The German Foreign Minister Annalena Baerbock and her Chinese counterpart Qin Gang have met no less than three times in one month. Unfortunately, the mood did not really warm up. Caution and mistrust again dominated the Sino-German dialogue at Tuesday’s meeting in Berlin. Even supposedly straightforward issues, such as the joint fight against climate change, culminated in minor friction, as Michael Radunski observed.

Ultimately, Baerbock once again criticized China’s supposed neutrality in the Ukraine war, quoting South African Nobel laureate Desmond Tutu: “If you are neutral in situations of injustice, you have chosen the side of the oppressor.” Qin retorted by saying that China had not caused the crisis and, unlike other countries, was not pouring oil on the fire.

The canceled visit of German Finance Minister Christian Lindner to China was also raised during the talks. For a “true dialogue,” ministers from both sides must have the chance to make direct contact, Baerbock warned. In any case, the two have already warmed up in Berlin for the next clash.

The 63rd Annual General Meeting of the Volkswagen Aktiengesellschaft will also be held in Berlin on Wednesday. Like BASF in mid-April, the company’s top executives will have to answer for their poor performance in China and the suspicion of forced labor in the supply chain. As Marcel Grzanna reports, representatives of the World Uyghur Congress will be present. This means that China board member Ralf Brantstaetter will face some difficult questions.

The mere numbers are impressive: Within a few months, Foreign Minister Annalena Baerbock has already met her Chinese counterpart for the third time. After her talks in China less than four weeks ago, Qin Gang traveled to Berlin on Tuesday. One might almost think the two of them are just getting along.

But the opposite seems true: The atmosphere between Baerbock and Qin is one of chilly caution and mistrust. On the one side is the values-driven Green politician; on the other, the former wolf warrior. Both have clear opinions – and express them. How this can end was evident three weeks ago in Beijing, when Baerbock and Qin exchanged verbal blows in front of the cameras.

This did not happen on Tuesday in Berlin. Instead, both sides notably attempted to find common ground on supposedly straightforward issues – albeit with limited success. The differences again quickly dominated the meeting, for example:

Regarding possible EU sanctions against Chinese companies, Baerbock pointed out that consultations were still ongoing. However, possible measures would not be directed against a specific country, but against the transfer of military and dual-use goods. In this regard, she said, China was also expected to exert corresponding pressure on its companies.

Qin assured that China would not supply weapons to crisis regions and would abide by Chinese laws regarding dual-use goods. He said there is a normal exchange between Chinese and Russian companies, which should not be disturbed. On the contrary, Qin said that China would strictly oppose any unilateral sanctions imposed by the EU against China. “We will also defend the legitimate and legal interests of our country and our companies.”

Baerbock sharply criticized China’s supposed neutrality in the Ukraine war – albeit indirectly. She quoted Desmond Tutu, the late South African Nobel laureate and Archbishop of Cape Town, who died at the end of 2021. He once said: “If you are neutral in situations of injustice, you have chosen the side of the oppressor.”

At this point, Qin barricaded himself behind familiar phrases: He insisted the crisis had not been caused by China and, unlike other countries, it was not pouring oil into the fire. Instead, President Xi Jinping had spoken with Vladimir Putin in Moscow and pushed for “peaceful dialogue” – and Russia’s leader had expressed his willingness to engage in dialogue.

The tension between Baerbock and Qin was also evident in the details. In response to a question from a Chinese journalist, Qin Gang was supposed to answer first, but the reporter carefully asked the German Foreign Minister to answer first – saying, “ladies first.” This would have been an excellent opportunity to lighten the tense atmosphere of the press conference with a smile – Qin, however, only rolled his eyes.

The two foreign ministers initially even tried to highlight the similarities – on supposedly uncomplicated issues:

But even here, frictions between China and Germany quickly erupt. While Baerbock praised China as a pioneer in renewable energies, she also criticized China as the largest emitter of greenhouse gases. She pointed out that around one-third of global emissions are caused by the People’s Republic.

And even when it comes to the preparations for the government consultations, problems exist – not between Baerbock and Qin, but involving Christian Lindner. The German Finance Minister actually planned to prepare the consultations for their ministries with his Chinese colleague Liu Kun in Beijing on Wednesday. But China canceled the meeting on short notice. The official reason: scheduling problems – which is probably more the polite form of: “We don’t have time for you right now.”

Berlin is correspondingly peeved. “A disrespectful affront not only to Germany’s finance minister, but also against us as a liberal party,” commented Frank Müller-Rosentritt, MP for the Liberal Democratic Party (FDP) and member of the Committee on Foreign Affairs. “If Beijing’s leadership believes it can ‘educate’ us with such actions, it is on the wrong track.”

Green European politician Reinhard Buetikofer ranted on Twitter: “This Chinese affront does not only concern the FDP. We will not let Beijing dictate our China-Taiwan policy.”

Lindner himself promised “a confident and realistic” relationship with China. “Those who only focus on economic relations lose a piece of the civilizational mission,” Lindner wrote on Twitter. He continued: “We won’t let anyone buy our liberal values for good business, but we need a better balance than before.” However, it would be naïve to believe that Germany could simply decouple itself economically from China, Lindner added.

Baerbock and Qin also sought common ground in Tuesday’s éclat. The German Foreign Minister called for a “genuine dialogue,” for which direct contact between the respective ministers was necessary. Qin, in turn, assured that Lindner was naturally welcome in China. It was a purely technical question that should not be over-interpreted. In any case, he expressed the hope that a new date for the meeting would be found quickly.

However, Baerbock and Qin should know that frequent meetings are no guarantee for common positions. But it is also clear that a frequent exchange at least increases the chances of eventually finding common ground again.

Next DAX company, same procedure: As with BASF in mid-April, the asset management company Union Investment, the Association of Critical Shareholders and representatives of the World Uyghur Congress will also confront Volkswagen’s executives at the annual general meeting. “We have asked the questions about the treatment of the Uyghurs, about possible human rights violations and about an independent investigation in dialogue with VW several times, but have not yet received satisfactory answers,” says Janne Werning, Head of ESG Capital Markets & Stewardship at Union Investment. His commentary is available to China.Table in advance.

