China had to announce some difficult numbers on Tuesday. On the one hand, although economic growth in 2022 of just under three percent exceeded the even more pessimistic forecasts of many analysts, it was still well below the official target. In addition, the People’s Republic recorded fewer births than deaths in 2022 for the first time in decades. The latter in particular represents a turning point: China’s population is aging and declining before it reached the prosperity level of industrialized nations. The declining population will therefore create significant political-economic problems for China in the future, as Finn Mayer-Kuckuk explains. Pension funds are at risk, as is general economic momentum.

Meanwhile, a wonky comparison at the start of the week caused a stir in the automotive community. China’s Automobile Manufacturers Association (CAAM) announced excellent car export figures. Chinese media and subsequently we at China.Table drew the conclusion from the data that China had thus outperformed Germany. But there was a hitch to the story: CAAM included commercial vehicles in its statistics for China, as it usually does, but the German statistics do not. This resulted in a distorted comparison. Looking at car exports alone, Germany remains ahead of China for the time being. However, the German industry still has a long way to go before it can rest easy, as Frank Sieren analyzes.

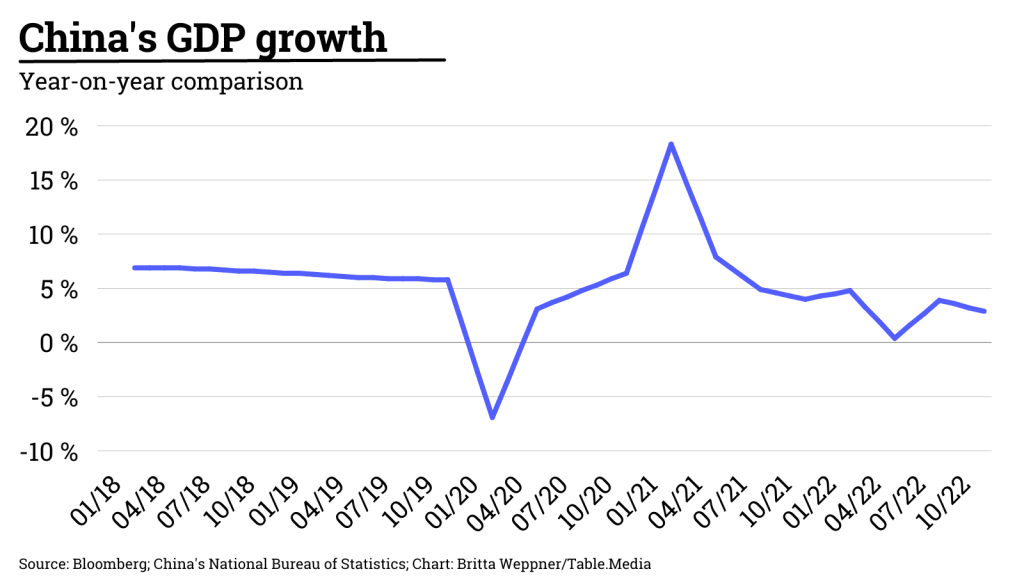

