basic rules and to make the procedures for enforcing the rules more effective than before, without watering down the European fiscal rules,” according to a motion tabled by the CDU/CSU parliamentary group. This is to be introduced in the Bundestag by the end of the week and is available to Europe.Table.

An extension of the flexibility clauses in the SGP would be equivalent to an “invitation to unrestrained government borrowing”. Certain types of spending (such as investments in climate protection or defense) should not be excluded when determining the relevant structural balance. Public investment is not currently failing due to a lack of debt capacity, as the Next Generation EU recovery program shows.

The motion tabled by the largest opposition group has no chance of winning a majority in the Bundestag. Nevertheless, the Christian Democrats’ position is politically significant: In the ongoing talks in the Council on the reform of fiscal rules, Federal Finance Minister Christian Lindner (FDP) must be careful not to open the political flank too wide in the conservative camp.

In their motion, the CDU/CSU MEPs welcome the fact that the German government wants to strengthen the preventive arm of the SGP and advocates more binding enforcement of the spending rule. However, the proposals of the traffic light on the mandatory reduction of excessive debt levels threaten to significantly dilute the European fiscal rules, they criticize.

In their position paper, the governing parties had stated that, if the requirements from the preventive arm were met in full, they wanted to dispense with the application of the one-twentieth rule, which would overburden the governments of highly indebted countries. The CDU/CSU parliamentary group also sees this problem. However, it could be “remedied, for example, by smoothing the reduction path”.

Additionally, the CDU/CSU want to severely restrict the EU Commission’s discretionary powers. Deficit procedures should be initiated automatically, they demand. Additionally, supervision of the SGP should be “guaranteed by an independent institution“. tho

The EU internal market is unique and has become an indispensable part of companies’ everyday lives. Whether it is a matter of procuring important parts for their own production, visiting a customer in a neighboring European country, or handling payment transactions with suppliers: Without the EU single market, the business of a European mechanical engineering company would look much more complicated.

What happens when the single market suddenly stops functioning was vividly illustrated by the Covid crisis. After the uncoordinated border closures, the assembly lines in many industrial companies stood still because relevant parts from other EU member states no longer arrived at the factories. Such challenges show that a functioning single market is never a done deal but rather a constant work in progress.

As a convinced European, I am delighted that the EU Commission is taking account of the importance of the single market and is now drawing lessons from the past two and a half years. Keeping borders open in times of crisis is something I fully support. Ensuring the posting of workers in the event of a crisis is essential, especially for export-oriented industries such as mechanical and plant engineering.

But unfortunately, the SMEI proposal also contains parts that go in a completely wrong direction. In times of crisis, the Commission wants to dictate to companies which orders have priority for which customer and which application or decide what is of strategic importance. It can recommend that EU member states take measures to guarantee the availability of crisis-relevant goods and services. And it threatens fines in certain cases if companies do not adhere to the externally determined priorities.

This kind of crisis policy is interventionism and definitely goes too far. It is almost never appropriate for politics to intervene in entrepreneurial processes and decisions. This is true in normal times but just as true in times of crisis. Companies need the freedom to make their own decisions, especially in crises where speed and agility can make or break their existence. Mechanical and plant engineering is a globally networked industry, consisting primarily of small and medium-sized, family-run companies that are true export champions. The success of our industry depends not least on our delivery reliability. Politicians must not interfere with this. That would do lasting damage to our companies in Europe and put the brakes on the effectiveness of entrepreneurial action.

So how do you protect the single market in times of crisis? That is no easy task. It is clear that a gentle touch is required here. Once again, policymakers must strike a balance here and allow industry to assume its own responsibility. At the same time, the roles and powers of companies and the European Union and the member states in times of crisis should be clearly delineated and defined. The fact that the state intervenes more strongly in crisis situations than in normal times is justifiable and necessary. It is also clear that in times of crisis, we in Europe, in particular, will be dependent on internationally functioning supply chains. The EU should therefore be very cautious with government-imposed supply restrictions.

It is important that the rules of the single market are developed further so that it does not lose its power. And it is certainly worth investing energy in a European common market. After all, it is the single market that has ensured economic prosperity in Europe for almost 30 years.

Karl Haeusgen is Chairman of the Supervisory Board of the family-owned company HAWE Hydraulik SE and President of the German Mechanical Engineering Industry Association (VDMA). The VDMA represents around 3,500 German and European companies in the mechanical engineering industry.

