Trump’s potential next term in office has climate activists worried, at the very least. Trump could increase fossil fuel subsidies, reverse some IRA investments and weaken US agencies in an effort to undermine climate action. Umair Irfan has examined the erratic ex-president’s master plan for climate policy and the factors that speak against his absolute power in Washington.

Joe Biden’s recent decision to put the approval of new LNG terminals on hold was met with much approval. Parts of the climate movement see this as a first step towards the “transition away from fossil fuels,” decided at COP28. However, many countries – including climate frontrunners – still have big plans for oil and gas, reports Bernhard Pötter.

Germany currently debates climate money. Will it be paid out in the current legislative period and from what funds? Malte Kreutzfeld is very skeptical: Even in 2027, financing it will be problematic. Although the government is counting on new funds from ETS 2, EU regulations will make it difficult.

The 2024 United States presidential election is shaping up to be a rematch between Joe Biden and Donald Trump. Polls show that support for both candidates is close for the moment, but much can change between now and the November election. Nonetheless, the chances of another Trump presidency are not trivial. And even if he doesn’t win, his rhetoric will drive the agenda for the Republican Party in Congress and in state governments, especially when it comes to the environment.

Trump’s long-standing personal antipathy toward climate change and the tools to address it hasn’t changed much since he left office. In the past year, he has falsely claimed that wind turbines kill whales, that sea level rise will be a tiny fraction of what projections actually show, and that the US military under Biden wants to make electric tanks and green fighter jets.

However, the political landscape of a second Trump term will be drastically different from his first round in office as he seeks to undo his predecessor’s accomplishments. For one thing, Biden managed to actually sign two big pieces of climate legislation into law, the Bipartisan Infrastructure Law and the Inflation Reduction Act. The Republicans want to reverse this law – in April 2023, they already pushed a plan through the House of Representatives that would withdraw tax benefits for renewable energies and even introduce higher taxes in return.

The money from these laws is already allocated and it would require an act of Congress to halt their investments in clean energy, electric vehicles, and efficient appliances. Many Republican states are also benefiting from these investments, so Trump may be less inclined to try to block them entirely.

But there are still a number of policies enacted from the Biden White House that Trump could reverse. Having learned from his first chaotic term in office, Republicans have begun to chalk out a cohesive plan so they can hit the ground running if they win the presidency again. The Heritage Foundation, a right-wing think tank, worked with former Trump administration officials to assemble Project 2025.

The plan lays out how Trump officials would limit powers of federal offices like the Environmental Protection and Agency to give more authority to states and redirect the efforts of divisions like the Department of Energy to promote more fossil fuel development. The president has the authority to permit oil and gas exports, as well as mining on public lands, and it’s likely Trump will encourage more extraction.

Trump may also restart the process of pulling the US out of the Paris climate agreement. It may be a symbolic gesture and take years to formally carry out, but Trump loves symbols, ceremonies, and speaking in front of cameras, so another withdrawal announcement would be an easy way to accomplish all three.

However, even with federal agencies, Trump’s power isn’t absolute. One of the problems Trump ran into during his presidency was that many of his environmental rollbacks faced legal challenges from environmental activists and states led by Democrats. Many of his cuts to pollution regulations were stalled and never implemented. And Trump’s opposition has also learned from his first term. And Trump’s opposition has also learned from his first term. While groups of leaders at the state and local levels, such as We Are Still In, suspended their activities under Biden, activist organizations, such as the Sunrise Movement are still ready to oppose Trump if necessary.

This time, Trump has more favorable courts at his disposal. During his time in office, he placed 174 federal district court judges out of 677, 54 appeals court judges out of 179, and three out of nine supreme court judges. These judges have lifetime appointments and have continued to rule on policies, often acting to block new environmental regulations on water, vehicle emissions

One of the long-running goals for conservatives is to repeal the 2009 endangerment finding from the EPA. This is the core legal authority that requires the government to regulate greenhouse gasses. Though courts have rejected challenges to the endangerment finding so far, conservative groups haven’t given up and could one day have their case before a more favorable judge.

Trump also learned the hard way that “personnel is policy,” that the kind of people he picks to run his administration will ultimately shape what he can accomplish. Trump’s first pick to run the EPA was Scott Pruitt, who lavished praise on Trump but also racked up a long list of scandals. His successor, Andrew Wheeler, kept a lower profile but still managed to advance Trump’s deregulation agenda. It’s likely then that Trump will be more careful in selecting people to carry out his will without drawing too much unnecessary attention.

But one of the biggest variables in a second Trump term remains Trump himself. He is notorious for rejecting plans, deciding on whims, and acting on whatever he was told by the last person he spoke to. There will be a fierce battle for his attention.

The good news is that there is already momentum for decarbonization in the US economy. Coal-fired power generation is still declining, electric cars are growing in popularity, and renewables remain the cheapest source of new electricity, even in Republican states. Trump may slow down efforts to limit climate change, but he won’t be able to stop them. Umair Irfan, Washington, D.C.

The US government’s announcement to “temporarily pause” approvals for new LNG terminals raises hopes that the core decision of COP28 in Dubai will be filled with life: countries’ pledge to “transition away from fossil fuels.” Many observers see the US government’s decision as a first step towards implementing this COP resolution.

