To get the out-of-control housing market back under control, China’s leadership has cracked down in recent years. The bankruptcy of the heavily indebted construction company Evergrande has served as a cautionary tale for the over-indebtedness of an entire industry.

Suddenly, however, high debts no longer seem so bad in Beijing – and if the desired growth could be achieved, old resolutions are quickly thrown overboard.

At the People’s Congress starting Sunday, Li Keqiang will announce another stimulus, Felix Lee predicts in his Feature on the economy and investment. In other words, the CP will fall back into old habits and abandon discipline for growth. At least in the short term, this will brighten the economic picture.

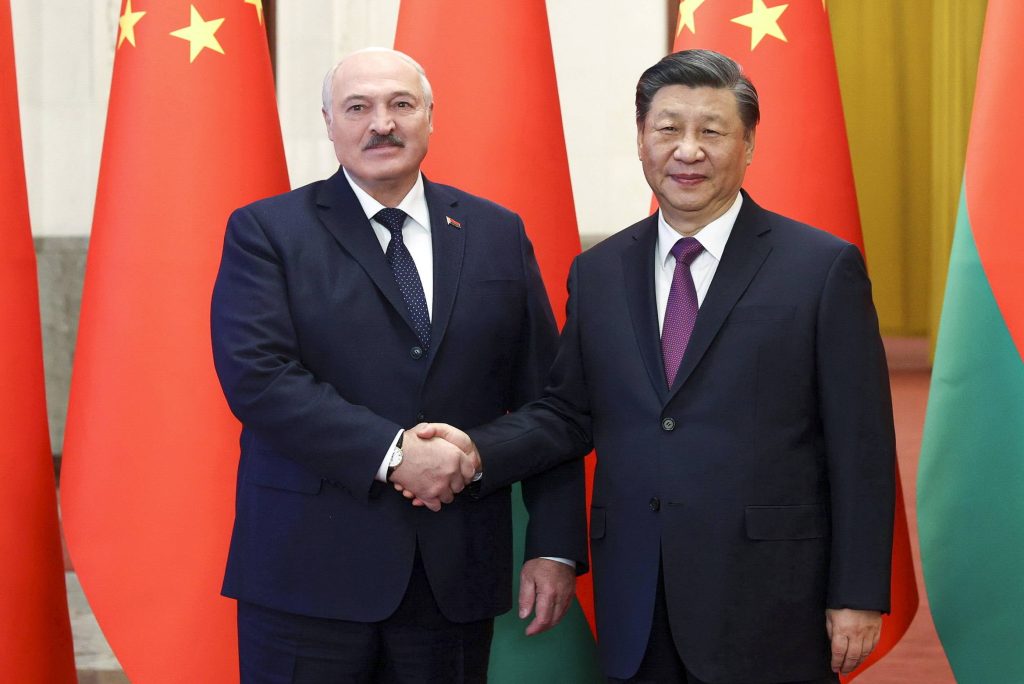

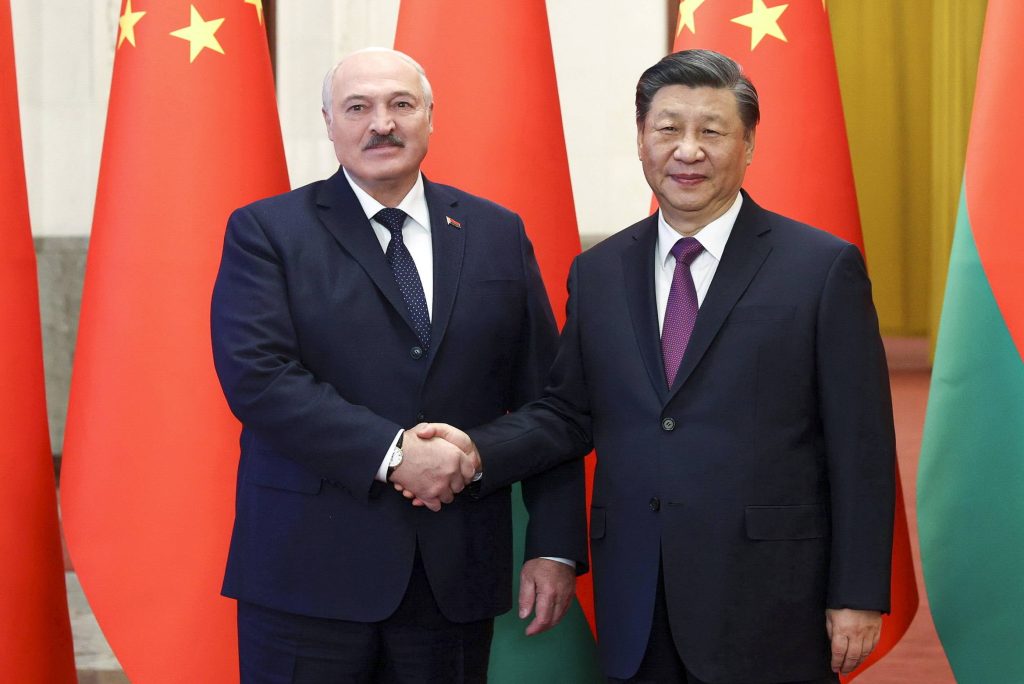

The Belarusian president’s visit to China was also about optics. Depending on the perspective, however, the visit produces very different images for the observer: The EU looks skeptically at Xi closing ranks with Lukashenko, who is loyal to Putin. The meeting of the dictators seems downright threatening to them.

