France’s President Emmanuel Macron has mainly caused strife on the international stage lately, or at least not less. Controversial statements on Taiwan, insistence on nuclear power plants for climate protection and, for months, a hard line on the Platform Work Directive. Today, with the start of the two-day “Summit for a New Global Financial Pact” in Paris, Macron could once again succeed in putting himself in a positive light.

At the summit, a little-known part of the Paris climate agreement is to get more attention: financing and the financial system. Macron wants to unite the various debates on this under one roof at the two-day meeting. For example, he will discuss partnerships for green growth and the further development of multilateral development banks. Private investors are also to be better integrated.

At least in view of the list of participants, Macron can already claim partial success in his mission to “unite instead of divide”: Numerous major players on the world stage have announced their attendance. From German Chancellor Olaf Scholz, Lula da Silva and China’s Premier Li Qiang to UN Secretary-General António Guterres, World Bank chief Kristalina Georgiewa and Commission President Ursula von der Leyen. If, in the end, a passable “operational” roadmap with practical measures emerges, then a lot more would be achieved.

With his “Summit for a New Global Finance Pact” starting today, French President Emmanuel Macron wants to give international climate finance new momentum, a new framework and new donors. The two-day meeting in Paris aims to bring together the diverse debates on climate finance under one roof. It is intended to make private investors more accountable for the capital needs of the global turnaround.

And it is intended to draw general attention to the hitherto often neglected third goal of the Paris Agreement from Article 2 I c: Namely, in addition to limiting temperature and adapting to climate change, to “make financial flows compatible with a pathway towards low emissions of greenhouse gases and climate-resilient development”.

The organizers hope for a “joint diagnosis” of the challenges and a “new political vision” that will lead to “tangible, actionable” results, according to the Élysée Palace. The plan is not a word-for-word negotiated joint declaration, but an “operational” roadmap with practical measures.

Macron announced his summit at the G20 summit in November 2022 after supporting the “Bridgetown Initiative” of Mia Mottley, Prime Minister of Barbados. Mottley will be a prominent guest in Paris. Her agenda calls for a global financial system based on the needs of the most vulnerable countries: It should mobilize a total of 100 billion Dollars in finance, particularly from the private sector, and reduce the cost of capital in developing countries to address the impacts of climate change. This is in addition to the 100 billion Dollars that developed countries promised to the Global South starting 2020, and which they have so far failed to deliver in full.

Shortly before the start of the summit in Paris, heads of state and government supported the call for a climate-proof reform of the financial system and called for a “new global consensus” on this issue, including US President Joe Biden, German Chancellor Olaf Scholz, Brazil’s President Lula da Silva, South Africa’s President Cyril Ramaphosa or the head of the EU Commission Ursula von der Leyen.

In any case, the G20 has called for reform of the Bretton Woods financial architecture, which it says is no longer functional in the face of 21st century challenges. “The climate issue clashes with the agenda of reforming the Bretton Woods institutions“, analyzes Philippe Zaouati, CEO of Mirova, an asset management company specializing in sustainable investments.

The French investor believes that the entire system needs to be “rethought” and “adapted” to the new climatic realities. And that requires greater involvement of the private financial sector. “Official development assistance is good, but it’s not everything”, Zaouati points out. “Currently, pension funds, for example, are still far too reluctant to invest in southern countries. Yet there is a great need for investment there in particular.”

From Paris’ point of view, the debates to date have one problem: They are taking place through numerous channels that do not necessarily agree with each other and are considered “distant”. At the International Monetary Fund (IMF) and World Bank, at UN climate negotiations, at G7 and G20. “These international forums are currently subject to disjointed action on climate finance. This summit aims to create a common framework“, said Laurence Tubiana, chair of the European Climate Foundation and architect of the Paris Agreement. She calls for the Paris Agreement’s financial target.

Paris aims to make the two days at Palais Brongniart the hub of these different negotiating spaces. Macron wants to succeed despite tensions between China and the US, the war in Ukraine and the deep anger of the countries of the South. The geopolitical context is “very complicated”, notes Bertrand Badré, director of the Blue Orange Capital responsible investment fund and former director general for finance at the World Bank. “There is less and less desire to agree.” But, “if we don’t manage to accommodate the developing countries on the issue of financing, they won’t sit at the negotiating table and start extracting coal, oil and gas”, he fears.

Around 50 heads of state and government have announced their attendance. In addition to the charismatic Mia Mottley from Barbados, the President of Brazil, Lula da Silva, has already confirmed his participation. China is also expected to be represented at a high level by its Premier Li Qiang. UN Secretary-General António Guterres will be there, as will the President of the European Commission, Ursula von der Leyen, the German Chancellor, Olaf Scholz, and the Presidents of Ghana, Nana Akufo-Addo, Senegal, Macky Sall, and Kenya, William Ruto. The US is expected to be represented by climate envoy John Kerry, and Treasury Secretary Janet Yellen.

Major international organizations, major foundations, the private sector, academia and civil society will also be present. Among them: the new president of the World Bank, Ajay Banga, who has been in office since June 1 and for whom this summit will be the first major international meeting. Also speaking at the summit will be IMF Managing Director Kristalina Georgieva and Mafalda Duarte, who is preparing to take over as head of the Green Climate Fund. Christine Lagarde, president of the European Central Bank and former IMF chief, will also be present. So will Mark Carney, former governor of the Bank of England, who launched the Gfanz (Glasgow Financial Alliance for Net Zero) initiative.

Six roundtable discussions are planned on the following topics:

You have just taken up your position as EUCCC president. What do you see as the most pressing issue at this early stage of your tenure?

At the moment, the whole discussion about ‘de-risking’ is our main cause. There is a lot of talk about ‘de-Risking’ in Europe, and there is a lot of talk about ‘de-Risking” in China. And we think that there is still a lot of work to do to give content to this concept, in terms of its quality or its terms. So we need to begin taking a closer look at what this idea means in Europe – and also thinking about what it means in the Chinese context. Actually, China has been de-risking for the past decade. They just call it something else: ‘Made in China 2025’, ‘Dual Circulation’ or even ’14th Five Year Plan’. So I think it will be important to try finding a common language and to break down and deconstruct the concept.

How then can the de-risking of the EU work?

We need to thoroughly analyze what is perceived as a risk and as a vulnerability when we look at trade and production flows, in order to to get to a much better understanding of what ‘de-risking’ means to the actual business. That is a priority. But it will need a little bit of thinking and cannot be accomplished overnight. Words matter a lot, and this is an agenda-setting concept, same as the 2019 EU concept of China as a partner, competitor and strategic rival. So we need to be really clear about the concept and its implications.

China is still an important trading partner for most countries in Europe, particularly Germany, so diversifying away from it will be complicated. What do you expect?

I think a lot of things are not really going to change. As for manufacturing, China has been continuing to increase its share of global export. What we see right now is that there is a continued high focus on supporting the supply side in export manufacturing, through policies like easier access to credit. So I think we will continue to see China being quite strong on the export production side, which is somewhat supported by the weakening of the renminbi, at least in the short term.

That doesn’t sound bad for the Chinese economy at first.

