Premier Li Qiang opened the National People’s Congress with his work report, as always, with many details. What is particularly striking is Li’s focus on continuity. The deficit, inflation, unemployment rate, and – most importantly – economic growth targets are practically the same as a year ago, writes Joern Petring. As expected, the NPC is not planning any significant economic stimulus packages.

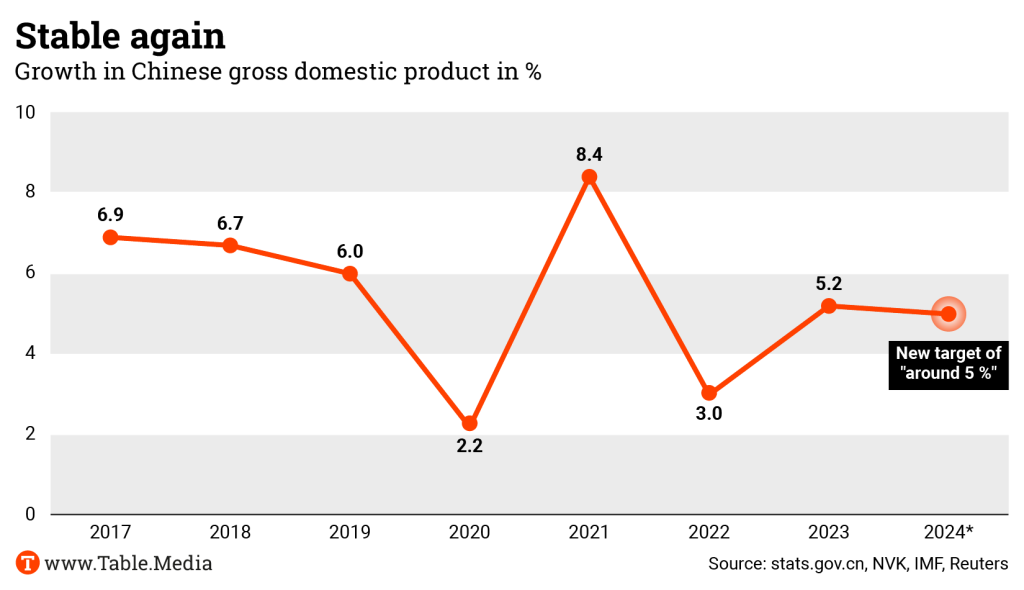

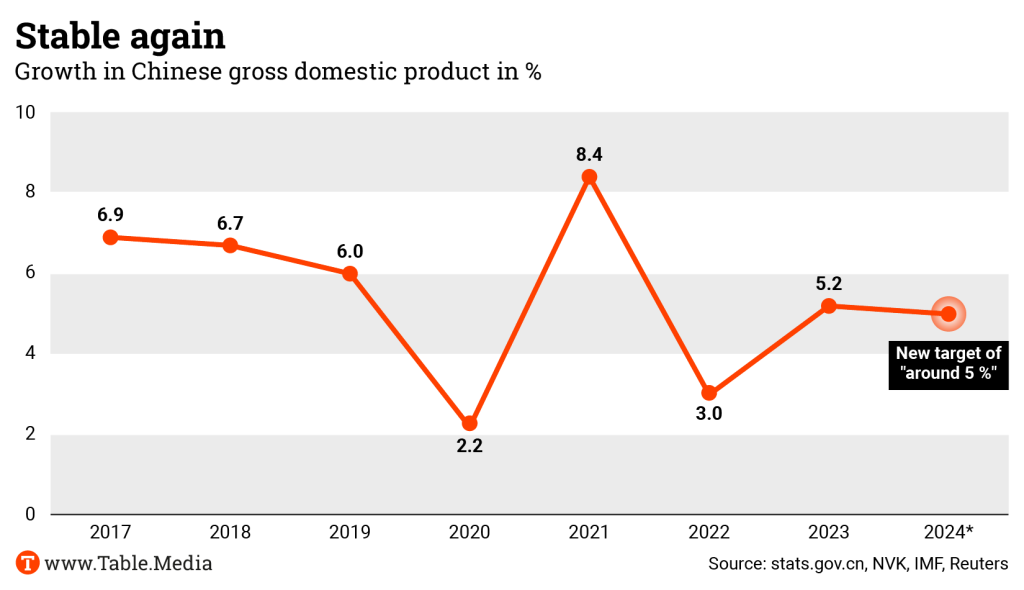

The growth target of “around five percent” sent share prices plummeting on Tuesday. However, this figure is not without ambition, explains Finn Mayer-Kuckuk. As China’s economy is already a bit larger than that of the EU, a growth rate of five percent means an enormous amount of goods and services. Consumption is the key here; the government cannot risk another loan-financed construction or investment boom. This, in turn, is good news for companies that produce for China’s consumer market.

