Import tariffs. They are the natural enemy of companies in the import/export business, hated by conservative economists who consider them unnecessary. However, in the increasingly competitive and distrustful world of states, they are gaining more fans.

This issue of China.Table is permeated with the theme of economic imbalances. Ursula von der Leyen is set to emphasize balanced trade with Xi Jinping at the EU-China summit on Thursday, as Amelie Richter reports. Otherwise…? Well, what happens otherwise? The EU could threaten higher duties on imports from China.

The Commission is already flexing its muscles. There are already concrete updates on the tariffs on EVs that are in the pipeline, including the approximate amount. Markus Grabitz reports. The tone in Brussels suggests that they are already a done deal.

In addition, there is a discussion about higher duties on imports of solar modules. The dilemma is apparent: Germany wants to reduce its dependence on the overpowering supplier. However, the energy transition relies on many inexpensive solar modules. Even in the German industry, the majority of managers are against higher tariffs, as Christiane Kuehl reports. Read today’s Feature to understand why companies believe they can survive without state intervention.

Meanwhile, Volkswagen has finally released its long-awaited audit report on the human rights situation in its factory in the Uyghur region of Xinjiang. The report gives the company a clean bill of health: no evidence of human rights violations.

Moody’s has downgraded its outlook for China from stable to negative in response to the increasing state debt and the worsening property crisis in the world’s second-largest economy.

Reasoning behind the agency’s decision:

Moody’s joins a long line of concerned economist assessments of the situation in China. The real estate sector, pivotal to both the real economy and lending, is teetering on the edge, dragging other industries down with it.

Moody’s downgrade is not helpful for China, but it is not a catastrophe either. The credit rating from international rating agencies has only indirect significance for China’s financing capability. While the country’s foreign debt has increased over time, it is by no means alarming. In fact, it has recently decreased.

Compared to other economies, China’s foreign debt, at 2.5 trillion dollars, is still low. Germany (2.8 trillion dollars), the Netherlands, Switzerland, Japan and the United Kingdom have higher foreign debts without it being considered a problem. As a country with full control over its currency and significant foreign exchange reserves, China can easily service its debts in the overall picture.

Foreign debts become a problem when they cannot be serviced due to a weak domestic currency or a lack of control over foreign exchange. Greece in 2011, Argentina in 2001, or Mexico in 1994 are examples of this.

There is explicitly no such default risk in China. Moody’s continues to rate Chinese government bonds as A1, a good grade. This corresponds to A+ at competing agencies Fitch and S&P. As China consistently runs trade surpluses, the country is not reliant on inflows in Western currencies. It also secures oil affordably from Russia against the yuan.

The concerns of analysts primarily revolve around domestic debts. Moody’s explicitly mentions “debts in China” rather than “China’s debts”. The debt in question is primarily that of local governments, including municipalities, among Chinese investors and institutions.

The International Monetary Fund estimates the liabilities of local governments at 13 trillion dollars. This is much higher than foreign debts and equals three times Germany’s annual economic output. Additionally, there are hidden debts of unknown amounts.

While concerns about local government debts in China are old, they remain as valid as ever. Municipalities’ expenditures on infrastructure drive growth, but they only work as long as revenues from real estate transactions are accurate – and growth is high. Decreasing growth becomes self-reinforcing. The economy is already caught in a vicious circle, putting local governments under pressure.

Now, foreign debts and financial flows come into play. In their increasing financial distress, local governments also incur short-term debts with high-interest promises in dollars. The buyers are mostly Chinese nationals who expect the government not to allow a widespread default of local governments. They see the risk of local government debts but consider it negligible, expecting state rescue.

However, a rise in the dollar’s exchange rate against the yuan would significantly pressure the debtors since they hold yuan and must service dollar-denominated debt. Following Moody’s report on Tuesday, investors have started selling off Chinese investments. Dollar purchases by local banks have stabilized the exchange rate.

Moody’s assesses China’s overall growth potential significantly lower than before. According to the forecast:

The Chinese ministry of finance expressed disappointment with Moody’s decision and added that the economy would maintain its recovery and positive trend. Moreover, it stated that risks in the real estate and municipal administration sectors are manageable. With Reuters

Ahead of the EU-China Summit, EU Commission President Ursula von der Leyen warned of a growing trade imbalance with China and issued a challenge: The EU will not tolerate this significant imbalance in the long term, she said in an interview with AFP for several European news agencies on Tuesday. “We have tools to protect our market.”

The trade imbalance with the People’s Republic had doubled to nearly 400 billion euros over the past two years, von der Leyen added. The EU prefers negotiated solutions. It is “also in China’s interest” to make decisions in coordination with Europeans at the summit.

On Thursday, the EU-China Summit will take place in person for the first time since 2019: von der Leyen and Council President Charles Michel will meet Xi Jinping and Li Qiang in Beijing. However, there are not too high expectations for concrete results.

Jens Hildebrandt, Managing Director of the German Chamber of Commerce (AHK) in China, also wishes for balanced trade as a discussion topic at the meeting: “From our point of view, the level playing field must be back on the agenda,” said Hildebrandt during a press briefing in Beijing.

It should no longer be allowed that European companies in China do not encounter the same competitive conditions as the Chinese economy in some areas, while Chinese companies can fully exploit the European market, he said. Nevertheless, Hildebrandt warns against an escalation of economic tensions between Europe and the People’s Republic.

He hopes that no trade conflict will be triggered, emphasized Hildebrandt on Tuesday: “Because the German economy needs open markets.” In the ongoing EU investigations into the subsidization of Chinese EVs, one should not put oneself in a disadvantageous position, according to him. Hildebrandt expected clear statements from EU representatives at the summit: “The EU side must make it clear at the meeting in which areas de-risking is envisaged.”

According to Hildebrandt, visa-free entry or other relaxations as part of China’s charm offensive before the meeting help only “minimally” to restore trust. He does not expect major structural changes in the near future: “The Chinese government is currently limited in its actions,” said the AHK chief. Too deep cuts in the economy are not possible at the moment. Hildebrandt sees the fact that both sides are meeting in person for the first time again as positive.

Von der Leyen and EU Council President Charles Michel will initially meet China’s President Xi Jinping and then Premier Li Qiang on Thursday. The meeting is the first personal one within this summit format since 2019. At that time, the EU Commission chief was still Jean-Claude Juncker, the EU Council was led by Donald Tusk and China’s prime minister was Li Keqiang.

