In the 1960s, a geopolitical truism was that whoever controls space has power over the planet. This idea was the decisive impetus for the space race between the Soviet Union and the United States.

The new century, on the other hand, started out space-weary. The projects in space were extremely expensive and did not yield any profit. Other technologies like digitalization seemed more interesting. The US outsourced space travel to the private sector.

China, on the other hand, currently goes all-out in space. Michael Radunski spoke with political scientist and arms researcher Niklas Schoernig about the implications of this. Because it actually remains true: Whoever sets their sights on the Earth from above is in the superior position. Militarily, technologically and economically.

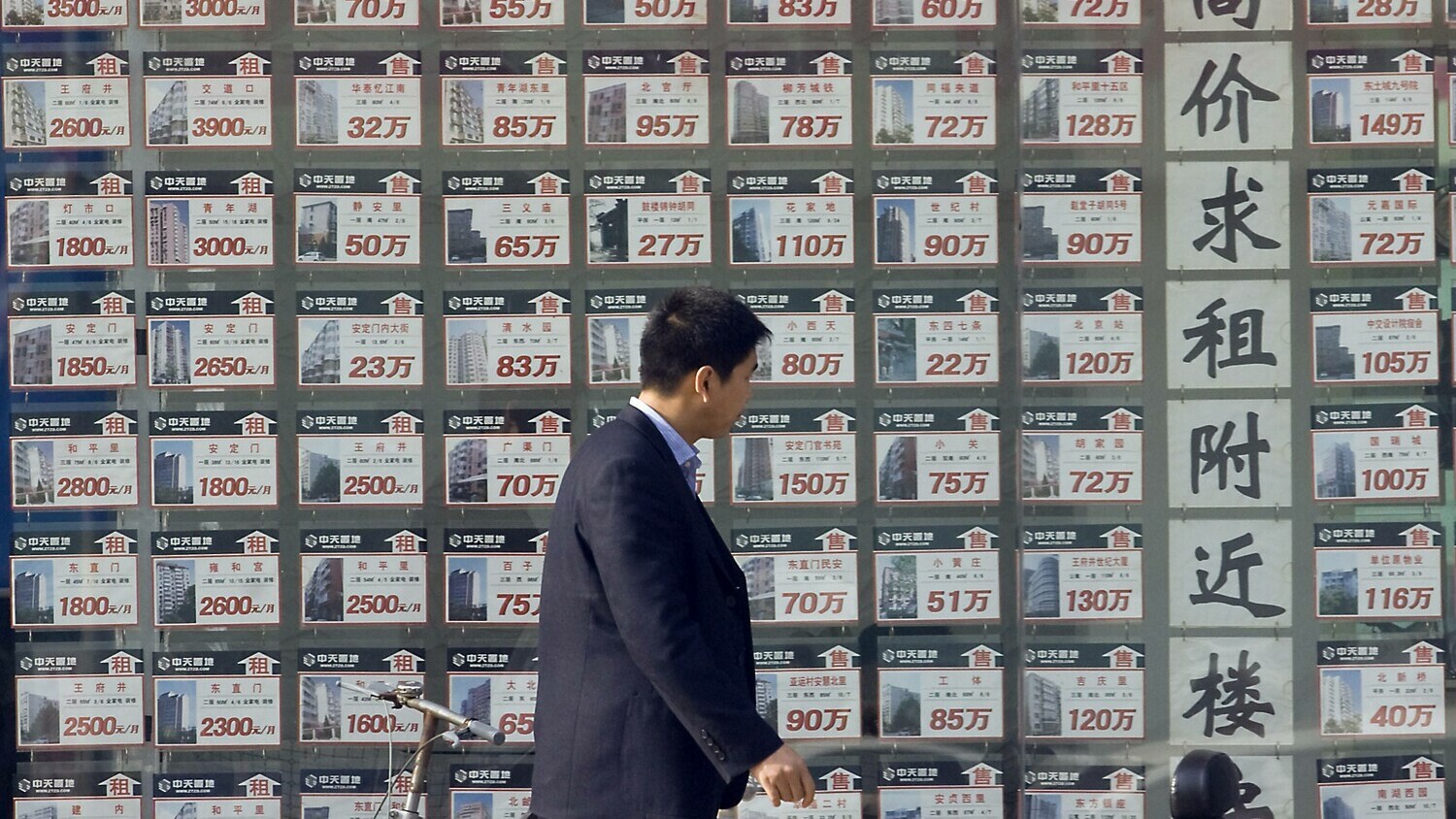

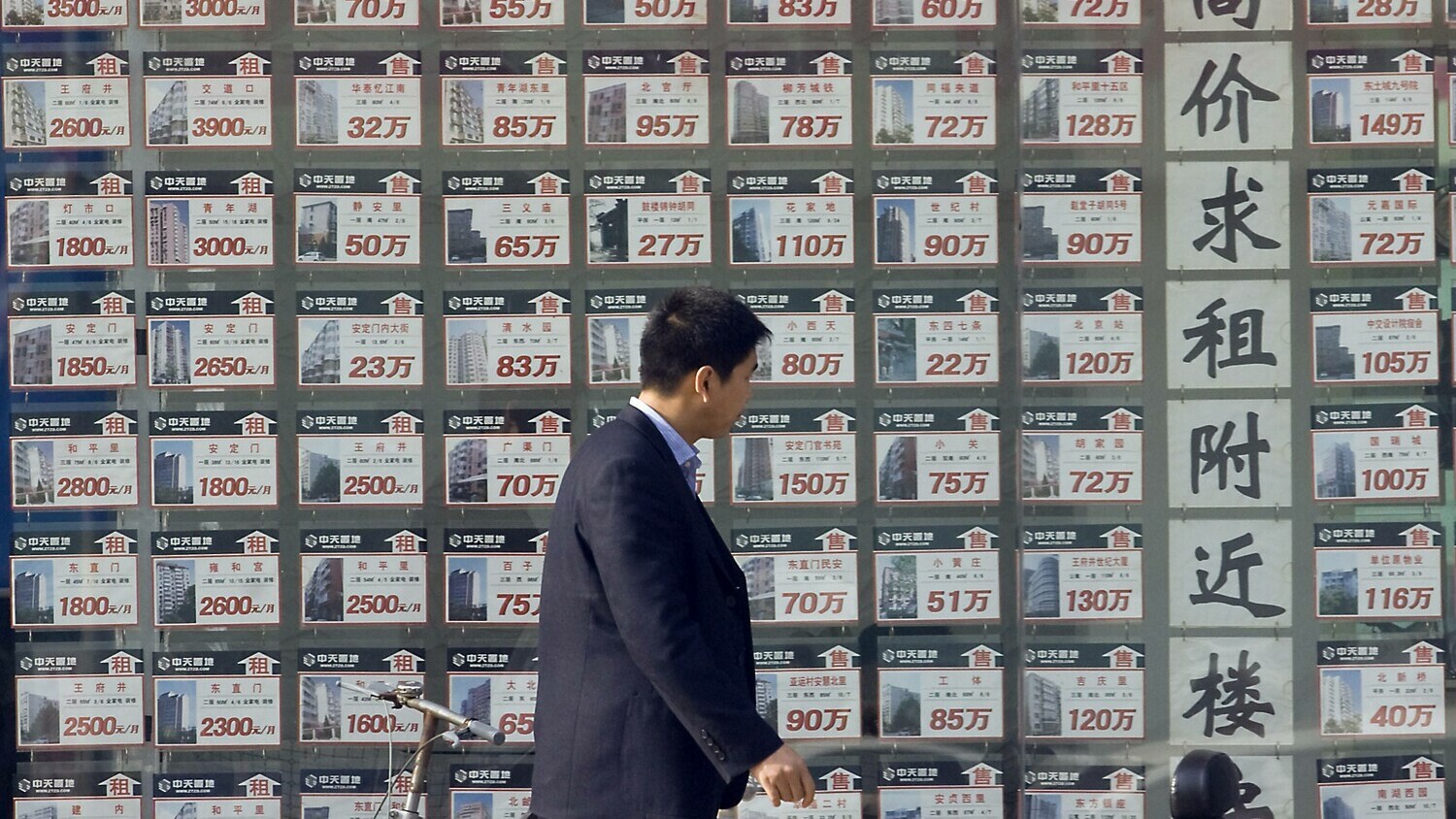

China’s influence is based primarily on its market power anyway. But this power is at risk since the real estate bubble burst, warns Felix Lee in his analysis. The main warning signs are falling prices and youth unemployment. The consequences of the bubble hit China at a much earlier point in its development than it did Japan in the early 1990s.

The reports about China’s successes in space are impressive. Is the People’s Republic the new superpower in space?

I personally think superpower is a bit too much. But the successes are indeed impressive. You have to note that China has already caught up with the US in some areas. Above all, China has positioned itself very broadly in space, both militarily and civilly. But Beijing has also spent a lot of money on this.

How much?

Figures from China should always be taken with a grain of salt, especially here, because much of it has to do with China’s military programs. But as a reference value: The leader in 2022 is the USA with 62 billion US dollars. But then China already follows in second place with about 12 billion US dollars.

That’s still a significant gap.

Yes, to the USA. But China has simultaneously stormed away from the rest of the competition. After China comes nothing for a long time, then at some point Russia with 3.4 billion US dollars and the EU as an institution with 2.6 billion. So a clear gap between the US, China and the rest can be observed. The trend is also important: The US lead is dwindling as China continues to invest massively and catch up.

Why does China put such a strong focus on space?

