Whether the Civil Aviation Organization, the International Telecommunication Union or the Food and Agriculture Organization – the UN’s sub-organizations lead a barely noticed existence in the Western public eye. China, on the other hand, puts a lot of money and personnel into these groups. And that is absolutely legitimate.

But Marcel Grzanna shows in his analysis what consequences this can have: The directors from the People’s Republic are deliberately brokering contracts with Chinese companies, deepening cooperation with their government – and ultimately seeking to upset the prevailing value system. China deliberately undermines the UN system.

In our second analysis, we turn our attention to the discount battle in China’s EV market. A brutal price war has broken out, as Fabian Kretschmer reports. And Germany’s car manufacturers are in the thick of it: For instance, VW offers the basic version of the ID.3 in China for as little as 15,000 euros. By comparison, European customers have to pay 40,000 euros, albeit for a model that differs in quality.

Several car manufacturers thought to have found a way out – and signed a “truce”. But the agreement did not even last 48 hours before Tesla dropped out again. It is a ruinous battle for new customers.

The re-election of Qu Dongyu as head of the Food and Agriculture Organisation of the United Nations (FAO) was a straightforward matter. The former Chinese Vice Minister of Agriculture received 168 of 182 votes at the beginning of July and will thus remain in office until 2027.

The election result was clearer than in Qu’s first candidacy four years ago when he still had to win against a French and a Georgian candidate. This year, Qu remained unchallenged. No one was willing or able to challenge the incumbent for his post. Not least because the People’s Republic has attracted many developing and emerging countries to its side with consistent lobbying and gained potential majorities in numerous bodies.

“China has displayed a skill and persistence in infiltrating international organizations and in using its bilateral initiatives such as the BRI to take advantage of the one-nation-one-vote system within UN agencies,” reads a study by the US-based Heritage Foundation.

The Sydney-based Australian think tank, Lowy Institute, recognizes this as China’s attempt to reform the UN system from within. Reform tends to sound positive. But the authors doubt whether this is actually the case from the international community’s perspective. They believe the Chinese concept of a community of humanity’s common destiny marginalizes universal values in favor of government interests.

Qu Dongyu is a clear example of how China instrumentalizes the UN to pursue its own interests. Investigations by the four German public broadcasters BR, MDR, rbb and SWR, suggest that the FAO follows a two-pronged approach. Apart from the interests of the global community, the organization is also very much focused on benefiting China.

Under Chinese leadership, shipments of controversial pesticides to Africa, Asia and Oceania were approved by the organization, which are produced by a Chinese company. Many of these pesticides are banned in the EU.

The investigation also revealed the direct benefit of several FAO projects for China’s Belt & Road Initiative (BRI) infrastructure project. China has the UN agency vaccinated cattle in neighboring Laos in order to import them. An FAO internal project description speaks of “alignment with […] China’s priority” to support BRI.

Under Qu, contracts and posts in the organization also increasingly went to China. The new FAO website was built by the Chinese Ministry of Agriculture. Beijing received 400,000 dollars for this project.

The initial two Chinese directors working for the Director General have grown to six during the first term. According to German public broadcaster ARD, Chinese tender documents show that all directors would be “strictly” vetted for “political ideology” – unthinkable in liberal democracies. The report also claims they report to the Chinese embassy in Rome, where FAO is headquartered. A source told journalists that the Chinese directors were internally referred to as “spies”.

China is spending a handsome amount for its growing influence on UN organizations. UN spending has increased massively in parallel with the rise of the People’s Republic to become the second-largest economy. A good 20 years ago, the country contributed around two percent of the regular UN budget. By 2022, the figure had climbed to 15.25 percent. UN experts expect the Chinese share to continue to grow in the coming years.

Qu is just one example of how Chinese UN officials use their power to pursue Beijing’s interests. Another example is Liu Fang. She was the first woman to chair the International Civil Aviation Organisation (ICAO). She drew strong criticism several times during her term until 2021. In 2016, she excluded Taiwan from the 27th ICAO session, even though the island state is considered an internationally recognized hub for civil aviation.

After the outbreak of the Covid pandemic, Liu again excluded Taiwan from the organization’s crisis coordination. Critics of this exclusion were blocked by ICAO’s Twitter account and offered to get their access back if they deleted their comments.

Or Zhao Houlin, head of the International Telecommunication Union (ITU) until the end of last year: In 2015, Zhao promised in a conversation with then Prime Minister Li Keqiang to “promote ITU cooperation with China”. According to its “China Standards 2035” strategy, China wants to set global telecommunications standards. In 2019 alone, the country submitted 830 technical specifications to the ITU, more than South Korea, Japan and the USA in second to fourth place combined.

Chinese telecom companies Huawei and ZTE have now submitted almost 24,000 Standard Essential Patents (SEP) in the 5G field. By registering, all other 5G participants can be forced to use chipsets and algorithms produced by the SEP holders. This is to ensure compatibility with the global 3GPP standards. By comparison, US chipmakers Intel and Qualcomm have submitted 3000 SEPs. Critics blame the discrepancy on the close ties between Beijing and the ITU.

Not only the United States, which as the leading world power could be accused of being biased, recognizes the pattern behind this. India is also aware of China’s influence on the UN. In a study, the Gateway House, a private research institute on international relations, found “a disproportionate influence” of China not only on the ITU, ICAO and FAO, but also on the Industrial Development Organization (UNIDO), the International Maritime Organization (IMO) and the World Health Organization (WHO).

“The clusters of agencies headed by China are directly and indirectly linked to its domestic agendas like the Belt and Road Initiative, Make in China 2025 and the rise of Chinese companies. The world is just starting to take notice – and so must India,” the authors write.

Not even the most creative comedy writer could have come up with such a punchline: At the end of last week, Elon Musk signed an open letter under the aegis of the Chinese Ministry of Industry in which the Tesla founder pledged to strengthen “socialist core values”. Obviously, the 52-year-old had to learn the hard way: If you want to survive on the Chinese market, you have to bow to the rules of the Communist Party.

