It almost seems like a trend of moving away from the new Silk Road. The Philippines are rejecting China’s loans and are opting to borrow money from Japan instead. President Ferdinand Marcos also invites the USA to expand military bases in their country. This marks a clear departure from the China policy of his predecessor. For Marcos, the primary concern is the threat posed by the territorial claims of the overwhelmingly large neighbor, as reported by Joern Petring.

Meanwhile, Sri Lanka has invited the USA to invest in the port of Colombo. This port was previously considered a significant cornerstone of the Belt and Road Initiative. Together with Italy’s withdrawal from Belt and Road, we see a mixed picture: While some countries still have a great interest in Chinese engagement, others have become more suspicious.

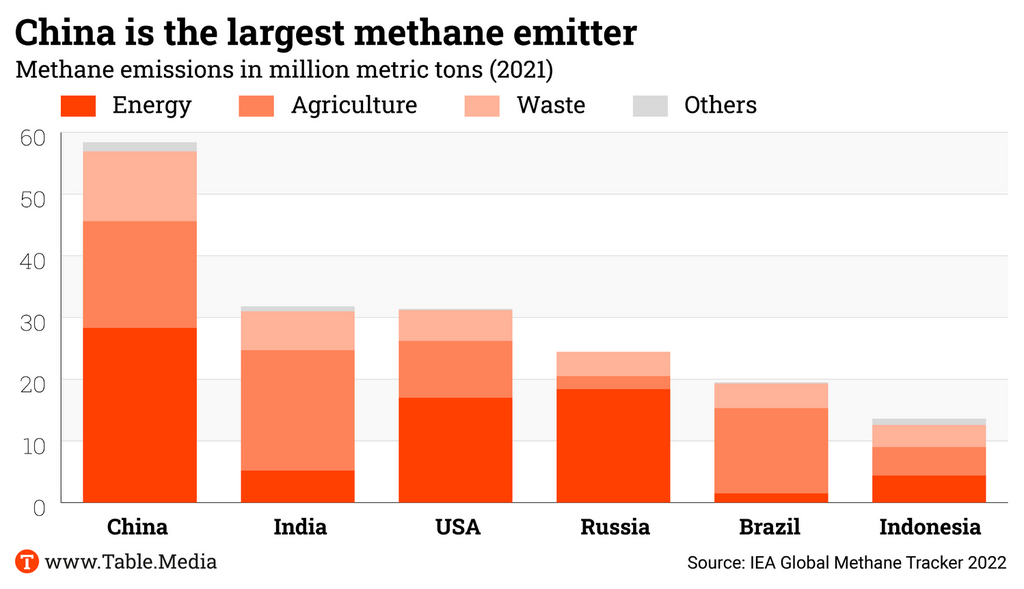

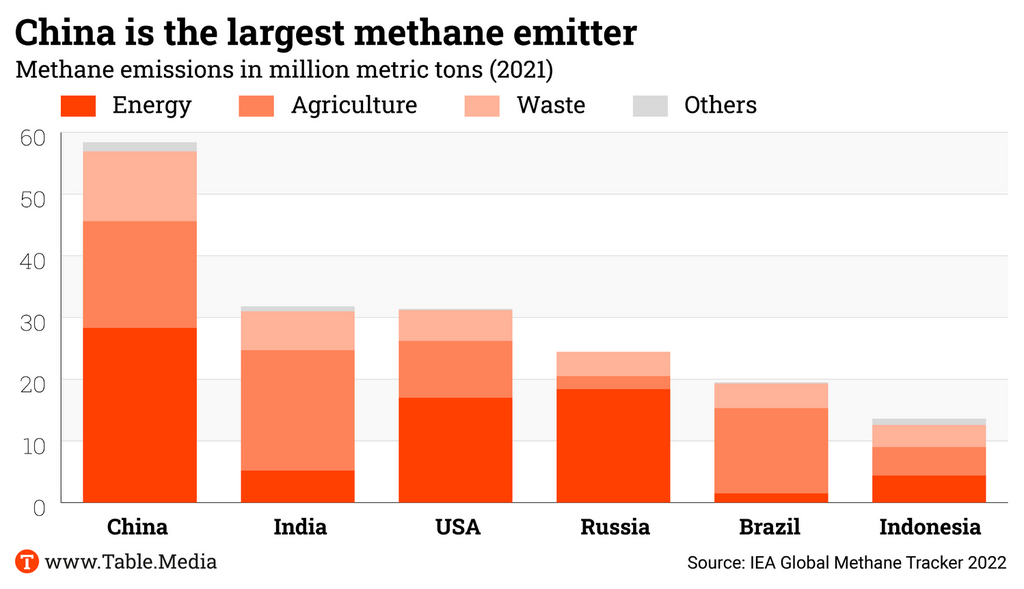

After much delay, China has finally unveiled its plan to reduce methane emissions. Nico Beckert analyzes why the proposed measures have disappointed climate activists. China is the world’s largest emitter of the particularly climate-damaging gas, and yet it is making minimal efforts to reduce these emissions.

