The European photovoltaic industry cannot seem to catch a break. Ten years ago, it almost died because of the influx of Chinese competitors. Today, companies like Longi, Trina Solar, Jinko Solar and Risen hold more than 80 percent of the global market share. This makes reports about European warehouses filled to the brim with solar modules from Chinese production all the more worrying, as Christiane Kuehl writes. This again fuels the debate about solar dumping. Manufacturers now hope that Brussels will help them.

On Wednesday and Thursday, the focus will also be on the Belgian capital regarding the EU’s own infrastructure initiative Global Gateway: EU Commission President Ursula von der Leyen will receive high-ranking representatives from around 40 countries. A detailed list of the participants has not yet been published. Which African countries will be present in Brussels?

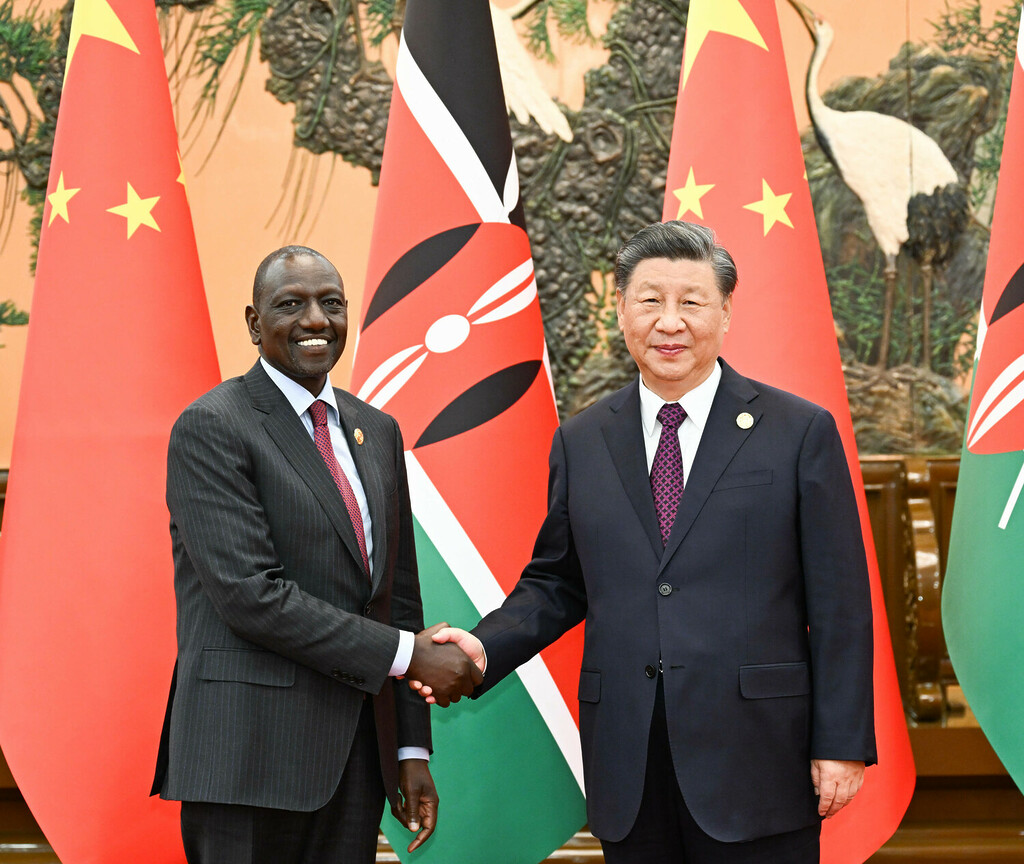

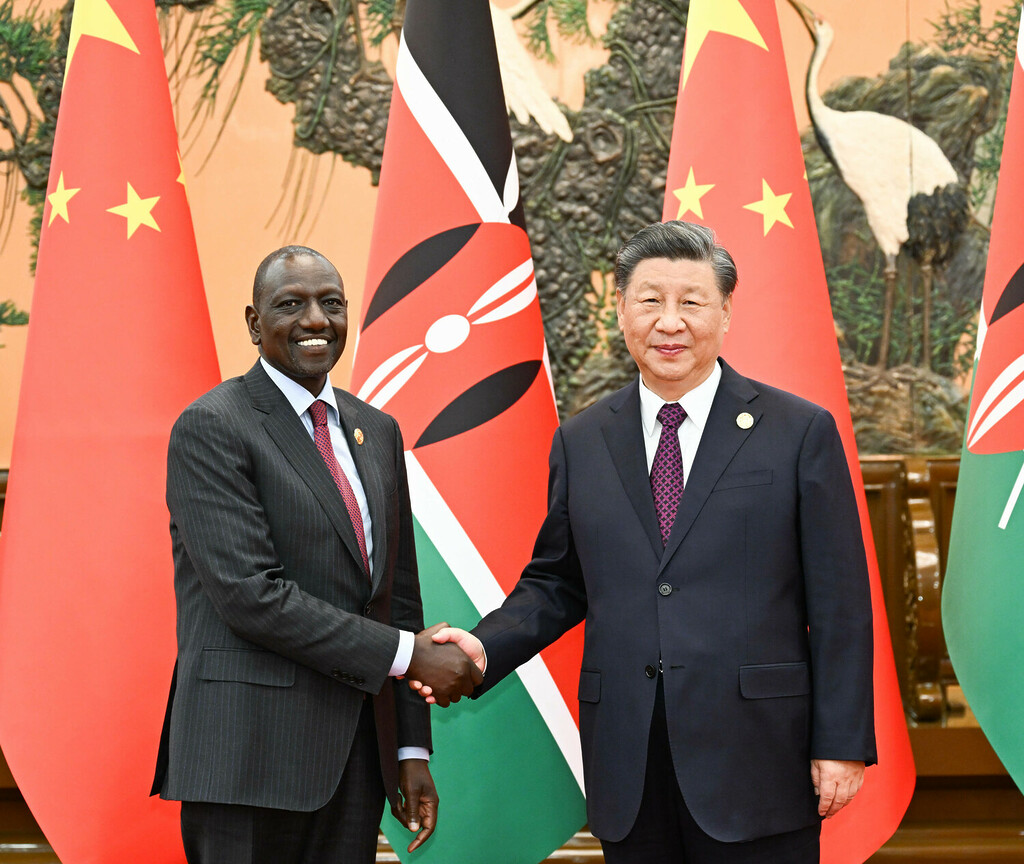

Among others, Kenya’s President William Ruto and Egypt’s Prime Minister Mustafa Madbuli attended the Belt and Road Initiative forum. African interest in the BRI has not waned in recent years, writes Andreas Sieren. He took a closer look at the African participants at last week’s BRI Forum and concludes that China is lending less and less there.

Ten years ago, the European photovoltaic industry almost perished under the onslaught of Chinese competition. Today, companies such as Longi, Trina Solar, Jinko Solar and Risen hold well over 80 percent of the global market share. According to the German Federal Statistical Office, around 87 percent of photovoltaic systems imported to Germany in 2022 came from the People’s Republic. Europe’s domestic photovoltaic industry is only slowly being rebuilt. And so it is easy to panic the young companies with horror reports.

This is what happened in early October when the business intelligence company Rystad Energy reported that solar modules with a total capacity of 80 gigawatts (GW) were piling up in Europe’s warehouses. The industry association European Solar Manufacturing Council (ESMC) estimated that at 40 GW, about half of stocks are Chinese-made solar modules. By comparison, EU countries installed a total of 41.4 GW of new solar capacity in 2022 – a record value.

Both Chinese and international sources have rejected Rystad’s mind-boggling figures, write energy analysts at Beijing-based consultancy Trivium. Nevertheless, the trend is apparent: “In the face of massive oversupply, China’s solar manufacturers are currently flooding overseas markets with cheap module exports.” And even if warehouse stocks are probably lower than calculated by Rystad: The industry agrees that levels are too high.

The overcapacities in the People’s Republic are high and apparently continue to grow. “Announcements for new production capacities in China show no pause and more companies are ramping new production lines, against all prudent business rules,” criticized the ESMC, which includes about 70 companies from the sector.