The situation is not only challenging for Tesla. A brutal price war is raging in the Chinese EV market. The fierce battle for market leadership in the transport transition, interpreted as a necessary healthy downsizing of an overheated market just a few short years ago, has taken on alarming proportions since the beginning of 2023.

This year alone, the sector has introduced over 150 new car models in China. This cannot go on for long. Of the countless e-mobility start-ups operating in China, only a few will survive in the medium term. Dozens are likely to run out of money in the coming months. Even promising brands like Xpeng or the Shanghai-based carmaker NIO, which currently aims to gain a foothold in Europe, are in the red.

As a traditional car brand with a solid foothold in the internal combustion segment, German manufacturer Volkswagen is also in the thick of the discount battle for EVs. After an aggressive price cut of 16 percent, the basic version of the ID.3 model is now sold in China for around 15,000 euros. By comparison: On the European market, the (not exactly identical) electric car costs just under 40,000 euros.

Volkswagen is under massive pressure. For years, they held pole position on the Chinese market, but now the Chinese competition from BYD sells more cars. Nevertheless, international manufacturers continue to hope for good business. The paradigm shift is driven above all by the transport transition, where German carmakers are clearly falling behind. The Chinese brands are technically at least on par and, above all, significantly cheaper than “Made in Germany”.

To counteract the price war, the industry came to an unusual decision last week: At a conference in Shanghai, a total of 16 manufacturers signed an open letter in which they pledged to avoid “abnormal pricing”. Tesla was the only foreign company to sign the statement – thus supporting the “socialism clause” mentioned at the beginning.

Volkswagen also hopes that the price war will finally abate. China CEO Ralf Brandstatter spoke of an “unhealthy market development” at the China Auto Forum in Shanghai. The capital the industry is burning due to the price war is actually needed for long-term investments. “Volkswagen wants to continue to grow even in this challenging environment. But certainly not at any price,” said the 54-year-old.

VW only holds a market share of 2.7 percent in the EV segment. Even with the sales of the two joint ventures, VW only ranks tenth. BYD sells around ten times as many EVs as the Wolfsburg-based company. The goal now is to remain the front-runner, at least among foreign car manufacturers.

E-mobility has taken a staggering development in China, mainly thanks to massive state subsidies and strict regulation of combustion cars. More EVs are now sold in the People’s Republic than in the rest of the world combined. But the slowing post-Covid recovery is being felt even by the otherwise prosperous sector: While the growth rates for electric and hybrid cars in the past two years have always been in the triple-digit percentage range, the forecast by the state car association for 2023 is a modest 36 percent.

This is another reason why car manufacturers are wooing customers with an increasingly aggressive pricing policy. So this ruinous trend will not subside in the coming months. Even the “truce” of the 16 carmakers lasted just 48 hours.

The first company has already violated the voluntary commitment: Elon Musk, of all people, broke the self-commitment and promised Chinese buyers the equivalent of 450 euros if they bought a new Model 3 or Model Y following the recommendation of an existing Tesla customer. On Saturday, the Chinese Association of Automobile Manufacturers (CAAM) eventually officially withdrew the letter. The reason: it could possibly violate antitrust law.

The umbrella organization Association of Ethical Shareholders Germany harbors serious doubts about the validity of an investigation into Volkswagen’s Xinjiang plant. In an open letter made available to China.Table in advance, the association points to the drastic policy of repression in the Uyghur region. This would make collecting valid information on the ground impossible.

While the Ethical Shareholders welcome that Volkswagen takes potential human rights violations at the Volkswagen-SAIC plant in Urumqi seriously, there are serious indications of forced labor, especially in the supply chain. “With regard to Volkswagen’s planned audit of the Volkswagen-SAIC plant, we have reasonable doubts as to whether an external audit can be an effective and sufficient measure in this specific case,” says the letter, which will be published today, Tuesday.

At the end of June, Volkswagen CEO Oliver Blume announced “a transparent, independent external audit” and “full transparency”. The group thus complies with a key demand of fund companies, which are among Volkswagen’s major shareholders. The shareholders’ meeting in May saw several activist protests. They accused Volkswagen of earning money at the expense of Uyghur forced laborers.

The Ethical Shareholders now want to know, among other things, how the independence and validity of the audit results can be guaranteed and whether workers can speak freely and without the risk of state repression. In addition, the association asks whether the audit includes suppliers to the Volkswagen SAIC plant in Urumqi as well as suppliers from the affected region to other VW plants.

In December 2022, Sheffield Hallam University published a comprehensive report documenting the likelihood of Uyghur forced labor in the automotive industry’s supply chains. Not only Volkswagen is affected, but also other German and international manufacturers such as Mercedes, BMW, Toyota, Ford. grz

Weak consumer demand, including from Germany, is fuelling deflation concerns in China. In June, Chinese manufacturers lowered their prices more than at any time in the last seven and a half years. Producer prices fell by 5.4 percent year-on-year, according to the National Bureau of Statistics of China on Monday. It was the ninth consecutive decline. China is at risk of deflation.

Especially companies in the energy, metals and chemicals sectors were forced to cut prices as domestic and international demand weakened. In addition, consumer prices stagnated for the first time in almost two and a half years. Sluggish demand is likely to be a reason here as well. This, in turn, increases the likelihood of the government and central bank taking new stimulus measures.

Falling property prices and the financial problems of numerous developers have not only curbed construction activity but probably also consumer spending. In addition, the world champion exporter is struggling with the fact that important sales markets such as Germany and the Eurozone as a whole have fallen into recession.

Deflation is a wide-scale price fall that can trigger a downward spiral of declining sales, wages and investment – with devastating consequences for the economy. Concerns are also spreading on the financial markets. The exchange rate of the national currency, the yuan, fell and Asian stocks also slid into the red. rtr/grz

China’s central bank extended its measures to support the real estate market until the end of 2024 on Monday. Specifically, the measures include the deferral of real estate loans. For instance, it will be possible to postpone the repayment of certain real estate loans for one year. This is according to a statement by the People’s Bank of China and the National Administration of Financial Regulation, as reported by Xinhua.

