Who truly knows everything about China? According to US commentator Kaiser Kuo, the range of people with relevant assessments and analyses shrinks massively. His criteria are so extensive that analyzing facts and figures, as well as Chinese history, is not enough. In an interview with Fabian Peltsch, he says that close human interaction and empathy are also important.

Kuo does not tell which analysts and China experts meet his definition. However, he leaves no doubt that he considers himself to be among those who are pretty well-informed. Keyword: China expertise. Why don’t you take the test yourself and compare your own expertise with Kuo’s criteria?

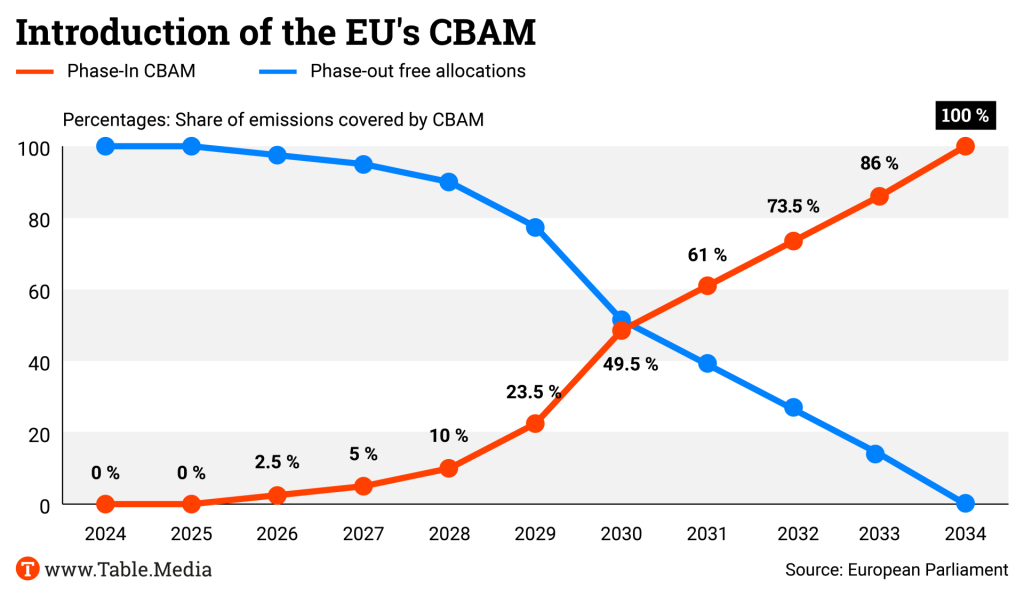

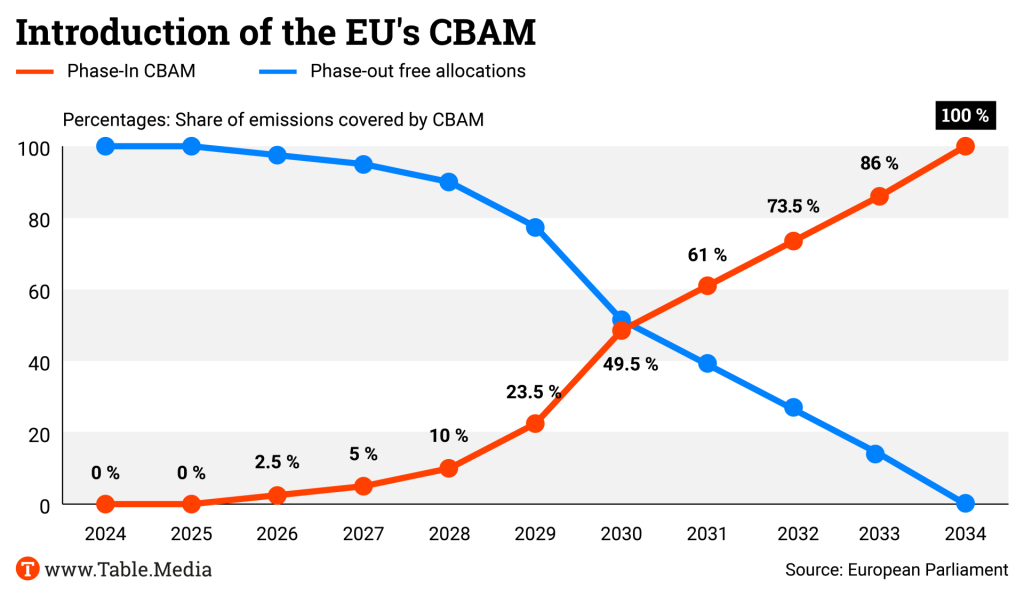

However, relatively little China expertise is needed to predict the next trade conflict between the EU and China. The next dispute will likely revolve around the Carbon Border Adjustment Mechanism, or CBAM for short, writes Finn Mayer-Kuckuk.

Today’s opinion piece, on the other hand, looks at another hotly debated topic in Sino-European trade – the EU countervailing duties on electric cars. The authors call for a consistent implementation. Their message: Fight back, EU!

You are one of the most proficient China watchers in the USA and you also have many fans in Europe that read your blog and listen to your Sinica podcasts. Recently, you surprised your readers in a “Letter From Beijing” that you plan to return and spend at least six months per year in China after living in the USA since 2016. Why is that?