On the other hand though, the weak Yuan is not doing a lot of good to Chinese households, because it makes imported stuff more expensive. This shows that government support is now flowing more to the supply side rather than to the demand side. We don’t see many measures that support consumption growth these days. But that’s what we would like to see.

What would help to boost consumption?

China’s people need to feel that the real estate sector is stabilizing. 70 percent of household wealth is tied up in real estate, and as long as people feel uncertain about where real estate is going, they will be conservative in their spending habits.

How do you see China’s current economic situation in general, post-Covid?

It is still early days to evaluate the reopening. We saw things were going relatively well in the first quarter, followed by some softening in the second quarter. So, yes, we are a bit concerned, we do see weaknesses in some sectors, especially in big-ticket manufactured goods, while services performed better. We may have a clearer picture in three months from now.

How much does this uncertainty about growth hit European companies?

My observation is that GDP figures are becoming less and less important and you need to look much more closely at sectors. When China was growing 12 percent a year, everyone could grow in China. I think now that growth is softening, you need to be looking a bit more carefully to pick the winners, because growth is not universal anymore. But in some sectors, there are still significant opportunities in China.

Which sectors?

We have made the point previously in one of our papers that China will mean different things in different industries. There are certain industries where China is going to account for more than half of global demand going forward. And you have others that are simply so complicated that you might ask yourself, is China really for me? So if you are doing specialty chemicals, then China is the place to be. But if you make digital platforms or digital content, then China could be a bit more difficult.

Companies are complaining about the various security laws that make their life increasingly difficult. At the same time, Europe is working on laws forcing enterprises to assess and control their value chains abroad. What does all this mean for long-established or new value chains in China? And how can companies navigate in this complicated environment – SMEs in particular?

If you are not a very large company, and it comes to a point where you have to establish and run two separate value chains – one for the West, and one for China – the cost might become prohibitively high. I would rather invest in one value chain that works very well, in a market that I know – rather than beginning to establish two, and run the second one in a market I am not too well acquainted with.

Does this have concrete consequences for European companies?

It is beginning to impact investment decisions. If I cannot predict with some amount of certainty, what the world is going to look like five years from now, and whether China will be the right place for me at that point, I will not invest. I actually don’t know of a single SME that has established itself in China since the beginning of Covid. It’s not all related to politics. But I think a lot of our companies were shaken during Covid, when they realized how vulnerable their supply chains were and how dependent they had become on a single location.

What can companies do about this?

People are sitting over their calculators trying to figure out what investments they need to make – and how those investments match the expected profits they could make in the Chinese market. And the more the costs of separating the value chain rise, the higher the threshold at which it becomes interesting for companies to set up shop here.

How does that play out in China?

This poses a risk and shrinks the variety in size and types of companies that have a longer-term interest in coming to China. I think these are exactly the kind of conversations we need to have with the Chinese government: Regulations and restrictions have consequences in real life, and consequences in invested Euros and US Dollars. So Beijing has some work to do in order to demonstrate to the international business community that China is an efficient and predictable place where companies can come and put down roots.

Is it true that local governments continue to be eager to attract foreign companies – all the while the central government is putting more attention on security and stability these days, with less focus on business?

Yes, there is a lot of interest in most provinces and municipalities in attracting foreign investment – especially under the present circumstances of a softening economy. I think anything that boosts economic activity is welcome. I certainly recognize that myself when I am traveling around. There is a high appetite for engaging with the foreign business community – and we of course appreciate that.

Beijing sends a not-so-open message.

Frankly, many of us got a bit concerned after the CCP Congress in October where there was so much focus on security and self-reliance which seemed to push in the other direction. But then we had the NPC in March, where talk was a lot more about unwavering support for reform and opening up, which was nice to hear.

What do you think the direction will be in the future?

At this point, we don’t really know which side is for real. It is wonderful that local governments want to talk to us. We like the attention. But will it translate to results on the ground? I think that remains to be seen.

Jens Eskelund has lived in China for 25 years and is the chief representative of the Danish Maersk Group. He has already served two terms as Vice President of the EU Chamber – from 2019 to 2021 and from October 2022 to May 2023 – and has also been actively involved in the Chamber’s working groups since its inception. He has also been a board member and chairman of the Danish Chamber of Commerce in China.

June, 22, 2023; 8:30-9:30 a.m., online

DGAP, Discussion Morning Briefing on Geopolitical Challenges

The German Council on Foreign Relations (DGAP) looks at the European Commission’s Economic Security Strategy. INFO & REGISTRATION

June, 23, 2023; 8:45 a.m.-2:30 p.m., London (UK)/online

GMF, Conference Building A Transparent and Accountable Ukraine: Key Steps to Recovery

The German Marshall Fund (GMF) brings together officials from governments, donor agencies, and civil society to discuss how Ukraine can prepare for a process of recovery and reconstruction that promotes digitalization, strong governance, transparency, and integrity. INFO & REGISTRATION

June, 23, 2023; 9 a.m.-6 p.m., Naples (Italy)

EC, Conference 1st Conference on Sustainable Banking and Finance CSBF 2023

The European Commission (EC) aims at stimulating the discussion about the bidirectional nature of the relationship between climate change and finance. INFO & REGISTRATION

June, 23, 2023; 9:30 a.m.-12:30 p.m. Brussels (Belgium)/online

SGI Europe, Conference The EU Single Market at 30: What role for SGIs?

SGI Europe reflects the discussion about the bidirectional nature of the relationship between climate change and finance. INFO & REGISTRATION

June, 24-25, 2023; Amsterdam (Netherlands)

Steconf, Conference 3rd International Conference on Innovation in Renewable Energy and Power

Steconf addresses global and regional trends, innovative application frameworks, and current research. INFO & REGISTRATION

June, 26-30, 2023; Trier

ERA, Seminar Summer Course on European Intellectual Property Law

The Academy of European Law (ERA) provides a thorough introduction to European intellectual property law. INFO & REGISTRATION

June, 27 – July, 1, 2023; Champaign-Urbana, Illinois (USA)

Aspen Institute, Conference U.S.-German Forum on Future Agriculture

The Aspen Institute (AI) sheds light on solutions for a sustainable future for agriculture and rural areas. INFO & REGISTRATION

June, 27-29, 2023; Prague (Czech Republic)

Conference International Flow Battery Forum 2023

The conference addresses the central role that flow batteries play in the energy storage sector. INFO & REGISTRATION

June, 27, 2023; 10:30 a.m.-4:45 p.m., Brussels (Belgium)/online

Bruegel Future of Work and Inclusive Growth Annual Conference 2023

Bruegel discusses necessary skills demanded by the AI and green sectors, examines the impact of technology adoption on labor markets, and addresses the growing inequality brought on by digitalisation of capital. INFO & REGISTRATION

June, 27, 2023; 2:30-4:30 p.m., Brussels (Belgium)/online

ERCST, Discussion EU Climate Policy & Electricity Market

The European Roundtable on Climate Change and Sustainable Transition (ERCST) addresses the interactions between EU climate policy and the electricity market. INFO & REGISTRATION

The Commission hopes to end long vacancies at the top of representations in several member states by making the posts more attractive. According to information from Table.Media, the Commission’s representations in Berlin, Warsaw and Budapest will be upgraded. The head – he or she is the Commission’s representative in the respective member state – will hold the rank of director.

