In our Wednesday issue, we reported on China’s waning interest in investing in Europe. In particular, spending on company acquisitions is declining. Acquisitions of German companies by Chinese investors have frequently come under fire in the past. Now Berlin has refused the buyout of Heyer Medical AG by Aeonmed Group from Beijing – the deal, however, is already three years old and has practically already been completed in the meantime. Finn Mayer-Kuckuk looks for us at the already existing relations between the two companies.

A traditional German brand died its second death in China at the beginning of April. Beijing Borgward filed for bankruptcy in Beijing on April 8. Borgward was once one of the most famous car manufacturers in Germany. There, however, the inventor of legendary models such as the “Isabella” already went bankrupt in 1961. In China, truck manufacturer Beiqi Foton wanted to breathe new life into the Bremen car brand. But Foton’s distribution subsidiary Borgward China, founded in 2016, never made any money at all, writes Felix Lee in his analysis. In China, the brand lacked its nostalgic factor. The “dreams of the car phoenix from the ashes,” as a German newspaper once headlined, remained unfulfilled.

There are some numbers that are beyond anyone’s imagination. China’s steel production is one of them. The People’s Republic produces over one billion tons of crude steel annually. That is the weight of over six million blue whales. But can you imagine so many animals? China’s steel sector is one of the country’s biggest climate polluters. To cut emissions, more scrap metal is to be recycled, Ning Wang reports. Scrap metal that used to end up in landfills now becomes an important raw material.

The German government has retroactively barred an acquisition that had already been closed: Beijing-based Aeonmed Medical was not allowed to buy Heyer Medical. “This acquisition is prohibited for reasons of public order and safety,” a spokesman for the German Federal Ministry of Economics and Climate Protection (BMWK) told China.Table. The reason: Heyer Medical manufactures respiratory equipment. “During the COVID-19 pandemic, it became apparent that Germany needs to maintain its own manufacturing and production capacities to be able to supply itself with ventilators independently of non-European manufacturers,” the ministry said.

However, the German government has taken several years to reach this decision. This now poses significant problems for the companies. The two companies are already highly integrated. The new Chinese parent company advertises German quality and proudly presents a picture of the site in Bad Ems on its homepage. Heyer, in turn, received strong help from China in 2020 when the pandemic crippled production. The Beijing parent company unbureaucratically supplied the Germans with safety equipment. In the meantime, the company switched to selling equipment from Aeonmed in Germany.

But much more importantly, the Chinese parent was about to invest around a million euros to set up a customer service department based at Heyer, as Germany’s Westerwaelder Zeitung reported in October 2020. Twelve new employees were to be hired for this project. The two companies will probably have to cancel all these projects now. At Heyer Medical in Bad Ems, only an answering machine picked up on Wednesday, so a statement from the company is pending. German newspaper Handelsblatt first reported on the decision by the federal government.

By a sad twist of fate, Heyer Medical does manufacture one of the most sought-after products in the pandemic. But the company had already run out of money in 2018. Bankruptcy loomed to put an end to a 135-year company history. It was then that the investor from China came as a savior. Ventilators were considered a niche product at the time. The two companies seemed to be a perfect match.

Aeonmed (北京谊安医疗系统) manufactures a wide range of hospital equipment in Beijing. Devices for anesthesia, operating tables, surgical lamps, infusion pumps, computer technology – and said respirators and oxygen equipment. Most recently, mobile equipment of the kind needed for improvised hospitals has been introduced.

The plans of its Chinese owners were considered ambitious and fair. They wanted to relocate production from Beijing to Germany and continue to develop the new site. “Aeonmed is 100 percent committed to Bad Ems, to the long history of the company,” Managing Director Oliver Krell told a local newspaper at the time. The firm will to lead Heyer back to its former glory was “present and visible.” There was even a “Heyer hall” in the canteen at the Beijing headquarters.

But now foreign trade law is interfering with the German-Chinese partnership. The German government has the right to prevent the acquisition of a German company by a foreign investor. “In this particular case, an examination has led to the assessment that such risks to public safety and order, specifically health protection, in this case, are present,” the ministry spokesman said. The cabinet, that is, the round of federal ministers, has now decided accordingly.

Heyer is indeed a global brand in the industry. But before the acquisition, the company seemed old-fashioned and poorly managed. The first thing Aeonmed had to do was plug financial holes and clean up its product range. The Beijing-based company was founded in 2001. However, it grew fast with the rapid development of Chinese healthcare. Today, its customers include 800 hospitals in China. It was already active on the international stage before the Heyer takeover and also sold its products in South Asia and Latin America.

“Dreams of the car phoenix from the ashes,” was the headline of a German newspaper. In 2015, the Weser-Kurier in Bremen also spoke of a “dream of a lifetime”. “Traditional German brand awakens romantic feelings,” was also the headline in China’s official Xinhua news agency. The talk was about the legendary German car brand Borgward.

This dream is now over. As the Chinese news portal Gasgoo reports, Beijing Borgward filed for bankruptcy in Beijing on April 8. The carmaker has been making losses since it was founded, according to the report. Most recently, the company was no longer able to pay its debts.

Christian Borgward wanted to breathe new life into the legendary car brand by selling the brand to Chinese truck manufacturer Beiqi Foton. He is the grandson of founder Carl F. W. Borgward, who gained cult status in the 1950s with the luxury car Isabella, and held the trademark rights. He sold them to Beiqi Foton in 2014 for an estimated €5 million.