However, according to a report by the trade journal pv-magazine, the pandemic and the Ukraine war also contributed to the predicament. The Ukraine war fuelled demand for photovoltaics in Europe, while Chinese manufacturers, struggling with the aftermath of zero-Covid, initially failed to keep up with production in 2022. “Distributors across Europe saw that their inventories were running low and placed massive orders to be able to supply their customers immediately,” Edurne Zoco, an analyst at S&P Global, told the magazine. As a result, they massively ramped up production.

The dramatic consequences are starting to show now. While demand is growing at a more normal pace again, on the one hand, supply has increased massively. The result is a sudden price decline since the summer. Prices for solar systems plummeted to a record low within a few months. For example, the average prices for modules in the EU, at around 15 cents per watt of output, are barely above the prices in China, which, in turn, have dropped by about 40 percent since 2022, according to Trivium. This puts the potential selling prices of the stored modules below those that wholesalers and PV system builders paid for in the peak purchasing period.

The accusation is that China’s solar industry, which has been subsidized for years, sells its production surpluses below manufacturing costs, which would be dumping. 40 companies from the industry – including the Swiss manufacturer Meyer Burger, German module producer Heckert Solar, and the start-up Nexwafe – demanded Brussels’ support in a joint letter to the European Union in mid-September.

Two weeks later, several German federal states and solar industry representatives presented a ten-point program in Berlin to save Germany’s solar module manufacturers. Saxony and Saxony-Anhalt, in particular, are exerting pressure. According to the Saxony Energy Ministry, semiconductors, cells, modules, preliminary products and equipment for the solar industry are produced in the two states. At the presentation, Saxony’s Energy Minister Wolfram Gunther spoke of a “fierce dumping attack by China. Innovative and fully competitive European companies are being forced out of the market with state-subsidized predatory pricing.”

The paper calls for, among other things:

The latter is intended to force the unwelcome Chinese competition out of the market. After all, since the USA banned imports of solar modules with silicon from Xinjiang in 2021, China’s already strongly growing exports are increasingly being diverted to Europe. Therefore, the ESMC also calls for the forced labor import ban. “The aim is to ensure that development and value creation in this area remain with us and do not migrate permanently,” said Saxony’s Minister President Michael Kretschmer.

The EU aims to reduce its dependence on foreign countries, especially China. According to the EU Commission’s planned NetZero Industry Act, at least 40 percent of all photovoltaic systems are to be produced domestically in Europe by 2030. To this end, gigafactories are planned in France, Italy and Germany. How exactly this is to be achieved is still uncertain.

