How can Germany reestablish its own solar industry? The successes of the 1990s and 2000s can no longer be replicated. A high-tech industry that has once been lost to Asia cannot be cost-effectively rebuilt. No European location can achieve the high production and sales volumes common in China, which allow for competitive prices.

However, Europe is not doomed to dependency. In today’s Feature, Christiane Kuehl outlines a potential path to redeveloping domestic solar product manufacturing. This approach involves working not against China, but with China. Chinese suppliers could be encouraged to produce in the EU through joint ventures with the less advanced Europeans if they want to maintain market access. Do you notice anything?

Meanwhile, Amelie Richter has conducted a “China check” on the newly composed EU Parliament. She evaluates the positions of leading members from various parties who can now make their mark in the committees. These include the Germans Bernd Lange and Marie-Agnes Strack-Zimmermann. Overall, the Parliament is expected to continue posing critical questions regarding China policy.

More than a decade ago, the then-world-leading German solar manufacturers collapsed as Chinese companies entered global markets, coinciding with Berlin ceasing support for the sector. Since then, China has dominated the global photovoltaic market, holding a 90 percent market share in solar installations, with even higher shares in some components. Now, some European solar companies are considering forming joint ventures in Europe with their Chinese suppliers.

“The idea is to locate the core technologies of photovoltaics with large production capacities in Europe,” explains Henning Rath, Chief Supply Chain Manager at the solar company Enpal. Discussions with technology partners in China have been ongoing for about a year. For each production step – polysilicon, ingots, wafers, cells, modules – up to four partners from the EU and China are involved in the plans. Rath did not name the companies involved in his conversation with Table.Briefings. These joint ventures could produce more cheaply due to the participation of Chinese firms, providing direct access to China’s advanced solar technology.

Although much technological knowledge still exists in Europe in theory, it is increasingly less utilized due to the local solar sector’s struggles. The unexpected rapid price decline in the summer of 2023, due to an overabundance of ordered but unneeded solar modules from China, led to several manufacturers in Germany closing. Meyer Burger, one of Europe’s largest solar manufacturers, had planned to build new factories in Germany but instead closed its module plant in Freiberg, Saxony, and expanded in the USA, where substantial subsidies for the entire supply chain are available, unlike in Europe.

In Europe, the supply chain is almost nonexistent. According to a recent study by the European Council on Foreign Relations (ECFR), German company Wacker Chemie is the only European company among the top five globally in the raw material polysilicon. However, Wacker also has significant operations in China.

China’s solar sector continues to grow and develop rapidly despite overcapacity. For instance, by the end of 2023, China’s silicon wafer production capacity reached 953 gigawatts (GW), nearly 98 percent of the global total. In Hubei province, the world’s largest sodium-ion battery energy storage project has been launched. Energy storage is also a significant topic in Europe.

European companies now want to benefit from the technological advancements of their often state-supported Chinese partners. According to Rath, the European partners in the joint ventures will hold the majority shares, and there will be a technology transfer from China to Europe. “The technology transfer involves not only new product technology but also production technology,” including machines for producing solar components.

“We haven’t necessarily forgotten this area in Germany over the last 20 to 30 years, but outsourced it, arrogantly believing we could develop things but produce them in low-wage countries. This has now backfired on the EU,” Rath explains, “because we can no longer produce along the photovoltaic value chain and must now bring it back to Europe through partnerships.”

The German government appears willing to accept China as a supplier, recognizing that rebuilding an entire industry is disproportionately expensive and not competitive. China’s high production capacities are seen as an opportunity to maintain significant growth in solar capacities.

Thus, imports from China and establishing Chinese providers in Europe to regain domestic value creation are key elements in the government’s considerations. According to the ECFR study, while the analysis of risks and opportunities of cooperation with China in the cleantech sector has just begun, the risks in solar are comparatively low.

The plan to establish Chinese providers aligns with Enpal and its partners’ goals. Rath states that discussions with Chinese technology leaders and European partners about the joint venture project have been ongoing for about a year. The discussions involve determining roles, project capitalization and scaling up. “We need three things: demand to ensure a certain sales volume, know-how for product development and production expertise,” says Rath. Potential buyers include companies like Enpal, which markets complete solar systems directly to consumers.

Clarity on the project’s size, timing and funding framework is also necessary, including potential support from the German government or the EU. The planned joint ventures cannot proceed without subsidies, but Rath emphasizes that investment support is only needed for a limited period. For solar module production, subsidies are less crucial due to the high level of automation. “Chinese partners are also very open to investing in module production themselves.”

However, producing components like solar cells, wafers or polysilicon, which the partners also plan to manufacture together in Europe, requires significant investment and high operating costs. Discussions are ongoing about how support might be structured, says Rath.

Whether the planned joint ventures will receive political backing is uncertain. “Of course, support from the German government would be nice,” says Rath, aware of political reservations about involving Chinese companies. He emphasizes, “These are flagship projects that we should advance without undue fear.” with Finn Mayer-Kuckuk

After the EU elections in early June, the newly elected European Parliament is taking shape, with key positions in the committees being filled. Some positions remain with experienced hands, making a significant shift in the EU Parliament’s stance on China unlikely.

Last week, SPD MEP Bernd Lange was re-elected as the chair of the influential Trade Committee. During the last legislative period, Lange significantly advanced the EU’s Anti-Coercion Instrument (ACI) against economic coercion, which is still awaiting its first application. “We have a lot planned for the next five years: In the context of the increasing global competition between the USA and China, we need to set our own course,” Lange emphasized after his election.

