For the first time in four years, a German delegation has visited North Korea. It is a purely technical trip to inspect its own property there – and at the same time, a delicate mission, as Michael Radunski analyzes. Kim Jong-un has significantly aggravated the situation in recent weeks by conducting cruise missile tests and live-fire exercises. Experts consider the situation more dangerous than it has been since 1950. The German embassy in North Korea has been shut since 2020, although diplomatic relations have not been severed. The impact of direct contact should not be underestimated, especially in the current situation.

Meanwhile, Jens Ploetner, the foreign and security advisor to German Chancellor Olaf Scholz, has traveled to Beijing. He is preparing the Chancellor’s visit in April and met with China’s chief diplomat Wang Yi, among others. Staying in regular contact with China is equally important.

Also in today’s China.Table: Amelie Richter looks at the current state of the trade dispute between Lithuania and China, and Felix Lill takes a closer look at the relationship between Japan and the People’s Republic. In both cases, the focus is also on the dependency of other countries on Beijing as trading partners – and the consequences for them if they want to make their own rules. At least Japan could be a de-risking role model for Western countries, writes Felix Lill

A German delegation is currently in North Korea to inspect the condition of the embassy in Pyongyang. This was confirmed by the German Foreign Office to Table.Media. “This is a purely technical trip to inspect our property,” said a Foreign Office spokesperson on the phone. The delegation will spend several days in the North Korean capital and thoroughly inspect the premises of the German embassy.

It is a very tricky mission given the current tensions on the Korean peninsula. North Korea’s ruler Kim Jong-un has significantly exacerbated the situation in recent weeks with several moves:

“Kim Jong-un has made a strategic decision to go to war,” say North Korea experts Siegfried Hecker and Robert Carlin in an analysis for 38 North. Their conclusion: The situation is more dangerous than it has been since 1950.

And a German delegation has now visited North Korea in precisely this situation. It appears to be the first visit by European staff in around four years – and could serve to prepare for a possible return of German diplomats to North Korea. However, the Federal Foreign Office did not want to go that far: “It is neither a preliminary decision for nor against the reopening of our embassy in Pyongyang.”

John Everard, the former British ambassador to North Korea, considers the German inspection visit real progress. “For a long time it seemed that the DPRK would stall any move toward reopening Western embassies,” he told NK News. “That has now changed.”

The Foreign Office spokesperson pointed out that the current visit was closely coordinated with Germany’s partners, including those in the region. This could refer to the UK, Sweden and France, whose employees worked on the premises of the German embassy before the pandemic.

The German embassy was closed in March 2020 due to the Covid-19 pandemic. Diplomatic relations between Germany and North Korea were not severed, however. But the latest developments in North Korea, in particular, clearly show how important it is to maintain a local presence and direct contact.

Furthermore, North Korea is becoming an increasingly important partner for Russia in its war in Ukraine. On Monday, the South Korean Ministry of Defense announced that North Korea had shipped around 6,700 containers with millions of rounds of ammunition to Russia since July. Defense Minister Shin Won-sik explained that the containers could contain more than three million 152-mm artillery shells or 500,000 122-mm cartridges. In return, North Korea has so far mainly received food.

But it will probably not stop there. The more Russia relies on North Korean weapons, drones, and ammunition, the higher the chance that Moscow will not only provide Pyongyang with food but also weapons technology. It would be a dangerous escalation of the already tense situation on the Korean peninsula.

Against this backdrop, it is not surprising that North Korea was also a topic of discussion during Jens Ploetner’s talks in Beijing – albeit only in passing. Chancellor Olaf Scholz’s foreign and security advisor is currently visiting China. In the capital Beijing, he met China’s top foreign policy official Wang Yi, among others. The Chancellor is expected to visit China on April 15 and 16; Ploetner is preparing the visit on the ground.

“I look forward to our talks on the situation in Ukraine after the Russian war of aggression against Ukraine,” said Ploetner before the meeting with Wang in Beijing. Other topics will include the situation in the Middle East and the ongoing attacks by the Houthi militia in the Red Sea. These terrorist attacks particularly affect the two major export nations China and Germany. However, while Germany is at least militarily involved with the frigate “Hessen,” China has so far discreetly kept out of everything.

The Chinese side then made clear demands of Germany at the meeting. “We must adhere to unity and cooperation, oppose bloc confrontation, abandon protectionism and not engage in de-sinicization’,” Wang urged Ploetner, according to the Chinese Foreign Office. It is a clear rejection of Germany’s plans to further reduce its dependencies on China.

For his part, Ploetner reiterated that Germany attaches great importance to developing relations with China. Germany wants to strengthen the strategic dialogue with China and further expand cooperation in various areas – for example, in the green transformation and tackling climate change, as well as in securing world peace, he said.

Above all, it is time for China to back up its grand announcements with action – and show that it is not just a rhetorical alternative to the USA as a global power. Olaf Scholz will probably convey this message to Xi Jinping in person in April.

Scholz last spoke with Wang Yi on the fringes of the Munich Security Conference. There, too, the topic was China’s role in the war in Ukraine. The People’s Republic is Russia’s closest partner, even though Beijing officially calls itself neutral.

Not only has Europe grown increasingly suspicious of China’s rise, but this feeling has been shaping economic relations with China’s neighbor Japan for some time now. Compared to Germany and the EU, Japan’s challenges are similar: its dependence on trade with China is high.

While China only accounted for around ten percent of Japan’s foreign trade in 2001, it had already exceeded 20 percent by 2022. Japan’s main trading partner today is China – just like several EU countries. However, Japan has been pursuing a risk minimization strategy for some time now: Japan’s trade dependency on China has decreased significantly since 2020. At that time, trade with China accounted for almost a quarter of foreign trade. Now, it is only a fifth.

When NATO representatives visited Tokyo in November, David van Weel, Assistant Secretary-General for Emerging Security Challenges at NATO, expressed admiration for Japan’s national security approach. Van Weel hinted that he sees Japan as a role model for the West.

Over the past ten years, Japan has already taken several steps to reduce its vulnerability. A special feature that the NATO representative van Weel recognizes in the Japanese strategy is the interconnection of economic and security policy: “We can all learn from this regional and future-oriented approach,” said van Weel. Back in 2013, then Prime Minister Shinzō Abe adopted a “National Security Strategy,” which was significantly shaped by China’s rise. It served as the foundation for the government to create positions in its National Security Council that deal with the economic side of security.

In subsequent years, Japan signed foreign trade agreements that did not include China – such as the Trans-Pacific Partnership (TPP), which consists of eleven countries, as well as agreements with the US and the EU. Prime Minister Fumio Kishida, who has been in power since 2021, also appointed a minister for economic security. Japan also further developed the Free and Open Indo-Pacific concept: It reflects the effort to keep Asia’s nations in the liberal sphere of influence through infrastructure investments and an emphasis on human rights – as a counterweight to China.

Japan’s relationship with China is complicated: It encompasses the past of war and colonialism, territorial disputes – as well as Japan’s painful experience of being overtaken by China as the second-largest economy in 2010. Political conflicts between them always had a clear economic dimension. For example, in 2010, Japan’s government attempted to buy an island group from a Japanese investor that China considers its territory. China – the world’s largest producer of rare earths – drastically reduced its export quotas. The result was a sharp price surge. This move is now considered an example of how China can leverage its market power over critical materials in the event of a conflict.

