Siegfried Russwurm is not just the president of the Federation of German Industries, he is also involved with companies such as the mechanical engineering company Voith, which maintains a large presence in China. Stefan Braun spoke with Russwurm about his stance regarding the new regulatory shake-up the German government could inflict on business in China.

Russwurm believes geopolitical prudence is the right thing to do and supports Germany’s China strategy, but he opposes state intervention in too many areas. In his view, de-risking should essentially remain a business decision – after all, German companies have been managing international risks on their own since the beginning of globalization.

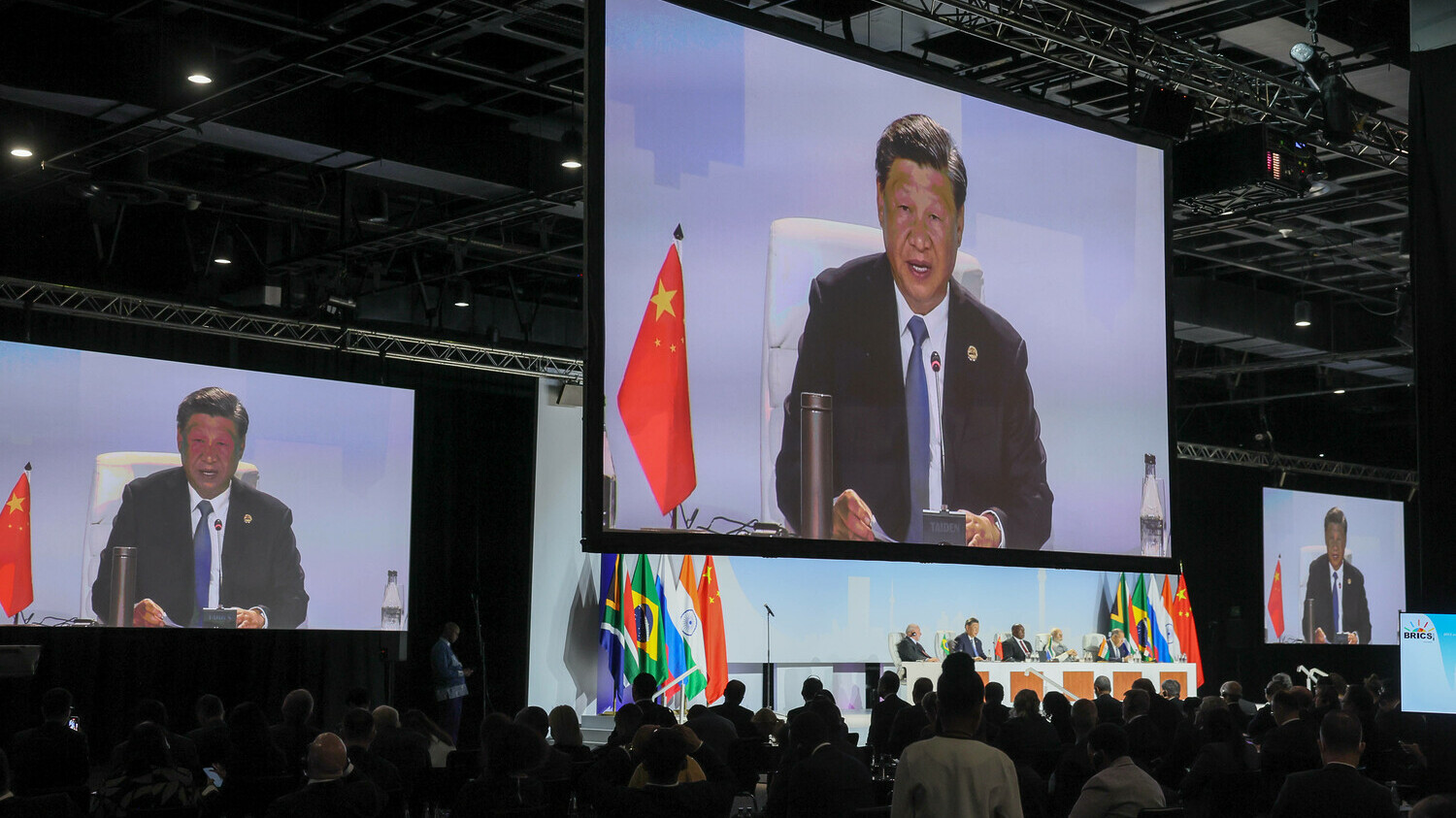

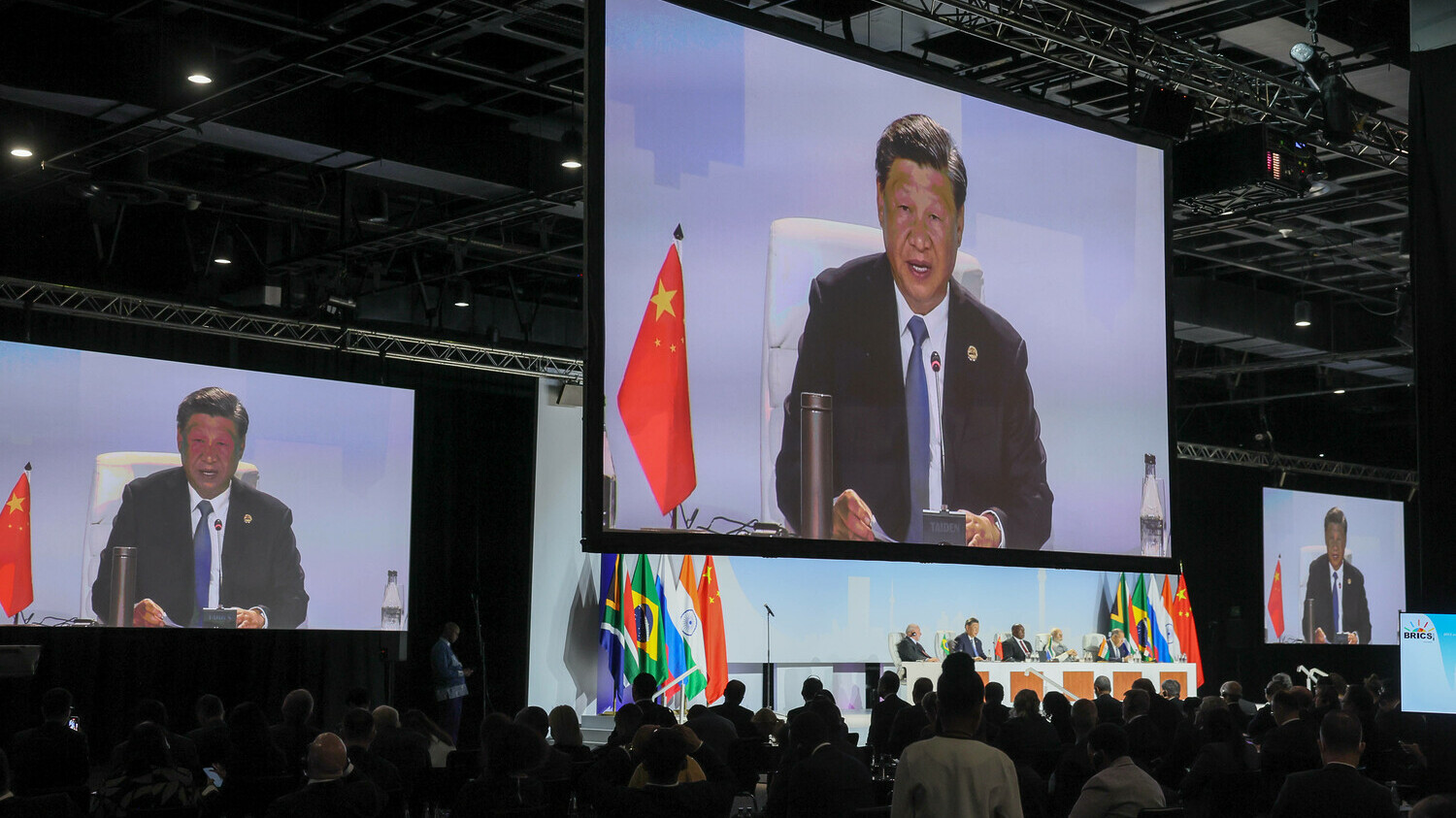

As the BRICS Summit in Johannesburg draws to a close, we present a comprehensive package of outcomes and assessments. The BRICS is admitting six new members. We explain why precisely these six have been chosen.

Those who have not yet noticed that other parts of the world perceive Russia differently than we do should look at the warm support Vladimir Putin is receiving from his BRICS partners. Next year’s meeting will be held in Russia as planned. By then, Putin’s forces will probably still be killing and laying mines in Ukraine.