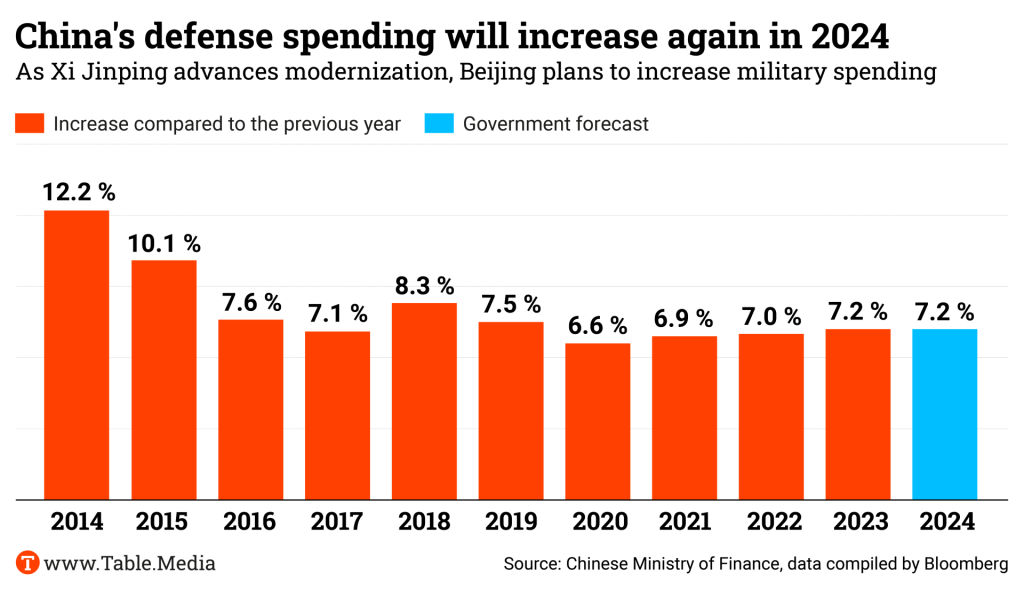

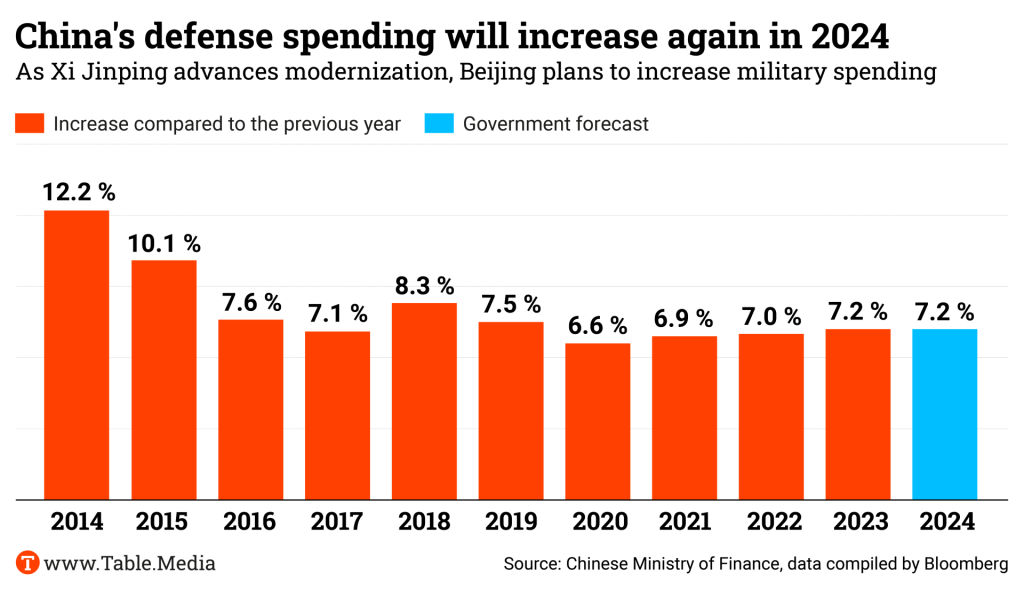

The military budget is once again set to grow faster than the economy. The People’s Liberation Army will receive an extra 7.2 percent this year. This raises concerns in the region, which is already feeling the pressure from its large and increasingly powerful neighbor, as Michael Radunski analyzes. And: Premier Li has once again sharpened his rhetoric towards Taiwan at the People’s Congress.

Despite an ambitious growth target of “around five percent” and aid promises for the struggling real estate sector, the annual government report at the start of the People’s Congress in Beijing failed to lift the mood in China’s economy. The markets’ initial reaction to the government plans for this year presented by Premier Li Qiang on Tuesday was sobering. While the Shanghai Composite Index made a slight gain by the close of trading, there was a veritable sell-off in Hong Kong, where the Hang Seng Index lost 2.6 percent.

Investors clearly gave the thumbs down. As expected, the Premier did not have a comprehensive economic stimulus package up his sleeve. Instead, Li clarified that Beijing will essentially maintain its current course: Money will no longer simply be handed out but will flow into future industries and new technologies.

“There were no surprises in today’s speech, but there were also no meaningful solutions,” said renowned Beijing economist Michael Pettis, summarizing his impressions of the opening. The “keep it up” approach is also evident in Li’s key figures on Tuesday. Many have remained almost identical to last year.

Premier Li apparently shares this view: “Achieving this year’s targets will not be easy,” he admitted to the 2,872 delegates in the Great Hall of the People. “It requires focused policies, redoubled efforts, and concerted efforts from all parties.” Li made it clear that the restructuring of the economy must continue. “We should stick to the principles of progress and stability,” said the Premier. New things must be created before old things are abolished.

Li presented plans to increase the national budget for science and technology research by a whopping ten percent compared to the previous year. The Development and Reform Commission’s plan, which was also presented on Tuesday, also showed that Beijing intends to keep up the pace in promoting new economic sectors. The overarching goal for 2024 is to “use scientific and technological innovation to lead the modernization of its industrial system.”

“We will work extensively to increase the autonomy and strength of science and technology and improve the basic system for comprehensive innovation,” it continues. The Chinese government “will vigorously advance new industrialization.” Beijing also wants to achieve “more breakthroughs in core technologies” and tap into “new growth drivers.”

Stimulating consumption was only mentioned second. At least the battered property owners received a somewhat positive signal. For the first time in years, the formula coined by state and party leader Xi Jinping, “houses are for living, not for speculation,” was no longer mentioned.

Although there is no sign of a departure from the strict policy on highly indebted real estate developers, the leadership’s plans emphasize keeping an eye on the problem. For instance, local governments are to exercise their “regulatory responsibility to ensure that houses that have already been sold are handed over on time.” Efforts are also to be made to meet the “appropriate financing needs” of real estate companies.

Economists consider China’s target of around five percent growth for 2024 ambitious but achievable. “It should not be seen as a forecast, but as a signal figure,” Doris Fischer, Professor of China Business and Economics at the University of Würzburg, told Table.Briefings. Premier Li Qiang wants to convey to the public that the government is trying to get the problems under control. According to Fischer, he aims to restore confidence in the economy and economic policy.

However, Fischer also believes that the economy will continue to drift apart. While things are going well in some sectors, the high unemployment rate is a particular cause for concern. “What I hear from China is that the mood is bad – especially among young academics.” She thinks Premier Li’s speech “will not be the starting signal for a new positive mood.”

This makes an active job market policy all the more urgent. However, the government does not seem entirely confident in its own means. It has set an unemployment rate target of 5.5 percent, whereas last year’s figure was 5.1 percent, according to the statistics bureau. Here, Fischer recognizes an admission that unemployment could rise despite the creation of new jobs.

Economists believe that significantly more positive signals are needed for a return to optimism among consumers and companies. “They are uncertain about the future,” says Horst Loechel, economist and Co-Chairman of the Sino-German Center at the Frankfurt School of Finance & Management. “And not just because growth has been so low, but also because of the regulation of internet companies in recent years, for example.”

However, in the overall picture, Premier Li has no choice but to stimulate consumption. After all, private consumption is the key to keeping growth in line with the planned targets: The government cannot risk another debt-fuelled construction or investment boom. “The debt-driven growth model is dead,” saidLoechel.

The prospect of a recovery in spending is, in turn, good news for German industry. “If consumption is revitalized, China will remain an interesting market thanks to its size,” said Fischer.

This is why the German economy wants to keep its share of what continues to be an important market, said Fischer. This applies to the automotive industry, its suppliers, and all other sectors that benefit directly and indirectly from consumer spending.

Li went to great lengths on Tuesday to give positive signals to the private sector and allay the fears of international corporations. He conceded that “state-owned enterprises, private businesses and foreign-funded companies all play an important role” in China’s modernization efforts. “This kind of thing goes down well in the industry,” observed Loechel, adding that China remains a crucial market for international strategies. Despite the property and debt crisis, it will become increasingly important for now.

Economist Fischer regards restoring confidence in the future and reducing the savings ratio as the most important means of stimulating consumption. During the COVID-19 pandemic, Chinese citizens have again started saving more money for a rainy day.

Only when they feel safer again can more dynamism emerge. One way of achieving this would be a more social policy that allays people’s fears of old-age poverty, hospital costs, and the like.

According to Fischer’s observations, however, President Xi Jinping is torn between the realization that inequality is detrimental to cohesion and an aversion to the European-style welfare state, which he believes encourages laziness. Fischer’s impression: The social and tax system ultimately contributes to maintaining inequality.

This is another area that could be addressed. After all, allowing the average population to have higher incomes would be another way of boosting consumption – at the expense of competitiveness. Xi and his government have been trying to “square the circle” here for years, creating progress without bringing about changes that could jeopardize his power.

The NPC report highlights several sectors that are likely to benefit significantly from the subsidy policy in the coming years:

German companies can certainly hope for additional contracts in some of these sectors or benefit from cost-effective procurement in China. Sanctions could make this more difficult for semiconductors, but Loechel sees particularly promising partnership opportunities in the energy supply sector.

