As expected, Xi Jinping called for stronger action on climate change at the climate conference in Glasgow. At home, however, coal production is rising to record levels. That’s how the energy crisis is to be tackled. The power shortage, along with a host of other problems, is putting pressure on domestic growth. From supply bottlenecks to tech crackdowns and mountains of debt in the real estate sector – the mood in Beijing, Shanghai, and Guangdong is turning sour. Felix Lee has taken this opportunity to take a closer look at the state of the Chinese economy and found that President Xi Jinping’s leadership is the root of most problems. Looking to the future, the question, therefore, arises: Is China’s strongman sacrificing China’s growth to his obsession for control?

Indimo takes a different approach to its business model. The car importer sells Chinese cars in Germany – and with success. Despite the Covid pandemic, Indimo’s sales numbers are soaring. These are cars of European quality paired with Chinese bling-bling. Christian Domke Seidel, however, has identified a different reason for its sales success.

Last but not least, I would like to recommend today’s tools section: It looks at a draft published by the Chinese Ministry of Information. The draft specifies which measures companies will have to take in the future when it comes to storing, processing, and transmitting their data.

I hope you enjoy today’s issue!

The port of Ningbo-Zhoushan is located about 250 kilometers south of Shanghai. It is the third-largest cargo port in the world. Almost 1.2 billion tons of goods were handled there last year alone. On August 11, one of the port’s workers tested positive for Covid. The man had been double-vaccinated with the Chinese Sinovac vaccine, and also showed no symptoms. Nevertheless, before dawn, authorities closed the entire Meishan terminal, including the associated bonded warehouse. Large parts of the port were closed for three weeks. The container backlog has still not been cleared.

In a globally coordinated just-in-time production, it only takes one Covid case in China – and all global trade comes to a grinding halt. China is the largest producer of both consumer goods and industrial intermediate products. At the same time, the Chinese leadership is adhering strictly to its “zero-covid” strategy – it reacts to every single case with massive restrictions. In return, it is ready to accept high economic losses. But the central government is not only cracking down on pandemic control.

Whether it is breaking up the recently booming tutoring sector, rigidly regulating equally highly successful IT corporations, or managing the crisis of the highly indebted Evergrande real estate group – unlike its predecessor governments, for whom economic growth was a top priority, China’s leadership under Xi Jinping is apparently not afraid to tackle problems with rules and bans. The leadership has had enough of “irrational expansion of capital” and “barbaric growth,” the Chinese state media blatantly say.

Entrepreneurs and investors were used to unprecedented growth for decades. They saw little in the way of rules to limit their expansion. Tech companies collected data without restraint. Now they are officially responding with humility. China’s Corporations are zealously declaring their commitment to the campaigns of State and Party leader Xi Jinping. Nevertheless, the shares of the two largest Chinese tech companies Alibaba and Tencent alone lost more than 40 percent of their value at times. More than three trillion US dollars were wiped out on the markets, according to estimates by US bank Goldman Sachs. “It’s remarkable how little Chinese policymakers seem to care about growth,” Louis Kuijs, a China expert and chief economist at Oxford Economics, told Bloomberg financial service.

Meanwhile, these measures are also clouding the mood of the economy as a whole. The upturn in the Chinese economy lost considerable momentum in the third quarter. According to numbers released by Beijing’s Bureau of Statistics in mid-October, the second-largest economy grew by only 4.9 percent year-on-year in the third quarter. This makes it the weakest value yet after the record growth of 18.3 percent in the first quarter and 7.9 percent in the second. “The new policy will dampen the entrepreneurial activity that is so important to the dynamism of China’s private sector, and that in turn will have lasting consequences for the next, innovation-driven phase of China’s economic development,” Stephen Roach, China economist at Yale University and former head of Bank Morgan Stanley in Asia, wrote.

In addition, there is the problem of power shortages, which have forced numerous industrial companies to curb their production in recent weeks. European companies operating in China are also suffering (China.Table reported). EU companies speak of “chaotic conditions”, reports Joerg Wuttke, chairman of the EU Chamber of Commerce in China. Companies are often only informed at short notice that power will be cut off – the night before or even an hour before the start of a shift. With the upcoming winter heating season, the situation is likely to deteriorate and will probably last at least until March, Wuttke expects.

But the power shortage is also to a large extent homemade, even if made with noble intentions. One reason for the coal shortage – still China’s most important power resource – can be found in the government’s climate policy. Last year, Head of State Xi announced his plan to achieve carbon neutrality by 2060 and, for the first time, gave provincial governments specific targets for the current year. However, almost all provinces had already exceeded these targets by the middle of the year. As a result, the central government stepped up the heat. Some local governments saw no other way out than to shut down coal-fired power plants. While they probably are running at full speed again, coal remains scarce since power plant operators have ordered too little in recent months due to high prices.

And also in the wake of the trade dispute with the Australian government, China’s leadership had ordered to curb coal imports from Australia. This is compounded by the general rise in commodity prices around the world. China contributes to this price increase and suffers from it at the same time.

