One of the biggest climate challenges of the coming decades is getting oil and gas producers to extract fewer fossil fuels. Iran is a particularly tough nut to crack. The country depends on fossil fuel exports, has not ratified the Paris Agreement, and sanctions hinder decarbonization. The new president, Massud Peseschkian, could be a glimmer of hope, as Jagoda Grondecka reports. Peseshkian supports opening up to the West.

Alex Veit has analyzed how the German government’s new growth initiative could slow down the energy transition. The coal phase-out by 2030 could be at risk. Environmental organizations also fear that too many fossil gas-fired power plants could be built and criticize state guarantees for gas imports. The backup power plants are actually to run on green hydrogen in the future. However, it is still unclear whether there will be enough of this energy source.

It is also still unclear what role direct air capture will play in reducing emissions. Nevertheless, Microsoft is strongly relying on DAC. The company has purchased 500,000 tons worth of emissions credits from a DAC plant that is not even finished yet. Positive news comes from the UK: The new Labour government wants to set up a new sovereign wealth fund to contribute seven billion pounds to the restructuring of the economy.

A glimpse of hope for Iran’s environmental future is the new president, reformist Masoud Pezeshkian. Although he hasn’t raised environmental issues in the last two debates, Pezeshkian advocates for dialogue with the West and resuming nuclear talks to remove sanctions and attract foreign investment. This could pave the way for green energy.

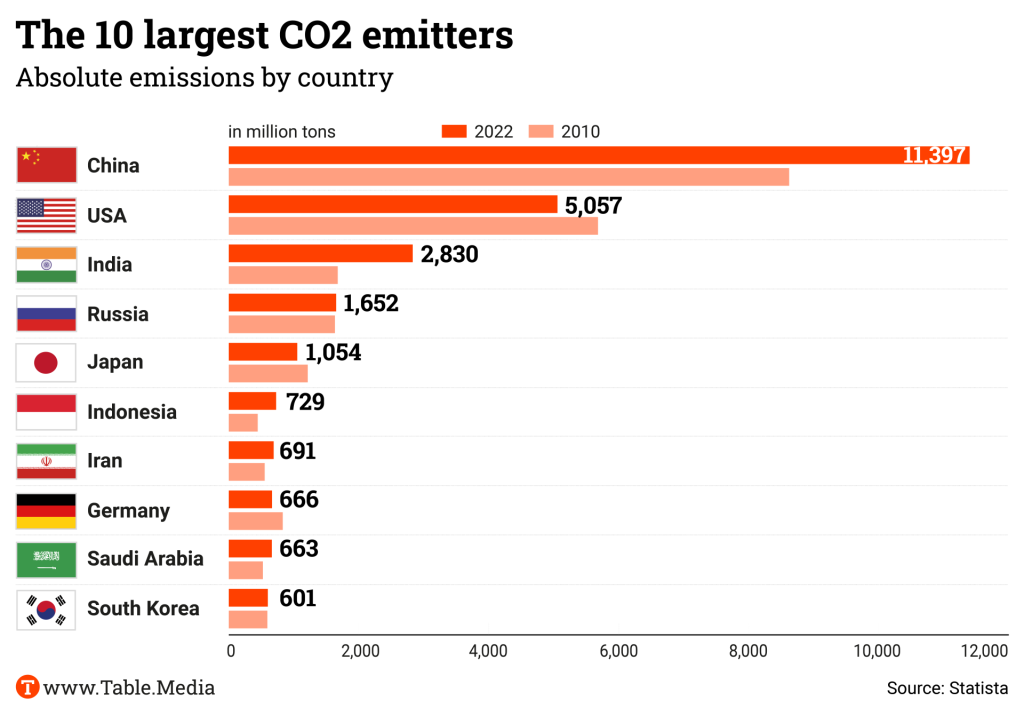

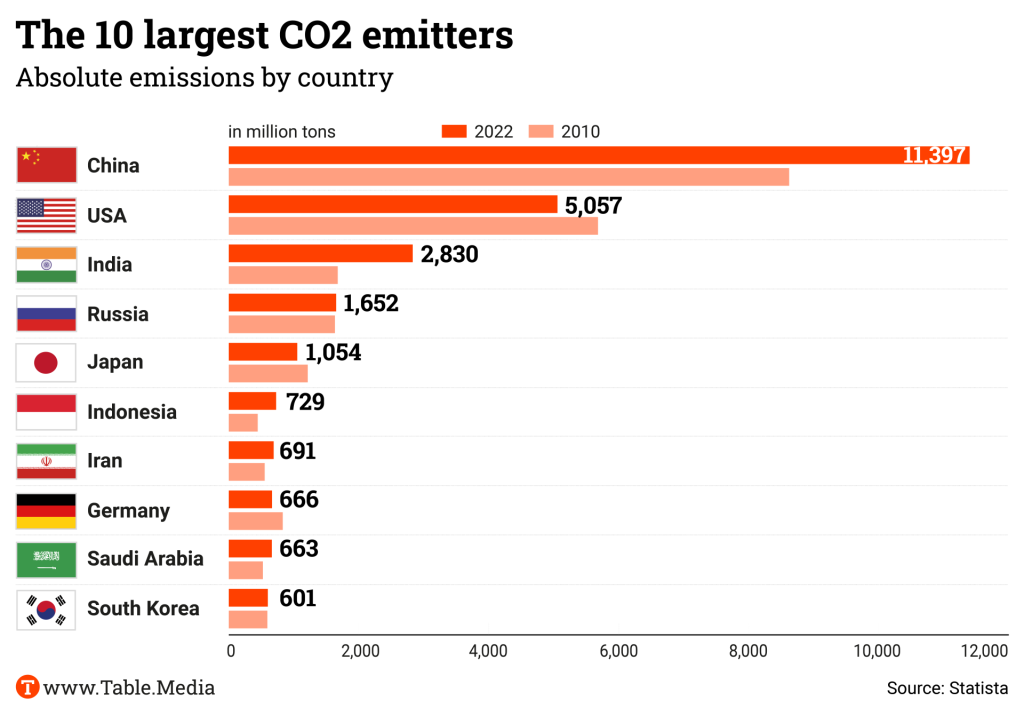

The country’s position as a major oil producer and its inefficient economy have made Iran one of the countries with the highest CO2 emissions in the world. Iran has been a major oil exporter since the beginning of the 20th century. The economy has been repeatedly hampered by international sanctions due to Iran’s nuclear program. Nevertheless, Iranian oil production and exports have increased since the end of 2020. They reached a value of almost 36 billion US dollars last year – partly because the oil sector circumvented the sanctions.

By the end of June, Oil Minister Javad Owji said that production volume had risen by 60 percent in the last three years, reaching 3.57 million barrels per day. The International Energy Agency estimates that Iran produced 2.99 million barrels daily last year and predicts a further rise of 160,000 barrels in 2024.

China, Iran’s top client, is willing to buy record amounts of Iranian crude, with shipments tripling between 2020 and 2023. Tehran has mastered various sanctions-evading tactics, including:

Iranian authorities are determined to further expand the country’s oil sector, the backbone of its troubled economy. Recently, Iran’s economic council approved a plan to increase oil production to four million barrels per day.

The country is also expanding its gas sector. The National Iranian Gas Company (NIGC) has signed a memorandum with Russian state-controlled giant Gazprom to supply Russian pipeline gas to Iran.