This has several reasons. First, there are economic interests that sometimes reach far into the future, such as the question of mining rights on asteroids. Far more short-term is the exchange of data and bandwidths that can be made available for communication. Then there is the military component: China has recognized that a modern army must have surveillance and communication satellites in space.

The military aspect usually sounds very abstract. Can you give an example?

China has launched its own navigation system called Beidou. This is important in case the US shuts down global GPS navigation in case of conflict. In the past, the Chinese military relied on this US system.

How does China manage to surpass Russia and Europe so quickly?

Space travel has been somewhat out of fashion in the West since the 2000s. In the US, the space shuttle program simply ended, Russia did not replace its Mir space station. A certain space fatigue could be felt everywhere. China is quite different. Beijing has invested a lot of money and has chosen space travel as a national prestige object.

A strategic mistake by the West?

Yes, because now we are experiencing a classic action-reaction: Since China has become so active, the West is now reacting because they recognize the strategic importance of space. Remarkably, however, it was not state actors such as NASA or the US military that reacted first, but primarily companies from the private sector. Most rocket launches are currently carried out by civilian actors like SpaceX.

So the West is lagging behind. How good are the Chinese already?

An important indicator is the number of successful rocket launches – and here the Chinese are on a par with the US. The important thing here is that the United States sometimes fails launches, while the Chinese consistently manage to do well. There is a lot of quality behind it. Another piece of evidence is the aforementioned navigation system Beidou. Since 2020, it has been a full alternative to American GPS.

China is thus on par with the US.

And in some cases, even further ahead, for example, in what is known as on-orbit servicing. This is the attempt to bring a satellite so close to another satellite that it can be refueled or collected for repairs. To do this, you have to navigate so precisely as not to damage the other object. Some experts are convinced that the Chinese already have more advanced systems than the US.