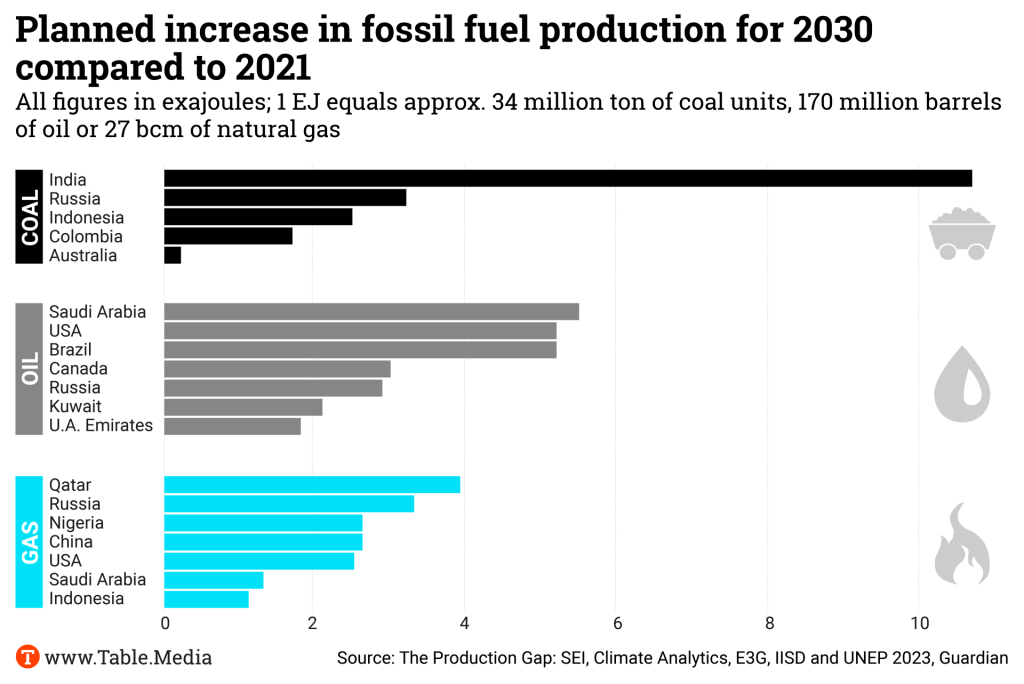

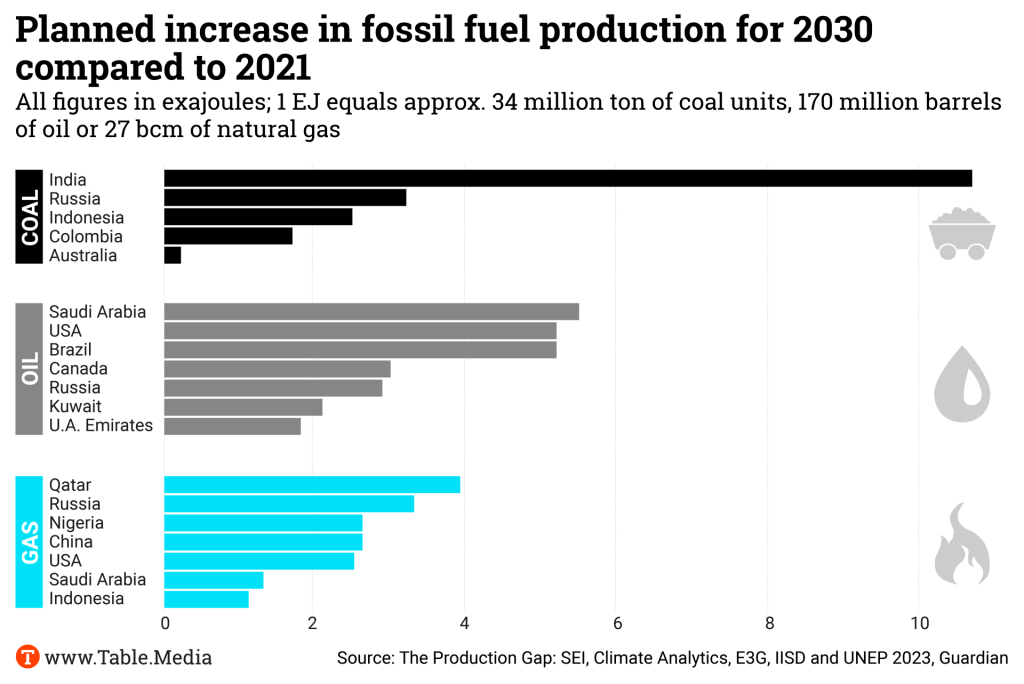

However, the global expansion plans for fossil fuels – including from countries in favor of ambitious climate policies – point in the opposite direction: oil and gas production is being further expanded.

At the end of last week, US President Joe Biden declared that his Department of Energy would suspend the approval process for new LNG terminals on the US Gulf Coast. The licenses would be reviewed in light of new findings to determine their impact on the economy, energy security, the burden on consumers, and climate policy. The US currently has seven operating LNG terminals, with five more under construction and 17 awaiting approvals. What has been hailed as a major success for the US environmental movement is also seen by many observers as a move to win over young and left-leaning voters in the upcoming US election campaign.

The climate movement reacted to the announcement with delight: It was “one of the most important moves President Biden could make on addressing the climate crisis,” wrote the environmental organization Sierra Club. Bill McKibben from 350.org also commented that Biden had “done more than any president before him to check the expansion of dirty energy.” German Climate Secretary Jennifer Morgan said that the decision “changes the calculation for future energy demand,” after all, everyone had decided at COP28 to move away from fossil fuels.

However, the reality in many other countries looks different. The Dubai resolution to “transition away from fossil fuels” has hardly led to a change of course. Many decisions in favor of expanding fossil fuel infrastructure were made in the weeks and months surrounding the conference in Dubai, particularly in pioneering climate action countries:

Even before the COP, several reports had pointed out the contradiction between international climate targets and the national energy plans of fossil fuel producers:

The pressure for the introduction of climate money in Germany continues to grow: On Tuesday, activists from Greenpeace, the German trade union Verdi and the Parity Welfare Association jumped into the River Spree together to protest “against social coldness” and for “climate money now!.” Shortly before, 16 leading associations had sent a letter to Finance Minister Christian Lindner calling for the rapid introduction of climate money. Earlier in the week, several scientists had stressed the importance of climate money for the public’s acceptance of rising carbon prices.

There are also calls from all three governing parties to start returning at least some of the revenue from national carbon pricing directly to citizens as quickly as possible. However, the chances of this happening have recently diminished further for several reasons.

It was already unclear where the climate money would come from, as the revenue from both European and national carbon pricing has already been fully earmarked. They will flow into the Climate and Transformation Fund (KTF), which funds most of Germany’s climate action programs. These include subsidies for green heating and energy-efficient modernization, the switch to electromobility, the green conversion of the steel sector and other industries, and natural climate action.

The KTF no longer has any reserves – on the contrary, since the Federal Constitutional Court’s ruling in November, 60 billion euros had to be cut from the reserve, and many programs have been trimmed or canceled altogether. And in order to be able to continue them at least at this reduced level, funds will have to be transferred from the normal budget to the KTF again from next year onwards.

It remains entirely unclear where the approximately 8.5 billion euros needed for climate money of 100 euros per capita per year, for example, would come from. The proposal from the Free Democratic Party (FDP) parliamentary group to scrap subsidies for chip plants, among other things, is just as unlikely to be agreed upon in the government as demands from the Greens to abolish tax breaks for company cars and diesel to fund the climate money.

In the meantime, the chances of a short-term payout have fallen even further. A new financial gap is emerging in the KTF this year. Firstly, the costs of paying the EEG levy on consumer power bills will probably be higher than expected. In addition to the 10.6 billion euros earmarked for this, grid operators recently informed the German Federal Ministry for Economic Affairs and Climate Action of an additional need of 7.8 billion euros. This is due to a leftover claim from 2022 and 2023 and because the electricity exchange price has dropped significantly, and therefore, the surcharges for renewable energy producers, which are paid from the EEG levy, are higher. The FDP expects demand to be even higher.