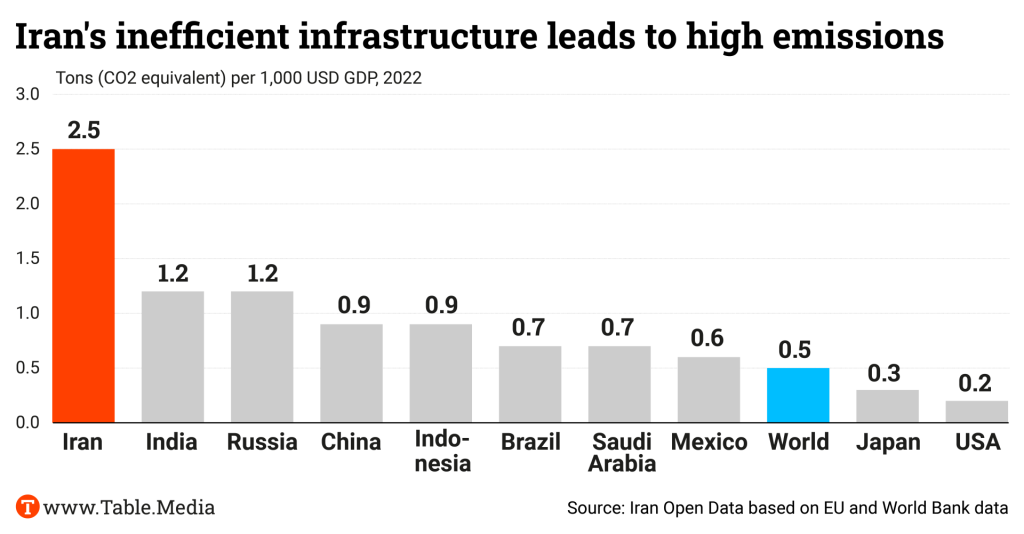

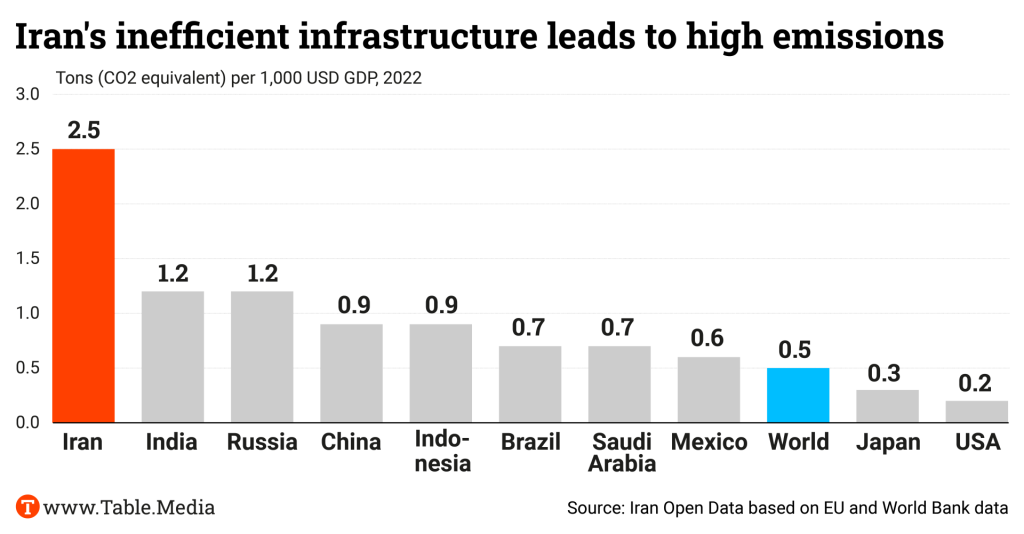

With over 90 percent of its energy mix composed of fossil fuels, Iran is ranked as the sixth-highest greenhouse gas emitter in the world. High domestic consumption, with government subsidizing energy usage prices, combined with inefficient, old energy infrastructure results in Iran producing more CO2 per a thousand dollars of gross domestic products than China or USA.

Along with substantial fossil fuel dependence, Iran faces several environmental challenges. One significant issue is rising temperatures. David Michele, senior research fellow at the Center for Climate and Security of the Atlantic Council, told The Climate Table that under a Business-as-Usual scenario of continuing high emissions, mean annual temperatures in Iran could be 5.2 degrees Celsius warmer by 2100. Two-thirds of all days year-round could become “hot days,” generating high risks for heat stress.

Another pressing issue is the water crisis. “They are extremely water stressed because of how their surface waters are diminished due to climate change and warming,” says Mohammed Mahmoud, former founding director of the Climate and Water Program at the Middle East Institute. However, experts often criticize Iran for mismanaging water resources, including constructing approximately 700 dams and more than a million wells in recent years.

Unprecedented heatwaves and severe droughts are already forcing tens of thousands of Iranians annually to seek new habitats, typically from rural areas to urban centers, which also suffer from water scarcity. Freshwater shortages have sparked massive demonstrations in recent years. A study published in Nature predicts “a grim future” for Iran between 2025-2049, with the driest areas of the country possibly becoming uninhabitable.

Despite these challenges, Iranian authorities have been nonchalant in addressing environmental issues and green energy transition. The Climate Action Tracker has rated Iran’s mitigation policies as “critically insufficient.” Its last carbon reduction plan, the Intended Nationally Determined Contributions (INDC), was made in 2015 and pledged to reduce emissions by 12 percent below business as usual (BAU) by 2030, conditional on lifting US sanctions and availability of international resources. This would cost around 70 billion US dollars, much more than the financially stressed country can bear.

The unconditional reduction is only 4 percent which “would lead to Iran’s emissions actually increasing by 145 percent compared to 2010,” David Michel from the Atlantic Council’s Center for Climate and Security points out. Iran does not have a net zero target and hasn’t submitted a long-term strategy to the UNFCCC. “Climate action is one area where Iran’s policies are clearly inadequate,” says David Michel from the Atlantic Council’s Center for Climate and Security. Iran has no net-zero target and has not submitted a long-term strategy to the UN. “Climate action is one area where Iranian policy is clearly inadequate,” said Michel. Alongside Libya and Yemen, Iran remains one of the three countries that haven’t ratified the Paris Agreement. Ali Salajegheh, Iranian delegate, said at COP26 that Iran will ratify the agreement only when the sanctions against the country are lifted, arguing that the country needs the transfer of modern technologies and finances.

Experts identify several obstacles to Iran’s green energy transition:

Emissions soared in recent years after the US reimposed sanctions, and several green energy projects were canceled. “By deterring foreign investment, the sanctions also prevent the knowledge transfer that foreign engagements in the renewables sector would bring,” says Michel.

Sanctions also prevent Iran from accessing funds allocated to it by the Global Environment Facility (GEF), an organization helping countries with environmental problems. “Sanctions do hamper green energy potential in Iran. But Tehran also tries to leverage the sanctions’ impacts impeding renewables development as an argument for lifting them,” argues Kaveh Madani, director of the UN University Institute for Water, Environment, and Health.

According to Vahid Pourmardan, the country’s Director General for Environmental Protection, the Paris Agreement has become a factional issue in Iran, “with the left wing supporting it and the right-wing opposing it.” “Environmental issues in Iran are pursued from a political perspective,” says the official.

The German government’s growth initiative presented over the weekend aims to boost the economy, but it could actually slow down the decarbonization of the energy sector. After a lengthy delay, the German Ministry for Economic Affairs and Climate Action (BMWK) at least presented new details on the planned backup power plants.

The differences between the now-announced “Power Plant Safety Act” and the power plant plans first presented in February leave room for doubt whether Germany can still achieve the coal phase-out in 2030 as envisaged by the German government.

The German government can hope that new storage systems and flexible consumers will make coal-fired power plants obsolete. “From today’s perspective, we still have a high degree of uncertainty regarding the total output required, as it is unclear to what extent other flexibilities can already be utilized in 2030,” said Patrick Jochem from the Institute of Networked Energy Systems at the German Aerospace Center (DLR).

The BMWK is partially abandoning plans for green hydrogen when building new power plants:

This means that the desired “ramp-up” of the green hydrogen market – which the German government’s growth initiative once again emphasizes rhetorically – potentially loses these major consumers.

“The Power Plant Security Act can create the basis for ensuring a permanently stable electricity supply even without CO2-intensive coal-fired power plants,” said Timm Kehler, Chairman and CEO of “Zukunft Gas,” Germany’s leading gas advocacy association. “Flexible and modern gas-fired power plants play a key role here, as they ensure the necessary stability in the electricity grid whilst also being able to be converted to run on hydrogen.”

