Germany’s economy minister Robert Habeck was in Washington this Monday and Tuesday to negotiate the direction of the Inflation Reduction Act with his US counterparts. The goal is to nip a green economic war between the US and the EU in the bud. Habeck came with proposals for green free trade. Bernhard Pötter is on the ground for us and has the details.

While Habeck is working on improving German-American relations, China has caused a lot of raised eyebrows in the US. A Chinese spy-or-weather balloon – balloon experts are divided – recently passed over US territory and was ultimately shot down. What flew under the radar was a news item that could have a far greater impact on the Western-Chinese relationship: The People’s Republic wants to restrict the export of solar manufacturing equipment. We have taken a closer look at the plan: It will set back plans for the development of a Western solar industry – and slow down the energy transition.

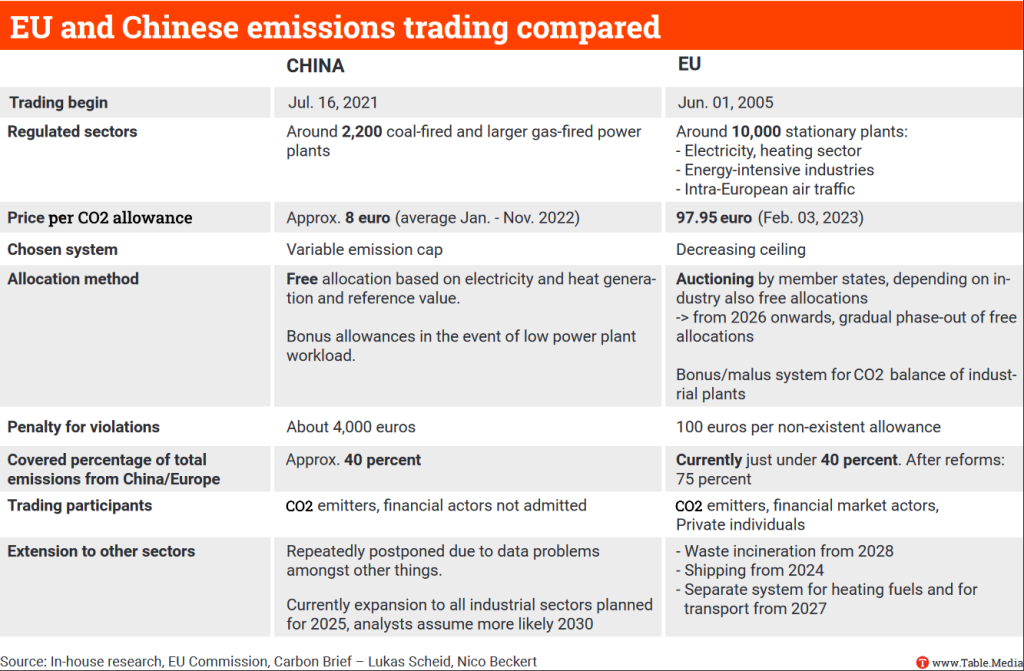

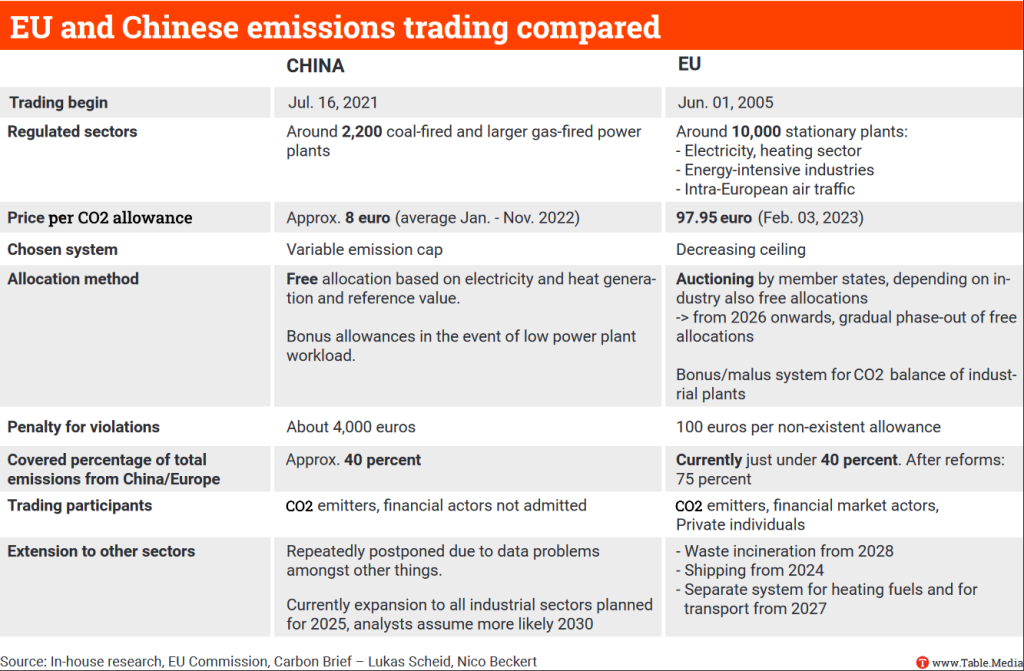

China shows much less activity when it comes to reforming its emissions trading system. It will have no effect on the climate for years to come. Experts do not expect a clear allowance cap and an expansion to other economic sectors before the end of the decade. Our analyses show the ETS problems and what they mean for Europe’s CBAM.

It is a minor announcement that could have a major impact: China wants to place an export ban on important technologies for the production of solar systems. A final decision on this is still pending. A public consultation was open until the end of January. But all China experts consulted are certain that the export restrictions will come. Once a consultation period is over, China rarely reverses major changes to regulations, according to Rebecca Arcesati, an analyst at the German China think tank Merics.

If the plan goes through, the export of solar production technologies will only be possible with the authorities’ approval. “It will not be easy to obtain such permits,” says trade expert Wan-Hsin Liu of the Kiel Institute for the World Economy. The application is said to be a complicated process.

First, a request has to be submitted, which is then reviewed based on, for example, security and industrial policy aspects. “Only then are companies allowed to negotiate the deals with potential buyers,” Liu says. If buyer and seller agree on the deal, a second export license must be applied for “with further documents”.

The export restrictions will “definitely” slow down the development of own production capacities in western countries, says Johannes Bernreuter, an expert on solar supply chains. The know-how still exists, even outside China. But “the production capacities are tiny and not price-competitive”.

Chinese production plants are much cheaper than Western ones – partly due to years of government subsidies for the sector, says the expert, who runs his own consulting agency. Due to the lack of price competitiveness, Western manufacturers of production equipment have withdrawn from the market. The Chinese export ban will therefore hit the Western industry at a critical weak point, Bernreuter says.

The export restrictions would affect:

The People’s Republic is the global leader in the production of these solar precursors. 97 percent of the solar wafers and ingots produced worldwide come from China.

In solar production equipment, too, China is the global market leader. Developing a solar industry in the West without using Chinese equipment is “almost impossible”, according to the analysts of the think tank Bloomberg NEF. The barriers to entry for the production of wafers and ingots are very high, they say. “The bleeding-edge knowledge” of photovoltaic manufacturing is in China, say the BNEF analysts.

These export restrictions do not come at a surprising juncture. The USA recently earmarked billions in subsidies for the development of green industries under the Inflation Reduction Act. The EU also wants to catch up in green technologies. And India is taking big steps to build up its own solar industry.