Union Investment wants to know when Volkswagen will appoint an external and independent audit firm to scrutinize VW’s activities in Xinjiang. A British Sheffield Hallam University study reinforced the suspicion that the German group’s supply chains are not free of forced labor. The company claims that its plant in the regional capital Urumqi is clean. However, Volkswagen fails to provide transparent information on the origin of its machined parts.

The fund managers stress that they raise critical questions entirely in the interest of shareholder benefit. “It is in all our interests to know what is happening there and then, if necessary, to draw the consequences,” says Werning. It is at least rumored that Union Investment could draw consequences, as the fund company Deka has already done. Deka pulled all VW stocks from its sustainability program.

Outside the entrance at the Messedamm in Berlin, shareholders already get a glimpse of what will be discussed on Wednesday morning in the City Cube. The Society for Threatened Peoples (GfbV), the Critical Shareholders and Uyghurs will hold a protest, demanding “the end of forced labor in VW supply chains.” It will involve a VW car with two people shaking hands in front of it. One person will wear a mask of China’s President Xi Jinping, and the other a VW mask. The person playing Xi will be holding forced laborers on a chain behind him.

During the shareholders’ meeting, Uyghur representatives Haiyuer Kuerban and Kendyl Salcito, co-author of the Sheffield study, will speak to shareholders. Kuerban will also address China board member Ralf Brandstätter, who traveled to Urumqi in February, visited the local factory, and spoke with workers on the ground. “In a region where there is total surveillance, how were you able to ensure that these workers could speak freely with you?” asks Kuerban, whose speech was also provided to China.Table in advance.

The sincere answer should be that this is not possible. Moreover, insiders claim that when speaking to high-ranking Volkswagen managers, they got the impression that the constant confrontation with the human rights crime in Xinjiang was only getting on their nerves and that many of those in charge were not genuinely interested in clarifying the situation.

