Today’s issue focuses twice on the decoupling of the economy. While our first text reports on how Premier Li Qiang denounces the trend of Western countries to disengage from China, our second text traces just such a decoupling – albeit one that China is eagerly aiding.

The irony is that hardly any Western politician is seriously calling for decoupling. That is what the magic word “de-risking” is for now, but it is equally unpopular with Li. Li expressed his criticism in a speech at “Summer Davos” in China, which Joern Petring reports on.

However, the actual estrangement of the economic regions is not the result of a single act of “politicization” (as Li puts it) of economic relations. There have been steps on both sides that have led away from each other. Then, last year, the distance became practically insurmountable.

As a result, China’s chip industry is catching up and becoming self-sufficient. This in turn is bad news for companies like Intel, Infineon or Samsung. They in turn cannot invest in modern production facilities in China because that would bar them from accessing the plentiful subsidy pots in the US. They are now trying to keep the Chinese market warm without falling out with the US.

What does a company do when Beijing spoils its China business on flimsy grounds? It will invest all the more in China because that is where its most important customers are. This is what the US semiconductor manufacturer Micron has now done.

Shortly after being banned from critical networks in China over safety concerns, Micron announced that it would put a lot of money into taking over and expanding an existing plant. The plant is located in Xi’an; the investment amount is 4.3 billion yuan (550 million euros).

The company’s behavior shows a certain desperation. Semiconductor manufacturers are fully caught between the fronts of the trade conflicts. China is rapidly expanding its own semiconductor industry in the face of pressure from US sanctions. Those who want to remain relevant there must produce locally. But increased involvement in China is more and more rejected by political strategists in Western capitals.

Like Micron, Intel, Infineon, Samsung, TSMC and other industry giants are looking for a way to maintain their presence in China without going against the political course of their home countries. Faced with a choice, they currently prefer to play on Team USA and invest in Western countries. But this weakens their position in China, where important customers are located.

As early as 2015, China decided to become independent in key technologies as quickly as possible. “Made in China 2025” also includes the semiconductor industry. The United States, on the other hand, has been playing aggressively against its rival in the Far East since 2017 and has escalated the tensions into a genuine trade conflict.

Last August, President Joe Biden took the first step to cut China off from US technology with the CHIPS and Science Act. Companies that want to benefit from billions in subsidies in the US are no longer allowed to transfer modern technology to China. Biden wants to bring know-how and jobs back to the US.

In October 2022, Biden went further and banned the supply of modern chips and equipment for their production to China. Later, the Netherlands and Japan followed suit with the so-called chip sanctions.

Then, China responded in December last year. The National Development and Reform Commission now provides one trillion yuan (125 billion euros) over five years to promote the sector. Chinese suppliers are now likely to catch up quickly in both processors and memory chips. The two largest economies are achieving what supposedly no one wants: a decoupling.

Politicians in Washington and Beijing have thus put executives of Western semiconductor manufacturers in a tight spot. The impulses of Made in China 2025 initially motivated companies to increase their investments in China. However, after the change of mood in Washington, the US manufacturers found themselves up against their own government.

Intel, for instance, wanted to ramp up production in China before the end of 2021 in order to counter the chip shortage. Biden foiled the plan. CEO Pat Gelsinger later shelved plans for other plants in China in order to benefit from the gigantic subsidies under the CHIPS Act.

Shortly after, however, Gelsinger called China “the most important market” for his company once again. He simply said what it is. Globally, most chips are installed in China. The country is consistently the largest and fastest-growing market for semiconductors.

After all, Chinese plants produce the bulk of the electronics sold globally, be it PCs, mobile phones, tablets, televisions or headphones. Semiconductors made in China do not even leave the country but go straight into the final product – which is then exported.

Micron’s investment in Xi’an is also a reaction to an impending crisis on the Chinese market. Chinese customers were apparently planning to switch to domestic suppliers. The planned investment of 550 million euros reflects a typical attempt to please both Washington and Beijing. Because it does not clash with the CHIPS Act. The plant in Xi’an has existed for a long time and was previously operated by a Chinese partner. So it does not provide China with access to any new technology.

Moreover, this mainly concerns packaging, while the restrictions from Washington are aimed at producing particularly small chips with structure sizes of less than 28 nanometers. At the same time, Micron is redirecting investments in advanced plants away from Asia to the United States. The company wants to spend 40 billion dollars in its home country, almost ten times more than in China.

The plights of the industry also have repercussions for Germany. Some of these are positive because Intel now invests in Germany instead of China, even if it took an insane amount of subsidies to convince Gelsinger to do so.

The German semiconductor manufacturer Infineon is also fundamentally affected. The involvement in China is fundamentally important to the company because of the market’s significance. Infineon operates a factory in Wuxi and administrative offices in Beijing, Shanghai and Shenzhen.

Infineon is also heading in the other direction and invests record sums where the money is safe: in its domestic market, in Dresden. The Korean electronics giant Samsung is behaving similarly. Despite a well-established presence in China, the company is now investing heavily in its home country of South Korea, bypassing criticism from Washington and keeping its own government happy.

At the start of Summer Davos, China’s Premier Li Qiang struck similar notes as he did during his inaugural visit to Germany: In the opening speech of the three-day economic summit in the eastern Chinese metropolis of Tianjin on Tuesday, Li warned the United States and Europe against moving ahead with breaking away from China.

“Politicization of economic issues” should be opposed. He warned of the consequences of “decoupling”: “In the West, some people are hyping up what is called ‘cutting reliance and de-risking’,” Li said. Both are wrong approaches. As he did last week in Germany and France, Li stressed that it is not politicians but companies who are best able to assess existing risks.

Li thus called – unsurprisingly – for a return to the cooperative policies of the US and EU, which have greatly benefited his own industry. The demand not to “politicize” economic relations is part of the standard repertoire of phrases used in Chinese foreign policy and propaganda media. It is always meant to sound a bit like only Western countries are willing to leverage their market power to exert influence.