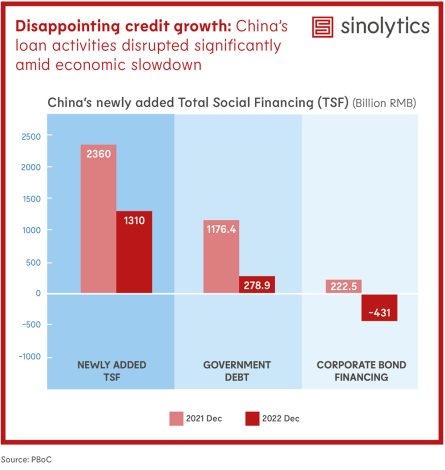

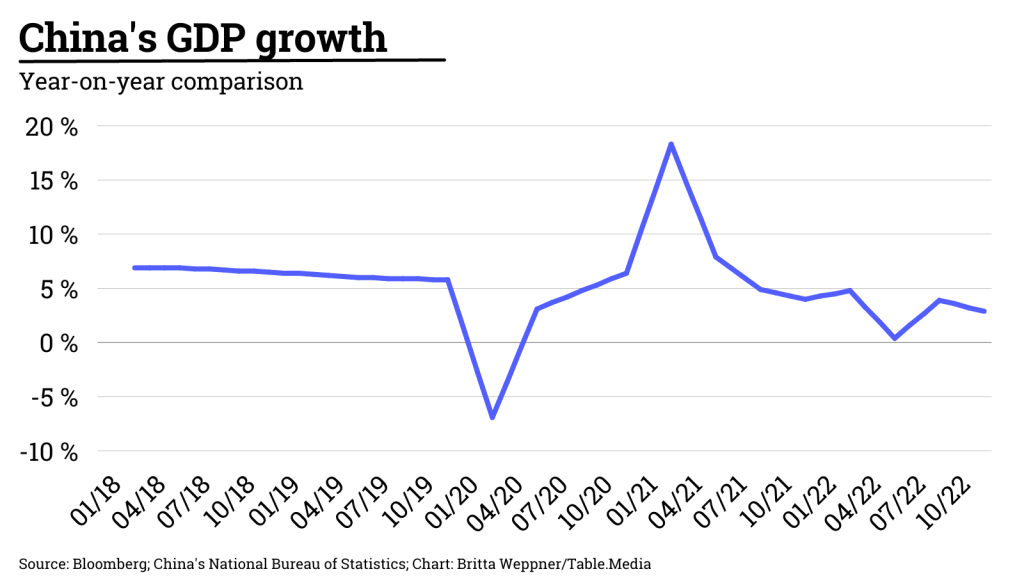

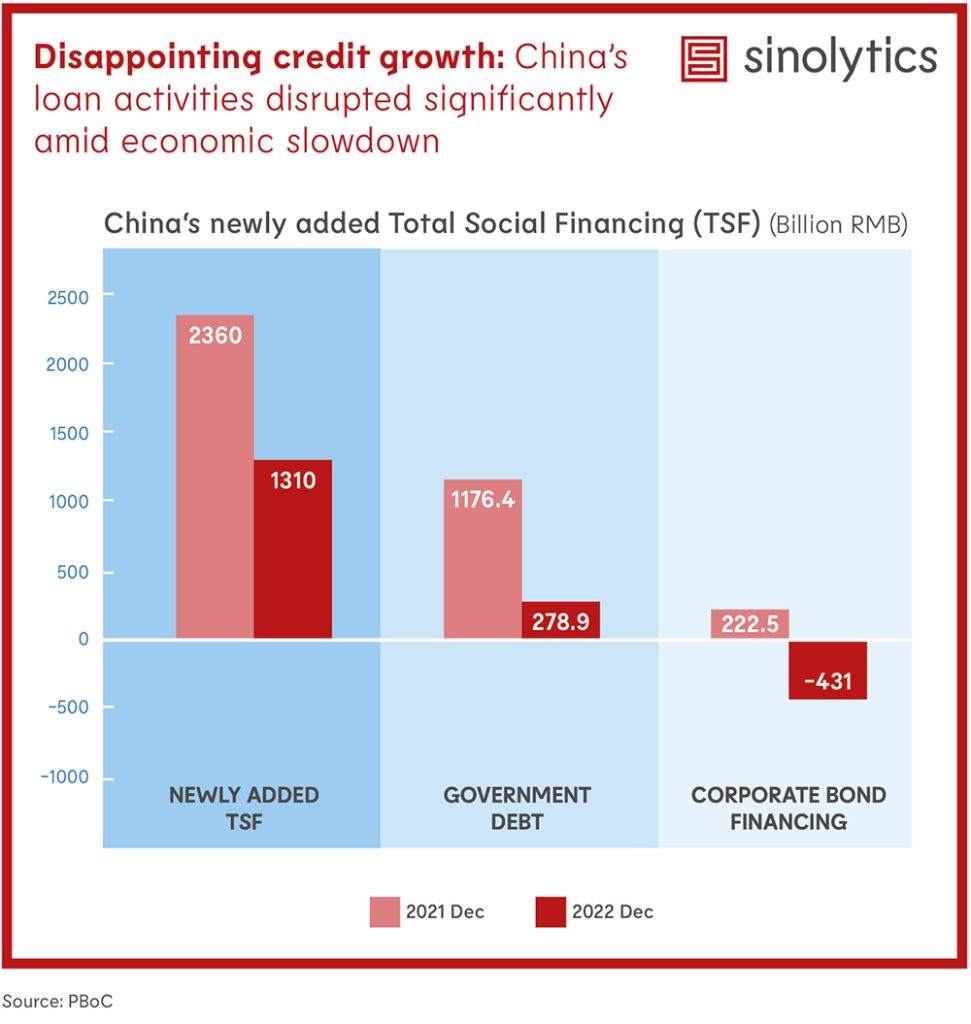

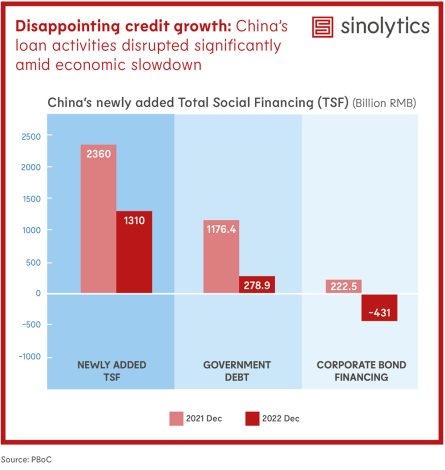

Chinese growth in 2022 was well below the original target. It also reached its second-lowest level since the 1970s. But with a plus of three percent, the economy still grew rather respectably, according to official figures issued on Tuesday. Many economists had expected an even weaker result.

Analysts now expect a certain recovery for this year. For instance, experts at the securities firm Nomura believe that steady growth will return in the first quarter once the Covid waves ease and mobility picks up again. But companies should not get their hopes up for an economic boom just yet.

The problems are too severe for that. Exports are weak and the real estate market is far from cleaned up. In addition, car purchase subsidies, which have bolstered sales in recent months, are expiring.

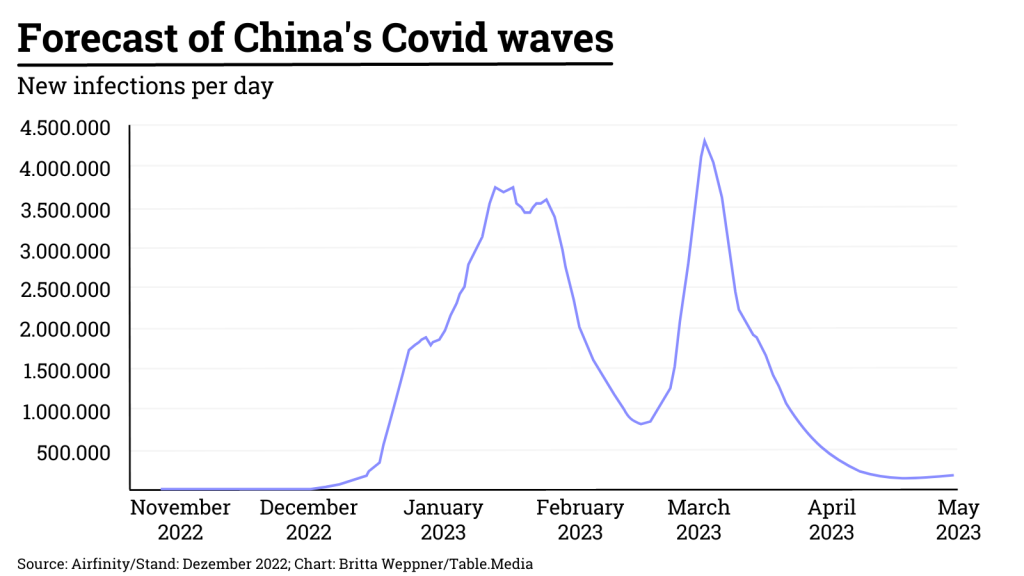

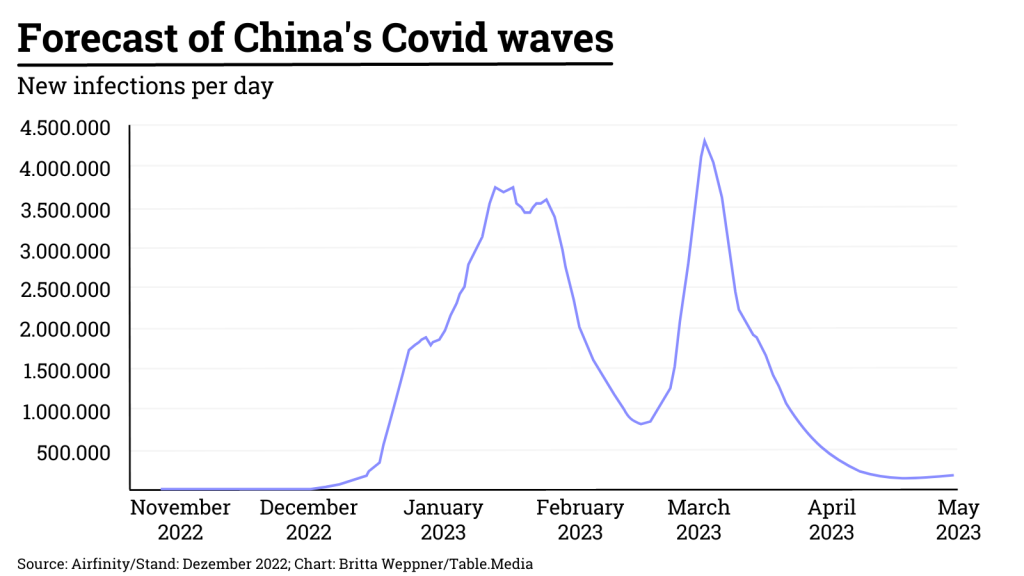

Overall, experts now expect growth for 2023 to be slightly below the original 2022 target, namely around five percent. For March and April, epidemiologists expect a second, very steep Covid wave. After that, China’s population should also have solid basic immunity and be able to return fully to normal life. Then nothing should stand in the way of opening the country to foreign travelers.