I’m going back for a month starting October 3rd, and then my wife and I are hoping to find a place to live. If all goes well, we’ll be living in Beijing by next summer. Our kids are in college now, and we’re alone in this big house. On my recent trip, my experience of being back in China was surprisingly positive. I hadn’t expected to be quite so delighted!

Why were you so pleasantly surprised to be back?

Many people said Beijing had completely changed and wasn’t fun anymore. Some gave the impression that anyone interesting had already left the city, but that wasn’t true. There’s still a very vibrant community, and many people felt free to speak their minds to me.

You said you started having “imposter syndrome” because you were talking about China without being there.

I still believe the view from across the ocean is very different from the view on the ground. You need both perspectives. Being in China all the time can make you lose sight of how things look from the outside, which is why I want to balance both. I’ve lived through equally repressive periods in Beijing, but there’s still a lot to love about the place. It remains a fascinating subject to study up close.

What image of China do you want to convey?

I try to correct the Western media narrative where it gets things wrong, but I don’t assume it’s always wrong. There’s a lot of valuable reporting coming out of China, but sometimes it needs to be balanced with other perspectives.

Debates in Germany and Europe continue about how we can acquire and communicate more competence on China. Do you have any suggestions?

First, we need to accept that not everyone can become an expert on China, especially not overnight. You can’t expect that of government officials or business leaders. There’s a lot of information out there about China, and we need to focus on sorting through it and identifying the voices worth listening to.

Who among the plethora of supposed experts and analysts should we listen to?

I propose five qualities to look for in an analyst. First, humility. China, especially at the highest levels, is very opaque. We can’t know the mind of Xi Jinping, and we need to acknowledge our own ignorance about China. Most people don’t understand much about Chinese history or the values that shape the way people think there. So, humility is key.

And what else?

Having a holistic view of China is essential as well. Look for analysts who don’t focus narrowly on one area, like economics or national security, but approach China from multiple angles-its humanities, politics, society, demographics, and especially history. A multidisciplinary approach gives a fuller picture.

Do you have the impression that some experts take a very one-sided view of China, perhaps partly to push their own interests or prove their point?

Exactly, which brings me to the third quality: sensitivity to bias. We need to recognize that the news we’re reading are structurally biased. It’s not a deliberate plot to make China look bad, but the stories selected tend to be more extreme or sensational. Most of life is far more ordinary. This happens with Chinese news on the US too – they focus on school shootings or ethnic violence. We need to adjust for that bias when analyzing reports.

You have already mentioned twice how important it is to have a fundamental knowledge of Chinese history. Why is that?

Historical understanding is very important. Analysts don’t need to know thousands of years of history in detail, but they should understand contingency’s role in their own history and avoid Western-centric views, like believing history inevitably leads to liberal democratic capitalism. That’s a biased perspective that distorts our understanding of China.

What’s the fifth quality you propose for more China competence?

Cognitive empathy – the ability to put yourself in the shoes of Chinese people. Analysts should ask how our policies and rhetoric are perceived in China and how Chinese people see the world. If an analyst shows humility, a holistic view, sensitivity to bias, historical understanding, and cognitive empathy, they’re worth listening to, even if their conclusions differ from mine.

How do you avoid the trap of repeating state narratives?

I’m careful to clarify when presenting the Chinese perspective, though it doesn’t always work. In discussions between the US and China, for example, I often ask each side to articulate the other’s viewpoint in good faith. This leads to more productive and civil conversations.

So what you’re saying is that it’s possible to be critical and keep an open mind?

I try to. Even when I find certain state narratives appalling – like Russia’s in the Ukraine war – I still feel it’s important to understand what Putin believes and why his message resonates with parts of the Russian population.

So, what exactly is your plan in Beijing for your future as a China watcher?

I don’t plan to do reporting or be a journalist, but I do want to talk to people, maybe even record podcasts -though likely with Americans outside of China. I’ll be spending half the year outside of China, so it’ll be easy to communicate with people there remotely. The main goal is to reconnect with Chinese society in a meaningful way. You just can’t fully grasp what people think unless you’re there, hearing conversations and having those late-night talks with friends over drinks. Plus, I genuinely enjoy being in China-the food, the ease of living, and traveling around make it a wonderful place to be.

Kaiser Kuo was born in the state of New York in 1966. His parents come from families who once fled to Taiwan as Guomindang supporters. He is now one of the most renowned China observers in the USA and co-founder of the Sinica podcast and the expert platform The China Project. Kuo previously worked for Baidu and Ogilvy. He was also the lead guitarist of the legendary Chinese heavy metal band Tang Dynasty.

It doesn’t take a prophet to predict that new tensions in EU trade with China are just around the corner. The culprit this time is the European Carbon Border Adjustment Mechanism, CBAM, which China has already condemned as “green protectionism.”

CBAM is intended to put a price on carbon emissions from imports into the EU. The idea behind it is easy to understand and almost compelling: If Europe makes carbon emissions more expensive through its emissions trading, more emission-heavy goods from other countries shouldn’t be cheaper.

To compensate for the price advantages caused by cheaper emissions, the EU will levy a surcharge from October, corresponding to the cost advantage. The introductory phase is already underway. China is particularly affected: It is the world’s largest production hub and thus emits the most greenhouse gases. However, the country also rejects any increase in the price of its exports to the EU and any interference in its climate strategy.

