A year ago, German companies in China hoped that the country would open up after the pandemic and experience a strong upswing in 2023. At least, that was the result of a survey by the German Chamber of Commerce in Beijing at that time. The survey results from this year, shedding light on the current business climate, are now primarily a reality check.

While there has been some degree of opening, the expectations of a strong upswing have clearly not been met, writes Joern Petring. The challenges that German companies face in China are still enormous. Increasing competition from local businesses, uneven market access, and geopolitical tensions are just a few of them. Despite the current concerns, the overwhelming majority of 91 percent of companies still want to stay in China. Simply put, there are still no strong alternatives.

Meanwhile, Brussels is calling for more China savviness for Germany and Europe. At the same time, it wants greater vigilance in scientific collaboration with China. A recent study by the EU project Reconnect China shows that EU countries cooperate with the People’s Republic in many ways, such as their companies jointly filing patents. According to the study, Germany is even China’s largest patent partner in Europe. Especially in the fields of telecommunications, information technology and electronics, there are such co-patents, writes Christiane Kuehl, who has dissected the cumbersome study for you.

The fact that primarily large companies are involved shows that joint patenting is primarily a commercial venture dominated by tech and industrial giants from Germany and France. Even if the data situation is often difficult to penetrate, it becomes clear: China’s interest in Europe’s know-how remains significant.

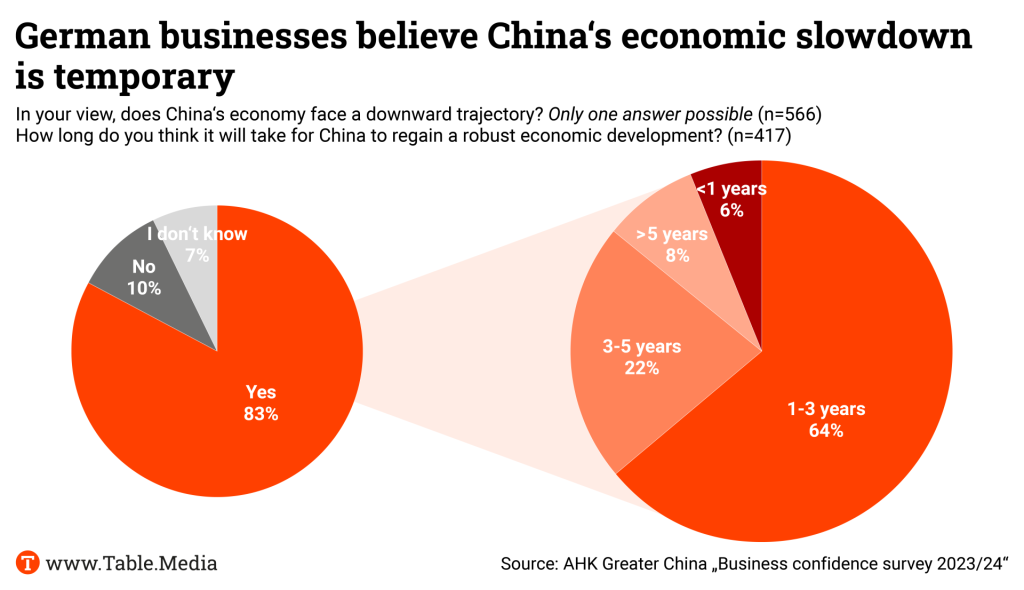

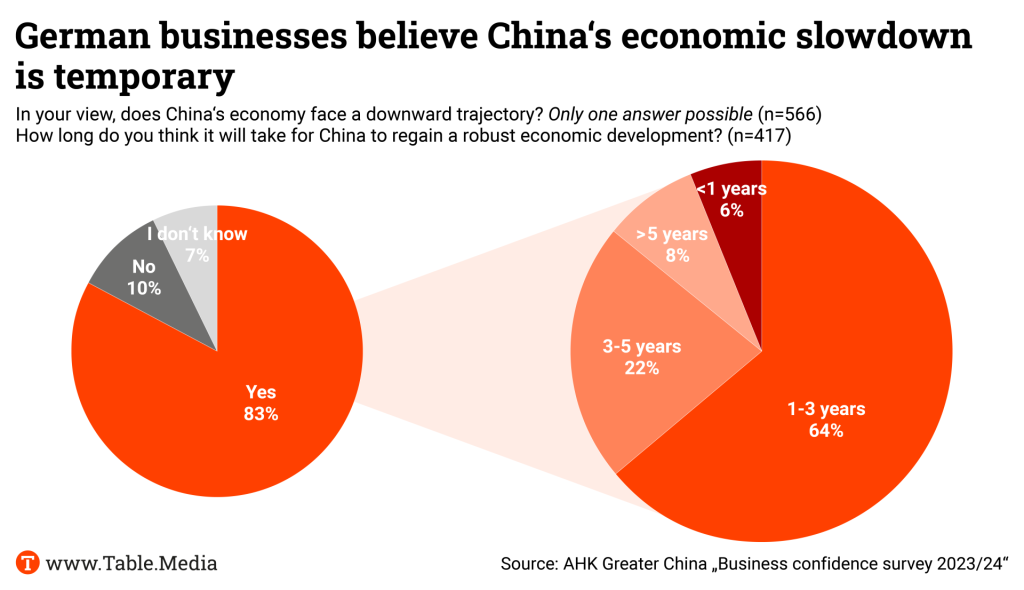

Light at the end of the tunnel – yet still significant challenges. This summarizes the current mood among members of the German Chamber of Commerce in China, as revealed by the annual chamber survey on business sentiment presented on Wednesday.