Many questions remain unanswered about the leaks in the two Baltic Sea gas pipelines Nord Stream 1 and Nord Stream 2. The governments in Denmark, Poland and Sweden assume sabotage after measuring stations in Denmark and Sweden recorded powerful detonations under water. German gas supplies are not affected, as no gas from Russia flows through either pipeline to Germany.

The German government wants to avoid possible bottlenecks in energy supply, also in view of the dire situation in France, by extending the operating lives of two German nuclear power plants, as German Economic Affairs Minister Robert Habeck said yesterday in Berlin.

In order to become independent of Russian energy, the heads of state and government of the EU member states also look to the African continent. Many investments are flowing into fossil energy sources. Ella Joyner analyzes to what extent this is an opportunity and a risk for African countries such as Mozambique, Nigeria, Algeria and Senegal.

Meanwhile, the planned excess profits tax for fossil energy companies in the EU could be extended from one to two years. This is the result of a compromise proposal by the Council Presidency. Read the details in the News.

Another look at the digital sector: For six months, nothing has happened with the Transatlantic Data Privacy Framework (TADPF). Personal data may still not be transferred from the EU to the USA without a legal basis. But there could soon be a decision, one that, as Falk Steiner reports, could become a very big problem for the German economy.

I wish you an informative read.

The EU High Representative for Foreign Affairs, Josep Borrell, put it succinctly when he recently described a renewed focus on Africa: “Energy is at the heart of our relations with the people of Africa,” he said in Prague. “We need them. They produce natural gas. And they need us.”

In doing so, he struck a different tone from the lofty rhetoric of the African Union-European Union summit in February, but the war in Ukraine and the energy crisis have changed many things.

In their quest to move away from Russian natural gas, EU leaders have courted various suppliers in recent months, including Norway, Qatar, the United States and Azerbaijan. Several African countries – notably Nigeria, Algeria, Senegal, Mozambique and Egypt – also have large supplies available to Europe for varying degrees of economic, security or political reasons.

In recent months, there have also been an impressive number of visits to Africa that seem to be bearing fruit. In June, EU Commission President Ursula von der Leyen proudly announced an agreement with Israel and Egypt. In July, Algeria took on Russia as Italy’s top gas supplier. Nigeria is also showing willingness to supply more gas to Europe. In return, these countries often receive investment in gas infrastructure that (officials and politicians believe) can later transport clean fuels such as hydrogen.

For Europe, the strategy has worked. Von der Leyen said the EU now gets 9 percent of its natural gas from Russia instead of 40 percent as before the invasion of Ukraine. Norway has now replaced Russia as the EU’s largest supplier.

And for Africa? Many governments in these countries would like to exploit their natural fossil resources, although activists warn that this would seriously undermine the fight against the climate crisis. AU countries are likely to use the next UN climate summit in November to push for massive new fossil fuel investments in Africa, the British newspaper The Guardian reported.

“This energy crisis comes at an interesting time for Africa,” said Gwamaka Kifukwe, an expert at the European Council on Foreign Relations. Many African countries often don’t even have enough energy for clean cooking or for interconnected power grids, Kifukwe says.

Europe is asking Africa to “make electricity an export commodity and sell to them, even though we have a shortage and need exponential growth in electricity,” he said. “And of course, resource extraction in Africa does not have a very good history.”

Mozambique, where a violent insurgency is raging in the north of the country, is often described by activists as a case of the “resource curse”. “The growth of the fossil fuel industry in the region and its impacts on local communities who continue to live in poverty, together with unmet political and corporate promises, has fuelled social unrest,” a coalition of more than 20 NGOs from Africa and Europe wrote in a March report. According to the report, public and private financial institutions have invested at least $132.3 billion in fossil fuel companies and projects in Africa between 2016 and 2021.

As Kifukwe points out, selling energy to Europe is an opportunity for growth, but also “an opportunity to find other people to be corrupt with”.

It is not only the energy crisis that has increased European interest in Africa. The war in Ukraine has also strengthened the resolve to counter Russia’s growing influence on the continent. This – like China’s influence – has been on the EU’s agenda for some time. At the end of 2021, it imposed sanctions on the mercenary Wagner Force. The EU accuses it of “fomenting violence, plundering natural resources and intimidating civilians”, particularly in Africa’s Sahel region”.