“China’s voice cannot be overlooked,” says Corinne Abele, representative of Germany Trade and Invest in Shanghai. After all, China remains one of Germany’s main trading partners. Abele was the keynote speaker at an event from the China.Table Toolbox series on the topic of “CBAM: Protectionism or climate action? Effects on international trade,” which was organized by Germany Trade and Invest (GTAI) as a cooperation partner.

CBAM covers iron, steel, aluminum, electricity, fertilizers and cement. It also includes metal products such as pipes, sheet metal, tubes and profiles. These are mainly manufactured by large companies, many of which are state-owned enterprises. “In many cases, they will see no reason to disclose the necessary emissions data,” says Abele. In some areas of the Chinese economy, such information is considered a trade or even state secret.

It also makes life more difficult for companies if they have to apply the mechanism to a large procurement market that does not necessarily support the idea of CBAM. Companies find CBAM complicated, bureaucratic and expensive. However, SMEs and small companies in particular will find it difficult to obtain the necessary emissions data when trading in China. It is still unclear how capable and willing Chinese suppliers are to provide this information, says Abele.

Intermediaries and small Chinese producers also tend not to have access to the necessary data, as this requires extensive knowledge about the production processes of the raw materials. Many do not want to disclose their raw material sources because they would lose a competitive advantage.

What can a German, medium-sized company do now? “Ultimately, they have to inform their suppliers and, if necessary, select them accordingly,” says Abele. This may reduce the circle of potential business partners to those who can share emissions data on their products.

The discussion segment of the China.Table Toolbox event also revealed great dissatisfaction with the burden that CBAM places on day-to-day operations. Obtaining the data is also considered difficult or even impossible in other markets. This is why companies consider the instrument impractical in its current form.

In an optimistic scenario, however, these problems could be alleviated in the near future, at least concerning China. After all, Chinese systems can be interlinked with EU structures, at least in theory. “China also sees the mutual benefit in reducing global carbon emissions and is participating,” says Abele.

China has its own CO2 emission reduction targets, such as achieving net zero by 2060. China also introduced a national emissions trading system (ETS) in 2021. Although it only covers the energy sector, an extension to steel, cement and aluminum is under consideration. Preparations are apparently already underway, especially for aluminum.

When a partner market has its own sophisticated emissions trading system for the CBAM commodity groups, calculating the difference to the European carbon price is relatively simple. Some projects already explore the possibility of ticking off the CBAM reporting obligations digitally and, in some cases, automatically.

The question is whether China is willing to participate at all – or whether it will put obstacles in the way of CBAM integration instead. After all, mutual goodwill is currently pretty much exhausted thanks to geopolitical upheavals, tariffs and other differences.

Furthermore, the EU has got bogged down in technical details with the CBAM without keeping an eye on the bigger picture. It was developed by emissions experts and intended as an environmental instrument. However, the result is – perhaps somewhat unintentionally – a trading instrument. And China perceives it as such. After all, imports are subject to a price, like a tariff.

However, Abele believes this perception is incorrect. The EU makes domestic production more expensive through emissions trading and mechanisms such as the CBAM. The primary goal is climate action; this approach does not bring any advantages in international competition. Nevertheless, she finds it understandable that China has reservations about unilateral action from the EU.

This article is part of our China.Table Toolbox event series and is based on an online discussion with Corinne Abele on CBAM: Protectionism or climate action? – Effects on international trade in cooperation with Germany Trade and Invest (GTAI). GTAI also advises German companies on how to deal with CBAM.

The United States continues to be the most influential power in Asia. This is the result of the latest “Asia Power Index” by the Lowy Institute, an independent Sydney-based think tank. However, the report also shows that China is catching up fast, particularly in the military sector. The “Asia Power Index” assesses the influence of 27 Asian countries and breaks them down into different areas such as the military, economy, defense and diplomacy. The “Asia Power Index” has been published once a year since 2018.

Accordingly, the USA is ahead of China in six out of eight index values – Washington has stronger defense networks, cultural influence and economic performance than Beijing. In particular, the United States’ successful efforts to strengthen its defense ties with allies such as Japan, Australia and the Philippines have strengthened US influence in Asia.

China’s power, on the other hand, is stagnating. The report states: “China’s power is neither surging nor collapsing. It is plateauing at a level below that of the United States, but still well above any Asian competitors.” The main reasons cited are slower economic growth and longer-term structural challenges such as the aging population. India now ranks third, having overtaken Japan. However, India’s influence still lags behind its resources’ potential. rad

German exports to China slumped in August. According to preliminary data published by the German Federal Statistical Office on Monday, goods worth seven billion euros were exported to the People’s Republic, 15.2 percent less than in the previous year.

This has two main reasons:

Germany’s most important trading partner is now the USA. However, US business also contracted in August. Exports to the US totaled 12.6 billion euros, down 3.2 percent year-on-year. rtr

On Monday, the leadership of the Social Democratic Party (SPD), including co-leader Lars Klingbeil, deputy leader Anke Rehlinger, parliamentary group leader Rolf Muetzenich and several MPs, met with representatives of the Chinese Communist Party in Berlin. Topics discussed included the war in Ukraine, China’s role as a possible mediator, as well as transformation and rule of law issues.