The head of NASA recently warned of China as a new space power. How great is this danger?

Hard to tell. But the connection between the Chinese space program and the military is extremely close. Many supposedly civilian applications can quickly be used for military purposes.

Like what?

With said on-orbit servicing, China could not only collect its own space debris, but simply capture a US satellite. It is more obvious with rockets. China is one of four countries worldwide that could shoot down satellites from Earth using missiles.

Could…

Yes, could, but that is quite realistic. In the novel “Ghost Fleet,” which is based on realistic possibilities, US political scientist Peter Singer described how a possible next world war between China and the USA could begin: With a Chinese attack on American satellites. And the logic behind this is shockingly apparent: The US military is currently so dependent on its own satellites that a strike against these satellites would hit the American military very hard. And China now has these capabilities.

What do these mean for the international order?

The global monopoly of the US is crumbling. China becomes an important alternative for all nations that do not want to cooperate with the US. Take GPS and Beidou, for example. However, in recent years, the Chinese have often behaved like a bull in a china shop when they launched satellites for testing purposes. These were their own satellites, but they created a lot of space debris. And that is dangerous for all nations.

None of this sounds good.

But I also see opportunities in China’s progress. The West has been shaken up. We urgently need to consider whether we seriously want to do without the European ISS or an American space station in 2030. We must be clear: Space has long since become a critical infrastructure. Do we really want to knock on the door of Chinese Tiangong asking for permission to join? Then China would really have power over space.

Niklas Schörnig is a research group coordinator at the Peace Research Institute Frankfurt.

Two dozen 30-floor condo towers stretch into the sky. Some are finished, the rest are still under construction. But the cranes are at a standstill, the scaffolding has been removed from some of the unfinished buildings. And even the apartment buildings that are ready for occupancy are empty.

Like in this suburb of the million metropolis Hangzhou, the situation looks similar in dozens of Chinese cities. The real estate market is in free fall. In June alone, real estate sales slumped by almost 30 percent compared to the same month last year. Across the country, China is sitting on a gigantic stock of more than 50 million homes that cannot find buyers – let alone tenants.

The most prominent loss-maker currently is Evergrande. The Chinese construction group has piled up more than 300 billion euros in debt – more than any other real estate company. About 30 other real estate companies have defaulted on their repayments to investors.

Economists have been warning about China’s bloated real estate sector for decades. Now, the warnings have come true: The bubble has burst. Not as suddenly as the world experienced in the real estate and financial crisis of 2008 with the collapse of Lehman Bank, but in a Chinese way: When real estate companies default on payments, the state steps in because it does not want to risk big companies going bankrupt. Nevertheless, buyers stay away from the market, investors flee, and the mountain of debt grows instead of shrinking.

Because 70 percent of Chinese private wealth is also bound up in real estate and many consumers are indebted, they are on buyer’s strike – and not only in the real estate segment, but also in buying and consumption. Car sales are declining, retail spending is barely growing. As a result, prices have already started to fall. So while Western central banks and most countries worldwide struggle with persistent inflation, China faces deflation.

According to the National Bureau of Statistics of China in Beijing, the year-on-year consumer price index was zero in June, and prices had only increased by a meager 0.2 percent year-on-year in May. Producer prices, the harbinger of general price trends, declined by a sharp 5.4 percent year-on-year. What now looms is a downward spiral of falling prices.

What makes deflation so dangerous: Consumers are reluctant to spend when they count on goods becoming cheaper and cheaper. Companies are stuck with their products, are forced to cut wages and lay off employees, further depressing consumption. In such a situation, companies do not even think about investing.

While central banks can counter inflation with higher interest rates, the instruments are less effective when it comes to deflation. Only “speedy, substantial, and sustained” fiscal stimulus by the government would help, according to Richard Koo, renowned chief economist of the Nomura Research Institute.

The central government’s debt level indeed remains low. But what matters much more in China: Local governments have also earned from the real estate business for decades. And they did so by selling land. With these deals missing, they have now also experienced payment difficulties. As a result, the public sector is reluctant to invest. Koo speaks of an impending “balance sheet recession“: Consumers, companies and municipalities prefer to pay back debts instead of taking out loans and investing. The downward spiral continues to move downwards.

And yet the economic figures do not look so bad right now. According to the statistics office, China’s economy grew by 6.3 percent in the past quarter compared to the same period last year. That sounds impressive. But this figure is deceiving. A year ago, Shanghai’s leaders and many other regions imposed one of the most draconian Covid lockdowns ever. The economy came to a virtual standstill for six weeks.

The Chinese economy grew by only 0.8 percent compared to the previous quarter. That is very little for a still-developing emerging market like China, which still has much growth potential, especially in rural areas. And a far cry from the average annual growth of seven percent in the years before the pandemic.

The high unemployment rate among young people and recent university graduates is now over 20 percent nationwide. And yet there should actually be a shortage of labor. Because of the decades-long one-child policy, which allowed each couple only one child, the workforce is already shrinking.

The fact that youth unemployment is so high shows how badly the Chinese economy is faring. “The demographic problem, hard landing of the property sector, heavy local government debt burden, pessimism of the private sector as well as China-US tensions do not allow us to hold an optimistic view towards mid- to long-term growth,” said Wang Jun, chief economist at Huatai Asset Management.

Memories of Japan in the early 1990s come to mind. Up until that time, the island nation also experienced an unprecedented boom. Then its bubble burst. The Japanese government managed to prevent the entire Japanese economy from crashing with massive government spending. But what followed were decades of deflation. This continues more or less until today.