For Lange, greater independence from Chinese goods is part of this strategy. He advocates offering non-Western partners an attractive package that includes market access, investments through the EU’s Global Gateway infrastructure initiative and opportunities for sustainable economic development. “It makes no sense to continue a practice where almost all raw materials are distributed worldwide but refined by or in China,” the SPD politician stated. Diversification and offering a genuine alternative to exploitative practices are crucial.

Lange supports a “fitness test” of economic defense instruments, citing the Foreign Subsidies Regulation (FSR) as an example. He believes it should be examined to see if it aligns with the EU’s green transition ambitions. The FSR was recently heavily criticized by China.

Alongside Lange, the Trade Committee will be led by Vice-Chairs including French MEP Manon Aubry (Left), Hungarian conservative Iuliu Winkler (EPP), Swedish MEP Karin Karlsbro (liberal Renew) and Belgian MEP Kathleen van Brempt (S&D). The committee also includes MEPs sanctioned by China, such as Raphaël Glucksmann and Miriam Lexmann. AfD MEP Maximilian Krah is also a member; his parliamentary assistant was arrested before the European elections on suspicion of spying for China.

The Foreign Affairs Committee is similarly composed of members critical of China: Mika Aaltola from Finland has repeatedly called Beijing an “imperialistic and autocratic threat”. Lithuanian Petras Auštrevičius is part of the Inter-Parliamentary Alliance on China (IPAC), an organization critical of Beijing, comprising members from over two dozen parliaments worldwide. French MEP Glucksmann is also a member. CDU MEP David McAllister was re-elected as the chair.

Green politician Anna Cavazzini will again chair the Committee on Internal Market and Consumer Protection. Cavazzini was a driving force behind the EU Parliament’s import ban on products made with forced labor, primarily affecting goods from Xinjiang, and the EU Supply Chain Act. She recently supported additional tariffs on Chinese electric vehicles.

Marie-Agnes Strack-Zimmermann (FDP) is the new chair of the Defense Committee in the EU Parliament. “The conflicts in our neighborhood and the shifting geopolitical tides mean we need a change in European security to take control of our destiny,” Strack-Zimmermann emphasized upon her election. The EU Parliament had already advocated for enhanced EU-NATO cooperation in the last legislative period. Strack-Zimmermann has repeatedly called for China to influence Moscow.

The Subcommittee on Human Rights will be chaired by French Green MEP Mounir Satouri. The subcommittee has been involved in several resolutions regarding Hong Kong and Xinjiang in the past. Satouri has so far focused less on China, with his primary focus on the Middle East.

In addition to the committees, the delegations are important for the European Parliament’s work on China. The China Delegation remains the largest with 38 members. The chair will be decided on September 19 in Strasbourg. Besides China, there will be delegations for Japan (24 members), India (24 members), ASEAN (27 members), the Korean Peninsula (13 members), Central Asia (19 members) and South Asia (15 members).

The European Taiwan Friendship Group, an informal group of EU MEPs, will continue to be led by CDU MEP Michael Gahler.

The German government blames China for a 2021 cyber attack on the Federal Agency for Cartography and Geodesy (BKG). Intelligence information indicated that Chinese actors were responsible for the cyber attack, said a spokesperson for the Federal Foreign Office on Wednesday in Berlin. This led to the Chinese ambassador in Germany being summoned for the first time since 1989. The German government condemned such attacks in the strongest terms.

A spokesperson for the Federal Ministry of the Interior added that there had been a comprehensive investigation of the case. The Chinese were successfully expelled from the BKG systems. The agency provides geodata. rtr

If the German government wants to meet its target of 15 million electric cars by 2030, Germany will depend on Chinese manufacturers. This is highlighted in a study by the think tank Agora Verkehrswende and the consulting firm Boston Consulting Group (BCG). With its current trajectory, Germany is set to miss the target by about six million vehicles.

The study’s authors criticize the higher import tariffs that the EU plans to impose on electric cars from China. These tariffs would lead to higher prices for customers and jeopardize the competitiveness of the German automotive industry. “To achieve climate goals and secure Germany’s automotive industry in the long term, we should advocate for the rapid expansion of e-mobility, including the participation of Chinese companies,” says Christian Hochfeld, director of Agora Verkehrswende.

“This may seem paradoxical at first glance, but a swift transition to e-mobility also contributes to greater sovereignty and competitiveness vis-à-vis China,” Hochfeld stated. Particularly in the segment of low-priced small vehicles, Chinese products could help accelerate the market adoption of EVs in Europe.

Hochfeld also calls for the “quick establishment of Chinese companies in Europe under common rules”. This would create more value than imports alone. It would also provide the opportunity to catch up in technological areas like battery production through cooperation. flee

According to insiders, the US government aims to introduce a stricter embargo on technology exports to China this August. However, the export of chip-making machinery from certain allied countries will be exempt, several people familiar with the matter told Reuters on Wednesday. Following this news, shares of suppliers like ASML from the Netherlands and Tokyo Electron from Japan rose by up to 7.4 percent. For both companies, China is a significant market.

“Effective export controls rely on multilateral cooperation,” said a US official. “We are continuously working with like-minded countries to achieve our common national security goals.” Exemptions will apply to more than 30 countries.

According to further statements from insiders, the US is invoking a provision from 1959, the Foreign Direct Product Rule, to justify the stricter embargo. This rule gives the US government the right to prohibit the sale of products developed using American technology. Foreign companies can also face penalties for violations.

In recent years, this provision has primarily been used to prevent the controversial Chinese company Huawei from accessing foreign computer chips. The planned tightening of the embargo would also include products with previously considered too low a share of American technology in their manufacture, the insiders added. Additionally, 120 more Chinese chip producers and suppliers will be added to the blacklist. However, it initially remained unclear which companies would be affected. rtr

Siemens Healthineers anticipates more orders for CT and MRI machines from Chinese hospitals and healthcare facilities in the next fiscal year. Currently, anti-corruption measures in the healthcare sector are delaying order placements. “We expect this to result in a backlog in 2025,” said CEO Bernd Montag.

