For almost a week, the Chinese People’s Liberation Army simulated an attack on Taiwan. On Wednesday, the military exercises came to an end – for the moment. Because the People’s Liberation Army announced that military exercises will become a regular occurrence in the future. A new white paper from Beijing also defines how the island should be conquered if necessary. US military experts from various think tanks have played out what this could look like. They simulated a hypothetical invasion by the Chinese for the year 2026. The computer calculations gave a result that, from an American perspective, was both hopeful and shocking, as Fabian Kretschmer writes.

The sun continues to blaze down on Europe non-stop this week – haven’t you already toyed with the idea of installing a solar system on the roof of your house or factory? Have you hesitated because it would be too much work? Last summer, China started an innovative pilot program that solves this problem, reports Nico Beckert. Roof areas in districts and cities are equipped with solar systems centrally by only a few project developers. This way, the roof owners have less work to do. Within a very short time, 20 gigawatts of new capacity were connected to the grid. Analysts praise the pilot project as “creative” and a “crucial component” in China’s energy transition. We also took a look at its problems.

In today’s Profile section, Fabian Peltsch introduces director C.B. Yi. For his film “Moneyboys”, the Austrian of Chinese descent has already gained a lot of attention at European festivals. C.B. Yi alias Chen Bo has spent eight years working on his sensitive drama about male prostitutes. Whether his film will ever make it to China is doubtful.

The first shock seems to have passed for the time being: On Wednesday, China’s People’s Liberation Army concluded its military exercises in the area around Taiwan. But this is by no means a reason to sound the all-clear – on the contrary: “The situation” will continue to be monitored and “regular combat readiness patrols” will be conducted, according to a statement. The threat of a Chinese invasion continues to hang over the heads of the island’s 23 million inhabitants.

Last week, a handful of American military experts from the renowned Center for Strategic and International Studies (CSIS) simulated a hypothetical invasion of Taiwan in the year 2026. The complex computer calculations generated a result that, from an American perspective, is both promising and shocking. In most of the likely scenarios, the Taiwanese could defend their island with Washington’s help. Victory, however, would involve catastrophic casualties on all sides – including the US military, which would lose an estimated half of its entire navy and air force in a four-week conflict.

Of course, it always leaves a cynical aftertaste when Washington think tanks run war simulations. After all, the massive consequences of a military conflict between the world’s two leading powers are unimaginable. In light of the greatest tensions around Taiwan in several decades, however, experts believe it is important to keep an eye on all eventualities.

Last week, Chinese troops ultimately practiced a blockade of the island just a few kilometers off the coast of Taiwan and fired several missiles over its waters. The maneuvers were accompanied by the Beijing leadership’s increasingly aggressive claim to power. On Wednesday, the leadership published a new white paper on the “Taiwan question”, which propagates an unmistakable message: “We will work with the greatest sincerity and exert our utmost efforts to achieve peaceful reunification. But we will not renounce the use of force, and we reserve the option of taking all necessary measures.” A few pages later it even says: “Never before have we been so close to our goal of national unification” – and never before “so confident” that they will be able to achieve it.

Whether this is mere propaganda or a realistic assessment is hard to say. But the validity of war simulations such as those conducted by CSIS last week is limited in any event. After all, many variables remain unclear – first and foremost, whether the United States would provide military support to Taiwan in the event of an attack. In addition, the opacity of the Chinese army makes it difficult to predict what weapons it will develop in the coming years.

Ultimately, an invasion of Taiwan is by no means the most likely scenario. On the one hand, China does not want to point its weapons directly at the people it calls its fellow citizens in its propaganda. There is also the risk that an invasion would also destroy Taiwan’s critical infrastructure – above all the semiconductor factories of undisputed market leader TSMC, which produces almost 60 percent of all microchips worldwide. Half of these go to Chinese companies alone.

Consequently, an island blockade, as the People’s Liberation Army has already tested in recent days, is considered more probable. The idea is to isolate Taiwan economically by blocking access to the island’s main ports by Chinese vessels. Currently, around 240 ships pass through the Taiwan Strait every day.

China’s military recently demonstrated how quickly it could enforce such an embargo. But these military drills have also exposed “China’s own economic vulnerability,” as David Uren of the Australian Strategic Policy Institute argues. After all, China’s largest ports in Shanghai, Tianjin and Dalian are also heavily dependent on the passage of the strait. As Bloomberg recently analyzed, tankers carrying around one million barrels of oil pass through the only 130-kilometer-wide Taiwan Strait every day. Navigating around this strait to the north of the Philippines is not an ideal alternative, as the so-called Luzon route carries a high risk of typhoons.

Aside from economic consequences, Michael E. O’Hanlon of the Washington-based Brookings Institution recently examined whether such a militarily enforced blockade would actually bring Taiwan to its knees. But his study comes to an unsatisfactory, open-ended, conclusion: There would be a similar number of credible scenarios predicting both a Chinese and a Taiwanese victory. In the end, the security expert draws the only meaningful conclusion: “It is abundantly clear that both sides should avoid this kind of war, both now and in the future.” Fabian Kretschmer