There are no easy solutions. According to Trivium experts, the EU is faced with an increasingly difficult choice: Either it settles for cheaper Chinese cleantech imports to enable a smooth decarbonization process. Or it protects domestic clean energy production, thus raising the cost of the energy transition. Launching a support package on par with the US Inflation Reduction Act (IRA) would be difficult for Brussels and take a long time.

The EU has already imposed anti-dumping and anti-subsidy duties on Chinese solar glass since 2014. Brussels also examined the impact of tariffs on the cost structure of European photovoltaic module manufacturers at that time and did not find them disproportionate.

However, anti-dumping duties are only possible if dumping is really taking place, i.e., the prices offered are below the manufacturing costs – or the manufacturers in the export markets charge less than in the domestic market. According to Trivium and pv magazine, prices in China are at a similar low level as in the EU. Chinese manufacturing costs are more difficult to determine, as is whether China’s subsidies distort the market enough to justify anti-subsidy duties.

Meyer Burger CEO Gunter Erfurt has a clear opinion on this. He recently wrote on Linkedin: “Only eight percent of all module capacities will not be controlled by China in 2023. We consider that normal and completely OK? In times of massive geopolitical change? I am enormously concerned, as we all should be.”

Africa’s big economies were all present in China last week when Chinese President Xi Jinping presented the milestones of the first decade of the Belt and Road Initiative (BRI). While China’s relations with Western countries are generally rocky, and the latter criticize the BRI, African governments sought closer ties with China at the third BRI Forum after 2017 and 2019.

About 130 high-level state representatives followed China’s invitation, including 23 heads of state or government. This was a significant decline of 37 top guests compared to the 2019 Forum. The African representatives, on the other hand, came in roughly equal numbers, including:

This corresponded roughly to African representation compared to the previous forum. However, participation from Europe dropped sharply. Only two EU member state representatives came, Hungarian Prime Minister Viktor Orbán and Serbian President Aleksandar Vučić.

The forum showed China’s commitment to good relations with the countries of the Global South. The government already made this clear at this year’s 15th BRICS Summit in South Africa and the G20 Summit in India. Actually, when President Xi presented the BRI in Kazakhstan ten years ago, the focus was initially on Central Asia. But today, Beijing has signed more than 200 cooperation agreements with 150 countries and 30 international organizations, mainly in Africa.

Researchers from the US-based Boston University estimate that between 2013 and 2021, China invested around 331 billion US dollars through the BRI. However, they also emphasize that many recipients of Chinese funding face “significant debt crises.” Nevertheless, a World Bank study found that Beijing supported debtor countries with financial injections of 240 billion dollars between 2008 and 2021.

Kenya, for instance, faces acute payment difficulties. At present, Kenya owes China about six billion dollars, which forced President William Ruto to cut government spending by ten percent. “Most of our earnings are actually going to paying Chinese loans and that is not going to be sustainable,” notes University of Nairobi professor Karuti Kanyinga.

Kenya used Chinese loans to build a new railway line from Mombasa via Nairobi to the Rift Valley. Originally, the 4.7 billion dollar railway line was to be extended to Uganda and connect other landlocked countries in East Africa. However, the government in Kampala distanced itself from China and opted for a partnership with Turkey.

Ruto was among the top African leaders present at the Belt and Road Forum. He requested another $1 billion cash injection from China and agreed with Xi Jinping to open the Chinese market to Kenyan agricultural products to, in Ruto’s words, “ensure the completion of infrastructure programs.”

New BRICS member Ethiopia also struggles with its debts to China. China was the first country to give Addis Ababa more breathing room. China is currently negotiating with other countries in Africa as well. “That is very encouraging,” says Annalisa Fedelino, Deputy Director of the US-dominated IMF. Overall, however, China plays a smaller role in Africa’s debt than is commonly assumed. Only 12 percent of Africa’s debt comes from loans from China. The China Exim Bank has granted most Chinese loans in Africa.

China has also become more careful about lending. While it was still 28 billion dollars a year in 2016, loans shrank to seven billion dollars as early as 2019, i.e., before COVID-19 and the Ukraine war. “There is no trap in the BRI,” is how Jean Louis Robinson, Madagascar’s ambassador to China, for example, sums up the situation. “On the contrary, for some developing countries, especially some emerging market economies, the BRI is a very good opportunity.”

Two studies published by the Ifa Institute for Foreign Cultural Relations show that China is also strongly engaged in African cultural policy. The results are to be presented in Berlin on Tuesday evening. According to the studies, one of China’s strategies is to build capacities to promote economic relations and to be perceived as a partner for development.

Following this logic, China has established cultural initiatives within organizations such as UNESCO. At the same time, the studies claim, it bypasses them and strengthens independent associations such as BRI and BRICS. The goal of Chinese cultural diplomacy is to establish its own narratives.

The EU is also working on its own narrative: On Wednesday and Thursday, the Global Gateway forum will be held in Brussels. The EU’s infrastructure initiative is intended as an alternative to the BRI – so far, however, there are still problems with its implementation. EU Commission President Ursula von der Leyen will receive high-ranking representatives from 40 countries at the forum under the motto “Stronger Together through Sustainable Investment.” It has not yet been announced which African countries will be attending.

China and Russia are deepening their economic cooperation. On Monday, the two countries signed a series of cooperation agreements, Chinese state media reported. The sectors range from industry and logistics to e-commerce and agriculture. The conference in Shenyang, capital of Liaoning Province, was attended by representatives of Russian business and politics, as well as nearly 800 Chinese companies.