The most crucial insight: Companies are cautiously optimistic, but they do not believe that China’s economic problems have been overcome. The challenging period will persist for the time being. However, the respondents hope it will not be permanent.

Despite current concerns, the overwhelming majority of companies plan to remain in China. 91 percent stated that they will remain loyal to the market. 79 percent expect continuous growth in their industry over the next five years, and more than half of the companies (54 percent) plan to increase investments.

The outlook for 2024 is generally cautiously optimistic. 42 percent of respondents expect an improvement in their industry’s situation in 2024, while 23 percent fear a deterioration. However, these figures should be viewed with caution, as a comparison with the previous year’s survey shows.

Back then, companies had set their expectations too high. They had hoped that China would open up and experience a robust upswing in 2023 after the pandemic. While the opening did occur, the expectations for a strong upswing clearly did not materialize.

While only 29 percent of respondents in their 2023 forecast anticipated a deterioration in business conditions in their industry, the actual retrospective value was 52 percent. While 38 percent expected an improvement, retrospectively, only 21 percent experienced it.

“Last year was a reality check for German companies in China,” commented Ulf Reinhardt, Chairman of the Board of the German Chamber of Commerce South and Southwest China, on the survey results. The survey shows that German companies face a range of challenges, including increasing competition from local companies, unequal market access, a weak economy, and geopolitical tensions.

In detail, German companies see the following problems:

“The legal framework in China weakens the competitiveness of German companies that are determined to benefit from China’s innovation strength,” said Reinhardt. Given the strengthening Chinese competition, the German Chamber of Commerce in China called on the Chinese government to create equal competitive conditions, which should positively impact investment confidence.

“Most Chinese companies have little reason to fear competition. Equal competition conditions will increase productivity and innovation in all industries,” Reinhardt added.

According to Jens Hildebrandt, Managing Board Member of the German Chamber of Commerce in Beijing, the Chinese leadership must do more to counteract the loss of trust in the economy. “Trust must be rebuilt,” said Hildebrandt. While the government is sending signals, concrete measures must be implemented – no later than the upcoming National People’s Congress in March – to truly improve the mood.

Companies are trying to adapt to the changed geopolitical situation. Thus, 44 percent state that they have taken concrete measures. These include establishing China-independent supply chains, expanding additional business activities outside China and localizing research and development activities within China.

Overall, the survey shows that German companies, like the previous year, may be at risk of starting the new year somewhat optimistically. However, they are also mindful of the risks.

European companies collaborate with Chinese firms and file joint patents for their developments. Especially in telecommunications, information technology, and electronics, such co-patents exist, as revealed by a recent study of the EU project Reconnect China. This program aims to determine in which areas collaboration between the European Union and China is “desirable, possible or impossible”.

The ultimate goal is to enhance Europe’s China expertise, even in specialized fields. The urgency of this goal was recently highlighted by a paper issued by the German Academic Exchange Service (DAAD), which criticizes a concerning decline in collaborations and mobility between Germany and China.

The authors are not providing recommendations for companies working on co-patents with China; their primary target audience is the scientific community. They consider the data and insights generated in their study as a potentially important foundation for further analyses by science and business.

To gain insight into joint patent projects, the authors combed through application entries in the PATSTAT database of the European Patent Office from 2011 to 2022. They sought joint patent applications by legal entities – including the inventors themselves or their companies – from China and the EU, including the UK, Norway and Switzerland (EU-27/AC). They found exactly 12,415 matching patent applications.