Directors are classified in grades AD 13 and 14 and earn a basic salary of €14,644.53 per month at the beginning of their term of service, or €16,569.31 per month. However, a correction coefficient applies depending on the location (in Poland currently 70.1; in Hungary currently 69.9), which means that basic salaries there are significantly lower.

Jörg Wojahn, the Commission’s representative in Berlin, is vacating his post in the summer, according to information from Table.Media. Indications that Martin Selmayr, the Commission’s representative in Austria and former Secretary General of the Commission, is moving to Berlin, are considered speculation.

With the upgrading of the representative in Berlin, Warsaw and Budapest, the respective representations are drawing level with Paris, where the head already works at the director level. There is reportedly resentment in Italy and Spain: The governments insist that the Commission also make the representatives in their countries directors.

So far, the heads of the representations have been classified as head of unit, and earn a basic salary at the beginning of their term of office in the grades AD 9 to AD 12, which in Germany is approximately between €8,936.26 and €12,943.31 per month.

The management of the Commission’s regional offices in Munich has been vacant since September 2020, while the office in Bonn has been managed on an interim basis from Berlin since September 2021. The Commission has decided to classify the heads of the regional offices as heads of unit, to make the posts more attractive. Until now, they had no designated rank.

The regional office in Bonn, which will soon move to Cologne, is responsible for North Rhine-Westphalia, Rhineland-Palatinate, Hesse and Saarland. Around 30 million citizens live in these federal states. This is roughly equivalent to the combined population of the member states Portugal, Sweden and the Czech Republic. The regional office in Munich is responsible for Baden-Württemberg and Bavaria. Around 25 million people live in these federal states. These state governments had repeatedly protested to the Commission about the vacancies. The representations report directly to the Commission President. Filling the posts is the responsibility of Ursula von der Leyen.

Since in Munich, for example, at least two rounds of applications in which only Commission officials were eligible ended without the head position being filled, the Commission has also admitted external applicants in the currently underway procedure.

The upgrading of the heads of the regional offices to the rank of head of unit has met with criticism: While heads of unit in the Commission have personnel responsibility for 15 to 20 civil servants, the regional office in Bonn, for example, has only a total of three employees. Such a small number of employees does not fit the post of a head of unit, the authority says. mgr

The EU is getting serious about closing the loopholes in its sanction regime against Russia. Member states’ ambassadors approved the eleventh sanctions package on Wednesday. It provides for the first time an instrument to impose punitive measures on companies and third countries that engage in or offer themselves as platforms for circumvention deals.

The sanctions package will deal a further blow to Putin’s war machine with tighter export restrictions and target entities that support the Kremlin, Commission President Ursula von der Leyen said in welcoming the agreement. She said the anti-sanctions circumvention tool will prevent Russia from getting its hands on sanctioned goods.

However, the EU Commission had to revise its original proposal from the end of March several times and tone down the instrument. This was due to pressure from Germany and other states. “We must prevent Russia from obtaining sanctioned war-related goods via third countries,” a directive from Berlin said as recently as last week. Combating sanctions evasion was indeed a top priority. At the same time, however, third countries must not be driven to Russia’s side.

Germany withdrew its review reservation only before the last round in the COREPER. The instrument against third countries is now to be used in a carefully graduated procedure and only as a last resort. Before punitive measures can be imposed against third countries, the EU Commission must prove that all other diplomatic efforts have failed. Diplomats now said the eleventh sanctions package creates “as a last resort, new exceptional measures” to restrict the sale, transfer or export of sensitive dual-use goods and technology to third countries. EU states would have to agree to punitive measures against third countries by consensus.

Specifically, third countries that serve as loopholes over a longer period and are assessed as “particularly high risk” with regard to circumvention transactions will be targeted. Only companies and third countries with a clear link to war-related goods from the EU are to be listed. There needs to be a clear demarcation from extraterritorial sanctions, which the EU otherwise rejects, Germany and other member states said.

Part of the package is also a port call ban on ships involved in ship-to-ship transfers to circumvent the oil import ban by sea. 71 individuals and 33 entities are also listed because they are suspected of involvement in, among other things, the deportation of Ukrainian children to Russia. In the future, individuals and entities can also be subject to punitive measures such as entry and account blocks if they participate in the circumvention of sanctions.

The EU Commission actually wanted to impose sanctions on seven Chinese companies. According to information from the afp news agency, only a listing of three majority Russian-controlled companies based in Hong Kong is planned.

The member states must now formally sign off on the agreement in the COREPER by Friday in a written procedure. The eleventh sanctions package could then enter into force on the same day as publication in the Official Journal. sti

Ukraine must continue to wait for the start of accession talks with the EU. Next week’s EU summit in Brussels will encourage the country to undertake additional reforms but will not give a date for the start of negotiations. This is according to draft conclusions for the summit, available to Europe.Table. The European Council recognizes Ukraine’s “substantial efforts,” the document says. “It encourages Ukraine to continue on its reform path.” However, there is no prospect of an accession conference.

Ukraine had called for negotiations to start this year. However, the EU Commission has made this dependent on seven conditions. So far, only two of the seven criteria have been met, it was said at a meeting of EU ambassadors in Brussels on Wednesday. “The main hurdles for Ukraine are the reform of the Constitutional Court and the fight against corruption and oligarchs,” a diplomat said. In contrast, he said, Ukraine has implemented recommendations to reduce political influence over the media and reform the judicial system.

The EU states must unanimously decide to start accession talks. The basis for this is a progress report on the candidate countries the EU Commission plans to present in October. Enlargement Commissioner Olivér Várhelyi gave only an oral interim report yesterday.

A year ago, the EU summit decided to grant Ukraine candidate status. Since then, Poland and the Baltic states in particular have been calling for a rapid start to accession negotiations. Germany is putting on the brakes – and referring to the EU Commission. eb

Several billion in aid for Ukraine has been pledged by leaders at a donor conference in London. London’s Prime Minister Rishi Sunak unveiled several support measures, including an additional $3 billion in guarantees to free loans from the World Bank. These include pledges of £20 million (about €23 million) to improve access to the World Bank’s Multilateral Investment Guarantee Agency, which provides political risk cover for projects.

European Commission President Ursula von der Leyen said the EU would provide Ukraine with €50 billion for 2024 to 2027, while US Secretary of State Antony Blinken offered $1.3 billion in additional aid. German Foreign Minister Annalena Baerbock said Berlin was offering an additional €381 million in humanitarian aid for 2023.

Ukrainian Prime Minister Denys Shmyhal said Wednesday he expected to pledge nearly $7 billion in aid after explaining to a London conference that Kyiv faces the largest reconstruction project in Europe since World War II because of the Russian war.

Sunak also addressed one of the biggest problems faced by many companies looking to invest in Ukraine – insuring against war damage and destruction. He announced the London Conference Framework for War Risk Insurance, intended to pave the way for lower-risk investments.

Marsh McLennan, which provides reinsurance and other services and had worked on the UK government’s program by their own account, said war risk insurance on an unprecedented scale should be available and backed by the government.