Sascha Müller-Kraenner from Environmental Action Germany was less enthusiastic. “The power plant strategy included in the German government’s growth initiative must not become an economic stimulus program for fossil gas-fired power plants,” he told Table.Briefings. “Instead, the expansion of renewable energies continues to need a reliable investment framework and cost-covering prices.”

However, regarding the Renewable Energy Act, which makes expanding electricity generation from wind and solar energy profitable (but also generates high government costs), the German government is planning a systemic change that could slow down further expansion.

As early as next year, hedging against negative prices will largely be scrapped for new plants. Later on, subsidies for supplied renewable electricity will be replaced by mere investment grants. The German Renewable Energy Federation (BEE), in which part of the industry is organized, warns against this. “The experiment of a radical change to investment cost subsidies harbors the risk of market uncertainty and a reluctance to invest,” said BEE President Simone Peter.

Many companies have called for power grid fees to be reduced. Expanding the power grids to allow renewable energy to be distributed across the country is expensive and the costs are passed on to consumers. As the electricity price is crucial for decarbonizing the economy as well as for the switch to electric cars and heat pumps, the German government has now at least held out the prospect of stabilizing grid fees.

The introduction of a so-called amortization account is being considered: The German government will pay a portion of the costs upfront, which will then be repaid by electricity consumers over a longer period of time.

Finally, the point “securing and diversifying gas supply” in the growth initiative diametrically contradicts decarbonization. It states that exemptions for the import of natural gas should be built into guarantee instruments for foreign trade promotion.

The prerequisite is that new natural gas projects comply with the global “1.5 degree limit” for global warming and avoid “lock-in effects”, i.e. do not represent binding investments in fossil gas. However, new gas import projects must, above all, safeguard “national security or geostrategic supply security interests.”

“It is alarming that the government apparently wants to continue to push ahead with the development of natural gas sources abroad,” commented Tina Löffelsend, climate action expert at the German Federation for the Environment and Nature Conservation (BUND), in an interview with Table.Briefings. “But this is precisely climate policy hara-kiri and must be avoided at all costs.”

July 11, 2 p.m. CEST, online

Webinar The Path to Net Zero: A Climate Mitigation Journey for Banks

This webinar will present the Climate Mitigation Journey for Banks – a net-zero strategy framework that outlines in a single place all the business capabilities that banks need to build and iterate for years to come to align themselves with the Paris Agreement. Info

July 11, 2 p.m. CEST, online

Webinar Spotlighting Cost-Effective and Scalable Solutions to Reduce Methane in the Agriculture Sector

The Climate and Clean Air Coalition (CCAC) is hosting this webinar to discuss how to reduce methane emissions in agriculture quickly and efficiently. Info

July 11-12, Belém

G20 meeting Global Mobilization against Climate Change Task Force

In the G20 cycle, the task force for “Global Mobilization against Climate Change” meets in Belém, Brazil. Info

July 16, 2 p.m. CEST, online

Webinar Decarbonizing Hard-to-Abate Sectors: A Pivotal Role for the G7

The International Renewable Energy Agency (IRENA) is hosting this event. This webinar will present the findings of a recent IRENA report commissioned by the Italian G7 Presidency 2024, which highlights the crucial role of the G7 in accelerating the decarbonization of these hard-to-abate sectors. Info

July 16, 2 p.m. CEST, online

Webinar Defossilizing Aviation with e-SAF

The Agora Verkehrswende webinar will discuss how e-SAFs – sustainable aviation fuels produced with renewables – can contribute to decarbonization. Info

The nuclear industry increasingly faces competition from renewable energies and flexible power supply. Recently, global investment in stationary electricity storage systems exceeded investment in nuclear technology for the first time.

In addition, the belief that small modular nuclear reactors (SMRs) can secure the future of energy supply has suffered another blow: Last week, the state-owned French energy company EDF declared that it would not be pursuing the development of its own SMR series at the EDF subsidiary “Nuward,” stating that the cost risk was too high. After four years of in-house development work, EDF plans to build on existing versions rather than focus on innovation.

According to information from Reuters, the decision was made following talks between EDF and potential customers such as Vattenfall and Fortum. These potential buyers of the small nuclear power plants had expressed concerns about rising prices and reliable supply. The original plan was for the new SMRs to be operational in the 2030s. EDF has not yet provided any information about the impact on the EDF budget or possible problems with this deadline.

The SMR concept is controversial. According to the latest “World Nuclear Industry Status Report,” the West has neither an approved design nor a pilot project. The leading SMR company, NuScale, in the US, shut down in November 2023 due to high costs. In February 2024, a research report by the German Federal Office for the Safety of Nuclear Waste Management scrutinized the so-called “new reactor concepts,” which are supposed to be smaller and more efficient while producing less waste. The conclusion: “Despite years of development in some cases, the concepts are either not yet technologically mature or have not become established for commercial or safety reasons.” bpo

Following the election victory of the social democratic Labour Party, the new British Chancellor of the Exchequer, Rachel Reeves, announced on Tuesday that the government will provide a fund for the decarbonization of heavy industry “with immediate effect.” The fund will provide 7.3 billion pounds sterling (8.66 billion euros) over the next five years. According to the Financial Times, the money will be paid out by the state-owned development bank.

The fund is a key element of the Labor Party’s “Green Prosperity Plan” and is intended to leverage 20 billion pounds in private capital for low-carbon investments. The fund will act as a “catalyst” and reduce financial start-up risks. The British Development Bank has been providing around twelve billion pounds in capital for the decarbonization of heavy industry since 2021 and has the option of issuing a further ten billion pounds in government guarantees.

According to Labor, the money from the national wealth fund will flow into these five areas in particular:

A task force of the British government, on the other hand, recommends a “broader” distribution of funds across other sectors. It says a total of 57 billion pounds in private and public investment is needed by 2030 to achieve the UK’s industrial decarbonization targets. The task force includes representatives from the Green Finance Institute, the NatWest Group and the former Governor of the Bank of England, Mark Carney. lb

In the first half of 2024, China only approved low-carbon steel mills. According to a new report by the Centre for Research on Energy and Clean Air (CREA), this is the first time since September 2020 that CO2-intensive steel mills have not received any permits. The authors describe the development as a potential trend reversal for decarbonizing the steel sector. In the first half of the year, permits were issued for new electric arc furnaces with a production capacity of seven million tons per year. While more permits were issued for these lower-CO2 production facilities in the previous six months, large quantities of new coal-based steel plants were also approved.

The steel sector is China’s second-largest CO2 emitter after the energy sector. If the industry were a country, it would be the fifth-largest CO2 emitter in the world. In 2025, the Chinese steel sector’s carbon emissions could be 200 million tons, ten percent below their peak in 2020, the CREA analysts predict. They estimate that China’s demand for steel is about to peak and that in the near future, there will be more steel scrap that can be recycled in electric arc furnaces with lower carbon emissions than traditional steel production causes. Therefore, the central government and the provinces have developed new action plans and guidelines for steel production in recent months, which could help cut emissions. According to CREA analyst Belinda Schäpe, the EU’s Carbon Border Adjustment Mechanism (CBAM) has also “accelerated the decarbonization of the Chinese steel sector.” nib

Microsoft has signed an agreement with Occidental Petroleum to purchase carbon credits worth 500,000 tons of CO2. Over the next six years, 1PointFive, a subsidiary of US oil company Occidental Petroleum, will remove half a million tons of CO2 from the atmosphere using a direct air capture (DAC) plant still under construction and store it underground. The plant is being built in Texas and is expected to go into operation in mid-2025. The plan is to remove and store 500,000 tons of CO2 annually – around three percent of Microsoft’s emissions in the 2023 fiscal year. Construction of the plant is expected to cost over one billion US dollars.