From then on, Japan sought to develop rare earth extraction elsewhere. And lessons were learned in general. The government is now explicitly trying to ensure that China is no longer part of critical supply chains. This applies, in particular, to the R&D of semiconductors, supercomputers, other high-tech products, and raw materials. The National Security Strategy adopted in December 2022 has reaffirmed this: Japan signed new contracts for rare earths with Vietnam and Australia. Despite this, Japan still buys two-thirds of its imports from China.

To encourage Japanese companies to generally reduce their investments in China, the government in Tokyo has already spent around 3.3 billion euros in subsidies since 2020 – as an incentive to relocate. Several well-known companies have heeded the call. One example is the camera manufacturer Canon, which shut down one of its plants in China in 2022, which until that point was the main production site for digital compact cameras. Tamura, a developer of garden tools such as lawnmowers, is now relocating from China to Romania. Car manufacturers such as Mazda and Honda have announced similar moves.

The Japanese government has also made extensive efforts to attract leading global semiconductor manufacturers to the country. The government has funded around 40 percent of the investment costs for Taiwanese semiconductor manufacturer TSMC to build a plant in the southwest of Japan – the equivalent of about three billion euros. Additional plants for small semiconductors, in particular, are now planned. After all, if China were to attack Taiwan – as it has threatened to do on several occasions – Japan would still be severely affected because it is dependent on Taiwanese imports. This is set to change.

All of this costs a lot of money and thus prosperity. Akira Igata, head of the Center for Advanced Technology Research at the University of Tokyo and security policy advisor to the Japanese government, does not deny this: “I think we are living in a time when we have to pick our poison,” he says. “If you want to invest more in security, you will have to give up some prosperity.” In recent decades, Japan – like Europe – has benefited from a “peace dividend.” But Igata sees that time as over. Felix Lill

The World Trade Organization (WTO) Ministerial Conference in Abu Dhabi is supposed to finally bring the urgently needed reform. In particular, reforming the dispute settlement mechanism is an important issue for EU-China relations – not least because of the economic blackmail against Lithuania. Since the Baltic country authorized Taipei to open a “Taiwan Office” in the capital Vilnius in 2021, a trade dispute with China has been simmering. And it has now reached the WTO.

The fact that the Baltic country can be a pioneer of practiced de-risking has not yet materialized. The relationship between the EU member state and China remains strained. The trade dispute has accelerated Lithuania’s diversification away from China. However, business representatives believe fully replacing the People’s Republic will be difficult.

It is evident that companies that previously traded with China are renewing their old contacts, says Eglė Stonkutė, an analyst at the Lithuanian Confederation of Industrialists. However, she says that fewer new trade contacts are being forged. Companies are looking for other markets, Stonkutė explains.

The process involving the WTO dispute settlement mechanism began in November 2021, when Lithuania opened the aforementioned “Taiwan Office.” Prior to this, Lithuania had already withdrawn from the 17+1 format, in which China sought to cooperate with 17 countries in Central and Eastern Europe. Other countries have since also withdrawn from this format.

After the “Taiwan Office” was established, Lithuanian companies encountered problems with Chinese customs, as the country was temporarily removed from the system. Trade between China and the Baltic state came to an almost complete standstill. It took some time before Lithuanian goods could pass through Chinese customs again – but since then, Lithuanian companies have received fewer orders from China.

Once China introduced its trade blockade, trade between Lithuania and Taiwan increased. For instance, it exported beer to Taiwan instead of the People’s Republic. However, trade with the island has remained relatively low, explains LPK analyst Stonkutė. Taiwan is not important as a trading partner in Lithuania’s overall international trade.

The start of the war against Ukraine also impacted Lithuania’s trade. Russia used to be one of the Baltic state’s largest export markets before the war. In February 2022, Lithuanian companies started diversifying their export markets – primarily to Kazakhstan and other countries in the region, as the LPK Association explains. In Asia, Lithuanian companies were looking for new sales markets in Australia, Singapore, South Korea and India, says Stonkutė.

However, exports to China are also increasing steadily, the analyst says. According to the Lithuanian Industry Association, the country exported goods worth just over 100 million euros to China in 2022 and 2023. However, they have not reached the pre-embargo level: In 2020, exports to the People’s Republic still amounted to 313 million euros.

The trade downturn was very painful for some companies, Stonkutė admits. Imports of goods from Lithuania never stopped altogether. However, in February 2022, they had dropped to a mere 45,000 euros.

In late 2022, the EU initiated proceedings against China at the WTO over the matter. After the People’s Republic blocked it the first time, the panel was set up in January 2023 – in anticipation of the currently blocked dispute settlement mechanism. However, one year later, the EU itself suspended the proceedings in January 2024. EU circles claim that the EU Commission wanted to gather more evidence for its case. The suspension is intended to buy time.

Observers expect hardly any progress on the reform of the WTO dispute settlement mechanism at the current Ministerial Conference – not least because the responsible diplomat, Marco Molina, was dismissed by his government in Guatemala last week.

So far, China has submitted two documents on WTO reform: one position paper in November 2018 and one in May 2019. Beijing’s primary goal is to restore functionality to the WTO – however, China would also like to sweep controversial issues such as trade distortions and subsidies under the rug.

A quick settlement of the Lithuania-China conflict before the WTO is not to be expected. The two countries are also still at loggerheads at the diplomatic level. China recently suspended issuing visas for Lithuanian citizens.

The downgraded diplomatic relations also remain unchanged. Lithuanian ambassador Diana Mickevičienė, who was expelled by China following the trade dispute, is now on assignment in India. Chargé d’affaires is Mantvydas Bekešius. The embassy in China states that the team is working remotely.

At the end of 2023, Foreign Minister Gabrielius Landsbergis emphasized that the name of the Taiwanese representative office in Vilnius would not change. Meanwhile, support for the Lithuanian approach appears to wane among the population: According to a survey conducted last week, 47.6 percent of respondents wish for a more pragmatic stance towards China. 21 percent were against it, and 31.5 percent were undecided.