Germany had high hopes for this investment. Foton wanted to build the brand’s new European headquarters in Stuttgart. Bremen, the former headquarters of this noble brand, was to get a new production facility. The plan was to produce up to 10,000 Borgward vehicles per year in the Hanseatic city, which would be purely electric. Bremerhaven was favored as the location, where a factory was to be built on an area of 10,000 square meters. The plan was to import assembled vehicle parts from China. The vehicles would then only be assembled at the plant.

Borgward used to be one of the most famous car manufacturers in Germany and went bankrupt in 1961. Until the early 1960s, up to 100,000 Borgward models rolled off production lines each year at what is now the Daimler plant in Bremen-Sebaldsbrueck.

The plant in the northern German city-state was never built. Foton already ran into financial difficulties in 2018 and put its stake in the brand up for sale. In Germany, Borgward shipped “a few units of a BX7 limited model,” according to industry portal kfz-betrieb.vogel. The planned “Brand Experience Center” in Stuttgart opened, but ceased operations only a short time later. In 2019, Chinese car service provider Ucar took over the brand. But business was no better under the new owner (China.Table reported). In the same year, the cars were pulled from the European market, and sales in China were also poor. Then came the de facto end last summer. Chinese media speculated that the electronics group Xiaomi might at least take over parts of Borgward. But these reports were false. With the bankruptcy, the end of the traditional brand is now officially sealed.

In fact, at no point did Foton even begin to make money with its distribution company Borgward China, which was founded in 2016. Borgward developed four models, all SUVs, some with electric drives. The last model, the BX3, was launched on the Chinese market in January 2020. But Foton sold just around 165,000 vehicles by 2021. The Miyun plant, which was built specifically for production and is located around 60 kilometers northeast of Beijing, was designed to manufacture 360,000 vehicles.

Even as the plans were unveiled in 2016, Chang Zhangyi, then Vice-Chairman of China’s Automobile Association (CAAM), had warned against such an investment. “The brand has been dead for too long and is too unknown in China to find many buyers,” he said in an interview. At the time, he already pointed to acquisitions of other foreign car brands by Chinese companies and their limited success. Swedish automaker Saab is one example. The brand was also acquired by Chinese investors in 2012. But by 2014, they had to stop production again. Today, the rights belong to the bankruptcy estate of the Evergrande real estate group.

Experts have been aware of this for a long time: The world’s landfills are considered raw material deposits of the future. Experts are already talking about urban mining to recover important raw materials. Waste, like aluminum, steel, plastic and wood, has become an important raw material that is in high demand.

For the steel sector, in particular, scrap is vital to create a “greener” steel production. To cut the steel sector’s CO2 emissions, more and more manufacturers rely on more sustainable production processes. For example, the electric arc furnace only recycles steel scrap. This produces around 80 percent less CO2 than conventional production methods. Steel produced in this way is regarded as “green steel”. China also increasingly relies on recycling. Analysts at S&P Global predict that the share of scrap in Chinese steel production will increase to 15 to 20 percent by 2025.