It is also becoming apparent that revenue from European emissions trading will be lower than anticipated because the carbon price has recently fallen compared to last year. Even if the payout mechanism is available by the end of the year, as announced by the Ministry of Finance, it is unlikely that the money can be disbursed in 2025.

So far, hopes for the coming years are all the higher. This is because in 2027, the national carbon price for heating and transport, which stipulates fixed values, will be transferred to the newly created EU emissions trading system for these sectors (ETS 2). The market will determine prices, and as the number of credits decreases each year, experts expect a significant price hike in the future – and, correspondingly, more revenue for the state.

However, the EU specifies in detail in the corresponding directive for what purpose it may be used. Alongside promoting green technologies and international climate financing, it also lists “national climate dividend schemes” – but with the addition that these must have a “proven positive environmental impact.” And a per capita payment without further requirements is unlikely to meet this condition, writes the Stiftung Umweltenergierecht in a study published in mid-January. The EU Commission did not comment on this assessment.

The EU directive also mentions “financial support to address social aspects in lower- and middle-income households” as another possible disbursement option. However, the study suggests that climate money is unlikely to fall under this category either. And the funds from the EU’s newly created Social Climate Fund, which will receive part of the carbon revenue, are also not eligible for the climate money in its current planned form. The reason is that payments from it may only be made for a limited period and only to disadvantaged households.

Feb. 5-9, 9 a.m., Potsdam, Germany

Workshop Climate Finance and Investment in Times of Crisis: Towards a New Partnership with the Global South

The purpose of this workshop is to bring together scholars who work on the topic of climate finance from an international political economy perspective. It is organized by the Research Institute for Sustainability – Helmholtz Centre Potsdam (RIFS). Info

Feb. 6, Brussels

Presentation 2040 climate target

The EU Commission presents its climate target for 2040 and the greenhouse gas budget for 2030 to 2050. Info

Feb. 7, 2:30 p.m. Brussels / Online

Seminar Hydrogen Bank: A Game Changer?

The event of the European Roundtable on Climate Change and Sustainable Transition aims at fuelling and informing the discussion on the different Hydrogen Bank’s instruments. Info

Feb. 8

Elections Parliamentary elections in Pakistan

The country with a population of around 240 million will elect a new parliament. In the run-up to the elections, there had been repeated concerns about the influence of the military.

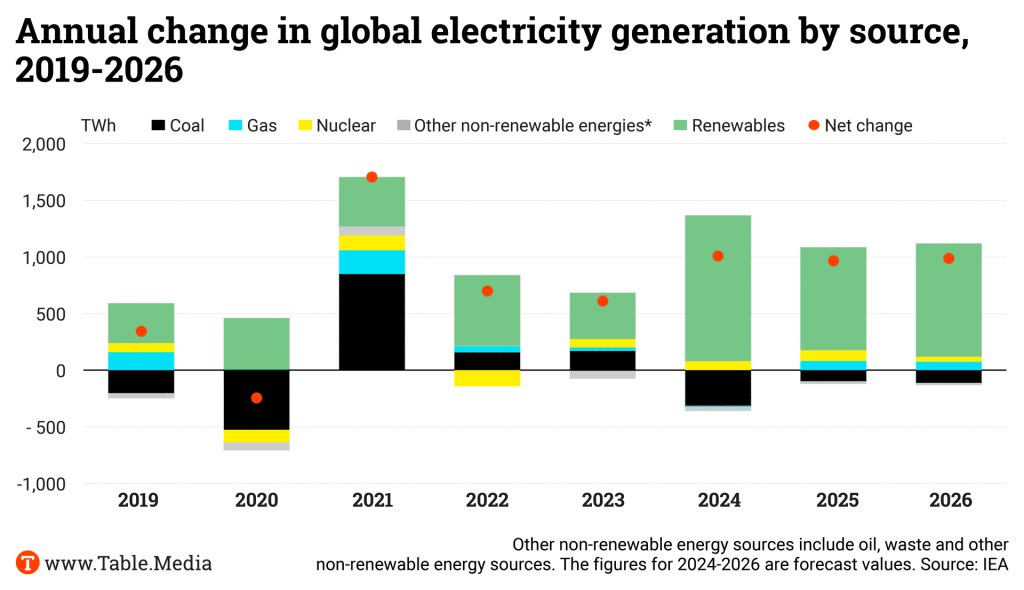

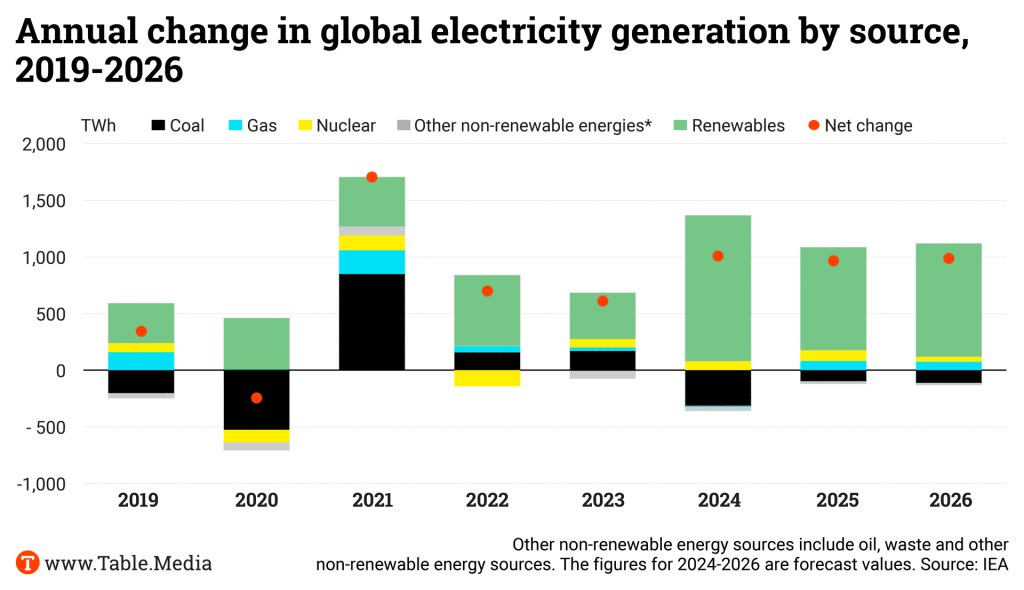

The combustion of coal for power generation peaked worldwide in 2023 and will decline in the coming years. This is according to the International Energy Agency (IEA) in its “Electricity 2024” outlook for 2024 to 2026, which predicts that the share of coal in the global electricity mix will decrease by three percent as early as 2024. This trend will continue in the following years, although the expected decline will only be around one percent per year. By 2026, the share of fossil fuels in electricity generation is expected to fall to 54 percent, the first time it has fallen below the 60 percent mark in 50 years.