China’s defense spending is set to increase by 7.2 percent this year. This is according to the Chinese Ministry of Finance’s budget plan presented to the National People’s Congress on Tuesday. Military spending is expected to rise to 1.67 trillion yuan (around 231 billion US dollars/214 billion euros). The internal comparison is also important: At 7.2 percent, this figure is significantly higher than the targeted economic growth of “around five percent.”

It is an alarming development. Pressure on Taiwan is increasing, disputes in the East and South China Seas are intensifying, and relations between China and the US are also strained. “China’s military is clearly focused on its immediate territorial targets. These are areas in the East and South China Seas, but above all Taiwan,” Dan Smith from the renowned Stockholm International Peace Research Institute (Sipri) told Table.Briefings.

Above all, pressure is mounting on Taiwan. On Tuesday, Premier Li also tightened the official wording regarding the democratically governed island before the People’s Congress. He refrained from the previously typical formulation of “peaceful reunification.” Instead, Li said the government was “firm in advancing the cause of China’s reunification, and uphold the fundamental interests of the Chinese nation.”

Although officials have occasionally omitted the adjective “peaceful” in this context in the past, but in light of the current tensions and such an important event as the National People’s Congress, it can be assumed that the leaders in Beijing also wanted to verbally increase the threat potential towards Taiwan this Tuesday.

Li also indirectly warned the United States: He called on the delegates to resolutely oppose “Taiwan independence separatist forces and the interference by external forces.”

Many observers are particularly concerned about the steadily rising military budget. “China is the only country that has increased its military spending every year for the past 28 years,” says Sipri head Smith. Over the past three decades, China’s military spending has risen by at least 6.6 percent annually – most recently by more than 7 percent, despite a continuous economic slowdown.

Analysts also note that the actual figure is likely to be far higher, as research and development spending, among other things, is not taken into account.

In any case, China’s defense spending has long been a core component of the national budget. It accounts for around 40 percent of the central government’s expected total spending. Beijing spends ten times as much on the military as on education. Accordingly, the Ministry of Finance declared that defense spending would be given priority while other expenditures would be strictly cut back. Premier Li emphasized: “We in governments at all levels will provide strong support to the development of national defense and the armed forces.”

However, China’s military spending reveals a much more balanced picture compared to other countries. Tuesday’s announcement of an increase in the defense budget means that China’s military budget only accounts for around 1.2 to 1.6 percent of GDP. Thus, the People’s Republic remains well below the 2 percent annual target of NATO members.

Sipri head Smith points to a global trend. “Overall, we are talking about a world where more money is spent on the military than ever. The global military build-up amounted to more than 2,200 trillion US dollars last year alone.” The USA remains the undisputed leader here, with 877 trillion US dollars in 2022, followed by China with 292 trillion US dollars.

But Taiwan, like China’s neighbors Japan, South Korea, Australia and the Philippines, international comparisons will hardly reassure Taiwan. They are well aware of the plans Xi Jinping has for China’s military.

China’s head of state has set the goal of turning the Chinese military into a “modern fighting force” by 2027. The increase in the military budget is in line with the “full implementation of Xi Jinping’s thoughts on strengthening the military,” the draft budget states.

Moreover, China’s neighbors already feel the enormous pressure potential of the Chinese armed forces in various forms. China boasts the largest navy in the world – measured by the number of ships. Along with the United States and Russia, the People’s Republic is the only country to produce fifth-generation fighter jets. And the USA warned last week that China is growing its military capabilities in space at a “breathtaking pace.”

China’s Premier Li also left no room for doubt on Tuesday. The leadership in Beijing is determined to make the Chinese military combat-ready. The armed forces “will strengthen all-around military training and combat readiness, make well-coordinated efforts to improve military preparedness … so as to firmly safeguard China’s national sovereignty, security, and development interests.”