At the same time, Li tried to strike a nerve with the business representatives present who want to engage further in China. Businesses “should be left to come to their own conclusions and make their own choice,” the Premier said. Governments and relevant organizations should not take it too far, let alone “overstretch the concept of risk or turn it into an ideological tool.”

This also raises questions. Li encourages Western companies to rebel against their governments. In the Chinese system, however, their own companies receive clear signals from the political leadership about which international strategy is currently called for. Li is applying double standards here. On the domestic market, the leadership holds the reins firmly over private companies. A major regulatory crackdown in the technology sector has just ended.

Two years ago, Beijing also intervened massively with the Chinese ride service provider Didi, which was forced to cancel its New York Stock Exchange listing after pressure from the Chinese authorities. Here, too, the risk assessment was not simply left to the company. Not to mention foreign companies in China, which continue to complain about a clear disadvantage.

Like the original Davos in Switzerland, where the global elite from politics and business meet every year, the World Economic Forum (WEF) also organizes the three-day meetings of the “New Champions.” This is the official name of the Summer Davos. It takes place alternately in the eastern Chinese metropolises of Tianjin and Dalian and is one of the few opportunities to hear the leaders of the People’s Republic speak live.

China, in turn, sees the Summer Davos as an opportunity to present itself and court international investment or capital. This year’s participants include New Zealand Prime Minister Chris Hipkins, World Trade Organisation Director-General Ngozi Okonjo-Iweala and Saudi Arabia’s Minister of Economy and Planning Faisal Alibrahim.

But the world is different than it was at the first Summer Davos in Tianjin in 2007. China and the USA were not yet on an aggressive course back then. And in Germany, too, hardly anyone asked how much dependence on China was actually healthy. Instead, politics and business regularly joined in praising globalization.

Things are different today. What Li had to say sounded, above all, like damage control. Western governments are thoroughly disillusioned with the ratio of opportunities to risks China offers. For business, a thorough risk assessment is vital for survival – and here, the red question marks about China are growing.

Li also brought a relatively optimistic forecast for the Chinese economy to the Summer Davos – and held out the prospect of new economic stimulus. China is “fully confident and capable” of developing stable and high-quality growth in the long term, he said. The government would “roll out more practical and effective measures” to boost domestic demand and promote market dynamism.

Despite the current signs of slowing recovery, Li expressed confidence that the economy had grown more strongly in the second quarter than at the beginning of the year. His government’s growth target of “around five percent” would be achieved this year.