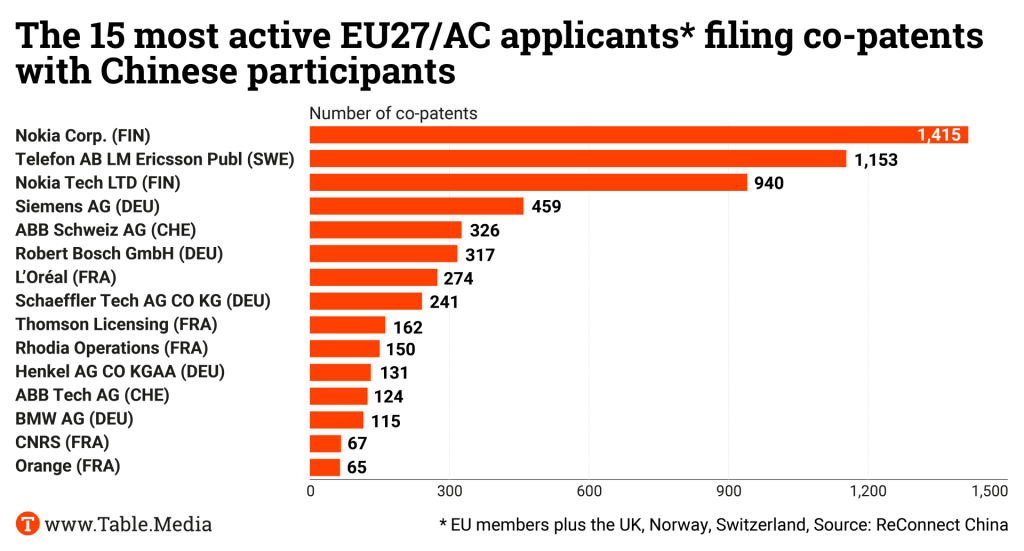

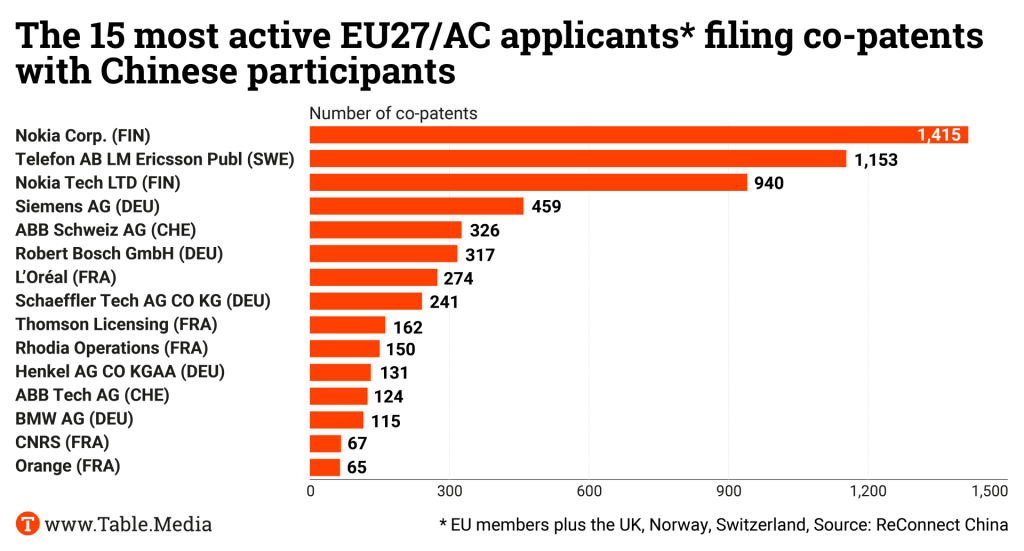

“Among the countries, Germany is the largest patent partner for China in Europe, followed by Finland, Sweden and France,” says co-author Philipp Brugner to Table.Media. “This is also reflected in the origin of the companies involved.” Nokia from Finland leads the pack, followed by Ericsson, a Nokia subsidiary, Siemens, ABB, Bosch and L’Oréal. All of them are major corporations.

This shows that “joint patenting between the EU27/AC and China is primarily a commercial endeavor dominated by the telecommunications/electronics industry and industrial heavyweights from Germany and France,” according to the study. A notable exception is the French state-supported research institute Centre National de la Recherche Scientifique (CNRS) with 67 co-patent applications with Chinese institutions in PATSTAT.