Not one but two of our articles look at the question of replacing the dollar as the reserve currency. We analyze a CCTV interview with Dilma Rousseff, head of the BRICS Bank. She has clear ideas on how to break the power of the greenback. And Johnny Erling looks at the rather old idea of the “redback” – the yuan as the new dollar.

The Federation of German Industries (BDI) has long been at the forefront of the debate about China. In the meantime, the German government has devised a China strategy. How much guidance does it offer the German economy?

I consider the strategy to be quite balanced. But there are some facts in this context that are still insufficiently reflected in the public discourse. A study by Merics and the German Economic Institute from April this year shows that the investments of German companies in China are entirely financed from the profits of their business in China. So, from a macro perspective, no money flows from Germany to China. This is something that should also be kept in mind by those who wonder how it can be that companies are still investing so much there.

However, this does not reduce the dependence of individual companies on China.

Companies should reduce dependencies and are systematically doing so. For instance, intra-company global value networks should not depend on individual components from Chinese factories. Every company can solve this quite quickly. The goal is similar for raw materials and components that can only be obtained exclusively or almost exclusively from China, but the adjustment takes much longer here. Here, we are talking about periods of five to ten years, which are generally necessary for developing new supply sources, finding investors for new mines and processing plants, and their construction.

How could the German government contribute to this?

I would like the German government to now apply the German pace to the supply of raw materials as well. Then we will be able to diversify more quickly. Increased domestic production in Germany and Europe should be part of the solution. Regarding sales in China and exports, I ask: What would improve if a company now deliberately sells less in China than it could? Of course, companies should open up additional new sales markets in other countries, and for that, we urgently need, among other things, more free trade agreements. But it wouldn’t help anyone if German companies reduced their sales volume in China.

German car manufacturers generate 40 percent of their revenues in China in some cases. If an increasingly authoritarian President Xi were to reach for Taiwan at some point and the EU were to impose sanctions, these companies could experience difficulties. And if push comes to shove, they’ll call for the German taxpayer.

Anyone who takes entrepreneurial risks must bear the consequences. Executive and supervisory boards are fully aware of this, and the “too-big-to-fail” argument cannot be relied upon. But let me reiterate: What would improve when companies withdraw from China purely as a precautionary measure?

German Economy Minister Robert Habeck plans to subject Chinese investments in Germany to stricter screening. Is that the right thing to do?

I prefer the American approach: High fences, but only around a small area. In other words, investment screening for strictly defined security-relevant areas to which certain countries should not have access. The discussion in Germany is far too unspecific for my liking. And populism is not helping.

Habeck plans to expand the screening scope.

We should not simply extend screening based on suspicion. I also find reversing the burden of proof, which is currently being discussed, quite bizarre in our legal system. According to the motto, the company must prove that it is not security-relevant. There shouldn’t be a Lex China either, but a Lex Germany. So, we should discuss how to deal with investments from countries whose actions we do not consider trustworthy, no matter what these countries are called.

Skepticism toward China is growing, including when it comes to scientific exchange. Germany’s research minister urges vigilance and, if in doubt, limiting exchange. What is your take on this?

Quite simply, exchanging good ideas is good, but only if it’s reciprocal and without abuse. So scientific cooperation – by all means! There are certain fundamental global issues that we can’t solve, for example, without China. But I can understand why a German university would say: If a Ph.D. fellow is 100 percent financed by a particular governmental organization of a country with obvious intentions, then we should not let them into the heart of our innovation.

Siegfried Russwurm, 60, is the President of the Federation of German Industries (BDI), Chair of the supervisory boards of thyssenkrupp and Voith Group, and a former member of the Siemens Executive Board.

You can find the Europe part of the interview with our colleagues at Europe.Table.

The last item of the 94-point manifesto adopted by the BRICS countries today packs a punch: “Brazil, India, China and South Africa extend their full support to Russia for its BRICS Chairship in 2024 and the holding of the XVI BRICS Summit in the city of Kazan, Russia.” The five founding members of the BRICS group – Brazil, Russia, India, China and South Africa – agreed on the 26-page paper on Thursday.

Russia’s President Putin could not travel to the BRICS summit, which is being held in Johannesburg from Tuesday until Thursday, because an international arrest warrant has been issued against him. Next year, he will host it instead. The will to oppose US dominance is apparently so strong that Russia’s aggression against Ukraine is completely omitted.

The original BRICS also agreed to admit six more countries. South Africa’s President Cyril Ramaphosa announced the list of future members:

will join the group on Jan. 1, 2024. “We have consensus on the first phase of this expansion process and other phases will follow,” Ramaphosa said

Observers already expected some of the newcomers. But there are surprises. First and foremost, Iran: The Islamic Republic is considered a pariah by the West and is considered to belong to the camp around China and Russia. For example, Iran is one of the most important suppliers of military drones to Russia, which are deployed in Ukraine.

In the run-up to the BRICS summit, experts had still considered Iran’s accession unlikely. They argued that the democracies Brazil, India and South Africa, which are also interested in maintaining good relations with the West, could hardly be interested in allowing BRICS to become a rogue group.

But apparently, other considerations outweighed for the five BRICS countries. Energy could have been an important factor. After all, with Iran, Saudi Arabia, Russia, the UAE and Brazil, the group will include some of the world’s largest energy producers. Iran is home to the world’s second-largest gas reserves and a quarter of the Middle East’s oil reserves.

In point 21 of the manifesto, Iran is mentioned as an explicit criticism of the West’s Iran policy: “We reiterate the need to resolve the Iranian nuclear issue through peaceful and diplomatic means in accordance with the international law.”

By contrast, experts had predicted Saudi Arabia’s accession. Ahead of the summit, China and Brazil had already voiced their support for the accession. Enlargement of the BRICS group only makes economic sense if Saudi Arabia joins, the inventor of the BRICS acronym, economist Jim O’Neill, told Bloomberg.

The kingdom, which also seeks good relations with the West, is the world’s largest oil producer, while China is the largest oil consumer. Since most of the world’s energy trade is denominated in dollars, the enlargement also facilitates the transition of trade to alternative currencies. Along with the United Arab Emirates, Saudi Arabia is also an important new contributor to the BRICS countries’ New Development Bank (NDB). The Emirates has been a member of the NDB since 2021.

Egypt has also been a shareholder in NDB since March. The country is one of the main recipients of US aid, but has long maintained close ties with Russia and has growing trade relations with China. Russia is building Egypt’s first nuclear power plant and China is developing parts of the new capital. Egypt is experiencing a currency crisis and is counting on trading within the BRICS group without the dollar.

Argentina is also struggling with a foreign exchange crisis. The country wants to gain access to alternative financing through the NDB. Its supporters within BRICS include its main trading partner and neighbor Brazil, as well as India and China.

Ethiopia ranks among the more unexpected newcomers. The country is the third-largest economy south of the Sahara and even ranks second in terms of population. The Ethiopian economy has also grown rapidly recently. However, its GDP is just half the size of the smallest BRICS member, South Africa. In addition, the country is currently being shaken again by armed conflicts.

Many observers had expected Indonesia to be one of the new BRICS members. However, Indonesia had asked to postpone its membership in order to consult with its ASEAN partners, South Africa’s BRICS ambassador Anil Sooklal said in an interview. He said that Indonesia may join in the next year or two.

The debate on the enlargement of the BRICS group was driven primarily by China. The People’s Republic hopes to create alternatives to the Western-dominated world order and wants to win over as many supporters as possible. Russia remains internationally isolated due to the Ukraine war and also hopes to gain new supporters by expanding the BRICS group.

India and Brazil have recently been more hesitant – even though they had agreed to the enlargement in principle. They fear a rushed enlargement could turn the economic bloc into an anti-Western club. Both countries reject such a positioning. India is also concerned about China’s dominance of the BRICS group.

In their manifesto, the BRICS states call for “a comprehensive reform of the UN, including its Security Council,” in which the victorious powers of World War II, the United States, the United Kingdom, and France, as well as the two BRICS states, Russia and China, are permanent members with veto rights.

This repeatedly causes controversy, as does the selection procedure for non-permanent members. The BRICS states demand that the UN Security Council become “more democratic, representative, effective and efficient” and more representative of the developing countries. Arne Schuette/Christian von Hiller

The reserve currency was the main substantive question at the BRICS summit on Wednesday and Thursday. The BRICS Bank, the development bank of the Group of Five established in Shanghai in 2015, plays a central role here. It is officially called the New Development Bank (NDB).

Brazil’s ex-president Dilma Rousseff is not the bank’s president by accident. Within the Brics, Brazil, along with Russia, is a pioneer in using the yuan in trade with China. Rousseff has recently made several comments about the intermediate steps she envisions for moving away from the dollar.

In a 30-minute interview with China’s state broadcaster CCTV, Rousseff explained that she expects the BRICS Bank to play a growing role in the Global South in the future. The interview resonates with the aspiration to turn the BRICS Bank into the central institution of a future dollar alternative. Rousseff said that the bank is still young and that the financing needs for infrastructure are enormous. She expects lending to grow by 30 percent over the next five years.