So China sees its dominance in the sector threatened. The solar sector is an important economic sector:

Restricting solar manufacturing tech exports is also politically motivated. “Beijing wants to keep Western countries dependent on China whenever possible and shore up dominance over the tech supply chains it controls,” says Merics analyst Arcesati. The country has built its export control system in recent years “to defend its security, economic, technological and industrial interests”. China’s decision should also be understood as a response to the US Inflation Reduction Act and the EU’s efforts to build its own green supply chains, according to the analyst.

The export restrictions on solar manufacturing technologies “are about China’s national security,” says Wan-Hsin Liu of the Kiel Institute for the World Economy. “It is economically as well as geopolitically crucial for China to protect its technological strength and competitive advantages in solar manufacturing.” These export restrictions could “slow down or even hinder” other countries’ efforts to build their own solar supply chains, Liu says.

The gravity of the decision is also evident from other goods that China has already added to its “export restriction list” in the past. The list was first issued in 2008. Technologies for the extraction and processing of rare earth elements were blacklisted early on, making exports of these technologies illegal. China is also the world leader in the extraction and export of rare earth elements and has almost established a monopoly in the meantime.

Beijing used its dominance over rare earth elements in a territorial dispute against Japan in 2010. It enacted an export ban and placed Japan under enormous pressure. Over the past few years, China has developed its export control system “to defend its security, economic, technological and industrial interests”, says Arcesati of Merics.

However, it is uncertain whether China will not hurt itself in the long run with these export restrictions. “Threats of controlling solar tech will make others increase efforts to diversify,” speculates energy expert Lauri Myllyvirta of the Centre for Research on Energy and Clean Air on Twitter. A similar case was observed with the Chinese rare-earth embargo against Japan. The neighboring country stepped up its efforts to diversify its supply sources.

The EU and the US want to cooperate more closely on the exchange of green goods. “We discuss whether common markets can be created through common standards and standard setting in green industries,” said Federal Minister for Economic Affairs Robert Habeck at the end of his visit to Washington on Tuesday. This is supposed to be achieved by the already existing expert group between the US and the EU, the Trade Technology Council (TTC).

He said the talks were not about a comprehensive free trade agreement but about practical agreements: For example, products approved in the US market could automatically be approved in Europe – and vice versa, Habeck said. This way, a “green bridge across the Atlantic” will be built.

The move shows how the US and the EU intend to move carefully toward each other in the dispute over subsidies for green US products. On Tuesday, Habeck came to Washington with French Economy and Finance Minister Bruno Le Maire to register European interests and sound out room for maneuver with the US government. In “close consultation with the EU Commission,” which is leading the negotiations, as was repeatedly emphasized.

Both ministers completed a day of talks in Washington: Habeck visited Secretary of Energy Jennifer Granholm, Secretary of State Antony Blinken, Treasury Secretary Janet Yellen, Secretary of Commerce Gina Raimondo and Trade Representative Katherine Tai, and US President Biden’s IRA advisor John Podesta.

Habeck praised the Inflation Reduction Act (IRA) repeatedly, through which the US Congress cleared the way last summer for massive investments, including in green technologies: Some 370 billion dollars will be spent over ten years on renewable energies, green hydrogen, clean mobility, battery production and carbon storage (CCS), among other things. The package is intended to help reduce carbon emissions in the USA by one billion metric tons a year by 2030. According to a comprehensive study, it thus achieves two-thirds of the reduction needed to bring the US to net-zero emissions by 2050 as agreed.

The IRA is particularly important in the US because:

For US President Joe Biden, the passage of the IRA in the summer of 2022 was a great and surprising success. The subsidy package was also a key topic of his address to the nation Tuesday night.

“We have been pushing the US to get serious about climate protection for a long time, and the IRA is a great thing,” Habeck said. Le Maire also stressed that a strong European industry cooperates best with a strong American industry. According to Habeck, European industries such as plant engineering would also benefit greatly from the IRA and the demand for products.

However, Le Maire also stressed the need for fairness in mutual dealings. This statement refers to provisions in the IRA, according to which about 60 percent of all tax incentives include a “local content” clause. This means products must be made in whole or in part in the US or originate in Canada or Mexico, with which the US has free trade agreements. The EU announced that it would also streamline its state aid rules in response to the IRA.

Europe pushes for changes in the IRA, particularly in the following areas:

Habeck and Le Maire emphasized that they did not expect the IRA to be changed again as a legislative package. They said it was now about progress in implementing provisions.

A new study by the German Institute for Economic Research (DIW) shows the importance of supply chains for green growth in the USA. According to the study, 76 percent of critical raw materials so far come from countries that do not have a free trade agreement with the US. In the case of critical green techs such as photovoltaics, wind turbines or lithium batteries, more than half of the raw materials come from non-free trade countries.

“With the Inflation Reduction Act, the US primarily wants to support its domestic economy, make it more resilient to supply bottlenecks, and position itself as a technology leader. But their strong dependence on raw materials and technology could mean they continue to rely on countries without free trade agreements,” explains study author Josefin Meyer.

The launch of China’s Emissions Trading System (ETS) in the summer of 2021 started off with high hopes. It is the largest ETS in the world and covers 40 percent of all Chinese emissions – 4.5 billion tonnes of carbon per year. Unfortunately, however, the system is plagued by design flaws that at best improve the efficiency of power plants, but cannot help reduce emissions. And frequent problems arise with the submitted emissions data. Analysts predict that it will take until the end of the decade before China’s emissions trading is effectively revised.

Almost 80 percent of all data reported by companies participating in the ETS have been found to be deficient, according to the Chinese Ministry of Ecology and Environment. The authorities now want to improve data gathering and monitoring with new guidelines.

Emissions from coal and gas-fired power plants are not measured directly. Instead, the plants calculate them based on the coal used to generate electricity and the efficiency of the plants. Authorities do not sufficiently monitor companies in this process. This is the reason for several data scandals in the past:

These scandals have increased pressure on the authorities to close loopholes, says Yan Qin, an analyst at Refinitiv, a provider of financial market data. The new regulations are “stricter in terms of checking the coal used”, she says. But controls themselves have not been tightened. The guidelines “do not provide for more spot checks, nor do they change the penalties for non-compliance with the requirements of the emissions trading system”, says Zhibin Chen, Senior Manager at the research and consulting institute Adelphi.

This leaves two major problems:

Reliable data is also important for the expansion of emissions trading to other sectors. So far, only larger coal and gas-fired power plants are included. The expansion to steel, cement and aluminum has been postponed repeatedly, partly due to the lack of reliable data.

Another problem is the flawed design of China’s emissions trading system. There is no cap on allowances, as is the case with the European ETS. Instead, emission allowances are allocated under a complicated benchmark system, which is based on emission intensity:

This energy intensity-focused ETS “can only improve the overall efficiency of the coal plants but cannot cap the emission of the power sector”, says Qin. Instead, this wrong focus “incentivize the build out of newer coal plants“.

So far, China’s emissions trading system has only finished its trial phase. Trading mechanisms have been established and participating companies have developed an awareness that emissions will cost money (in the future), says journalist Xiaoying You.

Projections for the expansion of the ETS to other sectors vary:

Qin also predicts that it will take at least until 2028 before China switches to a fixed allowance cap. A transition from the flexible to the fixed cap will be easier once allowance trading is established. She also believes that energy demand will continue to rise until late in the 2020s. “Therefore, it is difficult to set a fixed cap for the ETS too early.” So China’s emissions trading will continue to have hardly any climate impact in the near future.

In theory, the climate tariff CBAM applies to importers to Europe: Anyone who pays a carbon price on their products will receive a corresponding deduction when calculating the carbon import fee. This applies to all products that fall under the CBAM: cement, fertilizer, electricity, hydrogen, iron and steel, and aluminum.