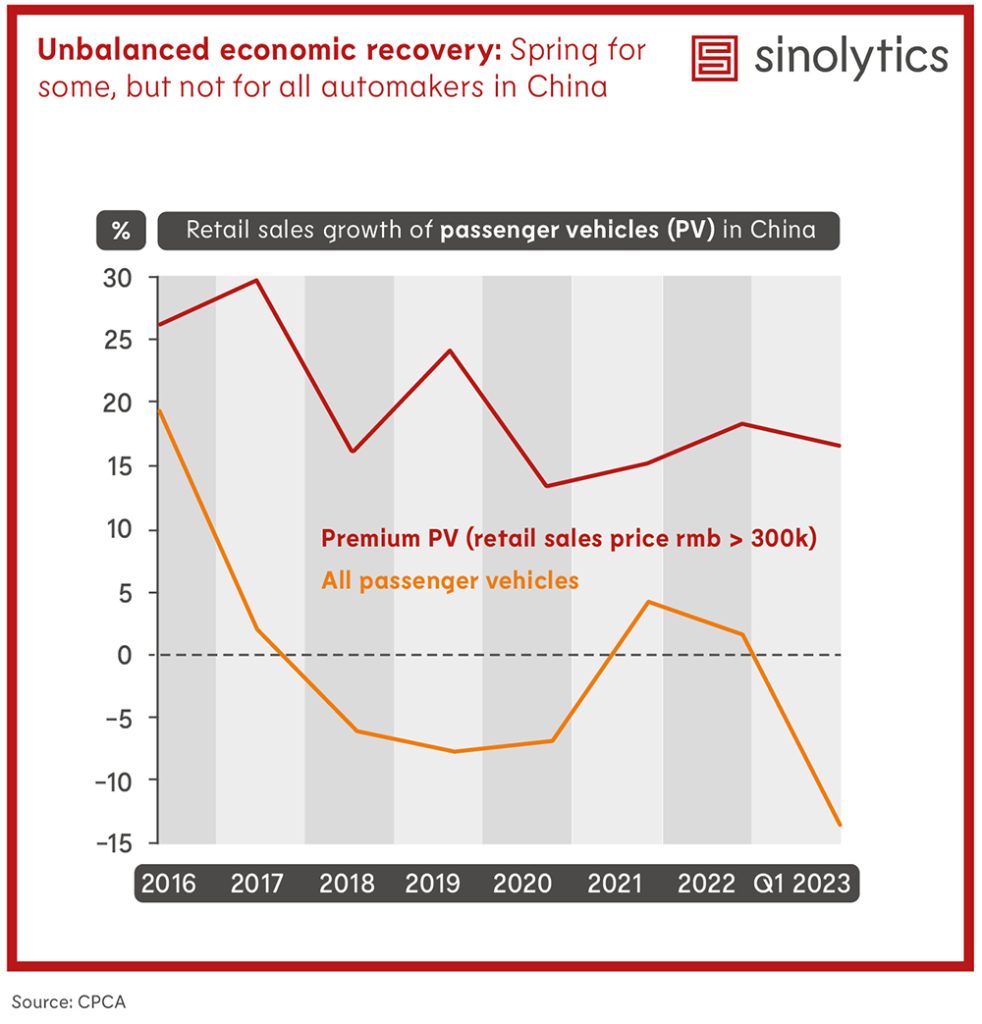

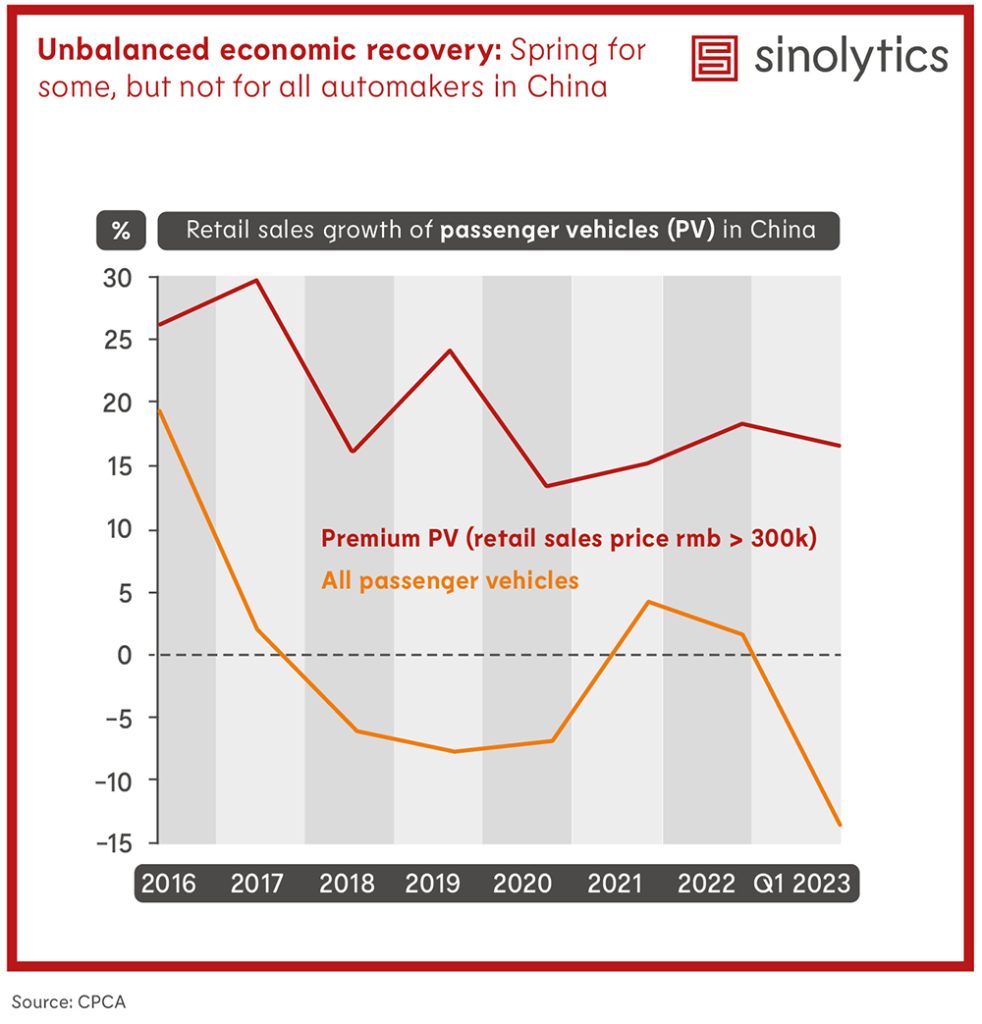

However, Union Investment will not only be addressing the Uyghur issue. The fund company also seeks answers to the developments on the Chinese car market. Werning believes it is not just a matter of fighting for market leadership for Volkswagen, but of “remaining relevant in the world’s largest car market.” Moreover, Union Investment expects that VW will have to defend its market position against Chinese competitors on its domestic market “in the not too distant future.”

“How will you keep up with companies like BYD? What gives you the confidence that the new electric models will meet the taste of Chinese buyers? And how do you plan to push sales of electric vehicles beyond China?” Werning will be asking VW executives.

BYD recently replaced Volkswagen as the Chinese market leader, winning over consumers primarily thanks to its EV product range. Volkswagen subsequently announced plans to streamline its decision-making and development processes.

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

German Chancellor Olaf Scholz has spoken before the EU Parliament in favor of reducing economic risks when dealing with China. Scholz told MEPs in Strasbourg on Tuesday that he agreed with EU Commission President Ursula von der Leyen that there should be no decoupling, but rather smart risk reduction.

The relationship with China is accurately defined by the well-known triad “partner, competitor, systemic rival,” Scholz said in a speech on the occasion of Europe Day. However, rivalry and competition on the part of China had undoubtedly increased.

The Chancellor stressed that the countries of the Global South are new partners whose concerns and legitimate interests must be taken seriously. Europe must stand up for food security and poverty reduction with solidarity and vigor – and keep the climate and environmental action promises that have been made, he said.

Scholz spoke out against attempts to turn the EU into a third superpower alongside the United States and China. “Those who are nostalgic for the dream of a European world power, those who serve national superpower fantasies, are stuck in the past.”

Instead, Europe could rely on new free trade agreements such as Mercosur. Such fair agreements must promote the economic development of the partners, not hinder it, Scholz said. “Fair, that means, for example, that processing of raw materials has to take place locally – not in China or elsewhere.” ari

The EU ambassador to China has criticized EU High Representative for Foreign Josep Borrell’s call for European warships to patrol the Taiwan Strait. This statement was “greatly exaggerated,” Jorge Toledo Albiñana said at a press conference in Beijing on Tuesday. In an op-ed article in the French Sunday newspaper Journal du Dimanche, Borrell called for European navies to patrol the strait because Taiwan affects the EU “economically, commercially and technologically.” The EU ambassador to China thus directly criticized statements made by his boss in Brussels. Toledo Albiñana himself has already caused uproar in the past with statements on Taiwan.

At the press conference, Toledo Albiñana also welcomed the telephone call between China’s President Xi Jinping and Ukraine’s President Volodymyr Zelenskiy: “We would like China to go further and help more to reach a just peace, which involves withdrawal of Russian troops from Ukraine.” He also criticized the new anti-espionage law as “not good news.” The new law is causing considerable unease among foreign companies in China. ari/rtr

China expelled Canadian Consul General in Shanghai Jennifer Lynn Lalonde on Tuesday. Lalonde must leave China by May 13. The move was Beijing’s response to a request by the Canadian government the day prior for a Toronto-based Chinese diplomat to leave the country. Tensions between the two countries thus continue to escalate.

Following the expulsion of the Consul General, Prime Minister Justin Trudeau said Canada will not be intimidated by China’s retaliation: “We will continue to do everything necessary to keep Canadians protected from foreign interference.”

The background to the dispute is an intelligence report that accused expelled Chinese diplomat Zhao Wei of attempts to influence and pressure Canadian MP Michael Chong. On May 1, details of the already two-year-old Canadian intelligence agency CSIS report on Chinese influence in Canada were leaked.

