With just two weeks left before the interim climate conference SBSTA in Bonn, tensions are rising in global climate diplomacy: The next COP President Sultan al Jaber remains controversial, his policies questionable: The invitation to the previously isolated Syrian President Bashar al-Assad to the COP28 in Dubai can be seen as a calculated provocation. This will be debated behind the scenes in Bonn – which is also why the Climate.Table will be on the ground from 5 June and produce special editions.

The pressure on the kettle is also rising elsewhere: Worldwide, rising interest rates and capital flight to developed countries are jeopardizing the urgently needed energy transition, as Nico Beckert has discovered. After the deadly storms in Italy, Spain is now facing an unprecedented drought that could influence the elections next weekend, writes Isabel Cuesta. And in the United States, the Republicans are massively campaigning against a UN initiative for the green transformation of the financial and economic world.

In addition, as always, there are many other exciting developments. We will stay on the ball.

The G7 summit in Hiroshima, Japan, over the weekend, revealed a threat that has hardly made the headlines so far: The debt crisis in many developing and emerging countries also jeopardizes the plans for a global energy transition. Addressing the climate crisis and debt vulnerability “are interrelated and mutually reinforcing,” the summit’s final document states.

The tense financial situation and interest rate hikes in industrialized countries also affect the urgently needed expansion of renewable energies in many emerging and developing countries. Rising interest rates and capital flight to industrialized countries have stalled the expansion of solar and wind power.

According to the International Renewable Energy Association (IRENA), the energy transition and the expansion of renewable energies will require global investments of 44 trillion US dollars by 2030. However, in order to fight inflation in the wake of the Ukraine war and high energy costs, the central banks of the industrialized countries keep raising key interest rates. This leads to skyrocketing capital costs in many developing and emerging countries. Development experts and economists warn that the expansion required to achieve the global climate goals could be severely slowed down. Some emerging and developing countries face “unfortunately a considerable headwind,” Ottmar Edenhofer, Director of the Berlin-based climate research institute MCC, told Table.Media.

While the rise of interest rates in the Global North remains mostly moderate, financing costs in many countries of the South have deteriorated sharply. For Germany, the rising interest rates are “a small headwind. But for Nigeria or Kenya, where US dollar lending rates are now at 13 percent, this has significantly increased the cost of building renewable energy,” says analyst Teal Emery.

The interest rate hike particularly affects the expansion of renewables. According to a recent IRENA report, solar and wind power plants require higher initial investments than coal-fired power plants of similar size. Even “small changes in interest rates have compounding effects on project costs over time,” IRENA writes. And Edenhofer says: “If interest rates rise, investments in sustainable infrastructure projects are cut back more compared to fossil ones.”

As Abebe Aemro Selassie, Director of the Africa Department of the International Monetary Fund (IMF), writes, developing and emerging countries are hardly responsible for the steep rise of capital costs. Many private and institutional investors have withdrawn from these countries in recent months. Inflation and a risky global economy push investors into safe investments, mostly in the Global North. This drying up of international financial flows is raising the capital costs in the Global South much more than in the North. As a result, “rising global interest rates are crushing renewables in Africa,” concludes Energy for Growth.

Selassie of the IMF calls the dire financing situation of developing and emerging economies “by far the most acute such situation in decades.” While “better-off economies can rely on their hefty foreign-exchange reserves and deeper capital markets,” debt costs and access to fresh capital have massively declined for countries in the Global South, Selassie says. This also affects the energy transition.

To reduce the costs of the energy transition in the Global South, experts propose certain countermeasures:

Experts say that the rising interest rates will not have such severe consequences in Germany. Although higher interest rates will raise the costs of the energy transition, the emissions trading system will provide enough incentive to continue investing in renewables, according to Kalkuhl. Foreseeable increases in CO2 prices due to the expansion of European emissions trading would give many investors planning security.

The past ten years of low interest rates were a “dream constellation” that was underused, says Hans Ulrich Buhl, an economics professor at the Augsburg and Bayreuth Core Competence Centre for Finance and Information Management. Before the Ukraine war, Germany had the lowest financing costs for the expansion of renewables, an IRENA study shows.

Buhl says that German politics should have advanced the energy transition “much faster” during this time. Germany is still in a good position in a global comparison when it comes to financing the energy transition. However, the Federal Republic can “no longer afford” additional “high costs, for example, due to long approval procedures”, the economics professor urges reducing bureaucracy and speeding up procedures.

Spain is struggling with a devastating drought. According to the national meteorological agency AEMET, the month of April 2023 was both the hottest April and the one with the least rainfall in Spain since record-keeping began in 1961. “In the first four months of the year, only 112 liters per square meter fell, whereas the normal amount would be 250 liters. So it rained less than half the normal amount,” Rubén del Campo, spokesman for the Spanish Meteorological Agency (AEMET), told Table.Media.

Water reservoirs for human consumption and agriculture are only at 39 percent of their capacity. The average for the last ten years was 69 percent. This is not only the result of the current drought, but also of a dry year in 2022. The water reserves of the reservoirs used for electricity generation have also declined. They are only at 66.6 percent of their capacity and are significantly below the average values of the last ten years (78.1 percent).

In response, Pedro Sánchez’s government approved a 2.19 billion euro aid package on May 11. These aid payments were announced during the ongoing campaign for the regional elections on May 28. They are intended to cushion the worst effects of the drought. But the opposition and one of Sánchez’s coalition partners suspect an election campaign stunt.

The aid package includes the following measures:

Spain has also imposed a ban on certain outdoor activities whenever the national meteorological agency issues a heat warning.

“Spain as a whole is affected by the rise in temperature and heat waves associated with climate change,” says AEMET spokesperson del Campo. But in large cities, the effects are amplified by the phenomenon known as “heat island“: “This leads to higher temperatures in urban areas compared to nearby rural areas,” del Campo explains. The reason: Asphalt in the streets prevents cooling through evaporation, and building materials such as concrete emit heat at night.

“As a result of the warming of the Mediterranean Sea in recent decades, the very hot summer nights on the coasts of the Mediterranean have also increased significantly. On the other hand, the size of Spain’s dry areas is increasing, especially near areas that were already dry before. This is particularly noticeable in the Murcia region, Castilla-La Mancha, Extremadura and the Ebro depression,” del Campo continues.

In the municipal and regional elections next Sunday, the opposition Partido Popular (PP) faces an important showdown in view of the general elections at the end of the year. The drought and the situation in the countryside will have an impact on municipalities already governed by the PP (Murcia region) or where the result will be close and where the election could tip the balance in favor of the opposition (Valencia region, Aragon and municipalities in Andalusia).

The PP criticized Pedro Sánchez’s (PSOE) drought package as “electoral posturing” and “five years” too late. “You can’t bait producers by supporting them on the day they put up posters,” said party leader Alberto Núñez Feijóo at one of his first campaign events. But even Sánchez’s coalition partner, Unidas Podemos, considers the plan “insufficient” and accuses the PSOE of “lacking ambition.”

The Integrated National Energy and Climate Plan (PNIEC), presented by the government of Pedro Sánchez in 2021, seeks to cut greenhouse gas emissions by 23 percent by 2030 compared to 1990 levels. The biennial review of the PNIEC is currently in progress, with the aim of tightening this target. According to a Reuters report, the target will be increased by about seven percentage points to a 30 percent reduction. The draft will be submitted to the European Commission in June and is expected to be approved in June 2024, a spokesperson for the Ministry for the Ecological Transition told Table.Media.

The current PNIEC stipulates that 42 percent of all energy in Spain will be generated from renewable sources by 2030. 74 percent of electricity generation should then be renewable. “Despite the drought, renewables accounted for 22 percent of energy and 42 percent of electricity in 2022. It is expected that more than 50 percent of electricity demand will be met by renewables by 2023,” the Ministry stated.

In the Climate Scorecard Country Ratings 2021, which assesses climate policy plans, Spain ranks fourth among EU countries behind Germany, the United Kingdom and France. The criteria look at whether a country has committed to reducing emissions by 50 percent by 2023 or 2030 at the latest, and whether carbon neutrality is to be achieved by 2050. For per capita emissions (2021 values), Spain’s 4.9 tons is far below the German value (8.1 tons) and the EU average of 6.1 tons.