The online formats during the pandemic did not deliver significant results, and that is still putting it nicely: EU foreign chief Josep Borrell retrospectively called the 2022 meeting a “summit of the deaf” – Brussels primarily wanted to discuss the Ukraine crisis, while Beijing focused on trade issues.

However, too much should not be expected from the personal summit in Beijing. The initially planned two official days have now been reduced to one. EU Council President Michel is expected to fly back on Thursday to take care of preparations for the EU summit of heads of state and government. A stop in Shanghai on Friday had originally been planned for him.

A joint statement for the summit is not planned, nor is the signing of technical agreements that were coordinated during visits by other EU representatives in recent weeks.

The limited results of the Biden-Xi summit in San Francisco were already a sign that China does not want to make substantial offers to the West, says Abigaël Vasselier, Head of the Foreign Relations Team at the Merics China Research Institute. “Given the elections in Europe and the USA in 2024, it is unlikely that Beijing will make concessions to the heads of state and government who may no longer be in office in a few months.” China’s economic and political support for Russia will be a point of attack for the Europeans, says Vasselier.

Her colleague Grzegorz Stec, EU-China Analyst at Merics, also expects only limited results at the summit. “The summit will, however, set the tone and agenda for relations between the EU and China until the end of the current EU mandate,” says Stec. The main theme of the meeting will be risk reduction. “Ahead of the summit, Chinese diplomats proposed replacing de-risking with a ‘rebuilding strategic trust’ through more robust dialogues.”

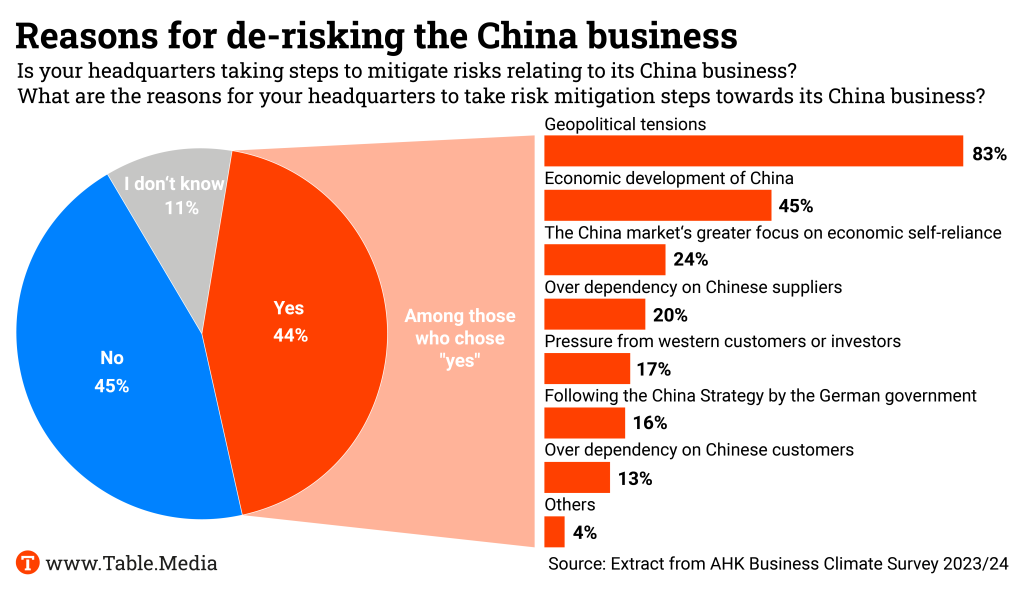

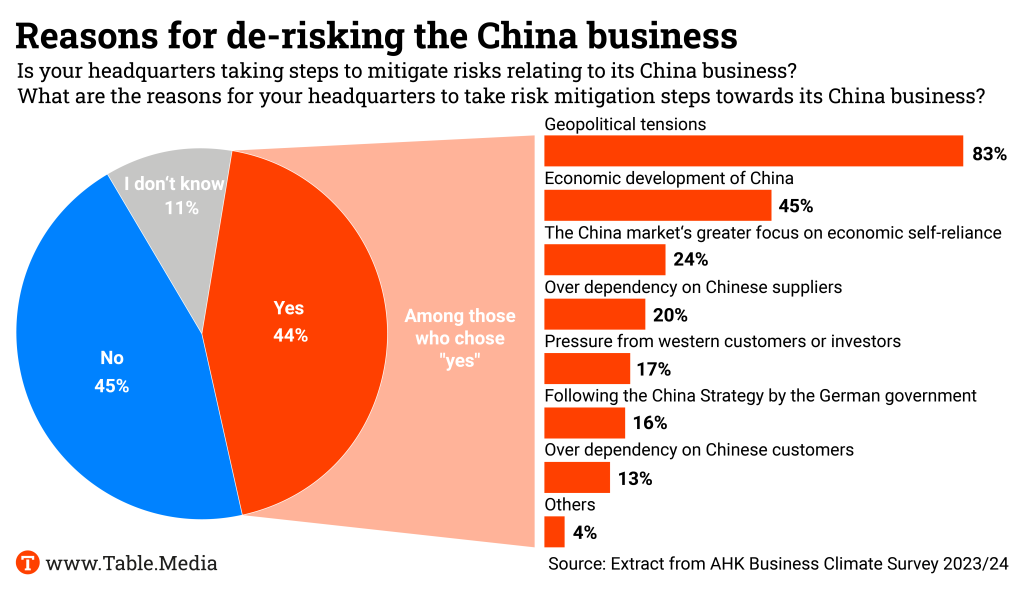

Due to political tensions and China’s economic situation, some German companies are already reducing risk associated with China business, according to an AHK survey: 44 percent of 566 respondents stated that their company headquarters are taking such steps. Slightly more companies (45 percent) denied this. The remainder answered with “I don’t know”.

The companies are relying, for example, on supply chains independent of China or are additionally establishing business in other countries. India is the biggest beneficiary in Asia: 72 percent of the surveyed companies are already active there in addition to China.

However, it is important that 54 percent of the companies want to expand their investments in China, said AHK Chief Hildebrandt. A large part of these companies justified the plan by wanting to remain competitive in China. For example, some are localizing their research and development in China. Because the huge Chinese market remains irreplaceable, as stated in the AHK survey.