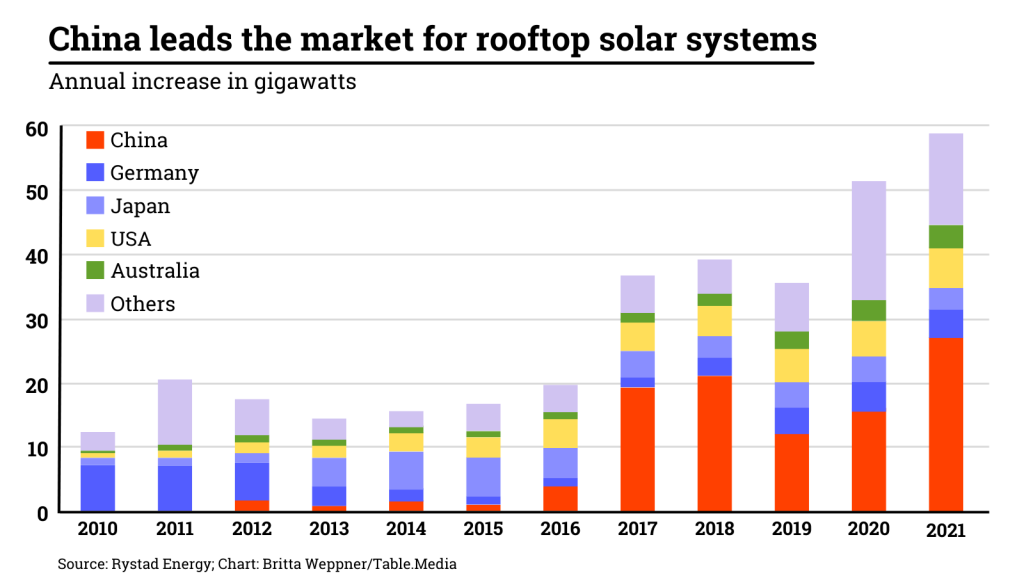

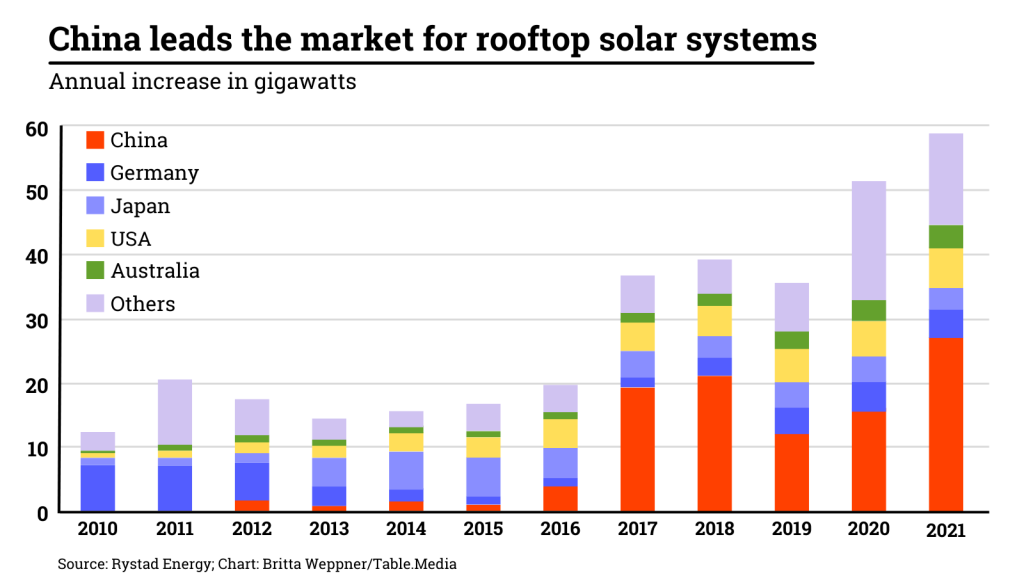

Until 2016, there were hardly any solar systems on rooftops in the People’s Republic. But since then, systems with a capacity of 12 to 25 nuclear power plants have been installed – every year.

In summer 2021, the government launched a new pilot program. It is “an absolutely crucial component for the expansion of solar power in China,” says Cosimo Ries of the consulting agency Trivium China. Energy experts like Lauri Myllyvirta call the program a “smart policy”. The numbers prove them right: Installations tripled in the first quarter of 2022 compared to the same period last year.

As part of the pilot program, counties, cities or boroughs partner with companies to fit a certain percentage of rooftops in the region with solar panels by the end of 2023. Roofs of both public buildings and private residences are included. The major advantage of this approach is that the entire process is centralized and the “roof owners” do not have to do anything. In addition, the program offers economies of scale, as the solar modules can be purchased in large quantities. Participating cities commit to install solar panels on:

The pilot program does not yet include a quota for urban residential buildings. However, many of the participating districts and neighborhoods officially count as rural areas, even though they are part of cities.

These companies work closely with local authorities, says Ries of Trivium China. That way, they can quickly determine how much rooftop space is available for building solar panels. Private homeowners are being approached about participating in the program, writes David Fishman of consulting agency Lantau Group. They can buy the solar panels themselves and sell the electricity generated to grid operators. Or, the project partners can rent the respective roof areas from owners and install their systems. In most cases, the first option is preferred because the program provides additional incentives: Homeowners do not have to pay value-added tax on the purchase of the solar systems, Fishman says.

Currently, 676 cities and counties are participating in the program. Project partners are often large, state-owned and private energy companies that have experience in building solar power plants or, like Jinko Solar, manufacture solar plants themselves.

According to Frank Haugwitz, renewable energy expert at consulting agency Apricum, the pilot program has added about 20 gigawatts since mid-2021. Ries estimates that participating cities will have installed about 100 gigawatts of new solar capacity on their roofs by the time the program ends. In comparison, Germany has added a total of 58 gigawatts of solar power in the past few decades.

David Fishman calls the program a “great example of bringing public and private resources together.” Collaboration between businesses, local governments and local “string-pullers” has created a “machinery” that will “power millions of rooftops with solar in just two years,” says the Lantau Group expert. The biggest advantage is that the pilot program does not rely on the participation of individuals such as homeowners, but is centrally coordinated.

This does come with certain problems. Some cities and districts look for only one partner to build solar plants. Such monopolies are actually supposed to be prevented, according to the central government. In some cases, it has also happened that residents of rural regions have been forced to take out loans for solar plants and have become over-indebted.

Decentralized rooftop solar systems have great advantages for the provinces in eastern China. Until now, the densely populated metropolises on China’s coasts have been dependent on imports of mostly coal-fired electricity from other parts of the country. If factories and private consumers generate part of the demand on their own roofs, fewer overland lines and transmission infrastructure have to be built. This even leads to cost advantages. In 2021, the construction of large-scale solar power plants in China cost 66 cents per watt. Decentralized small power plants on roofs cost slightly less at 59 cents per watt.

China’s government has recently set new targets. New public buildings and factories are to be fitted with 50 percent rooftop solar systems (China.Table reported). Major solar companies such as Jinko Solar expect rooftop installations and other distributed solar projects to account for half of China’s new solar capacity in the next five years. That compares to about 30 percent in 2019.