The rating gives Spain a positive score mainly due to its strong solar and wind energy performance. In addition, Spain plans to reduce its vehicle emissions by 39 percent by 2030. The previous PNIEC aims to introduce five million EVs (including motorbikes, vans and buses) by 2030.

Spain is strongly exposed to climate change. The Mediterranean is warming 20 percent faster than the global average. At current trends, the temperature on the Iberian Peninsula is expected to increase by an average of 2.2 degrees by 2040.

Resistance against the Commission’s plans for a European reaction to the US investment package Inflation Reduction Act (IRA) is forming in the EU Parliament. The responsible rapporteur of the European Parliament, Christian Ehler, demands far-reaching changes to the planned Net-Zero Industry Act (NZIA). The latter has a significant influence on the Parliament’s position in the legislative process.

The EU Commission’s legislative proposal was designed as a response to the US Inflation Reduction Act – but “that’s not what it is”, the EVP/CDU MEP said yesterday. Ehler will present his draft report today, Thursday; it was already available to Table.Media in advance.

These are the main changes to the Commission’s proposal:

The EU has created comprehensive climate protection regulation with the Fit for 55 legislation, said the EPP spokesperson in the Industry and Energy Committee (ITRE). However, “it is becoming increasingly obvious that we do not have a business case for industrial decarbonization in Europe“. The IRA would therefore represent a turning point. In a survey by the European Round Table for Industry published on Tuesday, almost 60 percent of company leaders indicated that they would relocate investments or sites from Europe to North America in the next two years.

Ehler demanded to set the focus on implementing the climate targets and the associated business case. He said that “you can’t do everything at the same time,” so other regulatory projects such as the EU supply chain law or the nature conservation package should be put on the back burner. Belgian Prime Minister Alexander De Croo made similar comments on Tuesday: “If we overwhelm people with rules and regulations, we risk losing public support for the green agenda.”

The Commission proposed to designate eight technology sectors as “strategic net-zero technologies,” including solar, wind, battery storage and heat pumps. Even more than other climate-friendly sectors, these are to benefit from preferential treatment, for example in the form of expedited approval procedures and priority treatment in judicial dispute resolution. Ehler, on the other hand, is now calling for abandoning the distinction between strategic and other net-zero technologies.

He wants to use the taxonomy to determine which technologies fall under the NZIA. Article 10 of the Taxonomy Regulation lists a number of criteria for activities that substantially contribute to climate action. This would include, for example, sustainable aviation fuel (SAF) or CO2 capture and storage (CCS). Ehler, on the other hand, does not want to factor in natural gas and nuclear power, which are classified as transitional technologies in the taxonomy. However, this will likely lead to more heated discussions with nuclear advocates in the European Parliament and the Council. The treatment of the nuclear industry had already been the main point of contention in the Commission.

Ehler wants to add the concept of “Net-Zero Industry Valleys” to the draft law: It would give member states the option of designating regional cluster locations for individual net-zero technologies. As part of this, the authorities are to handle the environmental impact assessments in advance, thus relieving companies in these clusters of the burden.

The authorities’ plans for the subsidized regions should also specify which public infrastructure investments are planned and which subsidies for their operating costs investors can expect. In his report, Ehler cites contracts for difference for energy costs as an example.

Ehler considers this regional approach to be more realistic than “grinding down environmental law” at the national level. The Brandenburg deputy probably had the German Tesla plant in Gruenheide in mind for this approach.

The rapporteur of the lead ITRE committee will present his draft today. The aim is to decide on the common position of the Parliament in plenary by the end of October at the latest and then start the trialogue with the member states, said Ehler. Whether the negotiations can be concluded before Christmas also depends on the Council. The Council has set itself the goal of wrapping up the Critical Raw Materials Act, which is being negotiated in parallel, by the end of the year. However, the discussions on the NZIA have not progressed as far in the Council as on the CRMA.

Mr Timmermans, you are drawing a lot of criticism for your proposals to restore nature and reduce pesticides. The EPP rejects them and argues with food safety.

We know very well where the real threat to food security comes from: the climate crisis, the overuse of pesticides and also farming practices that require a lot of fertilizer. There is therefore a real threat to biodiversity, the risk of losing a million species, and this must be prevented. The EPP, if I understand it correctly, is not questioning this at all. It is about whether we change our practices now or we wait and see. My experience with climate and nature is that the longer you wait, the more expensive it gets.

The majority in the European Parliament behind the Green Deal is crumbling. How do you want to make sure that your projects have priority until the end of the legislature?

First of all, we have to avoid the impression that we are already done. We have achieved much more than many believed. We have set ourselves the goal of reducing CO2 emissions by 55 percent by 2030, and with the measures we have adopted, we will achieve that goal. But we must enable nature to play its part in this. Soil that is dead does not absorb CO2. Forests that are in poor condition emit CO2 and they do not absorb it. That is why we need a Nature Restoration Law. We are therefore going full steam ahead to the end. But we are also ready to negotiate.

This week, you had the opportunity to clarify outstanding issues raised by members of the European Parliament. In your view, this also involved false statements. Can you name any examples?

For example, that nature restoration means that you can’t build wind turbines or solar panels there. That is just not true. I have also seen this in my own country when the prime minister said: ‘Now I can’t build offshore wind turbines’. No, quite the opposite, because building offshore wind turbines can also create a marine protection zone. I would even say that coalitions are possible between those who want to restore nature and biodiversity and those who want to build wind turbines or solar farms on the same land.

Do you think that a second Green Deal will be necessary after 2024? There is already talk about climate targets for 2040.

We will definitely make a proposal before the end of the term on what we think is necessary for 2040. Firstly, because we have an obligation to do this. Secondly, because I believe that the Green Deal, the climate crisis and the threat of ecocide must be the subject of a Europe-wide election campaign. Because these crises cannot be solved within five years of the Green Deal. And I want everyone to show their colors. We had an agreement with the EPP on the Green Deal right at the beginning of the term. Now, as the elections approach, they are making alliances with the extreme right in southern and northern Europe.

One of the last big commitments in your term is COP 28, and one of the big battle lines there is the phase-out of fossil fuels. How will you manage the negotiations around this issue?

The challenge is to be more precise in terms of mobilizing money, and hopefully more precise in terms of efforts to reduce emissions. Especially for the G20 countries, and here especially for China. Secondly, the success of renewable energies in Europe and worldwide should lead us to formulate a global target for the energy transition. We have a clear percentage target for renewable energies in the European Union. But we also need one at the global level, in combination with a very clear target for reducing energy consumption, i.e. for energy efficiency.

And how will you deal with fossil energies?

I may not agree with some of the activists on one point: We will not manage the transition without the fossil energy sector. You have to push the companies, but you also have to give them the opportunity to decarbonise themselves and to make the transition much faster than they are doing today. We should talk to all the international financial companies about the investments they are making. The big companies in the traditional energy industry have a very limited portfolio of investments in renewable energy.

Do the negotiation results of the Fit for 55 package allow us to go beyond the target of 55 percent less net emissions?

We are currently calculating this. Currently it’s about minus 57 percent, maybe 58 percent, by the COP we will have a more precise figure. But we have to make sure that the countries can actually reach the target. This applies above all to the state of nature.

Last week, Republican attorneys general from 23 US states sent a letter to around 30 insurance companies belonging to the Net-Zero Insurance Alliance (NZIA). In it, they expressed doubts that the merger of internationally operating insurers is legal under US law. It was formed in 2021 on the initiative of the United Nations. Instead, they accuse the NZIA in their letter of pursuing an “activist climate agenda” and suspect a violation of antitrust law. The members have until June 15 to present copies of their correspondence and documents detailing the level of cooperation within the NZIA.

“Under our nation’s antitrust laws and their state equivalents, it is well-established that certain arrangements among business competitors are strictly forbidden because they are unfair or unreasonably harmful to competition,” the states’ chief prosecutors warn in their letter. In addition, collusion could constitute an “illegal boycott” or unlawful discrimination based on factors unrelated to insurance.

The key point of criticism is the NZIA’s Target-Setting Protocol (TSP), presented at the World Economic Forum in Davos in January. According to this protocol, each member is to set scientifically-based interim targets for its respective insurance and reinsurance portfolio by July 31 of this year.