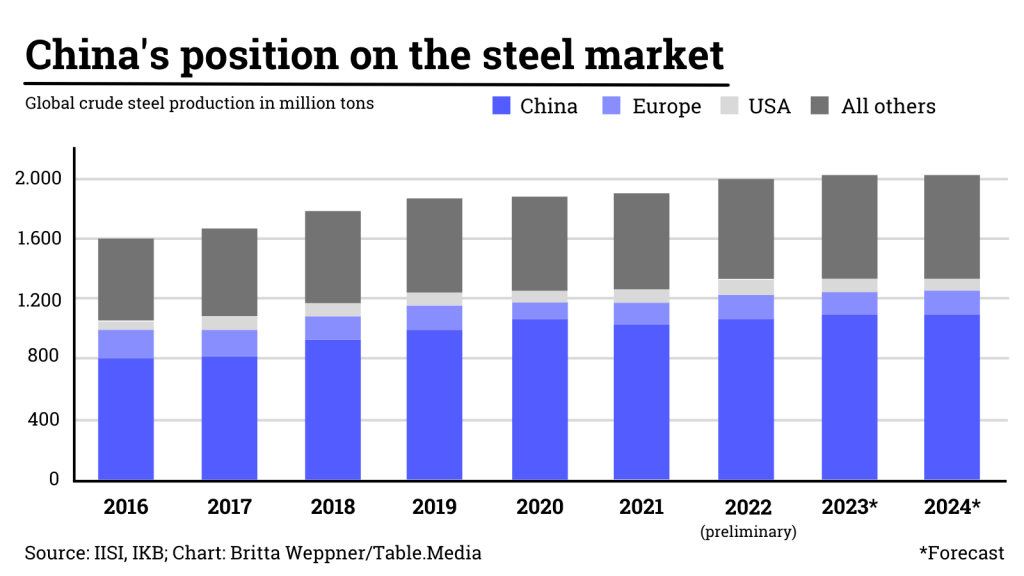

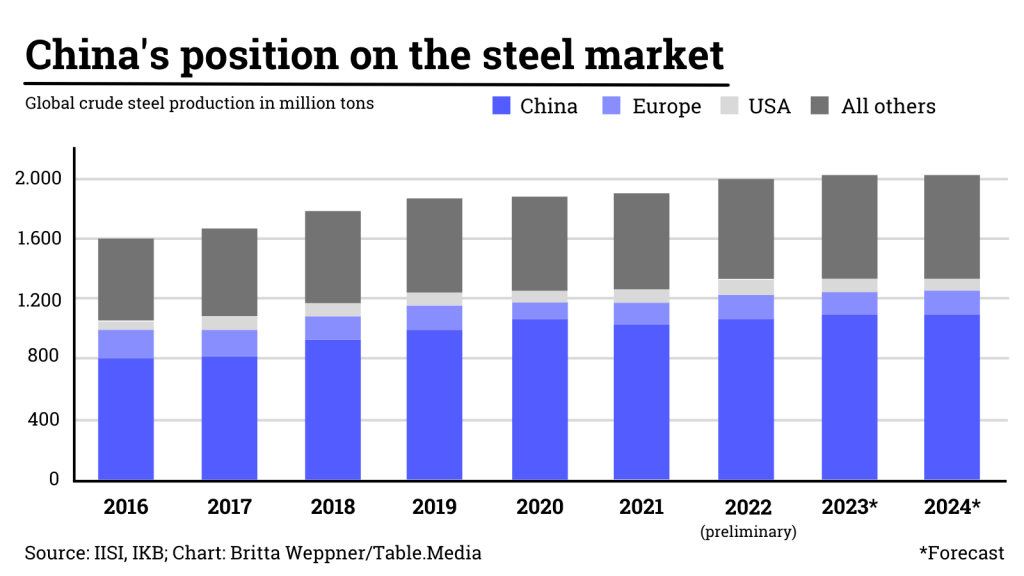

The People’s Republic produces more than half of the world’s steel, which puts it in a dominant position on the global market. IKB Deutsche Industriebank calculates that global crude steel production rose to a record of over 1.9 billion tons last year. China accounted for over 1 billion tons.

“We expect scrap prices to increase as many steel mills in China are being upgraded to reduce emissions and energy consumption in the sector,” Dr. Heinz-Juergen Buechner, Director at IKB for Industrials & Automotive, told China.Table.

But over 90 percent of Chinese steel mills still use conventional blast furnaces for production, making them one of the biggest emitters of CO2. The sector is responsible for around 15 percent of China’s CO2 emissions. China Baowu, the world’s largest steel producer, emitted more carbon dioxide into the atmosphere in 2020 than the whole of Pakistan, according to Bloomberg calculations.

But this is supposed to stop soon. The steel industry has pledged to cut emissions by 30 percent from their peak by the end of the decade. Old plants are to be replaced by newer and “cleaner” ones.

Heinz-Juergen Buechner of Deutsche Industriebank expects that “in ten years at the latest, but probably sooner, up to 20 percent of Chinese steel production will be produced in electric arc furnaces.” He also considers retrofitting a viable way to cope with the country’s rising scrap volume. In the future, more cars will have to be scrapped. If old cars are recycled in steel production, “two birds would be killed with one stone,” says Buechner.

To achieve carbon neutrality by 2060, Beijing digs even deeper into its toolbox. Last year, steel production was cut back significantly to curb climate-damaging emissions. But due to the economic downturn, goals have recently been watered down again (China.Table reported).

It was only on Saturday that Chen Kelong, spokesman for the Ministry of Industry and Information Technology (MIIT), said the government will do everything in its power to maintain reasonable prices for steel. The aim is to ensure that manufacturers along the entire value chain remain profitable.

Chen’s statement was preceded by a slump in global iron ore prices on Monday. In Singapore, futures contracts for this vital steel raw material fell as much as 12 percent at one point as concerns grew about Chinese demand, Bloomberg reported. On the same day, the most-traded iron ore futures contract on China’s Dalian Commodity Exchange for September shipment slumped by 10 percent, business magazine Caixin reported.

If steel mills use scrap instead of iron ore and coke, each ton of steel will save 1.67 metric tons of CO2 emissions, according to a study by the Fraunhofer Institute. These reductions would be equivalent to the average annual emissions emitted by a commuter driving 40 kilometers a day by car.

“China is moving in the direction of use of higher percentages of scrap and is reducing the percentage of steel made from iron ore,” Schott Newell of Newell Recycling Equipment, USA/China said at an industry webinar last year. “A few years ago, there was concern that China might become a huge scrap exporting country, with the effect that it would hurt scrap prices around the world. The opposite is what is happening. China will need to import scrap rather than iron ore and coal in order to reach the goals of a cleaner environment and more cost-effective steel production,” reports trade journal EU Recycling + Environmental Technology.

Europe will also see a further increase in demand for scrap. According to industry association Eurofer, 42 percent of all steel produced in Europe already comes from electric furnaces. Globally, a quarter of steel is produced in this way. With demand from China and other Asian countries, scrap will now become a valuable raw material in the fight against climate change.

Chinese drone manufacturer DJI has announced the temporary suspension of all business operations in Russia and Ukraine. “DJI is internally reassessing compliance requirements in various jurisdictions,” the global leader said in a statement. As a result, business in the two countries will be temporarily suspended. The company did not cite the sanctions against Russia. DJI is the first Chinese tech company to publicly temporarily suspend its business with Russia.

Last month, Ukraine heavily criticized the Shenzhen-based company. It accused DJI of allowing Russian forces to use its technology in military operations, even against civilians. “Are you sure you want to be a partner in these murders?” wrote Ukrainian Deputy Prime Minister Mychaylo Fedorov on Twitter directly to DJI. “Block your products that are helping Russia to kill the Ukrainians!”

Ukrainian criticism centered on DJI’s AeroScope system. This allows users to detect and monitor drones in the vicinity. It is marketed as a tool to protect sensitive facilities such as airports and prisons. The company denies that it has allowed Russia to use its products for military purposes.