The report also contained information about a possible threat against Conservative MP Michael Chong and his family members living in Hong Kong. Such intimidation attempts against politicians of Chinese origin are not uncommon in Canada and other countries with large Chinese diasporas. In 2021, Chong endorsed a successful motion in Parliament that labeled China’s treatment of its Uyghur minority as genocide.

Chong said he was “deeply disappointed” when he learned of the possible threat against his family from an article in the Canadian Globe and Mail newspaper. He criticized the Canadian government for its inaction. Since the report, he repeatedly called for Zhao’s expulsion. Citing an unnamed source, the newspaper also reported that Zhao was involved in obtaining information about Chong. China denied any interference in Canada’s internal affairs and said it had no interest in doing so. rtr/cyb

China has announced a summit meeting with five Central Asian states in the ancient imperial city of Xi’an. Xi will chair the meeting, dubbed “C+C5,” on May 18, the Foreign Ministry in Beijing announced. According to the statement, the presidents of Kazakhstan, Tajikistan, Uzbekistan, Kyrgyzstan and Turkmenistan are expected to attend. The meeting is considered part of Beijing’s ambitions to strengthen strategic cooperation with Central Asia on various issues, including the Silk Road Initiative (BRI) first launched in Kazakhstan. At a preparatory meeting of foreign ministers in April, China’s Foreign Office chief Qin Gang also underlined Beijing’s wish to work with Central Asia to push for a “solution to the Ukraine crisis.”

Western sanctions against Russia and global geopolitical tensions have created an economic vacuum in the region that Beijing is attempting to fill with the help of diplomatic advances and the BRI. The five states invited to Xi’an are former Soviet republics wedged between the giants of Russia and China. These countries are exercising caution in light of Putin’s war of aggression in Ukraine – which, after all, is also an ex-Soviet republic. Kazakhstan, for example, fears that Putin might get the idea of also wanting to “liberate” its Russian minority. The five states are therefore engaged in a balancing act in their relations with Moscow and China. At the United Nations they have so far abstained or not voted at all on resolutions concerning the war. Their presidents, however, attended Vladimir Putin’s military parade in Moscow on Tuesday, marking the Soviet Union’s victory over Nazi Germany in World War II. ck

The Taiwanese company Foxconn has acquired land near the Bangalore airport. Apple’s main supplier paid 3 billion rupees (33.55 million euros) for the 1.2 million square meters. This is according to a statement filed with the London Stock Exchange on Tuesday. It would be the second Foxconn factory in India. The company has already been manufacturing smartphones in the southern state of Tamil Nadu since 2019, including the latest iPhone 14.

Hon Hai Precision Industry – the tech company’s official name – also reportedly plans to acquire the rights to use a 480,000-square-meter plot in Vietnam’s Nghe An province. Foxconn’s production has so far been concentrated in China. The world’s largest iPhone factory in Zhengzhou currently employs 200,000 workers for Foxconn. Last fall, its workforce protested due to poor working conditions and strict lockdown measures.

It has been known for some time that Foxconn wants to set up more iPhone production facilities outside China. Bangalore, which is considered India’s Silicon Valley, is the capital of the southwestern Indian state of Karnataka. Foxconn CEO Young Liu had visited the city in March. Karnataka’s government chief Basavaraj Bommai announced then that Apple would “soon” manufacture iPhones in a new factory there and create “about 100,000 jobs.” cyb

What will be the next frontier amid escalating US-China strategic competition? As US national security advisor Jake Sullivan singled out critical minerals – the backbone of clean energy – in one breath with semiconductors in his remarks in April 2023 on “renewing American economic leadership” at the Brookings Institution, no one would doubt critical minerals such as lithium, cobalt, nickel, and graphite would become the next frontier where the US was determined to compete with China to make the respective supply chains more resilient and secure.

According to an OECD Trade Policy Paper from April 2023, Beijing increased the number of export restrictions on critical raw materials needed for electrical cars and renewable energy such as lithium, cobalt and manganese by a factor of nine in the 11 years to 2020. But it is not just China: countries like India, Argentina, Russia, Vietnam and Kazakhstan topped the chart of newly introduced export restrictions during the 2009-20 timeframe, according to the same paper.

Other minerals-rich countries have not helped ease the global competition for critical minerals either, rather they are pushing to take greater control of their domestic production: Chile, for example, the world’s second-largest lithium producer only behind Australia, has moved to take greater state control of lithium projects, at the potential expense of commercial investors. Governments from Indonesia to Bolivia and Mexico also stepped up their efforts to ask for greater processing and manufacturing to be done domestically through measures such as export bans on ore and renegotiating a state stake in privately run miners.

As a result, it came as no surprise that the EU, the most aggressive advocate for green transition on the planet, followed suit and unveiled the Critical Raw Materials Act in March 2023, to boost security and resilience of its clean energy supply chains by mining and processing more materials domestically and streamlining the administration of projects of strategic importance. When EU Commission President von der Leyen asked for “de-risking” its economic relations with China, she had securing critical materials supplies at the center of her mind.

Although the US has an unequivocal lead over China in semiconductor manufacturing, China is a world leader in critical minerals, processing more than 80 percent of such minerals in the world. Consider lithium, the critical electric vehicle battery metal, China is now the world’s third-largest lithium supplier, behind Australia and Chile, and it is forecast to become the biggest supplier by 2030. Chinese companies can be seen scouring the world, with a focus on Latin America and Africa, for investment in mineral assets.

In Sullivan’s remarks, he said that America would “unapologetically pursue a modern industrial strategy”, a concept previously viewed as the antithesis to the “Washington Consensus”. The sharp turn, if not a U-turn, on industrial policy can be seen as a sense of urgency, even anxiety, in Washington about America losing its core competitiveness to the whole-of-the-nation system championed by China. By taking some pages from China’s playbook, the US is on course to allow a more visible hand in key sectors that are considered “foundational” to American state capacity and competitiveness, as evidenced by the likes of the recently passed CHIPS & Science Act and the Inflation Reduction Act (IRA).