Xi must now strike a balance between his political plans and maintaining economic strength. So far, there is only speculation about where he will draw the line. Is he primarily concerned with bringing entire industries under control? Or should stricter regulation ultimately have the effect of keeping the economy fit in the long term? The protection of data and climate are, after all, thoroughly sustainable projects.

Doris Fischer, a China economist at the University of Wuerzburg, believes that concerns that the leadership’s political agenda could stifle economic momentum are exaggerated. The real estate sector has been overheating for years. And now “some heads would roll”. The economist believes that an expansion of the Evergrande crisis, which would possibly rock the entire financial market system, is unlikely. “The government will stabilize the banking system,” Fischer says. Most banks are largely state-owned anyway.

The economist sees the action against the large Chinese tech companies in a similar light. For years, she says, they were able to expand largely unregulated and eagerly collected data. And just as the threat to democracy posed by the IT giants is being discussed in Western industrialized countries, China asks itself: Are tech companies endangering the domestic party system? Fischer thinks it’s “actually astonishing” that China’s leadership has given its tech corporation this much leeway for so long. “We already observed this in other areas: You reform something, you let it run, and then you try to curb the excesses.”

The China expert is also relatively relaxed about the impact of these measures on economic growth. “The 4.9 percent is only surprising if you thought that the 18 percent from the first quarter would carry through the whole year.” She doesn’t put much stock in that, she says. “The trade surplus with the US has just widened again.” She suggests looking at China like a continent. “If Spain and Portugal, for example, are no longer prospering economically, that doesn’t mean that the entire European economy is no longer healthy.” So if there are problems in one Chinese region, it doesn’t mean that the whole country is in a slump.

Indimo is running out of space. The importer of Chinese cars saw sales grow by fifty percent in each Covid crisis year of 2019 and 2020. And in 2021, this trend continues. The now fifty employees (two of them in China) already met their sales target in October. So a new hall was needed. The company acquired a 16,000 square meters building, right next to its branch in Schwallungen, Thuringia.

Chinese vehicles are actually a niche market in Germany. But one with enormous growth rates. Since the big players from the People’s Republic are yet to venture in to Germany, the business is still in its infancy. There are hardly any branches of Chinese manufacturers. Only the electric brand Aiways, which was only founded in 2017, has ventured into Germany. And Indimo is happy to fill this gap.

In 2019, Indimo sold 1,500 vehicles – models from BAIC, Dongfeng, and Seres. In 2020, that number was 1,800, plus more than 400 commercial vehicles for municipalities and small businesses each year. Every car already on the road also needs maintenance and spare parts. Sales and services are handled by 195 partner dealers and workshops throughout Germany.

Chinese manufacturers have long since overcome their past quality problems. The learning curve for car manufacturing is extremely steep in China. “Cars from 2009 are no longer comparable to cars from 2021. The workmanship is terrific and the quality is top-notch. Even Mercedes and BMW dealers confirm that,” explains Christian Marr, who is responsible for marketing and sales at Indimo.

But their customers would never buy a Chinese car. “We have a hard time reaching those who drive a Daimler or an Audi. There are VW drivers who have switched because of the diesel scandal, but they are not the rule. We have customers who already own an Asian car.”

The experience gained by Indimo benefits Chinese manufacturers, who can tailor their cars to European customer requirements. “The vehicles themselves are of European standard. But it’s typical for the Chinese to glue a lot of bling-bling and tinsel to their cars. However, we have already told them that less is sometimes more,” says Marr. Accordingly, vehicles that are now shipped to Germany come with fewer frills on the bodywork.

The second major issue is the onboard computer. “The UI is in English by default. But we have customers in France and Spain who need their native language. That’s where the Chinese have been very responsive to our requests.” 70 percent of all Indimo customers can operate the menu in their own language. German cars, on the other hand, are usually not digital enough (China.Table reported).

The SUV boom was a stroke of luck for Indimo. Unlike Chinese station wagons and notchback sedans, SUVs are not only technically but also visually appealing in Europe. EVs could become the second big trend. “The demand for fully electric vehicles is there and interest is growing. But sales in Germany are only moderate. That’s also because the high-priced volume manufacturers are the top dogs in this sector. But Holland and France are electric countries where we no longer sell combustion cars,” says Marr, assessing the situation.

A new addition to the model range is the FAW brand – Volkswagen’s joint venture partner. This is proof of how good Indimo’s reputation has become in the People’s Republic. To safeguard it, Indimo even has two permanent employees in China who can directly negotiate with its Chinese partners. But soon there could be competition. Some manufacturers – including Great Wall – are pushing into the German market. Marr takes it in stride. The more talk there is about Chinese cars, the more Indimo will sell. Christian Domke Seidel

At the Climate Change Conference in Glasgow (COP26), which started yesterday, Xi Jinping only participated in the first meeting of Heads of State with a written statement. In it, Xi called on all nations to take “stronger action against the climate challenge.” Xi stressed the responsibility of developed countries to do more and provide greater support to developing countries. He also emphasized the relevance of innovation, science, and research to reduce emissions. He said China “rein in the irrational development of energy-intensive and high-emission projects,” and speed up the energy transition. Xi’s statements, however, did not name any new targets.