According to the company, it is the largest trade in emission credits from DAC processes concluded to date. The CO2 will not be used for the production of oil and gas. The oil and gas industry uses CO2 storage in extraction areas to access hard-to-extract deposits.

Microsoft wants to be “CO2-negative” by 2030. However, the company’s emissions have increased by almost a third since 2020, mainly due to new data centers – especially for the high data consumption of AI – as reported by the Financial Times. nib

In a perspective paper, the economic association “Wirtschaftsvereinigung der Grünen” complains that the transport transition in Germany is progressing too slowly. In particular, the sudden discontinuation of the purchase subsidies on EVs in December has led to “lasting uncertainty” among car buyers. “We need a change of course here that includes planning security and a clear commitment to electrification,” the association, whose members include around 250 companies such as Aldi, Amazon Germany, Siemens and Audi, demands.

The paper, available to Table.Briefings, was drawn up by the association’s “mobility competence cluster” and is entitled “Getting electric mobility on the road – what is still needed for Germany to really take off in emission-free transport.” Five measures are of key importance for this:

The latest figures from the German Motor Transport Authority show that the German EV continues to decline. While around 1.47 million new passenger cars were registered in the first half of 2024 – 5.4 percent more than in the same period last year – new registrations of electric cars declined by 16.4 percent. ch

The hydrogen import strategy comes at a crucial stage, as the hydrogen euphoria is over. Projects struggle to get off the ground, and as recently signaled by the National Hydrogen Council, it is not foreseeable where the necessary quantities of renewable hydrogen will come from.

Many industrial companies want to switch their production to hydrogen. However, they are afraid of running into a supply gap. That is why the German government wants to step up the pace with its import strategy and develop supply sources that are as diverse as possible. A one-sided dependency like on Russian gas should not be repeated with hydrogen imports.

We are very concerned that the German government now has reservations about whether sustainability criteria should be included in the import strategy, given the urgency. Some fear that such criteria could impede the acceleration and diversification of production.

However, the coalition government has pledged in its 2023 national hydrogen strategy to take sustainability criteria in line with the Agenda 2030 into account. Large parts of civil society, development organizations, think tanks and the National Hydrogen Council have long been calling for this promise to be kept.

It is essential for the climate that the import strategy establishes criteria that ensure that only renewable, green hydrogen is subsidized. Furthermore, hydrogen exports in producer countries must not lead to renewable electricity being used solely for hydrogen production instead of replacing fossil fuels. This would not benefit the climate.

Clear requirements for importing hydrogen and derivatives such as ammonia must be created in a timely manner for companies’ planning security. If investors are uncertain about the conditions that sustainable hydrogen must meet, the market’s development will be slowed down.

Hydrogen exports must improve the living conditions of people on the ground so acceptance can grow. However, the civil society of various African and South American countries harbors considerable skepticism towards such projects. This mistrust is understandable in light of the ongoing extractivism, such as in raw material extraction, which exports natural resources but results in ecological damage on the ground. Hydrogen projects are unlikely to be successful in the face of popular protest.

In the interests of equity, value creation, innovation, and jobs should be achieved, and damage should be avoided in countries of the Global South from the very beginning. Clear criteria help avoid land use conflicts or the deterioration of local water supplies.

In addition, people in many potential export countries experience energy poverty. Billions of people have no reliable access to electricity or low-emission cooking facilities. Importing energy in the form of hydrogen from such regions without significantly reducing local energy poverty would not be sustainable.

Hydrogen must not only be produced in these countries for export. It also needs to make a relevant contribution to local decarbonization, value creation and job creation. For example, the development of a local steel industry can create new economic opportunities in countries of the Global South.

A recent study by the Wuppertal Institute on behalf of Bread for the World and the Heinrich Böll Foundation shows that sustainability criteria and their implementation must be anchored in a coordinated mix of economic, regulatory and cooperative instruments of the German government.

An important component of the instrument mix is the H2Global funding program, which already has a list of criteria. It should urgently be given more weight for its second round of tenders. However, due diligence obligations and energy partnerships can also play an even greater role. The concrete design of the standards should be carried out in consultation with German civil society and the exporting countries.

Furthermore, Germany should also support ambitious standards on an international level. Particularly in the early phase of the state-supported market ramp-up with a small number of buyer countries, the German government can help shape global standards.

After all, even an import strategy with high sustainability standards will not relieve Germany and the EU of the need to reduce energy and resource consumption – or there will not be enough green hydrogen globally to achieve climate action targets.

Christiane Averbeck is Executive Director of Climate Alliance Germany

Joachim Fünfgelt is Energy Policy Advisor in the Economy and Sustainability Division at Bread for the World.

Jennifer Morgan – State Secretary, German Foreign Office

US-born Jennifer Morgan, who holds a German passport, is the face of German foreign climate policy alongside Foreign Minister Annalena Baerbock – responsible for day-to-day operations. As Minister of State and Climate Envoy of the Federal Foreign Office, she negotiates at conferences and in bilateral talks. She maintains close contact with important players in the climate circus: key countries, the negotiating community, NGOs, the UN apparatus and the scientific community. She draws on her experience and a worldwide network of acquaintances she has built up through more than 30 years of international work at the WWF, the World Resources Institute WRI and as head of Greenpeace International. Morgan emphasizes the importance of “Team Germany” from all German ministries involved in climate action.

Sultan Ahmed Al Jaber – COP28 President, Group CEO Abu Dhabi National Oil Company (Adnoc)

COP President Al Jaber did not start out as a high-profile negotiator or ambitious climate activist; his public image was shaped by his role as CEO of the Abu Dhabi National Oil Company (Adnoc). However, he had served as the United Arab Emirates’ Special Envoy for Climate Action since 2020 and was no stranger to the negotiations when he was appointed in 2022. And so, despite many doubts, some supported “Doctor Sultan” as COP28 President. He once again caused a stir in Dubai when he was accused of anti-science remarks, whereupon he appeared thin-skinned at a press conference, denying the accusations but failing to dispel them. Despite the huge criticism, Al Jaber achieved something historic by setting up the loss and damage fund and ensuring that the “transition away from fossil fuels” was included in the COP final declaration. As part of the COP troika with Azerbaijan and Brazil, his legacy in Baku will be about whether the transition away from fossil fuels was just an empty phrase or actually a historic turning point.

Wopke Hoekstra – EU Commissioner for Climate Action, European Commission

As the successor to long-time EU climate czar Frans Timmermans, Wopke Hoekstra had to familiarize himself with the international climate negotiations within just a few weeks. At first, he only had one task: preparing for COP28 in Dubai. Although he initially faced immense criticism for his career history at McKinsey and Shell, Hoekstra surprised even experienced EU climate politicians with his ambitious program: expanding carbon pricing, introducing global aviation taxes and using the revenue to finance loss and damage. He also was one of the first supporters of the EU Nature Restoration Law (his party family, the EPP, had strictly opposed it), calling for an end to fossil fuel subsidies in the EU and achieving global climate targets without CCS. He negotiated the final declaration and the “transition away from fossil fuels” in Dubai alongside Teresa Ribera.

John Podesta – US climate envoy, United Nations

Ever since Bill Clinton was president, John Podesta has repeatedly held important positions in the White House. He was Clinton’s chief of staff, and ensured the handover of government responsibility from George W. Bush as head of Barack Obama’s transition team. He later advised Obama on climate policy. During a break from the White House, he founded the liberal think tank Center for American Progress. In 2016, he headed Hillary Clinton’s presidential campaign. During this time, his emails were hacked and published on WikiLeaks, which severely damaged Clinton’s candidacy. In 2022, Joe Biden made him his renewable energy advisor. In this role, Podesta helped implement the Inflation Reduction Act, just as he helped implement the clean energy provisions of the American Recovery and Reinvestment Act under Obama. As a member of the US delegation to UN climate conferences, it was his job to convince China to join a climate agreement and commit to reducing its greenhouse gas emissions. He once said that the rest of the world could not achieve a successful climate policy without China. In March 2024, Podesta took over from John Kerry as the US President’s special climate envoy. Negotiations with China are once again likely to be one of his priorities.