Russia’s war against Ukraine has been raging for nearly 16 months. Numerous homes, hospitals, and key infrastructure facilities have been destroyed. The total bill is likely to be enormous: Ukraine, the World Bank, the European Commission and the United Nations estimated in March that the cost of the first year of the war would be $411 billion. They could easily reach more than $1 trillion. rtr/lei

The air force inspectors of Germany, France and Spain signed a treaty on cooperative air warfare at the Le Bourget air show near Paris – thus reaffirming existing agreements. According to the agreement, the Future Combat Air System (FCAS) is to be integrated into a network of armed and unarmed drones known as the Next Generation Weapon System (NGWS) by 2040.

French Air Force Inspector Stéphane Mille told Table.Media that the paper was conceived last year, at a time “when the project was faltering.” The point, he said, was to show “that we are still working together.”

The development of FCAS caused disagreements between Germany and France on several occasions, as the companies involved, Airbus and Dassault, argued over the division of tasks. Spain joined the initially bilateral Franco-German project in 2019.

France’s President Emmanuel Macron announced at the start of the Le Bourget air show on Monday that Belgium would henceforth accompany the development of FCAS as an observer. French General Jean-Luc Moritz, who heads the operational part of FCAS on the French side, said Wednesday that the now-signed contract makes clear the requirements for the next-generation weapon system NGWS to provide a centralized weapon system that can command other systems but also fight itself. Further, NGWS should be able to use artificial intelligence to synchronize drone maneuvers and provide communications resilient to cyberattacks, he said. Gb

Rainer Steffens sees his colleagues and himself as “a special kind of lobbyist.” He was already head of North Rhine-Westphalia (NRW) representation to the EU in Brussels from 2011 to 2018. Since November 2022, he has now stood up for the interests and concerns of the federal state for the second time. However, due to the openly accessible information on finances and employees, he sees a clear difference in his work compared to classic lobbying, says Steffens. As a native of Lower Saxony, he nevertheless has a family connection to NRW through his wife from the Rhineland and his father-in-law. He is pleased to be able to represent the state, which has a population of around 18 million, not least because it has “the greatest economic power of any region in Europe.”

The most important topic in the 62-year-old’s work is currently the transformation of industrial society against the backdrop of the Green Deal and Fit for 55. According to Rainer Steffens, the plans correspond very well with the activities of the EU Commission and Ursula von der Leyen. The events surrounding Lützerath have also occupied the head of NRW’s representation. He understands the criticism of the coal compromise. “It’s not the best that could have been achieved, but it’s what was politically possible for us.”

As a law student, he had demonstrated against nuclear power and also devoted himself to environmental issues later in his career. After working in the Lower Saxony Ministry for Federal and European Affairs, Rainer Steffens held several positions in the Federal Ministry for the Environment until 2005 and was later the first head of the Environment Division in Germany’s Permanent Representation.

Between the previous and current terms as head of the representation, he worked as a coordinator at the Committee of the Regions in Brussels. “In my view, this is the most underestimated body in Brussels,” says the 62-year-old. It is made up of about 350 representatives of European cities and regions, who have very good informal contacts with the institutions.

Rainer Steffens developed his enthusiasm for Europe and the corresponding orientation at the beginning of his career. As part of his law studies in Hanover and Berlin, he completed an elective period at the European Parliament in Luxembourg in the mid-1980s. At that time, the intercultural exchange with other students was the main trigger for his enthusiasm for Europe, says the 62-year-old.

Among many other tasks, the regional office regularly hosts events. Above all, they are known for their carnival parties. “That’s part of the cultural export, of course, and we’re proud that once a year we host the biggest carnival party west of Aachen, where we can welcome up to 800 guests.” Rainer Steffens likes the colorful hustle and bustle, but full dedication is not in his DNA. What he thrives on, he says, is cycling. He currently has seven bicycles in his basement, on which he rides twelve kilometers to and from work every day, whenever possible.

He also occasionally combines his passion with his job: He has already organized a week-long bike tour through the Ruhr region and the Rhineland to Aachen with colleagues from the NRW state representation. It is important to him to not only be active on the “Brussels stage,” but also “to be able to have an impact on the state of NRW.” Stops on the tour included EU-funded projects, schools and craft businesses that feel particularly connected to Europe, as well as talks with politicians from the cities. He already has plans to repeat the tour next year. By Kim Fischer

Qatargate, the corruption scandal surrounding the EU Parliament, is still good for surprises seven months after the raids. Surprise number one: On Monday, MEP Andrea Cozzolino (formerly S&D), whose extradition Belgian investigators have been demanding for months, surprisingly turned himself in at Zaventem airport. The Neapolitan is accused of having accepted bribes from Morocco and Qatar. The now factionless MP vehemently denies this. Cozzolino had been questioned on Tuesday by the Belgian investigating judge Michel Claise. Claise has a reputation like thunder in Belgium.

Now, surprise number two: Claise had to relinquish the investigation due to bias. The judge’s son, Nicolas, founded a company in 2018 with Ugo, the son of the Socialist MEP Marie Arena. The name of Marie Arena, another Belgian socialist with Italian roots, kept popping up in the scandal. She headed the Human Rights Committee, where dubious stories were going on. Marie Arena had an affair with the main suspect, Antonio Panzeri, through whose NGOs the bribe payments were probably made.