As a result, attorneys general fear competitive disadvantages for companies in the coal, gas, and oil industries, such as rising premiums or a refusal to insure certain projects at all in the future. Fossil fuel companies and energy-intensive industries are major contributors to economic output in many of their states.

Renaud Guidée, Group Chief Risk Officer of French insurer AXA, on the other hand, spoke of a significant breakthrough when presenting the TSP. “For the first time ever, insurance and reinsurance companies among the largest globally have built a framework and measurement tools to assess the impact of their activities on climate change,” Guidée said.

Jean-Jacques Henchoz and Mario Greco, the CEOs of Hannover Re and Zurich Insurance, also explicitly welcomed the TSP at the time. But that was months ago. In the meantime, the anti-ESG lobby has also begun to target insurers. As a result, the two founding members of the NZIA have now bowed to the pressure and turned their backs on the NZIA, as did Munich Re.

“In our view, the opportunities to pursue decarbonization goals in a collective approach among insurers worldwide without exposing ourselves to material antitrust risks are so limited that it is more effective to pursue our climate ambition to reduce global warming individually,” said Joachim Wenning, CEO of Munich Re, explaining the move in a statement at the end of March.

However, the letter from the attorneys general to NZIA members is just the latest high point in a campaign that has spread from the states to the national level over the past two years. Just days earlier, for instance, the influential House Committee on Oversight and Accountability held a hearing on ESG at the initiative of Republicans. Among the experts summoned were Republican Attorneys General Sean Reyes of Utah and Steve Marshall of Alabama, who are also signatories to the letter.

Reyes described ESG as an “open conspiracy” by key players of the financial system to impose their will on citizens, bypassing parliament. Marshall echoed the same sentiment, calling ESG a threat to consumers and democracy. “An unelected cabal of global Elites is using ESG,” Marshall said, “to hijack our capitalist system capture corporations and threaten hard-earned dollars of American workers.” He expressed pride that he and his fellow Republicans are now fighting back.

In addition to insurance companies, banks and fund companies are particularly affected by the anti-ESG campaign. Around a dozen states have now passed laws prohibiting the public sector from investing in funds that take ESG criteria into account. One key leverage point: State employees’ multi-billion dollar pension funds, especially teachers.

In many places, cities and towns are also prohibited from borrowing from banks that are considered suspected of ESG because of their membership in the Net-Zero Bank Alliance (NZBA), the counterpart to the NZIA. The states of West Virginia, Kentucky, Oklahoma, and Texas have already blacklisted domestic and foreign financial institutions deemed to be boycotters of fossil fuel companies.

The United Nations declined to comment to Table.Media on the allegations against NZBA in the United States. “We do not comment on political developments in individual UN member states or on our discussions with regulators there,” a UN spokesperson said upon inquiry.

Since August 2022, the large Swiss bank UBS has also been on such a list in Texas. This is why Ken Paxton, the state’s attorney general, prohibited the bank from subscribing to bonds worth 18.6 million US dollars issued by the Normangee Independent School District. The fact that the deal was agreed upon before August 2022 did not matter, nor did the bank’s assurances that it was not calling for a boycott of energy companies in the first place. A few days ago, a settlement was reached. UBS must pay $850,000 in compensation to the school district for additional costs incurred in reissuing the bonds at a higher interest rate. Of course, UBS was not allowed to bid this time.

Paxton expressed his satisfaction with the outcome: “I remain committed to combatting the corporate ESG investment agenda, shielding taxpayers from the extra costs that come with it by shifting the burden to banks, and protecting Texas energy companies.”

May 25; 12 a.m., Brussels

Seminar Hydrogen – Tale of the future or a real game changer?

To further increase European renewable hydrogen targets, the European Commission complemented the adoption of the EU Hydrogen Strategy with the publication of the REPowerEU plan in May 2022. These initiatives are designed to accelerate the introduction of renewable hydrogen, ammonia and other derivatives in energy-intensive industrial processes and hard-to-decarbonize industries. The Euractiv roundtable will discuss how realistic the plans are. Info

May 25; 8.30 p.m., online

Webinar COP28 and Beyond: How to Meet the Needs of Climate-Vulnerable Countries

The World Resources Institute webinar will discuss how vulnerable countries can be protected and strengthened in the COP process and beyond. Info and registration

May 25-26; Instanbul, Türkiye

Workshop Climate adaptation, transboundary water management, and political stability in the Middle East

The effects of climate change on water supply, food security, migration, and political stability are becoming evident in the Middle East. Discussions and policy recommendations developed during the workshop will feed into CASCADES’ ongoing consultation and outreach process with the European Commission and other European stakeholders. Infos

May, 4 p.m.; Online

Webinar Women energize Women – Feminist Energy Policy – What does it entail and how to achieve it?

In recent years, more and more states have adopted feminist foreign policy approaches. The definitions of what feminist foreign policy entails are broad and varied. The same applies to feminist energy policy, a term used less frequently but that has gained increasing attention in recent years. On the webinar of the German Renewable Energy Federation, we will discuss what is behind it. Info and registration

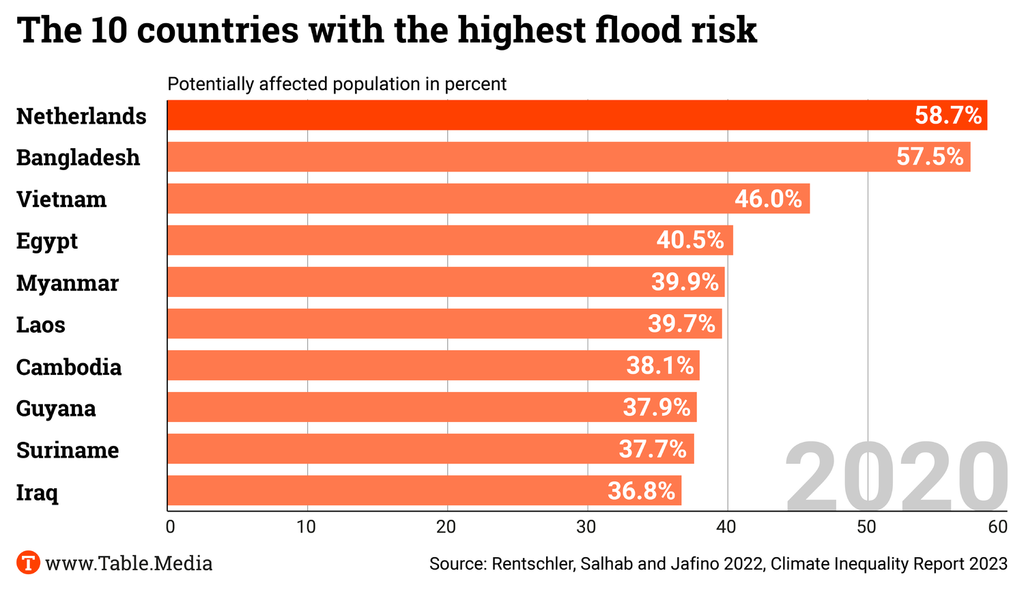

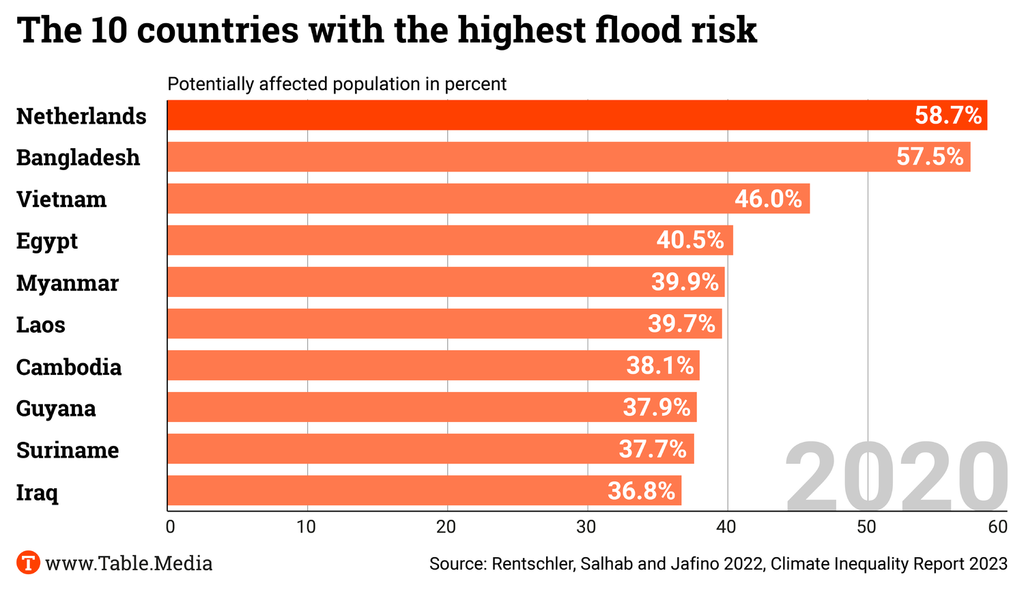

The images from the flooded Emilia-Romagna region in Italy look all too familiar: Flooded cities and regions, faces frozen in shock, politicians in rubber boots. Flooding caused by heavy rain, but also by rising sea levels, is one of the most visible consequences of climate change.