China’s financial authorities approved comprehensive aid for the real estate sector. Billions in aid were made available last November. The country will now extend the relevant policies until December 31, 2024, according to the statement.

The goal of these measures is clear: China wants to prop up its ailing real estate market. The real estate sector is of great importance to China’s economy. It accounts for a large share of the gross domestic product.

Now China’s banks are being encouraged to negotiate with real estate companies to extend loan repayments and provide financial support to real estate companies. The aim is to allow the completion of real estate projects currently under construction. rad

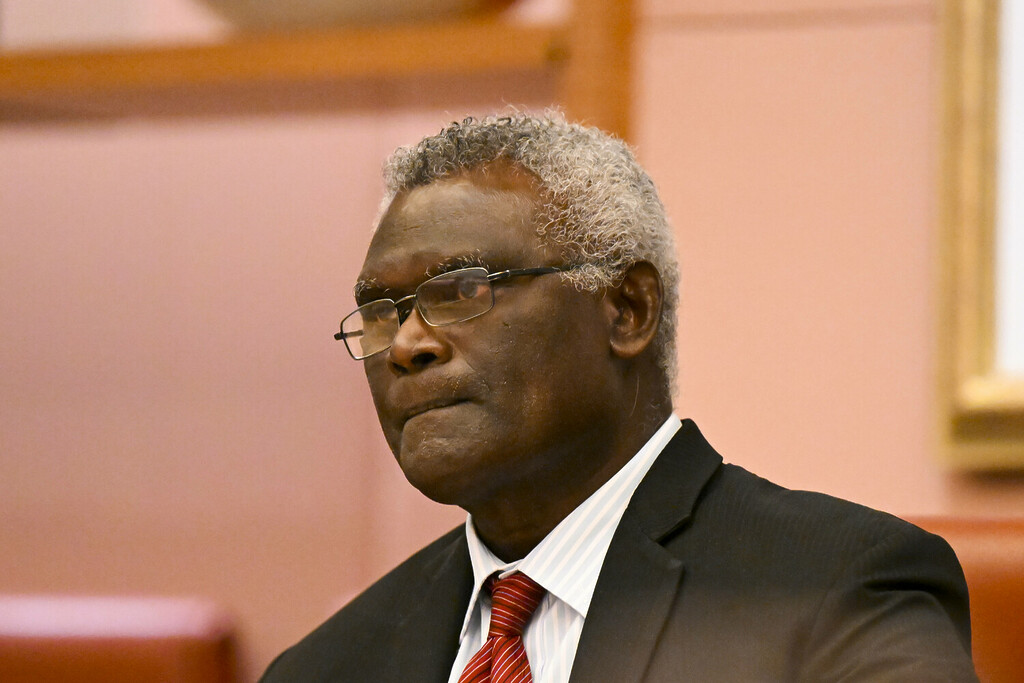

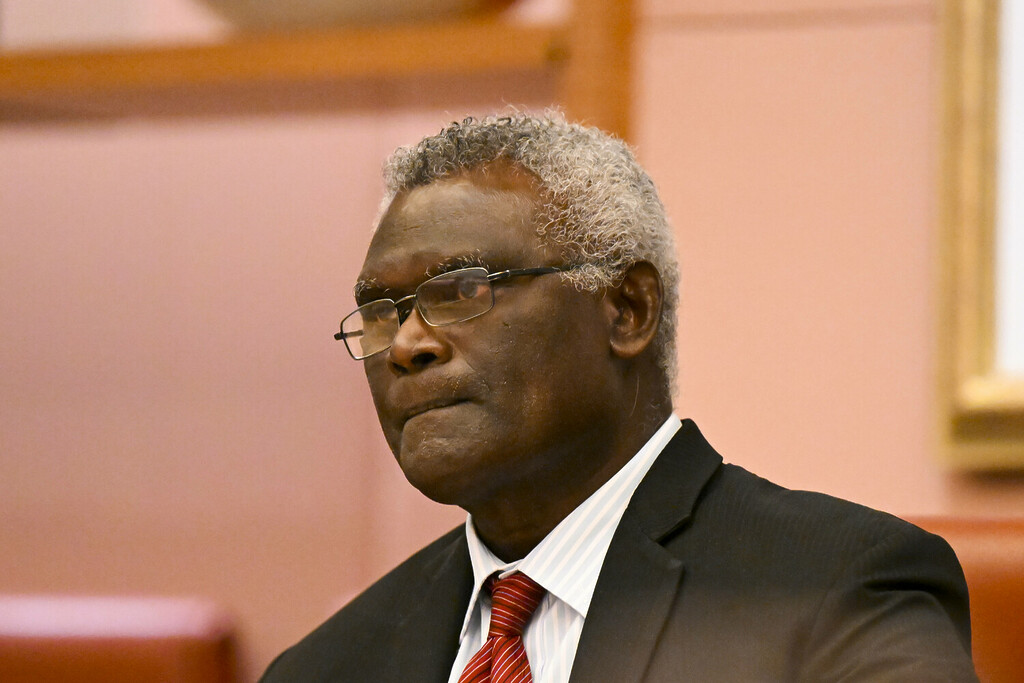

On Monday, China and the Solomon Islands signed several agreements to upgrade their relations to a comprehensive strategic partnership. Prime Minister Manasseh Sogavare and his Chinese counterpart Li Qiang agreed on a total of nine agreements in Beijing. Among other things, the agreements regulate police cooperation. This simplifies the deployment of Chinese units in the Solomon Islands, should Beijing be requested to do so.

It marks a rapid development in bilateral relations and underscores Sogavare’s clear focus on China. After he was elected in 2019, he shifted his country’s diplomatic focus away from Taiwan and toward China. Last year, the two countries signed a security agreement that generated considerable commotion in the region and the United States.

