On the night of Friday to Saturday, the Presidents of the United States and China spoke on the phone and discussed the war in Ukraine. Biden tried warnings, Xi vague appeasements. Biden threatens sanctions against Chinese companies that undermine the blockade on Russia. Xi tended to present himself as a friend of Russia, but at the same time urged global peace. No surprises there. But pressure is mounting on China to distance itself from Russia’s invasion, Christiane Kuehl writes. China is still resisting the pressure and ever-growing accusations from the West. How long can it maintain this kind of pro-Russian neutrality?

Meanwhile, changes are transpiring in China’s domestic politics that may be indirectly related to Ukraine. Forces within the CCP that call for international integration have once again the upper hand. Has Putin’s nationalist go-it-alone weakened the position of Chinese hardliners? In his analysis, Frank Sieren notes a thaw for IPOs in New York as the first sign of a change of course.

Regardless of this, efforts to achieve greater economic independence are continuing. The best example is automotive electronics. China’s powerful tech companies have anchored themselves as an indispensable part of the automotive industry, analyzes Christian Domke Seidel. This is a difference to Europe, where AI conglomerates like Tencent and Baidu do not even exist. Alibaba is now making a splash as a new player. The e-commerce giant is actively investing in car manufacturers.

Even a good three weeks after the war in Ukraine broke out, not a single critical word has been heard from China about the Russian invasion. Beijing is sticking to its diplomatic tightrope act, for which it has to begin to justify itself in the face of growing international pressure. China’s position on the Ukraine conflict is “objective and fair,” Foreign Minister Wang Yi defiantly stressed Saturday. Time would prove that Beijing is “on the right side of history.” China will make “an independent judgment,” the Foreign Ministry quoted Wang as saying. “We will never accept any external coercion or pressure, and we will also oppose any groundless accusations and suspicion against China.”

But this pressure grows with each passing day. The United States and the EU are urging China to finally distance itself from Moscow. On Saturday, Ukraine also appealed to China to condemn the war of aggression and “Russian barbarism.” Were China to make the right decision, it could “be an important element of the global security system,” Ukrainian presidential adviser Mychailo Podolyak wrote on Twitter on Saturday, according to AFP.

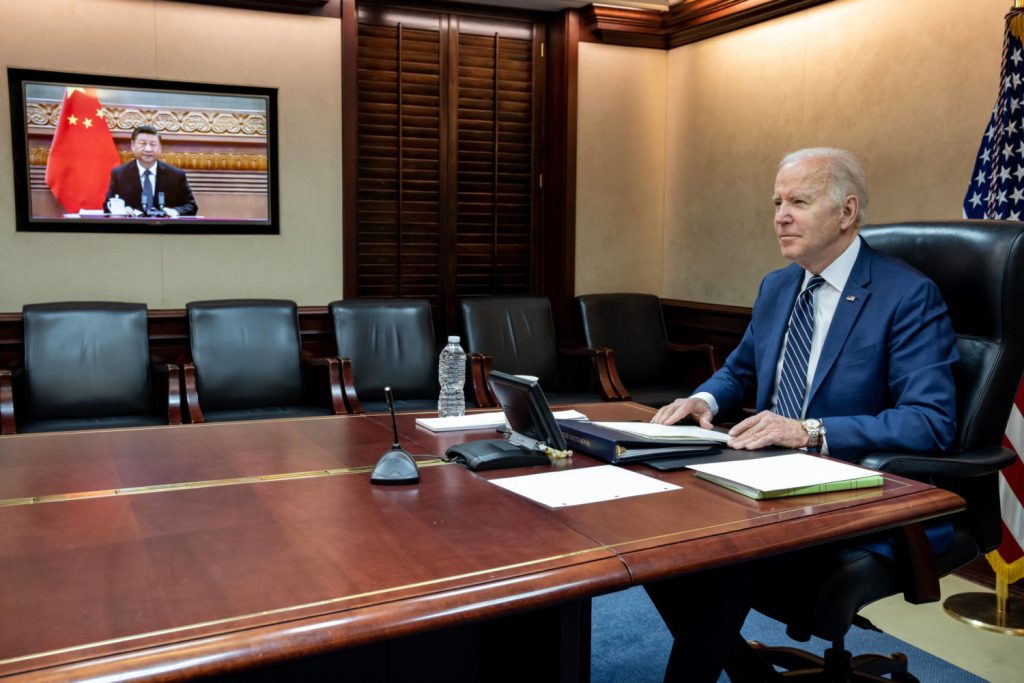

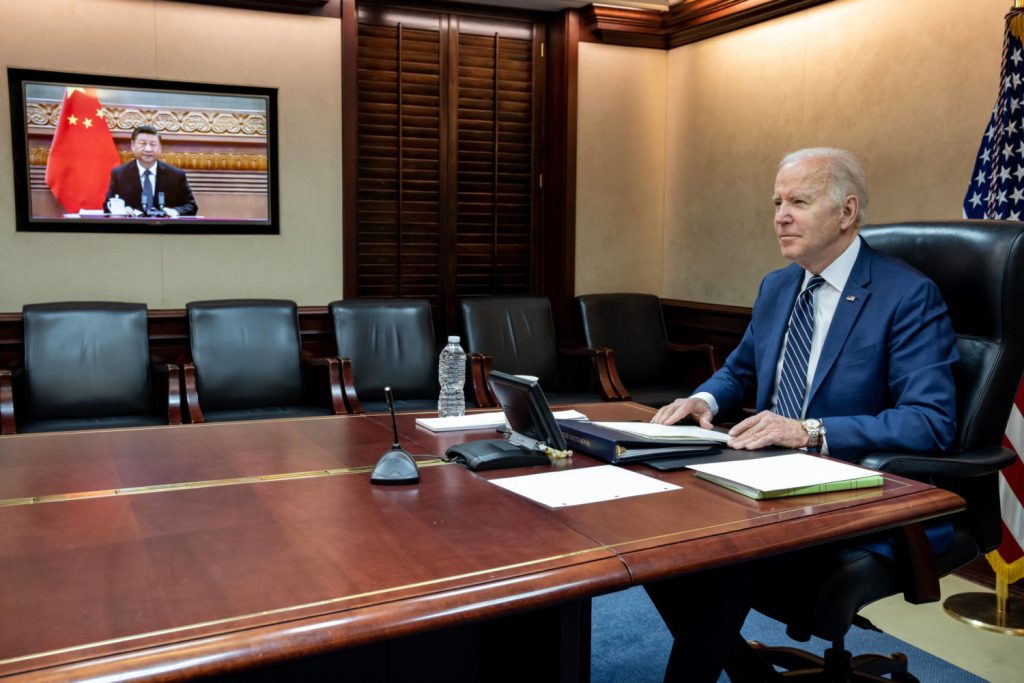

Last Friday, President Xi Jinping and US President Joe Biden spoke for almost two hours via video call. According to the White House, Biden warned Xi of “consequences” should Beijing provide “material” support to Moscow. According to Chinese state media, Xi called on the US to work with Beijing for global peace, saying, “The Ukraine crisis is something we don’t want to see. Events once again show that state-to-state relations cannot go to the stage of confrontation, conflict and confrontation are not in the interests of anyone” In any case, China and the US intend to remain in contact.