According to a Forbes Russia report earlier this month, Chinese telecommunications giant Huawei was also preparing to pull out of Russia. Employees on the ground have been granted leave and new contracts with operators have been suspended, the report said. Huawei did not yet confirm this. ari

New Covid infections in Shanghai have fallen to their lowest level in three weeks. As of Wednesday, there were just over 13,500 positive tests and 48 deaths, according to local authorities. In Beijing, the number of newly identified cases was 46, Bloomberg reports. According to the report, a representative of the Shanghai Municipal Health Commission announced that certain groups of people could be granted limited freedom of movement in districts where the virus no longer spreads. However, an exact schedule for these relaxations was not given. In the meantime, the majority of Shanghai residents remain confined to their homes.

Meanwhile, Beijing has tested nearly 20 million citizens in an effort to prevent a widespread outbreak like the one in Shanghai. On Thursday, 16 million people are to be tested again, Reuters reports. Mass testing involves testing multiple samples together in a single tube for speed and efficiency.

Yiwu, a city of 1.9 million people, went into a lockdown on Wednesday. Other cities, such as Changchun and Jilin, are expected to ease quarantine measures from Thursday. Covid restrictions affected 57 of China’s 100 largest cities last week, according to research by Gavekal Dragonomics. Industry associations say most factories are struggling to resume work as employees stay at home, trucks idle in parking lots and orders from suppliers facing the same situation are not being fulfilled, Reuters reports. nib

Spending on infrastructure is expected to boost growth in China. This was revealed at a meeting of the Central Committee for Financial and Economic Affairs. President Xi Jinping had stressed at the meeting that the People’s Republic must make every effort to boost infrastructure spending, Bloomberg reports. Xi had reportedly urged local authorities to improve the construction and efficiency of infrastructure networks in sectors such as transportation, energy and water conservancy. Investment is also expected to flow into regional airports, urban rail systems and oil and gas pipelines.

At a meeting of the State Council, additional measures to strengthen growth were decided. Tax cuts are to support companies that have been particularly hard hit by the pandemic, as business portal Caixin reports. Unemployment insurance tax is also to be cut.

China had already relied on infrastructure construction in the past to boost growth in times of crisis. The construction of roads, railroads or real estate boosts domestic demand for construction materials such as concrete and steel, but also for labor. In January, the People’s Republic released a Five-Year Plan for the development of a modern transportation system. The plan envisages the construction of tens of thousands of kilometers of roads and train lines (China.Table reported). nib

The first human infection with the H3N8 bird flu virus has been detected in China. This was announced by health authorities. However, large-scale transmission among humans is not expected. According to AFP, the National Health Commission of China stated that the risk was low. The infection was found in a four-year-old boy from Henan province. He had been hospitalized with fever and other symptoms in early April. Authorities called the case a “one-time transmission”. Bird flu mainly occurs in wild birds. Human-to-human transmissions are extremely rare. nib

According to a media report, the USA is investigating whether the Chinese chip manufacturer Yangtze Memory Technologies (YMTC) has violated US export controls. The background is said to be a supply of semiconductors for a new smartphone to Huawei, as the Financial Times reported, citing sources in the US Department of Commerce. The ministry and the White House have received a “credible” report on the matter: YMTC allegedly supplied Huawei with chips for the Enjoy 20e smartphone and thereby violated the so-called Foreign Direct Product Rule.

The US law stipulates that products containing US technology and software are also subject to US regulatory oversight outside the US. YMTC would therefore require a license to provide semiconductors to Huawei because it also contains US technology. According to the report, US authorities must now prove that YMTC’s semiconductors went to Huawei. Several US politicians called for YMTC to be placed on a Commerce Department trade restriction list. Huawei is already on this Entity List. ari

The mysterious case of the missing Tibetan teacher Rinchen Kyi has apparently found a happy ending. The mother of a 13-year-old daughter has been escorted back home by police officers on Sunday evening. Kyi had been taken to a hospital against her will by police on August 1 last year and disappeared for eight months just two days later.

She was accused of inciting separatism. But to this day, Chinese authorities have not explained to the family how exactly Rinchen Kyi broke the law, nor have they provided any information about the woman’s whereabouts or state of health.

As early as mid-February, the UN Special Rapporteurs of the Commission on Human Rights submitted a request to the Chinese embassy in Geneva seeking clarification on Kyi’s case, among others. It took six weeks before the Special Rapporteurs’ letter was finally allowed to be made public last week, according to the statutes. Kyi returned home just a few days later.

What is relatively certain is that her disappearance was linked to the closing of a middle school in the administrative district of Darlak in the province of Qinghai, as the human rights organization Tibet Watch found out. The private institution, once founded to give children of impoverished families and orphans access to formal education, had been ordered by authorities a few weeks earlier to stop teaching after more than 22 years. There was no conclusive explanation for this at the time. At that time, there was no plausible reason for the decision. The school had all necessary documents and “that it has abided by the constitution of the People’s Republic of China”.

Anonymous local sources who are in contact with Tibet Watch suspect political reasons behind the school’s closure. Over the years, the school had apparently earned a top reputation among Tibetan farmers and nomads. Initially opened as an elementary school, it had been allowed to operate as a middle school since 2008. Lessons were primarily taught in Tibetan. Authorities were aware and tolerated cultural-religious elements in education. Former students reportedly obtained jobs in the administration, became entrepreneurs or Buddhist monks or nuns.

Apparently, it was a thorn in the side of authorities that monks were trained in the school. This would have to take place in monasteries, the school administration had been told. Especially since the Chinese authorities have drastically increased their control over Buddhist monasteries since the unrest in Tibet in 2008. CCTV cameras and police stations in the immediate vicinity of the monasteries are intended to nip any flare-up of new resistance in the bud.