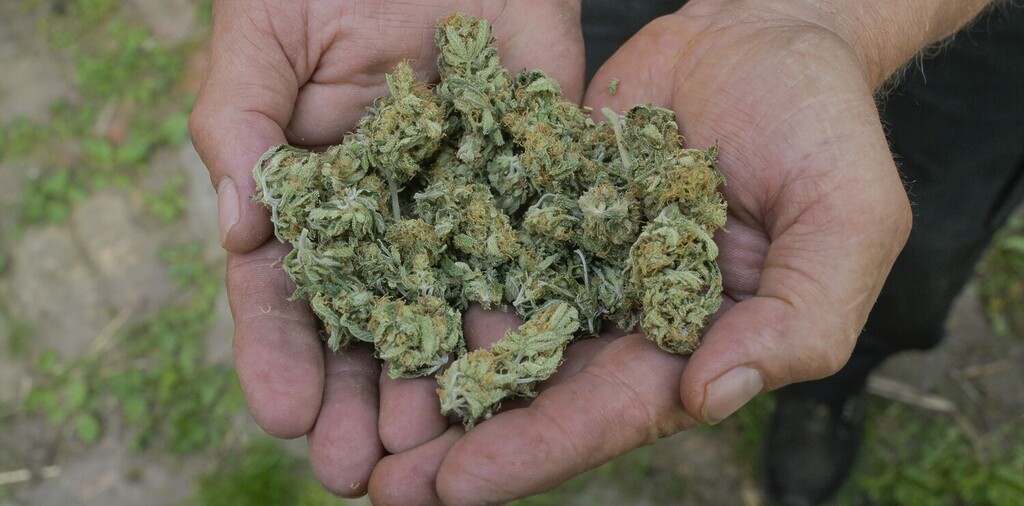

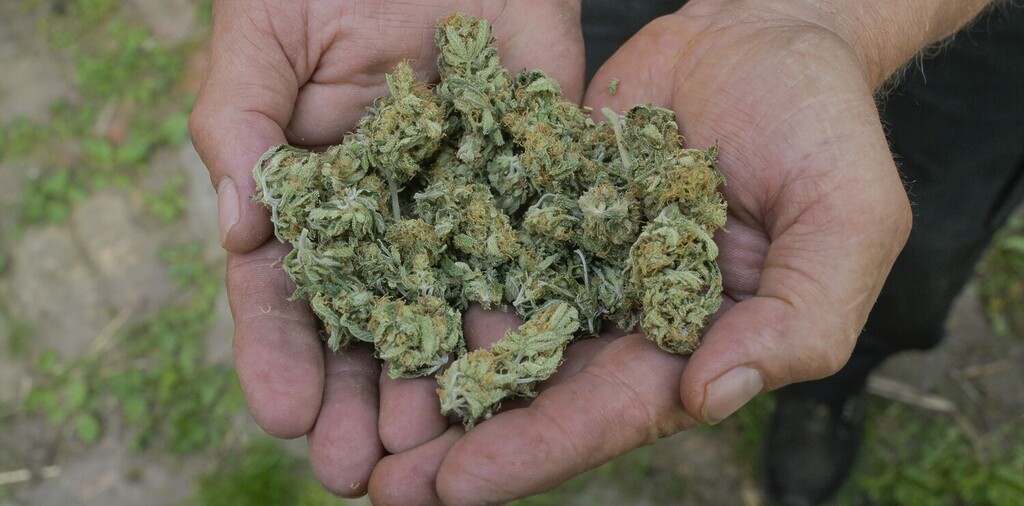

What is also interesting is what the two guys did to earn their money: Nicolas and Ugo sold hemp flowers. Quite legally, of course. Presumably, the stuff is only to be used for cosmetic purposes. Although the THC content is so low, you feel a little dizzy as an observer. mgr

France’s President Emmanuel Macron has mainly caused strife on the international stage lately, or at least not less. Controversial statements on Taiwan, insistence on nuclear power plants for climate protection and, for months, a hard line on the Platform Work Directive. Today, with the start of the two-day “Summit for a New Global Financial Pact” in Paris, Macron could once again succeed in putting himself in a positive light.

At the summit, a little-known part of the Paris climate agreement is to get more attention: financing and the financial system. Macron wants to unite the various debates on this under one roof at the two-day meeting. For example, he will discuss partnerships for green growth and the further development of multilateral development banks. Private investors are also to be better integrated.

At least in view of the list of participants, Macron can already claim partial success in his mission to “unite instead of divide”: Numerous major players on the world stage have announced their attendance. From German Chancellor Olaf Scholz, Lula da Silva and China’s Premier Li Qiang to UN Secretary-General António Guterres, World Bank chief Kristalina Georgiewa and Commission President Ursula von der Leyen. If, in the end, a passable “operational” roadmap with practical measures emerges, then a lot more would be achieved.

With his “Summit for a New Global Finance Pact” starting today, French President Emmanuel Macron wants to give international climate finance new momentum, a new framework and new donors. The two-day meeting in Paris aims to bring together the diverse debates on climate finance under one roof. It is intended to make private investors more accountable for the capital needs of the global turnaround.

And it is intended to draw general attention to the hitherto often neglected third goal of the Paris Agreement from Article 2 I c: Namely, in addition to limiting temperature and adapting to climate change, to “make financial flows compatible with a pathway towards low emissions of greenhouse gases and climate-resilient development”.

The organizers hope for a “joint diagnosis” of the challenges and a “new political vision” that will lead to “tangible, actionable” results, according to the Élysée Palace. The plan is not a word-for-word negotiated joint declaration, but an “operational” roadmap with practical measures.

Macron announced his summit at the G20 summit in November 2022 after supporting the “Bridgetown Initiative” of Mia Mottley, Prime Minister of Barbados. Mottley will be a prominent guest in Paris. Her agenda calls for a global financial system based on the needs of the most vulnerable countries: It should mobilize a total of 100 billion Dollars in finance, particularly from the private sector, and reduce the cost of capital in developing countries to address the impacts of climate change. This is in addition to the 100 billion Dollars that developed countries promised to the Global South starting 2020, and which they have so far failed to deliver in full.

Shortly before the start of the summit in Paris, heads of state and government supported the call for a climate-proof reform of the financial system and called for a “new global consensus” on this issue, including US President Joe Biden, German Chancellor Olaf Scholz, Brazil’s President Lula da Silva, South Africa’s President Cyril Ramaphosa or the head of the EU Commission Ursula von der Leyen.

In any case, the G20 has called for reform of the Bretton Woods financial architecture, which it says is no longer functional in the face of 21st century challenges. “The climate issue clashes with the agenda of reforming the Bretton Woods institutions“, analyzes Philippe Zaouati, CEO of Mirova, an asset management company specializing in sustainable investments.

The French investor believes that the entire system needs to be “rethought” and “adapted” to the new climatic realities. And that requires greater involvement of the private financial sector. “Official development assistance is good, but it’s not everything”, Zaouati points out. “Currently, pension funds, for example, are still far too reluctant to invest in southern countries. Yet there is a great need for investment there in particular.”

From Paris’ point of view, the debates to date have one problem: They are taking place through numerous channels that do not necessarily agree with each other and are considered “distant”. At the International Monetary Fund (IMF) and World Bank, at UN climate negotiations, at G7 and G20. “These international forums are currently subject to disjointed action on climate finance. This summit aims to create a common framework“, said Laurence Tubiana, chair of the European Climate Foundation and architect of the Paris Agreement. She calls for the Paris Agreement’s financial target.

Paris aims to make the two days at Palais Brongniart the hub of these different negotiating spaces. Macron wants to succeed despite tensions between China and the US, the war in Ukraine and the deep anger of the countries of the South. The geopolitical context is “very complicated”, notes Bertrand Badré, director of the Blue Orange Capital responsible investment fund and former director general for finance at the World Bank. “There is less and less desire to agree.” But, “if we don’t manage to accommodate the developing countries on the issue of financing, they won’t sit at the negotiating table and start extracting coal, oil and gas”, he fears.

Around 50 heads of state and government have announced their attendance. In addition to the charismatic Mia Mottley from Barbados, the President of Brazil, Lula da Silva, has already confirmed his participation. China is also expected to be represented at a high level by its Premier Li Qiang. UN Secretary-General António Guterres will be there, as will the President of the European Commission, Ursula von der Leyen, the German Chancellor, Olaf Scholz, and the Presidents of Ghana, Nana Akufo-Addo, Senegal, Macky Sall, and Kenya, William Ruto. The US is expected to be represented by climate envoy John Kerry, and Treasury Secretary Janet Yellen.

Major international organizations, major foundations, the private sector, academia and civil society will also be present. Among them: the new president of the World Bank, Ajay Banga, who has been in office since June 1 and for whom this summit will be the first major international meeting. Also speaking at the summit will be IMF Managing Director Kristalina Georgieva and Mafalda Duarte, who is preparing to take over as head of the Green Climate Fund. Christine Lagarde, president of the European Central Bank and former IMF chief, will also be present. So will Mark Carney, former governor of the Bank of England, who launched the Gfanz (Glasgow Financial Alliance for Net Zero) initiative.