But there is a significant difference. By the time the Japanese economy began to stagnate, it had already exceeded the average per capita GDP of high-income economies. China, on the other hand, is only just above the median global income level. In other words: Japan was already rich. China still isn’t.

The powerful National Development and Reform Commission (NDRC) in China is well aware of this problem. Its head, Zheng Shanjie, recently called in the CP organ Qiushi to accelerate the development of a modern industrial system to cope with the difficult transition from middle to high-income levels. But this is easier said than done.

China enthusiasts often cite the booming digital technology and electric cars as proof of progress. But will that be enough for the country’s development? Because much of the industry is not keeping up with the necessary modernization. “Many observers will look at some of the companies and say, wow, China can come up with all these fantastic products, so the future should be bright,” says Koo. But he wonders whether China has enough such companies in relation to its size.

According to the US news agency AP, China has urged Russia in the United Nations Security Council to avert a global food crisis. Chinese deputy UN ambassador Geng Shuang demanded of his Russian counterpart quickly restore Ukrainian grain shipments.

Geng referred to UN Secretary-General António Guterres’ commitment to do everything possible to ensure that Ukrainian grain as well as Russian food and fertilizers reach world markets in the interest of “maintaining international food security and alleviating the food crisis in developing countries in particular.”

Council members further criticized Moscow for attacking Ukrainian ports and destroying port infrastructure. They said this violates international law, which prohibits attacks on civilian infrastructure. In response to Russia declaring vast areas in the Black Sea dangerous for shipping, the UN warned that a military incident in the sea could have “catastrophic consequences.” flee

Volkswagen subsidiary Audi is in talks with its Chinese joint venture partner SAIC about the joint development of EVs. SAIC chief engineer Zu Sijie said his company had agreed with Audi to jointly accelerate the development of electric cars. He did not give details. Audi stated that it would work with partners on the future direction of its China business.

The German company brings its vehicles to the Chinese market via joint ventures with SAIC and FAW. According to an insider, negotiations are underway with both partners. Letters of intent are expected in the coming weeks, and a contract could be signed before the end of the year.

Audi is far behind the competition in the China business. Audi’s outgoing CEO Markus Duesmann recently said there are currently not enough vehicles on the market to meet Chinese needs. At the same time, he announced plans to localize some electric models earlier than initially planned. Audi is currently constructing a plant in Changchun together with FAW, where vehicles on the PPE platform will be produced starting at the end of 2024. In addition, Audi sells the electric Q4 in China.

An insider told Reuters that talks are now focusing on other vehicle segments. These concern stand-alone cars built in China for China. Other sources claim that Audi could take over SAIC’s electric platform. SAIC’s electric brand IM Motors, in which the Chinese e-commerce giant Alibaba has a stake, launched the L7 luxury sedan a year ago. rtr

The world’s largest chemical company BASF plans to set up a joint venture with the Chinese energy company Mingyang for an offshore wind farm on the coast off southern China. Mingyang will hold 90 percent and BASF ten percent of the shares, the two companies announced.

The planned wind farm in Zhanjiang in the province of Guangdong will have a capacity of 500 megawatts and is expected to be fully operational in 2025. The majority of the electricity generated is to be used for BASF’s new Verbund site in Zhanjiang, which will be supplied entirely with electricity from renewable sources.

BASF is investing up to ten billion euros in Zhanjiang – the largest single investment in company history. The first production plant for engineering plastics needed by the automotive and electronics industries already went into operation last year. After completion, Zhanjiang will be BASF’s third-largest production site after its headquarters in Ludwigshafen and Antwerp. rtr/flee

The People’s Liberation Army once again dispatched dozens of fighter jets toward Taiwan. Some 22 of them crossed the unofficial border line in the Taiwan Strait. This was reported by AP, citing the Taiwanese Ministry of Defence.

On Monday, the so-called Han Kuang exercise begins, during which Taiwan tests its combat readiness every year in case of a Chinese invasion. Another exercise is to prepare civilians for natural disasters and evacuations in the event of an air attack. flee

The G7 countries, the European Union and three other countries have sent a letter to China urging it to provide better support for the United Nations sanctions against North Korea. The letter to China’s UN permanent representative, Zhang Jun, says: “We have concerns regarding the continuing presence of multiple oil tankers … that use your territorial waters in Sansha Bay as refuge to facilitate their trade of sanctioned petroleum products to the DPRK.”

The letter reportedly includes satellite imagery that “clearly indicates these practices continued to occur within China’s jurisdiction in 2022 and have continued in 2023.” The letter also asks “that China inspects the vessels for evidence of illicit oil smuggling, deny them all services, and ultimately expel them from your waters as quickly as possible, if these vessels are discovered to again be anchored in Sansha Bay.”

China has repeatedly stated to abide by the UN Security Council sanctions. North Korea has been under United Nations sanctions since 2006 due to its missile and nuclear programs. This includes an annual import ban on refined and crude oil imposed in 2017. Nevertheless, China and North Korea remain allies. rtr

The expansion of trade between Russia and China against the backdrop of the Ukraine conflict also involves greater use of the Chinese currency for settling payments between the two countries. But the growing use of the yuan threatens to jeopardize China’s goal of establishing a multipolar world monetary system that is not dominated primarily by the dollar. China wants a controlled de-dollarisation to take place, which is now in jeopardy.

Western sanctions have made China Russia’s biggest trading partner. The function as China’s filling station is accompanied by the “yuanisation” of Russian capital and payment transactions. Yuan-ruble transactions are replacing dollar-ruble transactions. Russians can pay credit card bills via the Chinese payment system. Russian energy companies issue bonds in yuan and Russian banks increasingly hold receivables in the Chinese currency.

