The Italo-Swiss shipping company MSC will, in all likelihood, acquire about half of the German port of Hamburg. Unlike the offer from the Chinese state-owned company Cosco, there were no concerns here. After all, it is a European solution. Although MSC maintains obvious contacts with the Camorra and is involved in the smuggling of cocaine, the Italian drug mafia, unlike China, has not been classified as a rival power by Germany and the EU. Nor does it have an army threatening a neighboring country.

However, MSC’s growing ties to China are somewhat irritating. The shipping company not only builds its ships in China, it also invests heavily in the port of Shanghai. The company’s CEO was also recently at Cosco for confidential talks, as Frank Sieren learned on site. Granted, the Port of Hamburg itself has no problem with ties to China – after all, it originally invited Cosco to invest. But everyone who strongly opposed Cosco’s stale should now look closer. Because a formal alliance between MSC and Cosco is currently possible and even likely.

The intense dispute over the reefs in the South China Sea has now reached a level of intensity that experts consider warfare in the gray zone. This resembles China’s strategy vis-à-vis Taiwan. The actions remain below the threshold of what would internationally be considered an act of war. Coastguard vessels are deployed instead of navy ships, always under the guise of protecting their fishermen.

The Philippine government has now devised a clever counter-strategy, analyzes Michael Radunski. It relies on transparency. In other words, exactly what China does not have to offer. Manila invites journalists on site to be there and film the behavior of China’s huge coastguard vessels.

The Mediterranean Shipping Company (MSC), with its roots in Italy and current headquarters in Geneva, is moving ever closer to China. This is particularly relevant for Germany as MSC will soon become co-owner of the Hamburg port operator HHLA. Earlier this year, the German government only allowed the Chinese shipping group and port operator Cosco to acquire a small share in one of HHLA’s terminals, citing security concerns.

Now, however, Cosco could gain access to Hamburg logistics resources via MSC after all. MSC recently signed a contract taking over 49.9 percent of the port operator HHLA. And MSC apparently cooperates surprisingly closely with Cosco.

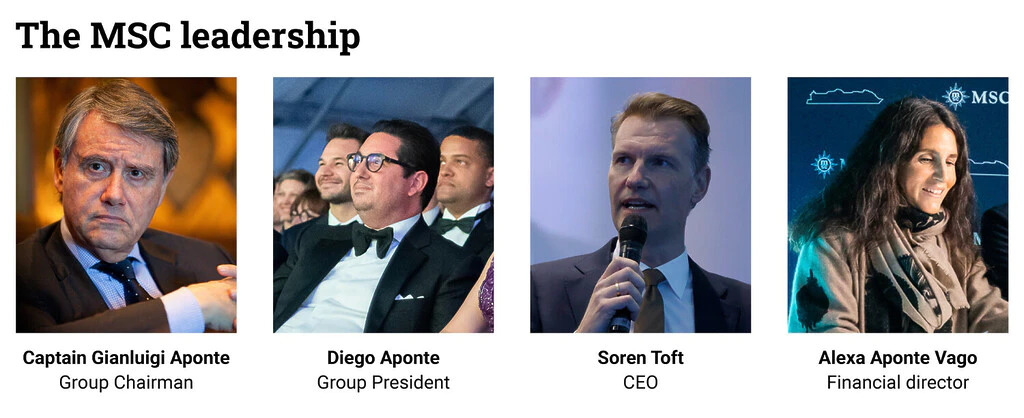

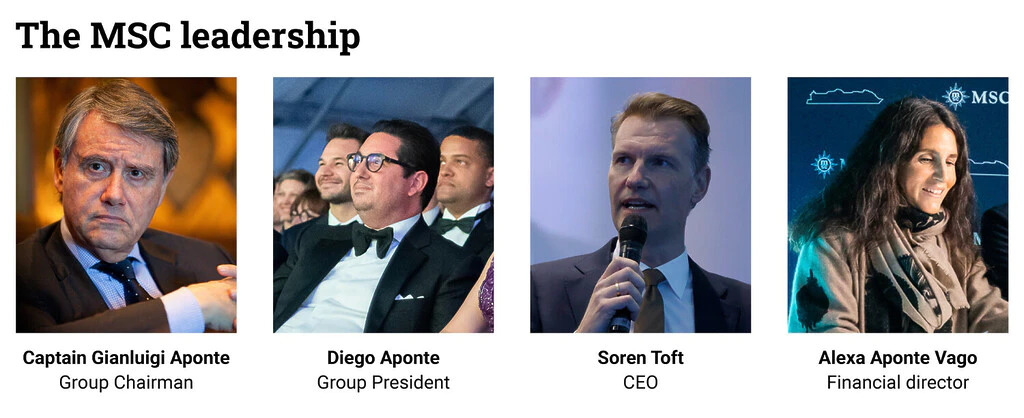

MSC CEO Soren Toft met Cosco CEO Wan Min in early September for secret talks. Table.Media learned this from industry circles. Toft was also received by Shanghai party leader Chen Jining on 21 September. Toft was in the Chinese port city for the 2023 North Bund International Shipping Forum. The forum was co-organized by Cosco.

While the details of Toft and Wan’s meeting remain unknown, the Shanghai Municipal Government stated that MSC is “constantly expanding” and in “close cooperation with Shanghai enterprises.” Shanghai welcomes MSC’s increasing investment.

Toft said China is “one of the most important markets in the world for MSC.” Its Chinese partners share “a common development philosophy,” adding that MSC plans to increase its investments. Toft also made similar comments shortly before in a meeting with China’s Vice Minister of Commerce Ling Ji (on 20 September). Ling is also the country’s deputy international trade representative.

