This year will not be an easy one for the automotive industry either. Felix Lee spoke with automotive expert Stefan Bratzel about the challenges the sector is facing. In China, the competition from newcomers such as NIO and Xpeng is now stronger and more numerous than in Europe. Bratzel has identified various deficiencies among German suppliers: Their software is lagging behind, and they should show more flexibility in their supply chains during Covid times. In general, German manufacturers should question their high dependence on China, says the industry expert from the Center of Automotive Management. After all, trade disputes and human rights issues can quickly affect the German auto industry’s billion-dollar business.

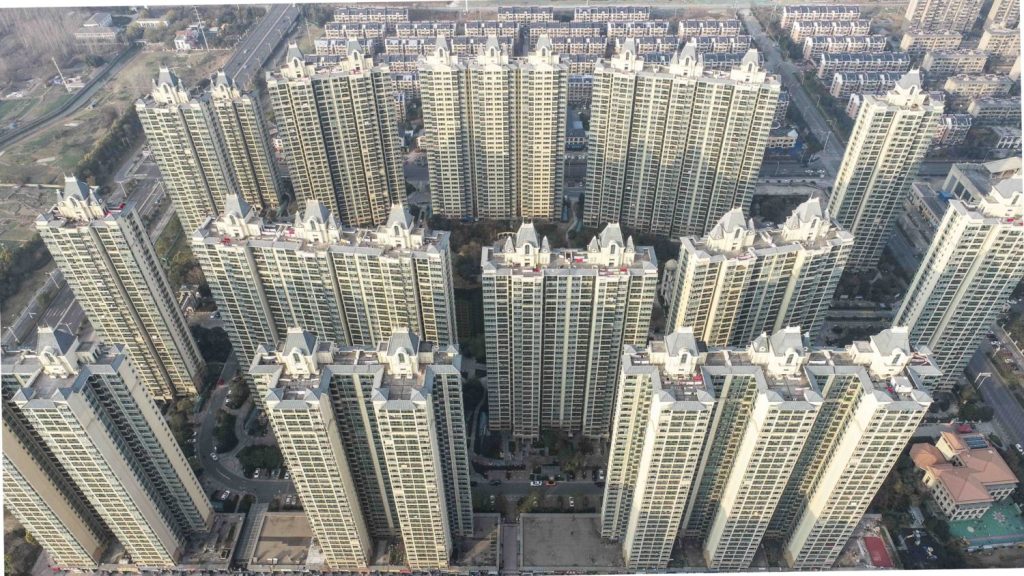

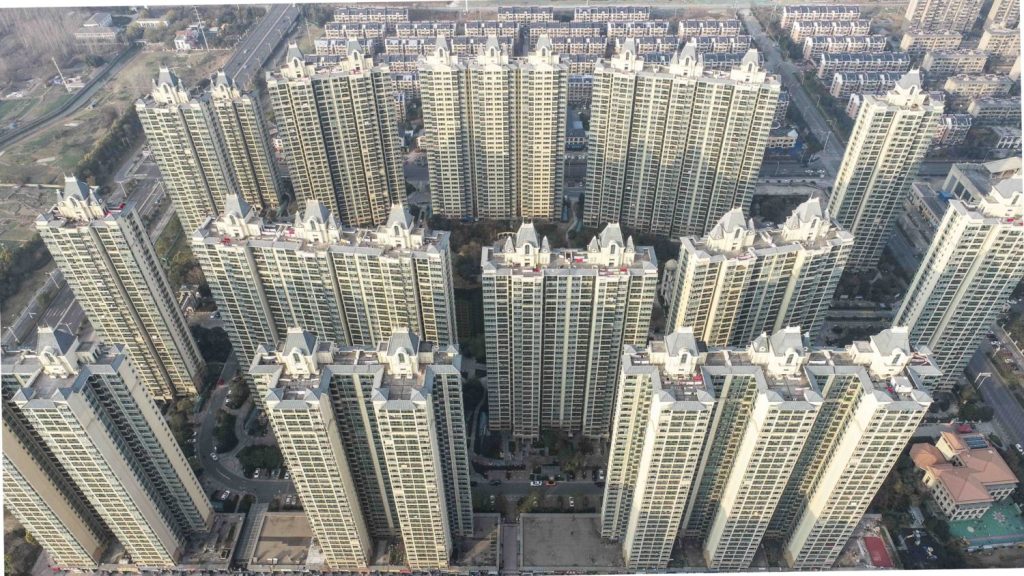

Real estate in China has been a kind of turbo savings account for many people from the middle and upper classes. This is because home prices have grown year by year – at times by several percent. As our Beijing team finds in today’s analysis of the real estate market, this development could soon come to an end – thanks to the crisis at Evergrande and other real estate developers. But the very fact that a large share of private household savings is in real estate could slow down reforms in the sector. Beijing must tread carefully if it does not want to trigger more protests from savers.

It sounds like something out of a science fiction movie: drones delivering food. But in China, the little planes might be put into regular service as early as this year. At least, that’s what the food delivery company Meituan is planning, reports Frank Sieren. After all, China’s roads are so jammed that air delivery could save valuable minutes. In addition, Meituan faces regular criticism: Its drivers are not paid enough and have become modern-day slaves thanks to computer-controlled time pressure. Yet, Meituan made 27 million deliveries per day alone last year. This is one reason why drone delivery will remain a niche market for the time being.

Mr. Bratzel, the pandemic, chip shortages, supply bottlenecks – the German automotive industry really didn’t have an easy year in 2021. Will 2022 be better?

Stefan Bratzel: The industry is undergoing the greatest change in its history – and in addition to this transformation, there are now various crises. I expect the chip crisis to continue in 2022 and to remain a burden on the automotive industry. There will probably be a slight relaxation from spring onwards. However, the issue is likely to remain on the agenda throughout the year. The drama is playing out against the backdrop of major technological changes: electromobility, connectivity, autonomous driving. Chips are fundamental to all these issues.

How can the chip problem be solved?

Car manufacturers are trying to make their technology more flexible to be able to switch to different manufacturers. Above all, however, carmakers are contacting manufacturers directly to secure batches and influence manufacturers to expand capacity. But that takes a year or two until the factories are expanded accordingly. Moreover, not all chip manufacturers are willing to do this. For them, high capacity utilization is key. If it’s not over 70 or 80 percent, they’re no longer in the black and fear oversupply. So they don’t invest wildly in the future, because they will ruin their own business.

Wouldn’t it make sense for the German automotive industry to get more involved in chip development?

Yes, that is already partly the case. It has long been not just manufacturers like Apple that develop their own chips. Tesla is already heavily involved in development. I recently spoke with the head of development at Daimler. He confirmed that his company is also entering chip development and wants to do most of the software development in-house. So the realization that software has become more important in all areas is there. However, not everyone will be able to pull this off. Only manufacturers who have already gained a certain level of expertise in this area will be able to do so.

Which car companies are you referring to specifically?

I wouldn’t put it past manufacturers like Daimler or BMW. Volkswagen has also adopted software as a core strategy. But I’m a bit skeptical about whether VW will be able to do it so quickly. I’m more optimistic about BMW and Daimler.