Borrell expressed concern about the spread of pro-Russian disinformation campaigns about the Ukraine war. A statement from the Polish government said, “The countries of the region are being persuaded that the West – especially the US – is treating Africa like a colonial territory in which Europe and the US have no serious interest.”

Many in Europe were disappointed that several African countries (including Algeria, Senegal, and South Africa) abstained from voting at the UN convention in March to condemn Russian aggression against Ukraine. For ECFR’s Kifukwe, however, this decision was not necessarily a sign of support for Russia. Rather, he said, it was a matter of maintaining a strategic balance.

“Most African countries negotiate with external partners from a position of weakness,” he said. “They are poor, they are needy, and so it is in their interest to have as many partnerships as possible. For many countries, this war is a “European problem,” he said.

In part, he said, it’s also about European colonialism: “Why put all your eggs in one basket, especially when you haven’t always had good experiences with that basket?” But there is no reason to panic. “The fact that other countries are gaining influence in Africa is not a problem per se, but a question of resilience,” stresses the ECFR expert.

The basic problem is exactly the same as it was six months ago when US President Joe Biden and EU Commission President Ursula von der Leyen appeared before the press together: Companies face heavy fines and a ban on transferring personal data from the EU to the US without a legal basis. So far, nothing concrete has come of the political announcement – and time is running out.

The various European data protection supervisors are still deliberating on the draft decision of the Irish data protection supervisory authority DPC Ireland in the relevant Meta/Facebook case. But this process is finite. The objections of other supervisory authorities are currently being tried to be resolved by consensus. And at some point in the coming weeks, according to the DPC, a decision will be made. In all likelihood, this will then also bring down the last widely used legal option for transferring personal data to the USA: the standard contractual clauses.

That would be a problem for the German economy, as shown by a recent survey by the German IT interest group Bitkom. 59 percent of the 277 companies that transfer data outside the scope of the GDPR do so to the United States – and 91 percent use standard contractual clauses to do so. If these cease to be an instrument and no adequate political solution is found, says Bitkom board member Susanne Dehmel, this would have massive consequences.

Above all, companies with more than 500 employees rely on solutions outside the immediate GDPR regime. At the top of the list for 87 percent of them is the use of cloud services. Communication systems are used by 83 percent. And for 80 percent of large companies, all kinds of service providers are standard. But without standard contractual clauses, the legal basis used for many data transfers would no longer apply.

The Transatlantic Data Privacy Framework (TADPF) announced by Biden and von der Leyen six months ago is actually intended to remedy this situation. On the surface, the procedure seems simple: The US side must ensure that data from EU citizens is processed in a way that meets the requirements of the European Court of Justice. But to avoid having to change laws that would require congressional approval, the Biden administration wants to rely exclusively on executive orders. Whether these can provide sufficient guarantees, however, is disputed.

EU Justice Commissioner Didier Reynders is currently in almost daily contact with US Commerce Secretary Gina Raimondo, Rupert Schlegelmilch, deputy director general at DG Trade reported at a conference last week.

Data protection activist Max Schrems successfully brought down the predecessor agreements Safe Harbor and Privacy Shield with lawsuits. He sees little reason for optimism at the moment, saying that what he knows about the TADPF so far is more reason to worry that a third inadequate agreement will be concluded. “It is astonishing that two democracies that agree on principles such as judicial authorization of surveillance measures cannot reach a proper agreement,” Schrems says. “It seems that the US is still taking the position that people outside the US should not have fundamental rights.”

And the next problem is already looming on the horizon: Although it is currently still at the beginning of the consultation process. But in the United Kingdom, which has left the EU, there are far-reaching plans to change the data protection standard, which has so far been well comparable with the EU’s GDPR standard. There, work is currently underway on the Data Protection and Digital Information Bill (DPDI).

This could significantly change data protection in the UK. And, depending on the degree of deviation from the GDPR, also call into question the Commission’s adequacy decision. This would then also make the UK a problem country for the transfer of personal data.

The parliamentary procedure is not yet far advanced. Actually, it was supposed to go quickly. But the change of prime minister and the mourning ceremonies surrounding the Queen’s death caused delays in the House of Commons. Work on this is now to continue at full speed in the fall. The law firm DAC Beachcroft has compiled a synopsis of the changes that the government’s proposed version of the DPDI could bring.