Bilateral relations between Russia and China are also intensifying in the field of digital currencies (digital yuan and digital rouble). However, at the global level, they are still far from threatening the dominance of the American dollar and the euro through the rise of the yuan as an international currency on par with the two leading currencies. In the fourth quarter of 2022, 58 percent of global allocated reserves were denominated in dollars, 20 percent in euros and less than 3 percent in yuan.

The Chinese government seeks a multipolar currency and payment system, pushing the international use of the yuan as an invoicing, transaction and reserve currency. By increasing the share of the yuan in the Special Drawing Rights (SDR) currency basket by 1.36 percentage points to 12.28 percent in August 2022 (thus now the third most important currency behind the dollar and the euro in the SDR basket), it has moved a step closer to this goal – albeit only in a small policy-determined segment of the global currency system.

However, the yuanization of the Russian economy could jeopardize this goal, or at least make it more expensive for China. To be sure, China could shape its currency policy along the lines of the old American practice of “our currency, your problem” without regard for Russia’s wishes, since the stability of China’s currency in the Western monetary system would still take priority over consideration of the interests of its political ally.

But if more and more yuan were to enter the market as a result of the increased use of the yuan in Russia, China would also have to hold more dollars in reserve in order not to lose control over the exchange rate to Western currencies in offshore banking units – especially to the dollar. But this would conflict with China’s goal of de-dollarizing itself, breaking away from US monetary policy, abandoning export focus in favor of domestic focus, reducing its current account surplus vis-à-vis the West, and allowing real income levels in China to rise broadly. Wage increases beyond the rise in commodity prices are equivalent to a controlled real appreciation of the yuan and a decline in foreign exchange reserves.

This downward trend, from a high level, has been observed over the past decade. This trend could be broken if Russia, and perhaps autocratically ruled followers of Russia, were to rapidly replace the dollar with the yuan. This would not be in line with China’s policy of controlled de-dollarization, unless China were willing not to hold additional dollars and thus allow the exchange rate to the dollar to fall in offshore banking units.

This would be a high price to pay for giving Russia the green light to replace the dollar and other Western currencies with the yuan. Because then, a falling exchange rate against the dollar, similar to August 2015, could trigger monetary disturbances, generate capital outflows from China, which the government would counter by imposing even stricter capital controls.

Even higher costs could arise for China if its ally Russia were to make monetary policy requests to China in order to stabilize the ruble’s exchange rate against Western currencies in the event of a devaluation of the yuan against the dollar and to stretch the cost of servicing Chinese loans. Here Russia could drag China into the familiar currency “mismatch” problem: Russia would invest in its domestic defense industry with the help of Chinese loans that would have to be serviced in yuan and would cost more to service if the ruble depreciates against the yuan.

The question of whether China is willing to write off loans for the sake of alliance loyalty and thereby mitigate Russia’s growing budget problems, or whether China sees Russia and its peg to the yuan as a financial shackle in its climb to the top league of international currencies and follows the motto “our currency, Russia’s problem” will become important for the future of international monetary relations.

This article was written as part of the Global China Conversations event series of the Kiel Institute for the World Economy (IfW). China.Table is the media partner of the series.

Rolf J. Langhammer is a Senior Researcher at the Kiel Institute for the World Economy. He was also Vice President of the Kiel Institute until 2012.

Dexter Roberts builds a new China program as Director of China Affairs at the Mansfield Center with a focus on US-China trade. He previously served as Bloomberg’s Beijing bureau chief and as a journalist for Businessweek, among other positions.

Is something changing in your organization? Let us know at heads@table.media!

Who let the elephants out? Their population in the province of Yunnan had declined massively in recent decades. Now their numbers are increasing again – thanks to the creation of special nature reserves. The only problem is that, like this family, they don’t always stick to the set boundaries, but trample around in one of the adjacent rice fields. The farmers are urged to take it with humor. Because the population has by no means recovered yet.

In the 1960s, a geopolitical truism was that whoever controls space has power over the planet. This idea was the decisive impetus for the space race between the Soviet Union and the United States.

The new century, on the other hand, started out space-weary. The projects in space were extremely expensive and did not yield any profit. Other technologies like digitalization seemed more interesting. The US outsourced space travel to the private sector.

China, on the other hand, currently goes all-out in space. Michael Radunski spoke with political scientist and arms researcher Niklas Schoernig about the implications of this. Because it actually remains true: Whoever sets their sights on the Earth from above is in the superior position. Militarily, technologically and economically.

China’s influence is based primarily on its market power anyway. But this power is at risk since the real estate bubble burst, warns Felix Lee in his analysis. The main warning signs are falling prices and youth unemployment. The consequences of the bubble hit China at a much earlier point in its development than it did Japan in the early 1990s.

The reports about China’s successes in space are impressive. Is the People’s Republic the new superpower in space?

I personally think superpower is a bit too much. But the successes are indeed impressive. You have to note that China has already caught up with the US in some areas. Above all, China has positioned itself very broadly in space, both militarily and civilly. But Beijing has also spent a lot of money on this.

How much?

Figures from China should always be taken with a grain of salt, especially here, because much of it has to do with China’s military programs. But as a reference value: The leader in 2022 is the USA with 62 billion US dollars. But then China already follows in second place with about 12 billion US dollars.

That’s still a significant gap.

Yes, to the USA. But China has simultaneously stormed away from the rest of the competition. After China comes nothing for a long time, then at some point Russia with 3.4 billion US dollars and the EU as an institution with 2.6 billion. So a clear gap between the US, China and the rest can be observed. The trend is also important: The US lead is dwindling as China continues to invest massively and catch up.