Rousseff called the dollar’s supremacy an “absurd privilege” that should be abolished. Its end as a reference currency is an important step on the way to a multipolar world, “away from a unipolar order based only on the dollar.” It will remain important, but there should be alternatives.

In the big picture, Rousseff outlines a vision of a monetary architecture centered on the BRICS bank that can operate independently of the United States:

Another recent interview with the British Financial Times shows her regret that the sanctions of the front against Russia still have so much impact on her institution. The Brics bank was forced to suspend the operation of its Moscow branch, even though Russia is a founding member. In addition, rating agencies downgraded it precisely because of Russia’s co-ownership. For the time being, one has to live with the international financial system being the way it is, Rousseff told the FT.

Speaking to CCTV, Rousseff outlined how she envisions the near future. The BRICS Bank wants to provide capital in local currency until the alternative is ready. “This eliminates exchange rate fluctuations and other harmful side effects such as crises and debt in foreign currency areas.”

In South Africa, for example, it could grant loans in rand. So far, developing countries have been exposed to considerable inflation risks from exchange rate fluctuations when devaluing their currency to service foreign loans.

The head of the BRICS bank also did not hold back on monetary criticism of the West and praise for China. In her view, the United States is violating its own globalization ideology by pursuing a protectionist trade policy. They are hypocritical and spend enormous sums on domestic subsidies, Rousseff told CCTV.

This not only harms the Chinese economy, but all economies linked by globalization. Here, she sees the economy being used as a weapon. The BRICS Bank, on the other hand, would grant loans without political preconditions and remain neutral. It does not want to interfere with the recipient countries. That is what would make it attractive.

Moreover, as an institution of the Global South, the BRICS Bank has a better understanding of the needs of the beneficiaries, as they themselves are in the process of building their infrastructure and know the problems of the countries of the Global South, Rousseff said. Only in this way can true multilateralism emerge. China can be a role model when it comes to developing high-speed trains and other modes of transport, she said.

In the CCTV interview, Rousseff repeatedly cited China as a model for other countries in the Global South and expressed her enthusiasm for Xi Jinping’s policies. In contrast, she voiced criticism of parliamentarism. She was accused of corruption in her home country. In her chief post at BRICS Bank, she earns about $60,000 a month.

August 28, 2023; 1:30 p.m.

AHK Greater China, Seminar: GCC Knowledge Hub: Arbitration, the Efficient Dispute Resolution More

August 28, 2023; 5 p.m. (11 a.m. EDT)

Center for Strategic and International Studies, webcast: Germany’s New China Strategy: A Conversation with German Ambassador Andreas Michaelis More

August 29, 2023, 10 a.m. CEST (4 p.m. CST)

Dezan Shira & Associates, Webinar: Digitalizing Your HR and Payroll in Asia: Value, Scale, and Compliance for the China+ Business More

August 29, 2023, 2 p.m.

AHK Greater China, Conference: The 7th HR Summit More

August 30, 2023; 2 p.m.

AHK Greater China, Presentation (hybrid): HR Deep Dive – Presentation of the German Chamber’s 16th Labor Market & Salary Report More

August 30, 2023; 2 p.m.

AHK Greater China, Webinar: Circular Economy: Effective Practices Sharing More

August 30, 2023; 2:30 p.m.

AHK Greater China, Presentation: GCC Knowledge Hub: Customs related administrative and criminal liability risks More

August 31, 2023; 10 a.m. CEST (4 p.m. CST)

Dezan Shira & Associates, Webinar: Navigating Impacts of Hong Kong’s Amended Foreign Source Income Exemption (FSIE) Regime More

US Secretary of State Antony Blinken has announced new sanctions against Chinese officials. According to the statement, the measures are directed against officials of the People’s Republic involved in the “forced assimilation” of more than one million Tibetan children. The US is responding to the implementation of a boarding school system in Tibet that forces children of all ages to leave their home villages and spend most of the year away from their families.

“These coercive policies seek to eliminate Tibet’s distinct linguistic, cultural, and religious traditions among younger generations of Tibetans,” Blinken said. The new restrictions apply to both current and former Chinese officials who share responsibility for education policy in Tibet. “We will continue to work with our allies and partners to highlight these actions and promote accountability.”

The chair of the Human Rights Committee in the German Bundestag, Renata Alt, sees the US decision as a “good example” for Europe. “The US is acting, the EU is again lacking the courage to react decisively and consistently to China’s human rights violations,” Alt said. She called on the EU to use existing instruments under the global human rights sanctions regime (Magnitsky Act) more confidently, and to coordinate more closely with its democratic partners the United States, Canada and the United Kingdom.

“Other governments should follow the example of the US government and sanction those responsible for the forced boarding schools in the Chinese party and state apparatus,” said the human rights organization International Campaign for Tibet. Its Executive Director in Germany, Kai Mueller, urged democratic states to “firmly demand a change of course by the Communist Party in Tibet” at the next review of China at the UN Human Rights Council in January next year.

The United States is the first country to impose sanctions over China’s boarding school system. In December, Washington already sanctioned two high-ranking Chinese officials for fundamental human rights violations in Tibet. China, in turn, responded with sanctions against two US citizens. Germany, on the other hand, had called for the closure of the boarding schools in April of this year, but has not pursued further action since.

Earlier this year, special rapporteurs of the United Nations published a report investigating evidence of the “acculturation and assimilation of Tibetan culture” into the dominant Han Chinese majority through a series of repressive measures.

In an interview with China.Table, exiled Tibetan President Penpa Tsering highlighted the dramatic consequences for nearly one million children in the region. He said they are deprived of daily contact with their parents and have no opportunity to use their mother tongue because Tibetan is strictly forbidden. “We are at a point where Tibetan children come home for holidays and are unable to communicate fluently with their parents. They have forgotten Tibetan, while their mother and father barely speak any Mandarin,” Tsering said. grz

China has announced to suspend all imports of fish and seafood from Japan. On Thursday, Japan started to release slightly radioactive water from the damaged Fukushima Daiichi nuclear power plant into the Pacific Ocean.

According to Chinese customs, the import suspension was to “protect the health of Chinese consumers.” The water was used to cool radioactive debris after an earthquake and tsunami caused three meltdowns in March 2011. The water is stored on site in more than 1,000 tanks that will be gradually dumped over the next 30 years.

China had previously imposed an import ban on seafood from ten Japanese prefectures. Seafood from other prefectures had to pass radioactivity tests. Hong Kong’s government had also banned the import of seafood from ten Japanese areas for an indefinite period on Wednesday. In South Korea, protests broke out in front of the Japanese Embassy building in central Seoul over the water release. Police arrested 16 people who attempted to enter the building. rtr

According to the German government’s foreign trade agency GTAI, Germany exported goods worth 16 billion US dollars (14.7 billion euros) to the ten countries of the Southeast Asian confederation ASEAN in the first half of 2023. The region thus compensated for some of the decline in German exports to China. ASEAN exports thus increased by 8.5 percent – or 9.7 percent in euro – compared to the same period of the previous year and reached their highest value since 2018.

Sales in the ASEAN region thus developed significantly better than overall exports, which only grew by 3.3 percent. The export increase was mainly attributable to machinery and motor vehicles; both sectors appear to have recovered from the previous crisis years, writes GTAI.

The fact that Germany and other suppliers can only benefit to a limited extent from the economic boom in Southeast Asia is due to China’s rise as a trading superpower, the agency analyzes. For instance, China is the main supplier of goods in every ASEAN country, usually far ahead of its competitors. The agency says that with a population of 670 million, the ASEAN countries have so far been of only secondary importance for Germany’s foreign trade – despite their positive development. Less than two percent of Germany’s total exports go to the region.

According to Bloomberg, European vehicle manufacturer Stellantis, parent of 14 car brands, is considering cooperation with Chinese EV manufacturers. The company, which also owns Opel, Citroën, Peugeot and Chrysler, was reportedly considering a partnership with Zhejiang Leapmotor. Shares of Leapmotor rose as much as 11.4 percent in Hong Kong on Thursday, the biggest intraday gain in more than four months.

When the People’s Republic was founded in 1949, it came with the matching currency: Its people’s money (人民币), the renminbi. However, its new leader Mao Zedong remained at odds with the socialist currency all his life. As a Marxist, the ideologue would have preferred to abolish all money. Even in 1976, the year of his death, he confessed to his nephew Mao Yuanxin to have failed.

His successors were more pragmatic. They gave the people’s money a makeover with more valuable banknotes up to 100 yuan and printed Mao’s portrait on them. From then on, Mao remained dear to the people’s wallets.

