The numbers are getting bigger and bigger – the G7 countries recently pledged €600 billion in infrastructure aid to developing countries and also want to compete with the Chinese Silk Road. The trick is that a large part of the money is to be mobilized by private investors. The G7 countries themselves are contributing only a small part. But this is going rather badly, as earlier promises by the World Bank, for example, under the slogan “From Billions to Trillions” show.

In Africa, this naive fallacy has long been seen through. The West can no longer score points in Africa with vague promises, reports Katja Scherer. Many Africans increasingly see China as a good partner. The rapid implementation of projects and non-interference in human rights violations are to the People’s Republic’s advantage. If the EU really wants to counter China’s growing influence on the African continent, its Africa policy must definitely become more flexible.

A lot of change is also emerging in mobility. EVs are booming. Soon, there will be a large number of spent EV batteries that will serve as raw materials for new batteries. China is way out in front here. Chinese recycling companies are already doing well, while the market in Europe is developing slowly, reports Leonie Düngefeld. After all, investments in recycling plants are only worthwhile when there is enough material to recycle. This is where China can exploit its advantages as an early entrant into electromobility.

Once again, they have wrested a great promise from each other. The G7 countries want to spend €600 billion to expand infrastructure in developing countries. This was recently announced at their meeting at Schloss Elmau.

The EU is at the forefront of this project. It wants to raise half of the money pledged, €100 billion more than the USA. And that’s not the only promise Brussels has recently made to poorer countries – especially in Africa. “Together we can build a more prosperous, peaceful, and sustainable future for all,” EU Commission chief Ursula von der Leyen has said repeatedly in her speeches. In February, she announced €150 billion in investments at the EU-Africa summit. The European Global Gateway initiative also has a strong focus on Africa, for example with a new submarine cable between the continents.

These efforts aim to counter China’s growing influence on the African continent. In doing so, the West relies on a simple narrative: The EU is fundamentally the better partner for Africa, European politicians and institutions repeatedly emphasize. Unlike China, the EU builds high-quality infrastructure, does not drive countries into debt, and works closely with the local population. “It is up to us to give the world a positive, strong investment impulse,” von der Leyen said at the G7 meeting. “This is how we show our partners in the developing world that they have a choice.” That this choice is not automatically pro-EU, however, is often overlooked in the West.

Contrary to what is portrayed in Europe, China is not perceived as a bad partner in Africa – on the contrary. A recent study commissioned by the Friedrich Naumann Foundation shows: China has surpassed Europe in infrastructure projects and commodity trade with Africa. A majority of 1,600 decision-makers surveyed on the continent praised China’s quick decisions, rapid implementation of projects, and Beijing’s non-interference in domestic affairs. Europe’s belief in the superiority of its own values contrasts with Africans’ sober view of Chinese achievements, says Stefan Schott, Project Director of the Friedrich Naumann Foundation in East Africa. “To put it simply: A road that is completed after a short construction period by the Chinese is also a value in the perception of Africans and more concrete than some European projects to promote democracy, human rights or sustainability.”

A recent study by the South African Ichikowitz Family Foundation draws a similar conclusion. It states that young Africans now perceive China as the major power with the most positive influence in Africa – for the first time, the People’s Republic is ahead of the USA and Europe. 76 percent of 4,500 young people surveyed in 15 countries like the fact that China is bringing them new roads, modern smartphones, and new job opportunities. “There is no question that China is the dominant player in Africa today,” said Ivor Ichikowitz, South African entrepreneur and founder of the Family Foundation. “Overall, we are seeing a much more positive approach to China, that’s going to drive a lot more engagement with China.”

China has a newcomer bonus in Africa, says Tom Bayes, explaining the results of the study. Bayes is an independent Africa-China researcher who recently studied the narratives China uses to expand its influence in Africa for the Konrad Adenauer Foundation. Beijing is perceived by many in Africa as a role model and development partner, he says. “When China announces new ventures, it gets a lot of attention – even though Europe and the US have been doing similar things on a larger scale for years.” Africa is a good market for Beijing to sell domestic overproduction, such as industrial goods, Bayes believes. “But China does a much better job than the EU of selling African countries on its own interests as an equal partnership.”

Among other things, there are historical reasons for this. While the West is still burdened with its colonial heritage, cooperation with China has been rather positive from the beginning. As early as the 1970s, China invested in the continent and, for example, expanded the railroad line between Tanzania and Zambia, writes the Tanzanian newspaper The Citizen. Tanzania and Zambia tried in vain to get Western support for the construction. Then the Chinese arrived and were received by Zambia’s then-president Kenneth Kaunda “as friends, as comrades with common struggle,” a narrative that China maintains to this day.

In addition, China is learning fast. The quality of Chinese construction projects had been a problem ten years ago, says Bayes. Now, that is no longer the case. Beijing is also trying to defuse the accusation that China is bringing too many of its workers to Africa. “For example, China has recently been building more education centers in Africa and bringing African students to China on scholarships.”

Cobus van Staden, a foreign policy expert at the South African Institute of International Affairs and co-host of the renowned “China in Africa Podcast,” agrees. He confirms that poor quality is hardly an issue in Chinese construction projects anymore. Rather, he says, China has set new standards in terms of how quickly projects can be implemented. The expert also considers the Western view of African countries’ debts to China to be exaggerated. “It’s true that it’s a problem in individual countries, for example in Zambia or Angola,” he says. “But it’s not the only source of debt problems on the continent.” Some debts to Western donors also caused trouble.

China is also currently taking its relations with Africa to a new level. This became clear at the Forum on China-Africa Cooperation (China.Table reported) in November, an important summit that has been held every three years since the turn of the millennium. “In the future, we will see fewer large infrastructure projects and more political and technological cooperation between China and Africa,” says Foreign Policy Expert Cobus van Staden. He says that means the countries will try harder to find a common position in international organizations such as the UN. And they will strengthen their cooperation in the areas of Internet expansion, satellite navigation, and digitization.

There could also be direct competition between China and the EU in the development of green technologies in Africa in the future. “China has built up a lot of expertise in solar and wind energy in recent years and has a keen interest in exporting it,” says Africa-China expert Tom Bayes. At the same time, the EU is trying to position itself as Africa’s partner in the expansion of renewable energy.