Avinash Persaud – Special Advisor on Climate Change to the President of the Inter-American Development Bank

Avinash Persaud is the man behind Barbados Prime Minister Mia Mottley’s Bridgetown Initiative. It aims to transform international climate financing to ensure that trillions of US dollars will flow into the expansion of renewables, climate adaptation and the repair of losses and damage. To this end, Persaud is also calling for higher taxes on fossil fuels, shipping and aviation. An economist specializing in international monetary policy, he is a member of the High-Level Expert Group on Climate Finance of the COP26, 27 and 28 Presidencies and the Independent Expert Group on Debt, Nature and Climate set up by the governments of Colombia, France and Kenya. Previously, he was a member of the UN Commission on Financial Reform and held senior positions at several large banks, including J.P. Morgan and UBS. He received the Jacques de Larosière Award in Global Finance for his work on financial risk management and systemic crises. Since January 16, 2024, he has been Special Climate Advisor to the President of the IDB, Ilan Goldfajn. It is a new position that was only created last September – because, like the World Bank and IMF, the IDB also wants to strengthen its climate work.

Teresa Ribera – Environment Minister, Spain

Teresa Ribera has been Spain’s Environment Minister since 2018. She is a member of the social democratic governing party Socialista Obrero Español (PSOE) and has campaigned for ambitious climate policy throughout her political career, including in the EU. For example, Ribera was instrumental in ensuring that COP19 took place in Madrid. She stood as the lead candidate for PEOS in the 2024 European elections and is also considered the frontrunner to become the next EU Commissioner from Spain. Ribera studied law and politics.

Gavin Newsom – Governor of California

As Governor of California, Democrat Gavin Newsom strongly focuses on climate action. He plans to make the state carbon-neutral by 2045. From 2035, all new cars sold are to be emission-free. Newsom has some strong words of criticism against large oil companies. He believes that Americans have been lied to by Big Oil for more than 50 years. But Newsom is also making a name for himself beyond California: He has been invited to UN climate summits, visited China, and met its President Xi Jinping. Newsom is also said to have ambitions for the highest post in the White House. However, he is widely supporting the battered President Joe Biden in the election campaign.

Jochen Flasbarth – State Secretary, Federal Ministry for Economic Cooperation and Development (BMZ)

Jochen Flasbarth has long held the position that Jennifer Morgan now fills – the German face of global climate policy. As State Secretary under Environment Ministers Barbara Hendricks and Svenja Schulze, he shaped the German and European positions. His experience and diplomatic skills repeatedly earned him delicate missions, for example, during the preparation of the Paris Agreement or in sensitive talks with resistant states. An economist, Flasbarth began his career in environmental policy as President of NABU, moved to the Ministry of the Environment and became President of the Federal Environment Agency (UBA). Since moving to the BMZ with Svenja Schulze, he has been more involved with the international and development policy dimension of global warming. He now represents the ministry that manages a large proportion of the funds for international climate action.

Thomas Heilmann – Chairman, Climate Union of the CDU, Member of the German Bundestag

Thomas Heilmann is a lawyer and entrepreneur. He has been a member of the German Bundestag for the Christian Democratic Union (CDU) since 2017. Before that, he was Senator for Justice and Consumer Protection in Berlin. He received much attention last year for his lawsuits against the German government before the Federal Constitutional Court. In early summer 2023, he stopped the Heating Act and forced a longer deliberation after the parliamentary summer break. In April 2024, he took legal action against the amendment to the Climate Change Act on technical grounds. However, the lawsuit was unsuccessful. Heilmann describes himself as a climate politician.

Boris Palmer – Lord Mayor, Tübingen

Boris Palmer has been mayor of the city of Tübingen since 2007, with a four-week break after verbal gaffes. He is considered highly talented, but also controversial. After a falling out with the Green Party over taboo-breaking, accusations of racism and criticism of the “Last Generation,” he left the party a year ago. However, his popularity with the people of Tübingen is apparently unbroken, which is also thanks to his climate policy. He reduced the city’s energy-related emissions by 30 percent between 2006 and 2019 and wants to make Tübingen climate-neutral by 2030. After all, he sees the energy and climate issue as the biggest challenge of our time.

One of the biggest climate challenges of the coming decades is getting oil and gas producers to extract fewer fossil fuels. Iran is a particularly tough nut to crack. The country depends on fossil fuel exports, has not ratified the Paris Agreement, and sanctions hinder decarbonization. The new president, Massud Peseschkian, could be a glimmer of hope, as Jagoda Grondecka reports. Peseshkian supports opening up to the West.

Alex Veit has analyzed how the German government’s new growth initiative could slow down the energy transition. The coal phase-out by 2030 could be at risk. Environmental organizations also fear that too many fossil gas-fired power plants could be built and criticize state guarantees for gas imports. The backup power plants are actually to run on green hydrogen in the future. However, it is still unclear whether there will be enough of this energy source.

It is also still unclear what role direct air capture will play in reducing emissions. Nevertheless, Microsoft is strongly relying on DAC. The company has purchased 500,000 tons worth of emissions credits from a DAC plant that is not even finished yet. Positive news comes from the UK: The new Labour government wants to set up a new sovereign wealth fund to contribute seven billion pounds to the restructuring of the economy.

A glimpse of hope for Iran’s environmental future is the new president, reformist Masoud Pezeshkian. Although he hasn’t raised environmental issues in the last two debates, Pezeshkian advocates for dialogue with the West and resuming nuclear talks to remove sanctions and attract foreign investment. This could pave the way for green energy.

The country’s position as a major oil producer and its inefficient economy have made Iran one of the countries with the highest CO2 emissions in the world. Iran has been a major oil exporter since the beginning of the 20th century. The economy has been repeatedly hampered by international sanctions due to Iran’s nuclear program. Nevertheless, Iranian oil production and exports have increased since the end of 2020. They reached a value of almost 36 billion US dollars last year – partly because the oil sector circumvented the sanctions.

By the end of June, Oil Minister Javad Owji said that production volume had risen by 60 percent in the last three years, reaching 3.57 million barrels per day. The International Energy Agency estimates that Iran produced 2.99 million barrels daily last year and predicts a further rise of 160,000 barrels in 2024.

China, Iran’s top client, is willing to buy record amounts of Iranian crude, with shipments tripling between 2020 and 2023. Tehran has mastered various sanctions-evading tactics, including:

Iranian authorities are determined to further expand the country’s oil sector, the backbone of its troubled economy. Recently, Iran’s economic council approved a plan to increase oil production to four million barrels per day.

The country is also expanding its gas sector. The National Iranian Gas Company (NIGC) has signed a memorandum with Russian state-controlled giant Gazprom to supply Russian pipeline gas to Iran.

With over 90 percent of its energy mix composed of fossil fuels, Iran is ranked as the sixth-highest greenhouse gas emitter in the world. High domestic consumption, with government subsidizing energy usage prices, combined with inefficient, old energy infrastructure results in Iran producing more CO2 per a thousand dollars of gross domestic products than China or USA.

Along with substantial fossil fuel dependence, Iran faces several environmental challenges. One significant issue is rising temperatures. David Michele, senior research fellow at the Center for Climate and Security of the Atlantic Council, told The Climate Table that under a Business-as-Usual scenario of continuing high emissions, mean annual temperatures in Iran could be 5.2 degrees Celsius warmer by 2100. Two-thirds of all days year-round could become “hot days,” generating high risks for heat stress.

Another pressing issue is the water crisis. “They are extremely water stressed because of how their surface waters are diminished due to climate change and warming,” says Mohammed Mahmoud, former founding director of the Climate and Water Program at the Middle East Institute. However, experts often criticize Iran for mismanaging water resources, including constructing approximately 700 dams and more than a million wells in recent years.