China’s current President, Xi Jinping, who was appointed autocrat by the 20th Party Congress in late 2022, has bigger plans for the people’s money. Part of his dream of China’s national rejuvenation is bringing his people’s money to the world. According to the 15-year plan approved in 2020, the People’s Republic is supposed to become a socialist superpower by 2035 and the renminbi is expected to become the global currency along with it. The popular expression “greenback” for the US dollar – green bi (绿币) in Chinese – is countered by China’s propaganda with “redback” for the renminbi, red bi (红币). If the renminbi can push the dollar off its pedestal in global payment transactions, it would be the ultimate trump card for a globalization with Chinese characteristics.

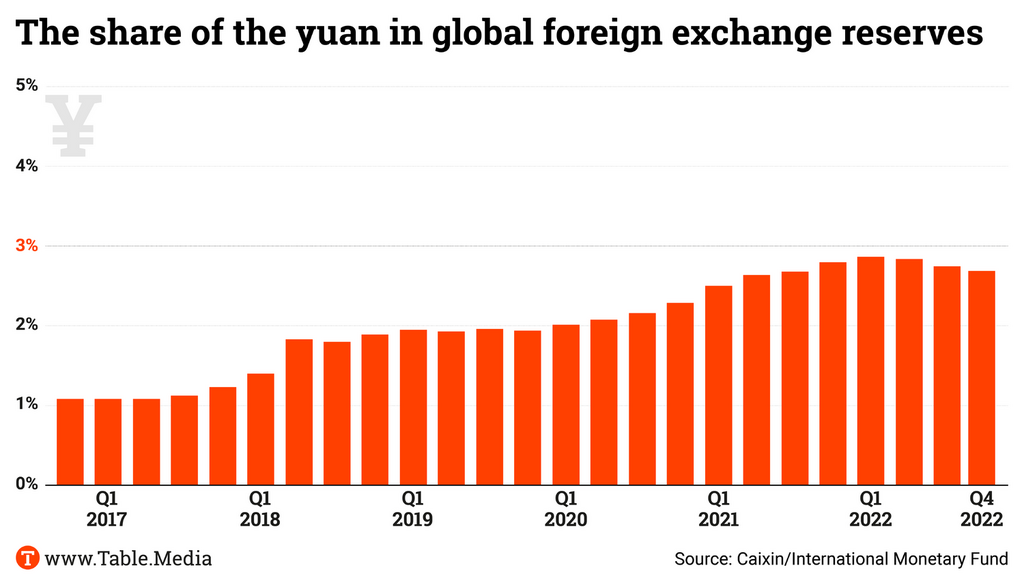

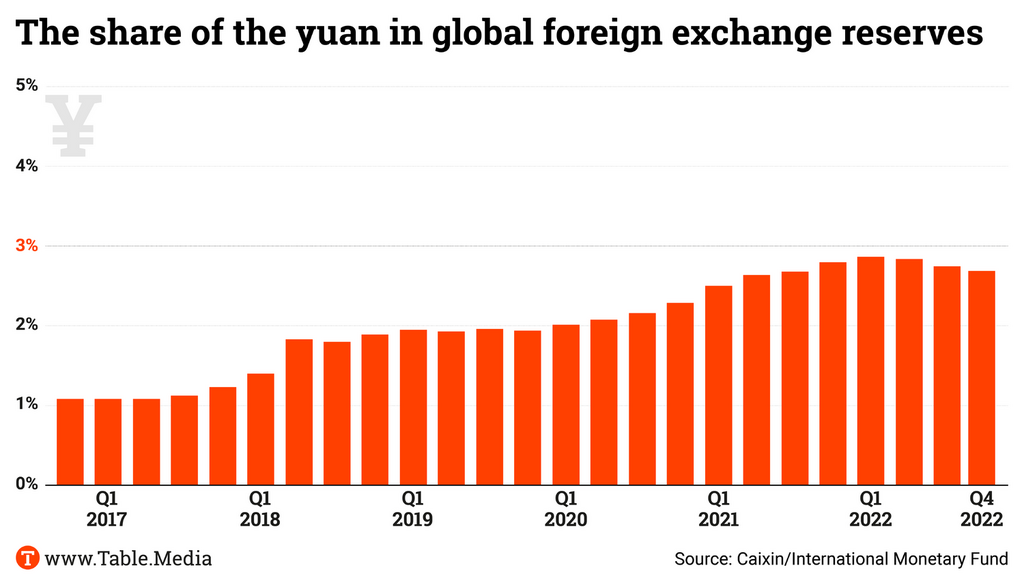

So far, the chances are slim for the People’s Republic, despite becoming the world’s workbench, the second-largest economy and a trade champion. This is reflected in the progress reports on the “internationalization of the RMB.” Since Xi took office in 2012, the PBOC State Bank has published annual white papers on this subject. The most recent one was published in June 2023. So far, the state bank has only recorded symbolic successes. In October 2016, for instance, the International Monetary Fund (IMF) included the people’s money in its basket of world reserve currencies. The nominal share of less than three percent benefits the renminbi’s internationalization no more than the establishment of yuan clearing houses, which only serve the bilateral clearing of China’s trade with a number of countries. The same applies to China’s newly established Cross-Border Interbank Payment Institutions (CIPS) network.

The reason is that Beijing’s money is not freely convertible, even after 40 years of economic reforms. Global financial markets do not trade the renminbi. Commodity markets know the “petrodollar” but no “petroyuan.” China’s leaders have always shied away from the necessary financial reforms, and shun systemic risks that could lead to a loss of control or even capital flight to this day. They trust neither the creditworthiness of their financial system nor the functioning of their legal system.

Only Russia swears by the renminbi, CIPS and trade settlements in yuan and rouble since the US boycotted all Moscow’s financial transactions over Putin’s invasion of Ukraine. At the current BRICS meeting, Russia’s leader, who was only allowed to participate via video link, therefore called on all BRICS countries to help him “de-dollarize” the world. Beijing supports him, and attacks the US for “militarizing the dollar.” Russia’s adoption of the renminbi instead of the dollar does not help Beijing internationalize its currency, despite Chinese media claiming the contrary.