This results in a peculiar situation for Hamburg. The Hamburg Senate gave up a 19 percent share in HHLA from its own holdings for MSC’s entry. MSC’s entry is thus happening with Hamburg’s highest blessing. Cosco, on the other hand, was only allowed to acquire a mere 24.9 percent of the shares without voting rights in one of HHLA’s terminals after an investment screening by the German government earlier this year – although Hamburg’s port operator HHLA would gladly have sold more and Cosco would have liked to buy more.

German Economy Minister Robert Habeck (Greens) justified limiting Cosco’s stake on the grounds of security concerns and protecting Germany’s infrastructure. However, MSC could now give Cosco access to the Port of Hamburg and its lucrative rail link to Eastern Europe after all.

The ties between MSC and Cosco already appear surprisingly close. The two companies apparently already collude on prices. In late summer 2021, a well-known US furniture manufacturer sued MSC and Cosco for alleged collusion during the pandemic at US consumers’ expense. Cosco settled with the furniture manufacturer out of court, but MSC was forced to pay the plaintiff US company one million US dollars in damages.

There was no ruling against Cosco or admission of guilt by the Chinese in the settlement before the Federal Maritime Commission (FMC). However, this does not rule out the possibility of collusion. MSC, on the other hand, denies price fixing. What certainly unites Cosco and MSC now is the anger at the US authorities pressuring both companies.

Especially as the United States has now also made MSC’s involvement in drug trafficking public. In the fall of 2022, Bloomberg, in close cooperation with US law enforcement agencies, revealed that MSC ships are the main distribution channel for drug traffickers from the Balkans to the world. Bloomberg based its reporting on interviews with more than a hundred individuals as well as documents from US court cases. The Balkan Cartel, one of Europe’s largest drug trafficking networks, has primarily used MSC ships in the past decade, including recruiting the shipping company’s employees, the report claims.

MSC denies that the drug mafia has infiltrated its shipping company or that it is even part of the mafia itself. However, the name of the shipping company appears repeatedly in connection with drug smuggling. US prosecutor William McSwain stated: “We certainly didn’t see MSC as a victim in all this.”

This is because almost 20 tons of cocaine were found on an MSC container ship seized by the US authorities in Philadelphia in June 2019. The drug had a street value of around 1.3 billion US dollars. It was the largest drug find by US Customs in 230 years. In light of the allegations, MSC faces a 700 million US dollar fine. Drugs have also been found on MSC ships in Peru, Panama and other countries.

The investigations have changed MSC’s positioning in international activities. Previously, the company was strongly oriented towards US interests. Now, the company has turned its attention to China instead. A comparison of the statements made by the company’s founder in recent years reveals the change. In October 2018, Gianluigi Aponte, the company’s founder and owner, said: “China is arrogant and to make business with them is not an easy task.” But he has not said a single critical word against China ever since.

Overall, MSC operates highly intransparently. It does not even publish its revenue figures. Gianluigi Aponte founded a shipping company in 1970 with used vessels in Sorrento in the Bay of Naples. The captain had previously “worked as a banker for a few years.” The company was founded at a time when the Italian mafia organization Camorra was massively expanding its business.

Aponte bought his first vessel from the Hamburg shipping company Hans Krueger. Other ships soon followed. It is unknown where the founder got the initial capital for the expansion. Later, however, he tapped into traceable money sources. Aponte was an attractive man, which Raffaela Denat also noticed. The daughter of a wealthy Swiss banker was on a cruise with her mother Patricia when she fell in love with the elegant captain – the two married. In 1974, MSC moved its headquarters to Geneva.