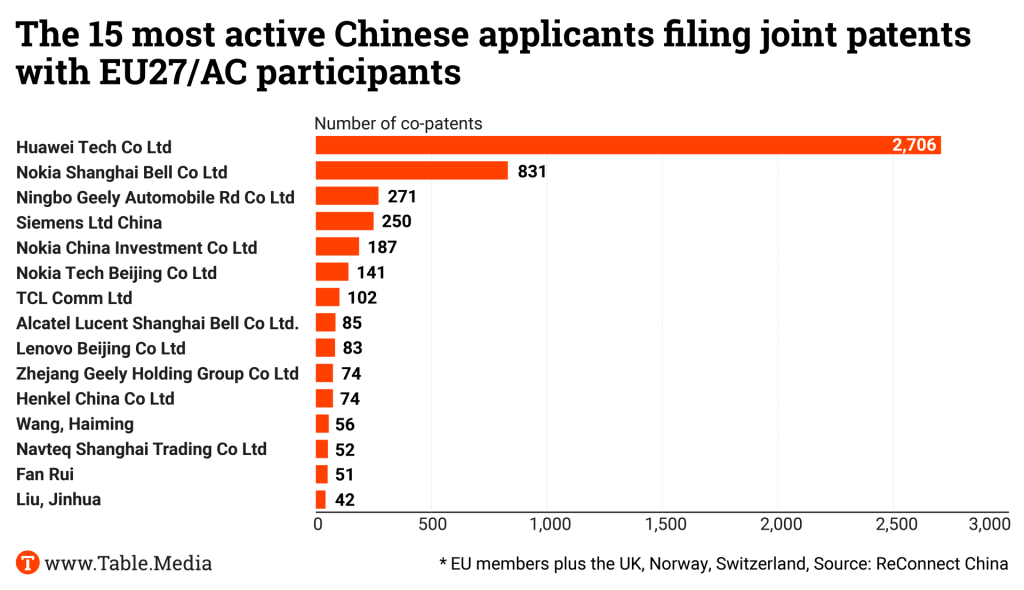

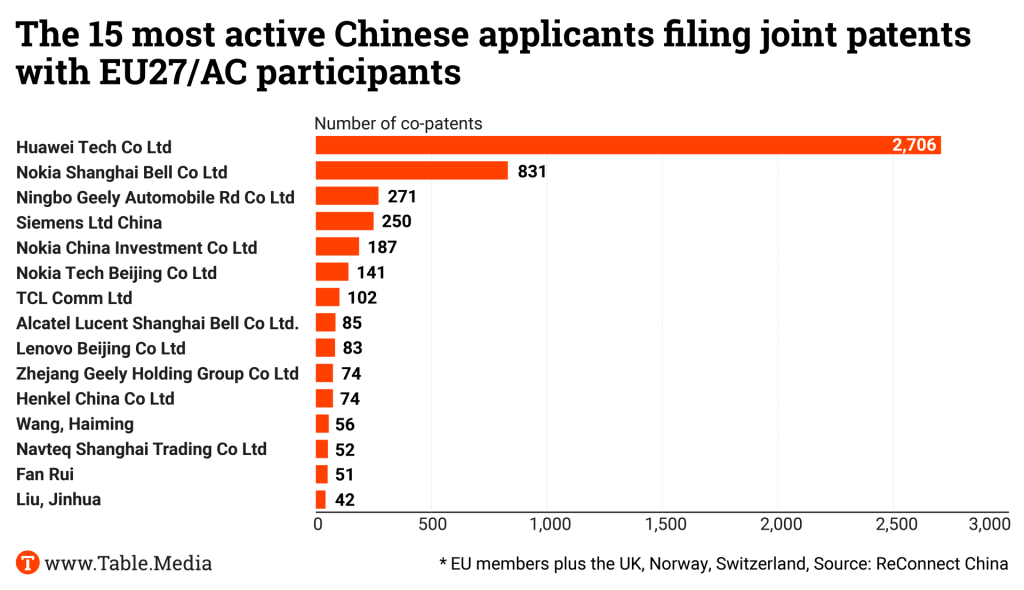

On the Chinese side, the situation is different. “Several of the most active applicants are Chinese subsidiaries of the European companies mentioned above,” write the authors. For example, Nokia Finland jointly files co-patents with its own Chinese subsidiaries. The Shanghai subsidiary of the US company NAVTEQ is also active. But “real” Chinese companies like Huawei, Lenovo, TCL or Geely are also strongly represented in co-patents. “It is noteworthy that all top 15 applicants from China are large companies.” Telecommunications and the electronics sector are also most strongly represented in China.

In general, access to innovations through patents is considered “secondary innovation”, where “technologies are not imported to copy, but to understand and fundamentally improve through one or more of their own development steps,” explains Brugner.

An example of how China has used this is in green technologies, where China initially relied on foreign products and facilities, such as wind turbines or photovoltaics. “Today, China is not only the main producer but also one of the strongest innovators in green technologies, as we could see from the share of internationally registered patents for these technologies.”

PATSTAT distinguishes between applicants and inventors in entries. Applicants are individuals or organizations who file a patent – an the future patent holder. Inventors are the minds behind an innovation and thus the creators of intellectual property. Chinese inventors can work, for example, in a Finnish company that applies for a patent for their idea.

A little more than half of the found co-patents (57.5 percent) contain at least one Chinese applicant. 71.2 percent contain at least one Chinese inventor. A subset of co-patents involves both Chinese inventors and applicants.

This is how the Chinese partners are distributed in the EU-27/AC states, according to the study:

The data situation for patent analysis is quite challenging, according to the study. “From filing a patent application to its publication in the PATSTAT database, an average of about two years elapse,” it says. For this reason, many applications from 2018 are not yet included in PATSTAT. Until 2018, the number of jointly filed patents had been steadily increasing. Due to the lack of data, it drops after that. However, the authors assume that the number of jointly filed patents has continued to rise in 2021 and 2022, “as the interest of China in Europe is great,” as Brugner says.

“I believe that we can see the same trend as with joint publications: Cooperation with China regarding artificial intelligence and digital technologies is becoming increasingly important,” says co-author Gábor Szüdi. “And with co-patents, we primarily see a focus on very concrete applied science.” China is very interested in cooperation in this field.

Another problem makes the list incomplete: Not every patent office lists the country of the applicants or the patent office where it is filed. As a result, many co-patents in PATSTAT fall through the researchers’ grid, simply because they are not recognizable as such. “The Chinese Patent Office is one of the most prominent examples of this negligence,” the study says. “We worked with the best currently available data. But I am not sure if these give the whole picture,” says Szüdi.

Among the national patent offices, based on the available data, Germany (5.6 percent), the United Kingdom (3.3 percent) and France (2.1 percent) are the most important filing authorities for co-patents, according to the study. There are practically no co-patents at the Chinese Patent Office in the available data – possibly only because the authority simply did not enter this data.

In addition to co-patents, the study also looks at joint scientific publications, which we recently reported on separately.

In a study, the Bundesbank cautions against a too rapid decoupling from China. In its monthly report for January, the bank’s analysts state that “an abrupt decoupling, such as due to a geopolitical crisis”, would significantly impact the German industry. Companies directly engaged in China could lose a substantial portion of their revenue and profit base. Industries such as the automotive sector, mechanical engineering, electronics or electrical engineering would be particularly affected.

The report examines German dependencies on China and how well the German economy could withstand an economic crisis in China or an abrupt decoupling from the People’s Republic. Even an orderly withdrawal from China would be associated with considerable losses, according to the experts at the Bundesbank. The close real economic interdependence between Germany and China also entails considerable risks for the German financial system, the report notes. These risks could affect the stability of the German financial system, such as an increasing probability of loan defaults.

According to the Bundesbank, decoupling from China would particularly impact the German industry severely. Many German industrial companies have generated high revenues and profits from production in China and substantial income from exports to China in the past. Therefore, a turn away from China is likely to be associated with long-term entrepreneurial and macroeconomic costs, according to the authors.

From the perspective of the German central bank, companies and policymakers should make efforts “to reduce risks and strengthen the resilience of the German economy”. The Bundesbank advocates for strengthening the international trade order as well as regional free trade agreements. According to the report, the German government’s China strategy and measures by the EU Commission to reduce dependence on critical raw materials are moving in the right direction. fpe

The EU is seeking to enhance the protection of its research and development from Chinese influence and access. On Wednesday, as part of its economic security strategy, the European Commission presented several points:

The EU economic security package includes initiatives in other areas: from plans to tighten the regulation on foreign direct investment to more effective controls to prevent the transfer of sensitive tech know-how, to better coordination of technology export controls.

The Brussels authority’s strategy received mixed reactions on Wednesday: The European Research Council emphasized that the EU must increase its budget for research and development to remain competitive. The business sector also viewed the proposals critically. Economic security in the EU should include more than the frequently cited toolkit, emphasized Wolfgang Niedermark, a member of the executive board of the Federation of German Industries. “So far, the Commission has almost exclusively delivered on the protective measures of its three-pillar strategy. That’s not enough.”