But aren’t Daimler and BMW rather lagging behind in the development of e-mobility, while VW is considered progressive?

You have to take a differentiated approach to this. Volkswagen has indeed been focusing extensively on e-mobility since the diesel scandal. Daimler is lagging behind in comparison. In the meantime, however, Daimler is catching up. BMW played a pioneering role in electromobility for a while, then took a break, but is now making a strong comeback.

Not least because China quickly got the pandemic under control a year and a half ago, business was relatively good for German automakers. But with Omicron, things have flared up again there, and China’s leadership is radically imposing lockdowns on entire cities with a population of millions. What will that mean for the auto industry?

The impact on supply chains is difficult to calculate. It always depends on where an outbreak is happening. Of course, if it happens in a city or at a supplier that has to shut down overnight – and that can easily happen with China’s strict Corona policy – it quickly puts supply chains at risk. Meanwhile, it is known that China’s vaccine so far provides poor protection against the Omicron variant. So the risk of lockdowns of entire regions is definitely there. There is not much that can be done in the short term. In the medium term, companies should be more flexible in their supply chains. However, this is easier said than done in this plant-based industry in times of sharply increased fixed costs.

VW, with its more than two dozen plants in the People’s Republic, thus faces a major problem should the pandemic break out again in China.

Yes, because if you make 40 percent of your global sales in China, like Volkswagen, you have to keep a close eye on what’s happening there. Then there is the issue of electromobility, which I mentioned earlier. VW is still the leader in China when it comes to combustion engines, but not when it comes to EVs. The competition in this field is completely different. Chinese suppliers in the low-cost segment in particular are very strong in China. So far, VW has not been able to keep up. This already poses major challenges for Volkswagen’s new China boss, Ralf Brandstaetter.

Is the Chinese competition really that much better technology-wise?

Some Chinese newcomers such as NIO or Xpeng benefit from the greenfield approach, i.e. starting completely from scratch. They do not have to go through a cumbersome restructuring process. In addition, there are players like BYD, which have long included electromobility in their value chain. Then there is also, for example, the Wuling brand, a joint venture between GM and SAIC, which is very strong. And Tesla is also already well represented with its own plant in China. So there is a lot more competition for German automakers in China than there is in Europe at the moment.

The launch of its ID electric models did not go as hoped for VW. Shouldn’t VW be positioning itself differently in China, perhaps by cooperating with its Chinese competitors?

The basic strategy is the right one. With the modular electric-drive toolkit (MEB), VW has a strong platform. For China, VW started a bit late. As a result, Volkswagen is still not active in all segments. In particular, VW does not yet offer anything in the lower segment.

So far, German manufacturers in China have mainly scored in the high-priced segment. Perhaps they don’t want to cover the low-price segment at all.

This may be true for the premium suppliers Audi, Mercedes, and BMW. VW is not a low-cost manufacturer either, but it is active in broader segments. And VW must be careful not to lose market share in these areas. Particularly in software, German manufacturers are lagging behind Chinese competitors. For EVs, carmakers must also manage the battery sector well. Here, too, Chinese manufacturers, especially BYD – who originally only produced batteries – are clearly ahead.

In the meantime, Chinese EV manufacturers are also gaining ground in Europe. Several Chinese suppliers are planning to enter the market in 2022. How do you rate their chances of success?

Yes, Chinese automakers also want to be represented globally, incidentally with the backing of the Chinese government. However, it is also clear that it will not be easy for Chinese EV manufacturers to gain a foothold in Europe. They will have to appeal to European tastes. Past attempts have failed to do so. The wave that is coming now has greater chances. I firmly expect that some will be successful here. With Geely-Volvo, we already have a European manufacturer with a Chinese parent. The cars are selling well as a result.

At the same time, political tensions are also growing between China and the new German government. To what extent will this development affect the automotive business?

This is not a sudden new development. China’s geopolitical ambitions have been a threat for several years – for the car business as well. Of course, China is also dependent on Europe. But China wants to become a global power, and the auto industry is a bargaining chip. And if political conflicts escalate, this can lead to major trade disruptions that also massively affect the auto industry. This vulnerability is a major problem.

German automakers have also created hundreds of thousands of jobs in China. Isn’t the dependence mutual?

When it comes down to it, national pride and political ambitions will prevail, despite Germany’s long-standing commitment.

What can the automotive industry do?

That will be really difficult for German carmakers. We have already seen that with Volkswagen and the Uyghurs: If the Chinese government wants something, carmakers have to react. I think the German government should also get more involved in such issues in the future. Companies can no longer negotiate this on their own. At the same time, automakers should balance their market position more and not focus too much on a single market. They should question their high dependence on China.

Stefan Bratzel is Director of the Center of Automotive Management at the University of Applied Sciences (FHDW) in Bergisch Gladbach, Germany. His research is particularly focused on the conditions for the success and survival of car manufacturers.

The US rating agency Fitch has published a gloomy outlook for China’s real estate market. In their latest report on the global housing market, experts warn that the People’s Republic of China, of all places, could be one of the few countries in the world where real estate prices will not continue to rise and could drop sharply instead.

Fitch predicts that Chinese home prices are likely to fall three to five percent both this year and next, largely due to the continued difficulties of China’s major real estate developers. The agency predicts that more developers will default on their loans, leading to a loss of trust among homebuyers. “While we expect the authorities to intervene to contain market volatility, downside risks are substantial,” Fitch writes.

When it comes to the question of what the future may hold for China’s real estate developers, the fate of Evergrande will play a major role. The real estate giant, which is currently experiencing payment difficulties, is still trying everything in its power to survive somehow. At least the group is trying to give the impression that it is working at full speed to find a solution for its creditors.

After having already sold company aircraft, the Group has now also parted with its headquarters in the southern Chinese metropolis of Shenzhen. Employees of the sleek high-rise building in the Nanshan district already moved out a little over a month ago. On Monday, construction workers stripped the company logo from the roof. Future business will once again be run from the neighboring city of Guangzhou, where Evergrande was first founded.

But the sale of silverware and the downsizing of its own office space have little impact on the group’s almost hopeless situation. Through its rapid expansion, Evergrande has accumulated a debt of more than €260 billion. At least that’s what the books say. But beyond that, there are said to be more liabilities of $150 billion.

Evergrande wants to gain some breathing room by negotiating with its creditors. Last week, the company announced a plan to postpone interest payments that are due soon by six months until the summer. Smaller competitors such as Kaisa and the Aoyuan Group are also trying to cheat the hangman.

In the end, however, it will depend less on their own negotiating skills and more on Beijing’s plans. After all, China’s real estate developers are mainly in a bind because the government suddenly tightened its grip on the entire industry last year for fear of a debt bubble. Beijing wants to reduce debt and take stronger action against speculation with apartments.

For this very purpose, “three red lines” have been drawn: The liability to asset ratio must not exceed 70 percent. The net gearing ratio must also not exceed 100 percent. The third red line concerns the cash to short-term debt ratio of companies, which cannot be lower than factor one. Although the government has made it clear that Evergrande will be made an example of, a complete bailout remains unlikely. But the deployment of a team of experts to the Group also shows that a collapse is also out of the question.