A statistical recovery is also likely because 2022 was a particularly weak year for China – thus setting the bar low for 2023. The economy struggled with two extremes during the pandemic. In the spring and summer, it suffered the consequences of harsh lockdowns in an attempt to maintain zero-Covid at all costs. This was followed in December by a chaotic opening including a huge infection surge.

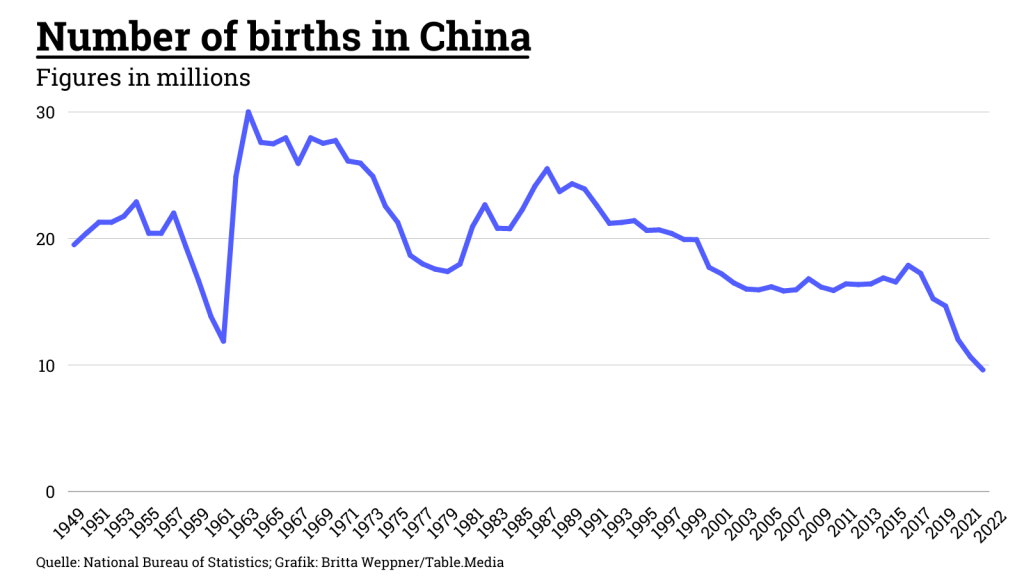

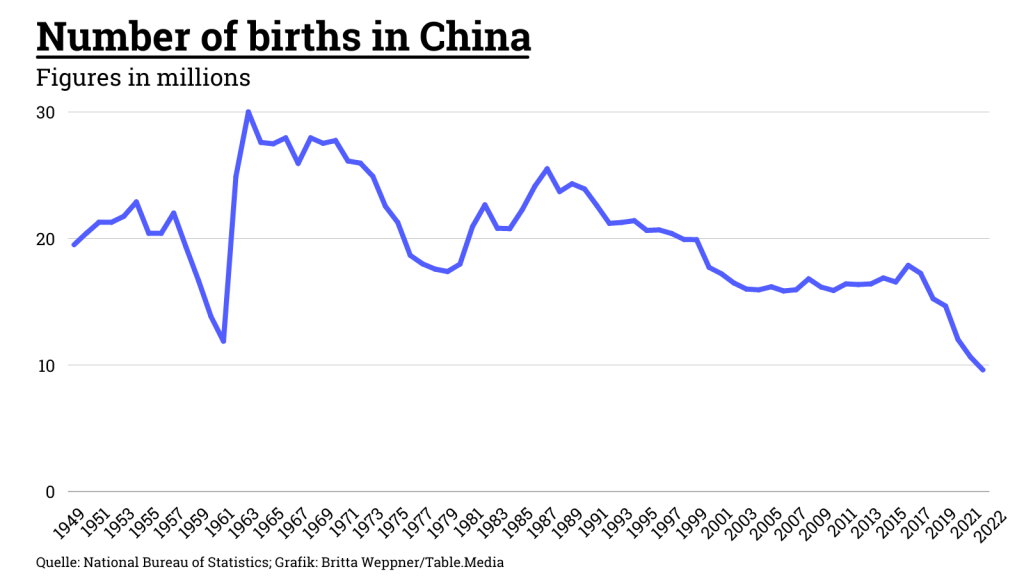

China’s statistical office had a second piece of big news to share on Tuesday. With 9.56 million births, the number of children born last year was the lowest in decades. At the same time, 10.41 million people died. This is the first time since the 1950s that the population declined. After a long period of growth, the demographic trend has now reversed as expected (China.Table reported).

Although the government has been attempting to control population growth since the 1970s by restricting births. But as prosperity grew, people were less willing to have children on their own. As a result, three children are now permitted and even expressly encouraged since 2021. But families are not cooperating. If the current trend continues, China’s population will halve to 770 million people by 2100. The population is expected to remain stable at around 1.4 billion until around 2044, after which it will decline rapidly.

A declining population will create significant political-economic problems for China in the future. Traditional indicators of economic performance are declining in tandem with the size of the population. Far more serious, however, is the question of how many old people will be cared for by fewer and fewer young people. China faces similar trends as Germany, Italy and Japan, albeit much earlier on the development path. China is still an emerging economy.

The biggest concern is the ability to provide an adequate pension system that will allow the elderly to maintain a certain standard of living. In addition, as the population ages, economic momentum may decline before a level of high incomes is reached. On the other hand, the market for medical and healthcare technology and medical equipment is expected to grow rapidly.

Exports of German passenger cars have increased in 2022. Nevertheless, the figures are cause for concern. Although with 2.61 million passenger cars exported, Germany exported ten percent more cars than in 2021, the figure is still below that of 2019, when it was 2.64 million cars. In other words, Germany sells fewer cars to the world than it did three years ago – in China, on the other hand, exports of all vehicle types are increasing.

Incorrect reports from various Chinese and international media, which China.Table also picked up, had caused irritation in Germany earlier this week. Reports included both passenger and commercial vehicle sales in order to rank China in second place in the global ranking, ahead of Germany. The numbers suggested that vehicle exports rose by 54.4 percent in 2022. According to the Chinese Automobile Manufacturers Association (CAAM), 3.11 million vehicles were exported. This would have meant that the People’s Republic surpassed Germany and was now the world’s second-largest car exporter behind Japan.