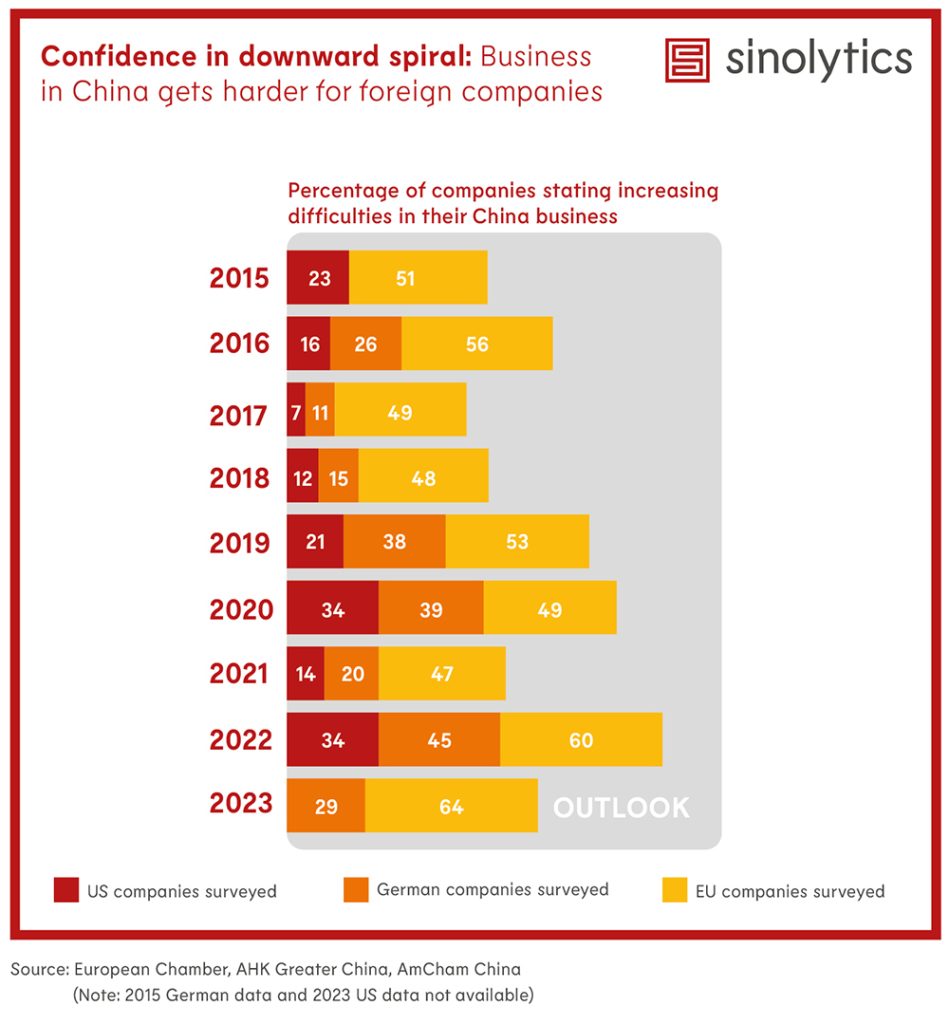

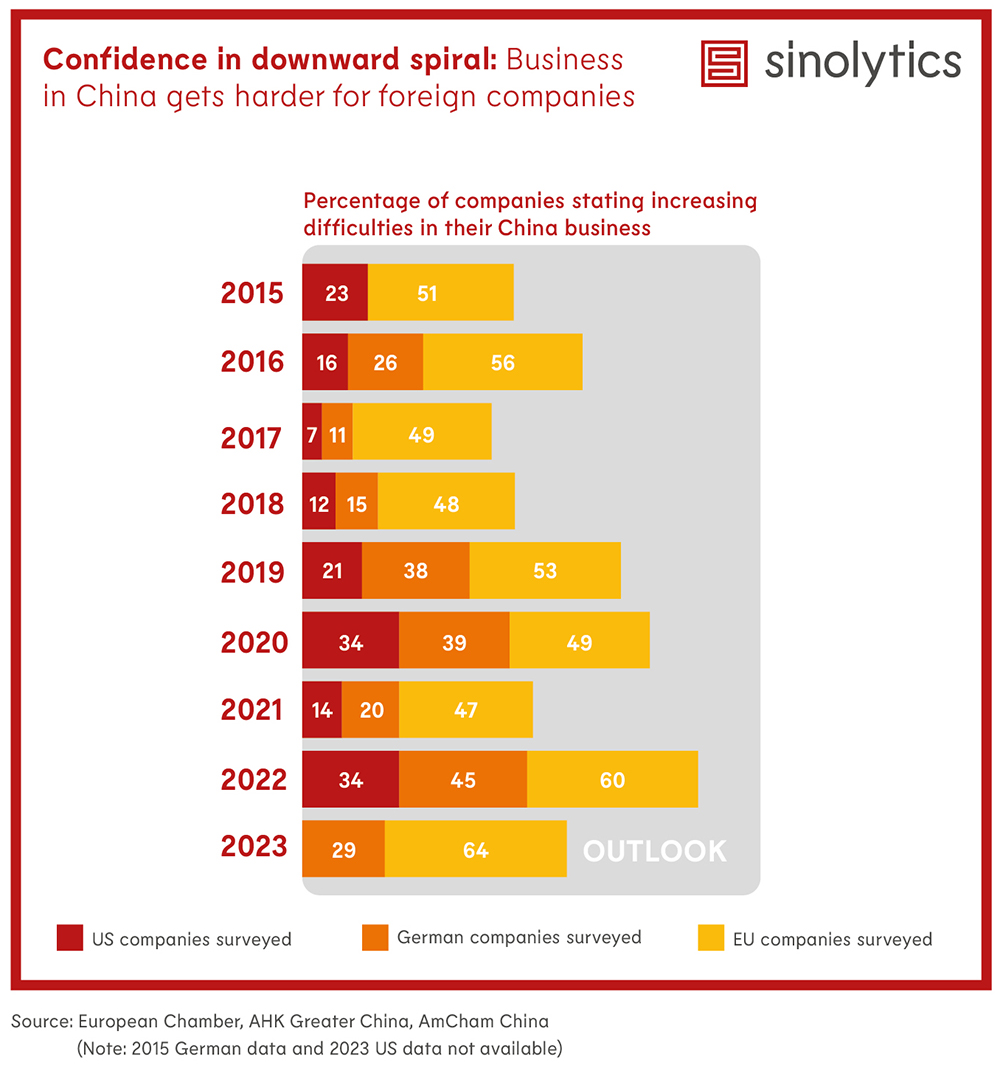

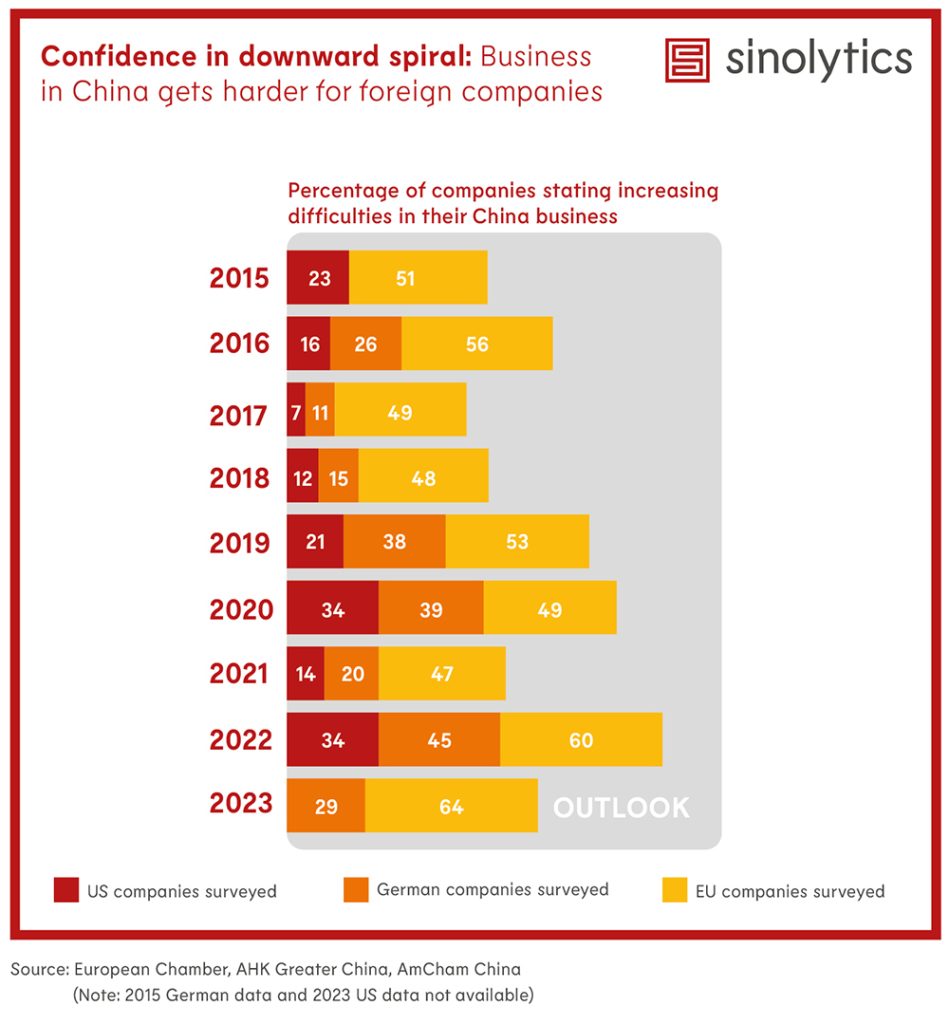

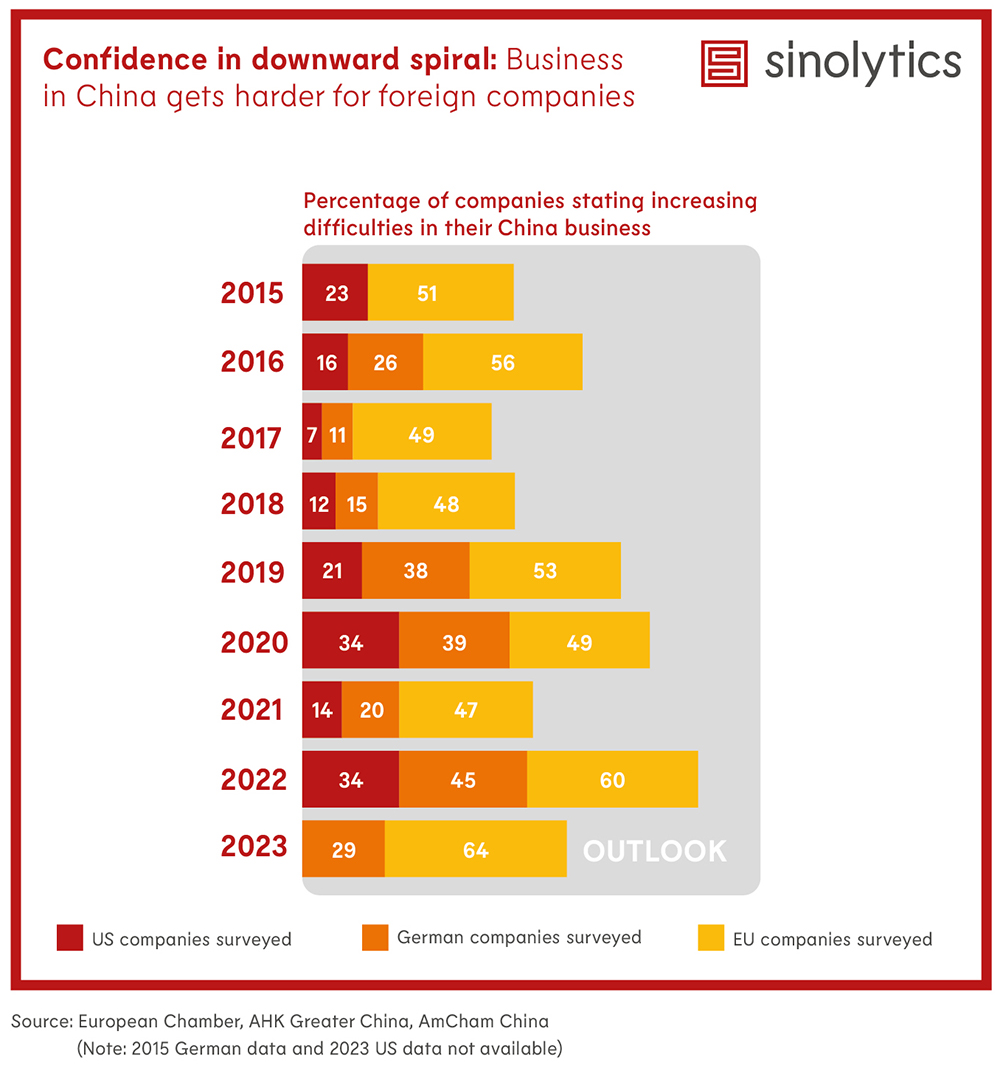

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

According to the German Institute for Economic Research (DIW), Chinese loans in Africa are relatively expensive and conflict with the interests of the debtors. Moreover, they often went to resource-rich countries with a low degree of democratization, as the DIW shows in a new study. “Chinese lending to African countries is thus in competition with Western development policy,” concludes author Lorenz Meister.

Loans largely finance Africa’s economic upswing. Until 2006, the volume of newly granted loans was ten billion dollars annually. Ten years later, in 2016, it was just under 80 billion dollars. Above all, the national debt rose rapidly. In 2020 it averaged 30 percent of gross domestic product (GDP). Some countries, including Ghana, are struggling to service their current debt. Kenya, Ghana and Zambia are currently negotiating their debt with the IMF.

According to the DIW, China has contributed significantly to credit growth. Between 2007 and 2017, the Chinese share accounted for almost 40 percent. However, the credit volume has been declining since 2016 – among other things, because China has shifted its focus from foreign trade to the domestic market.

Western players have also contributed to the high debt. According to the DIW, multilateral loans have more than offset the decline in Chinese loans in recent years. At the finance summit in Paris last week, criticism was voiced about Western development financiers mainly lending in Africa but offering little equity financing. Investment banks, especially American ones, have also placed Eurobonds of African issuers in dollars or euros on the international capital markets to a large extent in recent years.