But what does China, or what does Wang’s foreign office, consider the “right side of the story” in light of reports of Russian attacks, including against civilian targets in Ukraine? Ministry spokesmen continue to fail to mouth the words “invasion” or “war”. Instead, they rant about Western sanctions and NATO’s eastward expansion – attacking the US in particular. It can only be guessed what debates are being held behind the scenes in the party.

“China is not a party to the (Ukraine) crisis, nor does it want the sanctions to affect China,” Wang Yi had told his Spanish counterpart last week. That’s why, by all accounts, China has been complying with anti-Russia sanctions so far. According to isolated reports, several banks stopped financing Russian projects. China is also not supplying aircraft components to Russia. There have been no reports of Beijing undermining the sanctions so far.

It seems as if China wants to have it all: good relations with Russia, no hurdles in trade with Europe, eye level with the USA. But the problem in this conflict is that nothing comes for free. Every position involves costs – both tangible and intangible. Even China cannot escape this logic.

“China now finds itself defending Russia’s actions alongside a tiny number of failed states, including North Korea, Syria, and Belarus,” says Craig Singelton, China Fellow at the Foundation for Defense of Democracies and former US diplomat. “Leading this group of international outsiders is a far cry from Xi’s goal of ushering in an ‘international relations entering new era’ in which Beijing and Moscow replace the United States and the European Union,” Singleton writes in the US magazine Foreign Policy. “Frankly, it must now be an embarrassment to Beijing to have allowed itself to have become so closely tied to and complicit with Putin’s brutal war against Ukraine,” the South China Morning quoted George Magnus of Oxford University’s China Centre as saying.

Meanwhile, reports suggest that China may at least consider providing military aid to Russia. EU leaders had “very reliable evidence” that China was considering military aid to Russia, US news portal Politico reported on Friday, citing an unnamed “a senior EU official”. Politico did admit, however, that it was not clear whether this latest piece of EU information came from the EU’s own intelligence service or the same sources as US warnings last week.

For days, China has been fighting back against these accusations. “There is misinformation about China providing military assistance to Russia. We reject it,” Chinese Ambassador to the US Qin Gang told CBS television on Sunday. “What China is doing is sending food, medicine, sleeping bags and infant formula, not weapons or ammunition to any party.”

But it brought these accusations on itself with its unclear position. Especially since Russia’s Foreign Minister Sergei Lavrov said on Saturday: Cooperation with China will become stronger and stronger, Lavrov said, according to Reuters: “At a time when the west is blatantly undermining all the foundations on which the international system is based, we, as two great powers, need to think how to carry on in this world.”

Are these the advantages that China sees? Taking a stand together with Russia against the supposed hegemony of the despised West, and that at any price?

Last week, the regional government of Lviv in western Ukraine had quoted China’s ambassador to Ukraine Fan Xianrong as saying, “China will never attack Ukraine, we will help, particularly in the economic direction.” Beijing reiterated those comments on Wednesday. But this fits less and less with its position not to comment further on Russian attacks, even on Ukrainian supply lines.

China continues to insist on discussing the situation in Ukraine as little as possible. Last week, for example, Wang Yi and even head of state Xi Jinping pressured the host Indonesia to exclude the crisis from the agenda of this year’s G20 summit in Bali. Indonesia was said to be open to the proposal. An outcry in the West would likely ensue.

Last week, there was finally clarity. The government “supports various enterprises to seek listings in the overseas market,” Vice Premier Liu He said. IPOs in Hong Kong and the US would be welcome. Chinese regulators have made good progress in paving the way for these IPOs, according to Liu. “The two sides are working on a concrete cooperation plan.” In parallel, the China Securities Regulatory Commission (CSRC) – the counterpart to the US Securities and Exchange Commission (SEC) – has already announced that it will “continue to strengthen communication with US regulatory agencies.”

Vice Premier Liu He, who is in charge of the economy, is the most globally-focused of all vice premiers and ministers in Li Keqiang’s government. He has lectured at Harvard and is part of the internationalists, who have apparently now won a power struggle that has been brewing for months. The internationalists insist that China could become a true superpower if it integrated globally. The other faction of nationalists argues: China will become more powerful faster if it is as independent as possible from foreign countries.

The approval for US IPOs could thus be a sign of a broader shift in Chinese policy. For several years, proponents of decoupling from international economic partners held the upper hand. This trend has also caused concern for the German economy. After all, it wants to remain relevant in China and maintain its healthy market access. Now, things are moving again toward more openness.

So far, six Chinese companies have filed documents with the SEC for a US initial public offering. Among them are supply chain management and consulting company QinHong International Group and portable power source manufacturer Erayak Power Solution Group.

In the same period, at least nine Chinese companies sent their updated prospectus to the SEC. Following Vice Premier Liu’s announcement, the number could now quickly increase – even if the first Chinese IPO of the year was not particularly successful. The relatively small medical device manufacturer Meihua from Yangzhou in Jiangsu province took the plunge with a market capitalization of around $200 million. Its share price started at just under $12 and has since halved. Meihua was the first Chinese company to try an overseas IPO since DiDi Global’s stock market plans had crashed badly in July last year (China.Table reported).

A big boost is likely to happen if the US and China actually reach an agreement, making the IPO rules clear. But what is it about? Both US and Chinese regulators have recently tightened regulations on listings of Chinese companies in the United States. In December, a new SEC rule went into effect that forces foreign companies to delist in the US should they fail to submit their audit reports to the US audit regulator for three consecutive years.

This regulation is not Lex China. It is a regulation that was introduced 20 years ago after the spectacular bankruptcy of energy company Enron. It dates back to the Sarbanes-Oxley Act. Among other things, the Sarbanes-Oxley Act stipulates that the auditors of listed companies must have an independent auditing institution look over their shoulders. However, regulations have since become stricter.

So far, Beijing has refused to comply with the resulting demands. The concern: Chinese companies could be forced to hand over data that threatens China’s national security. Now the two sides are apparently close to a compromise on this matter.

Another delicate issue when it comes to listings of Chinese companies in the US are Variable Interest Entities, also known as VIEs (China.Table reported). Here, a China-based company sets up an offshore shell company, for example in the Cayman Islands, to issue shares on a foreign stock exchange. VIEs are thus shell companies “with limited liability”: While shareholders and investors can enjoy a share of returns, they do not have a stake in the actual company.

This VIE structure has already established itself in the noughties. Almost all Chinese shares are now exclusively available in VIE form. It is also used by Chinese tech giants such as Tencent, Alibaba and Baidu, which have been able to raise a lot of money on foreign capital markets this way. A solution that Beijing favors because it limits the influence of international investors on Chinese companies.

Some people see a VIE listing as a sham because they pay for something they don’t receive. That’s why many international investors do not want to get involved in the first place. Others take the risk because they are more interested in taking profits than in long-term investments. There is one thing about VIEs that even worries Beijing: The money that companies raise through their VIEs stays overseas and is difficult for the Chinese state to control.

Beijing critics of VIEs argue that Chinese corporate assets, which may have been built up with state support, are being sold abroad by entrepreneurs without China gaining anything from it. Proponents say that Chinese companies can use the money to expand their international market share or to conduct R&D, which, in turn, benefits the Chinese parent company.