This means in practice that, for example, instead of paying the full EU carbon price on steel imports, Chinese steel producers will be granted a discount on the Chinese carbon price – if they have to pay it at all in China until the introduction of CBAM.

However – and this is where it gets complicated – the Chinese steel producer must prove to the European authorities how much carbon dioxide was actually emitted during production. This carbon footprint for the product must be certified by an institution unrelated to the producer and state authorities, according to the regulation on the introduction of CBAM recently agreed in the trilogue.

The unreliable data situation of emissions from Chinese plants could present a problem for the assessment of climate tariffs on Chinese manufacturers. “It remains to be seen how much external scrutiny China will tolerate,” says Verena Graichen, ETS expert and senior researcher for energy and climate protection at the Öko-Institut. She says that although the Clean Development Mechanism (CDM) – a climate action instrument from the Kyoto Protocol – also has an international verification system that works in China, the country does not like others to take a closer look at its systems, says Graichen.

This will likely make it difficult for European authorities to reconstruct the data provided by China. At the same time, from a trade policy perspective, the EU cannot do without the promised CBAM rebate. “Because China has an emissions trading system and charges a carbon price, there also has to be a deduction in the CBAM for products covered by the Chinese ETS,” says Graichen. But she points out that the EU has found a loophole for such cases.

Since, as things stand, the EU Commission cannot rely on emissions data to assess the Chinese carbon price, it has the option of using its own criteria. If the actual emissions of a product cannot be determined, the average emission intensity of the product from the country of origin is taken and a “proportionally fixed price premium” is applied.

If there is no data from the country of production on this median value either, the emission intensity of the European plants with the worst performance is automatically applied to the product. In this way, European legislators hope to put pressure on their trading partners to provide reliable emissions data for their products.

How data reporting by foreign importers works in practice, in which form information is provided and how the foreign paid carbon price will be converted into rebates for the purchase of CBAM allowances, is still something the Commission intends to decide in so-called implementing acts. “Article 9 of the CBAM Directive only explains the principle, not the implementation,” Graichen said.

Even though the introduction of CBAM and the unreliability of China’s emissions trading system will impact trade policy on both sides, the actual proportion of Sino-European trade affected by CBAM is relatively small. China exported goods worth 472.7 billion euros to the EU in 2021. The sectors covered by CBAM accounted for only 1.8 percent of China’s exports to the EU in 2019, an analysis found.

Europe’s arguments for working towards a low-emissions industry in China have thus only grown slightly with CBAM. But there is another fear regarding the future of Sino-European trade. European industry circles that are critical of CBAM have repeatedly voiced that Chinese plants producing at low emissions could be prioritized for exports to avoid the CBAM fee. The dirty steel would then instead be used in the domestic market. This would do the climate not much good, the accusation goes, and European producers would be forced to compete with the Chinese product.

Graichen, on the other hand, does not necessarily see this as a disadvantage. The principle of emissions trading is precisely that producers with low emissions should have an advantage – both in the EU and in China. Competitive pressure would indeed increase for European producers with high emissions. But “emissions trading in combination with CBAM can help Europe become a leading market for green steel. And green leading markets also challenge the industry.” The consequence would have to be that European suppliers make their steel production even greener due to competitive pressure from China. This is the logic of carbon pricing, says the Öko-Institut scientist.

What is also clear is that the idea of CBAM is not to promote the decarbonization of other countries, but to protect European industry from carbon leakage and to compensate for the gradual phase-out of free allowances.

Feb. 9, 2023, 6 p.m. CET, online

Webinar Managing Water and Climate Change in South Asia and Germany

The connections between water and the climate crisis are the topic of the discussion event organized by the Friedrich Naumann Foundation. The focus will be on the challenges water management will face in the future. Cases of extreme weather events in Asia and Germany will be compared. Info and registration

Feb. 12, 2023, 11 a.m. CET, online

Publication Energy Technology Perspectives 2023

In this report, the International Energy Agency (IEA) analyzes the current risks and opportunities for developing renewables. Against the backdrop of the war in Ukraine, it also looks at how governments can make their energy supply chains more resilient. Info

Feb. 16, 2023, 11:30 a.m. CET, online

Publication 4C Carbon Outlook Launch

This webinar will discuss the findings presented in the Carbon Outlook 2022, released by the EU-funded project 4C (Climate-Carbon Interactions in the Current Century) in collaboration with Global Carbon Project researchers. Info

Feb. 17-19, 2023, Munich

Conference Munich Security Conference

The 59th Munich Security Conference brings foreign and security policy debates to Munich for three days. Almost a year after Russia invaded Ukraine, MSC 2023 is also an opportunity to take stock of cohesion within the alliance and political commitment to the rules-based international order. Info

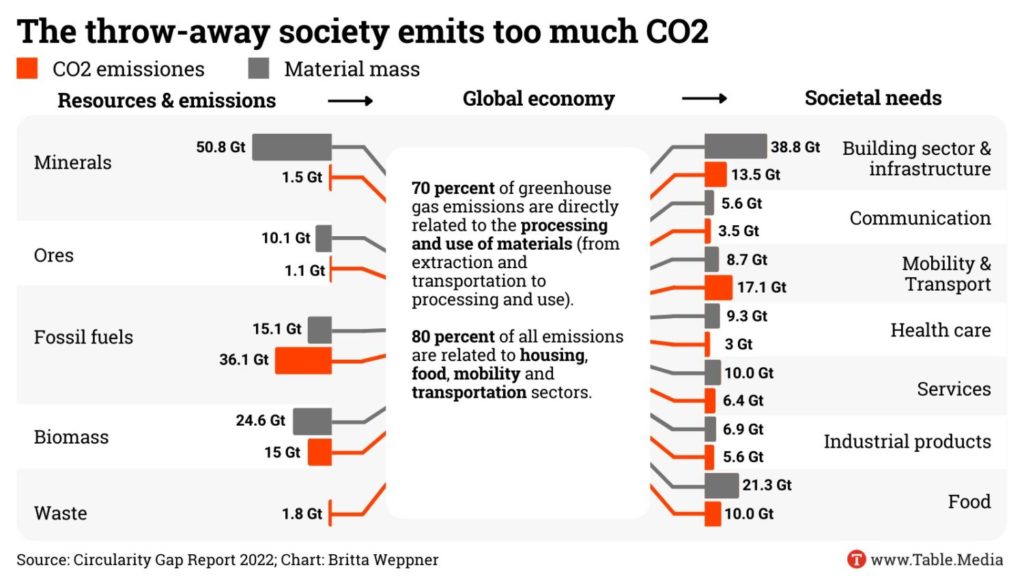

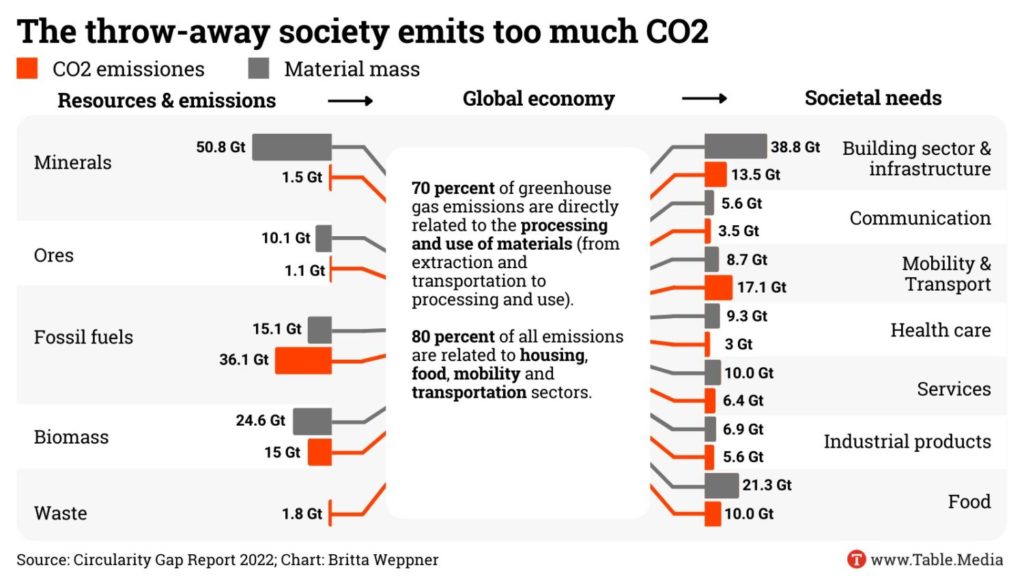

Mankind – and especially the rich parts of society in the Global North – are still living too grand. We are still a long way from a circular economy. Only 7.2 percent of the goods and raw materials extracted from the ground and produced worldwide are actually recycled. This is revealed by the Circularity Gap Report of the Circularity Gap Reporting Initiative.