However, the fact that China has expanded its loans to African borrowers is also because China has taken a significant role in building infrastructure in Africa. According to a study by the consulting firm Deloitte, the country was responsible for 31 percent of all infrastructure projects on the continent, with a contract value of more than 50 million dollars in 2020. In 2013, it was still 13 percent. The share of Western companies fell from 37 to 12 percent during this period. hlr

China wants to cooperate more closely militarily with its neighbor Vietnam. The aim is to strengthen high-level cooperation between the armed forces of both countries, said Chinese Defense Minister Li Shangfu at a meeting with his Vietnamese counterpart Phan Van Giang in Beijing on Tuesday. He said the security of the Asia-Pacific region faces significant challenges. “China and Vietnam should continue to work hand in hand and closely unite in the new journey of socialism, safeguard the common strategic interests of the two countries, and make positive contributions to regional peace and stability,” Li said.

There are numerous territorial disputes in the region, including between China and Vietnam. Both are at odds over islands in the South China Sea and fought a brief war on the land border in 1979. Insofar, the announcement is quite surprising. Besides China, the USA and European states like Germany are also trying to forge closer ties with Vietnam. Just on Sunday, the US aircraft carrier Ronald Reagan moored at the Vietnamese port of Danang. rtr/ck

China’s highest anti-corruption authority has placed a high-ranking official of the Central Commission for Discipline Inspection (CCDI) under surveillance. It is the latest case of a CCDI official being implicated in China’s comprehensive anti-corruption crackdown. This was reported by the news portal Caixin.