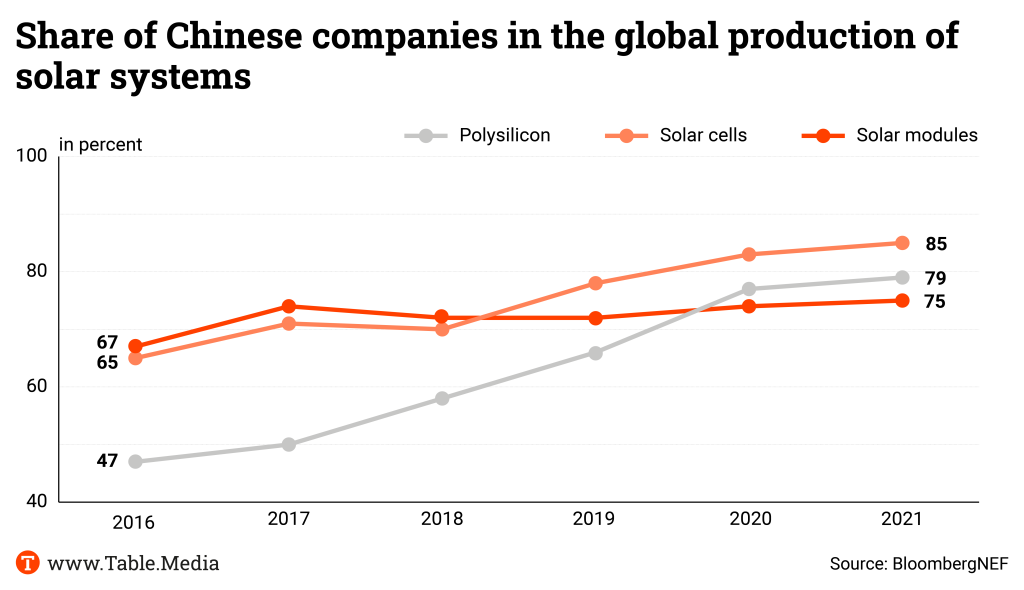

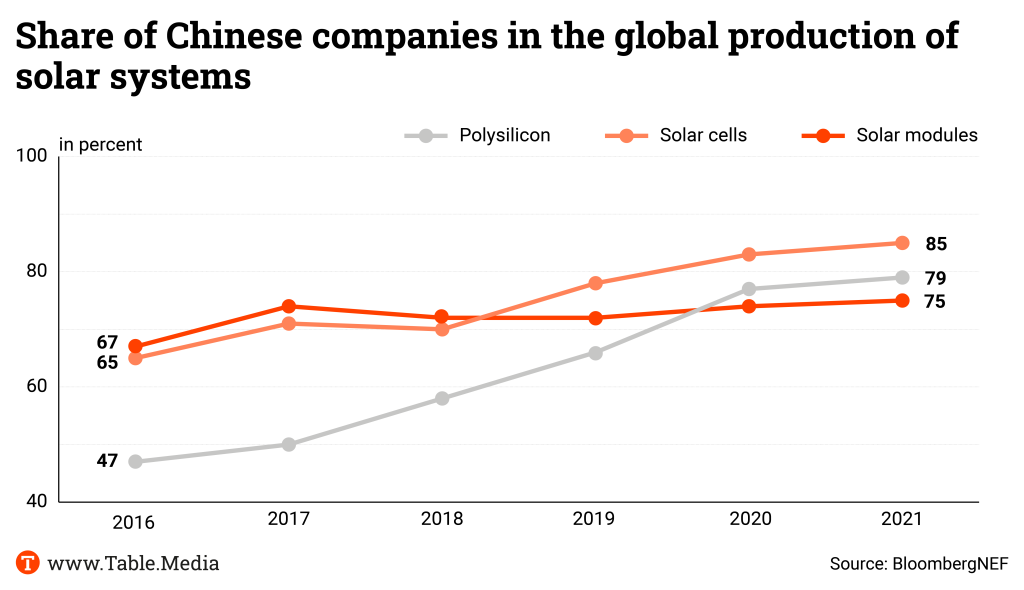

The European solar industry is currently grappling with how to handle the overpowering competition from China. The issues at hand include price declines, a surplus of modules from the Far East, forced labor in Xinjiang, jobs, resilience, and the necessary energy transition. Some politicians and companies are now considering trade restrictions against China; however, most companies are primarily demanding more government support to establish solar production.

429 solar companies recently issued a joint statement opposing trade protection measures addressed to EU Internal Market Commissioner Thierry Breton. “We are appalled by the rumors that a trade protection investigation could be initiated in the solar sector,” said Walburga Hemetsberger, CEO of the industry association SolarPower Europe, who coordinated the appeal. “We have better, faster, and more effective solutions for the crisis facing European manufacturers. Europe must not betray its climate and energy security goals.”

The downstream segment, in particular, opposes trade restrictions. Almost all plant sellers or installers use Chinese solar modules and cells, which account for around 90 percent of the global market share – and benefit from the low prices. These companies fear rising prices due to potential tariffs, endangering their own businesses.

The EU is facing a classic dilemma: the goal of strategic independence through the reconstruction of a crucial sector clashes with the objective of rapid and cost-effective expansion. Key EU initiatives reflect this dilemma:

To plan for the necessary establishment of production capacities for 30 gigawatts of photovoltaic systems, the European Solar PV Industry Alliance was founded a year ago, including the two major solar associations, SolarPower Europe and the European Solar Manufacturing Council. However, there is no unity – not even on the question of whether Chinese manufacturers are engaging in dumping in Europe or not; different figures on production costs in the People’s Republic circulate within the community. The sector has been subsidized in China for years. Now, the USA is following suit – no wonder EU companies are demanding assistance in response to the industrial policies of others.

The industry is uncertain because it already collapsed under the onslaught of Chinese photovoltaics in the 2010s. There was a dispute back then, too, and calls for tariffs prevailed. When these were introduced in 2013, the industry, already battered by the price war with China, collapsed entirely because demand dropped due to increased prices. In 2018, Brussels lifted the antidumping and countervailing duties imposed on solar modules from China, Taiwan, and Malaysia in 2013.

“Jobs in the solar sector, project investments, and the installation of solar modules declined significantly during the validity of these trade protection measures,” explains the solar firms’ statement justifying the rejection of tariffs. The signatories emphasize that today, 84 percent of approximately 648,000 jobs in the photovoltaic industry are in the downstream segment. By 2025, it could be more than a million jobs.

“We would jeopardize many jobs in the downstream sector with trade restrictions, as they would immediately impact the market,” says Markus Meyer, Director of Policy and Regulation at Berlin-based solar start-up Enpal, which sells or leases systems to end customers – and exclusively uses Chinese solar modules. “We and many of our competitors would have to cut jobs massively,” Meyer told Table.Media.