Beijing knows: The real estate sector accounts for more than a quarter of China’s economic growth. 70 percent of Chinese household assets are in real estate, which is why a crash would cause widespread anger among the population. Therefore, the government seems to have decided that, while reforms are still necessary, they don’t necessarily have to be done with brutal force. That seemingly applies to the three red lines as well. As state media reported on Friday, Beijing plans to alleviate them to some extent.

According to observers, relaxed regulations could cause remaining and relatively healthy developers to be more willing to take over construction projects from crisis groups such as Evergrande and take on more debt in the process. In the best-case scenario, the market could be reorganized through mergers and acquisitions without major upheavals. If this scenario materializes, a major price collapse in China’s housing market in 2022 could likely be averted. Gregor Koppenburg/Jörn Petring

Meituan plans to use drones for food delivery as early as this year. This would make the Beijing-based company the first company ever to utilize this type of contactless air delivery in everyday operations. This service has already entered the test phase in Shenzhen, southern China, reports the South China Morning Post (SCMP). There, a fleet of drones now delivers meals within a three-kilometer radius around Longgang COCO Park, a shopping and office complex located in the east of the city.

Meituan’s drivers first bring the food to the drone station. There, the packages are loaded onto the flying machines. These then airlift the delivery to a designated landing site, which resembles a vending machine. Customers can then pick up their orders after entering a pin code. The company is currently awaiting regulatory approval to expand the service, Mao Yinian, head of the drone division at Meituan, told SCMP.

The tech metropolis is considered an ideal location for low-altitude logistical flight projects. With Beijing’s permission, the local government can set up exceptionally liberal regulations to promote the technology of the future. Drone movements are monitored by the Chinese aviation authorities. The police and the Ministry of Industry and Information Technology (MIIT) oversee their safety.

Meituan’s drones weigh around four kilograms and can carry a load of up to three kilograms. This is also for regulatory reasons: Authorities currently limit the total weight of such delivery drones to seven kilograms. If everything works out, however, this limit could be raised, Meituan believes.

China’s market for food and goods delivery is booming, with industry experts predicting that it could already reach 93 billion orders per year in 2025. Meituan is China’s largest food delivery service. In 2020, the company had a market share of 68.5 percent. Investors consider Meituan’s business model to be compelling. In April last year, Meituan raised almost $10 billion in a securities offering, which is to flow primarily into delivery technology with drones and self-driving cars.

What’s particularly impressive is that the delivery service announced to be developing 90 percent of its drone components in-house. This proves how important this field is. Nevertheless, drone manager Mao expects drones to be used in limited areas for the time being. He assumes that drones will only be able to cover ten percent of logistics demand in the next ten years. However, based on forecasts for 2025, that would be over nine billion flights throughout China.

Despite the use of flying robots, staff shortages remain a factor. “We still have a shortage of drivers, especially at peak times like lunchtime.” However, even drone delivery still requires human assistance, for the time being, Mao said. “It will mainly be a supplement to our driver network.” In the long term, Meituan envisions “a collaborative, integrated network where our drones and delivery riders can work seamlessly together to deliver orders.” In 2020, Meituan employed about three million drivers who delivered an average of more than 27 million food orders per day.

Meituan’s competitors are also planning to use drones for delivery purposes as soon as possible. E-commerce company JD.com and logistics giant SF Holdings stated last year that they had completed China’s first unmanned cargo flight. The payload of their drone is said to have been 1.5 tons.

The World Economic Forum even proclaimed the “golden age of drone delivery” back in July 2020. The Osnabrueck-based freight forwarding company Hellmann, for example, is also planning to make deliveries in Europe via drone this year.

Meanwhile, Deutsche Post subsidiary DHL has discontinued its “Paketkopter” drone development project. Although “important insights” were gained in various use cases, regular operation of delivery drones is subsequently “not planned in Germany for the time being”. Apparently, both the cost of the service and the technical and bureaucratic hurdles are too high.

Amazon is also apparently only pursuing its “Prime-Air” drone project on the back burner. “We recently made organizational changes in our Prime Air business,” the company stated. What happens next is an open question. The Chinese seem to have the longer breath here. And the greater pressure to act, given the food delivery boom.