Beijing subsequently worked steadily to develop the relationship. Last month, Sogavare also called for a review of the 2017 security agreement with Australia. Crucial to all of this is the archipelago’s strategic location, which plays into China’s geostrategic ambitions.

Sogavare arrived in China on Sunday for his first visit to the country. Sogavare also met with China’s President Xi Jinping. “China and Pacific island countries are both developing countries and should strengthen mutual assistance within the framework of South-South cooperation,” Xi said. rad

China currently experiences days of weather extremes: Especially the capital Beijing experiences scorching heat with temperatures above 40 degrees Celsius, while central China struggles with the consequences of heavy rainfalls and floods.

At the start of the week, large parts of the country continued to suffer from extreme heat: Temperatures of more than 40 degrees were forecast for the capital Beijing. In parts of Hebei, Henan, Zhejiang and Fujian provinces, the thermometer also scratched the 40-degree mark. In the north and other parts of the country, temperatures of more than 35 degrees were also expected.

On Monday, China’s weather service issued an orange heat warning in some areas, the second-highest level. Accordingly, outdoor work should be kept as short as possible. Delivery services, however, continued to work. In the Beijing area, even the highest warning level was declared, where outdoor work is completely prohibited and authorities are required to prepare measures to protect the population. Authorities in Beijing have reported two heat-related deaths so far. The Ministry of Agriculture warned that the persistent heat could damage the rice harvest.

Meanwhile, rescue workers in Hubei searched for seven people missing after a landslide triggered by a thunderstorm. The earth masses had buried a road construction in central China on Saturday. At least one person died and five were injured, the state news agency Xinhua reported. Due to heavy torrential rain in large parts of the country, tens of thousands had to leave their homes. rad

The EU Commission has significantly revised the reporting obligations under the Foreign Subsidies Regulation (FSR). This was the Commission’s response to criticism from industry and member states. The new subsidy control rules are aimed primarily at companies from countries such as China, but apply equally to European companies operating outside the EU.

The FSR was passed by the Council and the European Parliament in a fast-track procedure a year ago. The regulation requires companies to notify the Commission of planned mergers and public contracts if they receive substantial financial contributions from non-EU countries. The authority has now severely narrowed the reporting obligations:

The new reporting requirements take effect on October 12. tho

A knife attack on the grounds of a kindergarten in the southern Chinese province of Guangdong has killed six people and injured another. Three children are said to be among the dead. A 25-year-old man was arrested as a prime suspect.

The incident triggered a wave of concern and an emotional debate on the social media platform Weibo. With 290 million views, the tragedy generated huge attention among users. “How many families are destroyed by this … I support the death penalty,” wrote one user. Another asked why such attacks continue to happen.

In the past ten years, there have been repeated attacks on kindergartens in China. Last August, three people were killed and six injured in a stabbing at a kindergarten in the southern province of Jiangxi. In 2021, a man killed two children and wounded 16 at a kindergarten in the southwestern region of Guangxi. In 2017, a 22-year-old man detonated an explosive device outside a kindergarten in Jiangsu province, killing himself and dozens others. rtr/grz

The end of COVID-19 lockdowns was supposed to unleash a powerful wave of pent-up demand. Instead, aggregate demand, which had been slowing before the pandemic, has returned to its previous trajectory. Though Chinese have been traveling, socializing, and dining out more, consumer-spending growth by households has been limited. Fixed-asset investment has not recovered.

With a few exceptions, such as the new-energy-vehicle (NEV) sector, economic activity has remained subdued. As a result, growth has been much weaker than expected. Though real GDP growth reached 4.5 percent in the first quarter, it is expected to slow in the second. Core inflation is hovering around zero, and the producer price index is in negative territory.

But this situation likely reflects temporary circumstances. In particular, when the new government took over earlier this year, it did not immediately introduce a comprehensive policy package aimed at bolstering the post-pandemic recovery.

To be sure, in the second half of last year, China’s government did pursue some measures aimed at loosening the constraints on households and businesses. But the interventions did not go far enough, particularly regarding the real-estate sector, which constitutes about 40 percent of China’s annual fixed-asset investment. Market expectations that housing prices are set to plummet have weighed on household balance sheets and deterred new home purchases.

Meanwhile, local governments are facing severe financial constraints, and the interest-bearing debt position of local-government financing platforms has deteriorated sharply, undermining infrastructure investment. While the financial constraints on the corporate sector are somewhat looser, lack of confidence is taking a toll on private investment. Add to this declining employment and wages, owing to the COVID-19 pandemic, and supportive policies are clearly needed.

Fortunately, a policy package aimed at supporting the economic recovery is most likely on its way. A recent briefing by China’s National Development and Reform Commission indicated that such a package would include interventions aimed at raising wages and supporting low-income households to boost consumption spending.

Funding curbs on property developers may also be loosened, in order to reinvigorate the real-estate sector. The People’s Bank of China already appears poised to cut lending rates further, in order to encourage borrowing. And the central government will most likely consider partial local-government-debt swaps, or request policy banks to offer long-term loans, in order to boost local governments’ spending power.

Of course, Chinese policymakers cannot circumvent all of the headwinds the economy faces. Global geopolitical shifts – especially China’s deteriorating relationship with the United States – will undoubtedly hamper China’s economic recovery in the short term. Yet it remains far from clear what the medium- or long-term effects will be. It is entirely possible that beyond the short-term shocks lie long-term opportunities for China, a country with a long track record of flourishing amid instability and crisis.

Already, China has responded to increasing uncertainty in its external environment by expanding and safeguarding its access to strategic resources, such as energy and critical minerals, whether by strengthening its partnerships with relevant countries or overcoming its dependence on foreign suppliers. China already dominates the rare earths market.

China’s strategic thinking and economic resilience are also reflected in the rapid recent growth in NEV exports. In the wake of the pandemic shock and the geopolitical crisis triggered by the Ukraine war, Chinese automakers saw opportunities to boost NEV exports to regions like Europe that were seeking to accelerate their green transitions.