1.8 billion people, almost a quarter of the world’s population, are at serious risk of floods. Even though the comparatively wealthy Netherlands is home to the largest share of the population at risk of flooding, people in the Global South are the most vulnerable. According to the Climate Inequality Report, nine of the ten countries most threatened by flooding are low- and middle-income countries. These are countries that have contributed least to climate change and have few resources for adaptation measures or coping with the damage. nib

Climate change is having a massive impact on the Hindu Kush-Himalaya water system and endangering the water and energy supply of 16 Asian countries, according to a new analysis by the think tank China Water Risk (CWR). The advancing climate change is threatening the water levels of major rivers such as the Ganges, Brahmaputra, Yangtze, Yellow River and Mekong. These and five other major rivers in the region provide water for almost three-quarters of the hydropower and 44 percent of the coal-fired power plants in the 16 countries. Coal-fired power plants use water for cooling and steam generation to drive the generators.

Over 330 gigawatts of power plant capacity are already located in regions with “high or extremely high water stress” – enough to power Japan. One-third of the installed capacity in India is spread across three rivers, while about half of the installed capacity in China is distributed across seven rivers.

The river levels are influenced by “glacial melt, snow/rainfall and monsoon patterns are all impacted by climate change”. “One in two Asians live in these 10 river basins where over 4.3 trillion US dollars of GDP is generated annually,” explains Debra Tan, head of CWR and lead author of the report.

The authors proposes, among other things:

The impact of low water levels on electricity supply was evident in the summer of 2022 in the Chinese provinces of Yunnan and Sichuan. Due to persistent drought, the levels of reservoirs and rivers had dropped significantly, resulting in reduced hydropower generation. This led to power rationing, with the industrial sector being the hardest hit. Some households also experienced restrictions in their supply. nib

According to a Reuters report, the Brazilian government plans to tighten its Nationally Determined Contribution (NDC) climate target filed with the United Nations before the end of the year. However, the decision has not been officially confirmed. Reuters cites two anonymous sources “with direct knowledge of the matter.”

The background: The former government under Jair Bolsonaro had already tightened Brazil’s NDC once in 2021 amid international pressure, but only on the surface: It announced plans to cut the country’s emissions by 50 percent by 2030 instead of just 43 percent, as previously planned. However, because it used a different base year for this, the two reduction rates were not easy to compare. The Brazilian environmental organization Climate Observatory calculated that the new target actually allowed for significantly more emissions than before.

The government of President Luiz Inácio Lula da Silva now wants to remedy the issue, Reuters reports. According to the report, the reduction quota of 50 percent is to be maintained and the problem with the base year is to be solved. A new, “more ambitious” target is to be formulated.

It would not be surprising: During the election campaign, Lula’s former environment minister and advisor on environmental issues, Izabella Teixeira, already announced that Lula would tighten the country’s “insufficient” climate targets in the event of a win. Brazil’s president took office with a promise to make the country a climate action leader. Above all, that includes stopping deforestation in the Amazon. The rainforest is considered one of Earth’s most important greenhouse gas sinks and is, therefore, of immense importance for global climate action. But deforestation, which particularly increased under Lula’s predecessor Bolsonaro, is threatening this function. rtr/ae

The EU will need additional financial resources to meet its 2030 climate targets, a new study says. Programs to involve private investors such as InvestEU are “no substitute for additional public spending at the EU level,” write the experts from the Jacques Delors Centre at Berlin’s Hertie School in the paper, which will be published today. The European economy “cannot be greened cheaply” in this way.

The EU Commission launched InvestEU in 2018 as the successor to the EFSI, often referred to as the Juncker Fund. With the help of guarantees totaling 26.2 billion euros from the EU budget, the Commission hopes to mobilize more than 372 billion euros in private and public investment by 2027. The funds will be allocated to investors via the European Investment Bank and 14 other development banks.

In its current form, the report says InvestEU is an effective instrument for financing projects with a low risk profile, such as the energy-efficient modernization of properties. However, many investments in future technologies envisaged in the Green Deal Industrial Plan, such as hydrogen drive technologies, are associated with considerable technological uncertainties. In order for the investments to be realized, the public sector would have to bear a significant part of the risks for the investors – for example, through equity financing, as made possible by the EU Innovation Fund. Climate change adaptation projects, on the other hand, are not commercially viable in the longer term and therefore depend on public subsidies.

The authors, therefore, recommend increasing the funding for InvestEU. They say only in this way could the program take on the necessary risks to trigger additional green investments. The Commission proposed additional funding for InvestEU in its Green Deal Industrial Plan. However, many member states are likely to oppose this in the upcoming negotiations on revising the medium-term financial framework. tho

Shortly before the start of the UN interim climate conference (SBSTA) in the German city of Bonn, global climate diplomacy is gathering momentum: In an open letter, about 130 members of the EU Parliament and the US Congress call for limiting the power of fossil fuel interests at the upcoming COP28 in Dubai. They also demand that COP President-designate Sultan Al Jaber be removed from his post. Al Jaber is the UAE’s minister of industry and head of state-owned oil and gas company ADNOC.

In their letter to UN Secretary-General António Guterres, US President Joe Biden, EU Council President Ursula von der Leyen and UNFCCC chief Simon Stiell, the MEPs call for climate science to take “precedence over climate delay and greenwashing” at COPs. For this reason, diplomatic efforts should “secure the withdrawal of the President-designate of COP28” and “limit the influence of polluting industries, particularly major fossil fuel industry players.” They point out that more than 636 fossil fuel industry lobbyists were registered at COP27 in Sharm el-Sheikh, an increase of more than 25 percent.

Al Jaber, in turn, has caused a stir because the UAE apparently invited Syrian President Bashar al-Assad to COP28. Organizers emphasized their commitment “to an inclusive COP process that produces transformational solutions” that could only happen if everyone was in the room. Assad had been internationally isolated due to the brutal crackdown by state authorities on civilians in Syria’s civil war. Just last week, however, he was welcomed back to the Arab League meeting for the first time. Should he appear at the COP in Dubai, diplomatic tensions with many Western countries could ensue.

Meanwhile, the organizing team has assembled a 31-member group of high-level experts and stakeholders for COP28. For example, the upcoming COP presidency appointed former French Foreign Minister and architect of the Paris Agreement Laurent Fabius, former Brazilian Environment Minister Izabella Teixeira, former BP CEO Bob Dudley, Indian environmental activist Sunita Narain, Larry Fink, CEO of investment firm Black Rock, former head of Chinese oil and gas company CNOOC Fu Chengyu, and Bangladeshi scientist and consultant Saleemul Huq to this “advisory committee.” bpo

In France, certain domestic flights over short distances are no longer permitted. This applies to distances that can be traveled by train in a maximum of two and a half hours – in practice, this means flights between Paris-Orly and the cities of Nantes, Bordeaux and Lyon. A decree to this effect officially came into force on Tuesday after being approved by the European Commission.

The ban has already been enshrined in a law passed in August 2021. In practice, it is already being implemented. Formally, however, it was on hold until approval by the EU. In the original version, the ban would have applied to flights on eight routes, reported the online medium Quartz. But because the EU Commission attached conditions to its approval, only three remained. This number could rise if the French rail network were to be expanded.