Unprecedented heatwaves and severe droughts are already forcing tens of thousands of Iranians annually to seek new habitats, typically from rural areas to urban centers, which also suffer from water scarcity. Freshwater shortages have sparked massive demonstrations in recent years. A study published in Nature predicts “a grim future” for Iran between 2025-2049, with the driest areas of the country possibly becoming uninhabitable.

Despite these challenges, Iranian authorities have been nonchalant in addressing environmental issues and green energy transition. The Climate Action Tracker has rated Iran’s mitigation policies as “critically insufficient.” Its last carbon reduction plan, the Intended Nationally Determined Contributions (INDC), was made in 2015 and pledged to reduce emissions by 12 percent below business as usual (BAU) by 2030, conditional on lifting US sanctions and availability of international resources. This would cost around 70 billion US dollars, much more than the financially stressed country can bear.

The unconditional reduction is only 4 percent which “would lead to Iran’s emissions actually increasing by 145 percent compared to 2010,” David Michel from the Atlantic Council’s Center for Climate and Security points out. Iran does not have a net zero target and hasn’t submitted a long-term strategy to the UNFCCC. “Climate action is one area where Iran’s policies are clearly inadequate,” says David Michel from the Atlantic Council’s Center for Climate and Security. Iran has no net-zero target and has not submitted a long-term strategy to the UN. “Climate action is one area where Iranian policy is clearly inadequate,” said Michel. Alongside Libya and Yemen, Iran remains one of the three countries that haven’t ratified the Paris Agreement. Ali Salajegheh, Iranian delegate, said at COP26 that Iran will ratify the agreement only when the sanctions against the country are lifted, arguing that the country needs the transfer of modern technologies and finances.

Experts identify several obstacles to Iran’s green energy transition:

Emissions soared in recent years after the US reimposed sanctions, and several green energy projects were canceled. “By deterring foreign investment, the sanctions also prevent the knowledge transfer that foreign engagements in the renewables sector would bring,” says Michel.

Sanctions also prevent Iran from accessing funds allocated to it by the Global Environment Facility (GEF), an organization helping countries with environmental problems. “Sanctions do hamper green energy potential in Iran. But Tehran also tries to leverage the sanctions’ impacts impeding renewables development as an argument for lifting them,” argues Kaveh Madani, director of the UN University Institute for Water, Environment, and Health.

According to Vahid Pourmardan, the country’s Director General for Environmental Protection, the Paris Agreement has become a factional issue in Iran, “with the left wing supporting it and the right-wing opposing it.” “Environmental issues in Iran are pursued from a political perspective,” says the official.

The German government’s growth initiative presented over the weekend aims to boost the economy, but it could actually slow down the decarbonization of the energy sector. After a lengthy delay, the German Ministry for Economic Affairs and Climate Action (BMWK) at least presented new details on the planned backup power plants.

The differences between the now-announced “Power Plant Safety Act” and the power plant plans first presented in February leave room for doubt whether Germany can still achieve the coal phase-out in 2030 as envisaged by the German government.

The German government can hope that new storage systems and flexible consumers will make coal-fired power plants obsolete. “From today’s perspective, we still have a high degree of uncertainty regarding the total output required, as it is unclear to what extent other flexibilities can already be utilized in 2030,” said Patrick Jochem from the Institute of Networked Energy Systems at the German Aerospace Center (DLR).

The BMWK is partially abandoning plans for green hydrogen when building new power plants:

This means that the desired “ramp-up” of the green hydrogen market – which the German government’s growth initiative once again emphasizes rhetorically – potentially loses these major consumers.

“The Power Plant Security Act can create the basis for ensuring a permanently stable electricity supply even without CO2-intensive coal-fired power plants,” said Timm Kehler, Chairman and CEO of “Zukunft Gas,” Germany’s leading gas advocacy association. “Flexible and modern gas-fired power plants play a key role here, as they ensure the necessary stability in the electricity grid whilst also being able to be converted to run on hydrogen.”

Sascha Müller-Kraenner from Environmental Action Germany was less enthusiastic. “The power plant strategy included in the German government’s growth initiative must not become an economic stimulus program for fossil gas-fired power plants,” he told Table.Briefings. “Instead, the expansion of renewable energies continues to need a reliable investment framework and cost-covering prices.”

However, regarding the Renewable Energy Act, which makes expanding electricity generation from wind and solar energy profitable (but also generates high government costs), the German government is planning a systemic change that could slow down further expansion.

As early as next year, hedging against negative prices will largely be scrapped for new plants. Later on, subsidies for supplied renewable electricity will be replaced by mere investment grants. The German Renewable Energy Federation (BEE), in which part of the industry is organized, warns against this. “The experiment of a radical change to investment cost subsidies harbors the risk of market uncertainty and a reluctance to invest,” said BEE President Simone Peter.

Many companies have called for power grid fees to be reduced. Expanding the power grids to allow renewable energy to be distributed across the country is expensive and the costs are passed on to consumers. As the electricity price is crucial for decarbonizing the economy as well as for the switch to electric cars and heat pumps, the German government has now at least held out the prospect of stabilizing grid fees.

The introduction of a so-called amortization account is being considered: The German government will pay a portion of the costs upfront, which will then be repaid by electricity consumers over a longer period of time.

Finally, the point “securing and diversifying gas supply” in the growth initiative diametrically contradicts decarbonization. It states that exemptions for the import of natural gas should be built into guarantee instruments for foreign trade promotion.

The prerequisite is that new natural gas projects comply with the global “1.5 degree limit” for global warming and avoid “lock-in effects”, i.e. do not represent binding investments in fossil gas. However, new gas import projects must, above all, safeguard “national security or geostrategic supply security interests.”

“It is alarming that the government apparently wants to continue to push ahead with the development of natural gas sources abroad,” commented Tina Löffelsend, climate action expert at the German Federation for the Environment and Nature Conservation (BUND), in an interview with Table.Briefings. “But this is precisely climate policy hara-kiri and must be avoided at all costs.”

July 11, 2 p.m. CEST, online

Webinar The Path to Net Zero: A Climate Mitigation Journey for Banks

This webinar will present the Climate Mitigation Journey for Banks – a net-zero strategy framework that outlines in a single place all the business capabilities that banks need to build and iterate for years to come to align themselves with the Paris Agreement. Info

July 11, 2 p.m. CEST, online

Webinar Spotlighting Cost-Effective and Scalable Solutions to Reduce Methane in the Agriculture Sector

The Climate and Clean Air Coalition (CCAC) is hosting this webinar to discuss how to reduce methane emissions in agriculture quickly and efficiently. Info

July 11-12, Belém

G20 meeting Global Mobilization against Climate Change Task Force

In the G20 cycle, the task force for “Global Mobilization against Climate Change” meets in Belém, Brazil. Info

July 16, 2 p.m. CEST, online

Webinar Decarbonizing Hard-to-Abate Sectors: A Pivotal Role for the G7

The International Renewable Energy Agency (IRENA) is hosting this event. This webinar will present the findings of a recent IRENA report commissioned by the Italian G7 Presidency 2024, which highlights the crucial role of the G7 in accelerating the decarbonization of these hard-to-abate sectors. Info

July 16, 2 p.m. CEST, online

Webinar Defossilizing Aviation with e-SAF

The Agora Verkehrswende webinar will discuss how e-SAFs – sustainable aviation fuels produced with renewables – can contribute to decarbonization. Info

The nuclear industry increasingly faces competition from renewable energies and flexible power supply. Recently, global investment in stationary electricity storage systems exceeded investment in nuclear technology for the first time.

In addition, the belief that small modular nuclear reactors (SMRs) can secure the future of energy supply has suffered another blow: Last week, the state-owned French energy company EDF declared that it would not be pursuing the development of its own SMR series at the EDF subsidiary “Nuward,” stating that the cost risk was too high. After four years of in-house development work, EDF plans to build on existing versions rather than focus on innovation.