Siemens Healthineers is observing preparations for a government program aimed at boosting investments in the Chinese healthcare system. In the ongoing fourth quarter of 2023/24, which runs until the end of September, the company expects a stabilization of its medical equipment business in China.

The subdued growth forecasts for the imaging segment are affecting margins in the current fiscal year. The operating profit margin in this segment is expected to be at the lower end of the 21.0 to 22.5 percent range, according to CFO Jochen Schmitz. This will be partially offset by better performance in the diagnostics segment, whose margin is expected to be at the upper end of the four to six percent range. The restructuring in diagnostics is progressing better than expected. rtr

The Chinese commerce group Alibaba is increasing its use of Artificial Intelligence (AI) on its B2B platform. Starting in September, Alibaba’s International Digital Commerce Group (AIDC) will offer an “AI-powered conversational sourcing engine,” Alibaba announced on Wednesday. This new technology is primarily intended to assist small and medium-sized enterprises.

According to the company, the AI-powered sourcing tool will be accessible via its own mobile app and the official website. The natural language-based sourcing engine will enable users to interact with the tool more easily. “We want to help European SMEs, not only buyers but also suppliers,” said Kuo Zhang, president of Alibaba.com, in an interview with Table.Briefings. “The sourcing engine will also be available to merchants on third-party platforms outside the Alibaba ecosystem.”

According to Kuo, the new sourcing engine will aggregate vast amounts of information and interpret it in natural language. This will allow buyers to be matched with products and suppliers with greater accuracy. In November, Alibaba launched the AI platform Aidge, which is now reportedly used by half a million suppliers. ari

US President George H.W. Bush once remarked that, “No nation on Earth has discovered a way to import the world’s goods and services while stopping foreign ideas at the border.” In an age when democracies dominated the technological frontier, the ideas Bush had in mind were those associated with America’s own model of political economy.

But now that China has become a leading innovator in artificial intelligence, might the same economic integration move countries in the opposite direction? This question is particularly relevant to developing countries, since many are not only institutionally fragile, but also increasingly connected to China via trade, foreign aid, loans, and investments.

While AI has been hailed as the basis for a “fourth industrial revolution,” it is also bringing many new challenges to the fore. AI technologies have the potential to drive economic growth in the coming years, but also to undermine democracies, aid autocrats‘ pursuit of social control, and empower “surveillance capitalists” who manipulate our behavior and profit from the data trails we leave online.

Since China has aggressively deployed AI-powered facial recognition to support its own surveillance state, we recently set out to explore the patterns and political consequences of trade in these technologies. After constructing a database for global trade in facial-recognition AI from 2008 to 2021, we found 1,636 deals from 36 exporting countries to 136 importing countries.

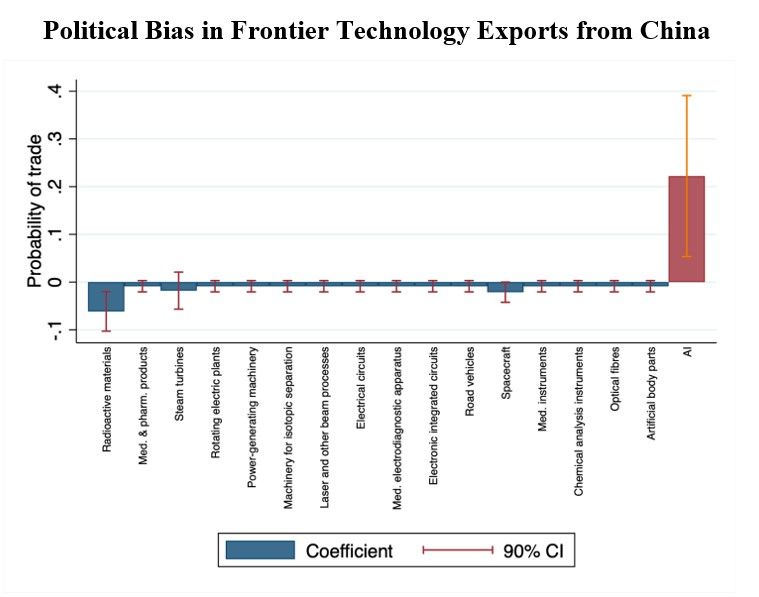

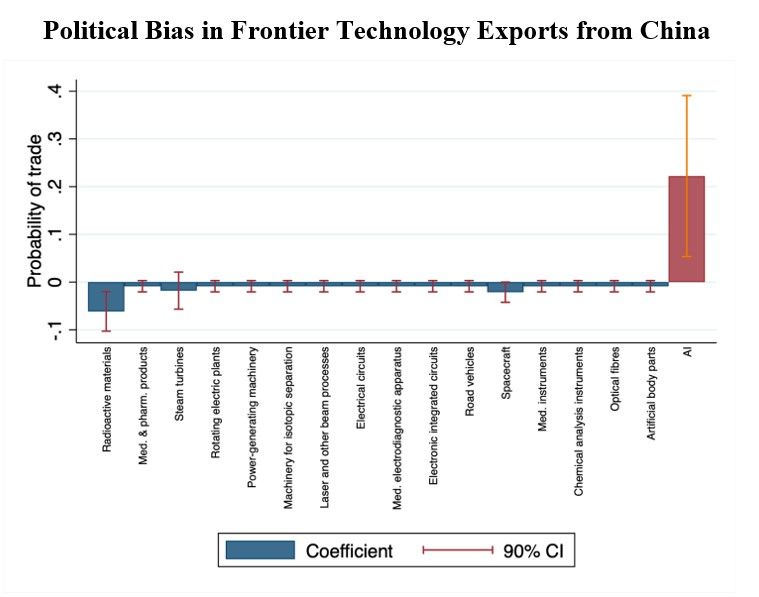

From this dataset, we document three developments. First, China has a comparative advantage in facial-recognition AI. It exports to roughly twice as many countries as the United States does (83 versus 57 links), and it has about 10 percent more trade deals (238 versus 211). Moreover, its comparative advantage in facial-recognition AI is larger than in other frontier-technology exports, such as radioactive materials, steam turbines, and laser and other beam processes.