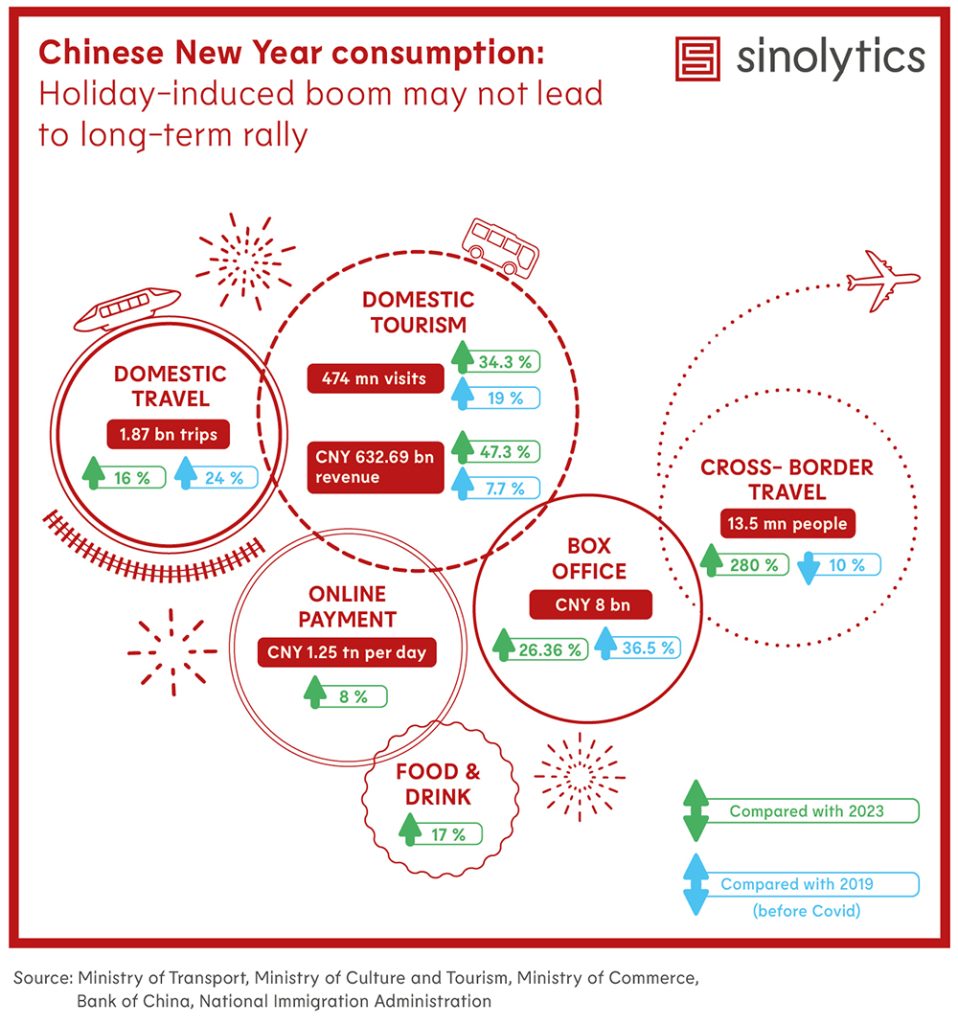

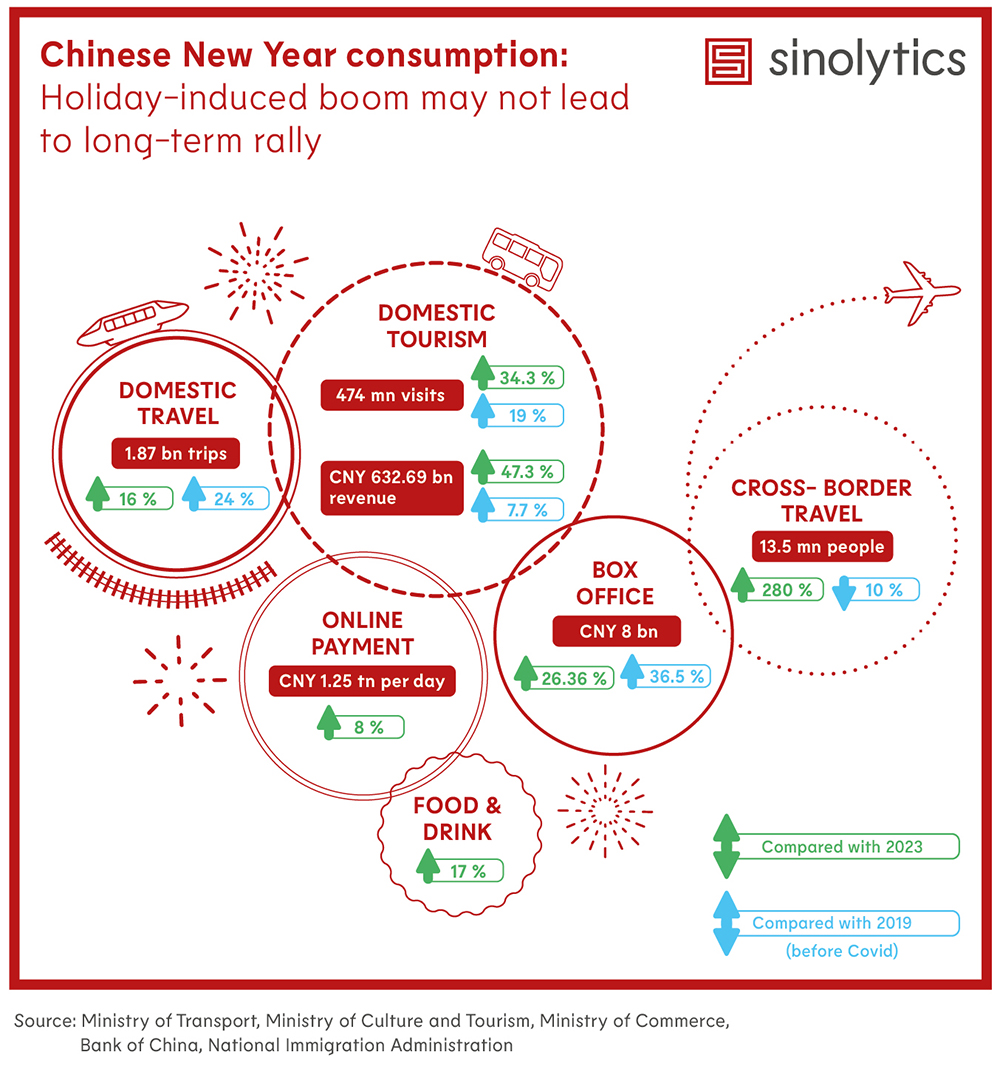

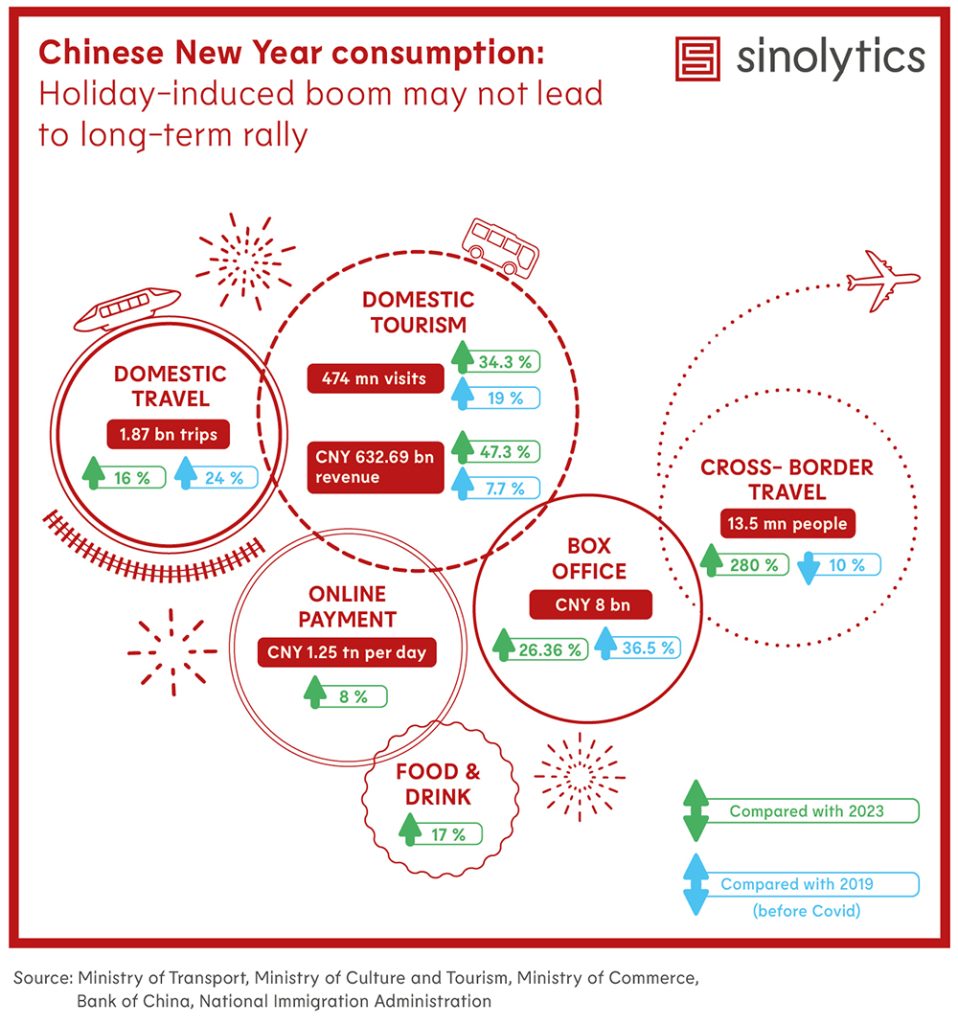

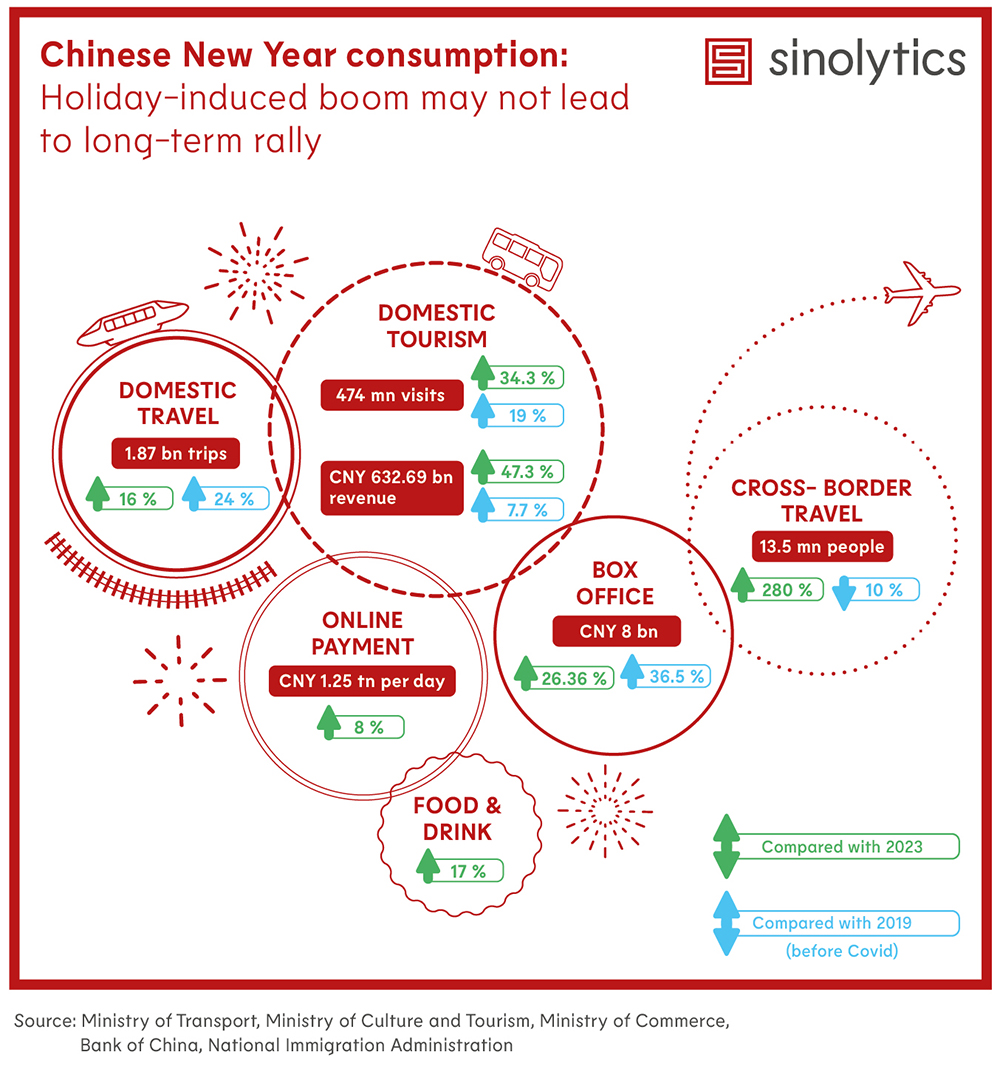

Sinolytics is a research-based business consultancy entirely focused on China. It advises European companies on their strategic orientation and specific business activities in the People’s Republic.

The number of Chinese company takeovers in Europe has fallen to its lowest level since 2012. According to a new analysis by management consultancy EY, investors from the People’s Republic acquired a total of 119 companies in Europe in 2023. In 2022, the number of M&A transactions was still 139, according to the study presented on Tuesday. EY also reports that the volume of transactions fell – from 4.3 to 2.0 billion US dollars. However, it noted that most acquisitions did not disclose acquisition prices.

However, the trend is reversed in Germany, where the number of Chinese acquisitions increased from 26 to 28. Despite the slight increase, Chinese companies only play a minor role as buyers in Germany, the study found: In 2023, China only ranked ninth in the investor ranking, which is led by the USA and the UK with 225 and 113 transactions, respectively. In the record year of 2016, China was still the fourth-largest investor in Germany with 68 Chinese acquisitions.

Conversely, Germany was at the top of China’s acquisition interest, according to EY 2023: “Chinese investors preferred to invest in Germany in both the industrial and high-tech sectors.” Germany thus overtook the UK, which had attracted the most investment in the previous two years. EY also counted a particularly high number of transactions in Germany in the healthcare sector, including biotech, pharmaceuticals and medical technology. ck

The dismissal of ministers Qin Gang and Li Shangfu, who have been missing since the summer of 2023, is entering the final stretch shortly before the National People’s Congress. Just before the start of the plenary session of the National People’s Congress (NPC), former Foreign Minister Qin Gang, who has not been seen since July 2023, has now stepped down from his seat on the body that passes laws and economic plans at the behest of China’s Communist Party leadership. The corresponding statement from the NPC Standing Committee said that Qin was neither dismissed nor expelled from the NPC. However, it is unlikely that he resigned voluntarily.