The Chinese NEV industry’s record speaks for itself. China overtook South Korea in total automobile exports in 2021, and Germany last year. This year, China is expected to export four million units – a significant share of which will be NEVs – surpassing Japan to become the world’s largest car exporter. At the same time, to increase NEV adoption at home, the government will extend the purchase-tax exemption on NEVs for another four years.

This record suggests that US-led efforts to restrict microchip exports to China will have limited impact in the long term. They are more likely to spur China to reduce its dependence on technology supply chains involving the US and its partners, whether by shifting its trade relationships or innovating at home.

China’s decentralized economic structure helps considerably. Flows of complex technology products are likely to be spread across dozens of cities and managed by thousands of firms, which can be state-owned enterprises, indigenous private firms, or foreign-owned companies.

When a sector begins to grow rapidly in China, investors and companies tend to flock to it, not least because of the supportive policies and subsidies that local governments are probably offering. This can accelerate the industry’s development considerably, even if it is an industry with technological thresholds that require huge investment (and large talent pools) to reach. For example, Tesla’s planned new Megapack (battery) factory in Shanghai will provide a further boost to China’s NEV sector, just as its “Gigafactory” has since 2019.

Of course, once the technological threshold is crossed, huge investments in newly thriving sectors can create challenges, not least excessive capital formation, and early-entry firms may be the ones that suffer the most. But as China’s photovoltaic industry showed, demand conditions can stabilize or improve, reinvigorating the sector. In other words, robust economic growth may still materialize, even if a macro boom is yet to come.

Zhang Jun, Dean of the School of Economics at Fudan University, is Director of the China Center for Economic Studies, a Shanghai-based think tank.

Copyright: Project Syndicate, 2023.

www.project-syndicate.org

Chen Jixing, former chief of finance of Guangdong Province, is suspected of corruption. The Central Commission for Discipline Inspection announced in a statement on Sunday that the 68-year-old retired official is suspected of “serious violations of discipline and Communist Party law” – a common euphemism for corruption.

Is something changing in your organization? Let us know at heads@table.media!

The Xiaoshan District Sports Center in Hangzhou will be the central venue for the Asian Games in September. They were originally supposed to be held last year, but were postponed to next late summer due to the Covid pandemic. The event will include dozens of sport disciplines. At past Asian Games in Indonesia, medals were awarded in 468 competitions. Advance ticket sales have been open since last weekend.

Whether the Civil Aviation Organization, the International Telecommunication Union or the Food and Agriculture Organization – the UN’s sub-organizations lead a barely noticed existence in the Western public eye. China, on the other hand, puts a lot of money and personnel into these groups. And that is absolutely legitimate.

But Marcel Grzanna shows in his analysis what consequences this can have: The directors from the People’s Republic are deliberately brokering contracts with Chinese companies, deepening cooperation with their government – and ultimately seeking to upset the prevailing value system. China deliberately undermines the UN system.

In our second analysis, we turn our attention to the discount battle in China’s EV market. A brutal price war has broken out, as Fabian Kretschmer reports. And Germany’s car manufacturers are in the thick of it: For instance, VW offers the basic version of the ID.3 in China for as little as 15,000 euros. By comparison, European customers have to pay 40,000 euros, albeit for a model that differs in quality.

Several car manufacturers thought to have found a way out – and signed a “truce”. But the agreement did not even last 48 hours before Tesla dropped out again. It is a ruinous battle for new customers.

The re-election of Qu Dongyu as head of the Food and Agriculture Organisation of the United Nations (FAO) was a straightforward matter. The former Chinese Vice Minister of Agriculture received 168 of 182 votes at the beginning of July and will thus remain in office until 2027.

The election result was clearer than in Qu’s first candidacy four years ago when he still had to win against a French and a Georgian candidate. This year, Qu remained unchallenged. No one was willing or able to challenge the incumbent for his post. Not least because the People’s Republic has attracted many developing and emerging countries to its side with consistent lobbying and gained potential majorities in numerous bodies.

“China has displayed a skill and persistence in infiltrating international organizations and in using its bilateral initiatives such as the BRI to take advantage of the one-nation-one-vote system within UN agencies,” reads a study by the US-based Heritage Foundation.

The Sydney-based Australian think tank, Lowy Institute, recognizes this as China’s attempt to reform the UN system from within. Reform tends to sound positive. But the authors doubt whether this is actually the case from the international community’s perspective. They believe the Chinese concept of a community of humanity’s common destiny marginalizes universal values in favor of government interests.

Qu Dongyu is a clear example of how China instrumentalizes the UN to pursue its own interests. Investigations by the four German public broadcasters BR, MDR, rbb and SWR, suggest that the FAO follows a two-pronged approach. Apart from the interests of the global community, the organization is also very much focused on benefiting China.

Under Chinese leadership, shipments of controversial pesticides to Africa, Asia and Oceania were approved by the organization, which are produced by a Chinese company. Many of these pesticides are banned in the EU.

The investigation also revealed the direct benefit of several FAO projects for China’s Belt & Road Initiative (BRI) infrastructure project. China has the UN agency vaccinated cattle in neighboring Laos in order to import them. An FAO internal project description speaks of “alignment with […] China’s priority” to support BRI.

Under Qu, contracts and posts in the organization also increasingly went to China. The new FAO website was built by the Chinese Ministry of Agriculture. Beijing received 400,000 dollars for this project.

The initial two Chinese directors working for the Director General have grown to six during the first term. According to German public broadcaster ARD, Chinese tender documents show that all directors would be “strictly” vetted for “political ideology” – unthinkable in liberal democracies. The report also claims they report to the Chinese embassy in Rome, where FAO is headquartered. A source told journalists that the Chinese directors were internally referred to as “spies”.

China is spending a handsome amount for its growing influence on UN organizations. UN spending has increased massively in parallel with the rise of the People’s Republic to become the second-largest economy. A good 20 years ago, the country contributed around two percent of the regular UN budget. By 2022, the figure had climbed to 15.25 percent. UN experts expect the Chinese share to continue to grow in the coming years.