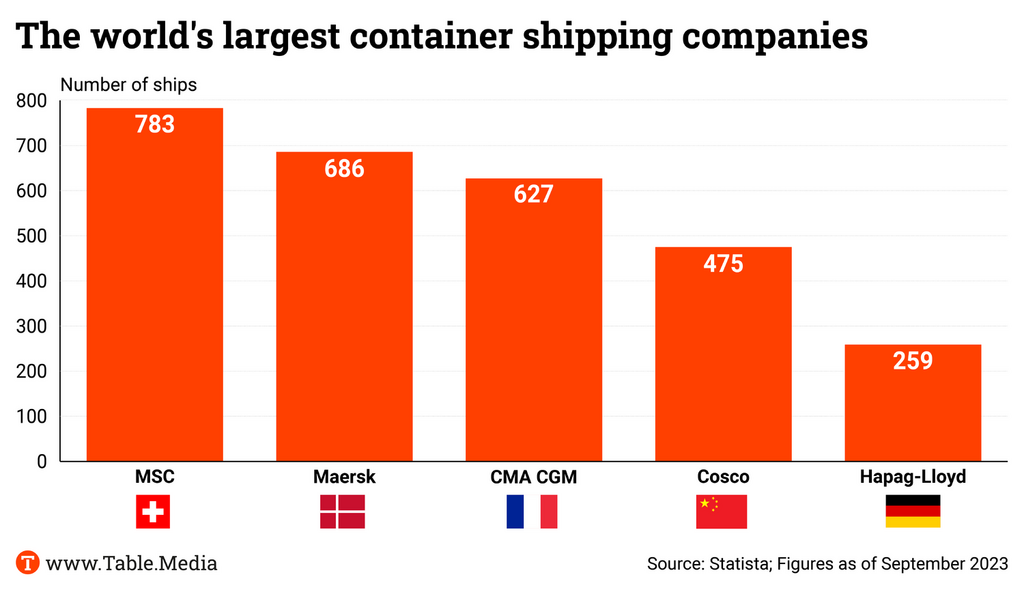

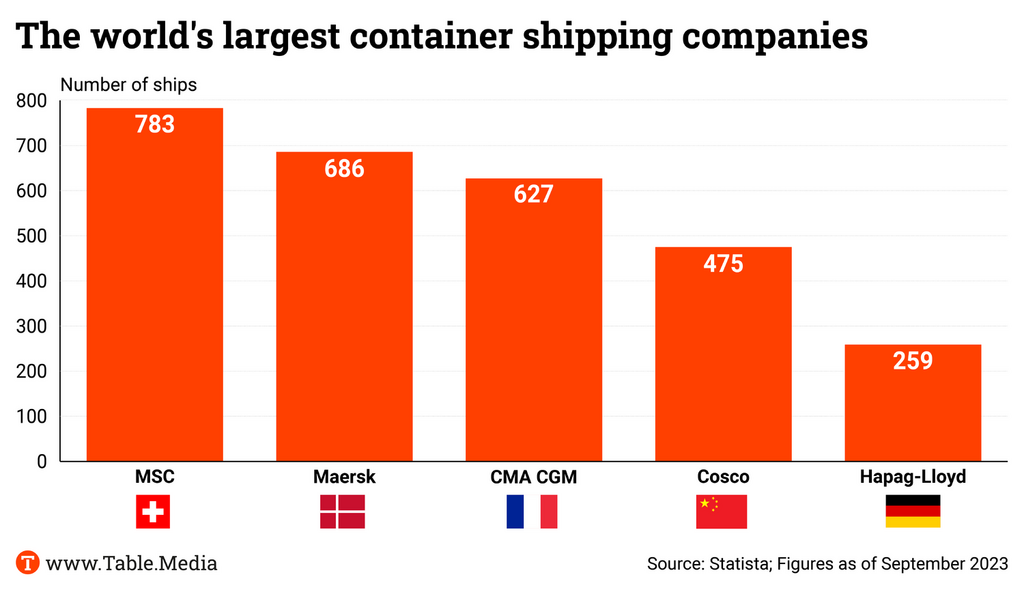

Until 1995, MSC exclusively acquired used container ships. After that, MSC also commissioned its own ships. During the pandemic, MSC bought more: Since August 2020 alone, MSC has acquired 271 used vessels with a capacity of over one million TEUs (20-foot containers). Over 780 ships now sail for MSC, including 23 cruise ships. The company has 150,000 employees in 55 countries. Aponte, now 82, is one of the world’s 50 richest people.

Although the family holds on to the CEO Toft, the core business is in family hands: Son Diego is group president, daughter Alexa Aponte Vago heads finances, son-in-law Pierfrancesco Vago manages the cruise business. And wife Raffaela Aponte decorates the passenger ships.

MSC is also an important client of the Chinese shipbuilding industry. In July, the “MSC Michel Cappellini” was christened, at that time officially the largest container ship in the world with a length of 399.9 meters. It was built at the Yangzijiang Shipbuilding yard and belongs to the Megamax class, which can carry over 24,000 TEU. In early October, however, it had to give this title to the “Berlin Express,” the latest colossus of Hamburg-based shipping company Hapag-Lloyd, which is a tiny bit bigger.

MSC’s six sister container ships are also similar in size and come from China. Four are already in operation, two others are still under construction in the shipyard of Jiangsu Yangzi Xinfu Shipbuilding near the city of Nanjing and the port of Shanghai, respectively. They have not yet been christened.

In mid-August this year, MSC also ordered ten liquefied natural gas freighters for a total of 1.3 billion US dollars from the Zhoushan Changhong International Shipyard in Zhejiang Province, south of Shanghai. The ships will be delivered in 2026 and 2027.

Previously, MSC maintained a close partnership with the Danish shipping company Maersk. However, after seven years, it broke this alliance even though they were very strong together: Each of the two partners controlled about a third of the global market.

Both companies aim to have completely separated their operations by 2025. For this reason, MSC is looking for a new partner. Cosco is a member of the Ocean Alliance with the French group CMA-CGM, the Taiwanese company Evergrande, and the Hong Kong player OOCL. Such alliances are commonplace in the shipping industry.

A partnership with Cosco would, therefore, be highly appealing to MSC. Conversely, MSC’s stake in the port also makes them more attractive from a Chinese perspective.

However, they not only have their eyes on the Port of Hamburg, but also on a very attractive rail network. The Port of Hamburg is the world’s largest railway port. In 2021, the port shipped over half of all arrived goods via rail. In Bremerhaven and Rotterdam, the figure is only around 20 percent each. This is a significant asset in times of climate change.

The HHLA subsidiary Metrans is even the market leader in container transport in seaport-hinterland traffic with Central, Eastern and Southern Europe. More than 500 trains a week currently run in Metrans’ closely meshed network. Its network stretches from the Netherlands, Germany and Austria via Slovakia and the Czech Republic to Hungary, Slovenia and Croatia – and even to the Greek port of Piraeus.

And Piraeus, which is now the most successful port in the Mediterranean after a long crisis, is owned by Cosco. What MSC is openly betting on: Hamburg continues to be attractive for the new, close partner Cosco because of the rail connection, even if the port itself is no longer competitive.

The video appears rather unremarkable: A man wearing diving goggles and a snorkel cuts a thick rope underwater with a knife. The footage is blurry, appearing almost amateurish – and shows the Philippines’ fiercest defensive measure against China to date. The diver is in the service of the Philippine Coast Guard, and the rope is part of a Chinese sea barrier that is supposed to keep Philippine boats out of Scarborough Reef.