The planned EU-wide excess profits tax for fossil energy companies could be extended from one to two years. Member states should be able to decide for themselves whether to levy the excess profits tax on oil, coal, gas, and refined products only in 2022, only in 2023 or in both years. That’s according to a compromise proposal from the Council presidency on Tuesday, which is available to Europe.Table. The Commission originally wanted a tax on profits from 2022.

Monday and Tuesday, the Council’s Energy Working Group had again discussed the draft regulation. Today, the Permanent Representatives will meet before the Energy Ministers are expected to adopt the text on Friday.

According to the bill, excess profits are taxable revenues that are more than 20 percent of the average for 2018 [previously 2019] through 2021. States are to use the revenues to relieve households and businesses of high energy costs, for example. Equivalent national measures already adopted are to remain unaffected by the regulation.

In the electricity sector, member states would be given the option of levying excess profits taxes only on 90 percent of the revenues concerned. Marketers would therefore be left with a kind of allowance of ten percent. Additionally, EU countries would be free to exempt income from balancing energy and redispatching from the tax. In Germany alone, this involves billions of euros to stabilize the power supply. Control energy is offered by power plants, energy-intensive industrial companies and electricity storage facilities.

“The excess profits must finally be skimmed off and quickly distributed to Europe’s citizens as energy money,” said Green Party MEP Michael Bloss. “At the same time, it must be clear that the money goes to those who need it. The conditions must be clearly defined. In the end, however, it must be clear to us that the motto of this crisis must be “save, save, save”. Electricity and gas savings must be mandatory for the member countries. Anyone who shirks responsibility here is shaking European solidarity.” ber

Federal Economic Affairs Minister Robert Habeck considers it necessary to operate the two nuclear reactors in southern Germany over the winter given the current situation. He referred to the situation in France, where many nuclear power plants cannot run due to maintenance work. There, he said, the situation had deteriorated further with a view to the winter. “Today, I must say that the data from France speak for the fact that we then also call the reserve,” said the Green politician on Tuesday in Berlin.

The Neckarwestheim 2 and Isar 2 nuclear power plants would then have to run beyond the planned shutdown at the end of the year. The final decision would have to be made in December at the latest for Isar 2 for technical reasons; for Neckarwestheim, this would also be possible at the beginning of the year. At the longest, the nuclear power plants are to run until mid-April 2023. In neighboring countries, the decision is being followed closely because of the energy shortage.

Actually, the last three nuclear power plants should be shut down at the end of the year as part of the nuclear phase-out. According to the Ministry for Economic Affairs, this will continue to apply to the Lingen reactor in the Emsland region in any case. rtr

Two days after the victory of the right-wing alliance in Italy’s parliamentary elections, the EU Commission has approved a further tranche from the Next Generation EU recovery program for the country. The authority was in favor of releasing €21 billion from the pot. The member states now have the final say.

The transfer rewards the efforts of the previous government under Prime Minister Mario Draghi, which had requested the disbursement of the second tranche at the end of June after it considered that the agreed 45 milestones had been reached. These included reforms to public administration, public procurement and financial management. The additional funds are to enable investments, for example, in the expansion of high-speed Internet provision and the digitization of schools.

Italy had already received a first tranche of €21 billion from the pot in April. The country is the biggest beneficiary of the reconstruction program. In total, it has the prospect of receiving almost €192 billion, of which €69 billion are grants. The rest is available as loans. However, all the money is tied to the implementation of further reforms.

Economic Affairs Commissioner Paolo Gentiloni appealed to the new government to “seize the opportunity”. It should fulfill the commitments it has made to drive forward the necessary structural change in the Italian economy.

The election victory of the right-wing camp around Giorgia Meloni, head of the Brothers of Italy party, had caused considerable unrest in Brussels and other capitals. The election result is also causing concern among citizens in Germany: In a representative survey conducted by the opinion research institute Civey on behalf of Europe.Table, two-thirds of respondents say the shift to the right endangers political cohesion in the EU. According to the survey, 61 percent fear that the new government’s policies could plunge Italy into a debt crisis. Only among AfD supporters is a clear majority unconcerned. tho

Germany and France will present a joint position on the planned Critical Raw Materials Act at tomorrow’s meeting of the Competitiveness Council. With this, the two delegations want to stimulate the discussion in the European Council and simultaneously ensure unity of both countries with regard to the raw materials strategy. Last week, they published the joint position in written form as a so-called non-paper.