As he did at last weekend’s G-20 summit in Rome, Xi announced several sector plans to reduce CO2 emissions. According to Xi, the sector plans are to include clear timeframes for China’s two climate goals – reaching the CO2 peak by 2030 and carbon neutrality by 2060. They fleshed out the supreme planning document on cutting emissions (China.Table reported). An initial action plan was unveiled in late October. The plan lists a variety of economic sectors and measures to reduce greenhouse gas emissions (China.Table reported).

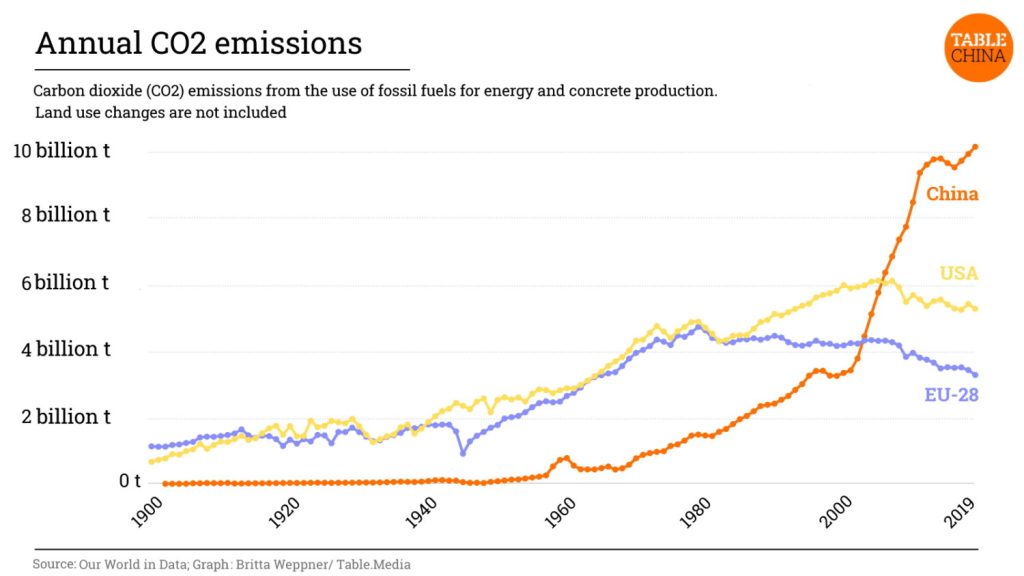

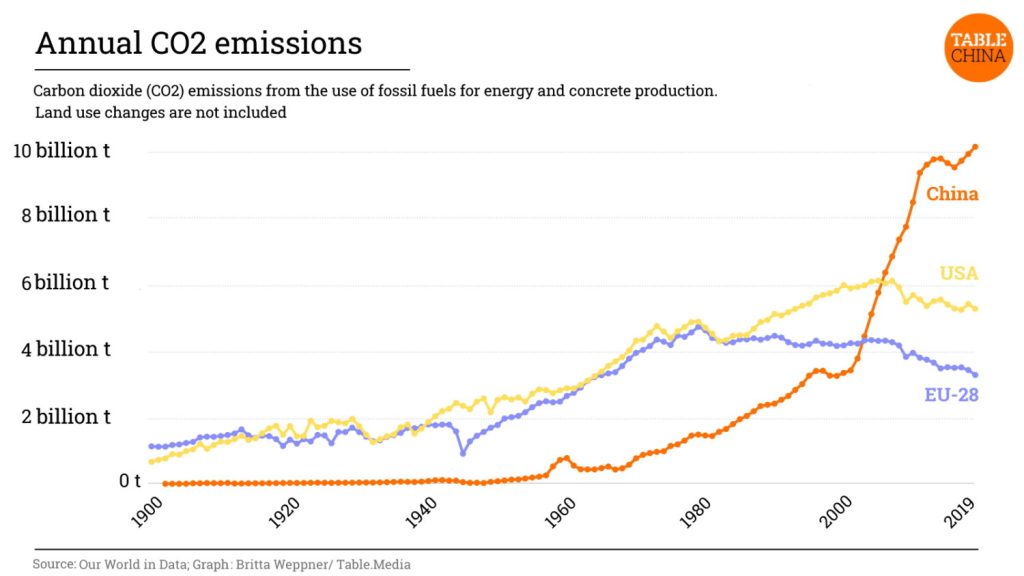

Xi was the only Head of State to present a written statement at COP26. The People’s Republic has a major role to play at the climate conference. It is now the largest CO2 emitter by a margin. China was responsible for almost 28 percent of global greenhouse gas emissions in 2019. On a per-capita basis, China’s emissions of 7.1 tonnes are just above those produced by an average EU resident per year (6.4 tonnes of CO2 equivalent). However, the USA (16 tons per capita) and Germany (8.4 tons per capita) are still ahead of China.

Above all, China’s dependence on coal-fired power contributes to the high emissions. In the recent power crisis, the People’s Republic has once again expanded coal production. According to Reuters calculations, China could produce more coal this year than ever before.