Also on Tuesday, former Defense Minister Li Shangfu no longer appeared on the list of participants of an official meeting of the Communist Party’s Central Military Commission (CMC). This also means that his departure from the military leadership body is complete.

It is customary in China to remove ousted functionaries from respective bodies only once the relevant meetings are being held. This explains the months-long, gradual dismantling of the two. In the summer of 2023, Qin suddenly stopped attending public meetings. In July, the career diplomat personally chosen by head of state and party leader Xi Jinping for the post was officially dismissed after only around seven months as foreign minister. It is unclear what caused his downfall. His predecessor Wang Yi is once again serving as China’s chief diplomat – albeit on an interim basis. Many observers expect a new foreign minister to be appointed at Monday’s NPC.

In the late summer of 2023, former Defense Minister Li Shangfu, whom Xi also handpicked, vanished after just a few months in office. Both were subsequently absent from Politburo meetings. Li was replaced by Navy Admiral Dong Jun in October 2023 without explanation. There are investigations into corruption in his circle regarding the procurement of weapons and equipment. The allegations against Li are unknown. ck

China will broaden the scope of the classification of “secrets.” To this end, the government passed an amendment to the law on Tuesday, as the state news agency Xinhua reported. The revised law on the protection of state secrets was passed by the Standing Committee of the National People’s Congress, the supreme legislative body, and immediately approved by President Xi Jinping.

The US-based website NPC Observer, which monitors the activities of the Chinese legislature, highlighted several changes that have caused a stir. Among other things, the law requires official bodies to label matters that are not technically state secrets as “work secrets” – provided they could compromise national security or the public interest if leaked.

The law, which is due to enter into force on May 1, is part of a whole series of national security laws that Beijing has passed in recent years – and is likely to place an additional burden on foreign companies in China. cyb

Investment in infrastructure is part of the DNA of the Chinese development model. So it makes sense to appoint the czar of Chinese infrastructure as the head of the new financial regulator. Even before the last National People’s Congress, He Lifeng was floated as Party Secretary of the Chinese Central Bank. He now heads the re-established Central Financial Commission (CFC), formerly known as the Central Financial Work Commission from 1998 to 2003.

This goes hand in hand with a shift in power towards the CFC: All regulatory authorities previously on the side of the State Council have been disempowered by the new financial regulator. At the same time, the newly established super ministry National Finance Regulatory Authority (NFRA) has swallowed up the old regulatory authority CBRIC. It is now responsible for implementing the policies of the Central Committee, i.e., of the CFC. The NFRA will manage banking and insurance assets totaling 58 trillion US dollars.

The new chief financial regulator, He Lifeng, succeeds Liu He, previously the most powerful man at Xi Jinping’s side. He Lifeng’s tasks are establishing economic security, relieving pressure from the real estate sector, promoting the “Green Silk Road,” and improving Sino-US relations behind the scenes. At least that is what the meeting between US Secretary of the Treasury Janet Yellen and He on the sidelines of the APEC summit in San Francisco in November 2023 suggests.

He is considered a daring person. During the 2008 financial crisis “China’s Manhattan” was his brainchild – the idea of boosting the economy through the construction boom in Tianjin. Against the backdrop of Evergrande’s bankruptcy, this raises the question of why and with what goal he is taking over the debt control at this stage.

In his previous position as head of the National Development and Reform Commission (NDRC), he stood for a loose credit policy, especially in infrastructure: prosperity through megaprojects. Under his leadership, 106 gigawatts of new coal-fired power capacity were approved in 2022. To put this into perspective, this is equivalent to 106 times the capacity of Germany’s controversial Datteln IV coal-fired power plant.

Many of these projects were fast-tracked, so construction could begin within a few months. The new coal-fired power plants will make achieving China’s climate targets more difficult and expensive. After all, the plant owners have an interest in protecting their assets.

Meanwhile, a new Carbon Brief report from February 22, 2024, even predicts that the sharp rise in emissions in 2023 will cause China to fall far behind its target of reducing carbon intensity by 18 percent in the 14th five-year plan (2021-25). The goal of increasing the share of non-fossil energy sources to 20 percent by 2025 is also a long way off.

Massive investment in the green climate transition, and above all, cooperation with the USA, is supposed to be the solution. Treasury Secretary Yellen has advocated increased cooperation in the climate sector, as well as easier market access for American companies.

The financial regulator, directly under the party leadership and headed by He Lifeng, brings the top brass closer to the American and European finance ministers. This also means that interests are once again converging: Chinese companies are leading globally in the expansion of natural gas pipelines, and the USA and Germany are at the top of the list of exporters and importers of liquefied natural gas, respectively.

While China, as showcased at COP28 in Dubai, likes to present itself as a leader in installed wind, solar, hydropower and biomass power, it would be illusory to believe that merely focusing on these green investments would make “China” as a state a global leader in climate action. For that, an immediate halt to investments by Chinese state firms in new coal, oil and gas projects, as well as a gradual phase-out of coal-fired power generation, would be necessary.

What our data shows, but is being overlooked, is that Chinese companies are leading globally in expanding installed gas power plant capacity, in the worldwide expansion of coal mining and in the construction of oil and gas pipelines.

Nevertheless, the outlook is somewhat positive. Global visiting diplomacy, the “inviting in” of investors, is opening doors. However, it will fail due to China’s reform backlog and power struggles. For example, Foreign Minister Annalena Baerbock has no official counterpart on the Chinese side. But financial cooperation in “green” labeled investments, liquefied natural gas infrastructure expansion, and digital infrastructure could develop positively in 2024 thanks to the Chinese initiative.

Margaret Zhang is leaving her position as Editorial Director of Vogue China. Zhang became the youngest person ever to hold this position in 2021 at the age of 27. She was already an influential fashion blogger as a teenager in Sydney. Before taking up the role, she had more than one million Instagram followers.

Kelly Wong, an immigrant rights activist, was unanimously appointed to the San Francisco Election Commission by a Board of Supervisors in mid-February. Wong, who came to the US from Hong Kong to study in 2019, is said to be the first non-citizen to ever sit on the Commission.

Is something changing in your organization? Let us know at heads@table.media!

What inspires poets to write verse and provides the perfect backdrop for children’s photos is also a robust industry in the People’s Republic: colorful flowers. China’s flower industry has changed considerably since the pandemic. Apparently, flowers are no longer only bought on festive and public holidays, but also “just because.” In 2023, sales of freshly cut flowers, in particular, increased, with consultants predicting an annual growth rate of over twelve percent for this sector between 2023 and 2029. After a gray winter, spring is simply dear to us all.

For the first time in four years, a German delegation has visited North Korea. It is a purely technical trip to inspect its own property there – and at the same time, a delicate mission, as Michael Radunski analyzes. Kim Jong-un has significantly aggravated the situation in recent weeks by conducting cruise missile tests and live-fire exercises. Experts consider the situation more dangerous than it has been since 1950. The German embassy in North Korea has been shut since 2020, although diplomatic relations have not been severed. The impact of direct contact should not be underestimated, especially in the current situation.