The report states that 70 percent of global greenhouse gas emissions are tied to the processing and use of raw materials and goods. To satisfy “global wants and needs,” nearly 60 billion metric tons of greenhouse gases were generated in 2019. 80 percent of that came from housing and infrastructure, transportation and mobility, and food, the authors write. “Unless we radically transform how we use materials to satisfy our needs, we cannot meaningfully cut emissions,” the report concludes. nib

In addition to the German government’s security strategy, which is currently being debated, the Federal Foreign Office is also working on a foreign climate policy strategy. The concept is currently being drafted in the ministry of Annalena Baerbock (Greens). In several rounds of coordination within the ministry and with representatives of civil society, this strategy is intended to bring to life what Baerbock has announced since taking office: A foreign policy that is increasingly oriented toward the global fight against climate change and its consequences as well as taking her concept of “feminist foreign policy” into account.

At the same time, the Foreign Ministry has internally designated over 50 of its foreign missions to give particular impetus to foreign climate policy. These include all embassies in the G20 states and the countries of the “V20,” which are particularly vulnerable to the effects of the climate crisis. These include the Philippines, Bangladesh, Costa Rica and Ethiopia.

The Foreign Office stated that there was no overall draft of the strategy yet. So far, only the titles of the individual chapters have been finalized. They sound more or less like the primary goals of the UNFCCC climate process:

According to a study by the United Nations Environment Programme (UNEP), the growth of bacteria is accelerating due to higher temperatures and pollutants, and antibiotic-resistant “superbugs” are becoming more common.

With rising temperatures, climate change is both increasing the frequency of infections with antibiotic-resistant germs and causing the germs to spread faster due to extreme weather events. The risk of developing “superbugs”, like antibiotic-resistant bacteria, parasites, viruses and other disease vectors, increases particularly sharply in polluted waterways because they provide protection and a suitable breeding ground, according to the UN study.

Antibiotic resistance could be responsible for up to 10 million annual deaths by 2050. Therefore, UNEP proposes implementing the “One Health” approach, which collectively covers human, animal and ecosystem health. Specifically, action would also need to be taken against pollution sources of water bodies.

Other pathogens are also spreading faster because of climate change: For example, tropical mosquitoes can also survive in Central Europe and spread diseases such as dengue and chikungunya fever. kul

In order to still meet the 1.5-degree target, large coal-consuming countries like China, India or South Africa would have to phase out coal-fired power generation at an unprecedented rate. The phase-out would have to happen more than twice as fast as other changes in a major energy source of the past 50 years – including those in times of crisis such as wars and state collapses. This is the result of a new study recently published in the scientific journal Nature Climate Change.

The authors conclude that the current rate of the coal phase-out is hardly socially acceptable. They suggest stronger efforts by the EU and the USA to reduce oil and gas consumption more quickly and thus give coal-dependent countries more leeway – without jeopardizing the 1.5-degree target.

Researchers at University College London and the International Institute for Sustainable Development (IISD) have calculated reduction pathways and concluded that:

Lead author and energy expert Greg Muttitt says that research shows that “climate models and policy debates rely too much on winding down coal at a pace that may not be feasible for coal-dependent developing countries.” Instead, more emphasis should be “placed on oil and gas phase-out.” He demanded that the Global North make a greater effort.

Meanwhile, BP announced on Tuesday plans to invest in expanding oil and gas production as quickly as possible. This is to be achieved through acquisitions and an expansion of production, as Bloomberg reports. In the medium term, the company plans to cut oil and gas production by only 25 percent. The group originally set a target of a 40 percent reduction by 2030. nib

France’s minister for ecological transition, Christophe Béchu, wants to prepare France for a warming of four degrees Celsius. Such a scenario must also be modeled in the third national plan for adaptation to climate change, Béchu said at an event organized by France Stratégie and the think tank Institut de l’Économie Pour le Climat (I4CE).

Paris is currently working on the third National Plan for Adaptation to Climate Change (PNACC). Béchu’s announcement means that the future plan could include two scenarios: One described by the minister as “optimistic,” based on the Paris Agreement pathway (+1.5 °C, or +2 °C globally), and one described as “pessimistic,” which is “undoubtedly more realistic given current dynamics.” The second scenario predicts a global temperature increase of at least +2.5 °C, which would correspond to an increase of +4 °C for France. “This scenario is essential for raising awareness in this country,” the minister continued.

“This announcement marks an important turning point,” Magali Reghezza, a geographer and member of the High Council on Climate, wrote on Twitter. “We need to take the time to assess what this +4 °C means for our regions, our daily lives and our jobs.” The High Council on Climate (“Haut conseil pour le climat”) was founded by Emmanuel Macron in 2018 and is tasked with independently advising the government’s climate policies. cst

The climate crisis could reduce the number of climate refugees, a new study shows. What sounds contradictory has a simple reason: The effects of climate change are causing more people to lose their livelihoods. As a result, they have less money to afford to flee in the first place.

Scientists at the Potsdam Institute for Climate Impact Research (PIK) have used models to examine the economic consequences of climate change and the impact on international migration. Their models also take into account that migration from middle-income countries is highest and that fewer people migrate from poorer countries, a fact that has been studied for some time.

According to the researchers’ model calculations, climate change will have a negative impact on economic growth and push poorer countries – in Africa, South Asia and West Asia – further away from the income threshold above which migration increases. Currently, most migration from these countries already happens within their respective regions of the world. Another factor for decreasing migration is that other states in the respective poorer regions of the world are becoming less attractive due to climate change.

Between the wealthier nations of the Global North, however, migration is more likely to increase due to climate change and declining incomes. Accordingly, climate change could lead to an increase in migration from Europe, Latin America and East Asia in North America. nib

Denmark has awarded its first three licenses allowing companies to store CO2 under the seabed of the North Sea on a larger scale. The permits went to the TotalEnergies group and a consortium comprising the companies Ineos and Wintershall Dea, the Danish climate and energy ministry announced on Monday. This means that work could begin immediately. It is expected that the two projects will be able to store up to 13 million tons of carbon dioxide per year under the Danish part of the North Sea, starting in 2030.

The Danish Energy Agency recommended that the ministry award the first three permits for research into major CO2 storage in the North Sea to the companies in question. It is an important step in making Denmark’s CCS strategy a reality, according to the agency. CCS stands for carbon capture and storage. The process captures emitted CO2 and pumps it underground.

Denmark wants to reach net-zero by 2045. Shortly after COP27, the new government in Copenhagen even announced a new net emissions reduction target of 110 percent by 2050.