The situation has been tense since the cable incident. Over the weekend, the BBC and other media reported a clash between Philippine ships and a Chinese Coast Guard contingent on Second Thomas Reef, which is also disputed between the two countries. The government in Manila invited international journalists to join its coast guard boats and observe China’s behavior at sea.

These actions reflect Manila’s new strategy against Beijing. Raymond Powell calls it an “assertive transparency campaign.” “With this new campaign, the Philippines is trying to defend itself against China’s “gray zone” tactics,” the former US Air Force pilot told Table.Media. Powell currently heads Sealight, a project on transparency in the law of the sea at Stanford University.

Powell examines China’s “gray zone” tactics in the South China Sea. These involve activities just below the threshold of war, in which Beijing uses asymmetrical advantages to systematically drive back rivals. Sometimes lasers are used to blind, sometimes water cannons are fired. Or, as recently, when a sea barrier was erected around Scarborough Reef.

Both China and the Philippines lay claim to the narrow Scarborough Reef, just 250 kilometers off the main Philippine island. However, while Manila has appealed to the International Court of Arbitration in The Hague, Beijing is relying on the power of the factual with gray zone tactics.

Powell explains that the South China Sea is predestined for this: “It’s a real breeding ground for gray-zone activities, because most of what happens there is out of the public eye.” If, for example, China pushes a Filipino fisherman off course or points a laser at a Philippine Coast Guard vessel, Beijing denies everything after the fact.

But Manila refuses to be put on the defensive any longer. Instead, the Philippines attempts to expose China’s gray zone attacks by publishing photos and videos of such incidents. One example is the shaky footage of the diver off Scarborough Reef, another is the journalist posse at Second Thomas Reef. “Beijing was clearly caught off guard,” Powell notes.

The reaction from China was correspondingly sharp. The Chinese Foreign Ministry sent a clear warning: “We advise the Philippines not to provoke or stir up trouble.” Beijing’s spokesperson reiterated that China’s determination to protect its sovereignty and maritime rights and interests with regard to Huangyan Dao is unwavering. Huangyan Dao (黄岩岛) is the Chinese designation for Scarborough Reef.

Song Zhongping, a former Chinese military officer, further demands: “China must take decisive measures to put an end to the Philippines’ provocation.” The Philippines cannot be allowed to pose a serious threat to China’s national sovereignty and security, he said, adding that the US is using the Philippines as a proxy. “The Philippines is just a disposable chess piece or cannon fodder in US strategic architecture,” Song told Global Times.

The Philippines is aware of China’s superior strength. At the same time, Defense Minister Gilberto Teodoro Jr. made it clear in an interview with the US television channel CNN over the weekend how much is at stake in this dispute. “We’re fighting for our fisherfolk, we’re fighting for our resources. We’re fighting for our integrity as an archipelagic state… Our existence as the Republic of the Philippines is vital to this fight,” Teodoro said. “It’s not for us, it’s for the future generations too.”

Raymond Powell also warns: “China may not want a major conflict, but over time, it has become accustomed to achieving its ambitions through bullying.” Therefore, he says, it is unlikely that Beijing will change its course – unless the gray zone tactics that have been so successful for so long no longer work.

To achieve this, the Philippines is not only relying on transparency, but also on alliances. For instance, the military exercise “Sama Sama” is currently being held in the South China Sea. “With this show of force and active engagement of our allies and partners, ‘Sama Sama’ transcends mere military exercises,” an admiral of the Philippine Navy said on Tuesday at the start of the naval exercises. The approximately 1,800 participants are from the US, Japan, the UK and Canada.

In addition, the United States regularly deploys combat vessels to the region on Freedom of Navigation Operations, or Fonops for short, in an effort to ensure open access to the South China Sea for all nations.

All this is not without risk. China’s increasingly aggressive posturing and the Philippines’ new courage increase the likelihood of accidental confrontations. Moreover, the USA and the Philippines share a military mutual assistance pact. Incidents in the South China Sea could thus quickly have unforeseeable consequences.

In view of the outbreak of violence in Israel, the Chinese government has issued a statement supporting a two-state solution. China is “deeply concerned about the … escalation of tension and violence between Palestine and Israel” and calls for a ceasefire. The resurgence of the conflict shows that the peace process is not making progress, it said. “The fundamental way out of the conflict lies in implementing the two-state solution and establishing an independent State of Palestine.” China is thus repeating an existing position. fin

The export controls on the industrial metals gallium and germanium put into effect in early August are already having an impact. Exports of the two metals dropped to zero in August, reports Carbon Brief. However, export licenses have been granted for September. Reuters reported that the US company AXT and a number of unnamed Chinese companies had received export licenses for certain customers. It was not initially known whether the exports would be made in September.

As of August, exporters must obtain a license to ship the two elements to other countries. The ministry’s directive is based on the 2020 Export Control Law. Among other things, gallium and germanium are used for photovoltaic cells and chips in the automotive industry.

However, China could soon have competition, at least for germanium. A recently inaugurated plant in the Democratic Republic of Congo is expected to produce about 30 percent of the world’s germanium, according to the operators, Bloomberg reported on Friday. China produces about 60 percent of global demand. The new plant in the country’s southeast will be operated by Societe Congolaise pour le Traitement du Terril de Lubumbashi (STL), a subsidiary of state-owned mining company Gecamines. It was inaugurated last week by Congo’s President Felix Tshisekedi. ck

Smartphone production in China is weakening. In the first eight months of this year, the country’s manufacturers produced 679 million smartphones, the South China Morning Post reported on Friday, citing data from the Ministry of Information. That is 7.5 percent less than in the same period last year. According to the report, the second quarter was particularly weak: Manufacturers recorded the lowest sales since 2014 as the weak economy curbs consumption.