However, the school administrators were not given an explanation as to why the middle school had to close completely. According to the family of Kyi, the teacher who was later abducted, authorities’ actions had caused the woman to barely eat. As a result, Kyi was taken into custody on August 1 last year. Chinese police accused her of “inciting separatism” because refusing to eat as a hunger strike is a crime against state security under Article 103 of China’s Criminal Law. A conviction could lead to up to ten years in prison. But there was never a trial. Not even a formal arrest, which under Chinese law must generally be handed down six months after detention.

On August 1, Kyi was forcibly taken to a hospital in the provincial capital of Xinin. Two days later, doctors diagnosed her as healthy, Tibet Watch reported. The family, which had traveled to Xining, was then informed by security officials that they were allowed to see the teacher. Officials limited the time window to arrive at the hospital to a few minutes, so the family ultimately arrived too late.

It then took eight long months and a formal request from the UN Commission on Human Rights before she was reunited with her family. In the letter, the Special Rapporteurs had also asked for the whereabouts of two other Tibetans already sentenced to prison. Lobsang Lhundup, a 50-year-old writer, was arrested in 2019 for “public disturbance” and two years later sentenced to four years in prison in a secret trial. To date, his family is unaware of his current whereabouts. Lobsang is the author of two books titled “The Art of Passive Resistance” and “Words Uttered with Risk of Life”.

The 38-year-old musician and singer Lhundrup Dhrakpa criticized the propaganda of the Chinese regime in his songs and called for the preservation of Tibetan identity and tradition. He was arrested in 2019 for publicly performing a song called “Black Hat” that was critical of the government. In 2020, he was sentenced to six years in prison. His whereabouts are also unknown. Marcel Grzanna

Daniel Zittel has been appointed the new CEO of Daimler China’s bus and truck division in Beijing at the beginning of the month. Zittel was previously Head of Sales for Mercedes-Benz Truck & Fuso in Berlin.

A freight train crosses the newly constructed Nizhneleninskoye-Tongjiang railroad bridge, which is scheduled to open in a month. The first Russian-Chinese bridge over the Amur River is more than 2.2 kilometers long.

In our Wednesday issue, we reported on China’s waning interest in investing in Europe. In particular, spending on company acquisitions is declining. Acquisitions of German companies by Chinese investors have frequently come under fire in the past. Now Berlin has refused the buyout of Heyer Medical AG by Aeonmed Group from Beijing – the deal, however, is already three years old and has practically already been completed in the meantime. Finn Mayer-Kuckuk looks for us at the already existing relations between the two companies.

A traditional German brand died its second death in China at the beginning of April. Beijing Borgward filed for bankruptcy in Beijing on April 8. Borgward was once one of the most famous car manufacturers in Germany. There, however, the inventor of legendary models such as the “Isabella” already went bankrupt in 1961. In China, truck manufacturer Beiqi Foton wanted to breathe new life into the Bremen car brand. But Foton’s distribution subsidiary Borgward China, founded in 2016, never made any money at all, writes Felix Lee in his analysis. In China, the brand lacked its nostalgic factor. The “dreams of the car phoenix from the ashes,” as a German newspaper once headlined, remained unfulfilled.

There are some numbers that are beyond anyone’s imagination. China’s steel production is one of them. The People’s Republic produces over one billion tons of crude steel annually. That is the weight of over six million blue whales. But can you imagine so many animals? China’s steel sector is one of the country’s biggest climate polluters. To cut emissions, more scrap metal is to be recycled, Ning Wang reports. Scrap metal that used to end up in landfills now becomes an important raw material.

The German government has retroactively barred an acquisition that had already been closed: Beijing-based Aeonmed Medical was not allowed to buy Heyer Medical. “This acquisition is prohibited for reasons of public order and safety,” a spokesman for the German Federal Ministry of Economics and Climate Protection (BMWK) told China.Table. The reason: Heyer Medical manufactures respiratory equipment. “During the COVID-19 pandemic, it became apparent that Germany needs to maintain its own manufacturing and production capacities to be able to supply itself with ventilators independently of non-European manufacturers,” the ministry said.

However, the German government has taken several years to reach this decision. This now poses significant problems for the companies. The two companies are already highly integrated. The new Chinese parent company advertises German quality and proudly presents a picture of the site in Bad Ems on its homepage. Heyer, in turn, received strong help from China in 2020 when the pandemic crippled production. The Beijing parent company unbureaucratically supplied the Germans with safety equipment. In the meantime, the company switched to selling equipment from Aeonmed in Germany.

But much more importantly, the Chinese parent was about to invest around a million euros to set up a customer service department based at Heyer, as Germany’s Westerwaelder Zeitung reported in October 2020. Twelve new employees were to be hired for this project. The two companies will probably have to cancel all these projects now. At Heyer Medical in Bad Ems, only an answering machine picked up on Wednesday, so a statement from the company is pending. German newspaper Handelsblatt first reported on the decision by the federal government.

By a sad twist of fate, Heyer Medical does manufacture one of the most sought-after products in the pandemic. But the company had already run out of money in 2018. Bankruptcy loomed to put an end to a 135-year company history. It was then that the investor from China came as a savior. Ventilators were considered a niche product at the time. The two companies seemed to be a perfect match.

Aeonmed (北京谊安医疗系统) manufactures a wide range of hospital equipment in Beijing. Devices for anesthesia, operating tables, surgical lamps, infusion pumps, computer technology – and said respirators and oxygen equipment. Most recently, mobile equipment of the kind needed for improvised hospitals has been introduced.

The plans of its Chinese owners were considered ambitious and fair. They wanted to relocate production from Beijing to Germany and continue to develop the new site. “Aeonmed is 100 percent committed to Bad Ems, to the long history of the company,” Managing Director Oliver Krell told a local newspaper at the time. The firm will to lead Heyer back to its former glory was “present and visible.” There was even a “Heyer hall” in the canteen at the Beijing headquarters.