Meanwhile, Jens Ploetner, the foreign and security advisor to German Chancellor Olaf Scholz, has traveled to Beijing. He is preparing the Chancellor’s visit in April and met with China’s chief diplomat Wang Yi, among others. Staying in regular contact with China is equally important.

Also in today’s China.Table: Amelie Richter looks at the current state of the trade dispute between Lithuania and China, and Felix Lill takes a closer look at the relationship between Japan and the People’s Republic. In both cases, the focus is also on the dependency of other countries on Beijing as trading partners – and the consequences for them if they want to make their own rules. At least Japan could be a de-risking role model for Western countries, writes Felix Lill

A German delegation is currently in North Korea to inspect the condition of the embassy in Pyongyang. This was confirmed by the German Foreign Office to Table.Media. “This is a purely technical trip to inspect our property,” said a Foreign Office spokesperson on the phone. The delegation will spend several days in the North Korean capital and thoroughly inspect the premises of the German embassy.

It is a very tricky mission given the current tensions on the Korean peninsula. North Korea’s ruler Kim Jong-un has significantly exacerbated the situation in recent weeks with several moves:

“Kim Jong-un has made a strategic decision to go to war,” say North Korea experts Siegfried Hecker and Robert Carlin in an analysis for 38 North. Their conclusion: The situation is more dangerous than it has been since 1950.

And a German delegation has now visited North Korea in precisely this situation. It appears to be the first visit by European staff in around four years – and could serve to prepare for a possible return of German diplomats to North Korea. However, the Federal Foreign Office did not want to go that far: “It is neither a preliminary decision for nor against the reopening of our embassy in Pyongyang.”

John Everard, the former British ambassador to North Korea, considers the German inspection visit real progress. “For a long time it seemed that the DPRK would stall any move toward reopening Western embassies,” he told NK News. “That has now changed.”

The Foreign Office spokesperson pointed out that the current visit was closely coordinated with Germany’s partners, including those in the region. This could refer to the UK, Sweden and France, whose employees worked on the premises of the German embassy before the pandemic.

The German embassy was closed in March 2020 due to the Covid-19 pandemic. Diplomatic relations between Germany and North Korea were not severed, however. But the latest developments in North Korea, in particular, clearly show how important it is to maintain a local presence and direct contact.

Furthermore, North Korea is becoming an increasingly important partner for Russia in its war in Ukraine. On Monday, the South Korean Ministry of Defense announced that North Korea had shipped around 6,700 containers with millions of rounds of ammunition to Russia since July. Defense Minister Shin Won-sik explained that the containers could contain more than three million 152-mm artillery shells or 500,000 122-mm cartridges. In return, North Korea has so far mainly received food.

But it will probably not stop there. The more Russia relies on North Korean weapons, drones, and ammunition, the higher the chance that Moscow will not only provide Pyongyang with food but also weapons technology. It would be a dangerous escalation of the already tense situation on the Korean peninsula.

Against this backdrop, it is not surprising that North Korea was also a topic of discussion during Jens Ploetner’s talks in Beijing – albeit only in passing. Chancellor Olaf Scholz’s foreign and security advisor is currently visiting China. In the capital Beijing, he met China’s top foreign policy official Wang Yi, among others. The Chancellor is expected to visit China on April 15 and 16; Ploetner is preparing the visit on the ground.

“I look forward to our talks on the situation in Ukraine after the Russian war of aggression against Ukraine,” said Ploetner before the meeting with Wang in Beijing. Other topics will include the situation in the Middle East and the ongoing attacks by the Houthi militia in the Red Sea. These terrorist attacks particularly affect the two major export nations China and Germany. However, while Germany is at least militarily involved with the frigate “Hessen,” China has so far discreetly kept out of everything.

The Chinese side then made clear demands of Germany at the meeting. “We must adhere to unity and cooperation, oppose bloc confrontation, abandon protectionism and not engage in de-sinicization’,” Wang urged Ploetner, according to the Chinese Foreign Office. It is a clear rejection of Germany’s plans to further reduce its dependencies on China.

For his part, Ploetner reiterated that Germany attaches great importance to developing relations with China. Germany wants to strengthen the strategic dialogue with China and further expand cooperation in various areas – for example, in the green transformation and tackling climate change, as well as in securing world peace, he said.

Above all, it is time for China to back up its grand announcements with action – and show that it is not just a rhetorical alternative to the USA as a global power. Olaf Scholz will probably convey this message to Xi Jinping in person in April.

Scholz last spoke with Wang Yi on the fringes of the Munich Security Conference. There, too, the topic was China’s role in the war in Ukraine. The People’s Republic is Russia’s closest partner, even though Beijing officially calls itself neutral.

Not only has Europe grown increasingly suspicious of China’s rise, but this feeling has been shaping economic relations with China’s neighbor Japan for some time now. Compared to Germany and the EU, Japan’s challenges are similar: its dependence on trade with China is high.

While China only accounted for around ten percent of Japan’s foreign trade in 2001, it had already exceeded 20 percent by 2022. Japan’s main trading partner today is China – just like several EU countries. However, Japan has been pursuing a risk minimization strategy for some time now: Japan’s trade dependency on China has decreased significantly since 2020. At that time, trade with China accounted for almost a quarter of foreign trade. Now, it is only a fifth.

When NATO representatives visited Tokyo in November, David van Weel, Assistant Secretary-General for Emerging Security Challenges at NATO, expressed admiration for Japan’s national security approach. Van Weel hinted that he sees Japan as a role model for the West.

Over the past ten years, Japan has already taken several steps to reduce its vulnerability. A special feature that the NATO representative van Weel recognizes in the Japanese strategy is the interconnection of economic and security policy: “We can all learn from this regional and future-oriented approach,” said van Weel. Back in 2013, then Prime Minister Shinzō Abe adopted a “National Security Strategy,” which was significantly shaped by China’s rise. It served as the foundation for the government to create positions in its National Security Council that deal with the economic side of security.

In subsequent years, Japan signed foreign trade agreements that did not include China – such as the Trans-Pacific Partnership (TPP), which consists of eleven countries, as well as agreements with the US and the EU. Prime Minister Fumio Kishida, who has been in power since 2021, also appointed a minister for economic security. Japan also further developed the Free and Open Indo-Pacific concept: It reflects the effort to keep Asia’s nations in the liberal sphere of influence through infrastructure investments and an emphasis on human rights – as a counterweight to China.

Japan’s relationship with China is complicated: It encompasses the past of war and colonialism, territorial disputes – as well as Japan’s painful experience of being overtaken by China as the second-largest economy in 2010. Political conflicts between them always had a clear economic dimension. For example, in 2010, Japan’s government attempted to buy an island group from a Japanese investor that China considers its territory. China – the world’s largest producer of rare earths – drastically reduced its export quotas. The result was a sharp price surge. This move is now considered an example of how China can leverage its market power over critical materials in the event of a conflict.