“I also seek dialogue in countries and with partners who don’t agree with us 100 percent,” Klingbeil recently told Table.Briefings, explaining the reasons for such meetings. His experience is that “after several meetings, you can say things much more clearly.” However, he also said: “You can’t go into these talks without a stance.”

Last year, Klingbeil was received by Premier Li Qiang in Beijing, and Rolf Muetzenich was received by Foreign Minister Wang Yi just a few weeks ago. Initiated by Willy Brandt and Deng Xiaoping in 1984, the Social Democratic Party (SPD) has maintained a dialogue with the Chinese Communist Party. Horand Knaup

On the tenth anniversary of the conviction of Uyghur economist Ilham Tohti, the European Union has called for his “immediate and unconditional release.” The economist was sentenced to life behind bars in fall 2014 on charges of separatism. According to the statement from the EU’s External Action Service, his imprisonment “is representative of the deeply worrying human rights situation in Xinjiang that was highlighted in numerous reports by UN Treaty Bodies and Special Rapporteurs, and in particular the 2022 assessment report by the Office of the United Nations High Commissioner for Human Rights.”

Until his arrest, Ilham Tohti had campaigned for dialogue between Uyghurs and Han Chinese for two decades. Tohti was initially arrested in January 2014. His trial lasted only two days. The PEN American Center described it as a “farce.” Amnesty International spoke of a “shameful judgment” that “has no basis in reality,” while Human Rights Watch called it “an injustice of the highest order.”

The EU also urged China to release other imprisoned human rights defenders, lawyers and intellectuals. According to the Uyghur Human Rights Project, there have been more than 300 documented cases of Uyghur intellectuals alone who have been detained or disappeared since 2016. grz

In July 2024, the EU Commission imposed provisional countervailing duties on EVs from China. These amount to an average of around 21%. They will only be imposed permanently for a period of five years once the Council has taken a position on them. The principle of reverse qualified majority applies: 15 member states representing 65% of the EU population are required to stop the Commission and thus the tariffs.

This decision is particularly controversial because it coincides with the Draghi Report: in four hundred pages, the former Italian prime minister and ECB chief argues that the EU can only strengthen its competitiveness if it cleverly combines its tools: for example, trade and industrial policy. This is particularly true in the field of electromobility, where the weakness of European industry is directly linked to unfair competition from China.

If the EU member states, above all Germany, do not pull together with regard to EV tariffs, the EU not only risks falling even further behind China and the USA in key technologies, but also risks losing its trade policy credibility.

Under EU and WTO law, the hurdles for such tariffs are high, precisely in order to prevent political abuse. The EU Commission’s decision therefore follows a detailed anti-subsidy investigation based on company data. These show that electric cars produced in China have market advantages due to subsidies that are illegal under WTO rules.

In contrast to other countries, such as the USA or Turkey, which – apparently without comparable studies – have imposed tariffs of 100 percent or, in the meantime, an additional 40 percent on EVs from China, the EU is therefore planning an objectively well-founded measure against unfair competition that is rather moderate in international comparison.

In recent months, the EU has also held talks with the Chinese government and EV manufacturers to find an alternative solution. However, the Commission rejected an offer from Chinese EV manufacturers regarding price commitments to compensate for the subsidies as insufficient after a thorough examination. At the meeting between Chinese Trade Minister Wang Wentao and EU Trade Commissioner Valdis Dombrovskis on Sept. 19 in Brussels, no political agreement was reached either.

However, the Commission has once again extended the already-expired deadline for manufacturers to submit price undertakings. If they submit a sufficient offer, the Commission can close the procedure, otherwise the next step is the vote of the member states on the countervailing duties, which must take place before Oct. 31.

Several member states, including, unsurprisingly, Hungary, but also Germany and Spain, are currently actively trying to stop the tariffs. This makes it all too clear that the much-vaunted and urgent unity of the EU and its member states vis-à-vis China has so far remained an illusion: China is repeatedly managing to divide the EU on key trade and industrial policy issues – and at the same time the EU is failing to stay together on its own.

In Germany, it is the fear of retaliatory measures against the automotive industry, which is heavily dependent on business with China, that has prompted Chancellor Olaf Scholz to campaign against the tariffs. In Spain, it is the hope of a Chinese investment worth billions following a trip to Beijing by Prime Minister Pedro Sánchez at the beginning of September and that the Spanish pork industry will be spared. Hungary has been happy to play the role of a “Trojan horse” for Chinese interests in the EU for some time now anyway.

If, despite clear evidence of distortions of competition to the detriment of Europe, the member states were to speak out against the countervailing duties and instead focus on their own particular economic interests, this would deeply undermine the credibility of the EU’s trade and industrial policy agenda. It would be a veritable invitation to third countries: Effective policies in the EU’s interests can be undermined via European capitals.

This would also send a strong political signal in light of the increasing geopoliticization of trade relations and efforts to “de-risk” China as part of the economic security strategy proposed by the Commission in 2023.

There are indeed viable economic policy arguments against the measure: Tariffs on imported products do not in themselves create a competitive industry in Europe. They merely compensate for unfair cost advantages resulting from subsidies and are thus intended to enable actual competition. The period during which the tariffs exist must therefore be used creatively and intelligently – both by industry and by politicians.