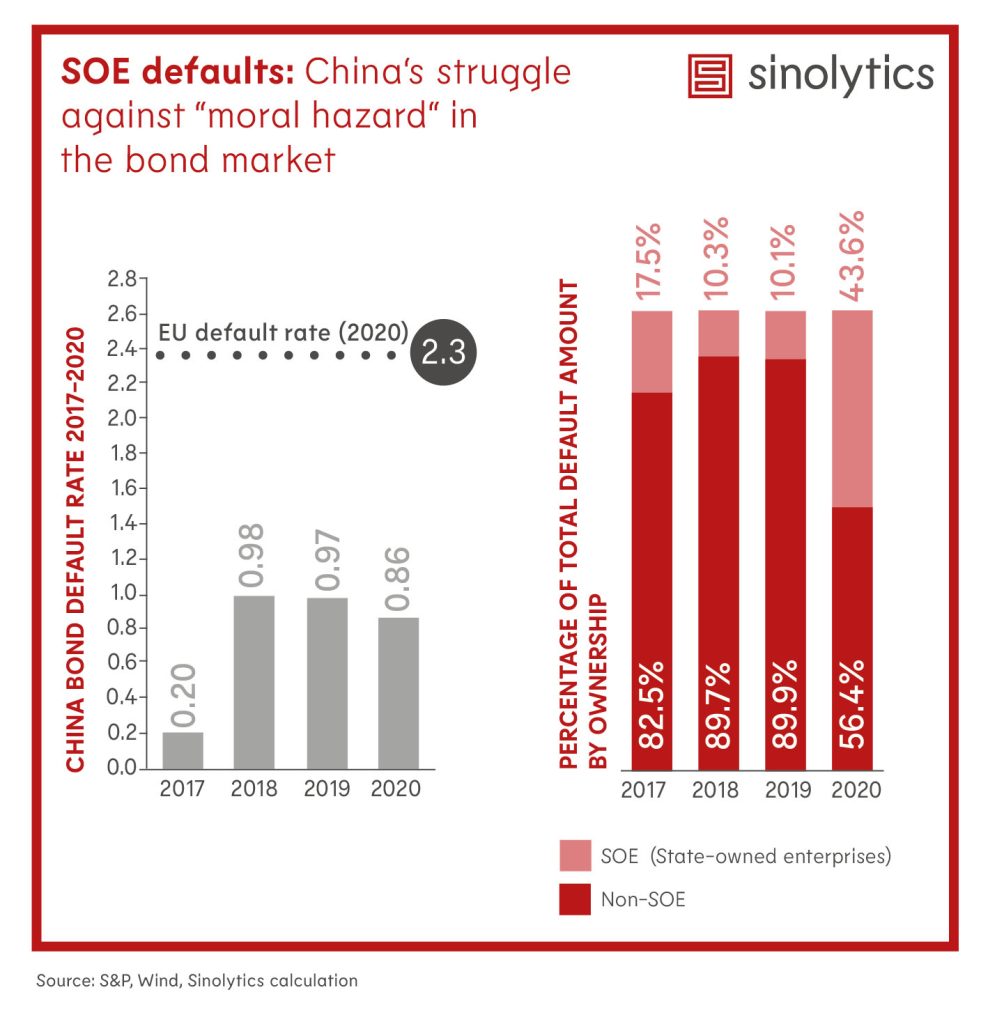

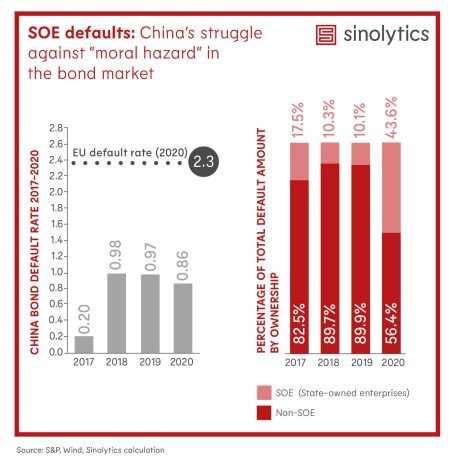

Sinolytics is a European consulting and analysis company focused entirely on China. It advises European companies on their strategic orientation and concrete business activities in China.

The Volkswagen Group sold 14 percent fewer cars in China in 2021 than in the same period of the year before. The group thus suffered heavy losses in its most important single market. VW China CEO Stephan Woellenstein cited a lack of chips and problems in supply chains as the reasons. “The production has lost 600,000 cars,” Woellenstein complained. “2021 was one of the most difficult years in our history in China.” The high-volume Škoda and Volkswagen brands, in particular, have seen significantly lower sales. Audi also sold 3.6 percent fewer cars. In contrast, the premium brands Porsche (up by eight percent) and Bentley (up by 43 percent) were able to expand their sales.

The Volkswagen Group’s market share, which had long been 14 or 15 percent in the People’s Republic, shrunk to 11.7 percent. Despite this, the Volkswagen brand remained the number one brand among Chinese customers, with a total of 3.3 million cars shipped, of which 2.4 million were of the core Volkswagen brand.

From the Group’s point of view, EV sales have also been disappointing. VW sold 70,625 battery-powered vehicles in China last year. Volkswagen thus fell well short of the projected target. The company aimed to sell between 80,000 and 100,000 models. The market launch of the new ID family apparently did not convince many Chinese customers. Woellenstein expressed confidence that 2022 will be a better year for the Group. He expects a 15 percent increase. Volkswagen is even aiming to double its EV sales. An important prerequisite for this, however, is the supply of chips. flee

China’s strict no-covid policy could soon affect the port in Shenzhen. As Bloomberg reports, 31 ships are already waiting outside the world’s fourth-largest port. Recently, eight new covid infections have occurred in Shenzhen. One of the infected is a port worker. Authorities suspect the Covid cases were transmitted through imported goods. They responded with mass testing of citizens and port workers. There are fears that the mass tests could restrict the processing of goods to and from the port, Bloomberg reported.

Back in May last year, Shenzhen Port’s Yantian Terminal was partially closed due to Covid cases among workers. This caused containerized goods to pile up for a month. Last week, there was also a restriction on truck traffic in some parts of the eastern province of Zhejiang to contain the Coronavirus. As a result, goods traffic to the Ningbo terminal was also delayed. However, 75 percent of traffic has since been restored, according to Bloomberg. The Ningbo terminal also experienced long delays last August due to local Covid outbreaks (China.Table reported).

In recent days, the first Omicron cases have been registered in China. The People’s Republic responded to these infections and other infections with the Delta variant with far-reaching measures. Yesterday, a lockdown was imposed on Anyang, a city of 5.5 million, after two Covid infections were confirmed there, AP reports. It is the third lockdown of a Chinese city of millions within a short time. According to the report, a total of 20 million Chinese citizens are currently no longer allowed to leave their homes. The port city of Tianjin with 14 million residents near Beijing has been placed under partial lockdown since Monday. nib

Canada and Taiwan want to begin talks on an international investment agreement, as Business representatives from Taipei and Ottawa agreed on at a virtual summit on Monday. These “exploratory discussions” are an important milestone in strengthening mutual economic and trade relations, according to a press release from the Canadian government.

An investment protection agreement is considered a precursor to a free trade treaty. The island state wants to become less dependent on the People’s Republic through new trade agreements. Although Taiwan is a member of the World Trade Organization, it has so far only been able to sign free trade pacts with Singapore and New Zealand. Taiwan is Canada’s sixth-largest trading partner in Asia. At the same time, Canada does not maintain diplomatic relations with Taipei in deference to Beijing’s one-China policy.

According to a statement on Monday, Canada’s Minister of International Trade Mary Ng highlighters Taiwan as “a key trade and investment partner as Canada broadens its trade links and deepens its economic partnerships in the Indo-Pacific region.” Wang Wenbin, the spokesman for the Chinese Foreign Ministry, criticized the meeting: “The Canadian side should respect the one-China principle and handle relevant issues prudently.” fpe

The acquisition of the Munich-based semiconductor group Siltronic by its Taiwanese competitor Globalwafers is as good as a done deal. This is reported by the German newspaper FAZ with reference to an interview with Doris Hsu, CEO of Globalwafers. According to Hsu, the sale is still subject to approval by the Chinese State Administration for Market Regulation (SAMR). However, this would only be “a technical procedure,” Hsu said. The German Federal Ministry of Economics and Technology also still has to give its final approval. The Federal Cartel Office had already approved the transaction at the beginning of 2021.

The €4.4 billion acquisition would make Globalwafers the world’s second-largest producer and supplier of silicon wafers after Japan’s Shin Etsu Group. Market observers believe the German government is deliberately delaying approval. Europe and Germany are scrambling to build their own semiconductor industries. Hsu told FAZ that the new German government’s goal is to make Europe a chip manufacturing powerhouse. “But the headquarters of Globalwafers is in Taiwan. This would not make us a European company,” Hsu said regarding such concerns.

If the takeover were to fall through, Globalwafers could theoretically make a second attempt, writes Handelsblatt. However, the Taiwanese would then have to dig deeper into their pockets than in their initial offer last year. Since the Covid pandemic, the chip industry has experienced a boom. The shares of Siltronic have also risen significantly. fpe

It was actually a defeat that brought Johannes Vogel to China. The FDP politician had just lost his job as a member of the German Bundestag. The party had failed miserably in the 2013 federal elections. The Liberals plummeted from 14.6 percent to 4.8 percent. Vogel says he witnessed how a party can crash down. And what did he do? He left for a while. After the election fiasco, he decided to move to a friend’s house in Beijing for a quarter of a year to learn Chinese.

He then took private lessons at a language school there. When he recounts these three months, during which politics was little more than a “time-consuming hobby” for him, he talks about his travels through a country of polarities. After his language course, he visited Inner Mongolia, where gigantic wind farms are being built on high plateaus. He has been to deserted ghost towns that were built so quickly that they are still completely uninhabited. He visited areas without sewage systems whose inhabitants had to clean their wells regularly.

