Even before the pandemic, handheld loudspeakers were popular in China for giving non-stop messages to the masses. Since the start of the Shanghai lockdown, however, a considerable amount of (real and fake) video clips featuring rather eerie loudspeaker announcements have emerged on the Internet: Creepy-looking robot “dogs” with stapled-on megaphones stalk abandoned city streets. Or drones, also equipped with megaphones, broadcast the following message from the night sky to people on balconies and at windows: “Please comply with Covid restrictions. Control your soul’s desire for freedom.”

The strict zero-covid policy of the Beijing government eats away at the nerves of the city’s residents – and also starts to become a problem for supply chains and production. Factories in Jiangsu, located on the border to Shanghai, also begin to feel the pain of the lockdown, reports Christiane Kuehl. Trans-regional transport is difficult and frustration among foreign companies grows. Besides disrupted operations, travel restrictions have been the worst measure, representatives of the EU Chamber and the German Chamber of Commerce told our author. After all, these mean: no factory visits, no business meetings and no trips home.

Apart from the Covid pandemic, climate change remains a pressing issue: China emits more methane than any other major economy. The gas emitted, for example, from coal mining and the cultivation of rice, has the same dramatic impact on climate change as CO2. Beijing has already rejected an international initiative to curb methane emissions. It prefers to pursue its own plans. Improved methane management would be a good start, analyzes Ning Wang. This way, China could even use this gas as an additional source of energy.

Companies across China are increasingly suffering from Omicron outbreaks in the country. Strict zero covid measures disrupt supply chains and production. Employees or logistics are practically overnight barred from entering factory premises. Or they are unexpectedly no longer allowed to cross city or district borders. And in Shanghai, there is the omnipresent fear of a positive Covid test and the resulting isolation in one of the city’s huge quarantine centers.

Restrictions have now been enforced throughout the country. Trans-regional transport is difficult because all areas classified as “medium risk” or “high risk” have to be avoided. If a driver passes through such an area, the health code on his smartphone automatically generates an asterisk, explains Jens Hildebrandt, Executive Board Member of the German Chamber of Foreign Trade (AHK) for North China. “That means the driver would then face quarantine at the next location – that is, wherever he exits the highway.”

Covid tests also delay cargo transports. “Containers are sometimes delayed for a month in ports or stuck in traffic jams at the border, for example between China and Kazakhstan, because of such tests,” Hildebrandt tells China.Table. The recipients of the goods – for example, a German company in China – are required to adhere to strict disinfection regulations. These include aseptic cleaning of all transport boxes as well as regular Covid tests of the staff responsible. “This regulation varies from province to province. In recent weeks, procedures have been tightened, especially in Jiangsu and Shandong provinces.” There, staff who sanitize goods have to stay separate from other staff members. The goal is to create a so-called “closed-loop” from which no pathogens can escape. Otherwise, the entire shipment would have to be quarantined at the recipient’s premises for ten days.

Cargo is also stuck at China’s seaports and airports. In sealed-off Shanghai, in particular, the two ports of Yangshan and Waigaoqiao are operating at reduced capacity. Worse, however, are the tests and massive restrictions on outbound goods transport. There have been reports that Shanghai’s surrounding provinces now attempt to divert exports to the deep-sea port of Ningbo, Hildebrandt reports. “To what extent that will work out remains to be seen.”

The health commission in Beijing reported a peak of more than 20,000 cases nationwide on Wednesday. More than 17,000 infections were reported in the Shanghai hotspot alone. This marked a new all-time peak. The majority continue to be asymptomatic cases. But due to China’s strict zero-covid policy, the metropolitan areas of Shanghai, Changchun, and Shenyang, with a combined population of around 38 million, have been in lockdown. Many other cities have additional restrictions in place.

More than half (51 percent) of German companies in China reported logistics and warehousing disruptions in an AHK flash survey last week. A full 46 percent suffer from supply chain disruptions. According to the AHK, companies in the mechanical engineering and industrial equipment sector have been hit particularly hard. 54 percent reported impaired logistics and warehousing in this sector, and 55 percent reported impaired supply chains. This means, for example, that important preliminary products do not reach factories. According to the AHK, the automotive and mobility sectors are also severely affected. Smaller companies also generally suffer more than large companies, as their ability to adapt is lower.

Only a handful of sectors are even still allowed to produce in Shanghai at all, Bettina Schoen-Behanzin of the EU Chamber in Shanghai reported on Wednesday at a webinar hosted by the chamber (EUCCC). Sectors still allowed to operate include food, pharmaceuticals and chemicals. “It’s not like you can just shut down a chemical plant,” Schoen-Behanzin said. The requirement in Shanghai, as elsewhere, is the closed loop: Employees spend the night on the company’s premises for days at a time and then rotate. “We hear that there are fewer and fewer volunteers for these closed loops,” Schoen-Behanzin reports.

The webinar hosted local chairpersons from all chamber locations in China. Their reports differed, but the main concerns remained the same. The supply chains of the Jiangsu province near Shanghai, with its numerous production sites, also suffer under the lockdown of the metropolis, said Andreas Risch, Chairman of the European Chamber in the provincial capital Nanjing. Jiangsu is a stronghold of German companies; many medium-sized companies have production facilities there. Risch reported a mess of different entry regulations or quarantine rules stretched across various locations. “Harmonization would be good.”