TotalEnergies’ project is called Bifrost and is expected to store up to 3 million metric tons of CO2 in an already depleted oil and gas field starting 2027 – eventually accumulating to 5 million metric tons by 2030. Ineos and Wintershall Dea plan to start storing up to 1.5 million metric tons of CO2 in depleted oil and gas fields in the North Sea with the Greensand project by 2025. In 2030, capacity is to be increased to 8 million tons per year.

According to Reuters information, the Danish state intends to bear just under half of the total investment of the equivalent of 60 million euros for Greensand and 21 million euros for Bifrost. dpa/luk/rtr

Sabine Nallinger is pleased with Joe Biden’s green industrial policy. The momentum created by the US will help Europe’s industry transform itself “and keep the 1.5-degree target within reach,” says Nallinger, who heads Stiftung KlimaWirtschaft. Nallinger also welcomes the recently unveiled EU Green Deal Industrial Plan. However, she says more clarity is needed on how the EU intends to position itself vis-à-vis global competitors. “Simpler processes, faster allocation of funds and more pragmatism” would have to be the focus. “The long-term goal of carbon neutrality” must continue to be pursued. Industrial policy measures should not hinder climate protection.

Nallinger has been interested in nature and climate protection since she was a child. On her school bag, she would carry buttons with slogans such as “The Greens are here” or “Nuclear power no thanks!” Her grandfather and father were successful German entrepreneurs. They did not want to hear about what was on her mind every day: dying forests, nuclear power, famine in Africa.

Since September 2014, the 59-year-old has been a member of the board of Stiftung KlimaWirtschaft, which was founded in 2011 under the name Stiftung 2° by CEOs, managing directors and family business owners. The foundation aims to help achieve a net-zero economy. Its supporters include many different companies, such as GLS Bank, the cruise provider Aida Cruises and Aldi Süd. Nallinger speaks with politicians and business leaders, supports initiatives, and helps create networks. But she never goes for confrontation. She is stern but constructive, says Nallinger.

KlimaWirtschaft also conducts studies to analyze concrete action plans for companies on the road to net zero. The foundation also launched a transformation tracker that monitors how far the climate action plans set out in the German government’s coalition agreement have been implemented.

But things do not always run smoothly: Greenwashing is an issue that concerns Nallinger. Scandals involving large corporations are the reason why KlimaWirtschaft was formed. The aim is to bring together companies that are serious about climate protection. “We choose our sponsoring companies carefully,” says Nallinger. “If we were to engage in greenwashing ourselves, we would lose our purpose.”

Nallinger even brings competitors to the same table. Most recently, two steel companies, Thyssenkrupp and Salzgitter AG, came together at the initiative of KlimaWirtschaft to discuss greener production with politicians. Thyssenkrupp alone accounts for 2.5 percent of Germany’s emissions.

Nallinger was already interested in politics in her youth. Back then, she says, there were the first major reports about how the earth’s resources were finite and how rich countries were doing business at the expense of poor countries. So she started taking action. She stopped eating meat, took to the streets against nuclear power. This was followed by studying urban, transport and environmental planning, as well as project work for NGOs. Nallinger has worked for more than two decades in the field of eco-friendly regional, urban and transport planning, including for the city of Munich and its public utilities, as well as for environmental associations. Between 2008 and 2020, she was a city councilor for the Green Party and currently serves on the supervisory board of Vattenfall Wärme Berlin AG.

What has she learned from all this? “It’s the economy, stupid!” she quotes the famous phrase of US President Bill Clinton. She believes that companies can achieve more and faster climate action than politicians. “When in doubt, implementation is faster there, and I’m sometimes a bit impatient,” says Nallinger.

Tempo, Tempo, Tempo! These are the three things that environmental action currently needs. Nallinger is worried. The green transformation was actually going well in recent years, she believed. But then crises hit: the pandemic, the Ukraine war. Climate concerns took a back seat again. “I can sympathize very well with the people from Fridays for Future,” Nallinger says. “I am all too familiar with this feeling of powerlessness.”

Germany is supposed to become carbon-neutral by 2045. No company will survive on the market if it does not orient its business model toward net-zero now. Nallinger is sure of that. “They will exit the market, as harsh as that sounds.” Anna Scheld

Germany’s economy minister Robert Habeck was in Washington this Monday and Tuesday to negotiate the direction of the Inflation Reduction Act with his US counterparts. The goal is to nip a green economic war between the US and the EU in the bud. Habeck came with proposals for green free trade. Bernhard Pötter is on the ground for us and has the details.

While Habeck is working on improving German-American relations, China has caused a lot of raised eyebrows in the US. A Chinese spy-or-weather balloon – balloon experts are divided – recently passed over US territory and was ultimately shot down. What flew under the radar was a news item that could have a far greater impact on the Western-Chinese relationship: The People’s Republic wants to restrict the export of solar manufacturing equipment. We have taken a closer look at the plan: It will set back plans for the development of a Western solar industry – and slow down the energy transition.

China shows much less activity when it comes to reforming its emissions trading system. It will have no effect on the climate for years to come. Experts do not expect a clear allowance cap and an expansion to other economic sectors before the end of the decade. Our analyses show the ETS problems and what they mean for Europe’s CBAM.

It is a minor announcement that could have a major impact: China wants to place an export ban on important technologies for the production of solar systems. A final decision on this is still pending. A public consultation was open until the end of January. But all China experts consulted are certain that the export restrictions will come. Once a consultation period is over, China rarely reverses major changes to regulations, according to Rebecca Arcesati, an analyst at the German China think tank Merics.

If the plan goes through, the export of solar production technologies will only be possible with the authorities’ approval. “It will not be easy to obtain such permits,” says trade expert Wan-Hsin Liu of the Kiel Institute for the World Economy. The application is said to be a complicated process.

First, a request has to be submitted, which is then reviewed based on, for example, security and industrial policy aspects. “Only then are companies allowed to negotiate the deals with potential buyers,” Liu says. If buyer and seller agree on the deal, a second export license must be applied for “with further documents”.

The export restrictions will “definitely” slow down the development of own production capacities in western countries, says Johannes Bernreuter, an expert on solar supply chains. The know-how still exists, even outside China. But “the production capacities are tiny and not price-competitive”.

Chinese production plants are much cheaper than Western ones – partly due to years of government subsidies for the sector, says the expert, who runs his own consulting agency. Due to the lack of price competitiveness, Western manufacturers of production equipment have withdrawn from the market. The Chinese export ban will therefore hit the Western industry at a critical weak point, Bernreuter says.

The export restrictions would affect:

The People’s Republic is the global leader in the production of these solar precursors. 97 percent of the solar wafers and ingots produced worldwide come from China.

In solar production equipment, too, China is the global market leader. Developing a solar industry in the West without using Chinese equipment is “almost impossible”, according to the analysts of the think tank Bloomberg NEF. The barriers to entry for the production of wafers and ingots are very high, they say. “The bleeding-edge knowledge” of photovoltaic manufacturing is in China, say the BNEF analysts.

These export restrictions do not come at a surprising juncture. The USA recently earmarked billions in subsidies for the development of green industries under the Inflation Reduction Act. The EU also wants to catch up in green technologies. And India is taking big steps to build up its own solar industry.

So China sees its dominance in the sector threatened. The solar sector is an important economic sector:

Restricting solar manufacturing tech exports is also politically motivated. “Beijing wants to keep Western countries dependent on China whenever possible and shore up dominance over the tech supply chains it controls,” says Merics analyst Arcesati. The country has built its export control system in recent years “to defend its security, economic, technological and industrial interests”. China’s decision should also be understood as a response to the US Inflation Reduction Act and the EU’s efforts to build its own green supply chains, according to the analyst.