Of course, companies and associations always threaten job cuts with unfavorable measures. However, the solar crisis has multiple dimensions due to the urgently needed energy transition and the new de-risking policy.

This also includes the issue of forced labor in Xinjiang. Since the US banned imports of solar modules with silicon from Xinjiang in 2021, China’s already strongly growing exports are increasingly being redirected to Europe. This mixes several issues: Human rights concerns intersect with the energy transition, job losses and resilience.

The ESMC also, for ethical reasons, calls for the rapid enactment of the planned EU regulation banning products from forced labor. In late November, the ESMC issued a statement accusing parts of the European solar industry, presumably out of fear for their existence, of lobbying to weaken the EU’s plans against forced labor. With an import ban similar to the USA’s, the EU would likely have to dig as deep into its pockets as Washington to achieve its goals for the energy transition and the solar sector. That could be challenging.

The industry currently seems to agree only on the need to take action. Thus, the statement from SolarPower Europe calls for:

Gunter Erfurt, CEO of Meyer Burger, the last major solar module manufacturer in Germany, also expressed opposition to tariffs and sanctions in a Table.Media interview – although he is annoyed by the cheap competition from China, which he believes is selling below production costs in Europe: “We are the dumping ground for Chinese cheap modules because they are no longer allowed into the USA and elsewhere.” Erfurt expects a smart instrument that “is not directed against China” but allows “the establishment of a resilient clean tech industry in the EU by 2030”. It’s about “quickly securing fair competitive conditions in the EU,” he said.

Meyer Burger is based in Switzerland and produces in Freiberg, Saxony, and in the “Solar Valley” near Bitterfeld in Saxony-Anhalt, as well as in the USA. It did not sign SolarPower Europe’s appeal but recently, along with about 40 other industry companies – including module producer Heckert Solar and start-up Nexwafe – issued a joint letter requesting support from Brussels. Erfurt emphasized in the interview that PV modules could be produced inexpensively in Germany. He advocated for resilience bonuses for plant operators “from individual rooftops to large solar parks” using European components.

Markus Meyer from Enpal is particularly in favor of resilience tenders because of the market-based components of this system. “Legislators could say that we have a gigawatt of European cells or modules with minimum local content.” A positive list shows which modules or components are eligible for funding. “The system takes into account the additional costs that I have with European products.” Collaboration: Horand Knaup

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and specific business activities in the People’s Republic.

Volkswagen has faced criticism for its factory in the Xinjiang province for years. On Monday evening, auditors commissioned by the company released their long-awaited report on the conditions in the factory. Result: A PR victory for VW. “We could not find any evidence or proof of forced labor among the employees,” said Markus Loening, former human rights commissioner of the German government until 2014, now operating the consulting firm Loening Human Rights & Responsible Business.

Volkswagen had engaged Loening’s firm to independently review the working conditions in the VW plant in Xinjiang based on international standards. Loening emphasized that the audit was limited to the 197 employees of the plant, of whom almost 50 are Uyghurs. For the investigation, Loening’s consulting firm conducted on-site interviews and, together with Chinese lawyers, reviewed documents. “The situation in China and Xinjiang and the challenges of data collection for audits are known,” said Loening.

Major international audit firms have long withdrawn from the region because the situation of employees cannot be independently verified. Due to state surveillance measures, it is considered impossible, for example, to speak with employees outside of companies. However, according to experts, it is possible to review documents such as employment contracts in the plant, inspect security measures on-site, such as barbed wire or conduct other plausibility checks. However, experts state that no definitive statements can be made about the situation with complete certainty.

Volkswagen itself reiterated that the employees are well qualified, have long company tenure of up to ten years, low workloads, and are paid above average. The company also denies knowledge of any collaboration between its Chinese joint ventures and vocational colleges integrated into the state’s forced labor system in Xinjiang. A spokesperson stated that the manufacturer promptly investigated potential connections to the institutions after China researcher Adrian Zenz discovered relevant indications in the Xinjiang Police Files.

“As of today, there is no cooperation with the Xinjiang Industry Technical College,” says the statement, which was issued before the audit report was released. The educational institution provides vocational education in cooperation with companies. According to the university’s website, Volkswagen is involved in it as part of its joint venture with the state-owned manufacturer SAIC. In any case, there have been no new hires since 2018. Before that, a careful compliance check was carried out for every newly hired employee.

Volkswagen’s joint venture with FAW in Tianjin is also not affected, according to the company. “To our knowledge, there is also no collaboration between the Hotan Vocational Skills College mentioned in the report and FAW-Volkswagen in Tianjin. There are no connections to other colleges in Xinjiang from Tianjin.” grz/rtr/cds

The EU investigation into Chinese EVs seems to be getting serious: It is expected that the EU Commission will impose preliminary tariffs on EVs from the People’s Republic by July 4 at the latest. The tariffs are expected to be in the low double-digit percentage range. The preliminary tariffs would then have to be officially imposed within four months. The anti-subsidy procedure, which Brussels has been conducting since Oct. 4, must be concluded within 13 months according to EU rules. The EU is considered one of the very few markets that are open to imports of battery electric vehicles (BEV) from China.

According to the Commission’s findings, China grants extensive and diverse subsidies to BEV manufacturers in the country, such as subsidies for land purchases, low-interest loans and tax breaks. It is not only companies originating from China that are supposed to be subsidized. Companies such as VW, BMW, Mercedes and Tesla, which produce BEVs in China and also export them to Europe, are said to be affected by the subsidies. There is no information that the subsidies are targeted at a specific market segment. Both the volume segment and the premium class are subsidized. It is said that Chinese companies and government authorities in China are very cooperative.

In the first step of the investigation, the Commission sent questionnaires to manufacturers in the EU and China, asking them to fill them out. Subsequently, the team of about 25 officials conducting the investigation in the Commission selected companies for a representative sample. Companies based in the EU must respond, while companies based in China are not obligated to do so. Currently, the evaluation of the several hundred pages of questionnaires from the representative sample is underway. Visits to China are also planned for early 2024 to verify the information. mgr

For a long time, William Lai was clearly leading in all polls. Lai is running for the China-critical Democratic Progressive Party (DPP) in the Taiwanese presidential election on Jan. 13. In view of the divided opposition, some observers were already predicting that Lai could “win the election lying down”. That is now a thing of the past.

The election campaign is developing into a two-way race between Lai and Hou Yu-ih from the more China-friendly Kuomintang Party (KMT). According to recent polls, Lai is around 36 percent, with Hou at 30 percent. Ko Wen-je of the newly formed Taiwan People’s Party, established in 2019, has fallen far behind in recent polls with just around 20 percent. Terry Gou, the founder of Foxconn, who entered the race as an independent, withdrew his presidential candidacy at the end of November.