US President Joe Biden also made no new pledges in his COP speech. He presented recently passed legislation that earmarks $555 billion for the promotion of renewable energies and electric vehicles. nib

China has submitted a formal application to join the Digital Economy Partnership Agreement (DEPA). This was announced by the Chinese Ministry of Commerce in Beijing on Monday. The application underscores China’s efforts to further open up its economy and increase cooperation with other partners in the digital economy, said Commerce Minister Wang Wentao.

On Sunday evening, President Xi Jinping had already announced such a move in his virtual speech at the G-20 meeting in Rome. “China attaches great importance to international cooperation on the digital economy,” Xi said. He said China was willing to work with all partners worldwide for the healthy and orderly development of all things digital.

With the DEPA agreement, various countries want to address the opportunities, problems, and risks of the increasingly digital exchange of goods, for example in data exchange, consumer protection, or cashless payments. So far, Singapore, New Zealand, and Chile are members of the agreement. In addition to China, Canada has also expressed interest in joining the agreement. The US has been working on a similar agreement for the Indo-Pacific since July. rad

As of November 12, Hong Kong’s financial capital is tightening quarantine rules. Quarantine exemptions for senior managers of listed companies in banking, insurance, and securities sectors will be lifted, Bloomberg reports. Diplomats and other embassy staff will have to isolate themselves in designated quarantine hotels. Isolation in private homes is only possible for ambassadors and their families.

Currently, Hong Kong still exempts representatives of some industries from mandatory quarantine measures, which can last up to three weeks. Business associations and chambers of commerce criticize the strict no-covid strategy and fear repercussions for Hong Kong as a trading center. nib

Chinese EV manufacturer Xpeng sold more than 10,000 vehicles in October, the company announced on Monday. The 10,138 cars sold represent a 233 percent year-on-year increase.

This makes October the second consecutive month that Xpeng has surpassed the 10,000-mark of shipped models. In September, the company had set a company sales record with 10,412 vehicles. This month’s sales were mainly boosted by the P7 electric sports sedan with 6,044 units, up 187 percent year-on-year.

The monthly mark of 10,000 vehicles is considered an important indicator in China. Especially since Xpeng was able to reach the sales figures despite nationwide power shortages and a global shortage of semiconductor chips.

Xpeng started shipping EVs to Norway last year and is planning to expand further in Europe. Last week, it had announced the sales prices of its flagship sedan P7 in Norway. It is competing with market leader Tesla and domestic rival Nio in the northern European market (China.Table reported). Nio had recently established its first battery swap station in Oslo. It is scheduled to open soon. rad

Following the Data Security Law, China has drawn up a new regulation clarifying how firms should handle sensitive industrial and telecoms data. The draft regulation classifies data into “core”, “important”, and “ordinary” categories, and requires firms to take different degrees of protection measures when collecting, processing, transferring, and disposing data.

On September 30, 2021, the Ministry of Industry and Information Technology (MIIT) published the Measures for the Administration of Data Security in the Field of Industrial and Information Technology sectors (Trial) (Draft) (hereafter “Measures”) and is soliciting public opinions until October 30, 2021.

The draft Measures apply to all kinds of enterprises, especially software and information technology (IT) service providers and telecom business license holders.

They aim to regulate data processing on an industrial scale. In particular, companies are clearly prohibited fIt aims to regulate the industrial and telecoms data processing activities carried out in China. Notably, it clearly bans enterprises from moving “core data” out of China. And it requires companies to get a government security review before providing “important data” abroad.

The document sets out detailed requirements regarding data storage, processing, disclosure, disposal, and cross-border transmission. Data processors may be obliged to record and report to the government on their activities in processing important and core data.

The Measures have become the first data security regulation formulated by a state agency in charge of industrial sectors, since the Data Security Law became effective on September 1, 2021.

In the document, “industrial data” is defined as information collected and generated in sectors such as raw materials, machinery, consumer goods, electronics manufacturing, and software and information technology. “Telecoms data” refers to information produced or gathered from the broad communications network market.

According to Article 11 of the Measures, businesses are obliged to sort and classify these industrial and telecoms data into core, important, and ordinary categories, and submit the catalog of important and core data to the local branch of the MIIT.

The document lists respective principles for identifying core, important, and ordinary data.

Generally, information that can pose a threat to national security, economic stability, and technological advancement, or significantly impact China’s industrial and telecommunication sectors can be labeled as important data or core data. However, the Measures does not provide any specific examples, leading many to find the definition still quite subjective.

Core data:

Important data:

Ordinary data:

According to the draft Measures, firms are required to sort out and record important and core data and report a data catalogue to the local branch of the MIIT. If reported data changes, firms are also obliged to report the updated information to the government within three months.

Based on the importance of the data, firms should adopt different degrees of protection measures when collecting, storing, processing, transferring, providing, disclosing, and disposing the important and core data.

Most notably, when it comes to cross-border data flows, the Measures has clearly prohibited core data from being transferred overseas and transferring important data overseas will be subject to government review.