Meanwhile, Beijing beams with joy due to praise for the 12-point plan presented last week to settle the war in Ukraine, as Joern Petring reports. And Lukashenko himself wants to use the visit primarily to boost trade with China.

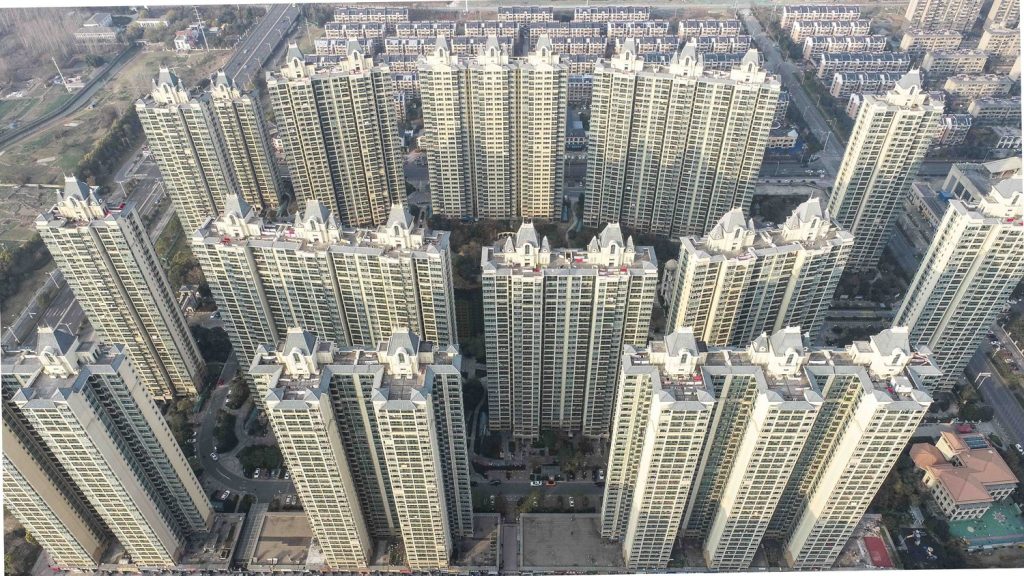

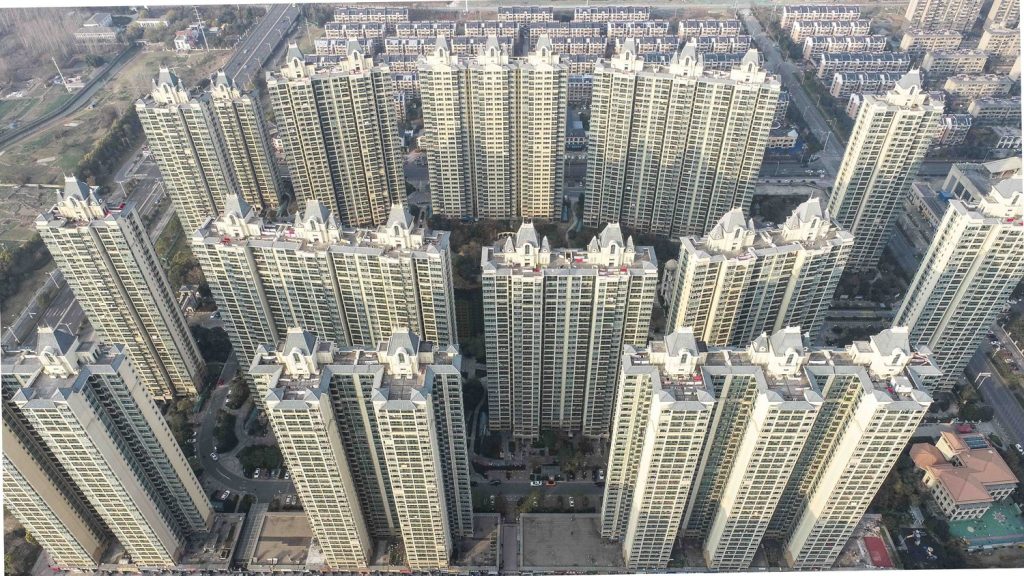

Just a year ago, the Chinese leadership had warned developers and investors: “No more excesses.” State and Party leader Xi Jinping himself reprimanded them: “Houses are for living, not for speculating.” But there is no sign of the supposed turnaround toward moderation in the real estate market. The government is falling back into old patterns and reigniting the spark in the housing market.

The National People’s Congress, the key economic policy event of the year, will now start on Sunday. Outgoing Premier Li Keqiang will announce a growth target for 2023 and the priorities for economic management. By then, there won’t be much left of the warnings to the construction industry other than familiar phrases. It becomes apparent that the communist leadership will fall back into old habits in order to create growth – and above all, will again focus on promoting the real estate sector.

Xi’s warnings were justified. For years, China has been slipping from one real estate crisis to the next. At times, housing prices exploded as investors drove them up. Then there were spectacular bankruptcies of construction companies. In particular, the insolvency of market leader Evergrande last year caused a real tremor. The real estate giant had run into the red with the equivalent of €300 billion from the construction and speculation of entire satellite cities and had thus incurred more debt than any other company in the world.

With the so-called “three red lines” issued by the government, the government wanted to put an end to this behavior. Property developers were to meet stricter financial requirements. And banks were also no longer allowed to grant loans as generously as they had been able to for a long time. But real estate sales subsequently slumped massively, and with them, the economy.

Now the government is backing down and has softened the very regulations that were supposed to ensure more discipline in the construction sector. What’s more, since the end of last year, it has again been pumping billions into the sector via the state banks. “Nobody cares about the three red lines anymore,” says Alicia Garcia Herrero, chief economist for Asia Pacific at French investment bank Natixis in Hong Kong.