In search of an alternative to China’s Belt and Road Initiative, the Philippines are looking towards the West and other regional partners. According to a Reuters report on Monday, Japan, South Korea and India have offered to finance railway projects in the Philippines worth nearly five billion US dollars, as announced by Manila’s Transportation Minister Jaime Bautista. The government could also fund a portion of the railway projects itself or seek investments from the private sector.

One thing is clear: Given the extremely tense relations, an agreement with Beijing, which originally wanted to build and finance the projects, seems impossible. Specifically, the projects in question include:

By rejecting Chinese project financing, Manila is effectively withdrawing from the Belt and Road Initiative. There is no formal, standardized process for joining the Belt and Road Initiative (BRI); membership often results from participation. In the case of the Philippines, their BRI membership began with their entry into the Asian Infrastructure Investment Bank (AIIB) in 2015 under President Rodrigo Duterte. Their primary interest from the beginning was in infrastructure loans, which his successor now deliberately rejects.

Together with Italy’s impending exit from the New Silk Road, these are two heavy blows to the trade network.

Lately, China and the Philippines have primarily made headlines due to their disputes in the South China Sea. In the past weeks and months, there have been multiple collisions between Philippine vessels and the Chinese Coast Guard. However, economic relations have been strained for some time, regardless of this.

From Beijing’s perspective, everything initially seemed promising. Duterte set aside the long-standing territorial disputes over the South China Sea, as desired by Xi Jinping. In return, China pledged billions of dollars in aid, loans and investments.

However, the money did not flow as expected. Over time, there were delays in project implementation. Critics questioned the loan terms, including the relatively high interest rates, and expressed concerns about the strategic implications of Chinese presence in the region.

In 2022, the new President Ferdinand Marcos Jr. took office. Under his leadership, the Philippine government critically reviewed the projects funded by China. He demanded better terms from Beijing, but from the Philippine perspective, these demands were ignored.

These developments are part of a larger geopolitical context. The Philippines are reevaluating their relationship with China while simultaneously strengthening their security ties with the USA. This cooperation is a sore point for China.

While the USA hasn’t had its own bases in the Philippines since the 1990s, the Enhanced Defense Cooperation Agreement (EDCA) grants the US military access to selected Philippine military bases.

In line with this, the Philippines began a large-scale naval exercise with Japan, South Korea and the USA. To China’s dismay, Marcos Jr. significantly expanded the EDCA. The number of bases where US forces can operate has doubled. The nine locations were announced in April:

These locations are strategically important as they are near Taiwan and the disputed Spratly Islands in the South China Sea, where China has built artificial islands with runways and missile systems.

In response to the EDCA expansion, Beijing emphasized that economic trade cannot flourish without a peaceful and stable regional environment. Additional EDCA locations would only create problems in the region. It’s also worth noting that Peking may not have been pleased with Marcos Jr.’s absence at the 10th-anniversary summit of the Belt and Road Initiative in Beijing in October.

It is becoming increasingly clear that relying on security assurances from the United States in the region makes it harder to conduct lucrative business with China. For the states in the region, this is a delicate balancing act.

The climate envoys of the USA and China, John Kerry and Xie Zhenhua, have been preparing for the APEC summit in California (Nov. 11-17), where Presidents Joe Biden and Xi Jinping will meet. The release of China’s methane strategy shortly after the Kerry-Xie meeting is seen as a significant signal.

The reduction of methane emissions has been a recurring topic between the climate superpowers. At COP26 in Glasgow in 2021, both countries agreed to make more efforts to reduce short-lived but highly climate-damaging methane. At that time, China committed to developing a methane strategy. In Sharm el-Sheikh, at COP27, Xie confirmed China’s decision to do more in the future.

The release of China’s methane strategy could set the ball rolling. COP President Al Jaber welcomed it as “a moment for international climate action measures”.

China is the world’s largest methane emitter. Methane, when considered over 20 years, is 80 times more harmful than CO2. Reducing its emissions is seen as the “fastest way to immediately slow global warming,” according to the Environmental Defense Fund.

China’s methane plan, which had been in the drawers of the Chinese Ministry of Ecology and Environment as a draft for more than a year, has been silent since Xie’s comments in November 2022.