The EU should pay even closer attention to the impact of grand gestures in these efforts, Bayes advises. The EU’s long refusal to release Covid vaccine patents, for example, has gone down very badly in Africa. The Global Gateway Initiative, on the other hand, is a good step toward more cooperation. However, Africa is still waiting for concrete plans, says van Staden.

The EU must listen carefully to what African countries want – and not use its own high standards to exclude certain countries and projects per se. Becoming a pawn between China and Europe, for example, is not in Africa’s interest, van Staden stresses. “There is a lot of need for development in Africa. We need all partners.” Katja Scherer

Now it’s certain: From 2035, no more internal combustion cars will be on the market in the EU; instead, electric vehicles will take over European roads. Mobility will then depend on lithium-ion batteries – and their recycling because the EU wants to achieve a circular economy and has to juggle raw material shortages.

There is no alternative to recycling these batteries. It has been prohibited in the European Union to dispose of batteries in landfills since 2006. It has also become strategically relevant: Due to the Green Deal, the goal of a circular economy, and the race to become less dependent on raw material imports.

There may be something to be learned here from the countries of East Asia. In global comparison, China is far ahead: With 188,000 tons per year, companies can recycle twice as many lithium-ion batteries as companies in Europe and have more than three times as much capacity as the US, researchers calculated at the beginning of this year. They referred to figures from the end of 2021.

In countries such as China and South Korea, recycling material has been in production much earlier than in Europe or the US, explains Matthias Buchert, Head of Resources & Mobility at the Oeko-Institut. Since there was a market and larger production capacities for lithium-ion cells earlier, the recycling industry was also boosted more quickly. Companies there were already able to test and optimize recycling processes with production scrap and scarce goods.

In addition, since 2012, governments have moved forward to build the recycling sector for lithium-ion batteries. In 2018, manufacturers in China were obligated to cooperate with recycling companies. However, many batteries still end up in landfills there or at companies that illegally recycle the batteries using outdated and polluting processes (China.Table reported).

Germany is now under pressure to ramp up its capacities very quickly. The Oeko-Institut has calculated that around 1.2 million tons of lithium-ion batteries per year will come onto the market in Germany from 2035 and will have to be recycled. In addition, there will be batteries from trucks and buses. Given the size of these batteries – Tesla’s Model 3 Long Range contains 4416 cells and weighs 480 kilograms – incredible amounts of waste are involved

The European recycling market for lithium-ion batteries will grow strongly over the next twenty years, delayed by the growth of electromobility, says Buchert. He expects it to pick up by the mid-2020s at the latest. Then there will be large-scale production scrap here, too – from the Gigafactories that are now starting up in Europe. “After 2030, this will take on completely different dimensions,” says Buchert.

In the industry, the expectation is that there will be a division of labor in Europe, he says. “Probably a larger number of companies with smaller capacities will do the initial, mechanical steps of the process, and about a half-dozen, larger companies will do the final refining.”

The largest currently active plant in Europe is operated by SungEel HiTech in Bátonyterenye, Hungary. It is a subsidiary of a South Korean company. There, 50,000 tons of lithium-ion batteries can be recycled per year. According to a study from the beginning of 2022, Germany has the highest recycling capacity in Europe with potentially 54,000 tons of lithium-ion batteries. The company Redux with its plant in Bremerhaven accounts for 10,000 tons.

In the coming years, several plants with capacities of several tens of thousands of tons per year will be added in Europe, for example in Spain, France, the UK, Germany, Poland, and the Scandinavian countries. Northvolt plans to recycle 125,000 tons of lithium-ion batteries annually in Skellefteå, Sweden, starting in 2030. Belgium’s Umicore is currently planning the largest project: It will increase its recycling capacity to 150,000 tons per year, said its head of Government Affairs EU, Jan Tytgat, in Berlin last week.

Torsten Brandenburg, an officer at the German Federal Ministry of Economics, sees the challenge for the European market in the lack of investment. “We need to close the value chain cycle in Europe to catch up with Asia,” he stated at an EIT Raw Materials discussion.

Germany and China basically face the same hurdles, which must be overcome with the help of government regulations. “As in any young market, the challenge in recycling is that companies first have to invest several million euros in the facilities,” says Matthias Buchert. At the moment, this is not worth it: EV batteries have a lifecycle of ten years on average, so it will take time before recyclers even get larger quantities of material. Buchert speaks of the “chicken-and-egg problem”: The larger a recycling plant, the more economically it can operate – but only if it is working to capacity.

According to Deutsche Umwelthilfe (DUH), the problem in Germany currently also lies in the legal collection rate, which is not being met. According to the battery act, 50 percent of used appliance batteries must be collected, which exceeds the EU minimum requirement of 45 percent. According to DUH, the figure for lithium-ion batteries was only about 32 percent. Manufacturers must declare the quantities of batteries placed on the market and take them back, via their own take-back system or one of six established ones. DUH is therefore calling for cost compensation for collection systems, ambitious collection quotas, and a deposit system for lithium-ion batteries.

When battery recycling will be cost-covering will also be influenced by raw material prices. Minerals such as lithium are currently very expensive, and current studies also warn of bottlenecks due to high demand. If prices remain at such a high level and processes and logistics are quickly optimized, recycling could become profitable very soon, says Buchert.

An important signal to investors will soon come from Brussels: the EU will adopt a new battery regulation. It is currently in the trilogue negotiations. Among other things, the new requirements stipulate that car manufacturers are responsible for recycling old batteries from their electric vehicles, that new lithium-ion batteries must contain a certain proportion of recycled material, and that new batteries must be easier to recycle. Minimum collection rates are to be increased to 85 percent by 2030, and batteries are to be provided with a digital passport of origin. The proposal is being praised in various quarters as a milestone, as it regulates the entire life cycle of batteries.