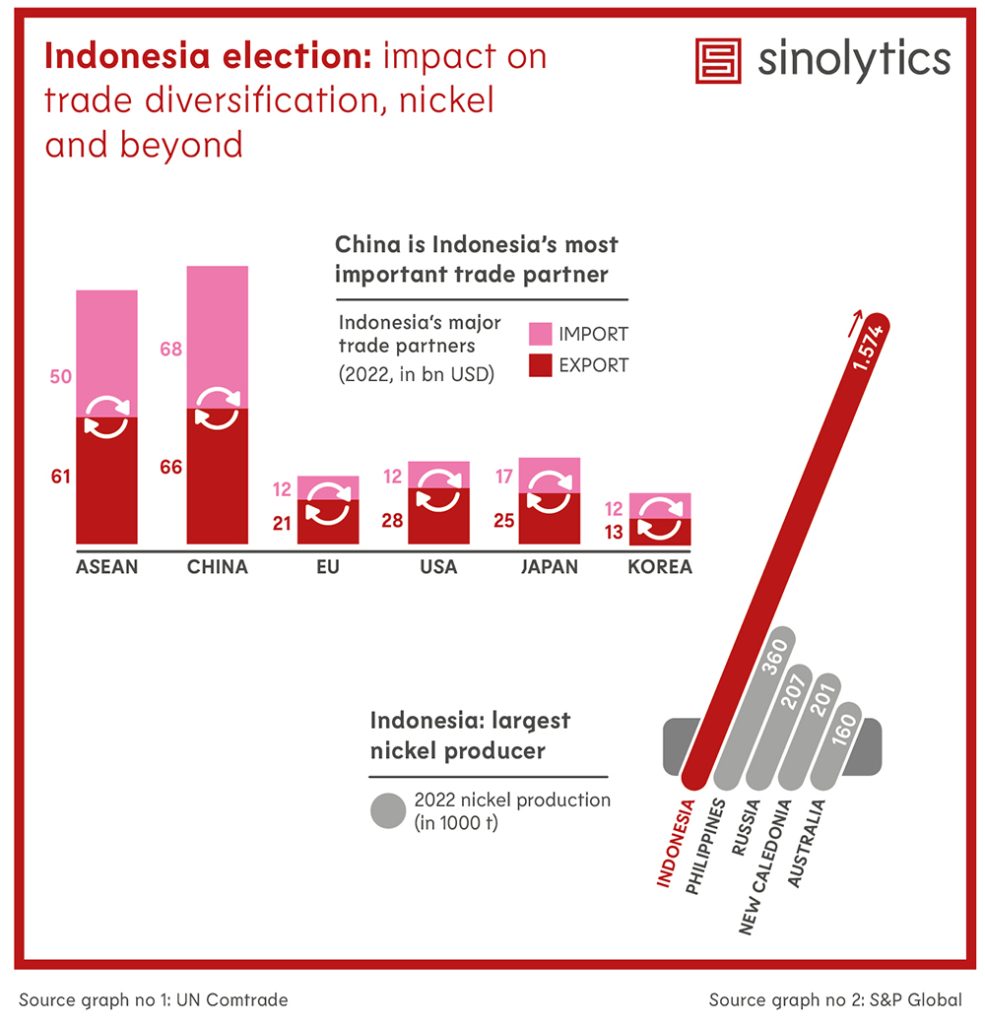

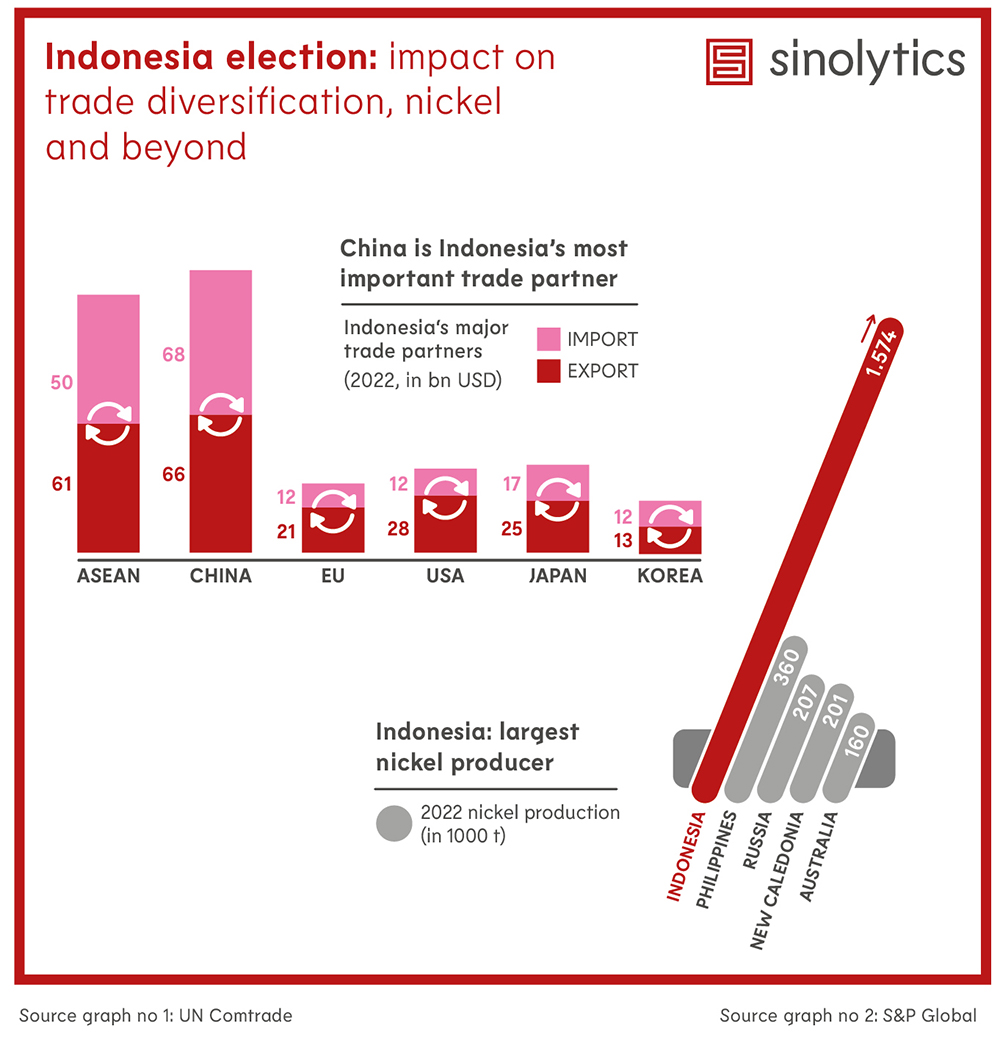

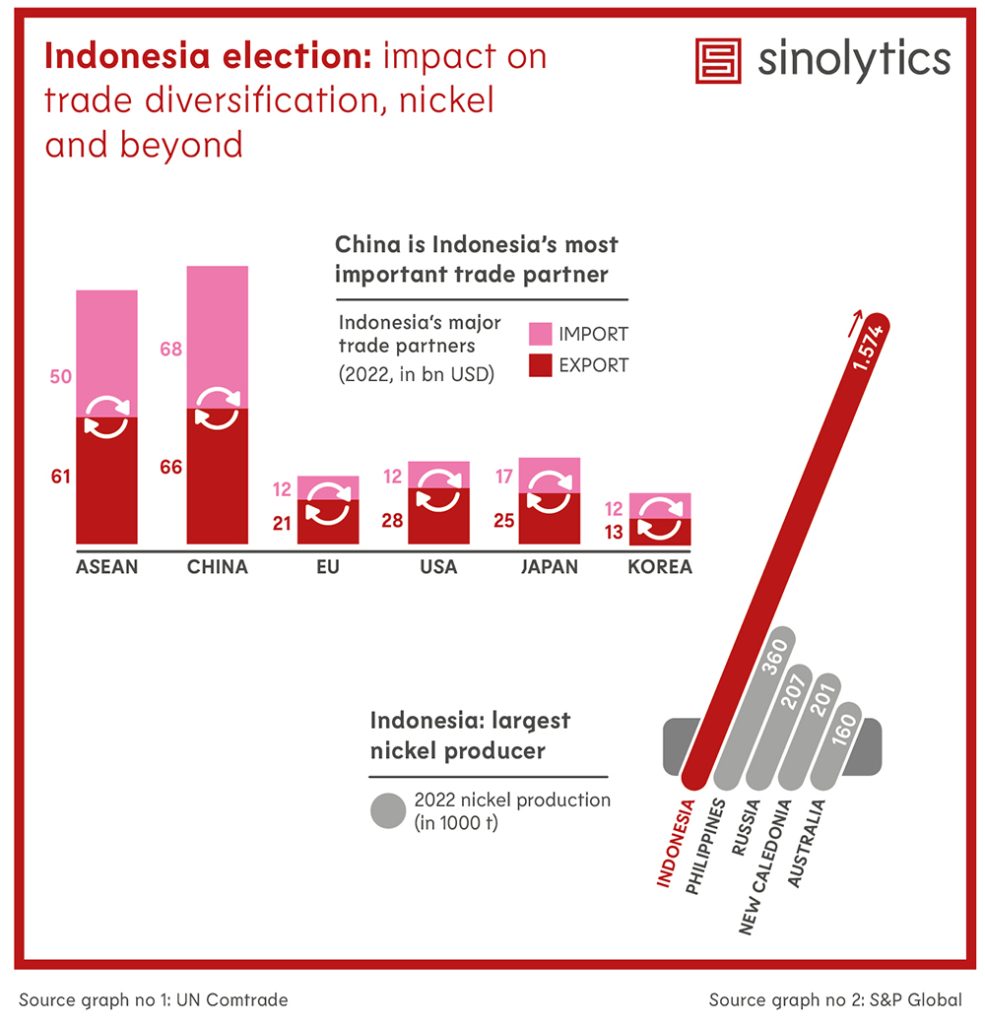

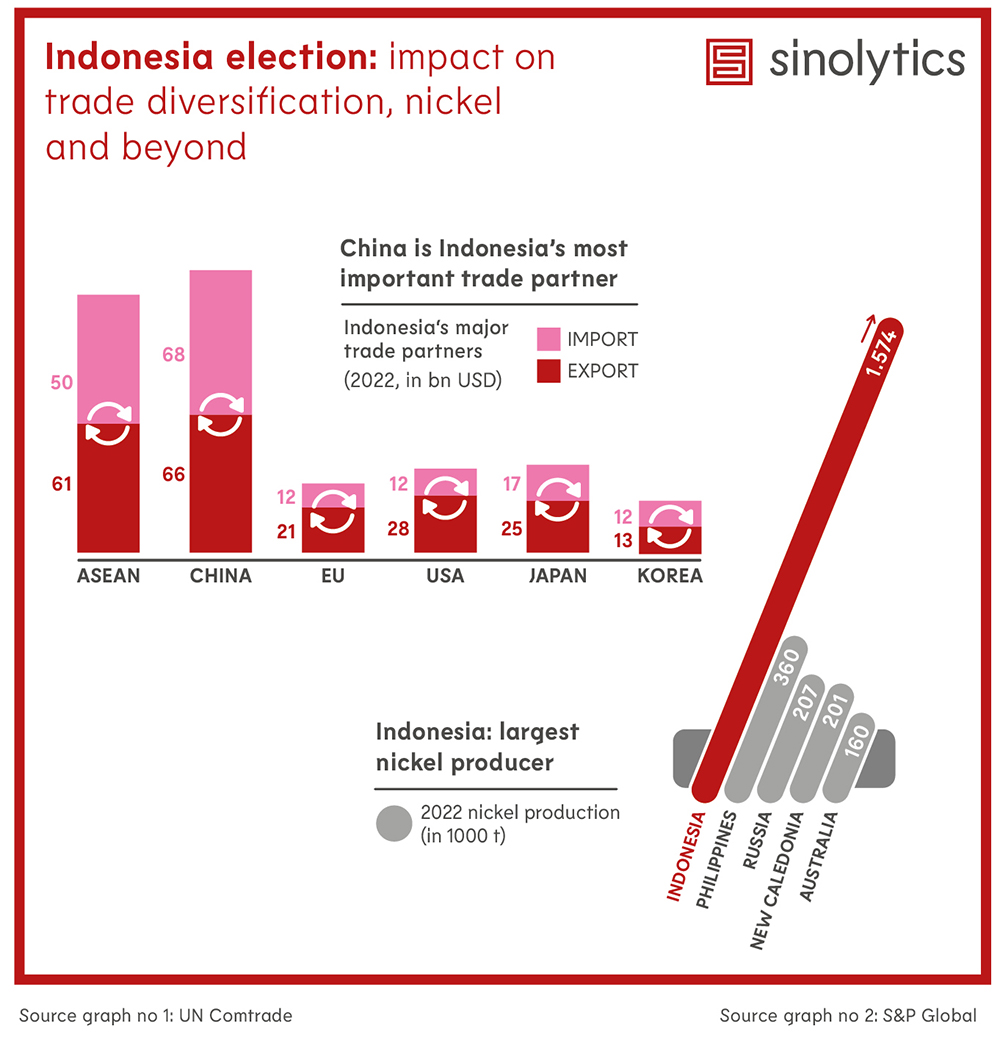

Sinolytics is a research-based business consultancy entirely focused on China. It advises European companies on their strategic orientation and specific business activities in the People’s Republic.

Products from forced labor will no longer be made available on the EU internal market, sold and exported from there. On Tuesday night, the EU Parliament and Council agreed on the new regulation. Contrary to what Parliament and civil society had demanded, it does not yet include any form of physical compensation for the victims of forced labor.

According to the regulation, the EU Commission and competent authorities in the member states are to identify products whose supply chain involves people in forced labor. The criteria include the extent and severity of forced labor and whether it was state-imposed. The draft deals specifically with state-imposed forced labor.

A database will identify sectors in regions with state-imposed forced labor, from which the EU Commission will then gather information on the risk of forced labor. The decision to ban products from these regions will be based on less detailed data. The Parliament initially demanded the designation of high-risk sectors in areas with predominantly state-imposed forced labor. This was because collecting the necessary evidence in regions like Xinjiang is generally impossible. The new wording accommodates the demands of Parliament to some extent.

However, whether the law will receive the necessary majority in the Council is unclear. Germany had already abstained from the vote on the Council’s negotiating mandate under pressure from the Free Democratic Party (FDP).

According to the International Labor Organization (ILO), around 27.6 million people were forced to work in 2021 – of whom about 12 percent were children. About 3.9 million were victims of state-imposed forced labor, like presumably in the Chinese region of Xinjiang. According to a 2021 report commissioned by Green Party MEP Anna Cavazzini, over 80 international brand corporations benefit directly or indirectly from the forced labor of Uyghurs in China. leo

China’s solar giant Longi Green Energy Technology has called on Beijing to take action against low prices and ensure the quality of solar modules. Overcapacity and tough competition were driving companies to bankruptcy, said Longi Chairman Zhong Baoshen in an interview with the Shanghai Securities News on the sidelines of the National People’s Congress. He said that some manufacturers were offering prices below production costs in tenders for solar parks, for example. Zhong demanded that Beijing should introduce new tendering rules to prevent dumping.