Home sales were down nearly 40 percent in 2022 at the worst time compared to the same time last year, she said. Now, the decline is 5 percent. The economist, therefore, expects the construction sector to recover in 2023 – and with it, the Chinese economy as a whole for the time being.

The process acts like a relapse into the use of a stimulant drug after withdrawal symptoms set in. Together with the end of Covid restrictions, this does not fail to have the desired effect. The Purchasing Managers’ Index for industry, an important economic barometer, rose by 2.5 points to 52.6 in February.

The index hit its highest level in nearly 13 years, according to a monthly business survey released by the statistics bureau on Wednesday. “The data point to a strong start to 2023 for the Chinese economy,” Commerzbank economist Tommy Wu said. The International Monetary Fund (IMF) expects the economy to grow 5.2 percent this year.

But the good figures are also based on a statistical effect. They start from a low base. China’s economy suffered in the last pandemic year, not least because of the completely excessive zero-Covid rules. It only grew by a meager three percent after 2020 – the first pandemic year – saw the lowest growth since economic reforms began 40 years ago.

Despite this stronger growth forecast for the current year, the IMF continues to see considerable risks for economic development. It remains important to restore confidence in the real estate market. Structural reforms should lead to a healthy contraction of the real estate market in the medium term.

But serious reforms are still a long way off. Instead, the leadership is relying on a recipe that lead to enormous growth in the 1990s and 1990s and contributed significantly to the steady growth: build, build, build.

But there are now so many highways, bridges and high-rise buildings in the country that sticking to this recipe is doomed to failure. After all, even more concrete in the landscape is nowhere near as much use in a highly modern economy as it was in the construction phase.

The benefits of the investments are diminishing rapidly. The first and second major bridges in the five-million-strong metropolis of Nanjing, for example, provided plenty of development and economic growth on both sides of the mighty Yangtze River. The fourth bridge, on the other hand, has done much less. And this can be applied to the whole of China. The more roads, bridges, skyscrapers and coal-fired power plants there are in the country, the less growth the government generates with every yuan invested. In any case, this strategy has long since ceased to be sustainable.

The problem: Construction activity is usually done on credit. In the past, the hope was for a future in which the economy continued to grow and prices rose so that the loans could be easily repaid. A “healthy shrinkage” of the construction industry, as recommended by the IMF, is not possible without general dislocation.

Significant parts of China’s economy depend on the real estate sector. Including downstream industries such as the production of steel and cement, it accounts for up to one-third of economic power. In addition, China lacks a trustworthy stock market and its social security system is poorly developed. Many Chinese know nothing but concrete gold for financial security. In addition, the financial sector is intertwined with the construction industry.

Because many people fear for their assets if prices fall and there is a threat of social unrest, the most obvious step for the party cadres seems to be to once again spend billions on boosting the real estate sector.

In addition, there is a much more severe problem that will continue to weigh on the real estate market in the long term: China’s demographic crisis. China’s population shrank for the first time last year – almost ten years earlier than the population had forecast. According to US-China demographics expert Yi Fuxian, the fertility rate is below 1.0, and 2.1 children are needed per woman to keep a country’s population at the same level. “In China, each generation will be half the size of the previous one,” Yi says.

Experts and the government had expected this shrinkage to occur because of the strict one-child policy. But they did not expect the tipping point to occur just yet. Yi, therefore, does not attribute the lower economic growth solely to the strict Covid measures of recent years. “The economy is growing more slowly because the population is shrinking.” And the real estate sector will be the worst hit by this development, he adds.

Once the end of the line has been reached for concrete investments, the German and global economy will also feel the effects. China’s share of the global gross domestic product is just under 19 percent. China is the largest exporting nation and the largest importer after the USA, with imports of around $2.7 trillion (in 2021). China’s construction industry was a major customer for German mechanical engineering in particular.

The billions the Chinese leadership uses to artificially push up the construction sector would be better spent on ecological restructuring. But the cadres need more courage for such a policy change. Until now, the comrades at the provincial and local level, in particular, have profited the most from the construction sector by selling land. This is another area that urgently needs structural reforms, but the leadership is shying away from them.

Only a few days after China presented its 12-point plan for settling the war in Ukraine, Belarusian President Alexander Lukashenko traveled to Beijing. Lukashenko, of all people, was immediately murmured in Western diplomatic circles. After all, he is one of the most important allies of Russian President Vladimir Putin.

Indeed, the optics of the visit appear problematic. China wants to be perceived as a mediator. But no sooner has China’s top foreign policy official Wang Yi finished his visit to Russia than the Lukashenko visit seems to send another pro-Russian signal. On the other hand, there are still no signs of a Chinese visit to Ukraine in the near future. Neutrality looks different.

Indeed, Beijing noted with satisfaction on Wednesday that Lukashenko praised the Chinese initiative, even though his country had served as a staging area for the Russians to invade. The Chinese proposal to resolve the crisis was “of great importance” and was “fully supported” by him, the guest said at a meeting with Xi Jinping in the evening, according to Chinese sources.

Lukashenko made it clear that he had by no means arrived as Moscow’s envoy. There, the Chinese 12-point plan is viewed less euphorically than the disappointment in the West would suggest. Above all, the first point of the Chinese initiative, compliance with territorial integrity, does not please Putin.

The fact that Lukashenko so clearly backed the Chinese initiative probably served his own agenda. Very positive tones ran through his entire visit. “I firmly believe that China will continue to achieve new and brilliant successes under the strong leadership of President Xi Jinping,” Lukashenko flattered his counterpart. Thus speaks one who needs friends and wants to free himself from isolation.