If this does not succeed, consumers in the EU will pay unnecessarily higher prices. Companies should therefore make every effort to establish and expand their competitiveness during this period. The Commission and member states should accompany the tariffs with further measures to promote local manufacturers – and coordinate more closely than before.

At present, however, the impression is that the member states working against the tariffs are driven by other, much less convincing reasons: The industries that China is threatening with tariffs form strong and well-organized interest groups that neither Scholz nor Sánchez want to antagonize. However, such particularistic consideration is certainly not in Europe’s long-term interests. Europe’s future should not be decided by individual sectors or even companies.

Those who argue against the tariffs are underestimating the potential to meet China on an equal footing. In view of major structural problems – youth unemployment, the real estate bubble and a generally weakening economy – as well as the uncertain impact of the US election on the already strained Sino-American relationship, China needs the EU and access to the European market.

It is therefore all the more important that the EU and its member states remain consistent on the customs issue and do not jeopardize the EU’s ability to act and its credibility in terms of trade policy vis-à-vis China and others. The EU can only remain competitive if it can simultaneously defend itself against distortions of competition by third parties – as the Draghi Report also argues. At this political moment, stopping tariffs on EVs manufactured in China would send exactly the wrong signal.

Cora Jungbluth has been working at the Bertelsmann Stiftung since August 2012 and is Senior Expert China and Asia-Pacific. Etienne Höra has been Project Manager at the Bertelsmann Stiftung since October 2023 and works on strategic partnerships between Europe and Asia.

Oliver Oehms will become the new Managing Director of the German Chamber of Commerce in North China on October 1. He succeeds Jens Hildebrandt, who recently left the Chamber. Oehms is currently still CEO of the German-Emirati Chamber of Industry and Commerce (AHK) in the United Arab Emirates and Delegate of German Business in Iraq.

Is something changing in your organization? Let us know at heads@table.media!

It is well known that anticipation is the greatest joy. And so it seems that many Chinese can hardly wait for the approaching anniversary of the founding of the People’s Republic. People are already busy taking pictures on Tiananmen Square in Beijing. These will probably be some pre-anniversary pictures, as the official date is next Tuesday.

Who truly knows everything about China? According to US commentator Kaiser Kuo, the range of people with relevant assessments and analyses shrinks massively. His criteria are so extensive that analyzing facts and figures, as well as Chinese history, is not enough. In an interview with Fabian Peltsch, he says that close human interaction and empathy are also important.

Kuo does not tell which analysts and China experts meet his definition. However, he leaves no doubt that he considers himself to be among those who are pretty well-informed. Keyword: China expertise. Why don’t you take the test yourself and compare your own expertise with Kuo’s criteria?

However, relatively little China expertise is needed to predict the next trade conflict between the EU and China. The next dispute will likely revolve around the Carbon Border Adjustment Mechanism, or CBAM for short, writes Finn Mayer-Kuckuk.

Today’s opinion piece, on the other hand, looks at another hotly debated topic in Sino-European trade – the EU countervailing duties on electric cars. The authors call for a consistent implementation. Their message: Fight back, EU!

You are one of the most proficient China watchers in the USA and you also have many fans in Europe that read your blog and listen to your Sinica podcasts. Recently, you surprised your readers in a “Letter From Beijing” that you plan to return and spend at least six months per year in China after living in the USA since 2016. Why is that?

I’m going back for a month starting October 3rd, and then my wife and I are hoping to find a place to live. If all goes well, we’ll be living in Beijing by next summer. Our kids are in college now, and we’re alone in this big house. On my recent trip, my experience of being back in China was surprisingly positive. I hadn’t expected to be quite so delighted!

Why were you so pleasantly surprised to be back?

Many people said Beijing had completely changed and wasn’t fun anymore. Some gave the impression that anyone interesting had already left the city, but that wasn’t true. There’s still a very vibrant community, and many people felt free to speak their minds to me.

You said you started having “imposter syndrome” because you were talking about China without being there.

I still believe the view from across the ocean is very different from the view on the ground. You need both perspectives. Being in China all the time can make you lose sight of how things look from the outside, which is why I want to balance both. I’ve lived through equally repressive periods in Beijing, but there’s still a lot to love about the place. It remains a fascinating subject to study up close.

What image of China do you want to convey?

I try to correct the Western media narrative where it gets things wrong, but I don’t assume it’s always wrong. There’s a lot of valuable reporting coming out of China, but sometimes it needs to be balanced with other perspectives.

Debates in Germany and Europe continue about how we can acquire and communicate more competence on China. Do you have any suggestions?

First, we need to accept that not everyone can become an expert on China, especially not overnight. You can’t expect that of government officials or business leaders. There’s a lot of information out there about China, and we need to focus on sorting through it and identifying the voices worth listening to.

Who among the plethora of supposed experts and analysts should we listen to?

I propose five qualities to look for in an analyst. First, humility. China, especially at the highest levels, is very opaque. We can’t know the mind of Xi Jinping, and we need to acknowledge our own ignorance about China. Most people don’t understand much about Chinese history or the values that shape the way people think there. So, humility is key.

And what else?

Having a holistic view of China is essential as well. Look for analysts who don’t focus narrowly on one area, like economics or national security, but approach China from multiple angles-its humanities, politics, society, demographics, and especially history. A multidisciplinary approach gives a fuller picture.