The government should reward companies that can deliver durable and reliable products, Bloomberg quoted Zhong as saying. Longi is currently number two in China, behind market leader Jinko Solar. Zhong’s remarks show that the crisis in the solar industry even affects China as the country dominating the global solar market. Despite a record expansion of solar installations in the country in 2023 (216.9 gigawatts) and a good forecast for 2024, manufacturers are forced to cut production far below capacity and lay off staff.

Experts have been expecting the Chinese solar industry to consolidate for some time now. Trina Solar Chairman Gao Jifan already warned in late 2023 that extremely low prices would force smaller companies out of the market. “Everyone is bleeding at this moment,” Longi’s Vice President Dennis She told the Financial Times in February, adding that only the big players could survive this. According to the FT report, Longi has currently scaled back its production to 70 to 80 percent of capacity.

China has exported its surplus solar modules since 2023, primarily to Europe. There, the oversupply from the People’s Republic caused prices to plummet to historic lows. ck

Russia and China are considering building a nuclear power plant on the moon between 2033 and 2035. “Today we are seriously considering a project – somewhere at the turn of 2033-2035 – to deliver and install a power unit on the lunar surface together with our Chinese colleagues,” said Yuri Borisov, head of the Russian space agency Roscosmos, on Tuesday. According to Borisov, Russia and China are working on a joint lunar program.

China announced at the end of February that the first Chinese astronaut is expected to land on the moon before 2030. A nuclear power reactor could one day even enable the construction of lunar settlements, said Borissov, adding that solar cells could not provide enough power for future moon settlements while nuclear power could.

Russia is not alone with these seemingly futuristic ideas: The US space agency NASA also considers nuclear power plants on the moon and commissioned companies two years ago to draw up designs for a nuclear power supply on the moon. Last year, aircraft engine manufacturer Rolls-Royce presented a model of a small nuclear power plant that could supply heat and electrical energy for humans on the moon or even on Mars. cyb/rtr

Reports about the growing ambitions of the Chinese EV market leader BYD abroad continue unabated. BYD plans to expand its car carrier fleet to eight within two years, Nikkei Asia reported on Tuesday. The Group aims to increase its export capacities in this way. Previously, only seven freighters were planned.

A shortage of shipping slots has been a bottleneck for Chinese car exports for some time now. Last Monday, one of BYD’s huge car freighters with 7,000 car bays arrived in Germany for the first time and unloaded 3,000 vehicles at its port in Bremerhaven.