However, there are doubts about the climate benefits of the ban. It hardly saves emissions, said Laurent Donceel, interim head of the industry association Airlines for Europe (A4E), according to the BBC. Others criticize the ban for not covering three-hour train journeys between Paris and Marseille, according to Le Monde newspaper. A citizens’ council on climate policy, set up by President Emmanuel Macron in 2019, had originally proposed a ban on flights on routes with up to four-hour rail connections. ae

Saudi Aramco, ExxonMobil, Shell and BP would have to pay the highest reparations for climate damage – because, measured by their emissions, they bear the most responsibility for climate change. This is the conclusion reached by the two authors, Marco Grasso and Richard Heede, in a commentary for the trade journal One Earth.

“The climate crisis and its rapidly increasing economic burdens bring to the forefront a question that has been poorly investigated,” the two write. “Who should bear the cost of the harm caused by anthropogenic climate change?” So far, they say, it has been primarily states and insurance companies.

However, they argue that “companies that engage in the exploration, production, refining, and distribution of oil, gas, and coal” also bear considerable responsibility, as they prevented effective climate action, for example, through disinformation and donations to politicians. Moreover, the “the polluter pays” principle, enshrined in Article 16 of the Rio Declaration, already obliges them to pay for the damage caused by their emissions.

For their calculation, Grasso and Heede first estimated how high the cumulative costs of climate damage attributable to fossil emissions will likely be between 2025 and 2050. They ended up with a figure of 23.2 trillion US dollars, and divided the sum between the 21 largest oil, coal and gas companies.

They classified the companies into three groups. Companies from wealthy countries – including state-owned and private oil companies such as Saudi Aramco, ExxonMobil and Shell, but also the publicly traded US coal company Peabody – were assigned the greatest obligation to pay reparations. They exclude companies from less wealthy countries – Iran, India, Venezuela – from the obligation to pay. In between, they see companies from Russia (Gazprom and Rosneft), China (PetroChina) and Brazil (Petrobras), for example. In the next step, Grasso and Heede derived the respective company’s liability from its cumulative emissions between 1988 and 2022.

Grasso is a political and economic geographer at the University of Milan-Bicocca. His research includes moral issues in climate policy. Heede is the principal of the Carbon Majors Project, which has regularly reassessed the emissions of major international oil, gas and coal companies for several years. His work is also relevant to climate lawsuits.

Such lawsuits can negatively impact the stock market value of the sued companies, as a research group at the London School of Economics has recently demonstrated: On average, it is 0.41 percent below the value expected without a lawsuit. For lawsuits against the largest emitters, the loss in value could be as much as 1.5 percent. ae

In the year 2100, one-third of humanity could live outside the so-called human climate niche. This is the result of a study published Monday in the journal Nature Sustainability. This forecast is based on the assumption that the average global temperature will increase by 2.7 degrees.

The human climate niche refers to the regions of the earth in which humans have so far preferred to live due to favorable climatic conditions. The average annual temperature in this region is between 11 and 15 degrees Celsius. Currently, around 9 percent of the global population lives outside this climatic niche. Global warming is causing conditions to deteriorate in ever larger regions, such as India, Indonesia, Nigeria and Mali.

Another study published in Nature Ecology & Evolution also concludes that with a warming of 2.5 degrees, more than 30 percent of all animal and plant species will face “collapse.” According to the authors, the climate risks for thousands of species will abruptly occur in the coming decades.

Even limiting global warming to 1.5 degrees will have far-reaching consequences: The two studies estimate that even then, around 14 percent of the world’s population will be living outside the human climate niche by the end of the century. Even in this case, about 15 percent of all animal and plant species would be threatened by global warming. kul

Philipp Nimmermann fully meets the most important criterion that Minister for Economic Affairs Robert Habeck had set internally for Patrick Graichen’s successor as State Secretary for Energy: He is not part of the closely interwoven energy scene that was Graichen’s undoing. On the contrary, the 57-year-old economist has had little to do with energy. Accordingly, hardly anyone had his name on their radar beforehand.

However, sources close to the minister say that Nimmermann is by no means a second choice because other traded candidates, such as network agency president Klaus Müller, were not available. Habeck knows him from the government in Schleswig-Holstein, where Nimmermann was State Secretary in the Ministry of Finance while Habeck was State Environment Minister there – and he apparently trusts him greatly. Nimmermann is “an experienced head of administration,” “has been Secretary of State for many years,” and “is a good economist,” Habeck said on Monday – visibly relieved to have the issue off the table.

Habeck apparently does not see the lack of experience in energy policy as a problem but rather as an opportunity. Nimmermann will “take another look at the processes with a fresh eye”, the minister said. In fact, many of the remaining major projects – from the heating law to the wind and solar package to industrial electricity pricing and LNG terminals – have already been largely worked out; the work that remains concerns him managing political processes and communication. The doctor of economics had repeatedly demonstrated in the past to have already mastered this.

Nimmermann is considered the architect of a deal that saved Hamburg and Schleswig-Holstein billions. Their joint Landesbank, HSH Nordbank, had accumulated the highest ratio of bad loans “outside of Greece and Cyprus”, as Nimmermann went on record in 2014 as a newly appointed state secretary in Schleswig-Holstein’s finance ministry. Three and a half years later, exactly eleven hours before the EU’s deadline for selling the indebted bank expired, Nimmermann was pleased with the “photo finish”. “We have managed to avert an existential crisis”, praised a relieved Olaf Scholz, then mayor of the Hanseatic city.

The economist certainly does not look like an ecologist. On the contrary, from his leather shoes to his bald head, the Frankfurt native always looks freshly polished, likes to wear a tie, a three-piece suit, even an extravagant frock coat. But the slim man has only outwardly left behind his influence in one of the first anti-authoritarian children’s stores in the left-wing alternative district of Nordend.

Nimmermann holds a Ph.D. in international tax law. Before earning it in 1998, he worked for five years at Johann-Wolfgang-Goethe University on state fiscal equalization, European integration, and regional development. He then moved to BHF Bank AG, where he had risen to the position of Chief Economist when the then Green Party Finance Minister Monika Heinold brought him to Kiel. From the waterfront, Nimmermann provided templates for the law on mandatory reporting of cross-border tax models, which has been in force since 2020. These templates were gladly taken up by the Federal Ministry of Finance, which Scholz led at the time.

The word “taxes” is not related to “stealing” (German: “Steuern” and “stehlen”), is one of Nimmermann’s one-liners. The word comes from the Middle High German “stiure”, and means “to support”. In his view, the fact that the state has allowed itself to be exploited by tax models such as “Cum Ex”, but also by real estate constructs such as the notorious “share deals”, endangers the common good. If he remains true to this line, the powerful lobbies, which also abound in the energy sector, are unlikely to have an easier time in the future than they did under Graichen.

On another topic, however, it is likely to be expressly desirable for Nimmermann to distance himself from Graichen. At the BHF-Bank, as is expressly emphasized by the ministry, the future state secretary was responsible, among other things, for adherence to compliance rules. Malte Kreutzfeldt

With just two weeks left before the interim climate conference SBSTA in Bonn, tensions are rising in global climate diplomacy: The next COP President Sultan al Jaber remains controversial, his policies questionable: The invitation to the previously isolated Syrian President Bashar al-Assad to the COP28 in Dubai can be seen as a calculated provocation. This will be debated behind the scenes in Bonn – which is also why the Climate.Table will be on the ground from 5 June and produce special editions.

The pressure on the kettle is also rising elsewhere: Worldwide, rising interest rates and capital flight to developed countries are jeopardizing the urgently needed energy transition, as Nico Beckert has discovered. After the deadly storms in Italy, Spain is now facing an unprecedented drought that could influence the elections next weekend, writes Isabel Cuesta. And in the United States, the Republicans are massively campaigning against a UN initiative for the green transformation of the financial and economic world.

In addition, as always, there are many other exciting developments. We will stay on the ball.

The G7 summit in Hiroshima, Japan, over the weekend, revealed a threat that has hardly made the headlines so far: The debt crisis in many developing and emerging countries also jeopardizes the plans for a global energy transition. Addressing the climate crisis and debt vulnerability “are interrelated and mutually reinforcing,” the summit’s final document states.