However, the plan presented now is not very ambitious:

“The goals mentioned in the plan are too ambiguous and mainly contain descriptive text,” says Yan Qin, an energy expert at the analysis firm Refinitiv, to Reuters. Analyst Lauri Myllyvirta also criticizes the plan’s “soft aims“. The plan only says that China will “study the establishment of” or “seek to establish” the establishment of a methane measurement, reporting, and verification system, he writes.

Zhang Kai, Deputy Program Director at the Beijing office of Greenpeace East Asia, however, sees the plan as a “positive step towards combating methane emissions,” as he writes on X. Controlling methane emissions in the coal sector should be a priority, Zhang writes.

China faces significant challenges in reducing methane emissions because a large portion of the emissions comes from the coal sector. These emissions are more challenging to control than those in the gas and oil sector. However, economic factors are not the only consideration in China’s methane plans. The country does not want to be pressured into more climate action by the USA; it would be a loss of face in front of the domestic audience if the major systemic rival could demand concrete targets and plans. Yet, China is highly threatened by climate change, so it’s in the country’s own interest to reduce emissions.

An official commitment from Beijing is still pending, but signs are increasingly pointing towards a conversation between China’s President Xi Jinping and US President Joe Biden on Nov. 16 at the Asia-Pacific Economic Cooperation (APEC) summit in San Francisco.

There have been several meetings between high-ranking politicians of the world’s two largest economies, all of which indicate such a top-level meeting. These are positive signs for improving the overall relationship between both nations, said China’s Vice President Han Zheng on Wednesday at the Bloomberg New Economy Forum in Singapore.

China is open to strengthening its strained relationship with the United States “at all levels”, Han stated. “We are ready to enhance communication and dialogue with the United States at all levels, promote mutually beneficial cooperation, manage differences appropriately, and address global challenges together.”

Xi and Biden last met personally at the G20 summit in Bali in 2022. The mood between the two was already tense during that meeting and hasn’t improved since. At the beginning of the year, a scandal involving a Chinese spy balloon over US territory rocked the relationship between the two superpowers. The relationship was further strained by the halt in the supply of critical high-performance chips to the People’s Republic as part of US-imposed sanctions.

However, the visit could now mark a turning point. Another positive sign is that China’s top finance official, He Lifeng, traveled to San Francisco on Wednesday to hold intensive talks with US Treasury Secretary Janet Yellen until Sunday. flee

China and Australia are on a path to relaxation. After a meeting on Monday in Beijing, Australian Prime Minister Anthony Albanese and China’s Party and State Leader Xi Jinping praised the “undoubtedly very positive” progress in their countries’ relations. According to reports from the state broadcaster CCTV, China and Australia could become “trustful and successful partners” and there are “no fundamental conflicts of interest“. Albanese also invited Xi to visit Australia.

It was the first visit by an Australian prime minister to China in nearly seven years. In 2017, relations between the two countries deteriorated rapidly after Australia formulated a law against foreign influence, primarily targeting Beijing’s influence on Australian politics. In 2018, China imposed a high import tariff on Australian barley after Australians excluded Huawei and ZTE from building the domestic 5G network.

In November of the same year, the Chinese embassy in Canberra presented a list of 14 demands that Australia had to meet to normalize relations. According to the Reuters news agency, the 14 demands were suddenly no longer a topic at the meeting on Monday.

Even before the meeting, Australia and China had come closer: Australia dropped a lawsuit with the World Trade Organization over Chinese tariffs, and Beijing released Australian journalist Cheng Lei, who had been detained for three years on charges of espionage. fpe

Russia and China continue to signal a closer relationship. In Moscow, senior General Zhang Youxia and Russian Defense Minister Sergey Shoigu discussed strengthening their military cooperation. A meeting with President Vladimir Putin was also planned, according to Kremlin spokesman Dmitry Peskov in Moscow on Wednesday.

Zhang Youxia is the Deputy Chairman of the Central Military Commission and the second-highest commander of the armed forces after President Xi Jinping. Zhang told the Russian news agency Interfax that China and Russia want to intensify their military relations and the cooperation of their armies. He reiterated the phrase of a “comprehensive partnership and a high-level strategic cooperation.”

Usually, China’s defense minister represents the country’s military interests abroad. Currently, China does not have a defense minister since Li Shangfu was officially removed a few weeks ago. fin

The United States is entering into direct competition with China in Sri Lanka in terms of development financing. On Wednesday, the US International Development Finance Corporation (DFC) announced the construction of a 553 million dollar deep-water container terminal in the port of Colombo. The project has the potential to transform Colombo “into a world-class logistics center at the crossroads of major shipping routes and emerging markets,” as stated by the agency.

The DFC loan will “expand the country’s shipping capabilities and contribute to more prosperity in Sri Lanka – without increasing government debt – while strengthening the position of our allies in the region,” said Scott Nathan, Chief Executive Officer of the DFC, which was founded five years ago in response to Beijing’s Belt and Road Initiative.