One silver lining was the hype surrounding the September presentation of Huawei’s new 5G smartphone Mate 60 with Chinese high-performance chips. According to estimates by market research firm Counterpoint, the Mate 60 could reach five to six million units sold by the end of the year. ck

Li Daokui, who goes by David Li in the West, is one of China’s leading economists. He is a regular speaker at the World Economic Forum and has served on the Monetary Policy Committee of the People’s Bank of China and the Chinese People’s Political Consultative Conference.

Li is currently a professor of economics and management at the prestigious Tsinghua University in Beijing, where he also holds the post of Director at the Center for China and the World Economy. Since 2013, Li is also founding dean of the university’s Schwarzman Scholars Program. This program is a fully funded master’s degree for future leaders, founded by American financier Stephen A. Schwarzman. Li lectures primarily on economic change, international economics and the economy of China.

Li sees the Covid pandemic and the Ukraine war as the biggest challenges for the Chinese economy. Speaking to Chinese foreign broadcaster CGTN, Li once mentioned mainly the financial and logistical risks that the conflict could bring to China. “There are some production facilities and supply chains for which Russia is important. You never know what impact this will have on us,” Li said.

While other countries struggle to find the right approach to climate change, Li looks optimistically at China’s prospects in the fight against rising emissions. But he has to be, because optimism is the first civic duty for economists in the Chinese system.

When it comes to reducing carbon emissions, he sees an opportunity for China to act as a global pioneer by introducing a carbon tax. “We have had regionally different regulations and approaches to reducing CO2 in China for a long time. Yet there is no other problem that more urgently needs a unified market,” Li told broadcaster CGTN. “I strongly advocate a carbon tax tied to long-term planning. Initially, the cost of emissions may be cheap, but over time, prices will rise. Such a plan also gives investors predictability.”

Recently, Li spoke with Bloomberg about the real estate crisis in China: “The collapse of the property market over the past two years has left real estate giants close to default, triggered market panic, and left housing projects unfinished.”

Li estimates the market will take up to a year to recover from the crisis. “I propose a mechanism to increase bank lending to developers.” About 100 billion yuan ($13.7 billion) will be needed to support developers during the current downturn. Svenja Schlicht

Xie Yijing has been appointed acting CEO of the financial group China Renaissance. He co-founded the company with Bao Fan, which is primarily active in investment banking and asset management. Bao disappeared from Hong Kong in February and is apparently in the custody of Chinese investigators. At the time, Xie had already taken over the day-to-day business as managing director.

Joe Cheung will be the new managing director of the Hong Kong office of wealth manager Harneys Fiduciary, which provides primarily offshore corporate services in four locations. Cheung previously headed the Hong Kong office of a global private client trust company.

Is something changing in your organization? Let us know at heads@table.media!

The Asian Games in Hangzhou ended on Sunday with a lavish closing ceremony. China won 201 gold medals, followed by Japan with 51 gold medals and South Korea with 42. In addition to traditional competitions like the Olympics, the Games featured specifically Asian competitions such as dragon boat races. In the picture, Team China fights for the medals in the finals.

The first Asian Games were held in New Delhi in 1951. The mega-event is now moving on to Nagoya, Japan. Unlike Hangzhou, which has opened 56 new sports venues, Aichi Prefecture wants to economize and build only two additional new facilities.

The Italo-Swiss shipping company MSC will, in all likelihood, acquire about half of the German port of Hamburg. Unlike the offer from the Chinese state-owned company Cosco, there were no concerns here. After all, it is a European solution. Although MSC maintains obvious contacts with the Camorra and is involved in the smuggling of cocaine, the Italian drug mafia, unlike China, has not been classified as a rival power by Germany and the EU. Nor does it have an army threatening a neighboring country.

However, MSC’s growing ties to China are somewhat irritating. The shipping company not only builds its ships in China, it also invests heavily in the port of Shanghai. The company’s CEO was also recently at Cosco for confidential talks, as Frank Sieren learned on site. Granted, the Port of Hamburg itself has no problem with ties to China – after all, it originally invited Cosco to invest. But everyone who strongly opposed Cosco’s stale should now look closer. Because a formal alliance between MSC and Cosco is currently possible and even likely.

The intense dispute over the reefs in the South China Sea has now reached a level of intensity that experts consider warfare in the gray zone. This resembles China’s strategy vis-à-vis Taiwan. The actions remain below the threshold of what would internationally be considered an act of war. Coastguard vessels are deployed instead of navy ships, always under the guise of protecting their fishermen.

The Philippine government has now devised a clever counter-strategy, analyzes Michael Radunski. It relies on transparency. In other words, exactly what China does not have to offer. Manila invites journalists on site to be there and film the behavior of China’s huge coastguard vessels.

The Mediterranean Shipping Company (MSC), with its roots in Italy and current headquarters in Geneva, is moving ever closer to China. This is particularly relevant for Germany as MSC will soon become co-owner of the Hamburg port operator HHLA. Earlier this year, the German government only allowed the Chinese shipping group and port operator Cosco to acquire a small share in one of HHLA’s terminals, citing security concerns.

Now, however, Cosco could gain access to Hamburg logistics resources via MSC after all. MSC recently signed a contract taking over 49.9 percent of the port operator HHLA. And MSC apparently cooperates surprisingly closely with Cosco.