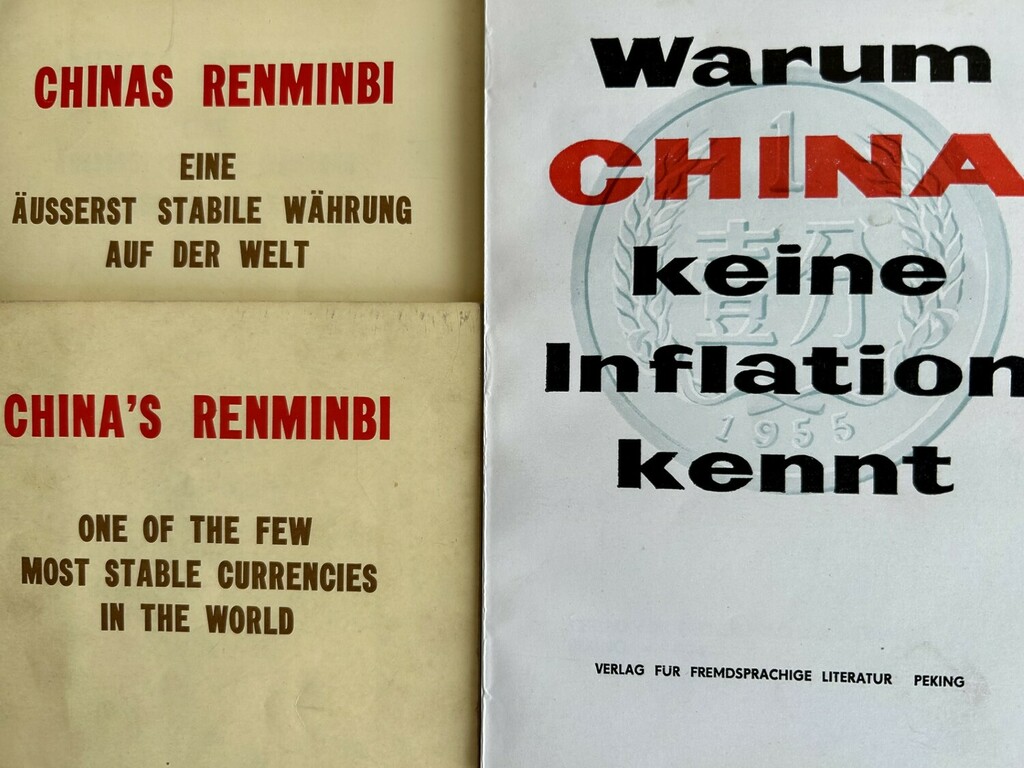

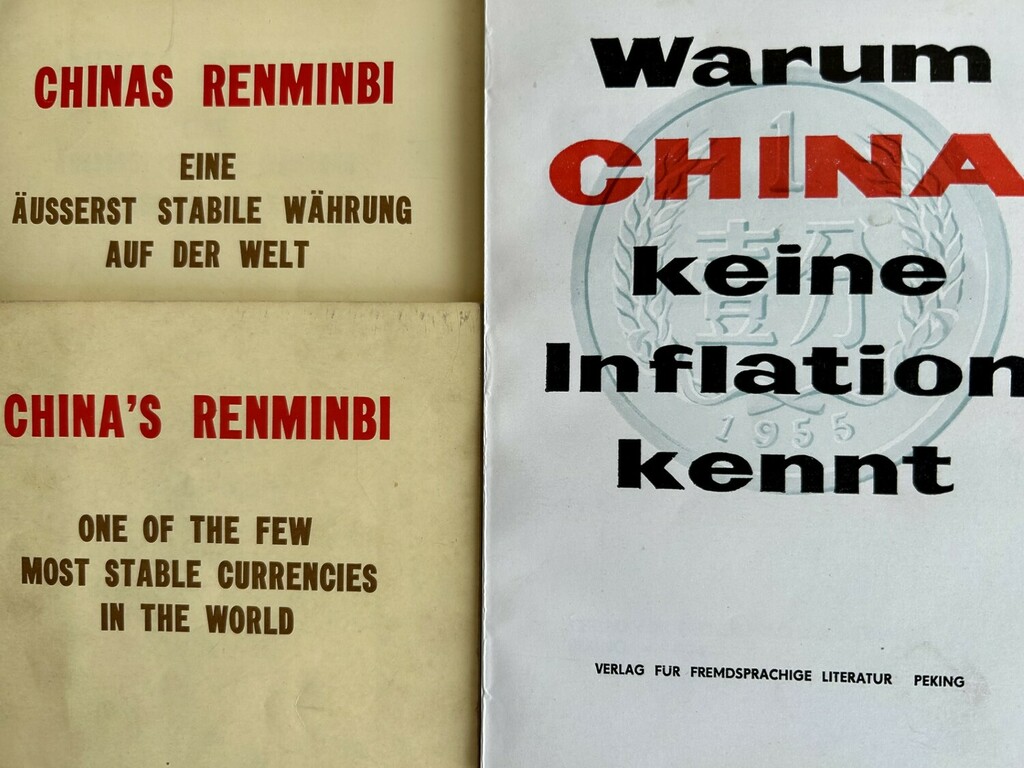

China has always talked big. Recently, I stumbled upon two yellowed propaganda pamphlets dating back to the Cultural Revolution. “China’s Renminbi. The first brochure printed in 1969 was called “One of the Few Most Stable Currencies in the World.” 中国的人民币 世界上少有的多最稳定的货币. It was even printed in German. The second came out in 1976: “Why China Doesn’t Know Inflation?”

Their authors, under pseudonyms like “Tsai Cheng” (Finance) and “Hung Yin-hang” (Red Bank), praised socialist China as a “country without domestic and foreign debt.” The text reads: “More and more countries are adopting the renminbi as their unit of account and settlement in trade with China.”

In truth, China engaged in barter trade, and isolated itself in the Cultural Revolution. There was nothing to spend money on in its scarcity society. Absurd “words of Chairman Mao” prefaced the pamphlets: “The enemy is rotting with each passing day, while we are getting better every day.”

Mao was terminally ill when, between October 1975 and January 1976, he pondered why his revolutions had failed to transform his country into a society without classes or money. Whenever he met with his nephew Mao Yuanxin, he scribbled words about it on pieces of paper: “We have built a state that is not very different from the old society.” 我们自己就是建设了这样一个国家,跟旧社会差不多. There was still an eight-tier wage system and distribution based on performance. Money was needed “to buy us rice, coal, cooking oil and vegetables.” Mao’s successors did not publish these notes until 1998. They preserved his body in a crystal coffin. Mao would spin if he saw what they did with the renminbi later.

In the meantime, Beijing wants to turn its people’s money into a global currency. For Xi Jinping, it is part of his program, brought forward to 2035, to elevate the nation to a superpower on par with the US, with the renminbi equal to the dollar. As chairman of the CC’s so-called Leading Small Group onFinance and Society, Xi demanded in 2017: “It is necessary to promote the opening of capital accounts in an orderly manner, continuously implement the internationalization of the RMB.” (要有序推进资本项目开放,稳步推动人民币国际化) Five years later, he somewhat toned down his wording at the 20th Party Congress. He said it was necessary to pursue an “orderly internationalization of the renminbi” (有序推进人民币国际化).

The Jingji Ribao, 经济日报, China’s only economic daily allowed to speak for the party, interviewed the country’s leading monetary and financial theorists in January 2023 on how to interpret Xi’s new formula. They warned that China would still need a lot of time and reforms before internationalizing the people’s money.

The ambitious party leader wants things to happen faster. Right after the 20th Party Congress, he rushed ahead in his welcoming address to the opening of the China-Gulf Cooperation Council (GCC) on 9 December 2022. Xi wanted to tie the Gulf countries to the renminbi. He explained that Beijing was willing to make joint efforts with GCC countries in the next three to five years to “make full use of the Shanghai Petroleum and National Gas Exchange as a platform to carry out yuan settlement of oil and gas trade.” He also suggested, “start currency swap cooperation, deepen digital currency cooperation and advance the m-CBDC Bridge project.”

Xi single-handedly attempted to upgrade the renminbi to the petroyuan, just as the US once transformed its US dollar into the OPEC-accepted petrodollar. But the Gulf states ignored his proposal. They mentioned it neither in their final declaration nor in the joint statement.

Despite such setbacks and spiraling economic problems at home, Beijing is taking another shot at it. It hopes to knock down pegs for a “new global order” at the current BRICS meeting while creating facts for a renminbi as an alternative currency to the dollar. While Chinese media have been drumming up propaganda for this for weeks, the former British financial secretary and Goldman Sachs economist, Jim O’Neill, voiced his objections. In an article in the Financial Times, he came to the devastating verdict that the BRICS countries had never achieved anything since their first meeting (in 2009). O’Neill dismissed any notions by Xi or Brazil’s President Lula da Silva about creating a new trade currency as ridiculous. “They’re going to create a BRICS central bank? How would you do that? It’s embarrassing almost.”

Normally, that would just be an isolated opinion. But O’Neill has been an esteemed guru in China for years and the most quoted key witness for Xi’s ambitious plans for BRICS’ rise. Beijing calls him the “father of BRICS.” Instead of dealing with his interview, only two days later and without any reference to it, the party newspaper “Global Times” printed a “counter-interview” with O’Neill on 17 August. In it, he allegedly showered the BRICS with praise, while calling the US-led Western G7 group “a bit crazy” for thinking it was on an upward trajectory. And the renminbi could gain growing status as a reserve currency within the BRICS.

O’Neill has not yet commented on who he told what. But China is on edge. Many renowned financial economists, including monetary policy advisers to the central bank, warned Beijing not to take premature steps to make the renminbi convertible or liberalize its capital controls.

Noticeably, Xi Jinping was very reserved on the renminbi issue at the BRICS summit, addressing the role of its internationalization only in a half-sentence: “We need to … push forward reform of the international financial and monetary systems. (推动国际金融货币体系改革) To this end, he spoke in favor of admitting more new BRICS members.

Xi now needs to be patient. In his video appearance, Russia’s President Putin promised to make every effort to expand the role of BRICS in the financial and monetary system, develop interbank cooperation and expand the use of national currencies. These issues will be on the agenda of the next BRICS Summit in Russia in October 2024. He will then preside over the expanded group of members.

Before that, Putin will come to Beijing this October, where Xi will host the tenth BRI Silk Road Conference. BRICS, SCO and BRI, over which China wields influence, are Xi’s new leverages to internationalize his people’s money while isolating the West, G7 and the dollar.

Cheng Li Qin has been appointed Non-Executive Director of China Nature Energy Technology this month. She was previously CFO of Kang Cheng Seafood Company from 2003 to 2012 and CFO of World Hero International since 2012.

Jaromir Cernik has been appointed head of the first CTP’s office in Asia, located in Hong Kong. He joins from fintech company Qupital, where he served as a Board Member and Director.

Is something changing in your organization? Let us know at heads@table.media!

Not ugly ducklings, but white geese are swimming on a lake in Huai in Jiangsu province. According to the information, it is not just an idyllic sight, but moreover an ecological aviculture.

Siegfried Russwurm is not just the president of the Federation of German Industries, he is also involved with companies such as the mechanical engineering company Voith, which maintains a large presence in China. Stefan Braun spoke with Russwurm about his stance regarding the new regulatory shake-up the German government could inflict on business in China.

Russwurm believes geopolitical prudence is the right thing to do and supports Germany’s China strategy, but he opposes state intervention in too many areas. In his view, de-risking should essentially remain a business decision – after all, German companies have been managing international risks on their own since the beginning of globalization.