The IEA expects hydroelectricity, which declined significantly in the drought year 2023, to return to its normal level. The share of gas will grow by around one percent per year. The IEA, the energy authority of the OECD countries, sees three important milestones in the global electricity supply over the next few years:

Advancing the energy transition while supporting Ukraine economically: This is the goal of a joint initiative by the think tank Liberale Moderne (LibMod) and the lobby association Zukunft Gas. Their aim is for large-scale imports of biomethane from Ukraine to Germany.

In a policy paper published last fall, they presented the potential of this cooperation and also analyzed the reasons for the previous lack of such an import. According to the paper, the country could produce around eleven terawatt hours (TWh) of biomethane in 2030 and 50 TWh in 2050. The total potential is estimated at 110 TWh annually. Two-thirds of the required biomass would consist of crop residues and waste and one-third of maize silage.

The initiators campaigned for support for their concept at a parliamentary evening on Tuesday. Former Green Party politician and current LibMod Managing Director Ralf Fücks emphasized that the technology and pipelines already exist, meaning that biomethane from Ukraine – unlike hydrogen – could be used to replace fossil natural gas in the short term. Fücks said that “more speed is needed” for the project, “which can create a bit of hope and confidence.”

However, implementation is still a long way off. German law needs to be amended in order to receive EEG remuneration for electricity from biomethane generated abroad. In addition, official bilateral cooperation between Germany and Ukraine is required so that Ukrainian biogas can receive the necessary proof of origin.

The Ministry of the Environment and the Ministry of Agriculture reportedly have reservations about the project because they are skeptical about the increased use of biogas. In addition, Ukraine still has to approve the export of biomethane via pipelines and the investments have to be secured. mkr

Environmental and climate organizations and the trade union IGBCE call on the German government to reform the debt brake, set up a special climate action fund and “strengthen the revenue side.” According to Germanwatch, the WWF, the Deutscher Naturschutzring (DNR) and the trade union for mining, chemicals and energy (IGBCE), these proposals must be “examined without prejudice” in the current budget debate.

These associations accuse the government’s austerity policy of resulting in “urgent investments in climate neutrality not being made.” This would jeopardize Germany’s competitiveness and jobs as well as the ability to achieve its climate targets. The organizations warn that investments in the climate transformation must not be played off against social equity. Christoph Bals, Executive Policy Director at Germanwatch, demands that in addition to taking on new debt, there should also be a debate about reducing fossil fuel subsidies and “expanding the tax base, for example, on financial market income.”

The German Council of Economic Experts (SVR) also supported revising the debt rules on Tuesday. The government should “create leeway so that future-oriented public spending can be made without undermining the sustainability of public finances,” said SVR chair Monika Schnitzler.

Voices are also increasingly coming from the business community regarding the reform of the debt brake. Over the weekend, the German CEO Alliance for Climate and Economy published an appeal signed by more than 50 companies. In it, companies such as Thyssenkrupp, Salzgitter AG and Wacker AG call for a “further development of the debt brake” in order to “enable investments towards a climate-neutral economy, which in turn will trigger follow-up investments by the private sector”. nib

Despite stricter EU regulations, a new study shows that the discrepancy between car manufacturers’ CO2 emissions specifications and actual values is growing. Between 2018 and 2022, the difference increased from 8 to 14 percent. This is the result of a study by the research organization International Council on Clean Transportation (ICCT), exclusively available to Table.Media.

The findings cast doubt on the effectiveness of the EU’s carbon reduction measures. According to EU figures, emissions should actually have declined by around 7.3 percent between 2018 and 2022. The ICCT study now casts this in a different light. Of the 7.3 percent reduction achieved on paper, only less than a third – 2.3 percent – remain in real-world operation on the road. The study accuses manufacturers of undermining the EU’s efforts to reduce transport-related carbon emissions.

To counteract this, the globally harmonized WLTP testing procedure for passenger cars and light commercial vehicles was introduced in 2017 following Dieselgate, which the ICCT helped uncover. Data is also collected from real-world driving. These values were supposed to be more representative than those of the pure NEDC laboratory test cycle.

However, the ICCT now also finds the WLTP to be inadequate. “Our analysis shows that the real-world gap is growing again, after the introduction of WLTP,” says Jan Dornoff, Research Lead at the ICCT and co-author of the report. “Without counteraction, official CO2 emission values will become increasingly unrepresentative of real-world values, and mandatory reductions for official values will not be reflected in the actual CO2 emissions.”

Last week, the European Court of Auditors gave the EU’s carbon fleet regulation a poor report in its special report “Reducing CO₂ emissions from passenger cars“: By 2020, “the intended benefits of the regulation had largely lapsed.” There had been little or no reduction in carbon emissions from new vehicles.

Just last week, the European Court of Auditors criticized the EU’s CO2 fleet regulation in its special report “Reducing carbon dioxide emissions from passenger cars“: There had been little or no reduction in carbon emissions from newly registered vehicles. This was mainly due to the fact that “manufacturers focused on reducing emissions in the laboratory rather than on the road.” löh

The economic benefits of transforming global agricultural and food systems towards greater climate and biodiversity conservation could reach between five and ten trillion US dollars per year by 2050. The costs, on the other hand, would only be between 200 and 500 billion US dollars per year. This is the conclusion of a study by the Food System Economics Commission (FSEC). The commission includes institutions such as the Potsdam Institute for Climate Impact Research, the World Bank and the World Health Organization. The study took four years to complete.

According to the study, the high profits result from agricultural and food systems generating 15 trillion US dollars of unaccounted yearly costs. Around eleven trillion US dollars alone are attributable to the economic costs of lower productivity, which are a consequence of obesity and malnutrition. The current food systems cost the climate and the environment around three trillion dollars annually. The resulting emissions also contribute to around a third of global carbon emissions.

Specifically, such a transformation means reducing the share of animal-based foods, especially in developed countries, says Johan Rockström, Director of the Potsdam Institute for Climate Impact Research (PIK). Furthermore, a move away from monocultures is necessary and the use of fertilizers must be reformed.

The researchers list five priorities for the transformation of agricultural and food systems:

Northern Europe experienced unusually cold snaps at the beginning of January caused by cold Arctic air. In Vittangi, Sweden, the temperature fell to -44.6 degrees on January 5. This was the lowest temperature recorded in Finland, Sweden and Norway since the turn of the century. North America also recorded unusually low temperatures in January. Is there a connection to global warming? An international team of 19 climate scientists has investigated this for Finland, Sweden and Norway in a first analysis.

Their findings: Man-made climate change makes extremely low temperatures much less likely in these three countries. However, the researchers warn against underestimating the danger of cold snaps, as, for example, these could be fatal for people without homes. Extreme cold will occur “less frequent in Northern Europe” but “may become more dangerous.” Due to milder temperatures, precautionary measures could be neglected. However, the need for reliable forecasts, early warning and prevention remains high.