Currently, Hao Zongqiang, deputy head of the CCDI’s public relations department, is suspected of “serious violations of discipline and law” – a euphemism for corruption. The accusations emerged from a statement issued by the CCDI on Sunday.

Hao is the fourth CCDI official to be investigated or punished for alleged corruption in the past month. As part of President Xi Jinping’s anti-corruption campaign, the regulator has also stepped up investigations within its own ranks. cyb

Since the beginning of the week, the world’s largest hybrid solar hydropower plant has been producing electricity on the eastern Tibetan plateau. This was reported by Chinese state media. With a capacity of 1 gigawatt of solar modules and 3 gigawatts of hydroelectric generators, the plant on the Yalong River plateau in the province of Sichuan can generate two billion kilowatt-hours of electricity a year. This is reportedly equivalent to the annual energy consumption of more than 700,000 households. The Kela plant is part of a large-scale project to generate clean energy for 100 million households. cyb

Shortly after Xi Jinping took office as General Secretary of the Chinese Communist Party, our access to the field deteriorated. The number of possible cooperation partners decreased dramatically. Economist Ilham Tohti of Minzu University was hauled off to Urumqi and sentenced to life for criticizing on his internet blog that money from Beijing in the Uyghur Autonomous Region of Xinjiang mainly benefits Han Chinese or immigrants. His family has not heard from him for years. Academics like Wu Qiang have been forced out of Chinese universities. The Uyghur anthropologist Rahile Dawut has disappeared.

Not only the number of scientists but also the number of topics that we Europeans are interested in cooperating on has dwindled over the years. The hands extended to us from China for cooperation are becoming fewer and more select. It would be a fatal gesture to simply carry on as usual and only cooperate with scientists who suit the Chinese Communist Party. Many, including the China scholar David Tobin, have decided to stop going to China under these conditions and suspended cooperation. Tobin believes that officially tolerated field research only works when researchers refuse to “listen, support, or intellectually analyze those Chinese citizens who challenge the arbitrary state violence that opresses them.” According to Tobin, there would always be something missing and cooperation under conditions of strict political control could no longer fill this gap.

It is precisely those who refuse the rhetorical offers of cooperation or gather information independently – and thus largely unobserved by the government – who are harshly ostracized. Adrian Zenz, whose research was crucial in uncovering the concentration camps in the Xinjiang Autonomous Region and is also mentioned in the report of the then UN Special Rapporteur on Human Rights, was sanctioned by the Chinese authorities along with other European female scholars and the entire Merics Institute.

At the same time, access in Germany to publicly available information in China is restricted, sometimes in violation of contracts. The operator of the Internet portal CNKI announced in late March that access to subscribed statistical yearbooks, Chinese dissertations and patents would not be available until further notice. Library associations then wrote an open letter. To what extent and when we will get access again is uncertain.

Under these conditions of censorship and restriction, do we just want to carry on as before?

Social scientific China research has always been embedded in political contexts or projects with tactical compromises and speech restrictions. Self-censorship thus guaranteed access to the field. At the same time, however, it is dishonest to conceal this partly unconscious concession. Unsurprisingly, surveys among professional colleagues consider self-censorship as important when dealing with China, but it is only perceived on the other side.

In our self-perception of a scientist, to whom free thought and speech are attributed and guaranteed by law, this tactical retreat is always an embarrassing admittance rather quickly kept quiet and tabooed. As soon as one admits this self-censorship in the scientific space, one has also voluntarily given up this role and rights. It is, therefore, not surprising that in a call for a special issue of a sinological journal on “Censorship and Self-Censorship in China,” none of the more than 50 submissions wanted to deal with self-censorship in Western science.

In his impressive book “10 Gebote der Feldforschung” (The Ten Commandments of Field Study), the Viennese anthropologist Roland Girtler pointed out that in order to understand and interpret the results in the field, it is indispensable to also precisely document and analyze how and in which social roles, expectations, but also attributions of the people encountered later, one has entered and left the field.

It makes a difference – for scholars and journalists, by the way – whether we enter Tibet in the entourage of the propaganda department of the Chinese Communist Party or as Yak herders – the interlocutors and topics and how we are treated would change. Equally important is how we leave the field […] Those who make tactical concessions must also find methods and our rules for talking about the position taken and the associated skills, resources, knowledge or the social role of the respective place of analysis.

This also requires new spaces or centers where self-censorship is documented and opened up for discussion, where people are allowed to talk and argue about China, and, last but not least, where the voices that are suppressed and censored in China are heard. Many Chinese scholars want to come to Germany, regrettably at the moment also with contracts of adhesion from the China Scholarship Council with the help of the DAAD or universities such as the FU Berlin or LMU Munich.

This interest in Germany as a scientific location should be used for a dialog consistently based on our society’s principles and freedom of speech. We need more and a different “China competence.” To attribute this only to sinology or to those who speak Chinese is too short-sighted and historically highly doubtful. With language skills and even better access to CP propaganda material, later Sinology professors were sometimes able to nail an even bigger board in front of their heads and contribute to the establishment of Maoism as 20th-century Chinoiserie in Western Europe. We need to create centers and forums where various forms of academic and non-academic, theoretical, linguistic, and practical China and autocracy expertise come together, with Chinese participation, but transparently and inclusively.

This translation is based on an abridged text approved by the author.

This article is produced in the context of the “Global China Conversations“ event series of the Kiel Institute for the World Economy (IfW). On Thursday, June 29, 11:00 a.m., Matthias Stepan from the research project “Universities as Actors in Dialogue with China” at Ruhr University Bochum and Sascha Klotzbuecher, Associate Professor at the East Asian Institute at the University of Bratislava, will discuss the topic: German Research Cooperation: Creating Knowledge for or with China?

China.Table is media partner of this event series.