According to information from Reuters, the decision was made following talks between EDF and potential customers such as Vattenfall and Fortum. These potential buyers of the small nuclear power plants had expressed concerns about rising prices and reliable supply. The original plan was for the new SMRs to be operational in the 2030s. EDF has not yet provided any information about the impact on the EDF budget or possible problems with this deadline.

The SMR concept is controversial. According to the latest “World Nuclear Industry Status Report,” the West has neither an approved design nor a pilot project. The leading SMR company, NuScale, in the US, shut down in November 2023 due to high costs. In February 2024, a research report by the German Federal Office for the Safety of Nuclear Waste Management scrutinized the so-called “new reactor concepts,” which are supposed to be smaller and more efficient while producing less waste. The conclusion: “Despite years of development in some cases, the concepts are either not yet technologically mature or have not become established for commercial or safety reasons.” bpo

Following the election victory of the social democratic Labour Party, the new British Chancellor of the Exchequer, Rachel Reeves, announced on Tuesday that the government will provide a fund for the decarbonization of heavy industry “with immediate effect.” The fund will provide 7.3 billion pounds sterling (8.66 billion euros) over the next five years. According to the Financial Times, the money will be paid out by the state-owned development bank.

The fund is a key element of the Labor Party’s “Green Prosperity Plan” and is intended to leverage 20 billion pounds in private capital for low-carbon investments. The fund will act as a “catalyst” and reduce financial start-up risks. The British Development Bank has been providing around twelve billion pounds in capital for the decarbonization of heavy industry since 2021 and has the option of issuing a further ten billion pounds in government guarantees.

According to Labor, the money from the national wealth fund will flow into these five areas in particular:

A task force of the British government, on the other hand, recommends a “broader” distribution of funds across other sectors. It says a total of 57 billion pounds in private and public investment is needed by 2030 to achieve the UK’s industrial decarbonization targets. The task force includes representatives from the Green Finance Institute, the NatWest Group and the former Governor of the Bank of England, Mark Carney. lb

In the first half of 2024, China only approved low-carbon steel mills. According to a new report by the Centre for Research on Energy and Clean Air (CREA), this is the first time since September 2020 that CO2-intensive steel mills have not received any permits. The authors describe the development as a potential trend reversal for decarbonizing the steel sector. In the first half of the year, permits were issued for new electric arc furnaces with a production capacity of seven million tons per year. While more permits were issued for these lower-CO2 production facilities in the previous six months, large quantities of new coal-based steel plants were also approved.

The steel sector is China’s second-largest CO2 emitter after the energy sector. If the industry were a country, it would be the fifth-largest CO2 emitter in the world. In 2025, the Chinese steel sector’s carbon emissions could be 200 million tons, ten percent below their peak in 2020, the CREA analysts predict. They estimate that China’s demand for steel is about to peak and that in the near future, there will be more steel scrap that can be recycled in electric arc furnaces with lower carbon emissions than traditional steel production causes. Therefore, the central government and the provinces have developed new action plans and guidelines for steel production in recent months, which could help cut emissions. According to CREA analyst Belinda Schäpe, the EU’s Carbon Border Adjustment Mechanism (CBAM) has also “accelerated the decarbonization of the Chinese steel sector.” nib

Microsoft has signed an agreement with Occidental Petroleum to purchase carbon credits worth 500,000 tons of CO2. Over the next six years, 1PointFive, a subsidiary of US oil company Occidental Petroleum, will remove half a million tons of CO2 from the atmosphere using a direct air capture (DAC) plant still under construction and store it underground. The plant is being built in Texas and is expected to go into operation in mid-2025. The plan is to remove and store 500,000 tons of CO2 annually – around three percent of Microsoft’s emissions in the 2023 fiscal year. Construction of the plant is expected to cost over one billion US dollars.

According to the company, it is the largest trade in emission credits from DAC processes concluded to date. The CO2 will not be used for the production of oil and gas. The oil and gas industry uses CO2 storage in extraction areas to access hard-to-extract deposits.

Microsoft wants to be “CO2-negative” by 2030. However, the company’s emissions have increased by almost a third since 2020, mainly due to new data centers – especially for the high data consumption of AI – as reported by the Financial Times. nib

In a perspective paper, the economic association “Wirtschaftsvereinigung der Grünen” complains that the transport transition in Germany is progressing too slowly. In particular, the sudden discontinuation of the purchase subsidies on EVs in December has led to “lasting uncertainty” among car buyers. “We need a change of course here that includes planning security and a clear commitment to electrification,” the association, whose members include around 250 companies such as Aldi, Amazon Germany, Siemens and Audi, demands.

The paper, available to Table.Briefings, was drawn up by the association’s “mobility competence cluster” and is entitled “Getting electric mobility on the road – what is still needed for Germany to really take off in emission-free transport.” Five measures are of key importance for this:

The latest figures from the German Motor Transport Authority show that the German EV continues to decline. While around 1.47 million new passenger cars were registered in the first half of 2024 – 5.4 percent more than in the same period last year – new registrations of electric cars declined by 16.4 percent. ch

The hydrogen import strategy comes at a crucial stage, as the hydrogen euphoria is over. Projects struggle to get off the ground, and as recently signaled by the National Hydrogen Council, it is not foreseeable where the necessary quantities of renewable hydrogen will come from.

Many industrial companies want to switch their production to hydrogen. However, they are afraid of running into a supply gap. That is why the German government wants to step up the pace with its import strategy and develop supply sources that are as diverse as possible. A one-sided dependency like on Russian gas should not be repeated with hydrogen imports.

We are very concerned that the German government now has reservations about whether sustainability criteria should be included in the import strategy, given the urgency. Some fear that such criteria could impede the acceleration and diversification of production.

However, the coalition government has pledged in its 2023 national hydrogen strategy to take sustainability criteria in line with the Agenda 2030 into account. Large parts of civil society, development organizations, think tanks and the National Hydrogen Council have long been calling for this promise to be kept.

It is essential for the climate that the import strategy establishes criteria that ensure that only renewable, green hydrogen is subsidized. Furthermore, hydrogen exports in producer countries must not lead to renewable electricity being used solely for hydrogen production instead of replacing fossil fuels. This would not benefit the climate.

Clear requirements for importing hydrogen and derivatives such as ammonia must be created in a timely manner for companies’ planning security. If investors are uncertain about the conditions that sustainable hydrogen must meet, the market’s development will be slowed down.

Hydrogen exports must improve the living conditions of people on the ground so acceptance can grow. However, the civil society of various African and South American countries harbors considerable skepticism towards such projects. This mistrust is understandable in light of the ongoing extractivism, such as in raw material extraction, which exports natural resources but results in ecological damage on the ground. Hydrogen projects are unlikely to be successful in the face of popular protest.

In the interests of equity, value creation, innovation, and jobs should be achieved, and damage should be avoided in countries of the Global South from the very beginning. Clear criteria help avoid land use conflicts or the deterioration of local water supplies.

In addition, people in many potential export countries experience energy poverty. Billions of people have no reliable access to electricity or low-emission cooking facilities. Importing energy in the form of hydrogen from such regions without significantly reducing local energy poverty would not be sustainable.

Hydrogen must not only be produced in these countries for export. It also needs to make a relevant contribution to local decarbonization, value creation and job creation. For example, the development of a local steel industry can create new economic opportunities in countries of the Global South.

A recent study by the Wuppertal Institute on behalf of Bread for the World and the Heinrich Böll Foundation shows that sustainability criteria and their implementation must be anchored in a coordinated mix of economic, regulatory and cooperative instruments of the German government.

An important component of the instrument mix is the H2Global funding program, which already has a list of criteria. It should urgently be given more weight for its second round of tenders. However, due diligence obligations and energy partnerships can also play an even greater role. The concrete design of the standards should be carried out in consultation with German civil society and the exporting countries.

Furthermore, Germany should also support ambitious standards on an international level. Particularly in the early phase of the state-supported market ramp-up with a small number of buyer countries, the German government can help shape global standards.