The researchers compared the actual temperatures with climate models that simulated a world without man-made global warming. They examined two different cold events: The coldest five-day period in an area covering certain regions in Norway, Sweden and Finland, and the coldest daily temperature at a weather station in Oslo. The study found that both temperature values would have been four degrees lower without climate change. The probability of an extreme five-day cold snap like this January would have been five times higher without climate change, while the likelihood of a one-day extreme cold snap would have been twelve times higher. ae

The EU hydrogen strategy provides for an ambitious growth plan: The capacities for the production of green hydrogen are to be increased from six gigawatts (GW) planned for this year to 40 GW by 2030. The target by 2050 is 500 GW. However, installed capacities only amounted to around 0.2 GW by the end of 2023. The reasons: Major uncertainties regarding the regulation of clean hydrogen and its derivatives as well as a lack of buyers due to the significantly higher prices compared to fossil alternatives.

The third amendment to the Renewable Energy Directive (RED III) has largely removed the uncertainties, for example by clearly defining the requirements for renewable hydrogen, but also defines ambitious targets: All hydrogen used by industry is to be 42 percent renewable as early as 2030.

In concrete terms, this means that within the next six years it must be possible to provide 2 to 3.5 million tons of green hydrogen for refineries, fertilizer and chemical companies alone – but currently only around 50,000 tons of clean hydrogen are available.

These figures alone show that Hydrogen expansion cannot succeed if nobody wants to move forward. What we are currently seeing among companies is a cultivation of the first-mover disadvantage: Whoever invests in a new technology first must also deal with its “teething troubles” and develop appropriate solutions. Many companies shy away from the risk and projects are delayed indefinitely.

This hesitation is only human, but in view of the necessary massive transformation of our energy industry, we as a society and as an economy need entrepreneurs who are actively shaping the change. And there are certainly examples of this: the first steel manufacturers are in the starting blocks to operate the first direct reduction plants for the production of green iron. Some energy companies are planning their first large-scale plants to produce green hydrogen, and many refineries are developing local electrolyzer projects.

The times are good for this, despite the current economic situation. The EU’s goal is clear, now it needs the interaction of public and private stakeholders. Numerous funding instruments are available at both national and European levels for the development of the hydrogen economy and the necessary infrastructure, for example from the Recovery and Resilience Facility (ARF) for the European Hydrogen Bank or money from the European Innovation Fund.

They are essential means for companies to minimize risks and cover the costs of the necessary investments. At least five billion euros have already been promised to companies in the steel industry.

Achieving the expansion targets in a relatively short period of time is no easy task. One thing is certain: The capacities of renewable power generation and electrolyzers must be massively expanded. Despite numerous project announcements, the target of six gigawatts in 2024 could be missed by a huge margin and would have to be compensated for in subsequent years.

According to the International Energy Agency’s Global Hydrogen Review 2023, only four percent of global hydrogen projects have a final investment decision. The situation in Europe is similar. At the same time, a large number of electrolyzers and currently even the corresponding production capacities are lacking.

There is also a lack of infrastructure. The political will to complete the German hydrogen core network by 2028 is an important step. However, in view of the duration of planning procedures and the construction of infrastructure, the time pressure to act becomes even more apparent. Another time factor is the long-term customer structures that need to be established first.

The first production capacities, in particular, are dependent on reliable customers, as green hydrogen will be more expensive than the fossil alternative, especially at the beginning. In addition, hydrogen will also be transported over long distances in the future by converting hydrogen into ammonia, as this is easier to transport. This will also require scalable technical solutions that enable the respective conversion in large quantities.

Despite unanswered questions, companies can benefit from the enormous potential offered by the development of the hydrogen economy. They need to find a way through the current challenges. Energy-intensive companies, in particular, should draw up a strategy and roadmap now to secure their supply of green hydrogen in the long term.

Here, too, it is essential to use existing funding mechanisms and analyze possible technologies and business models. At the same time, long-term cooperation between producers and customers can ensure the quantities of green hydrogen required in the future and guarantee planning security for the first projects.

So are the goals of European regulation achievable? Only if industry, politics and society work closely together over the next six years and actively drive change. The RED III targets for hydrogen should serve as a motivator. Those who get actively involved and implement the innovation will benefit from economic gains – and make an important contribution to the energy transition.

Trump’s potential next term in office has climate activists worried, at the very least. Trump could increase fossil fuel subsidies, reverse some IRA investments and weaken US agencies in an effort to undermine climate action. Umair Irfan has examined the erratic ex-president’s master plan for climate policy and the factors that speak against his absolute power in Washington.

Joe Biden’s recent decision to put the approval of new LNG terminals on hold was met with much approval. Parts of the climate movement see this as a first step towards the “transition away from fossil fuels,” decided at COP28. However, many countries – including climate frontrunners – still have big plans for oil and gas, reports Bernhard Pötter.

Germany currently debates climate money. Will it be paid out in the current legislative period and from what funds? Malte Kreutzfeld is very skeptical: Even in 2027, financing it will be problematic. Although the government is counting on new funds from ETS 2, EU regulations will make it difficult.

The 2024 United States presidential election is shaping up to be a rematch between Joe Biden and Donald Trump. Polls show that support for both candidates is close for the moment, but much can change between now and the November election. Nonetheless, the chances of another Trump presidency are not trivial. And even if he doesn’t win, his rhetoric will drive the agenda for the Republican Party in Congress and in state governments, especially when it comes to the environment.

Trump’s long-standing personal antipathy toward climate change and the tools to address it hasn’t changed much since he left office. In the past year, he has falsely claimed that wind turbines kill whales, that sea level rise will be a tiny fraction of what projections actually show, and that the US military under Biden wants to make electric tanks and green fighter jets.

However, the political landscape of a second Trump term will be drastically different from his first round in office as he seeks to undo his predecessor’s accomplishments. For one thing, Biden managed to actually sign two big pieces of climate legislation into law, the Bipartisan Infrastructure Law and the Inflation Reduction Act. The Republicans want to reverse this law – in April 2023, they already pushed a plan through the House of Representatives that would withdraw tax benefits for renewable energies and even introduce higher taxes in return.

The money from these laws is already allocated and it would require an act of Congress to halt their investments in clean energy, electric vehicles, and efficient appliances. Many Republican states are also benefiting from these investments, so Trump may be less inclined to try to block them entirely.

But there are still a number of policies enacted from the Biden White House that Trump could reverse. Having learned from his first chaotic term in office, Republicans have begun to chalk out a cohesive plan so they can hit the ground running if they win the presidency again. The Heritage Foundation, a right-wing think tank, worked with former Trump administration officials to assemble Project 2025.