This is consistent with China’s Data Security Law and Cybersecurity Law. The Cybersecurity Law stipulates that the operator of a critical information infrastructure should store important data collected and generated domestically within the territory of China. Where such information and data have to be provided abroad for business purpose, a security review should be conducted.

China’s Data Security Law, while it doesn’t offer detailed rules on the safety management for cross-border transfers of important data, prescribes the penalties for firms transferring important data overseas in violation of the Cybersecurity Law as well as other data security measures. The penalties include fines, suspension of the relevant business, suspension of the business for rectification, and revocation of the relevant business permit or business license.

In addition, the draft Measures point out that enterprises should set up the responsible departments and identify main persons in charge of data security management, as well as make clear key positions and personnel for data processing.

The following compliance requirements also deserve the attention of enterprises:

China has been tightening its data-related regulations. This summer, the government launched a cybersecurity investigation into ride-hailing app Didi after it rushed its public listing in the US. Didi was accused of seriously violating laws and regulations in its collection and use of personal information and was ordered to suspend new user registration.

In July, the Cyberspace Administration of China (CAC) revised its Cybersecurity Review Measures to make clear that any Chinese companies that hold the personal information of one million or more users would need to seek a government cybersecurity review before listing abroad.

A month later, China’s top legislature passed the Personal Information Protection Law. And in September, China’s new Data Security Law went effective. The MIIT’s Measures, once passed, will be yet be another key regulatory document on data security and help make rules clearer.

Cheng Yixiao will be the new CEO at Kuaishou Technology. Cheng founded the company with current CEO Su Hua. Su is stepping down as CEO to become chairman of the board. TikTok rival Kuaishou is currently struggling with major losses and a declining stock market value.

Trapped in Disneyland: On Sunday evening, authorities tested 33,000 people for COVID-19 at the Shanghai amusement park. Tens of thousands had to wait for hours for their test results before they were allowed to leave the park. The reason: On Saturday, a man had apparently visited the amusement park and tested positive for the Coronavirus.

As expected, Xi Jinping called for stronger action on climate change at the climate conference in Glasgow. At home, however, coal production is rising to record levels. That’s how the energy crisis is to be tackled. The power shortage, along with a host of other problems, is putting pressure on domestic growth. From supply bottlenecks to tech crackdowns and mountains of debt in the real estate sector – the mood in Beijing, Shanghai, and Guangdong is turning sour. Felix Lee has taken this opportunity to take a closer look at the state of the Chinese economy and found that President Xi Jinping’s leadership is the root of most problems. Looking to the future, the question, therefore, arises: Is China’s strongman sacrificing China’s growth to his obsession for control?

Indimo takes a different approach to its business model. The car importer sells Chinese cars in Germany – and with success. Despite the Covid pandemic, Indimo’s sales numbers are soaring. These are cars of European quality paired with Chinese bling-bling. Christian Domke Seidel, however, has identified a different reason for its sales success.

Last but not least, I would like to recommend today’s tools section: It looks at a draft published by the Chinese Ministry of Information. The draft specifies which measures companies will have to take in the future when it comes to storing, processing, and transmitting their data.

I hope you enjoy today’s issue!

The port of Ningbo-Zhoushan is located about 250 kilometers south of Shanghai. It is the third-largest cargo port in the world. Almost 1.2 billion tons of goods were handled there last year alone. On August 11, one of the port’s workers tested positive for Covid. The man had been double-vaccinated with the Chinese Sinovac vaccine, and also showed no symptoms. Nevertheless, before dawn, authorities closed the entire Meishan terminal, including the associated bonded warehouse. Large parts of the port were closed for three weeks. The container backlog has still not been cleared.

In a globally coordinated just-in-time production, it only takes one Covid case in China – and all global trade comes to a grinding halt. China is the largest producer of both consumer goods and industrial intermediate products. At the same time, the Chinese leadership is adhering strictly to its “zero-covid” strategy – it reacts to every single case with massive restrictions. In return, it is ready to accept high economic losses. But the central government is not only cracking down on pandemic control.

Whether it is breaking up the recently booming tutoring sector, rigidly regulating equally highly successful IT corporations, or managing the crisis of the highly indebted Evergrande real estate group – unlike its predecessor governments, for whom economic growth was a top priority, China’s leadership under Xi Jinping is apparently not afraid to tackle problems with rules and bans. The leadership has had enough of “irrational expansion of capital” and “barbaric growth,” the Chinese state media blatantly say.

Entrepreneurs and investors were used to unprecedented growth for decades. They saw little in the way of rules to limit their expansion. Tech companies collected data without restraint. Now they are officially responding with humility. China’s Corporations are zealously declaring their commitment to the campaigns of State and Party leader Xi Jinping. Nevertheless, the shares of the two largest Chinese tech companies Alibaba and Tencent alone lost more than 40 percent of their value at times. More than three trillion US dollars were wiped out on the markets, according to estimates by US bank Goldman Sachs. “It’s remarkable how little Chinese policymakers seem to care about growth,” Louis Kuijs, a China expert and chief economist at Oxford Economics, told Bloomberg financial service.