Qu is just one example of how Chinese UN officials use their power to pursue Beijing’s interests. Another example is Liu Fang. She was the first woman to chair the International Civil Aviation Organisation (ICAO). She drew strong criticism several times during her term until 2021. In 2016, she excluded Taiwan from the 27th ICAO session, even though the island state is considered an internationally recognized hub for civil aviation.

After the outbreak of the Covid pandemic, Liu again excluded Taiwan from the organization’s crisis coordination. Critics of this exclusion were blocked by ICAO’s Twitter account and offered to get their access back if they deleted their comments.

Or Zhao Houlin, head of the International Telecommunication Union (ITU) until the end of last year: In 2015, Zhao promised in a conversation with then Prime Minister Li Keqiang to “promote ITU cooperation with China”. According to its “China Standards 2035” strategy, China wants to set global telecommunications standards. In 2019 alone, the country submitted 830 technical specifications to the ITU, more than South Korea, Japan and the USA in second to fourth place combined.

Chinese telecom companies Huawei and ZTE have now submitted almost 24,000 Standard Essential Patents (SEP) in the 5G field. By registering, all other 5G participants can be forced to use chipsets and algorithms produced by the SEP holders. This is to ensure compatibility with the global 3GPP standards. By comparison, US chipmakers Intel and Qualcomm have submitted 3000 SEPs. Critics blame the discrepancy on the close ties between Beijing and the ITU.

Not only the United States, which as the leading world power could be accused of being biased, recognizes the pattern behind this. India is also aware of China’s influence on the UN. In a study, the Gateway House, a private research institute on international relations, found “a disproportionate influence” of China not only on the ITU, ICAO and FAO, but also on the Industrial Development Organization (UNIDO), the International Maritime Organization (IMO) and the World Health Organization (WHO).

“The clusters of agencies headed by China are directly and indirectly linked to its domestic agendas like the Belt and Road Initiative, Make in China 2025 and the rise of Chinese companies. The world is just starting to take notice – and so must India,” the authors write.

Not even the most creative comedy writer could have come up with such a punchline: At the end of last week, Elon Musk signed an open letter under the aegis of the Chinese Ministry of Industry in which the Tesla founder pledged to strengthen “socialist core values”. Obviously, the 52-year-old had to learn the hard way: If you want to survive on the Chinese market, you have to bow to the rules of the Communist Party.

The situation is not only challenging for Tesla. A brutal price war is raging in the Chinese EV market. The fierce battle for market leadership in the transport transition, interpreted as a necessary healthy downsizing of an overheated market just a few short years ago, has taken on alarming proportions since the beginning of 2023.

This year alone, the sector has introduced over 150 new car models in China. This cannot go on for long. Of the countless e-mobility start-ups operating in China, only a few will survive in the medium term. Dozens are likely to run out of money in the coming months. Even promising brands like Xpeng or the Shanghai-based carmaker NIO, which currently aims to gain a foothold in Europe, are in the red.

As a traditional car brand with a solid foothold in the internal combustion segment, German manufacturer Volkswagen is also in the thick of the discount battle for EVs. After an aggressive price cut of 16 percent, the basic version of the ID.3 model is now sold in China for around 15,000 euros. By comparison: On the European market, the (not exactly identical) electric car costs just under 40,000 euros.

Volkswagen is under massive pressure. For years, they held pole position on the Chinese market, but now the Chinese competition from BYD sells more cars. Nevertheless, international manufacturers continue to hope for good business. The paradigm shift is driven above all by the transport transition, where German carmakers are clearly falling behind. The Chinese brands are technically at least on par and, above all, significantly cheaper than “Made in Germany”.

To counteract the price war, the industry came to an unusual decision last week: At a conference in Shanghai, a total of 16 manufacturers signed an open letter in which they pledged to avoid “abnormal pricing”. Tesla was the only foreign company to sign the statement – thus supporting the “socialism clause” mentioned at the beginning.

Volkswagen also hopes that the price war will finally abate. China CEO Ralf Brandstatter spoke of an “unhealthy market development” at the China Auto Forum in Shanghai. The capital the industry is burning due to the price war is actually needed for long-term investments. “Volkswagen wants to continue to grow even in this challenging environment. But certainly not at any price,” said the 54-year-old.

VW only holds a market share of 2.7 percent in the EV segment. Even with the sales of the two joint ventures, VW only ranks tenth. BYD sells around ten times as many EVs as the Wolfsburg-based company. The goal now is to remain the front-runner, at least among foreign car manufacturers.

E-mobility has taken a staggering development in China, mainly thanks to massive state subsidies and strict regulation of combustion cars. More EVs are now sold in the People’s Republic than in the rest of the world combined. But the slowing post-Covid recovery is being felt even by the otherwise prosperous sector: While the growth rates for electric and hybrid cars in the past two years have always been in the triple-digit percentage range, the forecast by the state car association for 2023 is a modest 36 percent.

This is another reason why car manufacturers are wooing customers with an increasingly aggressive pricing policy. So this ruinous trend will not subside in the coming months. Even the “truce” of the 16 carmakers lasted just 48 hours.

The first company has already violated the voluntary commitment: Elon Musk, of all people, broke the self-commitment and promised Chinese buyers the equivalent of 450 euros if they bought a new Model 3 or Model Y following the recommendation of an existing Tesla customer. On Saturday, the Chinese Association of Automobile Manufacturers (CAAM) eventually officially withdrew the letter. The reason: it could possibly violate antitrust law.

The umbrella organization Association of Ethical Shareholders Germany harbors serious doubts about the validity of an investigation into Volkswagen’s Xinjiang plant. In an open letter made available to China.Table in advance, the association points to the drastic policy of repression in the Uyghur region. This would make collecting valid information on the ground impossible.

While the Ethical Shareholders welcome that Volkswagen takes potential human rights violations at the Volkswagen-SAIC plant in Urumqi seriously, there are serious indications of forced labor, especially in the supply chain. “With regard to Volkswagen’s planned audit of the Volkswagen-SAIC plant, we have reasonable doubts as to whether an external audit can be an effective and sufficient measure in this specific case,” says the letter, which will be published today, Tuesday.