Sri Lanka was once considered an outpost of China due to massive Chinese investments and an example of Beijing’s “debt-trap diplomacy”. Recently, the government in Colombo asked the Chinese for debt restructuring. The island nation of 22 million people is still in its most severe economic crisis in decades. fpe

China’s financial regulatory authority is apparently urging the insurer Ping An to undertake the rescue of the insolvent property developer Country Garden. Reuters reported this, citing four sources. The instruction for the rescue comes from the top, namely, Premier Li Qiang.

Ping An itself denies the report. This is not surprising since the development would not be good news for the insurer. Ping An is financially sound, whereas Country Garden is burdened with debts of approximately 17 billion euros. A state-engineered takeover of a troubled company by a healthy one tends to result in a construct that is only half-healthy rather than entirely healthy, thus the concern. As a result, Ping An’s stock price fell on the Hong Kong Stock Exchange.

On the other hand, the rescue of Country Garden would be an important signal that the government is addressing problems in the real estate sector. Concerns about China’s most critical economic sector are weighing down sentiment and growth. “If the news is true, it will have a very positive impact on the real estate and capital markets,” said Xu Tianchen, an economist at the Economist Intelligence Unit.

Although Ping An is a private company and one of the world’s largest insurance companies, it cannot evade a direct directive from Beijing. On the authorities’ side, the Chinese central bank and the financial regulatory authority are involved in the negotiations. fin/rtr

Now, it is as official as an ascent to an unofficial role can be: Vice Premier He Lifeng is China’s new economic czar. A few days ago, it was announced that he was promoted to leading positions in three CCP internal committees that oversee finances and the economy. These committees are part of the network of party commissions created by State and Party Chairman Xi Jinping over the past ten years, most of which he formally chairs. These commissions have transferred significant powers from the State Council to the party.

The 68-year-old He has thus reached the highest circle of power, with a close connection to Xi. The multitude of various, outwardly vague-sounding party roles is common for high-level CCP leaders. Observers, therefore, coined the term “economic czar” for the chief economic advisor to the party leader.

He Lifeng is now the Bureau Director of the Central Finance and Economic Commission (中央财经委员会) led by Xi, Bureau Director of the Central Finance Commission (中央金融委员会), and Party Secretary of the Central Financial Work Commission (中央金融工作委员会). Both finance commissions were established in March; the former shapes policies for the country’s massive financial sector, while the latter ensures that “the financial system is in line with the party’s political goals, theories, morals, and discipline,” as described by the business magazine Caixin.

The previous occupant of the position at the Central Finance and Economic Commission was the former economic czar Liu He, China’s most famous international economic policy maker in recent years. Liu He was also one of four Vice Premiers responsible for the economy in the government until he retired in March 2023. However, Liu is only three years older than his successor. Both belong to the same generation of politicians and are close confidants of Xi. However, they are fundamentally different.

Liu He studied and conducted research in the United States and was comfortable on the international stage. He negotiated with representatives of the Trump administration from the beginning of the US-China trade war and delivered a keynote speech at the Davos Economic Forum in 2018 on behalf of Xi. In China, Liu has stood for reform-oriented economic policies for many years, which he significantly shaped.

He Lifeng, on the other hand, has a reputation as an inconspicuous bureaucrat who implements Xi Jinping’s directives. There are no iconic statements on economic policy attributed to him, and he is just now becoming known abroad. A diplomat recently involved in trade talks with China described He as “tough and uncompromising” to Reuters. Unlike Liu, He doesn’t communicate in English.

He Lifeng was born in 1955 to a Hakka minority family in the Yongding district in the southeastern coastal province of Fujian, known for its tulou roundhouses. Like many of his generation, he was sent to do agricultural work during the Cultural Revolution and contributed to building a dam. He studied finance at Xiamen University from 1978 to 1984. In 1998, he earned a doctorate in economics. At that time, he was already the party secretary of the nearby city of Quanzhou.

A significant part of his party career took place in Fujian, and back then, his path crossed that of Xi Jinping. As a finance official in Xiamen, he worked alongside Xi, who was then the Vice Mayor of the port city. He later became the Party Secretary of the provincial capital, Fuzhou, when Xi was the provincial governor. He Lifeng belongs to a group that Cheng Li of the US think tank Brookings Institution calls the “circle of secretaries” (秘书), men who supported Xi Jinping during his career and thus became confidants and proteges.

As Xi became Vice President, He also moved north, becoming the party secretary of Tianjin’s Binhai New Area, which is a financial special zone. In 2014, He became Deputy Chief of the powerful National Development and Reform Commission, of which he was Chairman from 2017 until March 2023. Among other things, he implemented Xi’s Belt and Road initiative during those years.