In January to September, 40 Russian firms set up businesses in Liaoning, China’s national broadcaster reported on Monday. Exports from Liaoning to Russia also increased by 82.3 percent to 42.64 billion yuan (5.5 billion euros) during the period. rtr

According to insiders, China’s tax investigation into Apple supplier Foxconn may be “politically motivated.” China’s tax investigation into Apple supplier Foxconn may have “political reasons,” according to insiders. On Monday, Reuters quoted two sources close to Foxconn as saying the audit is unusual because it comes less than three months before Taiwan’s presidential election and is related to Foxconn’s diversification efforts to shift some production out of China.

According to a state media report, the Chinese tax authorities had subjected Foxconn to a search. The offices of the electronics giant in Guangdong and Jiangsu provinces were searched, according to the state-run Global Times newspaper on Sunday. The Ministry of Natural Resources also inspected Foxconn offices in Henan and Hubei provinces, where the company operates large production facilities. Foxconn employs hundreds of thousands of workers in China.

The tabloid report did not provide further details on the searches, their date, or possible findings. However, it quoted an expert saying that “while Taiwan-funded enterprises, including Foxconn, are sharing in dividends from development and making remarkable progress in the mainland, they should also assume corresponding social responsibilities and play a positive role in promoting the peaceful development of cross-strait relations.”

Foxconn manufactures iPhones for Apple, but also produces for other electronics and computer companies. Foxconn founder Terry Gou announced in August his candidacy in Taiwan’s presidential election early next year. He is considered pro-China. rtr/ari

Conservative German politician Norbert Lammert, chairman of the Konrad Adenauer Foundation and former president of the German Bundestag, warns against underestimating the BRICS states. “Personally, I find the expansion of BRICS remarkable, especially since it is easy to foresee who is the cook and who is the waiter between Russia and China,” Lammert said in an interview with Table.Media. Lammert noted that the most exciting aspect of the open-ended development is to see that there are a growing number of countries reorienting themselves. “One would underestimate the at least potential significance of this BRICS expansion by reducing it to trade interests,” Lammert stressed.

Lammert sees the debate about the establishment of a national security council in Germany as outdated. He believes that a European security council should be discussed by now. However, Lammert believes that it would be “clearly unrealistic” to expect unanimity in this area if all the nation-states were at the same time determined to retain sole control over their armies. ari

The European Union will take the final step towards the introduction of the new trade instrument against economic coercion at the end of November. As the Council of the European Union announced on Monday, the new instrument is expected to be signed on November 22. 20 days after publication in the Official Journal of the EU, the Anti-Coercion Instrument (ACI) will then enter into force.

“The aim is to use this legislation to de-escalate and induce the discontinuation of coercive measures in trade and investment through dialogue,” the Council said. If this was not possible, the EU could then, as a last resort, take countermeasures such as the introduction of trade restrictions, for example, in the form of increased tariffs, import or export licenses.

The prime example for invoking the ACI is China’s de facto trade embargo against Lithuania after Taiwan opened a representative office in Vilnius called the “Taiwan” Office. In December, the dispute will already be two years old. However, the ACI will not be applied retroactively. ari

On October 28-29, Japan will host the G7 Trade Ministers’ Meeting in Osaka. The primary focus of the gathering will be improving supply-chain resilience and strengthening export controls on critical minerals and technologies. But China’s “economic coercion,” particularly the widespread disruption caused by its non-transparent and market-distorting industrial policies, is also expected to be high on the agenda.

Since joining the World Trade Organization in 2001, China has repeatedly been accused of providing unfair industrial subsidies, resulting in multiple WTO dispute cases. In 2006, for example, the European Union, the United States, and Canada complained that China was offering export subsidies to its automobile and auto parts industries, primarily through its “export base” programs. The WTO strictly prohibits export subsidies due to their significant trade-distorting effects.

Moreover, in 2010, the US asserted that China was subsidizing its wind-power equipment manufacturers by offering grants to companies that used Chinese-made components. In 2017, the focus shifted to alleged Chinese subsidies to large aluminum producers. And a year later, the WTO vindicated the federal government’s complaint that China was imposing countervailing and anti-dumping duties on broiler products from the US.

Meanwhile, bilateral trade between China and South Korea has declined significantly amid rising geopolitical tensions and following China’s decision to exclude from its subsidies program electric-vehicle manufacturers that used South Korean battery packs. Trade relations between China and Australia also soured after China responded to then-Australian Prime Minister Scott Morrison’s call for an independent international investigation into the origins of the COVID-19 pandemic by imposing tariffs on Australian goods such as barley, wine, red meat, timber, and lobsters.

Earlier this year, G7 leaders pledged to combat all forms of economic coercion. But this effort could have far-reaching consequences, given that China accounts for 19.4 percent, 7.5 percent, 6.8 percent, and 6.5 percent of exports from Japan, the US, Germany, and the United Kingdom, respectively. Should the group implement anti-coercion measures targeting China, Chinese President Xi Jinping might retaliate.

But, beyond the potential implications for G7 economies, the group’s anti-coercion campaign could negatively affect global trade. For starters, the vagueness of the term “economic coercion” provides an opportunity not just for the G7 but for governments worldwide to use it as a pretext for protectionist measures, which could increase production costs and overall prices.