There has been a barrage of new regulations on foreign listings in China recently, which have spooked investors. And at the same time, the Securities and Exchange Commission (CSRC) has remained vague about VIEs. This is because the central planning authority, the National Development and Reform Commission (NDRC), is responsible for regulation and access to foreign investment. With its ministerial status, it is part of the State Council. Whether companies are granted access to foreign investment depends on a negative list titled “Special Administrative Measures for Foreign Investment Access,” issued by the NDRC and the Ministry of Commerce MOFCOM and updated every year.

Companies on this list must first undergo extensive checks by the authorities. These checks assess whether a VIE-structured listing abroad poses a risk to the country’s data security. The latest version of the negative list was presented at the end of December. The extent to which they give the green light on a case-by-case basis also depends on the political climate. The balance of power in Beijing has now shifted in favor of increased internationalization. The supporters of decoupling have suffered a setback.

Tech giants have discovered the automotive industry. As the industry maintains a steady shift towards digitalization, key strengths of traditional manufacturers are playing a decreasing role. So they have to reinvent themselves to keep up. The starting point for such a renewed shift in the global mobility market is China. Despite supply chain problems, semiconductor shortages, and the war in Ukraine, business is booming (China.Table reported).

The latest example is the L7 from IM Motors. The premium sedan will be available for purchase on March 29. Three Chinese economic giants are behind the brand. Car company SAIC owns 54 percent, real estate developer Shanghai Zhangjiang Hi-Tech Park Development 18 percent and IT giant Alibaba another 18 percent. After Huawei, Xiaomi and Baidu, this makes Alibaba the next tech group to seek fortune and profits in the car industry.

Car expert Ferdinand Dudenhoeffer sums up this trend for China.Table: “The car of tomorrow will be equipped with a great deal of technology for autonomous driving. That’s why value creation will largely happen in software. So it makes sense for high-tech groups to get involved in companies that are in the car business.” And the electric car business seems big enough. Although large and high-profile manufacturers such as Tesla, Xpeng and Nio have long since secured huge chunks of the EV market in the People’s Republic, the China Passenger Car Association expects growth of 84 percent to 5.5 million EVs in 2022. So the pie, of which everyone wants a piece, is still growing considerably.

Timo Moeller, head of the McKinsey Center for Future Mobility, also highlights the opportunities of this development to Table.Media: “The dynamics in the automotive market are basically very high right now. The shift toward a greater emphasis on software, new electronics architectures and, of course, the electrified powertrain require a change in thinking.” The way cars are built is changing radically. Customers were asking for other features. In addition, automakers are reorganizing themselves and would require far more IT specialists.

This poses greater challenges for traditional manufacturers such as Volkswagen, Mercedes and BMW. Their core competencies are different. The investment required to compete on an equal footing in the software sector with Chinese tech giants would be tremendous. It is true that the brands are working at full speed to further develop their software and electronics architecture, Moeller reports. “But one thing is clear: It will be difficult for traditional manufacturers to score equally in all elements along the value chain.”

The solution lies in cross-sector cooperation. Alibaba, for example, has been partnering with SAIC since 2016. Some of the automaker’s vehicles run the YunOS operating system, including smart maps, cameras, and voice control and connected car software. IM Motors primarily receives money and is likely to be a buyer of such technologies in the future.

Baidu has founded the joint venture Jidu Automotive with Geely and is bringing its expertise in artificial intelligence to the table. The goal is to launch a vehicle that is capable of level 4 autonomous driving – in other words, fully automated driving.

Dudenhoeffer does see the problems posed by the changes in the market and new competitors. But he believes that automakers should see this change as an opportunity rather than a threat. “Automakers can consider how they want to enter this new world.” Some claim they will be able to acquire the necessary expertise on their own. “Others prefer to source them because the investment and learning costs are relatively high.” However, only time will tell whether in-house development or partnerships with Chinese companies promise more success.

In the end, cars are more than simply software on wheels, says the car expert. “The handling, the safety, the engineering of the vehicle and the knowledge of how to translate these things into components that generate the desired performance, that’s not so easy. It’s not a simple programming task. That’s where traditional manufacturers have a huge head start.”

This trend toward electrification and more and more IT in cars is still taking place primarily in China. This is partly because Chinese customers are far more open to digitization in all areas than their European peers. Secondly, because the government has boosted EV sales with massive subsidies. But this program is coming to an end. In 2022, the People’s Republic will cut subsidies for the purchase of EVs by around a third (China.Table reported). And this comes amid a very complicated market situation.

This is why Moeller believes that while China will remain the largest EV market, Europe will attract manufacturers with higher growth rates. “Many Chinese manufacturers have already set their sights on Europe because demand for electric cars is picking up strongly here. They will provide additional offers and competition in many car sectors in the years to come.”

For the first time in more than a year, China has reported two Covid-related deaths. Both COVID-19 patients died in the northeastern province of Jilin, the National Health Commission announced on Saturday. The People’s Republic had reported the last Covid death on January 26, 2021.

China’s Jilin province has been the most affected by the current wave. The provincial capital Changchun, which has been under lockdown since March 11, tightened the lockdown for its nine million residents for three days. Until now, they were allowed to leave their homes every two days to buy groceries. Now, for the time being, only medical and other workers needed to fight the pandemic will be allowed to go outside, AFP reports. In the province’s second-largest city, also called Jilin, some 4.5 million people will not be allowed to leave their homes for three days from Monday evening, according to an announcement by local authorities on Sunday.

The number of new infections in China has fluctuated somewhat, but remains in the four-digit range. Whereas on Saturday and Sunday the number nationwide was around 4000 each and thus slightly lower than on Friday with 4365. Two-thirds of the new infections on Sunday occurred in the province of Jilin. There, authorities have now set up eight makeshift hospitals and two quarantine centers. Because the province normally only has about 23,000 hospital beds for about 24 million citizens.

This shows the huge effort that many regions have to put into strict Covid control. This is apparently eating into the finances of local governments. During the first outbreak in early 2020, the central government had provided funds to help local governments combat the pandemic. But since 2021, local authorities have to bear all costs themselves.

For this reason, cities such as Shanghai are trying to avoid a complete city shutdown by imposing limited lockdowns. Shanghai, for example, repeatedly sends individual residential districts or streets into lockdown for 48 hours and tests all residents during this time. Shenzhen, on the other hand, already announced a gradual easing of the one-week lockdown on Friday. This means that since that time, factories can resume operations under certain conditions.

One reason for continued tension in the government is probably the low vaccination rate among the elderly in China. Only about 51 percent of people older than 80 had received two jabs, Beijing health officials said on Friday. One in five had received booster shots. According to Bloomberg, it is the first time China has broken down vaccination rates by age group. Overall, 87.9 percent of China’s 1.4 billion citizens have received two vaccinations. That is a relatively high rate. But no one knows exactly how effective Chinese vaccines are against the Omicron variant.

Hong Kong also sees numerous fatalities due to the low vaccination rate among elders. There, authorities reported 16,597 new infections and 243 deaths related to the virus on Sunday. Still, government executive Carrie Lam on Sunday said there are early signs that the peak of the current wave has passed. “Having gone through the peak … I think a responsible government should regularly and vigorously review these measures, to see whether there is room for adjustment,” Lam said. ck

The Wuhan municipal government invests in establishing the space industry. Companies that manufacture satellites, rockets or space vehicles in the city are to receive a financial incentive of up to ¥50 million (€7.2 million) each. In addition, further incentives are to follow if companies use equipment, software or services from the region in their production.