The plan lays out how Trump officials would limit powers of federal offices like the Environmental Protection and Agency to give more authority to states and redirect the efforts of divisions like the Department of Energy to promote more fossil fuel development. The president has the authority to permit oil and gas exports, as well as mining on public lands, and it’s likely Trump will encourage more extraction.

Trump may also restart the process of pulling the US out of the Paris climate agreement. It may be a symbolic gesture and take years to formally carry out, but Trump loves symbols, ceremonies, and speaking in front of cameras, so another withdrawal announcement would be an easy way to accomplish all three.

However, even with federal agencies, Trump’s power isn’t absolute. One of the problems Trump ran into during his presidency was that many of his environmental rollbacks faced legal challenges from environmental activists and states led by Democrats. Many of his cuts to pollution regulations were stalled and never implemented. And Trump’s opposition has also learned from his first term. And Trump’s opposition has also learned from his first term. While groups of leaders at the state and local levels, such as We Are Still In, suspended their activities under Biden, activist organizations, such as the Sunrise Movement are still ready to oppose Trump if necessary.

This time, Trump has more favorable courts at his disposal. During his time in office, he placed 174 federal district court judges out of 677, 54 appeals court judges out of 179, and three out of nine supreme court judges. These judges have lifetime appointments and have continued to rule on policies, often acting to block new environmental regulations on water, vehicle emissions

One of the long-running goals for conservatives is to repeal the 2009 endangerment finding from the EPA. This is the core legal authority that requires the government to regulate greenhouse gasses. Though courts have rejected challenges to the endangerment finding so far, conservative groups haven’t given up and could one day have their case before a more favorable judge.

Trump also learned the hard way that “personnel is policy,” that the kind of people he picks to run his administration will ultimately shape what he can accomplish. Trump’s first pick to run the EPA was Scott Pruitt, who lavished praise on Trump but also racked up a long list of scandals. His successor, Andrew Wheeler, kept a lower profile but still managed to advance Trump’s deregulation agenda. It’s likely then that Trump will be more careful in selecting people to carry out his will without drawing too much unnecessary attention.

But one of the biggest variables in a second Trump term remains Trump himself. He is notorious for rejecting plans, deciding on whims, and acting on whatever he was told by the last person he spoke to. There will be a fierce battle for his attention.

The good news is that there is already momentum for decarbonization in the US economy. Coal-fired power generation is still declining, electric cars are growing in popularity, and renewables remain the cheapest source of new electricity, even in Republican states. Trump may slow down efforts to limit climate change, but he won’t be able to stop them. Umair Irfan, Washington, D.C.

The US government’s announcement to “temporarily pause” approvals for new LNG terminals raises hopes that the core decision of COP28 in Dubai will be filled with life: countries’ pledge to “transition away from fossil fuels.” Many observers see the US government’s decision as a first step towards implementing this COP resolution.

However, the global expansion plans for fossil fuels – including from countries in favor of ambitious climate policies – point in the opposite direction: oil and gas production is being further expanded.

At the end of last week, US President Joe Biden declared that his Department of Energy would suspend the approval process for new LNG terminals on the US Gulf Coast. The licenses would be reviewed in light of new findings to determine their impact on the economy, energy security, the burden on consumers, and climate policy. The US currently has seven operating LNG terminals, with five more under construction and 17 awaiting approvals. What has been hailed as a major success for the US environmental movement is also seen by many observers as a move to win over young and left-leaning voters in the upcoming US election campaign.

The climate movement reacted to the announcement with delight: It was “one of the most important moves President Biden could make on addressing the climate crisis,” wrote the environmental organization Sierra Club. Bill McKibben from 350.org also commented that Biden had “done more than any president before him to check the expansion of dirty energy.” German Climate Secretary Jennifer Morgan said that the decision “changes the calculation for future energy demand,” after all, everyone had decided at COP28 to move away from fossil fuels.

However, the reality in many other countries looks different. The Dubai resolution to “transition away from fossil fuels” has hardly led to a change of course. Many decisions in favor of expanding fossil fuel infrastructure were made in the weeks and months surrounding the conference in Dubai, particularly in pioneering climate action countries:

Even before the COP, several reports had pointed out the contradiction between international climate targets and the national energy plans of fossil fuel producers:

The pressure for the introduction of climate money in Germany continues to grow: On Tuesday, activists from Greenpeace, the German trade union Verdi and the Parity Welfare Association jumped into the River Spree together to protest “against social coldness” and for “climate money now!.” Shortly before, 16 leading associations had sent a letter to Finance Minister Christian Lindner calling for the rapid introduction of climate money. Earlier in the week, several scientists had stressed the importance of climate money for the public’s acceptance of rising carbon prices.

There are also calls from all three governing parties to start returning at least some of the revenue from national carbon pricing directly to citizens as quickly as possible. However, the chances of this happening have recently diminished further for several reasons.

It was already unclear where the climate money would come from, as the revenue from both European and national carbon pricing has already been fully earmarked. They will flow into the Climate and Transformation Fund (KTF), which funds most of Germany’s climate action programs. These include subsidies for green heating and energy-efficient modernization, the switch to electromobility, the green conversion of the steel sector and other industries, and natural climate action.

The KTF no longer has any reserves – on the contrary, since the Federal Constitutional Court’s ruling in November, 60 billion euros had to be cut from the reserve, and many programs have been trimmed or canceled altogether. And in order to be able to continue them at least at this reduced level, funds will have to be transferred from the normal budget to the KTF again from next year onwards.

It remains entirely unclear where the approximately 8.5 billion euros needed for climate money of 100 euros per capita per year, for example, would come from. The proposal from the Free Democratic Party (FDP) parliamentary group to scrap subsidies for chip plants, among other things, is just as unlikely to be agreed upon in the government as demands from the Greens to abolish tax breaks for company cars and diesel to fund the climate money.

In the meantime, the chances of a short-term payout have fallen even further. A new financial gap is emerging in the KTF this year. Firstly, the costs of paying the EEG levy on consumer power bills will probably be higher than expected. In addition to the 10.6 billion euros earmarked for this, grid operators recently informed the German Federal Ministry for Economic Affairs and Climate Action of an additional need of 7.8 billion euros. This is due to a leftover claim from 2022 and 2023 and because the electricity exchange price has dropped significantly, and therefore, the surcharges for renewable energy producers, which are paid from the EEG levy, are higher. The FDP expects demand to be even higher.

It is also becoming apparent that revenue from European emissions trading will be lower than anticipated because the carbon price has recently fallen compared to last year. Even if the payout mechanism is available by the end of the year, as announced by the Ministry of Finance, it is unlikely that the money can be disbursed in 2025.