BMW’s joint venture in Shenyang continued operations in such a closed loop as long as it was possible, says Harald Kumpfert, Regional Manager of the German Chamber of Commerce in Shenyang. However, it then had to stop production due to disruptions in the supply chain. Supply problems, however, have become a secondary concern in the meantime, says Kumpfert. “Because no one can come to work at all.” For the past two weeks, Shenyang has been under lockdown; driving on roads is only allowed with special permission.

There have been few local cases and restrictions in southwest China so far, said Massimo Bagnasco, EU Chamber Chair in Chengdu. But there is “a sense of uncertainty about future developments.” Concern is high that the Omicron wave could spread from the East Coast. Several companies already operate nationwide as it is, he said. “They are already affected by supply chain problems.”

According to Hildebrandt, there is a general degree of acceptance for the Covid measures among companies in China. “There is mainly frustration about changes that are made on short notice and lack transparency – meaning that companies can only adjust to them reactively.” Apart from recurring restrictions on the ground in China, entry restrictions are a major headache for companies, Hildebrandt says. “There are virtually no business interactions on the ground anymore.”

EU representatives across the country gave similar reports: travel restrictions have the most severe effect. No factory visits, no face-to-face negotiations with clients, no trips home: travel within the country and abroad is prohibited. Known problems caused by the restrictions only keep getting worse, they said. The problems of recruiting and retaining skilled employees, the lack of face-to-face interaction, the isolation from headquarters in Europe along with a certain loss of trust. Given the situation, local chamber chairs demand one thing above all: the deployment of more effective vaccinations in China.

In a recent International Energy Agency (IEA) report, China has ascended to a regrettable 1st place among greenhouse gas emitters. But it’s not the usual suspect, carbon dioxide, that’s at issue here. It’s the gas methane, whose emission is also changing the climate. The IEA has become alarmed by the trend. And it leaves China with new problems if it wants to meet its targets.

Cutting methane emissions is just as tricky a maneuver in economic policy as dealing with CO2. At the COP 26 climate conference in Glasgow, the People’s Republic has thus recently refused to join an international initiative led by the US and the EU to curb methane emissions (China.Table reported). Instead, China has pledged to work on its own methane plans. Experts, however, have doubts about how genuine these efforts are. But at least the latest Five-Year Plan included a methane gas reduction goal for the first time.