Up to €2 million (¥15 million), for example, will be granted to a company that uses more than 10 percent local products for the production of high- and low-orbit satellites and spacecraft. If more than 30 percent of local products are used, up to ¥50 million will be awarded. By 2025, Wuhan aims to have created a space industry worth ¥100 billion (about €14 billion) in its region as a result. The aim is to grow into a sort of “satellite valley”.

China wants to become the global leader in space technology. The satellites it is building for this purpose are intended on the one hand to promote the prosperity of its population – and on the other hand to expand the global influence of the People’s Republic. Above all, Beijing hopes to catch up with the space nations Russia and the USA (China.Table reported).

Last year, Shenzhen, a high-tech city in the southern province of Guangdong, also offered up to ¥300 million (€45 million) in incentives for any project related to the development of satellites and associated industrial applications. niw/rtr

China has launched a billion-dollar infrastructure program in Xinjiang. The region recently launched 4,467 construction projects, state-run newspaper Xinjiang Daily reported on Friday. These are said to be part of a multi-year ¥1.75 trillion (€249 billion) program for the region. 27 of the projects launched are major projects with more than ¥5 billion of investment, the paper reported, without giving details.

According to the South China Morning Post, these projects are part of Beijing’s giant stimulus program across the country to boost post-pandemic economic recovery. The launch of these major projects appears to be a sign that Beijing is confident it has society under control, the newspaper quoted an unnamed observer as saying. As a result, Xinjiang policy may turn back to economic development. This shift was evident with the replacement of the CP chief for Xinjiang, the report said. Ma Xingrui, the former governor of the boom province of Guangdong and a well-known technocrat, succeeded Chen Quanguo at the end of December 2021.

Chen was the chief architect of a program of social control of Uyghurs and other Muslim minorities in Xinjiang. According to reliable reports, at least one million Uyghurs have been detained in re-education camps. Added to this are allegations of forced labor and forced sterilization. These human rights violations in Xinjiang were one of the main reasons for the diplomatic boycott of the Olympic Games by many Western countries.

Beijing has not yet announced a successor post for Chen Quanguo, although he continues to attend Politburo meetings, according to the South China Morning Post. How far a possible policy of détente under Ma Xingrui could go is unclear, however. The newspaper quoted local residents as saying that several roadblocks had been removed and some cultural events were expected to be held again. ck

Zhou Guanyu finished 10th in the first Formula 1 race of his career and earned his first points. At the season-opening Bahrain Grand Prix on Sunday, the rookie in the Alfa Romeo finished one position ahead of Mick Schumacher. Zhou is the first Chinese to ever compete in Formula 1.

A place in the top ten is a huge success for Zhou. Only the top ten score points in Formula 1 races. Even after reaching the second stage in Saturday’s qualifying and finishing 15th, the 22-year-old said: “I didn’t expect this in my first race.”

The former kart driver moved to London at the age of twelve to train for his dream of competing in Formula 1. ck

Fifteen years ago, many people in Taiwan would have thought that the next war of this magnitude would break out in Taiwan or on the border to North Korea, not in Ukraine. However, I believe in Murphy’s Law: Anything that can go wrong will go wrong one day. That was true for Hong Kong, and it is true for an invasion from China. The only question is when it will happen.

What happened in Crimea could happen similarly in Jinmen, a group of islands that mostly belongs to Taiwan but is geographically closer to the mainland. Many people there feel closer to the People’s Republic. Like the pro-Russian residents in Crimea, they could serve as a pretext for China to justify an invasion.

As a dictator, Putin is the perfect role model for Xi Jinping. Putin has taken the sanctions into account from the very beginning. They are harsher than those against Chinese cadres in Hong Kong, but many Taiwanese, like the people in Ukraine, think that sanctions are not enough of a deterrent. We see that Western countries are not providing direct military assistance in the form of troops to Ukraine, but are at best supplying war material. The consensus in the West: This is all that can be done.

Now that many Taiwanese see that neither the United States nor the United Kingdom is providing military aid to Ukraine, the government is trying to reassure its people. The situation in Taiwan should not be overly confused with the situation in Ukraine. Taiwan is of greater geopolitical importance than Ukraine. If Taiwan falls, the USA will lack an important base in the Pacific region. This is also how most media and opinion leaders communicate it. Moreover, it looks like Russia cannot win this war as easily as it thought. And this is even though the Russian forces do not even have to cross a strait or any other natural obstacle. Therefore, many Taiwanese believe that it will be much harder for China to take Taiwan.

While China could cripple infrastructure with targeted missile strikes and wreak the maximum amount of destruction, controlling the island will be a considerable challenge, as the people would resist. But like Ukraine, Taiwan is not a member of any international security alliance. Unlike Ukraine, Taiwan is not even a member of the United Nations. We do have mandatory military training, but it is not very structured, and only the healthiest are drafted. However, I think that, like in Ukraine, most Taiwanese would volunteer for national defense in one way or another. People may then do things that they can’t imagine doing now. Like in Hong Kong, if you had told people ten years ago that they would throw a Molotov cocktail at the police, they certainly wouldn’t have believed it.

I don’t have any great expectations of Germany when it comes to Taiwan. We thought there would be stronger support for us after the change of government. But although Germany now even has a green foreign minister, nothing has happened. After talks with China’s Foreign Minister Wang Yi, she even said that they wanted to intensify cooperation in various areas. Of course, we are disappointed about this. But this is the trend all over the world: people talk a lot, regret the situation, but do not act. This is how dictatorships have been able to grow stronger and stronger around the world over the past 20 years. Recorded by Fabian Peltsch

Jessie Lian Jia is the new Chief Executive Officer and Executive Director of the Board of Pulnovo Medical. The company manufactures devices for the treatment of cardiopulmonary diseases and was founded in Wuxi in 2013. Lian holds a Bachelor of Science (Biology) degree from Peking University and an EMBA degree from China Europe International Business School.

Covid and war, competition and city fever – the world doesn’t seem very welcoming at the moment. In China, too, the adversities of modernity and media storms are constantly trickling through all the cracks of consciousness. Young urbanites in particular are longing for a place of refuge for their troubled souls, or at least a soul massage as a compromise. A new genre promises healing in this respect, with the program already in its name. 治愈 zhìyù “healing” or 治愈系 zhìyùxì “healing school” or “healing system” is the name of the trend that is now tenderly budding in many areas of everyday life and lifestyle in China.

The term was paved by the composted exhaustion, which finds its linguistic expression in buzzwords like 内卷 nèijuǎn (excessive competition revolving around itself) and 996-grind (九九六 jiǔ jiǔ liù – working from 9 to 9, 6 days a week), but also in the resulting “lying-flat” movement (躺平 tǎngpíng – resignation and refusal to compete) and the so-called sang culture (丧文化 sàng wénhuà – a melancholy culture that promotes, for example, a slower lifestyle). The salubriousness trend now virtually nudges the pendulum of mind in the opposite direction.