Meanwhile, these measures are also clouding the mood of the economy as a whole. The upturn in the Chinese economy lost considerable momentum in the third quarter. According to numbers released by Beijing’s Bureau of Statistics in mid-October, the second-largest economy grew by only 4.9 percent year-on-year in the third quarter. This makes it the weakest value yet after the record growth of 18.3 percent in the first quarter and 7.9 percent in the second. “The new policy will dampen the entrepreneurial activity that is so important to the dynamism of China’s private sector, and that in turn will have lasting consequences for the next, innovation-driven phase of China’s economic development,” Stephen Roach, China economist at Yale University and former head of Bank Morgan Stanley in Asia, wrote.

In addition, there is the problem of power shortages, which have forced numerous industrial companies to curb their production in recent weeks. European companies operating in China are also suffering (China.Table reported). EU companies speak of “chaotic conditions”, reports Joerg Wuttke, chairman of the EU Chamber of Commerce in China. Companies are often only informed at short notice that power will be cut off – the night before or even an hour before the start of a shift. With the upcoming winter heating season, the situation is likely to deteriorate and will probably last at least until March, Wuttke expects.

But the power shortage is also to a large extent homemade, even if made with noble intentions. One reason for the coal shortage – still China’s most important power resource – can be found in the government’s climate policy. Last year, Head of State Xi announced his plan to achieve carbon neutrality by 2060 and, for the first time, gave provincial governments specific targets for the current year. However, almost all provinces had already exceeded these targets by the middle of the year. As a result, the central government stepped up the heat. Some local governments saw no other way out than to shut down coal-fired power plants. While they probably are running at full speed again, coal remains scarce since power plant operators have ordered too little in recent months due to high prices.

And also in the wake of the trade dispute with the Australian government, China’s leadership had ordered to curb coal imports from Australia. This is compounded by the general rise in commodity prices around the world. China contributes to this price increase and suffers from it at the same time.

Xi must now strike a balance between his political plans and maintaining economic strength. So far, there is only speculation about where he will draw the line. Is he primarily concerned with bringing entire industries under control? Or should stricter regulation ultimately have the effect of keeping the economy fit in the long term? The protection of data and climate are, after all, thoroughly sustainable projects.

Doris Fischer, a China economist at the University of Wuerzburg, believes that concerns that the leadership’s political agenda could stifle economic momentum are exaggerated. The real estate sector has been overheating for years. And now “some heads would roll”. The economist believes that an expansion of the Evergrande crisis, which would possibly rock the entire financial market system, is unlikely. “The government will stabilize the banking system,” Fischer says. Most banks are largely state-owned anyway.

The economist sees the action against the large Chinese tech companies in a similar light. For years, she says, they were able to expand largely unregulated and eagerly collected data. And just as the threat to democracy posed by the IT giants is being discussed in Western industrialized countries, China asks itself: Are tech companies endangering the domestic party system? Fischer thinks it’s “actually astonishing” that China’s leadership has given its tech corporation this much leeway for so long. “We already observed this in other areas: You reform something, you let it run, and then you try to curb the excesses.”

The China expert is also relatively relaxed about the impact of these measures on economic growth. “The 4.9 percent is only surprising if you thought that the 18 percent from the first quarter would carry through the whole year.” She doesn’t put much stock in that, she says. “The trade surplus with the US has just widened again.” She suggests looking at China like a continent. “If Spain and Portugal, for example, are no longer prospering economically, that doesn’t mean that the entire European economy is no longer healthy.” So if there are problems in one Chinese region, it doesn’t mean that the whole country is in a slump.

Indimo is running out of space. The importer of Chinese cars saw sales grow by fifty percent in each Covid crisis year of 2019 and 2020. And in 2021, this trend continues. The now fifty employees (two of them in China) already met their sales target in October. So a new hall was needed. The company acquired a 16,000 square meters building, right next to its branch in Schwallungen, Thuringia.

Chinese vehicles are actually a niche market in Germany. But one with enormous growth rates. Since the big players from the People’s Republic are yet to venture in to Germany, the business is still in its infancy. There are hardly any branches of Chinese manufacturers. Only the electric brand Aiways, which was only founded in 2017, has ventured into Germany. And Indimo is happy to fill this gap.

In 2019, Indimo sold 1,500 vehicles – models from BAIC, Dongfeng, and Seres. In 2020, that number was 1,800, plus more than 400 commercial vehicles for municipalities and small businesses each year. Every car already on the road also needs maintenance and spare parts. Sales and services are handled by 195 partner dealers and workshops throughout Germany.

Chinese manufacturers have long since overcome their past quality problems. The learning curve for car manufacturing is extremely steep in China. “Cars from 2009 are no longer comparable to cars from 2021. The workmanship is terrific and the quality is top-notch. Even Mercedes and BMW dealers confirm that,” explains Christian Marr, who is responsible for marketing and sales at Indimo.

But their customers would never buy a Chinese car. “We have a hard time reaching those who drive a Daimler or an Audi. There are VW drivers who have switched because of the diesel scandal, but they are not the rule. We have customers who already own an Asian car.”