From then on, Japan sought to develop rare earth extraction elsewhere. And lessons were learned in general. The government is now explicitly trying to ensure that China is no longer part of critical supply chains. This applies, in particular, to the R&D of semiconductors, supercomputers, other high-tech products, and raw materials. The National Security Strategy adopted in December 2022 has reaffirmed this: Japan signed new contracts for rare earths with Vietnam and Australia. Despite this, Japan still buys two-thirds of its imports from China.

To encourage Japanese companies to generally reduce their investments in China, the government in Tokyo has already spent around 3.3 billion euros in subsidies since 2020 – as an incentive to relocate. Several well-known companies have heeded the call. One example is the camera manufacturer Canon, which shut down one of its plants in China in 2022, which until that point was the main production site for digital compact cameras. Tamura, a developer of garden tools such as lawnmowers, is now relocating from China to Romania. Car manufacturers such as Mazda and Honda have announced similar moves.

The Japanese government has also made extensive efforts to attract leading global semiconductor manufacturers to the country. The government has funded around 40 percent of the investment costs for Taiwanese semiconductor manufacturer TSMC to build a plant in the southwest of Japan – the equivalent of about three billion euros. Additional plants for small semiconductors, in particular, are now planned. After all, if China were to attack Taiwan – as it has threatened to do on several occasions – Japan would still be severely affected because it is dependent on Taiwanese imports. This is set to change.

All of this costs a lot of money and thus prosperity. Akira Igata, head of the Center for Advanced Technology Research at the University of Tokyo and security policy advisor to the Japanese government, does not deny this: “I think we are living in a time when we have to pick our poison,” he says. “If you want to invest more in security, you will have to give up some prosperity.” In recent decades, Japan – like Europe – has benefited from a “peace dividend.” But Igata sees that time as over. Felix Lill

The World Trade Organization (WTO) Ministerial Conference in Abu Dhabi is supposed to finally bring the urgently needed reform. In particular, reforming the dispute settlement mechanism is an important issue for EU-China relations – not least because of the economic blackmail against Lithuania. Since the Baltic country authorized Taipei to open a “Taiwan Office” in the capital Vilnius in 2021, a trade dispute with China has been simmering. And it has now reached the WTO.

The fact that the Baltic country can be a pioneer of practiced de-risking has not yet materialized. The relationship between the EU member state and China remains strained. The trade dispute has accelerated Lithuania’s diversification away from China. However, business representatives believe fully replacing the People’s Republic will be difficult.

It is evident that companies that previously traded with China are renewing their old contacts, says Eglė Stonkutė, an analyst at the Lithuanian Confederation of Industrialists. However, she says that fewer new trade contacts are being forged. Companies are looking for other markets, Stonkutė explains.

The process involving the WTO dispute settlement mechanism began in November 2021, when Lithuania opened the aforementioned “Taiwan Office.” Prior to this, Lithuania had already withdrawn from the 17+1 format, in which China sought to cooperate with 17 countries in Central and Eastern Europe. Other countries have since also withdrawn from this format.

After the “Taiwan Office” was established, Lithuanian companies encountered problems with Chinese customs, as the country was temporarily removed from the system. Trade between China and the Baltic state came to an almost complete standstill. It took some time before Lithuanian goods could pass through Chinese customs again – but since then, Lithuanian companies have received fewer orders from China.

Once China introduced its trade blockade, trade between Lithuania and Taiwan increased. For instance, it exported beer to Taiwan instead of the People’s Republic. However, trade with the island has remained relatively low, explains LPK analyst Stonkutė. Taiwan is not important as a trading partner in Lithuania’s overall international trade.

The start of the war against Ukraine also impacted Lithuania’s trade. Russia used to be one of the Baltic state’s largest export markets before the war. In February 2022, Lithuanian companies started diversifying their export markets – primarily to Kazakhstan and other countries in the region, as the LPK Association explains. In Asia, Lithuanian companies were looking for new sales markets in Australia, Singapore, South Korea and India, says Stonkutė.

However, exports to China are also increasing steadily, the analyst says. According to the Lithuanian Industry Association, the country exported goods worth just over 100 million euros to China in 2022 and 2023. However, they have not reached the pre-embargo level: In 2020, exports to the People’s Republic still amounted to 313 million euros.

The trade downturn was very painful for some companies, Stonkutė admits. Imports of goods from Lithuania never stopped altogether. However, in February 2022, they had dropped to a mere 45,000 euros.

In late 2022, the EU initiated proceedings against China at the WTO over the matter. After the People’s Republic blocked it the first time, the panel was set up in January 2023 – in anticipation of the currently blocked dispute settlement mechanism. However, one year later, the EU itself suspended the proceedings in January 2024. EU circles claim that the EU Commission wanted to gather more evidence for its case. The suspension is intended to buy time.

Observers expect hardly any progress on the reform of the WTO dispute settlement mechanism at the current Ministerial Conference – not least because the responsible diplomat, Marco Molina, was dismissed by his government in Guatemala last week.

So far, China has submitted two documents on WTO reform: one position paper in November 2018 and one in May 2019. Beijing’s primary goal is to restore functionality to the WTO – however, China would also like to sweep controversial issues such as trade distortions and subsidies under the rug.

A quick settlement of the Lithuania-China conflict before the WTO is not to be expected. The two countries are also still at loggerheads at the diplomatic level. China recently suspended issuing visas for Lithuanian citizens.

The downgraded diplomatic relations also remain unchanged. Lithuanian ambassador Diana Mickevičienė, who was expelled by China following the trade dispute, is now on assignment in India. Chargé d’affaires is Mantvydas Bekešius. The embassy in China states that the team is working remotely.

At the end of 2023, Foreign Minister Gabrielius Landsbergis emphasized that the name of the Taiwanese representative office in Vilnius would not change. Meanwhile, support for the Lithuanian approach appears to wane among the population: According to a survey conducted last week, 47.6 percent of respondents wish for a more pragmatic stance towards China. 21 percent were against it, and 31.5 percent were undecided.

Sinolytics is a research-based business consultancy entirely focused on China. It advises European companies on their strategic orientation and specific business activities in the People’s Republic.

The number of Chinese company takeovers in Europe has fallen to its lowest level since 2012. According to a new analysis by management consultancy EY, investors from the People’s Republic acquired a total of 119 companies in Europe in 2023. In 2022, the number of M&A transactions was still 139, according to the study presented on Tuesday. EY also reports that the volume of transactions fell – from 4.3 to 2.0 billion US dollars. However, it noted that most acquisitions did not disclose acquisition prices.

However, the trend is reversed in Germany, where the number of Chinese acquisitions increased from 26 to 28. Despite the slight increase, Chinese companies only play a minor role as buyers in Germany, the study found: In 2023, China only ranked ninth in the investor ranking, which is led by the USA and the UK with 225 and 113 transactions, respectively. In the record year of 2016, China was still the fourth-largest investor in Germany with 68 Chinese acquisitions.