As the BRICS Summit in Johannesburg draws to a close, we present a comprehensive package of outcomes and assessments. The BRICS is admitting six new members. We explain why precisely these six have been chosen.

Those who have not yet noticed that other parts of the world perceive Russia differently than we do should look at the warm support Vladimir Putin is receiving from his BRICS partners. Next year’s meeting will be held in Russia as planned. By then, Putin’s forces will probably still be killing and laying mines in Ukraine.

Not one but two of our articles look at the question of replacing the dollar as the reserve currency. We analyze a CCTV interview with Dilma Rousseff, head of the BRICS Bank. She has clear ideas on how to break the power of the greenback. And Johnny Erling looks at the rather old idea of the “redback” – the yuan as the new dollar.

The Federation of German Industries (BDI) has long been at the forefront of the debate about China. In the meantime, the German government has devised a China strategy. How much guidance does it offer the German economy?

I consider the strategy to be quite balanced. But there are some facts in this context that are still insufficiently reflected in the public discourse. A study by Merics and the German Economic Institute from April this year shows that the investments of German companies in China are entirely financed from the profits of their business in China. So, from a macro perspective, no money flows from Germany to China. This is something that should also be kept in mind by those who wonder how it can be that companies are still investing so much there.

However, this does not reduce the dependence of individual companies on China.

Companies should reduce dependencies and are systematically doing so. For instance, intra-company global value networks should not depend on individual components from Chinese factories. Every company can solve this quite quickly. The goal is similar for raw materials and components that can only be obtained exclusively or almost exclusively from China, but the adjustment takes much longer here. Here, we are talking about periods of five to ten years, which are generally necessary for developing new supply sources, finding investors for new mines and processing plants, and their construction.

How could the German government contribute to this?

I would like the German government to now apply the German pace to the supply of raw materials as well. Then we will be able to diversify more quickly. Increased domestic production in Germany and Europe should be part of the solution. Regarding sales in China and exports, I ask: What would improve if a company now deliberately sells less in China than it could? Of course, companies should open up additional new sales markets in other countries, and for that, we urgently need, among other things, more free trade agreements. But it wouldn’t help anyone if German companies reduced their sales volume in China.

German car manufacturers generate 40 percent of their revenues in China in some cases. If an increasingly authoritarian President Xi were to reach for Taiwan at some point and the EU were to impose sanctions, these companies could experience difficulties. And if push comes to shove, they’ll call for the German taxpayer.

Anyone who takes entrepreneurial risks must bear the consequences. Executive and supervisory boards are fully aware of this, and the “too-big-to-fail” argument cannot be relied upon. But let me reiterate: What would improve when companies withdraw from China purely as a precautionary measure?

German Economy Minister Robert Habeck plans to subject Chinese investments in Germany to stricter screening. Is that the right thing to do?

I prefer the American approach: High fences, but only around a small area. In other words, investment screening for strictly defined security-relevant areas to which certain countries should not have access. The discussion in Germany is far too unspecific for my liking. And populism is not helping.

Habeck plans to expand the screening scope.

We should not simply extend screening based on suspicion. I also find reversing the burden of proof, which is currently being discussed, quite bizarre in our legal system. According to the motto, the company must prove that it is not security-relevant. There shouldn’t be a Lex China either, but a Lex Germany. So, we should discuss how to deal with investments from countries whose actions we do not consider trustworthy, no matter what these countries are called.

Skepticism toward China is growing, including when it comes to scientific exchange. Germany’s research minister urges vigilance and, if in doubt, limiting exchange. What is your take on this?

Quite simply, exchanging good ideas is good, but only if it’s reciprocal and without abuse. So scientific cooperation – by all means! There are certain fundamental global issues that we can’t solve, for example, without China. But I can understand why a German university would say: If a Ph.D. fellow is 100 percent financed by a particular governmental organization of a country with obvious intentions, then we should not let them into the heart of our innovation.

Siegfried Russwurm, 60, is the President of the Federation of German Industries (BDI), Chair of the supervisory boards of thyssenkrupp and Voith Group, and a former member of the Siemens Executive Board.

You can find the Europe part of the interview with our colleagues at Europe.Table.

The last item of the 94-point manifesto adopted by the BRICS countries today packs a punch: “Brazil, India, China and South Africa extend their full support to Russia for its BRICS Chairship in 2024 and the holding of the XVI BRICS Summit in the city of Kazan, Russia.” The five founding members of the BRICS group – Brazil, Russia, India, China and South Africa – agreed on the 26-page paper on Thursday.

Russia’s President Putin could not travel to the BRICS summit, which is being held in Johannesburg from Tuesday until Thursday, because an international arrest warrant has been issued against him. Next year, he will host it instead. The will to oppose US dominance is apparently so strong that Russia’s aggression against Ukraine is completely omitted.

The original BRICS also agreed to admit six more countries. South Africa’s President Cyril Ramaphosa announced the list of future members:

will join the group on Jan. 1, 2024. “We have consensus on the first phase of this expansion process and other phases will follow,” Ramaphosa said

Observers already expected some of the newcomers. But there are surprises. First and foremost, Iran: The Islamic Republic is considered a pariah by the West and is considered to belong to the camp around China and Russia. For example, Iran is one of the most important suppliers of military drones to Russia, which are deployed in Ukraine.

In the run-up to the BRICS summit, experts had still considered Iran’s accession unlikely. They argued that the democracies Brazil, India and South Africa, which are also interested in maintaining good relations with the West, could hardly be interested in allowing BRICS to become a rogue group.

But apparently, other considerations outweighed for the five BRICS countries. Energy could have been an important factor. After all, with Iran, Saudi Arabia, Russia, the UAE and Brazil, the group will include some of the world’s largest energy producers. Iran is home to the world’s second-largest gas reserves and a quarter of the Middle East’s oil reserves.

In point 21 of the manifesto, Iran is mentioned as an explicit criticism of the West’s Iran policy: “We reiterate the need to resolve the Iranian nuclear issue through peaceful and diplomatic means in accordance with the international law.”

By contrast, experts had predicted Saudi Arabia’s accession. Ahead of the summit, China and Brazil had already voiced their support for the accession. Enlargement of the BRICS group only makes economic sense if Saudi Arabia joins, the inventor of the BRICS acronym, economist Jim O’Neill, told Bloomberg.

The kingdom, which also seeks good relations with the West, is the world’s largest oil producer, while China is the largest oil consumer. Since most of the world’s energy trade is denominated in dollars, the enlargement also facilitates the transition of trade to alternative currencies. Along with the United Arab Emirates, Saudi Arabia is also an important new contributor to the BRICS countries’ New Development Bank (NDB). The Emirates has been a member of the NDB since 2021.

Egypt has also been a shareholder in NDB since March. The country is one of the main recipients of US aid, but has long maintained close ties with Russia and has growing trade relations with China. Russia is building Egypt’s first nuclear power plant and China is developing parts of the new capital. Egypt is experiencing a currency crisis and is counting on trading within the BRICS group without the dollar.

Argentina is also struggling with a foreign exchange crisis. The country wants to gain access to alternative financing through the NDB. Its supporters within BRICS include its main trading partner and neighbor Brazil, as well as India and China.

Ethiopia ranks among the more unexpected newcomers. The country is the third-largest economy south of the Sahara and even ranks second in terms of population. The Ethiopian economy has also grown rapidly recently. However, its GDP is just half the size of the smallest BRICS member, South Africa. In addition, the country is currently being shaken again by armed conflicts.

Many observers had expected Indonesia to be one of the new BRICS members. However, Indonesia had asked to postpone its membership in order to consult with its ASEAN partners, South Africa’s BRICS ambassador Anil Sooklal said in an interview. He said that Indonesia may join in the next year or two.

The debate on the enlargement of the BRICS group was driven primarily by China. The People’s Republic hopes to create alternatives to the Western-dominated world order and wants to win over as many supporters as possible. Russia remains internationally isolated due to the Ukraine war and also hopes to gain new supporters by expanding the BRICS group.

India and Brazil have recently been more hesitant – even though they had agreed to the enlargement in principle. They fear a rushed enlargement could turn the economic bloc into an anti-Western club. Both countries reject such a positioning. India is also concerned about China’s dominance of the BRICS group.

In their manifesto, the BRICS states call for “a comprehensive reform of the UN, including its Security Council,” in which the victorious powers of World War II, the United States, the United Kingdom, and France, as well as the two BRICS states, Russia and China, are permanent members with veto rights.

This repeatedly causes controversy, as does the selection procedure for non-permanent members. The BRICS states demand that the UN Security Council become “more democratic, representative, effective and efficient” and more representative of the developing countries. Arne Schuette/Christian von Hiller

The reserve currency was the main substantive question at the BRICS summit on Wednesday and Thursday. The BRICS Bank, the development bank of the Group of Five established in Shanghai in 2015, plays a central role here. It is officially called the New Development Bank (NDB).