The experience gained by Indimo benefits Chinese manufacturers, who can tailor their cars to European customer requirements. “The vehicles themselves are of European standard. But it’s typical for the Chinese to glue a lot of bling-bling and tinsel to their cars. However, we have already told them that less is sometimes more,” says Marr. Accordingly, vehicles that are now shipped to Germany come with fewer frills on the bodywork.

The second major issue is the onboard computer. “The UI is in English by default. But we have customers in France and Spain who need their native language. That’s where the Chinese have been very responsive to our requests.” 70 percent of all Indimo customers can operate the menu in their own language. German cars, on the other hand, are usually not digital enough (China.Table reported).

The SUV boom was a stroke of luck for Indimo. Unlike Chinese station wagons and notchback sedans, SUVs are not only technically but also visually appealing in Europe. EVs could become the second big trend. “The demand for fully electric vehicles is there and interest is growing. But sales in Germany are only moderate. That’s also because the high-priced volume manufacturers are the top dogs in this sector. But Holland and France are electric countries where we no longer sell combustion cars,” says Marr, assessing the situation.

A new addition to the model range is the FAW brand – Volkswagen’s joint venture partner. This is proof of how good Indimo’s reputation has become in the People’s Republic. To safeguard it, Indimo even has two permanent employees in China who can directly negotiate with its Chinese partners. But soon there could be competition. Some manufacturers – including Great Wall – are pushing into the German market. Marr takes it in stride. The more talk there is about Chinese cars, the more Indimo will sell. Christian Domke Seidel

At the Climate Change Conference in Glasgow (COP26), which started yesterday, Xi Jinping only participated in the first meeting of Heads of State with a written statement. In it, Xi called on all nations to take “stronger action against the climate challenge.” Xi stressed the responsibility of developed countries to do more and provide greater support to developing countries. He also emphasized the relevance of innovation, science, and research to reduce emissions. He said China “rein in the irrational development of energy-intensive and high-emission projects,” and speed up the energy transition. Xi’s statements, however, did not name any new targets.

As he did at last weekend’s G-20 summit in Rome, Xi announced several sector plans to reduce CO2 emissions. According to Xi, the sector plans are to include clear timeframes for China’s two climate goals – reaching the CO2 peak by 2030 and carbon neutrality by 2060. They fleshed out the supreme planning document on cutting emissions (China.Table reported). An initial action plan was unveiled in late October. The plan lists a variety of economic sectors and measures to reduce greenhouse gas emissions (China.Table reported).

Xi was the only Head of State to present a written statement at COP26. The People’s Republic has a major role to play at the climate conference. It is now the largest CO2 emitter by a margin. China was responsible for almost 28 percent of global greenhouse gas emissions in 2019. On a per-capita basis, China’s emissions of 7.1 tonnes are just above those produced by an average EU resident per year (6.4 tonnes of CO2 equivalent). However, the USA (16 tons per capita) and Germany (8.4 tons per capita) are still ahead of China.

Above all, China’s dependence on coal-fired power contributes to the high emissions. In the recent power crisis, the People’s Republic has once again expanded coal production. According to Reuters calculations, China could produce more coal this year than ever before.

US President Joe Biden also made no new pledges in his COP speech. He presented recently passed legislation that earmarks $555 billion for the promotion of renewable energies and electric vehicles. nib

China has submitted a formal application to join the Digital Economy Partnership Agreement (DEPA). This was announced by the Chinese Ministry of Commerce in Beijing on Monday. The application underscores China’s efforts to further open up its economy and increase cooperation with other partners in the digital economy, said Commerce Minister Wang Wentao.

On Sunday evening, President Xi Jinping had already announced such a move in his virtual speech at the G-20 meeting in Rome. “China attaches great importance to international cooperation on the digital economy,” Xi said. He said China was willing to work with all partners worldwide for the healthy and orderly development of all things digital.

With the DEPA agreement, various countries want to address the opportunities, problems, and risks of the increasingly digital exchange of goods, for example in data exchange, consumer protection, or cashless payments. So far, Singapore, New Zealand, and Chile are members of the agreement. In addition to China, Canada has also expressed interest in joining the agreement. The US has been working on a similar agreement for the Indo-Pacific since July. rad

As of November 12, Hong Kong’s financial capital is tightening quarantine rules. Quarantine exemptions for senior managers of listed companies in banking, insurance, and securities sectors will be lifted, Bloomberg reports. Diplomats and other embassy staff will have to isolate themselves in designated quarantine hotels. Isolation in private homes is only possible for ambassadors and their families.

Currently, Hong Kong still exempts representatives of some industries from mandatory quarantine measures, which can last up to three weeks. Business associations and chambers of commerce criticize the strict no-covid strategy and fear repercussions for Hong Kong as a trading center. nib

Chinese EV manufacturer Xpeng sold more than 10,000 vehicles in October, the company announced on Monday. The 10,138 cars sold represent a 233 percent year-on-year increase.