Zhìyù combines a whole array of genres, products and phenomena that have recently sprouted in China. What they all have in common is the idea of deceleration, simplicity and a return to nature. In the West, this trend is known as mindfulness, simplify your life, do-it-yourself, or work-life balance. But zhìyù is much more than that. The label of “Healing” has become a genre label of its own, for example for wholesome movies and streaming shows, music, comics, and animated films.

In fact, the term is a loanword from Japanese. The country experienced a “healing wave” in the mid-nineties, under the words “iyashi” 癒し and “iyashikei” 癒し系, which the Chinese have now simply translated. In Japan, “iyashi” first appeared as a distinct subgenre in 1995, as a result of the Great Hanshin Earthquake and the Tokyo subway sarin attack. These events ultimately pushed the country’s public mood barometer, already depressed by the economic recession, to a low point. The remedy that many Japanese subsequently prescribed themselves were movies, literature and mangas, in which the characters led peaceful, mostly natural lives in soothing environments. The healing effect was meant to jump over to the audience. As the mood in the country slowly cleared, the genre remained. To this day, “iyashi” enjoys unwavering popularity in Japan.

In China, the trend is taking on a life of its own. On social media, for example, where DIY videos, nature films and minimalist clips of simple everyday activities such as cooking, baking or DIY are becoming click magnets. Formerly considered elderly hobbies, zen pastimes of China’s older generation such as gardening (养花 yǎng huā), fish farming (养鱼 yǎng yú), tea culture (茶文化 chá wénhuà) or walking in the park (逛公园 guàng gōngyuán) are now back in vogue among young urbanites and considered a new remedy. Indeed, some are scrambling back even further on the timeline and throw on traditional Han garb, called 汉服 hànfú, for park strolls or pagoda visits. These both nostalgic and photogenic garments are selling like hotcakes on Taobao.

The indispensable healing vocabulary also includes terms such as 复古 fùgǔ (“retro” or “back to the roots” – literally: reviving the old), 乡愁 xiāngchóu (homesickness), and refueling of 正能量 zhèngnéngliàng (positive energy). Anything that helps the wandering soul to rest is considered “genuinely healing” (很治愈 zhìyù) to young Chinese. And if the mood cure was successful in the end, one “was cured” (被治愈 bèi zhìyù). Perhaps words already have a certain healing effect at times.

Verena Menzel runs the language school New Chinese in Beijing.

On the night of Friday to Saturday, the Presidents of the United States and China spoke on the phone and discussed the war in Ukraine. Biden tried warnings, Xi vague appeasements. Biden threatens sanctions against Chinese companies that undermine the blockade on Russia. Xi tended to present himself as a friend of Russia, but at the same time urged global peace. No surprises there. But pressure is mounting on China to distance itself from Russia’s invasion, Christiane Kuehl writes. China is still resisting the pressure and ever-growing accusations from the West. How long can it maintain this kind of pro-Russian neutrality?

Meanwhile, changes are transpiring in China’s domestic politics that may be indirectly related to Ukraine. Forces within the CCP that call for international integration have once again the upper hand. Has Putin’s nationalist go-it-alone weakened the position of Chinese hardliners? In his analysis, Frank Sieren notes a thaw for IPOs in New York as the first sign of a change of course.

Regardless of this, efforts to achieve greater economic independence are continuing. The best example is automotive electronics. China’s powerful tech companies have anchored themselves as an indispensable part of the automotive industry, analyzes Christian Domke Seidel. This is a difference to Europe, where AI conglomerates like Tencent and Baidu do not even exist. Alibaba is now making a splash as a new player. The e-commerce giant is actively investing in car manufacturers.

Even a good three weeks after the war in Ukraine broke out, not a single critical word has been heard from China about the Russian invasion. Beijing is sticking to its diplomatic tightrope act, for which it has to begin to justify itself in the face of growing international pressure. China’s position on the Ukraine conflict is “objective and fair,” Foreign Minister Wang Yi defiantly stressed Saturday. Time would prove that Beijing is “on the right side of history.” China will make “an independent judgment,” the Foreign Ministry quoted Wang as saying. “We will never accept any external coercion or pressure, and we will also oppose any groundless accusations and suspicion against China.”

But this pressure grows with each passing day. The United States and the EU are urging China to finally distance itself from Moscow. On Saturday, Ukraine also appealed to China to condemn the war of aggression and “Russian barbarism.” Were China to make the right decision, it could “be an important element of the global security system,” Ukrainian presidential adviser Mychailo Podolyak wrote on Twitter on Saturday, according to AFP.

Last Friday, President Xi Jinping and US President Joe Biden spoke for almost two hours via video call. According to the White House, Biden warned Xi of “consequences” should Beijing provide “material” support to Moscow. According to Chinese state media, Xi called on the US to work with Beijing for global peace, saying, “The Ukraine crisis is something we don’t want to see. Events once again show that state-to-state relations cannot go to the stage of confrontation, conflict and confrontation are not in the interests of anyone” In any case, China and the US intend to remain in contact.

But what does China, or what does Wang’s foreign office, consider the “right side of the story” in light of reports of Russian attacks, including against civilian targets in Ukraine? Ministry spokesmen continue to fail to mouth the words “invasion” or “war”. Instead, they rant about Western sanctions and NATO’s eastward expansion – attacking the US in particular. It can only be guessed what debates are being held behind the scenes in the party.

“China is not a party to the (Ukraine) crisis, nor does it want the sanctions to affect China,” Wang Yi had told his Spanish counterpart last week. That’s why, by all accounts, China has been complying with anti-Russia sanctions so far. According to isolated reports, several banks stopped financing Russian projects. China is also not supplying aircraft components to Russia. There have been no reports of Beijing undermining the sanctions so far.

It seems as if China wants to have it all: good relations with Russia, no hurdles in trade with Europe, eye level with the USA. But the problem in this conflict is that nothing comes for free. Every position involves costs – both tangible and intangible. Even China cannot escape this logic.

“China now finds itself defending Russia’s actions alongside a tiny number of failed states, including North Korea, Syria, and Belarus,” says Craig Singelton, China Fellow at the Foundation for Defense of Democracies and former US diplomat. “Leading this group of international outsiders is a far cry from Xi’s goal of ushering in an ‘international relations entering new era’ in which Beijing and Moscow replace the United States and the European Union,” Singleton writes in the US magazine Foreign Policy. “Frankly, it must now be an embarrassment to Beijing to have allowed itself to have become so closely tied to and complicit with Putin’s brutal war against Ukraine,” the South China Morning quoted George Magnus of Oxford University’s China Centre as saying.

Meanwhile, reports suggest that China may at least consider providing military aid to Russia. EU leaders had “very reliable evidence” that China was considering military aid to Russia, US news portal Politico reported on Friday, citing an unnamed “a senior EU official”. Politico did admit, however, that it was not clear whether this latest piece of EU information came from the EU’s own intelligence service or the same sources as US warnings last week.

For days, China has been fighting back against these accusations. “There is misinformation about China providing military assistance to Russia. We reject it,” Chinese Ambassador to the US Qin Gang told CBS television on Sunday. “What China is doing is sending food, medicine, sleeping bags and infant formula, not weapons or ammunition to any party.”