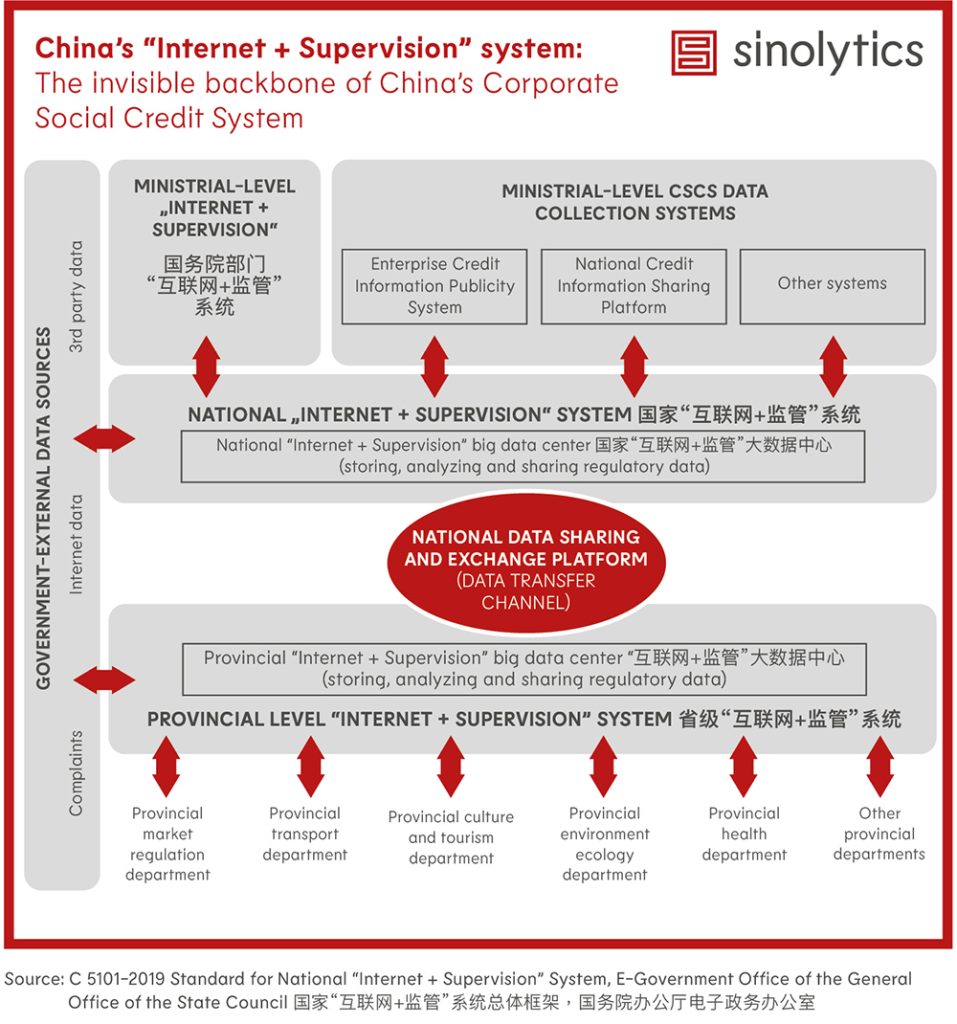

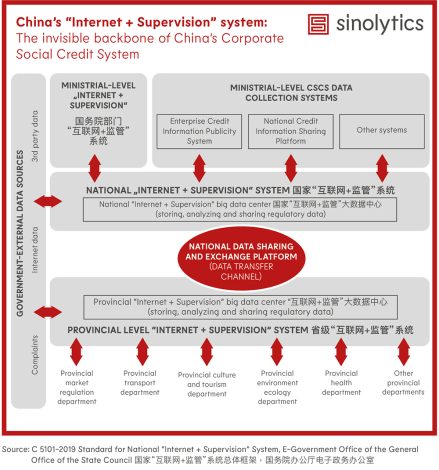

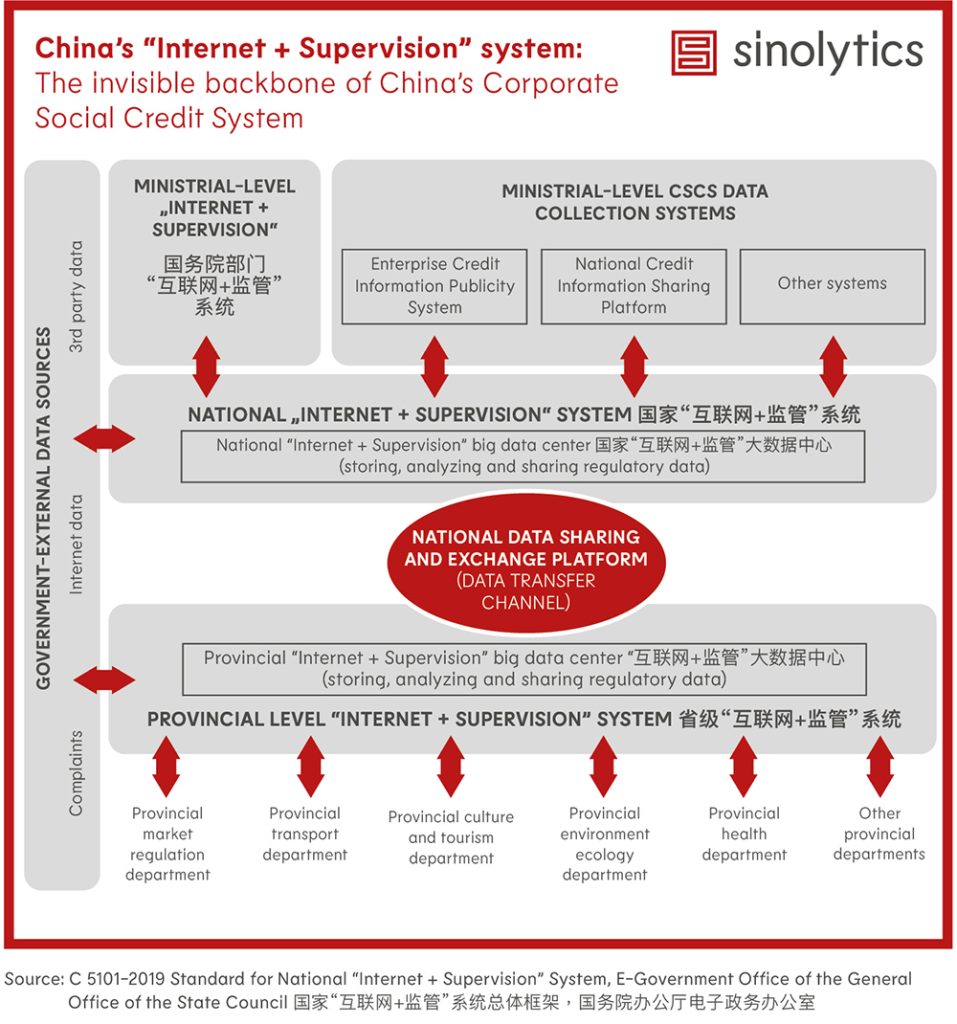

Sinolytics is a European consulting and analysis company specializing in China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

Chinese automaker BYD has overtaken Tesla as the largest EV manufacturer. According to company data, the Shenzhen-based company sold 641,000 cars in the 1st half of the current year. Tesla sold 564,000 units in the same period.