All that was two legislative periods ago. Today, the 39-year-old is back in political Berlin. In the 2021 elections, he entered the Bundestag on rank fifth of the NRW state election list. In mid-December, he was elected parliamentary director of the FDP parliamentary group. He has been on leave from his actual job as head of the strategy department at the Federal Employment Agency since his party’s political comeback in 2017. However, Vogel, who is also Vice-Chairman of the German-Chinese parliamentary group, continues to keep an eye on China.

“You simply cannot not be interested in this country,” he explains. And it is precisely now, after the change of policy in Berlin, that mutual German-Chinese interest is shifting back into focus. What does the new federal government’s China policy look like? The FDP is considered to be a party that takes a particularly strict line on China – despite economic interests. Ratification of the EU-China investment agreement will “not take place at present.” That’s what the coalition agreement says. “Nor will it happen as long as China imposes sanctions on EU politicians,” Vogel adds. Among others, this applies to the German MEPs Reinhard Buetikofer (Greens) and Michael Gahler (CDU). Instead, the new German government wants to “clearly address China’s human rights violations.”

How does that fit in with an economic liberal party? The party stands for economic and social freedoms. Vogel, a political scientist, emphasized this in an interview with China.Table shortly before the federal elections. These are indivisible aspects – and core values, of the liberals. For a long time, the hope was that the liberalization of the Chinese economy would also lead to a more free society. Since Xi Jinping, we know that these hopes will remain unfulfilled. Vogel himself has experienced what this can mean: In Hong Kong, he says, he once spoke with free members of parliament who have since been imprisoned. In this systemic competition, Germany must not remain silent, he demands. But what does that mean by that?

Vogel advocates strengthening the exchange with other Asian players: Malaysia, Australia – and Hong Kong. “That’s the big lever,” he says, who has already been described as “the man behind and next to party leader Christian Lindner.”

Both grew up in the small town of Wermelskirchen in the German region Bergisches Land. After finishing school, Vogel completed his civilian service as a paramedic. He later studied political science, history, and international law in Bonn. Vogel still knows one of his new coalition partners from old times: In the meantime, he is involved with the Green Youth. There, he took offense at the way people talked about entrepreneurship. He has been a member of the FDP since 1999. A few years later, he became Federal Chairman of the Young Liberals. During this time, he led a delegation to China. Vogel later became Deputy Chairman of the German-Chinese parliamentary group, which maintains contact with the parliaments of the respective partner countries.

Vogel criticized the lack of a common EU strategy toward China. The current developments are more than worrying. The Chinese security apparatus is growing rapidly. Since Covid, digital surveillance in China has become widespread. Vogel believes it is unlikely that it will be scaled back again at some point after the pandemic ends. “Covid is a turning point.” Rather, he warns against becoming too dependent on China. And emphasizes that reciprocity is needed instead.

Will this also come to a mutual agreement between the coalition partners? Chancellor Olaf Scholz had assured Angela Merkel that nothing would change in the fundamental line of German-Chinese relations, the German business weekly Wirtschaftswoche reported. When it comes to China policy, the new parliamentary director could still face a conflict or two. Pauline Schinkels

Javid Qaem, Afghanistan’s ambassador to China, has resigned after not receiving a salary for the past six months. The Afghan embassy located at its key partner China is now down to one employee, Bloomberg reports. Qaem was part of the Islamic Republic’s government, which was overthrown by the Taliban.

Roland Palmer becomes Alibaba’s new General Manager for the UK, Netherlands, and Scandinavia. Palmer was previously head of Alipay Europe, Alibaba’s payment services provider. The Chinese e-commerce giant plans to expand even further into Europe with its online platforms Tmall, Small Global, AliExpress, and Alibaba.com.

The ceramic art exhibition “Jingdezhen International Ceramic Art Biennale” will open in Jingdezhen at the end of February. Some visitors were allowed to visit the exhibition rooms earlier. The exhibition displays 206 ceramic artworks from all over the world. Jingdezhen is considered China’s “porcelain capital”. As early as 1,000 years ago, Chinese rulers had their imperial ceramics made there.

This year will not be an easy one for the automotive industry either. Felix Lee spoke with automotive expert Stefan Bratzel about the challenges the sector is facing. In China, the competition from newcomers such as NIO and Xpeng is now stronger and more numerous than in Europe. Bratzel has identified various deficiencies among German suppliers: Their software is lagging behind, and they should show more flexibility in their supply chains during Covid times. In general, German manufacturers should question their high dependence on China, says the industry expert from the Center of Automotive Management. After all, trade disputes and human rights issues can quickly affect the German auto industry’s billion-dollar business.

Real estate in China has been a kind of turbo savings account for many people from the middle and upper classes. This is because home prices have grown year by year – at times by several percent. As our Beijing team finds in today’s analysis of the real estate market, this development could soon come to an end – thanks to the crisis at Evergrande and other real estate developers. But the very fact that a large share of private household savings is in real estate could slow down reforms in the sector. Beijing must tread carefully if it does not want to trigger more protests from savers.

It sounds like something out of a science fiction movie: drones delivering food. But in China, the little planes might be put into regular service as early as this year. At least, that’s what the food delivery company Meituan is planning, reports Frank Sieren. After all, China’s roads are so jammed that air delivery could save valuable minutes. In addition, Meituan faces regular criticism: Its drivers are not paid enough and have become modern-day slaves thanks to computer-controlled time pressure. Yet, Meituan made 27 million deliveries per day alone last year. This is one reason why drone delivery will remain a niche market for the time being.

Mr. Bratzel, the pandemic, chip shortages, supply bottlenecks – the German automotive industry really didn’t have an easy year in 2021. Will 2022 be better?

Stefan Bratzel: The industry is undergoing the greatest change in its history – and in addition to this transformation, there are now various crises. I expect the chip crisis to continue in 2022 and to remain a burden on the automotive industry. There will probably be a slight relaxation from spring onwards. However, the issue is likely to remain on the agenda throughout the year. The drama is playing out against the backdrop of major technological changes: electromobility, connectivity, autonomous driving. Chips are fundamental to all these issues.

How can the chip problem be solved?

Car manufacturers are trying to make their technology more flexible to be able to switch to different manufacturers. Above all, however, carmakers are contacting manufacturers directly to secure batches and influence manufacturers to expand capacity. But that takes a year or two until the factories are expanded accordingly. Moreover, not all chip manufacturers are willing to do this. For them, high capacity utilization is key. If it’s not over 70 or 80 percent, they’re no longer in the black and fear oversupply. So they don’t invest wildly in the future, because they will ruin their own business.

Wouldn’t it make sense for the German automotive industry to get more involved in chip development?

Yes, that is already partly the case. It has long been not just manufacturers like Apple that develop their own chips. Tesla is already heavily involved in development. I recently spoke with the head of development at Daimler. He confirmed that his company is also entering chip development and wants to do most of the software development in-house. So the realization that software has become more important in all areas is there. However, not everyone will be able to pull this off. Only manufacturers who have already gained a certain level of expertise in this area will be able to do so.

Which car companies are you referring to specifically?

I wouldn’t put it past manufacturers like Daimler or BMW. Volkswagen has also adopted software as a core strategy. But I’m a bit skeptical about whether VW will be able to do it so quickly. I’m more optimistic about BMW and Daimler.