The EU defines economic coercion as an attempt by a non-member state to pressure one or more of its members to take a specific action by implementing or threatening to implement measures that affect trade or investment relations between those countries. But while some tactics and tools are clearly coercive, there is no clear explanation of what constitutes an action “against” another country. Given this ambiguity, the term could apply to policies adopted by many countries.

Moreover, while the G7 has repeatedly emphasized its view that export controls are a “fundamental policy tool” to prevent critical technologies from being used for military purposes, such measures can distort long-term resource allocation and global trade, undermine competitiveness, and impede economic growth in both exporting and importing countries.

In a 1981 study, for example, Princeton economist Gene M. Grossman showed that local content requirements often result in reduced output and higher prices for final goods, though their effects on domestic intermediate goods remain unclear and largely depend on market-specific factors and production processes.

In a 1992 paper, Grossman and Elhanan Helpman outlined a trade protection framework in which industries with higher import demand or export-supply elasticities deviate less from free-trade practices. And in 2012, Will Martin and Kym Anderson found that shifts in trade policies, especially export restrictions, played a major role in driving up global staple-crop prices during the commodity booms of 1973-74 and 2006-08.

By adopting anti-coercion measures, G7 members may inadvertently encourage other countries to erect their own trade barriers. In 2022 alone, governments worldwide introduced nearly 3,000 protectionist measures affecting investment and trade in goods and services. These actions, whether undertaken by individual countries or larger groupings, could exacerbate uncertainty and inhibit global trade.

This increasing fragmentation is already having a negative effect. While the value of global trade reached 49.5 trillion US dollars in 2022, the WTO recently lowered its trade growth forecast for 2023 from 1.7 to 0.8 percent, citing trade disruptions and a manufacturing slowdown.

The G7 must take the lead in de-escalating tensions. By ensuring that the WTO operates effectively, and by avoiding punitive measures that pose a threat to economic stability, the group could steer global trade in the right direction.

Lili Yan Ing, Secretary General of the International Economic Association, is Lead Adviser for the Southeast Asian region at the Economic Research Institute for ASEAN and East Asia.

Copyright: Project Syndicate, 2023.

www.project-syndicate.org

Sophia Yan, previously a journalist in Taipei, will be the new correspondent for the British Daily Telegraph in Istanbul. Yan has reported from Asia for more than eleven years, including Taiwan, Hong Kong, Beijing and Tokyo.

Is something changing in your organization? Let us know at heads@table.media!

They have not been seen together for 163 years. Now the Poly Art Museum in Beijing has reassembled them in one room for the public. In 1860, the five copper busts depicting Chinese zodiac signs were looted from the old Summer Palace by British and French troops and scattered to the four winds. Two ended up in the collection of fashion designer Yves Saint Laurent. In the noughties, a controversial debate flared up around the art pieces. For the newly empowered China, they became a symbol of national pride and coming to terms with the past. Several Chinese museums were eventually able to buy seven of the busts at auction with government support. Five others, depicting a dragon, a snake, a rooster, a goat and a dog, remain missing to this day.

The European photovoltaic industry cannot seem to catch a break. Ten years ago, it almost died because of the influx of Chinese competitors. Today, companies like Longi, Trina Solar, Jinko Solar and Risen hold more than 80 percent of the global market share. This makes reports about European warehouses filled to the brim with solar modules from Chinese production all the more worrying, as Christiane Kuehl writes. This again fuels the debate about solar dumping. Manufacturers now hope that Brussels will help them.

On Wednesday and Thursday, the focus will also be on the Belgian capital regarding the EU’s own infrastructure initiative Global Gateway: EU Commission President Ursula von der Leyen will receive high-ranking representatives from around 40 countries. A detailed list of the participants has not yet been published. Which African countries will be present in Brussels?

Among others, Kenya’s President William Ruto and Egypt’s Prime Minister Mustafa Madbuli attended the Belt and Road Initiative forum. African interest in the BRI has not waned in recent years, writes Andreas Sieren. He took a closer look at the African participants at last week’s BRI Forum and concludes that China is lending less and less there.

Ten years ago, the European photovoltaic industry almost perished under the onslaught of Chinese competition. Today, companies such as Longi, Trina Solar, Jinko Solar and Risen hold well over 80 percent of the global market share. According to the German Federal Statistical Office, around 87 percent of photovoltaic systems imported to Germany in 2022 came from the People’s Republic. Europe’s domestic photovoltaic industry is only slowly being rebuilt. And so it is easy to panic the young companies with horror reports.

This is what happened in early October when the business intelligence company Rystad Energy reported that solar modules with a total capacity of 80 gigawatts (GW) were piling up in Europe’s warehouses. The industry association European Solar Manufacturing Council (ESMC) estimated that at 40 GW, about half of stocks are Chinese-made solar modules. By comparison, EU countries installed a total of 41.4 GW of new solar capacity in 2022 – a record value.

Both Chinese and international sources have rejected Rystad’s mind-boggling figures, write energy analysts at Beijing-based consultancy Trivium. Nevertheless, the trend is apparent: “In the face of massive oversupply, China’s solar manufacturers are currently flooding overseas markets with cheap module exports.” And even if warehouse stocks are probably lower than calculated by Rystad: The industry agrees that levels are too high.

The overcapacities in the People’s Republic are high and apparently continue to grow. “Announcements for new production capacities in China show no pause and more companies are ramping new production lines, against all prudent business rules,” criticized the ESMC, which includes about 70 companies from the sector.