Tesla has had a difficult second quarter. The company attributes the poorer figures to disruptions in the supply chain and sales in China. BYD was not quite as affected by these problems as its competitors, as BYD factories are located in regions that were not as affected by lockdowns as where Tesla, XPeng, Nio, and others produce. BYD also sells many plug-in hybrids, which fall into the EV category. Tesla, on the other hand, produces only battery-powered EVs.

BYD is also celebrating success in other areas. The company has overtaken South Korean competitor LG in the production of EV batteries. Behind CATL, which is also Chinese, BYD now ranks second among the largest battery manufacturers for EVs. Analysts expect BYD and other Chinese manufacturers to step up their efforts to penetrate Western markets. nib

According to insiders, China wants to boost investment in infrastructure and help the ailing economy get back on its feet with a state fund worth billions. The pot is to be filled with ¥500 billion (a good €70 billion), two people familiar with the plans told the Reuters news agency on Tuesday. The fund is to be established in the current summer quarter.

The Chinese economy is presently recovering slowly from the bottlenecks caused by the extensive Covid lockdowns in major cities such as Shanghai. In addition, the real estate market, which has been booming for a long time, is weaker, while consumers are skimping on consumption. In addition, possible recurring waves of infections are instilling fear.

The government is already trying to counteract this with other measures. The central bank, for example, is making loans cheaper. The authorities are also doubling down on infrastructure measures and resorting to an old tool to boost the economy by pledging ¥800 billion (€115 billion) in new loans to finance major projects. rtr/nib

China’s authorities warn of heat waves in the north of the country. Temperatures of over 40 degrees are expected in northern China for several consecutive days in the next two weeks. 250 million people in the regions of Xinjiang, Inner Mongolia, and Ningxia, as well as the provinces of Hebei, Henan, Gansu, and Shaanxi, could be affected, according to Fang Xiang, Deputy Director of the National Meteorological Center (NMC).

According to authorities, June was the hottest since 1961, with heat waves affecting more than half of China’s population last month. “The lasting high temperatures will cause a marked impact on production and life, such as increased pressure on power supply,” Fang said. The risk of forest fires will increase and production of rice, cotton, and corn could be negatively affected, the meteorologist said. The People’s Republic is not the only country struggling with heat waves. Much of the Northern Hemisphere has experienced extreme heat in recent weeks.

China is trying to better adapt to the consequences of climate change and has recently presented a strategy for doing so. However, short-term success is not to be expected, as adaptation is a time-consuming and cost-intensive undertaking (China.Table reported). nib

The event was as feared as it was predictable: Covid sub-variant BA.5, which is currently driving the summer wave in Germany, is now spreading in China. In the provincial capital Xi’an, BA.5 is already dominating the infection scene, reports the Shaanxi Health Department. However, the numbers remain very manageable. Xi’an has been able to identify seven cases. The outbreaks in Shanghai and Beijing were due to the BA.2 variant. “The Cmicron subvariant BA.5 is even more contagious,” warns infectiologist Zhang Yi of the health authority. fin

Former Employer President Dieter Hundt has sold his company to a Chinese investor. The Westron Group from Beijing is taking over 88.9 percent of the shares in Allgaier Werke. The new owner intends to continue operations largely unchanged. Westron is an investor focusing on companies in the automotive, technology, and robotics sectors. Allgaier, therefore, fits well into its portfolio; it is an automotive supplier and industrial equipment manufacturer.

The Westron Group also includes the Hong Kong-based investment company FountainVest, which owns BMTS Technology, known as Bosch Mahle Turbo Systems until the 2018 acquisition. Hundt was President of the Employers’ Association from 1996 to 2013. He is still Chairman of the Supervisory Board of Allgaier. fin

In China, where subcultures are critically eyed, censored, and sometimes sanctioned, heavy metal – Zhòngjīnshǔ 重金属 in Chinese – has established itself as a solid niche since the early 1990s. The scene here is rarely political or socially critical. Instead, local color is an important selling point. Many bands are proud to address their history. The use of traditional instruments such as the knee fiddle is a standard for many groups, as is a country-specific aesthetic. A combination of hard rock music and Chinese elements is not always easy to digest. Some bands take to the stage in kitschy Hanfu costumes, while others specialize in patriotic irritant themes like the Nanjing Massacre.

One band that has perfected the tightrope walk between tradition and heavy metal aesthetics is the group Zuriaake, or Zàngshīhú 葬尸湖 in Chinese – “Lake of Buried Corpses” – founded in Jinan in 1998. To date, it is unknown who is behind the formation. The members neither show their faces nor use clear names. Zuriaake plays black metal, the most extreme form of heavy metal. The singer of the band goes by the stage name Bloodfire. He explained in one of his rare interviews that Zuriaake was formed to escape the “desert of modern culture”.

Their debut album “Afterimage Of Autumn”, released in 2007, is considered one of the classics of Chinese heavy metal. Its atmospheric keyboard passages evoke not the dark, snow-covered forests of Norway – the birthplace of the genre – but the enchanted chasms of Taishan, one of Daoism’s five sacred mountains. The bamboo flute tells of world-weary loneliness and social alienation – the self-chosen counterculture of hermits has a millennia-old tradition in China. “As a carrier of a philosophy, black metal is a music of loneliness,” Bloodfire explains in the interview.

Zuriaake’s album covers depict dilapidated pagodas but also traditional ink painting, which here transforms quite naturally into “Chinese Gothic”: The empty spaces of the Shanshui paintings seem shrouded in mist, the twisted, dabbed branches windswept and restless. It is a darkness that has always been there, but in China’s art-historical reception has taken a back seat to the nature-loving grandeur of monkish life.

In their lyrics, Zuriaake refers to the poet Qu Yuan, who was born in 340 BC during the turbulent age of the “Warring States Period” and is said to have drowned himself on a full moon night in 278. In their composition process, the word came first, Bloodfire explains. “China is a country that deeply reveres its written language. We believe that our ancestors created the most beautiful and meaningful poems in the world. Chinese characters have their unique soul. We engrave these words into each and every song and mix them with the drops of our blood.”