The EU’s roadmap is now tied to the outcome of the mega-election year 2024, explained Tobias Gehrke from the think tank European Council on Foreign Relations. Ursula von der Leyen’s strategy focuses on three things, according to Gehrke: a transatlantic orientation, monitoring China and navigating the “labyrinth of critical technologies”. ari

At least 39 people died in a major fire in the city of Xinyu in the central Chinese province of Jiangxi. Another nine people are reported to have been injured. According to reports from the Xinhua news agency, the fire broke out in the basement of a business in the city of Xinyu in the afternoon. As the fire spread to the building, dozens of residents were also trapped.

This is the second deadly fire in less than a week. Six days ago, 13 students died in a nighttime fire at a boarding school in the central Chinese province of Henan. The cause of the fire remained unclear. According to state media reports, the headmaster of the private boarding school in the village of Yanshanpu near the city of Nanyang has been taken into custody. fpe

China’s central bank announced a drastic reduction in the reserve requirement ratio for commercial banks, effective from Feb. 5, lowering it by 50 basis points. The required reserve ratio is a percentage of certain liabilities that banks must always hold. These reserves are intended to prevent financial institutions from being insufficiently liquid in a crisis to meet these liabilities.

With this reduction, approximately 130 billion euros (1 trillion yuan) in cash can be injected into the banking system. Banks are now allowed to release parts of the previously held reserves and use them for their operations.

Furthermore, effective Thursday, the People’s Bank of China lowered the interest rate for the re-lending and rediscount of bank loans for small businesses and agricultural enterprises by 25 basis points to 1.75 percent.

The announcement just before the close of the stock market is a clear signal that policymakers want to counteract the weak economy and falling stock markets, said central bank governor Pan Gongsheng on Wednesday at a press conference in Beijing. “The People’s Bank of China will strengthen the countercyclical and cyclical adjustment of monetary policy instruments, strive to stabilize the market and confidence, and consolidate and strengthen the positive economic recovery,” Pan said. rtr

When Roy Chun Lee was appointed to a government position by Taiwan’s Minister of Foreign Affairs Joseph Wu in early 2023, he was visibly surprised. In his role as deputy minister of foreign affairs, he sought to explore unconventional paths in foreign policy, considering Taiwan’s limited political room for maneuver. “I alone cannot change the world, but I can try to encourage the foreign ministry to think outside the box.”

In November of last year, Lee spoke at the second Berlin Taiwan Conference initiated by Green MEP Reinhard Buetikofer. “European countries need their own Taiwan policy,” Lee demanded, connected live via video from his office in the foreign ministry. Taiwan is a valuable partner for the EU, especially due to its long-standing experience in analyzing and reducing economic dependencies on China. Lee specifically highlighted the opportunities for sectoral cooperation between Taiwan and European governments and companies, such as in the semiconductor industry, renewable energy or the research of secure supply chains.

Regarding the possibility of a classic bilateral trade agreement between Taiwan and the EU, Lee appeared rather reserved. “A trade agreement is not a priority for us. We should move towards a broader concept of comprehensive economic cooperation.” He could not precisely articulate how such a concept could be legally formulated and structured at that time.

Now, Roy Chun Lee has the opportunity to officially continue these considerations. Since Jan. 8, Lee has been the new envoy at Taiwan’s representative office for Belgium and the European Union in Brussels.

Lee is a trained lawyer. After studying in Taiwan, he pursued a doctoral program in Public Policy Analysis at the Australian National University in 2002. Since then, Lee has developed into a proficient trade specialist. As Deputy Director of the state-funded Chung-Hua Institute for Economic Research, Lee was actively involved in Taiwan’s actions in the World Trade Organization (WTO) and the initiation of regional trade agreements.

However, after Taiwan’s accession to the WTO in 2002, it became increasingly difficult for the country, under Chinese pressure, to conclude bilateral or multilateral agreements, including with the EU. In 2015, European Commission guidelines suggested exploring separate “investment agreements” with Taiwan based on the then-hoped-for Comprehensive Agreement on Investment (CAI) between the EU and China. However, the ratification of the investment agreement with China in the European Parliament has been on hold since 2021 due to political tensions.

Roy Chun Lee himself doubts that the EU, under China’s pressure, will dare to first conclude a formal trade or investment agreement with Taiwan under these conditions. With the recent victory of the China-critical Democratic Progressive Party (DPP) in Taiwan’s presidential elections and William Lai becoming the next president, Taiwan’s international political room for maneuver may not expand.

Therefore, Lee aims to focus more on intergovernmental agreements and softer forms of economic and political cooperation. Examples for this can be the Trade Framework Agreement concluded with the USA last June and the “Enhanced Trade Partnership” agreement signed with the UK in November. Recently, there was only one ministerial-level agreement between Taiwan and Germany: During the visit of Minister of Education and Research Bettina Stark-Watzinger in March 2023, a cooperation agreement focusing on collaboration in artificial intelligence, hydrogen energy, battery, and semiconductor technology was signed. Leonardo Pape

Chi Zhang has been the new Project Manager at the China Institute for German Business (CIDW) since December. She was previously a Senior Consultant at CPC Enterprise Management in Beijing.

Uwe Sailer has returned to Germany after several years in China and is now Head of Powertrain Homologation at Audi in Neckarsulm. Sailer has been in China since January 2020, most recently as Head of Powertrain Calibration and Testing for Volkswagen in Beijing.

Is something changing in your organization? Let us know at heads@table.media!