The background: European leaders no longer recognize Lukashenko as a legitimate head of state since the mass protests in 2020 and consider the presidential election at the time to have been rigged. In addition, the EU and the USA have imposed far-reaching sanctions against Belarus. This plays into Russia’s hands. Those who no longer have any contacts in the West can hardly say no to Putin.

Belarus and China have maintained close diplomatic relations for decades. Before the pandemic, Lukashenko visited the People’s Republic almost every year. So a trip was long overdue.

Trade between the two countries rose by 33 percent last year to five billion US dollars. And this is precisely where Lukashenko came in. He hoped for a further expansion of economic cooperation. Beijing showed an open mind on Wednesday. Only in September, both heads of state announced a “comprehensive strategic all-weather partnership” at a meeting in Samarkand, Uzbekistan. According to Xi, this agreement should now be filled with life. The friendship between the two states is “unbreakable,” Xi said. A whole series of agreements were signed, so the visit was well worth it for Lukashenko.

And what was in it for China? A good connection to Minsk could help Beijing exert influence on Russia. If China’s commitment to peace is to gain credibility in the West, however, it must also finally enter into talks with Ukraine.

Germany continues to rely heavily on China for solar installations. Around 87 percent of imported photovoltaic systems came from the People’s Republic last year, as the Federal Statistical Office reported on Wednesday.

The value of these plants was a good €3.1 billion. In total, photovoltaic systems worth around €3.6 billion were supplied to Germany last year. China as the most important supplier of solar cells and solar modules was followed by a wide margin by the Netherlands (€143 million or 4 percent) and Taiwan (€94 million or 3 percent).

The value of imports of photovoltaic systems was thus more than twice that of exports of these goods from Germany. Last year, plants worth a good €1.4 billion were exported. A large proportion of these went to European countries.

Europe can become less dependent on China for the production of solar products in the medium term. However, such a turnaround requires a lot of political will, billions of euros in start-up financing and several years of time, experts and business representatives agree. rtr/ari

Harassment by the authorities, surveillance, intimidation of interlocutors – the working conditions for foreign journalists were already not good before. But according to the Foreign Correspondents’ Club of China (FCCC), it has never been as miserable as it was last year. Since the start of the Covid pandemic three years ago, “press freedom throughout the country has been declining at an increasing rate,” the journalists’ association complains, basing its findings on its annual survey of its members. Working conditions “do not meet international standards”.

The report adds that more than one-third of media professionals surveyed complained that at least one of their sources had been harassed, detained, asked to be interrogated or otherwise put under pressure for speaking to foreign journalists. The previous year, the figure was a quarter. 78 percent reported that potential interviewees were not allowed to speak to them at all. 102 journalists took part in the survey.

The Correspondents’ Club spoke of the “most difficult year” as a journalist in China. The controls of the zero-Covid policy, had been used to restrict the reporting of correspondents even more. Nearly half of those interviewed were not allowed to leave their location, in some cases for months, even though they would not have posed a health risk even under China’s strict rules.

Covid controls have since been lifted. “But a series of government restrictions, ongoing digital surveillance, and continued harassment of Chinese colleagues and sources testified to the fact that challenges to genuine press freedom remain,” laments the Foreign Press Club. flee

During the National People’s Congress, which begins on Saturday, similarly strict rules will apply again as during the zero-Covid policy. Diplomats and journalists who want to attend the opening ceremony in the Great Hall of the People in Tiananmen Square will have to spend the day before in quarantine in a hotel, reports Deutsche Presse-Agentur.

At the same time, two weeks ago, the Chinese leadership had proclaimed a “great and decisive” victory over the coronavirus. The ambassadors of most European countries, including the German ambassador, would therefore refrain from attending, the report said. flee

The People’s Republic has sent three warships, 25 fighter planes – 19 of them over Taiwan’s air defense zone – towards Taiwan, according to the Ministry of Defense in Taipei. The leadership in Beijing did not confirm this information. Taiwan has activated missile defenses and sent ships in response, the local defense ministry said. The situation is being closely monitored. flee

Too many observers have lost sight of one of the key lessons of World War I. The Great War was triggered by the assassination of Austrian Archduke Franz Ferdinand in June 1914, which occurred against the backdrop of a long-simmering conflict between Europe’s major powers. This interplay between conflict escalation and a political spark has special resonance today.,

With war raging in Ukraine and a cold-war mentality gripping the United States and China, there can be no mistaking the historical parallels. The world is simmering with conflict and resentment. All that is missing is a triggering event. With tensions in Taiwan, the South China Sea, and Ukraine, there are plenty of possible sparks to worry about.

Taiwan is a leading candidate. Even if, like me, you do not accept the US view that President Xi Jinping has consciously shortened the timeline for reunification, recent actions by the US government may end up forcing his hand. Former House Speaker Nancy Pelosi traveled to Taipei last August, and her successor, Kevin McCarthy, seems intent on doing the same. The newly established House Select Committee on China appears likely to send its own mission shortly, especially following the unannounced recent visit of its chairman, Mike Gallagher.

Meanwhile, a just-completed visit to Taipei by a senior official from the Pentagon, in the aftermath of the December enactment of the $10 billion Taiwan Enhanced Resilience Act, leaves little doubt about US military support for China’s so-called renegade province. While the US squirms to defend the One China principle enshrined in the 1972 Shanghai Communiqué, there can no longer be any doubt about US political support for preserving Taiwan’s independent status. That is a red line for China – and a geopolitical flashpoint for everyone else.