However, looking only at the passenger car segment, China’s exports are still just behind Germany with 2.53 million cars. This was also pointed out by the German Automobile Manufacturers Association (VDA).

Nevertheless, the passenger car export growth of around 57 percent in an economically challenging year for China is remarkable. One thing is clear: Regardless of whether commercial vehicles are included in the calculation or not, Germany has a problem that cannot be talked away. Even if China’s car sales have not yet surpassed Germany’s in 2022, that will very likely be the case this year. At least Germany can still take comfort in one statistic: The average value of exported German cars is significantly higher.

A look at another figure reveals how dramatic the competitive situation really is: China reported a 120 percent increase in EV exports. This brings the total number of cars sold in the People’s Republic to 679,000. Chinese brands such as BYD, Xpeng and Nio are now turning into international competitors for German automakers. And the trend is also clear on the Chinese market: Volkswagen’s market share in the People’s Republic, for example, shrank from 17.5 percent to 14.1 percent. The situation was no better for Bavarian manufacturer BMW, whose share dropped from 4.6 percent to 3.5 percent. Mercedes also saw its share decline from 4.1 percent to 3.4 percent.

Electric cars have become crucial to the development of the global car market in the meantime. For the first time, the share of electric models of all cars sold worldwide rose to more than ten percent. While global car sales with combustion engines are stagnating, EV sales have risen globally by 68 percent to 7.8 million vehicles. So this is where the path is headed. And China is already a pioneer in this segment. According to CAAM, China accounted for around two-thirds of global EV sales last year.

And the Chinese market for new energy vehicles (NEVs) continues to play an increasingly important role for the world’s automakers. 19 percent of cars sold in China are EVs; in Europe, the figure is only eleven percent. VW China board member Ralf Brandstaetter believes the point is close where the company will sell fewer and fewer internal combustion vehicles in China: “We haven’t reached the tipping point yet, but we’re expecting to get there between 2025 and 2030,” he said at a roundtable in Beijing earlier this week. That is also likely to affect global markets and global EV trade flows: In and out of China.

VW needs to adapt even more to the new conditions. “China is one giant fitness center for the industry,” Brandstätter said. And there is no gain without pain. This is what the German auto industry will have to prepare for.

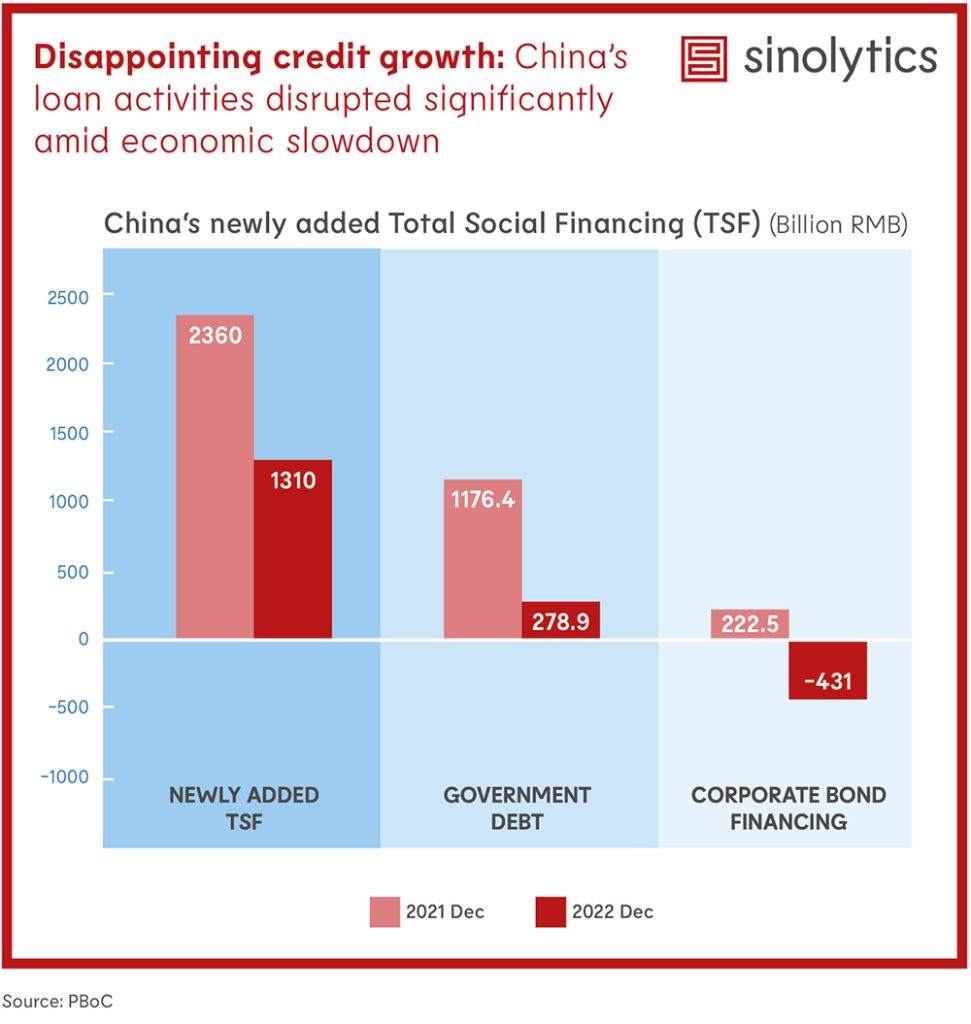

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

Taiwanese semiconductor manufacturer TSMC has spoken publicly for the first time about a possible plant in the EU. TSMC CEO C.C. Wei mentioned microchips for use in cars in particular in this context. Wei told analysts that in Europe “we’re engaging with customers and partners to evaluate the possibility of building a specialty fab, focusing on automotive-specific technologies, based on the demand from customers and level of government support,” according to a transcript.

Rumors about an investment by TSMC in Europe have been circulating for some time. The EU seeks to attract the world’s leading chip manufacturer to Europe. Germany, as an automotive location, has a particular interest here. At present, a commercial area near Dresden is under discussion for the construction of the factory (China.Table reported). The production of important components in the EU country is supposed to make the economy less susceptible to supply chain problems and geopolitical uncertainties. TSMC reportedly expects high subsidies in return for the costly expansion. fin

US Secretary of State Antony Blinken will travel to Beijing for two days on Feb. 5. China’s foreign office spokesman Wang Wenbin on Tuesday welcomed the visit. “Both China and the United States are in communication now over the specific arrangements,” Wang said in response to a US media report. Blinken will meet with his new counterpart Qin Gang in Beijing on Feb. 5 and 6.