But it brought these accusations on itself with its unclear position. Especially since Russia’s Foreign Minister Sergei Lavrov said on Saturday: Cooperation with China will become stronger and stronger, Lavrov said, according to Reuters: “At a time when the west is blatantly undermining all the foundations on which the international system is based, we, as two great powers, need to think how to carry on in this world.”

Are these the advantages that China sees? Taking a stand together with Russia against the supposed hegemony of the despised West, and that at any price?

Last week, the regional government of Lviv in western Ukraine had quoted China’s ambassador to Ukraine Fan Xianrong as saying, “China will never attack Ukraine, we will help, particularly in the economic direction.” Beijing reiterated those comments on Wednesday. But this fits less and less with its position not to comment further on Russian attacks, even on Ukrainian supply lines.

China continues to insist on discussing the situation in Ukraine as little as possible. Last week, for example, Wang Yi and even head of state Xi Jinping pressured the host Indonesia to exclude the crisis from the agenda of this year’s G20 summit in Bali. Indonesia was said to be open to the proposal. An outcry in the West would likely ensue.

Last week, there was finally clarity. The government “supports various enterprises to seek listings in the overseas market,” Vice Premier Liu He said. IPOs in Hong Kong and the US would be welcome. Chinese regulators have made good progress in paving the way for these IPOs, according to Liu. “The two sides are working on a concrete cooperation plan.” In parallel, the China Securities Regulatory Commission (CSRC) – the counterpart to the US Securities and Exchange Commission (SEC) – has already announced that it will “continue to strengthen communication with US regulatory agencies.”

Vice Premier Liu He, who is in charge of the economy, is the most globally-focused of all vice premiers and ministers in Li Keqiang’s government. He has lectured at Harvard and is part of the internationalists, who have apparently now won a power struggle that has been brewing for months. The internationalists insist that China could become a true superpower if it integrated globally. The other faction of nationalists argues: China will become more powerful faster if it is as independent as possible from foreign countries.

The approval for US IPOs could thus be a sign of a broader shift in Chinese policy. For several years, proponents of decoupling from international economic partners held the upper hand. This trend has also caused concern for the German economy. After all, it wants to remain relevant in China and maintain its healthy market access. Now, things are moving again toward more openness.

So far, six Chinese companies have filed documents with the SEC for a US initial public offering. Among them are supply chain management and consulting company QinHong International Group and portable power source manufacturer Erayak Power Solution Group.

In the same period, at least nine Chinese companies sent their updated prospectus to the SEC. Following Vice Premier Liu’s announcement, the number could now quickly increase – even if the first Chinese IPO of the year was not particularly successful. The relatively small medical device manufacturer Meihua from Yangzhou in Jiangsu province took the plunge with a market capitalization of around $200 million. Its share price started at just under $12 and has since halved. Meihua was the first Chinese company to try an overseas IPO since DiDi Global’s stock market plans had crashed badly in July last year (China.Table reported).

A big boost is likely to happen if the US and China actually reach an agreement, making the IPO rules clear. But what is it about? Both US and Chinese regulators have recently tightened regulations on listings of Chinese companies in the United States. In December, a new SEC rule went into effect that forces foreign companies to delist in the US should they fail to submit their audit reports to the US audit regulator for three consecutive years.

This regulation is not Lex China. It is a regulation that was introduced 20 years ago after the spectacular bankruptcy of energy company Enron. It dates back to the Sarbanes-Oxley Act. Among other things, the Sarbanes-Oxley Act stipulates that the auditors of listed companies must have an independent auditing institution look over their shoulders. However, regulations have since become stricter.

So far, Beijing has refused to comply with the resulting demands. The concern: Chinese companies could be forced to hand over data that threatens China’s national security. Now the two sides are apparently close to a compromise on this matter.

Another delicate issue when it comes to listings of Chinese companies in the US are Variable Interest Entities, also known as VIEs (China.Table reported). Here, a China-based company sets up an offshore shell company, for example in the Cayman Islands, to issue shares on a foreign stock exchange. VIEs are thus shell companies “with limited liability”: While shareholders and investors can enjoy a share of returns, they do not have a stake in the actual company.

This VIE structure has already established itself in the noughties. Almost all Chinese shares are now exclusively available in VIE form. It is also used by Chinese tech giants such as Tencent, Alibaba and Baidu, which have been able to raise a lot of money on foreign capital markets this way. A solution that Beijing favors because it limits the influence of international investors on Chinese companies.

Some people see a VIE listing as a sham because they pay for something they don’t receive. That’s why many international investors do not want to get involved in the first place. Others take the risk because they are more interested in taking profits than in long-term investments. There is one thing about VIEs that even worries Beijing: The money that companies raise through their VIEs stays overseas and is difficult for the Chinese state to control.

Beijing critics of VIEs argue that Chinese corporate assets, which may have been built up with state support, are being sold abroad by entrepreneurs without China gaining anything from it. Proponents say that Chinese companies can use the money to expand their international market share or to conduct R&D, which, in turn, benefits the Chinese parent company.

There has been a barrage of new regulations on foreign listings in China recently, which have spooked investors. And at the same time, the Securities and Exchange Commission (CSRC) has remained vague about VIEs. This is because the central planning authority, the National Development and Reform Commission (NDRC), is responsible for regulation and access to foreign investment. With its ministerial status, it is part of the State Council. Whether companies are granted access to foreign investment depends on a negative list titled “Special Administrative Measures for Foreign Investment Access,” issued by the NDRC and the Ministry of Commerce MOFCOM and updated every year.

Companies on this list must first undergo extensive checks by the authorities. These checks assess whether a VIE-structured listing abroad poses a risk to the country’s data security. The latest version of the negative list was presented at the end of December. The extent to which they give the green light on a case-by-case basis also depends on the political climate. The balance of power in Beijing has now shifted in favor of increased internationalization. The supporters of decoupling have suffered a setback.

Tech giants have discovered the automotive industry. As the industry maintains a steady shift towards digitalization, key strengths of traditional manufacturers are playing a decreasing role. So they have to reinvent themselves to keep up. The starting point for such a renewed shift in the global mobility market is China. Despite supply chain problems, semiconductor shortages, and the war in Ukraine, business is booming (China.Table reported).

The latest example is the L7 from IM Motors. The premium sedan will be available for purchase on March 29. Three Chinese economic giants are behind the brand. Car company SAIC owns 54 percent, real estate developer Shanghai Zhangjiang Hi-Tech Park Development 18 percent and IT giant Alibaba another 18 percent. After Huawei, Xiaomi and Baidu, this makes Alibaba the next tech group to seek fortune and profits in the car industry.

Car expert Ferdinand Dudenhoeffer sums up this trend for China.Table: “The car of tomorrow will be equipped with a great deal of technology for autonomous driving. That’s why value creation will largely happen in software. So it makes sense for high-tech groups to get involved in companies that are in the car business.” And the electric car business seems big enough. Although large and high-profile manufacturers such as Tesla, Xpeng and Nio have long since secured huge chunks of the EV market in the People’s Republic, the China Passenger Car Association expects growth of 84 percent to 5.5 million EVs in 2022. So the pie, of which everyone wants a piece, is still growing considerably.