Dario Gargiulo is Bottega Veneta’s new Managing Director for Greater China, effective July. Gargiulo was previously Chief Marketing & Digital Business Officer at the luxury brand. He succeeds Mauro Malta as China head.

Ao Wang has been Manager for R&D Validation and Testing at Great Wall Motor Deutschland GmbH since April. He was previously New Energy Powertrain Expert, also at Great Wall Motor in Munich.

Is something changing in your organization? Let us know at heads@table.media!

Bachelor’s and master’s graduates get their picture taken for a souvenir photo after the graduation ceremony at Renmin University in Beijing. A record 11.6 million young people are expected to graduate from Chinese universities this year, including more doctoral students than ever before.

Today’s issue focuses twice on the decoupling of the economy. While our first text reports on how Premier Li Qiang denounces the trend of Western countries to disengage from China, our second text traces just such a decoupling – albeit one that China is eagerly aiding.

The irony is that hardly any Western politician is seriously calling for decoupling. That is what the magic word “de-risking” is for now, but it is equally unpopular with Li. Li expressed his criticism in a speech at “Summer Davos” in China, which Joern Petring reports on.

However, the actual estrangement of the economic regions is not the result of a single act of “politicization” (as Li puts it) of economic relations. There have been steps on both sides that have led away from each other. Then, last year, the distance became practically insurmountable.

As a result, China’s chip industry is catching up and becoming self-sufficient. This in turn is bad news for companies like Intel, Infineon or Samsung. They in turn cannot invest in modern production facilities in China because that would bar them from accessing the plentiful subsidy pots in the US. They are now trying to keep the Chinese market warm without falling out with the US.

What does a company do when Beijing spoils its China business on flimsy grounds? It will invest all the more in China because that is where its most important customers are. This is what the US semiconductor manufacturer Micron has now done.

Shortly after being banned from critical networks in China over safety concerns, Micron announced that it would put a lot of money into taking over and expanding an existing plant. The plant is located in Xi’an; the investment amount is 4.3 billion yuan (550 million euros).

The company’s behavior shows a certain desperation. Semiconductor manufacturers are fully caught between the fronts of the trade conflicts. China is rapidly expanding its own semiconductor industry in the face of pressure from US sanctions. Those who want to remain relevant there must produce locally. But increased involvement in China is more and more rejected by political strategists in Western capitals.

Like Micron, Intel, Infineon, Samsung, TSMC and other industry giants are looking for a way to maintain their presence in China without going against the political course of their home countries. Faced with a choice, they currently prefer to play on Team USA and invest in Western countries. But this weakens their position in China, where important customers are located.

As early as 2015, China decided to become independent in key technologies as quickly as possible. “Made in China 2025” also includes the semiconductor industry. The United States, on the other hand, has been playing aggressively against its rival in the Far East since 2017 and has escalated the tensions into a genuine trade conflict.

Last August, President Joe Biden took the first step to cut China off from US technology with the CHIPS and Science Act. Companies that want to benefit from billions in subsidies in the US are no longer allowed to transfer modern technology to China. Biden wants to bring know-how and jobs back to the US.

In October 2022, Biden went further and banned the supply of modern chips and equipment for their production to China. Later, the Netherlands and Japan followed suit with the so-called chip sanctions.

Then, China responded in December last year. The National Development and Reform Commission now provides one trillion yuan (125 billion euros) over five years to promote the sector. Chinese suppliers are now likely to catch up quickly in both processors and memory chips. The two largest economies are achieving what supposedly no one wants: a decoupling.

Politicians in Washington and Beijing have thus put executives of Western semiconductor manufacturers in a tight spot. The impulses of Made in China 2025 initially motivated companies to increase their investments in China. However, after the change of mood in Washington, the US manufacturers found themselves up against their own government.

Intel, for instance, wanted to ramp up production in China before the end of 2021 in order to counter the chip shortage. Biden foiled the plan. CEO Pat Gelsinger later shelved plans for other plants in China in order to benefit from the gigantic subsidies under the CHIPS Act.

Shortly after, however, Gelsinger called China “the most important market” for his company once again. He simply said what it is. Globally, most chips are installed in China. The country is consistently the largest and fastest-growing market for semiconductors.

After all, Chinese plants produce the bulk of the electronics sold globally, be it PCs, mobile phones, tablets, televisions or headphones. Semiconductors made in China do not even leave the country but go straight into the final product – which is then exported.

Micron’s investment in Xi’an is also a reaction to an impending crisis on the Chinese market. Chinese customers were apparently planning to switch to domestic suppliers. The planned investment of 550 million euros reflects a typical attempt to please both Washington and Beijing. Because it does not clash with the CHIPS Act. The plant in Xi’an has existed for a long time and was previously operated by a Chinese partner. So it does not provide China with access to any new technology.

Moreover, this mainly concerns packaging, while the restrictions from Washington are aimed at producing particularly small chips with structure sizes of less than 28 nanometers. At the same time, Micron is redirecting investments in advanced plants away from Asia to the United States. The company wants to spend 40 billion dollars in its home country, almost ten times more than in China.

The plights of the industry also have repercussions for Germany. Some of these are positive because Intel now invests in Germany instead of China, even if it took an insane amount of subsidies to convince Gelsinger to do so.

The German semiconductor manufacturer Infineon is also fundamentally affected. The involvement in China is fundamentally important to the company because of the market’s significance. Infineon operates a factory in Wuxi and administrative offices in Beijing, Shanghai and Shenzhen.

Infineon is also heading in the other direction and invests record sums where the money is safe: in its domestic market, in Dresden. The Korean electronics giant Samsung is behaving similarly. Despite a well-established presence in China, the company is now investing heavily in its home country of South Korea, bypassing criticism from Washington and keeping its own government happy.

At the start of Summer Davos, China’s Premier Li Qiang struck similar notes as he did during his inaugural visit to Germany: In the opening speech of the three-day economic summit in the eastern Chinese metropolis of Tianjin on Tuesday, Li warned the United States and Europe against moving ahead with breaking away from China.

“Politicization of economic issues” should be opposed. He warned of the consequences of “decoupling”: “In the West, some people are hyping up what is called ‘cutting reliance and de-risking’,” Li said. Both are wrong approaches. As he did last week in Germany and France, Li stressed that it is not politicians but companies who are best able to assess existing risks.