However, according to a report by the trade journal pv-magazine, the pandemic and the Ukraine war also contributed to the predicament. The Ukraine war fuelled demand for photovoltaics in Europe, while Chinese manufacturers, struggling with the aftermath of zero-Covid, initially failed to keep up with production in 2022. “Distributors across Europe saw that their inventories were running low and placed massive orders to be able to supply their customers immediately,” Edurne Zoco, an analyst at S&P Global, told the magazine. As a result, they massively ramped up production.

The dramatic consequences are starting to show now. While demand is growing at a more normal pace again, on the one hand, supply has increased massively. The result is a sudden price decline since the summer. Prices for solar systems plummeted to a record low within a few months. For example, the average prices for modules in the EU, at around 15 cents per watt of output, are barely above the prices in China, which, in turn, have dropped by about 40 percent since 2022, according to Trivium. This puts the potential selling prices of the stored modules below those that wholesalers and PV system builders paid for in the peak purchasing period.

The accusation is that China’s solar industry, which has been subsidized for years, sells its production surpluses below manufacturing costs, which would be dumping. 40 companies from the industry – including the Swiss manufacturer Meyer Burger, German module producer Heckert Solar, and the start-up Nexwafe – demanded Brussels’ support in a joint letter to the European Union in mid-September.

Two weeks later, several German federal states and solar industry representatives presented a ten-point program in Berlin to save Germany’s solar module manufacturers. Saxony and Saxony-Anhalt, in particular, are exerting pressure. According to the Saxony Energy Ministry, semiconductors, cells, modules, preliminary products and equipment for the solar industry are produced in the two states. At the presentation, Saxony’s Energy Minister Wolfram Gunther spoke of a “fierce dumping attack by China. Innovative and fully competitive European companies are being forced out of the market with state-subsidized predatory pricing.”

The paper calls for, among other things:

The latter is intended to force the unwelcome Chinese competition out of the market. After all, since the USA banned imports of solar modules with silicon from Xinjiang in 2021, China’s already strongly growing exports are increasingly being diverted to Europe. Therefore, the ESMC also calls for the forced labor import ban. “The aim is to ensure that development and value creation in this area remain with us and do not migrate permanently,” said Saxony’s Minister President Michael Kretschmer.

The EU aims to reduce its dependence on foreign countries, especially China. According to the EU Commission’s planned NetZero Industry Act, at least 40 percent of all photovoltaic systems are to be produced domestically in Europe by 2030. To this end, gigafactories are planned in France, Italy and Germany. How exactly this is to be achieved is still uncertain.

There are no easy solutions. According to Trivium experts, the EU is faced with an increasingly difficult choice: Either it settles for cheaper Chinese cleantech imports to enable a smooth decarbonization process. Or it protects domestic clean energy production, thus raising the cost of the energy transition. Launching a support package on par with the US Inflation Reduction Act (IRA) would be difficult for Brussels and take a long time.

The EU has already imposed anti-dumping and anti-subsidy duties on Chinese solar glass since 2014. Brussels also examined the impact of tariffs on the cost structure of European photovoltaic module manufacturers at that time and did not find them disproportionate.

However, anti-dumping duties are only possible if dumping is really taking place, i.e., the prices offered are below the manufacturing costs – or the manufacturers in the export markets charge less than in the domestic market. According to Trivium and pv magazine, prices in China are at a similar low level as in the EU. Chinese manufacturing costs are more difficult to determine, as is whether China’s subsidies distort the market enough to justify anti-subsidy duties.

Meyer Burger CEO Gunter Erfurt has a clear opinion on this. He recently wrote on Linkedin: “Only eight percent of all module capacities will not be controlled by China in 2023. We consider that normal and completely OK? In times of massive geopolitical change? I am enormously concerned, as we all should be.”

Africa’s big economies were all present in China last week when Chinese President Xi Jinping presented the milestones of the first decade of the Belt and Road Initiative (BRI). While China’s relations with Western countries are generally rocky, and the latter criticize the BRI, African governments sought closer ties with China at the third BRI Forum after 2017 and 2019.

About 130 high-level state representatives followed China’s invitation, including 23 heads of state or government. This was a significant decline of 37 top guests compared to the 2019 Forum. The African representatives, on the other hand, came in roughly equal numbers, including:

This corresponded roughly to African representation compared to the previous forum. However, participation from Europe dropped sharply. Only two EU member state representatives came, Hungarian Prime Minister Viktor Orbán and Serbian President Aleksandar Vučić.

The forum showed China’s commitment to good relations with the countries of the Global South. The government already made this clear at this year’s 15th BRICS Summit in South Africa and the G20 Summit in India. Actually, when President Xi presented the BRI in Kazakhstan ten years ago, the focus was initially on Central Asia. But today, Beijing has signed more than 200 cooperation agreements with 150 countries and 30 international organizations, mainly in Africa.

Researchers from the US-based Boston University estimate that between 2013 and 2021, China invested around 331 billion US dollars through the BRI. However, they also emphasize that many recipients of Chinese funding face “significant debt crises.” Nevertheless, a World Bank study found that Beijing supported debtor countries with financial injections of 240 billion dollars between 2008 and 2021.

Kenya, for instance, faces acute payment difficulties. At present, Kenya owes China about six billion dollars, which forced President William Ruto to cut government spending by ten percent. “Most of our earnings are actually going to paying Chinese loans and that is not going to be sustainable,” notes University of Nairobi professor Karuti Kanyinga.