BYD also aims to rapidly expand its production capacities worldwide. Bloomberg reported last week that the Italian government has contacted the car manufacturer. Rome wants to attract a second car manufacturer, in addition to the Fiat manufacturer, Stellantis. “We have some contacts to discuss about that,” Bloomberg quoted Michael Shu, Managing Director of BYD Europe, as saying. The company has been selling two electric models in Italy since 2023. However, BYD was currently focussing on Hungary, Shu emphasized. It was too early to say whether and when a decision would be made on a second European site. In December, BYD announced the construction of a plant in Hungary.

BYD is also negotiating with the Mexican government about the construction of a plant. Production in Mexico could provide a customs-free route to the US car market. BYD also plans to invest billions in intelligent vehicles and enter the premium and luxury segment. ck

More and more Chinese smartphone users favor local competitors over Apple products. According to research firm Counterpoint, iPhone sales in the People’s Republic fell by 24 percent year-on-year in the first six weeks of this year. At the same time, Apple’s main Chinese rival Huawei increased its sales by 64 percent. Overall, sales in the Chinese mobile phone market were seven percent down on the previous year during this period.

Apple “faced stiff competition at the high end from a resurgent Huawei while getting squeezed in the middle on aggressive pricing from the likes of OPPO, Vivo and Xiaomi,” Counterpoint’s senior analyst Mengmeng Zhang said.

Counterpoint reports that the Dongguan-based company Vivo, which focuses on the low-cost segment, held the largest market share in the reviewed period. Meanwhile, Apple’s market share shrank from 19 percent to 15.7 percent, placing it fourth among the largest smartphone providers in China. Huawei, on the other hand, has almost doubled its share to 16.5 percent and ranks second. All manufacturers had a market share of under 20 percent.

Shortly before the presentation of the current iPhone generation, Huawei presented its new top model “Mate 60 Pro+” last fall. Apple already responded to the lower demand in January by offering one of its rare discount campaigns. Chinese online retailers currently offer the iPhone 15 with discounts of the equivalent of 170 euros. rtr

The US government has barred the US chip manufacturer Advanced Micro Devices (AMD) from selling an AI chip tailored to the Chinese market. This was reported by Bloomberg, citing people familiar with the matter.

AMD reportedly hoped to receive a permit from the Ministry of Commerce to sell the AI chip to Chinese customers. The chip has a lower performance than the products that AMD sells outside of China. The company developed it specifically in compliance with US export restrictions. However, US officials have informed AMD that the chip is still too fast.

The report stated that the company must obtain a license from the US Department of Commerce’s Bureau of Industry and Security. AMD and the Bureau of Industry and Security declined to comment. It is not yet known whether AMD will apply for a license. cyb

Liang Zhang took over the position of Head of Procurement China JV BFDA at Daimler China in January. Zhang has worked in the Chinese automotive industry for more than five years, most recently as General Manager at Lotus in Shanghai. He has relocated to Beijing for his new position.

Axel Christian has been CFO Greater China at Carl Zeiss in Shanghai since January. Christian previously worked for two years as Head of Corporate Finance and Controlling for the globally operating German tech company.

Is something changing in your organization? Let us know at heads@table.media!

Taylor Swift is arguably the most popular pop singer of our time – including in China. The fact that their idol is giving six exclusive Southeast Asian concerts in relatively close Singapore between now and 9 March is causing a sensation among “Swifties”- as the singer’s fans call themselves. The city-state only recently suspended visa requirements for Chinese tourists. However, Chinese traveling from the mainland will have to dig deep into their pockets for flights, hotels and the 300 euro concert tickets. Meanwhile, a canceled Singapore Airlines (SIA) flight caused panic. Fans explained that the offered alternative flights would not get them to the concerts on time.

Premier Li Qiang opened the National People’s Congress with his work report, as always, with many details. What is particularly striking is Li’s focus on continuity. The deficit, inflation, unemployment rate, and – most importantly – economic growth targets are practically the same as a year ago, writes Joern Petring. As expected, the NPC is not planning any significant economic stimulus packages.

The growth target of “around five percent” sent share prices plummeting on Tuesday. However, this figure is not without ambition, explains Finn Mayer-Kuckuk. As China’s economy is already a bit larger than that of the EU, a growth rate of five percent means an enormous amount of goods and services. Consumption is the key here; the government cannot risk another loan-financed construction or investment boom. This, in turn, is good news for companies that produce for China’s consumer market.

The military budget is once again set to grow faster than the economy. The People’s Liberation Army will receive an extra 7.2 percent this year. This raises concerns in the region, which is already feeling the pressure from its large and increasingly powerful neighbor, as Michael Radunski analyzes. And: Premier Li has once again sharpened his rhetoric towards Taiwan at the People’s Congress.

Despite an ambitious growth target of “around five percent” and aid promises for the struggling real estate sector, the annual government report at the start of the People’s Congress in Beijing failed to lift the mood in China’s economy. The markets’ initial reaction to the government plans for this year presented by Premier Li Qiang on Tuesday was sobering. While the Shanghai Composite Index made a slight gain by the close of trading, there was a veritable sell-off in Hong Kong, where the Hang Seng Index lost 2.6 percent.

Investors clearly gave the thumbs down. As expected, the Premier did not have a comprehensive economic stimulus package up his sleeve. Instead, Li clarified that Beijing will essentially maintain its current course: Money will no longer simply be handed out but will flow into future industries and new technologies.

“There were no surprises in today’s speech, but there were also no meaningful solutions,” said renowned Beijing economist Michael Pettis, summarizing his impressions of the opening. The “keep it up” approach is also evident in Li’s key figures on Tuesday. Many have remained almost identical to last year.

Premier Li apparently shares this view: “Achieving this year’s targets will not be easy,” he admitted to the 2,872 delegates in the Great Hall of the People. “It requires focused policies, redoubled efforts, and concerted efforts from all parties.” Li made it clear that the restructuring of the economy must continue. “We should stick to the principles of progress and stability,” said the Premier. New things must be created before old things are abolished.

Li presented plans to increase the national budget for science and technology research by a whopping ten percent compared to the previous year. The Development and Reform Commission’s plan, which was also presented on Tuesday, also showed that Beijing intends to keep up the pace in promoting new economic sectors. The overarching goal for 2024 is to “use scientific and technological innovation to lead the modernization of its industrial system.”

“We will work extensively to increase the autonomy and strength of science and technology and improve the basic system for comprehensive innovation,” it continues. The Chinese government “will vigorously advance new industrialization.” Beijing also wants to achieve “more breakthroughs in core technologies” and tap into “new growth drivers.”

Stimulating consumption was only mentioned second. At least the battered property owners received a somewhat positive signal. For the first time in years, the formula coined by state and party leader Xi Jinping, “houses are for living, not for speculation,” was no longer mentioned.

Although there is no sign of a departure from the strict policy on highly indebted real estate developers, the leadership’s plans emphasize keeping an eye on the problem. For instance, local governments are to exercise their “regulatory responsibility to ensure that houses that have already been sold are handed over on time.” Efforts are also to be made to meet the “appropriate financing needs” of real estate companies.

Economists consider China’s target of around five percent growth for 2024 ambitious but achievable. “It should not be seen as a forecast, but as a signal figure,” Doris Fischer, Professor of China Business and Economics at the University of Würzburg, told Table.Briefings. Premier Li Qiang wants to convey to the public that the government is trying to get the problems under control. According to Fischer, he aims to restore confidence in the economy and economic policy.