But aren’t Daimler and BMW rather lagging behind in the development of e-mobility, while VW is considered progressive?

You have to take a differentiated approach to this. Volkswagen has indeed been focusing extensively on e-mobility since the diesel scandal. Daimler is lagging behind in comparison. In the meantime, however, Daimler is catching up. BMW played a pioneering role in electromobility for a while, then took a break, but is now making a strong comeback.

Not least because China quickly got the pandemic under control a year and a half ago, business was relatively good for German automakers. But with Omicron, things have flared up again there, and China’s leadership is radically imposing lockdowns on entire cities with a population of millions. What will that mean for the auto industry?

The impact on supply chains is difficult to calculate. It always depends on where an outbreak is happening. Of course, if it happens in a city or at a supplier that has to shut down overnight – and that can easily happen with China’s strict Corona policy – it quickly puts supply chains at risk. Meanwhile, it is known that China’s vaccine so far provides poor protection against the Omicron variant. So the risk of lockdowns of entire regions is definitely there. There is not much that can be done in the short term. In the medium term, companies should be more flexible in their supply chains. However, this is easier said than done in this plant-based industry in times of sharply increased fixed costs.

VW, with its more than two dozen plants in the People’s Republic, thus faces a major problem should the pandemic break out again in China.

Yes, because if you make 40 percent of your global sales in China, like Volkswagen, you have to keep a close eye on what’s happening there. Then there is the issue of electromobility, which I mentioned earlier. VW is still the leader in China when it comes to combustion engines, but not when it comes to EVs. The competition in this field is completely different. Chinese suppliers in the low-cost segment in particular are very strong in China. So far, VW has not been able to keep up. This already poses major challenges for Volkswagen’s new China boss, Ralf Brandstaetter.

Is the Chinese competition really that much better technology-wise?

Some Chinese newcomers such as NIO or Xpeng benefit from the greenfield approach, i.e. starting completely from scratch. They do not have to go through a cumbersome restructuring process. In addition, there are players like BYD, which have long included electromobility in their value chain. Then there is also, for example, the Wuling brand, a joint venture between GM and SAIC, which is very strong. And Tesla is also already well represented with its own plant in China. So there is a lot more competition for German automakers in China than there is in Europe at the moment.

The launch of its ID electric models did not go as hoped for VW. Shouldn’t VW be positioning itself differently in China, perhaps by cooperating with its Chinese competitors?

The basic strategy is the right one. With the modular electric-drive toolkit (MEB), VW has a strong platform. For China, VW started a bit late. As a result, Volkswagen is still not active in all segments. In particular, VW does not yet offer anything in the lower segment.

So far, German manufacturers in China have mainly scored in the high-priced segment. Perhaps they don’t want to cover the low-price segment at all.

This may be true for the premium suppliers Audi, Mercedes, and BMW. VW is not a low-cost manufacturer either, but it is active in broader segments. And VW must be careful not to lose market share in these areas. Particularly in software, German manufacturers are lagging behind Chinese competitors. For EVs, carmakers must also manage the battery sector well. Here, too, Chinese manufacturers, especially BYD – who originally only produced batteries – are clearly ahead.

In the meantime, Chinese EV manufacturers are also gaining ground in Europe. Several Chinese suppliers are planning to enter the market in 2022. How do you rate their chances of success?

Yes, Chinese automakers also want to be represented globally, incidentally with the backing of the Chinese government. However, it is also clear that it will not be easy for Chinese EV manufacturers to gain a foothold in Europe. They will have to appeal to European tastes. Past attempts have failed to do so. The wave that is coming now has greater chances. I firmly expect that some will be successful here. With Geely-Volvo, we already have a European manufacturer with a Chinese parent. The cars are selling well as a result.

At the same time, political tensions are also growing between China and the new German government. To what extent will this development affect the automotive business?

This is not a sudden new development. China’s geopolitical ambitions have been a threat for several years – for the car business as well. Of course, China is also dependent on Europe. But China wants to become a global power, and the auto industry is a bargaining chip. And if political conflicts escalate, this can lead to major trade disruptions that also massively affect the auto industry. This vulnerability is a major problem.

German automakers have also created hundreds of thousands of jobs in China. Isn’t the dependence mutual?

When it comes down to it, national pride and political ambitions will prevail, despite Germany’s long-standing commitment.

What can the automotive industry do?

That will be really difficult for German carmakers. We have already seen that with Volkswagen and the Uyghurs: If the Chinese government wants something, carmakers have to react. I think the German government should also get more involved in such issues in the future. Companies can no longer negotiate this on their own. At the same time, automakers should balance their market position more and not focus too much on a single market. They should question their high dependence on China.

Stefan Bratzel is Director of the Center of Automotive Management at the University of Applied Sciences (FHDW) in Bergisch Gladbach, Germany. His research is particularly focused on the conditions for the success and survival of car manufacturers.

The US rating agency Fitch has published a gloomy outlook for China’s real estate market. In their latest report on the global housing market, experts warn that the People’s Republic of China, of all places, could be one of the few countries in the world where real estate prices will not continue to rise and could drop sharply instead.

Fitch predicts that Chinese home prices are likely to fall three to five percent both this year and next, largely due to the continued difficulties of China’s major real estate developers. The agency predicts that more developers will default on their loans, leading to a loss of trust among homebuyers. “While we expect the authorities to intervene to contain market volatility, downside risks are substantial,” Fitch writes.

When it comes to the question of what the future may hold for China’s real estate developers, the fate of Evergrande will play a major role. The real estate giant, which is currently experiencing payment difficulties, is still trying everything in its power to survive somehow. At least the group is trying to give the impression that it is working at full speed to find a solution for its creditors.

After having already sold company aircraft, the Group has now also parted with its headquarters in the southern Chinese metropolis of Shenzhen. Employees of the sleek high-rise building in the Nanshan district already moved out a little over a month ago. On Monday, construction workers stripped the company logo from the roof. Future business will once again be run from the neighboring city of Guangzhou, where Evergrande was first founded.

But the sale of silverware and the downsizing of its own office space have little impact on the group’s almost hopeless situation. Through its rapid expansion, Evergrande has accumulated a debt of more than €260 billion. At least that’s what the books say. But beyond that, there are said to be more liabilities of $150 billion.

Evergrande wants to gain some breathing room by negotiating with its creditors. Last week, the company announced a plan to postpone interest payments that are due soon by six months until the summer. Smaller competitors such as Kaisa and the Aoyuan Group are also trying to cheat the hangman.

In the end, however, it will depend less on their own negotiating skills and more on Beijing’s plans. After all, China’s real estate developers are mainly in a bind because the government suddenly tightened its grip on the entire industry last year for fear of a debt bubble. Beijing wants to reduce debt and take stronger action against speculation with apartments.

For this very purpose, “three red lines” have been drawn: The liability to asset ratio must not exceed 70 percent. The net gearing ratio must also not exceed 100 percent. The third red line concerns the cash to short-term debt ratio of companies, which cannot be lower than factor one. Although the government has made it clear that Evergrande will be made an example of, a complete bailout remains unlikely. But the deployment of a team of experts to the Group also shows that a collapse is also out of the question.