This position gave He the “opportunity to show his capacity in financial and economic matters at the national level of leadership,” Cheng Li wrote at the time. He, like Liu He and other economic advisors to Xi, was considered one of the market-friendly technocrats of the country, as opposed to Xi’s conservative propaganda advisors. However, what He Lifeng is truly like will only become evident now.

In any case, He Lifeng will face an even more challenging environment in his new role than his predecessor, Liu. Geopolitical tensions are increasing further abroad. China’s economy is faltering. As the head of the Central Finance Commission, He Lifeng will be responsible for managing the municipal debt crisis and the real estate sector crisis in China. Both are weighing heavily on the Chinese economy.

In October, he participated in the 3rd German-Chinese Financial Dialogue in Frankfurt, where he met with German Finance Minister Christian Lindner. He advocated for opening financial markets and strengthening cooperation between central banks and insurance regulatory authorities. This week, He is traveling to the United States, where he will meet with Treasury Secretary Janet Yellen in San Francisco, among others. Christiane Kühl

Sebastian Blaettler is now Managing Director China at the Boschung Group from Switzerland, a machine and plant manufacturer specializing in infrastructure maintenance equipment such as airport sweepers. Blaettler was previously a partner at Consulting Blaettler & Miescher KIG.

Tiffany Wu has been appointed Managing Director Greater China by Birkenstock. In this newly created position, Wu will be responsible for increasing brand visibility, brand equity and sales in the region. She will report to Klaus Baumann, Chief Sales Officer of the Birkenstock Group.

Is something changing in your organization? Let us know at heads@table.media!

Using heavy equipment to battle the snow: Over the weekend, northern China was hit by a cold front. The central weather authority issued the highest level of warning for parts of the country due to heavy snowstorms. The provinces of Heilongjiang, Jilin, Liaoning and Inner Mongolia were particularly affected. In Harbin, the capital of Heilongjiang province, around 24,000 workers were dispatched to clear the snow from the roads.

It almost seems like a trend of moving away from the new Silk Road. The Philippines are rejecting China’s loans and are opting to borrow money from Japan instead. President Ferdinand Marcos also invites the USA to expand military bases in their country. This marks a clear departure from the China policy of his predecessor. For Marcos, the primary concern is the threat posed by the territorial claims of the overwhelmingly large neighbor, as reported by Joern Petring.

Meanwhile, Sri Lanka has invited the USA to invest in the port of Colombo. This port was previously considered a significant cornerstone of the Belt and Road Initiative. Together with Italy’s withdrawal from Belt and Road, we see a mixed picture: While some countries still have a great interest in Chinese engagement, others have become more suspicious.

After much delay, China has finally unveiled its plan to reduce methane emissions. Nico Beckert analyzes why the proposed measures have disappointed climate activists. China is the world’s largest emitter of the particularly climate-damaging gas, and yet it is making minimal efforts to reduce these emissions.

In search of an alternative to China’s Belt and Road Initiative, the Philippines are looking towards the West and other regional partners. According to a Reuters report on Monday, Japan, South Korea and India have offered to finance railway projects in the Philippines worth nearly five billion US dollars, as announced by Manila’s Transportation Minister Jaime Bautista. The government could also fund a portion of the railway projects itself or seek investments from the private sector.

One thing is clear: Given the extremely tense relations, an agreement with Beijing, which originally wanted to build and finance the projects, seems impossible. Specifically, the projects in question include:

By rejecting Chinese project financing, Manila is effectively withdrawing from the Belt and Road Initiative. There is no formal, standardized process for joining the Belt and Road Initiative (BRI); membership often results from participation. In the case of the Philippines, their BRI membership began with their entry into the Asian Infrastructure Investment Bank (AIIB) in 2015 under President Rodrigo Duterte. Their primary interest from the beginning was in infrastructure loans, which his successor now deliberately rejects.

Together with Italy’s impending exit from the New Silk Road, these are two heavy blows to the trade network.

Lately, China and the Philippines have primarily made headlines due to their disputes in the South China Sea. In the past weeks and months, there have been multiple collisions between Philippine vessels and the Chinese Coast Guard. However, economic relations have been strained for some time, regardless of this.

From Beijing’s perspective, everything initially seemed promising. Duterte set aside the long-standing territorial disputes over the South China Sea, as desired by Xi Jinping. In return, China pledged billions of dollars in aid, loans and investments.

However, the money did not flow as expected. Over time, there were delays in project implementation. Critics questioned the loan terms, including the relatively high interest rates, and expressed concerns about the strategic implications of Chinese presence in the region.