Along with the pilot project, several other incentives have also been responsible for the massive growth of rooftop solar installations in China:

Collaboration: Renxiu Zhao

The global economy has been facing multiple problems in recent months. First the Covid pandemic with constant lockdowns, now the Ukraine war and unrest over Taiwan. How are the major blocs – the USA, the EU and China – positioned? A comparison of key macroeconomic factors provides insight.

When attempting to capture the current situation, the strong international interconnection between the individual blocs becomes apparent: If one economic region slips into a severe crisis, others will also be affected. The inflation is particularly heavy in the USA and Europe. At the same time, China is catching up strongly on direct foreign investment.

Trade balance: Despite the harsh lockdown in Shanghai and the sanctions against China’s neighbor Russia, China’s exports grew by 17 percent in the first half of 2022. The US, on the other hand, continues to run a gigantic trade deficit. In other words, they have imported more than they have been able to export. The EU is running a slim surplus. This is a trend that was already evident in 2021: While China saw a record increase of 28 percent and generated a surplus of $690 billion, the EU only managed a surplus of €68 billion – the lowest figure since 2011. Despite extensive punitive tariffs against China, the USA still recorded a deficit of $861 billion, which increased by over 18 percent – a negative milestone.

But one country’s deficit is the other’s surplus. Without an American trade deficit, the Chinese surplus would be much smaller. If the American economy slumps even harder in the coming months, Chinese exports will likely be affected as well. The two economies are still highly intertwined through bilateral trade. A prolonged economic crisis in the USA would hurt China’s trade balance.

In addition, from a purely logical perspective, the major trading blocs cannot all run a surplus, since there would be no region running deficits otherwise: The economies of Latin America, Africa and Australia are too small – and it is not in their interest to permanently run deficits.

Trade balances are reflected in countries’ foreign exchange reserves. Since China exports a lot to the rest of the world, Beijing earns a lot of US dollars, which it invests globally. China has $3 trillion in reserves. The EU’s reserves are $307 billion. The US, on the other hand, has hardly any reserves, but mostly foreign debt. Many experts claim that the USA can afford this because it has the US dollar as its global reserve currency and many investors buy US government bonds.

Others insist that debt should be avoided and reserves are an advantage. But here, too, one person’s debt is another person’s reserve. The US and China are particularly closely linked here. The People’s Republic is the second-largest creditor of the USA after Japan. The US is indebted to China to the tune of a good $1 trillion. If the US were to stop borrowing, China would lose a safe haven for its reserves. Conversely, the USA would then also face problems: Should China switch its foreign exchange reserves into other currencies – which is hardly possible in the short term – the dollar would lose its importance as a global reserve currency. Here, too, the still close interdependence of the two major economic areas is evident. They cannot easily escape their relationship as creditor and debtor.

There are also major differences in inflation rates between the blocs. China has by far the lowest inflation. It stands at 2.7 percent. This was the highest rate since July 2020, when consumer prices had risen by only 2.5 percent year-on-year in June. Analysts expected a slightly higher inflation rate on average, and had projected 2.9 percent for July. The rise in Chinese producer prices slowed significantly, with output prices rising 4.2 percent year-on-year in July, the statistics bureau said Wednesday. The increase was the lowest since February 2021.

US inflation was 8.5 percent in July, down from 9.1 percent the previous month. EU inflation is at the same high level. In July, it was 8.9 percent. Particularly high energy costs and supply chain problems are to blame. Here, China is benefiting from cheap Russian energy because it does not participate in the sanctions. Supply chain problems are also absent because China exports more and is thus less affected by the lockdowns in Chinese ports than the USA and EU countries.

Due to the high inflation rates, the USA is debating whether to reduce the punitive tariffs against China. Social peace is apparently more important than economic confrontation with China. Cheap products from China dampen inflation. That means China will earn even more. The US is spending even more than it earns. Europe is also under pressure to buy more Chinese products.

Still, many consumers or businesses have no choice but to go into debt. That is why it is important to look at bad loans, which are loans that can no longer be serviced. According to World Bank calculations, only just over 1.8 percent of all loans in China are bad. In the US, the figure is 1.3 percent. Here, the EU brings up the rear with a good 2 percent. Ultimately, however, the differences between individual economic areas are small.

There is one clear loser when it comes to growth. That is the United States. After two quarters of negative growth (minus 1.6 and minus 0.9 percent), the American government had to announce a technical recession. In terms of growth, the EU fared better: A good 2.5 percent growth is possible, albeit with record inflation. Despite the Covid crisis, China is still ahead, even if growth is significantly lower than normal.

An important sign of the stability and credibility of countries is the sums that foreign companies choose to invest in them. Foreign Direct Investment (FDI) increased 114 percent to $382 billion in the US in 2021 after the worst of the Covid fallout ended. This is good, although it is the lowest level since 2014. China came in at an all-time high of $334 billion, close behind the United States.

Foreign investment in the EU has collapsed by 30 percent year-on-year to $138 billion. In 2019, the figure was still $481 billion. In 2015, it was as high as $630 billion. The figures from the first half of 2022 confirm the trend: Investments to China grew by 17 percent up to and including May, despite lockdown. FDI to the EU slumped because of the Ukraine war, especially in Germany. Investment in the USA stagnated in the first quarter of 2022 at a slightly lower level than in 2021.

Looking only at the FDI data, this means that global investor confidence in China has risen to a new all-time high. In the USA, it is stagnating at a high level. In the EU, it is declining somewhat. However, surveys among companies paint a different picture: More and more companies consider withdrawing investments from China.

Hard economic factors show: China appears to have a high level of crisis resilience in the “competition” between major economies, even if growth is comparatively low by Chinese standards in 2022.

Several indicators are pointing in the wrong direction in the USA and Europe. Above all, inflation is currently causing concern in the two major Western economies. Some experts also forecast a risk of crisis for the EU due to the high level of excessive debt in the southern countries. In addition, Europe has a war on its doorstep, with no end in sight. But the financial crisis of 2007/08 and the Covid crisis have shown that when it comes down to it, the USA and the EU also have the necessary (financial) resources to avert an economic collapse.

Despite all the rivalries, a serious economic crisis in the US or Europe is unlikely to spark any joy in China either. This is because it would also affect China as a “supplier,” since demand would fall. In other words, China’s high surpluses are on shaky ground. Added to this are other factors such as the demographic situation: China is at risk of over-aging before it has created sufficient wealth or “common prosperity” for the majority of its population.