The export restrictions on solar manufacturing technologies “are about China’s national security,” says Wan-Hsin Liu of the Kiel Institute for the World Economy. “It is economically as well as geopolitically crucial for China to protect its technological strength and competitive advantages in solar manufacturing.” These export restrictions could “slow down or even hinder” other countries’ efforts to build their own solar supply chains, Liu says.

The gravity of the decision is also evident from other goods that China has already added to its “export restriction list” in the past. The list was first issued in 2008. Technologies for the extraction and processing of rare earth elements were blacklisted early on, making exports of these technologies illegal. China is also the world leader in the extraction and export of rare earth elements and has almost established a monopoly in the meantime.

Beijing used its dominance over rare earth elements in a territorial dispute against Japan in 2010. It enacted an export ban and placed Japan under enormous pressure. Over the past few years, China has developed its export control system “to defend its security, economic, technological and industrial interests”, says Arcesati of Merics.

However, it is uncertain whether China will not hurt itself in the long run with these export restrictions. “Threats of controlling solar tech will make others increase efforts to diversify,” speculates energy expert Lauri Myllyvirta of the Centre for Research on Energy and Clean Air on Twitter. A similar case was observed with the Chinese rare-earth embargo against Japan. The neighboring country stepped up its efforts to diversify its supply sources.

The EU and the US want to cooperate more closely on the exchange of green goods. “We discuss whether common markets can be created through common standards and standard setting in green industries,” said Federal Minister for Economic Affairs Robert Habeck at the end of his visit to Washington on Tuesday. This is supposed to be achieved by the already existing expert group between the US and the EU, the Trade Technology Council (TTC).

He said the talks were not about a comprehensive free trade agreement but about practical agreements: For example, products approved in the US market could automatically be approved in Europe – and vice versa, Habeck said. This way, a “green bridge across the Atlantic” will be built.

The move shows how the US and the EU intend to move carefully toward each other in the dispute over subsidies for green US products. On Tuesday, Habeck came to Washington with French Economy and Finance Minister Bruno Le Maire to register European interests and sound out room for maneuver with the US government. In “close consultation with the EU Commission,” which is leading the negotiations, as was repeatedly emphasized.

Both ministers completed a day of talks in Washington: Habeck visited Secretary of Energy Jennifer Granholm, Secretary of State Antony Blinken, Treasury Secretary Janet Yellen, Secretary of Commerce Gina Raimondo and Trade Representative Katherine Tai, and US President Biden’s IRA advisor John Podesta.

Habeck praised the Inflation Reduction Act (IRA) repeatedly, through which the US Congress cleared the way last summer for massive investments, including in green technologies: Some 370 billion dollars will be spent over ten years on renewable energies, green hydrogen, clean mobility, battery production and carbon storage (CCS), among other things. The package is intended to help reduce carbon emissions in the USA by one billion metric tons a year by 2030. According to a comprehensive study, it thus achieves two-thirds of the reduction needed to bring the US to net-zero emissions by 2050 as agreed.

The IRA is particularly important in the US because:

For US President Joe Biden, the passage of the IRA in the summer of 2022 was a great and surprising success. The subsidy package was also a key topic of his address to the nation Tuesday night.

“We have been pushing the US to get serious about climate protection for a long time, and the IRA is a great thing,” Habeck said. Le Maire also stressed that a strong European industry cooperates best with a strong American industry. According to Habeck, European industries such as plant engineering would also benefit greatly from the IRA and the demand for products.

However, Le Maire also stressed the need for fairness in mutual dealings. This statement refers to provisions in the IRA, according to which about 60 percent of all tax incentives include a “local content” clause. This means products must be made in whole or in part in the US or originate in Canada or Mexico, with which the US has free trade agreements. The EU announced that it would also streamline its state aid rules in response to the IRA.

Europe pushes for changes in the IRA, particularly in the following areas:

Habeck and Le Maire emphasized that they did not expect the IRA to be changed again as a legislative package. They said it was now about progress in implementing provisions.

A new study by the German Institute for Economic Research (DIW) shows the importance of supply chains for green growth in the USA. According to the study, 76 percent of critical raw materials so far come from countries that do not have a free trade agreement with the US. In the case of critical green techs such as photovoltaics, wind turbines or lithium batteries, more than half of the raw materials come from non-free trade countries.

“With the Inflation Reduction Act, the US primarily wants to support its domestic economy, make it more resilient to supply bottlenecks, and position itself as a technology leader. But their strong dependence on raw materials and technology could mean they continue to rely on countries without free trade agreements,” explains study author Josefin Meyer.

The launch of China’s Emissions Trading System (ETS) in the summer of 2021 started off with high hopes. It is the largest ETS in the world and covers 40 percent of all Chinese emissions – 4.5 billion tonnes of carbon per year. Unfortunately, however, the system is plagued by design flaws that at best improve the efficiency of power plants, but cannot help reduce emissions. And frequent problems arise with the submitted emissions data. Analysts predict that it will take until the end of the decade before China’s emissions trading is effectively revised.

Almost 80 percent of all data reported by companies participating in the ETS have been found to be deficient, according to the Chinese Ministry of Ecology and Environment. The authorities now want to improve data gathering and monitoring with new guidelines.

Emissions from coal and gas-fired power plants are not measured directly. Instead, the plants calculate them based on the coal used to generate electricity and the efficiency of the plants. Authorities do not sufficiently monitor companies in this process. This is the reason for several data scandals in the past:

These scandals have increased pressure on the authorities to close loopholes, says Yan Qin, an analyst at Refinitiv, a provider of financial market data. The new regulations are “stricter in terms of checking the coal used”, she says. But controls themselves have not been tightened. The guidelines “do not provide for more spot checks, nor do they change the penalties for non-compliance with the requirements of the emissions trading system”, says Zhibin Chen, Senior Manager at the research and consulting institute Adelphi.

This leaves two major problems:

Reliable data is also important for the expansion of emissions trading to other sectors. So far, only larger coal and gas-fired power plants are included. The expansion to steel, cement and aluminum has been postponed repeatedly, partly due to the lack of reliable data.

Another problem is the flawed design of China’s emissions trading system. There is no cap on allowances, as is the case with the European ETS. Instead, emission allowances are allocated under a complicated benchmark system, which is based on emission intensity:

This energy intensity-focused ETS “can only improve the overall efficiency of the coal plants but cannot cap the emission of the power sector”, says Qin. Instead, this wrong focus “incentivize the build out of newer coal plants“.

So far, China’s emissions trading system has only finished its trial phase. Trading mechanisms have been established and participating companies have developed an awareness that emissions will cost money (in the future), says journalist Xiaoying You.

Projections for the expansion of the ETS to other sectors vary:

Qin also predicts that it will take at least until 2028 before China switches to a fixed allowance cap. A transition from the flexible to the fixed cap will be easier once allowance trading is established. She also believes that energy demand will continue to rise until late in the 2020s. “Therefore, it is difficult to set a fixed cap for the ETS too early.” So China’s emissions trading will continue to have hardly any climate impact in the near future.

In theory, the climate tariff CBAM applies to importers to Europe: Anyone who pays a carbon price on their products will receive a corresponding deduction when calculating the carbon import fee. This applies to all products that fall under the CBAM: cement, fertilizer, electricity, hydrogen, iron and steel, and aluminum.

This means in practice that, for example, instead of paying the full EU carbon price on steel imports, Chinese steel producers will be granted a discount on the Chinese carbon price – if they have to pay it at all in China until the introduction of CBAM.