It is thus interesting to see more convergence than divergence in both countries’ approach toward economic growth and security in times of geopolitical competition, when strategic technologies – beyond critical minerals – are seen to have the potential to catapult the succeeding competitor to a hard-to-shake position of economic dominance. Be it de-coupling or de-risking, the US and Europe would be more similar to their strategic rivals like China in securing their national ambitions and laying a solid foundation for long-term growth.

From this perspective, even a potential wholesale decoupling would not change the fact that approaches towards strengthened national security and industrial resilience will continue to be pursued on all sides. The most immediate implication from this is that the globalized supply chains of the past four decades are being fragmented into regionalized chains, in which like-minded countries would coalesce to guarantee they do not fall victim to the weaponization of other countries’ supply. With regards to critical minerals, all trade blocs are mounting narrower or broader initiatives to build their “clubs”: the US under its Minerals Security Partnership, the EU under its Critical Raw Materials Club or China using its omnipotent cooperation tool of the Belt and Road Initiative.

During times defined by geopolitical competition, even the most powerful country could fall into the position of victimhood. The best scenario that can be expected appears to be healthy competition, whereby the success of one country does not come at the expense of the other and when there are diplomatic guardrails or sufficient economic interdependence in place to disincentivize further weaponization of supply chains.

However, in the words of Jake Sullivan, the US ultimately strives for “a strong, resilient, and leading-edge techno-industrial base that the United States and its like-minded partners, established and emerging economies alike, can invest in and rely upon together.” This bluntly forebodes a future with more contoured technological bloc building with critical minerals becoming another key fault line.

Shan Huang is Senior Advisor at China Macro Group, focusing on China’s foreign and trade policy, geopolitics, and China-US relations.

Markus Herrmann is the co-founder and Managing Director of China Macro Group (CMG / www.chinamacro.eu) and an experienced consultant for European companies and public institutions in the Chinese market.

This article is part of the series “Global China Conversations” of the Kiel Institute for the World Economy (IfW). On Thursday, 11. May 2023 (12:00 CET), authors Markus Herrmann and Nadine Godehardt (German Institute for International and Security Affairs) will discuss the topic: “Geopolitics and Raw Materials: How Can Europe Balance China’s Centrality?”. China.Table is the media partner of the event series.

Sebastian Moerler moved up from Consultant to Project Manager at Boston Consulting Group’s Shanghai office in May. He is a member of the Principal Investors & Private Equity (PIPE) taskforce and conducts commercial due diligence, strategy and portfolio optimization projects for investors.

Kuangxin Zhou has been Technical Director of Abionik Group China, a provider of environmental technology for water and air treatment, since April. He previously worked as Project Manager at the Kompetenzzentrum Wasser Berlin. Since 2013, he has also served as Chairman of the German-Sino Promotion Center for Environment and Energy, which he also founded.

Is something changing in your organization? Why not send a note for our staff section to heads@table.media!

A drone flies over the vast burial grounds of the Songhe Cemetery in Shanghai. The cemetery was built in 1987 and is currently the target of criticism on China’s social media due to its horrendous “real estate prices.” Anyone wishing to be laid to rest here has to pay the equivalent of up to 45,000 euros – and this for plots as small as 0.6 square meters. This means that the dead reside in the pagoda-decorated celebrity cemetery at prices six times higher than the living in the Huangpu district in the heart of the already very expensive metropolis.

The German Foreign Minister Annalena Baerbock and her Chinese counterpart Qin Gang have met no less than three times in one month. Unfortunately, the mood did not really warm up. Caution and mistrust again dominated the Sino-German dialogue at Tuesday’s meeting in Berlin. Even supposedly straightforward issues, such as the joint fight against climate change, culminated in minor friction, as Michael Radunski observed.

Ultimately, Baerbock once again criticized China’s supposed neutrality in the Ukraine war, quoting South African Nobel laureate Desmond Tutu: “If you are neutral in situations of injustice, you have chosen the side of the oppressor.” Qin retorted by saying that China had not caused the crisis and, unlike other countries, was not pouring oil on the fire.

The canceled visit of German Finance Minister Christian Lindner to China was also raised during the talks. For a “true dialogue,” ministers from both sides must have the chance to make direct contact, Baerbock warned. In any case, the two have already warmed up in Berlin for the next clash.

The 63rd Annual General Meeting of the Volkswagen Aktiengesellschaft will also be held in Berlin on Wednesday. Like BASF in mid-April, the company’s top executives will have to answer for their poor performance in China and the suspicion of forced labor in the supply chain. As Marcel Grzanna reports, representatives of the World Uyghur Congress will be present. This means that China board member Ralf Brantstaetter will face some difficult questions.

The mere numbers are impressive: Within a few months, Foreign Minister Annalena Baerbock has already met her Chinese counterpart for the third time. After her talks in China less than four weeks ago, Qin Gang traveled to Berlin on Tuesday. One might almost think the two of them are just getting along.

But the opposite seems true: The atmosphere between Baerbock and Qin is one of chilly caution and mistrust. On the one side is the values-driven Green politician; on the other, the former wolf warrior. Both have clear opinions – and express them. How this can end was evident three weeks ago in Beijing, when Baerbock and Qin exchanged verbal blows in front of the cameras.

This did not happen on Tuesday in Berlin. Instead, both sides notably attempted to find common ground on supposedly straightforward issues – albeit with limited success. The differences again quickly dominated the meeting, for example:

Regarding possible EU sanctions against Chinese companies, Baerbock pointed out that consultations were still ongoing. However, possible measures would not be directed against a specific country, but against the transfer of military and dual-use goods. In this regard, she said, China was also expected to exert corresponding pressure on its companies.

Qin assured that China would not supply weapons to crisis regions and would abide by Chinese laws regarding dual-use goods. He said there is a normal exchange between Chinese and Russian companies, which should not be disturbed. On the contrary, Qin said that China would strictly oppose any unilateral sanctions imposed by the EU against China. “We will also defend the legitimate and legal interests of our country and our companies.”