However, Fischer also believes that the economy will continue to drift apart. While things are going well in some sectors, the high unemployment rate is a particular cause for concern. “What I hear from China is that the mood is bad – especially among young academics.” She thinks Premier Li’s speech “will not be the starting signal for a new positive mood.”

This makes an active job market policy all the more urgent. However, the government does not seem entirely confident in its own means. It has set an unemployment rate target of 5.5 percent, whereas last year’s figure was 5.1 percent, according to the statistics bureau. Here, Fischer recognizes an admission that unemployment could rise despite the creation of new jobs.

Economists believe that significantly more positive signals are needed for a return to optimism among consumers and companies. “They are uncertain about the future,” says Horst Loechel, economist and Co-Chairman of the Sino-German Center at the Frankfurt School of Finance & Management. “And not just because growth has been so low, but also because of the regulation of internet companies in recent years, for example.”

However, in the overall picture, Premier Li has no choice but to stimulate consumption. After all, private consumption is the key to keeping growth in line with the planned targets: The government cannot risk another debt-fuelled construction or investment boom. “The debt-driven growth model is dead,” saidLoechel.

The prospect of a recovery in spending is, in turn, good news for German industry. “If consumption is revitalized, China will remain an interesting market thanks to its size,” said Fischer.

This is why the German economy wants to keep its share of what continues to be an important market, said Fischer. This applies to the automotive industry, its suppliers, and all other sectors that benefit directly and indirectly from consumer spending.

Li went to great lengths on Tuesday to give positive signals to the private sector and allay the fears of international corporations. He conceded that “state-owned enterprises, private businesses and foreign-funded companies all play an important role” in China’s modernization efforts. “This kind of thing goes down well in the industry,” observed Loechel, adding that China remains a crucial market for international strategies. Despite the property and debt crisis, it will become increasingly important for now.

Economist Fischer regards restoring confidence in the future and reducing the savings ratio as the most important means of stimulating consumption. During the COVID-19 pandemic, Chinese citizens have again started saving more money for a rainy day.

Only when they feel safer again can more dynamism emerge. One way of achieving this would be a more social policy that allays people’s fears of old-age poverty, hospital costs, and the like.

According to Fischer’s observations, however, President Xi Jinping is torn between the realization that inequality is detrimental to cohesion and an aversion to the European-style welfare state, which he believes encourages laziness. Fischer’s impression: The social and tax system ultimately contributes to maintaining inequality.

This is another area that could be addressed. After all, allowing the average population to have higher incomes would be another way of boosting consumption – at the expense of competitiveness. Xi and his government have been trying to “square the circle” here for years, creating progress without bringing about changes that could jeopardize his power.

The NPC report highlights several sectors that are likely to benefit significantly from the subsidy policy in the coming years:

German companies can certainly hope for additional contracts in some of these sectors or benefit from cost-effective procurement in China. Sanctions could make this more difficult for semiconductors, but Loechel sees particularly promising partnership opportunities in the energy supply sector.

China’s defense spending is set to increase by 7.2 percent this year. This is according to the Chinese Ministry of Finance’s budget plan presented to the National People’s Congress on Tuesday. Military spending is expected to rise to 1.67 trillion yuan (around 231 billion US dollars/214 billion euros). The internal comparison is also important: At 7.2 percent, this figure is significantly higher than the targeted economic growth of “around five percent.”

It is an alarming development. Pressure on Taiwan is increasing, disputes in the East and South China Seas are intensifying, and relations between China and the US are also strained. “China’s military is clearly focused on its immediate territorial targets. These are areas in the East and South China Seas, but above all Taiwan,” Dan Smith from the renowned Stockholm International Peace Research Institute (Sipri) told Table.Briefings.

Above all, pressure is mounting on Taiwan. On Tuesday, Premier Li also tightened the official wording regarding the democratically governed island before the People’s Congress. He refrained from the previously typical formulation of “peaceful reunification.” Instead, Li said the government was “firm in advancing the cause of China’s reunification, and uphold the fundamental interests of the Chinese nation.”

Although officials have occasionally omitted the adjective “peaceful” in this context in the past, but in light of the current tensions and such an important event as the National People’s Congress, it can be assumed that the leaders in Beijing also wanted to verbally increase the threat potential towards Taiwan this Tuesday.

Li also indirectly warned the United States: He called on the delegates to resolutely oppose “Taiwan independence separatist forces and the interference by external forces.”

Many observers are particularly concerned about the steadily rising military budget. “China is the only country that has increased its military spending every year for the past 28 years,” says Sipri head Smith. Over the past three decades, China’s military spending has risen by at least 6.6 percent annually – most recently by more than 7 percent, despite a continuous economic slowdown.

Analysts also note that the actual figure is likely to be far higher, as research and development spending, among other things, is not taken into account.

In any case, China’s defense spending has long been a core component of the national budget. It accounts for around 40 percent of the central government’s expected total spending. Beijing spends ten times as much on the military as on education. Accordingly, the Ministry of Finance declared that defense spending would be given priority while other expenditures would be strictly cut back. Premier Li emphasized: “We in governments at all levels will provide strong support to the development of national defense and the armed forces.”

However, China’s military spending reveals a much more balanced picture compared to other countries. Tuesday’s announcement of an increase in the defense budget means that China’s military budget only accounts for around 1.2 to 1.6 percent of GDP. Thus, the People’s Republic remains well below the 2 percent annual target of NATO members.

Sipri head Smith points to a global trend. “Overall, we are talking about a world where more money is spent on the military than ever. The global military build-up amounted to more than 2,200 trillion US dollars last year alone.” The USA remains the undisputed leader here, with 877 trillion US dollars in 2022, followed by China with 292 trillion US dollars.

But Taiwan, like China’s neighbors Japan, South Korea, Australia and the Philippines, international comparisons will hardly reassure Taiwan. They are well aware of the plans Xi Jinping has for China’s military.

China’s head of state has set the goal of turning the Chinese military into a “modern fighting force” by 2027. The increase in the military budget is in line with the “full implementation of Xi Jinping’s thoughts on strengthening the military,” the draft budget states.

Moreover, China’s neighbors already feel the enormous pressure potential of the Chinese armed forces in various forms. China boasts the largest navy in the world – measured by the number of ships. Along with the United States and Russia, the People’s Republic is the only country to produce fifth-generation fighter jets. And the USA warned last week that China is growing its military capabilities in space at a “breathtaking pace.”

China’s Premier Li also left no room for doubt on Tuesday. The leadership in Beijing is determined to make the Chinese military combat-ready. The armed forces “will strengthen all-around military training and combat readiness, make well-coordinated efforts to improve military preparedness … so as to firmly safeguard China’s national sovereignty, security, and development interests.”

Sinolytics is a research-based business consultancy entirely focused on China. It advises European companies on their strategic orientation and specific business activities in the People’s Republic.

Products from forced labor will no longer be made available on the EU internal market, sold and exported from there. On Tuesday night, the EU Parliament and Council agreed on the new regulation. Contrary to what Parliament and civil society had demanded, it does not yet include any form of physical compensation for the victims of forced labor.

According to the regulation, the EU Commission and competent authorities in the member states are to identify products whose supply chain involves people in forced labor. The criteria include the extent and severity of forced labor and whether it was state-imposed. The draft deals specifically with state-imposed forced labor.