At the end of June, Volkswagen CEO Oliver Blume announced “a transparent, independent external audit” and “full transparency”. The group thus complies with a key demand of fund companies, which are among Volkswagen’s major shareholders. The shareholders’ meeting in May saw several activist protests. They accused Volkswagen of earning money at the expense of Uyghur forced laborers.

The Ethical Shareholders now want to know, among other things, how the independence and validity of the audit results can be guaranteed and whether workers can speak freely and without the risk of state repression. In addition, the association asks whether the audit includes suppliers to the Volkswagen SAIC plant in Urumqi as well as suppliers from the affected region to other VW plants.

In December 2022, Sheffield Hallam University published a comprehensive report documenting the likelihood of Uyghur forced labor in the automotive industry’s supply chains. Not only Volkswagen is affected, but also other German and international manufacturers such as Mercedes, BMW, Toyota, Ford. grz

Weak consumer demand, including from Germany, is fuelling deflation concerns in China. In June, Chinese manufacturers lowered their prices more than at any time in the last seven and a half years. Producer prices fell by 5.4 percent year-on-year, according to the National Bureau of Statistics of China on Monday. It was the ninth consecutive decline. China is at risk of deflation.

Especially companies in the energy, metals and chemicals sectors were forced to cut prices as domestic and international demand weakened. In addition, consumer prices stagnated for the first time in almost two and a half years. Sluggish demand is likely to be a reason here as well. This, in turn, increases the likelihood of the government and central bank taking new stimulus measures.

Falling property prices and the financial problems of numerous developers have not only curbed construction activity but probably also consumer spending. In addition, the world champion exporter is struggling with the fact that important sales markets such as Germany and the Eurozone as a whole have fallen into recession.

Deflation is a wide-scale price fall that can trigger a downward spiral of declining sales, wages and investment – with devastating consequences for the economy. Concerns are also spreading on the financial markets. The exchange rate of the national currency, the yuan, fell and Asian stocks also slid into the red. rtr/grz

China’s central bank extended its measures to support the real estate market until the end of 2024 on Monday. Specifically, the measures include the deferral of real estate loans. For instance, it will be possible to postpone the repayment of certain real estate loans for one year. This is according to a statement by the People’s Bank of China and the National Administration of Financial Regulation, as reported by Xinhua.

China’s financial authorities approved comprehensive aid for the real estate sector. Billions in aid were made available last November. The country will now extend the relevant policies until December 31, 2024, according to the statement.

The goal of these measures is clear: China wants to prop up its ailing real estate market. The real estate sector is of great importance to China’s economy. It accounts for a large share of the gross domestic product.

Now China’s banks are being encouraged to negotiate with real estate companies to extend loan repayments and provide financial support to real estate companies. The aim is to allow the completion of real estate projects currently under construction. rad

On Monday, China and the Solomon Islands signed several agreements to upgrade their relations to a comprehensive strategic partnership. Prime Minister Manasseh Sogavare and his Chinese counterpart Li Qiang agreed on a total of nine agreements in Beijing. Among other things, the agreements regulate police cooperation. This simplifies the deployment of Chinese units in the Solomon Islands, should Beijing be requested to do so.

It marks a rapid development in bilateral relations and underscores Sogavare’s clear focus on China. After he was elected in 2019, he shifted his country’s diplomatic focus away from Taiwan and toward China. Last year, the two countries signed a security agreement that generated considerable commotion in the region and the United States.

Beijing subsequently worked steadily to develop the relationship. Last month, Sogavare also called for a review of the 2017 security agreement with Australia. Crucial to all of this is the archipelago’s strategic location, which plays into China’s geostrategic ambitions.

Sogavare arrived in China on Sunday for his first visit to the country. Sogavare also met with China’s President Xi Jinping. “China and Pacific island countries are both developing countries and should strengthen mutual assistance within the framework of South-South cooperation,” Xi said. rad

China currently experiences days of weather extremes: Especially the capital Beijing experiences scorching heat with temperatures above 40 degrees Celsius, while central China struggles with the consequences of heavy rainfalls and floods.

At the start of the week, large parts of the country continued to suffer from extreme heat: Temperatures of more than 40 degrees were forecast for the capital Beijing. In parts of Hebei, Henan, Zhejiang and Fujian provinces, the thermometer also scratched the 40-degree mark. In the north and other parts of the country, temperatures of more than 35 degrees were also expected.

On Monday, China’s weather service issued an orange heat warning in some areas, the second-highest level. Accordingly, outdoor work should be kept as short as possible. Delivery services, however, continued to work. In the Beijing area, even the highest warning level was declared, where outdoor work is completely prohibited and authorities are required to prepare measures to protect the population. Authorities in Beijing have reported two heat-related deaths so far. The Ministry of Agriculture warned that the persistent heat could damage the rice harvest.

Meanwhile, rescue workers in Hubei searched for seven people missing after a landslide triggered by a thunderstorm. The earth masses had buried a road construction in central China on Saturday. At least one person died and five were injured, the state news agency Xinhua reported. Due to heavy torrential rain in large parts of the country, tens of thousands had to leave their homes. rad

The EU Commission has significantly revised the reporting obligations under the Foreign Subsidies Regulation (FSR). This was the Commission’s response to criticism from industry and member states. The new subsidy control rules are aimed primarily at companies from countries such as China, but apply equally to European companies operating outside the EU.

The FSR was passed by the Council and the European Parliament in a fast-track procedure a year ago. The regulation requires companies to notify the Commission of planned mergers and public contracts if they receive substantial financial contributions from non-EU countries. The authority has now severely narrowed the reporting obligations:

The new reporting requirements take effect on October 12. tho

A knife attack on the grounds of a kindergarten in the southern Chinese province of Guangdong has killed six people and injured another. Three children are said to be among the dead. A 25-year-old man was arrested as a prime suspect.