I worry just as much about a spark in Ukraine. One year into this horrific and once-unthinkable conflict, there is a new and ominous twist to Russian President Vladimir Putin’s spring offensive. The US is warning of an escalation of Chinese support for Russia from non-lethal assistance (like purchasing Russian energy products) to lethal aid (weapons, ammunition, or logistical arms-supply capabilities).

The Biden administration’s vague threat of serious consequences for China if it offers lethal aid to Russia’s war effort is reminiscent of similar US warnings that preceded the imposition of unprecedented sanctions on Russia. In the eyes of US politicians, China would be guilty by association and forced to pay a very steep price. Just as Taiwan is China’s red line, Washington believes the same can be said of Chinese military support for Russia’s war campaign.

There are plenty of other potential sparks, not least from ongoing tensions in the South China Sea. The recent expansion of US access to Philippine military bases located midway between Taiwan and China’s militarized islands in the Scarborough Shoal and the Spratly (Nansha) Archipelago is a case in point.

As the US continues to enforce freedom of navigation in the international waters of the South China Sea by sailing naval vessels through it, the possibility of an accident or unintended confrontation can hardly be ruled out. A near-miss between a US reconnaissance flight and a Chinese warplane in late December is indicative of these risks, which are all the more serious given the breakdown in military-to-military communications between the two superpowers – glaringly evident during the great balloon fiasco earlier this month.

Context is key in assessing the likelihood of any spark. Under the political cover of what it bills as a battle between autocracy and democracy, the US has clearly been the aggressor in turning up the heat on Taiwan over the past six months. Similarly, the Chinese surveillance balloon incident brought the cold-war threat much closer to home for the US public.

And senior diplomats on both sides – US Secretary of State Antony Blinken and his Chinese counterpart, Wang Yi – have taken on the role of classic cold warriors. Their belligerent rhetoric at the recent Munich Security Conference mirrored that of their first meeting in Anchorage nearly two years ago.

As was the case before World War I, it is tempting to minimize the risk of a major conflict. After all, today’s globalized, interconnected world has too much at stake to risk a seismic unraveling. That argument is painfully familiar. It is the same one made in the early twentieth century, when the first wave of globalization was at its peak. It seemed compelling to many right up to June 28, 1914.

The historical comparison with 2023 must be updated to reflect the grand strategy of cold war conflict. A decisive turning point in the Cold War with the Soviet Union came in 1972, when US President Richard Nixon went to China and ultimately joined with Mao Zedong in executing a successful triangulation strategy against the USSR. Today, the US is on the receiving end of a new cold-war triangulation, with China having joined Russia in a partnership “without limits” that takes dead aim at US hegemonic power. This pivotal shift brings the lessons of 1914 into increasingly sharper focus.

Having just published a book about accidental conflict as an outgrowth of dueling false narratives between the US and China, I am particularly worried about “narrative segmentation.” Each side is convinced that it holds the moral high ground as conflict lurches from one incident to another. For the US, China’s surveillance balloon was a threat to national sovereignty. For China, US support for Taiwan is a similar threat. Each point of tension then triggers a cascading stream of retaliatory responses without recognition of collateral implications for a deeply conflicted relationship.

Three great powers – America, China, and Russia – all seem to be afflicted by a profound sense of historical amnesia. They are collectively sleepwalking down a path of conflict escalation, carrying high-octane fuel that could be ignited all too easily. Just like 1914.

Stephen S. Roach, a former chairman of Morgan Stanley Asia, is a faculty member at Yale University and the author, most recently, of Accidental Conflict: America, China, and the Clash of False Narratives (Yale University Press, 2022).

Copyright: Project Syndicate, 2023.

www.project-syndicate.org

Qian Bo was appointed China’s first special envoy for Pacific Islands affairs. Qian has already been ambassador for the island nation of Fiji since 2018.

Laura Baumann has returned to Germany after several years working for Volkswagen in Beijing. Baumann has been Assistant Recruiting & Talent Marketing in Wolfsburg since the beginning of the year.

Is something changing in your organization? Why not let us know at heads@table.media!

Closed – hopefully forever. The authorities in Hong Kong celebrate the closure of the Covid Isolation Center in Penny Bay with an oversized cardboard lock. “Mission accomplished,” reads the sign on the entrance gate.

To get the out-of-control housing market back under control, China’s leadership has cracked down in recent years. The bankruptcy of the heavily indebted construction company Evergrande has served as a cautionary tale for the over-indebtedness of an entire industry.

Suddenly, however, high debts no longer seem so bad in Beijing – and if the desired growth could be achieved, old resolutions are quickly thrown overboard.

At the People’s Congress starting Sunday, Li Keqiang will announce another stimulus, Felix Lee predicts in his Feature on the economy and investment. In other words, the CP will fall back into old habits and abandon discipline for growth. At least in the short term, this will brighten the economic picture.

The Belarusian president’s visit to China was also about optics. Depending on the perspective, however, the visit produces very different images for the observer: The EU looks skeptically at Xi closing ranks with Lukashenko, who is loyal to Putin. The meeting of the dictators seems downright threatening to them.

Meanwhile, Beijing beams with joy due to praise for the 12-point plan presented last week to settle the war in Ukraine, as Joern Petring reports. And Lukashenko himself wants to use the visit primarily to boost trade with China.

Just a year ago, the Chinese leadership had warned developers and investors: “No more excesses.” State and Party leader Xi Jinping himself reprimanded them: “Houses are for living, not for speculating.” But there is no sign of the supposed turnaround toward moderation in the real estate market. The government is falling back into old patterns and reigniting the spark in the housing market.