The chairwoman of the German Bundestag’s Committee on Human Rights and Humanitarian Aid, Renata Alt, urges the German government and the European Union to take a tougher stance regarding relations with China. “If we still want to be taken seriously internationally, then it is important that we take a clear position,” the FDP member of parliament told Reuters news agency in an interview published Wednesday. “Germany must become more independent of China,” Alt said. “Cooperation with China must be reconsidered, and if necessary, we might have to think about sanctions on individuals, merely because of the human rights situation.”

Alt defended a trip to Taiwan planned for October by members of the Bundestag committee. “I share the concern that the date may not be the most convenient because of US House Speaker Nancy Pelosi’s visit,” she admitted. “But I would advise against aligning ourselves with China’s aggressive rhetoric. We are an independent country, we are independent members of parliament. If we want to visit Taiwan, that should be respected.” Pelosi’s visit to Taiwan last week massively escalated the conflict over the island, which China sees as part of its own territory and a breakaway province.

However, the visit of the German members of parliament is not yet definitely fixed, said Alt. The corresponding request to the President of the Bundestag will be made in the session week at the beginning of September. However, it would then be necessary to wait and see how the Covid pandemic in Taiwan develops.

“The visit should send the signal that we are committed to Taiwan’s independence and democracy,” Alt said. She had “always been annoyed by the lax and weak foreign policy under Chancellor Angela Merkel. Germany and the EU should have sent out clear signals in time, and that also applies to Russia.” She added that the Western world must be careful that the government in Beijing does not use Russia’s actions in Ukraine as a “blueprint” for Taiwan. rtr/nib

According to reports, Taiwan security authorities reject Foxconn’s investment in Chinese chipmaker Tsinghua Unigroup. The Apple supplier’s $800 million investment in China will “definitely not materialize,” the Financial Times quoted a senior Taiwanese government official as saying on Wednesday. In July, Foxconn stated to have a stake of about 20 percent in the Chinese semiconductor conglomerate through a series of subsidiaries. Taiwan’s cabinet committee has yet to formally review the investment, the newspaper report said. Due to rising tensions, Taiwan’s National Security Council reportedly wants to block the deal. Foxconn only said it was in talks with government officials.

The Taiwanese company has been able to produce in China without any interference for decades. The Apple supplier has created more than one million jobs in Mainland China, making it the largest foreign employer in the People’s Republic. But the ongoing tensions between China and Taiwan seem to be taking their toll on the world’s largest electronics manufacturer.

In the 1990s and 2000s, Taiwanese entrepreneurs were still among the largest investors in the People’s Republic. The Taiwanese government now prohibits companies from building production plants in China for fear of a technology exodus. Foxconn has begun to diversify and relocated factories to other countries. However, China remains the central production location for the Taiwanese company. flee/rtr

Family gathering in the Chinese province. Five men are seated around a table, slightly drunk, waiting for their wives to serve the next dishes. With shot glasses at the ready, they question the youngest: “Fei, do you have a girlfriend yet? Your father has been waiting for a grandchild for a long time,” says one of the drunkards. After Fei, a tender man in his late twenties with a K-pop haircut, only gives an evasive answer, the man loses his temper and shouts that they know exactly what he is doing in the city. “You have disgraced your family,” he yells as Fei flees the room.

It is a pivotal scene from the movie “Moneyboys”, which depicts the fate of male sex workers in China. It was directed by C.B. Yi. The Austrian director of Chinese origin worked for eight years on his emotional drama. In long, sometimes distressing scenes, the film follows the story of Fei, his lover Xiaolai, who is beaten up by a client, and his childhood friend Long, who, impressed by Fei’s earnings, also wants to work as a prostitute.

Although “Moneyboys” was his debut, C.B. Yi was able to show the film in Cannes last year in the “Un Certain Regard” series. At the Max Ophüls Film Festival, it won multiple awards for best feature film, best screenplay, and the prize of the Ecumenical Jury, which honors important social and interreligious topics

Even though “Moneyboys” was his first movie, C.B. Yi was able to show the film in Cannes last year in the “Un Certain Regard” series. At the Max Ophüls Film Festival, it won several awards for Best Feature Film, Best Screenplay and the Prize of the Ecumenical Jury, which honors important social and interreligious topics. However, C.B. Yi’s primary goal is not to condemn the terrible fate and social stigma of male prostitutes in China. Rather, he portrays the sex workers as “unsung heroes” who often send their money to their families as their main earners. “In China’s patriarchal society, male sex-working is a bigger taboo than female sex-working,” the director says. “These men sacrifice themselves even though they know they are breaking the law and that their work usually conflicts with their family’s morals.”

Prostitution of both sexes has been strictly forbidden in China since the Communists came to power. But male prostitution is even less visible in public. Mao Zedong considered it a symptom of the disease of capitalism. Concubines and consorts were also considered relics of ancient China and were supposed to disappear. Beneath the surface, however, the world’s oldest trade continued to flourish to this day. Estimates suggest that 17 percent of all Chinese men between 18 and 61 have visited a prostitute at some point in their lives. There are no estimates for male prostitution. This is one of the reasons why C.B. Yi chose this topic, but also wanted to tell it in the form of a love story of uprooted young people.

In a way, “Moneyboys” also reflects his own lack of a home, says the filmmaker, who grew up in a village in Zhejiang. “I also wanted to explore the question of what would have become of me if I had stayed in China – what opportunities would I have had?” C.B. Yi came to Austria at the difficult age of 13. For a long time he was unable to settle down, he says slowly and thoughtfully with an audible Viennese accent. “The head didn’t want to learn the language. But I was good at the visual language.

While studying sinology at the University of Vienna, he bought a simple camera and won a photography competition with it on the first attempt. “That’s when I realized I wanted to be behind the camera.” In 2003, he went to the Film Academy in Beijing for a year abroad. With the short film he made there, he applied to the Film Academy Vienna to work with director Michael Haneke – and was accepted right away.