The incident triggered a wave of concern and an emotional debate on the social media platform Weibo. With 290 million views, the tragedy generated huge attention among users. “How many families are destroyed by this … I support the death penalty,” wrote one user. Another asked why such attacks continue to happen.

In the past ten years, there have been repeated attacks on kindergartens in China. Last August, three people were killed and six injured in a stabbing at a kindergarten in the southern province of Jiangxi. In 2021, a man killed two children and wounded 16 at a kindergarten in the southwestern region of Guangxi. In 2017, a 22-year-old man detonated an explosive device outside a kindergarten in Jiangsu province, killing himself and dozens others. rtr/grz

The end of COVID-19 lockdowns was supposed to unleash a powerful wave of pent-up demand. Instead, aggregate demand, which had been slowing before the pandemic, has returned to its previous trajectory. Though Chinese have been traveling, socializing, and dining out more, consumer-spending growth by households has been limited. Fixed-asset investment has not recovered.

With a few exceptions, such as the new-energy-vehicle (NEV) sector, economic activity has remained subdued. As a result, growth has been much weaker than expected. Though real GDP growth reached 4.5 percent in the first quarter, it is expected to slow in the second. Core inflation is hovering around zero, and the producer price index is in negative territory.

But this situation likely reflects temporary circumstances. In particular, when the new government took over earlier this year, it did not immediately introduce a comprehensive policy package aimed at bolstering the post-pandemic recovery.

To be sure, in the second half of last year, China’s government did pursue some measures aimed at loosening the constraints on households and businesses. But the interventions did not go far enough, particularly regarding the real-estate sector, which constitutes about 40 percent of China’s annual fixed-asset investment. Market expectations that housing prices are set to plummet have weighed on household balance sheets and deterred new home purchases.

Meanwhile, local governments are facing severe financial constraints, and the interest-bearing debt position of local-government financing platforms has deteriorated sharply, undermining infrastructure investment. While the financial constraints on the corporate sector are somewhat looser, lack of confidence is taking a toll on private investment. Add to this declining employment and wages, owing to the COVID-19 pandemic, and supportive policies are clearly needed.

Fortunately, a policy package aimed at supporting the economic recovery is most likely on its way. A recent briefing by China’s National Development and Reform Commission indicated that such a package would include interventions aimed at raising wages and supporting low-income households to boost consumption spending.

Funding curbs on property developers may also be loosened, in order to reinvigorate the real-estate sector. The People’s Bank of China already appears poised to cut lending rates further, in order to encourage borrowing. And the central government will most likely consider partial local-government-debt swaps, or request policy banks to offer long-term loans, in order to boost local governments’ spending power.

Of course, Chinese policymakers cannot circumvent all of the headwinds the economy faces. Global geopolitical shifts – especially China’s deteriorating relationship with the United States – will undoubtedly hamper China’s economic recovery in the short term. Yet it remains far from clear what the medium- or long-term effects will be. It is entirely possible that beyond the short-term shocks lie long-term opportunities for China, a country with a long track record of flourishing amid instability and crisis.

Already, China has responded to increasing uncertainty in its external environment by expanding and safeguarding its access to strategic resources, such as energy and critical minerals, whether by strengthening its partnerships with relevant countries or overcoming its dependence on foreign suppliers. China already dominates the rare earths market.

China’s strategic thinking and economic resilience are also reflected in the rapid recent growth in NEV exports. In the wake of the pandemic shock and the geopolitical crisis triggered by the Ukraine war, Chinese automakers saw opportunities to boost NEV exports to regions like Europe that were seeking to accelerate their green transitions.

The Chinese NEV industry’s record speaks for itself. China overtook South Korea in total automobile exports in 2021, and Germany last year. This year, China is expected to export four million units – a significant share of which will be NEVs – surpassing Japan to become the world’s largest car exporter. At the same time, to increase NEV adoption at home, the government will extend the purchase-tax exemption on NEVs for another four years.

This record suggests that US-led efforts to restrict microchip exports to China will have limited impact in the long term. They are more likely to spur China to reduce its dependence on technology supply chains involving the US and its partners, whether by shifting its trade relationships or innovating at home.

China’s decentralized economic structure helps considerably. Flows of complex technology products are likely to be spread across dozens of cities and managed by thousands of firms, which can be state-owned enterprises, indigenous private firms, or foreign-owned companies.

When a sector begins to grow rapidly in China, investors and companies tend to flock to it, not least because of the supportive policies and subsidies that local governments are probably offering. This can accelerate the industry’s development considerably, even if it is an industry with technological thresholds that require huge investment (and large talent pools) to reach. For example, Tesla’s planned new Megapack (battery) factory in Shanghai will provide a further boost to China’s NEV sector, just as its “Gigafactory” has since 2019.

Of course, once the technological threshold is crossed, huge investments in newly thriving sectors can create challenges, not least excessive capital formation, and early-entry firms may be the ones that suffer the most. But as China’s photovoltaic industry showed, demand conditions can stabilize or improve, reinvigorating the sector. In other words, robust economic growth may still materialize, even if a macro boom is yet to come.

Zhang Jun, Dean of the School of Economics at Fudan University, is Director of the China Center for Economic Studies, a Shanghai-based think tank.

Copyright: Project Syndicate, 2023.

www.project-syndicate.org

Chen Jixing, former chief of finance of Guangdong Province, is suspected of corruption. The Central Commission for Discipline Inspection announced in a statement on Sunday that the 68-year-old retired official is suspected of “serious violations of discipline and Communist Party law” – a common euphemism for corruption.

Is something changing in your organization? Let us know at heads@table.media!

The Xiaoshan District Sports Center in Hangzhou will be the central venue for the Asian Games in September. They were originally supposed to be held last year, but were postponed to next late summer due to the Covid pandemic. The event will include dozens of sport disciplines. At past Asian Games in Indonesia, medals were awarded in 468 competitions. Advance ticket sales have been open since last weekend.