Kenya used Chinese loans to build a new railway line from Mombasa via Nairobi to the Rift Valley. Originally, the 4.7 billion dollar railway line was to be extended to Uganda and connect other landlocked countries in East Africa. However, the government in Kampala distanced itself from China and opted for a partnership with Turkey.

Ruto was among the top African leaders present at the Belt and Road Forum. He requested another $1 billion cash injection from China and agreed with Xi Jinping to open the Chinese market to Kenyan agricultural products to, in Ruto’s words, “ensure the completion of infrastructure programs.”

New BRICS member Ethiopia also struggles with its debts to China. China was the first country to give Addis Ababa more breathing room. China is currently negotiating with other countries in Africa as well. “That is very encouraging,” says Annalisa Fedelino, Deputy Director of the US-dominated IMF. Overall, however, China plays a smaller role in Africa’s debt than is commonly assumed. Only 12 percent of Africa’s debt comes from loans from China. The China Exim Bank has granted most Chinese loans in Africa.

China has also become more careful about lending. While it was still 28 billion dollars a year in 2016, loans shrank to seven billion dollars as early as 2019, i.e., before COVID-19 and the Ukraine war. “There is no trap in the BRI,” is how Jean Louis Robinson, Madagascar’s ambassador to China, for example, sums up the situation. “On the contrary, for some developing countries, especially some emerging market economies, the BRI is a very good opportunity.”

Two studies published by the Ifa Institute for Foreign Cultural Relations show that China is also strongly engaged in African cultural policy. The results are to be presented in Berlin on Tuesday evening. According to the studies, one of China’s strategies is to build capacities to promote economic relations and to be perceived as a partner for development.

Following this logic, China has established cultural initiatives within organizations such as UNESCO. At the same time, the studies claim, it bypasses them and strengthens independent associations such as BRI and BRICS. The goal of Chinese cultural diplomacy is to establish its own narratives.

The EU is also working on its own narrative: On Wednesday and Thursday, the Global Gateway forum will be held in Brussels. The EU’s infrastructure initiative is intended as an alternative to the BRI – so far, however, there are still problems with its implementation. EU Commission President Ursula von der Leyen will receive high-ranking representatives from 40 countries at the forum under the motto “Stronger Together through Sustainable Investment.” It has not yet been announced which African countries will be attending.

China and Russia are deepening their economic cooperation. On Monday, the two countries signed a series of cooperation agreements, Chinese state media reported. The sectors range from industry and logistics to e-commerce and agriculture. The conference in Shenyang, capital of Liaoning Province, was attended by representatives of Russian business and politics, as well as nearly 800 Chinese companies.

In January to September, 40 Russian firms set up businesses in Liaoning, China’s national broadcaster reported on Monday. Exports from Liaoning to Russia also increased by 82.3 percent to 42.64 billion yuan (5.5 billion euros) during the period. rtr

According to insiders, China’s tax investigation into Apple supplier Foxconn may be “politically motivated.” China’s tax investigation into Apple supplier Foxconn may have “political reasons,” according to insiders. On Monday, Reuters quoted two sources close to Foxconn as saying the audit is unusual because it comes less than three months before Taiwan’s presidential election and is related to Foxconn’s diversification efforts to shift some production out of China.

According to a state media report, the Chinese tax authorities had subjected Foxconn to a search. The offices of the electronics giant in Guangdong and Jiangsu provinces were searched, according to the state-run Global Times newspaper on Sunday. The Ministry of Natural Resources also inspected Foxconn offices in Henan and Hubei provinces, where the company operates large production facilities. Foxconn employs hundreds of thousands of workers in China.

The tabloid report did not provide further details on the searches, their date, or possible findings. However, it quoted an expert saying that “while Taiwan-funded enterprises, including Foxconn, are sharing in dividends from development and making remarkable progress in the mainland, they should also assume corresponding social responsibilities and play a positive role in promoting the peaceful development of cross-strait relations.”

Foxconn manufactures iPhones for Apple, but also produces for other electronics and computer companies. Foxconn founder Terry Gou announced in August his candidacy in Taiwan’s presidential election early next year. He is considered pro-China. rtr/ari

Conservative German politician Norbert Lammert, chairman of the Konrad Adenauer Foundation and former president of the German Bundestag, warns against underestimating the BRICS states. “Personally, I find the expansion of BRICS remarkable, especially since it is easy to foresee who is the cook and who is the waiter between Russia and China,” Lammert said in an interview with Table.Media. Lammert noted that the most exciting aspect of the open-ended development is to see that there are a growing number of countries reorienting themselves. “One would underestimate the at least potential significance of this BRICS expansion by reducing it to trade interests,” Lammert stressed.

Lammert sees the debate about the establishment of a national security council in Germany as outdated. He believes that a European security council should be discussed by now. However, Lammert believes that it would be “clearly unrealistic” to expect unanimity in this area if all the nation-states were at the same time determined to retain sole control over their armies. ari

The European Union will take the final step towards the introduction of the new trade instrument against economic coercion at the end of November. As the Council of the European Union announced on Monday, the new instrument is expected to be signed on November 22. 20 days after publication in the Official Journal of the EU, the Anti-Coercion Instrument (ACI) will then enter into force.

“The aim is to use this legislation to de-escalate and induce the discontinuation of coercive measures in trade and investment through dialogue,” the Council said. If this was not possible, the EU could then, as a last resort, take countermeasures such as the introduction of trade restrictions, for example, in the form of increased tariffs, import or export licenses.