Baerbock sharply criticized China’s supposed neutrality in the Ukraine war – albeit indirectly. She quoted Desmond Tutu, the late South African Nobel laureate and Archbishop of Cape Town, who died at the end of 2021. He once said: “If you are neutral in situations of injustice, you have chosen the side of the oppressor.”

At this point, Qin barricaded himself behind familiar phrases: He insisted the crisis had not been caused by China and, unlike other countries, it was not pouring oil into the fire. Instead, President Xi Jinping had spoken with Vladimir Putin in Moscow and pushed for “peaceful dialogue” – and Russia’s leader had expressed his willingness to engage in dialogue.

The tension between Baerbock and Qin was also evident in the details. In response to a question from a Chinese journalist, Qin Gang was supposed to answer first, but the reporter carefully asked the German Foreign Minister to answer first – saying, “ladies first.” This would have been an excellent opportunity to lighten the tense atmosphere of the press conference with a smile – Qin, however, only rolled his eyes.

The two foreign ministers initially even tried to highlight the similarities – on supposedly uncomplicated issues:

But even here, frictions between China and Germany quickly erupt. While Baerbock praised China as a pioneer in renewable energies, she also criticized China as the largest emitter of greenhouse gases. She pointed out that around one-third of global emissions are caused by the People’s Republic.

And even when it comes to the preparations for the government consultations, problems exist – not between Baerbock and Qin, but involving Christian Lindner. The German Finance Minister actually planned to prepare the consultations for their ministries with his Chinese colleague Liu Kun in Beijing on Wednesday. But China canceled the meeting on short notice. The official reason: scheduling problems – which is probably more the polite form of: “We don’t have time for you right now.”

Berlin is correspondingly peeved. “A disrespectful affront not only to Germany’s finance minister, but also against us as a liberal party,” commented Frank Müller-Rosentritt, MP for the Liberal Democratic Party (FDP) and member of the Committee on Foreign Affairs. “If Beijing’s leadership believes it can ‘educate’ us with such actions, it is on the wrong track.”

Green European politician Reinhard Buetikofer ranted on Twitter: “This Chinese affront does not only concern the FDP. We will not let Beijing dictate our China-Taiwan policy.”

Lindner himself promised “a confident and realistic” relationship with China. “Those who only focus on economic relations lose a piece of the civilizational mission,” Lindner wrote on Twitter. He continued: “We won’t let anyone buy our liberal values for good business, but we need a better balance than before.” However, it would be naïve to believe that Germany could simply decouple itself economically from China, Lindner added.

Baerbock and Qin also sought common ground in Tuesday’s éclat. The German Foreign Minister called for a “genuine dialogue,” for which direct contact between the respective ministers was necessary. Qin, in turn, assured that Lindner was naturally welcome in China. It was a purely technical question that should not be over-interpreted. In any case, he expressed the hope that a new date for the meeting would be found quickly.

However, Baerbock and Qin should know that frequent meetings are no guarantee for common positions. But it is also clear that a frequent exchange at least increases the chances of eventually finding common ground again.

Next DAX company, same procedure: As with BASF in mid-April, the asset management company Union Investment, the Association of Critical Shareholders and representatives of the World Uyghur Congress will also confront Volkswagen’s executives at the annual general meeting. “We have asked the questions about the treatment of the Uyghurs, about possible human rights violations and about an independent investigation in dialogue with VW several times, but have not yet received satisfactory answers,” says Janne Werning, Head of ESG Capital Markets & Stewardship at Union Investment. His commentary is available to China.Table in advance.

Union Investment wants to know when Volkswagen will appoint an external and independent audit firm to scrutinize VW’s activities in Xinjiang. A British Sheffield Hallam University study reinforced the suspicion that the German group’s supply chains are not free of forced labor. The company claims that its plant in the regional capital Urumqi is clean. However, Volkswagen fails to provide transparent information on the origin of its machined parts.

The fund managers stress that they raise critical questions entirely in the interest of shareholder benefit. “It is in all our interests to know what is happening there and then, if necessary, to draw the consequences,” says Werning. It is at least rumored that Union Investment could draw consequences, as the fund company Deka has already done. Deka pulled all VW stocks from its sustainability program.

Outside the entrance at the Messedamm in Berlin, shareholders already get a glimpse of what will be discussed on Wednesday morning in the City Cube. The Society for Threatened Peoples (GfbV), the Critical Shareholders and Uyghurs will hold a protest, demanding “the end of forced labor in VW supply chains.” It will involve a VW car with two people shaking hands in front of it. One person will wear a mask of China’s President Xi Jinping, and the other a VW mask. The person playing Xi will be holding forced laborers on a chain behind him.

During the shareholders’ meeting, Uyghur representatives Haiyuer Kuerban and Kendyl Salcito, co-author of the Sheffield study, will speak to shareholders. Kuerban will also address China board member Ralf Brandstätter, who traveled to Urumqi in February, visited the local factory, and spoke with workers on the ground. “In a region where there is total surveillance, how were you able to ensure that these workers could speak freely with you?” asks Kuerban, whose speech was also provided to China.Table in advance.

The sincere answer should be that this is not possible. Moreover, insiders claim that when speaking to high-ranking Volkswagen managers, they got the impression that the constant confrontation with the human rights crime in Xinjiang was only getting on their nerves and that many of those in charge were not genuinely interested in clarifying the situation.

However, Union Investment will not only be addressing the Uyghur issue. The fund company also seeks answers to the developments on the Chinese car market. Werning believes it is not just a matter of fighting for market leadership for Volkswagen, but of “remaining relevant in the world’s largest car market.” Moreover, Union Investment expects that VW will have to defend its market position against Chinese competitors on its domestic market “in the not too distant future.”

“How will you keep up with companies like BYD? What gives you the confidence that the new electric models will meet the taste of Chinese buyers? And how do you plan to push sales of electric vehicles beyond China?” Werning will be asking VW executives.

BYD recently replaced Volkswagen as the Chinese market leader, winning over consumers primarily thanks to its EV product range. Volkswagen subsequently announced plans to streamline its decision-making and development processes.