So far, hopes for the coming years are all the higher. This is because in 2027, the national carbon price for heating and transport, which stipulates fixed values, will be transferred to the newly created EU emissions trading system for these sectors (ETS 2). The market will determine prices, and as the number of credits decreases each year, experts expect a significant price hike in the future – and, correspondingly, more revenue for the state.

However, the EU specifies in detail in the corresponding directive for what purpose it may be used. Alongside promoting green technologies and international climate financing, it also lists “national climate dividend schemes” – but with the addition that these must have a “proven positive environmental impact.” And a per capita payment without further requirements is unlikely to meet this condition, writes the Stiftung Umweltenergierecht in a study published in mid-January. The EU Commission did not comment on this assessment.

The EU directive also mentions “financial support to address social aspects in lower- and middle-income households” as another possible disbursement option. However, the study suggests that climate money is unlikely to fall under this category either. And the funds from the EU’s newly created Social Climate Fund, which will receive part of the carbon revenue, are also not eligible for the climate money in its current planned form. The reason is that payments from it may only be made for a limited period and only to disadvantaged households.

Feb. 5-9, 9 a.m., Potsdam, Germany

Workshop Climate Finance and Investment in Times of Crisis: Towards a New Partnership with the Global South

The purpose of this workshop is to bring together scholars who work on the topic of climate finance from an international political economy perspective. It is organized by the Research Institute for Sustainability – Helmholtz Centre Potsdam (RIFS). Info

Feb. 6, Brussels

Presentation 2040 climate target

The EU Commission presents its climate target for 2040 and the greenhouse gas budget for 2030 to 2050. Info

Feb. 7, 2:30 p.m. Brussels / Online

Seminar Hydrogen Bank: A Game Changer?

The event of the European Roundtable on Climate Change and Sustainable Transition aims at fuelling and informing the discussion on the different Hydrogen Bank’s instruments. Info

Feb. 8

Elections Parliamentary elections in Pakistan

The country with a population of around 240 million will elect a new parliament. In the run-up to the elections, there had been repeated concerns about the influence of the military.

The combustion of coal for power generation peaked worldwide in 2023 and will decline in the coming years. This is according to the International Energy Agency (IEA) in its “Electricity 2024” outlook for 2024 to 2026, which predicts that the share of coal in the global electricity mix will decrease by three percent as early as 2024. This trend will continue in the following years, although the expected decline will only be around one percent per year. By 2026, the share of fossil fuels in electricity generation is expected to fall to 54 percent, the first time it has fallen below the 60 percent mark in 50 years.

The IEA expects hydroelectricity, which declined significantly in the drought year 2023, to return to its normal level. The share of gas will grow by around one percent per year. The IEA, the energy authority of the OECD countries, sees three important milestones in the global electricity supply over the next few years:

Advancing the energy transition while supporting Ukraine economically: This is the goal of a joint initiative by the think tank Liberale Moderne (LibMod) and the lobby association Zukunft Gas. Their aim is for large-scale imports of biomethane from Ukraine to Germany.

In a policy paper published last fall, they presented the potential of this cooperation and also analyzed the reasons for the previous lack of such an import. According to the paper, the country could produce around eleven terawatt hours (TWh) of biomethane in 2030 and 50 TWh in 2050. The total potential is estimated at 110 TWh annually. Two-thirds of the required biomass would consist of crop residues and waste and one-third of maize silage.

The initiators campaigned for support for their concept at a parliamentary evening on Tuesday. Former Green Party politician and current LibMod Managing Director Ralf Fücks emphasized that the technology and pipelines already exist, meaning that biomethane from Ukraine – unlike hydrogen – could be used to replace fossil natural gas in the short term. Fücks said that “more speed is needed” for the project, “which can create a bit of hope and confidence.”

However, implementation is still a long way off. German law needs to be amended in order to receive EEG remuneration for electricity from biomethane generated abroad. In addition, official bilateral cooperation between Germany and Ukraine is required so that Ukrainian biogas can receive the necessary proof of origin.

The Ministry of the Environment and the Ministry of Agriculture reportedly have reservations about the project because they are skeptical about the increased use of biogas. In addition, Ukraine still has to approve the export of biomethane via pipelines and the investments have to be secured. mkr

Environmental and climate organizations and the trade union IGBCE call on the German government to reform the debt brake, set up a special climate action fund and “strengthen the revenue side.” According to Germanwatch, the WWF, the Deutscher Naturschutzring (DNR) and the trade union for mining, chemicals and energy (IGBCE), these proposals must be “examined without prejudice” in the current budget debate.

These associations accuse the government’s austerity policy of resulting in “urgent investments in climate neutrality not being made.” This would jeopardize Germany’s competitiveness and jobs as well as the ability to achieve its climate targets. The organizations warn that investments in the climate transformation must not be played off against social equity. Christoph Bals, Executive Policy Director at Germanwatch, demands that in addition to taking on new debt, there should also be a debate about reducing fossil fuel subsidies and “expanding the tax base, for example, on financial market income.”

The German Council of Economic Experts (SVR) also supported revising the debt rules on Tuesday. The government should “create leeway so that future-oriented public spending can be made without undermining the sustainability of public finances,” said SVR chair Monika Schnitzler.

Voices are also increasingly coming from the business community regarding the reform of the debt brake. Over the weekend, the German CEO Alliance for Climate and Economy published an appeal signed by more than 50 companies. In it, companies such as Thyssenkrupp, Salzgitter AG and Wacker AG call for a “further development of the debt brake” in order to “enable investments towards a climate-neutral economy, which in turn will trigger follow-up investments by the private sector”. nib

Despite stricter EU regulations, a new study shows that the discrepancy between car manufacturers’ CO2 emissions specifications and actual values is growing. Between 2018 and 2022, the difference increased from 8 to 14 percent. This is the result of a study by the research organization International Council on Clean Transportation (ICCT), exclusively available to Table.Media.

The findings cast doubt on the effectiveness of the EU’s carbon reduction measures. According to EU figures, emissions should actually have declined by around 7.3 percent between 2018 and 2022. The ICCT study now casts this in a different light. Of the 7.3 percent reduction achieved on paper, only less than a third – 2.3 percent – remain in real-world operation on the road. The study accuses manufacturers of undermining the EU’s efforts to reduce transport-related carbon emissions.

To counteract this, the globally harmonized WLTP testing procedure for passenger cars and light commercial vehicles was introduced in 2017 following Dieselgate, which the ICCT helped uncover. Data is also collected from real-world driving. These values were supposed to be more representative than those of the pure NEDC laboratory test cycle.

However, the ICCT now also finds the WLTP to be inadequate. “Our analysis shows that the real-world gap is growing again, after the introduction of WLTP,” says Jan Dornoff, Research Lead at the ICCT and co-author of the report. “Without counteraction, official CO2 emission values will become increasingly unrepresentative of real-world values, and mandatory reductions for official values will not be reflected in the actual CO2 emissions.”