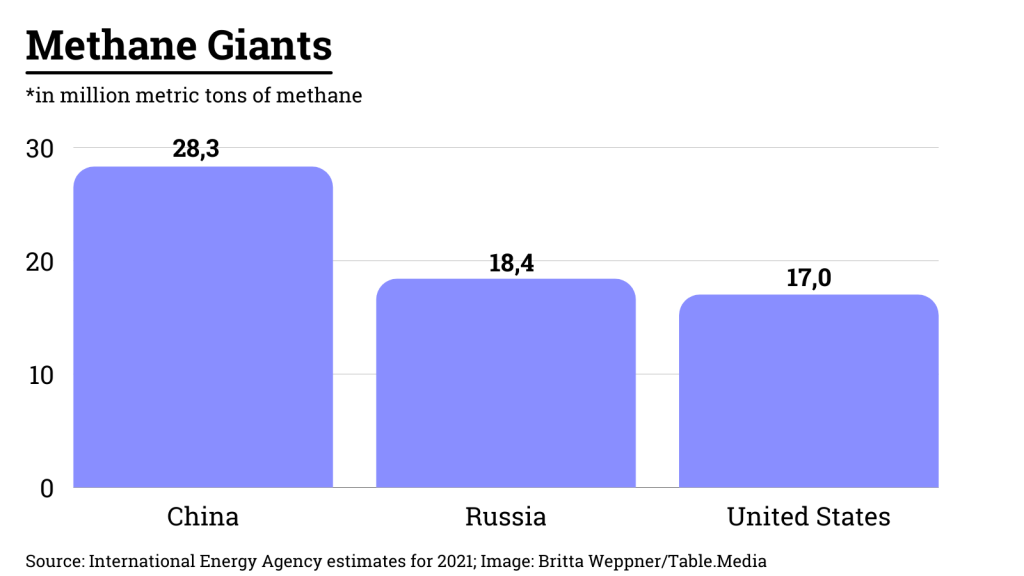

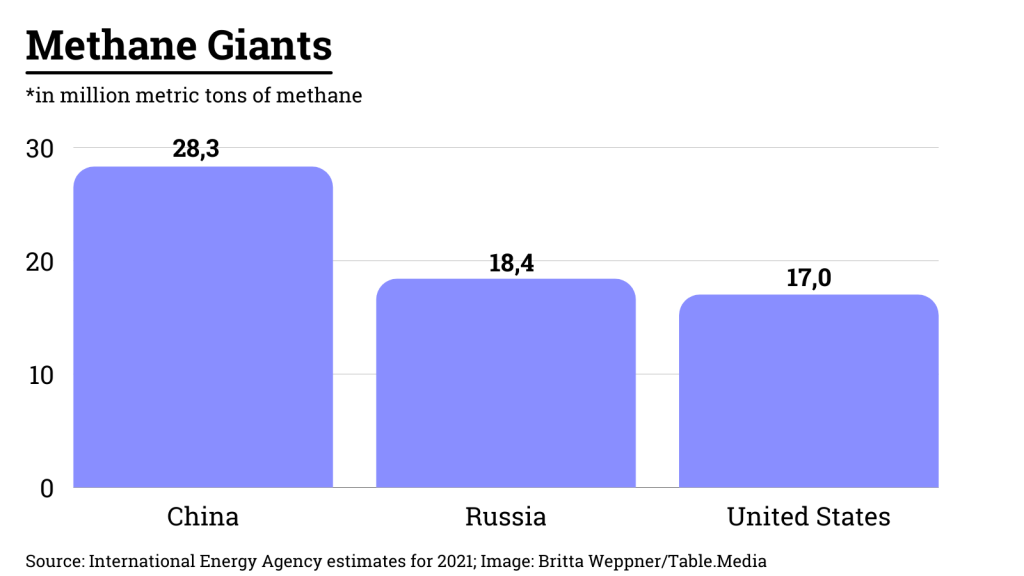

China’s methane emissions have long dwarfed those of other major economies. According to calculations by Bloomberg NEF, China’s energy sector accounts for about one-fifth of total global methane emissions from oil, gas, coal and biomass. It generated over 50 percent more methane than the next largest emitters: Russia and the United States.

But even with the best of intentions, China will not be able to simply cut back on its emissions. Just like in other countries, China emits in three sectors:

In agriculture, China is already responsible for considerable methane emissions from its rice cultivation alone, because rice often grows underwater and thus emits methane. To avoid jeopardizing the food supply for its population, Beijing will probably not address methane emissions caused by agriculture or animal husbandry first.

According to a United Nations study, China’s coal sector offers the most promising opportunity to cut its methane emissions. But activity in exactly this sector has surged since power outages hit several parts of the country last fall, threatening to break supply chains (China.Table reported). This caused authorities to quickly turn back to coal as an energy source. Among other things, this has led to a renewed buildup of methane gas clouds over coal mines in the country.

Researchers express disappointment that the gas that accumulates in mines is not being used actively. After all, it is nothing more than natural gas, and thus a valuable energy source in its own right. ” While China has encouraged mine operators to make better use of the methane generated during the mining process, major obstacles remain,” said Kou Nannan, an analyst at Bloomberg NEF in Beijing. “Capturing the gas requires a lot of capital investment and most mines aren’t near major gas transmission pipelines.”

China plans to study methane emissions more closely and publish a nationwide action plan to control them. It has included Sinopec and China National Petroleum Corp (CNPC) in a pilot program to evaluate methods for measuring greenhouse gasses, Reuters reports. Scientists are only just beginning to use satellite data to calculate how much methane is caused by coal mining worldwide. Even without accurate data, one thing is probably already certain: China is leading the way.

But even though the US and Canada, like many Chinese companies, are not obligated to release data on their methane gas emissions, various studies show that most companies report their methane emissions to be significantly lower than they actually are. The IEA warns that methane emissions from the global energy sector are approximately 70 percent higher than the sum of estimates provided by national governments. China is probably not the only country that needs to do more besides pilot projects to better understand the sources of emissions to enable comprehensive methane management.

Methane has recently become the focus of scientific and political attention. According to climate researchers, half of the global warming since the mid-19th century can be traced back to methane gas. In the atmosphere, the gas absorbs more heat than CO2. Thus, the greenhouse effect of one kilogram of methane is around 30 times greater than that of the same amount of carbon dioxide. EU Commission President Ursula von der Leyen has therefore even given the gas priority: “the most effective things we can do to reduce near-term global warming and keep 1.5 degrees Celsius,” she said.

At the climate conference in Glasgow, von der Leyen and US President Joe Biden presented a climate package, in which around 100 countries intend to participate. By 2030, participating countries plan to cut their methane emissions by 30 percent compared to 2020 levels. Countries such as Germany, France, Canada and Japan, which are responsible for around half of global methane emissions and at the same time represent 70 percent of the global economy, joined the agreement. However, large emitters such as India, China, Russia and Australia have not signed the initiative.

China is probably having a hard time with methane pledges because the Party and government bodies are divided over the goals. Authorities also often get in each other’s way, as responsibilities are apparently unclear. Different units are often responsible for regulating coal and methane, complicating efforts to curb emissions, says Bloomberg analyst Kou.

Following the massacre of civilians in the Ukrainian town of Bucha, the EU has once again urged Beijing to take a clear stand against Russia’s war of aggression. As a permanent member of the United Nations Security Council, China has a special responsibility to maintain international peace and security, EU Commission chief Ursula von der Leyen told the EU Parliament plenary on Wednesday. “Nobody can be neutral when faced with such naked aggression against civilians.” Von der Leyen said this was also stressed at the EU-China summit last Friday. “We made clear how crucial it is for us in Europe, but also for the rest of the world, to take a clear stance.”

EU High Representative for Foreign Affairs Josep Borrell voiced an unusually harsh opinion about the virtual summit. He called the meeting a “dialogue of the deaf“. The Chinese leadership “didn’t want to talk about Ukraine,” Borrell told the European Parliament on Tuesday night. “They didn’t want to talk about human rights and other stuff and instead focus on positive things,” Borrell remarked about Chinese Premier Li Keqiang and President Xi Jinping. “So we couldn’t talk about Ukraine a lot, but we didn’t agree on anything else,” the EU foreign affairs representative said during the plenary week in Strasbourg.

However, Borrell said, there is a red line for Beijing in the Ukraine war: “That is weapons of mass destruction.” That had been made clear during talks before the actual summit meeting. The first EU-China summit since June 2020 took place last Friday without any significant results (China.Table reported).