In 2022, the new President Ferdinand Marcos Jr. took office. Under his leadership, the Philippine government critically reviewed the projects funded by China. He demanded better terms from Beijing, but from the Philippine perspective, these demands were ignored.

These developments are part of a larger geopolitical context. The Philippines are reevaluating their relationship with China while simultaneously strengthening their security ties with the USA. This cooperation is a sore point for China.

While the USA hasn’t had its own bases in the Philippines since the 1990s, the Enhanced Defense Cooperation Agreement (EDCA) grants the US military access to selected Philippine military bases.

In line with this, the Philippines began a large-scale naval exercise with Japan, South Korea and the USA. To China’s dismay, Marcos Jr. significantly expanded the EDCA. The number of bases where US forces can operate has doubled. The nine locations were announced in April:

These locations are strategically important as they are near Taiwan and the disputed Spratly Islands in the South China Sea, where China has built artificial islands with runways and missile systems.

In response to the EDCA expansion, Beijing emphasized that economic trade cannot flourish without a peaceful and stable regional environment. Additional EDCA locations would only create problems in the region. It’s also worth noting that Peking may not have been pleased with Marcos Jr.’s absence at the 10th-anniversary summit of the Belt and Road Initiative in Beijing in October.

It is becoming increasingly clear that relying on security assurances from the United States in the region makes it harder to conduct lucrative business with China. For the states in the region, this is a delicate balancing act.

The climate envoys of the USA and China, John Kerry and Xie Zhenhua, have been preparing for the APEC summit in California (Nov. 11-17), where Presidents Joe Biden and Xi Jinping will meet. The release of China’s methane strategy shortly after the Kerry-Xie meeting is seen as a significant signal.

The reduction of methane emissions has been a recurring topic between the climate superpowers. At COP26 in Glasgow in 2021, both countries agreed to make more efforts to reduce short-lived but highly climate-damaging methane. At that time, China committed to developing a methane strategy. In Sharm el-Sheikh, at COP27, Xie confirmed China’s decision to do more in the future.

The release of China’s methane strategy could set the ball rolling. COP President Al Jaber welcomed it as “a moment for international climate action measures”.

China is the world’s largest methane emitter. Methane, when considered over 20 years, is 80 times more harmful than CO2. Reducing its emissions is seen as the “fastest way to immediately slow global warming,” according to the Environmental Defense Fund.

China’s methane plan, which had been in the drawers of the Chinese Ministry of Ecology and Environment as a draft for more than a year, has been silent since Xie’s comments in November 2022.

However, the plan presented now is not very ambitious:

“The goals mentioned in the plan are too ambiguous and mainly contain descriptive text,” says Yan Qin, an energy expert at the analysis firm Refinitiv, to Reuters. Analyst Lauri Myllyvirta also criticizes the plan’s “soft aims“. The plan only says that China will “study the establishment of” or “seek to establish” the establishment of a methane measurement, reporting, and verification system, he writes.

Zhang Kai, Deputy Program Director at the Beijing office of Greenpeace East Asia, however, sees the plan as a “positive step towards combating methane emissions,” as he writes on X. Controlling methane emissions in the coal sector should be a priority, Zhang writes.

China faces significant challenges in reducing methane emissions because a large portion of the emissions comes from the coal sector. These emissions are more challenging to control than those in the gas and oil sector. However, economic factors are not the only consideration in China’s methane plans. The country does not want to be pressured into more climate action by the USA; it would be a loss of face in front of the domestic audience if the major systemic rival could demand concrete targets and plans. Yet, China is highly threatened by climate change, so it’s in the country’s own interest to reduce emissions.

An official commitment from Beijing is still pending, but signs are increasingly pointing towards a conversation between China’s President Xi Jinping and US President Joe Biden on Nov. 16 at the Asia-Pacific Economic Cooperation (APEC) summit in San Francisco.

There have been several meetings between high-ranking politicians of the world’s two largest economies, all of which indicate such a top-level meeting. These are positive signs for improving the overall relationship between both nations, said China’s Vice President Han Zheng on Wednesday at the Bloomberg New Economy Forum in Singapore.

China is open to strengthening its strained relationship with the United States “at all levels”, Han stated. “We are ready to enhance communication and dialogue with the United States at all levels, promote mutually beneficial cooperation, manage differences appropriately, and address global challenges together.”

Xi and Biden last met personally at the G20 summit in Bali in 2022. The mood between the two was already tense during that meeting and hasn’t improved since. At the beginning of the year, a scandal involving a Chinese spy balloon over US territory rocked the relationship between the two superpowers. The relationship was further strained by the halt in the supply of critical high-performance chips to the People’s Republic as part of US-imposed sanctions.