Last week, the European Court of Auditors gave the EU’s carbon fleet regulation a poor report in its special report “Reducing CO₂ emissions from passenger cars“: By 2020, “the intended benefits of the regulation had largely lapsed.” There had been little or no reduction in carbon emissions from new vehicles.

Just last week, the European Court of Auditors criticized the EU’s CO2 fleet regulation in its special report “Reducing carbon dioxide emissions from passenger cars“: There had been little or no reduction in carbon emissions from newly registered vehicles. This was mainly due to the fact that “manufacturers focused on reducing emissions in the laboratory rather than on the road.” löh

The economic benefits of transforming global agricultural and food systems towards greater climate and biodiversity conservation could reach between five and ten trillion US dollars per year by 2050. The costs, on the other hand, would only be between 200 and 500 billion US dollars per year. This is the conclusion of a study by the Food System Economics Commission (FSEC). The commission includes institutions such as the Potsdam Institute for Climate Impact Research, the World Bank and the World Health Organization. The study took four years to complete.

According to the study, the high profits result from agricultural and food systems generating 15 trillion US dollars of unaccounted yearly costs. Around eleven trillion US dollars alone are attributable to the economic costs of lower productivity, which are a consequence of obesity and malnutrition. The current food systems cost the climate and the environment around three trillion dollars annually. The resulting emissions also contribute to around a third of global carbon emissions.

Specifically, such a transformation means reducing the share of animal-based foods, especially in developed countries, says Johan Rockström, Director of the Potsdam Institute for Climate Impact Research (PIK). Furthermore, a move away from monocultures is necessary and the use of fertilizers must be reformed.

The researchers list five priorities for the transformation of agricultural and food systems:

Northern Europe experienced unusually cold snaps at the beginning of January caused by cold Arctic air. In Vittangi, Sweden, the temperature fell to -44.6 degrees on January 5. This was the lowest temperature recorded in Finland, Sweden and Norway since the turn of the century. North America also recorded unusually low temperatures in January. Is there a connection to global warming? An international team of 19 climate scientists has investigated this for Finland, Sweden and Norway in a first analysis.

Their findings: Man-made climate change makes extremely low temperatures much less likely in these three countries. However, the researchers warn against underestimating the danger of cold snaps, as, for example, these could be fatal for people without homes. Extreme cold will occur “less frequent in Northern Europe” but “may become more dangerous.” Due to milder temperatures, precautionary measures could be neglected. However, the need for reliable forecasts, early warning and prevention remains high.

The researchers compared the actual temperatures with climate models that simulated a world without man-made global warming. They examined two different cold events: The coldest five-day period in an area covering certain regions in Norway, Sweden and Finland, and the coldest daily temperature at a weather station in Oslo. The study found that both temperature values would have been four degrees lower without climate change. The probability of an extreme five-day cold snap like this January would have been five times higher without climate change, while the likelihood of a one-day extreme cold snap would have been twelve times higher. ae

The EU hydrogen strategy provides for an ambitious growth plan: The capacities for the production of green hydrogen are to be increased from six gigawatts (GW) planned for this year to 40 GW by 2030. The target by 2050 is 500 GW. However, installed capacities only amounted to around 0.2 GW by the end of 2023. The reasons: Major uncertainties regarding the regulation of clean hydrogen and its derivatives as well as a lack of buyers due to the significantly higher prices compared to fossil alternatives.

The third amendment to the Renewable Energy Directive (RED III) has largely removed the uncertainties, for example by clearly defining the requirements for renewable hydrogen, but also defines ambitious targets: All hydrogen used by industry is to be 42 percent renewable as early as 2030.

In concrete terms, this means that within the next six years it must be possible to provide 2 to 3.5 million tons of green hydrogen for refineries, fertilizer and chemical companies alone – but currently only around 50,000 tons of clean hydrogen are available.

These figures alone show that Hydrogen expansion cannot succeed if nobody wants to move forward. What we are currently seeing among companies is a cultivation of the first-mover disadvantage: Whoever invests in a new technology first must also deal with its “teething troubles” and develop appropriate solutions. Many companies shy away from the risk and projects are delayed indefinitely.

This hesitation is only human, but in view of the necessary massive transformation of our energy industry, we as a society and as an economy need entrepreneurs who are actively shaping the change. And there are certainly examples of this: the first steel manufacturers are in the starting blocks to operate the first direct reduction plants for the production of green iron. Some energy companies are planning their first large-scale plants to produce green hydrogen, and many refineries are developing local electrolyzer projects.

The times are good for this, despite the current economic situation. The EU’s goal is clear, now it needs the interaction of public and private stakeholders. Numerous funding instruments are available at both national and European levels for the development of the hydrogen economy and the necessary infrastructure, for example from the Recovery and Resilience Facility (ARF) for the European Hydrogen Bank or money from the European Innovation Fund.

They are essential means for companies to minimize risks and cover the costs of the necessary investments. At least five billion euros have already been promised to companies in the steel industry.

Achieving the expansion targets in a relatively short period of time is no easy task. One thing is certain: The capacities of renewable power generation and electrolyzers must be massively expanded. Despite numerous project announcements, the target of six gigawatts in 2024 could be missed by a huge margin and would have to be compensated for in subsequent years.

According to the International Energy Agency’s Global Hydrogen Review 2023, only four percent of global hydrogen projects have a final investment decision. The situation in Europe is similar. At the same time, a large number of electrolyzers and currently even the corresponding production capacities are lacking.

There is also a lack of infrastructure. The political will to complete the German hydrogen core network by 2028 is an important step. However, in view of the duration of planning procedures and the construction of infrastructure, the time pressure to act becomes even more apparent. Another time factor is the long-term customer structures that need to be established first.

The first production capacities, in particular, are dependent on reliable customers, as green hydrogen will be more expensive than the fossil alternative, especially at the beginning. In addition, hydrogen will also be transported over long distances in the future by converting hydrogen into ammonia, as this is easier to transport. This will also require scalable technical solutions that enable the respective conversion in large quantities.

Despite unanswered questions, companies can benefit from the enormous potential offered by the development of the hydrogen economy. They need to find a way through the current challenges. Energy-intensive companies, in particular, should draw up a strategy and roadmap now to secure their supply of green hydrogen in the long term.

Here, too, it is essential to use existing funding mechanisms and analyze possible technologies and business models. At the same time, long-term cooperation between producers and customers can ensure the quantities of green hydrogen required in the future and guarantee planning security for the first projects.

So are the goals of European regulation achievable? Only if industry, politics and society work closely together over the next six years and actively drive change. The RED III targets for hydrogen should serve as a motivator. Those who get actively involved and implement the innovation will benefit from economic gains – and make an important contribution to the energy transition.