China addressed the Bucha massacre for the first time at the UN Security Council on Tuesday, but did not condemn it. “The reports and images showing civilian deaths in the Ukrainian city of Bucha are very disturbing,” UN Ambassador Zhang Jun said, according to state media. However, he added that all allegations must be based on facts and all parties should “avoid unfounded accusations before a conclusion of the investigation is drawn.” While the horrific images from Ukraine’s Bucha are currently filling the front pages of international newspapers, Chinese media remains silent (China.Table reported). ari

Hong Kong Security Chief John Lee has announced his bid to become the city’s new Chief Executive. The 64-year-old has already submitted his letter of resignation, which still has to be accepted by the Chinese central government in accordance with the Basic Law. This step is now only considered a formal act because Lee enjoys Beijing’s support for his candidacy, according to media reports.

On May 8, the newly constituted Hong Kong parliament will choose the city’s new chief executive. The incumbent Chief Executive Carrie Lam will not run again and will resign from office on June 30.

Lee had been appointed to the post of Chief Security Officer by Lam in 2017. Last year, he also took on the role of Deputy Chief Executive of the Hong Kong government, ranking second behind Lam in the administrative hierarchy. Lee has served in the public service for more than 40 years. In his role as security chief, he has played a significant role in the city’s political purge since the introduction of the National Security Law. grz

Chinese EV and battery manufacturer BYD has announced to cease production of fossil-fuel-powered vehicles. BYD announced in a tweet that it has not produced any combustion models since March.

BYD’s EV sales volume reached nearly 604,000 units in 2021, an increase of 218 percent, according to Caixin’s calculations. Production of other vehicle types, on the other hand, declined by 43 percent and amounted to only 137,000 units. Data from the China Passenger Car Association (CPCA) shows that BYD was the best-selling EV manufacturer in China last year, with more than 17 percent market share. SAIC-GM-Wuling Automobile Co.Ltd. ranked second with about 12 percent, and Tesla was third with 9 percent.

To reassure customers of its non-electric division, BYD announced that it would continue to manufacture replacement parts for fossil-fuel vehicles and provide after-sales services to customers who purchased such cars.

The Shenzhen-based carmaker has quickly become the leader among EV manufacturers in the People’s Republic. Last year, BYD sold more EVs than vehicles with internal combustion engines for the first time. BYD’s 2021 revenue rose 38 percent to ¥211 billion (about €30 billion). However, BYD was unable to increase its profits. Due to the increase of raw materials costs and bottlenecks in global supply chains, BYD has also increased prices for several models (China.Table reported).

Together with several other carmakers, BYD signed a pledge at the UN Climate Change Conference to offer only zero-emission vehicles in key markets by 2035 and globally by 2040. niw

A political dispute has erupted in the UK over acquisition plans for the Newport Wafer Fab microchip factory. The British government had approved the controversial sale of the Welsh semiconductor factory to Nexperia, a Dutch subsidiary of China’s Wingtech Group. In July 2021, London had ordered National Security Advisor Sir Stephen Lovegrove to review the deal (China.Table reported). As local media now reports, Lovegrove concluded that there had not been sufficient security concerns to stop the sale. Newport Wafer Fab is one of the few plants in the UK that still manufactures semiconductors. The exact timescale of the takeover had not been publicly announced.

The review of the deal used too narrow a definition of “national security,” criticized Tom Tugendhat, Chairman of the UK Foreign Affairs Select Committee, among others. “As we urge Germany and others to opt out of Russian gas, it seems odd that we’re allowing China to buy semiconductor companies in the UK,” Tugendhat said. The Conservative politician criticized the fact that under the National Security and Investment Act, which has been in effect since January, the acquisition was not re-examined more closely. “The government has no clear strategy to protect what is left of our semiconductor industry,” Tugendhat said. ari

As Managing Director for Asia and the Pacific in the European External Action Service (EEAS), Gunnar Wiegand is responsible for EU relations with 41 countries, from Afghanistan to Fiji – and he has passed through exciting stations in his career. As a policy advisor, he was there when Spain joined the EU. As an associate of a political foundation, he has been involved in the support for the consolidation of new democracies in Southern Europe and Eastern Europe. In 1990, shortly before the German reunification, he began to work for the European Commission, first as a so-called GDR consultant, and later focused on the transformation processes in the former Soviet Union.

Before the start of the Covid pandemic, Gunnar Wiegand traveled to Asia twice a month on average. He maintains numerous professional and also some personal contacts in the region. His three sons enjoy traveling to Asia, and his wife was born in Lebanon, which is, after all, part of the Near East. At first glance, he doesn’t have much to do with China itself.

He did not study Chinese, but law and international relations in Italy and the USA. Mandarin is not one of the six languages he learned. And his first stations abroad did not take him to Hong Kong or Beijing, but to Latin America and Spain. “I’m not an expert on Asia, but on EU external relations, where it’s about bringing together EU foreign and security policy and member states with trade policy, development cooperation and sectoral policies of the European Commission,” he says.

China first appears on his CV in the late 1990s. At the time, he was a spokesman for European Commissioner for External Relations Chris Patten, who had previously served as the last British Empire governor of Hong Kong. “Patten was very well known in China, but he was an undesirable person at the time. I saw how popular he was in Hong Kong, on the other hand, when we made a trip there,” recalls Wiegand, who also traveled with him to India, Pakistan and Korea, among other places. Later, as Director at the European Commission, he was responsible for Russia, Eastern Europe and Central Asia and was, among other things, chief negotiator for the EU’s association agreements with Georgia and Moldova.