However, the visit could now mark a turning point. Another positive sign is that China’s top finance official, He Lifeng, traveled to San Francisco on Wednesday to hold intensive talks with US Treasury Secretary Janet Yellen until Sunday. flee

China and Australia are on a path to relaxation. After a meeting on Monday in Beijing, Australian Prime Minister Anthony Albanese and China’s Party and State Leader Xi Jinping praised the “undoubtedly very positive” progress in their countries’ relations. According to reports from the state broadcaster CCTV, China and Australia could become “trustful and successful partners” and there are “no fundamental conflicts of interest“. Albanese also invited Xi to visit Australia.

It was the first visit by an Australian prime minister to China in nearly seven years. In 2017, relations between the two countries deteriorated rapidly after Australia formulated a law against foreign influence, primarily targeting Beijing’s influence on Australian politics. In 2018, China imposed a high import tariff on Australian barley after Australians excluded Huawei and ZTE from building the domestic 5G network.

In November of the same year, the Chinese embassy in Canberra presented a list of 14 demands that Australia had to meet to normalize relations. According to the Reuters news agency, the 14 demands were suddenly no longer a topic at the meeting on Monday.

Even before the meeting, Australia and China had come closer: Australia dropped a lawsuit with the World Trade Organization over Chinese tariffs, and Beijing released Australian journalist Cheng Lei, who had been detained for three years on charges of espionage. fpe

Russia and China continue to signal a closer relationship. In Moscow, senior General Zhang Youxia and Russian Defense Minister Sergey Shoigu discussed strengthening their military cooperation. A meeting with President Vladimir Putin was also planned, according to Kremlin spokesman Dmitry Peskov in Moscow on Wednesday.

Zhang Youxia is the Deputy Chairman of the Central Military Commission and the second-highest commander of the armed forces after President Xi Jinping. Zhang told the Russian news agency Interfax that China and Russia want to intensify their military relations and the cooperation of their armies. He reiterated the phrase of a “comprehensive partnership and a high-level strategic cooperation.”

Usually, China’s defense minister represents the country’s military interests abroad. Currently, China does not have a defense minister since Li Shangfu was officially removed a few weeks ago. fin

The United States is entering into direct competition with China in Sri Lanka in terms of development financing. On Wednesday, the US International Development Finance Corporation (DFC) announced the construction of a 553 million dollar deep-water container terminal in the port of Colombo. The project has the potential to transform Colombo “into a world-class logistics center at the crossroads of major shipping routes and emerging markets,” as stated by the agency.

The DFC loan will “expand the country’s shipping capabilities and contribute to more prosperity in Sri Lanka – without increasing government debt – while strengthening the position of our allies in the region,” said Scott Nathan, Chief Executive Officer of the DFC, which was founded five years ago in response to Beijing’s Belt and Road Initiative.

Sri Lanka was once considered an outpost of China due to massive Chinese investments and an example of Beijing’s “debt-trap diplomacy”. Recently, the government in Colombo asked the Chinese for debt restructuring. The island nation of 22 million people is still in its most severe economic crisis in decades. fpe

China’s financial regulatory authority is apparently urging the insurer Ping An to undertake the rescue of the insolvent property developer Country Garden. Reuters reported this, citing four sources. The instruction for the rescue comes from the top, namely, Premier Li Qiang.

Ping An itself denies the report. This is not surprising since the development would not be good news for the insurer. Ping An is financially sound, whereas Country Garden is burdened with debts of approximately 17 billion euros. A state-engineered takeover of a troubled company by a healthy one tends to result in a construct that is only half-healthy rather than entirely healthy, thus the concern. As a result, Ping An’s stock price fell on the Hong Kong Stock Exchange.

On the other hand, the rescue of Country Garden would be an important signal that the government is addressing problems in the real estate sector. Concerns about China’s most critical economic sector are weighing down sentiment and growth. “If the news is true, it will have a very positive impact on the real estate and capital markets,” said Xu Tianchen, an economist at the Economist Intelligence Unit.

Although Ping An is a private company and one of the world’s largest insurance companies, it cannot evade a direct directive from Beijing. On the authorities’ side, the Chinese central bank and the financial regulatory authority are involved in the negotiations. fin/rtr

Now, it is as official as an ascent to an unofficial role can be: Vice Premier He Lifeng is China’s new economic czar. A few days ago, it was announced that he was promoted to leading positions in three CCP internal committees that oversee finances and the economy. These committees are part of the network of party commissions created by State and Party Chairman Xi Jinping over the past ten years, most of which he formally chairs. These commissions have transferred significant powers from the State Council to the party.

The 68-year-old He has thus reached the highest circle of power, with a close connection to Xi. The multitude of various, outwardly vague-sounding party roles is common for high-level CCP leaders. Observers, therefore, coined the term “economic czar” for the chief economic advisor to the party leader.