Autonomously driving, labor-free delivery: Each of these unmanned delivery vehicles, currently put into operation in the northern Chinese province of Hebei, accomplishes 500 to 800 deliveries per day, has a maximum payload of 1,000 kilograms and a range of 200 kilometers per charge. Communication is also automated: Recipients schedule the delivery time through a mobile application and the vehicle sends a notification before its arrival. Only ordering is something people still need to do themselves.

A year ago, German companies in China hoped that the country would open up after the pandemic and experience a strong upswing in 2023. At least, that was the result of a survey by the German Chamber of Commerce in Beijing at that time. The survey results from this year, shedding light on the current business climate, are now primarily a reality check.

While there has been some degree of opening, the expectations of a strong upswing have clearly not been met, writes Joern Petring. The challenges that German companies face in China are still enormous. Increasing competition from local businesses, uneven market access, and geopolitical tensions are just a few of them. Despite the current concerns, the overwhelming majority of 91 percent of companies still want to stay in China. Simply put, there are still no strong alternatives.

Meanwhile, Brussels is calling for more China savviness for Germany and Europe. At the same time, it wants greater vigilance in scientific collaboration with China. A recent study by the EU project Reconnect China shows that EU countries cooperate with the People’s Republic in many ways, such as their companies jointly filing patents. According to the study, Germany is even China’s largest patent partner in Europe. Especially in the fields of telecommunications, information technology and electronics, there are such co-patents, writes Christiane Kuehl, who has dissected the cumbersome study for you.

The fact that primarily large companies are involved shows that joint patenting is primarily a commercial venture dominated by tech and industrial giants from Germany and France. Even if the data situation is often difficult to penetrate, it becomes clear: China’s interest in Europe’s know-how remains significant.

Light at the end of the tunnel – yet still significant challenges. This summarizes the current mood among members of the German Chamber of Commerce in China, as revealed by the annual chamber survey on business sentiment presented on Wednesday.

The most crucial insight: Companies are cautiously optimistic, but they do not believe that China’s economic problems have been overcome. The challenging period will persist for the time being. However, the respondents hope it will not be permanent.

Despite current concerns, the overwhelming majority of companies plan to remain in China. 91 percent stated that they will remain loyal to the market. 79 percent expect continuous growth in their industry over the next five years, and more than half of the companies (54 percent) plan to increase investments.

The outlook for 2024 is generally cautiously optimistic. 42 percent of respondents expect an improvement in their industry’s situation in 2024, while 23 percent fear a deterioration. However, these figures should be viewed with caution, as a comparison with the previous year’s survey shows.

Back then, companies had set their expectations too high. They had hoped that China would open up and experience a robust upswing in 2023 after the pandemic. While the opening did occur, the expectations for a strong upswing clearly did not materialize.

While only 29 percent of respondents in their 2023 forecast anticipated a deterioration in business conditions in their industry, the actual retrospective value was 52 percent. While 38 percent expected an improvement, retrospectively, only 21 percent experienced it.

“Last year was a reality check for German companies in China,” commented Ulf Reinhardt, Chairman of the Board of the German Chamber of Commerce South and Southwest China, on the survey results. The survey shows that German companies face a range of challenges, including increasing competition from local companies, unequal market access, a weak economy, and geopolitical tensions.

In detail, German companies see the following problems:

“The legal framework in China weakens the competitiveness of German companies that are determined to benefit from China’s innovation strength,” said Reinhardt. Given the strengthening Chinese competition, the German Chamber of Commerce in China called on the Chinese government to create equal competitive conditions, which should positively impact investment confidence.

“Most Chinese companies have little reason to fear competition. Equal competition conditions will increase productivity and innovation in all industries,” Reinhardt added.

According to Jens Hildebrandt, Managing Board Member of the German Chamber of Commerce in Beijing, the Chinese leadership must do more to counteract the loss of trust in the economy. “Trust must be rebuilt,” said Hildebrandt. While the government is sending signals, concrete measures must be implemented – no later than the upcoming National People’s Congress in March – to truly improve the mood.

Companies are trying to adapt to the changed geopolitical situation. Thus, 44 percent state that they have taken concrete measures. These include establishing China-independent supply chains, expanding additional business activities outside China and localizing research and development activities within China.

Overall, the survey shows that German companies, like the previous year, may be at risk of starting the new year somewhat optimistically. However, they are also mindful of the risks.

European companies collaborate with Chinese firms and file joint patents for their developments. Especially in telecommunications, information technology, and electronics, such co-patents exist, as revealed by a recent study of the EU project Reconnect China. This program aims to determine in which areas collaboration between the European Union and China is “desirable, possible or impossible”.

The ultimate goal is to enhance Europe’s China expertise, even in specialized fields. The urgency of this goal was recently highlighted by a paper issued by the German Academic Exchange Service (DAAD), which criticizes a concerning decline in collaborations and mobility between Germany and China.

The authors are not providing recommendations for companies working on co-patents with China; their primary target audience is the scientific community. They consider the data and insights generated in their study as a potentially important foundation for further analyses by science and business.

To gain insight into joint patent projects, the authors combed through application entries in the PATSTAT database of the European Patent Office from 2011 to 2022. They sought joint patent applications by legal entities – including the inventors themselves or their companies – from China and the EU, including the UK, Norway and Switzerland (EU-27/AC). They found exactly 12,415 matching patent applications.

“Among the countries, Germany is the largest patent partner for China in Europe, followed by Finland, Sweden and France,” says co-author Philipp Brugner to Table.Media. “This is also reflected in the origin of the companies involved.” Nokia from Finland leads the pack, followed by Ericsson, a Nokia subsidiary, Siemens, ABB, Bosch and L’Oréal. All of them are major corporations.