The document says Germany and France want the position to “contribute to the work of the Commission (…)” and encourage the other member states to comment at Thursday’s Council meeting. They name three pillars on which legislation on critical raw materials should be based:

The European Commission is planning a law on critical raw materials as part of its raw materials strategy. Commission President Ursula von der Leyen had once again underlined the importance of such a Raw Materials Act in her State of the Union address in mid-September. A Commission proposal is expected next year.

At tomorrow’s Competitiveness Council meeting, ministers will mainly discuss the Single Market Emergency Instrument (SMEI) and the Ecodesign Directive for Sustainable Products (ESPR) . The German delegation will also provide information on an initiative to establish a “European Alliance for Transformation Technologies”. leo

The future of money is digital. The European Central Bank (ECB) is also working on a digital euro. But for the Federation of German Industries, this is not happening fast enough. “Due to the partially large lead of other central banks, Europe is in danger of losing out here,” says a BDI position paper on the digital euro available to Europe.Table. This applies, in particular, to use by companies, for example, in supply chain management. “The danger is too great that waiting too long would create competitive disadvantages that would be difficult to make up,” write the BDI authors.

Approximately over 80 percent of central banks are considering the introduction of a digital central bank currency (CBDC) or have already done so, according to a study by the accounting firm PwC. The CBDC tracker provides an overview of the status of digital central bank currencies. While China and Canada are already in the pilot phase, the ECB has been stuck in the research phase since October 2021 and will not decide whether to introduce the digital euro – and in what form – until it is completed in 2023. The BDI is now calling for “aspects of international competition and the associated time component to be taken into account in the analyses currently underway”.

The ability to innovate is of great importance for the economic success of Germany and Europe. To this end, industry needs an innovation framework that fits the dynamic developments of industrial production that is becoming increasingly digitally networked across its value chains (Industry 4.0). “The digital currency is the currency of these ecosystems. We, therefore, consider the establishment of a digital euro to be indispensable,” the BDI said. The introduction of a digital euro has the potential to significantly accelerate the digitization of the European economy – both for large corporations and SMEs.

However, industry is concerned that insufficient attention is being paid to business needs. “In the event that business needs are not sufficiently heard, private-sector solutions would have to fill the application gaps on a transitional basis,” the position paper states. These solutions, which are being discussed among experts in parallel to the ECB project, could be used “if the digital euro is not equipped with the functionalities that are important for companies or if it is introduced too late in relation to the needs of market participants”. Essentially, this is about the programmability of the euro for Industry 4.0.

To harness the full potential of a digital currency, the entire payment process would have to be programmable. But it doesn’t look like that’s going to happen at the moment: In July, Burkhard Balz, a member of the Deutsche Bundesbank’s executive board, had said during a speech that the digital euro could be designed to support programmable payments in a highly automated environment. “This possibility will probably not be available immediately at launch, but should be taken into account during development.”

If private-sector solutions come first, the BDI urges standardization and interoperability. And for “reasons of confidence-building, acceptance and legal stability,” a digital currency should always be issued by a regulated entity – i.e., a bank and not, say, a big-tech company like Apple or Google. Finally, the BDI also wants the digital euro to be issued and managed in an energy-efficient manner so as not to hinder the achievement of European climate targets. vis

In the case of the possible remuneration for Manfred Weber as EPP party leader, reported by Europe.Table, further details become known. According to the report, the Presidium of the European People’s Party decided at a meeting after Weber’s election as party leader at the end of May that he may receive an “expense allowance“. According to information available to Europa.Table, at the beginning of the meeting, a table document in English was distributed to the party’s vice leaders and secretary general, Commission President Ursula von der Leyen and Parliament President Roberta Metsola, which spoke of a “remuneration” for Weber.

The amount of the expense allowance is not specified in the paper. It is expected that the details of the payment should be decided at another meeting of the Presidium. In the EPP, it was said yesterday that the news on the expense allowance for Manfred Weber will cause questions from the national parties that are members of the European family of parties of the Christian Democrats.

Until now, the leadership of European parties was an honorary position. Only if the party leader was not also a member of the European Parliament and therefore did not have a salary was there payment. Weber also leads the EPP group in the European Parliament. In CDU circles, the demand was made that a possible expense allowance for Weber as party leader should be partially offset against his other remunerations. mgr

The CDU/CSU parliamentary group in the Bundestag is against more leeway in EU fiscal rules. It is necessary to “slim down the Stability and Growth Pact (SGP) to a few basic rules and to make the procedures for enforcing the rules more effective than before, without watering down the European fiscal rules,” according to a motion tabled by the CDU/CSU parliamentary group. This is to be introduced in the Bundestag by the end of the week and is available to Europe.Table.