While different factors may have contributed to China’s comparative advantage, we know that the Chinese government has made global dominance in AI an explicit developmental and strategic goal, and that the facial-recognition AI industry has benefited from its demand for surveillance technology, often receiving access to large government datasets.

Second, we find that autocracies and weak democracies are more likely to import facial-recognition AI from China. While the US predominantly exports the technology to mature democracies (these account for roughly two-thirds of its links, or three-quarters of its deals), China exports roughly equal amounts to mature democracies and autocracies or weak democracies.

Does China have an autocratic bias, or is it simply exporting more to autocracies and weak democracies across all products? When we compared China’s exports of facial-recognition AI to its exports of other frontier technologies, we found that facial-recognition AI is the only technology for which China displays an autocratic bias. Equally notable, we found no such bias when investigating the US.

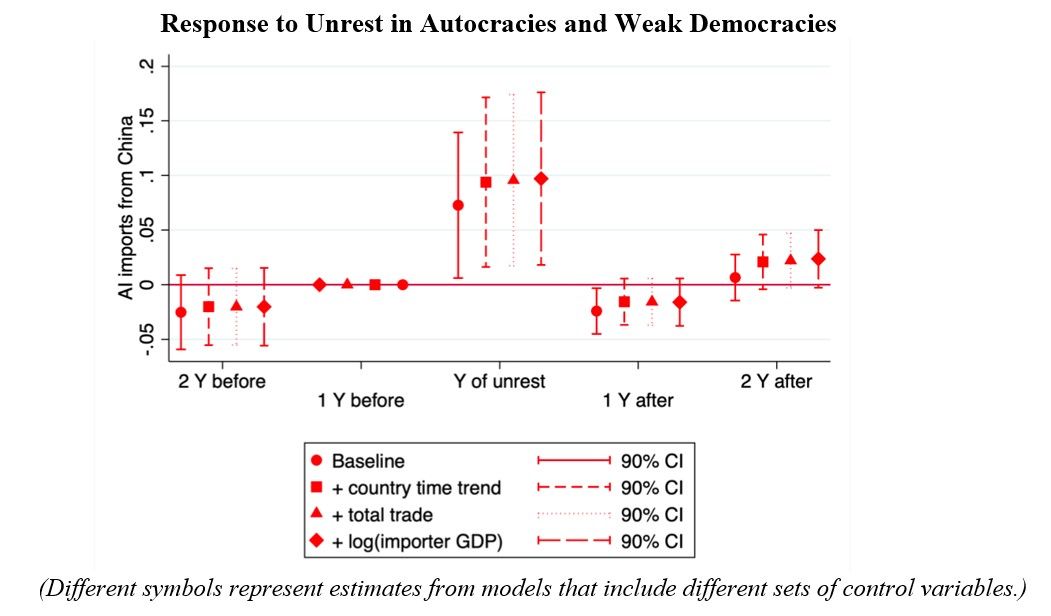

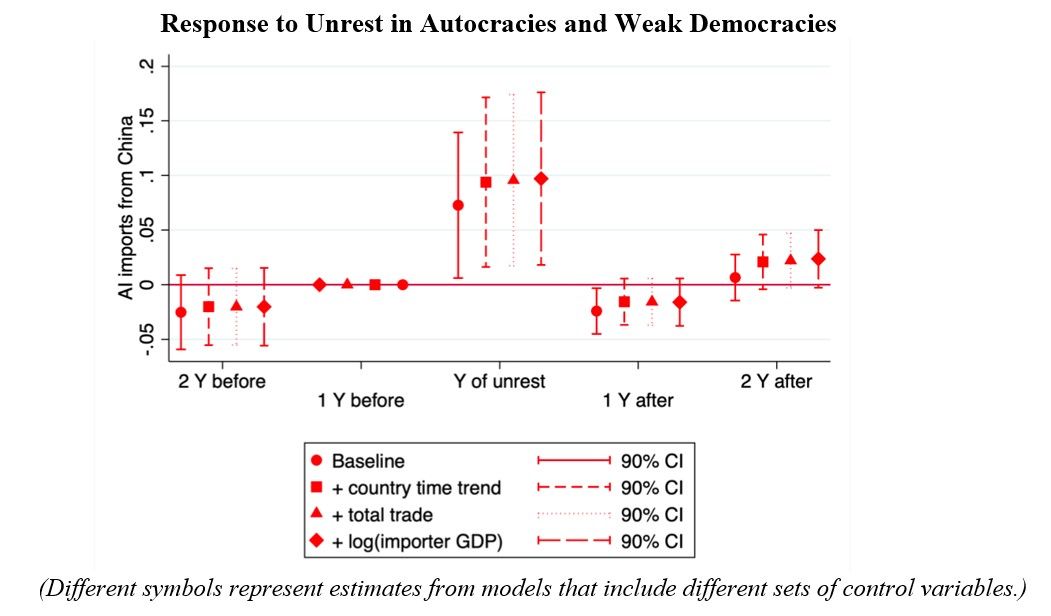

One potential explanation for this difference is that autocracies and weak democracies might be turning specifically to China for surveillance technologies. That brings us to our third finding: autocracies and weak democracies are more likely to import facial-recognition AI from China in years when they experience domestic unrest.