Conversely, Germany was at the top of China’s acquisition interest, according to EY 2023: “Chinese investors preferred to invest in Germany in both the industrial and high-tech sectors.” Germany thus overtook the UK, which had attracted the most investment in the previous two years. EY also counted a particularly high number of transactions in Germany in the healthcare sector, including biotech, pharmaceuticals and medical technology. ck

The dismissal of ministers Qin Gang and Li Shangfu, who have been missing since the summer of 2023, is entering the final stretch shortly before the National People’s Congress. Just before the start of the plenary session of the National People’s Congress (NPC), former Foreign Minister Qin Gang, who has not been seen since July 2023, has now stepped down from his seat on the body that passes laws and economic plans at the behest of China’s Communist Party leadership. The corresponding statement from the NPC Standing Committee said that Qin was neither dismissed nor expelled from the NPC. However, it is unlikely that he resigned voluntarily.

Also on Tuesday, former Defense Minister Li Shangfu no longer appeared on the list of participants of an official meeting of the Communist Party’s Central Military Commission (CMC). This also means that his departure from the military leadership body is complete.

It is customary in China to remove ousted functionaries from respective bodies only once the relevant meetings are being held. This explains the months-long, gradual dismantling of the two. In the summer of 2023, Qin suddenly stopped attending public meetings. In July, the career diplomat personally chosen by head of state and party leader Xi Jinping for the post was officially dismissed after only around seven months as foreign minister. It is unclear what caused his downfall. His predecessor Wang Yi is once again serving as China’s chief diplomat – albeit on an interim basis. Many observers expect a new foreign minister to be appointed at Monday’s NPC.

In the late summer of 2023, former Defense Minister Li Shangfu, whom Xi also handpicked, vanished after just a few months in office. Both were subsequently absent from Politburo meetings. Li was replaced by Navy Admiral Dong Jun in October 2023 without explanation. There are investigations into corruption in his circle regarding the procurement of weapons and equipment. The allegations against Li are unknown. ck

China will broaden the scope of the classification of “secrets.” To this end, the government passed an amendment to the law on Tuesday, as the state news agency Xinhua reported. The revised law on the protection of state secrets was passed by the Standing Committee of the National People’s Congress, the supreme legislative body, and immediately approved by President Xi Jinping.

The US-based website NPC Observer, which monitors the activities of the Chinese legislature, highlighted several changes that have caused a stir. Among other things, the law requires official bodies to label matters that are not technically state secrets as “work secrets” – provided they could compromise national security or the public interest if leaked.

The law, which is due to enter into force on May 1, is part of a whole series of national security laws that Beijing has passed in recent years – and is likely to place an additional burden on foreign companies in China. cyb

Investment in infrastructure is part of the DNA of the Chinese development model. So it makes sense to appoint the czar of Chinese infrastructure as the head of the new financial regulator. Even before the last National People’s Congress, He Lifeng was floated as Party Secretary of the Chinese Central Bank. He now heads the re-established Central Financial Commission (CFC), formerly known as the Central Financial Work Commission from 1998 to 2003.

This goes hand in hand with a shift in power towards the CFC: All regulatory authorities previously on the side of the State Council have been disempowered by the new financial regulator. At the same time, the newly established super ministry National Finance Regulatory Authority (NFRA) has swallowed up the old regulatory authority CBRIC. It is now responsible for implementing the policies of the Central Committee, i.e., of the CFC. The NFRA will manage banking and insurance assets totaling 58 trillion US dollars.

The new chief financial regulator, He Lifeng, succeeds Liu He, previously the most powerful man at Xi Jinping’s side. He Lifeng’s tasks are establishing economic security, relieving pressure from the real estate sector, promoting the “Green Silk Road,” and improving Sino-US relations behind the scenes. At least that is what the meeting between US Secretary of the Treasury Janet Yellen and He on the sidelines of the APEC summit in San Francisco in November 2023 suggests.

He is considered a daring person. During the 2008 financial crisis “China’s Manhattan” was his brainchild – the idea of boosting the economy through the construction boom in Tianjin. Against the backdrop of Evergrande’s bankruptcy, this raises the question of why and with what goal he is taking over the debt control at this stage.

In his previous position as head of the National Development and Reform Commission (NDRC), he stood for a loose credit policy, especially in infrastructure: prosperity through megaprojects. Under his leadership, 106 gigawatts of new coal-fired power capacity were approved in 2022. To put this into perspective, this is equivalent to 106 times the capacity of Germany’s controversial Datteln IV coal-fired power plant.

Many of these projects were fast-tracked, so construction could begin within a few months. The new coal-fired power plants will make achieving China’s climate targets more difficult and expensive. After all, the plant owners have an interest in protecting their assets.

Meanwhile, a new Carbon Brief report from February 22, 2024, even predicts that the sharp rise in emissions in 2023 will cause China to fall far behind its target of reducing carbon intensity by 18 percent in the 14th five-year plan (2021-25). The goal of increasing the share of non-fossil energy sources to 20 percent by 2025 is also a long way off.

Massive investment in the green climate transition, and above all, cooperation with the USA, is supposed to be the solution. Treasury Secretary Yellen has advocated increased cooperation in the climate sector, as well as easier market access for American companies.

The financial regulator, directly under the party leadership and headed by He Lifeng, brings the top brass closer to the American and European finance ministers. This also means that interests are once again converging: Chinese companies are leading globally in the expansion of natural gas pipelines, and the USA and Germany are at the top of the list of exporters and importers of liquefied natural gas, respectively.

While China, as showcased at COP28 in Dubai, likes to present itself as a leader in installed wind, solar, hydropower and biomass power, it would be illusory to believe that merely focusing on these green investments would make “China” as a state a global leader in climate action. For that, an immediate halt to investments by Chinese state firms in new coal, oil and gas projects, as well as a gradual phase-out of coal-fired power generation, would be necessary.

What our data shows, but is being overlooked, is that Chinese companies are leading globally in expanding installed gas power plant capacity, in the worldwide expansion of coal mining and in the construction of oil and gas pipelines.

Nevertheless, the outlook is somewhat positive. Global visiting diplomacy, the “inviting in” of investors, is opening doors. However, it will fail due to China’s reform backlog and power struggles. For example, Foreign Minister Annalena Baerbock has no official counterpart on the Chinese side. But financial cooperation in “green” labeled investments, liquefied natural gas infrastructure expansion, and digital infrastructure could develop positively in 2024 thanks to the Chinese initiative.

Margaret Zhang is leaving her position as Editorial Director of Vogue China. Zhang became the youngest person ever to hold this position in 2021 at the age of 27. She was already an influential fashion blogger as a teenager in Sydney. Before taking up the role, she had more than one million Instagram followers.

Kelly Wong, an immigrant rights activist, was unanimously appointed to the San Francisco Election Commission by a Board of Supervisors in mid-February. Wong, who came to the US from Hong Kong to study in 2019, is said to be the first non-citizen to ever sit on the Commission.

Is something changing in your organization? Let us know at heads@table.media!

What inspires poets to write verse and provides the perfect backdrop for children’s photos is also a robust industry in the People’s Republic: colorful flowers. China’s flower industry has changed considerably since the pandemic. Apparently, flowers are no longer only bought on festive and public holidays, but also “just because.” In 2023, sales of freshly cut flowers, in particular, increased, with consultants predicting an annual growth rate of over twelve percent for this sector between 2023 and 2029. After a gray winter, spring is simply dear to us all.