He also negotiated the first “Association Agenda”, the document on the concrete implementation of the Association Agreement, between the EU and Ukraine. In 2016, he was given responsibility for Asia and the Pacific in the European External Action Service, where he negotiated the new Strategic Partnership Agreement with Japan in 2017, contributed significantly to the first EU-Asia connectivity strategy in 2018, helped to reorient EU policy toward China (“Cooperation-Competition-Systemic Rivalry”) in 2019, and was responsible for drafting the EU’s Indo-Pacific cooperation strategy in 2021.

Gunnar Wiegand himself describes his career path in European politics as somewhat unusual: “The normal diplomatic course is that people move between headquarters and abroad. I myself have always developed and negotiated more content in Brussels and have thus been able to make an impact both internally and externally,” he says.

At present, aside from the implementation of the Indo-Pacific strategy and the issue of how the EU can best contribute to help stabilize Afghanistan, the EU official is mainly preoccupied with the EU’s relations with China. And this work in recent days – naturally – has been particularly dominated by the Ukraine crisis, where it is essential to achieve a ceasefire and establish humanitarian corridors as quickly as possible. Janna Degener-Storr

Laurent Cathala has been appointed as the new president of Gucci’s fashion division in Greater China. Cathala previously worked for luxury jeweler Tiffany & Co.

The US newspaper New York Times is restructuring its China staff: The new Beijing office head will be Keith Bradsher, who previously headed the Shanghai office. Vivian Wang will also join the Beijing team. Wang was previously working in Hong Kong. Alexandra Stevenson will be the new head of the Shanghai office.

Tea harvest in Ankang in the Shaanxi province. The region is one of China’s seven major tea-growing areas. Here in Liping County, the local government has particularly boosted production in recent years.

Even before the pandemic, handheld loudspeakers were popular in China for giving non-stop messages to the masses. Since the start of the Shanghai lockdown, however, a considerable amount of (real and fake) video clips featuring rather eerie loudspeaker announcements have emerged on the Internet: Creepy-looking robot “dogs” with stapled-on megaphones stalk abandoned city streets. Or drones, also equipped with megaphones, broadcast the following message from the night sky to people on balconies and at windows: “Please comply with Covid restrictions. Control your soul’s desire for freedom.”

The strict zero-covid policy of the Beijing government eats away at the nerves of the city’s residents – and also starts to become a problem for supply chains and production. Factories in Jiangsu, located on the border to Shanghai, also begin to feel the pain of the lockdown, reports Christiane Kuehl. Trans-regional transport is difficult and frustration among foreign companies grows. Besides disrupted operations, travel restrictions have been the worst measure, representatives of the EU Chamber and the German Chamber of Commerce told our author. After all, these mean: no factory visits, no business meetings and no trips home.

Apart from the Covid pandemic, climate change remains a pressing issue: China emits more methane than any other major economy. The gas emitted, for example, from coal mining and the cultivation of rice, has the same dramatic impact on climate change as CO2. Beijing has already rejected an international initiative to curb methane emissions. It prefers to pursue its own plans. Improved methane management would be a good start, analyzes Ning Wang. This way, China could even use this gas as an additional source of energy.

Companies across China are increasingly suffering from Omicron outbreaks in the country. Strict zero covid measures disrupt supply chains and production. Employees or logistics are practically overnight barred from entering factory premises. Or they are unexpectedly no longer allowed to cross city or district borders. And in Shanghai, there is the omnipresent fear of a positive Covid test and the resulting isolation in one of the city’s huge quarantine centers.

Restrictions have now been enforced throughout the country. Trans-regional transport is difficult because all areas classified as “medium risk” or “high risk” have to be avoided. If a driver passes through such an area, the health code on his smartphone automatically generates an asterisk, explains Jens Hildebrandt, Executive Board Member of the German Chamber of Foreign Trade (AHK) for North China. “That means the driver would then face quarantine at the next location – that is, wherever he exits the highway.”

Covid tests also delay cargo transports. “Containers are sometimes delayed for a month in ports or stuck in traffic jams at the border, for example between China and Kazakhstan, because of such tests,” Hildebrandt tells China.Table. The recipients of the goods – for example, a German company in China – are required to adhere to strict disinfection regulations. These include aseptic cleaning of all transport boxes as well as regular Covid tests of the staff responsible. “This regulation varies from province to province. In recent weeks, procedures have been tightened, especially in Jiangsu and Shandong provinces.” There, staff who sanitize goods have to stay separate from other staff members. The goal is to create a so-called “closed-loop” from which no pathogens can escape. Otherwise, the entire shipment would have to be quarantined at the recipient’s premises for ten days.

Cargo is also stuck at China’s seaports and airports. In sealed-off Shanghai, in particular, the two ports of Yangshan and Waigaoqiao are operating at reduced capacity. Worse, however, are the tests and massive restrictions on outbound goods transport. There have been reports that Shanghai’s surrounding provinces now attempt to divert exports to the deep-sea port of Ningbo, Hildebrandt reports. “To what extent that will work out remains to be seen.”