The data make clear that weak democracies and autocracies tend to import surveillance AI from China – but not from the US – during years of unrest, rather than pre-emptively or after the fact. Imports of military technology follow a similar pattern. By contrast, we do not find that mature democracies import more facial-recognition AI in response to unrest.

A final question concerns broader institutional changes in these countries. Our analysis shows that imports of Chinese surveillance AI during episodes of domestic unrest are indeed associated with a country’s elections becoming less fair, less peaceful, and less credible overall. And a similar pattern appears to hold with imports of US surveillance AI, though this finding is less precisely estimated.

At the same time, we do not find any association between surveillance AI imports and institutional quality among mature democracies. So, rather than interpreting our findings as the causal impact of AI on institutions, we view imports of surveillance AI and the erosion of domestic institutions in autocracies and weak democracies as the joint outcome of a regime’s pursuit of greater political control.

Interestingly, we also find suggestive evidence that autocracies and weak democracies importing large amounts of Chinese surveillance AI during unrest are less likely to develop into mature democracies than peer countries with low imports of surveillance AI. This suggests that the tactics employed by autocracies during times of unrest – importing surveillance AI, eroding electoral institutions, and importing military technology – may be effective in entrenching non-democratic regimes.

Our research adds to the evidence that trade does not always foster democracy or liberalize regimes. Instead, China’s greater integration with the developing world may do precisely the opposite.

This suggests a need for tighter AI trade regulation, which could be modeled on the regulation of other goods that produce negative externalities. Insofar as autocratically biased AI is trained on data collected for the purpose of political repression, it is similar to goods produced from unethically sourced inputs, such as child labor. And since surveillance AI may have negative downstream externalities, such as lost civil liberties and political rights, it is not unlike pollution.

Like all dual-use technologies, facial-recognition AI has the potential to benefit consumers and firms. But regulations must be carefully designed to ensure that this frontier technology is diffused around the world without facilitating autocratization.

Martin Beraja is Assistant Professor of Economics at MIT. David Y. Yang is Professor of Economics and Director of the Center for History and Economics at Harvard University. Noam Yuchtman is Professor of Political Economy and a fellow of All Souls College at the University of Oxford.

Copyright: Project Syndicate, 2024.

www.project-syndicate.org

Francesca Ghiretti is a new Research Leader at the NGO think tank Rand Europe. Ghiretti previously worked as an analyst at Merics, among others.

Is something changing in your organization? Let us know at heads@table.media!

The Chinese internet is abuzz with excitement over the 405 athletes from the People’s Republic who have traveled to Paris. Every day, a new hero or heroine is celebrated, such as Hong Kong fencer Vivian Kong Man-wai or table tennis stars Wang Chuqin and Sun Yingsha, who have all won gold.

At the same time, netizens are expressing concerns about the conditions in the athletes’ accommodations. Because the Olympic Games in France are striving to be particularly eco-friendly, there is a lack of adequate comfort. Nine athletes reportedly have to share one sofa and two toilets on a single floor of the Olympic Village. Beds and chairs are made from recyclable cardboard and are correspondingly uncomfortable. Air conditioning is also missing, despite the heat.

Critics warn that all these factors will negatively impact the athletes’ performance. They sarcastically refer to the games as “self-initiated” 自主奥运 – suggesting that anyone who wants to shine must bring their own furniture, cook their own food or order portable air conditioners from China online.

How can Germany reestablish its own solar industry? The successes of the 1990s and 2000s can no longer be replicated. A high-tech industry that has once been lost to Asia cannot be cost-effectively rebuilt. No European location can achieve the high production and sales volumes common in China, which allow for competitive prices.

However, Europe is not doomed to dependency. In today’s Feature, Christiane Kuehl outlines a potential path to redeveloping domestic solar product manufacturing. This approach involves working not against China, but with China. Chinese suppliers could be encouraged to produce in the EU through joint ventures with the less advanced Europeans if they want to maintain market access. Do you notice anything?

Meanwhile, Amelie Richter has conducted a “China check” on the newly composed EU Parliament. She evaluates the positions of leading members from various parties who can now make their mark in the committees. These include the Germans Bernd Lange and Marie-Agnes Strack-Zimmermann. Overall, the Parliament is expected to continue posing critical questions regarding China policy.

More than a decade ago, the then-world-leading German solar manufacturers collapsed as Chinese companies entered global markets, coinciding with Berlin ceasing support for the sector. Since then, China has dominated the global photovoltaic market, holding a 90 percent market share in solar installations, with even higher shares in some components. Now, some European solar companies are considering forming joint ventures in Europe with their Chinese suppliers.

“The idea is to locate the core technologies of photovoltaics with large production capacities in Europe,” explains Henning Rath, Chief Supply Chain Manager at the solar company Enpal. Discussions with technology partners in China have been ongoing for about a year. For each production step – polysilicon, ingots, wafers, cells, modules – up to four partners from the EU and China are involved in the plans. Rath did not name the companies involved in his conversation with Table.Briefings. These joint ventures could produce more cheaply due to the participation of Chinese firms, providing direct access to China’s advanced solar technology.

Although much technological knowledge still exists in Europe in theory, it is increasingly less utilized due to the local solar sector’s struggles. The unexpected rapid price decline in the summer of 2023, due to an overabundance of ordered but unneeded solar modules from China, led to several manufacturers in Germany closing. Meyer Burger, one of Europe’s largest solar manufacturers, had planned to build new factories in Germany but instead closed its module plant in Freiberg, Saxony, and expanded in the USA, where substantial subsidies for the entire supply chain are available, unlike in Europe.