The National People’s Congress, the key economic policy event of the year, will now start on Sunday. Outgoing Premier Li Keqiang will announce a growth target for 2023 and the priorities for economic management. By then, there won’t be much left of the warnings to the construction industry other than familiar phrases. It becomes apparent that the communist leadership will fall back into old habits in order to create growth – and above all, will again focus on promoting the real estate sector.

Xi’s warnings were justified. For years, China has been slipping from one real estate crisis to the next. At times, housing prices exploded as investors drove them up. Then there were spectacular bankruptcies of construction companies. In particular, the insolvency of market leader Evergrande last year caused a real tremor. The real estate giant had run into the red with the equivalent of €300 billion from the construction and speculation of entire satellite cities and had thus incurred more debt than any other company in the world.

With the so-called “three red lines” issued by the government, the government wanted to put an end to this behavior. Property developers were to meet stricter financial requirements. And banks were also no longer allowed to grant loans as generously as they had been able to for a long time. But real estate sales subsequently slumped massively, and with them, the economy.

Now the government is backing down and has softened the very regulations that were supposed to ensure more discipline in the construction sector. What’s more, since the end of last year, it has again been pumping billions into the sector via the state banks. “Nobody cares about the three red lines anymore,” says Alicia Garcia Herrero, chief economist for Asia Pacific at French investment bank Natixis in Hong Kong.

Home sales were down nearly 40 percent in 2022 at the worst time compared to the same time last year, she said. Now, the decline is 5 percent. The economist, therefore, expects the construction sector to recover in 2023 – and with it, the Chinese economy as a whole for the time being.

The process acts like a relapse into the use of a stimulant drug after withdrawal symptoms set in. Together with the end of Covid restrictions, this does not fail to have the desired effect. The Purchasing Managers’ Index for industry, an important economic barometer, rose by 2.5 points to 52.6 in February.

The index hit its highest level in nearly 13 years, according to a monthly business survey released by the statistics bureau on Wednesday. “The data point to a strong start to 2023 for the Chinese economy,” Commerzbank economist Tommy Wu said. The International Monetary Fund (IMF) expects the economy to grow 5.2 percent this year.

But the good figures are also based on a statistical effect. They start from a low base. China’s economy suffered in the last pandemic year, not least because of the completely excessive zero-Covid rules. It only grew by a meager three percent after 2020 – the first pandemic year – saw the lowest growth since economic reforms began 40 years ago.

Despite this stronger growth forecast for the current year, the IMF continues to see considerable risks for economic development. It remains important to restore confidence in the real estate market. Structural reforms should lead to a healthy contraction of the real estate market in the medium term.

But serious reforms are still a long way off. Instead, the leadership is relying on a recipe that lead to enormous growth in the 1990s and 1990s and contributed significantly to the steady growth: build, build, build.

But there are now so many highways, bridges and high-rise buildings in the country that sticking to this recipe is doomed to failure. After all, even more concrete in the landscape is nowhere near as much use in a highly modern economy as it was in the construction phase.

The benefits of the investments are diminishing rapidly. The first and second major bridges in the five-million-strong metropolis of Nanjing, for example, provided plenty of development and economic growth on both sides of the mighty Yangtze River. The fourth bridge, on the other hand, has done much less. And this can be applied to the whole of China. The more roads, bridges, skyscrapers and coal-fired power plants there are in the country, the less growth the government generates with every yuan invested. In any case, this strategy has long since ceased to be sustainable.

The problem: Construction activity is usually done on credit. In the past, the hope was for a future in which the economy continued to grow and prices rose so that the loans could be easily repaid. A “healthy shrinkage” of the construction industry, as recommended by the IMF, is not possible without general dislocation.

Significant parts of China’s economy depend on the real estate sector. Including downstream industries such as the production of steel and cement, it accounts for up to one-third of economic power. In addition, China lacks a trustworthy stock market and its social security system is poorly developed. Many Chinese know nothing but concrete gold for financial security. In addition, the financial sector is intertwined with the construction industry.

Because many people fear for their assets if prices fall and there is a threat of social unrest, the most obvious step for the party cadres seems to be to once again spend billions on boosting the real estate sector.

In addition, there is a much more severe problem that will continue to weigh on the real estate market in the long term: China’s demographic crisis. China’s population shrank for the first time last year – almost ten years earlier than the population had forecast. According to US-China demographics expert Yi Fuxian, the fertility rate is below 1.0, and 2.1 children are needed per woman to keep a country’s population at the same level. “In China, each generation will be half the size of the previous one,” Yi says.

Experts and the government had expected this shrinkage to occur because of the strict one-child policy. But they did not expect the tipping point to occur just yet. Yi, therefore, does not attribute the lower economic growth solely to the strict Covid measures of recent years. “The economy is growing more slowly because the population is shrinking.” And the real estate sector will be the worst hit by this development, he adds.

Once the end of the line has been reached for concrete investments, the German and global economy will also feel the effects. China’s share of the global gross domestic product is just under 19 percent. China is the largest exporting nation and the largest importer after the USA, with imports of around $2.7 trillion (in 2021). China’s construction industry was a major customer for German mechanical engineering in particular.

The billions the Chinese leadership uses to artificially push up the construction sector would be better spent on ecological restructuring. But the cadres need more courage for such a policy change. Until now, the comrades at the provincial and local level, in particular, have profited the most from the construction sector by selling land. This is another area that urgently needs structural reforms, but the leadership is shying away from them.