A database will identify sectors in regions with state-imposed forced labor, from which the EU Commission will then gather information on the risk of forced labor. The decision to ban products from these regions will be based on less detailed data. The Parliament initially demanded the designation of high-risk sectors in areas with predominantly state-imposed forced labor. This was because collecting the necessary evidence in regions like Xinjiang is generally impossible. The new wording accommodates the demands of Parliament to some extent.

However, whether the law will receive the necessary majority in the Council is unclear. Germany had already abstained from the vote on the Council’s negotiating mandate under pressure from the Free Democratic Party (FDP).

According to the International Labor Organization (ILO), around 27.6 million people were forced to work in 2021 – of whom about 12 percent were children. About 3.9 million were victims of state-imposed forced labor, like presumably in the Chinese region of Xinjiang. According to a 2021 report commissioned by Green Party MEP Anna Cavazzini, over 80 international brand corporations benefit directly or indirectly from the forced labor of Uyghurs in China. leo

China’s solar giant Longi Green Energy Technology has called on Beijing to take action against low prices and ensure the quality of solar modules. Overcapacity and tough competition were driving companies to bankruptcy, said Longi Chairman Zhong Baoshen in an interview with the Shanghai Securities News on the sidelines of the National People’s Congress. He said that some manufacturers were offering prices below production costs in tenders for solar parks, for example. Zhong demanded that Beijing should introduce new tendering rules to prevent dumping.

The government should reward companies that can deliver durable and reliable products, Bloomberg quoted Zhong as saying. Longi is currently number two in China, behind market leader Jinko Solar. Zhong’s remarks show that the crisis in the solar industry even affects China as the country dominating the global solar market. Despite a record expansion of solar installations in the country in 2023 (216.9 gigawatts) and a good forecast for 2024, manufacturers are forced to cut production far below capacity and lay off staff.

Experts have been expecting the Chinese solar industry to consolidate for some time now. Trina Solar Chairman Gao Jifan already warned in late 2023 that extremely low prices would force smaller companies out of the market. “Everyone is bleeding at this moment,” Longi’s Vice President Dennis She told the Financial Times in February, adding that only the big players could survive this. According to the FT report, Longi has currently scaled back its production to 70 to 80 percent of capacity.

China has exported its surplus solar modules since 2023, primarily to Europe. There, the oversupply from the People’s Republic caused prices to plummet to historic lows. ck

Russia and China are considering building a nuclear power plant on the moon between 2033 and 2035. “Today we are seriously considering a project – somewhere at the turn of 2033-2035 – to deliver and install a power unit on the lunar surface together with our Chinese colleagues,” said Yuri Borisov, head of the Russian space agency Roscosmos, on Tuesday. According to Borisov, Russia and China are working on a joint lunar program.

China announced at the end of February that the first Chinese astronaut is expected to land on the moon before 2030. A nuclear power reactor could one day even enable the construction of lunar settlements, said Borissov, adding that solar cells could not provide enough power for future moon settlements while nuclear power could.

Russia is not alone with these seemingly futuristic ideas: The US space agency NASA also considers nuclear power plants on the moon and commissioned companies two years ago to draw up designs for a nuclear power supply on the moon. Last year, aircraft engine manufacturer Rolls-Royce presented a model of a small nuclear power plant that could supply heat and electrical energy for humans on the moon or even on Mars. cyb/rtr

Reports about the growing ambitions of the Chinese EV market leader BYD abroad continue unabated. BYD plans to expand its car carrier fleet to eight within two years, Nikkei Asia reported on Tuesday. The Group aims to increase its export capacities in this way. Previously, only seven freighters were planned.

A shortage of shipping slots has been a bottleneck for Chinese car exports for some time now. Last Monday, one of BYD’s huge car freighters with 7,000 car bays arrived in Germany for the first time and unloaded 3,000 vehicles at its port in Bremerhaven.

BYD also aims to rapidly expand its production capacities worldwide. Bloomberg reported last week that the Italian government has contacted the car manufacturer. Rome wants to attract a second car manufacturer, in addition to the Fiat manufacturer, Stellantis. “We have some contacts to discuss about that,” Bloomberg quoted Michael Shu, Managing Director of BYD Europe, as saying. The company has been selling two electric models in Italy since 2023. However, BYD was currently focussing on Hungary, Shu emphasized. It was too early to say whether and when a decision would be made on a second European site. In December, BYD announced the construction of a plant in Hungary.

BYD is also negotiating with the Mexican government about the construction of a plant. Production in Mexico could provide a customs-free route to the US car market. BYD also plans to invest billions in intelligent vehicles and enter the premium and luxury segment. ck

More and more Chinese smartphone users favor local competitors over Apple products. According to research firm Counterpoint, iPhone sales in the People’s Republic fell by 24 percent year-on-year in the first six weeks of this year. At the same time, Apple’s main Chinese rival Huawei increased its sales by 64 percent. Overall, sales in the Chinese mobile phone market were seven percent down on the previous year during this period.

Apple “faced stiff competition at the high end from a resurgent Huawei while getting squeezed in the middle on aggressive pricing from the likes of OPPO, Vivo and Xiaomi,” Counterpoint’s senior analyst Mengmeng Zhang said.

Counterpoint reports that the Dongguan-based company Vivo, which focuses on the low-cost segment, held the largest market share in the reviewed period. Meanwhile, Apple’s market share shrank from 19 percent to 15.7 percent, placing it fourth among the largest smartphone providers in China. Huawei, on the other hand, has almost doubled its share to 16.5 percent and ranks second. All manufacturers had a market share of under 20 percent.

Shortly before the presentation of the current iPhone generation, Huawei presented its new top model “Mate 60 Pro+” last fall. Apple already responded to the lower demand in January by offering one of its rare discount campaigns. Chinese online retailers currently offer the iPhone 15 with discounts of the equivalent of 170 euros. rtr

The US government has barred the US chip manufacturer Advanced Micro Devices (AMD) from selling an AI chip tailored to the Chinese market. This was reported by Bloomberg, citing people familiar with the matter.

AMD reportedly hoped to receive a permit from the Ministry of Commerce to sell the AI chip to Chinese customers. The chip has a lower performance than the products that AMD sells outside of China. The company developed it specifically in compliance with US export restrictions. However, US officials have informed AMD that the chip is still too fast.

The report stated that the company must obtain a license from the US Department of Commerce’s Bureau of Industry and Security. AMD and the Bureau of Industry and Security declined to comment. It is not yet known whether AMD will apply for a license. cyb

Liang Zhang took over the position of Head of Procurement China JV BFDA at Daimler China in January. Zhang has worked in the Chinese automotive industry for more than five years, most recently as General Manager at Lotus in Shanghai. He has relocated to Beijing for his new position.

Axel Christian has been CFO Greater China at Carl Zeiss in Shanghai since January. Christian previously worked for two years as Head of Corporate Finance and Controlling for the globally operating German tech company.

Is something changing in your organization? Let us know at heads@table.media!

Taylor Swift is arguably the most popular pop singer of our time – including in China. The fact that their idol is giving six exclusive Southeast Asian concerts in relatively close Singapore between now and 9 March is causing a sensation among “Swifties”- as the singer’s fans call themselves. The city-state only recently suspended visa requirements for Chinese tourists. However, Chinese traveling from the mainland will have to dig deep into their pockets for flights, hotels and the 300 euro concert tickets. Meanwhile, a canceled Singapore Airlines (SIA) flight caused panic. Fans explained that the offered alternative flights would not get them to the concerts on time.