After all, even an import strategy with high sustainability standards will not relieve Germany and the EU of the need to reduce energy and resource consumption – or there will not be enough green hydrogen globally to achieve climate action targets.

Christiane Averbeck is Executive Director of Climate Alliance Germany

Joachim Fünfgelt is Energy Policy Advisor in the Economy and Sustainability Division at Bread for the World.

Jennifer Morgan – State Secretary, German Foreign Office

US-born Jennifer Morgan, who holds a German passport, is the face of German foreign climate policy alongside Foreign Minister Annalena Baerbock – responsible for day-to-day operations. As Minister of State and Climate Envoy of the Federal Foreign Office, she negotiates at conferences and in bilateral talks. She maintains close contact with important players in the climate circus: key countries, the negotiating community, NGOs, the UN apparatus and the scientific community. She draws on her experience and a worldwide network of acquaintances she has built up through more than 30 years of international work at the WWF, the World Resources Institute WRI and as head of Greenpeace International. Morgan emphasizes the importance of “Team Germany” from all German ministries involved in climate action.

Sultan Ahmed Al Jaber – COP28 President, Group CEO Abu Dhabi National Oil Company (Adnoc)

COP President Al Jaber did not start out as a high-profile negotiator or ambitious climate activist; his public image was shaped by his role as CEO of the Abu Dhabi National Oil Company (Adnoc). However, he had served as the United Arab Emirates’ Special Envoy for Climate Action since 2020 and was no stranger to the negotiations when he was appointed in 2022. And so, despite many doubts, some supported “Doctor Sultan” as COP28 President. He once again caused a stir in Dubai when he was accused of anti-science remarks, whereupon he appeared thin-skinned at a press conference, denying the accusations but failing to dispel them. Despite the huge criticism, Al Jaber achieved something historic by setting up the loss and damage fund and ensuring that the “transition away from fossil fuels” was included in the COP final declaration. As part of the COP troika with Azerbaijan and Brazil, his legacy in Baku will be about whether the transition away from fossil fuels was just an empty phrase or actually a historic turning point.

Wopke Hoekstra – EU Commissioner for Climate Action, European Commission

As the successor to long-time EU climate czar Frans Timmermans, Wopke Hoekstra had to familiarize himself with the international climate negotiations within just a few weeks. At first, he only had one task: preparing for COP28 in Dubai. Although he initially faced immense criticism for his career history at McKinsey and Shell, Hoekstra surprised even experienced EU climate politicians with his ambitious program: expanding carbon pricing, introducing global aviation taxes and using the revenue to finance loss and damage. He also was one of the first supporters of the EU Nature Restoration Law (his party family, the EPP, had strictly opposed it), calling for an end to fossil fuel subsidies in the EU and achieving global climate targets without CCS. He negotiated the final declaration and the “transition away from fossil fuels” in Dubai alongside Teresa Ribera.

John Podesta – US climate envoy, United Nations

Ever since Bill Clinton was president, John Podesta has repeatedly held important positions in the White House. He was Clinton’s chief of staff, and ensured the handover of government responsibility from George W. Bush as head of Barack Obama’s transition team. He later advised Obama on climate policy. During a break from the White House, he founded the liberal think tank Center for American Progress. In 2016, he headed Hillary Clinton’s presidential campaign. During this time, his emails were hacked and published on WikiLeaks, which severely damaged Clinton’s candidacy. In 2022, Joe Biden made him his renewable energy advisor. In this role, Podesta helped implement the Inflation Reduction Act, just as he helped implement the clean energy provisions of the American Recovery and Reinvestment Act under Obama. As a member of the US delegation to UN climate conferences, it was his job to convince China to join a climate agreement and commit to reducing its greenhouse gas emissions. He once said that the rest of the world could not achieve a successful climate policy without China. In March 2024, Podesta took over from John Kerry as the US President’s special climate envoy. Negotiations with China are once again likely to be one of his priorities.

Avinash Persaud – Special Advisor on Climate Change to the President of the Inter-American Development Bank

Avinash Persaud is the man behind Barbados Prime Minister Mia Mottley’s Bridgetown Initiative. It aims to transform international climate financing to ensure that trillions of US dollars will flow into the expansion of renewables, climate adaptation and the repair of losses and damage. To this end, Persaud is also calling for higher taxes on fossil fuels, shipping and aviation. An economist specializing in international monetary policy, he is a member of the High-Level Expert Group on Climate Finance of the COP26, 27 and 28 Presidencies and the Independent Expert Group on Debt, Nature and Climate set up by the governments of Colombia, France and Kenya. Previously, he was a member of the UN Commission on Financial Reform and held senior positions at several large banks, including J.P. Morgan and UBS. He received the Jacques de Larosière Award in Global Finance for his work on financial risk management and systemic crises. Since January 16, 2024, he has been Special Climate Advisor to the President of the IDB, Ilan Goldfajn. It is a new position that was only created last September – because, like the World Bank and IMF, the IDB also wants to strengthen its climate work.

Teresa Ribera – Environment Minister, Spain

Teresa Ribera has been Spain’s Environment Minister since 2018. She is a member of the social democratic governing party Socialista Obrero Español (PSOE) and has campaigned for ambitious climate policy throughout her political career, including in the EU. For example, Ribera was instrumental in ensuring that COP19 took place in Madrid. She stood as the lead candidate for PEOS in the 2024 European elections and is also considered the frontrunner to become the next EU Commissioner from Spain. Ribera studied law and politics.

Gavin Newsom – Governor of California

As Governor of California, Democrat Gavin Newsom strongly focuses on climate action. He plans to make the state carbon-neutral by 2045. From 2035, all new cars sold are to be emission-free. Newsom has some strong words of criticism against large oil companies. He believes that Americans have been lied to by Big Oil for more than 50 years. But Newsom is also making a name for himself beyond California: He has been invited to UN climate summits, visited China, and met its President Xi Jinping. Newsom is also said to have ambitions for the highest post in the White House. However, he is widely supporting the battered President Joe Biden in the election campaign.

Jochen Flasbarth – State Secretary, Federal Ministry for Economic Cooperation and Development (BMZ)

Jochen Flasbarth has long held the position that Jennifer Morgan now fills – the German face of global climate policy. As State Secretary under Environment Ministers Barbara Hendricks and Svenja Schulze, he shaped the German and European positions. His experience and diplomatic skills repeatedly earned him delicate missions, for example, during the preparation of the Paris Agreement or in sensitive talks with resistant states. An economist, Flasbarth began his career in environmental policy as President of NABU, moved to the Ministry of the Environment and became President of the Federal Environment Agency (UBA). Since moving to the BMZ with Svenja Schulze, he has been more involved with the international and development policy dimension of global warming. He now represents the ministry that manages a large proportion of the funds for international climate action.

Thomas Heilmann – Chairman, Climate Union of the CDU, Member of the German Bundestag

Thomas Heilmann is a lawyer and entrepreneur. He has been a member of the German Bundestag for the Christian Democratic Union (CDU) since 2017. Before that, he was Senator for Justice and Consumer Protection in Berlin. He received much attention last year for his lawsuits against the German government before the Federal Constitutional Court. In early summer 2023, he stopped the Heating Act and forced a longer deliberation after the parliamentary summer break. In April 2024, he took legal action against the amendment to the Climate Change Act on technical grounds. However, the lawsuit was unsuccessful. Heilmann describes himself as a climate politician.

Boris Palmer – Lord Mayor, Tübingen

Boris Palmer has been mayor of the city of Tübingen since 2007, with a four-week break after verbal gaffes. He is considered highly talented, but also controversial. After a falling out with the Green Party over taboo-breaking, accusations of racism and criticism of the “Last Generation,” he left the party a year ago. However, his popularity with the people of Tübingen is apparently unbroken, which is also thanks to his climate policy. He reduced the city’s energy-related emissions by 30 percent between 2006 and 2019 and wants to make Tübingen climate-neutral by 2030. After all, he sees the energy and climate issue as the biggest challenge of our time.