Beijing knows: The real estate sector accounts for more than a quarter of China’s economic growth. 70 percent of Chinese household assets are in real estate, which is why a crash would cause widespread anger among the population. Therefore, the government seems to have decided that, while reforms are still necessary, they don’t necessarily have to be done with brutal force. That seemingly applies to the three red lines as well. As state media reported on Friday, Beijing plans to alleviate them to some extent.

According to observers, relaxed regulations could cause remaining and relatively healthy developers to be more willing to take over construction projects from crisis groups such as Evergrande and take on more debt in the process. In the best-case scenario, the market could be reorganized through mergers and acquisitions without major upheavals. If this scenario materializes, a major price collapse in China’s housing market in 2022 could likely be averted. Gregor Koppenburg/Jörn Petring

Meituan plans to use drones for food delivery as early as this year. This would make the Beijing-based company the first company ever to utilize this type of contactless air delivery in everyday operations. This service has already entered the test phase in Shenzhen, southern China, reports the South China Morning Post (SCMP). There, a fleet of drones now delivers meals within a three-kilometer radius around Longgang COCO Park, a shopping and office complex located in the east of the city.

Meituan’s drivers first bring the food to the drone station. There, the packages are loaded onto the flying machines. These then airlift the delivery to a designated landing site, which resembles a vending machine. Customers can then pick up their orders after entering a pin code. The company is currently awaiting regulatory approval to expand the service, Mao Yinian, head of the drone division at Meituan, told SCMP.

The tech metropolis is considered an ideal location for low-altitude logistical flight projects. With Beijing’s permission, the local government can set up exceptionally liberal regulations to promote the technology of the future. Drone movements are monitored by the Chinese aviation authorities. The police and the Ministry of Industry and Information Technology (MIIT) oversee their safety.

Meituan’s drones weigh around four kilograms and can carry a load of up to three kilograms. This is also for regulatory reasons: Authorities currently limit the total weight of such delivery drones to seven kilograms. If everything works out, however, this limit could be raised, Meituan believes.

China’s market for food and goods delivery is booming, with industry experts predicting that it could already reach 93 billion orders per year in 2025. Meituan is China’s largest food delivery service. In 2020, the company had a market share of 68.5 percent. Investors consider Meituan’s business model to be compelling. In April last year, Meituan raised almost $10 billion in a securities offering, which is to flow primarily into delivery technology with drones and self-driving cars.

What’s particularly impressive is that the delivery service announced to be developing 90 percent of its drone components in-house. This proves how important this field is. Nevertheless, drone manager Mao expects drones to be used in limited areas for the time being. He assumes that drones will only be able to cover ten percent of logistics demand in the next ten years. However, based on forecasts for 2025, that would be over nine billion flights throughout China.

Despite the use of flying robots, staff shortages remain a factor. “We still have a shortage of drivers, especially at peak times like lunchtime.” However, even drone delivery still requires human assistance, for the time being, Mao said. “It will mainly be a supplement to our driver network.” In the long term, Meituan envisions “a collaborative, integrated network where our drones and delivery riders can work seamlessly together to deliver orders.” In 2020, Meituan employed about three million drivers who delivered an average of more than 27 million food orders per day.

Meituan’s competitors are also planning to use drones for delivery purposes as soon as possible. E-commerce company JD.com and logistics giant SF Holdings stated last year that they had completed China’s first unmanned cargo flight. The payload of their drone is said to have been 1.5 tons.

The World Economic Forum even proclaimed the “golden age of drone delivery” back in July 2020. The Osnabrueck-based freight forwarding company Hellmann, for example, is also planning to make deliveries in Europe via drone this year.

Meanwhile, Deutsche Post subsidiary DHL has discontinued its “Paketkopter” drone development project. Although “important insights” were gained in various use cases, regular operation of delivery drones is subsequently “not planned in Germany for the time being”. Apparently, both the cost of the service and the technical and bureaucratic hurdles are too high.

Amazon is also apparently only pursuing its “Prime-Air” drone project on the back burner. “We recently made organizational changes in our Prime Air business,” the company stated. What happens next is an open question. The Chinese seem to have the longer breath here. And the greater pressure to act, given the food delivery boom.

Sinolytics is a European consulting and analysis company focused entirely on China. It advises European companies on their strategic orientation and concrete business activities in China.

The Volkswagen Group sold 14 percent fewer cars in China in 2021 than in the same period of the year before. The group thus suffered heavy losses in its most important single market. VW China CEO Stephan Woellenstein cited a lack of chips and problems in supply chains as the reasons. “The production has lost 600,000 cars,” Woellenstein complained. “2021 was one of the most difficult years in our history in China.” The high-volume Škoda and Volkswagen brands, in particular, have seen significantly lower sales. Audi also sold 3.6 percent fewer cars. In contrast, the premium brands Porsche (up by eight percent) and Bentley (up by 43 percent) were able to expand their sales.

The Volkswagen Group’s market share, which had long been 14 or 15 percent in the People’s Republic, shrunk to 11.7 percent. Despite this, the Volkswagen brand remained the number one brand among Chinese customers, with a total of 3.3 million cars shipped, of which 2.4 million were of the core Volkswagen brand.

From the Group’s point of view, EV sales have also been disappointing. VW sold 70,625 battery-powered vehicles in China last year. Volkswagen thus fell well short of the projected target. The company aimed to sell between 80,000 and 100,000 models. The market launch of the new ID family apparently did not convince many Chinese customers. Woellenstein expressed confidence that 2022 will be a better year for the Group. He expects a 15 percent increase. Volkswagen is even aiming to double its EV sales. An important prerequisite for this, however, is the supply of chips. flee

China’s strict no-covid policy could soon affect the port in Shenzhen. As Bloomberg reports, 31 ships are already waiting outside the world’s fourth-largest port. Recently, eight new covid infections have occurred in Shenzhen. One of the infected is a port worker. Authorities suspect the Covid cases were transmitted through imported goods. They responded with mass testing of citizens and port workers. There are fears that the mass tests could restrict the processing of goods to and from the port, Bloomberg reported.

Back in May last year, Shenzhen Port’s Yantian Terminal was partially closed due to Covid cases among workers. This caused containerized goods to pile up for a month. Last week, there was also a restriction on truck traffic in some parts of the eastern province of Zhejiang to contain the Coronavirus. As a result, goods traffic to the Ningbo terminal was also delayed. However, 75 percent of traffic has since been restored, according to Bloomberg. The Ningbo terminal also experienced long delays last August due to local Covid outbreaks (China.Table reported).

In recent days, the first Omicron cases have been registered in China. The People’s Republic responded to these infections and other infections with the Delta variant with far-reaching measures. Yesterday, a lockdown was imposed on Anyang, a city of 5.5 million, after two Covid infections were confirmed there, AP reports. It is the third lockdown of a Chinese city of millions within a short time. According to the report, a total of 20 million Chinese citizens are currently no longer allowed to leave their homes. The port city of Tianjin with 14 million residents near Beijing has been placed under partial lockdown since Monday. nib

Canada and Taiwan want to begin talks on an international investment agreement, as Business representatives from Taipei and Ottawa agreed on at a virtual summit on Monday. These “exploratory discussions” are an important milestone in strengthening mutual economic and trade relations, according to a press release from the Canadian government.