Brazil’s ex-president Dilma Rousseff is not the bank’s president by accident. Within the Brics, Brazil, along with Russia, is a pioneer in using the yuan in trade with China. Rousseff has recently made several comments about the intermediate steps she envisions for moving away from the dollar.

In a 30-minute interview with China’s state broadcaster CCTV, Rousseff explained that she expects the BRICS Bank to play a growing role in the Global South in the future. The interview resonates with the aspiration to turn the BRICS Bank into the central institution of a future dollar alternative. Rousseff said that the bank is still young and that the financing needs for infrastructure are enormous. She expects lending to grow by 30 percent over the next five years.

Rousseff called the dollar’s supremacy an “absurd privilege” that should be abolished. Its end as a reference currency is an important step on the way to a multipolar world, “away from a unipolar order based only on the dollar.” It will remain important, but there should be alternatives.

In the big picture, Rousseff outlines a vision of a monetary architecture centered on the BRICS bank that can operate independently of the United States:

Another recent interview with the British Financial Times shows her regret that the sanctions of the front against Russia still have so much impact on her institution. The Brics bank was forced to suspend the operation of its Moscow branch, even though Russia is a founding member. In addition, rating agencies downgraded it precisely because of Russia’s co-ownership. For the time being, one has to live with the international financial system being the way it is, Rousseff told the FT.

Speaking to CCTV, Rousseff outlined how she envisions the near future. The BRICS Bank wants to provide capital in local currency until the alternative is ready. “This eliminates exchange rate fluctuations and other harmful side effects such as crises and debt in foreign currency areas.”

In South Africa, for example, it could grant loans in rand. So far, developing countries have been exposed to considerable inflation risks from exchange rate fluctuations when devaluing their currency to service foreign loans.

The head of the BRICS bank also did not hold back on monetary criticism of the West and praise for China. In her view, the United States is violating its own globalization ideology by pursuing a protectionist trade policy. They are hypocritical and spend enormous sums on domestic subsidies, Rousseff told CCTV.

This not only harms the Chinese economy, but all economies linked by globalization. Here, she sees the economy being used as a weapon. The BRICS Bank, on the other hand, would grant loans without political preconditions and remain neutral. It does not want to interfere with the recipient countries. That is what would make it attractive.

Moreover, as an institution of the Global South, the BRICS Bank has a better understanding of the needs of the beneficiaries, as they themselves are in the process of building their infrastructure and know the problems of the countries of the Global South, Rousseff said. Only in this way can true multilateralism emerge. China can be a role model when it comes to developing high-speed trains and other modes of transport, she said.

In the CCTV interview, Rousseff repeatedly cited China as a model for other countries in the Global South and expressed her enthusiasm for Xi Jinping’s policies. In contrast, she voiced criticism of parliamentarism. She was accused of corruption in her home country. In her chief post at BRICS Bank, she earns about $60,000 a month.

August 28, 2023; 1:30 p.m.

AHK Greater China, Seminar: GCC Knowledge Hub: Arbitration, the Efficient Dispute Resolution More

August 28, 2023; 5 p.m. (11 a.m. EDT)

Center for Strategic and International Studies, webcast: Germany’s New China Strategy: A Conversation with German Ambassador Andreas Michaelis More

August 29, 2023, 10 a.m. CEST (4 p.m. CST)

Dezan Shira & Associates, Webinar: Digitalizing Your HR and Payroll in Asia: Value, Scale, and Compliance for the China+ Business More

August 29, 2023, 2 p.m.

AHK Greater China, Conference: The 7th HR Summit More

August 30, 2023; 2 p.m.

AHK Greater China, Presentation (hybrid): HR Deep Dive – Presentation of the German Chamber’s 16th Labor Market & Salary Report More

August 30, 2023; 2 p.m.

AHK Greater China, Webinar: Circular Economy: Effective Practices Sharing More

August 30, 2023; 2:30 p.m.

AHK Greater China, Presentation: GCC Knowledge Hub: Customs related administrative and criminal liability risks More

August 31, 2023; 10 a.m. CEST (4 p.m. CST)

Dezan Shira & Associates, Webinar: Navigating Impacts of Hong Kong’s Amended Foreign Source Income Exemption (FSIE) Regime More

US Secretary of State Antony Blinken has announced new sanctions against Chinese officials. According to the statement, the measures are directed against officials of the People’s Republic involved in the “forced assimilation” of more than one million Tibetan children. The US is responding to the implementation of a boarding school system in Tibet that forces children of all ages to leave their home villages and spend most of the year away from their families.

“These coercive policies seek to eliminate Tibet’s distinct linguistic, cultural, and religious traditions among younger generations of Tibetans,” Blinken said. The new restrictions apply to both current and former Chinese officials who share responsibility for education policy in Tibet. “We will continue to work with our allies and partners to highlight these actions and promote accountability.”

The chair of the Human Rights Committee in the German Bundestag, Renata Alt, sees the US decision as a “good example” for Europe. “The US is acting, the EU is again lacking the courage to react decisively and consistently to China’s human rights violations,” Alt said. She called on the EU to use existing instruments under the global human rights sanctions regime (Magnitsky Act) more confidently, and to coordinate more closely with its democratic partners the United States, Canada and the United Kingdom.

“Other governments should follow the example of the US government and sanction those responsible for the forced boarding schools in the Chinese party and state apparatus,” said the human rights organization International Campaign for Tibet. Its Executive Director in Germany, Kai Mueller, urged democratic states to “firmly demand a change of course by the Communist Party in Tibet” at the next review of China at the UN Human Rights Council in January next year.

The United States is the first country to impose sanctions over China’s boarding school system. In December, Washington already sanctioned two high-ranking Chinese officials for fundamental human rights violations in Tibet. China, in turn, responded with sanctions against two US citizens. Germany, on the other hand, had called for the closure of the boarding schools in April of this year, but has not pursued further action since.

Earlier this year, special rapporteurs of the United Nations published a report investigating evidence of the “acculturation and assimilation of Tibetan culture” into the dominant Han Chinese majority through a series of repressive measures.

In an interview with China.Table, exiled Tibetan President Penpa Tsering highlighted the dramatic consequences for nearly one million children in the region. He said they are deprived of daily contact with their parents and have no opportunity to use their mother tongue because Tibetan is strictly forbidden. “We are at a point where Tibetan children come home for holidays and are unable to communicate fluently with their parents. They have forgotten Tibetan, while their mother and father barely speak any Mandarin,” Tsering said. grz

China has announced to suspend all imports of fish and seafood from Japan. On Thursday, Japan started to release slightly radioactive water from the damaged Fukushima Daiichi nuclear power plant into the Pacific Ocean.

According to Chinese customs, the import suspension was to “protect the health of Chinese consumers.” The water was used to cool radioactive debris after an earthquake and tsunami caused three meltdowns in March 2011. The water is stored on site in more than 1,000 tanks that will be gradually dumped over the next 30 years.

China had previously imposed an import ban on seafood from ten Japanese prefectures. Seafood from other prefectures had to pass radioactivity tests. Hong Kong’s government had also banned the import of seafood from ten Japanese areas for an indefinite period on Wednesday. In South Korea, protests broke out in front of the Japanese Embassy building in central Seoul over the water release. Police arrested 16 people who attempted to enter the building. rtr

According to the German government’s foreign trade agency GTAI, Germany exported goods worth 16 billion US dollars (14.7 billion euros) to the ten countries of the Southeast Asian confederation ASEAN in the first half of 2023. The region thus compensated for some of the decline in German exports to China. ASEAN exports thus increased by 8.5 percent – or 9.7 percent in euro – compared to the same period of the previous year and reached their highest value since 2018.

Sales in the ASEAN region thus developed significantly better than overall exports, which only grew by 3.3 percent. The export increase was mainly attributable to machinery and motor vehicles; both sectors appear to have recovered from the previous crisis years, writes GTAI.

The fact that Germany and other suppliers can only benefit to a limited extent from the economic boom in Southeast Asia is due to China’s rise as a trading superpower, the agency analyzes. For instance, China is the main supplier of goods in every ASEAN country, usually far ahead of its competitors. The agency says that with a population of 670 million, the ASEAN countries have so far been of only secondary importance for Germany’s foreign trade – despite their positive development. Less than two percent of Germany’s total exports go to the region.

According to Bloomberg, European vehicle manufacturer Stellantis, parent of 14 car brands, is considering cooperation with Chinese EV manufacturers. The company, which also owns Opel, Citroën, Peugeot and Chrysler, was reportedly considering a partnership with Zhejiang Leapmotor. Shares of Leapmotor rose as much as 11.4 percent in Hong Kong on Thursday, the biggest intraday gain in more than four months.