This shows that “joint patenting between the EU27/AC and China is primarily a commercial endeavor dominated by the telecommunications/electronics industry and industrial heavyweights from Germany and France,” according to the study. A notable exception is the French state-supported research institute Centre National de la Recherche Scientifique (CNRS) with 67 co-patent applications with Chinese institutions in PATSTAT.

On the Chinese side, the situation is different. “Several of the most active applicants are Chinese subsidiaries of the European companies mentioned above,” write the authors. For example, Nokia Finland jointly files co-patents with its own Chinese subsidiaries. The Shanghai subsidiary of the US company NAVTEQ is also active. But “real” Chinese companies like Huawei, Lenovo, TCL or Geely are also strongly represented in co-patents. “It is noteworthy that all top 15 applicants from China are large companies.” Telecommunications and the electronics sector are also most strongly represented in China.

In general, access to innovations through patents is considered “secondary innovation”, where “technologies are not imported to copy, but to understand and fundamentally improve through one or more of their own development steps,” explains Brugner.

An example of how China has used this is in green technologies, where China initially relied on foreign products and facilities, such as wind turbines or photovoltaics. “Today, China is not only the main producer but also one of the strongest innovators in green technologies, as we could see from the share of internationally registered patents for these technologies.”

PATSTAT distinguishes between applicants and inventors in entries. Applicants are individuals or organizations who file a patent – an the future patent holder. Inventors are the minds behind an innovation and thus the creators of intellectual property. Chinese inventors can work, for example, in a Finnish company that applies for a patent for their idea.

A little more than half of the found co-patents (57.5 percent) contain at least one Chinese applicant. 71.2 percent contain at least one Chinese inventor. A subset of co-patents involves both Chinese inventors and applicants.

This is how the Chinese partners are distributed in the EU-27/AC states, according to the study:

The data situation for patent analysis is quite challenging, according to the study. “From filing a patent application to its publication in the PATSTAT database, an average of about two years elapse,” it says. For this reason, many applications from 2018 are not yet included in PATSTAT. Until 2018, the number of jointly filed patents had been steadily increasing. Due to the lack of data, it drops after that. However, the authors assume that the number of jointly filed patents has continued to rise in 2021 and 2022, “as the interest of China in Europe is great,” as Brugner says.

“I believe that we can see the same trend as with joint publications: Cooperation with China regarding artificial intelligence and digital technologies is becoming increasingly important,” says co-author Gábor Szüdi. “And with co-patents, we primarily see a focus on very concrete applied science.” China is very interested in cooperation in this field.

Another problem makes the list incomplete: Not every patent office lists the country of the applicants or the patent office where it is filed. As a result, many co-patents in PATSTAT fall through the researchers’ grid, simply because they are not recognizable as such. “The Chinese Patent Office is one of the most prominent examples of this negligence,” the study says. “We worked with the best currently available data. But I am not sure if these give the whole picture,” says Szüdi.

Among the national patent offices, based on the available data, Germany (5.6 percent), the United Kingdom (3.3 percent) and France (2.1 percent) are the most important filing authorities for co-patents, according to the study. There are practically no co-patents at the Chinese Patent Office in the available data – possibly only because the authority simply did not enter this data.

In addition to co-patents, the study also looks at joint scientific publications, which we recently reported on separately.

In a study, the Bundesbank cautions against a too rapid decoupling from China. In its monthly report for January, the bank’s analysts state that “an abrupt decoupling, such as due to a geopolitical crisis”, would significantly impact the German industry. Companies directly engaged in China could lose a substantial portion of their revenue and profit base. Industries such as the automotive sector, mechanical engineering, electronics or electrical engineering would be particularly affected.

The report examines German dependencies on China and how well the German economy could withstand an economic crisis in China or an abrupt decoupling from the People’s Republic. Even an orderly withdrawal from China would be associated with considerable losses, according to the experts at the Bundesbank. The close real economic interdependence between Germany and China also entails considerable risks for the German financial system, the report notes. These risks could affect the stability of the German financial system, such as an increasing probability of loan defaults.

According to the Bundesbank, decoupling from China would particularly impact the German industry severely. Many German industrial companies have generated high revenues and profits from production in China and substantial income from exports to China in the past. Therefore, a turn away from China is likely to be associated with long-term entrepreneurial and macroeconomic costs, according to the authors.

From the perspective of the German central bank, companies and policymakers should make efforts “to reduce risks and strengthen the resilience of the German economy”. The Bundesbank advocates for strengthening the international trade order as well as regional free trade agreements. According to the report, the German government’s China strategy and measures by the EU Commission to reduce dependence on critical raw materials are moving in the right direction. fpe

The EU is seeking to enhance the protection of its research and development from Chinese influence and access. On Wednesday, as part of its economic security strategy, the European Commission presented several points:

The EU economic security package includes initiatives in other areas: from plans to tighten the regulation on foreign direct investment to more effective controls to prevent the transfer of sensitive tech know-how, to better coordination of technology export controls.

The Brussels authority’s strategy received mixed reactions on Wednesday: The European Research Council emphasized that the EU must increase its budget for research and development to remain competitive. The business sector also viewed the proposals critically. Economic security in the EU should include more than the frequently cited toolkit, emphasized Wolfgang Niedermark, a member of the executive board of the Federation of German Industries. “So far, the Commission has almost exclusively delivered on the protective measures of its three-pillar strategy. That’s not enough.”