MSC CEO Soren Toft met Cosco CEO Wan Min in early September for secret talks. Table.Media learned this from industry circles. Toft was also received by Shanghai party leader Chen Jining on 21 September. Toft was in the Chinese port city for the 2023 North Bund International Shipping Forum. The forum was co-organized by Cosco.

While the details of Toft and Wan’s meeting remain unknown, the Shanghai Municipal Government stated that MSC is “constantly expanding” and in “close cooperation with Shanghai enterprises.” Shanghai welcomes MSC’s increasing investment.

Toft said China is “one of the most important markets in the world for MSC.” Its Chinese partners share “a common development philosophy,” adding that MSC plans to increase its investments. Toft also made similar comments shortly before in a meeting with China’s Vice Minister of Commerce Ling Ji (on 20 September). Ling is also the country’s deputy international trade representative.

This results in a peculiar situation for Hamburg. The Hamburg Senate gave up a 19 percent share in HHLA from its own holdings for MSC’s entry. MSC’s entry is thus happening with Hamburg’s highest blessing. Cosco, on the other hand, was only allowed to acquire a mere 24.9 percent of the shares without voting rights in one of HHLA’s terminals after an investment screening by the German government earlier this year – although Hamburg’s port operator HHLA would gladly have sold more and Cosco would have liked to buy more.

German Economy Minister Robert Habeck (Greens) justified limiting Cosco’s stake on the grounds of security concerns and protecting Germany’s infrastructure. However, MSC could now give Cosco access to the Port of Hamburg and its lucrative rail link to Eastern Europe after all.

The ties between MSC and Cosco already appear surprisingly close. The two companies apparently already collude on prices. In late summer 2021, a well-known US furniture manufacturer sued MSC and Cosco for alleged collusion during the pandemic at US consumers’ expense. Cosco settled with the furniture manufacturer out of court, but MSC was forced to pay the plaintiff US company one million US dollars in damages.

There was no ruling against Cosco or admission of guilt by the Chinese in the settlement before the Federal Maritime Commission (FMC). However, this does not rule out the possibility of collusion. MSC, on the other hand, denies price fixing. What certainly unites Cosco and MSC now is the anger at the US authorities pressuring both companies.

Especially as the United States has now also made MSC’s involvement in drug trafficking public. In the fall of 2022, Bloomberg, in close cooperation with US law enforcement agencies, revealed that MSC ships are the main distribution channel for drug traffickers from the Balkans to the world. Bloomberg based its reporting on interviews with more than a hundred individuals as well as documents from US court cases. The Balkan Cartel, one of Europe’s largest drug trafficking networks, has primarily used MSC ships in the past decade, including recruiting the shipping company’s employees, the report claims.

MSC denies that the drug mafia has infiltrated its shipping company or that it is even part of the mafia itself. However, the name of the shipping company appears repeatedly in connection with drug smuggling. US prosecutor William McSwain stated: “We certainly didn’t see MSC as a victim in all this.”

This is because almost 20 tons of cocaine were found on an MSC container ship seized by the US authorities in Philadelphia in June 2019. The drug had a street value of around 1.3 billion US dollars. It was the largest drug find by US Customs in 230 years. In light of the allegations, MSC faces a 700 million US dollar fine. Drugs have also been found on MSC ships in Peru, Panama and other countries.

The investigations have changed MSC’s positioning in international activities. Previously, the company was strongly oriented towards US interests. Now, the company has turned its attention to China instead. A comparison of the statements made by the company’s founder in recent years reveals the change. In October 2018, Gianluigi Aponte, the company’s founder and owner, said: “China is arrogant and to make business with them is not an easy task.” But he has not said a single critical word against China ever since.

Overall, MSC operates highly intransparently. It does not even publish its revenue figures. Gianluigi Aponte founded a shipping company in 1970 with used vessels in Sorrento in the Bay of Naples. The captain had previously “worked as a banker for a few years.” The company was founded at a time when the Italian mafia organization Camorra was massively expanding its business.

Aponte bought his first vessel from the Hamburg shipping company Hans Krueger. Other ships soon followed. It is unknown where the founder got the initial capital for the expansion. Later, however, he tapped into traceable money sources. Aponte was an attractive man, which Raffaela Denat also noticed. The daughter of a wealthy Swiss banker was on a cruise with her mother Patricia when she fell in love with the elegant captain – the two married. In 1974, MSC moved its headquarters to Geneva.

Until 1995, MSC exclusively acquired used container ships. After that, MSC also commissioned its own ships. During the pandemic, MSC bought more: Since August 2020 alone, MSC has acquired 271 used vessels with a capacity of over one million TEUs (20-foot containers). Over 780 ships now sail for MSC, including 23 cruise ships. The company has 150,000 employees in 55 countries. Aponte, now 82, is one of the world’s 50 richest people.

Although the family holds on to the CEO Toft, the core business is in family hands: Son Diego is group president, daughter Alexa Aponte Vago heads finances, son-in-law Pierfrancesco Vago manages the cruise business. And wife Raffaela Aponte decorates the passenger ships.

MSC is also an important client of the Chinese shipbuilding industry. In July, the “MSC Michel Cappellini” was christened, at that time officially the largest container ship in the world with a length of 399.9 meters. It was built at the Yangzijiang Shipbuilding yard and belongs to the Megamax class, which can carry over 24,000 TEU. In early October, however, it had to give this title to the “Berlin Express,” the latest colossus of Hamburg-based shipping company Hapag-Lloyd, which is a tiny bit bigger.

MSC’s six sister container ships are also similar in size and come from China. Four are already in operation, two others are still under construction in the shipyard of Jiangsu Yangzi Xinfu Shipbuilding near the city of Nanjing and the port of Shanghai, respectively. They have not yet been christened.