But now foreign trade law is interfering with the German-Chinese partnership. The German government has the right to prevent the acquisition of a German company by a foreign investor. “In this particular case, an examination has led to the assessment that such risks to public safety and order, specifically health protection, in this case, are present,” the ministry spokesman said. The cabinet, that is, the round of federal ministers, has now decided accordingly.

Heyer is indeed a global brand in the industry. But before the acquisition, the company seemed old-fashioned and poorly managed. The first thing Aeonmed had to do was plug financial holes and clean up its product range. The Beijing-based company was founded in 2001. However, it grew fast with the rapid development of Chinese healthcare. Today, its customers include 800 hospitals in China. It was already active on the international stage before the Heyer takeover and also sold its products in South Asia and Latin America.

“Dreams of the car phoenix from the ashes,” was the headline of a German newspaper. In 2015, the Weser-Kurier in Bremen also spoke of a “dream of a lifetime”. “Traditional German brand awakens romantic feelings,” was also the headline in China’s official Xinhua news agency. The talk was about the legendary German car brand Borgward.

This dream is now over. As the Chinese news portal Gasgoo reports, Beijing Borgward filed for bankruptcy in Beijing on April 8. The carmaker has been making losses since it was founded, according to the report. Most recently, the company was no longer able to pay its debts.

Christian Borgward wanted to breathe new life into the legendary car brand by selling the brand to Chinese truck manufacturer Beiqi Foton. He is the grandson of founder Carl F. W. Borgward, who gained cult status in the 1950s with the luxury car Isabella, and held the trademark rights. He sold them to Beiqi Foton in 2014 for an estimated €5 million.

Germany had high hopes for this investment. Foton wanted to build the brand’s new European headquarters in Stuttgart. Bremen, the former headquarters of this noble brand, was to get a new production facility. The plan was to produce up to 10,000 Borgward vehicles per year in the Hanseatic city, which would be purely electric. Bremerhaven was favored as the location, where a factory was to be built on an area of 10,000 square meters. The plan was to import assembled vehicle parts from China. The vehicles would then only be assembled at the plant.

Borgward used to be one of the most famous car manufacturers in Germany and went bankrupt in 1961. Until the early 1960s, up to 100,000 Borgward models rolled off production lines each year at what is now the Daimler plant in Bremen-Sebaldsbrueck.

The plant in the northern German city-state was never built. Foton already ran into financial difficulties in 2018 and put its stake in the brand up for sale. In Germany, Borgward shipped “a few units of a BX7 limited model,” according to industry portal kfz-betrieb.vogel. The planned “Brand Experience Center” in Stuttgart opened, but ceased operations only a short time later. In 2019, Chinese car service provider Ucar took over the brand. But business was no better under the new owner (China.Table reported). In the same year, the cars were pulled from the European market, and sales in China were also poor. Then came the de facto end last summer. Chinese media speculated that the electronics group Xiaomi might at least take over parts of Borgward. But these reports were false. With the bankruptcy, the end of the traditional brand is now officially sealed.

In fact, at no point did Foton even begin to make money with its distribution company Borgward China, which was founded in 2016. Borgward developed four models, all SUVs, some with electric drives. The last model, the BX3, was launched on the Chinese market in January 2020. But Foton sold just around 165,000 vehicles by 2021. The Miyun plant, which was built specifically for production and is located around 60 kilometers northeast of Beijing, was designed to manufacture 360,000 vehicles.

Even as the plans were unveiled in 2016, Chang Zhangyi, then Vice-Chairman of China’s Automobile Association (CAAM), had warned against such an investment. “The brand has been dead for too long and is too unknown in China to find many buyers,” he said in an interview. At the time, he already pointed to acquisitions of other foreign car brands by Chinese companies and their limited success. Swedish automaker Saab is one example. The brand was also acquired by Chinese investors in 2012. But by 2014, they had to stop production again. Today, the rights belong to the bankruptcy estate of the Evergrande real estate group.

Experts have been aware of this for a long time: The world’s landfills are considered raw material deposits of the future. Experts are already talking about urban mining to recover important raw materials. Waste, like aluminum, steel, plastic and wood, has become an important raw material that is in high demand.

For the steel sector, in particular, scrap is vital to create a “greener” steel production. To cut the steel sector’s CO2 emissions, more and more manufacturers rely on more sustainable production processes. For example, the electric arc furnace only recycles steel scrap. This produces around 80 percent less CO2 than conventional production methods. Steel produced in this way is regarded as “green steel”. China also increasingly relies on recycling. Analysts at S&P Global predict that the share of scrap in Chinese steel production will increase to 15 to 20 percent by 2025.

The People’s Republic produces more than half of the world’s steel, which puts it in a dominant position on the global market. IKB Deutsche Industriebank calculates that global crude steel production rose to a record of over 1.9 billion tons last year. China accounted for over 1 billion tons.

“We expect scrap prices to increase as many steel mills in China are being upgraded to reduce emissions and energy consumption in the sector,” Dr. Heinz-Juergen Buechner, Director at IKB for Industrials & Automotive, told China.Table.

But over 90 percent of Chinese steel mills still use conventional blast furnaces for production, making them one of the biggest emitters of CO2. The sector is responsible for around 15 percent of China’s CO2 emissions. China Baowu, the world’s largest steel producer, emitted more carbon dioxide into the atmosphere in 2020 than the whole of Pakistan, according to Bloomberg calculations.