Timo Moeller, head of the McKinsey Center for Future Mobility, also highlights the opportunities of this development to Table.Media: “The dynamics in the automotive market are basically very high right now. The shift toward a greater emphasis on software, new electronics architectures and, of course, the electrified powertrain require a change in thinking.” The way cars are built is changing radically. Customers were asking for other features. In addition, automakers are reorganizing themselves and would require far more IT specialists.

This poses greater challenges for traditional manufacturers such as Volkswagen, Mercedes and BMW. Their core competencies are different. The investment required to compete on an equal footing in the software sector with Chinese tech giants would be tremendous. It is true that the brands are working at full speed to further develop their software and electronics architecture, Moeller reports. “But one thing is clear: It will be difficult for traditional manufacturers to score equally in all elements along the value chain.”

The solution lies in cross-sector cooperation. Alibaba, for example, has been partnering with SAIC since 2016. Some of the automaker’s vehicles run the YunOS operating system, including smart maps, cameras, and voice control and connected car software. IM Motors primarily receives money and is likely to be a buyer of such technologies in the future.

Baidu has founded the joint venture Jidu Automotive with Geely and is bringing its expertise in artificial intelligence to the table. The goal is to launch a vehicle that is capable of level 4 autonomous driving – in other words, fully automated driving.

Dudenhoeffer does see the problems posed by the changes in the market and new competitors. But he believes that automakers should see this change as an opportunity rather than a threat. “Automakers can consider how they want to enter this new world.” Some claim they will be able to acquire the necessary expertise on their own. “Others prefer to source them because the investment and learning costs are relatively high.” However, only time will tell whether in-house development or partnerships with Chinese companies promise more success.

In the end, cars are more than simply software on wheels, says the car expert. “The handling, the safety, the engineering of the vehicle and the knowledge of how to translate these things into components that generate the desired performance, that’s not so easy. It’s not a simple programming task. That’s where traditional manufacturers have a huge head start.”

This trend toward electrification and more and more IT in cars is still taking place primarily in China. This is partly because Chinese customers are far more open to digitization in all areas than their European peers. Secondly, because the government has boosted EV sales with massive subsidies. But this program is coming to an end. In 2022, the People’s Republic will cut subsidies for the purchase of EVs by around a third (China.Table reported). And this comes amid a very complicated market situation.

This is why Moeller believes that while China will remain the largest EV market, Europe will attract manufacturers with higher growth rates. “Many Chinese manufacturers have already set their sights on Europe because demand for electric cars is picking up strongly here. They will provide additional offers and competition in many car sectors in the years to come.”

For the first time in more than a year, China has reported two Covid-related deaths. Both COVID-19 patients died in the northeastern province of Jilin, the National Health Commission announced on Saturday. The People’s Republic had reported the last Covid death on January 26, 2021.

China’s Jilin province has been the most affected by the current wave. The provincial capital Changchun, which has been under lockdown since March 11, tightened the lockdown for its nine million residents for three days. Until now, they were allowed to leave their homes every two days to buy groceries. Now, for the time being, only medical and other workers needed to fight the pandemic will be allowed to go outside, AFP reports. In the province’s second-largest city, also called Jilin, some 4.5 million people will not be allowed to leave their homes for three days from Monday evening, according to an announcement by local authorities on Sunday.

The number of new infections in China has fluctuated somewhat, but remains in the four-digit range. Whereas on Saturday and Sunday the number nationwide was around 4000 each and thus slightly lower than on Friday with 4365. Two-thirds of the new infections on Sunday occurred in the province of Jilin. There, authorities have now set up eight makeshift hospitals and two quarantine centers. Because the province normally only has about 23,000 hospital beds for about 24 million citizens.

This shows the huge effort that many regions have to put into strict Covid control. This is apparently eating into the finances of local governments. During the first outbreak in early 2020, the central government had provided funds to help local governments combat the pandemic. But since 2021, local authorities have to bear all costs themselves.

For this reason, cities such as Shanghai are trying to avoid a complete city shutdown by imposing limited lockdowns. Shanghai, for example, repeatedly sends individual residential districts or streets into lockdown for 48 hours and tests all residents during this time. Shenzhen, on the other hand, already announced a gradual easing of the one-week lockdown on Friday. This means that since that time, factories can resume operations under certain conditions.

One reason for continued tension in the government is probably the low vaccination rate among the elderly in China. Only about 51 percent of people older than 80 had received two jabs, Beijing health officials said on Friday. One in five had received booster shots. According to Bloomberg, it is the first time China has broken down vaccination rates by age group. Overall, 87.9 percent of China’s 1.4 billion citizens have received two vaccinations. That is a relatively high rate. But no one knows exactly how effective Chinese vaccines are against the Omicron variant.

Hong Kong also sees numerous fatalities due to the low vaccination rate among elders. There, authorities reported 16,597 new infections and 243 deaths related to the virus on Sunday. Still, government executive Carrie Lam on Sunday said there are early signs that the peak of the current wave has passed. “Having gone through the peak … I think a responsible government should regularly and vigorously review these measures, to see whether there is room for adjustment,” Lam said. ck

The Wuhan municipal government invests in establishing the space industry. Companies that manufacture satellites, rockets or space vehicles in the city are to receive a financial incentive of up to ¥50 million (€7.2 million) each. In addition, further incentives are to follow if companies use equipment, software or services from the region in their production.

Up to €2 million (¥15 million), for example, will be granted to a company that uses more than 10 percent local products for the production of high- and low-orbit satellites and spacecraft. If more than 30 percent of local products are used, up to ¥50 million will be awarded. By 2025, Wuhan aims to have created a space industry worth ¥100 billion (about €14 billion) in its region as a result. The aim is to grow into a sort of “satellite valley”.

China wants to become the global leader in space technology. The satellites it is building for this purpose are intended on the one hand to promote the prosperity of its population – and on the other hand to expand the global influence of the People’s Republic. Above all, Beijing hopes to catch up with the space nations Russia and the USA (China.Table reported).

Last year, Shenzhen, a high-tech city in the southern province of Guangdong, also offered up to ¥300 million (€45 million) in incentives for any project related to the development of satellites and associated industrial applications. niw/rtr

China has launched a billion-dollar infrastructure program in Xinjiang. The region recently launched 4,467 construction projects, state-run newspaper Xinjiang Daily reported on Friday. These are said to be part of a multi-year ¥1.75 trillion (€249 billion) program for the region. 27 of the projects launched are major projects with more than ¥5 billion of investment, the paper reported, without giving details.

According to the South China Morning Post, these projects are part of Beijing’s giant stimulus program across the country to boost post-pandemic economic recovery. The launch of these major projects appears to be a sign that Beijing is confident it has society under control, the newspaper quoted an unnamed observer as saying. As a result, Xinjiang policy may turn back to economic development. This shift was evident with the replacement of the CP chief for Xinjiang, the report said. Ma Xingrui, the former governor of the boom province of Guangdong and a well-known technocrat, succeeded Chen Quanguo at the end of December 2021.

Chen was the chief architect of a program of social control of Uyghurs and other Muslim minorities in Xinjiang. According to reliable reports, at least one million Uyghurs have been detained in re-education camps. Added to this are allegations of forced labor and forced sterilization. These human rights violations in Xinjiang were one of the main reasons for the diplomatic boycott of the Olympic Games by many Western countries.