“I am a political worker for Taiwanese independence, and that will not change no matter what position I hold,” declared William Lai in 2017 during his inaugural speech as the Prime Minister, the second most powerful position in Taiwan, in front of the Taiwanese Parliament. Statements like these are what political opponents repeatedly use against the DPP’s presidential candidate, labeling him a hardliner for Taiwanese independence.

The KMT, more inclined toward China, attempts to portray Lai as a hardliner for Taiwanese independence, suggesting that his election would provoke the Beijing government, leading to further escalation in Taiwan-China relations. According to their formula, the presidential election is a choice between war and peace.

Contrary to such sensational accusations within the DPP, Lai is considered moderate regarding Taiwan’s relations with China. Recently, he has expressed himself more cautiously, distancing himself from the formal goal of Taiwanese independence and showing a willingness to engage in dialogue with the leadership in Beijing. “My goal is to maintain the status quo and contribute to peaceful development between Taiwan and China. I always keep the doors open for dialogue on an equal footing,” he stated in a recent campaign appearance.

To navigate Taiwan’s challenging course amid the conflict between the US and China, Lai has chosen Bi-khim Hsiao, Taiwan’s former representative to the US, as his vice-presidential candidate.

William Lai was born in 1959 in Wanli, a rural region on the northeast coast of Taiwan. Lai’s father was a miner who died in a mining accident when Lai was just 95 days old. His mother raised Lai and five other children. Lai became the first student from his region to secure a place at the prestigious Chien Kuo High School in Taipei.

He later studied rehabilitation medicine, initially in the capital Taipei, later at Cheng Kung University in Tainan in southern Taiwan, and also at Harvard University. For his supporters, Lai embodies the highly valued promise of upward mobility through education and hard work in Taiwan.

William Lai began his political career in Tainan. From 1996, he served as a member of the National Parliament. In 2010, he became the mayor of Tainan. During this time, he earned a reputation as an upright and pragmatic politician. He criticized Chuan Chiao-Lee, then-chairman of the city parliament in Tainan, sharply for alleged vote-buying. In his re-election as mayor in 2014, Lai won with a 45 percent lead over the KMT’s opposing candidate. In southern Taiwan, where the DPP traditionally enjoys significant support stemming from its roots as a resistance movement against the former KMT dictatorship, Lai is still highly regarded.

After his appointment as Prime Minister, William Lai was increasingly considered a potential presidential candidate. Before the 2020 presidential elections, he even participated in party primaries against the incumbent President Tsai Ing-wen – and lost. He then joined as the vice-presidential candidate under Tsai, who eventually won the election convincingly. In his current candidacy, the DPP is solidly behind Lai.

However, after eight years of DPP governance under Tsai, Lai is contending with dissatisfaction among a significant portion of the population. Lai is considered conservative on social issues. During his time as Prime Minister, he was responsible for reforms that increased the monthly allowable overtime hours. He remarked that workers could consider longer working hours as “good deeds”.

Especially among young people, who predominantly supported the DPP during Tsai Ing-wen’s tenure, support for Lai is weak. Many feel abandoned by the DPP on urgent social issues such as housing shortages in major cities and stagnant wages. The KMT’s war-and-peace rhetoric does not resonate with them. Yet, Lai has not succeeded in conveying a convincing vision for his presidency to them.

If Lai becomes president, the DPP will likely lose its majority in the legislature in the simultaneous parliamentary elections and will need to make significantly more compromises in the future. William Lai and his party are facing challenging times. Leonardo Pape

James Crabtree is the new Distinguished Visiting Fellow in the Asia team of the European Council on Foreign Relations. The analyst and author was previously Executive Director of the International Institute for Strategic Studies in Singapore.

Is something changing in your organization? Let us know at heads@table.media!

Last call at Lixiahe National Wetland Park in the eastern Chinese province of Jiangsu: Migratory birds gather before departure – with an apparent sense for a picturesque setting.

Import tariffs. They are the natural enemy of companies in the import/export business, hated by conservative economists who consider them unnecessary. However, in the increasingly competitive and distrustful world of states, they are gaining more fans.

This issue of China.Table is permeated with the theme of economic imbalances. Ursula von der Leyen is set to emphasize balanced trade with Xi Jinping at the EU-China summit on Thursday, as Amelie Richter reports. Otherwise…? Well, what happens otherwise? The EU could threaten higher duties on imports from China.

The Commission is already flexing its muscles. There are already concrete updates on the tariffs on EVs that are in the pipeline, including the approximate amount. Markus Grabitz reports. The tone in Brussels suggests that they are already a done deal.

In addition, there is a discussion about higher duties on imports of solar modules. The dilemma is apparent: Germany wants to reduce its dependence on the overpowering supplier. However, the energy transition relies on many inexpensive solar modules. Even in the German industry, the majority of managers are against higher tariffs, as Christiane Kuehl reports. Read today’s Feature to understand why companies believe they can survive without state intervention.

Meanwhile, Volkswagen has finally released its long-awaited audit report on the human rights situation in its factory in the Uyghur region of Xinjiang. The report gives the company a clean bill of health: no evidence of human rights violations.

Moody’s has downgraded its outlook for China from stable to negative in response to the increasing state debt and the worsening property crisis in the world’s second-largest economy.

Reasoning behind the agency’s decision:

Moody’s joins a long line of concerned economist assessments of the situation in China. The real estate sector, pivotal to both the real economy and lending, is teetering on the edge, dragging other industries down with it.

Moody’s downgrade is not helpful for China, but it is not a catastrophe either. The credit rating from international rating agencies has only indirect significance for China’s financing capability. While the country’s foreign debt has increased over time, it is by no means alarming. In fact, it has recently decreased.

Compared to other economies, China’s foreign debt, at 2.5 trillion dollars, is still low. Germany (2.8 trillion dollars), the Netherlands, Switzerland, Japan and the United Kingdom have higher foreign debts without it being considered a problem. As a country with full control over its currency and significant foreign exchange reserves, China can easily service its debts in the overall picture.

Foreign debts become a problem when they cannot be serviced due to a weak domestic currency or a lack of control over foreign exchange. Greece in 2011, Argentina in 2001, or Mexico in 1994 are examples of this.