An investment protection agreement is considered a precursor to a free trade treaty. The island state wants to become less dependent on the People’s Republic through new trade agreements. Although Taiwan is a member of the World Trade Organization, it has so far only been able to sign free trade pacts with Singapore and New Zealand. Taiwan is Canada’s sixth-largest trading partner in Asia. At the same time, Canada does not maintain diplomatic relations with Taipei in deference to Beijing’s one-China policy.

According to a statement on Monday, Canada’s Minister of International Trade Mary Ng highlighters Taiwan as “a key trade and investment partner as Canada broadens its trade links and deepens its economic partnerships in the Indo-Pacific region.” Wang Wenbin, the spokesman for the Chinese Foreign Ministry, criticized the meeting: “The Canadian side should respect the one-China principle and handle relevant issues prudently.” fpe

The acquisition of the Munich-based semiconductor group Siltronic by its Taiwanese competitor Globalwafers is as good as a done deal. This is reported by the German newspaper FAZ with reference to an interview with Doris Hsu, CEO of Globalwafers. According to Hsu, the sale is still subject to approval by the Chinese State Administration for Market Regulation (SAMR). However, this would only be “a technical procedure,” Hsu said. The German Federal Ministry of Economics and Technology also still has to give its final approval. The Federal Cartel Office had already approved the transaction at the beginning of 2021.

The €4.4 billion acquisition would make Globalwafers the world’s second-largest producer and supplier of silicon wafers after Japan’s Shin Etsu Group. Market observers believe the German government is deliberately delaying approval. Europe and Germany are scrambling to build their own semiconductor industries. Hsu told FAZ that the new German government’s goal is to make Europe a chip manufacturing powerhouse. “But the headquarters of Globalwafers is in Taiwan. This would not make us a European company,” Hsu said regarding such concerns.

If the takeover were to fall through, Globalwafers could theoretically make a second attempt, writes Handelsblatt. However, the Taiwanese would then have to dig deeper into their pockets than in their initial offer last year. Since the Covid pandemic, the chip industry has experienced a boom. The shares of Siltronic have also risen significantly. fpe

It was actually a defeat that brought Johannes Vogel to China. The FDP politician had just lost his job as a member of the German Bundestag. The party had failed miserably in the 2013 federal elections. The Liberals plummeted from 14.6 percent to 4.8 percent. Vogel says he witnessed how a party can crash down. And what did he do? He left for a while. After the election fiasco, he decided to move to a friend’s house in Beijing for a quarter of a year to learn Chinese.

He then took private lessons at a language school there. When he recounts these three months, during which politics was little more than a “time-consuming hobby” for him, he talks about his travels through a country of polarities. After his language course, he visited Inner Mongolia, where gigantic wind farms are being built on high plateaus. He has been to deserted ghost towns that were built so quickly that they are still completely uninhabited. He visited areas without sewage systems whose inhabitants had to clean their wells regularly.

All that was two legislative periods ago. Today, the 39-year-old is back in political Berlin. In the 2021 elections, he entered the Bundestag on rank fifth of the NRW state election list. In mid-December, he was elected parliamentary director of the FDP parliamentary group. He has been on leave from his actual job as head of the strategy department at the Federal Employment Agency since his party’s political comeback in 2017. However, Vogel, who is also Vice-Chairman of the German-Chinese parliamentary group, continues to keep an eye on China.

“You simply cannot not be interested in this country,” he explains. And it is precisely now, after the change of policy in Berlin, that mutual German-Chinese interest is shifting back into focus. What does the new federal government’s China policy look like? The FDP is considered to be a party that takes a particularly strict line on China – despite economic interests. Ratification of the EU-China investment agreement will “not take place at present.” That’s what the coalition agreement says. “Nor will it happen as long as China imposes sanctions on EU politicians,” Vogel adds. Among others, this applies to the German MEPs Reinhard Buetikofer (Greens) and Michael Gahler (CDU). Instead, the new German government wants to “clearly address China’s human rights violations.”

How does that fit in with an economic liberal party? The party stands for economic and social freedoms. Vogel, a political scientist, emphasized this in an interview with China.Table shortly before the federal elections. These are indivisible aspects – and core values, of the liberals. For a long time, the hope was that the liberalization of the Chinese economy would also lead to a more free society. Since Xi Jinping, we know that these hopes will remain unfulfilled. Vogel himself has experienced what this can mean: In Hong Kong, he says, he once spoke with free members of parliament who have since been imprisoned. In this systemic competition, Germany must not remain silent, he demands. But what does that mean by that?

Vogel advocates strengthening the exchange with other Asian players: Malaysia, Australia – and Hong Kong. “That’s the big lever,” he says, who has already been described as “the man behind and next to party leader Christian Lindner.”

Both grew up in the small town of Wermelskirchen in the German region Bergisches Land. After finishing school, Vogel completed his civilian service as a paramedic. He later studied political science, history, and international law in Bonn. Vogel still knows one of his new coalition partners from old times: In the meantime, he is involved with the Green Youth. There, he took offense at the way people talked about entrepreneurship. He has been a member of the FDP since 1999. A few years later, he became Federal Chairman of the Young Liberals. During this time, he led a delegation to China. Vogel later became Deputy Chairman of the German-Chinese parliamentary group, which maintains contact with the parliaments of the respective partner countries.

Vogel criticized the lack of a common EU strategy toward China. The current developments are more than worrying. The Chinese security apparatus is growing rapidly. Since Covid, digital surveillance in China has become widespread. Vogel believes it is unlikely that it will be scaled back again at some point after the pandemic ends. “Covid is a turning point.” Rather, he warns against becoming too dependent on China. And emphasizes that reciprocity is needed instead.

Will this also come to a mutual agreement between the coalition partners? Chancellor Olaf Scholz had assured Angela Merkel that nothing would change in the fundamental line of German-Chinese relations, the German business weekly Wirtschaftswoche reported. When it comes to China policy, the new parliamentary director could still face a conflict or two. Pauline Schinkels

Javid Qaem, Afghanistan’s ambassador to China, has resigned after not receiving a salary for the past six months. The Afghan embassy located at its key partner China is now down to one employee, Bloomberg reports. Qaem was part of the Islamic Republic’s government, which was overthrown by the Taliban.

Roland Palmer becomes Alibaba’s new General Manager for the UK, Netherlands, and Scandinavia. Palmer was previously head of Alipay Europe, Alibaba’s payment services provider. The Chinese e-commerce giant plans to expand even further into Europe with its online platforms Tmall, Small Global, AliExpress, and Alibaba.com.

The ceramic art exhibition “Jingdezhen International Ceramic Art Biennale” will open in Jingdezhen at the end of February. Some visitors were allowed to visit the exhibition rooms earlier. The exhibition displays 206 ceramic artworks from all over the world. Jingdezhen is considered China’s “porcelain capital”. As early as 1,000 years ago, Chinese rulers had their imperial ceramics made there.