In mid-August this year, MSC also ordered ten liquefied natural gas freighters for a total of 1.3 billion US dollars from the Zhoushan Changhong International Shipyard in Zhejiang Province, south of Shanghai. The ships will be delivered in 2026 and 2027.

Previously, MSC maintained a close partnership with the Danish shipping company Maersk. However, after seven years, it broke this alliance even though they were very strong together: Each of the two partners controlled about a third of the global market.

Both companies aim to have completely separated their operations by 2025. For this reason, MSC is looking for a new partner. Cosco is a member of the Ocean Alliance with the French group CMA-CGM, the Taiwanese company Evergrande, and the Hong Kong player OOCL. Such alliances are commonplace in the shipping industry.

A partnership with Cosco would, therefore, be highly appealing to MSC. Conversely, MSC’s stake in the port also makes them more attractive from a Chinese perspective.

However, they not only have their eyes on the Port of Hamburg, but also on a very attractive rail network. The Port of Hamburg is the world’s largest railway port. In 2021, the port shipped over half of all arrived goods via rail. In Bremerhaven and Rotterdam, the figure is only around 20 percent each. This is a significant asset in times of climate change.

The HHLA subsidiary Metrans is even the market leader in container transport in seaport-hinterland traffic with Central, Eastern and Southern Europe. More than 500 trains a week currently run in Metrans’ closely meshed network. Its network stretches from the Netherlands, Germany and Austria via Slovakia and the Czech Republic to Hungary, Slovenia and Croatia – and even to the Greek port of Piraeus.

And Piraeus, which is now the most successful port in the Mediterranean after a long crisis, is owned by Cosco. What MSC is openly betting on: Hamburg continues to be attractive for the new, close partner Cosco because of the rail connection, even if the port itself is no longer competitive.

The video appears rather unremarkable: A man wearing diving goggles and a snorkel cuts a thick rope underwater with a knife. The footage is blurry, appearing almost amateurish – and shows the Philippines’ fiercest defensive measure against China to date. The diver is in the service of the Philippine Coast Guard, and the rope is part of a Chinese sea barrier that is supposed to keep Philippine boats out of Scarborough Reef.

The situation has been tense since the cable incident. Over the weekend, the BBC and other media reported a clash between Philippine ships and a Chinese Coast Guard contingent on Second Thomas Reef, which is also disputed between the two countries. The government in Manila invited international journalists to join its coast guard boats and observe China’s behavior at sea.

These actions reflect Manila’s new strategy against Beijing. Raymond Powell calls it an “assertive transparency campaign.” “With this new campaign, the Philippines is trying to defend itself against China’s “gray zone” tactics,” the former US Air Force pilot told Table.Media. Powell currently heads Sealight, a project on transparency in the law of the sea at Stanford University.

Powell examines China’s “gray zone” tactics in the South China Sea. These involve activities just below the threshold of war, in which Beijing uses asymmetrical advantages to systematically drive back rivals. Sometimes lasers are used to blind, sometimes water cannons are fired. Or, as recently, when a sea barrier was erected around Scarborough Reef.

Both China and the Philippines lay claim to the narrow Scarborough Reef, just 250 kilometers off the main Philippine island. However, while Manila has appealed to the International Court of Arbitration in The Hague, Beijing is relying on the power of the factual with gray zone tactics.

Powell explains that the South China Sea is predestined for this: “It’s a real breeding ground for gray-zone activities, because most of what happens there is out of the public eye.” If, for example, China pushes a Filipino fisherman off course or points a laser at a Philippine Coast Guard vessel, Beijing denies everything after the fact.

But Manila refuses to be put on the defensive any longer. Instead, the Philippines attempts to expose China’s gray zone attacks by publishing photos and videos of such incidents. One example is the shaky footage of the diver off Scarborough Reef, another is the journalist posse at Second Thomas Reef. “Beijing was clearly caught off guard,” Powell notes.

The reaction from China was correspondingly sharp. The Chinese Foreign Ministry sent a clear warning: “We advise the Philippines not to provoke or stir up trouble.” Beijing’s spokesperson reiterated that China’s determination to protect its sovereignty and maritime rights and interests with regard to Huangyan Dao is unwavering. Huangyan Dao (黄岩岛) is the Chinese designation for Scarborough Reef.

Song Zhongping, a former Chinese military officer, further demands: “China must take decisive measures to put an end to the Philippines’ provocation.” The Philippines cannot be allowed to pose a serious threat to China’s national sovereignty and security, he said, adding that the US is using the Philippines as a proxy. “The Philippines is just a disposable chess piece or cannon fodder in US strategic architecture,” Song told Global Times.

The Philippines is aware of China’s superior strength. At the same time, Defense Minister Gilberto Teodoro Jr. made it clear in an interview with the US television channel CNN over the weekend how much is at stake in this dispute. “We’re fighting for our fisherfolk, we’re fighting for our resources. We’re fighting for our integrity as an archipelagic state… Our existence as the Republic of the Philippines is vital to this fight,” Teodoro said. “It’s not for us, it’s for the future generations too.”

Raymond Powell also warns: “China may not want a major conflict, but over time, it has become accustomed to achieving its ambitions through bullying.” Therefore, he says, it is unlikely that Beijing will change its course – unless the gray zone tactics that have been so successful for so long no longer work.

To achieve this, the Philippines is not only relying on transparency, but also on alliances. For instance, the military exercise “Sama Sama” is currently being held in the South China Sea. “With this show of force and active engagement of our allies and partners, ‘Sama Sama’ transcends mere military exercises,” an admiral of the Philippine Navy said on Tuesday at the start of the naval exercises. The approximately 1,800 participants are from the US, Japan, the UK and Canada.