Blinken’s visit to China in February would be the first by a secretary of state since October 2018, when Mike Pompeo, who belonged to the Trump administration, traveled to Beijing for a meeting with then-Foreign Minister Wang Yi that was marked by disputes over the escalating trade war. Currently, both sides are working to revive diplomacy. Wang Wenbin called on the United States to engage in “dialogue, partnership and win-win instead of confrontation, alliance and a zero-sum approach.”

Conversely, Wang Yi, who has risen to become China’s foreign policy czar, will visit Germany and Belgium in February, according to a report by the US news platform Politico. The trip will reportedly be an opportunity to ease tensions between China and Europe. Wang will attend the Munich Security Conference and visit the EU headquarters in Brussels, Politico reported, citing three unnamed diplomats familiar with the itinerary. The exact dates of the Brussels trip have not yet been determined. The EU did not initially want to confirm the travel plans. rtr/ck

For the first time since 2018, a Chinese representative has personally attended the World Economic Forum in Davos, Switzerland. China wants to open up further to the world, Vice Premier Liu He said on Tuesday. Beijing expressed confidence that China’s economy would return to its normal growth trend in 2023, Liu said. He expects a noticeable increase in imports, business investment and domestic consumption. “Foreign investments are welcome in China, and the door to China will only open up further,” Liu said.

In his speech, the Deputy Prime Minister also rejected the idea of a return to a planned economy. Beijing would continue “deepen SOE reform, support the private sector, and promote fair competition, anti-monopoly and entrepreneurship,” Liu stressed. The vice premier also stressed China would continue to increase sustainable energy production. The world must fight climate change together, he said.

EU Commission President Ursula von der Leyen, meanwhile, criticized the market conditions for European companies in the People’s Republic. China would heavily subsidize its industry and restricts access for EU companies. Nevertheless, von der Leyen added, it was necessary to cooperate with China when it came to the green transition. “We need to focus on de-risking rather than decoupling.” She promised the EU would do everything possible to crack down on unfair practices. For example, she said, Europe should look at alternatives for lithium supplies.

Von der Leyen also had critical words for Liu He on climate action, saying China had openly encouraged energy-intensive companies in Europe and elsewhere to relocate all or part of their production to the People’s Republic. “They do so with the promise of cheap energy,” von der Leyen said. She added, however, that China has made promoting clean-tech innovation and manufacturing a key priority in its current Five-Year Plan.

The Davos World Economic Forum will continue until the end of the week. The leaders will also hold bilateral talks on the sidelines of the event. For example, Liu He is expected to meet US Secretary of the Treasury Janet Yellen on Wednesday. ari

A female protester believed to have been abducted during the “white paper protests” has asked for help in a video message. In a video circulating on social media, the woman draws attention to the situation of arrested protesters. “If you are seeing this video, that means I have already been taken away by the police, like my other friends,” a young woman says into the camera.

The woman is believed to be 26-year-old editor Cao Zhixin. According to her own statements, she took part in a vigil at Beijing’s Liangma Bridge on November 27 to commemorate the victims of a high-rise fire in Xinjiang. Similar vigils had formed throughout China in December. Some culminated in protests in which participants openly demanded more freedoms and even the resignation of President Xi Jinping (China.Table reported).

In the video, Cao explains how she was interrogated for 24 hours after the protests in Beijing and subsequently released. In mid-December, however, a second wave of arrests followed, during which some of her friends were forced to sign blank arrest warrants, she says. People had also been taken to secret locations, she said. In her video, Cao claims they followed the rules at the vigil and did not clash with the authorities. She further says that she gave the video to friends who were supposed to make the video public in case of her arrest. Cao’s current whereabouts are unknown.

A list with the names of 20 arrested individuals has also been spreading on social media channels since the beginning of the week. It is said the people included on the list have been taken away from their homes or workplaces. Weiquanwang, a website that documents human rights cases in China, claims more than 100 protestors may have been detained. Most were reportedly young people in their twenties. Several held degrees from the country’s top universities, including Tsinghua University, Xi Jinping’s alma mater. fpe

The Shanghai Grand Prix scheduled for April 16 has been canceled. This was announced by the Formula 1 management on Tuesday. “All existing race dates on the calendar remain unchanged,” it said in a statement. China’s current Covid situation with high infection numbers is believed to be the cause of the cancellation. The wave is expected to continue to spread through the spring.

The organizers in China had hoped that the race could once again be held in Shanghai following the relaxation of the Covid measures. Relevant talks had already taken place in December, it was reported.

The cancellation means that China 2023 will be missing from the Formula One calendar for the fourth consecutive year. The last race was held in 2019. It was the 1,000th race in Formula One history before the Covid pandemic put an end to major international events. fpe

It was long assumed that ideology no longer played a role in the Chinese Communist Party (CCP). Since the beginning of economic reforms in the late 1970s, the common assumption, especially in Western countries, was that the CCP had abandoned ideological considerations and was guided primarily by pragmatic assumptions.

This belief has gradually changed since Xi Jinping took office in 2012, and it is increasingly argued that the CCP is undergoing a re-ideologization process. Regarding the party itself, Xi’s massive anti-corruption and education campaign for party members and cadres contributed to this. At the same time, the party-state’s increased intervention in the Chinese economy and also the party’s stronger role in controlling social structures are argued to be evidence of the party’s re-ideologization.

These assumptions are problematic on two levels. First, they assume a conception of ideology that implicitly sees ideology as irrational and not practical or pragmatic. Second, they assume that ideology in China automatically means Marxism – and that the introduction of economic reforms consequently must also mean the end of ideology.

However, in order to use ideology as an analytically expedient concept, it would be useful to define it more broadly. In this sense, ideology can be understood as a thought and communication scheme whose task is to classify and interpret socio-political and economic contexts. Such an analytical understanding of ideology also allows us to question the assumption that ideology no longer plays a role in China as Marxism loses its importance.

Party ideology since the beginning of the period of reform and opening is not primarily Marxist. The credo of adapting Marxism to Chinese conditions, and thus changing Marxist thought in the spirit of the Chinese Revolution, already happened under Mao. With the beginning of the reform and opening-up policy, the party was then confronted with massive political and socio-economic changes, which it had to re-embed ideologically.

The most striking feature in this post-1978 party ideology is the central position of the party itself. In its presentation of its own history and historical achievements, the party mythologizes itself. It asserts sole interpretive sovereignty over its ideological concepts, including rhetorical set pieces of Marxist thinking. This also includes a monopoly on the definition and implementation of future scenarios. At the same time, the party rhetorically signals to all its members and cadres that it is omnipresent and that the sole potential for punishment and commendation rests within the party. Thus, the main message of party ideology is the party itself.

This central message of party ideology is neither new nor characteristic of Xi Jinping. This characteristic could already be observed since the beginning of the reform and opening-up policy. The main task of party ideology is to define and justify the centrality of the party. Under Xi Jinping, we merely observe an increased emphasis on this central ideological feature.