Zuriaake’s artistic vision, however, is most clearly revealed at their concerts. Their stage outfits are coarse, tattered robes of linen and raven-black rice farmer hats that permanently shroud their faces in shadow. “Our costumes are based on the ancient poem ‘Jiang Xue’,” Bloodfire explains. It says: “an old man in a straw cloak and hat, sitting alone in the snow in a boat, fishing in the freezing, snow-covered river” (孤江蓑笠翁,独钓寒江雪).

Zuriaake shows are as theatrical as a funeral service in provincial China, and steeped in the awareness that the afterlife is working through this world at every moment. “Even though I listen to rock, even though I strive for freedom, even though I’ve been abroad and exposed to a foreign culture, I can’t scrub those elements from my bones,” Bloodfire says. “The screams that come out of my mouth will inevitably be Chinese.”

Tobias Czapka has moved to the position of Manager for System Engineering BEV-Powertrain China at VW. The Doctor of Engineering was Lead Technical Project Manager Gasoline Engines at VW until June. Here, Czapka was already responsible for China and the Eastern Regions.

Chunwei Yin has been Facility Manager Data Center for the German subsidiary of China Mobile International since June. The graduate engineer, educated in Shanghai and Mannheim, is based in Mörfelden-Walldorf in Hesse.

Is something changing in your organization? Why not send a tip for our HR column to heads@table.media!

Stairway to heaven? Clouds above the Great Wall of China give the impression that you can climb directly into the sky above the fortress complex.

The numbers are getting bigger and bigger – the G7 countries recently pledged €600 billion in infrastructure aid to developing countries and also want to compete with the Chinese Silk Road. The trick is that a large part of the money is to be mobilized by private investors. The G7 countries themselves are contributing only a small part. But this is going rather badly, as earlier promises by the World Bank, for example, under the slogan “From Billions to Trillions” show.

In Africa, this naive fallacy has long been seen through. The West can no longer score points in Africa with vague promises, reports Katja Scherer. Many Africans increasingly see China as a good partner. The rapid implementation of projects and non-interference in human rights violations are to the People’s Republic’s advantage. If the EU really wants to counter China’s growing influence on the African continent, its Africa policy must definitely become more flexible.

A lot of change is also emerging in mobility. EVs are booming. Soon, there will be a large number of spent EV batteries that will serve as raw materials for new batteries. China is way out in front here. Chinese recycling companies are already doing well, while the market in Europe is developing slowly, reports Leonie Düngefeld. After all, investments in recycling plants are only worthwhile when there is enough material to recycle. This is where China can exploit its advantages as an early entrant into electromobility.

Once again, they have wrested a great promise from each other. The G7 countries want to spend €600 billion to expand infrastructure in developing countries. This was recently announced at their meeting at Schloss Elmau.

The EU is at the forefront of this project. It wants to raise half of the money pledged, €100 billion more than the USA. And that’s not the only promise Brussels has recently made to poorer countries – especially in Africa. “Together we can build a more prosperous, peaceful, and sustainable future for all,” EU Commission chief Ursula von der Leyen has said repeatedly in her speeches. In February, she announced €150 billion in investments at the EU-Africa summit. The European Global Gateway initiative also has a strong focus on Africa, for example with a new submarine cable between the continents.

These efforts aim to counter China’s growing influence on the African continent. In doing so, the West relies on a simple narrative: The EU is fundamentally the better partner for Africa, European politicians and institutions repeatedly emphasize. Unlike China, the EU builds high-quality infrastructure, does not drive countries into debt, and works closely with the local population. “It is up to us to give the world a positive, strong investment impulse,” von der Leyen said at the G7 meeting. “This is how we show our partners in the developing world that they have a choice.” That this choice is not automatically pro-EU, however, is often overlooked in the West.

Contrary to what is portrayed in Europe, China is not perceived as a bad partner in Africa – on the contrary. A recent study commissioned by the Friedrich Naumann Foundation shows: China has surpassed Europe in infrastructure projects and commodity trade with Africa. A majority of 1,600 decision-makers surveyed on the continent praised China’s quick decisions, rapid implementation of projects, and Beijing’s non-interference in domestic affairs. Europe’s belief in the superiority of its own values contrasts with Africans’ sober view of Chinese achievements, says Stefan Schott, Project Director of the Friedrich Naumann Foundation in East Africa. “To put it simply: A road that is completed after a short construction period by the Chinese is also a value in the perception of Africans and more concrete than some European projects to promote democracy, human rights or sustainability.”

A recent study by the South African Ichikowitz Family Foundation draws a similar conclusion. It states that young Africans now perceive China as the major power with the most positive influence in Africa – for the first time, the People’s Republic is ahead of the USA and Europe. 76 percent of 4,500 young people surveyed in 15 countries like the fact that China is bringing them new roads, modern smartphones, and new job opportunities. “There is no question that China is the dominant player in Africa today,” said Ivor Ichikowitz, South African entrepreneur and founder of the Family Foundation. “Overall, we are seeing a much more positive approach to China, that’s going to drive a lot more engagement with China.”

China has a newcomer bonus in Africa, says Tom Bayes, explaining the results of the study. Bayes is an independent Africa-China researcher who recently studied the narratives China uses to expand its influence in Africa for the Konrad Adenauer Foundation. Beijing is perceived by many in Africa as a role model and development partner, he says. “When China announces new ventures, it gets a lot of attention – even though Europe and the US have been doing similar things on a larger scale for years.” Africa is a good market for Beijing to sell domestic overproduction, such as industrial goods, Bayes believes. “But China does a much better job than the EU of selling African countries on its own interests as an equal partnership.”

Among other things, there are historical reasons for this. While the West is still burdened with its colonial heritage, cooperation with China has been rather positive from the beginning. As early as the 1970s, China invested in the continent and, for example, expanded the railroad line between Tanzania and Zambia, writes the Tanzanian newspaper The Citizen. Tanzania and Zambia tried in vain to get Western support for the construction. Then the Chinese arrived and were received by Zambia’s then-president Kenneth Kaunda “as friends, as comrades with common struggle,” a narrative that China maintains to this day.