In Europe, the supply chain is almost nonexistent. According to a recent study by the European Council on Foreign Relations (ECFR), German company Wacker Chemie is the only European company among the top five globally in the raw material polysilicon. However, Wacker also has significant operations in China.

China’s solar sector continues to grow and develop rapidly despite overcapacity. For instance, by the end of 2023, China’s silicon wafer production capacity reached 953 gigawatts (GW), nearly 98 percent of the global total. In Hubei province, the world’s largest sodium-ion battery energy storage project has been launched. Energy storage is also a significant topic in Europe.

European companies now want to benefit from the technological advancements of their often state-supported Chinese partners. According to Rath, the European partners in the joint ventures will hold the majority shares, and there will be a technology transfer from China to Europe. “The technology transfer involves not only new product technology but also production technology,” including machines for producing solar components.

“We haven’t necessarily forgotten this area in Germany over the last 20 to 30 years, but outsourced it, arrogantly believing we could develop things but produce them in low-wage countries. This has now backfired on the EU,” Rath explains, “because we can no longer produce along the photovoltaic value chain and must now bring it back to Europe through partnerships.”

The German government appears willing to accept China as a supplier, recognizing that rebuilding an entire industry is disproportionately expensive and not competitive. China’s high production capacities are seen as an opportunity to maintain significant growth in solar capacities.

Thus, imports from China and establishing Chinese providers in Europe to regain domestic value creation are key elements in the government’s considerations. According to the ECFR study, while the analysis of risks and opportunities of cooperation with China in the cleantech sector has just begun, the risks in solar are comparatively low.

The plan to establish Chinese providers aligns with Enpal and its partners’ goals. Rath states that discussions with Chinese technology leaders and European partners about the joint venture project have been ongoing for about a year. The discussions involve determining roles, project capitalization and scaling up. “We need three things: demand to ensure a certain sales volume, know-how for product development and production expertise,” says Rath. Potential buyers include companies like Enpal, which markets complete solar systems directly to consumers.

Clarity on the project’s size, timing and funding framework is also necessary, including potential support from the German government or the EU. The planned joint ventures cannot proceed without subsidies, but Rath emphasizes that investment support is only needed for a limited period. For solar module production, subsidies are less crucial due to the high level of automation. “Chinese partners are also very open to investing in module production themselves.”

However, producing components like solar cells, wafers or polysilicon, which the partners also plan to manufacture together in Europe, requires significant investment and high operating costs. Discussions are ongoing about how support might be structured, says Rath.

Whether the planned joint ventures will receive political backing is uncertain. “Of course, support from the German government would be nice,” says Rath, aware of political reservations about involving Chinese companies. He emphasizes, “These are flagship projects that we should advance without undue fear.” with Finn Mayer-Kuckuk

After the EU elections in early June, the newly elected European Parliament is taking shape, with key positions in the committees being filled. Some positions remain with experienced hands, making a significant shift in the EU Parliament’s stance on China unlikely.

Last week, SPD MEP Bernd Lange was re-elected as the chair of the influential Trade Committee. During the last legislative period, Lange significantly advanced the EU’s Anti-Coercion Instrument (ACI) against economic coercion, which is still awaiting its first application. “We have a lot planned for the next five years: In the context of the increasing global competition between the USA and China, we need to set our own course,” Lange emphasized after his election.

For Lange, greater independence from Chinese goods is part of this strategy. He advocates offering non-Western partners an attractive package that includes market access, investments through the EU’s Global Gateway infrastructure initiative and opportunities for sustainable economic development. “It makes no sense to continue a practice where almost all raw materials are distributed worldwide but refined by or in China,” the SPD politician stated. Diversification and offering a genuine alternative to exploitative practices are crucial.

Lange supports a “fitness test” of economic defense instruments, citing the Foreign Subsidies Regulation (FSR) as an example. He believes it should be examined to see if it aligns with the EU’s green transition ambitions. The FSR was recently heavily criticized by China.

Alongside Lange, the Trade Committee will be led by Vice-Chairs including French MEP Manon Aubry (Left), Hungarian conservative Iuliu Winkler (EPP), Swedish MEP Karin Karlsbro (liberal Renew) and Belgian MEP Kathleen van Brempt (S&D). The committee also includes MEPs sanctioned by China, such as Raphaël Glucksmann and Miriam Lexmann. AfD MEP Maximilian Krah is also a member; his parliamentary assistant was arrested before the European elections on suspicion of spying for China.

The Foreign Affairs Committee is similarly composed of members critical of China: Mika Aaltola from Finland has repeatedly called Beijing an “imperialistic and autocratic threat”. Lithuanian Petras Auštrevičius is part of the Inter-Parliamentary Alliance on China (IPAC), an organization critical of Beijing, comprising members from over two dozen parliaments worldwide. French MEP Glucksmann is also a member. CDU MEP David McAllister was re-elected as the chair.

Green politician Anna Cavazzini will again chair the Committee on Internal Market and Consumer Protection. Cavazzini was a driving force behind the EU Parliament’s import ban on products made with forced labor, primarily affecting goods from Xinjiang, and the EU Supply Chain Act. She recently supported additional tariffs on Chinese electric vehicles.

Marie-Agnes Strack-Zimmermann (FDP) is the new chair of the Defense Committee in the EU Parliament. “The conflicts in our neighborhood and the shifting geopolitical tides mean we need a change in European security to take control of our destiny,” Strack-Zimmermann emphasized upon her election. The EU Parliament had already advocated for enhanced EU-NATO cooperation in the last legislative period. Strack-Zimmermann has repeatedly called for China to influence Moscow.