But this is supposed to stop soon. The steel industry has pledged to cut emissions by 30 percent from their peak by the end of the decade. Old plants are to be replaced by newer and “cleaner” ones.

Heinz-Juergen Buechner of Deutsche Industriebank expects that “in ten years at the latest, but probably sooner, up to 20 percent of Chinese steel production will be produced in electric arc furnaces.” He also considers retrofitting a viable way to cope with the country’s rising scrap volume. In the future, more cars will have to be scrapped. If old cars are recycled in steel production, “two birds would be killed with one stone,” says Buechner.

To achieve carbon neutrality by 2060, Beijing digs even deeper into its toolbox. Last year, steel production was cut back significantly to curb climate-damaging emissions. But due to the economic downturn, goals have recently been watered down again (China.Table reported).

It was only on Saturday that Chen Kelong, spokesman for the Ministry of Industry and Information Technology (MIIT), said the government will do everything in its power to maintain reasonable prices for steel. The aim is to ensure that manufacturers along the entire value chain remain profitable.

Chen’s statement was preceded by a slump in global iron ore prices on Monday. In Singapore, futures contracts for this vital steel raw material fell as much as 12 percent at one point as concerns grew about Chinese demand, Bloomberg reported. On the same day, the most-traded iron ore futures contract on China’s Dalian Commodity Exchange for September shipment slumped by 10 percent, business magazine Caixin reported.

If steel mills use scrap instead of iron ore and coke, each ton of steel will save 1.67 metric tons of CO2 emissions, according to a study by the Fraunhofer Institute. These reductions would be equivalent to the average annual emissions emitted by a commuter driving 40 kilometers a day by car.

“China is moving in the direction of use of higher percentages of scrap and is reducing the percentage of steel made from iron ore,” Schott Newell of Newell Recycling Equipment, USA/China said at an industry webinar last year. “A few years ago, there was concern that China might become a huge scrap exporting country, with the effect that it would hurt scrap prices around the world. The opposite is what is happening. China will need to import scrap rather than iron ore and coal in order to reach the goals of a cleaner environment and more cost-effective steel production,” reports trade journal EU Recycling + Environmental Technology.

Europe will also see a further increase in demand for scrap. According to industry association Eurofer, 42 percent of all steel produced in Europe already comes from electric furnaces. Globally, a quarter of steel is produced in this way. With demand from China and other Asian countries, scrap will now become a valuable raw material in the fight against climate change.

Chinese drone manufacturer DJI has announced the temporary suspension of all business operations in Russia and Ukraine. “DJI is internally reassessing compliance requirements in various jurisdictions,” the global leader said in a statement. As a result, business in the two countries will be temporarily suspended. The company did not cite the sanctions against Russia. DJI is the first Chinese tech company to publicly temporarily suspend its business with Russia.

Last month, Ukraine heavily criticized the Shenzhen-based company. It accused DJI of allowing Russian forces to use its technology in military operations, even against civilians. “Are you sure you want to be a partner in these murders?” wrote Ukrainian Deputy Prime Minister Mychaylo Fedorov on Twitter directly to DJI. “Block your products that are helping Russia to kill the Ukrainians!”

Ukrainian criticism centered on DJI’s AeroScope system. This allows users to detect and monitor drones in the vicinity. It is marketed as a tool to protect sensitive facilities such as airports and prisons. The company denies that it has allowed Russia to use its products for military purposes.

According to a Forbes Russia report earlier this month, Chinese telecommunications giant Huawei was also preparing to pull out of Russia. Employees on the ground have been granted leave and new contracts with operators have been suspended, the report said. Huawei did not yet confirm this. ari

New Covid infections in Shanghai have fallen to their lowest level in three weeks. As of Wednesday, there were just over 13,500 positive tests and 48 deaths, according to local authorities. In Beijing, the number of newly identified cases was 46, Bloomberg reports. According to the report, a representative of the Shanghai Municipal Health Commission announced that certain groups of people could be granted limited freedom of movement in districts where the virus no longer spreads. However, an exact schedule for these relaxations was not given. In the meantime, the majority of Shanghai residents remain confined to their homes.

Meanwhile, Beijing has tested nearly 20 million citizens in an effort to prevent a widespread outbreak like the one in Shanghai. On Thursday, 16 million people are to be tested again, Reuters reports. Mass testing involves testing multiple samples together in a single tube for speed and efficiency.

Yiwu, a city of 1.9 million people, went into a lockdown on Wednesday. Other cities, such as Changchun and Jilin, are expected to ease quarantine measures from Thursday. Covid restrictions affected 57 of China’s 100 largest cities last week, according to research by Gavekal Dragonomics. Industry associations say most factories are struggling to resume work as employees stay at home, trucks idle in parking lots and orders from suppliers facing the same situation are not being fulfilled, Reuters reports. nib

Spending on infrastructure is expected to boost growth in China. This was revealed at a meeting of the Central Committee for Financial and Economic Affairs. President Xi Jinping had stressed at the meeting that the People’s Republic must make every effort to boost infrastructure spending, Bloomberg reports. Xi had reportedly urged local authorities to improve the construction and efficiency of infrastructure networks in sectors such as transportation, energy and water conservancy. Investment is also expected to flow into regional airports, urban rail systems and oil and gas pipelines.

At a meeting of the State Council, additional measures to strengthen growth were decided. Tax cuts are to support companies that have been particularly hard hit by the pandemic, as business portal Caixin reports. Unemployment insurance tax is also to be cut.