The tense financial situation and interest rate hikes in industrialized countries also affect the urgently needed expansion of renewable energies in many emerging and developing countries. Rising interest rates and capital flight to industrialized countries have stalled the expansion of solar and wind power.

According to the International Renewable Energy Association (IRENA), the energy transition and the expansion of renewable energies will require global investments of 44 trillion US dollars by 2030. However, in order to fight inflation in the wake of the Ukraine war and high energy costs, the central banks of the industrialized countries keep raising key interest rates. This leads to skyrocketing capital costs in many developing and emerging countries. Development experts and economists warn that the expansion required to achieve the global climate goals could be severely slowed down. Some emerging and developing countries face “unfortunately a considerable headwind,” Ottmar Edenhofer, Director of the Berlin-based climate research institute MCC, told Table.Media.

While the rise of interest rates in the Global North remains mostly moderate, financing costs in many countries of the South have deteriorated sharply. For Germany, the rising interest rates are “a small headwind. But for Nigeria or Kenya, where US dollar lending rates are now at 13 percent, this has significantly increased the cost of building renewable energy,” says analyst Teal Emery.

The interest rate hike particularly affects the expansion of renewables. According to a recent IRENA report, solar and wind power plants require higher initial investments than coal-fired power plants of similar size. Even “small changes in interest rates have compounding effects on project costs over time,” IRENA writes. And Edenhofer says: “If interest rates rise, investments in sustainable infrastructure projects are cut back more compared to fossil ones.”

As Abebe Aemro Selassie, Director of the Africa Department of the International Monetary Fund (IMF), writes, developing and emerging countries are hardly responsible for the steep rise of capital costs. Many private and institutional investors have withdrawn from these countries in recent months. Inflation and a risky global economy push investors into safe investments, mostly in the Global North. This drying up of international financial flows is raising the capital costs in the Global South much more than in the North. As a result, “rising global interest rates are crushing renewables in Africa,” concludes Energy for Growth.

Selassie of the IMF calls the dire financing situation of developing and emerging economies “by far the most acute such situation in decades.” While “better-off economies can rely on their hefty foreign-exchange reserves and deeper capital markets,” debt costs and access to fresh capital have massively declined for countries in the Global South, Selassie says. This also affects the energy transition.

To reduce the costs of the energy transition in the Global South, experts propose certain countermeasures:

Experts say that the rising interest rates will not have such severe consequences in Germany. Although higher interest rates will raise the costs of the energy transition, the emissions trading system will provide enough incentive to continue investing in renewables, according to Kalkuhl. Foreseeable increases in CO2 prices due to the expansion of European emissions trading would give many investors planning security.

The past ten years of low interest rates were a “dream constellation” that was underused, says Hans Ulrich Buhl, an economics professor at the Augsburg and Bayreuth Core Competence Centre for Finance and Information Management. Before the Ukraine war, Germany had the lowest financing costs for the expansion of renewables, an IRENA study shows.

Buhl says that German politics should have advanced the energy transition “much faster” during this time. Germany is still in a good position in a global comparison when it comes to financing the energy transition. However, the Federal Republic can “no longer afford” additional “high costs, for example, due to long approval procedures”, the economics professor urges reducing bureaucracy and speeding up procedures.

Spain is struggling with a devastating drought. According to the national meteorological agency AEMET, the month of April 2023 was both the hottest April and the one with the least rainfall in Spain since record-keeping began in 1961. “In the first four months of the year, only 112 liters per square meter fell, whereas the normal amount would be 250 liters. So it rained less than half the normal amount,” Rubén del Campo, spokesman for the Spanish Meteorological Agency (AEMET), told Table.Media.

Water reservoirs for human consumption and agriculture are only at 39 percent of their capacity. The average for the last ten years was 69 percent. This is not only the result of the current drought, but also of a dry year in 2022. The water reserves of the reservoirs used for electricity generation have also declined. They are only at 66.6 percent of their capacity and are significantly below the average values of the last ten years (78.1 percent).

In response, Pedro Sánchez’s government approved a 2.19 billion euro aid package on May 11. These aid payments were announced during the ongoing campaign for the regional elections on May 28. They are intended to cushion the worst effects of the drought. But the opposition and one of Sánchez’s coalition partners suspect an election campaign stunt.

The aid package includes the following measures:

Spain has also imposed a ban on certain outdoor activities whenever the national meteorological agency issues a heat warning.

“Spain as a whole is affected by the rise in temperature and heat waves associated with climate change,” says AEMET spokesperson del Campo. But in large cities, the effects are amplified by the phenomenon known as “heat island“: “This leads to higher temperatures in urban areas compared to nearby rural areas,” del Campo explains. The reason: Asphalt in the streets prevents cooling through evaporation, and building materials such as concrete emit heat at night.

“As a result of the warming of the Mediterranean Sea in recent decades, the very hot summer nights on the coasts of the Mediterranean have also increased significantly. On the other hand, the size of Spain’s dry areas is increasing, especially near areas that were already dry before. This is particularly noticeable in the Murcia region, Castilla-La Mancha, Extremadura and the Ebro depression,” del Campo continues.

In the municipal and regional elections next Sunday, the opposition Partido Popular (PP) faces an important showdown in view of the general elections at the end of the year. The drought and the situation in the countryside will have an impact on municipalities already governed by the PP (Murcia region) or where the result will be close and where the election could tip the balance in favor of the opposition (Valencia region, Aragon and municipalities in Andalusia).

The PP criticized Pedro Sánchez’s (PSOE) drought package as “electoral posturing” and “five years” too late. “You can’t bait producers by supporting them on the day they put up posters,” said party leader Alberto Núñez Feijóo at one of his first campaign events. But even Sánchez’s coalition partner, Unidas Podemos, considers the plan “insufficient” and accuses the PSOE of “lacking ambition.”

The Integrated National Energy and Climate Plan (PNIEC), presented by the government of Pedro Sánchez in 2021, seeks to cut greenhouse gas emissions by 23 percent by 2030 compared to 1990 levels. The biennial review of the PNIEC is currently in progress, with the aim of tightening this target. According to a Reuters report, the target will be increased by about seven percentage points to a 30 percent reduction. The draft will be submitted to the European Commission in June and is expected to be approved in June 2024, a spokesperson for the Ministry for the Ecological Transition told Table.Media.

The current PNIEC stipulates that 42 percent of all energy in Spain will be generated from renewable sources by 2030. 74 percent of electricity generation should then be renewable. “Despite the drought, renewables accounted for 22 percent of energy and 42 percent of electricity in 2022. It is expected that more than 50 percent of electricity demand will be met by renewables by 2023,” the Ministry stated.

In the Climate Scorecard Country Ratings 2021, which assesses climate policy plans, Spain ranks fourth among EU countries behind Germany, the United Kingdom and France. The criteria look at whether a country has committed to reducing emissions by 50 percent by 2023 or 2030 at the latest, and whether carbon neutrality is to be achieved by 2050. For per capita emissions (2021 values), Spain’s 4.9 tons is far below the German value (8.1 tons) and the EU average of 6.1 tons.

The rating gives Spain a positive score mainly due to its strong solar and wind energy performance. In addition, Spain plans to reduce its vehicle emissions by 39 percent by 2030. The previous PNIEC aims to introduce five million EVs (including motorbikes, vans and buses) by 2030.

Spain is strongly exposed to climate change. The Mediterranean is warming 20 percent faster than the global average. At current trends, the temperature on the Iberian Peninsula is expected to increase by an average of 2.2 degrees by 2040.

Resistance against the Commission’s plans for a European reaction to the US investment package Inflation Reduction Act (IRA) is forming in the EU Parliament. The responsible rapporteur of the European Parliament, Christian Ehler, demands far-reaching changes to the planned Net-Zero Industry Act (NZIA). The latter has a significant influence on the Parliament’s position in the legislative process.

The EU Commission’s legislative proposal was designed as a response to the US Inflation Reduction Act – but “that’s not what it is”, the EVP/CDU MEP said yesterday. Ehler will present his draft report today, Thursday; it was already available to Table.Media in advance.

These are the main changes to the Commission’s proposal:

The EU has created comprehensive climate protection regulation with the Fit for 55 legislation, said the EPP spokesperson in the Industry and Energy Committee (ITRE). However, “it is becoming increasingly obvious that we do not have a business case for industrial decarbonization in Europe“. The IRA would therefore represent a turning point. In a survey by the European Round Table for Industry published on Tuesday, almost 60 percent of company leaders indicated that they would relocate investments or sites from Europe to North America in the next two years.