Li thus called – unsurprisingly – for a return to the cooperative policies of the US and EU, which have greatly benefited his own industry. The demand not to “politicize” economic relations is part of the standard repertoire of phrases used in Chinese foreign policy and propaganda media. It is always meant to sound a bit like only Western countries are willing to leverage their market power to exert influence.

At the same time, Li tried to strike a nerve with the business representatives present who want to engage further in China. Businesses “should be left to come to their own conclusions and make their own choice,” the Premier said. Governments and relevant organizations should not take it too far, let alone “overstretch the concept of risk or turn it into an ideological tool.”

This also raises questions. Li encourages Western companies to rebel against their governments. In the Chinese system, however, their own companies receive clear signals from the political leadership about which international strategy is currently called for. Li is applying double standards here. On the domestic market, the leadership holds the reins firmly over private companies. A major regulatory crackdown in the technology sector has just ended.

Two years ago, Beijing also intervened massively with the Chinese ride service provider Didi, which was forced to cancel its New York Stock Exchange listing after pressure from the Chinese authorities. Here, too, the risk assessment was not simply left to the company. Not to mention foreign companies in China, which continue to complain about a clear disadvantage.

Like the original Davos in Switzerland, where the global elite from politics and business meet every year, the World Economic Forum (WEF) also organizes the three-day meetings of the “New Champions.” This is the official name of the Summer Davos. It takes place alternately in the eastern Chinese metropolises of Tianjin and Dalian and is one of the few opportunities to hear the leaders of the People’s Republic speak live.

China, in turn, sees the Summer Davos as an opportunity to present itself and court international investment or capital. This year’s participants include New Zealand Prime Minister Chris Hipkins, World Trade Organisation Director-General Ngozi Okonjo-Iweala and Saudi Arabia’s Minister of Economy and Planning Faisal Alibrahim.

But the world is different than it was at the first Summer Davos in Tianjin in 2007. China and the USA were not yet on an aggressive course back then. And in Germany, too, hardly anyone asked how much dependence on China was actually healthy. Instead, politics and business regularly joined in praising globalization.

Things are different today. What Li had to say sounded, above all, like damage control. Western governments are thoroughly disillusioned with the ratio of opportunities to risks China offers. For business, a thorough risk assessment is vital for survival – and here, the red question marks about China are growing.

Li also brought a relatively optimistic forecast for the Chinese economy to the Summer Davos – and held out the prospect of new economic stimulus. China is “fully confident and capable” of developing stable and high-quality growth in the long term, he said. The government would “roll out more practical and effective measures” to boost domestic demand and promote market dynamism.

Despite the current signs of slowing recovery, Li expressed confidence that the economy had grown more strongly in the second quarter than at the beginning of the year. His government’s growth target of “around five percent” would be achieved this year.

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

According to the German Institute for Economic Research (DIW), Chinese loans in Africa are relatively expensive and conflict with the interests of the debtors. Moreover, they often went to resource-rich countries with a low degree of democratization, as the DIW shows in a new study. “Chinese lending to African countries is thus in competition with Western development policy,” concludes author Lorenz Meister.

Loans largely finance Africa’s economic upswing. Until 2006, the volume of newly granted loans was ten billion dollars annually. Ten years later, in 2016, it was just under 80 billion dollars. Above all, the national debt rose rapidly. In 2020 it averaged 30 percent of gross domestic product (GDP). Some countries, including Ghana, are struggling to service their current debt. Kenya, Ghana and Zambia are currently negotiating their debt with the IMF.

According to the DIW, China has contributed significantly to credit growth. Between 2007 and 2017, the Chinese share accounted for almost 40 percent. However, the credit volume has been declining since 2016 – among other things, because China has shifted its focus from foreign trade to the domestic market.

Western players have also contributed to the high debt. According to the DIW, multilateral loans have more than offset the decline in Chinese loans in recent years. At the finance summit in Paris last week, criticism was voiced about Western development financiers mainly lending in Africa but offering little equity financing. Investment banks, especially American ones, have also placed Eurobonds of African issuers in dollars or euros on the international capital markets to a large extent in recent years.

However, the fact that China has expanded its loans to African borrowers is also because China has taken a significant role in building infrastructure in Africa. According to a study by the consulting firm Deloitte, the country was responsible for 31 percent of all infrastructure projects on the continent, with a contract value of more than 50 million dollars in 2020. In 2013, it was still 13 percent. The share of Western companies fell from 37 to 12 percent during this period. hlr

China wants to cooperate more closely militarily with its neighbor Vietnam. The aim is to strengthen high-level cooperation between the armed forces of both countries, said Chinese Defense Minister Li Shangfu at a meeting with his Vietnamese counterpart Phan Van Giang in Beijing on Tuesday. He said the security of the Asia-Pacific region faces significant challenges. “China and Vietnam should continue to work hand in hand and closely unite in the new journey of socialism, safeguard the common strategic interests of the two countries, and make positive contributions to regional peace and stability,” Li said.

There are numerous territorial disputes in the region, including between China and Vietnam. Both are at odds over islands in the South China Sea and fought a brief war on the land border in 1979. Insofar, the announcement is quite surprising. Besides China, the USA and European states like Germany are also trying to forge closer ties with Vietnam. Just on Sunday, the US aircraft carrier Ronald Reagan moored at the Vietnamese port of Danang. rtr/ck

China’s highest anti-corruption authority has placed a high-ranking official of the Central Commission for Discipline Inspection (CCDI) under surveillance. It is the latest case of a CCDI official being implicated in China’s comprehensive anti-corruption crackdown. This was reported by the news portal Caixin.

Currently, Hao Zongqiang, deputy head of the CCDI’s public relations department, is suspected of “serious violations of discipline and law” – a euphemism for corruption. The accusations emerged from a statement issued by the CCDI on Sunday.