An extension of the flexibility clauses in the SGP would be equivalent to an “invitation to unrestrained government borrowing”. Certain types of spending (such as investments in climate protection or defense) should not be excluded when determining the relevant structural balance. Public investment is not currently failing due to a lack of debt capacity, as the Next Generation EU recovery program shows.

The motion tabled by the largest opposition group has no chance of winning a majority in the Bundestag. Nevertheless, the Christian Democrats’ position is politically significant: In the ongoing talks in the Council on the reform of fiscal rules, Federal Finance Minister Christian Lindner (FDP) must be careful not to open the political flank too wide in the conservative camp.

In their motion, the CDU/CSU MEPs welcome the fact that the German government wants to strengthen the preventive arm of the SGP and advocates more binding enforcement of the spending rule. However, the proposals of the traffic light on the mandatory reduction of excessive debt levels threaten to significantly dilute the European fiscal rules, they criticize.

In their position paper, the governing parties had stated that, if the requirements from the preventive arm were met in full, they wanted to dispense with the application of the one-twentieth rule, which would overburden the governments of highly indebted countries. The CDU/CSU parliamentary group also sees this problem. However, it could be “remedied, for example, by smoothing the reduction path”.

Additionally, the CDU/CSU want to severely restrict the EU Commission’s discretionary powers. Deficit procedures should be initiated automatically, they demand. Additionally, supervision of the SGP should be “guaranteed by an independent institution“. tho

The EU internal market is unique and has become an indispensable part of companies’ everyday lives. Whether it is a matter of procuring important parts for their own production, visiting a customer in a neighboring European country, or handling payment transactions with suppliers: Without the EU single market, the business of a European mechanical engineering company would look much more complicated.

What happens when the single market suddenly stops functioning was vividly illustrated by the Covid crisis. After the uncoordinated border closures, the assembly lines in many industrial companies stood still because relevant parts from other EU member states no longer arrived at the factories. Such challenges show that a functioning single market is never a done deal but rather a constant work in progress.

As a convinced European, I am delighted that the EU Commission is taking account of the importance of the single market and is now drawing lessons from the past two and a half years. Keeping borders open in times of crisis is something I fully support. Ensuring the posting of workers in the event of a crisis is essential, especially for export-oriented industries such as mechanical and plant engineering.

But unfortunately, the SMEI proposal also contains parts that go in a completely wrong direction. In times of crisis, the Commission wants to dictate to companies which orders have priority for which customer and which application or decide what is of strategic importance. It can recommend that EU member states take measures to guarantee the availability of crisis-relevant goods and services. And it threatens fines in certain cases if companies do not adhere to the externally determined priorities.

This kind of crisis policy is interventionism and definitely goes too far. It is almost never appropriate for politics to intervene in entrepreneurial processes and decisions. This is true in normal times but just as true in times of crisis. Companies need the freedom to make their own decisions, especially in crises where speed and agility can make or break their existence. Mechanical and plant engineering is a globally networked industry, consisting primarily of small and medium-sized, family-run companies that are true export champions. The success of our industry depends not least on our delivery reliability. Politicians must not interfere with this. That would do lasting damage to our companies in Europe and put the brakes on the effectiveness of entrepreneurial action.

So how do you protect the single market in times of crisis? That is no easy task. It is clear that a gentle touch is required here. Once again, policymakers must strike a balance here and allow industry to assume its own responsibility. At the same time, the roles and powers of companies and the European Union and the member states in times of crisis should be clearly delineated and defined. The fact that the state intervenes more strongly in crisis situations than in normal times is justifiable and necessary. It is also clear that in times of crisis, we in Europe, in particular, will be dependent on internationally functioning supply chains. The EU should therefore be very cautious with government-imposed supply restrictions.

It is important that the rules of the single market are developed further so that it does not lose its power. And it is certainly worth investing energy in a European common market. After all, it is the single market that has ensured economic prosperity in Europe for almost 30 years.

Karl Haeusgen is Chairman of the Supervisory Board of the family-owned company HAWE Hydraulik SE and President of the German Mechanical Engineering Industry Association (VDMA). The VDMA represents around 3,500 German and European companies in the mechanical engineering industry.