China had already relied on infrastructure construction in the past to boost growth in times of crisis. The construction of roads, railroads or real estate boosts domestic demand for construction materials such as concrete and steel, but also for labor. In January, the People’s Republic released a Five-Year Plan for the development of a modern transportation system. The plan envisages the construction of tens of thousands of kilometers of roads and train lines (China.Table reported). nib

The first human infection with the H3N8 bird flu virus has been detected in China. This was announced by health authorities. However, large-scale transmission among humans is not expected. According to AFP, the National Health Commission of China stated that the risk was low. The infection was found in a four-year-old boy from Henan province. He had been hospitalized with fever and other symptoms in early April. Authorities called the case a “one-time transmission”. Bird flu mainly occurs in wild birds. Human-to-human transmissions are extremely rare. nib

According to a media report, the USA is investigating whether the Chinese chip manufacturer Yangtze Memory Technologies (YMTC) has violated US export controls. The background is said to be a supply of semiconductors for a new smartphone to Huawei, as the Financial Times reported, citing sources in the US Department of Commerce. The ministry and the White House have received a “credible” report on the matter: YMTC allegedly supplied Huawei with chips for the Enjoy 20e smartphone and thereby violated the so-called Foreign Direct Product Rule.

The US law stipulates that products containing US technology and software are also subject to US regulatory oversight outside the US. YMTC would therefore require a license to provide semiconductors to Huawei because it also contains US technology. According to the report, US authorities must now prove that YMTC’s semiconductors went to Huawei. Several US politicians called for YMTC to be placed on a Commerce Department trade restriction list. Huawei is already on this Entity List. ari

The mysterious case of the missing Tibetan teacher Rinchen Kyi has apparently found a happy ending. The mother of a 13-year-old daughter has been escorted back home by police officers on Sunday evening. Kyi had been taken to a hospital against her will by police on August 1 last year and disappeared for eight months just two days later.

She was accused of inciting separatism. But to this day, Chinese authorities have not explained to the family how exactly Rinchen Kyi broke the law, nor have they provided any information about the woman’s whereabouts or state of health.

As early as mid-February, the UN Special Rapporteurs of the Commission on Human Rights submitted a request to the Chinese embassy in Geneva seeking clarification on Kyi’s case, among others. It took six weeks before the Special Rapporteurs’ letter was finally allowed to be made public last week, according to the statutes. Kyi returned home just a few days later.

What is relatively certain is that her disappearance was linked to the closing of a middle school in the administrative district of Darlak in the province of Qinghai, as the human rights organization Tibet Watch found out. The private institution, once founded to give children of impoverished families and orphans access to formal education, had been ordered by authorities a few weeks earlier to stop teaching after more than 22 years. There was no conclusive explanation for this at the time. At that time, there was no plausible reason for the decision. The school had all necessary documents and “that it has abided by the constitution of the People’s Republic of China”.

Anonymous local sources who are in contact with Tibet Watch suspect political reasons behind the school’s closure. Over the years, the school had apparently earned a top reputation among Tibetan farmers and nomads. Initially opened as an elementary school, it had been allowed to operate as a middle school since 2008. Lessons were primarily taught in Tibetan. Authorities were aware and tolerated cultural-religious elements in education. Former students reportedly obtained jobs in the administration, became entrepreneurs or Buddhist monks or nuns.

Apparently, it was a thorn in the side of authorities that monks were trained in the school. This would have to take place in monasteries, the school administration had been told. Especially since the Chinese authorities have drastically increased their control over Buddhist monasteries since the unrest in Tibet in 2008. CCTV cameras and police stations in the immediate vicinity of the monasteries are intended to nip any flare-up of new resistance in the bud.

However, the school administrators were not given an explanation as to why the middle school had to close completely. According to the family of Kyi, the teacher who was later abducted, authorities’ actions had caused the woman to barely eat. As a result, Kyi was taken into custody on August 1 last year. Chinese police accused her of “inciting separatism” because refusing to eat as a hunger strike is a crime against state security under Article 103 of China’s Criminal Law. A conviction could lead to up to ten years in prison. But there was never a trial. Not even a formal arrest, which under Chinese law must generally be handed down six months after detention.

On August 1, Kyi was forcibly taken to a hospital in the provincial capital of Xinin. Two days later, doctors diagnosed her as healthy, Tibet Watch reported. The family, which had traveled to Xining, was then informed by security officials that they were allowed to see the teacher. Officials limited the time window to arrive at the hospital to a few minutes, so the family ultimately arrived too late.

It then took eight long months and a formal request from the UN Commission on Human Rights before she was reunited with her family. In the letter, the Special Rapporteurs had also asked for the whereabouts of two other Tibetans already sentenced to prison. Lobsang Lhundup, a 50-year-old writer, was arrested in 2019 for “public disturbance” and two years later sentenced to four years in prison in a secret trial. To date, his family is unaware of his current whereabouts. Lobsang is the author of two books titled “The Art of Passive Resistance” and “Words Uttered with Risk of Life”.

The 38-year-old musician and singer Lhundrup Dhrakpa criticized the propaganda of the Chinese regime in his songs and called for the preservation of Tibetan identity and tradition. He was arrested in 2019 for publicly performing a song called “Black Hat” that was critical of the government. In 2020, he was sentenced to six years in prison. His whereabouts are also unknown. Marcel Grzanna

Daniel Zittel has been appointed the new CEO of Daimler China’s bus and truck division in Beijing at the beginning of the month. Zittel was previously Head of Sales for Mercedes-Benz Truck & Fuso in Berlin.

A freight train crosses the newly constructed Nizhneleninskoye-Tongjiang railroad bridge, which is scheduled to open in a month. The first Russian-Chinese bridge over the Amur River is more than 2.2 kilometers long.