He Lifeng is now the Bureau Director of the Central Finance and Economic Commission (中央财经委员会) led by Xi, Bureau Director of the Central Finance Commission (中央金融委员会), and Party Secretary of the Central Financial Work Commission (中央金融工作委员会). Both finance commissions were established in March; the former shapes policies for the country’s massive financial sector, while the latter ensures that “the financial system is in line with the party’s political goals, theories, morals, and discipline,” as described by the business magazine Caixin.

The previous occupant of the position at the Central Finance and Economic Commission was the former economic czar Liu He, China’s most famous international economic policy maker in recent years. Liu He was also one of four Vice Premiers responsible for the economy in the government until he retired in March 2023. However, Liu is only three years older than his successor. Both belong to the same generation of politicians and are close confidants of Xi. However, they are fundamentally different.

Liu He studied and conducted research in the United States and was comfortable on the international stage. He negotiated with representatives of the Trump administration from the beginning of the US-China trade war and delivered a keynote speech at the Davos Economic Forum in 2018 on behalf of Xi. In China, Liu has stood for reform-oriented economic policies for many years, which he significantly shaped.

He Lifeng, on the other hand, has a reputation as an inconspicuous bureaucrat who implements Xi Jinping’s directives. There are no iconic statements on economic policy attributed to him, and he is just now becoming known abroad. A diplomat recently involved in trade talks with China described He as “tough and uncompromising” to Reuters. Unlike Liu, He doesn’t communicate in English.

He Lifeng was born in 1955 to a Hakka minority family in the Yongding district in the southeastern coastal province of Fujian, known for its tulou roundhouses. Like many of his generation, he was sent to do agricultural work during the Cultural Revolution and contributed to building a dam. He studied finance at Xiamen University from 1978 to 1984. In 1998, he earned a doctorate in economics. At that time, he was already the party secretary of the nearby city of Quanzhou.

A significant part of his party career took place in Fujian, and back then, his path crossed that of Xi Jinping. As a finance official in Xiamen, he worked alongside Xi, who was then the Vice Mayor of the port city. He later became the Party Secretary of the provincial capital, Fuzhou, when Xi was the provincial governor. He Lifeng belongs to a group that Cheng Li of the US think tank Brookings Institution calls the “circle of secretaries” (秘书), men who supported Xi Jinping during his career and thus became confidants and proteges.

As Xi became Vice President, He also moved north, becoming the party secretary of Tianjin’s Binhai New Area, which is a financial special zone. In 2014, He became Deputy Chief of the powerful National Development and Reform Commission, of which he was Chairman from 2017 until March 2023. Among other things, he implemented Xi’s Belt and Road initiative during those years.

This position gave He the “opportunity to show his capacity in financial and economic matters at the national level of leadership,” Cheng Li wrote at the time. He, like Liu He and other economic advisors to Xi, was considered one of the market-friendly technocrats of the country, as opposed to Xi’s conservative propaganda advisors. However, what He Lifeng is truly like will only become evident now.

In any case, He Lifeng will face an even more challenging environment in his new role than his predecessor, Liu. Geopolitical tensions are increasing further abroad. China’s economy is faltering. As the head of the Central Finance Commission, He Lifeng will be responsible for managing the municipal debt crisis and the real estate sector crisis in China. Both are weighing heavily on the Chinese economy.

In October, he participated in the 3rd German-Chinese Financial Dialogue in Frankfurt, where he met with German Finance Minister Christian Lindner. He advocated for opening financial markets and strengthening cooperation between central banks and insurance regulatory authorities. This week, He is traveling to the United States, where he will meet with Treasury Secretary Janet Yellen in San Francisco, among others. Christiane Kühl

Sebastian Blaettler is now Managing Director China at the Boschung Group from Switzerland, a machine and plant manufacturer specializing in infrastructure maintenance equipment such as airport sweepers. Blaettler was previously a partner at Consulting Blaettler & Miescher KIG.

Tiffany Wu has been appointed Managing Director Greater China by Birkenstock. In this newly created position, Wu will be responsible for increasing brand visibility, brand equity and sales in the region. She will report to Klaus Baumann, Chief Sales Officer of the Birkenstock Group.

Is something changing in your organization? Let us know at heads@table.media!

Using heavy equipment to battle the snow: Over the weekend, northern China was hit by a cold front. The central weather authority issued the highest level of warning for parts of the country due to heavy snowstorms. The provinces of Heilongjiang, Jilin, Liaoning and Inner Mongolia were particularly affected. In Harbin, the capital of Heilongjiang province, around 24,000 workers were dispatched to clear the snow from the roads.