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

German Chancellor Olaf Scholz has spoken before the EU Parliament in favor of reducing economic risks when dealing with China. Scholz told MEPs in Strasbourg on Tuesday that he agreed with EU Commission President Ursula von der Leyen that there should be no decoupling, but rather smart risk reduction.

The relationship with China is accurately defined by the well-known triad “partner, competitor, systemic rival,” Scholz said in a speech on the occasion of Europe Day. However, rivalry and competition on the part of China had undoubtedly increased.

The Chancellor stressed that the countries of the Global South are new partners whose concerns and legitimate interests must be taken seriously. Europe must stand up for food security and poverty reduction with solidarity and vigor – and keep the climate and environmental action promises that have been made, he said.

Scholz spoke out against attempts to turn the EU into a third superpower alongside the United States and China. “Those who are nostalgic for the dream of a European world power, those who serve national superpower fantasies, are stuck in the past.”

Instead, Europe could rely on new free trade agreements such as Mercosur. Such fair agreements must promote the economic development of the partners, not hinder it, Scholz said. “Fair, that means, for example, that processing of raw materials has to take place locally – not in China or elsewhere.” ari

The EU ambassador to China has criticized EU High Representative for Foreign Josep Borrell’s call for European warships to patrol the Taiwan Strait. This statement was “greatly exaggerated,” Jorge Toledo Albiñana said at a press conference in Beijing on Tuesday. In an op-ed article in the French Sunday newspaper Journal du Dimanche, Borrell called for European navies to patrol the strait because Taiwan affects the EU “economically, commercially and technologically.” The EU ambassador to China thus directly criticized statements made by his boss in Brussels. Toledo Albiñana himself has already caused uproar in the past with statements on Taiwan.

At the press conference, Toledo Albiñana also welcomed the telephone call between China’s President Xi Jinping and Ukraine’s President Volodymyr Zelenskiy: “We would like China to go further and help more to reach a just peace, which involves withdrawal of Russian troops from Ukraine.” He also criticized the new anti-espionage law as “not good news.” The new law is causing considerable unease among foreign companies in China. ari/rtr

China expelled Canadian Consul General in Shanghai Jennifer Lynn Lalonde on Tuesday. Lalonde must leave China by May 13. The move was Beijing’s response to a request by the Canadian government the day prior for a Toronto-based Chinese diplomat to leave the country. Tensions between the two countries thus continue to escalate.

Following the expulsion of the Consul General, Prime Minister Justin Trudeau said Canada will not be intimidated by China’s retaliation: “We will continue to do everything necessary to keep Canadians protected from foreign interference.”

The background to the dispute is an intelligence report that accused expelled Chinese diplomat Zhao Wei of attempts to influence and pressure Canadian MP Michael Chong. On May 1, details of the already two-year-old Canadian intelligence agency CSIS report on Chinese influence in Canada were leaked.

The report also contained information about a possible threat against Conservative MP Michael Chong and his family members living in Hong Kong. Such intimidation attempts against politicians of Chinese origin are not uncommon in Canada and other countries with large Chinese diasporas. In 2021, Chong endorsed a successful motion in Parliament that labeled China’s treatment of its Uyghur minority as genocide.

Chong said he was “deeply disappointed” when he learned of the possible threat against his family from an article in the Canadian Globe and Mail newspaper. He criticized the Canadian government for its inaction. Since the report, he repeatedly called for Zhao’s expulsion. Citing an unnamed source, the newspaper also reported that Zhao was involved in obtaining information about Chong. China denied any interference in Canada’s internal affairs and said it had no interest in doing so. rtr/cyb

China has announced a summit meeting with five Central Asian states in the ancient imperial city of Xi’an. Xi will chair the meeting, dubbed “C+C5,” on May 18, the Foreign Ministry in Beijing announced. According to the statement, the presidents of Kazakhstan, Tajikistan, Uzbekistan, Kyrgyzstan and Turkmenistan are expected to attend. The meeting is considered part of Beijing’s ambitions to strengthen strategic cooperation with Central Asia on various issues, including the Silk Road Initiative (BRI) first launched in Kazakhstan. At a preparatory meeting of foreign ministers in April, China’s Foreign Office chief Qin Gang also underlined Beijing’s wish to work with Central Asia to push for a “solution to the Ukraine crisis.”

Western sanctions against Russia and global geopolitical tensions have created an economic vacuum in the region that Beijing is attempting to fill with the help of diplomatic advances and the BRI. The five states invited to Xi’an are former Soviet republics wedged between the giants of Russia and China. These countries are exercising caution in light of Putin’s war of aggression in Ukraine – which, after all, is also an ex-Soviet republic. Kazakhstan, for example, fears that Putin might get the idea of also wanting to “liberate” its Russian minority. The five states are therefore engaged in a balancing act in their relations with Moscow and China. At the United Nations they have so far abstained or not voted at all on resolutions concerning the war. Their presidents, however, attended Vladimir Putin’s military parade in Moscow on Tuesday, marking the Soviet Union’s victory over Nazi Germany in World War II. ck

The Taiwanese company Foxconn has acquired land near the Bangalore airport. Apple’s main supplier paid 3 billion rupees (33.55 million euros) for the 1.2 million square meters. This is according to a statement filed with the London Stock Exchange on Tuesday. It would be the second Foxconn factory in India. The company has already been manufacturing smartphones in the southern state of Tamil Nadu since 2019, including the latest iPhone 14.

Hon Hai Precision Industry – the tech company’s official name – also reportedly plans to acquire the rights to use a 480,000-square-meter plot in Vietnam’s Nghe An province. Foxconn’s production has so far been concentrated in China. The world’s largest iPhone factory in Zhengzhou currently employs 200,000 workers for Foxconn. Last fall, its workforce protested due to poor working conditions and strict lockdown measures.