Only a few days after China presented its 12-point plan for settling the war in Ukraine, Belarusian President Alexander Lukashenko traveled to Beijing. Lukashenko, of all people, was immediately murmured in Western diplomatic circles. After all, he is one of the most important allies of Russian President Vladimir Putin.

Indeed, the optics of the visit appear problematic. China wants to be perceived as a mediator. But no sooner has China’s top foreign policy official Wang Yi finished his visit to Russia than the Lukashenko visit seems to send another pro-Russian signal. On the other hand, there are still no signs of a Chinese visit to Ukraine in the near future. Neutrality looks different.

Indeed, Beijing noted with satisfaction on Wednesday that Lukashenko praised the Chinese initiative, even though his country had served as a staging area for the Russians to invade. The Chinese proposal to resolve the crisis was “of great importance” and was “fully supported” by him, the guest said at a meeting with Xi Jinping in the evening, according to Chinese sources.

Lukashenko made it clear that he had by no means arrived as Moscow’s envoy. There, the Chinese 12-point plan is viewed less euphorically than the disappointment in the West would suggest. Above all, the first point of the Chinese initiative, compliance with territorial integrity, does not please Putin.

The fact that Lukashenko so clearly backed the Chinese initiative probably served his own agenda. Very positive tones ran through his entire visit. “I firmly believe that China will continue to achieve new and brilliant successes under the strong leadership of President Xi Jinping,” Lukashenko flattered his counterpart. Thus speaks one who needs friends and wants to free himself from isolation.

The background: European leaders no longer recognize Lukashenko as a legitimate head of state since the mass protests in 2020 and consider the presidential election at the time to have been rigged. In addition, the EU and the USA have imposed far-reaching sanctions against Belarus. This plays into Russia’s hands. Those who no longer have any contacts in the West can hardly say no to Putin.

Belarus and China have maintained close diplomatic relations for decades. Before the pandemic, Lukashenko visited the People’s Republic almost every year. So a trip was long overdue.

Trade between the two countries rose by 33 percent last year to five billion US dollars. And this is precisely where Lukashenko came in. He hoped for a further expansion of economic cooperation. Beijing showed an open mind on Wednesday. Only in September, both heads of state announced a “comprehensive strategic all-weather partnership” at a meeting in Samarkand, Uzbekistan. According to Xi, this agreement should now be filled with life. The friendship between the two states is “unbreakable,” Xi said. A whole series of agreements were signed, so the visit was well worth it for Lukashenko.

And what was in it for China? A good connection to Minsk could help Beijing exert influence on Russia. If China’s commitment to peace is to gain credibility in the West, however, it must also finally enter into talks with Ukraine.

Germany continues to rely heavily on China for solar installations. Around 87 percent of imported photovoltaic systems came from the People’s Republic last year, as the Federal Statistical Office reported on Wednesday.

The value of these plants was a good €3.1 billion. In total, photovoltaic systems worth around €3.6 billion were supplied to Germany last year. China as the most important supplier of solar cells and solar modules was followed by a wide margin by the Netherlands (€143 million or 4 percent) and Taiwan (€94 million or 3 percent).

The value of imports of photovoltaic systems was thus more than twice that of exports of these goods from Germany. Last year, plants worth a good €1.4 billion were exported. A large proportion of these went to European countries.

Europe can become less dependent on China for the production of solar products in the medium term. However, such a turnaround requires a lot of political will, billions of euros in start-up financing and several years of time, experts and business representatives agree. rtr/ari

Harassment by the authorities, surveillance, intimidation of interlocutors – the working conditions for foreign journalists were already not good before. But according to the Foreign Correspondents’ Club of China (FCCC), it has never been as miserable as it was last year. Since the start of the Covid pandemic three years ago, “press freedom throughout the country has been declining at an increasing rate,” the journalists’ association complains, basing its findings on its annual survey of its members. Working conditions “do not meet international standards”.

The report adds that more than one-third of media professionals surveyed complained that at least one of their sources had been harassed, detained, asked to be interrogated or otherwise put under pressure for speaking to foreign journalists. The previous year, the figure was a quarter. 78 percent reported that potential interviewees were not allowed to speak to them at all. 102 journalists took part in the survey.

The Correspondents’ Club spoke of the “most difficult year” as a journalist in China. The controls of the zero-Covid policy, had been used to restrict the reporting of correspondents even more. Nearly half of those interviewed were not allowed to leave their location, in some cases for months, even though they would not have posed a health risk even under China’s strict rules.

Covid controls have since been lifted. “But a series of government restrictions, ongoing digital surveillance, and continued harassment of Chinese colleagues and sources testified to the fact that challenges to genuine press freedom remain,” laments the Foreign Press Club. flee

During the National People’s Congress, which begins on Saturday, similarly strict rules will apply again as during the zero-Covid policy. Diplomats and journalists who want to attend the opening ceremony in the Great Hall of the People in Tiananmen Square will have to spend the day before in quarantine in a hotel, reports Deutsche Presse-Agentur.

At the same time, two weeks ago, the Chinese leadership had proclaimed a “great and decisive” victory over the coronavirus. The ambassadors of most European countries, including the German ambassador, would therefore refrain from attending, the report said. flee

The People’s Republic has sent three warships, 25 fighter planes – 19 of them over Taiwan’s air defense zone – towards Taiwan, according to the Ministry of Defense in Taipei. The leadership in Beijing did not confirm this information. Taiwan has activated missile defenses and sent ships in response, the local defense ministry said. The situation is being closely monitored. flee

Too many observers have lost sight of one of the key lessons of World War I. The Great War was triggered by the assassination of Austrian Archduke Franz Ferdinand in June 1914, which occurred against the backdrop of a long-simmering conflict between Europe’s major powers. This interplay between conflict escalation and a political spark has special resonance today.,

With war raging in Ukraine and a cold-war mentality gripping the United States and China, there can be no mistaking the historical parallels. The world is simmering with conflict and resentment. All that is missing is a triggering event. With tensions in Taiwan, the South China Sea, and Ukraine, there are plenty of possible sparks to worry about.