In addition, China is learning fast. The quality of Chinese construction projects had been a problem ten years ago, says Bayes. Now, that is no longer the case. Beijing is also trying to defuse the accusation that China is bringing too many of its workers to Africa. “For example, China has recently been building more education centers in Africa and bringing African students to China on scholarships.”

Cobus van Staden, a foreign policy expert at the South African Institute of International Affairs and co-host of the renowned “China in Africa Podcast,” agrees. He confirms that poor quality is hardly an issue in Chinese construction projects anymore. Rather, he says, China has set new standards in terms of how quickly projects can be implemented. The expert also considers the Western view of African countries’ debts to China to be exaggerated. “It’s true that it’s a problem in individual countries, for example in Zambia or Angola,” he says. “But it’s not the only source of debt problems on the continent.” Some debts to Western donors also caused trouble.

China is also currently taking its relations with Africa to a new level. This became clear at the Forum on China-Africa Cooperation (China.Table reported) in November, an important summit that has been held every three years since the turn of the millennium. “In the future, we will see fewer large infrastructure projects and more political and technological cooperation between China and Africa,” says Foreign Policy Expert Cobus van Staden. He says that means the countries will try harder to find a common position in international organizations such as the UN. And they will strengthen their cooperation in the areas of Internet expansion, satellite navigation, and digitization.

There could also be direct competition between China and the EU in the development of green technologies in Africa in the future. “China has built up a lot of expertise in solar and wind energy in recent years and has a keen interest in exporting it,” says Africa-China expert Tom Bayes. At the same time, the EU is trying to position itself as Africa’s partner in the expansion of renewable energy.

The EU should pay even closer attention to the impact of grand gestures in these efforts, Bayes advises. The EU’s long refusal to release Covid vaccine patents, for example, has gone down very badly in Africa. The Global Gateway Initiative, on the other hand, is a good step toward more cooperation. However, Africa is still waiting for concrete plans, says van Staden.

The EU must listen carefully to what African countries want – and not use its own high standards to exclude certain countries and projects per se. Becoming a pawn between China and Europe, for example, is not in Africa’s interest, van Staden stresses. “There is a lot of need for development in Africa. We need all partners.” Katja Scherer

Now it’s certain: From 2035, no more internal combustion cars will be on the market in the EU; instead, electric vehicles will take over European roads. Mobility will then depend on lithium-ion batteries – and their recycling because the EU wants to achieve a circular economy and has to juggle raw material shortages.

There is no alternative to recycling these batteries. It has been prohibited in the European Union to dispose of batteries in landfills since 2006. It has also become strategically relevant: Due to the Green Deal, the goal of a circular economy, and the race to become less dependent on raw material imports.

There may be something to be learned here from the countries of East Asia. In global comparison, China is far ahead: With 188,000 tons per year, companies can recycle twice as many lithium-ion batteries as companies in Europe and have more than three times as much capacity as the US, researchers calculated at the beginning of this year. They referred to figures from the end of 2021.

In countries such as China and South Korea, recycling material has been in production much earlier than in Europe or the US, explains Matthias Buchert, Head of Resources & Mobility at the Oeko-Institut. Since there was a market and larger production capacities for lithium-ion cells earlier, the recycling industry was also boosted more quickly. Companies there were already able to test and optimize recycling processes with production scrap and scarce goods.

In addition, since 2012, governments have moved forward to build the recycling sector for lithium-ion batteries. In 2018, manufacturers in China were obligated to cooperate with recycling companies. However, many batteries still end up in landfills there or at companies that illegally recycle the batteries using outdated and polluting processes (China.Table reported).

Germany is now under pressure to ramp up its capacities very quickly. The Oeko-Institut has calculated that around 1.2 million tons of lithium-ion batteries per year will come onto the market in Germany from 2035 and will have to be recycled. In addition, there will be batteries from trucks and buses. Given the size of these batteries – Tesla’s Model 3 Long Range contains 4416 cells and weighs 480 kilograms – incredible amounts of waste are involved

The European recycling market for lithium-ion batteries will grow strongly over the next twenty years, delayed by the growth of electromobility, says Buchert. He expects it to pick up by the mid-2020s at the latest. Then there will be large-scale production scrap here, too – from the Gigafactories that are now starting up in Europe. “After 2030, this will take on completely different dimensions,” says Buchert.

In the industry, the expectation is that there will be a division of labor in Europe, he says. “Probably a larger number of companies with smaller capacities will do the initial, mechanical steps of the process, and about a half-dozen, larger companies will do the final refining.”

The largest currently active plant in Europe is operated by SungEel HiTech in Bátonyterenye, Hungary. It is a subsidiary of a South Korean company. There, 50,000 tons of lithium-ion batteries can be recycled per year. According to a study from the beginning of 2022, Germany has the highest recycling capacity in Europe with potentially 54,000 tons of lithium-ion batteries. The company Redux with its plant in Bremerhaven accounts for 10,000 tons.

In the coming years, several plants with capacities of several tens of thousands of tons per year will be added in Europe, for example in Spain, France, the UK, Germany, Poland, and the Scandinavian countries. Northvolt plans to recycle 125,000 tons of lithium-ion batteries annually in Skellefteå, Sweden, starting in 2030. Belgium’s Umicore is currently planning the largest project: It will increase its recycling capacity to 150,000 tons per year, said its head of Government Affairs EU, Jan Tytgat, in Berlin last week.

Torsten Brandenburg, an officer at the German Federal Ministry of Economics, sees the challenge for the European market in the lack of investment. “We need to close the value chain cycle in Europe to catch up with Asia,” he stated at an EIT Raw Materials discussion.

Germany and China basically face the same hurdles, which must be overcome with the help of government regulations. “As in any young market, the challenge in recycling is that companies first have to invest several million euros in the facilities,” says Matthias Buchert. At the moment, this is not worth it: EV batteries have a lifecycle of ten years on average, so it will take time before recyclers even get larger quantities of material. Buchert speaks of the “chicken-and-egg problem”: The larger a recycling plant, the more economically it can operate – but only if it is working to capacity.

According to Deutsche Umwelthilfe (DUH), the problem in Germany currently also lies in the legal collection rate, which is not being met. According to the battery act, 50 percent of used appliance batteries must be collected, which exceeds the EU minimum requirement of 45 percent. According to DUH, the figure for lithium-ion batteries was only about 32 percent. Manufacturers must declare the quantities of batteries placed on the market and take them back, via their own take-back system or one of six established ones. DUH is therefore calling for cost compensation for collection systems, ambitious collection quotas, and a deposit system for lithium-ion batteries.