Do you have the impression that some experts take a very one-sided view of China, perhaps partly to push their own interests or prove their point?

Exactly, which brings me to the third quality: sensitivity to bias. We need to recognize that the news we’re reading are structurally biased. It’s not a deliberate plot to make China look bad, but the stories selected tend to be more extreme or sensational. Most of life is far more ordinary. This happens with Chinese news on the US too – they focus on school shootings or ethnic violence. We need to adjust for that bias when analyzing reports.

You have already mentioned twice how important it is to have a fundamental knowledge of Chinese history. Why is that?

Historical understanding is very important. Analysts don’t need to know thousands of years of history in detail, but they should understand contingency’s role in their own history and avoid Western-centric views, like believing history inevitably leads to liberal democratic capitalism. That’s a biased perspective that distorts our understanding of China.

What’s the fifth quality you propose for more China competence?

Cognitive empathy – the ability to put yourself in the shoes of Chinese people. Analysts should ask how our policies and rhetoric are perceived in China and how Chinese people see the world. If an analyst shows humility, a holistic view, sensitivity to bias, historical understanding, and cognitive empathy, they’re worth listening to, even if their conclusions differ from mine.

How do you avoid the trap of repeating state narratives?

I’m careful to clarify when presenting the Chinese perspective, though it doesn’t always work. In discussions between the US and China, for example, I often ask each side to articulate the other’s viewpoint in good faith. This leads to more productive and civil conversations.

So what you’re saying is that it’s possible to be critical and keep an open mind?

I try to. Even when I find certain state narratives appalling – like Russia’s in the Ukraine war – I still feel it’s important to understand what Putin believes and why his message resonates with parts of the Russian population.

So, what exactly is your plan in Beijing for your future as a China watcher?

I don’t plan to do reporting or be a journalist, but I do want to talk to people, maybe even record podcasts -though likely with Americans outside of China. I’ll be spending half the year outside of China, so it’ll be easy to communicate with people there remotely. The main goal is to reconnect with Chinese society in a meaningful way. You just can’t fully grasp what people think unless you’re there, hearing conversations and having those late-night talks with friends over drinks. Plus, I genuinely enjoy being in China-the food, the ease of living, and traveling around make it a wonderful place to be.

Kaiser Kuo was born in the state of New York in 1966. His parents come from families who once fled to Taiwan as Guomindang supporters. He is now one of the most renowned China observers in the USA and co-founder of the Sinica podcast and the expert platform The China Project. Kuo previously worked for Baidu and Ogilvy. He was also the lead guitarist of the legendary Chinese heavy metal band Tang Dynasty.

It doesn’t take a prophet to predict that new tensions in EU trade with China are just around the corner. The culprit this time is the European Carbon Border Adjustment Mechanism, CBAM, which China has already condemned as “green protectionism.”

CBAM is intended to put a price on carbon emissions from imports into the EU. The idea behind it is easy to understand and almost compelling: If Europe makes carbon emissions more expensive through its emissions trading, more emission-heavy goods from other countries shouldn’t be cheaper.

To compensate for the price advantages caused by cheaper emissions, the EU will levy a surcharge from October, corresponding to the cost advantage. The introductory phase is already underway. China is particularly affected: It is the world’s largest production hub and thus emits the most greenhouse gases. However, the country also rejects any increase in the price of its exports to the EU and any interference in its climate strategy.

“China’s voice cannot be overlooked,” says Corinne Abele, representative of Germany Trade and Invest in Shanghai. After all, China remains one of Germany’s main trading partners. Abele was the keynote speaker at an event from the China.Table Toolbox series on the topic of “CBAM: Protectionism or climate action? Effects on international trade,” which was organized by Germany Trade and Invest (GTAI) as a cooperation partner.

CBAM covers iron, steel, aluminum, electricity, fertilizers and cement. It also includes metal products such as pipes, sheet metal, tubes and profiles. These are mainly manufactured by large companies, many of which are state-owned enterprises. “In many cases, they will see no reason to disclose the necessary emissions data,” says Abele. In some areas of the Chinese economy, such information is considered a trade or even state secret.

It also makes life more difficult for companies if they have to apply the mechanism to a large procurement market that does not necessarily support the idea of CBAM. Companies find CBAM complicated, bureaucratic and expensive. However, SMEs and small companies in particular will find it difficult to obtain the necessary emissions data when trading in China. It is still unclear how capable and willing Chinese suppliers are to provide this information, says Abele.

Intermediaries and small Chinese producers also tend not to have access to the necessary data, as this requires extensive knowledge about the production processes of the raw materials. Many do not want to disclose their raw material sources because they would lose a competitive advantage.

What can a German, medium-sized company do now? “Ultimately, they have to inform their suppliers and, if necessary, select them accordingly,” says Abele. This may reduce the circle of potential business partners to those who can share emissions data on their products.

The discussion segment of the China.Table Toolbox event also revealed great dissatisfaction with the burden that CBAM places on day-to-day operations. Obtaining the data is also considered difficult or even impossible in other markets. This is why companies consider the instrument impractical in its current form.

In an optimistic scenario, however, these problems could be alleviated in the near future, at least concerning China. After all, Chinese systems can be interlinked with EU structures, at least in theory. “China also sees the mutual benefit in reducing global carbon emissions and is participating,” says Abele.