Why does China put such a strong focus on space?

This has several reasons. First, there are economic interests that sometimes reach far into the future, such as the question of mining rights on asteroids. Far more short-term is the exchange of data and bandwidths that can be made available for communication. Then there is the military component: China has recognized that a modern army must have surveillance and communication satellites in space.

The military aspect usually sounds very abstract. Can you give an example?

China has launched its own navigation system called Beidou. This is important in case the US shuts down global GPS navigation in case of conflict. In the past, the Chinese military relied on this US system.

How does China manage to surpass Russia and Europe so quickly?

Space travel has been somewhat out of fashion in the West since the 2000s. In the US, the space shuttle program simply ended, Russia did not replace its Mir space station. A certain space fatigue could be felt everywhere. China is quite different. Beijing has invested a lot of money and has chosen space travel as a national prestige object.

A strategic mistake by the West?

Yes, because now we are experiencing a classic action-reaction: Since China has become so active, the West is now reacting because they recognize the strategic importance of space. Remarkably, however, it was not state actors such as NASA or the US military that reacted first, but primarily companies from the private sector. Most rocket launches are currently carried out by civilian actors like SpaceX.

So the West is lagging behind. How good are the Chinese already?

An important indicator is the number of successful rocket launches – and here the Chinese are on a par with the US. The important thing here is that the United States sometimes fails launches, while the Chinese consistently manage to do well. There is a lot of quality behind it. Another piece of evidence is the aforementioned navigation system Beidou. Since 2020, it has been a full alternative to American GPS.

China is thus on par with the US.

And in some cases, even further ahead, for example, in what is known as on-orbit servicing. This is the attempt to bring a satellite so close to another satellite that it can be refueled or collected for repairs. To do this, you have to navigate so precisely as not to damage the other object. Some experts are convinced that the Chinese already have more advanced systems than the US.

The head of NASA recently warned of China as a new space power. How great is this danger?

Hard to tell. But the connection between the Chinese space program and the military is extremely close. Many supposedly civilian applications can quickly be used for military purposes.

Like what?

With said on-orbit servicing, China could not only collect its own space debris, but simply capture a US satellite. It is more obvious with rockets. China is one of four countries worldwide that could shoot down satellites from Earth using missiles.

Could…

Yes, could, but that is quite realistic. In the novel “Ghost Fleet,” which is based on realistic possibilities, US political scientist Peter Singer described how a possible next world war between China and the USA could begin: With a Chinese attack on American satellites. And the logic behind this is shockingly apparent: The US military is currently so dependent on its own satellites that a strike against these satellites would hit the American military very hard. And China now has these capabilities.

What do these mean for the international order?

The global monopoly of the US is crumbling. China becomes an important alternative for all nations that do not want to cooperate with the US. Take GPS and Beidou, for example. However, in recent years, the Chinese have often behaved like a bull in a china shop when they launched satellites for testing purposes. These were their own satellites, but they created a lot of space debris. And that is dangerous for all nations.

None of this sounds good.

But I also see opportunities in China’s progress. The West has been shaken up. We urgently need to consider whether we seriously want to do without the European ISS or an American space station in 2030. We must be clear: Space has long since become a critical infrastructure. Do we really want to knock on the door of Chinese Tiangong asking for permission to join? Then China would really have power over space.

Niklas Schörnig is a research group coordinator at the Peace Research Institute Frankfurt.

Two dozen 30-floor condo towers stretch into the sky. Some are finished, the rest are still under construction. But the cranes are at a standstill, the scaffolding has been removed from some of the unfinished buildings. And even the apartment buildings that are ready for occupancy are empty.

Like in this suburb of the million metropolis Hangzhou, the situation looks similar in dozens of Chinese cities. The real estate market is in free fall. In June alone, real estate sales slumped by almost 30 percent compared to the same month last year. Across the country, China is sitting on a gigantic stock of more than 50 million homes that cannot find buyers – let alone tenants.

The most prominent loss-maker currently is Evergrande. The Chinese construction group has piled up more than 300 billion euros in debt – more than any other real estate company. About 30 other real estate companies have defaulted on their repayments to investors.

Economists have been warning about China’s bloated real estate sector for decades. Now, the warnings have come true: The bubble has burst. Not as suddenly as the world experienced in the real estate and financial crisis of 2008 with the collapse of Lehman Bank, but in a Chinese way: When real estate companies default on payments, the state steps in because it does not want to risk big companies going bankrupt. Nevertheless, buyers stay away from the market, investors flee, and the mountain of debt grows instead of shrinking.

Because 70 percent of Chinese private wealth is also bound up in real estate and many consumers are indebted, they are on buyer’s strike – and not only in the real estate segment, but also in buying and consumption. Car sales are declining, retail spending is barely growing. As a result, prices have already started to fall. So while Western central banks and most countries worldwide struggle with persistent inflation, China faces deflation.

According to the National Bureau of Statistics of China in Beijing, the year-on-year consumer price index was zero in June, and prices had only increased by a meager 0.2 percent year-on-year in May. Producer prices, the harbinger of general price trends, declined by a sharp 5.4 percent year-on-year. What now looms is a downward spiral of falling prices.

What makes deflation so dangerous: Consumers are reluctant to spend when they count on goods becoming cheaper and cheaper. Companies are stuck with their products, are forced to cut wages and lay off employees, further depressing consumption. In such a situation, companies do not even think about investing.

While central banks can counter inflation with higher interest rates, the instruments are less effective when it comes to deflation. Only “speedy, substantial, and sustained” fiscal stimulus by the government would help, according to Richard Koo, renowned chief economist of the Nomura Research Institute.