At the same time, the means available to the party to underline its central position are changing. As part of its anti-corruption and education campaign, the party is increasingly relying on digital means of indoctrination and surveillance. These include study apps and the ability to report misbehavior digitally. Again, the principle of indoctrination and surveillance is not new and can be found in party documents even before Xi Jinping. Only the implementation is becoming increasingly comprehensive.

The party’s means are also changing for cooperation with – especially international – actors in the economic and international political system. China’s growing strength allows the party to leverage it economically and internationally to advance its own interests. If the party deems changed political and economic measures to be in China’s interests – and thus in its own – it is increasingly in a position to implement them against international actors as well.

In summary, this means that international actors, in particular, must learn to take the party seriously again. China’s economic reforms and increasing pluralization have resulted in a tendency to neglect the party as an actor. In its own ideological pronouncements, however, the party always held a central position. This also means that its political actions are entirely focused on its main ideological goal: Securing the rule and central position of the Communist Party.

For party members and cadres, but also for state employees, this means increased pressure to be loyal. For economic as well as social actors, it means taking the party seriously again and not dismissing ideological pronouncements as irrational or insignificant. After all, party ideology is a reminder of who really holds the reins – the Chinese Communist Party.

This article is published in the context of the event series “Global China Conversations” of the Kiel Institute for the World Economy (IfW). On Thursday, January 26, 2023 (12 p.m. CET), author Carolin Kautz and Joerg Wuttke (European Chamber of Commerce in China) will discuss the topic: “Ideology First, Economy Second? What Challenges do European Companies Face in China?”. China.Table is the media partner of the event series.

Dr. Carolin Kautz researches the ideology of the Chinese Communist Party and completed her dissertation on party social identity and the importance of ideology for the Chinese Communist Party at the University of Göttingen last year.

Michael Chiang will take over as the new head of the iPhone assembly segment at Taiwanese electronics giant Foxconn. The new appointment is also a response to worker protests at the main iPhone manufacturing site in the central Chinese city of Zhengzhou. Chiang, who has worked for Foxconn since 1999, played a crucial role in communicating with local authorities during the unrest, according to the company.

Yujia Jin has been working in the risk controlling department of Bank of China’s Frankfurt branch since January. The Chinese state-owned bank operates six branches in Germany. Jin has been working for the Bank of China since 2020, most recently as a customer advisor and credit analyst in Munich.

Is something changing in your organization? Why not let us know at heads@table.media!

With around 5,300 members (as of 2010), the Hezhen from Heilongjiang Province are one of China’s smallest officially recognized ethnic minorities. Starting at the end of December, they celebrate the beginning of the fishing season and the preparation for the New Year with feasts and games, as shown in this back-to-back tug-of-war. Among other things, the Hezhen are famous for their traditional clothing made of fish skin, although few still know how to make it. For their winter fun, the younger generation prefers a fashion update with a fishbone pattern and plush antlers.

China had to announce some difficult numbers on Tuesday. On the one hand, although economic growth in 2022 of just under three percent exceeded the even more pessimistic forecasts of many analysts, it was still well below the official target. In addition, the People’s Republic recorded fewer births than deaths in 2022 for the first time in decades. The latter in particular represents a turning point: China’s population is aging and declining before it reached the prosperity level of industrialized nations. The declining population will therefore create significant political-economic problems for China in the future, as Finn Mayer-Kuckuk explains. Pension funds are at risk, as is general economic momentum.

Meanwhile, a wonky comparison at the start of the week caused a stir in the automotive community. China’s Automobile Manufacturers Association (CAAM) announced excellent car export figures. Chinese media and subsequently we at China.Table drew the conclusion from the data that China had thus outperformed Germany. But there was a hitch to the story: CAAM included commercial vehicles in its statistics for China, as it usually does, but the German statistics do not. This resulted in a distorted comparison. Looking at car exports alone, Germany remains ahead of China for the time being. However, the German industry still has a long way to go before it can rest easy, as Frank Sieren analyzes.

Chinese growth in 2022 was well below the original target. It also reached its second-lowest level since the 1970s. But with a plus of three percent, the economy still grew rather respectably, according to official figures issued on Tuesday. Many economists had expected an even weaker result.

Analysts now expect a certain recovery for this year. For instance, experts at the securities firm Nomura believe that steady growth will return in the first quarter once the Covid waves ease and mobility picks up again. But companies should not get their hopes up for an economic boom just yet.

The problems are too severe for that. Exports are weak and the real estate market is far from cleaned up. In addition, car purchase subsidies, which have bolstered sales in recent months, are expiring.

Overall, experts now expect growth for 2023 to be slightly below the original 2022 target, namely around five percent. For March and April, epidemiologists expect a second, very steep Covid wave. After that, China’s population should also have solid basic immunity and be able to return fully to normal life. Then nothing should stand in the way of opening the country to foreign travelers.

A statistical recovery is also likely because 2022 was a particularly weak year for China – thus setting the bar low for 2023. The economy struggled with two extremes during the pandemic. In the spring and summer, it suffered the consequences of harsh lockdowns in an attempt to maintain zero-Covid at all costs. This was followed in December by a chaotic opening including a huge infection surge.

China’s statistical office had a second piece of big news to share on Tuesday. With 9.56 million births, the number of children born last year was the lowest in decades. At the same time, 10.41 million people died. This is the first time since the 1950s that the population declined. After a long period of growth, the demographic trend has now reversed as expected (China.Table reported).

Although the government has been attempting to control population growth since the 1970s by restricting births. But as prosperity grew, people were less willing to have children on their own. As a result, three children are now permitted and even expressly encouraged since 2021. But families are not cooperating. If the current trend continues, China’s population will halve to 770 million people by 2100. The population is expected to remain stable at around 1.4 billion until around 2044, after which it will decline rapidly.

A declining population will create significant political-economic problems for China in the future. Traditional indicators of economic performance are declining in tandem with the size of the population. Far more serious, however, is the question of how many old people will be cared for by fewer and fewer young people. China faces similar trends as Germany, Italy and Japan, albeit much earlier on the development path. China is still an emerging economy.

The biggest concern is the ability to provide an adequate pension system that will allow the elderly to maintain a certain standard of living. In addition, as the population ages, economic momentum may decline before a level of high incomes is reached. On the other hand, the market for medical and healthcare technology and medical equipment is expected to grow rapidly.

Exports of German passenger cars have increased in 2022. Nevertheless, the figures are cause for concern. Although with 2.61 million passenger cars exported, Germany exported ten percent more cars than in 2021, the figure is still below that of 2019, when it was 2.64 million cars. In other words, Germany sells fewer cars to the world than it did three years ago – in China, on the other hand, exports of all vehicle types are increasing.