However – and this is where it gets complicated – the Chinese steel producer must prove to the European authorities how much carbon dioxide was actually emitted during production. This carbon footprint for the product must be certified by an institution unrelated to the producer and state authorities, according to the regulation on the introduction of CBAM recently agreed in the trilogue.

The unreliable data situation of emissions from Chinese plants could present a problem for the assessment of climate tariffs on Chinese manufacturers. “It remains to be seen how much external scrutiny China will tolerate,” says Verena Graichen, ETS expert and senior researcher for energy and climate protection at the Öko-Institut. She says that although the Clean Development Mechanism (CDM) – a climate action instrument from the Kyoto Protocol – also has an international verification system that works in China, the country does not like others to take a closer look at its systems, says Graichen.

This will likely make it difficult for European authorities to reconstruct the data provided by China. At the same time, from a trade policy perspective, the EU cannot do without the promised CBAM rebate. “Because China has an emissions trading system and charges a carbon price, there also has to be a deduction in the CBAM for products covered by the Chinese ETS,” says Graichen. But she points out that the EU has found a loophole for such cases.

Since, as things stand, the EU Commission cannot rely on emissions data to assess the Chinese carbon price, it has the option of using its own criteria. If the actual emissions of a product cannot be determined, the average emission intensity of the product from the country of origin is taken and a “proportionally fixed price premium” is applied.

If there is no data from the country of production on this median value either, the emission intensity of the European plants with the worst performance is automatically applied to the product. In this way, European legislators hope to put pressure on their trading partners to provide reliable emissions data for their products.

How data reporting by foreign importers works in practice, in which form information is provided and how the foreign paid carbon price will be converted into rebates for the purchase of CBAM allowances, is still something the Commission intends to decide in so-called implementing acts. “Article 9 of the CBAM Directive only explains the principle, not the implementation,” Graichen said.

Even though the introduction of CBAM and the unreliability of China’s emissions trading system will impact trade policy on both sides, the actual proportion of Sino-European trade affected by CBAM is relatively small. China exported goods worth 472.7 billion euros to the EU in 2021. The sectors covered by CBAM accounted for only 1.8 percent of China’s exports to the EU in 2019, an analysis found.

Europe’s arguments for working towards a low-emissions industry in China have thus only grown slightly with CBAM. But there is another fear regarding the future of Sino-European trade. European industry circles that are critical of CBAM have repeatedly voiced that Chinese plants producing at low emissions could be prioritized for exports to avoid the CBAM fee. The dirty steel would then instead be used in the domestic market. This would do the climate not much good, the accusation goes, and European producers would be forced to compete with the Chinese product.

Graichen, on the other hand, does not necessarily see this as a disadvantage. The principle of emissions trading is precisely that producers with low emissions should have an advantage – both in the EU and in China. Competitive pressure would indeed increase for European producers with high emissions. But “emissions trading in combination with CBAM can help Europe become a leading market for green steel. And green leading markets also challenge the industry.” The consequence would have to be that European suppliers make their steel production even greener due to competitive pressure from China. This is the logic of carbon pricing, says the Öko-Institut scientist.

What is also clear is that the idea of CBAM is not to promote the decarbonization of other countries, but to protect European industry from carbon leakage and to compensate for the gradual phase-out of free allowances.

Feb. 9, 2023, 6 p.m. CET, online

Webinar Managing Water and Climate Change in South Asia and Germany

The connections between water and the climate crisis are the topic of the discussion event organized by the Friedrich Naumann Foundation. The focus will be on the challenges water management will face in the future. Cases of extreme weather events in Asia and Germany will be compared. Info and registration

Feb. 12, 2023, 11 a.m. CET, online

Publication Energy Technology Perspectives 2023

In this report, the International Energy Agency (IEA) analyzes the current risks and opportunities for developing renewables. Against the backdrop of the war in Ukraine, it also looks at how governments can make their energy supply chains more resilient. Info

Feb. 16, 2023, 11:30 a.m. CET, online

Publication 4C Carbon Outlook Launch

This webinar will discuss the findings presented in the Carbon Outlook 2022, released by the EU-funded project 4C (Climate-Carbon Interactions in the Current Century) in collaboration with Global Carbon Project researchers. Info

Feb. 17-19, 2023, Munich

Conference Munich Security Conference

The 59th Munich Security Conference brings foreign and security policy debates to Munich for three days. Almost a year after Russia invaded Ukraine, MSC 2023 is also an opportunity to take stock of cohesion within the alliance and political commitment to the rules-based international order. Info

Mankind – and especially the rich parts of society in the Global North – are still living too grand. We are still a long way from a circular economy. Only 7.2 percent of the goods and raw materials extracted from the ground and produced worldwide are actually recycled. This is revealed by the Circularity Gap Report of the Circularity Gap Reporting Initiative.

The report states that 70 percent of global greenhouse gas emissions are tied to the processing and use of raw materials and goods. To satisfy “global wants and needs,” nearly 60 billion metric tons of greenhouse gases were generated in 2019. 80 percent of that came from housing and infrastructure, transportation and mobility, and food, the authors write. “Unless we radically transform how we use materials to satisfy our needs, we cannot meaningfully cut emissions,” the report concludes. nib

In addition to the German government’s security strategy, which is currently being debated, the Federal Foreign Office is also working on a foreign climate policy strategy. The concept is currently being drafted in the ministry of Annalena Baerbock (Greens). In several rounds of coordination within the ministry and with representatives of civil society, this strategy is intended to bring to life what Baerbock has announced since taking office: A foreign policy that is increasingly oriented toward the global fight against climate change and its consequences as well as taking her concept of “feminist foreign policy” into account.

At the same time, the Foreign Ministry has internally designated over 50 of its foreign missions to give particular impetus to foreign climate policy. These include all embassies in the G20 states and the countries of the “V20,” which are particularly vulnerable to the effects of the climate crisis. These include the Philippines, Bangladesh, Costa Rica and Ethiopia.

The Foreign Office stated that there was no overall draft of the strategy yet. So far, only the titles of the individual chapters have been finalized. They sound more or less like the primary goals of the UNFCCC climate process:

According to a study by the United Nations Environment Programme (UNEP), the growth of bacteria is accelerating due to higher temperatures and pollutants, and antibiotic-resistant “superbugs” are becoming more common.

With rising temperatures, climate change is both increasing the frequency of infections with antibiotic-resistant germs and causing the germs to spread faster due to extreme weather events. The risk of developing “superbugs”, like antibiotic-resistant bacteria, parasites, viruses and other disease vectors, increases particularly sharply in polluted waterways because they provide protection and a suitable breeding ground, according to the UN study.

Antibiotic resistance could be responsible for up to 10 million annual deaths by 2050. Therefore, UNEP proposes implementing the “One Health” approach, which collectively covers human, animal and ecosystem health. Specifically, action would also need to be taken against pollution sources of water bodies.

Other pathogens are also spreading faster because of climate change: For example, tropical mosquitoes can also survive in Central Europe and spread diseases such as dengue and chikungunya fever. kul

In order to still meet the 1.5-degree target, large coal-consuming countries like China, India or South Africa would have to phase out coal-fired power generation at an unprecedented rate. The phase-out would have to happen more than twice as fast as other changes in a major energy source of the past 50 years – including those in times of crisis such as wars and state collapses. This is the result of a new study recently published in the scientific journal Nature Climate Change.

The authors conclude that the current rate of the coal phase-out is hardly socially acceptable. They suggest stronger efforts by the EU and the USA to reduce oil and gas consumption more quickly and thus give coal-dependent countries more leeway – without jeopardizing the 1.5-degree target.