Six roundtable discussions are planned on the following topics:

You have just taken up your position as EUCCC president. What do you see as the most pressing issue at this early stage of your tenure?

At the moment, the whole discussion about ‘de-risking’ is our main cause. There is a lot of talk about ‘de-Risking’ in Europe, and there is a lot of talk about ‘de-Risking” in China. And we think that there is still a lot of work to do to give content to this concept, in terms of its quality or its terms. So we need to begin taking a closer look at what this idea means in Europe – and also thinking about what it means in the Chinese context. Actually, China has been de-risking for the past decade. They just call it something else: ‘Made in China 2025’, ‘Dual Circulation’ or even ’14th Five Year Plan’. So I think it will be important to try finding a common language and to break down and deconstruct the concept.

How then can the de-risking of the EU work?

We need to thoroughly analyze what is perceived as a risk and as a vulnerability when we look at trade and production flows, in order to to get to a much better understanding of what ‘de-risking’ means to the actual business. That is a priority. But it will need a little bit of thinking and cannot be accomplished overnight. Words matter a lot, and this is an agenda-setting concept, same as the 2019 EU concept of China as a partner, competitor and strategic rival. So we need to be really clear about the concept and its implications.

China is still an important trading partner for most countries in Europe, particularly Germany, so diversifying away from it will be complicated. What do you expect?

I think a lot of things are not really going to change. As for manufacturing, China has been continuing to increase its share of global export. What we see right now is that there is a continued high focus on supporting the supply side in export manufacturing, through policies like easier access to credit. So I think we will continue to see China being quite strong on the export production side, which is somewhat supported by the weakening of the renminbi, at least in the short term.

That doesn’t sound bad for the Chinese economy at first.

On the other hand though, the weak Yuan is not doing a lot of good to Chinese households, because it makes imported stuff more expensive. This shows that government support is now flowing more to the supply side rather than to the demand side. We don’t see many measures that support consumption growth these days. But that’s what we would like to see.

What would help to boost consumption?

China’s people need to feel that the real estate sector is stabilizing. 70 percent of household wealth is tied up in real estate, and as long as people feel uncertain about where real estate is going, they will be conservative in their spending habits.

How do you see China’s current economic situation in general, post-Covid?

It is still early days to evaluate the reopening. We saw things were going relatively well in the first quarter, followed by some softening in the second quarter. So, yes, we are a bit concerned, we do see weaknesses in some sectors, especially in big-ticket manufactured goods, while services performed better. We may have a clearer picture in three months from now.

How much does this uncertainty about growth hit European companies?

My observation is that GDP figures are becoming less and less important and you need to look much more closely at sectors. When China was growing 12 percent a year, everyone could grow in China. I think now that growth is softening, you need to be looking a bit more carefully to pick the winners, because growth is not universal anymore. But in some sectors, there are still significant opportunities in China.

Which sectors?

We have made the point previously in one of our papers that China will mean different things in different industries. There are certain industries where China is going to account for more than half of global demand going forward. And you have others that are simply so complicated that you might ask yourself, is China really for me? So if you are doing specialty chemicals, then China is the place to be. But if you make digital platforms or digital content, then China could be a bit more difficult.

Companies are complaining about the various security laws that make their life increasingly difficult. At the same time, Europe is working on laws forcing enterprises to assess and control their value chains abroad. What does all this mean for long-established or new value chains in China? And how can companies navigate in this complicated environment – SMEs in particular?

If you are not a very large company, and it comes to a point where you have to establish and run two separate value chains – one for the West, and one for China – the cost might become prohibitively high. I would rather invest in one value chain that works very well, in a market that I know – rather than beginning to establish two, and run the second one in a market I am not too well acquainted with.

Does this have concrete consequences for European companies?

It is beginning to impact investment decisions. If I cannot predict with some amount of certainty, what the world is going to look like five years from now, and whether China will be the right place for me at that point, I will not invest. I actually don’t know of a single SME that has established itself in China since the beginning of Covid. It’s not all related to politics. But I think a lot of our companies were shaken during Covid, when they realized how vulnerable their supply chains were and how dependent they had become on a single location.

What can companies do about this?

People are sitting over their calculators trying to figure out what investments they need to make – and how those investments match the expected profits they could make in the Chinese market. And the more the costs of separating the value chain rise, the higher the threshold at which it becomes interesting for companies to set up shop here.

How does that play out in China?

This poses a risk and shrinks the variety in size and types of companies that have a longer-term interest in coming to China. I think these are exactly the kind of conversations we need to have with the Chinese government: Regulations and restrictions have consequences in real life, and consequences in invested Euros and US Dollars. So Beijing has some work to do in order to demonstrate to the international business community that China is an efficient and predictable place where companies can come and put down roots.

Is it true that local governments continue to be eager to attract foreign companies – all the while the central government is putting more attention on security and stability these days, with less focus on business?

Yes, there is a lot of interest in most provinces and municipalities in attracting foreign investment – especially under the present circumstances of a softening economy. I think anything that boosts economic activity is welcome. I certainly recognize that myself when I am traveling around. There is a high appetite for engaging with the foreign business community – and we of course appreciate that.

Beijing sends a not-so-open message.

Frankly, many of us got a bit concerned after the CCP Congress in October where there was so much focus on security and self-reliance which seemed to push in the other direction. But then we had the NPC in March, where talk was a lot more about unwavering support for reform and opening up, which was nice to hear.

What do you think the direction will be in the future?

At this point, we don’t really know which side is for real. It is wonderful that local governments want to talk to us. We like the attention. But will it translate to results on the ground? I think that remains to be seen.

Jens Eskelund has lived in China for 25 years and is the chief representative of the Danish Maersk Group. He has already served two terms as Vice President of the EU Chamber – from 2019 to 2021 and from October 2022 to May 2023 – and has also been actively involved in the Chamber’s working groups since its inception. He has also been a board member and chairman of the Danish Chamber of Commerce in China.

June, 22, 2023; 8:30-9:30 a.m., online

DGAP, Discussion Morning Briefing on Geopolitical Challenges

The German Council on Foreign Relations (DGAP) looks at the European Commission’s Economic Security Strategy. INFO & REGISTRATION

June, 23, 2023; 8:45 a.m.-2:30 p.m., London (UK)/online

GMF, Conference Building A Transparent and Accountable Ukraine: Key Steps to Recovery

The German Marshall Fund (GMF) brings together officials from governments, donor agencies, and civil society to discuss how Ukraine can prepare for a process of recovery and reconstruction that promotes digitalization, strong governance, transparency, and integrity. INFO & REGISTRATION

June, 23, 2023; 9 a.m.-6 p.m., Naples (Italy)

EC, Conference 1st Conference on Sustainable Banking and Finance CSBF 2023

The European Commission (EC) aims at stimulating the discussion about the bidirectional nature of the relationship between climate change and finance. INFO & REGISTRATION

June, 23, 2023; 9:30 a.m.-12:30 p.m. Brussels (Belgium)/online

SGI Europe, Conference The EU Single Market at 30: What role for SGIs?