There is explicitly no such default risk in China. Moody’s continues to rate Chinese government bonds as A1, a good grade. This corresponds to A+ at competing agencies Fitch and S&P. As China consistently runs trade surpluses, the country is not reliant on inflows in Western currencies. It also secures oil affordably from Russia against the yuan.

The concerns of analysts primarily revolve around domestic debts. Moody’s explicitly mentions “debts in China” rather than “China’s debts”. The debt in question is primarily that of local governments, including municipalities, among Chinese investors and institutions.

The International Monetary Fund estimates the liabilities of local governments at 13 trillion dollars. This is much higher than foreign debts and equals three times Germany’s annual economic output. Additionally, there are hidden debts of unknown amounts.

While concerns about local government debts in China are old, they remain as valid as ever. Municipalities’ expenditures on infrastructure drive growth, but they only work as long as revenues from real estate transactions are accurate – and growth is high. Decreasing growth becomes self-reinforcing. The economy is already caught in a vicious circle, putting local governments under pressure.

Now, foreign debts and financial flows come into play. In their increasing financial distress, local governments also incur short-term debts with high-interest promises in dollars. The buyers are mostly Chinese nationals who expect the government not to allow a widespread default of local governments. They see the risk of local government debts but consider it negligible, expecting state rescue.

However, a rise in the dollar’s exchange rate against the yuan would significantly pressure the debtors since they hold yuan and must service dollar-denominated debt. Following Moody’s report on Tuesday, investors have started selling off Chinese investments. Dollar purchases by local banks have stabilized the exchange rate.

Moody’s assesses China’s overall growth potential significantly lower than before. According to the forecast:

The Chinese ministry of finance expressed disappointment with Moody’s decision and added that the economy would maintain its recovery and positive trend. Moreover, it stated that risks in the real estate and municipal administration sectors are manageable. With Reuters

Ahead of the EU-China Summit, EU Commission President Ursula von der Leyen warned of a growing trade imbalance with China and issued a challenge: The EU will not tolerate this significant imbalance in the long term, she said in an interview with AFP for several European news agencies on Tuesday. “We have tools to protect our market.”

The trade imbalance with the People’s Republic had doubled to nearly 400 billion euros over the past two years, von der Leyen added. The EU prefers negotiated solutions. It is “also in China’s interest” to make decisions in coordination with Europeans at the summit.

On Thursday, the EU-China Summit will take place in person for the first time since 2019: von der Leyen and Council President Charles Michel will meet Xi Jinping and Li Qiang in Beijing. However, there are not too high expectations for concrete results.

Jens Hildebrandt, Managing Director of the German Chamber of Commerce (AHK) in China, also wishes for balanced trade as a discussion topic at the meeting: “From our point of view, the level playing field must be back on the agenda,” said Hildebrandt during a press briefing in Beijing.

It should no longer be allowed that European companies in China do not encounter the same competitive conditions as the Chinese economy in some areas, while Chinese companies can fully exploit the European market, he said. Nevertheless, Hildebrandt warns against an escalation of economic tensions between Europe and the People’s Republic.

He hopes that no trade conflict will be triggered, emphasized Hildebrandt on Tuesday: “Because the German economy needs open markets.” In the ongoing EU investigations into the subsidization of Chinese EVs, one should not put oneself in a disadvantageous position, according to him. Hildebrandt expected clear statements from EU representatives at the summit: “The EU side must make it clear at the meeting in which areas de-risking is envisaged.”

According to Hildebrandt, visa-free entry or other relaxations as part of China’s charm offensive before the meeting help only “minimally” to restore trust. He does not expect major structural changes in the near future: “The Chinese government is currently limited in its actions,” said the AHK chief. Too deep cuts in the economy are not possible at the moment. Hildebrandt sees the fact that both sides are meeting in person for the first time again as positive.

Von der Leyen and EU Council President Charles Michel will initially meet China’s President Xi Jinping and then Premier Li Qiang on Thursday. The meeting is the first personal one within this summit format since 2019. At that time, the EU Commission chief was still Jean-Claude Juncker, the EU Council was led by Donald Tusk and China’s prime minister was Li Keqiang.

The online formats during the pandemic did not deliver significant results, and that is still putting it nicely: EU foreign chief Josep Borrell retrospectively called the 2022 meeting a “summit of the deaf” – Brussels primarily wanted to discuss the Ukraine crisis, while Beijing focused on trade issues.

However, too much should not be expected from the personal summit in Beijing. The initially planned two official days have now been reduced to one. EU Council President Michel is expected to fly back on Thursday to take care of preparations for the EU summit of heads of state and government. A stop in Shanghai on Friday had originally been planned for him.

A joint statement for the summit is not planned, nor is the signing of technical agreements that were coordinated during visits by other EU representatives in recent weeks.

The limited results of the Biden-Xi summit in San Francisco were already a sign that China does not want to make substantial offers to the West, says Abigaël Vasselier, Head of the Foreign Relations Team at the Merics China Research Institute. “Given the elections in Europe and the USA in 2024, it is unlikely that Beijing will make concessions to the heads of state and government who may no longer be in office in a few months.” China’s economic and political support for Russia will be a point of attack for the Europeans, says Vasselier.

Her colleague Grzegorz Stec, EU-China Analyst at Merics, also expects only limited results at the summit. “The summit will, however, set the tone and agenda for relations between the EU and China until the end of the current EU mandate,” says Stec. The main theme of the meeting will be risk reduction. “Ahead of the summit, Chinese diplomats proposed replacing de-risking with a ‘rebuilding strategic trust’ through more robust dialogues.”

Due to political tensions and China’s economic situation, some German companies are already reducing risk associated with China business, according to an AHK survey: 44 percent of 566 respondents stated that their company headquarters are taking such steps. Slightly more companies (45 percent) denied this. The remainder answered with “I don’t know”.

The companies are relying, for example, on supply chains independent of China or are additionally establishing business in other countries. India is the biggest beneficiary in Asia: 72 percent of the surveyed companies are already active there in addition to China.

However, it is important that 54 percent of the companies want to expand their investments in China, said AHK Chief Hildebrandt. A large part of these companies justified the plan by wanting to remain competitive in China. For example, some are localizing their research and development in China. Because the huge Chinese market remains irreplaceable, as stated in the AHK survey.

The European solar industry is currently grappling with how to handle the overpowering competition from China. The issues at hand include price declines, a surplus of modules from the Far East, forced labor in Xinjiang, jobs, resilience, and the necessary energy transition. Some politicians and companies are now considering trade restrictions against China; however, most companies are primarily demanding more government support to establish solar production.