Incorrect reports from various Chinese and international media, which China.Table also picked up, had caused irritation in Germany earlier this week. Reports included both passenger and commercial vehicle sales in order to rank China in second place in the global ranking, ahead of Germany. The numbers suggested that vehicle exports rose by 54.4 percent in 2022. According to the Chinese Automobile Manufacturers Association (CAAM), 3.11 million vehicles were exported. This would have meant that the People’s Republic surpassed Germany and was now the world’s second-largest car exporter behind Japan.

However, looking only at the passenger car segment, China’s exports are still just behind Germany with 2.53 million cars. This was also pointed out by the German Automobile Manufacturers Association (VDA).

Nevertheless, the passenger car export growth of around 57 percent in an economically challenging year for China is remarkable. One thing is clear: Regardless of whether commercial vehicles are included in the calculation or not, Germany has a problem that cannot be talked away. Even if China’s car sales have not yet surpassed Germany’s in 2022, that will very likely be the case this year. At least Germany can still take comfort in one statistic: The average value of exported German cars is significantly higher.

A look at another figure reveals how dramatic the competitive situation really is: China reported a 120 percent increase in EV exports. This brings the total number of cars sold in the People’s Republic to 679,000. Chinese brands such as BYD, Xpeng and Nio are now turning into international competitors for German automakers. And the trend is also clear on the Chinese market: Volkswagen’s market share in the People’s Republic, for example, shrank from 17.5 percent to 14.1 percent. The situation was no better for Bavarian manufacturer BMW, whose share dropped from 4.6 percent to 3.5 percent. Mercedes also saw its share decline from 4.1 percent to 3.4 percent.

Electric cars have become crucial to the development of the global car market in the meantime. For the first time, the share of electric models of all cars sold worldwide rose to more than ten percent. While global car sales with combustion engines are stagnating, EV sales have risen globally by 68 percent to 7.8 million vehicles. So this is where the path is headed. And China is already a pioneer in this segment. According to CAAM, China accounted for around two-thirds of global EV sales last year.

And the Chinese market for new energy vehicles (NEVs) continues to play an increasingly important role for the world’s automakers. 19 percent of cars sold in China are EVs; in Europe, the figure is only eleven percent. VW China board member Ralf Brandstaetter believes the point is close where the company will sell fewer and fewer internal combustion vehicles in China: “We haven’t reached the tipping point yet, but we’re expecting to get there between 2025 and 2030,” he said at a roundtable in Beijing earlier this week. That is also likely to affect global markets and global EV trade flows: In and out of China.

VW needs to adapt even more to the new conditions. “China is one giant fitness center for the industry,” Brandstätter said. And there is no gain without pain. This is what the German auto industry will have to prepare for.

Sinolytics is a European research-based consultancy entirely focused on China. It advises European companies on their strategic orientation and concrete business activities in the People’s Republic.

Taiwanese semiconductor manufacturer TSMC has spoken publicly for the first time about a possible plant in the EU. TSMC CEO C.C. Wei mentioned microchips for use in cars in particular in this context. Wei told analysts that in Europe “we’re engaging with customers and partners to evaluate the possibility of building a specialty fab, focusing on automotive-specific technologies, based on the demand from customers and level of government support,” according to a transcript.

Rumors about an investment by TSMC in Europe have been circulating for some time. The EU seeks to attract the world’s leading chip manufacturer to Europe. Germany, as an automotive location, has a particular interest here. At present, a commercial area near Dresden is under discussion for the construction of the factory (China.Table reported). The production of important components in the EU country is supposed to make the economy less susceptible to supply chain problems and geopolitical uncertainties. TSMC reportedly expects high subsidies in return for the costly expansion. fin

US Secretary of State Antony Blinken will travel to Beijing for two days on Feb. 5. China’s foreign office spokesman Wang Wenbin on Tuesday welcomed the visit. “Both China and the United States are in communication now over the specific arrangements,” Wang said in response to a US media report. Blinken will meet with his new counterpart Qin Gang in Beijing on Feb. 5 and 6.

Blinken’s visit to China in February would be the first by a secretary of state since October 2018, when Mike Pompeo, who belonged to the Trump administration, traveled to Beijing for a meeting with then-Foreign Minister Wang Yi that was marked by disputes over the escalating trade war. Currently, both sides are working to revive diplomacy. Wang Wenbin called on the United States to engage in “dialogue, partnership and win-win instead of confrontation, alliance and a zero-sum approach.”

Conversely, Wang Yi, who has risen to become China’s foreign policy czar, will visit Germany and Belgium in February, according to a report by the US news platform Politico. The trip will reportedly be an opportunity to ease tensions between China and Europe. Wang will attend the Munich Security Conference and visit the EU headquarters in Brussels, Politico reported, citing three unnamed diplomats familiar with the itinerary. The exact dates of the Brussels trip have not yet been determined. The EU did not initially want to confirm the travel plans. rtr/ck

For the first time since 2018, a Chinese representative has personally attended the World Economic Forum in Davos, Switzerland. China wants to open up further to the world, Vice Premier Liu He said on Tuesday. Beijing expressed confidence that China’s economy would return to its normal growth trend in 2023, Liu said. He expects a noticeable increase in imports, business investment and domestic consumption. “Foreign investments are welcome in China, and the door to China will only open up further,” Liu said.

In his speech, the Deputy Prime Minister also rejected the idea of a return to a planned economy. Beijing would continue “deepen SOE reform, support the private sector, and promote fair competition, anti-monopoly and entrepreneurship,” Liu stressed. The vice premier also stressed China would continue to increase sustainable energy production. The world must fight climate change together, he said.

EU Commission President Ursula von der Leyen, meanwhile, criticized the market conditions for European companies in the People’s Republic. China would heavily subsidize its industry and restricts access for EU companies. Nevertheless, von der Leyen added, it was necessary to cooperate with China when it came to the green transition. “We need to focus on de-risking rather than decoupling.” She promised the EU would do everything possible to crack down on unfair practices. For example, she said, Europe should look at alternatives for lithium supplies.

Von der Leyen also had critical words for Liu He on climate action, saying China had openly encouraged energy-intensive companies in Europe and elsewhere to relocate all or part of their production to the People’s Republic. “They do so with the promise of cheap energy,” von der Leyen said. She added, however, that China has made promoting clean-tech innovation and manufacturing a key priority in its current Five-Year Plan.

The Davos World Economic Forum will continue until the end of the week. The leaders will also hold bilateral talks on the sidelines of the event. For example, Liu He is expected to meet US Secretary of the Treasury Janet Yellen on Wednesday. ari

A female protester believed to have been abducted during the “white paper protests” has asked for help in a video message. In a video circulating on social media, the woman draws attention to the situation of arrested protesters. “If you are seeing this video, that means I have already been taken away by the police, like my other friends,” a young woman says into the camera.