When battery recycling will be cost-covering will also be influenced by raw material prices. Minerals such as lithium are currently very expensive, and current studies also warn of bottlenecks due to high demand. If prices remain at such a high level and processes and logistics are quickly optimized, recycling could become profitable very soon, says Buchert.

An important signal to investors will soon come from Brussels: the EU will adopt a new battery regulation. It is currently in the trilogue negotiations. Among other things, the new requirements stipulate that car manufacturers are responsible for recycling old batteries from their electric vehicles, that new lithium-ion batteries must contain a certain proportion of recycled material, and that new batteries must be easier to recycle. Minimum collection rates are to be increased to 85 percent by 2030, and batteries are to be provided with a digital passport of origin. The proposal is being praised in various quarters as a milestone, as it regulates the entire life cycle of batteries.

Sinolytics is a European consulting and analysis company specializing in China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

Chinese automaker BYD has overtaken Tesla as the largest EV manufacturer. According to company data, the Shenzhen-based company sold 641,000 cars in the 1st half of the current year. Tesla sold 564,000 units in the same period.

Tesla has had a difficult second quarter. The company attributes the poorer figures to disruptions in the supply chain and sales in China. BYD was not quite as affected by these problems as its competitors, as BYD factories are located in regions that were not as affected by lockdowns as where Tesla, XPeng, Nio, and others produce. BYD also sells many plug-in hybrids, which fall into the EV category. Tesla, on the other hand, produces only battery-powered EVs.

BYD is also celebrating success in other areas. The company has overtaken South Korean competitor LG in the production of EV batteries. Behind CATL, which is also Chinese, BYD now ranks second among the largest battery manufacturers for EVs. Analysts expect BYD and other Chinese manufacturers to step up their efforts to penetrate Western markets. nib

According to insiders, China wants to boost investment in infrastructure and help the ailing economy get back on its feet with a state fund worth billions. The pot is to be filled with ¥500 billion (a good €70 billion), two people familiar with the plans told the Reuters news agency on Tuesday. The fund is to be established in the current summer quarter.

The Chinese economy is presently recovering slowly from the bottlenecks caused by the extensive Covid lockdowns in major cities such as Shanghai. In addition, the real estate market, which has been booming for a long time, is weaker, while consumers are skimping on consumption. In addition, possible recurring waves of infections are instilling fear.

The government is already trying to counteract this with other measures. The central bank, for example, is making loans cheaper. The authorities are also doubling down on infrastructure measures and resorting to an old tool to boost the economy by pledging ¥800 billion (€115 billion) in new loans to finance major projects. rtr/nib

China’s authorities warn of heat waves in the north of the country. Temperatures of over 40 degrees are expected in northern China for several consecutive days in the next two weeks. 250 million people in the regions of Xinjiang, Inner Mongolia, and Ningxia, as well as the provinces of Hebei, Henan, Gansu, and Shaanxi, could be affected, according to Fang Xiang, Deputy Director of the National Meteorological Center (NMC).

According to authorities, June was the hottest since 1961, with heat waves affecting more than half of China’s population last month. “The lasting high temperatures will cause a marked impact on production and life, such as increased pressure on power supply,” Fang said. The risk of forest fires will increase and production of rice, cotton, and corn could be negatively affected, the meteorologist said. The People’s Republic is not the only country struggling with heat waves. Much of the Northern Hemisphere has experienced extreme heat in recent weeks.

China is trying to better adapt to the consequences of climate change and has recently presented a strategy for doing so. However, short-term success is not to be expected, as adaptation is a time-consuming and cost-intensive undertaking (China.Table reported). nib

The event was as feared as it was predictable: Covid sub-variant BA.5, which is currently driving the summer wave in Germany, is now spreading in China. In the provincial capital Xi’an, BA.5 is already dominating the infection scene, reports the Shaanxi Health Department. However, the numbers remain very manageable. Xi’an has been able to identify seven cases. The outbreaks in Shanghai and Beijing were due to the BA.2 variant. “The Cmicron subvariant BA.5 is even more contagious,” warns infectiologist Zhang Yi of the health authority. fin

Former Employer President Dieter Hundt has sold his company to a Chinese investor. The Westron Group from Beijing is taking over 88.9 percent of the shares in Allgaier Werke. The new owner intends to continue operations largely unchanged. Westron is an investor focusing on companies in the automotive, technology, and robotics sectors. Allgaier, therefore, fits well into its portfolio; it is an automotive supplier and industrial equipment manufacturer.

The Westron Group also includes the Hong Kong-based investment company FountainVest, which owns BMTS Technology, known as Bosch Mahle Turbo Systems until the 2018 acquisition. Hundt was President of the Employers’ Association from 1996 to 2013. He is still Chairman of the Supervisory Board of Allgaier. fin