The central government’s debt level indeed remains low. But what matters much more in China: Local governments have also earned from the real estate business for decades. And they did so by selling land. With these deals missing, they have now also experienced payment difficulties. As a result, the public sector is reluctant to invest. Koo speaks of an impending “balance sheet recession“: Consumers, companies and municipalities prefer to pay back debts instead of taking out loans and investing. The downward spiral continues to move downwards.

And yet the economic figures do not look so bad right now. According to the statistics office, China’s economy grew by 6.3 percent in the past quarter compared to the same period last year. That sounds impressive. But this figure is deceiving. A year ago, Shanghai’s leaders and many other regions imposed one of the most draconian Covid lockdowns ever. The economy came to a virtual standstill for six weeks.

The Chinese economy grew by only 0.8 percent compared to the previous quarter. That is very little for a still-developing emerging market like China, which still has much growth potential, especially in rural areas. And a far cry from the average annual growth of seven percent in the years before the pandemic.

The high unemployment rate among young people and recent university graduates is now over 20 percent nationwide. And yet there should actually be a shortage of labor. Because of the decades-long one-child policy, which allowed each couple only one child, the workforce is already shrinking.

The fact that youth unemployment is so high shows how badly the Chinese economy is faring. “The demographic problem, hard landing of the property sector, heavy local government debt burden, pessimism of the private sector as well as China-US tensions do not allow us to hold an optimistic view towards mid- to long-term growth,” said Wang Jun, chief economist at Huatai Asset Management.

Memories of Japan in the early 1990s come to mind. Up until that time, the island nation also experienced an unprecedented boom. Then its bubble burst. The Japanese government managed to prevent the entire Japanese economy from crashing with massive government spending. But what followed were decades of deflation. This continues more or less until today.

But there is a significant difference. By the time the Japanese economy began to stagnate, it had already exceeded the average per capita GDP of high-income economies. China, on the other hand, is only just above the median global income level. In other words: Japan was already rich. China still isn’t.

The powerful National Development and Reform Commission (NDRC) in China is well aware of this problem. Its head, Zheng Shanjie, recently called in the CP organ Qiushi to accelerate the development of a modern industrial system to cope with the difficult transition from middle to high-income levels. But this is easier said than done.

China enthusiasts often cite the booming digital technology and electric cars as proof of progress. But will that be enough for the country’s development? Because much of the industry is not keeping up with the necessary modernization. “Many observers will look at some of the companies and say, wow, China can come up with all these fantastic products, so the future should be bright,” says Koo. But he wonders whether China has enough such companies in relation to its size.

According to the US news agency AP, China has urged Russia in the United Nations Security Council to avert a global food crisis. Chinese deputy UN ambassador Geng Shuang demanded of his Russian counterpart quickly restore Ukrainian grain shipments.

Geng referred to UN Secretary-General António Guterres’ commitment to do everything possible to ensure that Ukrainian grain as well as Russian food and fertilizers reach world markets in the interest of “maintaining international food security and alleviating the food crisis in developing countries in particular.”

Council members further criticized Moscow for attacking Ukrainian ports and destroying port infrastructure. They said this violates international law, which prohibits attacks on civilian infrastructure. In response to Russia declaring vast areas in the Black Sea dangerous for shipping, the UN warned that a military incident in the sea could have “catastrophic consequences.” flee

Volkswagen subsidiary Audi is in talks with its Chinese joint venture partner SAIC about the joint development of EVs. SAIC chief engineer Zu Sijie said his company had agreed with Audi to jointly accelerate the development of electric cars. He did not give details. Audi stated that it would work with partners on the future direction of its China business.

The German company brings its vehicles to the Chinese market via joint ventures with SAIC and FAW. According to an insider, negotiations are underway with both partners. Letters of intent are expected in the coming weeks, and a contract could be signed before the end of the year.

Audi is far behind the competition in the China business. Audi’s outgoing CEO Markus Duesmann recently said there are currently not enough vehicles on the market to meet Chinese needs. At the same time, he announced plans to localize some electric models earlier than initially planned. Audi is currently constructing a plant in Changchun together with FAW, where vehicles on the PPE platform will be produced starting at the end of 2024. In addition, Audi sells the electric Q4 in China.

An insider told Reuters that talks are now focusing on other vehicle segments. These concern stand-alone cars built in China for China. Other sources claim that Audi could take over SAIC’s electric platform. SAIC’s electric brand IM Motors, in which the Chinese e-commerce giant Alibaba has a stake, launched the L7 luxury sedan a year ago. rtr

The world’s largest chemical company BASF plans to set up a joint venture with the Chinese energy company Mingyang for an offshore wind farm on the coast off southern China. Mingyang will hold 90 percent and BASF ten percent of the shares, the two companies announced.

The planned wind farm in Zhanjiang in the province of Guangdong will have a capacity of 500 megawatts and is expected to be fully operational in 2025. The majority of the electricity generated is to be used for BASF’s new Verbund site in Zhanjiang, which will be supplied entirely with electricity from renewable sources.

BASF is investing up to ten billion euros in Zhanjiang – the largest single investment in company history. The first production plant for engineering plastics needed by the automotive and electronics industries already went into operation last year. After completion, Zhanjiang will be BASF’s third-largest production site after its headquarters in Ludwigshafen and Antwerp. rtr/flee

The People’s Liberation Army once again dispatched dozens of fighter jets toward Taiwan. Some 22 of them crossed the unofficial border line in the Taiwan Strait. This was reported by AP, citing the Taiwanese Ministry of Defence.