Hao is the fourth CCDI official to be investigated or punished for alleged corruption in the past month. As part of President Xi Jinping’s anti-corruption campaign, the regulator has also stepped up investigations within its own ranks. cyb

Since the beginning of the week, the world’s largest hybrid solar hydropower plant has been producing electricity on the eastern Tibetan plateau. This was reported by Chinese state media. With a capacity of 1 gigawatt of solar modules and 3 gigawatts of hydroelectric generators, the plant on the Yalong River plateau in the province of Sichuan can generate two billion kilowatt-hours of electricity a year. This is reportedly equivalent to the annual energy consumption of more than 700,000 households. The Kela plant is part of a large-scale project to generate clean energy for 100 million households. cyb

Shortly after Xi Jinping took office as General Secretary of the Chinese Communist Party, our access to the field deteriorated. The number of possible cooperation partners decreased dramatically. Economist Ilham Tohti of Minzu University was hauled off to Urumqi and sentenced to life for criticizing on his internet blog that money from Beijing in the Uyghur Autonomous Region of Xinjiang mainly benefits Han Chinese or immigrants. His family has not heard from him for years. Academics like Wu Qiang have been forced out of Chinese universities. The Uyghur anthropologist Rahile Dawut has disappeared.

Not only the number of scientists but also the number of topics that we Europeans are interested in cooperating on has dwindled over the years. The hands extended to us from China for cooperation are becoming fewer and more select. It would be a fatal gesture to simply carry on as usual and only cooperate with scientists who suit the Chinese Communist Party. Many, including the China scholar David Tobin, have decided to stop going to China under these conditions and suspended cooperation. Tobin believes that officially tolerated field research only works when researchers refuse to “listen, support, or intellectually analyze those Chinese citizens who challenge the arbitrary state violence that opresses them.” According to Tobin, there would always be something missing and cooperation under conditions of strict political control could no longer fill this gap.

It is precisely those who refuse the rhetorical offers of cooperation or gather information independently – and thus largely unobserved by the government – who are harshly ostracized. Adrian Zenz, whose research was crucial in uncovering the concentration camps in the Xinjiang Autonomous Region and is also mentioned in the report of the then UN Special Rapporteur on Human Rights, was sanctioned by the Chinese authorities along with other European female scholars and the entire Merics Institute.

At the same time, access in Germany to publicly available information in China is restricted, sometimes in violation of contracts. The operator of the Internet portal CNKI announced in late March that access to subscribed statistical yearbooks, Chinese dissertations and patents would not be available until further notice. Library associations then wrote an open letter. To what extent and when we will get access again is uncertain.

Under these conditions of censorship and restriction, do we just want to carry on as before?

Social scientific China research has always been embedded in political contexts or projects with tactical compromises and speech restrictions. Self-censorship thus guaranteed access to the field. At the same time, however, it is dishonest to conceal this partly unconscious concession. Unsurprisingly, surveys among professional colleagues consider self-censorship as important when dealing with China, but it is only perceived on the other side.

In our self-perception of a scientist, to whom free thought and speech are attributed and guaranteed by law, this tactical retreat is always an embarrassing admittance rather quickly kept quiet and tabooed. As soon as one admits this self-censorship in the scientific space, one has also voluntarily given up this role and rights. It is, therefore, not surprising that in a call for a special issue of a sinological journal on “Censorship and Self-Censorship in China,” none of the more than 50 submissions wanted to deal with self-censorship in Western science.

In his impressive book “10 Gebote der Feldforschung” (The Ten Commandments of Field Study), the Viennese anthropologist Roland Girtler pointed out that in order to understand and interpret the results in the field, it is indispensable to also precisely document and analyze how and in which social roles, expectations, but also attributions of the people encountered later, one has entered and left the field.

It makes a difference – for scholars and journalists, by the way – whether we enter Tibet in the entourage of the propaganda department of the Chinese Communist Party or as Yak herders – the interlocutors and topics and how we are treated would change. Equally important is how we leave the field […] Those who make tactical concessions must also find methods and our rules for talking about the position taken and the associated skills, resources, knowledge or the social role of the respective place of analysis.

This also requires new spaces or centers where self-censorship is documented and opened up for discussion, where people are allowed to talk and argue about China, and, last but not least, where the voices that are suppressed and censored in China are heard. Many Chinese scholars want to come to Germany, regrettably at the moment also with contracts of adhesion from the China Scholarship Council with the help of the DAAD or universities such as the FU Berlin or LMU Munich.

This interest in Germany as a scientific location should be used for a dialog consistently based on our society’s principles and freedom of speech. We need more and a different “China competence.” To attribute this only to sinology or to those who speak Chinese is too short-sighted and historically highly doubtful. With language skills and even better access to CP propaganda material, later Sinology professors were sometimes able to nail an even bigger board in front of their heads and contribute to the establishment of Maoism as 20th-century Chinoiserie in Western Europe. We need to create centers and forums where various forms of academic and non-academic, theoretical, linguistic, and practical China and autocracy expertise come together, with Chinese participation, but transparently and inclusively.

This translation is based on an abridged text approved by the author.

This article is produced in the context of the “Global China Conversations“ event series of the Kiel Institute for the World Economy (IfW). On Thursday, June 29, 11:00 a.m., Matthias Stepan from the research project “Universities as Actors in Dialogue with China” at Ruhr University Bochum and Sascha Klotzbuecher, Associate Professor at the East Asian Institute at the University of Bratislava, will discuss the topic: German Research Cooperation: Creating Knowledge for or with China?

China.Table is media partner of this event series.

Dario Gargiulo is Bottega Veneta’s new Managing Director for Greater China, effective July. Gargiulo was previously Chief Marketing & Digital Business Officer at the luxury brand. He succeeds Mauro Malta as China head.

Ao Wang has been Manager for R&D Validation and Testing at Great Wall Motor Deutschland GmbH since April. He was previously New Energy Powertrain Expert, also at Great Wall Motor in Munich.

Is something changing in your organization? Let us know at heads@table.media!

Bachelor’s and master’s graduates get their picture taken for a souvenir photo after the graduation ceremony at Renmin University in Beijing. A record 11.6 million young people are expected to graduate from Chinese universities this year, including more doctoral students than ever before.