Researchers at University College London and the International Institute for Sustainable Development (IISD) have calculated reduction pathways and concluded that:

Lead author and energy expert Greg Muttitt says that research shows that “climate models and policy debates rely too much on winding down coal at a pace that may not be feasible for coal-dependent developing countries.” Instead, more emphasis should be “placed on oil and gas phase-out.” He demanded that the Global North make a greater effort.

Meanwhile, BP announced on Tuesday plans to invest in expanding oil and gas production as quickly as possible. This is to be achieved through acquisitions and an expansion of production, as Bloomberg reports. In the medium term, the company plans to cut oil and gas production by only 25 percent. The group originally set a target of a 40 percent reduction by 2030. nib

France’s minister for ecological transition, Christophe Béchu, wants to prepare France for a warming of four degrees Celsius. Such a scenario must also be modeled in the third national plan for adaptation to climate change, Béchu said at an event organized by France Stratégie and the think tank Institut de l’Économie Pour le Climat (I4CE).

Paris is currently working on the third National Plan for Adaptation to Climate Change (PNACC). Béchu’s announcement means that the future plan could include two scenarios: One described by the minister as “optimistic,” based on the Paris Agreement pathway (+1.5 °C, or +2 °C globally), and one described as “pessimistic,” which is “undoubtedly more realistic given current dynamics.” The second scenario predicts a global temperature increase of at least +2.5 °C, which would correspond to an increase of +4 °C for France. “This scenario is essential for raising awareness in this country,” the minister continued.

“This announcement marks an important turning point,” Magali Reghezza, a geographer and member of the High Council on Climate, wrote on Twitter. “We need to take the time to assess what this +4 °C means for our regions, our daily lives and our jobs.” The High Council on Climate (“Haut conseil pour le climat”) was founded by Emmanuel Macron in 2018 and is tasked with independently advising the government’s climate policies. cst

The climate crisis could reduce the number of climate refugees, a new study shows. What sounds contradictory has a simple reason: The effects of climate change are causing more people to lose their livelihoods. As a result, they have less money to afford to flee in the first place.

Scientists at the Potsdam Institute for Climate Impact Research (PIK) have used models to examine the economic consequences of climate change and the impact on international migration. Their models also take into account that migration from middle-income countries is highest and that fewer people migrate from poorer countries, a fact that has been studied for some time.

According to the researchers’ model calculations, climate change will have a negative impact on economic growth and push poorer countries – in Africa, South Asia and West Asia – further away from the income threshold above which migration increases. Currently, most migration from these countries already happens within their respective regions of the world. Another factor for decreasing migration is that other states in the respective poorer regions of the world are becoming less attractive due to climate change.

Between the wealthier nations of the Global North, however, migration is more likely to increase due to climate change and declining incomes. Accordingly, climate change could lead to an increase in migration from Europe, Latin America and East Asia in North America. nib

Denmark has awarded its first three licenses allowing companies to store CO2 under the seabed of the North Sea on a larger scale. The permits went to the TotalEnergies group and a consortium comprising the companies Ineos and Wintershall Dea, the Danish climate and energy ministry announced on Monday. This means that work could begin immediately. It is expected that the two projects will be able to store up to 13 million tons of carbon dioxide per year under the Danish part of the North Sea, starting in 2030.

The Danish Energy Agency recommended that the ministry award the first three permits for research into major CO2 storage in the North Sea to the companies in question. It is an important step in making Denmark’s CCS strategy a reality, according to the agency. CCS stands for carbon capture and storage. The process captures emitted CO2 and pumps it underground.

Denmark wants to reach net-zero by 2045. Shortly after COP27, the new government in Copenhagen even announced a new net emissions reduction target of 110 percent by 2050.

TotalEnergies’ project is called Bifrost and is expected to store up to 3 million metric tons of CO2 in an already depleted oil and gas field starting 2027 – eventually accumulating to 5 million metric tons by 2030. Ineos and Wintershall Dea plan to start storing up to 1.5 million metric tons of CO2 in depleted oil and gas fields in the North Sea with the Greensand project by 2025. In 2030, capacity is to be increased to 8 million tons per year.

According to Reuters information, the Danish state intends to bear just under half of the total investment of the equivalent of 60 million euros for Greensand and 21 million euros for Bifrost. dpa/luk/rtr

Sabine Nallinger is pleased with Joe Biden’s green industrial policy. The momentum created by the US will help Europe’s industry transform itself “and keep the 1.5-degree target within reach,” says Nallinger, who heads Stiftung KlimaWirtschaft. Nallinger also welcomes the recently unveiled EU Green Deal Industrial Plan. However, she says more clarity is needed on how the EU intends to position itself vis-à-vis global competitors. “Simpler processes, faster allocation of funds and more pragmatism” would have to be the focus. “The long-term goal of carbon neutrality” must continue to be pursued. Industrial policy measures should not hinder climate protection.

Nallinger has been interested in nature and climate protection since she was a child. On her school bag, she would carry buttons with slogans such as “The Greens are here” or “Nuclear power no thanks!” Her grandfather and father were successful German entrepreneurs. They did not want to hear about what was on her mind every day: dying forests, nuclear power, famine in Africa.

Since September 2014, the 59-year-old has been a member of the board of Stiftung KlimaWirtschaft, which was founded in 2011 under the name Stiftung 2° by CEOs, managing directors and family business owners. The foundation aims to help achieve a net-zero economy. Its supporters include many different companies, such as GLS Bank, the cruise provider Aida Cruises and Aldi Süd. Nallinger speaks with politicians and business leaders, supports initiatives, and helps create networks. But she never goes for confrontation. She is stern but constructive, says Nallinger.

KlimaWirtschaft also conducts studies to analyze concrete action plans for companies on the road to net zero. The foundation also launched a transformation tracker that monitors how far the climate action plans set out in the German government’s coalition agreement have been implemented.

But things do not always run smoothly: Greenwashing is an issue that concerns Nallinger. Scandals involving large corporations are the reason why KlimaWirtschaft was formed. The aim is to bring together companies that are serious about climate protection. “We choose our sponsoring companies carefully,” says Nallinger. “If we were to engage in greenwashing ourselves, we would lose our purpose.”

Nallinger even brings competitors to the same table. Most recently, two steel companies, Thyssenkrupp and Salzgitter AG, came together at the initiative of KlimaWirtschaft to discuss greener production with politicians. Thyssenkrupp alone accounts for 2.5 percent of Germany’s emissions.

Nallinger was already interested in politics in her youth. Back then, she says, there were the first major reports about how the earth’s resources were finite and how rich countries were doing business at the expense of poor countries. So she started taking action. She stopped eating meat, took to the streets against nuclear power. This was followed by studying urban, transport and environmental planning, as well as project work for NGOs. Nallinger has worked for more than two decades in the field of eco-friendly regional, urban and transport planning, including for the city of Munich and its public utilities, as well as for environmental associations. Between 2008 and 2020, she was a city councilor for the Green Party and currently serves on the supervisory board of Vattenfall Wärme Berlin AG.

What has she learned from all this? “It’s the economy, stupid!” she quotes the famous phrase of US President Bill Clinton. She believes that companies can achieve more and faster climate action than politicians. “When in doubt, implementation is faster there, and I’m sometimes a bit impatient,” says Nallinger.

Tempo, Tempo, Tempo! These are the three things that environmental action currently needs. Nallinger is worried. The green transformation was actually going well in recent years, she believed. But then crises hit: the pandemic, the Ukraine war. Climate concerns took a back seat again. “I can sympathize very well with the people from Fridays for Future,” Nallinger says. “I am all too familiar with this feeling of powerlessness.”

Germany is supposed to become carbon-neutral by 2045. No company will survive on the market if it does not orient its business model toward net-zero now. Nallinger is sure of that. “They will exit the market, as harsh as that sounds.” Anna Scheld