China has its own CO2 emission reduction targets, such as achieving net zero by 2060. China also introduced a national emissions trading system (ETS) in 2021. Although it only covers the energy sector, an extension to steel, cement and aluminum is under consideration. Preparations are apparently already underway, especially for aluminum.

When a partner market has its own sophisticated emissions trading system for the CBAM commodity groups, calculating the difference to the European carbon price is relatively simple. Some projects already explore the possibility of ticking off the CBAM reporting obligations digitally and, in some cases, automatically.

The question is whether China is willing to participate at all – or whether it will put obstacles in the way of CBAM integration instead. After all, mutual goodwill is currently pretty much exhausted thanks to geopolitical upheavals, tariffs and other differences.

Furthermore, the EU has got bogged down in technical details with the CBAM without keeping an eye on the bigger picture. It was developed by emissions experts and intended as an environmental instrument. However, the result is – perhaps somewhat unintentionally – a trading instrument. And China perceives it as such. After all, imports are subject to a price, like a tariff.

However, Abele believes this perception is incorrect. The EU makes domestic production more expensive through emissions trading and mechanisms such as the CBAM. The primary goal is climate action; this approach does not bring any advantages in international competition. Nevertheless, she finds it understandable that China has reservations about unilateral action from the EU.

This article is part of our China.Table Toolbox event series and is based on an online discussion with Corinne Abele on CBAM: Protectionism or climate action? – Effects on international trade in cooperation with Germany Trade and Invest (GTAI). GTAI also advises German companies on how to deal with CBAM.

The United States continues to be the most influential power in Asia. This is the result of the latest “Asia Power Index” by the Lowy Institute, an independent Sydney-based think tank. However, the report also shows that China is catching up fast, particularly in the military sector. The “Asia Power Index” assesses the influence of 27 Asian countries and breaks them down into different areas such as the military, economy, defense and diplomacy. The “Asia Power Index” has been published once a year since 2018.

Accordingly, the USA is ahead of China in six out of eight index values – Washington has stronger defense networks, cultural influence and economic performance than Beijing. In particular, the United States’ successful efforts to strengthen its defense ties with allies such as Japan, Australia and the Philippines have strengthened US influence in Asia.

China’s power, on the other hand, is stagnating. The report states: “China’s power is neither surging nor collapsing. It is plateauing at a level below that of the United States, but still well above any Asian competitors.” The main reasons cited are slower economic growth and longer-term structural challenges such as the aging population. India now ranks third, having overtaken Japan. However, India’s influence still lags behind its resources’ potential. rad

German exports to China slumped in August. According to preliminary data published by the German Federal Statistical Office on Monday, goods worth seven billion euros were exported to the People’s Republic, 15.2 percent less than in the previous year.

This has two main reasons:

Germany’s most important trading partner is now the USA. However, US business also contracted in August. Exports to the US totaled 12.6 billion euros, down 3.2 percent year-on-year. rtr

On Monday, the leadership of the Social Democratic Party (SPD), including co-leader Lars Klingbeil, deputy leader Anke Rehlinger, parliamentary group leader Rolf Muetzenich and several MPs, met with representatives of the Chinese Communist Party in Berlin. Topics discussed included the war in Ukraine, China’s role as a possible mediator, as well as transformation and rule of law issues.

“I also seek dialogue in countries and with partners who don’t agree with us 100 percent,” Klingbeil recently told Table.Briefings, explaining the reasons for such meetings. His experience is that “after several meetings, you can say things much more clearly.” However, he also said: “You can’t go into these talks without a stance.”

Last year, Klingbeil was received by Premier Li Qiang in Beijing, and Rolf Muetzenich was received by Foreign Minister Wang Yi just a few weeks ago. Initiated by Willy Brandt and Deng Xiaoping in 1984, the Social Democratic Party (SPD) has maintained a dialogue with the Chinese Communist Party. Horand Knaup

On the tenth anniversary of the conviction of Uyghur economist Ilham Tohti, the European Union has called for his “immediate and unconditional release.” The economist was sentenced to life behind bars in fall 2014 on charges of separatism. According to the statement from the EU’s External Action Service, his imprisonment “is representative of the deeply worrying human rights situation in Xinjiang that was highlighted in numerous reports by UN Treaty Bodies and Special Rapporteurs, and in particular the 2022 assessment report by the Office of the United Nations High Commissioner for Human Rights.”

Until his arrest, Ilham Tohti had campaigned for dialogue between Uyghurs and Han Chinese for two decades. Tohti was initially arrested in January 2014. His trial lasted only two days. The PEN American Center described it as a “farce.” Amnesty International spoke of a “shameful judgment” that “has no basis in reality,” while Human Rights Watch called it “an injustice of the highest order.”

The EU also urged China to release other imprisoned human rights defenders, lawyers and intellectuals. According to the Uyghur Human Rights Project, there have been more than 300 documented cases of Uyghur intellectuals alone who have been detained or disappeared since 2016. grz

In July 2024, the EU Commission imposed provisional countervailing duties on EVs from China. These amount to an average of around 21%. They will only be imposed permanently for a period of five years once the Council has taken a position on them. The principle of reverse qualified majority applies: 15 member states representing 65% of the EU population are required to stop the Commission and thus the tariffs.