When the People’s Republic was founded in 1949, it came with the matching currency: Its people’s money (人民币), the renminbi. However, its new leader Mao Zedong remained at odds with the socialist currency all his life. As a Marxist, the ideologue would have preferred to abolish all money. Even in 1976, the year of his death, he confessed to his nephew Mao Yuanxin to have failed.

His successors were more pragmatic. They gave the people’s money a makeover with more valuable banknotes up to 100 yuan and printed Mao’s portrait on them. From then on, Mao remained dear to the people’s wallets.

China’s current President, Xi Jinping, who was appointed autocrat by the 20th Party Congress in late 2022, has bigger plans for the people’s money. Part of his dream of China’s national rejuvenation is bringing his people’s money to the world. According to the 15-year plan approved in 2020, the People’s Republic is supposed to become a socialist superpower by 2035 and the renminbi is expected to become the global currency along with it. The popular expression “greenback” for the US dollar – green bi (绿币) in Chinese – is countered by China’s propaganda with “redback” for the renminbi, red bi (红币). If the renminbi can push the dollar off its pedestal in global payment transactions, it would be the ultimate trump card for a globalization with Chinese characteristics.

So far, the chances are slim for the People’s Republic, despite becoming the world’s workbench, the second-largest economy and a trade champion. This is reflected in the progress reports on the “internationalization of the RMB.” Since Xi took office in 2012, the PBOC State Bank has published annual white papers on this subject. The most recent one was published in June 2023. So far, the state bank has only recorded symbolic successes. In October 2016, for instance, the International Monetary Fund (IMF) included the people’s money in its basket of world reserve currencies. The nominal share of less than three percent benefits the renminbi’s internationalization no more than the establishment of yuan clearing houses, which only serve the bilateral clearing of China’s trade with a number of countries. The same applies to China’s newly established Cross-Border Interbank Payment Institutions (CIPS) network.

The reason is that Beijing’s money is not freely convertible, even after 40 years of economic reforms. Global financial markets do not trade the renminbi. Commodity markets know the “petrodollar” but no “petroyuan.” China’s leaders have always shied away from the necessary financial reforms, and shun systemic risks that could lead to a loss of control or even capital flight to this day. They trust neither the creditworthiness of their financial system nor the functioning of their legal system.

Only Russia swears by the renminbi, CIPS and trade settlements in yuan and rouble since the US boycotted all Moscow’s financial transactions over Putin’s invasion of Ukraine. At the current BRICS meeting, Russia’s leader, who was only allowed to participate via video link, therefore called on all BRICS countries to help him “de-dollarize” the world. Beijing supports him, and attacks the US for “militarizing the dollar.” Russia’s adoption of the renminbi instead of the dollar does not help Beijing internationalize its currency, despite Chinese media claiming the contrary.

China has always talked big. Recently, I stumbled upon two yellowed propaganda pamphlets dating back to the Cultural Revolution. “China’s Renminbi. The first brochure printed in 1969 was called “One of the Few Most Stable Currencies in the World.” 中国的人民币 世界上少有的多最稳定的货币. It was even printed in German. The second came out in 1976: “Why China Doesn’t Know Inflation?”

Their authors, under pseudonyms like “Tsai Cheng” (Finance) and “Hung Yin-hang” (Red Bank), praised socialist China as a “country without domestic and foreign debt.” The text reads: “More and more countries are adopting the renminbi as their unit of account and settlement in trade with China.”

In truth, China engaged in barter trade, and isolated itself in the Cultural Revolution. There was nothing to spend money on in its scarcity society. Absurd “words of Chairman Mao” prefaced the pamphlets: “The enemy is rotting with each passing day, while we are getting better every day.”

Mao was terminally ill when, between October 1975 and January 1976, he pondered why his revolutions had failed to transform his country into a society without classes or money. Whenever he met with his nephew Mao Yuanxin, he scribbled words about it on pieces of paper: “We have built a state that is not very different from the old society.” 我们自己就是建设了这样一个国家,跟旧社会差不多. There was still an eight-tier wage system and distribution based on performance. Money was needed “to buy us rice, coal, cooking oil and vegetables.” Mao’s successors did not publish these notes until 1998. They preserved his body in a crystal coffin. Mao would spin if he saw what they did with the renminbi later.

In the meantime, Beijing wants to turn its people’s money into a global currency. For Xi Jinping, it is part of his program, brought forward to 2035, to elevate the nation to a superpower on par with the US, with the renminbi equal to the dollar. As chairman of the CC’s so-called Leading Small Group onFinance and Society, Xi demanded in 2017: “It is necessary to promote the opening of capital accounts in an orderly manner, continuously implement the internationalization of the RMB.” (要有序推进资本项目开放,稳步推动人民币国际化) Five years later, he somewhat toned down his wording at the 20th Party Congress. He said it was necessary to pursue an “orderly internationalization of the renminbi” (有序推进人民币国际化).

The Jingji Ribao, 经济日报, China’s only economic daily allowed to speak for the party, interviewed the country’s leading monetary and financial theorists in January 2023 on how to interpret Xi’s new formula. They warned that China would still need a lot of time and reforms before internationalizing the people’s money.

The ambitious party leader wants things to happen faster. Right after the 20th Party Congress, he rushed ahead in his welcoming address to the opening of the China-Gulf Cooperation Council (GCC) on 9 December 2022. Xi wanted to tie the Gulf countries to the renminbi. He explained that Beijing was willing to make joint efforts with GCC countries in the next three to five years to “make full use of the Shanghai Petroleum and National Gas Exchange as a platform to carry out yuan settlement of oil and gas trade.” He also suggested, “start currency swap cooperation, deepen digital currency cooperation and advance the m-CBDC Bridge project.”

Xi single-handedly attempted to upgrade the renminbi to the petroyuan, just as the US once transformed its US dollar into the OPEC-accepted petrodollar. But the Gulf states ignored his proposal. They mentioned it neither in their final declaration nor in the joint statement.

Despite such setbacks and spiraling economic problems at home, Beijing is taking another shot at it. It hopes to knock down pegs for a “new global order” at the current BRICS meeting while creating facts for a renminbi as an alternative currency to the dollar. While Chinese media have been drumming up propaganda for this for weeks, the former British financial secretary and Goldman Sachs economist, Jim O’Neill, voiced his objections. In an article in the Financial Times, he came to the devastating verdict that the BRICS countries had never achieved anything since their first meeting (in 2009). O’Neill dismissed any notions by Xi or Brazil’s President Lula da Silva about creating a new trade currency as ridiculous. “They’re going to create a BRICS central bank? How would you do that? It’s embarrassing almost.”

Normally, that would just be an isolated opinion. But O’Neill has been an esteemed guru in China for years and the most quoted key witness for Xi’s ambitious plans for BRICS’ rise. Beijing calls him the “father of BRICS.” Instead of dealing with his interview, only two days later and without any reference to it, the party newspaper “Global Times” printed a “counter-interview” with O’Neill on 17 August. In it, he allegedly showered the BRICS with praise, while calling the US-led Western G7 group “a bit crazy” for thinking it was on an upward trajectory. And the renminbi could gain growing status as a reserve currency within the BRICS.

O’Neill has not yet commented on who he told what. But China is on edge. Many renowned financial economists, including monetary policy advisers to the central bank, warned Beijing not to take premature steps to make the renminbi convertible or liberalize its capital controls.

Noticeably, Xi Jinping was very reserved on the renminbi issue at the BRICS summit, addressing the role of its internationalization only in a half-sentence: “We need to … push forward reform of the international financial and monetary systems. (推动国际金融货币体系改革) To this end, he spoke in favor of admitting more new BRICS members.

Xi now needs to be patient. In his video appearance, Russia’s President Putin promised to make every effort to expand the role of BRICS in the financial and monetary system, develop interbank cooperation and expand the use of national currencies. These issues will be on the agenda of the next BRICS Summit in Russia in October 2024. He will then preside over the expanded group of members.

Before that, Putin will come to Beijing this October, where Xi will host the tenth BRI Silk Road Conference. BRICS, SCO and BRI, over which China wields influence, are Xi’s new leverages to internationalize his people’s money while isolating the West, G7 and the dollar.

Cheng Li Qin has been appointed Non-Executive Director of China Nature Energy Technology this month. She was previously CFO of Kang Cheng Seafood Company from 2003 to 2012 and CFO of World Hero International since 2012.

Jaromir Cernik has been appointed head of the first CTP’s office in Asia, located in Hong Kong. He joins from fintech company Qupital, where he served as a Board Member and Director.

Is something changing in your organization? Let us know at heads@table.media!

Not ugly ducklings, but white geese are swimming on a lake in Huai in Jiangsu province. According to the information, it is not just an idyllic sight, but moreover an ecological aviculture.