429 solar companies recently issued a joint statement opposing trade protection measures addressed to EU Internal Market Commissioner Thierry Breton. “We are appalled by the rumors that a trade protection investigation could be initiated in the solar sector,” said Walburga Hemetsberger, CEO of the industry association SolarPower Europe, who coordinated the appeal. “We have better, faster, and more effective solutions for the crisis facing European manufacturers. Europe must not betray its climate and energy security goals.”

The downstream segment, in particular, opposes trade restrictions. Almost all plant sellers or installers use Chinese solar modules and cells, which account for around 90 percent of the global market share – and benefit from the low prices. These companies fear rising prices due to potential tariffs, endangering their own businesses.

The EU is facing a classic dilemma: the goal of strategic independence through the reconstruction of a crucial sector clashes with the objective of rapid and cost-effective expansion. Key EU initiatives reflect this dilemma:

To plan for the necessary establishment of production capacities for 30 gigawatts of photovoltaic systems, the European Solar PV Industry Alliance was founded a year ago, including the two major solar associations, SolarPower Europe and the European Solar Manufacturing Council. However, there is no unity – not even on the question of whether Chinese manufacturers are engaging in dumping in Europe or not; different figures on production costs in the People’s Republic circulate within the community. The sector has been subsidized in China for years. Now, the USA is following suit – no wonder EU companies are demanding assistance in response to the industrial policies of others.

The industry is uncertain because it already collapsed under the onslaught of Chinese photovoltaics in the 2010s. There was a dispute back then, too, and calls for tariffs prevailed. When these were introduced in 2013, the industry, already battered by the price war with China, collapsed entirely because demand dropped due to increased prices. In 2018, Brussels lifted the antidumping and countervailing duties imposed on solar modules from China, Taiwan, and Malaysia in 2013.

“Jobs in the solar sector, project investments, and the installation of solar modules declined significantly during the validity of these trade protection measures,” explains the solar firms’ statement justifying the rejection of tariffs. The signatories emphasize that today, 84 percent of approximately 648,000 jobs in the photovoltaic industry are in the downstream segment. By 2025, it could be more than a million jobs.

“We would jeopardize many jobs in the downstream sector with trade restrictions, as they would immediately impact the market,” says Markus Meyer, Director of Policy and Regulation at Berlin-based solar start-up Enpal, which sells or leases systems to end customers – and exclusively uses Chinese solar modules. “We and many of our competitors would have to cut jobs massively,” Meyer told Table.Media.

Of course, companies and associations always threaten job cuts with unfavorable measures. However, the solar crisis has multiple dimensions due to the urgently needed energy transition and the new de-risking policy.

This also includes the issue of forced labor in Xinjiang. Since the US banned imports of solar modules with silicon from Xinjiang in 2021, China’s already strongly growing exports are increasingly being redirected to Europe. This mixes several issues: Human rights concerns intersect with the energy transition, job losses and resilience.

The ESMC also, for ethical reasons, calls for the rapid enactment of the planned EU regulation banning products from forced labor. In late November, the ESMC issued a statement accusing parts of the European solar industry, presumably out of fear for their existence, of lobbying to weaken the EU’s plans against forced labor. With an import ban similar to the USA’s, the EU would likely have to dig as deep into its pockets as Washington to achieve its goals for the energy transition and the solar sector. That could be challenging.

The industry currently seems to agree only on the need to take action. Thus, the statement from SolarPower Europe calls for:

Gunter Erfurt, CEO of Meyer Burger, the last major solar module manufacturer in Germany, also expressed opposition to tariffs and sanctions in a Table.Media interview – although he is annoyed by the cheap competition from China, which he believes is selling below production costs in Europe: “We are the dumping ground for Chinese cheap modules because they are no longer allowed into the USA and elsewhere.” Erfurt expects a smart instrument that “is not directed against China” but allows “the establishment of a resilient clean tech industry in the EU by 2030”. It’s about “quickly securing fair competitive conditions in the EU,” he said.

Meyer Burger is based in Switzerland and produces in Freiberg, Saxony, and in the “Solar Valley” near Bitterfeld in Saxony-Anhalt, as well as in the USA. It did not sign SolarPower Europe’s appeal but recently, along with about 40 other industry companies – including module producer Heckert Solar and start-up Nexwafe – issued a joint letter requesting support from Brussels. Erfurt emphasized in the interview that PV modules could be produced inexpensively in Germany. He advocated for resilience bonuses for plant operators “from individual rooftops to large solar parks” using European components.

Markus Meyer from Enpal is particularly in favor of resilience tenders because of the market-based components of this system. “Legislators could say that we have a gigawatt of European cells or modules with minimum local content.” A positive list shows which modules or components are eligible for funding. “The system takes into account the additional costs that I have with European products.” Collaboration: Horand Knaup

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and specific business activities in the People’s Republic.

Volkswagen has faced criticism for its factory in the Xinjiang province for years. On Monday evening, auditors commissioned by the company released their long-awaited report on the conditions in the factory. Result: A PR victory for VW. “We could not find any evidence or proof of forced labor among the employees,” said Markus Loening, former human rights commissioner of the German government until 2014, now operating the consulting firm Loening Human Rights & Responsible Business.

Volkswagen had engaged Loening’s firm to independently review the working conditions in the VW plant in Xinjiang based on international standards. Loening emphasized that the audit was limited to the 197 employees of the plant, of whom almost 50 are Uyghurs. For the investigation, Loening’s consulting firm conducted on-site interviews and, together with Chinese lawyers, reviewed documents. “The situation in China and Xinjiang and the challenges of data collection for audits are known,” said Loening.

Major international audit firms have long withdrawn from the region because the situation of employees cannot be independently verified. Due to state surveillance measures, it is considered impossible, for example, to speak with employees outside of companies. However, according to experts, it is possible to review documents such as employment contracts in the plant, inspect security measures on-site, such as barbed wire or conduct other plausibility checks. However, experts state that no definitive statements can be made about the situation with complete certainty.

Volkswagen itself reiterated that the employees are well qualified, have long company tenure of up to ten years, low workloads, and are paid above average. The company also denies knowledge of any collaboration between its Chinese joint ventures and vocational colleges integrated into the state’s forced labor system in Xinjiang. A spokesperson stated that the manufacturer promptly investigated potential connections to the institutions after China researcher Adrian Zenz discovered relevant indications in the Xinjiang Police Files.