It has been known for some time that Foxconn wants to set up more iPhone production facilities outside China. Bangalore, which is considered India’s Silicon Valley, is the capital of the southwestern Indian state of Karnataka. Foxconn CEO Young Liu had visited the city in March. Karnataka’s government chief Basavaraj Bommai announced then that Apple would “soon” manufacture iPhones in a new factory there and create “about 100,000 jobs.” cyb

What will be the next frontier amid escalating US-China strategic competition? As US national security advisor Jake Sullivan singled out critical minerals – the backbone of clean energy – in one breath with semiconductors in his remarks in April 2023 on “renewing American economic leadership” at the Brookings Institution, no one would doubt critical minerals such as lithium, cobalt, nickel, and graphite would become the next frontier where the US was determined to compete with China to make the respective supply chains more resilient and secure.

According to an OECD Trade Policy Paper from April 2023, Beijing increased the number of export restrictions on critical raw materials needed for electrical cars and renewable energy such as lithium, cobalt and manganese by a factor of nine in the 11 years to 2020. But it is not just China: countries like India, Argentina, Russia, Vietnam and Kazakhstan topped the chart of newly introduced export restrictions during the 2009-20 timeframe, according to the same paper.

Other minerals-rich countries have not helped ease the global competition for critical minerals either, rather they are pushing to take greater control of their domestic production: Chile, for example, the world’s second-largest lithium producer only behind Australia, has moved to take greater state control of lithium projects, at the potential expense of commercial investors. Governments from Indonesia to Bolivia and Mexico also stepped up their efforts to ask for greater processing and manufacturing to be done domestically through measures such as export bans on ore and renegotiating a state stake in privately run miners.

As a result, it came as no surprise that the EU, the most aggressive advocate for green transition on the planet, followed suit and unveiled the Critical Raw Materials Act in March 2023, to boost security and resilience of its clean energy supply chains by mining and processing more materials domestically and streamlining the administration of projects of strategic importance. When EU Commission President von der Leyen asked for “de-risking” its economic relations with China, she had securing critical materials supplies at the center of her mind.

Although the US has an unequivocal lead over China in semiconductor manufacturing, China is a world leader in critical minerals, processing more than 80 percent of such minerals in the world. Consider lithium, the critical electric vehicle battery metal, China is now the world’s third-largest lithium supplier, behind Australia and Chile, and it is forecast to become the biggest supplier by 2030. Chinese companies can be seen scouring the world, with a focus on Latin America and Africa, for investment in mineral assets.

In Sullivan’s remarks, he said that America would “unapologetically pursue a modern industrial strategy”, a concept previously viewed as the antithesis to the “Washington Consensus”. The sharp turn, if not a U-turn, on industrial policy can be seen as a sense of urgency, even anxiety, in Washington about America losing its core competitiveness to the whole-of-the-nation system championed by China. By taking some pages from China’s playbook, the US is on course to allow a more visible hand in key sectors that are considered “foundational” to American state capacity and competitiveness, as evidenced by the likes of the recently passed CHIPS & Science Act and the Inflation Reduction Act (IRA).

It is thus interesting to see more convergence than divergence in both countries’ approach toward economic growth and security in times of geopolitical competition, when strategic technologies – beyond critical minerals – are seen to have the potential to catapult the succeeding competitor to a hard-to-shake position of economic dominance. Be it de-coupling or de-risking, the US and Europe would be more similar to their strategic rivals like China in securing their national ambitions and laying a solid foundation for long-term growth.

From this perspective, even a potential wholesale decoupling would not change the fact that approaches towards strengthened national security and industrial resilience will continue to be pursued on all sides. The most immediate implication from this is that the globalized supply chains of the past four decades are being fragmented into regionalized chains, in which like-minded countries would coalesce to guarantee they do not fall victim to the weaponization of other countries’ supply. With regards to critical minerals, all trade blocs are mounting narrower or broader initiatives to build their “clubs”: the US under its Minerals Security Partnership, the EU under its Critical Raw Materials Club or China using its omnipotent cooperation tool of the Belt and Road Initiative.

During times defined by geopolitical competition, even the most powerful country could fall into the position of victimhood. The best scenario that can be expected appears to be healthy competition, whereby the success of one country does not come at the expense of the other and when there are diplomatic guardrails or sufficient economic interdependence in place to disincentivize further weaponization of supply chains.

However, in the words of Jake Sullivan, the US ultimately strives for “a strong, resilient, and leading-edge techno-industrial base that the United States and its like-minded partners, established and emerging economies alike, can invest in and rely upon together.” This bluntly forebodes a future with more contoured technological bloc building with critical minerals becoming another key fault line.

Shan Huang is Senior Advisor at China Macro Group, focusing on China’s foreign and trade policy, geopolitics, and China-US relations.

Markus Herrmann is the co-founder and Managing Director of China Macro Group (CMG / www.chinamacro.eu) and an experienced consultant for European companies and public institutions in the Chinese market.

This article is part of the series “Global China Conversations” of the Kiel Institute for the World Economy (IfW). On Thursday, 11. May 2023 (12:00 CET), authors Markus Herrmann and Nadine Godehardt (German Institute for International and Security Affairs) will discuss the topic: “Geopolitics and Raw Materials: How Can Europe Balance China’s Centrality?”. China.Table is the media partner of the event series.

Sebastian Moerler moved up from Consultant to Project Manager at Boston Consulting Group’s Shanghai office in May. He is a member of the Principal Investors & Private Equity (PIPE) taskforce and conducts commercial due diligence, strategy and portfolio optimization projects for investors.

Kuangxin Zhou has been Technical Director of Abionik Group China, a provider of environmental technology for water and air treatment, since April. He previously worked as Project Manager at the Kompetenzzentrum Wasser Berlin. Since 2013, he has also served as Chairman of the German-Sino Promotion Center for Environment and Energy, which he also founded.

Is something changing in your organization? Why not send a note for our staff section to heads@table.media!

A drone flies over the vast burial grounds of the Songhe Cemetery in Shanghai. The cemetery was built in 1987 and is currently the target of criticism on China’s social media due to its horrendous “real estate prices.” Anyone wishing to be laid to rest here has to pay the equivalent of up to 45,000 euros – and this for plots as small as 0.6 square meters. This means that the dead reside in the pagoda-decorated celebrity cemetery at prices six times higher than the living in the Huangpu district in the heart of the already very expensive metropolis.