This decision is particularly controversial because it coincides with the Draghi Report: in four hundred pages, the former Italian prime minister and ECB chief argues that the EU can only strengthen its competitiveness if it cleverly combines its tools: for example, trade and industrial policy. This is particularly true in the field of electromobility, where the weakness of European industry is directly linked to unfair competition from China.

If the EU member states, above all Germany, do not pull together with regard to EV tariffs, the EU not only risks falling even further behind China and the USA in key technologies, but also risks losing its trade policy credibility.

Under EU and WTO law, the hurdles for such tariffs are high, precisely in order to prevent political abuse. The EU Commission’s decision therefore follows a detailed anti-subsidy investigation based on company data. These show that electric cars produced in China have market advantages due to subsidies that are illegal under WTO rules.

In contrast to other countries, such as the USA or Turkey, which – apparently without comparable studies – have imposed tariffs of 100 percent or, in the meantime, an additional 40 percent on EVs from China, the EU is therefore planning an objectively well-founded measure against unfair competition that is rather moderate in international comparison.

In recent months, the EU has also held talks with the Chinese government and EV manufacturers to find an alternative solution. However, the Commission rejected an offer from Chinese EV manufacturers regarding price commitments to compensate for the subsidies as insufficient after a thorough examination. At the meeting between Chinese Trade Minister Wang Wentao and EU Trade Commissioner Valdis Dombrovskis on Sept. 19 in Brussels, no political agreement was reached either.

However, the Commission has once again extended the already-expired deadline for manufacturers to submit price undertakings. If they submit a sufficient offer, the Commission can close the procedure, otherwise the next step is the vote of the member states on the countervailing duties, which must take place before Oct. 31.

Several member states, including, unsurprisingly, Hungary, but also Germany and Spain, are currently actively trying to stop the tariffs. This makes it all too clear that the much-vaunted and urgent unity of the EU and its member states vis-à-vis China has so far remained an illusion: China is repeatedly managing to divide the EU on key trade and industrial policy issues – and at the same time the EU is failing to stay together on its own.

In Germany, it is the fear of retaliatory measures against the automotive industry, which is heavily dependent on business with China, that has prompted Chancellor Olaf Scholz to campaign against the tariffs. In Spain, it is the hope of a Chinese investment worth billions following a trip to Beijing by Prime Minister Pedro Sánchez at the beginning of September and that the Spanish pork industry will be spared. Hungary has been happy to play the role of a “Trojan horse” for Chinese interests in the EU for some time now anyway.

If, despite clear evidence of distortions of competition to the detriment of Europe, the member states were to speak out against the countervailing duties and instead focus on their own particular economic interests, this would deeply undermine the credibility of the EU’s trade and industrial policy agenda. It would be a veritable invitation to third countries: Effective policies in the EU’s interests can be undermined via European capitals.

This would also send a strong political signal in light of the increasing geopoliticization of trade relations and efforts to “de-risk” China as part of the economic security strategy proposed by the Commission in 2023.

There are indeed viable economic policy arguments against the measure: Tariffs on imported products do not in themselves create a competitive industry in Europe. They merely compensate for unfair cost advantages resulting from subsidies and are thus intended to enable actual competition. The period during which the tariffs exist must therefore be used creatively and intelligently – both by industry and by politicians.

If this does not succeed, consumers in the EU will pay unnecessarily higher prices. Companies should therefore make every effort to establish and expand their competitiveness during this period. The Commission and member states should accompany the tariffs with further measures to promote local manufacturers – and coordinate more closely than before.

At present, however, the impression is that the member states working against the tariffs are driven by other, much less convincing reasons: The industries that China is threatening with tariffs form strong and well-organized interest groups that neither Scholz nor Sánchez want to antagonize. However, such particularistic consideration is certainly not in Europe’s long-term interests. Europe’s future should not be decided by individual sectors or even companies.

Those who argue against the tariffs are underestimating the potential to meet China on an equal footing. In view of major structural problems – youth unemployment, the real estate bubble and a generally weakening economy – as well as the uncertain impact of the US election on the already strained Sino-American relationship, China needs the EU and access to the European market.

It is therefore all the more important that the EU and its member states remain consistent on the customs issue and do not jeopardize the EU’s ability to act and its credibility in terms of trade policy vis-à-vis China and others. The EU can only remain competitive if it can simultaneously defend itself against distortions of competition by third parties – as the Draghi Report also argues. At this political moment, stopping tariffs on EVs manufactured in China would send exactly the wrong signal.

Cora Jungbluth has been working at the Bertelsmann Stiftung since August 2012 and is Senior Expert China and Asia-Pacific. Etienne Höra has been Project Manager at the Bertelsmann Stiftung since October 2023 and works on strategic partnerships between Europe and Asia.

Oliver Oehms will become the new Managing Director of the German Chamber of Commerce in North China on October 1. He succeeds Jens Hildebrandt, who recently left the Chamber. Oehms is currently still CEO of the German-Emirati Chamber of Industry and Commerce (AHK) in the United Arab Emirates and Delegate of German Business in Iraq.

Is something changing in your organization? Let us know at heads@table.media!

It is well known that anticipation is the greatest joy. And so it seems that many Chinese can hardly wait for the approaching anniversary of the founding of the People’s Republic. People are already busy taking pictures on Tiananmen Square in Beijing. These will probably be some pre-anniversary pictures, as the official date is next Tuesday.