SGI Europe reflects the discussion about the bidirectional nature of the relationship between climate change and finance. INFO & REGISTRATION

June, 24-25, 2023; Amsterdam (Netherlands)

Steconf, Conference 3rd International Conference on Innovation in Renewable Energy and Power

Steconf addresses global and regional trends, innovative application frameworks, and current research. INFO & REGISTRATION

June, 26-30, 2023; Trier

ERA, Seminar Summer Course on European Intellectual Property Law

The Academy of European Law (ERA) provides a thorough introduction to European intellectual property law. INFO & REGISTRATION

June, 27 – July, 1, 2023; Champaign-Urbana, Illinois (USA)

Aspen Institute, Conference U.S.-German Forum on Future Agriculture

The Aspen Institute (AI) sheds light on solutions for a sustainable future for agriculture and rural areas. INFO & REGISTRATION

June, 27-29, 2023; Prague (Czech Republic)

Conference International Flow Battery Forum 2023

The conference addresses the central role that flow batteries play in the energy storage sector. INFO & REGISTRATION

June, 27, 2023; 10:30 a.m.-4:45 p.m., Brussels (Belgium)/online

Bruegel Future of Work and Inclusive Growth Annual Conference 2023

Bruegel discusses necessary skills demanded by the AI and green sectors, examines the impact of technology adoption on labor markets, and addresses the growing inequality brought on by digitalisation of capital. INFO & REGISTRATION

June, 27, 2023; 2:30-4:30 p.m., Brussels (Belgium)/online

ERCST, Discussion EU Climate Policy & Electricity Market

The European Roundtable on Climate Change and Sustainable Transition (ERCST) addresses the interactions between EU climate policy and the electricity market. INFO & REGISTRATION

The Commission hopes to end long vacancies at the top of representations in several member states by making the posts more attractive. According to information from Table.Media, the Commission’s representations in Berlin, Warsaw and Budapest will be upgraded. The head – he or she is the Commission’s representative in the respective member state – will hold the rank of director.

Directors are classified in grades AD 13 and 14 and earn a basic salary of €14,644.53 per month at the beginning of their term of service, or €16,569.31 per month. However, a correction coefficient applies depending on the location (in Poland currently 70.1; in Hungary currently 69.9), which means that basic salaries there are significantly lower.

Jörg Wojahn, the Commission’s representative in Berlin, is vacating his post in the summer, according to information from Table.Media. Indications that Martin Selmayr, the Commission’s representative in Austria and former Secretary General of the Commission, is moving to Berlin, are considered speculation.

With the upgrading of the representative in Berlin, Warsaw and Budapest, the respective representations are drawing level with Paris, where the head already works at the director level. There is reportedly resentment in Italy and Spain: The governments insist that the Commission also make the representatives in their countries directors.

So far, the heads of the representations have been classified as head of unit, and earn a basic salary at the beginning of their term of office in the grades AD 9 to AD 12, which in Germany is approximately between €8,936.26 and €12,943.31 per month.

The management of the Commission’s regional offices in Munich has been vacant since September 2020, while the office in Bonn has been managed on an interim basis from Berlin since September 2021. The Commission has decided to classify the heads of the regional offices as heads of unit, to make the posts more attractive. Until now, they had no designated rank.

The regional office in Bonn, which will soon move to Cologne, is responsible for North Rhine-Westphalia, Rhineland-Palatinate, Hesse and Saarland. Around 30 million citizens live in these federal states. This is roughly equivalent to the combined population of the member states Portugal, Sweden and the Czech Republic. The regional office in Munich is responsible for Baden-Württemberg and Bavaria. Around 25 million people live in these federal states. These state governments had repeatedly protested to the Commission about the vacancies. The representations report directly to the Commission President. Filling the posts is the responsibility of Ursula von der Leyen.

Since in Munich, for example, at least two rounds of applications in which only Commission officials were eligible ended without the head position being filled, the Commission has also admitted external applicants in the currently underway procedure.

The upgrading of the heads of the regional offices to the rank of head of unit has met with criticism: While heads of unit in the Commission have personnel responsibility for 15 to 20 civil servants, the regional office in Bonn, for example, has only a total of three employees. Such a small number of employees does not fit the post of a head of unit, the authority says. mgr

The EU is getting serious about closing the loopholes in its sanction regime against Russia. Member states’ ambassadors approved the eleventh sanctions package on Wednesday. It provides for the first time an instrument to impose punitive measures on companies and third countries that engage in or offer themselves as platforms for circumvention deals.

The sanctions package will deal a further blow to Putin’s war machine with tighter export restrictions and target entities that support the Kremlin, Commission President Ursula von der Leyen said in welcoming the agreement. She said the anti-sanctions circumvention tool will prevent Russia from getting its hands on sanctioned goods.

However, the EU Commission had to revise its original proposal from the end of March several times and tone down the instrument. This was due to pressure from Germany and other states. “We must prevent Russia from obtaining sanctioned war-related goods via third countries,” a directive from Berlin said as recently as last week. Combating sanctions evasion was indeed a top priority. At the same time, however, third countries must not be driven to Russia’s side.

Germany withdrew its review reservation only before the last round in the COREPER. The instrument against third countries is now to be used in a carefully graduated procedure and only as a last resort. Before punitive measures can be imposed against third countries, the EU Commission must prove that all other diplomatic efforts have failed. Diplomats now said the eleventh sanctions package creates “as a last resort, new exceptional measures” to restrict the sale, transfer or export of sensitive dual-use goods and technology to third countries. EU states would have to agree to punitive measures against third countries by consensus.

Specifically, third countries that serve as loopholes over a longer period and are assessed as “particularly high risk” with regard to circumvention transactions will be targeted. Only companies and third countries with a clear link to war-related goods from the EU are to be listed. There needs to be a clear demarcation from extraterritorial sanctions, which the EU otherwise rejects, Germany and other member states said.

Part of the package is also a port call ban on ships involved in ship-to-ship transfers to circumvent the oil import ban by sea. 71 individuals and 33 entities are also listed because they are suspected of involvement in, among other things, the deportation of Ukrainian children to Russia. In the future, individuals and entities can also be subject to punitive measures such as entry and account blocks if they participate in the circumvention of sanctions.

The EU Commission actually wanted to impose sanctions on seven Chinese companies. According to information from the afp news agency, only a listing of three majority Russian-controlled companies based in Hong Kong is planned.

The member states must now formally sign off on the agreement in the COREPER by Friday in a written procedure. The eleventh sanctions package could then enter into force on the same day as publication in the Official Journal. sti

Ukraine must continue to wait for the start of accession talks with the EU. Next week’s EU summit in Brussels will encourage the country to undertake additional reforms but will not give a date for the start of negotiations. This is according to draft conclusions for the summit, available to Europe.Table. The European Council recognizes Ukraine’s “substantial efforts,” the document says. “It encourages Ukraine to continue on its reform path.” However, there is no prospect of an accession conference.

Ukraine had called for negotiations to start this year. However, the EU Commission has made this dependent on seven conditions. So far, only two of the seven criteria have been met, it was said at a meeting of EU ambassadors in Brussels on Wednesday. “The main hurdles for Ukraine are the reform of the Constitutional Court and the fight against corruption and oligarchs,” a diplomat said. In contrast, he said, Ukraine has implemented recommendations to reduce political influence over the media and reform the judicial system.