In addition, the United States regularly deploys combat vessels to the region on Freedom of Navigation Operations, or Fonops for short, in an effort to ensure open access to the South China Sea for all nations.

All this is not without risk. China’s increasingly aggressive posturing and the Philippines’ new courage increase the likelihood of accidental confrontations. Moreover, the USA and the Philippines share a military mutual assistance pact. Incidents in the South China Sea could thus quickly have unforeseeable consequences.

In view of the outbreak of violence in Israel, the Chinese government has issued a statement supporting a two-state solution. China is “deeply concerned about the … escalation of tension and violence between Palestine and Israel” and calls for a ceasefire. The resurgence of the conflict shows that the peace process is not making progress, it said. “The fundamental way out of the conflict lies in implementing the two-state solution and establishing an independent State of Palestine.” China is thus repeating an existing position. fin

The export controls on the industrial metals gallium and germanium put into effect in early August are already having an impact. Exports of the two metals dropped to zero in August, reports Carbon Brief. However, export licenses have been granted for September. Reuters reported that the US company AXT and a number of unnamed Chinese companies had received export licenses for certain customers. It was not initially known whether the exports would be made in September.

As of August, exporters must obtain a license to ship the two elements to other countries. The ministry’s directive is based on the 2020 Export Control Law. Among other things, gallium and germanium are used for photovoltaic cells and chips in the automotive industry.

However, China could soon have competition, at least for germanium. A recently inaugurated plant in the Democratic Republic of Congo is expected to produce about 30 percent of the world’s germanium, according to the operators, Bloomberg reported on Friday. China produces about 60 percent of global demand. The new plant in the country’s southeast will be operated by Societe Congolaise pour le Traitement du Terril de Lubumbashi (STL), a subsidiary of state-owned mining company Gecamines. It was inaugurated last week by Congo’s President Felix Tshisekedi. ck

Smartphone production in China is weakening. In the first eight months of this year, the country’s manufacturers produced 679 million smartphones, the South China Morning Post reported on Friday, citing data from the Ministry of Information. That is 7.5 percent less than in the same period last year. According to the report, the second quarter was particularly weak: Manufacturers recorded the lowest sales since 2014 as the weak economy curbs consumption.

One silver lining was the hype surrounding the September presentation of Huawei’s new 5G smartphone Mate 60 with Chinese high-performance chips. According to estimates by market research firm Counterpoint, the Mate 60 could reach five to six million units sold by the end of the year. ck

Li Daokui, who goes by David Li in the West, is one of China’s leading economists. He is a regular speaker at the World Economic Forum and has served on the Monetary Policy Committee of the People’s Bank of China and the Chinese People’s Political Consultative Conference.

Li is currently a professor of economics and management at the prestigious Tsinghua University in Beijing, where he also holds the post of Director at the Center for China and the World Economy. Since 2013, Li is also founding dean of the university’s Schwarzman Scholars Program. This program is a fully funded master’s degree for future leaders, founded by American financier Stephen A. Schwarzman. Li lectures primarily on economic change, international economics and the economy of China.

Li sees the Covid pandemic and the Ukraine war as the biggest challenges for the Chinese economy. Speaking to Chinese foreign broadcaster CGTN, Li once mentioned mainly the financial and logistical risks that the conflict could bring to China. “There are some production facilities and supply chains for which Russia is important. You never know what impact this will have on us,” Li said.

While other countries struggle to find the right approach to climate change, Li looks optimistically at China’s prospects in the fight against rising emissions. But he has to be, because optimism is the first civic duty for economists in the Chinese system.

When it comes to reducing carbon emissions, he sees an opportunity for China to act as a global pioneer by introducing a carbon tax. “We have had regionally different regulations and approaches to reducing CO2 in China for a long time. Yet there is no other problem that more urgently needs a unified market,” Li told broadcaster CGTN. “I strongly advocate a carbon tax tied to long-term planning. Initially, the cost of emissions may be cheap, but over time, prices will rise. Such a plan also gives investors predictability.”

Recently, Li spoke with Bloomberg about the real estate crisis in China: “The collapse of the property market over the past two years has left real estate giants close to default, triggered market panic, and left housing projects unfinished.”

Li estimates the market will take up to a year to recover from the crisis. “I propose a mechanism to increase bank lending to developers.” About 100 billion yuan ($13.7 billion) will be needed to support developers during the current downturn. Svenja Schlicht

Xie Yijing has been appointed acting CEO of the financial group China Renaissance. He co-founded the company with Bao Fan, which is primarily active in investment banking and asset management. Bao disappeared from Hong Kong in February and is apparently in the custody of Chinese investigators. At the time, Xie had already taken over the day-to-day business as managing director.

Joe Cheung will be the new managing director of the Hong Kong office of wealth manager Harneys Fiduciary, which provides primarily offshore corporate services in four locations. Cheung previously headed the Hong Kong office of a global private client trust company.

Is something changing in your organization? Let us know at heads@table.media!

The Asian Games in Hangzhou ended on Sunday with a lavish closing ceremony. China won 201 gold medals, followed by Japan with 51 gold medals and South Korea with 42. In addition to traditional competitions like the Olympics, the Games featured specifically Asian competitions such as dragon boat races. In the picture, Team China fights for the medals in the finals.

The first Asian Games were held in New Delhi in 1951. The mega-event is now moving on to Nagoya, Japan. Unlike Hangzhou, which has opened 56 new sports venues, Aichi Prefecture wants to economize and build only two additional new facilities.