The health commission in Beijing reported a peak of more than 20,000 cases nationwide on Wednesday. More than 17,000 infections were reported in the Shanghai hotspot alone. This marked a new all-time peak. The majority continue to be asymptomatic cases. But due to China’s strict zero-covid policy, the metropolitan areas of Shanghai, Changchun, and Shenyang, with a combined population of around 38 million, have been in lockdown. Many other cities have additional restrictions in place.

More than half (51 percent) of German companies in China reported logistics and warehousing disruptions in an AHK flash survey last week. A full 46 percent suffer from supply chain disruptions. According to the AHK, companies in the mechanical engineering and industrial equipment sector have been hit particularly hard. 54 percent reported impaired logistics and warehousing in this sector, and 55 percent reported impaired supply chains. This means, for example, that important preliminary products do not reach factories. According to the AHK, the automotive and mobility sectors are also severely affected. Smaller companies also generally suffer more than large companies, as their ability to adapt is lower.

Only a handful of sectors are even still allowed to produce in Shanghai at all, Bettina Schoen-Behanzin of the EU Chamber in Shanghai reported on Wednesday at a webinar hosted by the chamber (EUCCC). Sectors still allowed to operate include food, pharmaceuticals and chemicals. “It’s not like you can just shut down a chemical plant,” Schoen-Behanzin said. The requirement in Shanghai, as elsewhere, is the closed loop: Employees spend the night on the company’s premises for days at a time and then rotate. “We hear that there are fewer and fewer volunteers for these closed loops,” Schoen-Behanzin reports.

The webinar hosted local chairpersons from all chamber locations in China. Their reports differed, but the main concerns remained the same. The supply chains of the Jiangsu province near Shanghai, with its numerous production sites, also suffer under the lockdown of the metropolis, said Andreas Risch, Chairman of the European Chamber in the provincial capital Nanjing. Jiangsu is a stronghold of German companies; many medium-sized companies have production facilities there. Risch reported a mess of different entry regulations or quarantine rules stretched across various locations. “Harmonization would be good.”

BMW’s joint venture in Shenyang continued operations in such a closed loop as long as it was possible, says Harald Kumpfert, Regional Manager of the German Chamber of Commerce in Shenyang. However, it then had to stop production due to disruptions in the supply chain. Supply problems, however, have become a secondary concern in the meantime, says Kumpfert. “Because no one can come to work at all.” For the past two weeks, Shenyang has been under lockdown; driving on roads is only allowed with special permission.

There have been few local cases and restrictions in southwest China so far, said Massimo Bagnasco, EU Chamber Chair in Chengdu. But there is “a sense of uncertainty about future developments.” Concern is high that the Omicron wave could spread from the East Coast. Several companies already operate nationwide as it is, he said. “They are already affected by supply chain problems.”

According to Hildebrandt, there is a general degree of acceptance for the Covid measures among companies in China. “There is mainly frustration about changes that are made on short notice and lack transparency – meaning that companies can only adjust to them reactively.” Apart from recurring restrictions on the ground in China, entry restrictions are a major headache for companies, Hildebrandt says. “There are virtually no business interactions on the ground anymore.”

EU representatives across the country gave similar reports: travel restrictions have the most severe effect. No factory visits, no face-to-face negotiations with clients, no trips home: travel within the country and abroad is prohibited. Known problems caused by the restrictions only keep getting worse, they said. The problems of recruiting and retaining skilled employees, the lack of face-to-face interaction, the isolation from headquarters in Europe along with a certain loss of trust. Given the situation, local chamber chairs demand one thing above all: the deployment of more effective vaccinations in China.

In a recent International Energy Agency (IEA) report, China has ascended to a regrettable 1st place among greenhouse gas emitters. But it’s not the usual suspect, carbon dioxide, that’s at issue here. It’s the gas methane, whose emission is also changing the climate. The IEA has become alarmed by the trend. And it leaves China with new problems if it wants to meet its targets.

Cutting methane emissions is just as tricky a maneuver in economic policy as dealing with CO2. At the COP 26 climate conference in Glasgow, the People’s Republic has thus recently refused to join an international initiative led by the US and the EU to curb methane emissions (China.Table reported). Instead, China has pledged to work on its own methane plans. Experts, however, have doubts about how genuine these efforts are. But at least the latest Five-Year Plan included a methane gas reduction goal for the first time.

China’s methane emissions have long dwarfed those of other major economies. According to calculations by Bloomberg NEF, China’s energy sector accounts for about one-fifth of total global methane emissions from oil, gas, coal and biomass. It generated over 50 percent more methane than the next largest emitters: Russia and the United States.

But even with the best of intentions, China will not be able to simply cut back on its emissions. Just like in other countries, China emits in three sectors:

In agriculture, China is already responsible for considerable methane emissions from its rice cultivation alone, because rice often grows underwater and thus emits methane. To avoid jeopardizing the food supply for its population, Beijing will probably not address methane emissions caused by agriculture or animal husbandry first.

According to a United Nations study, China’s coal sector offers the most promising opportunity to cut its methane emissions. But activity in exactly this sector has surged since power outages hit several parts of the country last fall, threatening to break supply chains (China.Table reported). This caused authorities to quickly turn back to coal as an energy source. Among other things, this has led to a renewed buildup of methane gas clouds over coal mines in the country.

Researchers express disappointment that the gas that accumulates in mines is not being used actively. After all, it is nothing more than natural gas, and thus a valuable energy source in its own right. ” While China has encouraged mine operators to make better use of the methane generated during the mining process, major obstacles remain,” said Kou Nannan, an analyst at Bloomberg NEF in Beijing. “Capturing the gas requires a lot of capital investment and most mines aren’t near major gas transmission pipelines.”