“As of today, there is no cooperation with the Xinjiang Industry Technical College,” says the statement, which was issued before the audit report was released. The educational institution provides vocational education in cooperation with companies. According to the university’s website, Volkswagen is involved in it as part of its joint venture with the state-owned manufacturer SAIC. In any case, there have been no new hires since 2018. Before that, a careful compliance check was carried out for every newly hired employee.

Volkswagen’s joint venture with FAW in Tianjin is also not affected, according to the company. “To our knowledge, there is also no collaboration between the Hotan Vocational Skills College mentioned in the report and FAW-Volkswagen in Tianjin. There are no connections to other colleges in Xinjiang from Tianjin.” grz/rtr/cds

The EU investigation into Chinese EVs seems to be getting serious: It is expected that the EU Commission will impose preliminary tariffs on EVs from the People’s Republic by July 4 at the latest. The tariffs are expected to be in the low double-digit percentage range. The preliminary tariffs would then have to be officially imposed within four months. The anti-subsidy procedure, which Brussels has been conducting since Oct. 4, must be concluded within 13 months according to EU rules. The EU is considered one of the very few markets that are open to imports of battery electric vehicles (BEV) from China.

According to the Commission’s findings, China grants extensive and diverse subsidies to BEV manufacturers in the country, such as subsidies for land purchases, low-interest loans and tax breaks. It is not only companies originating from China that are supposed to be subsidized. Companies such as VW, BMW, Mercedes and Tesla, which produce BEVs in China and also export them to Europe, are said to be affected by the subsidies. There is no information that the subsidies are targeted at a specific market segment. Both the volume segment and the premium class are subsidized. It is said that Chinese companies and government authorities in China are very cooperative.

In the first step of the investigation, the Commission sent questionnaires to manufacturers in the EU and China, asking them to fill them out. Subsequently, the team of about 25 officials conducting the investigation in the Commission selected companies for a representative sample. Companies based in the EU must respond, while companies based in China are not obligated to do so. Currently, the evaluation of the several hundred pages of questionnaires from the representative sample is underway. Visits to China are also planned for early 2024 to verify the information. mgr

For a long time, William Lai was clearly leading in all polls. Lai is running for the China-critical Democratic Progressive Party (DPP) in the Taiwanese presidential election on Jan. 13. In view of the divided opposition, some observers were already predicting that Lai could “win the election lying down”. That is now a thing of the past.

The election campaign is developing into a two-way race between Lai and Hou Yu-ih from the more China-friendly Kuomintang Party (KMT). According to recent polls, Lai is around 36 percent, with Hou at 30 percent. Ko Wen-je of the newly formed Taiwan People’s Party, established in 2019, has fallen far behind in recent polls with just around 20 percent. Terry Gou, the founder of Foxconn, who entered the race as an independent, withdrew his presidential candidacy at the end of November.

“I am a political worker for Taiwanese independence, and that will not change no matter what position I hold,” declared William Lai in 2017 during his inaugural speech as the Prime Minister, the second most powerful position in Taiwan, in front of the Taiwanese Parliament. Statements like these are what political opponents repeatedly use against the DPP’s presidential candidate, labeling him a hardliner for Taiwanese independence.

The KMT, more inclined toward China, attempts to portray Lai as a hardliner for Taiwanese independence, suggesting that his election would provoke the Beijing government, leading to further escalation in Taiwan-China relations. According to their formula, the presidential election is a choice between war and peace.

Contrary to such sensational accusations within the DPP, Lai is considered moderate regarding Taiwan’s relations with China. Recently, he has expressed himself more cautiously, distancing himself from the formal goal of Taiwanese independence and showing a willingness to engage in dialogue with the leadership in Beijing. “My goal is to maintain the status quo and contribute to peaceful development between Taiwan and China. I always keep the doors open for dialogue on an equal footing,” he stated in a recent campaign appearance.

To navigate Taiwan’s challenging course amid the conflict between the US and China, Lai has chosen Bi-khim Hsiao, Taiwan’s former representative to the US, as his vice-presidential candidate.

William Lai was born in 1959 in Wanli, a rural region on the northeast coast of Taiwan. Lai’s father was a miner who died in a mining accident when Lai was just 95 days old. His mother raised Lai and five other children. Lai became the first student from his region to secure a place at the prestigious Chien Kuo High School in Taipei.

He later studied rehabilitation medicine, initially in the capital Taipei, later at Cheng Kung University in Tainan in southern Taiwan, and also at Harvard University. For his supporters, Lai embodies the highly valued promise of upward mobility through education and hard work in Taiwan.

William Lai began his political career in Tainan. From 1996, he served as a member of the National Parliament. In 2010, he became the mayor of Tainan. During this time, he earned a reputation as an upright and pragmatic politician. He criticized Chuan Chiao-Lee, then-chairman of the city parliament in Tainan, sharply for alleged vote-buying. In his re-election as mayor in 2014, Lai won with a 45 percent lead over the KMT’s opposing candidate. In southern Taiwan, where the DPP traditionally enjoys significant support stemming from its roots as a resistance movement against the former KMT dictatorship, Lai is still highly regarded.

After his appointment as Prime Minister, William Lai was increasingly considered a potential presidential candidate. Before the 2020 presidential elections, he even participated in party primaries against the incumbent President Tsai Ing-wen – and lost. He then joined as the vice-presidential candidate under Tsai, who eventually won the election convincingly. In his current candidacy, the DPP is solidly behind Lai.

However, after eight years of DPP governance under Tsai, Lai is contending with dissatisfaction among a significant portion of the population. Lai is considered conservative on social issues. During his time as Prime Minister, he was responsible for reforms that increased the monthly allowable overtime hours. He remarked that workers could consider longer working hours as “good deeds”.

Especially among young people, who predominantly supported the DPP during Tsai Ing-wen’s tenure, support for Lai is weak. Many feel abandoned by the DPP on urgent social issues such as housing shortages in major cities and stagnant wages. The KMT’s war-and-peace rhetoric does not resonate with them. Yet, Lai has not succeeded in conveying a convincing vision for his presidency to them.

If Lai becomes president, the DPP will likely lose its majority in the legislature in the simultaneous parliamentary elections and will need to make significantly more compromises in the future. William Lai and his party are facing challenging times. Leonardo Pape

James Crabtree is the new Distinguished Visiting Fellow in the Asia team of the European Council on Foreign Relations. The analyst and author was previously Executive Director of the International Institute for Strategic Studies in Singapore.

Is something changing in your organization? Let us know at heads@table.media!

Last call at Lixiahe National Wetland Park in the eastern Chinese province of Jiangsu: Migratory birds gather before departure – with an apparent sense for a picturesque setting.