Beijing has not yet announced a successor post for Chen Quanguo, although he continues to attend Politburo meetings, according to the South China Morning Post. How far a possible policy of détente under Ma Xingrui could go is unclear, however. The newspaper quoted local residents as saying that several roadblocks had been removed and some cultural events were expected to be held again. ck

Zhou Guanyu finished 10th in the first Formula 1 race of his career and earned his first points. At the season-opening Bahrain Grand Prix on Sunday, the rookie in the Alfa Romeo finished one position ahead of Mick Schumacher. Zhou is the first Chinese to ever compete in Formula 1.

A place in the top ten is a huge success for Zhou. Only the top ten score points in Formula 1 races. Even after reaching the second stage in Saturday’s qualifying and finishing 15th, the 22-year-old said: “I didn’t expect this in my first race.”

The former kart driver moved to London at the age of twelve to train for his dream of competing in Formula 1. ck

Fifteen years ago, many people in Taiwan would have thought that the next war of this magnitude would break out in Taiwan or on the border to North Korea, not in Ukraine. However, I believe in Murphy’s Law: Anything that can go wrong will go wrong one day. That was true for Hong Kong, and it is true for an invasion from China. The only question is when it will happen.

What happened in Crimea could happen similarly in Jinmen, a group of islands that mostly belongs to Taiwan but is geographically closer to the mainland. Many people there feel closer to the People’s Republic. Like the pro-Russian residents in Crimea, they could serve as a pretext for China to justify an invasion.

As a dictator, Putin is the perfect role model for Xi Jinping. Putin has taken the sanctions into account from the very beginning. They are harsher than those against Chinese cadres in Hong Kong, but many Taiwanese, like the people in Ukraine, think that sanctions are not enough of a deterrent. We see that Western countries are not providing direct military assistance in the form of troops to Ukraine, but are at best supplying war material. The consensus in the West: This is all that can be done.

Now that many Taiwanese see that neither the United States nor the United Kingdom is providing military aid to Ukraine, the government is trying to reassure its people. The situation in Taiwan should not be overly confused with the situation in Ukraine. Taiwan is of greater geopolitical importance than Ukraine. If Taiwan falls, the USA will lack an important base in the Pacific region. This is also how most media and opinion leaders communicate it. Moreover, it looks like Russia cannot win this war as easily as it thought. And this is even though the Russian forces do not even have to cross a strait or any other natural obstacle. Therefore, many Taiwanese believe that it will be much harder for China to take Taiwan.

While China could cripple infrastructure with targeted missile strikes and wreak the maximum amount of destruction, controlling the island will be a considerable challenge, as the people would resist. But like Ukraine, Taiwan is not a member of any international security alliance. Unlike Ukraine, Taiwan is not even a member of the United Nations. We do have mandatory military training, but it is not very structured, and only the healthiest are drafted. However, I think that, like in Ukraine, most Taiwanese would volunteer for national defense in one way or another. People may then do things that they can’t imagine doing now. Like in Hong Kong, if you had told people ten years ago that they would throw a Molotov cocktail at the police, they certainly wouldn’t have believed it.

I don’t have any great expectations of Germany when it comes to Taiwan. We thought there would be stronger support for us after the change of government. But although Germany now even has a green foreign minister, nothing has happened. After talks with China’s Foreign Minister Wang Yi, she even said that they wanted to intensify cooperation in various areas. Of course, we are disappointed about this. But this is the trend all over the world: people talk a lot, regret the situation, but do not act. This is how dictatorships have been able to grow stronger and stronger around the world over the past 20 years. Recorded by Fabian Peltsch

Jessie Lian Jia is the new Chief Executive Officer and Executive Director of the Board of Pulnovo Medical. The company manufactures devices for the treatment of cardiopulmonary diseases and was founded in Wuxi in 2013. Lian holds a Bachelor of Science (Biology) degree from Peking University and an EMBA degree from China Europe International Business School.

Covid and war, competition and city fever – the world doesn’t seem very welcoming at the moment. In China, too, the adversities of modernity and media storms are constantly trickling through all the cracks of consciousness. Young urbanites in particular are longing for a place of refuge for their troubled souls, or at least a soul massage as a compromise. A new genre promises healing in this respect, with the program already in its name. 治愈 zhìyù “healing” or 治愈系 zhìyùxì “healing school” or “healing system” is the name of the trend that is now tenderly budding in many areas of everyday life and lifestyle in China.

The term was paved by the composted exhaustion, which finds its linguistic expression in buzzwords like 内卷 nèijuǎn (excessive competition revolving around itself) and 996-grind (九九六 jiǔ jiǔ liù – working from 9 to 9, 6 days a week), but also in the resulting “lying-flat” movement (躺平 tǎngpíng – resignation and refusal to compete) and the so-called sang culture (丧文化 sàng wénhuà – a melancholy culture that promotes, for example, a slower lifestyle). The salubriousness trend now virtually nudges the pendulum of mind in the opposite direction.

Zhìyù combines a whole array of genres, products and phenomena that have recently sprouted in China. What they all have in common is the idea of deceleration, simplicity and a return to nature. In the West, this trend is known as mindfulness, simplify your life, do-it-yourself, or work-life balance. But zhìyù is much more than that. The label of “Healing” has become a genre label of its own, for example for wholesome movies and streaming shows, music, comics, and animated films.

In fact, the term is a loanword from Japanese. The country experienced a “healing wave” in the mid-nineties, under the words “iyashi” 癒し and “iyashikei” 癒し系, which the Chinese have now simply translated. In Japan, “iyashi” first appeared as a distinct subgenre in 1995, as a result of the Great Hanshin Earthquake and the Tokyo subway sarin attack. These events ultimately pushed the country’s public mood barometer, already depressed by the economic recession, to a low point. The remedy that many Japanese subsequently prescribed themselves were movies, literature and mangas, in which the characters led peaceful, mostly natural lives in soothing environments. The healing effect was meant to jump over to the audience. As the mood in the country slowly cleared, the genre remained. To this day, “iyashi” enjoys unwavering popularity in Japan.

In China, the trend is taking on a life of its own. On social media, for example, where DIY videos, nature films and minimalist clips of simple everyday activities such as cooking, baking or DIY are becoming click magnets. Formerly considered elderly hobbies, zen pastimes of China’s older generation such as gardening (养花 yǎng huā), fish farming (养鱼 yǎng yú), tea culture (茶文化 chá wénhuà) or walking in the park (逛公园 guàng gōngyuán) are now back in vogue among young urbanites and considered a new remedy. Indeed, some are scrambling back even further on the timeline and throw on traditional Han garb, called 汉服 hànfú, for park strolls or pagoda visits. These both nostalgic and photogenic garments are selling like hotcakes on Taobao.

The indispensable healing vocabulary also includes terms such as 复古 fùgǔ (“retro” or “back to the roots” – literally: reviving the old), 乡愁 xiāngchóu (homesickness), and refueling of 正能量 zhèngnéngliàng (positive energy). Anything that helps the wandering soul to rest is considered “genuinely healing” (很治愈 zhìyù) to young Chinese. And if the mood cure was successful in the end, one “was cured” (被治愈 bèi zhìyù). Perhaps words already have a certain healing effect at times.

Verena Menzel runs the language school New Chinese in Beijing.