The Subcommittee on Human Rights will be chaired by French Green MEP Mounir Satouri. The subcommittee has been involved in several resolutions regarding Hong Kong and Xinjiang in the past. Satouri has so far focused less on China, with his primary focus on the Middle East.

In addition to the committees, the delegations are important for the European Parliament’s work on China. The China Delegation remains the largest with 38 members. The chair will be decided on September 19 in Strasbourg. Besides China, there will be delegations for Japan (24 members), India (24 members), ASEAN (27 members), the Korean Peninsula (13 members), Central Asia (19 members) and South Asia (15 members).

The European Taiwan Friendship Group, an informal group of EU MEPs, will continue to be led by CDU MEP Michael Gahler.

The German government blames China for a 2021 cyber attack on the Federal Agency for Cartography and Geodesy (BKG). Intelligence information indicated that Chinese actors were responsible for the cyber attack, said a spokesperson for the Federal Foreign Office on Wednesday in Berlin. This led to the Chinese ambassador in Germany being summoned for the first time since 1989. The German government condemned such attacks in the strongest terms.

A spokesperson for the Federal Ministry of the Interior added that there had been a comprehensive investigation of the case. The Chinese were successfully expelled from the BKG systems. The agency provides geodata. rtr

If the German government wants to meet its target of 15 million electric cars by 2030, Germany will depend on Chinese manufacturers. This is highlighted in a study by the think tank Agora Verkehrswende and the consulting firm Boston Consulting Group (BCG). With its current trajectory, Germany is set to miss the target by about six million vehicles.

The study’s authors criticize the higher import tariffs that the EU plans to impose on electric cars from China. These tariffs would lead to higher prices for customers and jeopardize the competitiveness of the German automotive industry. “To achieve climate goals and secure Germany’s automotive industry in the long term, we should advocate for the rapid expansion of e-mobility, including the participation of Chinese companies,” says Christian Hochfeld, director of Agora Verkehrswende.

“This may seem paradoxical at first glance, but a swift transition to e-mobility also contributes to greater sovereignty and competitiveness vis-à-vis China,” Hochfeld stated. Particularly in the segment of low-priced small vehicles, Chinese products could help accelerate the market adoption of EVs in Europe.

Hochfeld also calls for the “quick establishment of Chinese companies in Europe under common rules”. This would create more value than imports alone. It would also provide the opportunity to catch up in technological areas like battery production through cooperation. flee

According to insiders, the US government aims to introduce a stricter embargo on technology exports to China this August. However, the export of chip-making machinery from certain allied countries will be exempt, several people familiar with the matter told Reuters on Wednesday. Following this news, shares of suppliers like ASML from the Netherlands and Tokyo Electron from Japan rose by up to 7.4 percent. For both companies, China is a significant market.

“Effective export controls rely on multilateral cooperation,” said a US official. “We are continuously working with like-minded countries to achieve our common national security goals.” Exemptions will apply to more than 30 countries.

According to further statements from insiders, the US is invoking a provision from 1959, the Foreign Direct Product Rule, to justify the stricter embargo. This rule gives the US government the right to prohibit the sale of products developed using American technology. Foreign companies can also face penalties for violations.

In recent years, this provision has primarily been used to prevent the controversial Chinese company Huawei from accessing foreign computer chips. The planned tightening of the embargo would also include products with previously considered too low a share of American technology in their manufacture, the insiders added. Additionally, 120 more Chinese chip producers and suppliers will be added to the blacklist. However, it initially remained unclear which companies would be affected. rtr

Siemens Healthineers anticipates more orders for CT and MRI machines from Chinese hospitals and healthcare facilities in the next fiscal year. Currently, anti-corruption measures in the healthcare sector are delaying order placements. “We expect this to result in a backlog in 2025,” said CEO Bernd Montag.

Siemens Healthineers is observing preparations for a government program aimed at boosting investments in the Chinese healthcare system. In the ongoing fourth quarter of 2023/24, which runs until the end of September, the company expects a stabilization of its medical equipment business in China.

The subdued growth forecasts for the imaging segment are affecting margins in the current fiscal year. The operating profit margin in this segment is expected to be at the lower end of the 21.0 to 22.5 percent range, according to CFO Jochen Schmitz. This will be partially offset by better performance in the diagnostics segment, whose margin is expected to be at the upper end of the four to six percent range. The restructuring in diagnostics is progressing better than expected. rtr

The Chinese commerce group Alibaba is increasing its use of Artificial Intelligence (AI) on its B2B platform. Starting in September, Alibaba’s International Digital Commerce Group (AIDC) will offer an “AI-powered conversational sourcing engine,” Alibaba announced on Wednesday. This new technology is primarily intended to assist small and medium-sized enterprises.

According to the company, the AI-powered sourcing tool will be accessible via its own mobile app and the official website. The natural language-based sourcing engine will enable users to interact with the tool more easily. “We want to help European SMEs, not only buyers but also suppliers,” said Kuo Zhang, president of Alibaba.com, in an interview with Table.Briefings. “The sourcing engine will also be available to merchants on third-party platforms outside the Alibaba ecosystem.”

According to Kuo, the new sourcing engine will aggregate vast amounts of information and interpret it in natural language. This will allow buyers to be matched with products and suppliers with greater accuracy. In November, Alibaba launched the AI platform Aidge, which is now reportedly used by half a million suppliers. ari

US President George H.W. Bush once remarked that, “No nation on Earth has discovered a way to import the world’s goods and services while stopping foreign ideas at the border.” In an age when democracies dominated the technological frontier, the ideas Bush had in mind were those associated with America’s own model of political economy.