The prime example for invoking the ACI is China’s de facto trade embargo against Lithuania after Taiwan opened a representative office in Vilnius called the “Taiwan” Office. In December, the dispute will already be two years old. However, the ACI will not be applied retroactively. ari

On October 28-29, Japan will host the G7 Trade Ministers’ Meeting in Osaka. The primary focus of the gathering will be improving supply-chain resilience and strengthening export controls on critical minerals and technologies. But China’s “economic coercion,” particularly the widespread disruption caused by its non-transparent and market-distorting industrial policies, is also expected to be high on the agenda.

Since joining the World Trade Organization in 2001, China has repeatedly been accused of providing unfair industrial subsidies, resulting in multiple WTO dispute cases. In 2006, for example, the European Union, the United States, and Canada complained that China was offering export subsidies to its automobile and auto parts industries, primarily through its “export base” programs. The WTO strictly prohibits export subsidies due to their significant trade-distorting effects.

Moreover, in 2010, the US asserted that China was subsidizing its wind-power equipment manufacturers by offering grants to companies that used Chinese-made components. In 2017, the focus shifted to alleged Chinese subsidies to large aluminum producers. And a year later, the WTO vindicated the federal government’s complaint that China was imposing countervailing and anti-dumping duties on broiler products from the US.

Meanwhile, bilateral trade between China and South Korea has declined significantly amid rising geopolitical tensions and following China’s decision to exclude from its subsidies program electric-vehicle manufacturers that used South Korean battery packs. Trade relations between China and Australia also soured after China responded to then-Australian Prime Minister Scott Morrison’s call for an independent international investigation into the origins of the COVID-19 pandemic by imposing tariffs on Australian goods such as barley, wine, red meat, timber, and lobsters.

Earlier this year, G7 leaders pledged to combat all forms of economic coercion. But this effort could have far-reaching consequences, given that China accounts for 19.4 percent, 7.5 percent, 6.8 percent, and 6.5 percent of exports from Japan, the US, Germany, and the United Kingdom, respectively. Should the group implement anti-coercion measures targeting China, Chinese President Xi Jinping might retaliate.

But, beyond the potential implications for G7 economies, the group’s anti-coercion campaign could negatively affect global trade. For starters, the vagueness of the term “economic coercion” provides an opportunity not just for the G7 but for governments worldwide to use it as a pretext for protectionist measures, which could increase production costs and overall prices.

The EU defines economic coercion as an attempt by a non-member state to pressure one or more of its members to take a specific action by implementing or threatening to implement measures that affect trade or investment relations between those countries. But while some tactics and tools are clearly coercive, there is no clear explanation of what constitutes an action “against” another country. Given this ambiguity, the term could apply to policies adopted by many countries.

Moreover, while the G7 has repeatedly emphasized its view that export controls are a “fundamental policy tool” to prevent critical technologies from being used for military purposes, such measures can distort long-term resource allocation and global trade, undermine competitiveness, and impede economic growth in both exporting and importing countries.

In a 1981 study, for example, Princeton economist Gene M. Grossman showed that local content requirements often result in reduced output and higher prices for final goods, though their effects on domestic intermediate goods remain unclear and largely depend on market-specific factors and production processes.

In a 1992 paper, Grossman and Elhanan Helpman outlined a trade protection framework in which industries with higher import demand or export-supply elasticities deviate less from free-trade practices. And in 2012, Will Martin and Kym Anderson found that shifts in trade policies, especially export restrictions, played a major role in driving up global staple-crop prices during the commodity booms of 1973-74 and 2006-08.

By adopting anti-coercion measures, G7 members may inadvertently encourage other countries to erect their own trade barriers. In 2022 alone, governments worldwide introduced nearly 3,000 protectionist measures affecting investment and trade in goods and services. These actions, whether undertaken by individual countries or larger groupings, could exacerbate uncertainty and inhibit global trade.

This increasing fragmentation is already having a negative effect. While the value of global trade reached 49.5 trillion US dollars in 2022, the WTO recently lowered its trade growth forecast for 2023 from 1.7 to 0.8 percent, citing trade disruptions and a manufacturing slowdown.

The G7 must take the lead in de-escalating tensions. By ensuring that the WTO operates effectively, and by avoiding punitive measures that pose a threat to economic stability, the group could steer global trade in the right direction.

Lili Yan Ing, Secretary General of the International Economic Association, is Lead Adviser for the Southeast Asian region at the Economic Research Institute for ASEAN and East Asia.

Copyright: Project Syndicate, 2023.

www.project-syndicate.org

Sophia Yan, previously a journalist in Taipei, will be the new correspondent for the British Daily Telegraph in Istanbul. Yan has reported from Asia for more than eleven years, including Taiwan, Hong Kong, Beijing and Tokyo.

Is something changing in your organization? Let us know at heads@table.media!

They have not been seen together for 163 years. Now the Poly Art Museum in Beijing has reassembled them in one room for the public. In 1860, the five copper busts depicting Chinese zodiac signs were looted from the old Summer Palace by British and French troops and scattered to the four winds. Two ended up in the collection of fashion designer Yves Saint Laurent. In the noughties, a controversial debate flared up around the art pieces. For the newly empowered China, they became a symbol of national pride and coming to terms with the past. Several Chinese museums were eventually able to buy seven of the busts at auction with government support. Five others, depicting a dragon, a snake, a rooster, a goat and a dog, remain missing to this day.