Originally, he also wanted to shoot “Moneyboys” in China. “I’m emotionally closer to the people there. And as a filmmaker, it’s good to start where you are familiar with.” He already found a village in the province of Hunan that would have made a great setting. Casting was already underway for two years when he changed his mind. Material and filming permits were getting more and more expensive. Actors quit. In the end, C.B. Yi made the movie in Taiwan with Taiwanese actors.

“Moneyboys” will not be released in China. Topics dealing with same-sex love are more taboo than ever there. C.B. Yi believes this austerity may be rooted in the government’s desire to have children. China is aging. But the country can hardly expect children from the LGBTQ community. Still, he has hope that his work will not go unseen in his homeland. “Movies find their way,” says the director, who is already working on the sequel, which will be set in Vienna. “For Europeans, I made an Asian, image-heavy movie. For Asians, it’s a European movie in the style of Haneke. You also see here: I have remained homeless, both in China and here.” Fabian Peltsch

Jan Aßmann is the new Managing Director at Bernstein Taicang. Aßmann took over the post from Uwe Birnbaum in June. Bernstein, headquartered in Porta Westfalica, manufactures switch and enclosure technology.

Matthias Al-Amiry is the new Managing Director of Kempinski Hotel Beijing Lufthansa Center. Most recently, he held the dual position of Managing Director of The Capitol Kempinski Hotel Singapore and Regional Vice President Southeast Asia.

Ma Chuan will become the new President of the China subsidiary of automotive supplier Faurecia on September 1. He is the first Chinese to hold this position. Ma has worked for the company since 2009. He succeeds Francois Tardif, who will head Faurecia Asia from Japan in the future.

Is something changing in your organization? Why not let us know at heads@table.media?

At least border traffic still flows here: Goods and passengers are transported on wooden rafts on the Quay Sơn River between Vietnam and China. The river runs between the Vietnamese province of Cao Bang and the Chinese province of Guangxi, very close to the Ban Gioc Detian Waterfalls, the world’s fourth largest transnational waterfalls after Iguazú, Victoria and Niagara Falls.

For almost a week, the Chinese People’s Liberation Army simulated an attack on Taiwan. On Wednesday, the military exercises came to an end – for the moment. Because the People’s Liberation Army announced that military exercises will become a regular occurrence in the future. A new white paper from Beijing also defines how the island should be conquered if necessary. US military experts from various think tanks have played out what this could look like. They simulated a hypothetical invasion by the Chinese for the year 2026. The computer calculations gave a result that, from an American perspective, was both hopeful and shocking, as Fabian Kretschmer writes.

The sun continues to blaze down on Europe non-stop this week – haven’t you already toyed with the idea of installing a solar system on the roof of your house or factory? Have you hesitated because it would be too much work? Last summer, China started an innovative pilot program that solves this problem, reports Nico Beckert. Roof areas in districts and cities are equipped with solar systems centrally by only a few project developers. This way, the roof owners have less work to do. Within a very short time, 20 gigawatts of new capacity were connected to the grid. Analysts praise the pilot project as “creative” and a “crucial component” in China’s energy transition. We also took a look at its problems.

In today’s Profile section, Fabian Peltsch introduces director C.B. Yi. For his film “Moneyboys”, the Austrian of Chinese descent has already gained a lot of attention at European festivals. C.B. Yi alias Chen Bo has spent eight years working on his sensitive drama about male prostitutes. Whether his film will ever make it to China is doubtful.

The first shock seems to have passed for the time being: On Wednesday, China’s People’s Liberation Army concluded its military exercises in the area around Taiwan. But this is by no means a reason to sound the all-clear – on the contrary: “The situation” will continue to be monitored and “regular combat readiness patrols” will be conducted, according to a statement. The threat of a Chinese invasion continues to hang over the heads of the island’s 23 million inhabitants.

Last week, a handful of American military experts from the renowned Center for Strategic and International Studies (CSIS) simulated a hypothetical invasion of Taiwan in the year 2026. The complex computer calculations generated a result that, from an American perspective, is both promising and shocking. In most of the likely scenarios, the Taiwanese could defend their island with Washington’s help. Victory, however, would involve catastrophic casualties on all sides – including the US military, which would lose an estimated half of its entire navy and air force in a four-week conflict.

Of course, it always leaves a cynical aftertaste when Washington think tanks run war simulations. After all, the massive consequences of a military conflict between the world’s two leading powers are unimaginable. In light of the greatest tensions around Taiwan in several decades, however, experts believe it is important to keep an eye on all eventualities.

Last week, Chinese troops ultimately practiced a blockade of the island just a few kilometers off the coast of Taiwan and fired several missiles over its waters. The maneuvers were accompanied by the Beijing leadership’s increasingly aggressive claim to power. On Wednesday, the leadership published a new white paper on the “Taiwan question”, which propagates an unmistakable message: “We will work with the greatest sincerity and exert our utmost efforts to achieve peaceful reunification. But we will not renounce the use of force, and we reserve the option of taking all necessary measures.” A few pages later it even says: “Never before have we been so close to our goal of national unification” – and never before “so confident” that they will be able to achieve it.

Whether this is mere propaganda or a realistic assessment is hard to say. But the validity of war simulations such as those conducted by CSIS last week is limited in any event. After all, many variables remain unclear – first and foremost, whether the United States would provide military support to Taiwan in the event of an attack. In addition, the opacity of the Chinese army makes it difficult to predict what weapons it will develop in the coming years.

Ultimately, an invasion of Taiwan is by no means the most likely scenario. On the one hand, China does not want to point its weapons directly at the people it calls its fellow citizens in its propaganda. There is also the risk that an invasion would also destroy Taiwan’s critical infrastructure – above all the semiconductor factories of undisputed market leader TSMC, which produces almost 60 percent of all microchips worldwide. Half of these go to Chinese companies alone.

Consequently, an island blockade, as the People’s Liberation Army has already tested in recent days, is considered more probable. The idea is to isolate Taiwan economically by blocking access to the island’s main ports by Chinese vessels. Currently, around 240 ships pass through the Taiwan Strait every day.