This makes October the second consecutive month that Xpeng has surpassed the 10,000-mark of shipped models. In September, the company had set a company sales record with 10,412 vehicles. This month’s sales were mainly boosted by the P7 electric sports sedan with 6,044 units, up 187 percent year-on-year.

The monthly mark of 10,000 vehicles is considered an important indicator in China. Especially since Xpeng was able to reach the sales figures despite nationwide power shortages and a global shortage of semiconductor chips.

Xpeng started shipping EVs to Norway last year and is planning to expand further in Europe. Last week, it had announced the sales prices of its flagship sedan P7 in Norway. It is competing with market leader Tesla and domestic rival Nio in the northern European market (China.Table reported). Nio had recently established its first battery swap station in Oslo. It is scheduled to open soon. rad

Following the Data Security Law, China has drawn up a new regulation clarifying how firms should handle sensitive industrial and telecoms data. The draft regulation classifies data into “core”, “important”, and “ordinary” categories, and requires firms to take different degrees of protection measures when collecting, processing, transferring, and disposing data.

On September 30, 2021, the Ministry of Industry and Information Technology (MIIT) published the Measures for the Administration of Data Security in the Field of Industrial and Information Technology sectors (Trial) (Draft) (hereafter “Measures”) and is soliciting public opinions until October 30, 2021.

The draft Measures apply to all kinds of enterprises, especially software and information technology (IT) service providers and telecom business license holders.

They aim to regulate data processing on an industrial scale. In particular, companies are clearly prohibited fIt aims to regulate the industrial and telecoms data processing activities carried out in China. Notably, it clearly bans enterprises from moving “core data” out of China. And it requires companies to get a government security review before providing “important data” abroad.

The document sets out detailed requirements regarding data storage, processing, disclosure, disposal, and cross-border transmission. Data processors may be obliged to record and report to the government on their activities in processing important and core data.

The Measures have become the first data security regulation formulated by a state agency in charge of industrial sectors, since the Data Security Law became effective on September 1, 2021.

In the document, “industrial data” is defined as information collected and generated in sectors such as raw materials, machinery, consumer goods, electronics manufacturing, and software and information technology. “Telecoms data” refers to information produced or gathered from the broad communications network market.

According to Article 11 of the Measures, businesses are obliged to sort and classify these industrial and telecoms data into core, important, and ordinary categories, and submit the catalog of important and core data to the local branch of the MIIT.

The document lists respective principles for identifying core, important, and ordinary data.

Generally, information that can pose a threat to national security, economic stability, and technological advancement, or significantly impact China’s industrial and telecommunication sectors can be labeled as important data or core data. However, the Measures does not provide any specific examples, leading many to find the definition still quite subjective.

Core data:

Important data:

Ordinary data:

According to the draft Measures, firms are required to sort out and record important and core data and report a data catalogue to the local branch of the MIIT. If reported data changes, firms are also obliged to report the updated information to the government within three months.

Based on the importance of the data, firms should adopt different degrees of protection measures when collecting, storing, processing, transferring, providing, disclosing, and disposing the important and core data.

Most notably, when it comes to cross-border data flows, the Measures has clearly prohibited core data from being transferred overseas and transferring important data overseas will be subject to government review.

This is consistent with China’s Data Security Law and Cybersecurity Law. The Cybersecurity Law stipulates that the operator of a critical information infrastructure should store important data collected and generated domestically within the territory of China. Where such information and data have to be provided abroad for business purpose, a security review should be conducted.

China’s Data Security Law, while it doesn’t offer detailed rules on the safety management for cross-border transfers of important data, prescribes the penalties for firms transferring important data overseas in violation of the Cybersecurity Law as well as other data security measures. The penalties include fines, suspension of the relevant business, suspension of the business for rectification, and revocation of the relevant business permit or business license.

In addition, the draft Measures point out that enterprises should set up the responsible departments and identify main persons in charge of data security management, as well as make clear key positions and personnel for data processing.

The following compliance requirements also deserve the attention of enterprises:

China has been tightening its data-related regulations. This summer, the government launched a cybersecurity investigation into ride-hailing app Didi after it rushed its public listing in the US. Didi was accused of seriously violating laws and regulations in its collection and use of personal information and was ordered to suspend new user registration.

In July, the Cyberspace Administration of China (CAC) revised its Cybersecurity Review Measures to make clear that any Chinese companies that hold the personal information of one million or more users would need to seek a government cybersecurity review before listing abroad.

A month later, China’s top legislature passed the Personal Information Protection Law. And in September, China’s new Data Security Law went effective. The MIIT’s Measures, once passed, will be yet be another key regulatory document on data security and help make rules clearer.

Cheng Yixiao will be the new CEO at Kuaishou Technology. Cheng founded the company with current CEO Su Hua. Su is stepping down as CEO to become chairman of the board. TikTok rival Kuaishou is currently struggling with major losses and a declining stock market value.

Trapped in Disneyland: On Sunday evening, authorities tested 33,000 people for COVID-19 at the Shanghai amusement park. Tens of thousands had to wait for hours for their test results before they were allowed to leave the park. The reason: On Saturday, a man had apparently visited the amusement park and tested positive for the Coronavirus.