But now that China has become a leading innovator in artificial intelligence, might the same economic integration move countries in the opposite direction? This question is particularly relevant to developing countries, since many are not only institutionally fragile, but also increasingly connected to China via trade, foreign aid, loans, and investments.

While AI has been hailed as the basis for a “fourth industrial revolution,” it is also bringing many new challenges to the fore. AI technologies have the potential to drive economic growth in the coming years, but also to undermine democracies, aid autocrats‘ pursuit of social control, and empower “surveillance capitalists” who manipulate our behavior and profit from the data trails we leave online.

Since China has aggressively deployed AI-powered facial recognition to support its own surveillance state, we recently set out to explore the patterns and political consequences of trade in these technologies. After constructing a database for global trade in facial-recognition AI from 2008 to 2021, we found 1,636 deals from 36 exporting countries to 136 importing countries.

From this dataset, we document three developments. First, China has a comparative advantage in facial-recognition AI. It exports to roughly twice as many countries as the United States does (83 versus 57 links), and it has about 10 percent more trade deals (238 versus 211). Moreover, its comparative advantage in facial-recognition AI is larger than in other frontier-technology exports, such as radioactive materials, steam turbines, and laser and other beam processes.

While different factors may have contributed to China’s comparative advantage, we know that the Chinese government has made global dominance in AI an explicit developmental and strategic goal, and that the facial-recognition AI industry has benefited from its demand for surveillance technology, often receiving access to large government datasets.

Second, we find that autocracies and weak democracies are more likely to import facial-recognition AI from China. While the US predominantly exports the technology to mature democracies (these account for roughly two-thirds of its links, or three-quarters of its deals), China exports roughly equal amounts to mature democracies and autocracies or weak democracies.

Does China have an autocratic bias, or is it simply exporting more to autocracies and weak democracies across all products? When we compared China’s exports of facial-recognition AI to its exports of other frontier technologies, we found that facial-recognition AI is the only technology for which China displays an autocratic bias. Equally notable, we found no such bias when investigating the US.

One potential explanation for this difference is that autocracies and weak democracies might be turning specifically to China for surveillance technologies. That brings us to our third finding: autocracies and weak democracies are more likely to import facial-recognition AI from China in years when they experience domestic unrest.

The data make clear that weak democracies and autocracies tend to import surveillance AI from China – but not from the US – during years of unrest, rather than pre-emptively or after the fact. Imports of military technology follow a similar pattern. By contrast, we do not find that mature democracies import more facial-recognition AI in response to unrest.

A final question concerns broader institutional changes in these countries. Our analysis shows that imports of Chinese surveillance AI during episodes of domestic unrest are indeed associated with a country’s elections becoming less fair, less peaceful, and less credible overall. And a similar pattern appears to hold with imports of US surveillance AI, though this finding is less precisely estimated.

At the same time, we do not find any association between surveillance AI imports and institutional quality among mature democracies. So, rather than interpreting our findings as the causal impact of AI on institutions, we view imports of surveillance AI and the erosion of domestic institutions in autocracies and weak democracies as the joint outcome of a regime’s pursuit of greater political control.

Interestingly, we also find suggestive evidence that autocracies and weak democracies importing large amounts of Chinese surveillance AI during unrest are less likely to develop into mature democracies than peer countries with low imports of surveillance AI. This suggests that the tactics employed by autocracies during times of unrest – importing surveillance AI, eroding electoral institutions, and importing military technology – may be effective in entrenching non-democratic regimes.

Our research adds to the evidence that trade does not always foster democracy or liberalize regimes. Instead, China’s greater integration with the developing world may do precisely the opposite.

This suggests a need for tighter AI trade regulation, which could be modeled on the regulation of other goods that produce negative externalities. Insofar as autocratically biased AI is trained on data collected for the purpose of political repression, it is similar to goods produced from unethically sourced inputs, such as child labor. And since surveillance AI may have negative downstream externalities, such as lost civil liberties and political rights, it is not unlike pollution.

Like all dual-use technologies, facial-recognition AI has the potential to benefit consumers and firms. But regulations must be carefully designed to ensure that this frontier technology is diffused around the world without facilitating autocratization.

Martin Beraja is Assistant Professor of Economics at MIT. David Y. Yang is Professor of Economics and Director of the Center for History and Economics at Harvard University. Noam Yuchtman is Professor of Political Economy and a fellow of All Souls College at the University of Oxford.

Copyright: Project Syndicate, 2024.

www.project-syndicate.org

Francesca Ghiretti is a new Research Leader at the NGO think tank Rand Europe. Ghiretti previously worked as an analyst at Merics, among others.

Is something changing in your organization? Let us know at heads@table.media!

The Chinese internet is abuzz with excitement over the 405 athletes from the People’s Republic who have traveled to Paris. Every day, a new hero or heroine is celebrated, such as Hong Kong fencer Vivian Kong Man-wai or table tennis stars Wang Chuqin and Sun Yingsha, who have all won gold.

At the same time, netizens are expressing concerns about the conditions in the athletes’ accommodations. Because the Olympic Games in France are striving to be particularly eco-friendly, there is a lack of adequate comfort. Nine athletes reportedly have to share one sofa and two toilets on a single floor of the Olympic Village. Beds and chairs are made from recyclable cardboard and are correspondingly uncomfortable. Air conditioning is also missing, despite the heat.

Critics warn that all these factors will negatively impact the athletes’ performance. They sarcastically refer to the games as “self-initiated” 自主奥运 – suggesting that anyone who wants to shine must bring their own furniture, cook their own food or order portable air conditioners from China online.