China’s military recently demonstrated how quickly it could enforce such an embargo. But these military drills have also exposed “China’s own economic vulnerability,” as David Uren of the Australian Strategic Policy Institute argues. After all, China’s largest ports in Shanghai, Tianjin and Dalian are also heavily dependent on the passage of the strait. As Bloomberg recently analyzed, tankers carrying around one million barrels of oil pass through the only 130-kilometer-wide Taiwan Strait every day. Navigating around this strait to the north of the Philippines is not an ideal alternative, as the so-called Luzon route carries a high risk of typhoons.

Aside from economic consequences, Michael E. O’Hanlon of the Washington-based Brookings Institution recently examined whether such a militarily enforced blockade would actually bring Taiwan to its knees. But his study comes to an unsatisfactory, open-ended, conclusion: There would be a similar number of credible scenarios predicting both a Chinese and a Taiwanese victory. In the end, the security expert draws the only meaningful conclusion: “It is abundantly clear that both sides should avoid this kind of war, both now and in the future.” Fabian Kretschmer

Until 2016, there were hardly any solar systems on rooftops in the People’s Republic. But since then, systems with a capacity of 12 to 25 nuclear power plants have been installed – every year.

In summer 2021, the government launched a new pilot program. It is “an absolutely crucial component for the expansion of solar power in China,” says Cosimo Ries of the consulting agency Trivium China. Energy experts like Lauri Myllyvirta call the program a “smart policy”. The numbers prove them right: Installations tripled in the first quarter of 2022 compared to the same period last year.

As part of the pilot program, counties, cities or boroughs partner with companies to fit a certain percentage of rooftops in the region with solar panels by the end of 2023. Roofs of both public buildings and private residences are included. The major advantage of this approach is that the entire process is centralized and the “roof owners” do not have to do anything. In addition, the program offers economies of scale, as the solar modules can be purchased in large quantities. Participating cities commit to install solar panels on:

The pilot program does not yet include a quota for urban residential buildings. However, many of the participating districts and neighborhoods officially count as rural areas, even though they are part of cities.

These companies work closely with local authorities, says Ries of Trivium China. That way, they can quickly determine how much rooftop space is available for building solar panels. Private homeowners are being approached about participating in the program, writes David Fishman of consulting agency Lantau Group. They can buy the solar panels themselves and sell the electricity generated to grid operators. Or, the project partners can rent the respective roof areas from owners and install their systems. In most cases, the first option is preferred because the program provides additional incentives: Homeowners do not have to pay value-added tax on the purchase of the solar systems, Fishman says.

Currently, 676 cities and counties are participating in the program. Project partners are often large, state-owned and private energy companies that have experience in building solar power plants or, like Jinko Solar, manufacture solar plants themselves.

According to Frank Haugwitz, renewable energy expert at consulting agency Apricum, the pilot program has added about 20 gigawatts since mid-2021. Ries estimates that participating cities will have installed about 100 gigawatts of new solar capacity on their roofs by the time the program ends. In comparison, Germany has added a total of 58 gigawatts of solar power in the past few decades.

David Fishman calls the program a “great example of bringing public and private resources together.” Collaboration between businesses, local governments and local “string-pullers” has created a “machinery” that will “power millions of rooftops with solar in just two years,” says the Lantau Group expert. The biggest advantage is that the pilot program does not rely on the participation of individuals such as homeowners, but is centrally coordinated.

This does come with certain problems. Some cities and districts look for only one partner to build solar plants. Such monopolies are actually supposed to be prevented, according to the central government. In some cases, it has also happened that residents of rural regions have been forced to take out loans for solar plants and have become over-indebted.

Decentralized rooftop solar systems have great advantages for the provinces in eastern China. Until now, the densely populated metropolises on China’s coasts have been dependent on imports of mostly coal-fired electricity from other parts of the country. If factories and private consumers generate part of the demand on their own roofs, fewer overland lines and transmission infrastructure have to be built. This even leads to cost advantages. In 2021, the construction of large-scale solar power plants in China cost 66 cents per watt. Decentralized small power plants on roofs cost slightly less at 59 cents per watt.

China’s government has recently set new targets. New public buildings and factories are to be fitted with 50 percent rooftop solar systems (China.Table reported). Major solar companies such as Jinko Solar expect rooftop installations and other distributed solar projects to account for half of China’s new solar capacity in the next five years. That compares to about 30 percent in 2019.

Along with the pilot project, several other incentives have also been responsible for the massive growth of rooftop solar installations in China:

Collaboration: Renxiu Zhao

The global economy has been facing multiple problems in recent months. First the Covid pandemic with constant lockdowns, now the Ukraine war and unrest over Taiwan. How are the major blocs – the USA, the EU and China – positioned? A comparison of key macroeconomic factors provides insight.

When attempting to capture the current situation, the strong international interconnection between the individual blocs becomes apparent: If one economic region slips into a severe crisis, others will also be affected. The inflation is particularly heavy in the USA and Europe. At the same time, China is catching up strongly on direct foreign investment.

Trade balance: Despite the harsh lockdown in Shanghai and the sanctions against China’s neighbor Russia, China’s exports grew by 17 percent in the first half of 2022. The US, on the other hand, continues to run a gigantic trade deficit. In other words, they have imported more than they have been able to export. The EU is running a slim surplus. This is a trend that was already evident in 2021: While China saw a record increase of 28 percent and generated a surplus of $690 billion, the EU only managed a surplus of €68 billion – the lowest figure since 2011. Despite extensive punitive tariffs against China, the USA still recorded a deficit of $861 billion, which increased by over 18 percent – a negative milestone.

But one country’s deficit is the other’s surplus. Without an American trade deficit, the Chinese surplus would be much smaller. If the American economy slumps even harder in the coming months, Chinese exports will likely be affected as well. The two economies are still highly intertwined through bilateral trade. A prolonged economic crisis in the USA would hurt China’s trade balance.

In addition, from a purely logical perspective, the major trading blocs cannot all run a surplus, since there would be no region running deficits otherwise: The economies of Latin America, Africa and Australia are too small – and it is not in their interest to permanently run deficits.

Trade balances are reflected in countries’ foreign exchange reserves. Since China exports a lot to the rest of the world, Beijing earns a lot of US dollars, which it invests globally. China has $3 trillion in reserves. The EU’s reserves are $307 billion. The US, on the other hand, has hardly any reserves, but mostly foreign debt. Many experts claim that the USA can afford this because it has the US dollar as its global reserve currency and many investors buy US government bonds.