China plans to study methane emissions more closely and publish a nationwide action plan to control them. It has included Sinopec and China National Petroleum Corp (CNPC) in a pilot program to evaluate methods for measuring greenhouse gasses, Reuters reports. Scientists are only just beginning to use satellite data to calculate how much methane is caused by coal mining worldwide. Even without accurate data, one thing is probably already certain: China is leading the way.

But even though the US and Canada, like many Chinese companies, are not obligated to release data on their methane gas emissions, various studies show that most companies report their methane emissions to be significantly lower than they actually are. The IEA warns that methane emissions from the global energy sector are approximately 70 percent higher than the sum of estimates provided by national governments. China is probably not the only country that needs to do more besides pilot projects to better understand the sources of emissions to enable comprehensive methane management.

Methane has recently become the focus of scientific and political attention. According to climate researchers, half of the global warming since the mid-19th century can be traced back to methane gas. In the atmosphere, the gas absorbs more heat than CO2. Thus, the greenhouse effect of one kilogram of methane is around 30 times greater than that of the same amount of carbon dioxide. EU Commission President Ursula von der Leyen has therefore even given the gas priority: “the most effective things we can do to reduce near-term global warming and keep 1.5 degrees Celsius,” she said.

At the climate conference in Glasgow, von der Leyen and US President Joe Biden presented a climate package, in which around 100 countries intend to participate. By 2030, participating countries plan to cut their methane emissions by 30 percent compared to 2020 levels. Countries such as Germany, France, Canada and Japan, which are responsible for around half of global methane emissions and at the same time represent 70 percent of the global economy, joined the agreement. However, large emitters such as India, China, Russia and Australia have not signed the initiative.

China is probably having a hard time with methane pledges because the Party and government bodies are divided over the goals. Authorities also often get in each other’s way, as responsibilities are apparently unclear. Different units are often responsible for regulating coal and methane, complicating efforts to curb emissions, says Bloomberg analyst Kou.

Following the massacre of civilians in the Ukrainian town of Bucha, the EU has once again urged Beijing to take a clear stand against Russia’s war of aggression. As a permanent member of the United Nations Security Council, China has a special responsibility to maintain international peace and security, EU Commission chief Ursula von der Leyen told the EU Parliament plenary on Wednesday. “Nobody can be neutral when faced with such naked aggression against civilians.” Von der Leyen said this was also stressed at the EU-China summit last Friday. “We made clear how crucial it is for us in Europe, but also for the rest of the world, to take a clear stance.”

EU High Representative for Foreign Affairs Josep Borrell voiced an unusually harsh opinion about the virtual summit. He called the meeting a “dialogue of the deaf“. The Chinese leadership “didn’t want to talk about Ukraine,” Borrell told the European Parliament on Tuesday night. “They didn’t want to talk about human rights and other stuff and instead focus on positive things,” Borrell remarked about Chinese Premier Li Keqiang and President Xi Jinping. “So we couldn’t talk about Ukraine a lot, but we didn’t agree on anything else,” the EU foreign affairs representative said during the plenary week in Strasbourg.

However, Borrell said, there is a red line for Beijing in the Ukraine war: “That is weapons of mass destruction.” That had been made clear during talks before the actual summit meeting. The first EU-China summit since June 2020 took place last Friday without any significant results (China.Table reported).

China addressed the Bucha massacre for the first time at the UN Security Council on Tuesday, but did not condemn it. “The reports and images showing civilian deaths in the Ukrainian city of Bucha are very disturbing,” UN Ambassador Zhang Jun said, according to state media. However, he added that all allegations must be based on facts and all parties should “avoid unfounded accusations before a conclusion of the investigation is drawn.” While the horrific images from Ukraine’s Bucha are currently filling the front pages of international newspapers, Chinese media remains silent (China.Table reported). ari

Hong Kong Security Chief John Lee has announced his bid to become the city’s new Chief Executive. The 64-year-old has already submitted his letter of resignation, which still has to be accepted by the Chinese central government in accordance with the Basic Law. This step is now only considered a formal act because Lee enjoys Beijing’s support for his candidacy, according to media reports.

On May 8, the newly constituted Hong Kong parliament will choose the city’s new chief executive. The incumbent Chief Executive Carrie Lam will not run again and will resign from office on June 30.

Lee had been appointed to the post of Chief Security Officer by Lam in 2017. Last year, he also took on the role of Deputy Chief Executive of the Hong Kong government, ranking second behind Lam in the administrative hierarchy. Lee has served in the public service for more than 40 years. In his role as security chief, he has played a significant role in the city’s political purge since the introduction of the National Security Law. grz

Chinese EV and battery manufacturer BYD has announced to cease production of fossil-fuel-powered vehicles. BYD announced in a tweet that it has not produced any combustion models since March.

BYD’s EV sales volume reached nearly 604,000 units in 2021, an increase of 218 percent, according to Caixin’s calculations. Production of other vehicle types, on the other hand, declined by 43 percent and amounted to only 137,000 units. Data from the China Passenger Car Association (CPCA) shows that BYD was the best-selling EV manufacturer in China last year, with more than 17 percent market share. SAIC-GM-Wuling Automobile Co.Ltd. ranked second with about 12 percent, and Tesla was third with 9 percent.