The EU’s roadmap is now tied to the outcome of the mega-election year 2024, explained Tobias Gehrke from the think tank European Council on Foreign Relations. Ursula von der Leyen’s strategy focuses on three things, according to Gehrke: a transatlantic orientation, monitoring China and navigating the “labyrinth of critical technologies”. ari

At least 39 people died in a major fire in the city of Xinyu in the central Chinese province of Jiangxi. Another nine people are reported to have been injured. According to reports from the Xinhua news agency, the fire broke out in the basement of a business in the city of Xinyu in the afternoon. As the fire spread to the building, dozens of residents were also trapped.

This is the second deadly fire in less than a week. Six days ago, 13 students died in a nighttime fire at a boarding school in the central Chinese province of Henan. The cause of the fire remained unclear. According to state media reports, the headmaster of the private boarding school in the village of Yanshanpu near the city of Nanyang has been taken into custody. fpe

China’s central bank announced a drastic reduction in the reserve requirement ratio for commercial banks, effective from Feb. 5, lowering it by 50 basis points. The required reserve ratio is a percentage of certain liabilities that banks must always hold. These reserves are intended to prevent financial institutions from being insufficiently liquid in a crisis to meet these liabilities.

With this reduction, approximately 130 billion euros (1 trillion yuan) in cash can be injected into the banking system. Banks are now allowed to release parts of the previously held reserves and use them for their operations.

Furthermore, effective Thursday, the People’s Bank of China lowered the interest rate for the re-lending and rediscount of bank loans for small businesses and agricultural enterprises by 25 basis points to 1.75 percent.

The announcement just before the close of the stock market is a clear signal that policymakers want to counteract the weak economy and falling stock markets, said central bank governor Pan Gongsheng on Wednesday at a press conference in Beijing. “The People’s Bank of China will strengthen the countercyclical and cyclical adjustment of monetary policy instruments, strive to stabilize the market and confidence, and consolidate and strengthen the positive economic recovery,” Pan said. rtr

When Roy Chun Lee was appointed to a government position by Taiwan’s Minister of Foreign Affairs Joseph Wu in early 2023, he was visibly surprised. In his role as deputy minister of foreign affairs, he sought to explore unconventional paths in foreign policy, considering Taiwan’s limited political room for maneuver. “I alone cannot change the world, but I can try to encourage the foreign ministry to think outside the box.”

In November of last year, Lee spoke at the second Berlin Taiwan Conference initiated by Green MEP Reinhard Buetikofer. “European countries need their own Taiwan policy,” Lee demanded, connected live via video from his office in the foreign ministry. Taiwan is a valuable partner for the EU, especially due to its long-standing experience in analyzing and reducing economic dependencies on China. Lee specifically highlighted the opportunities for sectoral cooperation between Taiwan and European governments and companies, such as in the semiconductor industry, renewable energy or the research of secure supply chains.

Regarding the possibility of a classic bilateral trade agreement between Taiwan and the EU, Lee appeared rather reserved. “A trade agreement is not a priority for us. We should move towards a broader concept of comprehensive economic cooperation.” He could not precisely articulate how such a concept could be legally formulated and structured at that time.

Now, Roy Chun Lee has the opportunity to officially continue these considerations. Since Jan. 8, Lee has been the new envoy at Taiwan’s representative office for Belgium and the European Union in Brussels.

Lee is a trained lawyer. After studying in Taiwan, he pursued a doctoral program in Public Policy Analysis at the Australian National University in 2002. Since then, Lee has developed into a proficient trade specialist. As Deputy Director of the state-funded Chung-Hua Institute for Economic Research, Lee was actively involved in Taiwan’s actions in the World Trade Organization (WTO) and the initiation of regional trade agreements.

However, after Taiwan’s accession to the WTO in 2002, it became increasingly difficult for the country, under Chinese pressure, to conclude bilateral or multilateral agreements, including with the EU. In 2015, European Commission guidelines suggested exploring separate “investment agreements” with Taiwan based on the then-hoped-for Comprehensive Agreement on Investment (CAI) between the EU and China. However, the ratification of the investment agreement with China in the European Parliament has been on hold since 2021 due to political tensions.

Roy Chun Lee himself doubts that the EU, under China’s pressure, will dare to first conclude a formal trade or investment agreement with Taiwan under these conditions. With the recent victory of the China-critical Democratic Progressive Party (DPP) in Taiwan’s presidential elections and William Lai becoming the next president, Taiwan’s international political room for maneuver may not expand.

Therefore, Lee aims to focus more on intergovernmental agreements and softer forms of economic and political cooperation. Examples for this can be the Trade Framework Agreement concluded with the USA last June and the “Enhanced Trade Partnership” agreement signed with the UK in November. Recently, there was only one ministerial-level agreement between Taiwan and Germany: During the visit of Minister of Education and Research Bettina Stark-Watzinger in March 2023, a cooperation agreement focusing on collaboration in artificial intelligence, hydrogen energy, battery, and semiconductor technology was signed. Leonardo Pape

Chi Zhang has been the new Project Manager at the China Institute for German Business (CIDW) since December. She was previously a Senior Consultant at CPC Enterprise Management in Beijing.

Uwe Sailer has returned to Germany after several years in China and is now Head of Powertrain Homologation at Audi in Neckarsulm. Sailer has been in China since January 2020, most recently as Head of Powertrain Calibration and Testing for Volkswagen in Beijing.

Is something changing in your organization? Let us know at heads@table.media!

Autonomously driving, labor-free delivery: Each of these unmanned delivery vehicles, currently put into operation in the northern Chinese province of Hebei, accomplishes 500 to 800 deliveries per day, has a maximum payload of 1,000 kilograms and a range of 200 kilometers per charge. Communication is also automated: Recipients schedule the delivery time through a mobile application and the vehicle sends a notification before its arrival. Only ordering is something people still need to do themselves.