Others insist that debt should be avoided and reserves are an advantage. But here, too, one person’s debt is another person’s reserve. The US and China are particularly closely linked here. The People’s Republic is the second-largest creditor of the USA after Japan. The US is indebted to China to the tune of a good $1 trillion. If the US were to stop borrowing, China would lose a safe haven for its reserves. Conversely, the USA would then also face problems: Should China switch its foreign exchange reserves into other currencies – which is hardly possible in the short term – the dollar would lose its importance as a global reserve currency. Here, too, the still close interdependence of the two major economic areas is evident. They cannot easily escape their relationship as creditor and debtor.

There are also major differences in inflation rates between the blocs. China has by far the lowest inflation. It stands at 2.7 percent. This was the highest rate since July 2020, when consumer prices had risen by only 2.5 percent year-on-year in June. Analysts expected a slightly higher inflation rate on average, and had projected 2.9 percent for July. The rise in Chinese producer prices slowed significantly, with output prices rising 4.2 percent year-on-year in July, the statistics bureau said Wednesday. The increase was the lowest since February 2021.

US inflation was 8.5 percent in July, down from 9.1 percent the previous month. EU inflation is at the same high level. In July, it was 8.9 percent. Particularly high energy costs and supply chain problems are to blame. Here, China is benefiting from cheap Russian energy because it does not participate in the sanctions. Supply chain problems are also absent because China exports more and is thus less affected by the lockdowns in Chinese ports than the USA and EU countries.

Due to the high inflation rates, the USA is debating whether to reduce the punitive tariffs against China. Social peace is apparently more important than economic confrontation with China. Cheap products from China dampen inflation. That means China will earn even more. The US is spending even more than it earns. Europe is also under pressure to buy more Chinese products.

Still, many consumers or businesses have no choice but to go into debt. That is why it is important to look at bad loans, which are loans that can no longer be serviced. According to World Bank calculations, only just over 1.8 percent of all loans in China are bad. In the US, the figure is 1.3 percent. Here, the EU brings up the rear with a good 2 percent. Ultimately, however, the differences between individual economic areas are small.

There is one clear loser when it comes to growth. That is the United States. After two quarters of negative growth (minus 1.6 and minus 0.9 percent), the American government had to announce a technical recession. In terms of growth, the EU fared better: A good 2.5 percent growth is possible, albeit with record inflation. Despite the Covid crisis, China is still ahead, even if growth is significantly lower than normal.

An important sign of the stability and credibility of countries is the sums that foreign companies choose to invest in them. Foreign Direct Investment (FDI) increased 114 percent to $382 billion in the US in 2021 after the worst of the Covid fallout ended. This is good, although it is the lowest level since 2014. China came in at an all-time high of $334 billion, close behind the United States.

Foreign investment in the EU has collapsed by 30 percent year-on-year to $138 billion. In 2019, the figure was still $481 billion. In 2015, it was as high as $630 billion. The figures from the first half of 2022 confirm the trend: Investments to China grew by 17 percent up to and including May, despite lockdown. FDI to the EU slumped because of the Ukraine war, especially in Germany. Investment in the USA stagnated in the first quarter of 2022 at a slightly lower level than in 2021.

Looking only at the FDI data, this means that global investor confidence in China has risen to a new all-time high. In the USA, it is stagnating at a high level. In the EU, it is declining somewhat. However, surveys among companies paint a different picture: More and more companies consider withdrawing investments from China.

Hard economic factors show: China appears to have a high level of crisis resilience in the “competition” between major economies, even if growth is comparatively low by Chinese standards in 2022.

Several indicators are pointing in the wrong direction in the USA and Europe. Above all, inflation is currently causing concern in the two major Western economies. Some experts also forecast a risk of crisis for the EU due to the high level of excessive debt in the southern countries. In addition, Europe has a war on its doorstep, with no end in sight. But the financial crisis of 2007/08 and the Covid crisis have shown that when it comes down to it, the USA and the EU also have the necessary (financial) resources to avert an economic collapse.

Despite all the rivalries, a serious economic crisis in the US or Europe is unlikely to spark any joy in China either. This is because it would also affect China as a “supplier,” since demand would fall. In other words, China’s high surpluses are on shaky ground. Added to this are other factors such as the demographic situation: China is at risk of over-aging before it has created sufficient wealth or “common prosperity” for the majority of its population.

The chairwoman of the German Bundestag’s Committee on Human Rights and Humanitarian Aid, Renata Alt, urges the German government and the European Union to take a tougher stance regarding relations with China. “If we still want to be taken seriously internationally, then it is important that we take a clear position,” the FDP member of parliament told Reuters news agency in an interview published Wednesday. “Germany must become more independent of China,” Alt said. “Cooperation with China must be reconsidered, and if necessary, we might have to think about sanctions on individuals, merely because of the human rights situation.”

Alt defended a trip to Taiwan planned for October by members of the Bundestag committee. “I share the concern that the date may not be the most convenient because of US House Speaker Nancy Pelosi’s visit,” she admitted. “But I would advise against aligning ourselves with China’s aggressive rhetoric. We are an independent country, we are independent members of parliament. If we want to visit Taiwan, that should be respected.” Pelosi’s visit to Taiwan last week massively escalated the conflict over the island, which China sees as part of its own territory and a breakaway province.

However, the visit of the German members of parliament is not yet definitely fixed, said Alt. The corresponding request to the President of the Bundestag will be made in the session week at the beginning of September. However, it would then be necessary to wait and see how the Covid pandemic in Taiwan develops.

“The visit should send the signal that we are committed to Taiwan’s independence and democracy,” Alt said. She had “always been annoyed by the lax and weak foreign policy under Chancellor Angela Merkel. Germany and the EU should have sent out clear signals in time, and that also applies to Russia.” She added that the Western world must be careful that the government in Beijing does not use Russia’s actions in Ukraine as a “blueprint” for Taiwan. rtr/nib

According to reports, Taiwan security authorities reject Foxconn’s investment in Chinese chipmaker Tsinghua Unigroup. The Apple supplier’s $800 million investment in China will “definitely not materialize,” the Financial Times quoted a senior Taiwanese government official as saying on Wednesday. In July, Foxconn stated to have a stake of about 20 percent in the Chinese semiconductor conglomerate through a series of subsidiaries. Taiwan’s cabinet committee has yet to formally review the investment, the newspaper report said. Due to rising tensions, Taiwan’s National Security Council reportedly wants to block the deal. Foxconn only said it was in talks with government officials.