To reassure customers of its non-electric division, BYD announced that it would continue to manufacture replacement parts for fossil-fuel vehicles and provide after-sales services to customers who purchased such cars.

The Shenzhen-based carmaker has quickly become the leader among EV manufacturers in the People’s Republic. Last year, BYD sold more EVs than vehicles with internal combustion engines for the first time. BYD’s 2021 revenue rose 38 percent to ¥211 billion (about €30 billion). However, BYD was unable to increase its profits. Due to the increase of raw materials costs and bottlenecks in global supply chains, BYD has also increased prices for several models (China.Table reported).

Together with several other carmakers, BYD signed a pledge at the UN Climate Change Conference to offer only zero-emission vehicles in key markets by 2035 and globally by 2040. niw

A political dispute has erupted in the UK over acquisition plans for the Newport Wafer Fab microchip factory. The British government had approved the controversial sale of the Welsh semiconductor factory to Nexperia, a Dutch subsidiary of China’s Wingtech Group. In July 2021, London had ordered National Security Advisor Sir Stephen Lovegrove to review the deal (China.Table reported). As local media now reports, Lovegrove concluded that there had not been sufficient security concerns to stop the sale. Newport Wafer Fab is one of the few plants in the UK that still manufactures semiconductors. The exact timescale of the takeover had not been publicly announced.

The review of the deal used too narrow a definition of “national security,” criticized Tom Tugendhat, Chairman of the UK Foreign Affairs Select Committee, among others. “As we urge Germany and others to opt out of Russian gas, it seems odd that we’re allowing China to buy semiconductor companies in the UK,” Tugendhat said. The Conservative politician criticized the fact that under the National Security and Investment Act, which has been in effect since January, the acquisition was not re-examined more closely. “The government has no clear strategy to protect what is left of our semiconductor industry,” Tugendhat said. ari

As Managing Director for Asia and the Pacific in the European External Action Service (EEAS), Gunnar Wiegand is responsible for EU relations with 41 countries, from Afghanistan to Fiji – and he has passed through exciting stations in his career. As a policy advisor, he was there when Spain joined the EU. As an associate of a political foundation, he has been involved in the support for the consolidation of new democracies in Southern Europe and Eastern Europe. In 1990, shortly before the German reunification, he began to work for the European Commission, first as a so-called GDR consultant, and later focused on the transformation processes in the former Soviet Union.

Before the start of the Covid pandemic, Gunnar Wiegand traveled to Asia twice a month on average. He maintains numerous professional and also some personal contacts in the region. His three sons enjoy traveling to Asia, and his wife was born in Lebanon, which is, after all, part of the Near East. At first glance, he doesn’t have much to do with China itself.

He did not study Chinese, but law and international relations in Italy and the USA. Mandarin is not one of the six languages he learned. And his first stations abroad did not take him to Hong Kong or Beijing, but to Latin America and Spain. “I’m not an expert on Asia, but on EU external relations, where it’s about bringing together EU foreign and security policy and member states with trade policy, development cooperation and sectoral policies of the European Commission,” he says.

China first appears on his CV in the late 1990s. At the time, he was a spokesman for European Commissioner for External Relations Chris Patten, who had previously served as the last British Empire governor of Hong Kong. “Patten was very well known in China, but he was an undesirable person at the time. I saw how popular he was in Hong Kong, on the other hand, when we made a trip there,” recalls Wiegand, who also traveled with him to India, Pakistan and Korea, among other places. Later, as Director at the European Commission, he was responsible for Russia, Eastern Europe and Central Asia and was, among other things, chief negotiator for the EU’s association agreements with Georgia and Moldova.

He also negotiated the first “Association Agenda”, the document on the concrete implementation of the Association Agreement, between the EU and Ukraine. In 2016, he was given responsibility for Asia and the Pacific in the European External Action Service, where he negotiated the new Strategic Partnership Agreement with Japan in 2017, contributed significantly to the first EU-Asia connectivity strategy in 2018, helped to reorient EU policy toward China (“Cooperation-Competition-Systemic Rivalry”) in 2019, and was responsible for drafting the EU’s Indo-Pacific cooperation strategy in 2021.

Gunnar Wiegand himself describes his career path in European politics as somewhat unusual: “The normal diplomatic course is that people move between headquarters and abroad. I myself have always developed and negotiated more content in Brussels and have thus been able to make an impact both internally and externally,” he says.

At present, aside from the implementation of the Indo-Pacific strategy and the issue of how the EU can best contribute to help stabilize Afghanistan, the EU official is mainly preoccupied with the EU’s relations with China. And this work in recent days – naturally – has been particularly dominated by the Ukraine crisis, where it is essential to achieve a ceasefire and establish humanitarian corridors as quickly as possible. Janna Degener-Storr

Laurent Cathala has been appointed as the new president of Gucci’s fashion division in Greater China. Cathala previously worked for luxury jeweler Tiffany & Co.

The US newspaper New York Times is restructuring its China staff: The new Beijing office head will be Keith Bradsher, who previously headed the Shanghai office. Vivian Wang will also join the Beijing team. Wang was previously working in Hong Kong. Alexandra Stevenson will be the new head of the Shanghai office.

Tea harvest in Ankang in the Shaanxi province. The region is one of China’s seven major tea-growing areas. Here in Liping County, the local government has particularly boosted production in recent years.