On Monday, the so-called Han Kuang exercise begins, during which Taiwan tests its combat readiness every year in case of a Chinese invasion. Another exercise is to prepare civilians for natural disasters and evacuations in the event of an air attack. flee

The G7 countries, the European Union and three other countries have sent a letter to China urging it to provide better support for the United Nations sanctions against North Korea. The letter to China’s UN permanent representative, Zhang Jun, says: “We have concerns regarding the continuing presence of multiple oil tankers … that use your territorial waters in Sansha Bay as refuge to facilitate their trade of sanctioned petroleum products to the DPRK.”

The letter reportedly includes satellite imagery that “clearly indicates these practices continued to occur within China’s jurisdiction in 2022 and have continued in 2023.” The letter also asks “that China inspects the vessels for evidence of illicit oil smuggling, deny them all services, and ultimately expel them from your waters as quickly as possible, if these vessels are discovered to again be anchored in Sansha Bay.”

China has repeatedly stated to abide by the UN Security Council sanctions. North Korea has been under United Nations sanctions since 2006 due to its missile and nuclear programs. This includes an annual import ban on refined and crude oil imposed in 2017. Nevertheless, China and North Korea remain allies. rtr

The expansion of trade between Russia and China against the backdrop of the Ukraine conflict also involves greater use of the Chinese currency for settling payments between the two countries. But the growing use of the yuan threatens to jeopardize China’s goal of establishing a multipolar world monetary system that is not dominated primarily by the dollar. China wants a controlled de-dollarisation to take place, which is now in jeopardy.

Western sanctions have made China Russia’s biggest trading partner. The function as China’s filling station is accompanied by the “yuanisation” of Russian capital and payment transactions. Yuan-ruble transactions are replacing dollar-ruble transactions. Russians can pay credit card bills via the Chinese payment system. Russian energy companies issue bonds in yuan and Russian banks increasingly hold receivables in the Chinese currency.

Bilateral relations between Russia and China are also intensifying in the field of digital currencies (digital yuan and digital rouble). However, at the global level, they are still far from threatening the dominance of the American dollar and the euro through the rise of the yuan as an international currency on par with the two leading currencies. In the fourth quarter of 2022, 58 percent of global allocated reserves were denominated in dollars, 20 percent in euros and less than 3 percent in yuan.

The Chinese government seeks a multipolar currency and payment system, pushing the international use of the yuan as an invoicing, transaction and reserve currency. By increasing the share of the yuan in the Special Drawing Rights (SDR) currency basket by 1.36 percentage points to 12.28 percent in August 2022 (thus now the third most important currency behind the dollar and the euro in the SDR basket), it has moved a step closer to this goal – albeit only in a small policy-determined segment of the global currency system.

However, the yuanization of the Russian economy could jeopardize this goal, or at least make it more expensive for China. To be sure, China could shape its currency policy along the lines of the old American practice of “our currency, your problem” without regard for Russia’s wishes, since the stability of China’s currency in the Western monetary system would still take priority over consideration of the interests of its political ally.

But if more and more yuan were to enter the market as a result of the increased use of the yuan in Russia, China would also have to hold more dollars in reserve in order not to lose control over the exchange rate to Western currencies in offshore banking units – especially to the dollar. But this would conflict with China’s goal of de-dollarizing itself, breaking away from US monetary policy, abandoning export focus in favor of domestic focus, reducing its current account surplus vis-à-vis the West, and allowing real income levels in China to rise broadly. Wage increases beyond the rise in commodity prices are equivalent to a controlled real appreciation of the yuan and a decline in foreign exchange reserves.

This downward trend, from a high level, has been observed over the past decade. This trend could be broken if Russia, and perhaps autocratically ruled followers of Russia, were to rapidly replace the dollar with the yuan. This would not be in line with China’s policy of controlled de-dollarization, unless China were willing not to hold additional dollars and thus allow the exchange rate to the dollar to fall in offshore banking units.

This would be a high price to pay for giving Russia the green light to replace the dollar and other Western currencies with the yuan. Because then, a falling exchange rate against the dollar, similar to August 2015, could trigger monetary disturbances, generate capital outflows from China, which the government would counter by imposing even stricter capital controls.

Even higher costs could arise for China if its ally Russia were to make monetary policy requests to China in order to stabilize the ruble’s exchange rate against Western currencies in the event of a devaluation of the yuan against the dollar and to stretch the cost of servicing Chinese loans. Here Russia could drag China into the familiar currency “mismatch” problem: Russia would invest in its domestic defense industry with the help of Chinese loans that would have to be serviced in yuan and would cost more to service if the ruble depreciates against the yuan.

The question of whether China is willing to write off loans for the sake of alliance loyalty and thereby mitigate Russia’s growing budget problems, or whether China sees Russia and its peg to the yuan as a financial shackle in its climb to the top league of international currencies and follows the motto “our currency, Russia’s problem” will become important for the future of international monetary relations.

This article was written as part of the Global China Conversations event series of the Kiel Institute for the World Economy (IfW). China.Table is the media partner of the series.

Rolf J. Langhammer is a Senior Researcher at the Kiel Institute for the World Economy. He was also Vice President of the Kiel Institute until 2012.

Dexter Roberts builds a new China program as Director of China Affairs at the Mansfield Center with a focus on US-China trade. He previously served as Bloomberg’s Beijing bureau chief and as a journalist for Businessweek, among other positions.

Is something changing in your organization? Let us know at heads@table.media!

Who let the elephants out? Their population in the province of Yunnan had declined massively in recent decades. Now their numbers are increasing again – thanks to the creation of special nature reserves. The only problem is that, like this family, they don’t always stick to the set boundaries, but trample around in one of the adjacent rice fields. The farmers are urged to take it with humor. Because the population has by no means recovered yet.