The woman is believed to be 26-year-old editor Cao Zhixin. According to her own statements, she took part in a vigil at Beijing’s Liangma Bridge on November 27 to commemorate the victims of a high-rise fire in Xinjiang. Similar vigils had formed throughout China in December. Some culminated in protests in which participants openly demanded more freedoms and even the resignation of President Xi Jinping (China.Table reported).

In the video, Cao explains how she was interrogated for 24 hours after the protests in Beijing and subsequently released. In mid-December, however, a second wave of arrests followed, during which some of her friends were forced to sign blank arrest warrants, she says. People had also been taken to secret locations, she said. In her video, Cao claims they followed the rules at the vigil and did not clash with the authorities. She further says that she gave the video to friends who were supposed to make the video public in case of her arrest. Cao’s current whereabouts are unknown.

A list with the names of 20 arrested individuals has also been spreading on social media channels since the beginning of the week. It is said the people included on the list have been taken away from their homes or workplaces. Weiquanwang, a website that documents human rights cases in China, claims more than 100 protestors may have been detained. Most were reportedly young people in their twenties. Several held degrees from the country’s top universities, including Tsinghua University, Xi Jinping’s alma mater. fpe

The Shanghai Grand Prix scheduled for April 16 has been canceled. This was announced by the Formula 1 management on Tuesday. “All existing race dates on the calendar remain unchanged,” it said in a statement. China’s current Covid situation with high infection numbers is believed to be the cause of the cancellation. The wave is expected to continue to spread through the spring.

The organizers in China had hoped that the race could once again be held in Shanghai following the relaxation of the Covid measures. Relevant talks had already taken place in December, it was reported.

The cancellation means that China 2023 will be missing from the Formula One calendar for the fourth consecutive year. The last race was held in 2019. It was the 1,000th race in Formula One history before the Covid pandemic put an end to major international events. fpe

It was long assumed that ideology no longer played a role in the Chinese Communist Party (CCP). Since the beginning of economic reforms in the late 1970s, the common assumption, especially in Western countries, was that the CCP had abandoned ideological considerations and was guided primarily by pragmatic assumptions.

This belief has gradually changed since Xi Jinping took office in 2012, and it is increasingly argued that the CCP is undergoing a re-ideologization process. Regarding the party itself, Xi’s massive anti-corruption and education campaign for party members and cadres contributed to this. At the same time, the party-state’s increased intervention in the Chinese economy and also the party’s stronger role in controlling social structures are argued to be evidence of the party’s re-ideologization.

These assumptions are problematic on two levels. First, they assume a conception of ideology that implicitly sees ideology as irrational and not practical or pragmatic. Second, they assume that ideology in China automatically means Marxism – and that the introduction of economic reforms consequently must also mean the end of ideology.

However, in order to use ideology as an analytically expedient concept, it would be useful to define it more broadly. In this sense, ideology can be understood as a thought and communication scheme whose task is to classify and interpret socio-political and economic contexts. Such an analytical understanding of ideology also allows us to question the assumption that ideology no longer plays a role in China as Marxism loses its importance.

Party ideology since the beginning of the period of reform and opening is not primarily Marxist. The credo of adapting Marxism to Chinese conditions, and thus changing Marxist thought in the spirit of the Chinese Revolution, already happened under Mao. With the beginning of the reform and opening-up policy, the party was then confronted with massive political and socio-economic changes, which it had to re-embed ideologically.

The most striking feature in this post-1978 party ideology is the central position of the party itself. In its presentation of its own history and historical achievements, the party mythologizes itself. It asserts sole interpretive sovereignty over its ideological concepts, including rhetorical set pieces of Marxist thinking. This also includes a monopoly on the definition and implementation of future scenarios. At the same time, the party rhetorically signals to all its members and cadres that it is omnipresent and that the sole potential for punishment and commendation rests within the party. Thus, the main message of party ideology is the party itself.

This central message of party ideology is neither new nor characteristic of Xi Jinping. This characteristic could already be observed since the beginning of the reform and opening-up policy. The main task of party ideology is to define and justify the centrality of the party. Under Xi Jinping, we merely observe an increased emphasis on this central ideological feature.

At the same time, the means available to the party to underline its central position are changing. As part of its anti-corruption and education campaign, the party is increasingly relying on digital means of indoctrination and surveillance. These include study apps and the ability to report misbehavior digitally. Again, the principle of indoctrination and surveillance is not new and can be found in party documents even before Xi Jinping. Only the implementation is becoming increasingly comprehensive.

The party’s means are also changing for cooperation with – especially international – actors in the economic and international political system. China’s growing strength allows the party to leverage it economically and internationally to advance its own interests. If the party deems changed political and economic measures to be in China’s interests – and thus in its own – it is increasingly in a position to implement them against international actors as well.

In summary, this means that international actors, in particular, must learn to take the party seriously again. China’s economic reforms and increasing pluralization have resulted in a tendency to neglect the party as an actor. In its own ideological pronouncements, however, the party always held a central position. This also means that its political actions are entirely focused on its main ideological goal: Securing the rule and central position of the Communist Party.

For party members and cadres, but also for state employees, this means increased pressure to be loyal. For economic as well as social actors, it means taking the party seriously again and not dismissing ideological pronouncements as irrational or insignificant. After all, party ideology is a reminder of who really holds the reins – the Chinese Communist Party.

This article is published in the context of the event series “Global China Conversations” of the Kiel Institute for the World Economy (IfW). On Thursday, January 26, 2023 (12 p.m. CET), author Carolin Kautz and Joerg Wuttke (European Chamber of Commerce in China) will discuss the topic: “Ideology First, Economy Second? What Challenges do European Companies Face in China?”. China.Table is the media partner of the event series.

Dr. Carolin Kautz researches the ideology of the Chinese Communist Party and completed her dissertation on party social identity and the importance of ideology for the Chinese Communist Party at the University of Göttingen last year.

Michael Chiang will take over as the new head of the iPhone assembly segment at Taiwanese electronics giant Foxconn. The new appointment is also a response to worker protests at the main iPhone manufacturing site in the central Chinese city of Zhengzhou. Chiang, who has worked for Foxconn since 1999, played a crucial role in communicating with local authorities during the unrest, according to the company.

Yujia Jin has been working in the risk controlling department of Bank of China’s Frankfurt branch since January. The Chinese state-owned bank operates six branches in Germany. Jin has been working for the Bank of China since 2020, most recently as a customer advisor and credit analyst in Munich.

Is something changing in your organization? Why not let us know at heads@table.media!

With around 5,300 members (as of 2010), the Hezhen from Heilongjiang Province are one of China’s smallest officially recognized ethnic minorities. Starting at the end of December, they celebrate the beginning of the fishing season and the preparation for the New Year with feasts and games, as shown in this back-to-back tug-of-war. Among other things, the Hezhen are famous for their traditional clothing made of fish skin, although few still know how to make it. For their winter fun, the younger generation prefers a fashion update with a fishbone pattern and plush antlers.