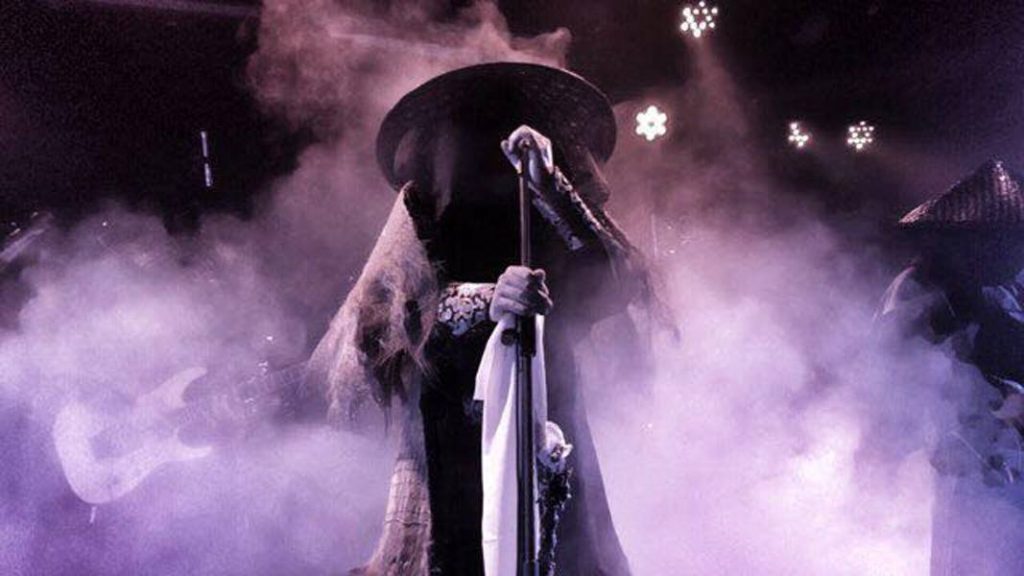

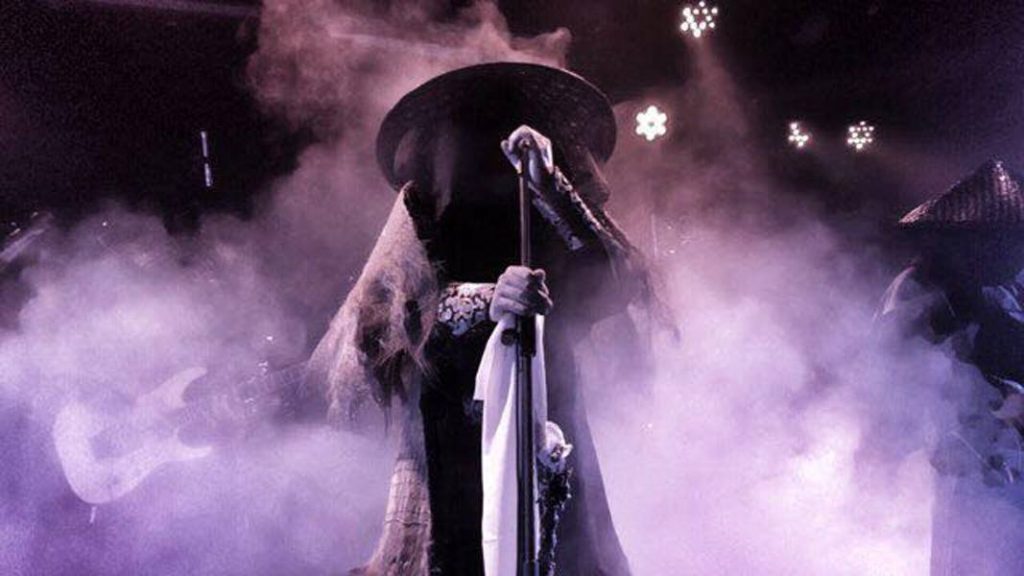

In China, where subcultures are critically eyed, censored, and sometimes sanctioned, heavy metal – Zhòngjīnshǔ 重金属 in Chinese – has established itself as a solid niche since the early 1990s. The scene here is rarely political or socially critical. Instead, local color is an important selling point. Many bands are proud to address their history. The use of traditional instruments such as the knee fiddle is a standard for many groups, as is a country-specific aesthetic. A combination of hard rock music and Chinese elements is not always easy to digest. Some bands take to the stage in kitschy Hanfu costumes, while others specialize in patriotic irritant themes like the Nanjing Massacre.

One band that has perfected the tightrope walk between tradition and heavy metal aesthetics is the group Zuriaake, or Zàngshīhú 葬尸湖 in Chinese – “Lake of Buried Corpses” – founded in Jinan in 1998. To date, it is unknown who is behind the formation. The members neither show their faces nor use clear names. Zuriaake plays black metal, the most extreme form of heavy metal. The singer of the band goes by the stage name Bloodfire. He explained in one of his rare interviews that Zuriaake was formed to escape the “desert of modern culture”.

Their debut album “Afterimage Of Autumn”, released in 2007, is considered one of the classics of Chinese heavy metal. Its atmospheric keyboard passages evoke not the dark, snow-covered forests of Norway – the birthplace of the genre – but the enchanted chasms of Taishan, one of Daoism’s five sacred mountains. The bamboo flute tells of world-weary loneliness and social alienation – the self-chosen counterculture of hermits has a millennia-old tradition in China. “As a carrier of a philosophy, black metal is a music of loneliness,” Bloodfire explains in the interview.

Zuriaake’s album covers depict dilapidated pagodas but also traditional ink painting, which here transforms quite naturally into “Chinese Gothic”: The empty spaces of the Shanshui paintings seem shrouded in mist, the twisted, dabbed branches windswept and restless. It is a darkness that has always been there, but in China’s art-historical reception has taken a back seat to the nature-loving grandeur of monkish life.

In their lyrics, Zuriaake refers to the poet Qu Yuan, who was born in 340 BC during the turbulent age of the “Warring States Period” and is said to have drowned himself on a full moon night in 278. In their composition process, the word came first, Bloodfire explains. “China is a country that deeply reveres its written language. We believe that our ancestors created the most beautiful and meaningful poems in the world. Chinese characters have their unique soul. We engrave these words into each and every song and mix them with the drops of our blood.”

Zuriaake’s artistic vision, however, is most clearly revealed at their concerts. Their stage outfits are coarse, tattered robes of linen and raven-black rice farmer hats that permanently shroud their faces in shadow. “Our costumes are based on the ancient poem ‘Jiang Xue’,” Bloodfire explains. It says: “an old man in a straw cloak and hat, sitting alone in the snow in a boat, fishing in the freezing, snow-covered river” (孤江蓑笠翁,独钓寒江雪).

Zuriaake shows are as theatrical as a funeral service in provincial China, and steeped in the awareness that the afterlife is working through this world at every moment. “Even though I listen to rock, even though I strive for freedom, even though I’ve been abroad and exposed to a foreign culture, I can’t scrub those elements from my bones,” Bloodfire says. “The screams that come out of my mouth will inevitably be Chinese.”

Tobias Czapka has moved to the position of Manager for System Engineering BEV-Powertrain China at VW. The Doctor of Engineering was Lead Technical Project Manager Gasoline Engines at VW until June. Here, Czapka was already responsible for China and the Eastern Regions.

Chunwei Yin has been Facility Manager Data Center for the German subsidiary of China Mobile International since June. The graduate engineer, educated in Shanghai and Mannheim, is based in Mörfelden-Walldorf in Hesse.

Is something changing in your organization? Why not send a tip for our HR column to heads@table.media!

Stairway to heaven? Clouds above the Great Wall of China give the impression that you can climb directly into the sky above the fortress complex.