Taiwan is a leading candidate. Even if, like me, you do not accept the US view that President Xi Jinping has consciously shortened the timeline for reunification, recent actions by the US government may end up forcing his hand. Former House Speaker Nancy Pelosi traveled to Taipei last August, and her successor, Kevin McCarthy, seems intent on doing the same. The newly established House Select Committee on China appears likely to send its own mission shortly, especially following the unannounced recent visit of its chairman, Mike Gallagher.

Meanwhile, a just-completed visit to Taipei by a senior official from the Pentagon, in the aftermath of the December enactment of the $10 billion Taiwan Enhanced Resilience Act, leaves little doubt about US military support for China’s so-called renegade province. While the US squirms to defend the One China principle enshrined in the 1972 Shanghai Communiqué, there can no longer be any doubt about US political support for preserving Taiwan’s independent status. That is a red line for China – and a geopolitical flashpoint for everyone else.

I worry just as much about a spark in Ukraine. One year into this horrific and once-unthinkable conflict, there is a new and ominous twist to Russian President Vladimir Putin’s spring offensive. The US is warning of an escalation of Chinese support for Russia from non-lethal assistance (like purchasing Russian energy products) to lethal aid (weapons, ammunition, or logistical arms-supply capabilities).

The Biden administration’s vague threat of serious consequences for China if it offers lethal aid to Russia’s war effort is reminiscent of similar US warnings that preceded the imposition of unprecedented sanctions on Russia. In the eyes of US politicians, China would be guilty by association and forced to pay a very steep price. Just as Taiwan is China’s red line, Washington believes the same can be said of Chinese military support for Russia’s war campaign.

There are plenty of other potential sparks, not least from ongoing tensions in the South China Sea. The recent expansion of US access to Philippine military bases located midway between Taiwan and China’s militarized islands in the Scarborough Shoal and the Spratly (Nansha) Archipelago is a case in point.

As the US continues to enforce freedom of navigation in the international waters of the South China Sea by sailing naval vessels through it, the possibility of an accident or unintended confrontation can hardly be ruled out. A near-miss between a US reconnaissance flight and a Chinese warplane in late December is indicative of these risks, which are all the more serious given the breakdown in military-to-military communications between the two superpowers – glaringly evident during the great balloon fiasco earlier this month.

Context is key in assessing the likelihood of any spark. Under the political cover of what it bills as a battle between autocracy and democracy, the US has clearly been the aggressor in turning up the heat on Taiwan over the past six months. Similarly, the Chinese surveillance balloon incident brought the cold-war threat much closer to home for the US public.

And senior diplomats on both sides – US Secretary of State Antony Blinken and his Chinese counterpart, Wang Yi – have taken on the role of classic cold warriors. Their belligerent rhetoric at the recent Munich Security Conference mirrored that of their first meeting in Anchorage nearly two years ago.

As was the case before World War I, it is tempting to minimize the risk of a major conflict. After all, today’s globalized, interconnected world has too much at stake to risk a seismic unraveling. That argument is painfully familiar. It is the same one made in the early twentieth century, when the first wave of globalization was at its peak. It seemed compelling to many right up to June 28, 1914.

The historical comparison with 2023 must be updated to reflect the grand strategy of cold war conflict. A decisive turning point in the Cold War with the Soviet Union came in 1972, when US President Richard Nixon went to China and ultimately joined with Mao Zedong in executing a successful triangulation strategy against the USSR. Today, the US is on the receiving end of a new cold-war triangulation, with China having joined Russia in a partnership “without limits” that takes dead aim at US hegemonic power. This pivotal shift brings the lessons of 1914 into increasingly sharper focus.

Having just published a book about accidental conflict as an outgrowth of dueling false narratives between the US and China, I am particularly worried about “narrative segmentation.” Each side is convinced that it holds the moral high ground as conflict lurches from one incident to another. For the US, China’s surveillance balloon was a threat to national sovereignty. For China, US support for Taiwan is a similar threat. Each point of tension then triggers a cascading stream of retaliatory responses without recognition of collateral implications for a deeply conflicted relationship.

Three great powers – America, China, and Russia – all seem to be afflicted by a profound sense of historical amnesia. They are collectively sleepwalking down a path of conflict escalation, carrying high-octane fuel that could be ignited all too easily. Just like 1914.

Stephen S. Roach, a former chairman of Morgan Stanley Asia, is a faculty member at Yale University and the author, most recently, of Accidental Conflict: America, China, and the Clash of False Narratives (Yale University Press, 2022).

Copyright: Project Syndicate, 2023.

www.project-syndicate.org

Qian Bo was appointed China’s first special envoy for Pacific Islands affairs. Qian has already been ambassador for the island nation of Fiji since 2018.

Laura Baumann has returned to Germany after several years working for Volkswagen in Beijing. Baumann has been Assistant Recruiting & Talent Marketing in Wolfsburg since the beginning of the year.

Is something changing in your organization? Why not let us know at heads@table.media!

Closed – hopefully forever. The authorities in Hong Kong celebrate the closure of the Covid Isolation Center in Penny Bay with an oversized cardboard lock. “Mission accomplished,” reads the sign on the entrance gate.