The EU states must unanimously decide to start accession talks. The basis for this is a progress report on the candidate countries the EU Commission plans to present in October. Enlargement Commissioner Olivér Várhelyi gave only an oral interim report yesterday.

A year ago, the EU summit decided to grant Ukraine candidate status. Since then, Poland and the Baltic states in particular have been calling for a rapid start to accession negotiations. Germany is putting on the brakes – and referring to the EU Commission. eb

Several billion in aid for Ukraine has been pledged by leaders at a donor conference in London. London’s Prime Minister Rishi Sunak unveiled several support measures, including an additional $3 billion in guarantees to free loans from the World Bank. These include pledges of £20 million (about €23 million) to improve access to the World Bank’s Multilateral Investment Guarantee Agency, which provides political risk cover for projects.

European Commission President Ursula von der Leyen said the EU would provide Ukraine with €50 billion for 2024 to 2027, while US Secretary of State Antony Blinken offered $1.3 billion in additional aid. German Foreign Minister Annalena Baerbock said Berlin was offering an additional €381 million in humanitarian aid for 2023.

Ukrainian Prime Minister Denys Shmyhal said Wednesday he expected to pledge nearly $7 billion in aid after explaining to a London conference that Kyiv faces the largest reconstruction project in Europe since World War II because of the Russian war.

Sunak also addressed one of the biggest problems faced by many companies looking to invest in Ukraine – insuring against war damage and destruction. He announced the London Conference Framework for War Risk Insurance, intended to pave the way for lower-risk investments.

Marsh McLennan, which provides reinsurance and other services and had worked on the UK government’s program by their own account, said war risk insurance on an unprecedented scale should be available and backed by the government.

Russia’s war against Ukraine has been raging for nearly 16 months. Numerous homes, hospitals, and key infrastructure facilities have been destroyed. The total bill is likely to be enormous: Ukraine, the World Bank, the European Commission and the United Nations estimated in March that the cost of the first year of the war would be $411 billion. They could easily reach more than $1 trillion. rtr/lei

The air force inspectors of Germany, France and Spain signed a treaty on cooperative air warfare at the Le Bourget air show near Paris – thus reaffirming existing agreements. According to the agreement, the Future Combat Air System (FCAS) is to be integrated into a network of armed and unarmed drones known as the Next Generation Weapon System (NGWS) by 2040.

French Air Force Inspector Stéphane Mille told Table.Media that the paper was conceived last year, at a time “when the project was faltering.” The point, he said, was to show “that we are still working together.”

The development of FCAS caused disagreements between Germany and France on several occasions, as the companies involved, Airbus and Dassault, argued over the division of tasks. Spain joined the initially bilateral Franco-German project in 2019.

France’s President Emmanuel Macron announced at the start of the Le Bourget air show on Monday that Belgium would henceforth accompany the development of FCAS as an observer. French General Jean-Luc Moritz, who heads the operational part of FCAS on the French side, said Wednesday that the now-signed contract makes clear the requirements for the next-generation weapon system NGWS to provide a centralized weapon system that can command other systems but also fight itself. Further, NGWS should be able to use artificial intelligence to synchronize drone maneuvers and provide communications resilient to cyberattacks, he said. Gb

Rainer Steffens sees his colleagues and himself as “a special kind of lobbyist.” He was already head of North Rhine-Westphalia (NRW) representation to the EU in Brussels from 2011 to 2018. Since November 2022, he has now stood up for the interests and concerns of the federal state for the second time. However, due to the openly accessible information on finances and employees, he sees a clear difference in his work compared to classic lobbying, says Steffens. As a native of Lower Saxony, he nevertheless has a family connection to NRW through his wife from the Rhineland and his father-in-law. He is pleased to be able to represent the state, which has a population of around 18 million, not least because it has “the greatest economic power of any region in Europe.”

The most important topic in the 62-year-old’s work is currently the transformation of industrial society against the backdrop of the Green Deal and Fit for 55. According to Rainer Steffens, the plans correspond very well with the activities of the EU Commission and Ursula von der Leyen. The events surrounding Lützerath have also occupied the head of NRW’s representation. He understands the criticism of the coal compromise. “It’s not the best that could have been achieved, but it’s what was politically possible for us.”

As a law student, he had demonstrated against nuclear power and also devoted himself to environmental issues later in his career. After working in the Lower Saxony Ministry for Federal and European Affairs, Rainer Steffens held several positions in the Federal Ministry for the Environment until 2005 and was later the first head of the Environment Division in Germany’s Permanent Representation.

Between the previous and current terms as head of the representation, he worked as a coordinator at the Committee of the Regions in Brussels. “In my view, this is the most underestimated body in Brussels,” says the 62-year-old. It is made up of about 350 representatives of European cities and regions, who have very good informal contacts with the institutions.

Rainer Steffens developed his enthusiasm for Europe and the corresponding orientation at the beginning of his career. As part of his law studies in Hanover and Berlin, he completed an elective period at the European Parliament in Luxembourg in the mid-1980s. At that time, the intercultural exchange with other students was the main trigger for his enthusiasm for Europe, says the 62-year-old.

Among many other tasks, the regional office regularly hosts events. Above all, they are known for their carnival parties. “That’s part of the cultural export, of course, and we’re proud that once a year we host the biggest carnival party west of Aachen, where we can welcome up to 800 guests.” Rainer Steffens likes the colorful hustle and bustle, but full dedication is not in his DNA. What he thrives on, he says, is cycling. He currently has seven bicycles in his basement, on which he rides twelve kilometers to and from work every day, whenever possible.

He also occasionally combines his passion with his job: He has already organized a week-long bike tour through the Ruhr region and the Rhineland to Aachen with colleagues from the NRW state representation. It is important to him to not only be active on the “Brussels stage,” but also “to be able to have an impact on the state of NRW.” Stops on the tour included EU-funded projects, schools and craft businesses that feel particularly connected to Europe, as well as talks with politicians from the cities. He already has plans to repeat the tour next year. By Kim Fischer

Qatargate, the corruption scandal surrounding the EU Parliament, is still good for surprises seven months after the raids. Surprise number one: On Monday, MEP Andrea Cozzolino (formerly S&D), whose extradition Belgian investigators have been demanding for months, surprisingly turned himself in at Zaventem airport. The Neapolitan is accused of having accepted bribes from Morocco and Qatar. The now factionless MP vehemently denies this. Cozzolino had been questioned on Tuesday by the Belgian investigating judge Michel Claise. Claise has a reputation like thunder in Belgium.

Now, surprise number two: Claise had to relinquish the investigation due to bias. The judge’s son, Nicolas, founded a company in 2018 with Ugo, the son of the Socialist MEP Marie Arena. The name of Marie Arena, another Belgian socialist with Italian roots, kept popping up in the scandal. She headed the Human Rights Committee, where dubious stories were going on. Marie Arena had an affair with the main suspect, Antonio Panzeri, through whose NGOs the bribe payments were probably made.

What is also interesting is what the two guys did to earn their money: Nicolas and Ugo sold hemp flowers. Quite legally, of course. Presumably, the stuff is only to be used for cosmetic purposes. Although the THC content is so low, you feel a little dizzy as an observer. mgr