Ehler demanded to set the focus on implementing the climate targets and the associated business case. He said that “you can’t do everything at the same time,” so other regulatory projects such as the EU supply chain law or the nature conservation package should be put on the back burner. Belgian Prime Minister Alexander De Croo made similar comments on Tuesday: “If we overwhelm people with rules and regulations, we risk losing public support for the green agenda.”

The Commission proposed to designate eight technology sectors as “strategic net-zero technologies,” including solar, wind, battery storage and heat pumps. Even more than other climate-friendly sectors, these are to benefit from preferential treatment, for example in the form of expedited approval procedures and priority treatment in judicial dispute resolution. Ehler, on the other hand, is now calling for abandoning the distinction between strategic and other net-zero technologies.

He wants to use the taxonomy to determine which technologies fall under the NZIA. Article 10 of the Taxonomy Regulation lists a number of criteria for activities that substantially contribute to climate action. This would include, for example, sustainable aviation fuel (SAF) or CO2 capture and storage (CCS). Ehler, on the other hand, does not want to factor in natural gas and nuclear power, which are classified as transitional technologies in the taxonomy. However, this will likely lead to more heated discussions with nuclear advocates in the European Parliament and the Council. The treatment of the nuclear industry had already been the main point of contention in the Commission.

Ehler wants to add the concept of “Net-Zero Industry Valleys” to the draft law: It would give member states the option of designating regional cluster locations for individual net-zero technologies. As part of this, the authorities are to handle the environmental impact assessments in advance, thus relieving companies in these clusters of the burden.

The authorities’ plans for the subsidized regions should also specify which public infrastructure investments are planned and which subsidies for their operating costs investors can expect. In his report, Ehler cites contracts for difference for energy costs as an example.

Ehler considers this regional approach to be more realistic than “grinding down environmental law” at the national level. The Brandenburg deputy probably had the German Tesla plant in Gruenheide in mind for this approach.

The rapporteur of the lead ITRE committee will present his draft today. The aim is to decide on the common position of the Parliament in plenary by the end of October at the latest and then start the trialogue with the member states, said Ehler. Whether the negotiations can be concluded before Christmas also depends on the Council. The Council has set itself the goal of wrapping up the Critical Raw Materials Act, which is being negotiated in parallel, by the end of the year. However, the discussions on the NZIA have not progressed as far in the Council as on the CRMA.

Mr Timmermans, you are drawing a lot of criticism for your proposals to restore nature and reduce pesticides. The EPP rejects them and argues with food safety.

We know very well where the real threat to food security comes from: the climate crisis, the overuse of pesticides and also farming practices that require a lot of fertilizer. There is therefore a real threat to biodiversity, the risk of losing a million species, and this must be prevented. The EPP, if I understand it correctly, is not questioning this at all. It is about whether we change our practices now or we wait and see. My experience with climate and nature is that the longer you wait, the more expensive it gets.

The majority in the European Parliament behind the Green Deal is crumbling. How do you want to make sure that your projects have priority until the end of the legislature?

First of all, we have to avoid the impression that we are already done. We have achieved much more than many believed. We have set ourselves the goal of reducing CO2 emissions by 55 percent by 2030, and with the measures we have adopted, we will achieve that goal. But we must enable nature to play its part in this. Soil that is dead does not absorb CO2. Forests that are in poor condition emit CO2 and they do not absorb it. That is why we need a Nature Restoration Law. We are therefore going full steam ahead to the end. But we are also ready to negotiate.

This week, you had the opportunity to clarify outstanding issues raised by members of the European Parliament. In your view, this also involved false statements. Can you name any examples?

For example, that nature restoration means that you can’t build wind turbines or solar panels there. That is just not true. I have also seen this in my own country when the prime minister said: ‘Now I can’t build offshore wind turbines’. No, quite the opposite, because building offshore wind turbines can also create a marine protection zone. I would even say that coalitions are possible between those who want to restore nature and biodiversity and those who want to build wind turbines or solar farms on the same land.

Do you think that a second Green Deal will be necessary after 2024? There is already talk about climate targets for 2040.

We will definitely make a proposal before the end of the term on what we think is necessary for 2040. Firstly, because we have an obligation to do this. Secondly, because I believe that the Green Deal, the climate crisis and the threat of ecocide must be the subject of a Europe-wide election campaign. Because these crises cannot be solved within five years of the Green Deal. And I want everyone to show their colors. We had an agreement with the EPP on the Green Deal right at the beginning of the term. Now, as the elections approach, they are making alliances with the extreme right in southern and northern Europe.

One of the last big commitments in your term is COP 28, and one of the big battle lines there is the phase-out of fossil fuels. How will you manage the negotiations around this issue?

The challenge is to be more precise in terms of mobilizing money, and hopefully more precise in terms of efforts to reduce emissions. Especially for the G20 countries, and here especially for China. Secondly, the success of renewable energies in Europe and worldwide should lead us to formulate a global target for the energy transition. We have a clear percentage target for renewable energies in the European Union. But we also need one at the global level, in combination with a very clear target for reducing energy consumption, i.e. for energy efficiency.

And how will you deal with fossil energies?

I may not agree with some of the activists on one point: We will not manage the transition without the fossil energy sector. You have to push the companies, but you also have to give them the opportunity to decarbonise themselves and to make the transition much faster than they are doing today. We should talk to all the international financial companies about the investments they are making. The big companies in the traditional energy industry have a very limited portfolio of investments in renewable energy.

Do the negotiation results of the Fit for 55 package allow us to go beyond the target of 55 percent less net emissions?

We are currently calculating this. Currently it’s about minus 57 percent, maybe 58 percent, by the COP we will have a more precise figure. But we have to make sure that the countries can actually reach the target. This applies above all to the state of nature.

Last week, Republican attorneys general from 23 US states sent a letter to around 30 insurance companies belonging to the Net-Zero Insurance Alliance (NZIA). In it, they expressed doubts that the merger of internationally operating insurers is legal under US law. It was formed in 2021 on the initiative of the United Nations. Instead, they accuse the NZIA in their letter of pursuing an “activist climate agenda” and suspect a violation of antitrust law. The members have until June 15 to present copies of their correspondence and documents detailing the level of cooperation within the NZIA.

“Under our nation’s antitrust laws and their state equivalents, it is well-established that certain arrangements among business competitors are strictly forbidden because they are unfair or unreasonably harmful to competition,” the states’ chief prosecutors warn in their letter. In addition, collusion could constitute an “illegal boycott” or unlawful discrimination based on factors unrelated to insurance.

The key point of criticism is the NZIA’s Target-Setting Protocol (TSP), presented at the World Economic Forum in Davos in January. According to this protocol, each member is to set scientifically-based interim targets for its respective insurance and reinsurance portfolio by July 31 of this year.

As a result, attorneys general fear competitive disadvantages for companies in the coal, gas, and oil industries, such as rising premiums or a refusal to insure certain projects at all in the future. Fossil fuel companies and energy-intensive industries are major contributors to economic output in many of their states.

Renaud Guidée, Group Chief Risk Officer of French insurer AXA, on the other hand, spoke of a significant breakthrough when presenting the TSP. “For the first time ever, insurance and reinsurance companies among the largest globally have built a framework and measurement tools to assess the impact of their activities on climate change,” Guidée said.

Jean-Jacques Henchoz and Mario Greco, the CEOs of Hannover Re and Zurich Insurance, also explicitly welcomed the TSP at the time. But that was months ago. In the meantime, the anti-ESG lobby has also begun to target insurers. As a result, the two founding members of the NZIA have now bowed to the pressure and turned their backs on the NZIA, as did Munich Re.

“In our view, the opportunities to pursue decarbonization goals in a collective approach among insurers worldwide without exposing ourselves to material antitrust risks are so limited that it is more effective to pursue our climate ambition to reduce global warming individually,” said Joachim Wenning, CEO of Munich Re, explaining the move in a statement at the end of March.