The Taiwanese company has been able to produce in China without any interference for decades. The Apple supplier has created more than one million jobs in Mainland China, making it the largest foreign employer in the People’s Republic. But the ongoing tensions between China and Taiwan seem to be taking their toll on the world’s largest electronics manufacturer.

In the 1990s and 2000s, Taiwanese entrepreneurs were still among the largest investors in the People’s Republic. The Taiwanese government now prohibits companies from building production plants in China for fear of a technology exodus. Foxconn has begun to diversify and relocated factories to other countries. However, China remains the central production location for the Taiwanese company. flee/rtr

Family gathering in the Chinese province. Five men are seated around a table, slightly drunk, waiting for their wives to serve the next dishes. With shot glasses at the ready, they question the youngest: “Fei, do you have a girlfriend yet? Your father has been waiting for a grandchild for a long time,” says one of the drunkards. After Fei, a tender man in his late twenties with a K-pop haircut, only gives an evasive answer, the man loses his temper and shouts that they know exactly what he is doing in the city. “You have disgraced your family,” he yells as Fei flees the room.

It is a pivotal scene from the movie “Moneyboys”, which depicts the fate of male sex workers in China. It was directed by C.B. Yi. The Austrian director of Chinese origin worked for eight years on his emotional drama. In long, sometimes distressing scenes, the film follows the story of Fei, his lover Xiaolai, who is beaten up by a client, and his childhood friend Long, who, impressed by Fei’s earnings, also wants to work as a prostitute.

Although “Moneyboys” was his debut, C.B. Yi was able to show the film in Cannes last year in the “Un Certain Regard” series. At the Max Ophüls Film Festival, it won multiple awards for best feature film, best screenplay, and the prize of the Ecumenical Jury, which honors important social and interreligious topics

Even though “Moneyboys” was his first movie, C.B. Yi was able to show the film in Cannes last year in the “Un Certain Regard” series. At the Max Ophüls Film Festival, it won several awards for Best Feature Film, Best Screenplay and the Prize of the Ecumenical Jury, which honors important social and interreligious topics. However, C.B. Yi’s primary goal is not to condemn the terrible fate and social stigma of male prostitutes in China. Rather, he portrays the sex workers as “unsung heroes” who often send their money to their families as their main earners. “In China’s patriarchal society, male sex-working is a bigger taboo than female sex-working,” the director says. “These men sacrifice themselves even though they know they are breaking the law and that their work usually conflicts with their family’s morals.”

Prostitution of both sexes has been strictly forbidden in China since the Communists came to power. But male prostitution is even less visible in public. Mao Zedong considered it a symptom of the disease of capitalism. Concubines and consorts were also considered relics of ancient China and were supposed to disappear. Beneath the surface, however, the world’s oldest trade continued to flourish to this day. Estimates suggest that 17 percent of all Chinese men between 18 and 61 have visited a prostitute at some point in their lives. There are no estimates for male prostitution. This is one of the reasons why C.B. Yi chose this topic, but also wanted to tell it in the form of a love story of uprooted young people.

In a way, “Moneyboys” also reflects his own lack of a home, says the filmmaker, who grew up in a village in Zhejiang. “I also wanted to explore the question of what would have become of me if I had stayed in China – what opportunities would I have had?” C.B. Yi came to Austria at the difficult age of 13. For a long time he was unable to settle down, he says slowly and thoughtfully with an audible Viennese accent. “The head didn’t want to learn the language. But I was good at the visual language.

While studying sinology at the University of Vienna, he bought a simple camera and won a photography competition with it on the first attempt. “That’s when I realized I wanted to be behind the camera.” In 2003, he went to the Film Academy in Beijing for a year abroad. With the short film he made there, he applied to the Film Academy Vienna to work with director Michael Haneke – and was accepted right away.

Originally, he also wanted to shoot “Moneyboys” in China. “I’m emotionally closer to the people there. And as a filmmaker, it’s good to start where you are familiar with.” He already found a village in the province of Hunan that would have made a great setting. Casting was already underway for two years when he changed his mind. Material and filming permits were getting more and more expensive. Actors quit. In the end, C.B. Yi made the movie in Taiwan with Taiwanese actors.

“Moneyboys” will not be released in China. Topics dealing with same-sex love are more taboo than ever there. C.B. Yi believes this austerity may be rooted in the government’s desire to have children. China is aging. But the country can hardly expect children from the LGBTQ community. Still, he has hope that his work will not go unseen in his homeland. “Movies find their way,” says the director, who is already working on the sequel, which will be set in Vienna. “For Europeans, I made an Asian, image-heavy movie. For Asians, it’s a European movie in the style of Haneke. You also see here: I have remained homeless, both in China and here.” Fabian Peltsch

Jan Aßmann is the new Managing Director at Bernstein Taicang. Aßmann took over the post from Uwe Birnbaum in June. Bernstein, headquartered in Porta Westfalica, manufactures switch and enclosure technology.

Matthias Al-Amiry is the new Managing Director of Kempinski Hotel Beijing Lufthansa Center. Most recently, he held the dual position of Managing Director of The Capitol Kempinski Hotel Singapore and Regional Vice President Southeast Asia.

Ma Chuan will become the new President of the China subsidiary of automotive supplier Faurecia on September 1. He is the first Chinese to hold this position. Ma has worked for the company since 2009. He succeeds Francois Tardif, who will head Faurecia Asia from Japan in the future.

Is something changing in your organization? Why not let us know at heads@table.media?

At least border traffic still flows here: Goods and passengers are transported on wooden rafts on the Quay Sơn River between Vietnam and China. The river runs between the Vietnamese province of Cao Bang and the Chinese province of Guangxi, very close to the Ban Gioc Detian Waterfalls, the world’s fourth largest transnational waterfalls after Iguazú, Victoria and Niagara Falls.