However, the letter from the attorneys general to NZIA members is just the latest high point in a campaign that has spread from the states to the national level over the past two years. Just days earlier, for instance, the influential House Committee on Oversight and Accountability held a hearing on ESG at the initiative of Republicans. Among the experts summoned were Republican Attorneys General Sean Reyes of Utah and Steve Marshall of Alabama, who are also signatories to the letter.

Reyes described ESG as an “open conspiracy” by key players of the financial system to impose their will on citizens, bypassing parliament. Marshall echoed the same sentiment, calling ESG a threat to consumers and democracy. “An unelected cabal of global Elites is using ESG,” Marshall said, “to hijack our capitalist system capture corporations and threaten hard-earned dollars of American workers.” He expressed pride that he and his fellow Republicans are now fighting back.

In addition to insurance companies, banks and fund companies are particularly affected by the anti-ESG campaign. Around a dozen states have now passed laws prohibiting the public sector from investing in funds that take ESG criteria into account. One key leverage point: State employees’ multi-billion dollar pension funds, especially teachers.

In many places, cities and towns are also prohibited from borrowing from banks that are considered suspected of ESG because of their membership in the Net-Zero Bank Alliance (NZBA), the counterpart to the NZIA. The states of West Virginia, Kentucky, Oklahoma, and Texas have already blacklisted domestic and foreign financial institutions deemed to be boycotters of fossil fuel companies.

The United Nations declined to comment to Table.Media on the allegations against NZBA in the United States. “We do not comment on political developments in individual UN member states or on our discussions with regulators there,” a UN spokesperson said upon inquiry.

Since August 2022, the large Swiss bank UBS has also been on such a list in Texas. This is why Ken Paxton, the state’s attorney general, prohibited the bank from subscribing to bonds worth 18.6 million US dollars issued by the Normangee Independent School District. The fact that the deal was agreed upon before August 2022 did not matter, nor did the bank’s assurances that it was not calling for a boycott of energy companies in the first place. A few days ago, a settlement was reached. UBS must pay $850,000 in compensation to the school district for additional costs incurred in reissuing the bonds at a higher interest rate. Of course, UBS was not allowed to bid this time.

Paxton expressed his satisfaction with the outcome: “I remain committed to combatting the corporate ESG investment agenda, shielding taxpayers from the extra costs that come with it by shifting the burden to banks, and protecting Texas energy companies.”

May 25; 12 a.m., Brussels

Seminar Hydrogen – Tale of the future or a real game changer?

To further increase European renewable hydrogen targets, the European Commission complemented the adoption of the EU Hydrogen Strategy with the publication of the REPowerEU plan in May 2022. These initiatives are designed to accelerate the introduction of renewable hydrogen, ammonia and other derivatives in energy-intensive industrial processes and hard-to-decarbonize industries. The Euractiv roundtable will discuss how realistic the plans are. Info

May 25; 8.30 p.m., online

Webinar COP28 and Beyond: How to Meet the Needs of Climate-Vulnerable Countries

The World Resources Institute webinar will discuss how vulnerable countries can be protected and strengthened in the COP process and beyond. Info and registration

May 25-26; Instanbul, Türkiye

Workshop Climate adaptation, transboundary water management, and political stability in the Middle East

The effects of climate change on water supply, food security, migration, and political stability are becoming evident in the Middle East. Discussions and policy recommendations developed during the workshop will feed into CASCADES’ ongoing consultation and outreach process with the European Commission and other European stakeholders. Infos

May, 4 p.m.; Online

Webinar Women energize Women – Feminist Energy Policy – What does it entail and how to achieve it?

In recent years, more and more states have adopted feminist foreign policy approaches. The definitions of what feminist foreign policy entails are broad and varied. The same applies to feminist energy policy, a term used less frequently but that has gained increasing attention in recent years. On the webinar of the German Renewable Energy Federation, we will discuss what is behind it. Info and registration

The images from the flooded Emilia-Romagna region in Italy look all too familiar: Flooded cities and regions, faces frozen in shock, politicians in rubber boots. Flooding caused by heavy rain, but also by rising sea levels, is one of the most visible consequences of climate change.

1.8 billion people, almost a quarter of the world’s population, are at serious risk of floods. Even though the comparatively wealthy Netherlands is home to the largest share of the population at risk of flooding, people in the Global South are the most vulnerable. According to the Climate Inequality Report, nine of the ten countries most threatened by flooding are low- and middle-income countries. These are countries that have contributed least to climate change and have few resources for adaptation measures or coping with the damage. nib

Climate change is having a massive impact on the Hindu Kush-Himalaya water system and endangering the water and energy supply of 16 Asian countries, according to a new analysis by the think tank China Water Risk (CWR). The advancing climate change is threatening the water levels of major rivers such as the Ganges, Brahmaputra, Yangtze, Yellow River and Mekong. These and five other major rivers in the region provide water for almost three-quarters of the hydropower and 44 percent of the coal-fired power plants in the 16 countries. Coal-fired power plants use water for cooling and steam generation to drive the generators.

Over 330 gigawatts of power plant capacity are already located in regions with “high or extremely high water stress” – enough to power Japan. One-third of the installed capacity in India is spread across three rivers, while about half of the installed capacity in China is distributed across seven rivers.

The river levels are influenced by “glacial melt, snow/rainfall and monsoon patterns are all impacted by climate change”. “One in two Asians live in these 10 river basins where over 4.3 trillion US dollars of GDP is generated annually,” explains Debra Tan, head of CWR and lead author of the report.

The authors proposes, among other things:

The impact of low water levels on electricity supply was evident in the summer of 2022 in the Chinese provinces of Yunnan and Sichuan. Due to persistent drought, the levels of reservoirs and rivers had dropped significantly, resulting in reduced hydropower generation. This led to power rationing, with the industrial sector being the hardest hit. Some households also experienced restrictions in their supply. nib

According to a Reuters report, the Brazilian government plans to tighten its Nationally Determined Contribution (NDC) climate target filed with the United Nations before the end of the year. However, the decision has not been officially confirmed. Reuters cites two anonymous sources “with direct knowledge of the matter.”

The background: The former government under Jair Bolsonaro had already tightened Brazil’s NDC once in 2021 amid international pressure, but only on the surface: It announced plans to cut the country’s emissions by 50 percent by 2030 instead of just 43 percent, as previously planned. However, because it used a different base year for this, the two reduction rates were not easy to compare. The Brazilian environmental organization Climate Observatory calculated that the new target actually allowed for significantly more emissions than before.

The government of President Luiz Inácio Lula da Silva now wants to remedy the issue, Reuters reports. According to the report, the reduction quota of 50 percent is to be maintained and the problem with the base year is to be solved. A new, “more ambitious” target is to be formulated.

It would not be surprising: During the election campaign, Lula’s former environment minister and advisor on environmental issues, Izabella Teixeira, already announced that Lula would tighten the country’s “insufficient” climate targets in the event of a win. Brazil’s president took office with a promise to make the country a climate action leader. Above all, that includes stopping deforestation in the Amazon. The rainforest is considered one of Earth’s most important greenhouse gas sinks and is, therefore, of immense importance for global climate action. But deforestation, which particularly increased under Lula’s predecessor Bolsonaro, is threatening this function. rtr/ae

The EU will need additional financial resources to meet its 2030 climate targets, a new study says. Programs to involve private investors such as InvestEU are “no substitute for additional public spending at the EU level,” write the experts from the Jacques Delors Centre at Berlin’s Hertie School in the paper, which will be published today. The European economy “cannot be greened cheaply” in this way.

The EU Commission launched InvestEU in 2018 as the successor to the EFSI, often referred to as the Juncker Fund. With the help of guarantees totaling 26.2 billion euros from the EU budget, the Commission hopes to mobilize more than 372 billion euros in private and public investment by 2027. The funds will be allocated to investors via the European Investment Bank and 14 other development banks.

In its current form, the report says InvestEU is an effective instrument for financing projects with a low risk profile, such as the energy-efficient modernization of properties. However, many investments in future technologies envisaged in the Green Deal Industrial Plan, such as hydrogen drive technologies, are associated with considerable technological uncertainties. In order for the investments to be realized, the public sector would have to bear a significant part of the risks for the investors – for example, through equity financing, as made possible by the EU Innovation Fund. Climate change adaptation projects, on the other hand, are not commercially viable in the longer term and therefore depend on public subsidies.